The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2005) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is designed for an investor who retired at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

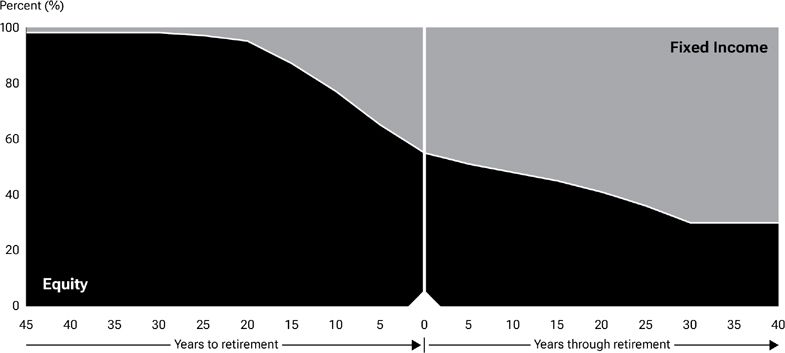

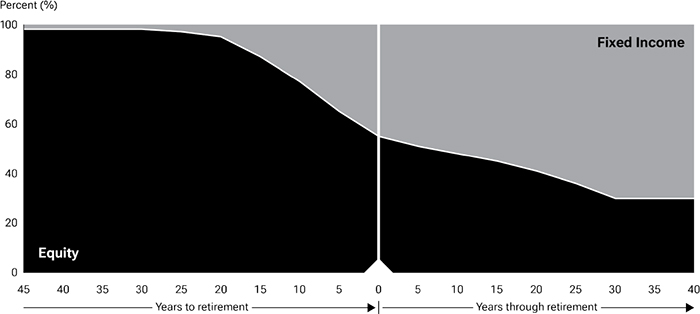

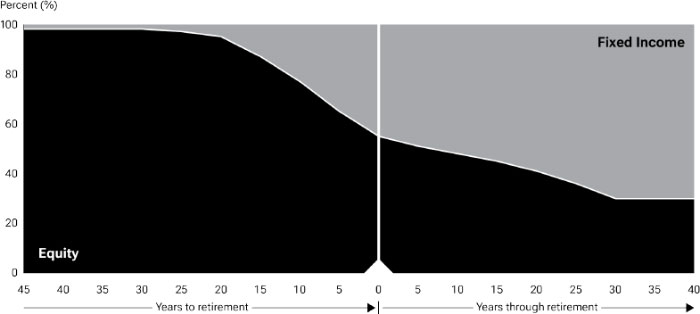

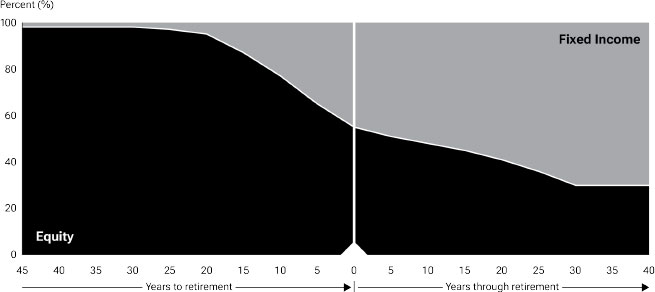

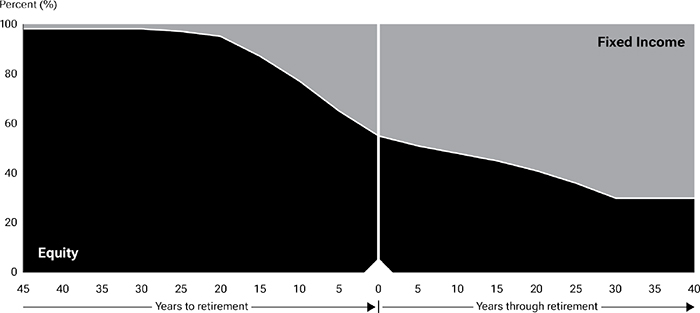

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2005 Fund | |||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | ||||

| Equity | 40.98 | % | Hedged Equity | 4.10 | % | Hedged Equity | |

| Inflation Focused | 2.05 | Real Assets | |||||

| International Developed Markets | 8.89 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 1.56 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 19.81 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 2.44 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 2.13 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 59.00 | Core Fixed Income | 28.70 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 30.30 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2010) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is designed for an investor who retired at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

