Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

T. ROWE PRICE TOTAL RETURN FUND, INC.

|

| Entity Central Index Key |

0001681576

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| C000174964 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Total Return Fund

|

| Class Name |

Investor Class

|

| Trading Symbol |

PTTFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Total Return Fund (the "fund") for the period of June 1, 2024 to May 31, 2025. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Material Fund Change Notice [Text Block] |

|

| Additional Information Phone Number |

1‑800‑638‑5660

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 17.3333px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">info@troweprice.com</span>

|

| Additional Information Website |

www.troweprice.com/prospectus

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

|

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Total Return Fund - Investor Class |

$47 |

0.46% | |

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.46%

|

| Factors Affecting Performance [Text Block] |

What drove fund performance during the past 12 months?The U.S. investment-grade fixed income market generated positive results for the 12-month reporting period. Treasury yields fell across most maturities, benefiting bond investors, and credit sectors continued to perform well amid a resilient economy, although policy uncertainty led to increased volatility in the second half of the period. Out-of-benchmark allocations to high yield corporate bonds and leveraged loans contributed versus the Bloomberg U.S. Aggregate Bond Index. Despite increased volatility late in the period, these sectors performed well through the second half of 2024 and into early 2025. Our positioning for a steeper yield curve was also beneficial. Tactical adjustments to the fund’s duration position detracted from performance versus the benchmark. Security selection in the agency mortgage-backed securities sector also hurt performance. The fund invests in a diversified portfolio of bonds and other debt instruments and is constructed with an aim of being able to respond to a wide variety of market conditions. By the end of the period, credit risk levels in the portfolio, as measured by the duration times spread metric, were below longer-term averages amid elevated uncertainty and stretched valuations. With increased inflation expectations, the fund also held inflation swaps. Overall, the fund held material exposure to derivatives, including interest rate and credit derivatives that help the investment team more efficiently manage duration and sector positioning.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

