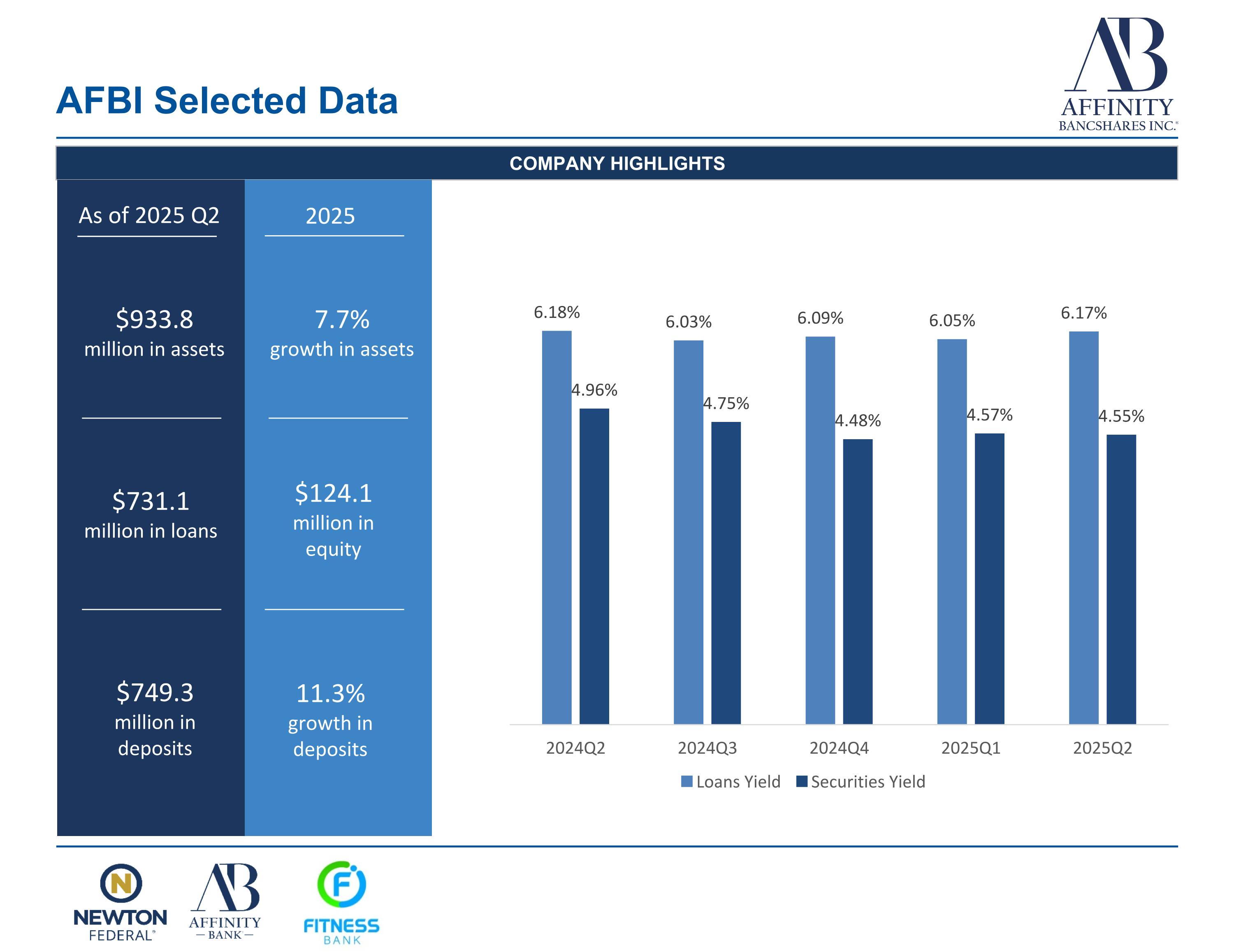

AFBI Selected Data COMPANY HIGHLIGHTS $933.8 million in assets $731.1 million in loans $749.3 million in deposits 7.7% growth in assets 11.3% growth in deposits $124.1 million in equity As of 2025 Q2 2025

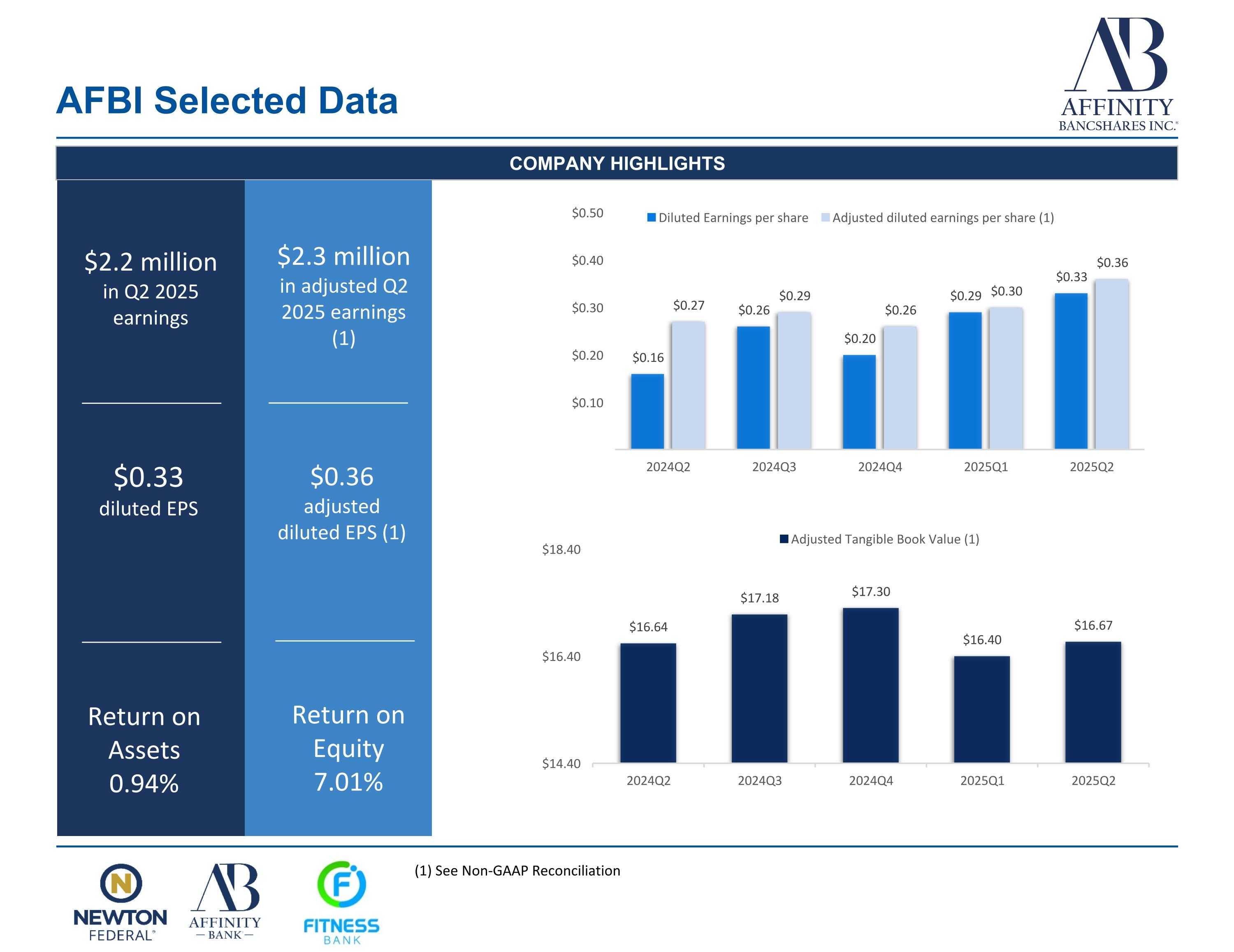

AFBI Selected Data COMPANY HIGHLIGHTS $2.3 million in adjusted Q2 2025 earnings (1) $2.2 million in Q2 2025 earnings $0.33 diluted EPS (1) See Non-GAAP Reconciliation $0.36 adjusted diluted EPS (1) Return on Assets 0.94% Return on Equity 7.01%

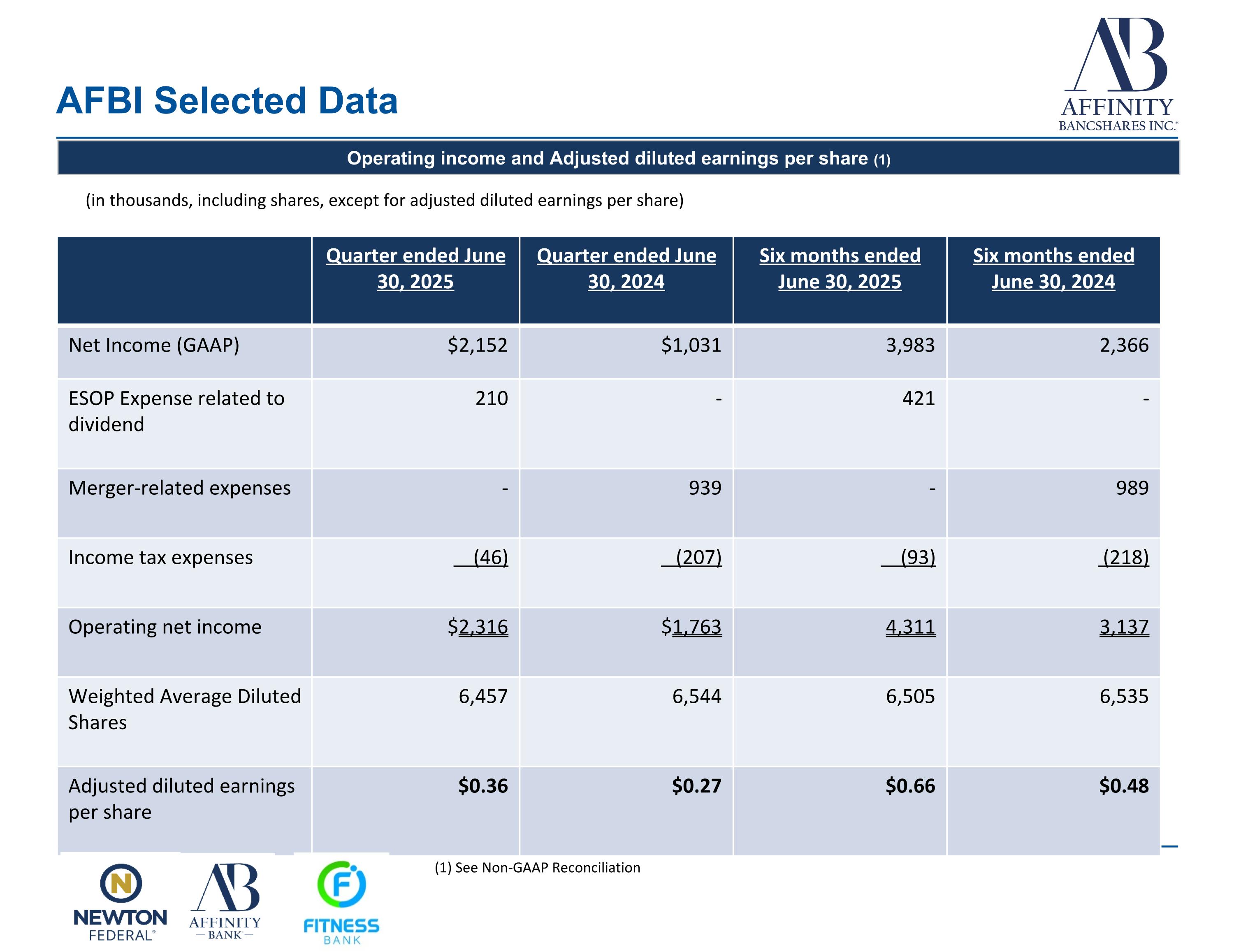

AFBI Selected Data Operating income and Adjusted diluted earnings per share (1) Quarter ended June 30, 2025 Quarter ended June 30, 2024 Six months ended June 30, 2025 Six months ended June 30, 2024 Net Income (GAAP) $2,152 $1,031 3,983 2,366 ESOP Expense related to dividend 210 - 421 - Merger-related expenses - 939 - 989 