| C&F Financial Corporation NASDAQ: CFFI Second Quarter 2025 Investor Presentation |

| Cautionary Statements Second Quarter 2025 Investor Presentation Forward-Looking Statements. Certain statements in this presentation may constitute “forward-looking statements” within the meaning of federal securities laws. These forward-looking statements are based on the beliefs of the Corporation’s management, as well as assumptions made by, and information currently available to, the Corporation’s management, and reflect management’s current views with respect to certain events that could have an impact on the Corporation’s future financial performance. These forward-looking statements relate to expectations concerning matters that are not historical fact, may express “belief,” “intention,” “expectation,” “potential” and similar expressions, and may use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “may,” “might,” “will,” “intend,” “target,” “should,” “could,” or similar expressions. These statements are inherently uncertain, and there can be no assurance that the underlying assumptions will prove to be accurate. Actual results could differ materially from those anticipated or implied by such statements. Factors that could have a material adverse effect on the operations and future prospects of the Corporation include, but are not limited to, changes in: (1) interest rates, such as volatility in short-term interest rates or yields on U.S. Treasury bonds, increases in interest rates following actions by the Federal Reserve and increases or volatility in mortgage interest rates, (2) general business conditions, as well as conditions within the financial markets, (3) general economic conditions, including unemployment levels, inflation rates, supply chain disruptions and slowdowns in economic growth, (4) general market conditions, including disruptions due to pandemics or significant health hazards, severe weather conditions, natural disasters, terrorist activities, financial crises, political crises, changes in trade policy and the implementation of tariffs, war and other military conflicts or other major events, or the prospect of these events, (5) average loan yields and average costs of interest-bearing deposits, (6) financial services industry conditions, including bank failures or concerns involving liquidity, (7) labor market conditions, including attracting, hiring, training, motivating and retaining qualified employees, (8) the legislative/regulatory climate, regulatory initiatives with respect to financial institutions, products and services, the Consumer Financial Protection Bureau (the CFPB) and the regulatory and enforcement activities of the CFPB, (9) monetary and fiscal policies of the U.S. Government, including policies of the FDIC, U.S. Department of the Treasury and the Board of Governors of the Federal Reserve System (the Federal Reserve Board), and the effect of these policies on interest rates and business in our markets, (10) demand for financial services in the Corporation’s market areas, (11) the value of securities held in the Corporation’s investment portfolios, (12) the quality or composition of the loan portfolios and the value of the collateral securing those loans, (13) the inventory level, demand and fluctuations in the pricing of used automobiles, including sales prices of repossessed vehicles, (14) the level of automobile loan delinquencies or defaults and our ability to repossess automobiles securing delinquent automobile finance installment contracts, (15) the level of net charge-offs on loans and the adequacy of our allowance for credit losses, (16) the level of indemnification losses related to mortgage loans sold, (17) demand for loan products, (18) deposit flows, (19) the strength of the Corporation’s counterparties, (20) the availability of lines of credit from the FHLB and other counterparties, (21) the soundness of other financial institutions and any indirect exposure related to the closings of other financial institutions and their impact on the broader market through other customers, suppliers and partners, or that the conditions which resulted in the liquidity concerns experienced by closed financial institutions may also adversely impact, directly or indirectly, other financial institutions and market participants with which the Corporation has commercial or deposit relationships, (22) competition from both banks and non-banks, including competition in the non-prime automobile finance markets and marine and recreational vehicle finance markets, (23) services provided by , or the level of the Corporation’s reliance upon third parties for key services, (24) the commercial and residential real estate markets, including changes in property values, (25) the demand for residential mortgages and conditions in the secondary residential mortgage loan markets, (26) the Corporation’s technology initiatives and other strategic initiatives, (27) the Corporation’s branch expansions and consolidations plans, (28) cyber threats, attacks or events, (29) C&F Bank’s product offerings, and (30) accounting principles, policies and guidelines, and elections by the Corporation thereunder . These risks and uncertainties should be considered in evaluating the forward-looking statements contained herein, and readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation. For additional information on risk factors that could affect the forward-looking statements contained herein, see the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2024 and other reports filed with the SEC. The Corporation undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Use of Certain Non-GAAP Financial Measures. The accounting and reporting policies of the Corporation conform to GAAP in the United States and prevailing practices in the banking industry. However, certain non-GAAP measures are used by management to supplement the evaluation of the Corporation’s financial condition and performance. These include return on average tangible common equity (ROATCE), tangible common equity to tangible assets (TCE/TA), and tangible book value per share. A reconciliation of the non-GAAP financial measures used by the Corporation to evaluate and measure the Corporation’s financial condition and performance to the most directly comparable GAAP financial measures is presented in an appendix. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About C&F Financial Corporation. Additional information regarding the Corporation’s products and services, as well as access to its filings with the SEC, are available on the Corporation’s website at http://www.cffc.com. 2 |

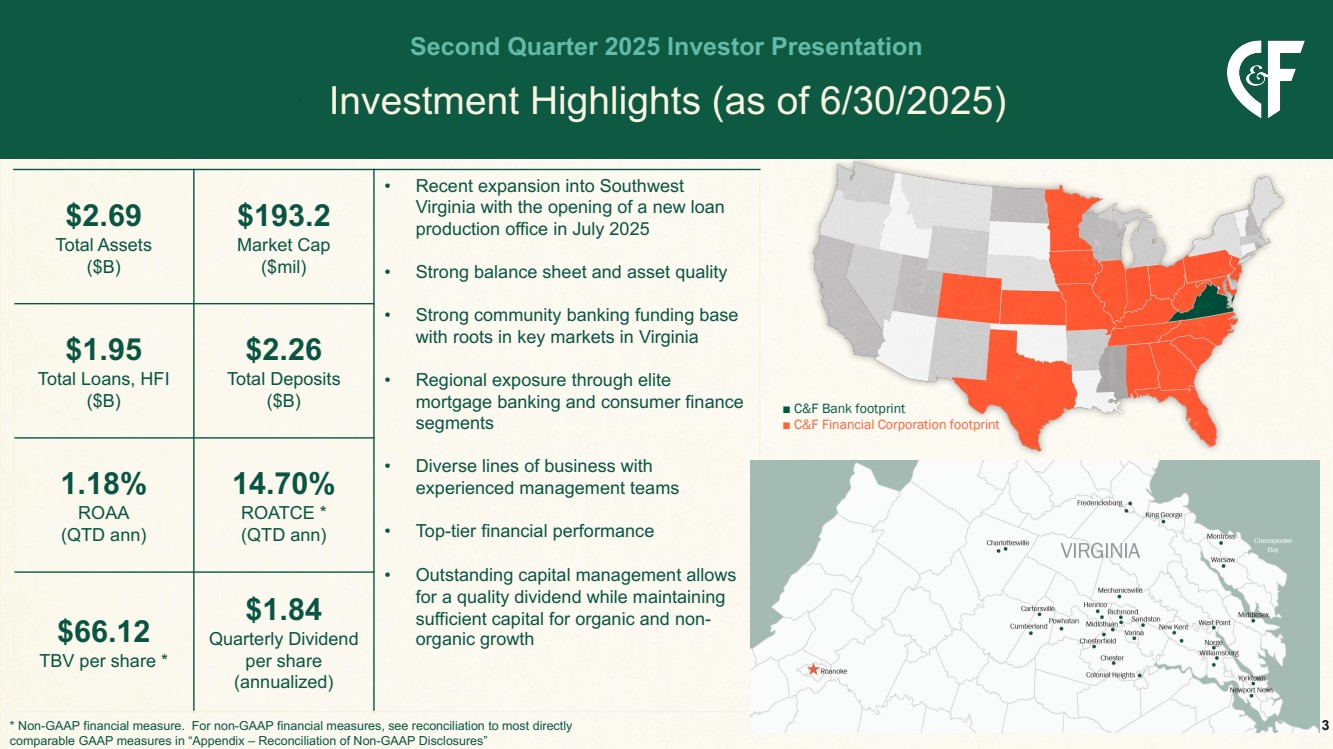

| Investment Highlights (as of 6/30/2025) Second Quarter 2025 Investor Presentation $2.69 Total Assets ($B) $193.2 Market Cap ($mil) • Recent expansion into Southwest Virginia with the opening of a new loan production office in July 2025 • Strong balance sheet and asset quality • Strong community banking funding base with roots in key markets in Virginia • Regional exposure through elite mortgage banking and consumer finance segments • Diverse lines of business with experienced management teams • Top-tier financial performance • Outstanding capital management allows for a quality dividend while maintaining sufficient capital for organic and non-organic growth $1.95 Total Loans, HFI ($B) $2.26 Total Deposits ($B) 1.18% ROAA (QTD ann) 14.70% ROATCE * (QTD ann) $66.12 TBV per share * $1.84 Quarterly Dividend per share (annualized) ■ C&F Bank footprint ■ C&F Financial Corporation footprint * Non-GAAP financial measure. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” 3 |

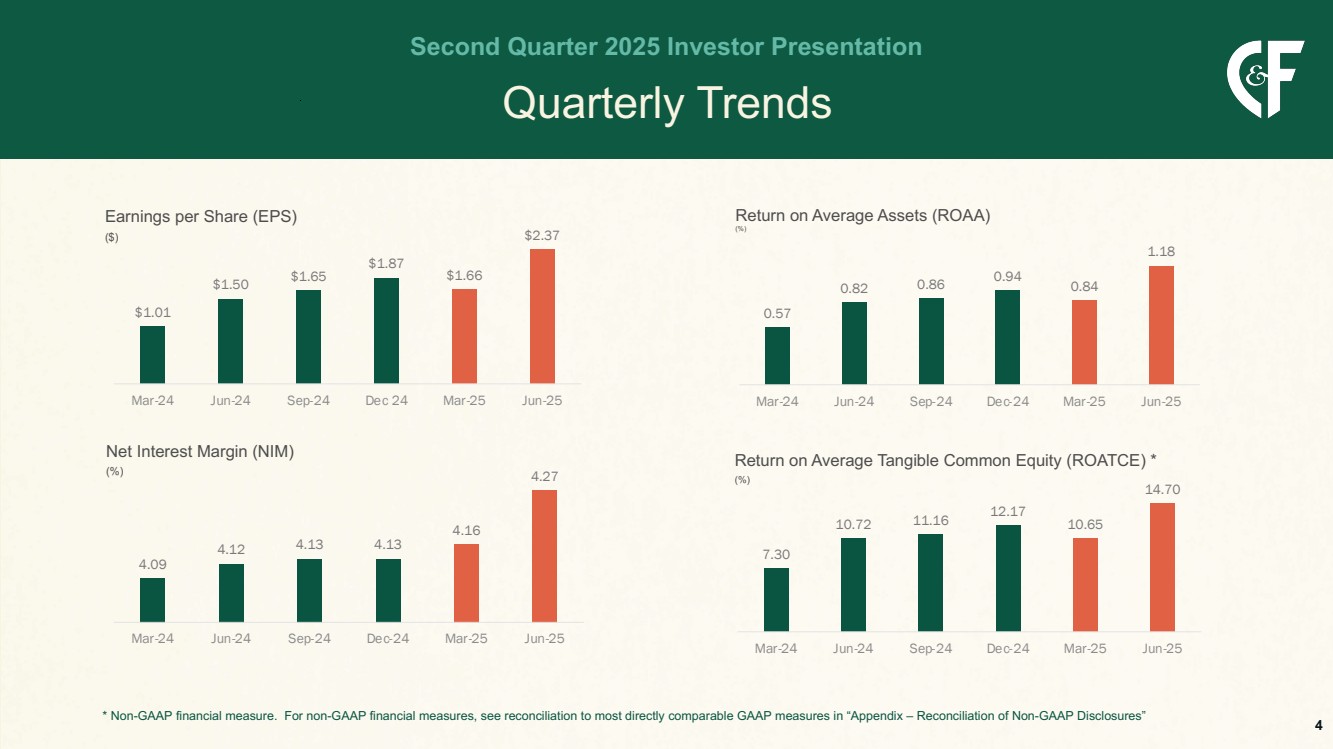

| Quarterly Trends Second Quarter 2025 Investor Presentation * Non-GAAP financial measure. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” Earnings per Share (EPS) ($) $1.01 $1.50 $1.65 $1.87 $1.66 $2.37 Mar-24 Jun-24 Sep-24 Dec 24 Mar-25 Jun-25 Return on Average Assets (ROAA) (%) 0.57 0.82 0.86 0.94 0.84 1.18 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Net Interest Margin (NIM) (%) 4.09 4.12 4.13 4.13 4.16 4.27 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Return on Average Tangible Common Equity (ROATCE) * (%) 7.30 10.72 11.16 12.17 10.65 14.70 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 4 |

| Our Executive Leadership Second Quarter 2025 Investor Presentation • President of C&F Bank • 25+ years in leadership at C&F • 30+ years in financial services industry including leadership experience with the Virginia Bankers Association and PricewaterhouseCoopers Thomas F. Cherry President & CEO C&F Financial Corporation Age: 56 • 10+ years in leadership at C&F • 20+ years in financial services industry including leadership experience with the financial services group at Yount, Hyde, & Barbour, CPA Jason E. Long EVP & CFO C&F Financial Corporation Age: 45 • 15+ years in leadership with C&F Finance Company • 30+ years in indirect auto lending business including leadership experience with Ally Financial and United Auto Credit • 10+ years as member of the American Financial Services Association (AFSA) Independent Auto Finance Executives Committee S. Dustin Crone President & CEO C&F Finance Company Age: 56 • 25+ years in leadership with C&F Mortgage Corporation • 25+ years in mortgage banking business Mark A. Fox President & CEO C&F Mortgage Corporation Age: 59 5 |