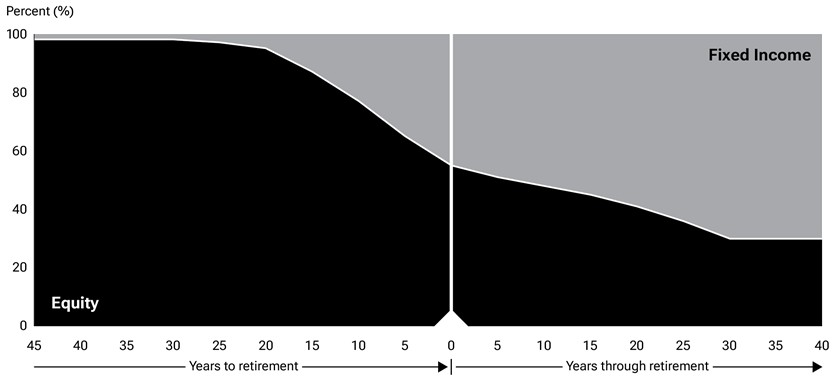

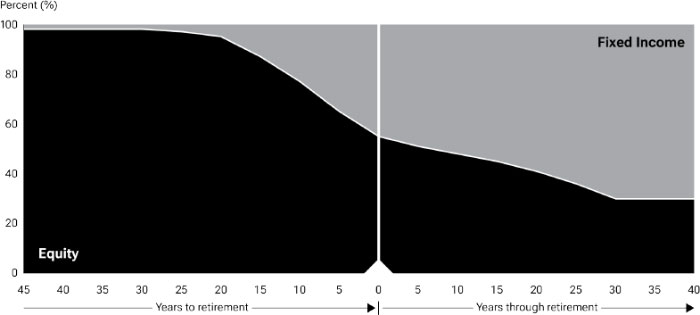

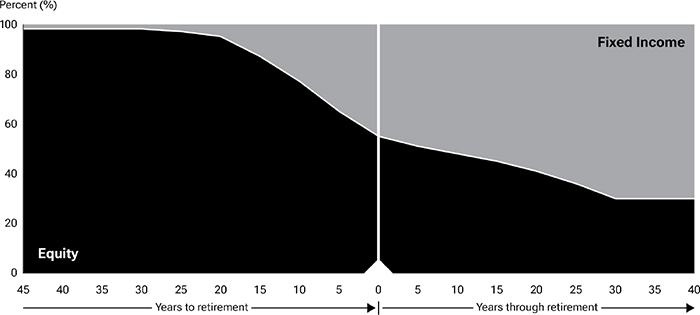

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2010 Fund | |||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | ||||

| Equity | 45.00 | % | Hedged Equity | 4.50 | % | Hedged Equity | |

| Inflation Focused | 2.25 | Real Assets | |||||

| International Developed Markets | 9.75 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 1.72 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 21.75 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 2.68 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 2.35 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 55.00 | Core Fixed Income | 27.30 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 27.70 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2015) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is designed for an investor who retired at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

