Exhibit 99.1

|

PRESS RELEASE | NASDAQ: IPX | ASX: IPX

July 23, 2025

|

IPERIONX – JUNE 2025 QUARTERLY REPORT

IperionX Limited (Nasdaq | ASX: IPX) is pleased to present its quarterly report for the period ending June 30, 2025. Key highlights during and

subsequent to the end of the quarter include:

Commercial operations: production online and commissioning of all major equipment complete

| • |

Successful commissioning of the Titanium Manufacturing Campus in Virginia, with all major scrap-to-forged titanium manufacturing equipment now online and proven to meet operational capacity.

|

| • |

Repeated back-to-back production cycles of the Hydrogen Assisted Metallothermic Reduction (HAMRTM) furnace continue to produce high-quality titanium that

exceeds industry standards.

|

| • |

Commissioning-phase process improvements have reinforced the low-capex modular scalability of the HAMR process and underscore strong potential to surpass original nameplate titanium powder production. Higher throughput capacities will be

confirmed in the coming weeks.

|

| • |

Commissioning of powder metallurgy and Hydrogen Sintering & Phase Transformation (HSPTTM) forging systems are complete, underpinning production of

near-net-shape and forged titanium components.

|

Strong momentum across commercial and strategic customer partnerships

| • |

Customer activities accelerated during the quarter with increasing engagement across automotive, defense and aerospace, with a range of customers completing inspection and pre-qualification visits to the Titanium Manufacturing Campus in

Virginia.

|

| • |

Consumer‑electronics scrap processing commenced, validating circular supply chain from recycled titanium feedstock to manufactured forged titanium parts, as announced in collaboration with ELG Utica on July 3, 2024.

|

| • |

New verticals opening across mass industrial titanium manufacturing, where material manufacturing waste is typically high — including the production of titanium fasteners. These efforts are opening up new sales channels across aerospace,

commercial, military, and large-scale commercial markets.

|

| • |

IperionX is building a pipeline of partnerships with global manufacturers seeking to transition to low-cost, sustainable, circular, and traceable titanium supply chains.

|

U.S. Government backing to secure a low-cost domestic titanium supply chain

| • |

IperionX received a Small Business Innovation Research (SBIR) Phase III Indefinite Delivery, Indefinite Quantity (IDIQ) contract allowing task order funding from U.S. Department of Defense (DoD) agencies up to a total of US$99 million.

|

| • |

First task order awarded under the SBIR IDIQ contract to expedite the production and delivery of titanium parts for U.S. Army ground vehicle programs.

|

| • |

The SBIR Phase III contract and task order are in addition to the US$47.1 million in DoD funding awarded to IperionX in the prior quarter to accelerate development of a secure, low-cost, mineral-to-metal titanium supply chain.

|

| • |

IperionX continues to progress its long-term, tax-exempt bond financing through Virginia’s Halifax County Industrial Development Authority to underpin future titanium production expansions.

|

Titanium production expansion plans fast-tracked

| • |

Strong customer momentum and U.S. Government funding commitments driving accelerated titanium production scale‑up.

|

| • |

Subsequent to the end of the quarter, on July 23, 2025, IperionX announced a private placement to raise approximately US$46 million.

|

| • |

IperionX intends to use proceeds from the private placement to fast-track ordering of long‑lead HAMR and HSPT modules, plus parallel expansion of forging capacity to meet 2026-2027 production schedules.

|

| • |

Modular, low‑capex design allows accelerated production growth phases through 2030.

|

|

North Carolina

|

Tennessee

|

Virginia

|

Utah

|

|

129 W Trade Street, Suite 1405

Charlotte, NC 28202

|

279 West Main Street

Camden, TN 38320

|

1092 Confroy Drive

South Boston, VA 24592

|

1782 W 2300 S

West Valley City, UT 84119

|

IperionX Limited ABN 84 618 935 372

Titan Critical Minerals Project: DFS to advance a vital U.S. critical minerals supply chain

| • |

Definitive Feasibility Study (DFS) activities continued at the Titan Project, funded in part by the recent U.S. DoD award.

|

| • |

Titan Project is the largest critical mineral sands project in the U.S. with a permitted multi-decade resource of titanium, zircon and rare earths.

|

| • |

DFS remains on track for completion in Q2 2026, which will underpin a long-term future supply of titanium feedstock and heavy rare earths, including dysprosium and terbium - key elements for high-performance defense systems.