| Awards Second Quarter 2025 Investor Presentation 6 |

| Our Vision and Promise Second Quarter 2025 Investor Presentation 7 |

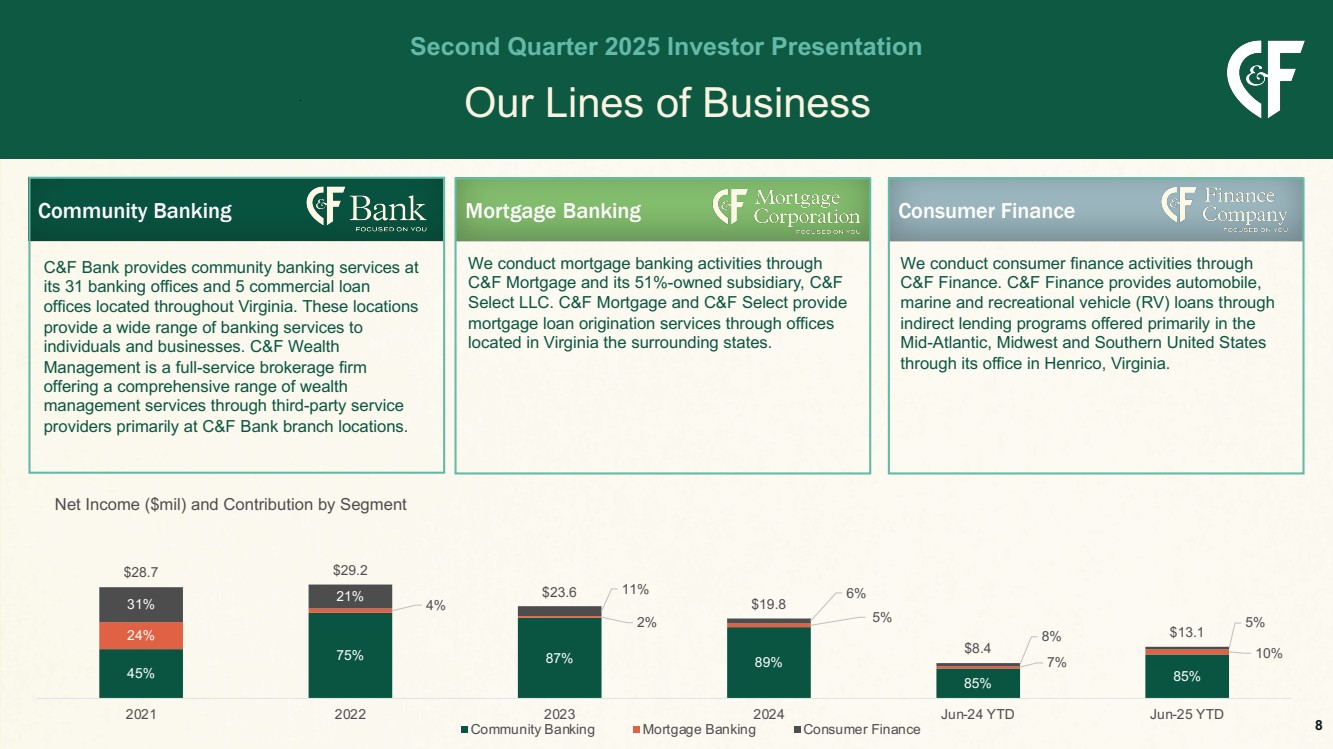

| Our Lines of Business Second Quarter 2025 Investor Presentation 45% 75% 87% 89% 85% 85% 24% 4% 2% 5% 7% 10% 31% 21% 11% 6% 8% 5% $28.7 $29.2 $23.6 $19.8 $8.4 $13.1 2021 2022 2023 2024 Jun-24 YTD Jun-25 YTD Net Income ($mil) and Contribution by Segment Community Banking Mortgage Banking Consumer Finance Community Banking Mortgage Banking Consumer Finance We conduct mortgage banking activities through C&F Mortgage and its 51%-owned subsidiary, C&F Select LLC. C&F Mortgage and C&F Select provide mortgage loan origination services through offices located in Virginia the surrounding states. We conduct consumer finance activities through C&F Finance. C&F Finance provides automobile, marine and recreational vehicle (RV) loans through indirect lending programs offered primarily in the Mid-Atlantic, Midwest and Southern United States through its office in Henrico, Virginia. C&F Bank provides community banking services at its 31 banking offices and 5 commercial loan offices located throughout Virginia. These locations provide a wide range of banking services to individuals and businesses. C&F Wealth Management is a full-service brokerage firm offering a comprehensive range of wealth management services through third-party service providers primarily at C&F Bank branch locations. 8 |

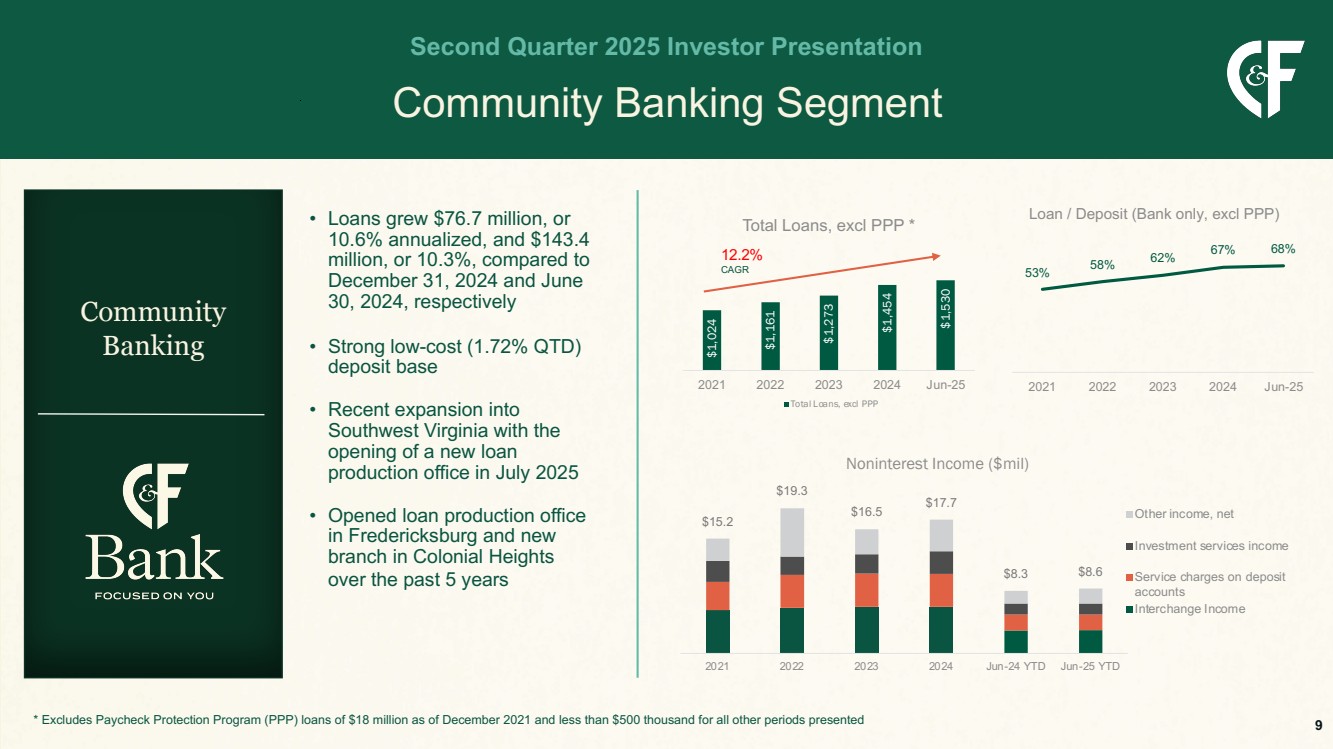

| $1,024 $1,161 $1,273 $1,454 $1,530 2021 2022 2023 2024 Jun-25 Total Loans, excl PPP * Total Loans, excl PPP Community Banking Segment Second Quarter 2025 Investor Presentation • Loans grew $76.7 million, or 10.6% annualized, and $143.4 million, or 10.3%, compared to December 31, 2024 and June 30, 2024, respectively • Strong low-cost (1.72% QTD) deposit base • Recent expansion into Southwest Virginia with the opening of a new loan production office in July 2025 • Opened loan production office in Fredericksburg and new branch in Colonial Heights over the past 5 years 12.2% CAGR Community Banking * Excludes Paycheck Protection Program (PPP) loans of $18 million as of December 2021 and less than $500 thousand for all other periods presented 53% 58% 62% 67% 68% 2021 2022 2023 2024 Jun-25 Loan / Deposit (Bank only, excl PPP) $15.2 $19.3 $16.5 $17.7 $8.3 $8.6 2021 2022 2023 2024 Jun-24 YTD Jun-25 YTD Noninterest Income ($mil) Other income, net Investment services income Service charges on deposit accounts Interchange Income 9 |

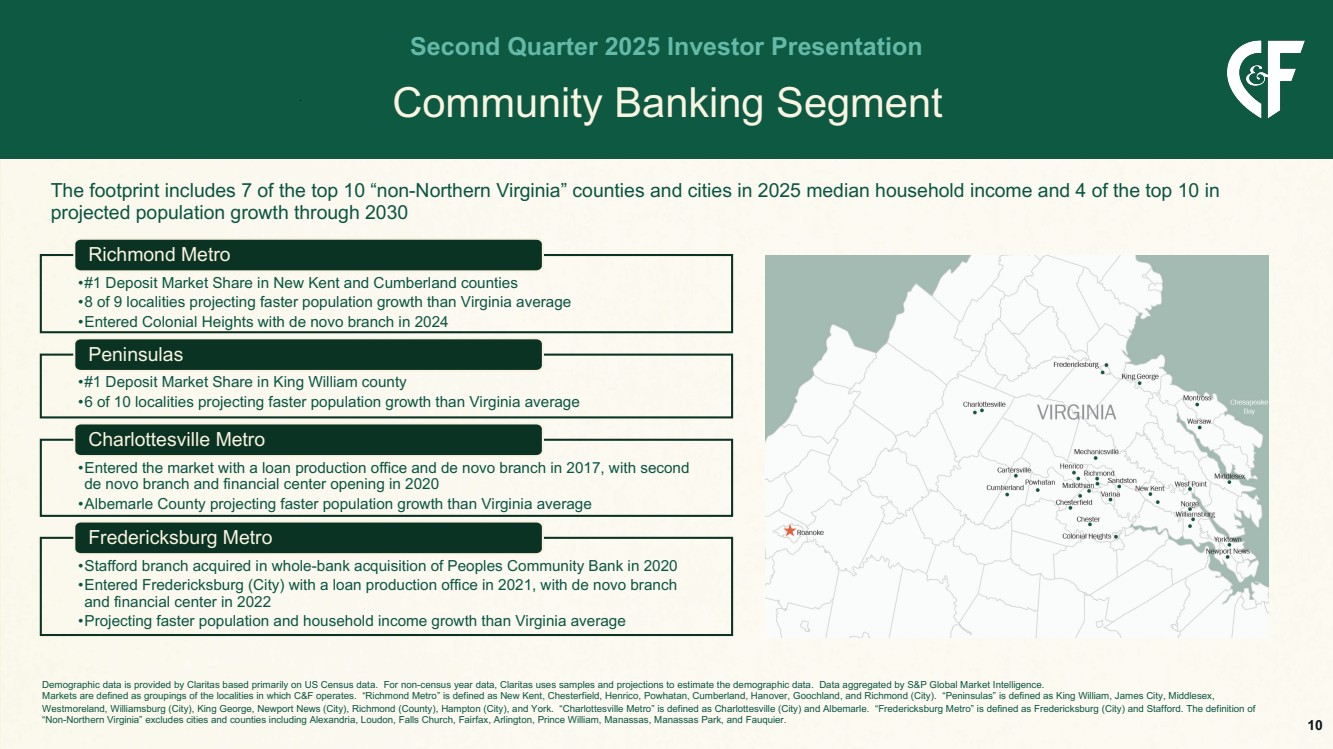

| Community Banking Segment Second Quarter 2025 Investor Presentation The footprint includes 7 of the top 10 “non-Northern Virginia” counties and cities in 2025 median household income and 4 of the top 10 in projected population growth through 2030 Demographic data is provided by Claritas based primarily on US Census data. For non-census year data, Claritas uses samples and projections to estimate the demographic data. Data aggregated by S&P Global Market Intelligence. Markets are defined as groupings of the localities in which C&F operates. “Richmond Metro” is defined as New Kent, Chesterfield, Henrico, Powhatan, Cumberland, Hanover, Goochland, and Richmond (City). “Peninsulas” is defined as King William, James City, Middlesex, Westmoreland, Williamsburg (City), King George, Newport News (City), Richmond (County), Hampton (City), and York. “Charlottesville Metro” is defined as Charlottesville (City) and Albemarle. “Fredericksburg Metro” is defined as Fredericksburg (City) and Stafford. The definition of “Non-Northern Virginia” excludes cities and counties including Alexandria, Loudon, Falls Church, Fairfax, Arlington, Prince William, Manassas, Manassas Park, and Fauquier. •#1 Deposit Market Share in New Kent and Cumberland counties •8 of 9 localities projecting faster population growth than Virginia average •Entered Colonial Heights with de novo branch in 2024 Richmond Metro •#1 Deposit Market Share in King William county •6 of 10 localities projecting faster population growth than Virginia average Peninsulas •Entered the market with a loan production office and de novo branch in 2017, with second de novo branch and financial center opening in 2020 •Albemarle County projecting faster population growth than Virginia average Charlottesville Metro •Stafford branch acquired in whole-bank acquisition of Peoples Community Bank in 2020 •Entered Fredericksburg (City) with a loan production office in 2021, with de novo branch and financial center in 2022 •Projecting faster population and household income growth than Virginia average Fredericksburg Metro 10 |

