Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

JOHN HANCOCK MUNICIPAL SECURITIES TRUST

|

| Entity Central Index Key |

0000857769

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000001874 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock High Yield Municipal Bond Fund

|

| Class Name |

Class A

|

| Trading Symbol |

JHTFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock High Yield Municipal Bond Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

High Yield Municipal Bond Fund

(Class A/JHTFX) |

$89 |

0.88% |

|

| Expenses Paid, Amount |

$ 89

|

| Expense Ratio, Percent |

0.88%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

High Yield Municipal Bond Fund (Class A/JHTFX) returned 2.94% (excluding sales charges) for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve. The outperformance of high-yield bonds within the municipal market was another key factor during the period.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

Special tax municipal bonds | The fund benefited from holdings of special tax bonds funding land development projects.

Education-related municipal bonds | Bonds funding charter schools and higher education contributed the most in this sector.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | The fund’s position in municipal bonds maturing in 10 or more years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

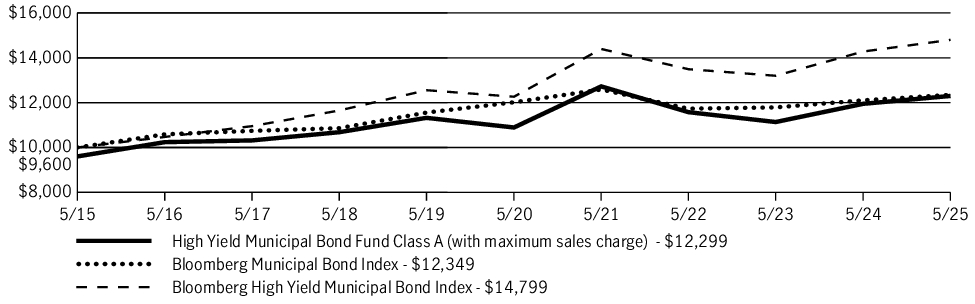

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| High Yield Municipal Bond Fund (Class A/JHTFX) |

(1.12)% |

1.61% |

2.09% |

| High Yield Municipal Bond Fund (Class A/JHTFX)—excluding sales charge |

2.94% |

2.46% |

2.51% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

| Bloomberg High Yield Municipal Bond Index |

3.64% |

3.83% |

4.00% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 336,882,048

|

| Holdings Count | Holding |

374

|

| Advisory Fees Paid, Amount |

$ 1,038,687

|

| Investment Company Portfolio Turnover |

34.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$336,882,048 |

| Total number of portfolio holdings |

374 |

| Total advisory fees paid (net) |

$1,038,687 |

| Portfolio turnover rate |

34% |

|

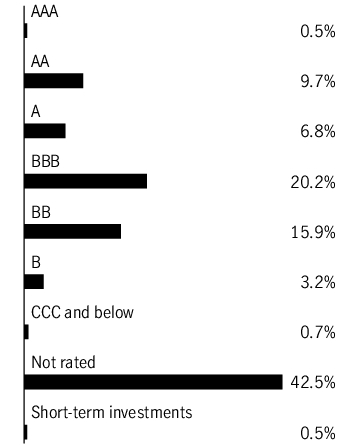

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total investments of the fund.

Portfolio Composition

| General obligation bonds |

11.3% |

| Revenue bonds |

87.6% |

| Health care |

20.2% |

| Education |

16.6% |

| Development |

16.1% |

| Other revenue |

10.4% |

| Airport |

8.9% |

| Tobacco |

6.1% |

| Housing |

3.4% |

| Transportation |

3.0% |

| Facilities |

1.2% |

| Pollution |

1.1% |

| Water and sewer |

0.4% |

| Utilities |

0.2% |

| Corporate bonds |

0.6% |

| Short-term investments |

0.5% |

|

|

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000001876 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock High Yield Municipal Bond Fund

|

| Class Name |

Class C

|

| Trading Symbol |

JCTFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock High Yield Municipal Bond Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

High Yield Municipal Bond Fund

(Class C/JCTFX) |

$165 |

1.63% |

|

| Expenses Paid, Amount |

$ 165

|

| Expense Ratio, Percent |

1.63%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

High Yield Municipal Bond Fund (Class C/JCTFX) returned 2.17% (excluding sales charges) for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve. The outperformance of high-yield bonds within the municipal market was another key factor during the period.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

Special tax municipal bonds | The fund benefited from holdings of special tax bonds funding land development projects.