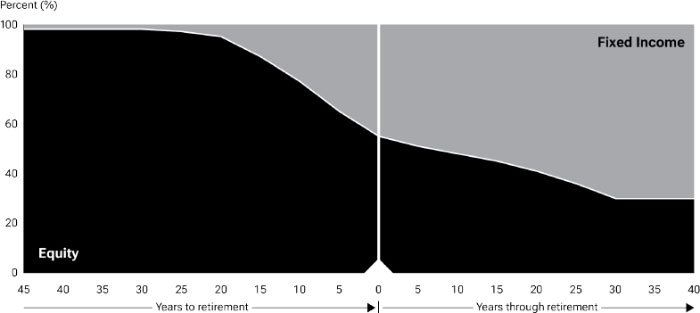

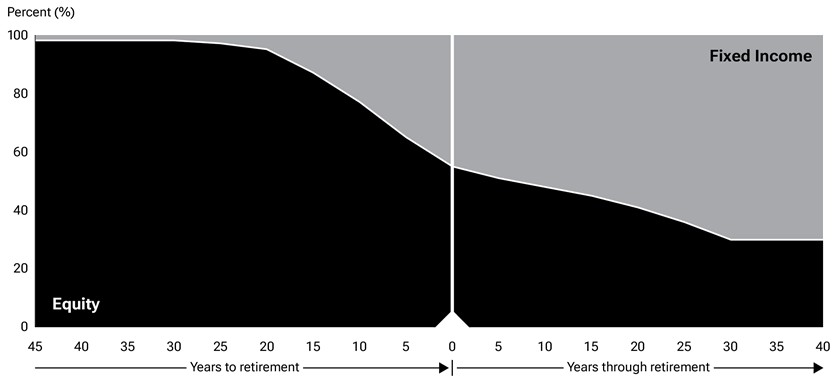

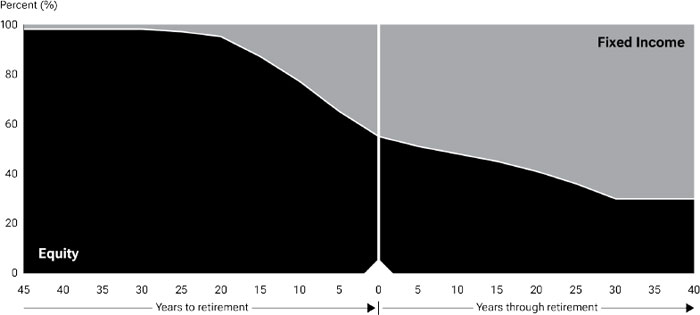

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2015 Fund | |||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | ||||

| Equity | 48.00 | % | Hedged Equity | 4.80 | % | Hedged Equity | |

| Inflation Focused | 2.40 | Real Assets | |||||

| International Developed Markets | 10.40 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 1.84 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 23.20 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 2.85 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 2.51 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 52.00 | Core Fixed Income | 26.60 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 25.40 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2020) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is designed for an investor who retired at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

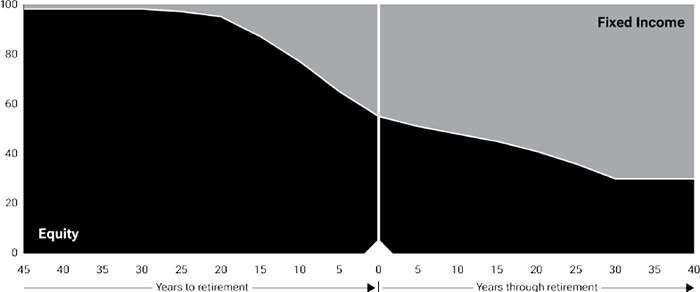

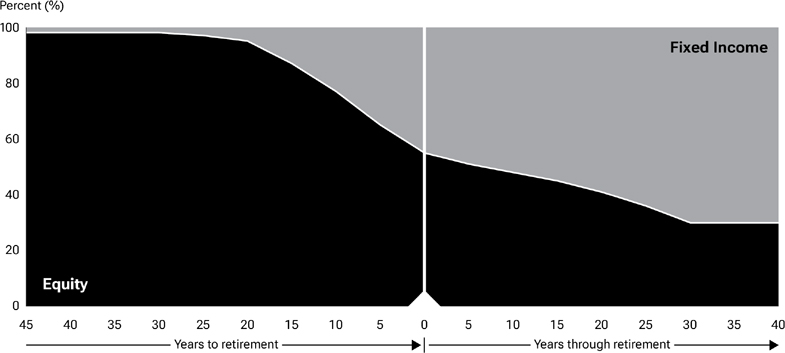

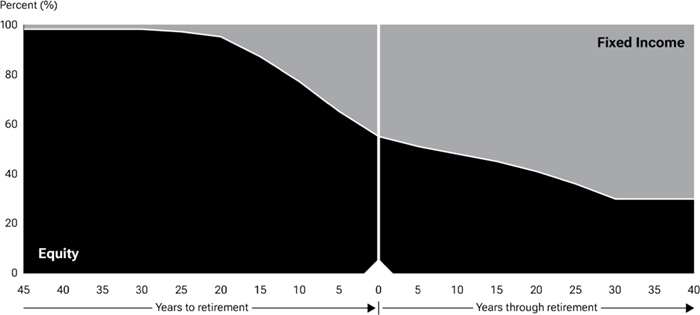

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2020 Fund | |||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | ||||