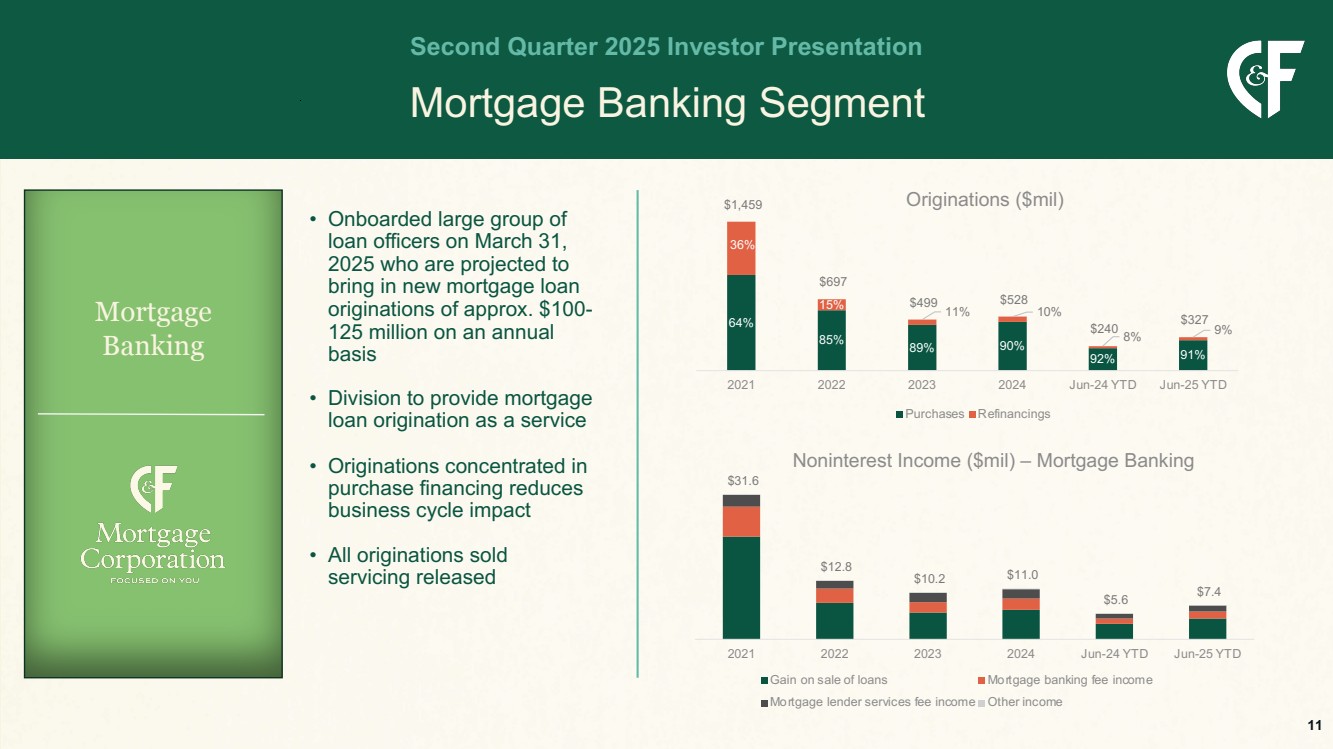

| Mortgage Banking Segment Second Quarter 2025 Investor Presentation • Onboarded large group of loan officers on March 31, 2025 who are projected to bring in new mortgage loan originations of approx. $100- 125 million on an annual basis • Division to provide mortgage loan origination as a service • Originations concentrated in purchase financing reduces business cycle impact • All originations sold servicing released Mortgage Banking $31.6 $12.8 $10.2 $11.0 $5.6 $7.4 2021 2022 2023 2024 Jun-24 YTD Jun-25 YTD Noninterest Income ($mil) – Mortgage Banking Gain on sale of loans Mortgage banking fee income Mortgage lender services fee income Other income 64% 85% 89% 90% 92% 91% 36% 15% 11% 10% 8% 9% $1,459 $697 $499 $528 $240 $327 2021 2022 2023 2024 Jun-24 YTD Jun-25 YTD Originations ($mil) Purchases Refinancings 11 |

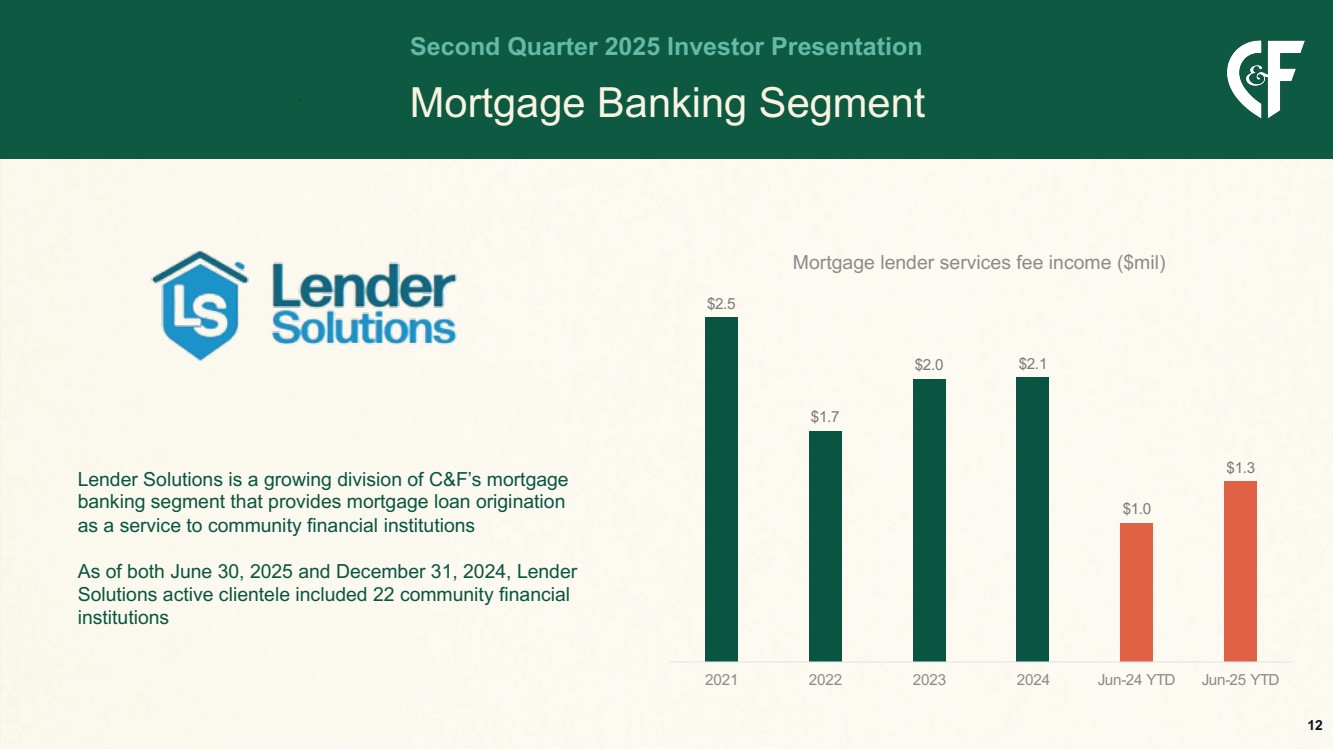

| Mortgage Banking Segment Second Quarter 2025 Investor Presentation Lender Solutions is a growing division of C&F’s mortgage banking segment that provides mortgage loan origination as a service to community financial institutions As of both June 30, 2025 and December 31, 2024, Lender Solutions active clientele included 22 community financial institutions $2.5 $1.7 $2.0 $2.1 $1.0 $1.3 2021 2022 2023 2024 Jun-24 YTD Jun-25 YTD Mortgage lender services fee income ($mil) 12 |

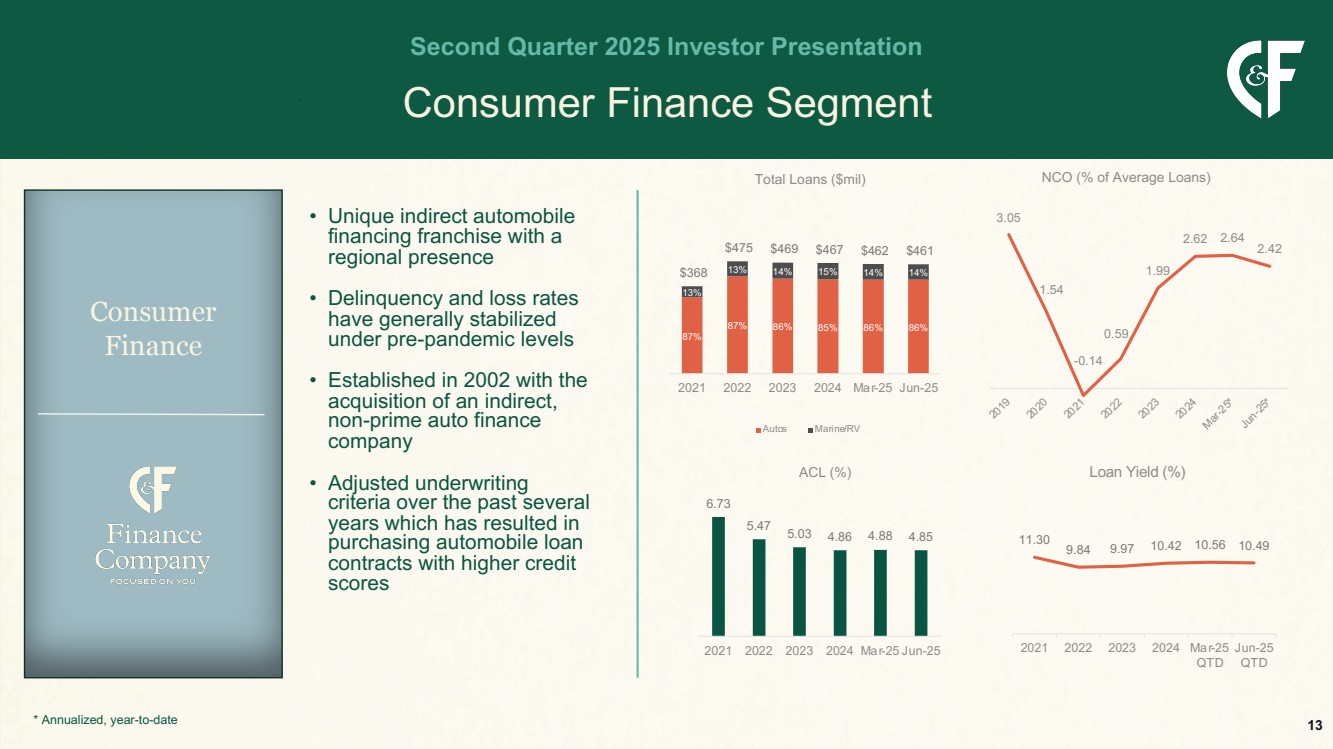

| Consumer Finance Segment Second Quarter 2025 Investor Presentation • Unique indirect automobile financing franchise with a regional presence • Delinquency and loss rates have generally stabilized under pre-pandemic levels • Established in 2002 with the acquisition of an indirect, non-prime auto finance company • Adjusted underwriting criteria over the past several years which has resulted in purchasing automobile loan contracts with higher credit scores Consumer Finance 3.05 1.54 -0.14 0.59 1.99 2.62 2.64 2.42 2019 2020 2021 2022 2023 2024 Mar-25* Jun-25* NCO (% of Average Loans) 6.73 5.47 5.03 4.86 4.88 4.85 2021 2022 2023 2024 Mar-25 Jun-25 ACL (%) 11.30 9.84 9.97 10.42 10.56 10.49 2021 2022 2023 2024 Mar-25 QTD Jun-25 QTD Loan Yield (%) 87% 87% 86% 85% 86% 86% 13% $368 13% 14% 15% 14% 14% $475 $469 $467 $462 $461 2021 2022 2023 2024 Mar-25 Jun-25 Total Loans ($mil) Autos Marine/RV 13 * Annualized, year-to-date |

