Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

T. ROWE PRICE RETIREMENT FUNDS, INC.

|

| Entity Central Index Key |

0001177017

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000129667 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Target 2025 Fund

|

| Class Name |

Investor Class

|

| Trading Symbol |

TRRVX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Target 2025 Fund (the "fund") for the period of June 1, 2024 to May 31, 2025. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Material Fund Change Notice [Text Block] |

|

| Additional Information Phone Number |

1‑800‑638‑5660

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 17.3333px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">info@troweprice.com</span>

|

| Additional Information Website |

www.troweprice.com/prospectus

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

|

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Target 2025 Fund - Investor Class |

$53 |

0.51% | |

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

0.51%

|

| Factors Affecting Performance [Text Block] |

What drove fund performance during the past 12 months?Global stock indexes and fixed income markets were broadly positive for the 12 months ended May 31, 2025. Many major central banks began easing interest rates early in the period as inflation slowed. Early optimism over the U.S. election of President Donald Trump brought, first, a boost to U.S. equities, followed by heightened volatility in global equity markets amid concerns over Trump’s fluctuating tariff policies. Versus the style-specific S&P Target Date 2025 Index, our diversified U.S. mid-cap equity structure contributed to performance for the trailing one-year period as our dedicated allocations to growth and value outpaced the benchmark’s core-oriented mid-cap equity allocation. Additionally, exposure to short duration Treasury inflation protected securities contributed to performance for the period. On the negative side, a leading detractor from relative results was security selection within the US Mid-Cap Growth Equity Strategy, which trailed its benchmark. The fund’s smaller allocation to U.S. large-cap equities versus small- and mid-cap equities compared with the benchmark also detracted. The fund seeks the highest total return over time, consistent with an emphasis on both capital growth and income. The fund invests in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. Its allocation among T. Rowe Price funds will change over time in relation to its target retirement date.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