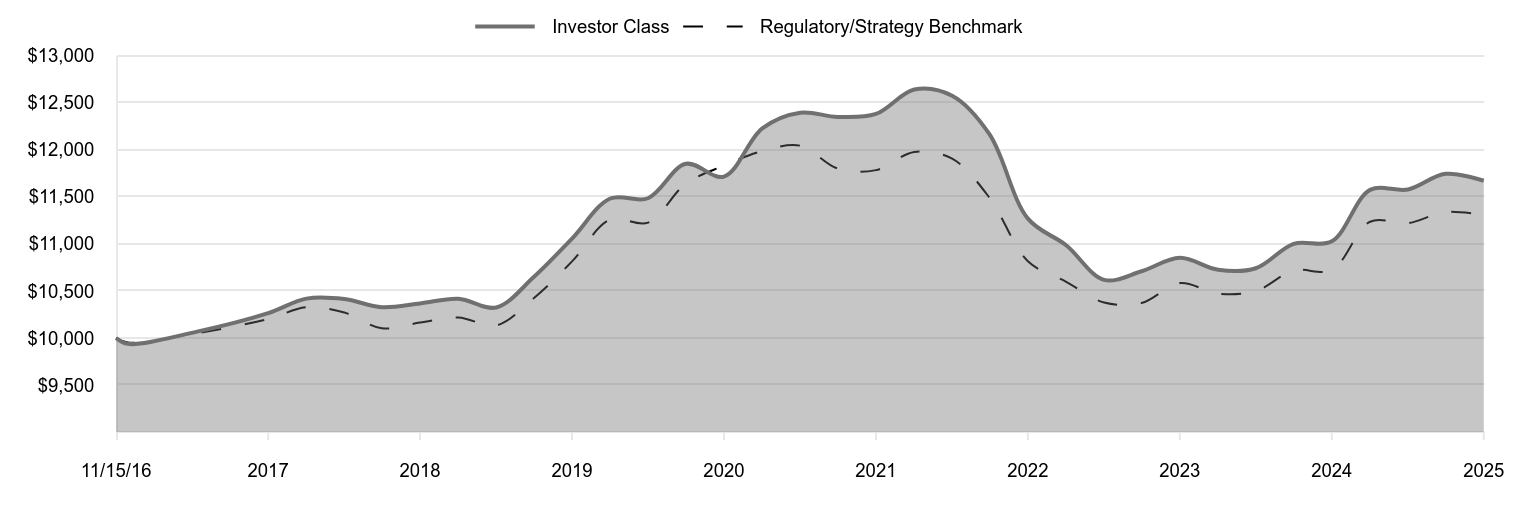

| Line Graph [Table Text Block] |

|

Investor Class |

Regulatory/Strategy Benchmark |

11/15/16 |

10,000 |

10,000 |

11/30/16 |

9,937 |

9,951 |

2/28/17 |

10,067 |

10,051 |

5/31/17 |

10,263 |

10,201 |

8/31/17 |

10,418 |

10,327 |

11/30/17 |

10,413 |

10,270 |

2/28/18 |

10,327 |

10,102 |

5/31/18 |

10,367 |

10,163 |

8/31/18 |

10,417 |

10,218 |

11/30/18 |

10,324 |

10,133 |

2/28/19 |

10,647 |

10,422 |

5/31/19 |

11,056 |

10,814 |

8/31/19 |

11,482 |

11,258 |

11/30/19 |

11,485 |

11,226 |

2/29/20 |

11,851 |

11,640 |

5/31/20 |

11,715 |

11,832 |

8/31/20 |

12,228 |

11,987 |

11/30/20 |

12,395 |

12,044 |

2/28/21 |

12,350 |

11,801 |

5/31/21 |

12,381 |

11,784 |

8/31/21 |

12,641 |

11,977 |

11/30/21 |

12,575 |

11,905 |

2/28/22 |

12,163 |

11,489 |

5/31/22 |

11,268 |

10,815 |

8/31/22 |

10,985 |

10,597 |

11/30/22 |

10,617 |

10,376 |

2/28/23 |

10,709 |

10,372 |

5/31/23 |

10,852 |

10,583 |

8/31/23 |

10,725 |

10,471 |

11/30/23 |

10,741 |

10,499 |

2/29/24 |

11,000 |

10,717 |

5/31/24 |

11,027 |

10,722 |

8/31/24 |

11,574 |

11,235 |

11/30/24 |

11,578 |

11,220 |

2/28/25 |

11,745 |

11,340 |

5/31/25 |

11,671 |

11,307 |

|

| Average Annual Return [Table Text Block] |

|

1 Year |

5 Years |

Since Inception 11/15/16 |

Total Return Fund (Investor Class) |

5.84% |

-0.07% |

1.83% |

Bloomberg U.S. Aggregate Bond Index (Regulatory/Strategy Benchmark) |

5.46 |

-0.90 |

1.45 | |

| Performance Inception Date |

Nov. 15, 2016

|

| No Deduction of Taxes [Text Block] |

Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information can be found at www.troweprice.com.

|

| Distribution of Capital [Text Block] |

The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.

|

| AssetsNet |

$ 652,211,000

|

| Holdings Count | Holding |

1,454

|

| Advisory Fees Paid, Amount |

$ 1,631,000

|

| InvestmentCompanyPortfolioTurnover |

150.30%

|

| Additional Fund Statistics Significance or Limits [Text Block] |

What are some fund statistics? - Total Net Assets (000s)$652,211

- Number of Portfolio Holdings1,454

|

| Holdings [Text Block] |

U.S. Government Agency Obligations (Excluding Mortgage-Backed) |

28.5% |

U.S. Government & Agency Mortgage-Backed Securities |

20.1 |

Corporate Bonds |

18.6 |

Asset-Backed Securities |

13.5 |

Bank Loans |

7.5 |

Non-U.S. Government Mortgage-Backed Securities |

7.5 |

Foreign Government Obligations & Municipalities |

1.3 |

Municipal Securities |

0.5 |

Short-Term and Other |

2.5 | |

| Largest Holdings [Text Block] |

U.S. Treasury Notes |

16.1% |

U.S. Treasury Bonds |

12.4 |

Federal National Mortgage Assn. |

9.4 |

Federal Home Loan Mortgage |

5.4 |

Government National Mortgage Assn. |

4.8 |

Carvana Auto Receivables Trust |

0.6 |

CarMax Auto Owner Trust |

0.6 |

Cross Mortgage Trust |

0.6 |

Santander Drive Auto Receivables Trust |

0.5 |

Octagon Investment Partners 47 |

0.5 | |

| Material Fund Change [Text Block] |

|

| Updated Prospectus Web Address |

www.troweprice.com/paperless

|

| C000174965 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Total Return Fund

|

| Class Name |

Advisor Class

|

| Trading Symbol |

PTATX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Total Return Fund (the "fund") for the period of June 1, 2024 to May 31, 2025. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Material Fund Change Notice [Text Block] |

|

| Additional Information Phone Number |

1‑800‑638‑5660

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 17.3333px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">info@troweprice.com</span>

|

| Additional Information Website |

www.troweprice.com/prospectus

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

|

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Total Return Fund - Advisor Class |