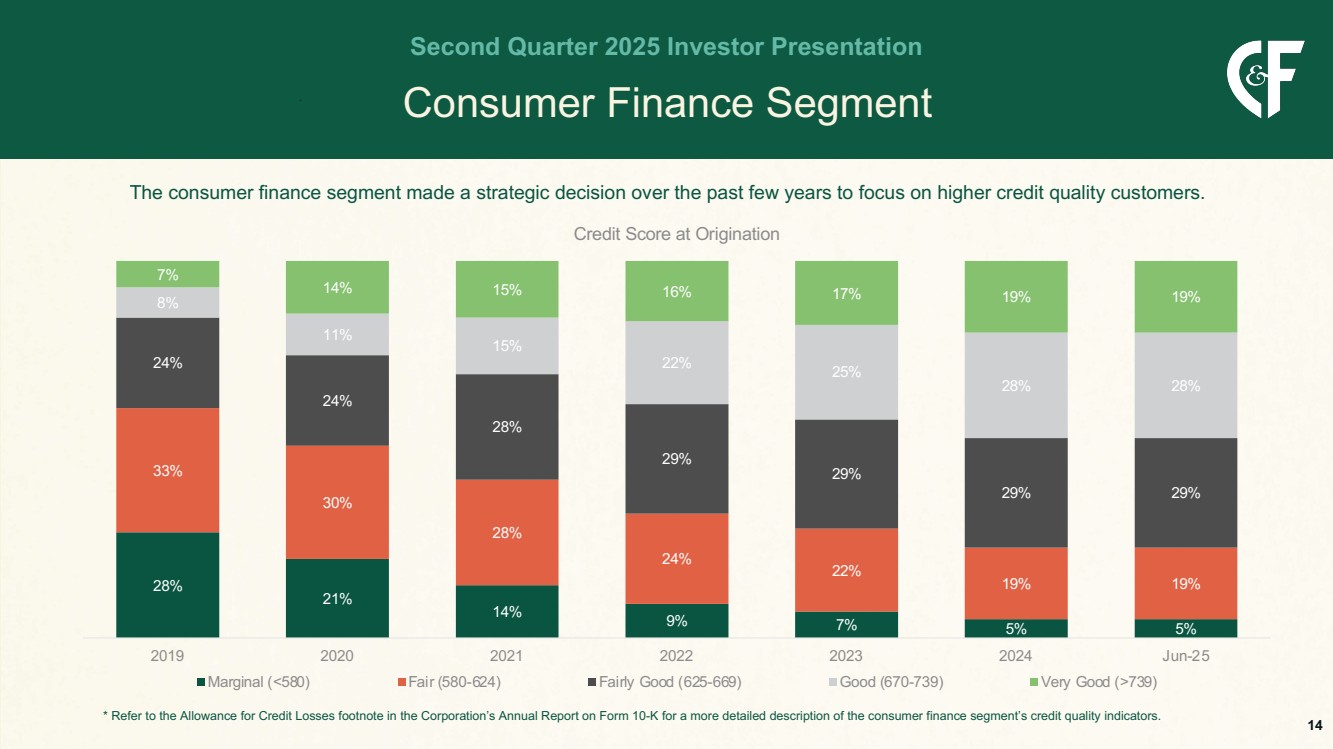

| Consumer Finance Segment Second Quarter 2025 Investor Presentation The consumer finance segment made a strategic decision over the past few years to focus on higher credit quality customers. * Refer to the Allowance for Credit Losses footnote in the Corporation’s Annual Report on Form 10-K for a more detailed description of the consumer finance segment’s credit quality indicators. 28% 21% 14% 9% 7% 5% 5% 33% 30% 28% 24% 22% 19% 19% 24% 24% 28% 29% 29% 29% 29% 8% 11% 15% 22% 25% 28% 28% 7% 14% 15% 16% 17% 19% 19% 2019 2020 2021 2022 2023 2024 Jun-25 Credit Score at Origination Marginal (<580) Fair (580-624) Fairly Good (625-669) Good (670-739) Very Good (>739) 14 |

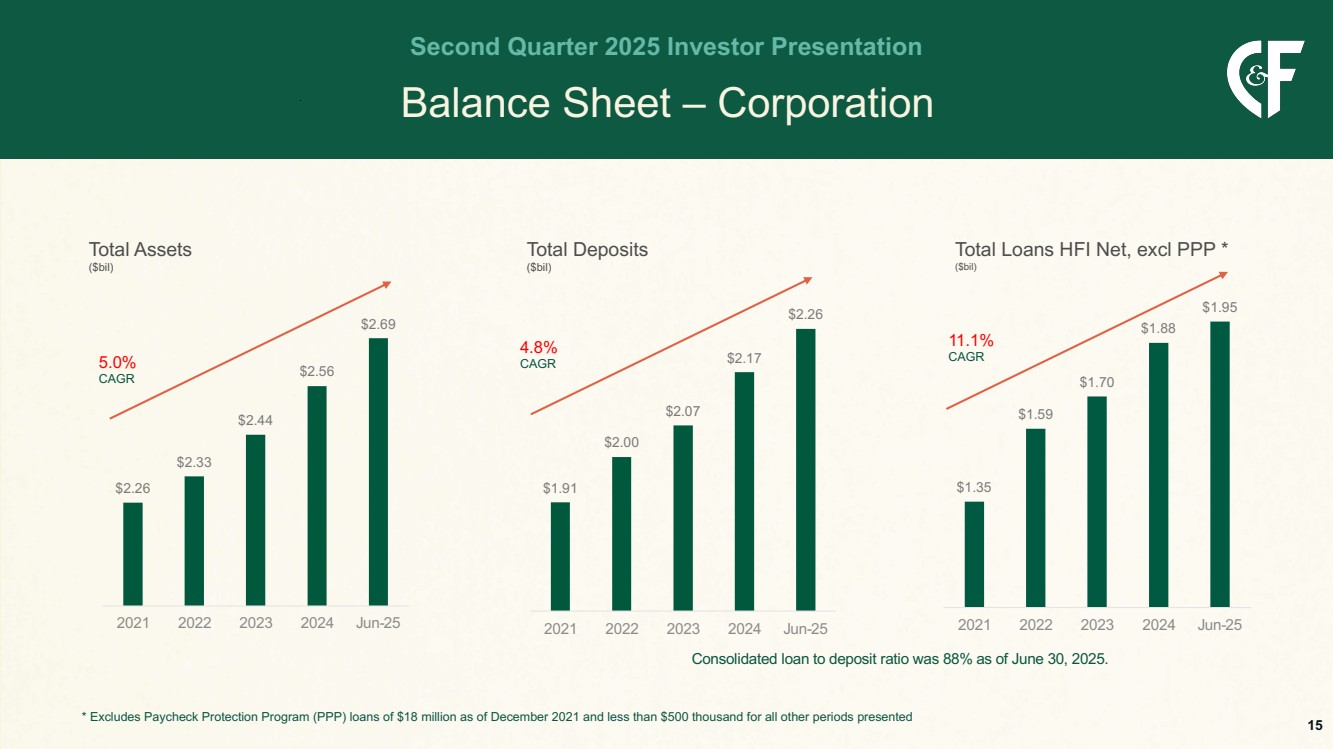

| $1.35 $1.59 $1.70 $1.88 $1.95 2021 2022 2023 2024 Jun-25 $2.26 $2.33 $2.44 $2.56 $2.69 2021 2022 2023 2024 Jun-25 $1.91 $2.00 $2.07 $2.17 $2.26 2021 2022 2023 2024 Jun-25 Balance Sheet – Corporation Second Quarter 2025 Investor Presentation Total Deposits ($bil) Total Assets ($bil) 5.0% CAGR 4.8% CAGR 11.1% CAGR Total Loans HFI Net, excl PPP * ($bil) * Excludes Paycheck Protection Program (PPP) loans of $18 million as of December 2021 and less than $500 thousand for all other periods presented Consolidated loan to deposit ratio was 88% as of June 30, 2025. 15 |

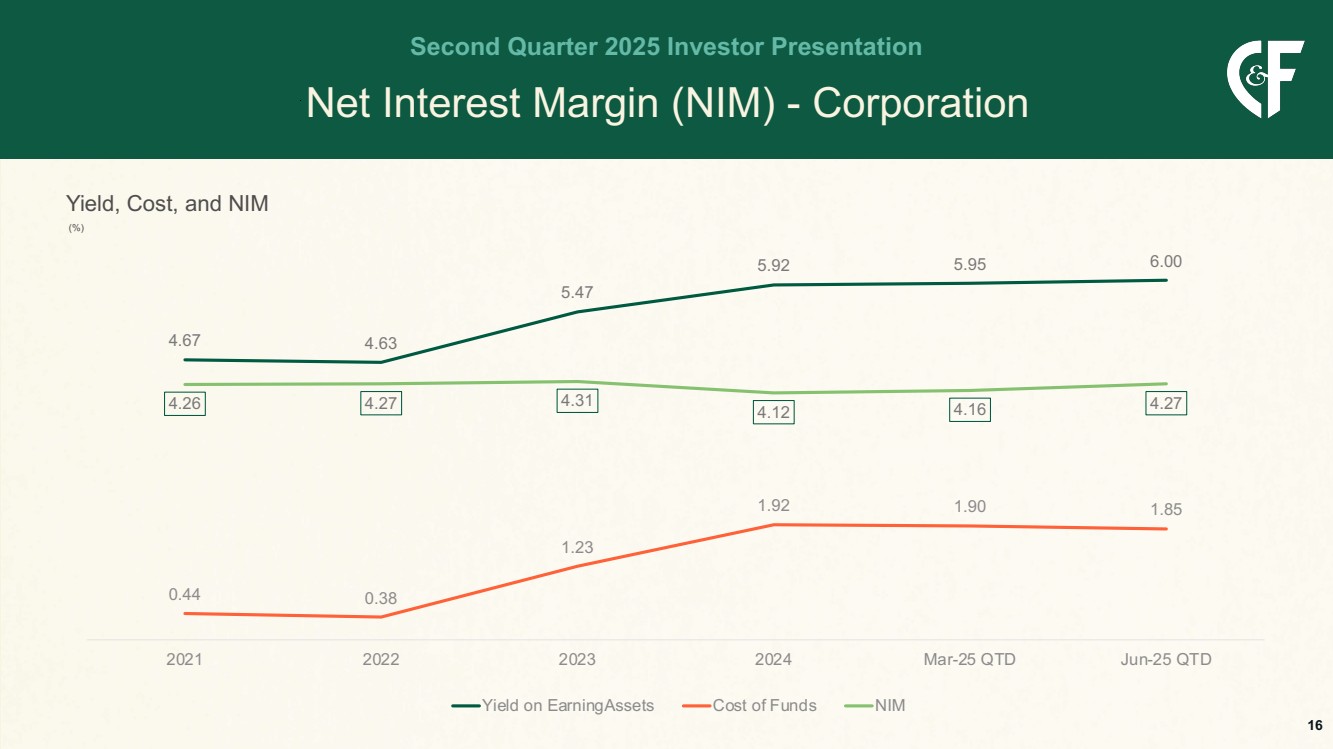

| Net Interest Margin (NIM) - Corporation Second Quarter 2025 Investor Presentation 4.67 4.63 5.47 5.92 5.95 6.00 0.44 0.38 1.23 1.92 1.90 1.85 4.26 4.27 4.31 4.12 4.16 4.27 2021 2022 2023 2024 Mar-25 QTD Jun-25 QTD Yield on EarningAssets Cost of Funds NIM Yield, Cost, and NIM (%) 16 |

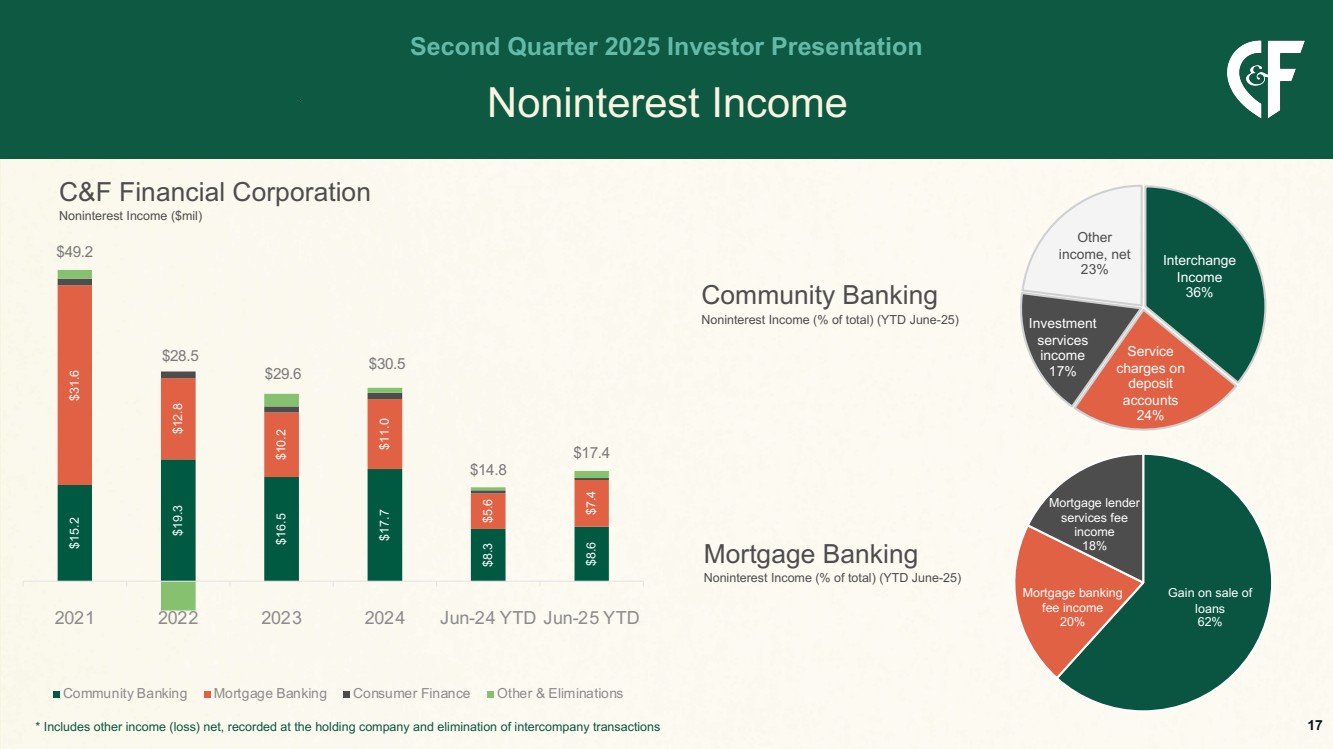

| Noninterest Income Second Quarter 2025 Investor Presentation $15.2 $19.3 $16.5 $17.7 $8.3 $8.6 $31.6 $12.8 $10.2 $11.0 $5.6 $7.4 $49.2 $28.5 $29.6 $30.5 $14.8 $17.4 2021 2022 2023 2024 Jun-24 YTD Jun-25 YTD Community Banking Mortgage Banking Consumer Finance Other & Eliminations C&F Financial Corporation Noninterest Income ($mil) Community Banking Noninterest Income (% of total) (YTD June-25) Mortgage Banking Noninterest Income (% of total) (YTD June-25) Interchange Income 36% Service charges on deposit accounts 24% Investment services income 17% Other income, net 23% Gain on sale of loans 62% Mortgage banking fee income 20% Mortgage lender services fee income 18% * Includes other income (loss) net, recorded at the holding company and elimination of intercompany transactions 17 |