| Equity | 51.00 | % | Hedged Equity | 5.10 | % | Hedged Equity | |

| Inflation Focused | 2.55 | Real Assets | |||||

| International Developed Markets | 11.05 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 1.96 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 24.65 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 3.04 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 2.65 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 49.00 | Core Fixed Income | 25.90 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 23.10 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2025) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2025 Fund | ||||||

| Asset Class | Sector(s) | Neutral Allocation |

Underlying Fund(s) | |||

| Equity | 55.00 | % | Hedged Equity | 5.50 | % | Hedged Equity |

| Inflation Focused | 2.75 | Real Assets | ||||

| International Developed Markets | 11.91 | International Equity Index, | ||||

| International Stock, and/or | ||||||

| International Value Equity | ||||||

| International Emerging Markets | 2.10 | Emerging Markets Discovery Stock and/or | ||||

| Emerging Markets Stock | ||||||

| U.S. Large-Cap | 26.59 | Equity Index 500, | ||||

| Growth Stock, and/or | ||||||

| Value | ||||||

| U.S. Mid-Cap | 3.28 | Mid-Cap Growth, | ||||

| Mid-Cap Index, and/or | ||||||

| Mid-Cap Value | ||||||

| U.S. Small-Cap | 2.87 | New Horizons, | ||||

| Small-Cap Index, and/or | ||||||

| Small-Cap Value | ||||||

| Fixed Income | 45.00 | Core Fixed Income | 24.50 | Dynamic Global Bond, | ||

| International Bond (USD Hedged), and/or | ||||||

| QM U.S. Bond Index | ||||||

| Diversifying Fixed Income | 20.50 | Dynamic Credit, | ||||

| Emerging Markets Bond, | ||||||

| Floating Rate, | ||||||

| High Yield, | ||||||

| U.S. Limited Duration TIPS Index, | ||||||

| U.S. Treasury Long-Term Index, and/or | ||||||

| U.S. Treasury Money | ||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2030) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2030 Fund | |||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | ||||

| Equity | 64.99 | % | Hedged Equity | 3.25 | % | Hedged Equity | |

| Inflation Focused | 3.25 | Real Assets | |||||

| International Developed Markets | 14.91 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 2.64 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 33.26 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 4.09 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 3.59 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 34.99 | Core Fixed Income | 21.00 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 13.99 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2035) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

Retirement Blend 2035 Fund

| Asset Class | Sector(s) | Neutral Allocation |

Underlying Fund(s) | ||||

| Equity | 77.00 | % | Hedged Equity | 0.00 | % | Hedged Equity | |

| Inflation Focused | 3.85 | Real Assets | |||||

| International Developed Markets | 18.65 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 3.30 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 41.60 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 5.12 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 4.48 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 22.99 | Core Fixed Income | 16.10 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 6.89 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2040) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2040 Fund | ||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | |||

| Equity | 87.02 | % | Hedged Equity | 0.00 | % | Hedged Equity |

| Inflation Focused | 4.35 | Real Assets | ||||

| International Developed Markets | 21.09 | International Equity Index, | ||||

| International Stock, and/or | ||||||

| International Value Equity | ||||||

| International Emerging Markets | 3.72 | Emerging Markets Discovery Stock and/or | ||||