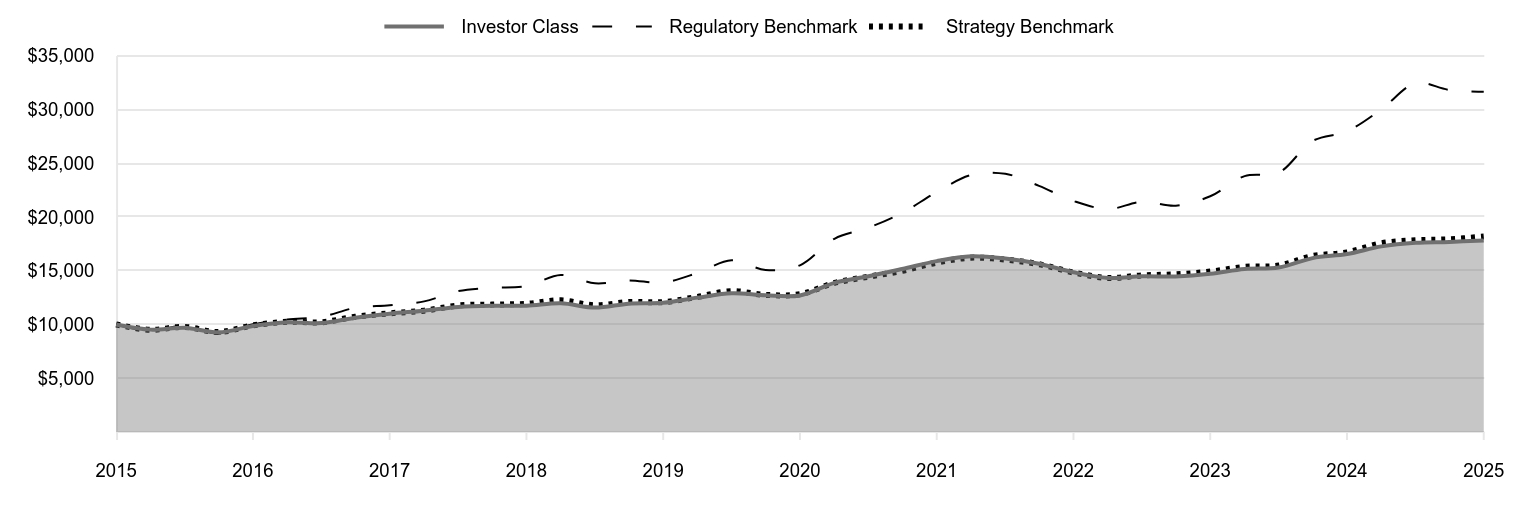

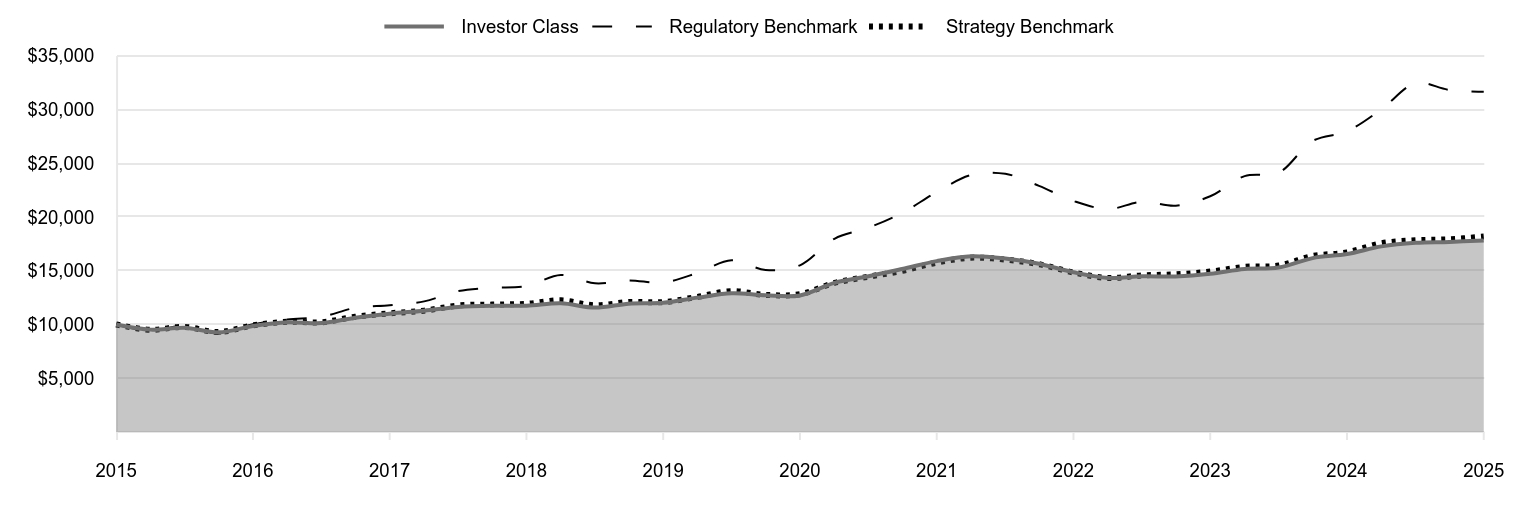

| Line Graph [Table Text Block] |

|

Investor Class |

Regulatory Benchmark |

Strategy Benchmark |

2015 |

10,000 |

10,000 |

10,000 |

2015 |

9,523 |

9,394 |

9,511 |

2015 |

9,705 |

9,895 |

9,776 |

2016 |

9,268 |

9,142 |

9,298 |

2016 |

9,860 |

10,022 |

9,915 |

2016 |

10,209 |

10,468 |

10,247 |

2016 |

10,128 |

10,717 |

10,208 |

2017 |

10,632 |

11,546 |

10,724 |

2017 |

11,010 |

11,795 |

11,041 |

2017 |

11,287 |

12,150 |

11,286 |

2017 |

11,638 |

13,104 |

11,766 |

2018 |

11,751 |

13,419 |

11,851 |

2018 |

11,751 |

13,572 |

11,923 |

2018 |

11,979 |

14,610 |

12,247 |

2018 |

11,570 |

13,828 |

11,781 |

2019 |

11,939 |

14,096 |

12,087 |

2019 |

12,019 |

13,911 |

12,083 |

2019 |

12,499 |

14,801 |

12,570 |

2019 |

12,899 |

15,970 |

13,103 |

2020 |

12,715 |

15,069 |

12,751 |

2020 |

12,704 |

15,505 |

12,822 |

2020 |

13,875 |

17,975 |

13,863 |

2020 |

14,487 |

19,008 |

14,448 |

2021 |

15,168 |

20,393 |

14,991 |

2021 |

15,896 |

22,314 |

15,756 |

2021 |

16,346 |

23,914 |

16,213 |

2021 |

16,143 |

24,014 |

16,043 |

2022 |

15,650 |

22,900 |

15,607 |

2022 |

14,857 |

21,492 |

14,839 |

2022 |

14,332 |

20,738 |

14,332 |

2022 |

14,477 |

21,420 |

14,571 |

2023 |

14,475 |

21,051 |

14,662 |

2023 |

14,716 |

21,929 |

14,921 |

2023 |

15,161 |

23,798 |

15,358 |

2023 |

15,294 |

24,121 |

15,484 |

2024 |

16,177 |

27,072 |

16,368 |

2024 |

16,553 |

27,978 |

16,708 |

2024 |

17,268 |

30,020 |

17,555 |

2024 |

17,606 |

32,439 |

17,834 |

2025 |

17,683 |

31,819 |

17,929 |

2025 |

17,815 |

31,648 |

18,181 |

|

| Average Annual Return [Table Text Block] |

|

1 Year |

5 Years |

10 Years |

Target 2025 Fund (Investor Class) |

7.62% |

7.00% |

5.94% |

Russell 3000 Index (Regulatory Benchmark) |

13.12 |

15.34 |

12.21 |

S&P Target Date 2025 Index (Strategy Benchmark) |

8.82 |

7.23 |

6.16 | |

| No Deduction of Taxes [Text Block] |

Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information can be found at www.troweprice.com.

|

| Distribution of Capital [Text Block] |

The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.

|

| AssetsNet |

$ 453,289,000

|

| Holdings Count | Holding |

27

|

| Advisory Fees Paid, Amount |

$ 1,856,000

|

| InvestmentCompanyPortfolioTurnover |

25.20%

|

| Additional Fund Statistics Significance or Limits [Text Block] |

What are some fund statistics? - Total Net Assets (000s)$453,289

- Number of Portfolio Holdings27

|

| Holdings [Text Block] |

Domestic Bond Funds |

40.1% |

Domestic Equity Funds |

30.7 |

International Bond Funds |

13.4 |

International Equity Funds |

11.4 |

Short-Term and Other |

4.4 | |

| Largest Holdings [Text Block] |

T. Rowe Price Limited Duration Inflation Focused Bond Fund |

19.6% |

T. Rowe Price New Income Fund |