Education-related municipal bonds | Bonds funding charter schools and higher education contributed the most in this sector.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | The fund’s position in municipal bonds maturing in 10 or more years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

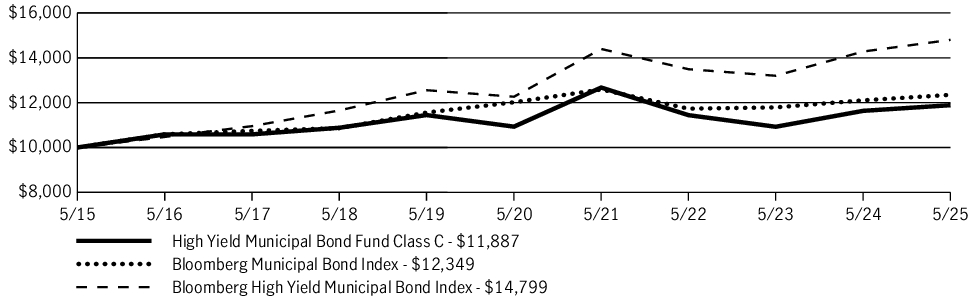

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| High Yield Municipal Bond Fund (Class C/JCTFX) |

1.19% |

1.69% |

1.74% |

| High Yield Municipal Bond Fund (Class C/JCTFX)—excluding sales charge |

2.17% |

1.69% |

1.74% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

| Bloomberg High Yield Municipal Bond Index |

3.64% |

3.83% |

4.00% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 336,882,048

|

| Holdings Count | Holding |

374

|

| Advisory Fees Paid, Amount |

$ 1,038,687

|

| Investment Company Portfolio Turnover |

34.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$336,882,048 |

| Total number of portfolio holdings |

374 |

| Total advisory fees paid (net) |

$1,038,687 |

| Portfolio turnover rate |

34% |

|

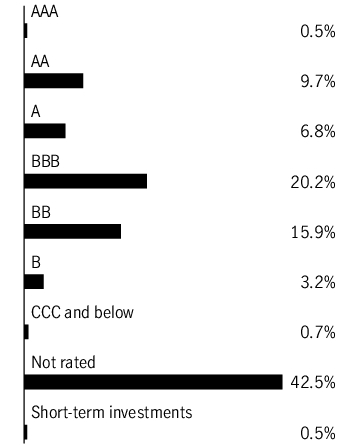

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total investments of the fund.

Portfolio Composition

| General obligation bonds |

11.3% |

| Revenue bonds |

87.6% |

| Health care |

20.2% |

| Education |

16.6% |

| Development |

16.1% |

| Other revenue |

10.4% |

| Airport |

8.9% |

| Tobacco |

6.1% |

| Housing |

3.4% |

| Transportation |

3.0% |

| Facilities |

1.2% |

| Pollution |

1.1% |

| Water and sewer |

0.4% |

| Utilities |

0.2% |

| Corporate bonds |

0.6% |

| Short-term investments |

0.5% |

|

|

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000193018 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock High Yield Municipal Bond Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

JCTRX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock High Yield Municipal Bond Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

High Yield Municipal Bond Fund

(Class R6/JCTRX) |

$69 |

0.68% |

|

| Expenses Paid, Amount |

$ 69

|

| Expense Ratio, Percent |

0.68%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

High Yield Municipal Bond Fund (Class R6/JCTRX) returned 3.31% for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve. The outperformance of high-yield bonds within the municipal market was another key factor during the period.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

Special tax municipal bonds | The fund benefited from holdings of special tax bonds funding land development projects.

Education-related municipal bonds | Bonds funding charter schools and higher education contributed the most in this sector.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | The fund’s position in municipal bonds maturing in 10 or more years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

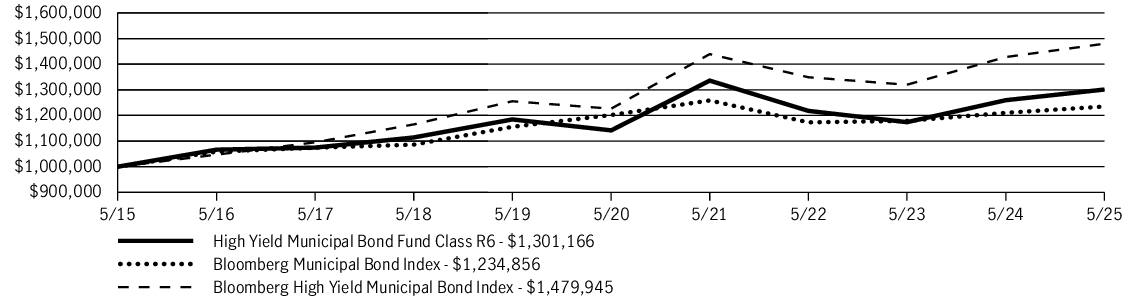

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $1,000,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $1,000,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| High Yield Municipal Bond Fund (Class R6/JCTRX) |

