Exhibit 99.2

SAGTEC GLOBAL LIMITED

INDEX TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

F-1

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS OF DECEMBER 31, 2024 AND JUNE 30, 2025

| As of | ||||||||||||||

| Note | December 31, 2024 | June 30, 2025 | June 30, 2025 | |||||||||||

| RM | RM | Convenience Translation USD | ||||||||||||

| ASSETS | ||||||||||||||

| Non-current assets | ||||||||||||||

| Plant and equipment | 7 | |||||||||||||

| Right-of-use assets | 8 | |||||||||||||

| Total non-current assets | ||||||||||||||

| Current assets | ||||||||||||||

| Trade receivables, net | 9 | |||||||||||||

| Other receivables | 10 | |||||||||||||

| Cash and short term deposits | 11 | |||||||||||||

| Total current assets | ||||||||||||||

| Total assets | ||||||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Current liabilities | ||||||||||||||

| Trade payables | 9 | |||||||||||||

| Amount due to director | 14 | |||||||||||||

| Other payables | 10 | |||||||||||||

| Provisions | 13 | |||||||||||||

| Tax payable | 15 | |||||||||||||

| Lease liabilities | 8 | |||||||||||||

| Bank overdraft | 14 | |||||||||||||

| Bank borrowings | 14 | |||||||||||||

| Total current liabilities | ||||||||||||||

| Non-current liabilities | ||||||||||||||

| Lease liabilities | 8 | |||||||||||||

| Bank borrowings | 14 | |||||||||||||

| Deferred tax liabilities | 15 | |||||||||||||

| Total non-current labilities | ||||||||||||||

| Total liabilities | ||||||||||||||

| Equity | ||||||||||||||

| Share capital, | 4 | |||||||||||||

| Reserves | 16 | |||||||||||||

| Retained earnings | ||||||||||||||

| Shareholders’ equity | ||||||||||||||

| Non-controlling interest | ||||||||||||||

| Total equity | ||||||||||||||

| Total liabilities and equity | ||||||||||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-2

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2025

| For the six months ended June 30, | ||||||||||||||

| Note | 2024 | 2025 | 2025 | |||||||||||

| RM | RM | Convenience Translation USD | ||||||||||||

| Revenue | 17 | |||||||||||||

| Total revenue | ||||||||||||||

| Cost of sales | 18 | ( | ) | ( | ) | ( | ) | |||||||

| Total cost of sales | ( | ) | ( | ) | ( | ) | ||||||||

| Gross profit | ||||||||||||||

| Selling and administrative expenses | 19 | ( | ) | ( | ) | ( | ) | |||||||

| Selling and administrative expenses from related parties | 19 | ( | ) | ( | ) | ( | ) | |||||||

| Income from operations before income tax | ||||||||||||||

| Other income | ||||||||||||||

| Finance costs | ( | ) | ( | ) | ( | ) | ||||||||

| Profit before income tax | ||||||||||||||

| Income tax expense | 15 | ( | ) | ( | ) | ( | ) | |||||||

| Net Profit for the period, representing total comprehensive income for the period | ||||||||||||||

| Profit attributable to: | ||||||||||||||

| Equity owners of the Company | ||||||||||||||

| Non-controlling interests | ||||||||||||||

| Total | ||||||||||||||

| Weighted Average Number of Common Shares Outstanding – Basic and Diluted | ||||||||||||||

| Basic and Diluted Net Income per Share | ||||||||||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-3

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2025

| Note | Number of outstanding shares | Share capital | Reserves | Retained earnings | Shareholders’ equity | Non-controlling interest | Total equity | |||||||||||||||||||||||

| RM | RM | RM | RM | RM | RM | |||||||||||||||||||||||||

| Balance at January 1, 2024 | ||||||||||||||||||||||||||||||

| Net profit for the period | - | |||||||||||||||||||||||||||||

| Balance at June 30, 2024 | ||||||||||||||||||||||||||||||

| Net profit for the period | - | |||||||||||||||||||||||||||||

| Balance at December 31, 2024 | ||||||||||||||||||||||||||||||

| Issuance of shares | 4 | |||||||||||||||||||||||||||||

| Net profit for the period | - | |||||||||||||||||||||||||||||

| Balance at June 30, 2025 | ||||||||||||||||||||||||||||||

| Note | Number of outstanding shares | Share capital | Reserves | Retained earnings | Shareholders’ equity | Non-controlling interest | Total equity | |||||||||||||||||||||||

| USD | USD | USD | USD | USD | USD | |||||||||||||||||||||||||

| Balance at June 30, 2024 | ||||||||||||||||||||||||||||||

| Balance at June 30, 2025 | ||||||||||||||||||||||||||||||

Equity transaction reflects changes in a parent’s ownership interest in a subsidiary that do not result in the parent losing control of the subsidiary.