14.4 |

T. Rowe Price Value Fund |

6.1 |

T. Rowe Price Growth Stock Fund |

5.7 |

T. Rowe Price International Bond Fund (USD Hedged) |

5.7 |

T. Rowe Price Hedged Equity Fund |

4.2 |

T. Rowe Price U.S. Large-Cap Core Fund |

4.1 |

T. Rowe Price International Value Equity Fund |

3.5 |

T. Rowe Price Dynamic Global Bond Fund |

3.4 |

T. Rowe Price Overseas Stock Fund |

3.0 | |

| Material Fund Change [Text Block] |

|

| Updated Prospectus Web Address |

www.troweprice.com/paperless

|

| C000129666 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Target 2025 Fund

|

| Class Name |

Advisor Class

|

| Trading Symbol |

PAJRX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Target 2025 Fund (the "fund") for the period of June 1, 2024 to May 31, 2025. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Material Fund Change Notice [Text Block] |

|

| Additional Information Phone Number |

1‑800‑638‑5660

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 17.3333px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">info@troweprice.com</span>

|

| Additional Information Website |

www.troweprice.com/prospectus

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

|

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Target 2025 Fund - Advisor Class |

$79 |

0.76% | |

| Expenses Paid, Amount |

$ 79

|

| Expense Ratio, Percent |

0.76%

|

| Factors Affecting Performance [Text Block] |

What drove fund performance during the past 12 months?Global stock indexes and fixed income markets were broadly positive for the 12 months ended May 31, 2025. Many major central banks began easing interest rates early in the period as inflation slowed. Early optimism over the U.S. election of President Donald Trump brought, first, a boost to U.S. equities, followed by heightened volatility in global equity markets amid concerns over Trump’s fluctuating tariff policies. Versus the style-specific S&P Target Date 2025 Index, our diversified U.S. mid-cap equity structure contributed to performance for the trailing one-year period as our dedicated allocations to growth and value outpaced the benchmark’s core-oriented mid-cap equity allocation. Additionally, exposure to short duration Treasury inflation protected securities contributed to performance for the period. On the negative side, a leading detractor from relative results was security selection within the US Mid-Cap Growth Equity Strategy, which trailed its benchmark. The fund’s smaller allocation to U.S. large-cap equities versus small- and mid-cap equities compared with the benchmark also detracted. The fund seeks the highest total return over time, consistent with an emphasis on both capital growth and income. The fund invests in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. Its allocation among T. Rowe Price funds will change over time in relation to its target retirement date.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