3.31% |

2.65% |

2.67% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

| Bloomberg High Yield Municipal Bond Index |

3.64% |

3.83% |

4.00% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 336,882,048

|

| Holdings Count | Holding |

374

|

| Advisory Fees Paid, Amount |

$ 1,038,687

|

| Investment Company Portfolio Turnover |

34.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$336,882,048 |

| Total number of portfolio holdings |

374 |

| Total advisory fees paid (net) |

$1,038,687 |

| Portfolio turnover rate |

34% |

|

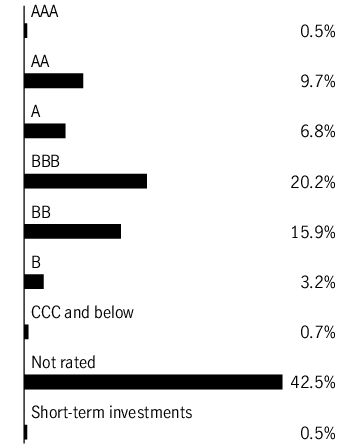

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the fund, representing a percentage of the total investments of the fund. Portfolio Composition

| General obligation bonds |

11.3% |

| Revenue bonds |

87.6% |

| Health care |

20.2% |

| Education |

16.6% |

| Development |

16.1% |

| Other revenue |

10.4% |

| Airport |

8.9% |

| Tobacco |

6.1% |

| Housing |

3.4% |

| Transportation |

3.0% |

| Facilities |

1.2% |

| Pollution |

1.1% |

| Water and sewer |

0.4% |

| Utilities |

0.2% |

| Corporate bonds |

0.6% |

| Short-term investments |

0.5% |

|

|

Quality Composition Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any. Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000178765 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock High Yield Municipal Bond Fund

|

| Class Name |

Class I

|

| Trading Symbol |

JHYMX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock High Yield Municipal Bond Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

High Yield Municipal Bond Fund

(Class I/JHYMX) |

$75 |

0.74% |

|

| Expenses Paid, Amount |

$ 75

|

| Expense Ratio, Percent |

0.74%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

High Yield Municipal Bond Fund (Class I/JHYMX) returned 3.09% for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve. The outperformance of high-yield bonds within the municipal market was another key factor during the period.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

Special tax municipal bonds | The fund benefited from holdings of special tax bonds funding land development projects.

Education-related municipal bonds | Bonds funding charter schools and higher education contributed the most in this sector.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | The fund’s position in municipal bonds maturing in 10 or more years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $250,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $250,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| High Yield Municipal Bond Fund (Class I/JHYMX) |

3.09% |

2.62% |

2.65% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

| Bloomberg High Yield Municipal Bond Index |

3.64% |

3.83% |

4.00% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 336,882,048

|

| Holdings Count | Holding |

374

|

| Advisory Fees Paid, Amount |

$ 1,038,687

|

| Investment Company Portfolio Turnover |

34.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$336,882,048 |

| Total number of portfolio holdings |

374 |

| Total advisory fees paid (net) |

$1,038,687 |

| Portfolio turnover rate |

34% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total investments of the fund.

Portfolio Composition

| General obligation bonds |

11.3% |

| Revenue bonds |

87.6% |

| Health care |

20.2% |

| Education |

16.6% |

| Development |

16.1% |

| Other revenue |

10.4% |

| Airport |

8.9% |

| Tobacco |

6.1% |

| Housing |

3.4% |

| Transportation |

3.0% |

| Facilities |

1.2% |

| Pollution |

1.1% |

| Water and sewer |

0.4% |

| Utilities |

0.2% |

| Corporate bonds |

0.6% |

| Short-term investments |

0.5% |

|

|

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.45% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000001877 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Municipal Opportunities Fund

|

| Class Name |

Class A

|

| Trading Symbol |

TAMBX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Municipal Opportunities Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Municipal Opportunities Fund

(Class A/TAMBX) |

$74 |

0.73% |

|

| Expenses Paid, Amount |

$ 74

|

| Expense Ratio, Percent |

0.73%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Municipal Opportunities Fund (Class A/TAMBX) returned 2.55% (excluding sales charges) for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

High-yield municipal bonds | The fund’s allocation in high-yield securities aided fund performance as high-yield bonds outperformed investment-grade securities.

Leasing-related municipal bonds | The fund’s holdings of bonds that finance leased equipment or facilities contributed positively to performance.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | A meaningful position in municipal bonds maturing in 10 to 20 years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

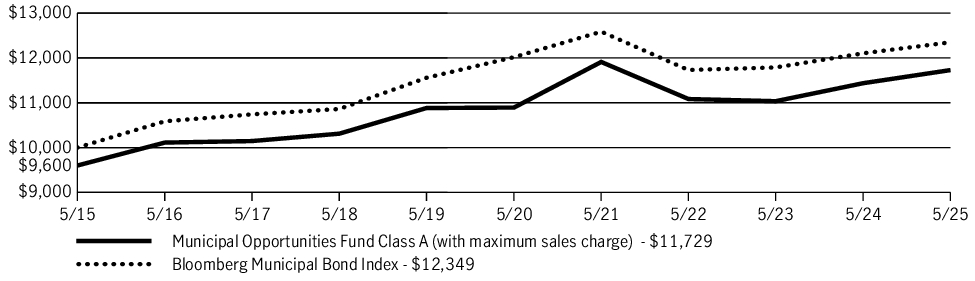

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Municipal Opportunities Fund (Class A/TAMBX) |