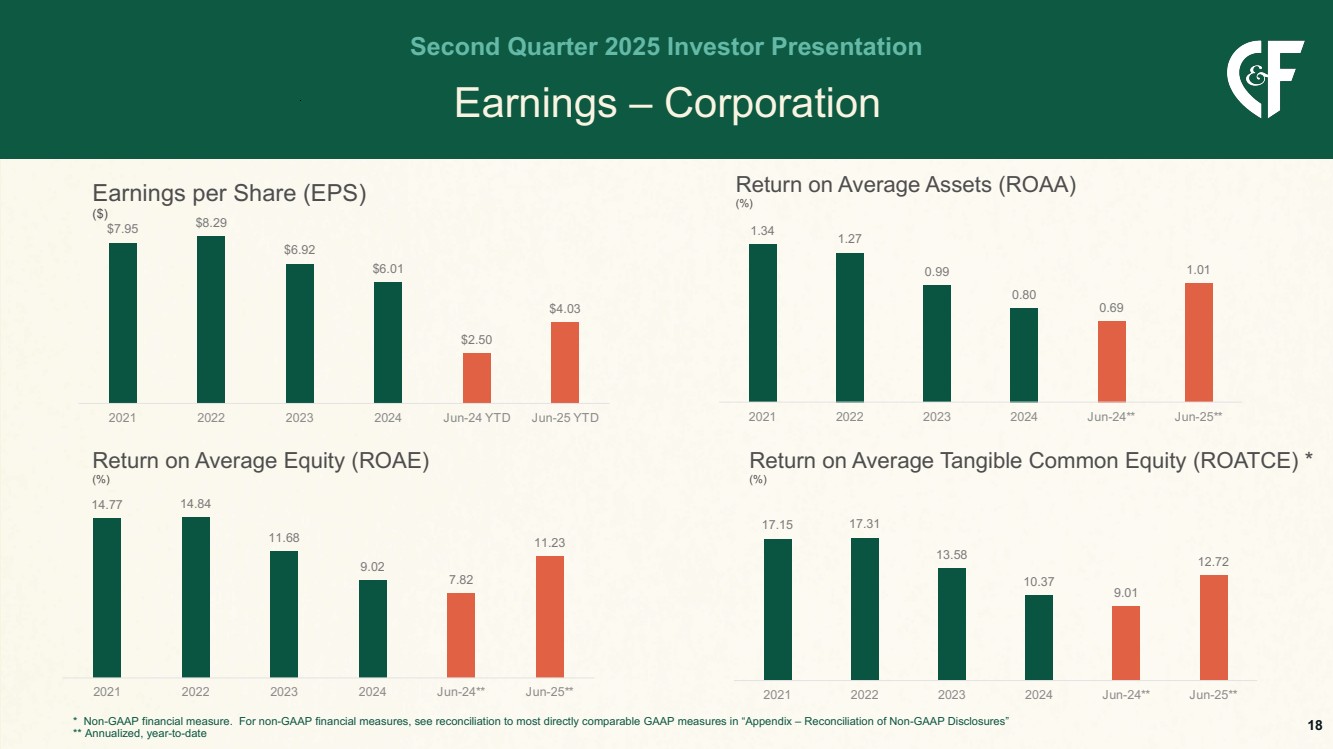

| Earnings – Corporation Second Quarter 2025 Investor Presentation Return on Average Equity (ROAE) (%) Earnings per Share (EPS) ($) Return on Average Assets (ROAA) (%) Return on Average Tangible Common Equity (ROATCE) * (%) * Non-GAAP financial measure. For non-GAAP financial measures, see reconciliation to most directly comparable GAAP measures in “Appendix – Reconciliation of Non-GAAP Disclosures” ** Annualized, year-to-date $7.95 $8.29 $6.92 $6.01 $2.50 $4.03 2021 2022 2023 2024 Jun-24 YTD Jun-25 YTD 1.34 1.27 0.99 0.80 0.69 1.01 2021 2022 2023 2024 Jun-24** Jun-25** 14.77 14.84 11.68 9.02 7.82 11.23 2021 2022 2023 2024 Jun-24** Jun-25** 17.15 17.31 13.58 10.37 9.01 12.72 2021 2022 2023 2024 Jun-24** Jun-25** 18 |

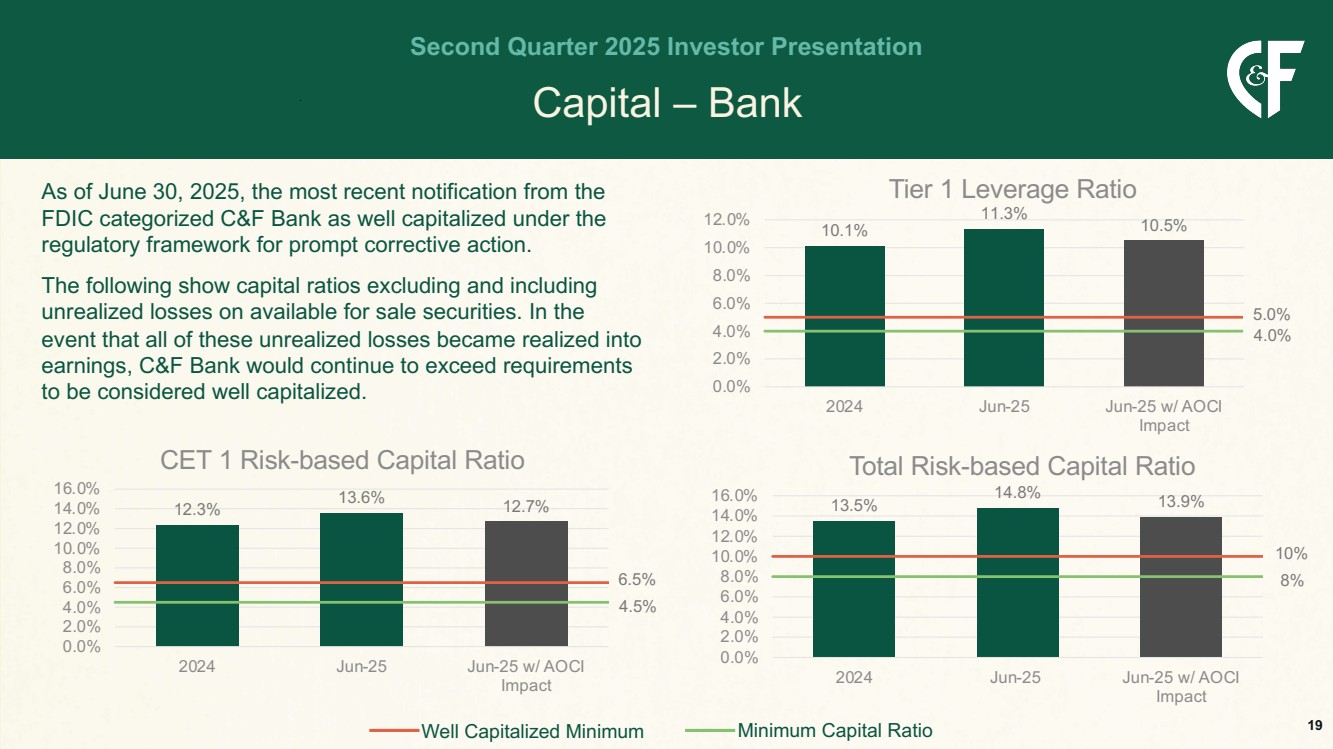

| Capital – Bank Second Quarter 2025 Investor Presentation As of June 30, 2025, the most recent notification from the FDIC categorized C&F Bank as well capitalized under the regulatory framework for prompt corrective action. The following show capital ratios excluding and including unrealized losses on available for sale securities. In the event that all of these unrealized losses became realized into earnings, C&F Bank would continue to exceed requirements to be considered well capitalized. 12.3% 13.6% 12.7% 6.5% 4.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2024 Jun-25 Jun-25 w/ AOCI Impact CET 1 Risk-based Capital Ratio 10.1% 11.3% 10.5% 5.0% 4.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2024 Jun-25 Jun-25 w/ AOCI Impact Tier 1 Leverage Ratio 13.5% 14.8% 13.9% 10% 8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2024 Jun-25 Jun-25 w/ AOCI Impact Total Risk-based Capital Ratio Well Capitalized Minimum Minimum Capital Ratio 19 |

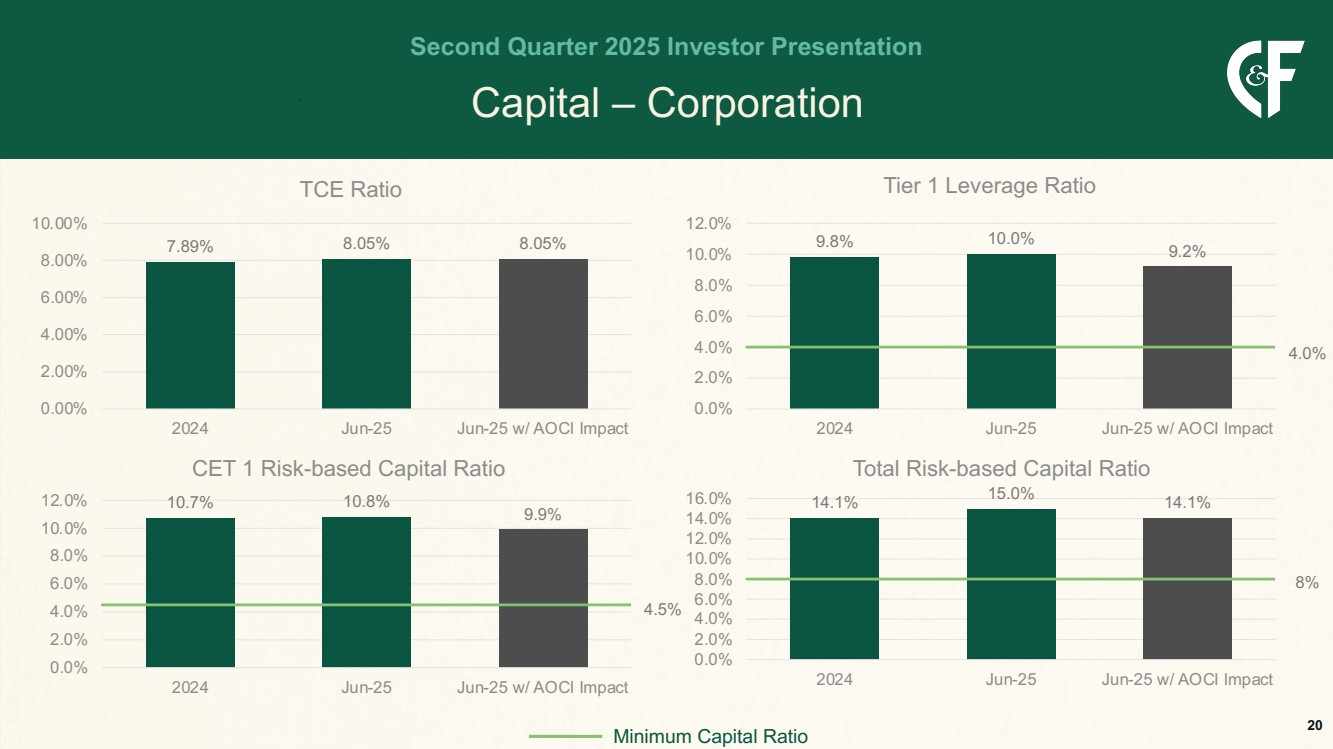

| Capital – Corporation Second Quarter 2025 Investor Presentation 9.8% 10.0% 9.2% 4.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2024 Jun-25 Jun-25 w/ AOCI Impact Tier 1 Leverage Ratio 7.89% 8.05% 8.05% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 2024 Jun-25 Jun-25 w/ AOCI Impact TCE Ratio 10.7% 10.8% 9.9% 4.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2024 Jun-25 Jun-25 w/ AOCI Impact CET 1 Risk-based Capital Ratio 14.1% 15.0% 14.1% 8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2024 Jun-25 Jun-25 w/ AOCI Impact Total Risk-based Capital Ratio Minimum Capital Ratio 20 |