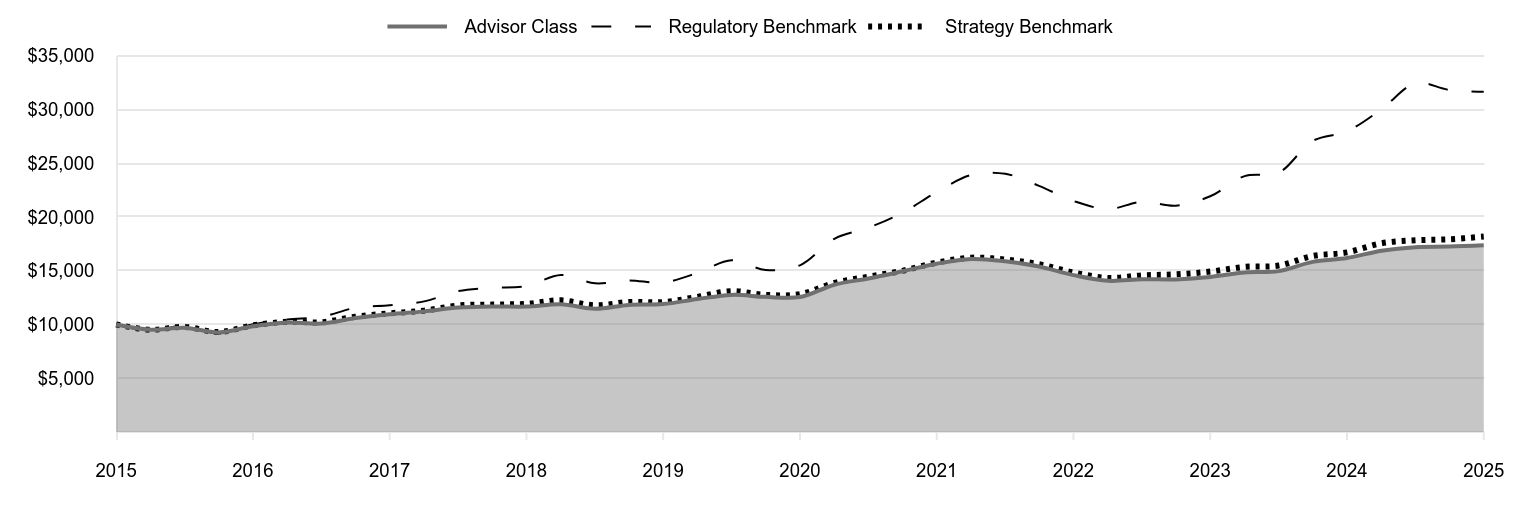

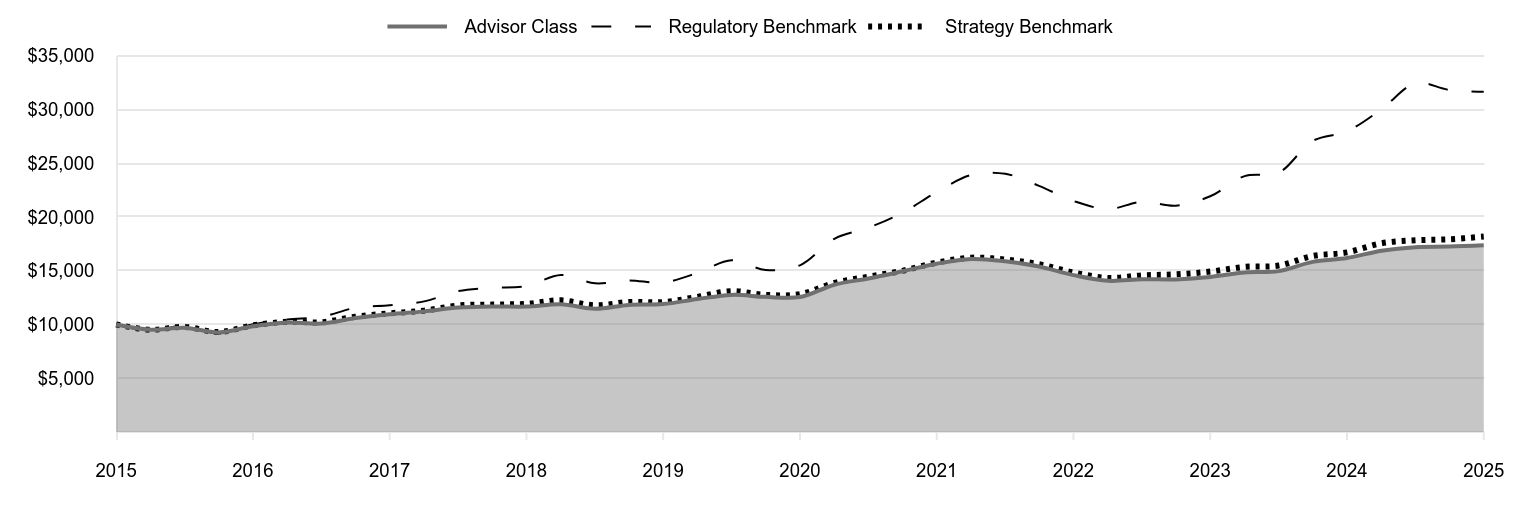

| Line Graph [Table Text Block] |

|

Advisor Class |

Regulatory Benchmark |

Strategy Benchmark |

2015 |

10,000 |

10,000 |

10,000 |

2015 |

9,522 |

9,394 |

9,511 |

2015 |

9,704 |

9,895 |

9,776 |

2016 |

9,258 |

9,142 |

9,298 |

2016 |

9,841 |

10,022 |

9,915 |

2016 |

10,181 |

10,468 |

10,247 |

2016 |

10,092 |

10,717 |

10,208 |

2017 |

10,595 |

11,546 |

10,724 |

2017 |

10,954 |

11,795 |

11,041 |

2017 |

11,221 |

12,150 |

11,286 |

2017 |

11,570 |

13,104 |

11,766 |

2018 |

11,674 |

13,419 |

11,851 |

2018 |

11,664 |

13,572 |

11,923 |

2018 |

11,882 |

14,610 |

12,247 |

2018 |

11,465 |

13,828 |

11,781 |

2019 |

11,820 |

14,096 |

12,087 |

2019 |

11,899 |

13,911 |

12,083 |

2019 |

12,366 |

14,801 |

12,570 |

2019 |

12,753 |

15,970 |

13,103 |

2020 |

12,570 |

15,069 |

12,751 |

2020 |

12,550 |

15,505 |

12,822 |

2020 |

13,699 |

17,975 |

13,863 |

2020 |

14,284 |

19,008 |

14,448 |

2021 |

14,948 |

20,393 |

14,991 |

2021 |

15,657 |

22,314 |

15,756 |

2021 |

16,092 |