|

| • |

Titan Project’s heavy rare earth resources, including dysprosium and terbium, complement light rare‑earth assets recently backed by the DoD, positioning IperionX as a potential partner of choice for a complete domestic magnet supply

chain.

|

Strong financial position

| • |

At June 30, 2025, IperionX closed the quarter with US$55 million in cash.

|

| • |

Subsequently, on July 23, 2025, IperionX announced that it had received firm commitments for a private placement of 14 million new ordinary shares at an issue price of A$5.00 per share, to raise approximately US$46 million before costs

(Placement), resulting in pro-forma cash of approximately US$100 million.

|

| • |

IperionX intends to use proceeds from the Placement for:

|

| o |

Accelerating Phase 2 capacity scale-up, with fast-track ordering of long lead time production and manufacturing equipment;

|

| o |

Scaling Phase 1 operations, including low-cost capital projects to further increase production over nameplate throughput capacities;

|

| o |

Scaling of HSPT pressing and furnace capacity to align with accelerated production scale-up; and

|

| o |

Operations, Phase 3 expansion studies and increased R&D.

|

| • |

Directors subscribed for A$2.2 million (~US$1.4 million) under the Placement, subject to shareholder approval, reinforcing alignment with shareholders.

|

For further information and enquiries please contact:

investorrelations@iperionx.com

+1-980-237-8900

2

TITANIUM METAL OPERATIONS UPDATE

Production online and commissioning of all major equipment complete

Successful commissioning of the Titanium Manufacturing Campus in Virginia, with all major scrap-to-forged titanium manufacturing equipment now online and proven to meet operational capacity including the jet mill

(scrap size reduction), HAMR furnace (deoxygenation), leaching room operations (post-deoxygenation processing) and all external ancillary facilities.

Figure 1: Titanium Production Facility ancillary facilities complete

Repeated back-to-back production cycles of the HAMR furnace continue to produce high-quality titanium that exceeds industry standards. Commissioning-phase process improvements have reinforced the low-capex modular

scalability of the HAMR process and underscore strong potential to surpass original nameplate titanium powder production. Higher throughput capacities will be confirmed in the coming weeks.

Notably, the majority of ancillary production process systems have already been scaled beyond the nameplate capacity, which supports future titanium production growth via modular addition of HAMR furnaces at lower

capital.

Commissioning of powder metallurgy and HSPT forging systems are complete, underpinning production of near-net-shape and forged titanium components using the currently installed pressing and additive manufacturing

apparatus.

Strong momentum across commercial and strategic customer partnerships

Customer activities accelerated during the quarter with increasing engagement across automotive, defense and aerospace, with a range of customers completing inspection and pre-qualification visits to the Titanium

Manufacturing Campus.

Consumer‑electronics scrap processing commenced, validating circular supply chain from recycled titanium feedstock to manufactured forged titanium parts, as announced in collaboration with ELG Utica on July 3, 2024.

New verticals are opening across mass industrial titanium manufacturing, where material manufacturing waste is typically high — including the production of titanium fasteners. These efforts are opening up new sales

channels across aerospace military, and large-scale commercial markets

As operations scale, IperionX expects to expand product development activities to support a growing customer pipeline across a wide range of industries, including those targeting advanced robotics, mobility, and

precision engineering.

3

Figure 2 (clockwise from LHS): Jet mill, leaching room, scrap loading machine installed and commissioned

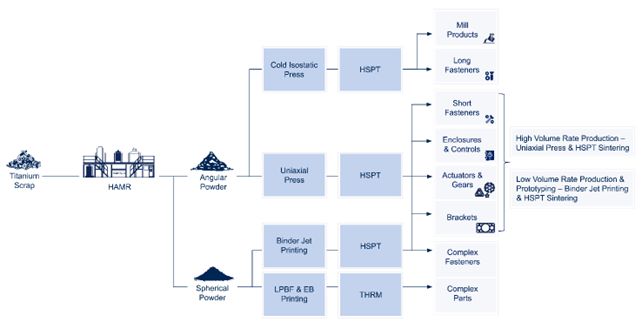

Figure 3: IperionX Titanium Technologies Product Map

Titanium production expansion plans fast-tracked

IperionX ‘s multiple DoD awards underpin planning and designs for expansion of titanium production capacity at the Titanium Manufacturing Campus, with strong customer momentum and U.S. Government funding commitments

driving accelerated titanium production scale‑up.

