Exhibit 99.2

Unaudited Pro Forma Condensed Combined Financial Statement of ALT5 Sigma Corporation as of March 29, 2025, for the year ended December 28, 2024, and for the three months ended March 29, 2025

Introduction

Mswipe Acquisition

On May 13, 2025, ALT5 Sigma Corporation (the “Company” or “ALT5”) disclosed in Note 20 to its unaudited condensed financial statements filed in its Quarterly Report on Form 10-Q (the “10-Q”) that, effective on May 9, 2025, ALT5 and its indirect, wholly-owned second tier Canadian subsidiary entered into an agreement to purchase all of the outstanding capital stock of an entity that, through its subsidiaries, offers multi-currency, fiat- and crypto-enabled payment card services. The business trades under the name Mswipe. Through a suite of physical and virtual cards that are available on both the Visa® and Mastercard® networks, the acquired operations enable users seamlessly to spend traditional and digital currencies across the globe. The acquired platform is built with robust compliance frameworks, advanced security protocols, and real-time exchange capabilities, which allow for fast, secure, and borderless transactions. This is a B2B solution, which, when combined with our current solutions, bridges the gap between the crypto economy and traditional financial systems—while ensuring regulatory alignment, interoperability with existing payment networks, and a seamless user experience for institutional partners and their end-users.

The purchase price for this transaction consisted of our (i) issuing one million restricted shares of our common stock to the three sellers, valued at the Historical NOCP on May 9, 2025 of $6.10, (ii) granting five hundred thousand four-year common stock warrants to the three sellers, with a per-share exercise price of $5.50 (which was the approximate market price at the time that we reached an agreement in principal for this transaction), (iii) issuing shares to two of the sellers in “Alyea Therapeutics Corporation,” our biotech business that we are in process of separating from our core business, which shares we valued at $4.8 million, and (iv) issuing two 14-month straight promissory notes in the aggregate initial principal balance of approximately one million dollars with an interest rate at the AFR for quarterly compounded notes of 3.99% per annum and all principal and interest due at the maturity date. We also are acknowledging an equivalent 14-month term straight promissory note at the acquired company level that pre-dated our acquisition. The principal balance as of May 9, 2025 was approximately $5.1 million and the interest was reset to match that of the two notes that we issued. We also granted the sellers the right to one earn-out payment in the amount of $20 million (payable in cash or unregistered shares of our common stock) right if the Operating Subsidiaries generate a minimum of $15 million in annualized or actual total revenue from the assets owned by the Operating subsidiaries at May 9, 2025.

Proforma information

The accompanying unaudited pro forma condensed combined financial information was prepared in accordance with Article 11 of SEC Regulation S-X. The historical consolidated financial information in the unaudited pro forma condensed combined financial information has been adjusted to give effect to pro forma events that are (1) directly attributable to the acquisition, (2) factually supportable, and (3) expected to have a continuing impact on the combined results of the Company.

The unaudited pro forma condensed combined financial information does not give effect to any operating or revenue synergies that may result from the merger or the costs to achieve any synergies.

The unaudited pro forma condensed combined financial information has been presented for informational purposes only and is not necessarily indicative of what the combined Company's financial position or results of operations would have been had the transactions been completed as of the dates indicated. In addition, the unaudited pro forma condensed combined financial information does not purport to project the future financial position or operating results of the combined Company.

The unaudited pro forma condensed combined financial information contains estimated adjustments, based upon available information and certain assumptions that we believe are reasonable under the circumstances. The assumptions underlying the pro forma adjustments are described in greater detail in the accompanying notes to the unaudited pro forma combined financial information. In many cases, these assumptions were based on preliminary information and estimates.