(1.54)% |

0.66% |

1.61% |

| Municipal Opportunities Fund (Class A/TAMBX)—excluding sales charge |

2.55% |

1.49% |

2.02% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 1,309,886,047

|

| Holdings Count | Holding |

969

|

| Advisory Fees Paid, Amount |

$ 5,679,876

|

| Investment Company Portfolio Turnover |

54.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$1,309,886,047 |

| Total number of portfolio holdings |

969 |

| Total advisory fees paid (net) |

$5,679,876 |

| Portfolio turnover rate |

54% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Portfolio Composition

| General obligation bonds |

14.0% |

| Revenue bonds |

85.2% |

| Other revenue |

20.7% |

| Health care |

19.8% |

| Education |

10.4% |

| Airport |

10.2% |

| Development |

9.1% |

| Water and sewer |

4.0% |

| Utilities |

3.6% |

| Transportation |

3.1% |

| Housing |

2.2% |

| Pollution |

1.2% |

| Tobacco |

0.6% |

| Facilities |

0.3% |

| Corporate bonds |

0.3% |

| Closed-end funds |

0.2% |

| Short-term investments and other |

0.3% |

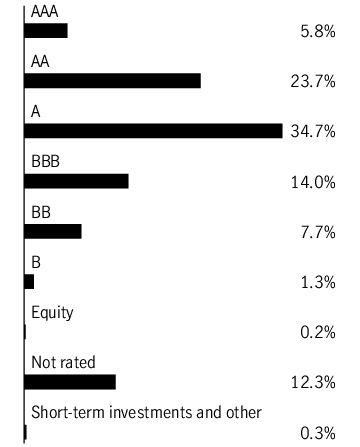

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000193019 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Municipal Opportunities Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

JTMRX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Municipal Opportunities Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Municipal Opportunities Fund

(Class R6/JTMRX) |

$53 |

0.52% |

|

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

0.52%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Municipal Opportunities Fund (Class R6/JTMRX) returned 2.65% for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

High-yield municipal bonds | The fund’s allocation in high-yield securities aided fund performance as high-yield bonds outperformed investment-grade securities.

Leasing-related municipal bonds | The fund’s holdings of bonds that finance leased equipment or facilities contributed positively to performance.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | A meaningful position in municipal bonds maturing in 10 to 20 years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

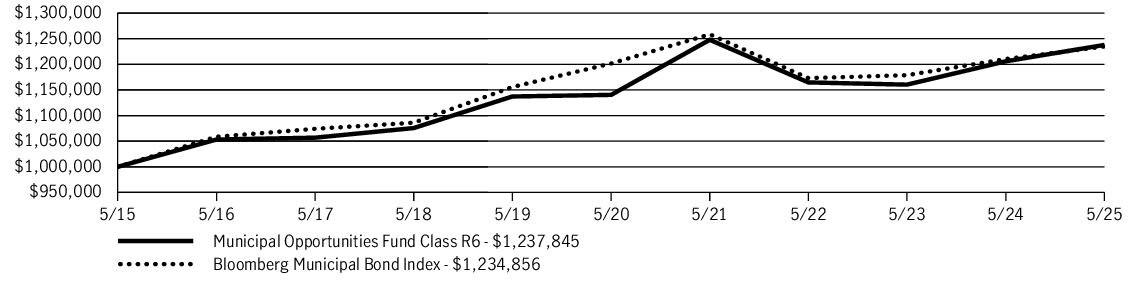

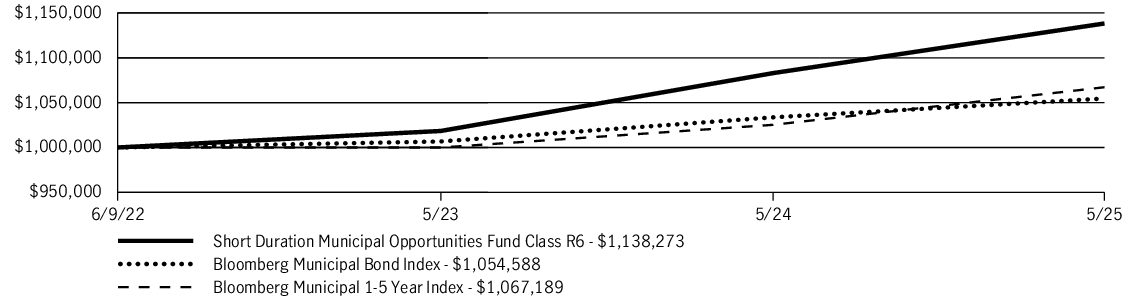

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $1,000,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $1,000,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Municipal Opportunities Fund (Class R6/JTMRX) |