$77 |

0.75% | |

| Expenses Paid, Amount |

$ 77

|

| Expense Ratio, Percent |

0.75%

|

| Factors Affecting Performance [Text Block] |

What drove fund performance during the past 12 months?The U.S. investment-grade fixed income market generated positive results for the 12-month reporting period. Treasury yields fell across most maturities, benefiting bond investors, and credit sectors continued to perform well amid a resilient economy, although policy uncertainty led to increased volatility in the second half of the period. Out-of-benchmark allocations to high yield corporate bonds and leveraged loans contributed versus the Bloomberg U.S. Aggregate Bond Index. Despite increased volatility late in the period, these sectors performed well through the second half of 2024 and into early 2025. Our positioning for a steeper yield curve was also beneficial. Tactical adjustments to the fund’s duration position detracted from performance versus the benchmark. Security selection in the agency mortgage-backed securities sector also hurt performance. The fund invests in a diversified portfolio of bonds and other debt instruments and is constructed with an aim of being able to respond to a wide variety of market conditions. By the end of the period, credit risk levels in the portfolio, as measured by the duration times spread metric, were below longer-term averages amid elevated uncertainty and stretched valuations. With increased inflation expectations, the fund also held inflation swaps. Overall, the fund held material exposure to derivatives, including interest rate and credit derivatives that help the investment team more efficiently manage duration and sector positioning.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