This recognition from the U.S. Government underscores IperionX’s national leadership in providing innovative, domestic, low-cost titanium solutions that meet the rigorous demands of defense and commercial sectors,

with IperionX well-positioned to scale future production capacity to support the U.S. government’s long-term objectives. The company remains committed to delivering unparalleled quality and sustainability, ensuring a secure and resilient titanium

supply chain for the nation’s most critical applications.

Subsequent to the end of the quarter, on July 23, 2025, IperionX announced a private placement to raise approximately US$46 million. IperionX intends to use proceeds from the Placement to fast-track ordering of

long‑lead HAMR and HSPT modules, plus parallel expansion of forging capacity to meet 2026-2027 production schedules. IperionX’s modular, low‑capex design allows accelerated production growth phases through 2030.

4

U.S. GOVERNMENT ACTIVITIES

IperionX received an SBIR Phase III IDIQ contract to achieve “Low-Cost Domestic Titanium for Defense Applications” in the U.S., allowing task order funding from U.S. DoD agencies up to a total of US$99 million.

The SBIR program, administered by the U.S. Small Business Administration, progresses innovations through three stages. Phase III is reserved for commercialization activities, allowing Federal agencies to procure

proven SBIR-funded technologies without further competition. This award recognizes IperionX’s readiness to deliver strategic titanium components for U.S. defense applications.

IperionX subsequently received the first task order under the SBIR IDIQ contract, valued at US$1.3 million to facilitate the production and delivery of titanium parts for U.S. Army ground vehicle programs. The U.S.

Army task order will be fulfilled at IperionX’s Titanium Manufacturing Campus in Virginia, using proprietary titanium production and advanced forging processes.

IperionX continues to advance a process relating to private activity bonds, with the IDA of Halifax County, Virginia (IDA) authorizing the issue of tax-exempt bonds of at least US$100 million and up to US$400

million. The potential issue of these tax-exempt private activity bonds, which, subject to further approvals, is expected to conclude in late 2025.

IperionX is increasingly recognized as the leading domestic solution to address the U.S. Government’s critical need for a secure, sustainable, and fully integrated titanium supply chain. With advanced patented

technologies, U.S.-based production capabilities, and the ability to produce titanium from 100% recycled scrap, IperionX is uniquely positioned to supply low-cost titanium for strategic sectors including defense, aerospace, and automotive.

TITAN CRITICAL MINERALS PROJECT

DFS to advance vital U.S. critical minerals supply chain

The DoD has obligated US$5 million to expedite the Titan Critical Minerals Project in Tennessee to ‘shovel-ready’ status through the completion of a Definitive Feasibility Study (DFS), an important milestone in

securing a new domestic source of titanium, rare earths and zircon critical minerals.

DFS activities are rapidly progressing and remain on track to be completed by Q2 2026. This study marks a major step in advancing the Titan Project towards production.

As a leading fully permitted critical minerals project in the U.S., the Titan Project is uniquely positioned to supply low-cost, domestic critical mineral feedstocks to support future large-scale expansions of

IperionX’s titanium production, enhancing the strength and resilience of the U.S. titanium supply chain.

Titan Project’s heavy rare earth resources, including dysprosium and terbium, complement light rare‑earth assets recently backed by the DoD, positioning IperionX as a potential partner of choice for a complete

domestic magnet supply chain.

BALANCE SHEET AND CORPORATE

Strong Financial Position

As of June 30, 2025, IperionX held US$54.8 million in cash which places the Company in a strong financial position to continue to ramp-up and optimize the initial production line and further scale production at the

Titanium Manufacturing Campus.

Private placement to accelerate Phase 2 expansion activities

Subsequent to the end of the quarter, on July 23, 2025, IperionX announced that it had received firm commitments for a private placement of 14 million new ordinary shares at an issue price of A$5.00 per share, to

raise A$70 million (approximately US$46 million) before costs. IperionX intends to use proceeds from the Placement for:

5

| • |

Accelerating Phase 2 capacity scale-up, with fast-track ordering of long lead time production and manufacturing equipment;

|

| • |

Scaling Phase 1 operations, including low-cost capital projects to further increase production over nameplate throughput capacities;

|

| • |

Scaling of HSPT pressing and furnace capacity to align with accelerated production scale-up; and

|

| • |

Operations, Phase 3 expansion studies and increased R&D.

|

Directors subscribed for A$2.2 million (~US$1.4 million) under the Placement, subject to shareholder approval, reinforcing alignment with shareholders.