2.65% |

1.65% |

2.16% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 1,309,886,047

|

| Holdings Count | Holding |

969

|

| Advisory Fees Paid, Amount |

$ 5,679,876

|

| Investment Company Portfolio Turnover |

54.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$1,309,886,047 |

| Total number of portfolio holdings |

969 |

| Total advisory fees paid (net) |

$5,679,876 |

| Portfolio turnover rate |

54% |

|

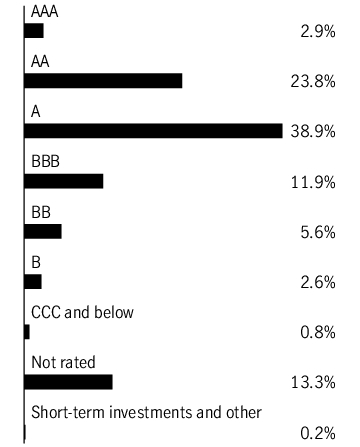

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Portfolio Composition

| General obligation bonds |

14.0% |

| Revenue bonds |

85.2% |

| Other revenue |

20.7% |

| Health care |

19.8% |

| Education |

10.4% |

| Airport |

10.2% |

| Development |

9.1% |

| Water and sewer |

4.0% |

| Utilities |

3.6% |

| Transportation |

3.1% |

| Housing |

2.2% |

| Pollution |

1.2% |

| Tobacco |

0.6% |

| Facilities |

0.3% |

| Corporate bonds |

0.3% |

| Closed-end funds |

0.2% |

| Short-term investments and other |

0.3% |

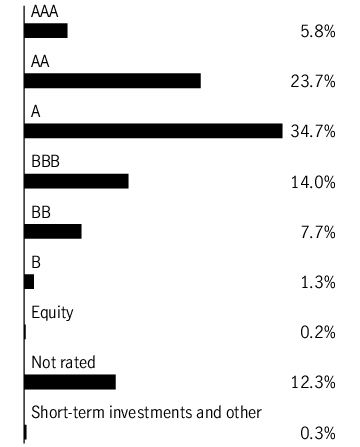

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000178766 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Municipal Opportunities Fund

|

| Class Name |

Class I

|

| Trading Symbol |

JTBDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Municipal Opportunities Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Municipal Opportunities Fund

(Class I/JTBDX) |

$59 |

0.58% |

|

| Expenses Paid, Amount |

$ 59

|

| Expense Ratio, Percent |

0.58%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Municipal Opportunities Fund (Class I/JTBDX) returned 2.71% for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

High-yield municipal bonds | The fund’s allocation in high-yield securities aided fund performance as high-yield bonds outperformed investment-grade securities.

Leasing-related municipal bonds | The fund’s holdings of bonds that finance leased equipment or facilities contributed positively to performance.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | A meaningful position in municipal bonds maturing in 10 to 20 years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