23,914 |

16,213 |

2021 |

15,880 |

24,014 |

16,043 |

2022 |

15,389 |

22,900 |

15,607 |

2022 |

14,595 |

21,492 |

14,839 |

2022 |

14,066 |

20,738 |

14,332 |

2022 |

14,209 |

21,420 |

14,571 |

2023 |

14,196 |

21,051 |

14,662 |

2023 |

14,421 |

21,929 |

14,921 |

2023 |

14,847 |

23,798 |

15,358 |

2023 |

14,966 |

24,121 |

15,484 |

2024 |

15,822 |

27,072 |

16,368 |

2024 |

16,178 |

27,978 |

16,708 |

2024 |

16,865 |

30,020 |

17,555 |

2024 |

17,196 |

32,439 |

17,834 |

2025 |

17,249 |

31,819 |

17,929 |

2025 |

17,365 |

31,648 |

18,181 |

|

| Average Annual Return [Table Text Block] |

|

1 Year |

5 Years |

10 Years |

Target 2025 Fund (Advisor Class) |

7.34% |

6.71% |

5.67% |

Russell 3000 Index (Regulatory Benchmark) |

13.12 |

15.34 |

12.21 |

S&P Target Date 2025 Index (Strategy Benchmark) |

8.82 |

7.23 |

6.16 | |

| No Deduction of Taxes [Text Block] |

Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information can be found at www.troweprice.com.

|

| Distribution of Capital [Text Block] |

The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.