The Placement will be completed in two tranches. Settlement of the first tranche of the Placement, comprising 13,566,770 ordinary shares, is expected to occur on or about July 29, 2025. Settlement of the second

tranche of the Placement, comprising 433,230 ordinary shares to be issued to participating directors of IperionX, is expected to occur after obtaining shareholder approval at a general meeting of shareholders to be called shortly.

ASX - ADDITIONAL INFORMATION

Mining properties – Titan Critical Minerals Project

The Titan Project is prospective for critical mineral sands including titanium minerals, rare earth minerals, high grade silica sand and zircon minerals. As of June 30, 2025,

the Titan Project comprised approximately 10,086 acres of surface and associated mineral rights in Tennessee, of which approximately 1,486 acres are owned by IperionX, approximately 422 acres are subject to long-term lease by IperionX, and

approximately 8,178 acres are subject to exclusive option agreements with IperionX. These exclusive option agreements, upon exercise, allow IperionX to lease or, in some cases, purchase the surface property and associated mineral rights.

Mining exploration expenditures

During the quarter, the following payments were made for mining exploration activities:

|

Activity

|

US$000

|

||

|

Mining and engineering consultants

|

(417)

|

||

|

Geological consultants

|

(15)

|

||

|

Metallurgical consultants

|

(23)

|

||

|

Land consultants

|

(8)

|

||

|

Sustainability

|

(3)

|

||

|

Surveying

|

(15)

|

||

|

Field supplies, equipment rental, vehicles, travel and deposit refunds

|

(17)

|

||

|

Total as reported in Appendix 5B

|

(498)

|

Table 2: Mining exploration expenditures

During the quarter, IperionX made no payments in relation to mining development or production activities.

Related party payments

During the quarter, IperionX made payments of approximately US$488,000 to related parties and their associates. These payments relate to executive directors’ remuneration, non-executive directors’ fees, employer

401(k) contributions, and superannuation contributions.

6

Not an offer in the United States

This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities

described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 and may not be offered or sold in the United States except in transactions exempt from, or not subject to, the registration requirements

of the US Securities Act and applicable US state securities laws.

ABOUT IPERIONX

IperionX aims to be the leading American titanium metal and critical materials company – using patented and proprietary metal technologies to produce high performance titanium alloys, from

titanium minerals or scrap titanium, at lower energy, cost and carbon emissions.

Our Titan critical minerals project is the largest JORC-compliant mineral resource of titanium, rare earth and zircon minerals sands in the U.S.

IperionX’s titanium metal and critical minerals are essential for advanced U.S. industries including aerospace, defense, consumer electronics, hydrogen, electric vehicles and additive

manufacturing.

This announcement has been authorized for release by the CEO & Managing Director.

|

Forward Looking Statements

Information included in this release constitutes

forward-looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and

“guidance”, or other similar words and may include, without limitation, statements regarding the timing of any Nasdaq listing, plans, strategies and objectives of management, anticipated production or construction commencement dates and

expected costs or production outputs.

Forward looking statements inherently involve known and

unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not

limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of

obtaining necessary licenses and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental

conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation, as well as other uncertainties and risks summarized in filings made by the Company from time to time with

the Australian Securities Exchange and in the Form 20-F filed with the U.S. Securities and Exchange Commission.

Forward looking statements are based on the Company and

its management’s assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the

assumptions on which forward looking statements are based will prove to be correct, or that the Company’s business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the

Company or management or beyond the Company’s control.

There may be other

factors that could cause actual results, performance, achievements, or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the Company. Accordingly, readers are cautioned not to

place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Except as required by applicable law or stock exchange listing rules, the Company does not undertake any

obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based.

Competent Persons Statement

The information in this announcement that relates to

Exploration Results is based on information compiled and/or reviewed by Mr. Adam Karst, P.G. Mr. Karst is a consultant to IperionX. Mr. Karst is a Registered Member of the Society of Mining, Metallurgy and Exploration (SME) which is a

Recognized Overseas Professional Organization (ROPO) as well as a Professional Geologist in the state of Tennessee. Mr. Karst has sufficient experience which is relevant to the style and type of mineralization present at the Titan Project

area and to the activity that he is undertaking to qualify as a Competent Person as defined in the 2012 edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” (the 2012 JORC Code). Mr.

Karst consents to the inclusion in this report of the matters based on this information in the form and context in which it appears.