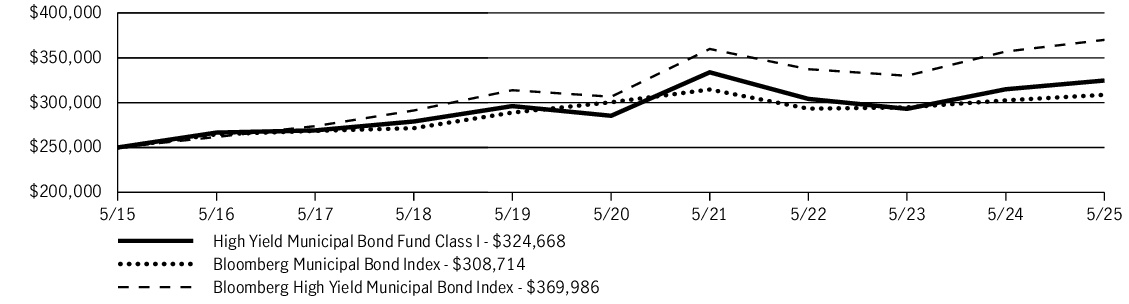

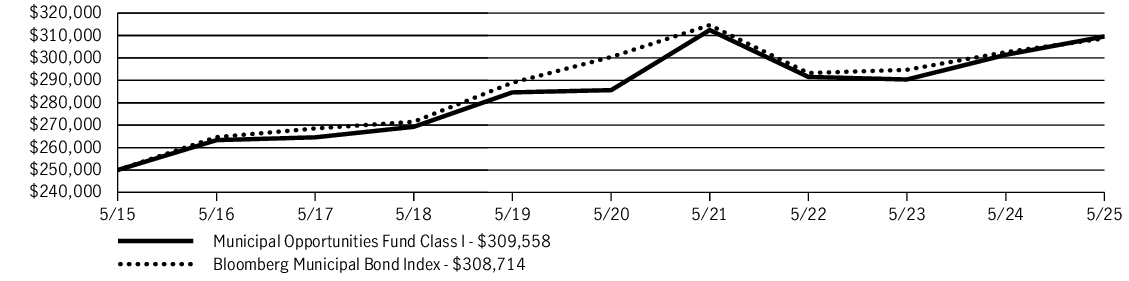

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $250,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $250,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Municipal Opportunities Fund (Class I/JTBDX) |

2.71% |

1.62% |

2.16% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 1,309,886,047

|

| Holdings Count | Holding |

969

|

| Advisory Fees Paid, Amount |

$ 5,679,876

|

| Investment Company Portfolio Turnover |

54.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$1,309,886,047 |

| Total number of portfolio holdings |

969 |

| Total advisory fees paid (net) |

$5,679,876 |

| Portfolio turnover rate |

54% |

|

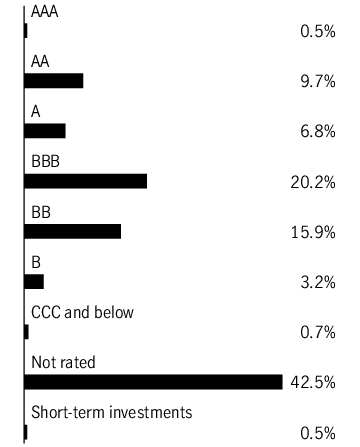

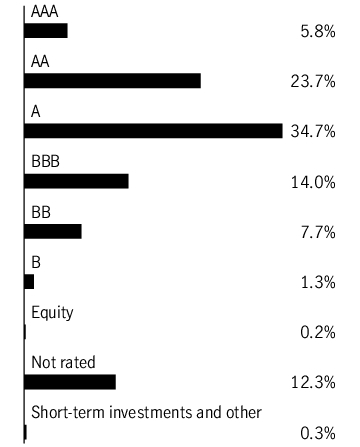

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Portfolio Composition

| General obligation bonds |

14.0% |

| Revenue bonds |

85.2% |

| Other revenue |

20.7% |

| Health care |

19.8% |

| Education |

10.4% |

| Airport |

10.2% |

| Development |

9.1% |

| Water and sewer |

4.0% |

| Utilities |

3.6% |

| Transportation |

3.1% |

| Housing |

2.2% |

| Pollution |

1.2% |

| Tobacco |

0.6% |

| Facilities |

0.3% |

| Corporate bonds |

0.3% |

| Closed-end funds |

0.2% |

| Short-term investments and other |

0.3% |

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000001879 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Municipal Opportunities Fund

|

| Class Name |

Class C

|

| Trading Symbol |

TBMBX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Municipal Opportunities Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Municipal Opportunities Fund

(Class C/TBMBX) |

$148 |

1.47% |

|

| Expenses Paid, Amount |

$ 148

|

| Expense Ratio, Percent |

1.47%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Municipal Opportunities Fund (Class C/TBMBX) returned 1.79% (excluding sales charges) for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short- and intermediate-term municipal bond yields, rising longer-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve.

TOP PERFORMANCE CONTRIBUTORS

Healthcare bonds | Bonds funding several smaller regional hospitals that were acquired by larger healthcare providers performed well during the period.

High-yield municipal bonds | The fund’s allocation in high-yield securities aided fund performance as high-yield bonds outperformed investment-grade securities.

Leasing-related municipal bonds | The fund’s holdings of bonds that finance leased equipment or facilities contributed positively to performance.

TOP PERFORMANCE DETRACTORS

Longer-term municipal bonds | A meaningful position in municipal bonds maturing in 10 to 20 years detracted from performance as this maturity sector declined.

Industrial development bonds | The fund’s holdings in this sector declined overall for the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