|

| AssetsNet |

$ 453,289,000

|

| Holdings Count | Holding |

27

|

| Advisory Fees Paid, Amount |

$ 1,856,000

|

| InvestmentCompanyPortfolioTurnover |

25.20%

|

| Additional Fund Statistics Significance or Limits [Text Block] |

What are some fund statistics? - Total Net Assets (000s)$453,289

- Number of Portfolio Holdings27

|

| Holdings [Text Block] |

Domestic Bond Funds |

40.1% |

Domestic Equity Funds |

30.7 |

International Bond Funds |

13.4 |

International Equity Funds |

11.4 |

Short-Term and Other |

4.4 | |

| Largest Holdings [Text Block] |

T. Rowe Price Limited Duration Inflation Focused Bond Fund |

19.6% |

T. Rowe Price New Income Fund |

14.4 |

T. Rowe Price Value Fund |

6.1 |

T. Rowe Price Growth Stock Fund |

5.7 |

T. Rowe Price International Bond Fund (USD Hedged) |

5.7 |

T. Rowe Price Hedged Equity Fund |

4.2 |

T. Rowe Price U.S. Large-Cap Core Fund |

4.1 |

T. Rowe Price International Value Equity Fund |

3.5 |

T. Rowe Price Dynamic Global Bond Fund |

3.4 |

T. Rowe Price Overseas Stock Fund |

3.0 | |

| Material Fund Change [Text Block] |

|

| Updated Prospectus Web Address |

www.troweprice.com/paperless

|

| C000169044 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Target 2025 Fund

|

| Class Name |

I Class

|

| Trading Symbol |

TRVVX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Target 2025 Fund (the "fund") for the period of June 1, 2024 to May 31, 2025. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Material Fund Change Notice [Text Block] |

|

| Additional Information Phone Number |

1‑800‑638‑5660

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 17.3333px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">info@troweprice.com</span>

|

| Additional Information Website |

www.troweprice.com/prospectus

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

|

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Target 2025 Fund - I Class |

$36 |

0.35% | |

| Expenses Paid, Amount |

$ 36

|

| Expense Ratio, Percent |

0.35%

|

| Factors Affecting Performance [Text Block] |

What drove fund performance during the past 12 months?Global stock indexes and fixed income markets were broadly positive for the 12 months ended May 31, 2025. Many major central banks began easing interest rates early in the period as inflation slowed. Early optimism over the U.S. election of President Donald Trump brought, first, a boost to U.S. equities, followed by heightened volatility in global equity markets amid concerns over Trump’s fluctuating tariff policies. Versus the style-specific S&P Target Date 2025 Index, our diversified U.S. mid-cap equity structure contributed to performance for the trailing one-year period as our dedicated allocations to growth and value outpaced the benchmark’s core-oriented mid-cap equity allocation. Additionally, exposure to short duration Treasury inflation protected securities contributed to performance for the period. On the negative side, a leading detractor from relative results was security selection within the US Mid-Cap Growth Equity Strategy, which trailed its benchmark. The fund’s smaller allocation to U.S. large-cap equities versus small- and mid-cap equities compared with the benchmark also detracted. The fund seeks the highest total return over time, consistent with an emphasis on both capital growth and income. The fund invests in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. Its allocation among T. Rowe Price funds will change over time in relation to its target retirement date.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