The information in this announcement that relates to Mineral Resources is extracted from IperionX’s ASX Announcement dated October 6, 2021 (“Original ASX Announcement”) which is available to view at IperionX’s

website at www.iperionx.com. IperionX confirms that a) it is not aware of any new information or data that materially affects the information included in the Original ASX Announcement; b) all material assumptions and technical parameters

underpinning the Mineral Resource Estimate included in the Original ASX Announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’ findings are presented in this report have

not been materially changed from the Original ASX Announcement.

|

7

Rule 5.5

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

|

Name of entity

|

||

|

IperionX Limited

|

||

|

ABN

|

Quarter ended (“current quarter”)

|

|

|

84 618 935 372

|

June 30, 2025

|

|

|

Consolidated statement of cash flows

|

Current

quarter

USD$’000

|

Year to date

(12 months)

USD$’000

|

|

|

1.

|

Cash flows from operating activities

|

|

|

|

1.1

|

Receipts from customers

|

37

|

568

|

|

1.2

|

Payments for

|

|

|

|

(a) exploration & evaluation

|

(498) | (615) | |

|

(b) development

|

-

|

-

|

|

|

(c) production

|

-

|

-

|

|

|

(d) staff costs

|

(3,183)

|

(15,180)

|

|

|

(e) administration and corporate costs

|

(1,654)

|

(5,269)

|

|

|

1.3

|

Dividends received (see note 3)

|

-

|

-

|

|

1.4

|

Interest received

|

557

|

2,208

|

|

1.5

|

Interest and other costs of finance paid

|

(55)

|

(254)

|

|

1.6

|

Income taxes paid

|

-

|

-

|

|

1.7

|

Government grants and tax incentives

|

96

|

96

|

|

1.8

|

Other (provide details if material):

|

|

|

|

(a) research & development

|

(1,293)

|

(4,713)

|

|

|

(b) business development

|

(84)

|

(391)

|

|

|

1.9

|

Net cash from / (used in) operating activities

|

(6,077)

|

(23,550)

|

|

2.

|

Cash flows from investing activities

|

||

|

2.1

|

Payments to acquire:

|

||

|

(a) entities

|

-

|

||

|

(b) tenements

|

(134)

|

(637)

|

|

|

(c) property, plant and equipment

|

(6,114)

|

(14,785)

|

|

|

(d) exploration & evaluation

|

-

|

-

|

|

|

(e) investments

|

-

|

-

|

|

|

(f) other non-current assets

|

-

|

(6,630)

|

|

Appendix 5B

|

|

Mining exploration entity and oil and gas exploration entity quarterly report

|

|

Consolidated statement of cash flows

|

Current

quarter

USD$’000

|

Year to date

(12 months)

USD$’000

|

|

|

2.2

|

Proceeds from the disposal of:

|

||

|

(a) entities

|

-

|

-

|

|

|

(b) tenements

|

-

|

-

|

|

|

(c) property, plant and equipment

|

-

|

-

|

|

|

(d) investments

|

-

|

-

|

|

|

(e) other non-current assets

|

-

|

-

|

|

|

2.3

|

Cash flows from loans to other entities

|

133

|

133

|

|

2.4

|

Dividends received (see note 3)

|

-

|

-

|

|

2.5

|

Other (provide details if material)

|

-

|

-

|

|

2.6

|

Net cash from / (used in) investing activities

|

(6,115)

|

(21,919)

|

|

3.

|

Cash flows from financing activities

|

|

|

|

3.1

|

Proceeds from issues of equity securities (excluding convertible debt securities)

|

-

|

70,245

|

|

3.2

|

Proceeds from issue of convertible debt securities

|

-

|

-

|

|

3.3

|

Proceeds from exercise of options

|

82

|

202

|

|

3.4

|

Transaction costs related to issues of equity securities or convertible debt securities

|

(18)

|

(2,652)

|

|

3.5

|

Proceeds from borrowings

|

-

|

-

|

|

3.6

|

Repayment of borrowings

|

-

|

-

|

|

3.7

|

Transaction costs related to loans and borrowings

|

-

|

-

|

|

3.8

|

Dividends paid

|

-

|

-

|

|

3.9

|

Other (provide details if material)

(a) principal portion of lease liabilities

|

(130)

|

(520)

|

|

3.10

|

Net cash from / (used in) financing activities

|

(66)

|

67,275

|

|

4.