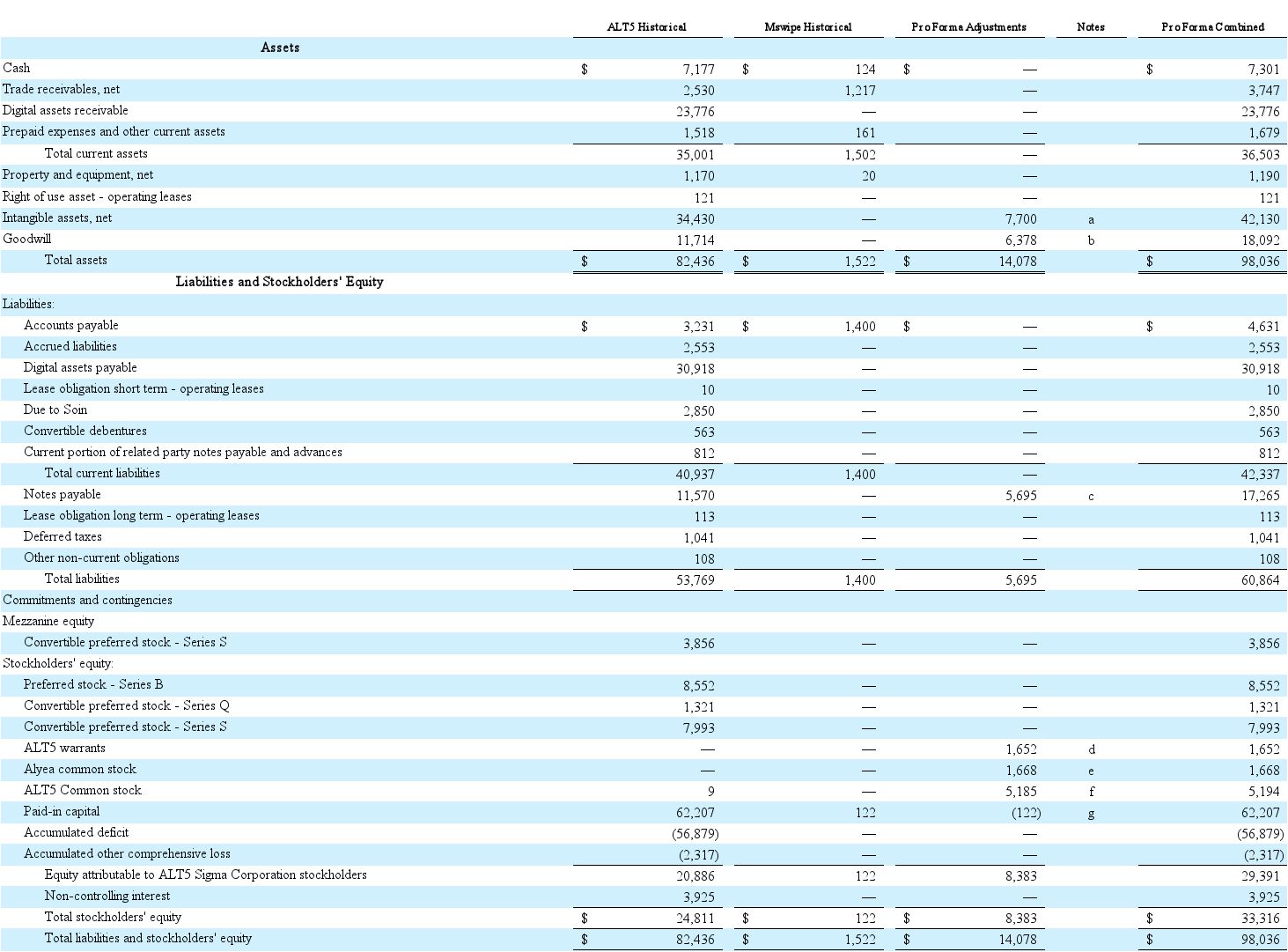

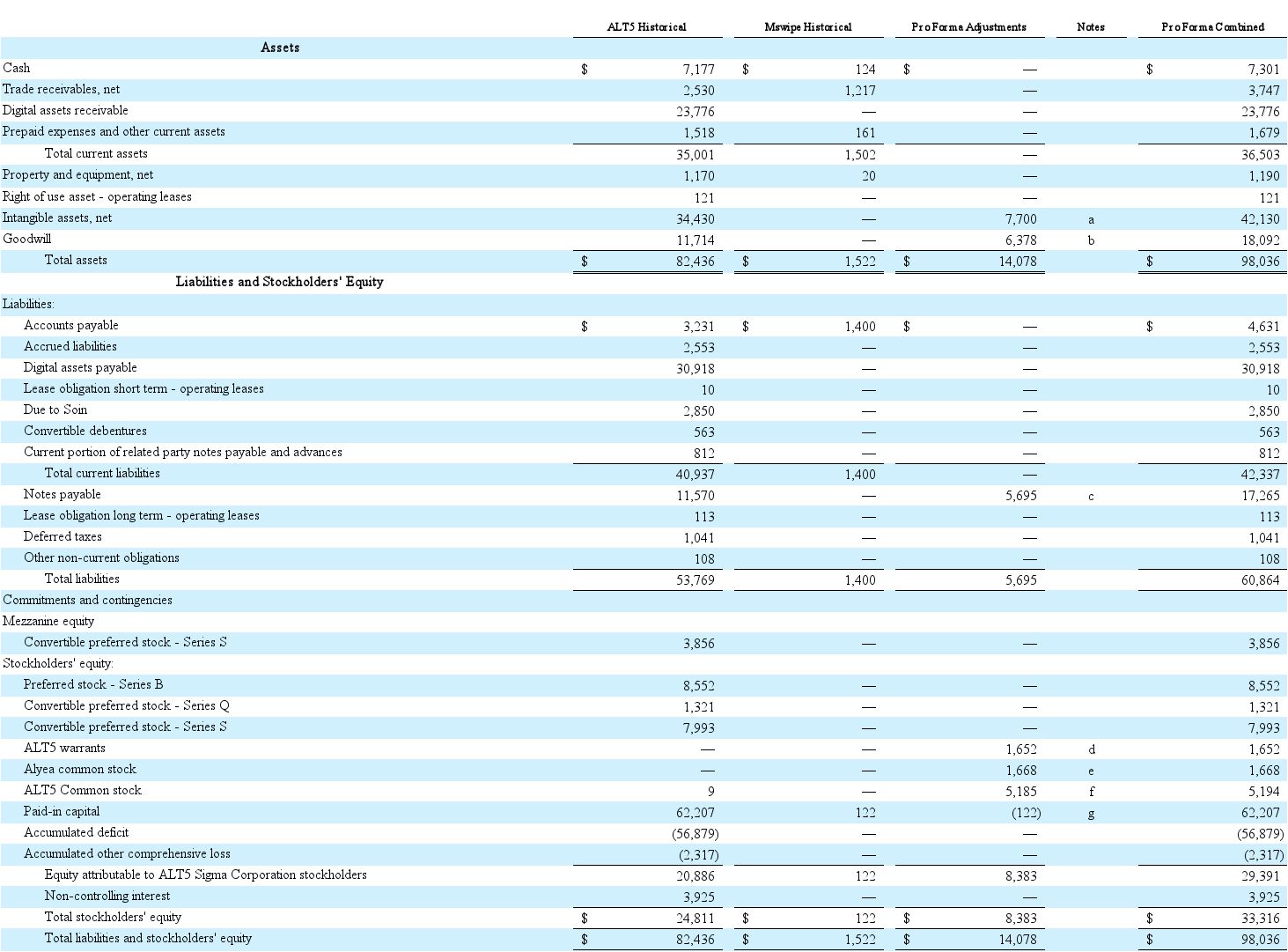

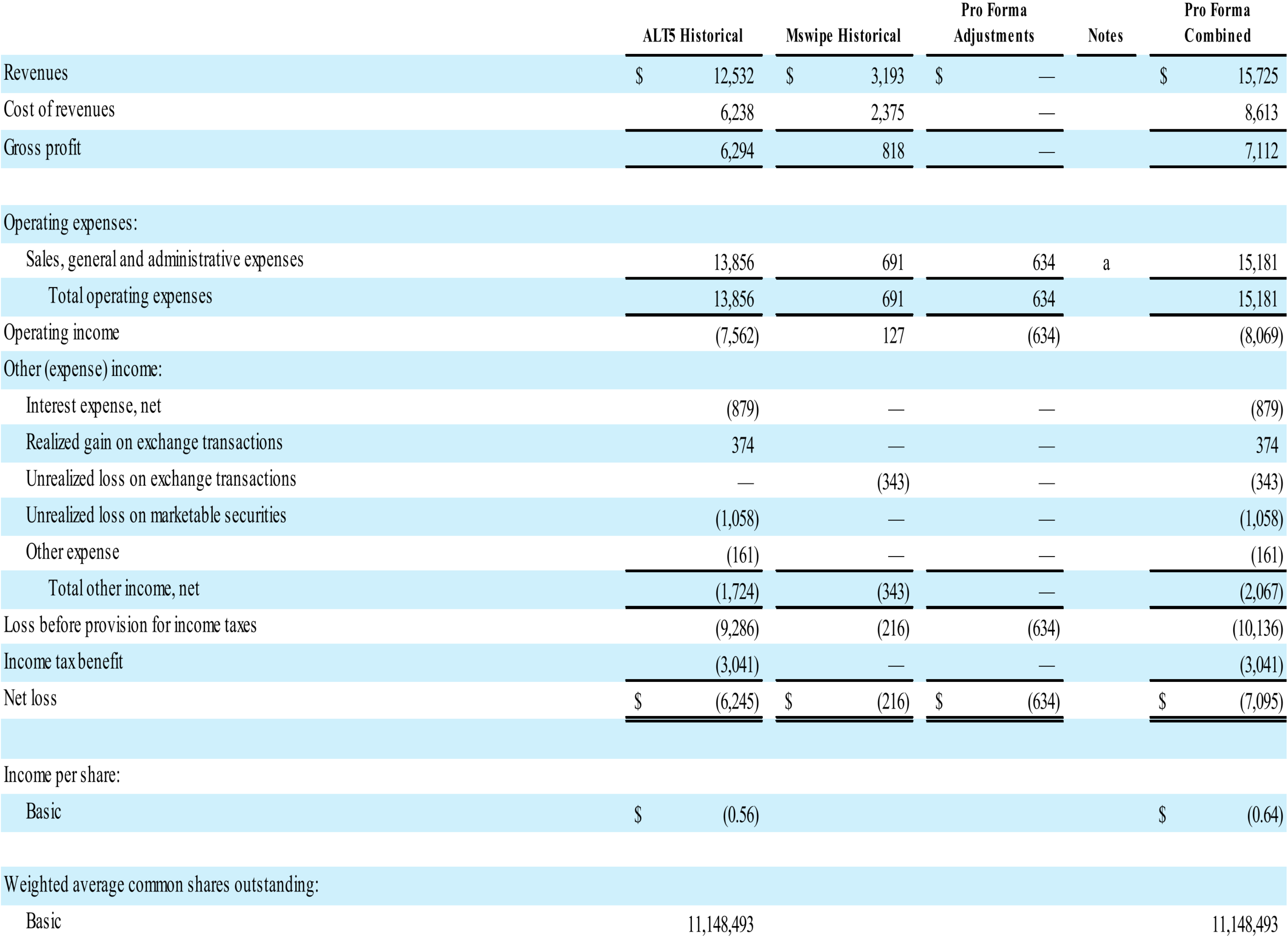

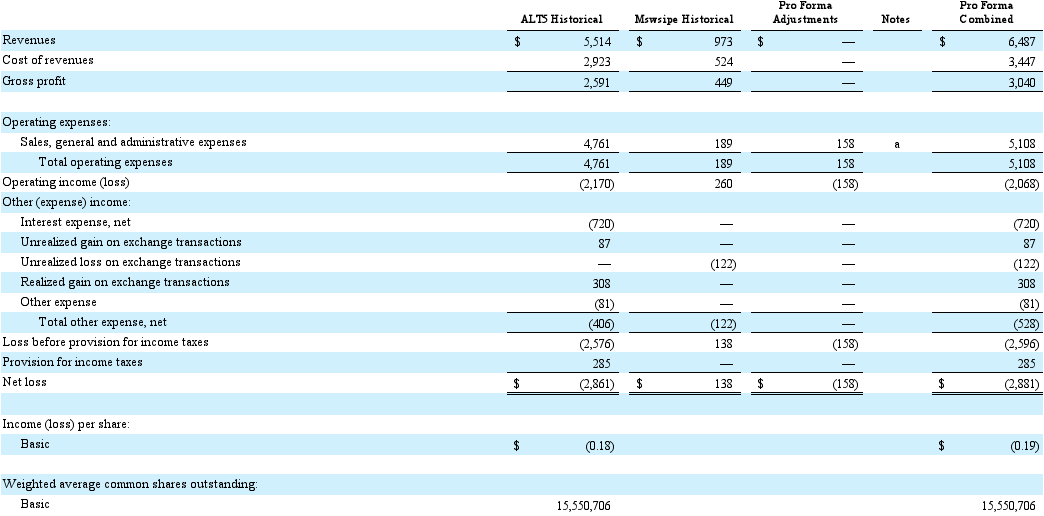

As of March 29, 2025, proforma total assets, liabilities, and total shareholders’ equity would have been approximately $98.0 million, $60.9 million, and $33.3 million, respectively. If the transaction had occurred on December 31, 2023, the pro forma statement of operations for the year ended December 28, 2024 would have reflected a net loss of approximately $7.1 million. Pro forma basic loss per share would have increased by $0.08 to $0.64. Additionally, the pro forma statement of operations for the three months ended March 29, 2025 would have reflected a net loss of approximately $2.9 million. Pro forma basic loss per share would have increased by $0.01 to $0.19.

ALT5 SIGMA CORPORATION

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEETS

MARCH 29, 2025

(dollars in thousands)

ALT5 SIGMA CORPORATION

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 28, 2024