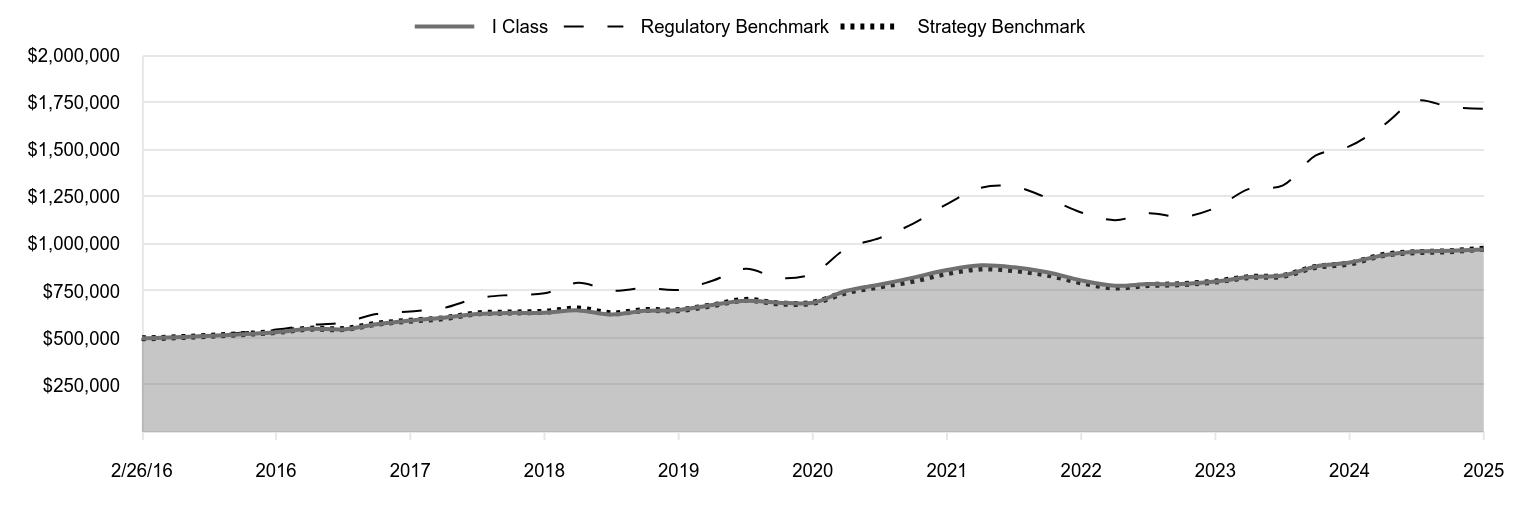

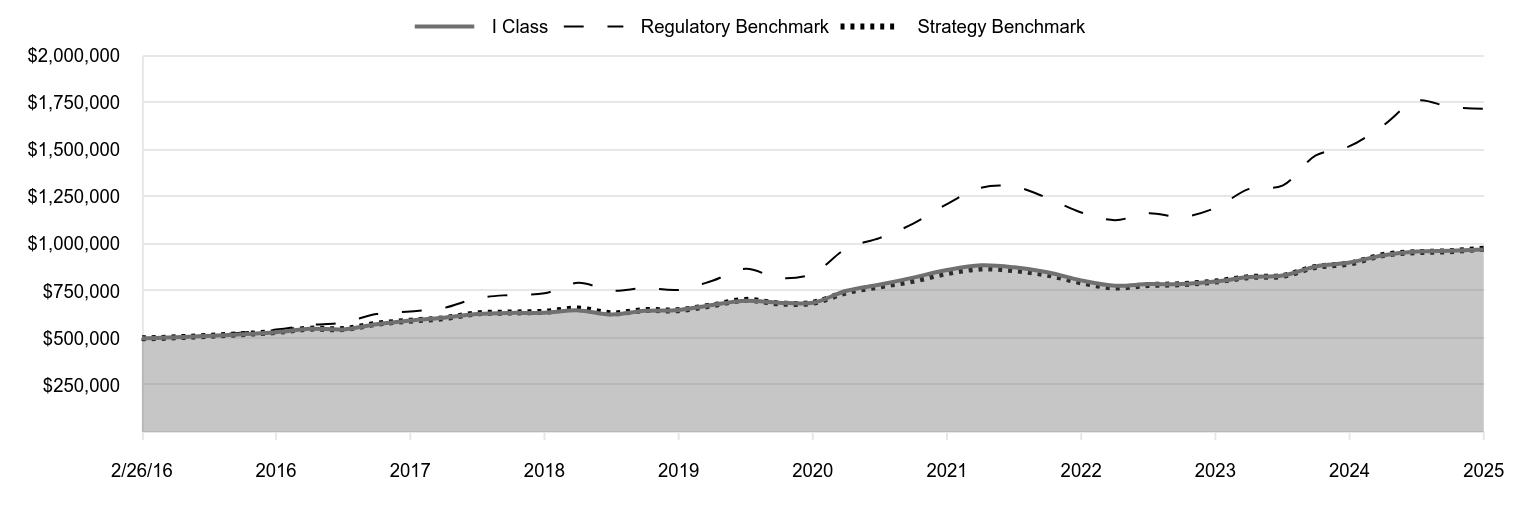

| Line Graph [Table Text Block] |

|

I Class |

Regulatory Benchmark |

Strategy Benchmark |

2/26/16 |

500,000 |

500,000 |

500,000 |

2/29/16 |

498,555 |

496,422 |

498,279 |

5/31/16 |

530,347 |

544,231 |

531,384 |

8/31/16 |

549,133 |

568,440 |

549,135 |

11/30/16 |

545,279 |

581,943 |

547,043 |

2/28/17 |

572,395 |

626,947 |

574,731 |

5/31/17 |

592,767 |

640,512 |

591,694 |

8/31/17 |

607,673 |

659,747 |

604,829 |

11/30/17 |

627,051 |

711,555 |

630,542 |

2/28/18 |

633,129 |

728,662 |

635,116 |

5/31/18 |

633,643 |

736,982 |

638,951 |

8/31/18 |

646,480 |

793,335 |

656,335 |

11/30/18 |

624,400 |

750,879 |

631,344 |

2/28/19 |

644,104 |

765,454 |

647,752 |

5/31/19 |

648,963 |

755,379 |

647,550 |

8/31/19 |

675,418 |

803,727 |

673,667 |

11/30/19 |

697,014 |

867,195 |

702,207 |

2/29/20 |

687,578 |

818,289 |

683,326 |

5/31/20 |

687,017 |

841,972 |

687,179 |

8/31/20 |

750,900 |

976,058 |

742,918 |

11/30/20 |

783,962 |

1,032,167 |

774,294 |

2/28/21 |

820,800 |

1,107,368 |

803,384 |

5/31/21 |

860,797 |

1,211,696 |

844,395 |

8/31/21 |

885,722 |

1,298,577 |

868,901 |

11/30/21 |

875,288 |

1,304,032 |

859,761 |

2/28/22 |

849,090 |

1,243,505 |

836,394 |

5/31/22 |

806,060 |

1,167,058 |

795,274 |

8/31/22 |

777,575 |

1,126,100 |

768,105 |

11/30/22 |

786,060 |

1,163,163 |

780,881 |

2/28/23 |

786,324 |

1,143,118 |

785,759 |

5/31/23 |

799,441 |

1,190,804 |

799,657 |

8/31/23 |

823,706 |

1,292,283 |

823,078 |

11/30/23 |

831,576 |

1,309,822 |

829,804 |

2/29/24 |

880,099 |

1,470,073 |

877,186 |

5/31/24 |

900,614 |

1,519,264 |

895,397 |

8/31/24 |

939,593 |

1,630,142 |

940,801 |

11/30/24 |

959,424 |

1,761,518 |

955,779 |

2/28/25 |