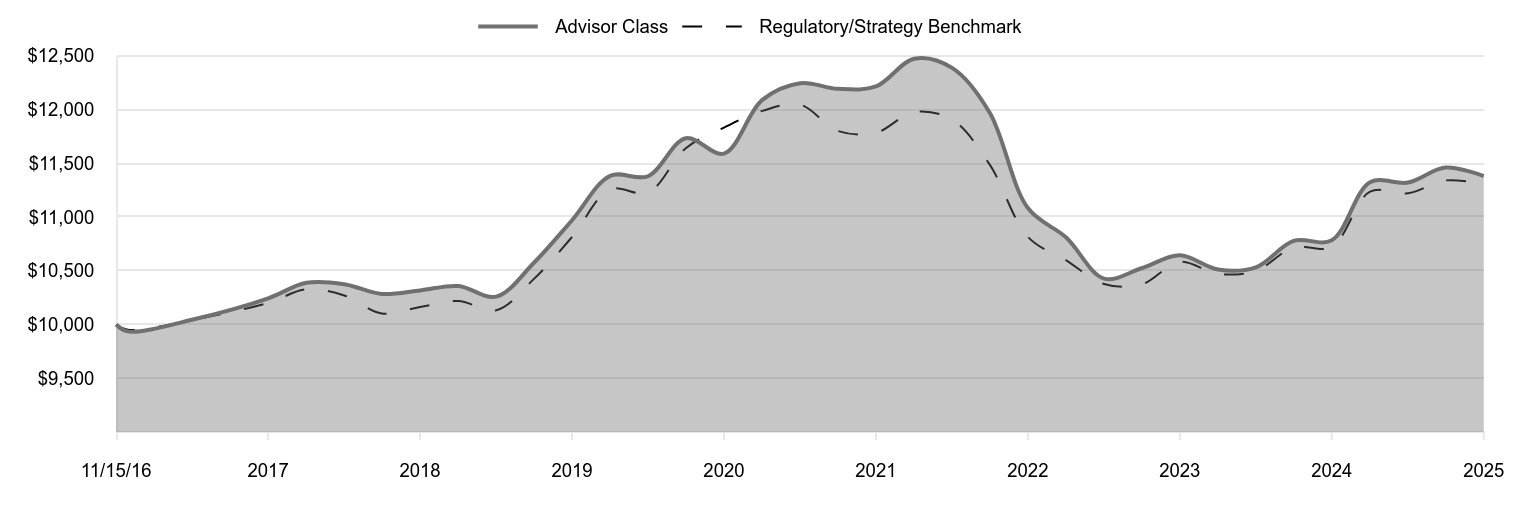

| Line Graph [Table Text Block] |

|

Advisor Class |

Regulatory/Strategy Benchmark |

11/15/16 |

10,000 |

10,000 |

11/30/16 |

9,936 |

9,951 |

2/28/17 |

10,056 |

10,051 |

5/31/17 |

10,243 |

10,201 |

8/31/17 |

10,388 |

10,327 |

11/30/17 |

10,375 |

10,270 |

2/28/18 |

10,284 |

10,102 |

5/31/18 |

10,317 |

10,163 |

8/31/18 |

10,358 |

10,218 |

11/30/18 |

10,259 |

10,133 |

2/28/19 |

10,572 |

10,422 |

5/31/19 |

10,970 |

10,814 |

8/31/19 |

11,383 |

11,258 |

11/30/19 |

11,379 |

11,226 |

2/29/20 |

11,733 |

11,640 |

5/31/20 |

11,590 |

11,832 |

8/31/20 |

12,089 |

11,987 |

11/30/20 |

12,245 |

12,044 |

2/28/21 |

12,192 |

11,801 |

5/31/21 |

12,214 |

11,784 |

8/31/21 |

12,472 |

11,977 |

11/30/21 |

12,387 |

11,905 |

2/28/22 |

11,972 |

11,489 |

5/31/22 |

11,083 |

10,815 |

8/31/22 |

10,809 |

10,597 |

11/30/22 |

10,427 |

10,376 |

2/28/23 |

10,523 |

10,372 |

5/31/23 |

10,643 |

10,583 |

8/31/23 |

10,511 |

10,471 |

11/30/23 |

10,532 |

10,499 |

2/29/24 |

10,778 |

10,717 |

5/31/24 |

10,784 |

10,722 |

8/31/24 |

11,323 |

11,235 |

11/30/24 |

11,320 |

11,220 |

2/28/25 |

11,460 |

11,340 |

5/31/25 |

11,381 |

11,307 |

|

| Average Annual Return [Table Text Block] |

|

1 Year |

5 Years |

Since Inception 11/15/16 |

Total Return Fund (Advisor Class) |

5.54% |

-0.36% |

1.53% |

Bloomberg U.S. Aggregate Bond Index (Regulatory/Strategy Benchmark) |

5.46 |

-0.90 |

1.45 | |

| Performance Inception Date |

Nov. 15, 2016

|

| No Deduction of Taxes [Text Block] |

Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information can be found at www.troweprice.com.

|

| Distribution of Capital [Text Block] |

The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.

|

| AssetsNet |

$ 652,211,000

|

| Holdings Count | Holding |

1,454

|

| Advisory Fees Paid, Amount |

$ 1,631,000

|

| InvestmentCompanyPortfolioTurnover |

150.30%

|

| Additional Fund Statistics Significance or Limits [Text Block] |

What are some fund statistics? - Total Net Assets (000s)$652,211

- Number of Portfolio Holdings1,454

|

| Holdings [Text Block] |

U.S. Government Agency Obligations (Excluding Mortgage-Backed) |

28.5% |

U.S. Government & Agency Mortgage-Backed Securities |

20.1 |

Corporate Bonds |

18.6 |

Asset-Backed Securities |

13.5 |

Bank Loans |

7.5 |

Non-U.S. Government Mortgage-Backed Securities |

7.5 |

Foreign Government Obligations & Municipalities |

1.3 |

Municipal Securities |

0.5 |

Short-Term and Other |

2.5 | |

| Largest Holdings [Text Block] |

U.S. Treasury Notes |

16.1% |

U.S. Treasury Bonds |

12.4 |

Federal National Mortgage Assn. |

9.4 |

Federal Home Loan Mortgage |

5.4 |

Government National Mortgage Assn. |

4.8 |

Carvana Auto Receivables Trust |

0.6 |

CarMax Auto Owner Trust |

0.6 |

Cross Mortgage Trust |

0.6 |

Santander Drive Auto Receivables Trust |

0.5 |

Octagon Investment Partners 47 |

0.5 | |

| Material Fund Change [Text Block] |

|

| Updated Prospectus Web Address |

www.troweprice.com/paperless

|

| C000174966 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Total Return Fund

|

| Class Name |

I Class

|

| Trading Symbol |

PTKIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Total Return Fund (the "fund") for the period of June 1, 2024 to May 31, 2025. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

|

| Material Fund Change Notice [Text Block] |

|

| Additional Information Phone Number |

1‑800‑638‑5660

|

| Additional Information Email |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 13.3333px; font-weight: 400; grid-area: auto; line-height: 17.3333px; margin: 0px; overflow: visible; text-align: justify; text-align-last: left; white-space-collapse: preserve-breaks;">info@troweprice.com</span>

|

| Additional Information Website |

www.troweprice.com/prospectus

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

|

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Total Return Fund - I Class |

