Pay vs Performance Disclosure

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

$ / shares

|

Mar. 31, 2024

USD ($)

$ / shares

|

Mar. 31, 2023

USD ($)

$ / shares

|

Mar. 31, 2022

USD ($)

$ / shares

|

Mar. 31, 2021

USD ($)

$ / shares

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

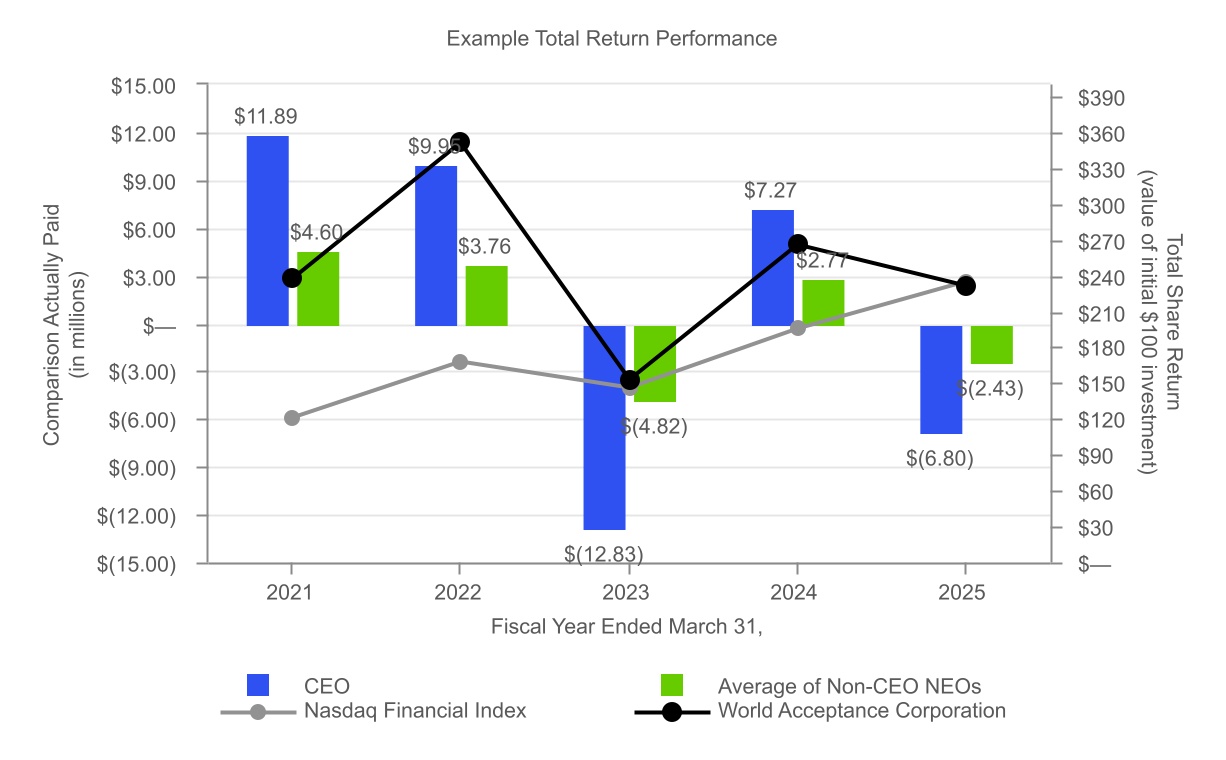

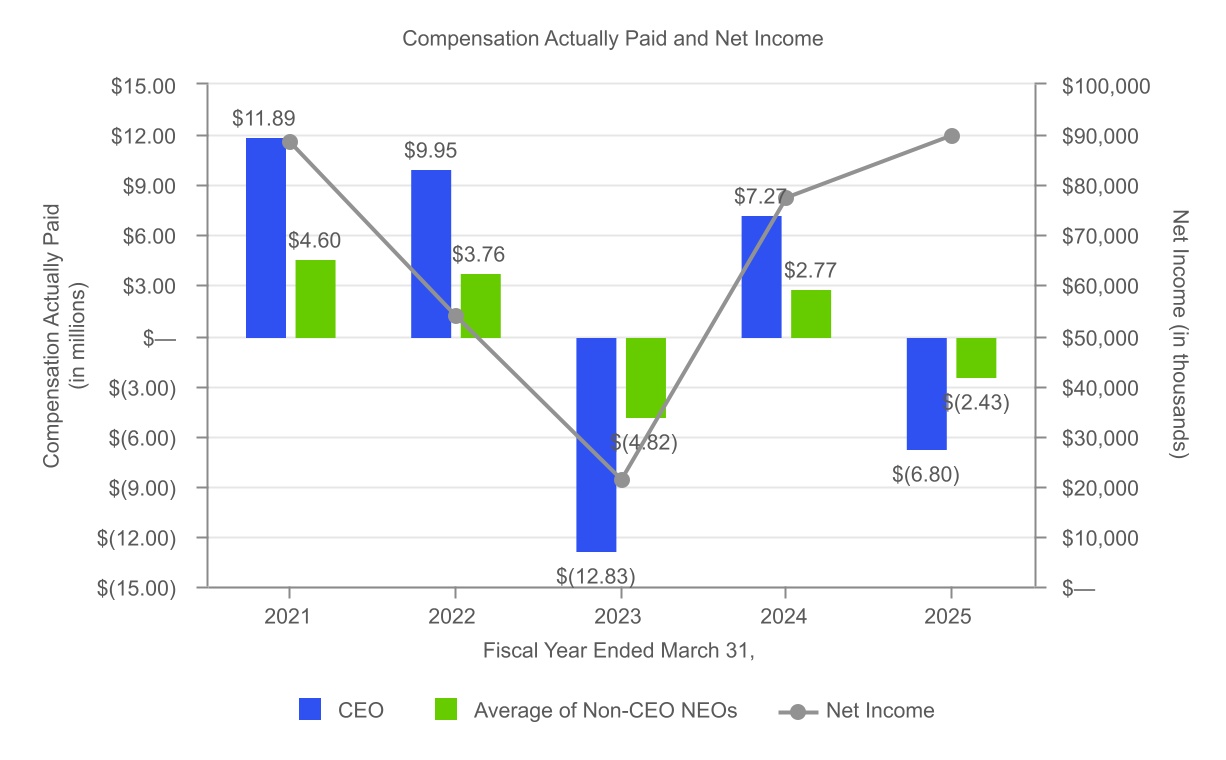