Income tax expenses (46) (207) (93) (218) Operating net income $2,316 $1,763 4,311 3,137 Weighted Average Diluted Shares 6,457 6,544 6,505 6,535 Adjusted diluted earnings per share $0.36 $0.27 $0.66 $0.48 (in thousands, including shares, except for adjusted diluted earnings per share) (1) See Non-GAAP Reconciliation

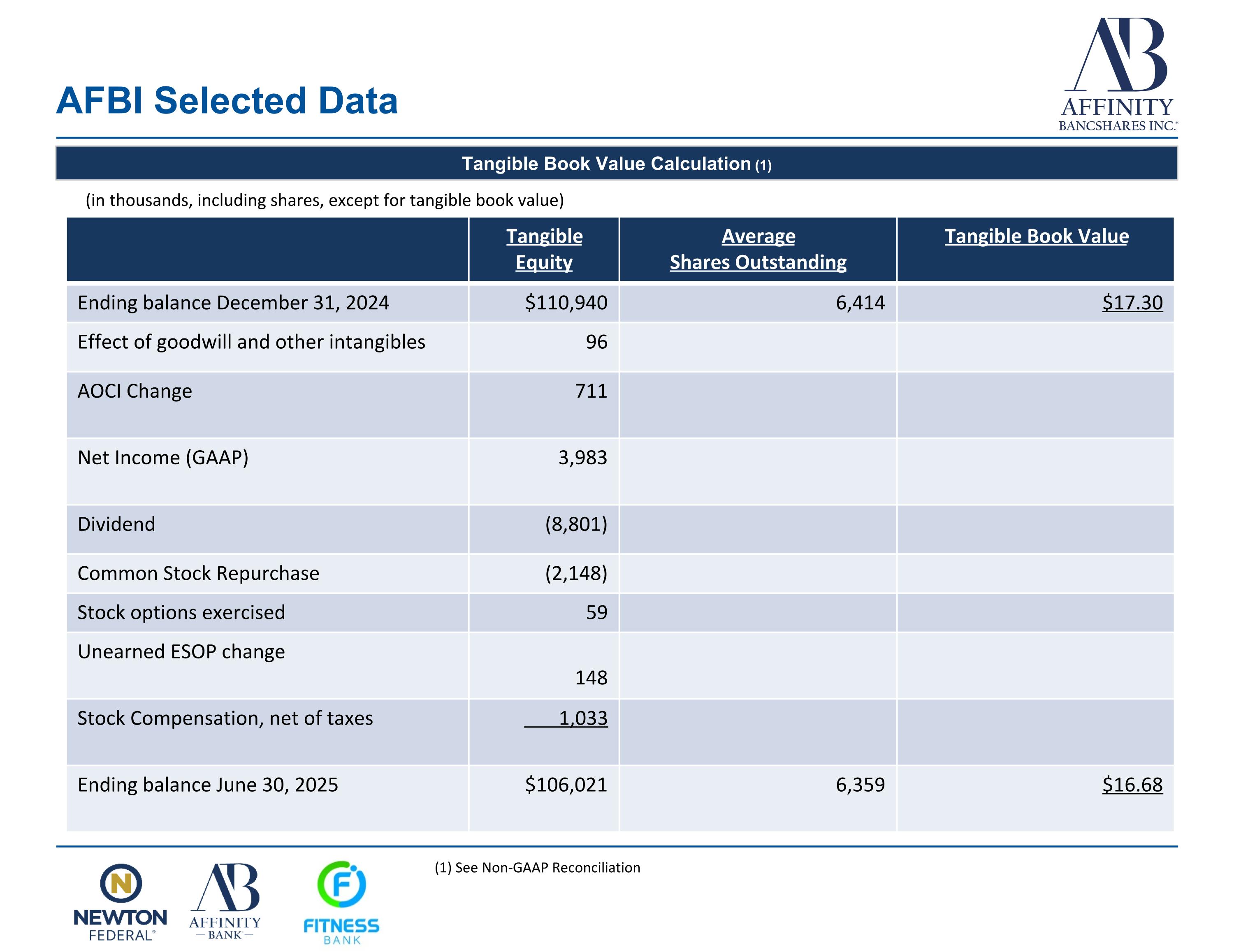

AFBI Selected Data Tangible Book Value Calculation (1) Tangible Equity Average Shares