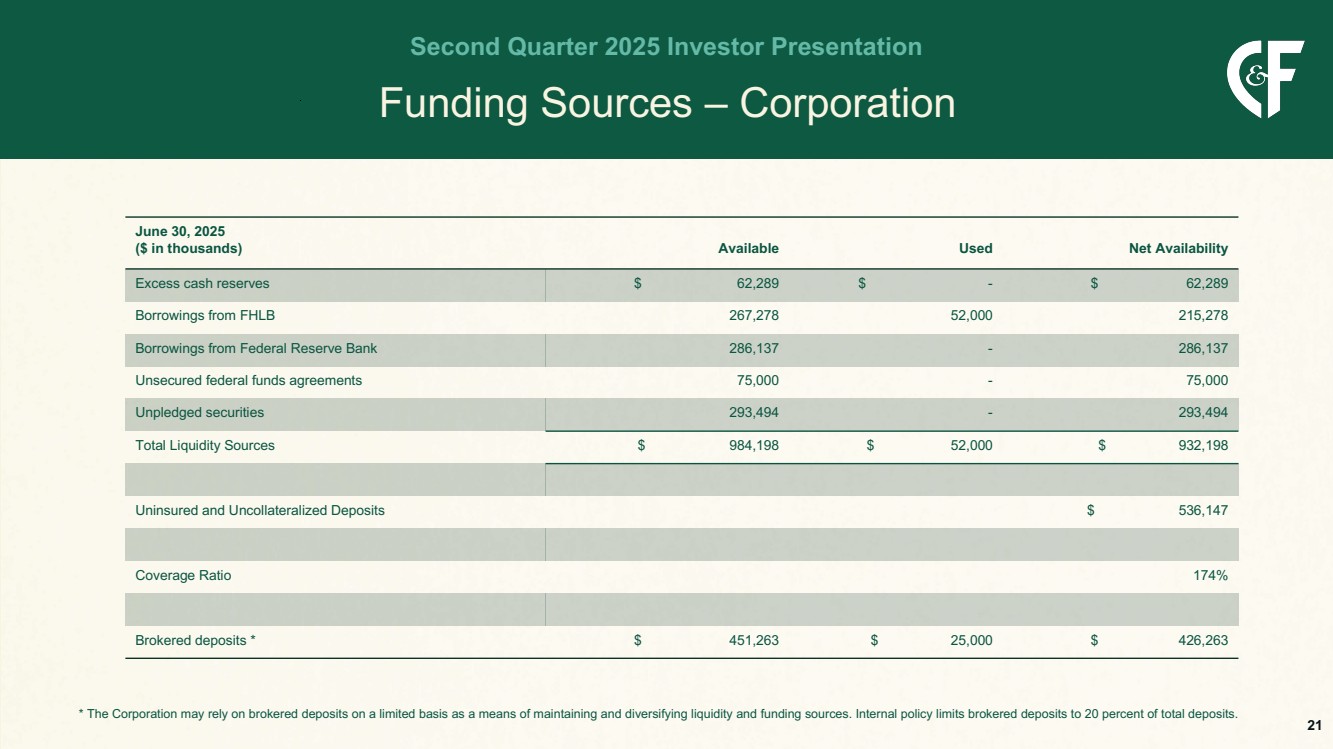

| Funding Sources – Corporation Second Quarter 2025 Investor Presentation * The Corporation may rely on brokered deposits on a limited basis as a means of maintaining and diversifying liquidity and funding sources. Internal policy limits brokered deposits to 20 percent of total deposits. June 30, 2025 ($ in thousands) Available Used Net Availability Excess cash reserves $ 62,289 $ - $ 62,289 Borrowings from FHLB 267,278 52,000 215,278 Borrowings from Federal Reserve Bank 286,137 - 286,137 Unsecured federal funds agreements 75,000 - 75,000 Unpledged securities 293,494 - 293,494 Total Liquidity Sources $ 984,198 $ 52,000 $ 932,198 Uninsured and Uncollateralized Deposits $ 536,147 Coverage Ratio 174% Brokered deposits * $ 451,263 $ 25,000 $ 426,263 21 |

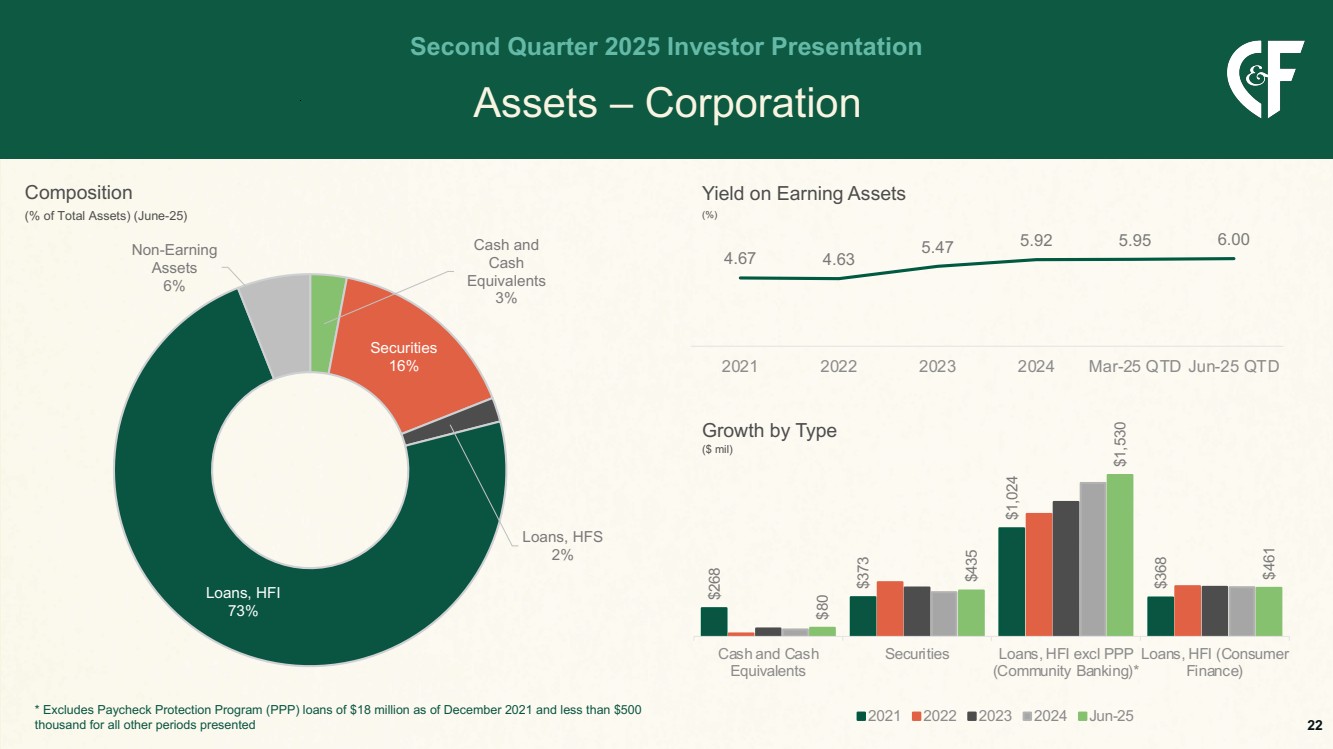

| Assets – Corporation Second Quarter 2025 Investor Presentation Cash and Cash Equivalents 3% Securities 16% Loans, HFS 2% Loans, HFI 73% Non-Earning Assets 6% 4.67 4.63 5.47 5.92 5.95 6.00 2021 2022 2023 2024 Mar-25 QTD Jun-25 QTD Yield on Earning Assets (%) $268 $373 $1,024 $368 $80 $435 $1,530 $461 Cash and Cash Equivalents Securities Loans, HFI excl PPP (Community Banking)* Loans, HFI (Consumer Finance) 2021 2022 2023 2024 Jun-25 Growth by Type ($ mil) Composition (% of Total Assets) (June-25) 22 * Excludes Paycheck Protection Program (PPP) loans of $18 million as of December 2021 and less than $500 thousand for all other periods presented |

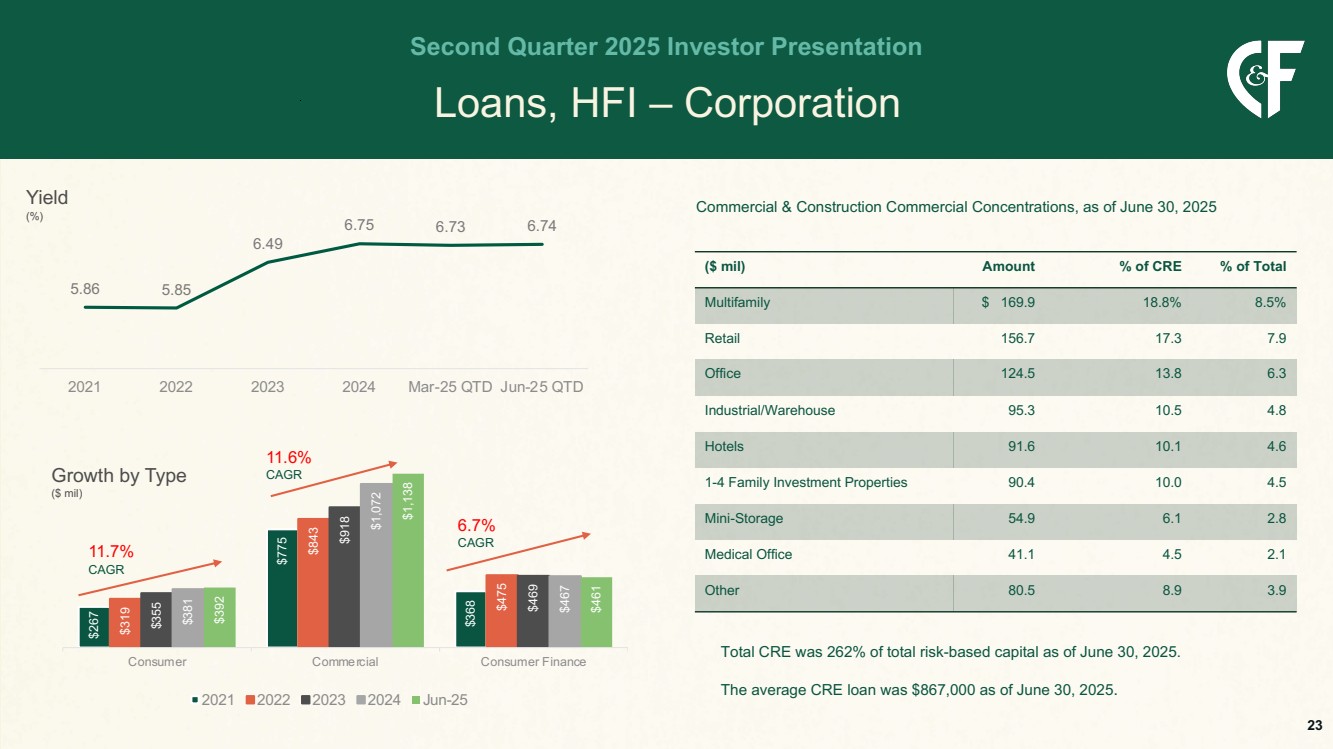

| $267 $775 $368 $319 $843 $475 $355 $918 $469 $381 $1,072 $467 $392 $1,138 $461 Consumer Commercial Consumer Finance 2021 2022 2023 2024 Jun-25 Loans, HFI – Corporation Second Quarter 2025 Investor Presentation Yield (%) 5.86 5.85 6.49 6.75 6.73 6.74 2021 2022 2023 2024 Mar-25 QTD Jun-25 QTD Growth by Type ($ mil) 11.6% CAGR 6.7% CAGR 11.7% CAGR Commercial & Construction Commercial Concentrations, as of June 30, 2025 Total CRE was 262% of total risk-based capital as of June 30, 2025. The average CRE loan was $867,000 as of June 30, 2025. ($ mil) Amount % of CRE % of Total Multifamily $ 169.9 18.8% 8.5% Retail 156.7 17.3 7.9 Office 124.5 13.8 6.3 Industrial/Warehouse 95.3 10.5 4.8 Hotels 91.6 10.1 4.6 1-4 Family Investment Properties 90.4 10.0 4.5 Mini-Storage 54.9 6.1 2.8 Medical Office 41.1 4.5 2.1 Other 80.5 8.9 3.9 23 |

| Asset Quality Second Quarter 2025 Investor Presentation 0.23 0.01 0.03 0.02 0.08 0.07 0.10 0.19 0.19 0.13 0.21 0.15 2021 2022 2023 2024 Mar-25 Jun-25 Bank Finance 0.04 0.01 0.01 0.02 0.01 0.01 0.01 0.01 3.05 1.54 -0.14 0.59 1.99 2.62 2.64 2.42 2019 2020 2021 2022 2023 2024 Mar-25* Jun-25* Bank Finance 1.43 1.25 1.26 1.20 1.18 1.12 6.73 5.47 5.03 4.86 4.88 4.85 2021 2022 2023 2024 Mar-25 Jun-25 Bank Finance Nonaccruals (% of Total Loans) Net Charge-offs (% of Average Loans) Allowance for Credit Losses (ACL) (% of Total Loans) Amendments to ASC 326 (“CECL”) were adopted by the Corporation on January 1, 2023. * Annualized, year-to-date 24 |