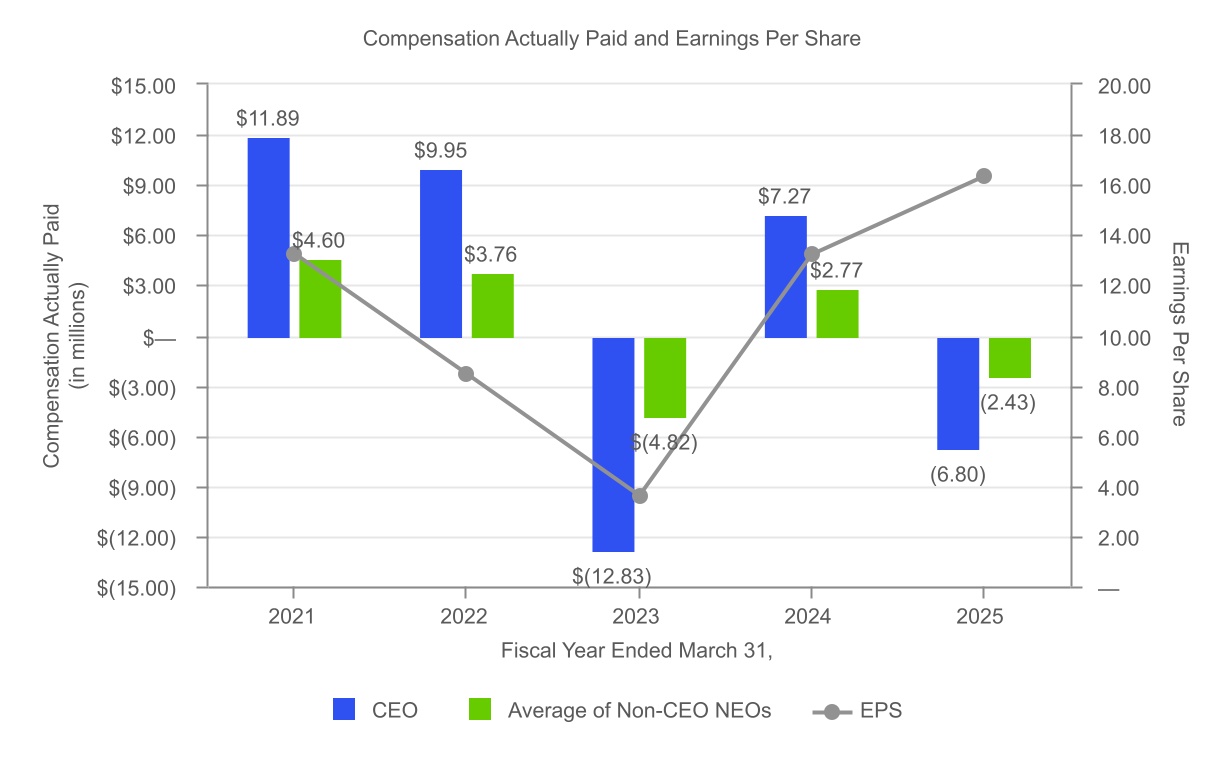

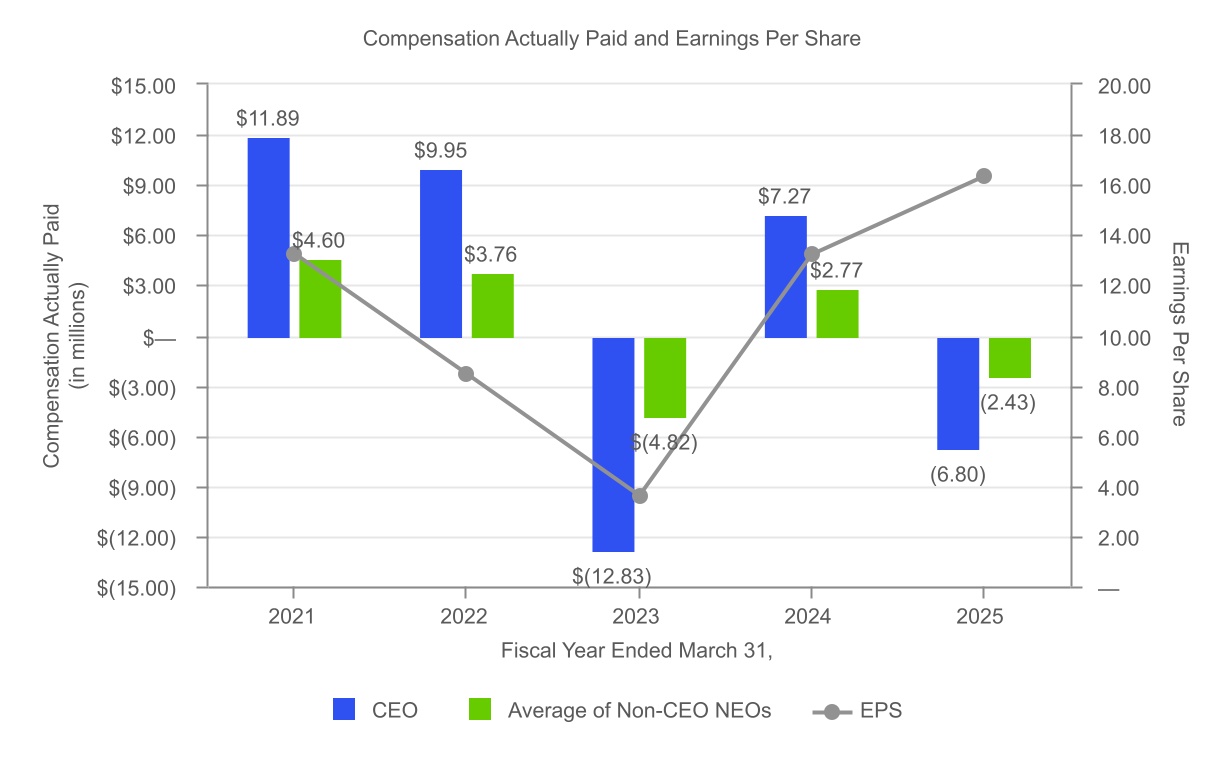

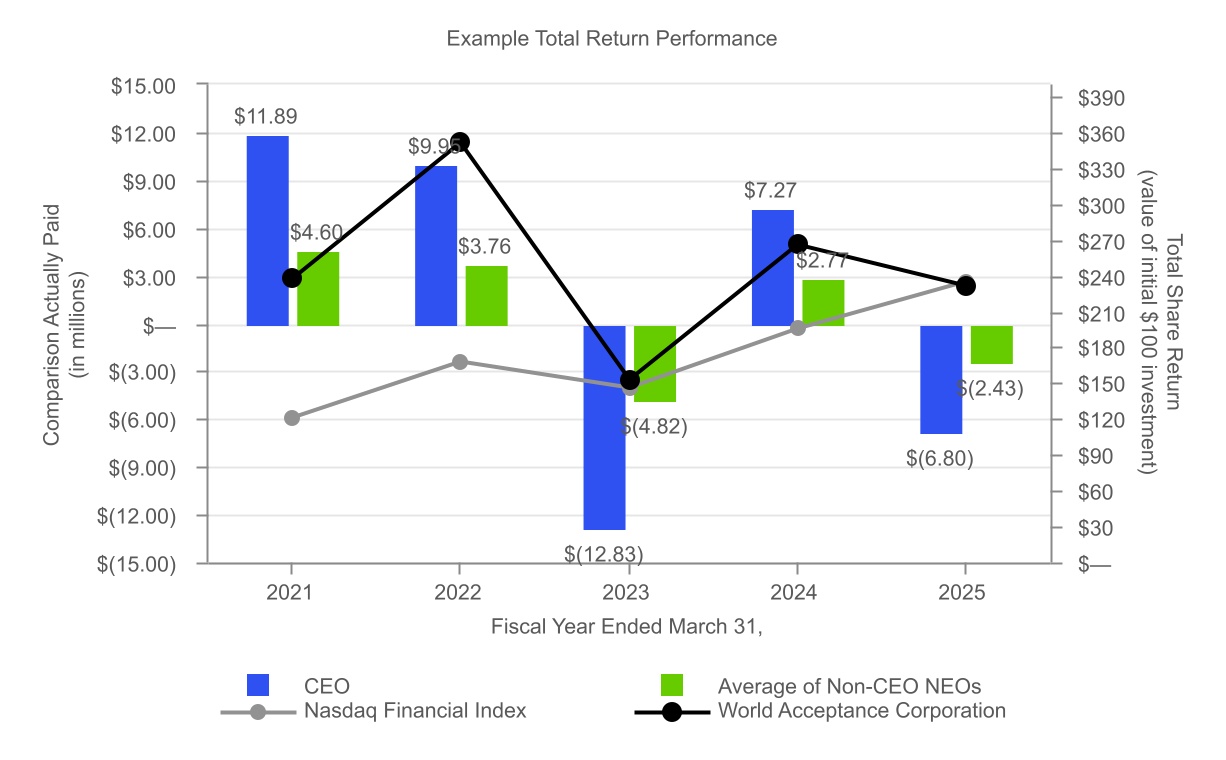

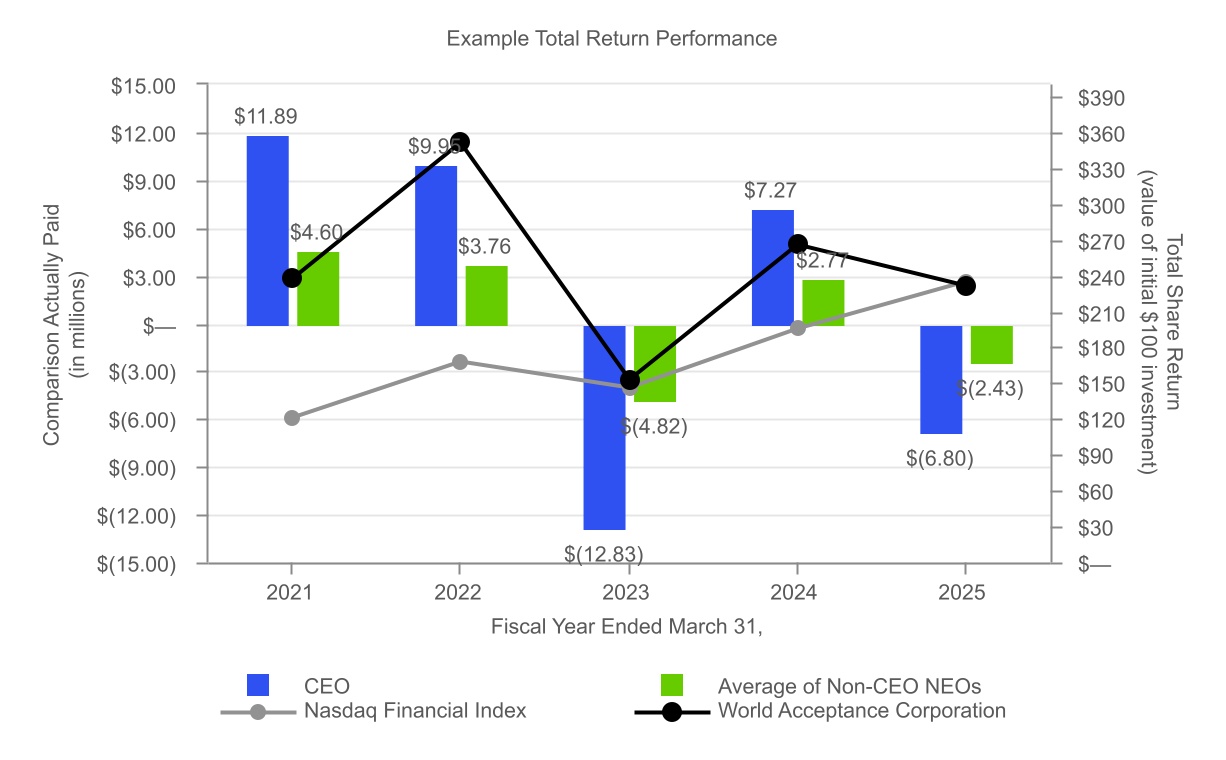

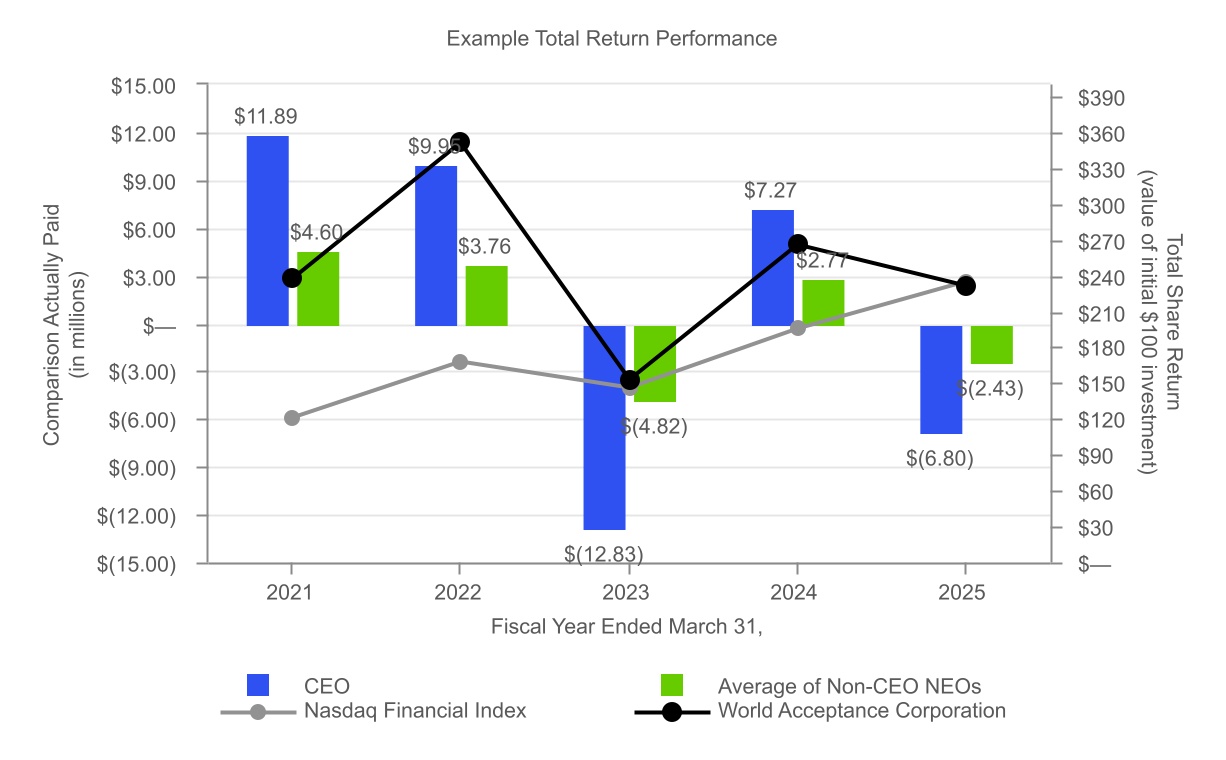

| | | | | | | | | | | | | | | | | | | | | | | | | | | Year | Summary Compensation Table Total for PEO(1) | Compensation Actually Paid for