Outstanding Tangible Book Value Ending balance December 31, 2024 $110,940 6,414 $17.30 Effect of goodwill and other intangibles 96 AOCI Change 711 Net Income (GAAP) 3,983 Dividend (8,801) Common Stock Repurchase (2,148) Stock options exercised 59 Unearned ESOP change 148 Stock Compensation, net of taxes 1,033 Ending balance June 30, 2025 $106,021 6,359 $16.68 (in thousands, including shares, except for tangible book value) (1) See Non-GAAP Reconciliation

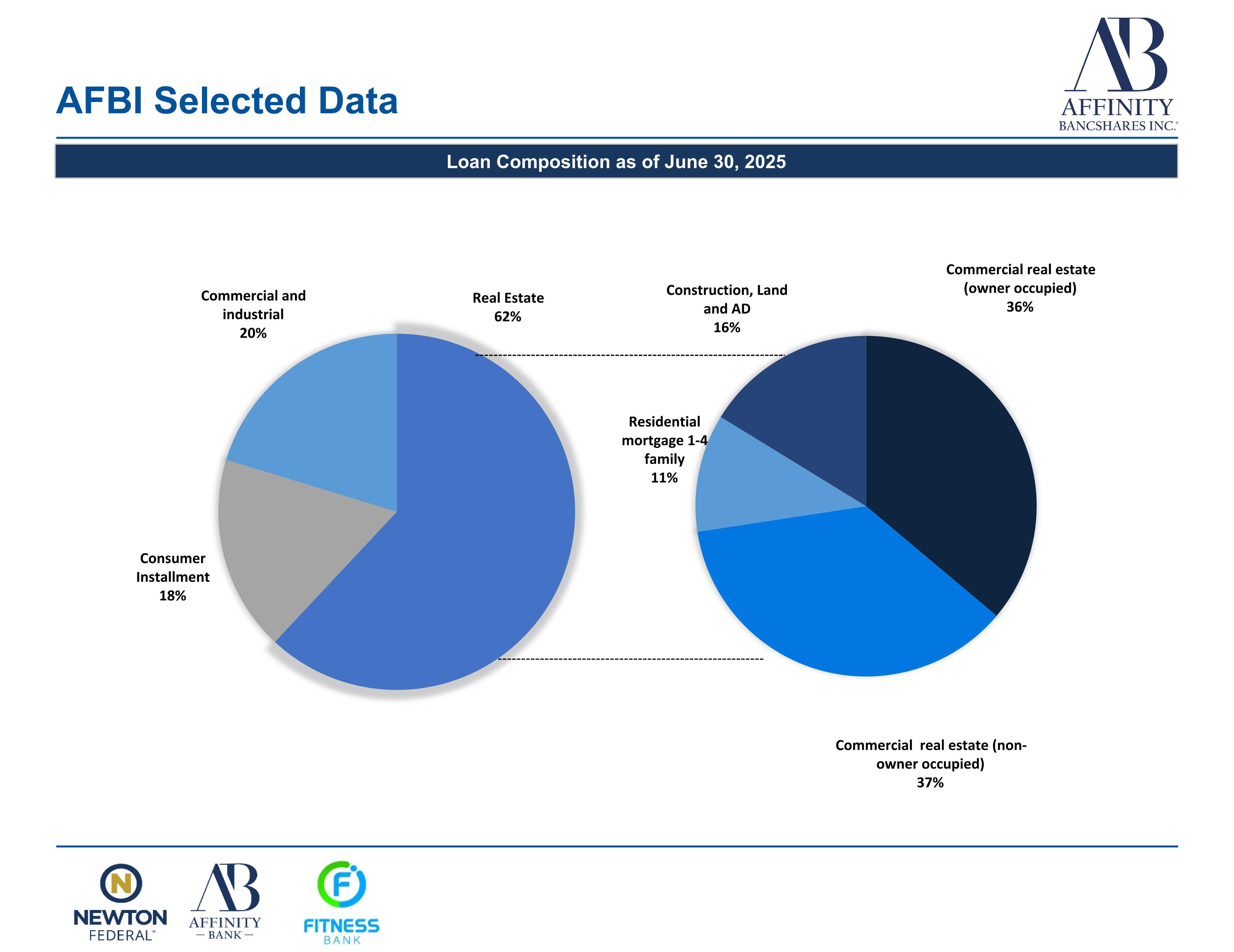

AFBI Selected Data Loan Composition as of June 30, 2025

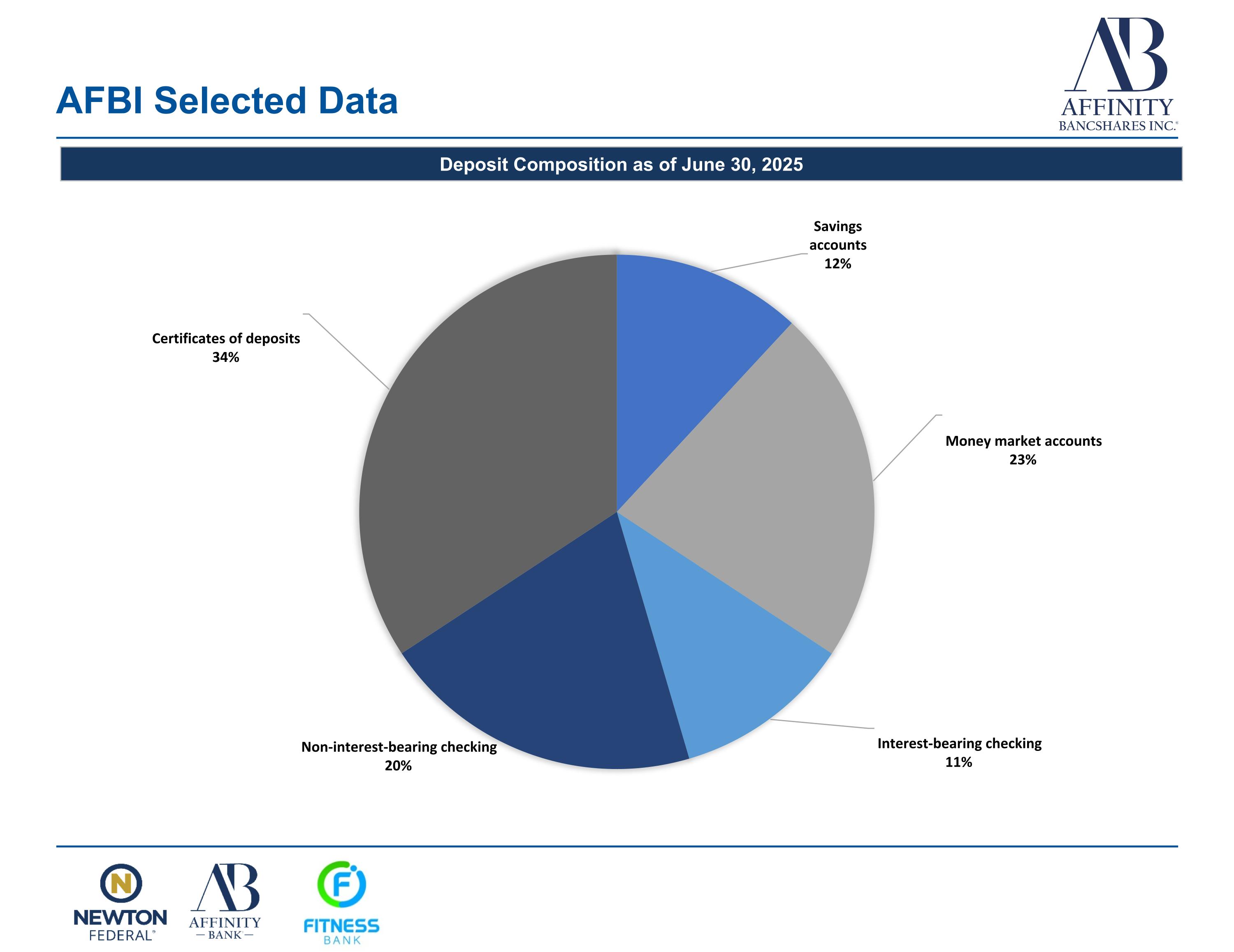

AFBI Selected Data Deposit Composition as of June 30, 2025

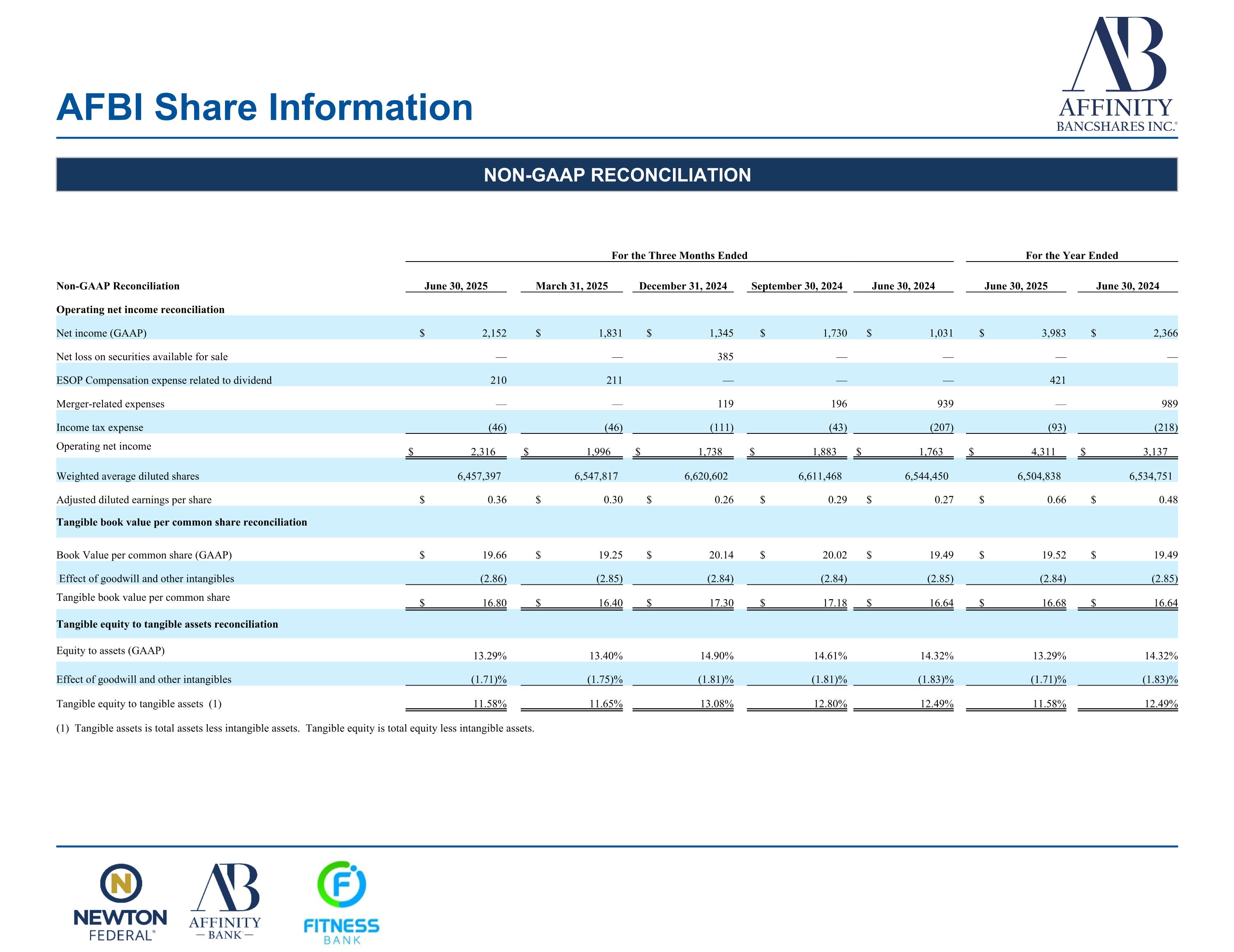

AFBI Share Information NON-GAAP RECONCILIATION For the Three Months Ended For the Year Ended Non-GAAP Reconciliation June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 June 30, 2025 June 30, 2024 