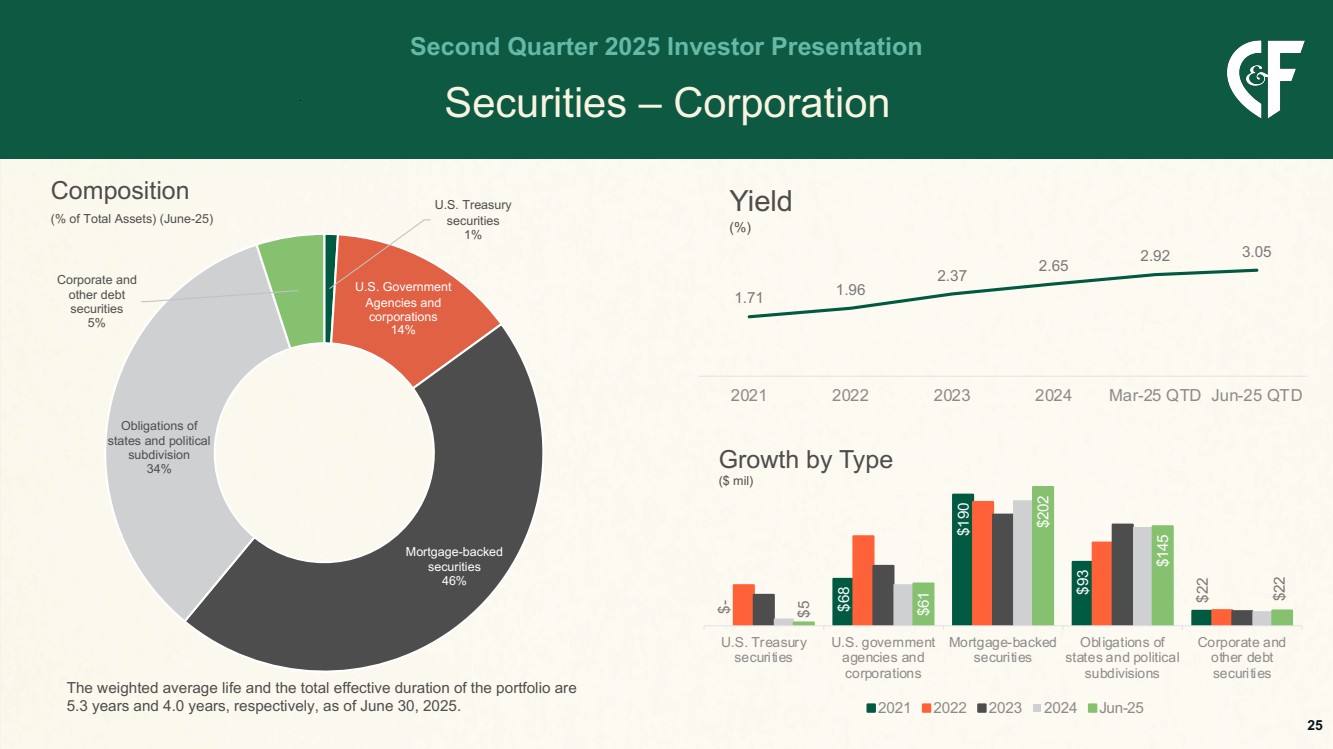

| Securities – Corporation Second Quarter 2025 Investor Presentation U.S. Treasury securities 1% U.S. Government Agencies and corporations 14% Mortgage-backed securities 46% Obligations of states and political subdivision 34% Corporate and other debt securities 5% The weighted average life and the total effective duration of the portfolio are 5.3 years and 4.0 years, respectively, as of June 30, 2025. Composition (% of Total Assets) (June-25) Yield (%) 1.71 1.96 2.37 2.65 2.92 3.05 2021 2022 2023 2024 Mar-25 QTD Jun-25 QTD $- $68 $190 $93 $22 $5 $61 $202 $145 $22 U.S. Treasury securities U.S. government agencies and corporations Mortgage-backed securities Obligations of states and political subdivisions Corporate and other debt securities 2021 2022 2023 2024 Jun-25 Growth by Type ($ mil) 25 |

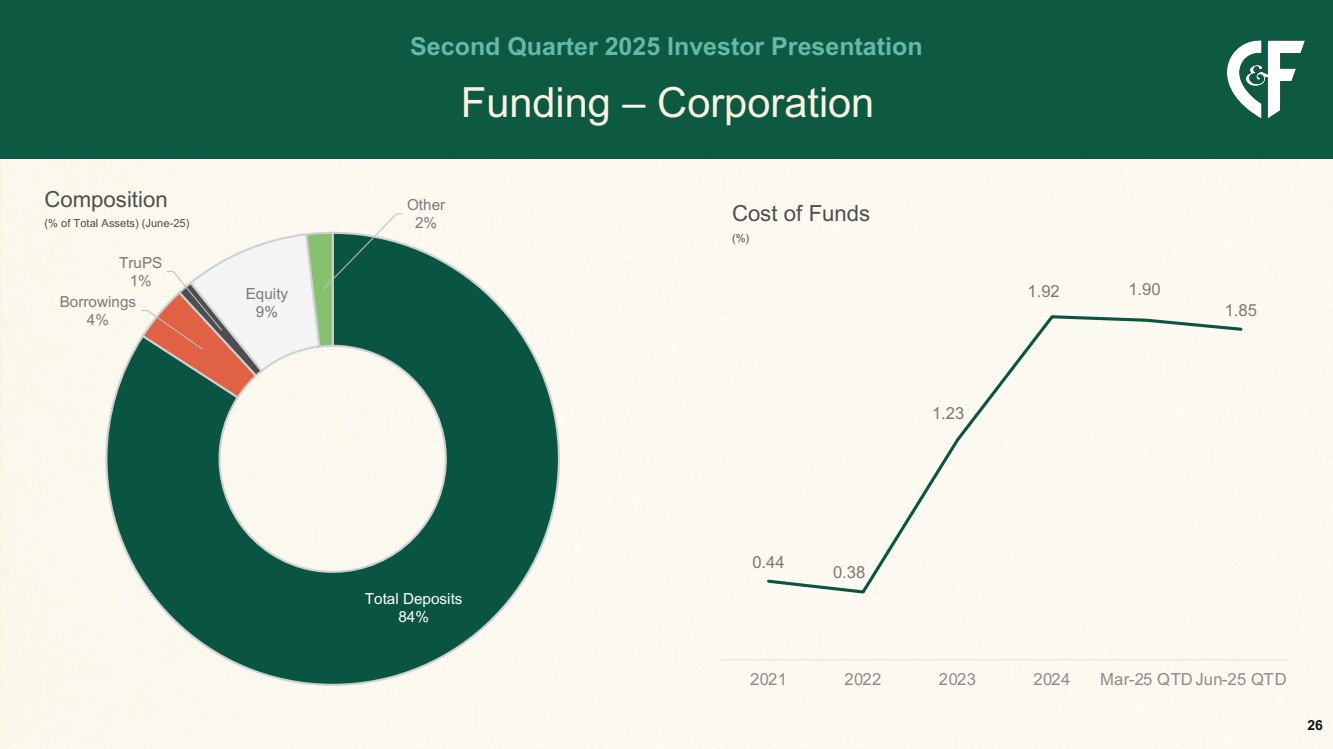

| Funding – Corporation Second Quarter 2025 Investor Presentation Total Deposits 84% Borrowings 4% TruPS 1% Equity 9% Other 2% Composition (% of Total Assets) (June-25) 0.44 0.38 1.23 1.92 1.90 1.85 2021 2022 2023 2024 Mar-25 QTD Jun-25 QTD Cost of Funds (%) 26 |

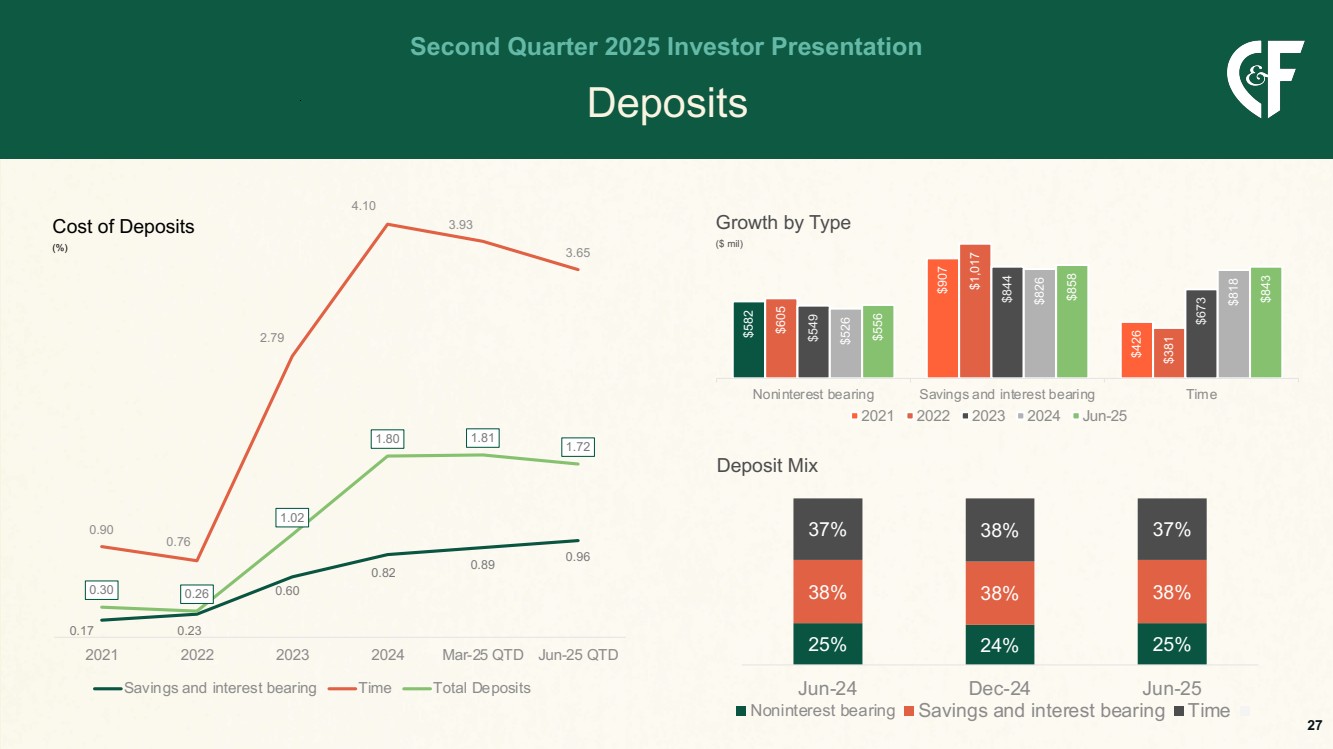

| Deposits Second Quarter 2025 Investor Presentation 0.17 0.23 0.60 0.82 0.89 0.96 0.90 0.76 2.79 4.10 3.93 3.65 0.30 0.26 1.02 1.80 1.81 1.72 2021 2022 2023 2024 Mar-25 QTD Jun-25 QTD Savings and interest bearing Time Total Deposits $582 $907 $426 $605 $1,017 $381 $549 $844 $673 $526 $826 $818 $556 $858 $843 Noninterest bearing Savings and interest bearing Time 2021 2022 2023 2024 Jun-25 Growth by Type ($ mil) 25% 24% 25% 38% 38% 38% 37% 38% 37% Jun-24 Dec-24 Jun-25 Noninterest bearing Savings and interest bearing Time Deposit Mix 27 Cost of Deposits (%) |

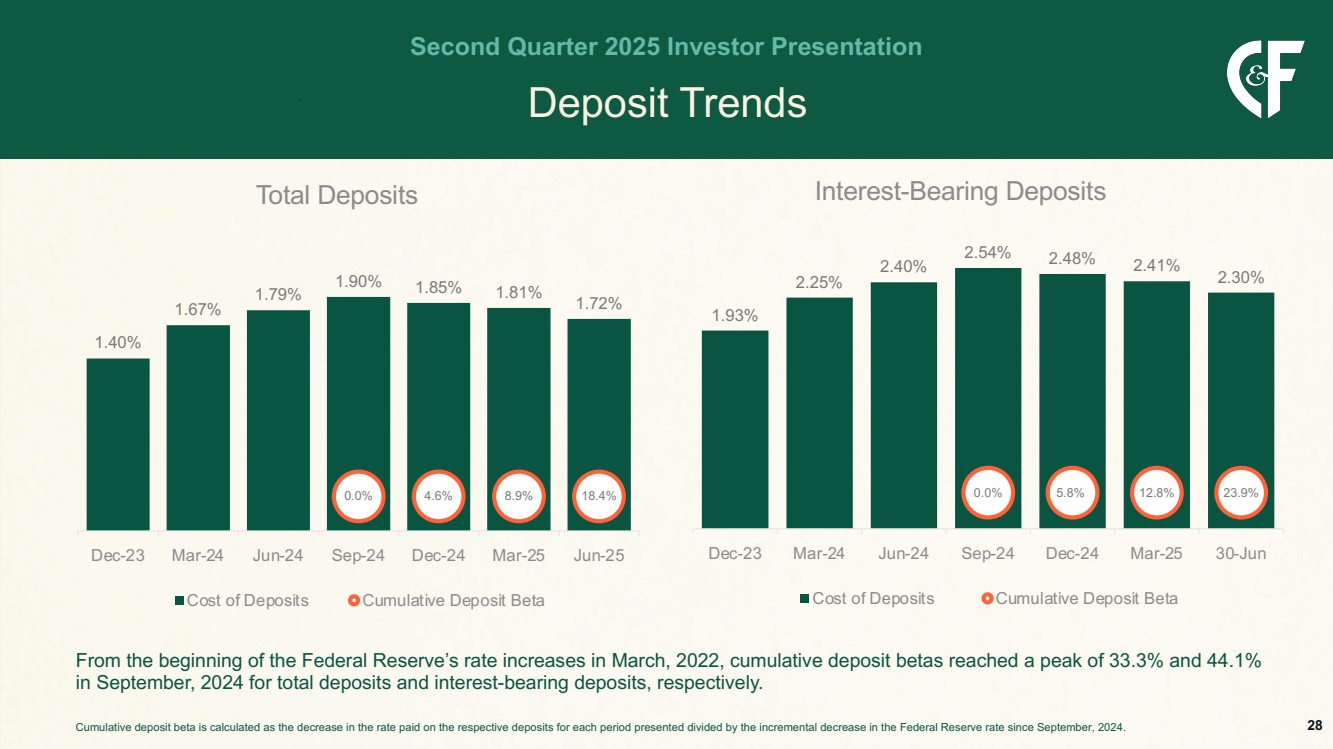

| Deposit Trends Second Quarter 2025 Investor Presentation 1.40% 1.67% 1.79% 1.90% 1.85% 1.81% 1.72% 0.0% 4.6% 8.9% 18.4% Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Total Deposits Cost of Deposits Cumulative Deposit Beta 1.93% 2.25% 2.40% 2.54% 2.48% 2.41% 2.30% 0.0% 5.8% 12.8% 23.9% Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 30-Jun Interest-Bearing Deposits Cost of Deposits Cumulative Deposit Beta From the beginning of the Federal Reserve’s rate increases in March, 2022, cumulative deposit betas reached a peak of 33.3% and 44.1% in September, 2024 for total deposits and interest-bearing deposits, respectively. Cumulative deposit beta is calculated as the decrease in the rate paid on the respective deposits for each period presented divided by the incremental decrease in the Federal Reserve rate since September, 2024. 28 |