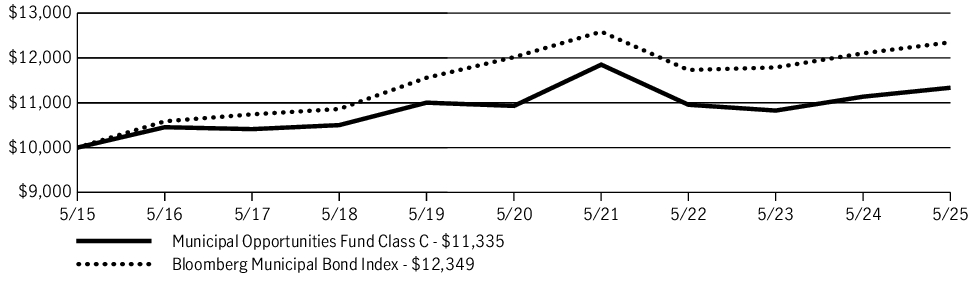

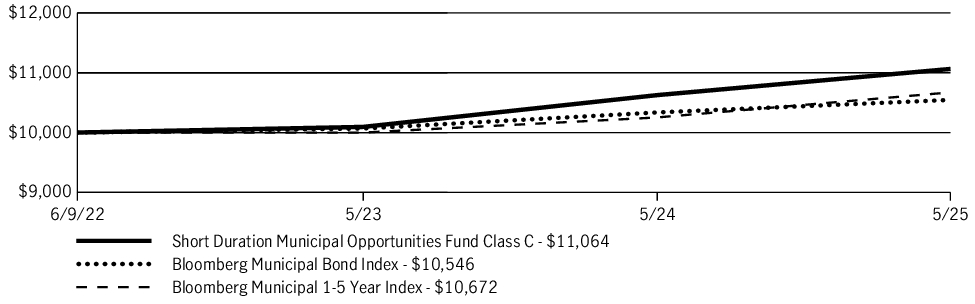

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Municipal Opportunities Fund (Class C/TBMBX) |

0.80% |

0.73% |

1.26% |

| Municipal Opportunities Fund (Class C/TBMBX)—excluding sales charge |

1.79% |

0.73% |

1.26% |

| Bloomberg Municipal Bond Index |

2.03% |

0.55% |

2.13% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 1,309,886,047

|

| Holdings Count | Holding |

969

|

| Advisory Fees Paid, Amount |

$ 5,679,876

|

| Investment Company Portfolio Turnover |

54.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$1,309,886,047 |

| Total number of portfolio holdings |

969 |

| Total advisory fees paid (net) |

$5,679,876 |

| Portfolio turnover rate |

54% |

|

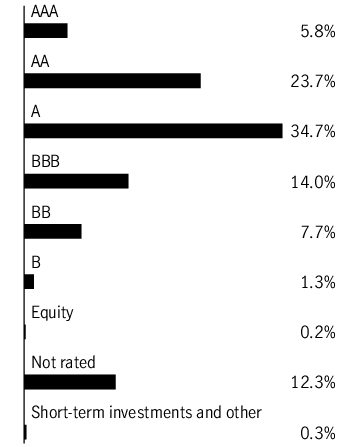

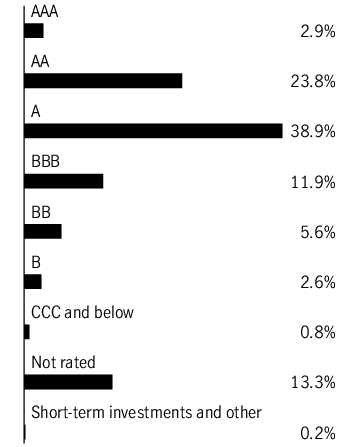

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Portfolio Composition

| General obligation bonds |

14.0% |

| Revenue bonds |

85.2% |

| Other revenue |

20.7% |

| Health care |

19.8% |

| Education |

10.4% |

| Airport |

10.2% |

| Development |

9.1% |

| Water and sewer |

4.0% |

| Utilities |

3.6% |

| Transportation |

3.1% |

| Housing |

2.2% |

| Pollution |

1.2% |

| Tobacco |

0.6% |

| Facilities |

0.3% |

| Corporate bonds |

0.3% |

| Closed-end funds |

0.2% |

| Short-term investments and other |

0.3% |

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.51% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000236446 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Short Duration Municipal Opportunities Fund

|

| Class Name |

Class A

|

| Trading Symbol |

JHSFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Short Duration Municipal Opportunities Fund (the fund) for the period of June 1, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Short Duration Municipal Opportunities Fund

(Class A/JHSFX) |

$62 |

0.61% |

|

| Expenses Paid, Amount |

$ 62

|

| Expense Ratio, Percent |

0.61%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Short Duration Municipal Opportunities Fund (Class A/JHSFX) returned 4.79% (excluding sales charges) for the year ended May 31, 2025. The most significant factors affecting fund performance during the period included declining short-term municipal bond yields, record levels of new municipal bond supply, and three short-term interest rate cuts by the U.S. Federal Reserve.

TOP PERFORMANCE CONTRIBUTORS

Duration (interest rate sensitivity) | Falling short-term municipal bond yields led to rising bond prices during the period.

Healthcare bonds | Bonds funding hospitals and continuing care retirement facilities added value.

Local general obligation (GO) bonds | The fund’s holdings among local GOs provided a boost to performance.

TOP PERFORMANCE DETRACTORS

Electric power bonds | Bonds funding municipal power utilities detracted from fund performance.