Operating net income reconciliation Net income (GAAP) $ 2,152 $ 1,831 $ 1,345 $ 1,730 $ 1,031 $ 3,983 $ 2,366 Net loss on securities available for sale — — 385 — — — — ESOP Compensation expense related to dividend 210 211 — — — 421 Merger-related expenses — — 119 196 939 — 989 Income tax expense (46) (46) (111) (43) (207) (93) (218) Operating net income $ 2,316 $ 1,996 $ 1,738 $ 1,883 $ 1,763 $ 4,311 $ 3,137 Weighted average diluted shares 6,457,397 6,547,817 6,620,602 6,611,468 6,544,450 6,504,838 6,534,751 Adjusted diluted earnings per share $ 0.36 $ 0.30 $ 0.26 $ 0.29 $ 0.27 $ 0.66 $ 0.48 Tangible book value per common share reconciliation Book Value per common share (GAAP) $ 19.66 $ 19.25 $ 20.14 $ 20.02 $ 19.49 $ 19.52 $ 19.49 Effect of goodwill and other intangibles (2.86) (2.85) (2.84) (2.84) (2.85) (2.84) (2.85) Tangible book value per common share $ 16.80 $ 16.40 $ 17.30 $ 17.18 $ 16.64 $ 16.68 $ 16.64 Tangible equity to tangible assets reconciliation Equity to assets (GAAP) 13.29% 13.40% 14.90% 14.61% 14.32% 13.29% 14.32% Effect of goodwill and other intangibles (1.71)% (1.75)% (1.81)% (1.81)% (1.83)% (1.71)% (1.83)% Tangible equity to tangible assets (1) 11.58% 11.65% 13.08% 12.80% 12.49% 11.58% 12.49% (1) Tangible assets is total assets less intangible assets. Tangible equity is total equity less intangible assets.