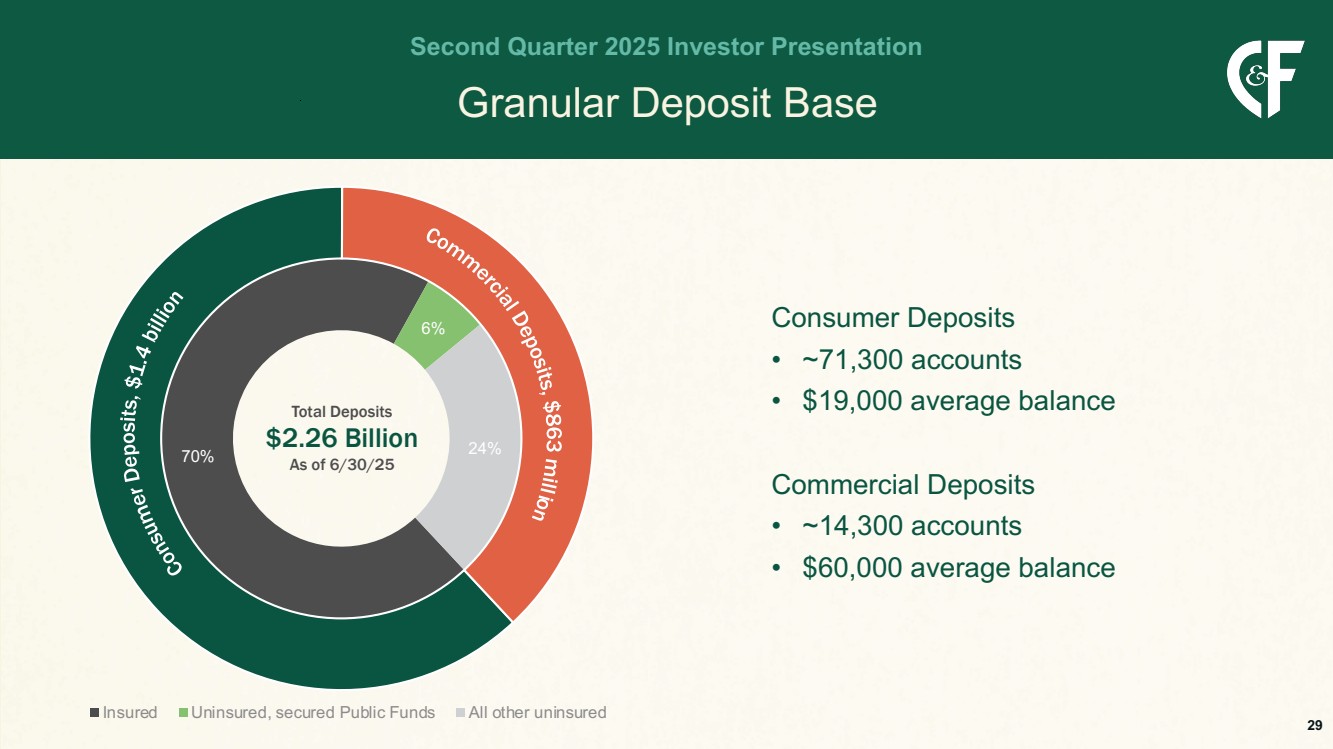

| Granular Deposit Base Second Quarter 2025 Investor Presentation 70% 6% 24% Insured Uninsured, secured Public Funds All other uninsured Consumer Deposits • ~71,300 accounts • $19,000 average balance Commercial Deposits • ~14,300 accounts • $60,000 average balance 29 Total Deposits $2.26 Billion As of 6/30/25 |

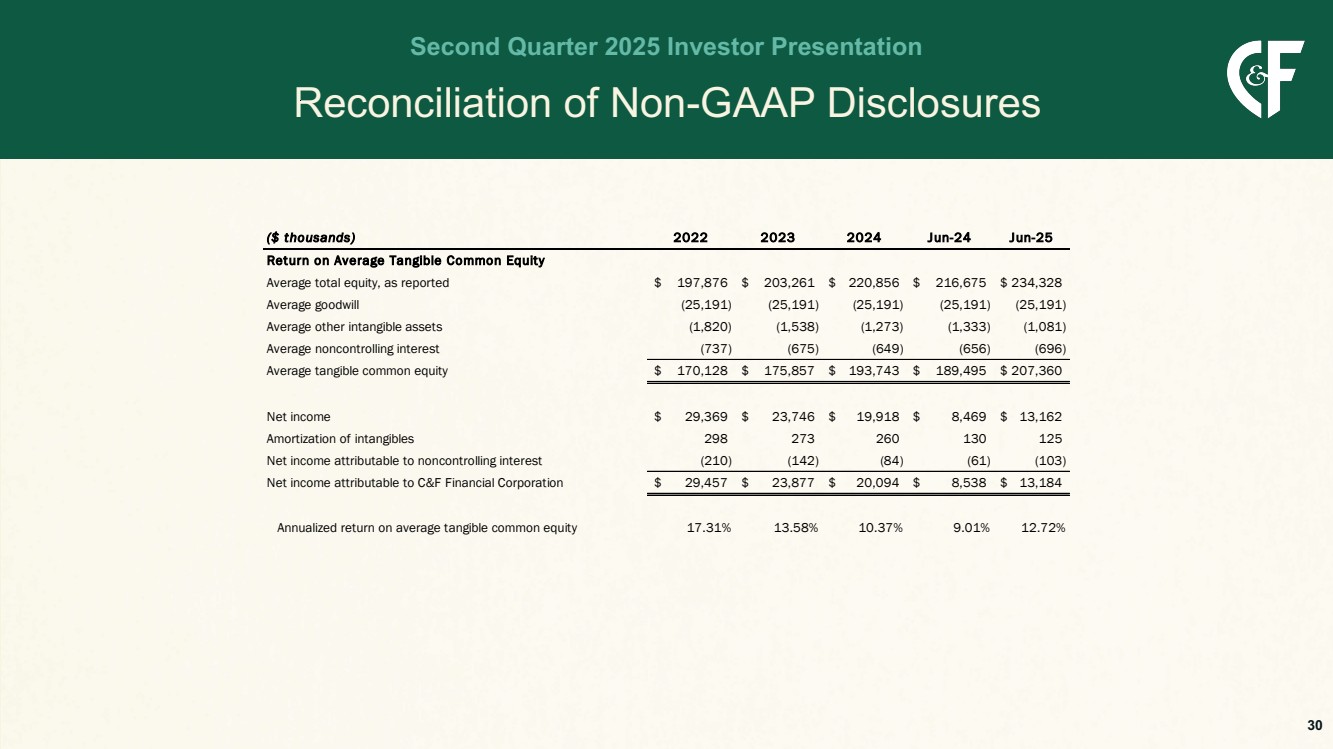

| Reconciliation of Non-GAAP Disclosures Second Quarter 2025 Investor Presentation 30 ($ thousands) 2022 2023 2024 Jun-24 Jun-25 Return on Average Tangible Common Equity Average total equity, as reported $ 197,876 $ 203,261 $ 220,856 $ 216,675 $ 234,328 Average goodwill (25,191) (25,191) (25,191) (25,191) (25,191) Average other intangible assets (1,820) (1,538) (1,273) (1,333) (1,081) Average noncontrolling interest (737) (675) (649) (656) (696) Average tangible common equity $ 170,128 $ 175,857 $ 193,743 $ 189,495 $ 207,360 Net income $ 29,369 $ 23,746 $ 19,918 $ 8,469 $ 13,162 Amortization of intangibles 298 273 260 130 125 Net income attributable to noncontrolling interest (210) (142) (84) (61) (103) Net income attributable to C&F Financial Corporation $ 29,457 $ 23,877 $ 20,094 $ 8,538 $ 13,184 Annualized return on average tangible common equity 17.31% 13.58% 10.37% 9.01% 12.72% |

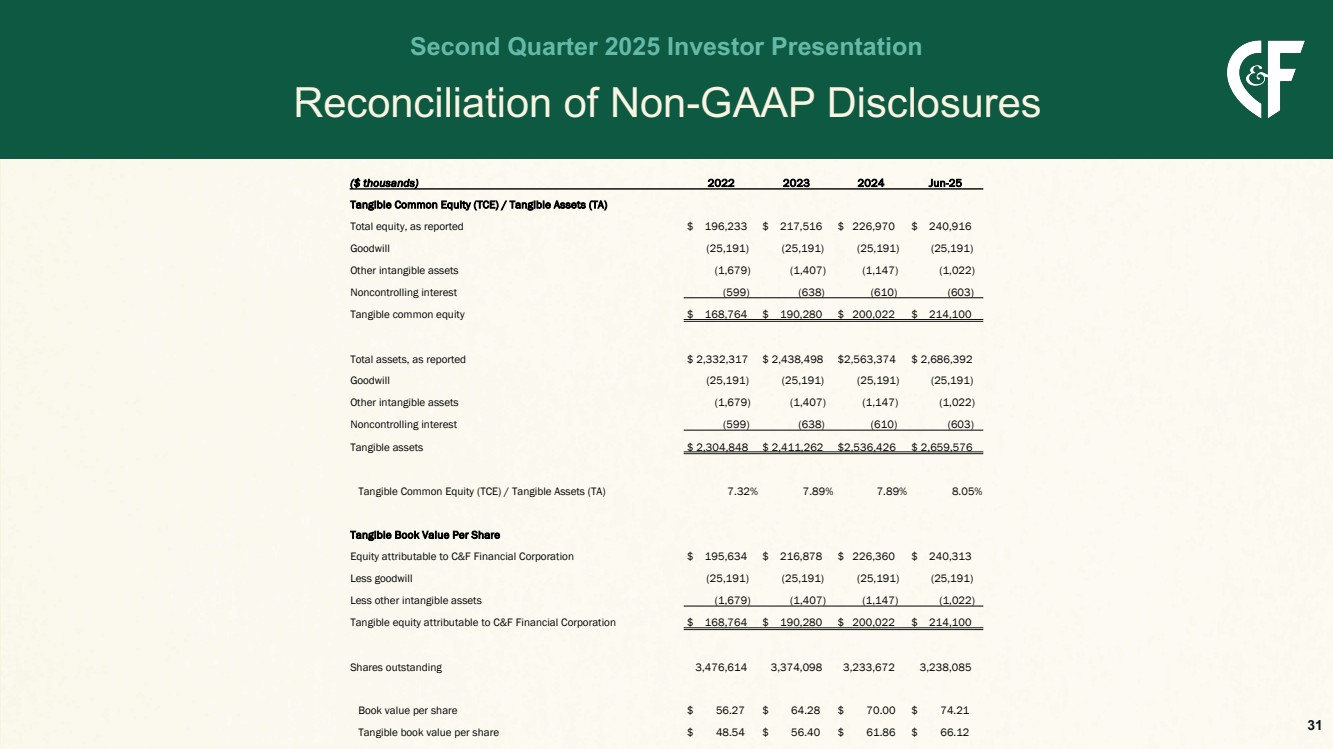

| Reconciliation of Non-GAAP Disclosures Second Quarter 2025 Investor Presentation 31 ($ thousands) 2022 2023 2024 Jun-25 Tangible Common Equity (TCE) / Tangible Assets (TA) Total equity, as reported $ 196,233 $ 217,516 $ 226,970 $ 240,916 Goodwill (25,191) (25,191) (25,191) (25,191) Other intangible assets (1,679) (1,407) (1,147) (1,022) Noncontrolling interest (599) (638) (610) (603) Tangible common equity $ 168,764 $ 190,280 $ 200,022 $ 214,100 Total assets, as reported $ 2,332,317 $ 2,438,498 $2,563,374 $ 2,686,392 Goodwill (25,191) (25,191) (25,191) (25,191) Other intangible assets (1,679) (1,407) (1,147) (1,022) Noncontrolling interest (599) (638) (610) (603) Tangible assets $ 2,304,848 $ 2,411,262 $2,536,426 $ 2,659,576 Tangible Common Equity (TCE) / Tangible Assets (TA) 7.32% 7.89% 7.89% 8.05% Tangible Book Value Per Share Equity attributable to C&F Financial Corporation $ 195,634 $ 216,878 $ 226,360 $ 240,313 Less goodwill (25,191) (25,191) (25,191) (25,191) Less other intangible assets (1,679) (1,407) (1,147) (1,022) Tangible equity attributable to C&F Financial Corporation $ 168,764 $ 190,280 $ 200,022 $ 214,100 Shares outstanding 3,476,614 3,374,098 3,233,672 3,238,085 Book value per share $ 56.27 $ 64.28 $ 70.00 $ 74.21 Tangible book value per share $ 48.54 $ 56.40 $ 61.86 $ 66.12 |