(dollars in thousands, except per share amounts)

ALT5 SIGMA CORPORATION

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

THREE MONTHS ENDED MARCH 29, 2025

(dollars in thousands, except per share amounts)

LIVE VENTURES INCORPORATED

NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Note 1. Basis of presentation

The unaudited pro forma condensed combined financial statements are based on ALT5 Sigma Corporation’s and Mswipe’s historical financial statements as adjusted to give effect to the acquisition of Mswipe.

The unaudited pro forma combined statements of operations for the year ended December 28, 2024 gives effect to the Mswipe acquisition as if it had occurred on December 31, 2023. ALT5 Sigma Corporation’s fiscal year was December 30, 2023 to December 28, 2024, and the combined proforma statement of operations represents this period.

The unaudited pro forma combined statements of operations for the three months ended March 29, 2025 gives effect to the Mswipe acquisition as if it had occurred on December 28, 2024. The statement of operations for “ALT5 Historical” includes proforma financial results for the period of December 29, 2024 to March 29, 2025. The statement of operations for “Mswipe Historical” includes the actual results for Mswipe for the period of January 1, 2025 to March 31, 2025.

The unaudited pro forma combined balance sheets as of March 29, 2025 give effect to the Mswipe acquisition as if it had occurred on March 29, 2025.

Note 2. Preliminary purchase price allocation

The following table shows the preliminary allocation of the purchase price for Mswipe to the acquired identifiable assets, liabilities assumed and pro forma goodwill (dollars in thousands):

Note 3. Pro forma adjustments

The pro forma adjustments are based on our preliminary estimates and assumptions that are subject to change. The following adjustments have been reflected in the unaudited pro forma condensed combined financial information:

Adjustments to the pro forma condensed combined balance sheet

(a)Reflect the fair value of intangible assets acquired based on independent third-party appraisal.

(b)Reflects the preliminary estimate of goodwill, which represents the excess of the purchase price over the fair value of Mswipe’s identifiable assets acquired and liabilities assumed as presented in Note 2.

(c)Reflects Mswipe’s seller’s notes to finance the acquisition.

(d)Reflect the fair value of ALT5 warrants issued to finance the acquisition based on independent third-party appraisal.

(e)Reflect the fair value of Alyea common stock issued to finance the acquisition based on independent third-party appraisal.

(f)Reflect the fair value of ALT5 common stock issued to finance the acquisition based on independent third-party appraisal.

(g)Reflects the elimination of Mswipe’s shareholders’ equity.

Adjustments to the pro forma condensed combined statement of operations

(a)Reflects amortization expense of intangible assets based on the preliminary fair value at acquisition date.