Longer-term municipal bonds | A small position in municipal bonds maturing in 5 to 10 years detracted from performance as this maturity sector declined overall during the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

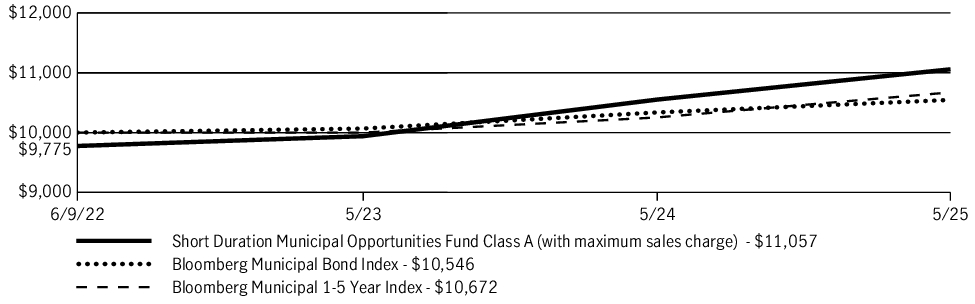

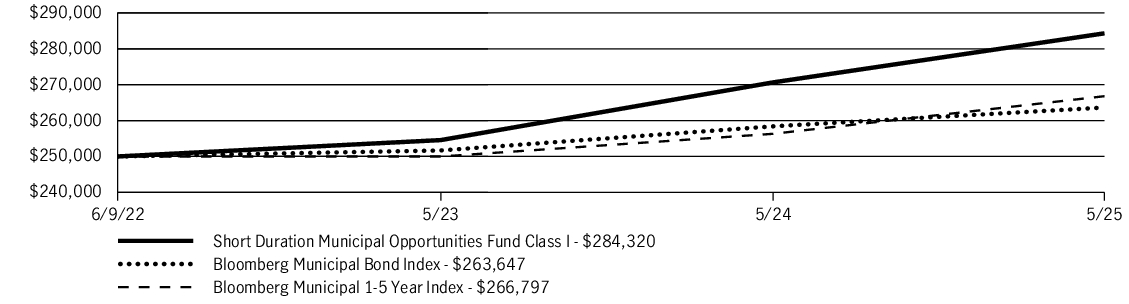

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

Since inception |

| Short Duration Municipal Opportunities Fund (Class A/JHSFX) |

2.44% |

3.43% |

| Short Duration Municipal Opportunities Fund (Class A/JHSFX)—excluding sales charge |

4.79% |

4.23% |

| Bloomberg Municipal Bond Index |

2.03% |

1.80% |

| Bloomberg Municipal 1-5 Year Index |

4.09% |

2.21% |

|

| Performance Inception Date |

Jun. 09, 2022

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Oct. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 53,794,541

|

| Holdings Count | Holding |

181

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$53,794,541 |

| Total number of portfolio holdings |

181 |

| Total advisory fees paid (net) |

$0 |

| Portfolio turnover rate |

56% |

|

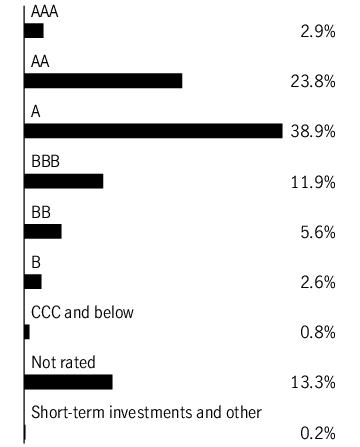

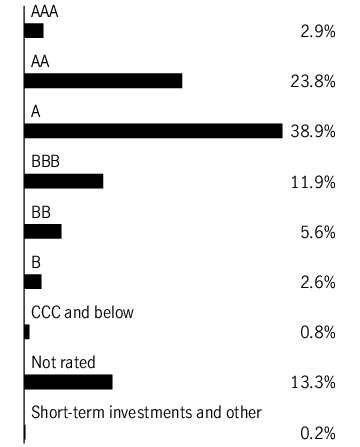

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Portfolio Composition

| General obligation bonds |

14.3% |

| Revenue bonds |

85.3% |

| Other revenue |

21.3% |

| Health care |

12.8% |

| Development |

12.1% |

| Airport |

11.9% |

| Education |

8.1% |

| Utilities |

6.3% |

| Housing |

3.9% |

| Water and sewer |

3.6% |

| Transportation |

2.8% |

| Pollution |

2.5% |

| Corporate bonds |

0.2% |

| Short-term investments and other |

0.2% |

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.39% of the fund’s average daily net assets.

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Expenses [Text Block] |

Effective October 1, 2024, the Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund in an amount equal to the amount by which expenses of the fund exceed 0.39% of the fund’s average daily net assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 6-1-24 . For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|