|

Net increase / (decrease) in cash and cash equivalents for the period

|

||

|

4.1

|

Cash and cash equivalents at beginning of period

|

66,094

|

33,157

|

|

4.2

|

Net cash from / (used in) operating activities (item 1.9 above)

|

(6,077)

|

(23,550)

|

|

4.3

|

Net cash from / (used in) investing activities (item 2.6 above)

|

(6,115)

|

(21,919)

|

|

4.4

|

Net cash from / (used in) financing activities (item 3.10 above)

|

(66)

|

67,275

|

|

4.5

|

Effect of movement in exchange rates on cash held

|

978

|

(149)

|

|

4.6

|

Cash and cash equivalents at end of period

|

54,814

|

54,814

|

|

Appendix 5B

|

|

Mining exploration entity and oil and gas exploration entity quarterly report

|

|

5.

|

Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts

|

Current quarter

USD$’000

|

Previous quarter

USD$’000

|

|

5.1

|

Bank balances

|

31,419

|

43,345

|

|

5.2

|

Call deposits

|

23,395

|

22,749

|

|

5.3

|

Bank overdrafts

|

-

|

-

|

|

5.4

|

Other (provide details)

|

-

|

-

|

|

5.5

|

Cash and cash equivalents at end of quarter (should equal item 4.6 above)

|

54,814

|

66,094

|

|

6.

|

Payments to related parties of the entity and their associates

|

Current quarter

USD$’000

|

|

6.1

|

Aggregate amount of payments to related parties and their associates included in item 1

|

488

|

|

6.2

|

Aggregate amount of payments to related parties and their associates included in item 2

|

-

|

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments

|

7.

|

Financing facilities

|

||

|

Note: the term “facility’ includes all forms of financing arrangements available to the entity.

Add notes as necessary for an understanding of the sources of finance available to the entity.

|

Total facility

amount at

quarter end

USD$’000

|

Amount

drawn at

quarter end

USD$’000

|

|

|

7.1

|

Loan facilities

|

-

|

-

|

|

7.2

|

Credit standby arrangements

|

-

|

-

|

|

7.3

|

Other (please specify)

|

-

|

-

|

|

7.4

|

Total financing facilities

|

-

|

-

|

|

7.5

|

Unused financing facilities available at quarter end

|

-

|

|

|

7.6

|

Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been

entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well.

|

||

|

Not applicable

|

|||

|

Appendix 5B

|

|

Mining exploration entity and oil and gas exploration entity quarterly report

|

|

8.

|

Estimated cash available for future operating activities

|

USD$’000

|

|

8.1

|

Net cash from / (used in) operating activities (item 1.9)

|

(6,077)

|

|

8.2

|

(Payments for exploration & evaluation classified as investment activities) (item 2.1(d))

|

-

|

|

8.3

|

Total relevant outgoings (item 8.1 + item 8.2)

|

(6,077)

|

|

8.4

|

Cash and cash equivalents at quarter end (item 4.6)

|

54,814

|

|

8.5

|

Unused finance facilities available at quarter end (item 7.5)

|

-

|

|

8.6

|

Total available funding (item 8.4 + item 8.5)

|

54,814

|

|

8.7

|

Estimated quarters of funding available (item 8.6 divided by item 8.3)

|

9.0

|

|

Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding

available must be included in item 8.7.

|

||

|

8.8

|

8.8.1. Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not,

why not?

|

|

Not applicable.

|

|

|

8.8.2. Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and,

if so, what are those steps and how likely does it believe that they will be successful?

|

|

|

Not applicable.

|

|

8.8.3. Does the entity expect to be able to continue its operations and to meet its business

objectives and, if so, on what basis?

|

|

|

Not applicable.

|

|

|

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

|

|

Appendix 5B

|

|

Mining exploration entity and oil and gas exploration entity quarterly report

|

Compliance statement

| 1 |

This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

|

| 2 |

This statement gives a true and fair view of the matters disclosed.

|

| Date: | July 23, 2025 | |

| Authorized by: | Chief Financial Officer | |

| (Name of body or officer authorizing release – see note 4) |

||

Notes

| 1. |

This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash

position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

|

| 2. |

If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral

Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

|

| 3. |

Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

|

| 4. |

If this report has been authorized for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorized for release to the market by a committee of your board of directors, you can insert

here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorized for release to the market by a disclosure committee, you

can insert here: “By the Disclosure Committee”.

|

| 5. |

If this report has been authorized for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate

Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with

the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating

effectively.

|