| Emerging Markets Stock | ||||||

| U.S. Large-Cap | 47.00 | Equity Index 500, | ||||

| Growth Stock, and/or | ||||||

| Value | ||||||

| U.S. Mid-Cap | 5.79 | Mid-Cap Growth, | ||||

| Mid-Cap Index, and/or | ||||||

| Mid-Cap Value | ||||||

| U.S. Small-Cap | 5.07 | New Horizons, | ||||

| Small-Cap Index, and/or | ||||||

| Small-Cap Value | ||||||

| Fixed Income | 13.00 | Core Fixed Income | 9.10 | Dynamic Global Bond, | ||

| International Bond (USD Hedged), and/or | ||||||

| QM U.S. Bond Index | ||||||

| Diversifying Fixed Income | 3.90 | Dynamic Credit, | ||||

| Emerging Markets Bond, | ||||||

| Floating Rate, | ||||||

| High Yield, | ||||||

| U.S. Limited Duration TIPS Index, | ||||||

| U.S. Treasury Long-Term Index, and/or | ||||||

| U.S. Treasury Money | ||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2045) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2045 Fund | |||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | ||||

| Equity | 95.00 | % | Hedged Equity | 0.00 | % | Hedged Equity | |

| Inflation Focused | 4.75 | Real Assets | |||||

| International Developed Markets | 23.01 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 4.06 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 51.34 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 6.32 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 5.52 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 5.00 | Core Fixed Income | 3.50 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 1.50 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date. The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2050) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

Retirement Blend 2050 Fund

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | |||

| Equity | 96.99 | % | Hedged Equity | 0.00 | % | Hedged Equity |

| Inflation Focused | 4.85 | Real Assets | ||||

| International Developed Markets | 23.50 | International Equity Index, | ||||

| International Stock, and/or | ||||||

| International Value Equity | ||||||

| International Emerging Markets | 4.14 | Emerging Markets Discovery Stock and/or | ||||

| Emerging Markets Stock | ||||||

| U.S. Large-Cap | 52.41 | Equity Index 500, | ||||

| Growth Stock, and/or | ||||||

| Value | ||||||

| U.S. Mid-Cap | 6.45 | Mid-Cap Growth, | ||||

| Mid-Cap Index, and/or | ||||||

| Mid-Cap Value | ||||||

| U.S. Small-Cap | 5.64 | New Horizons, | ||||

| Small-Cap Index, and/or | ||||||

| Small-Cap Value | ||||||

| Fixed Income | 3.00 | Core Fixed Income | 2.10 | Dynamic Global Bond, | ||

| International Bond (USD Hedged), and/or | ||||||

| QM U.S. Bond Index | ||||||

| Diversifying Fixed Income | 0.90 | Dynamic Credit, | ||||

| Emerging Markets Bond, | ||||||

| Floating Rate, | ||||||

| High Yield, | ||||||

| U.S. Limited Duration TIPS Index, | ||||||

| U.S. Treasury Long-Term Index, and/or | ||||||

| U.S. Treasury Money | ||||||

Principal Risks

As with any fund, there is no guarantee that the fund will achieve its objective(s). The fund’s share price fluctuates, which means you could lose money by investing in the fund. You may experience losses, including losses near, at, or after the target retirement date. There is no guarantee that the fund will provide adequate income at and through your retirement. The principal risks of investing in this fund, which may be even greater in bad or uncertain market conditions, are summarized as follows:

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2055) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.

The following table illustrates how the portfolio is generally expected to be allocated between the broad asset classes and the underlying T. Rowe Price mutual funds that are used to represent those asset classes and specific sectors. The fund invests in underlying funds that do not charge a management fee or in Z Class shares of an underlying fund when it is available. T. Rowe Price is contractually obligated to waive and/or bear all of the Z Class’ expenses, with certain limited exceptions. The fund’s overall allocation to equity is represented by a diversified mix of U.S. and international equity funds that employ both growth and value investment approaches and consist of large-cap, mid-cap, and small-cap stocks. The fund’s overall allocation to fixed income is represented by a “core” fixed income component designed to have lower overall volatility and a “diversifying” fixed income component designed to respond to a variety of market conditions and improve risk adjusted returns. The information in the table represents the neutral allocations for the fund as of August 1, 2025. The numbers may not add to 100% due to rounding. Updated allocations between equity funds and fixed income funds, and actual allocations to each underlying T. Rowe Price mutual fund, are available through troweprice.com. T. Rowe Price may periodically rebalance or modify the asset mix of the underlying funds and change the underlying fund allocations.