PEO(1)(3) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers(2) | Average Compensation Actually Paid for Non-PEO Named Executive Officers(2)(3) | Value of Initial Fixed $100 Investment Based on: | Net Income | EPS | Company TSR | Peer Group TSR(4) | | 2025 | $ | 2,276,080 | | $ | (6,797,172) | | $ | 938,728 | | $ | (2,434,661) | | 231.73 | 235.08 | 89,741,398 | | 16.30 | | 2024 | $ | 965,737 | | $ | 7,274,546 | | $ | 427,762 | | $ | 2,773,345 | | 265.48 | 195.62 | 77,345,227 | | 13.19 | | 2023 | $ | 956,588 | | $ | (12,833,581) | | $ | 422,206 | | $ | (4,820,535) | | 152.52 | 145.88 | 21,231,990 | | 3.60 | | 2022 | $ | 933,966 | | $ | 9,945,093 | | $ | 415,437 | | $ | 3,760,244 | | 351.29 | 167.55 | 53,919,837 | | 8.47 | | 2021 | $ | 938,071 | | $ | 11,889,842 | | $ | 476,344 | | $ | 4,602,519 | | 237.61 | 120.99 | 88,282,828 | | 13.23 |

|

|

|

|

|

| Company Selected Measure Name |

EPS

|

|

|

|

|

| Named Executive Officers, Footnote |

The principal executive officer (the “PEO”) for each of 2025, 2024, 2023, 2022 and 2021 is Mr. Prashad.The non-PEO named executive officers (the “Non-PEO NEOs”) for each of fiscal years 2025, 2024, 2023 and 2022 include the following individuals: Messrs. John L. Calmes, Jr., D. Clinton Dyer, Luke J. Umstetter, S. McIntyre, and Jason E. Childers, and Ms. A. Lindsay Caulder. The non-PEO NEOs for fiscal year 2021 include the following individuals: Messrs. John L. Calmes, Jr., D. Clinton Dyer, and Luke J. Umstetter, and Ms. A. Lindsay Caulder.