$33 |

0.32% | |

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.32%

|

| Factors Affecting Performance [Text Block] |

What drove fund performance during the past 12 months?The U.S. investment-grade fixed income market generated positive results for the 12-month reporting period. Treasury yields fell across most maturities, benefiting bond investors, and credit sectors continued to perform well amid a resilient economy, although policy uncertainty led to increased volatility in the second half of the period. Out-of-benchmark allocations to high yield corporate bonds and leveraged loans contributed versus the Bloomberg U.S. Aggregate Bond Index. Despite increased volatility late in the period, these sectors performed well through the second half of 2024 and into early 2025. Our positioning for a steeper yield curve was also beneficial. Tactical adjustments to the fund’s duration position detracted from performance versus the benchmark. Security selection in the agency mortgage-backed securities sector also hurt performance. The fund invests in a diversified portfolio of bonds and other debt instruments and is constructed with an aim of being able to respond to a wide variety of market conditions. By the end of the period, credit risk levels in the portfolio, as measured by the duration times spread metric, were below longer-term averages amid elevated uncertainty and stretched valuations. With increased inflation expectations, the fund also held inflation swaps. Overall, the fund held material exposure to derivatives, including interest rate and credit derivatives that help the investment team more efficiently manage duration and sector positioning.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

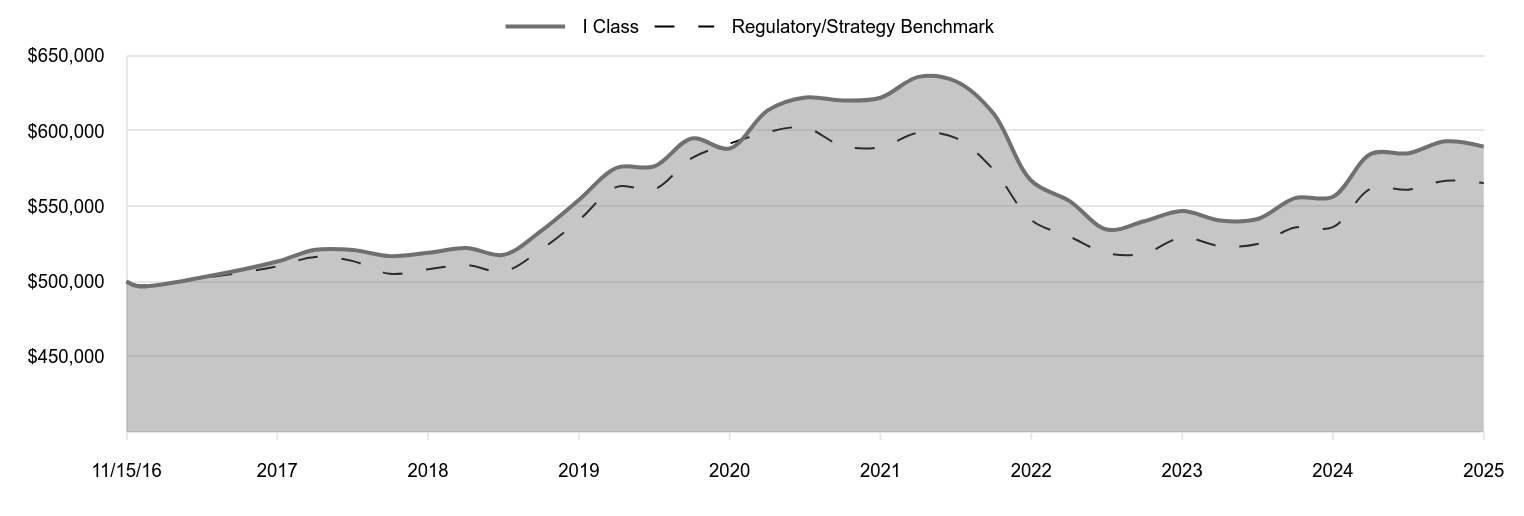

| Line Graph [Table Text Block] |

|

I Class |

Regulatory/Strategy Benchmark |

11/15/16 |

500,000 |

500,000 |

11/30/16 |

496,851 |

497,530 |

2/28/17 |

503,363 |

502,564 |

5/31/17 |

513,256 |

510,073 |

8/31/17 |

521,056 |

516,343 |

11/30/17 |

520,933 |

513,521 |

2/28/18 |

516,856 |

505,103 |

5/31/18 |

519,026 |

508,162 |

8/31/18 |

522,174 |

510,924 |

11/30/18 |

517,720 |

506,629 |

2/28/19 |

533,443 |

521,113 |

5/31/19 |

554,123 |

540,686 |

8/31/19 |

575,568 |

562,898 |

11/30/19 |

576,503 |

561,300 |

2/29/20 |

595,034 |

581,993 |

5/31/20 |

588,368 |

591,595 |

8/31/20 |

613,717 |

599,337 |

11/30/20 |

622,323 |

602,185 |

2/28/21 |