963,428 |

1,727,827 |

960,828 |

5/31/25 |

970,666 |

1,718,566 |

974,361 |

|

| Average Annual Return [Table Text Block] |

|

1 Year |

5 Years |

Since Inception 2/26/16 |

Target 2025 Fund (I Class) |

7.78% |

7.16% |

7.43% |

Russell 3000 Index (Regulatory Benchmark) |

13.12 |

15.34 |

14.27 |

S&P Target Date 2025 Index (Strategy Benchmark) |

8.82 |

7.23 |

7.47 | |

| Performance Inception Date |

Feb. 26, 2016

|

| No Deduction of Taxes [Text Block] |

Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information can be found at www.troweprice.com.

|

| Distribution of Capital [Text Block] |

The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.

|

| AssetsNet |

$ 453,289,000

|

| Holdings Count | Holding |

27

|

| Advisory Fees Paid, Amount |

$ 1,856,000

|

| InvestmentCompanyPortfolioTurnover |

25.20%

|

| Additional Fund Statistics Significance or Limits [Text Block] |

What are some fund statistics? - Total Net Assets (000s)$453,289

- Number of Portfolio Holdings27

|

| Holdings [Text Block] |

Domestic Bond Funds |

40.1% |

Domestic Equity Funds |

30.7 |

International Bond Funds |

13.4 |

International Equity Funds |

11.4 |

Short-Term and Other |

4.4 | |

| Largest Holdings [Text Block] |

T. Rowe Price Limited Duration Inflation Focused Bond Fund |

19.6% |

T. Rowe Price New Income Fund |

14.4 |

T. Rowe Price Value Fund |

6.1 |

T. Rowe Price Growth Stock Fund |

5.7 |

T. Rowe Price International Bond Fund (USD Hedged) |

5.7 |

T. Rowe Price Hedged Equity Fund |

4.2 |

T. Rowe Price U.S. Large-Cap Core Fund |

4.1 |

T. Rowe Price International Value Equity Fund |

3.5 |

T. Rowe Price Dynamic Global Bond Fund |

3.4 |

T. Rowe Price Overseas Stock Fund |

3.0 | |

| Material Fund Change [Text Block] |

|

| Updated Prospectus Web Address |

www.troweprice.com/paperless

|