|

|

|

|

|

| Peer Group Issuers, Footnote |

The peer group that we used for purposes of this disclosure is the Nasdaq Financial Index, the same index used for our performance graph disclosed in our Annual Report on Form 10-K for the year ended March 31, 2025.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 2,276,080

|

$ 965,737

|

$ 956,588

|

$ 933,966

|

$ 938,071

|

| PEO Actually Paid Compensation Amount |

$ (6,797,172)

|

7,274,546

|

(12,833,581)

|

9,945,093

|

11,889,842

|

| Adjustment To PEO Compensation, Footnote |

| | | | | | | | | | | | | | | | | | | | | | | | PEO NEO CAP | | | | | | | Year

| Summary Compensation Table Total for PEO(1) | Less: RSA Grant in SCT | Add: Year-End Value of Unvested Equity Awards Granted in Year | Add: Change in Value of Unvested Equity Awards Granted in Prior Years that Vested During Year | Add: Change in Year-End Value of Unvested Equity Awards Granted in Prior Years | Add: Vesting Date Value of Equity Awards Granted and Vested During Year | Total Compensation Actually Paid(1)(3) | | 2025 | $ | 2,276,080 | | $ | 1,299,936 | | $ | 1,473,548 | | $ | (626,525) | | $ | (8,620,339) | | $ | — | | $ | (6,797,172) | | | 2024 | $ | 965,737 | | $ | — | | $ | — | | $ | 557,700 | | $ | 5,751,109 | | $ | — | | $ | 7,274,546 | | | 2023 | $ | 956,588 | | $ | — | | $ | — | | $ | (1,134,510) | | $ | (12,655,659) | | $ | — | | $ | (12,833,581) | | | 2022 | $ | 933,966 | | $ | — | | $ | — | | $ | 973,765 | | $ | 8,037,362 | | $ | — | | $ | 9,945,093 | | | 2021 | $ | 938,071 | | $ | — | | $ | — | | $ | 750,858 | | $ | 10,200,913 | | $ | — | | $ | 11,889,842 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | Non-PEO NEO CAP | | | | | | | | Year

| Average Summary Compensation Table Total for Non-PEO Named Executive Officers(2) | Less: RSA Grant in SCT | | Add: Year-End Value of Unvested Equity Awards Granted in Year | Add: Change in Value of Unvested Equity Awards Granted in Prior Years that Vested During Year | Add: Change in Year-End Value of Unvested Equity Awards Granted in Prior Years | Add: Vesting Date Value of Equity Awards Granted and Vested During Year | Average Total Compensation Actually Paid(2)(3) | | 2025 | $ | 938,728 | | $ | 483,308 | | | $ | 547,856 | | $ | (232,939) | | $ | (3,204,998) | | $ | — | | $ | (2,434,661) | | | 2024 | $ | 427,762 | | $ | — | | | $ | — | | $ | 207,350 | | $ | 2,138,233 | | $ | — | | $ | 2,773,345 | | | 2023 | $ | 422,206 | | $ | — | | | $ | — | | $ | (421,805) | | $ | (4,820,936) | | $ | — | | $ | (4,820,535) | | | 2022 | $ | 415,437 | | $ | — | | | $ | — | | $ | 326,690 | | $ | 3,018,117 | | $ | — | | $ | 3,760,244 | | | 2021 | $ | 476,344 | | $ | 72,279 | | | $ | — | | $ | 278,203 | | $ | 3,847,972 | | $ | 72,279 | | $ | 4,602,519 | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 938,728

|

427,762

|

422,206

|

415,437

|

476,344

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ (2,434,661)

|

2,773,345

|

(4,820,535)

|

3,760,244

|

4,602,519

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | | | | | | | | | | | | | | | | PEO NEO CAP | | | | | | | Year