620,290 |

590,046 |

5/31/21 |

622,099 |

589,200 |

8/31/21 |

635,958 |

598,831 |

11/30/21 |

632,907 |

595,239 |

2/28/22 |

611,769 |

574,444 |

5/31/22 |

566,964 |

540,756 |

8/31/22 |

553,535 |

529,870 |

11/30/22 |

534,537 |

518,813 |

2/28/23 |

539,983 |

518,597 |

5/31/23 |

546,764 |

529,168 |

8/31/23 |

540,523 |

523,548 |

11/30/23 |

541,527 |

524,934 |

2/29/24 |

555,425 |

535,852 |

5/31/24 |

556,327 |

536,077 |

8/31/24 |

584,780 |

561,749 |

11/30/24 |

585,222 |

561,023 |

2/28/25 |

593,124 |

566,975 |

5/31/25 |

589,617 |

565,341 |

|

| Average Annual Return [Table Text Block] |

|

1 Year |

5 Years |

Since Inception 11/15/16 |

Total Return Fund (I Class) |

5.98% |

0.04% |

1.95% |

Bloomberg U.S. Aggregate Bond Index (Regulatory/Strategy Benchmark) |

5.46 |

-0.90 |

1.45 | |

| Performance Inception Date |

Nov. 15, 2016

|

| No Deduction of Taxes [Text Block] |

Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Updated performance information can be found at www.troweprice.com.

|

| Distribution of Capital [Text Block] |

The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.

|

| AssetsNet |

$ 652,211,000

|

| Holdings Count | Holding |

1,454

|

| Advisory Fees Paid, Amount |

$ 1,631,000

|

| InvestmentCompanyPortfolioTurnover |

150.30%

|

| Additional Fund Statistics Significance or Limits [Text Block] |

What are some fund statistics? - Total Net Assets (000s)$652,211

- Number of Portfolio Holdings1,454

|

| Holdings [Text Block] |

U.S. Government Agency Obligations (Excluding Mortgage-Backed) |

28.5% |

U.S. Government & Agency Mortgage-Backed Securities |

20.1 |

Corporate Bonds |

18.6 |

Asset-Backed Securities |

13.5 |

Bank Loans |

7.5 |

Non-U.S. Government Mortgage-Backed Securities |

7.5 |

Foreign Government Obligations & Municipalities |

1.3 |

Municipal Securities |

0.5 |

Short-Term and Other |

2.5 | |

| Largest Holdings [Text Block] |

U.S. Treasury Notes |

16.1% |

U.S. Treasury Bonds |

12.4 |

Federal National Mortgage Assn. |

9.4 |

Federal Home Loan Mortgage |

5.4 |

Government National Mortgage Assn. |

4.8 |

Carvana Auto Receivables Trust |

0.6 |

CarMax Auto Owner Trust |

0.6 |

Cross Mortgage Trust |

0.6 |

Santander Drive Auto Receivables Trust |

0.5 |

Octagon Investment Partners 47 |

0.5 | |

| Material Fund Change [Text Block] |

|

| Updated Prospectus Web Address |

www.troweprice.com/paperless

|