| Retirement Blend 2055 Fund | |||||||

| Asset Class | Sector(s) | Neutral Allocation | Underlying Fund(s) | ||||

| Equity | 98.02 | % | Hedged Equity | 0.00 | % | Hedged Equity | |

| Inflation Focused | 4.90 | Real Assets | |||||

| International Developed Markets | 23.74 | International Equity Index, | |||||

| International Stock, and/or | |||||||

| International Value Equity | |||||||

| International Emerging Markets | 4.20 | Emerging Markets Discovery Stock and/or | |||||

| Emerging Markets Stock | |||||||

| U.S. Large-Cap | 52.95 | Equity Index 500, | |||||

| Growth Stock, and/or | |||||||

| Value | |||||||

| U.S. Mid-Cap | 6.52 | Mid-Cap Growth, | |||||

| Mid-Cap Index, and/or | |||||||

| Mid-Cap Value | |||||||

| U.S. Small-Cap | 5.71 | New Horizons, | |||||

| Small-Cap Index, and/or | |||||||

| Small-Cap Value | |||||||

| Fixed Income | 2.00 | Core Fixed Income | 1.40 | Dynamic Global Bond, | |||

| International Bond (USD Hedged), and/or | |||||||

| QM U.S. Bond Index | |||||||

| Diversifying Fixed Income | 0.60 | Dynamic Credit, | |||||

| Emerging Markets Bond, | |||||||

| Floating Rate, | |||||||

| High Yield, | |||||||

| U.S. Limited Duration TIPS Index, | |||||||

| U.S. Treasury Long-Term Index, and/or | |||||||

| U.S. Treasury Money | |||||||

The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price equity and fixed income mutual funds that represent various asset classes and sectors. The fund’s allocations among underlying T. Rowe Price mutual funds will change over time in relation to the fund’s target retirement date.

The fund invests in a mix of both actively managed funds and passively managed index funds, which is an approach designed to reduce tracking error and result in lower overall fees in comparison to actively managed target date funds.

The fund is managed based on the specific retirement year (target date 2060) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement. However, if an investor retires earlier or later than age 65, the fund may not be an appropriate investment even if the investor retires on or near the fund’s target date.

Over time, the fund’s allocations to the broad asset classes (“Equity” and “Fixed Income”), and to the sectors and underlying funds used to represent those asset classes, will change according to a predetermined “glide path” shown in the following chart (the left axis indicates the overall neutral allocation to equity funds with the remainder of the allocation to fixed income funds). Equity allocations generally consist of investments in underlying funds that focus on stocks, and fixed income allocations generally consist of investments in underlying funds that focus on bonds and other debt instruments. The glide path represents the shifting of asset classes over time and shows how the fund’s asset mix becomes more conservative–both prior to and after retirement–as time elapses. This reflects the need for reduced market risks as retirement approaches and the need for lower portfolio volatility after retiring. Although the glide path is meant to dampen the fund’s potential volatility as retirement approaches, the fund is not designed for a lump sum redemption at the retirement date. The fund pursues an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. After the target date, the fund is designed to balance longevity and inflation risks along with the need for some income, although it does not guarantee a particular level of income.

RETIREMENT BLEND FUNDS

At the target date, the glide path provides for a neutral allocation to equity of 55%. The fund’s overall exposure to equity will continue to decline until approximately 30 years after its target date, when its neutral allocations to equity and fixed income will remain unchanged. There are no maturity restrictions within the fund’s overall allocation to fixed income, although the underlying fixed income funds in which the fund invests may impose specific limits on maturity or credit quality. The allocations are referred to as “neutral” allocations because they do not reflect any tactical decisions made by T. Rowe Price to overweight or underweight a particular asset class or sector based on its market outlook. The target allocations assigned to the broad asset classes (Equity and Fixed Income), which reflect any tactical decisions resulting from market outlook, are not expected to vary from the neutral allocations set forth in the glide path by more than plus or minus 5%. The target allocations and actual allocations may differ due to significant market movements or cash flows.