| Summary Compensation Table Total for PEO(1) | Less: RSA Grant in SCT | Add: Year-End Value of Unvested Equity Awards Granted in Year | Add: Change in Value of Unvested Equity Awards Granted in Prior Years that Vested During Year | Add: Change in Year-End Value of Unvested Equity Awards Granted in Prior Years | Add: Vesting Date Value of Equity Awards Granted and Vested During Year | Total Compensation Actually Paid(1)(3) | | 2025 | $ | 2,276,080 | | $ | 1,299,936 | | $ | 1,473,548 | | $ | (626,525) | | $ | (8,620,339) | | $ | — | | $ | (6,797,172) | | | 2024 | $ | 965,737 | | $ | — | | $ | — | | $ | 557,700 | | $ | 5,751,109 | | $ | — | | $ | 7,274,546 | | | 2023 | $ | 956,588 | | $ | — | | $ | — | | $ | (1,134,510) | | $ | (12,655,659) | | $ | — | | $ | (12,833,581) | | | 2022 | $ | 933,966 | | $ | — | | $ | — | | $ | 973,765 | | $ | 8,037,362 | | $ | — | | $ | 9,945,093 | | | 2021 | $ | 938,071 | | $ | — | | $ | — | | $ | 750,858 | | $ | 10,200,913 | | $ | — | | $ | 11,889,842 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | Non-PEO NEO CAP | | | | | | | | Year

| Average Summary Compensation Table Total for Non-PEO Named Executive Officers(2) | Less: RSA Grant in SCT | | Add: Year-End Value of Unvested Equity Awards Granted in Year | Add: Change in Value of Unvested Equity Awards Granted in Prior Years that Vested During Year | Add: Change in Year-End Value of Unvested Equity Awards Granted in Prior Years | Add: Vesting Date Value of Equity Awards Granted and Vested During Year | Average Total Compensation Actually Paid(2)(3) | | 2025 | $ | 938,728 | | $ | 483,308 | | | $ | 547,856 | | $ | (232,939) | | $ | (3,204,998) | | $ | — | | $ | (2,434,661) | | | 2024 | $ | 427,762 | | $ | — | | | $ | — | | $ | 207,350 | | $ | 2,138,233 | | $ | — | | $ | 2,773,345 | | | 2023 | $ | 422,206 | | $ | — | | | $ | — | | $ | (421,805) | | $ | (4,820,936) | | $ | — | | $ | (4,820,535) | | | 2022 | $ | 415,437 | | $ | — | | | $ | — | | $ | 326,690 | | $ | 3,018,117 | | $ | — | | $ | 3,760,244 | | | 2021 | $ | 476,344 | | $ | 72,279 | | | $ | — | | $ | 278,203 | | $ | 3,847,972 | | $ | 72,279 | | $ | 4,602,519 | |

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

|

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 231.73

|

265.48

|

152.52

|

351.29

|

237.61

|

| Peer Group Total Shareholder Return Amount |

235.08

|

195.62

|

145.88

|

167.55

|

120.99

|

| Net Income (Loss) |

$ 89,741,398

|

$ 77,345,227

|

$ 21,231,990

|

$ 53,919,837

|

$ 88,282,828

|

| Company Selected Measure Amount | $ / shares |

16.30

|

13.19

|

3.60

|

8.47

|

13.23

|

| PEO Name |

Mr. Prashad

|

|

|

|

|

| Additional 402(v) Disclosure |

These dollar amounts represent the “compensation actually paid”, or “CAP”, to the PEO and the Non-PEO NEOs, respectively, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to the PEO or the Non-PEO NEOs, respectively, during the applicable year. To calculate CAP for the PEO and average CAP for the Non-PEO NEOs, the following amounts were deducted from and added to Summary Compensation Table total compensation:

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (1,299,936)

|

$ 0

|

$ 0

|

$ 0

|

$ 0

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,473,548

|

0

|

0

|

0

|

0

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(8,620,339)

|

5,751,109

|

(12,655,659)

|

8,037,362

|

10,200,913

|

| PEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(626,525)

|

557,700

|

(1,134,510)

|

973,765

|

750,858

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(483,308)

|

0

|

0

|

0

|

(72,279)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

547,856

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(3,204,998)

|

2,138,233

|

(4,820,936)

|

3,018,117

|

3,847,972

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

72,279

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (232,939)

|

$ 207,350

|

$ (421,805)

|

$ 326,690

|

$ 278,203

|