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-4

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2025

| For the six months ended June 30, | |||||||||||||

| 2024 | 2025 | 2025 | |||||||||||

| RM | RM | Convenience Translation USD |

|||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||||

| Net (Loss)/Profit for the year | |||||||||||||

| Adjustments to reconcile net profit to net cash used in operating activities: | |||||||||||||

| Depreciation | |||||||||||||

| Amortization | |||||||||||||

| Provisions | ( |

) | ( |

) | ( |

) | |||||||

| Imputed interest of lease liability | |||||||||||||

| Finance costs | |||||||||||||

| Overdraft charges | |||||||||||||

| Income tax expenses | |||||||||||||

| Gain on disposal of plant & equipment | ( |

) | ( |

) | |||||||||

| Operating cash flows before movements in working capital | |||||||||||||

| Trade receivables | ( |

) | ( |

) | ( |

) | |||||||

| Other receivables and prepayment | ( |

) | ( |

) | |||||||||

| Other payables and accrued liabilities | ( |

) | ( |

) | ( |

) | |||||||

| Trade payables | ( |

) | |||||||||||

| Deferred revenue | ( |

) | |||||||||||

| Cash generated from operations | ( |

) | ( |

) | |||||||||

| Income tax paid | ( |

) | ( |

) | |||||||||

| Net cash provided by operating activities | ( |

) | ( |

) | |||||||||

| Investing activities | |||||||||||||

| Purchase of plant and equipment | ( |

) | ( |

) | ( |

) | |||||||

| Proceeds from disposal of plant and equipment | |||||||||||||

| Net cash used in investing activities | ( |

) | ( |

) | ( |

) | |||||||

| Financing activities | |||||||||||||

| Proceeds from issuance of Class A ordinary shares upon the completion of IPO | |||||||||||||

| Termination of right-of-use asset | |||||||||||||

| Termination of lease | ( |

) | ( |

) | |||||||||

| Repayment of lease liabilities | ( |

) | ( |

) | ( |

) | |||||||

| Increase in fixed deposits | ( |

) | ( |

) | ( |

) | |||||||

| Overdraft charges paid | ( |

) | ( |

) | ( |

) | |||||||

| Loan interest paid | ( |

) | ( |

) | ( |

) | |||||||

| Proceeds from bank loans | |||||||||||||

| Repayment of bank loans | ( |

) | ( |

) | ( |

) | |||||||

| Proceeds from amount due to shareholders | ( |

) | |||||||||||

| Proceeds from amount due (from)/to directors | ( |

) | |||||||||||

| Net cash provided by financing activities | |||||||||||||

| Net increase in cash and cash equivalents | |||||||||||||

| Cash and cash equivalents at beginning of period | ( |

) | |||||||||||

| Cash and cash equivalents at end of period | 11 | ||||||||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-5

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1 | ORGANIZATION AND PRINCIPAL ACTIVITIES |

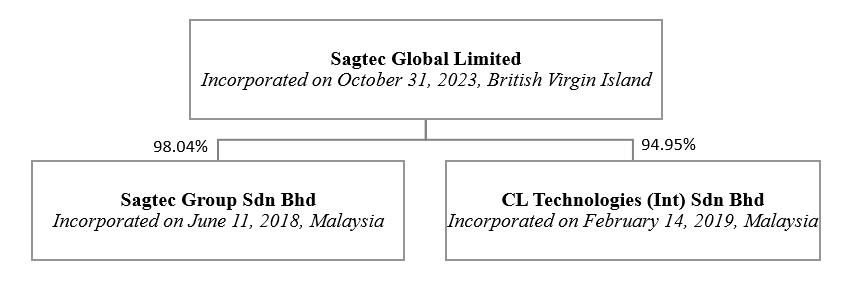

Sagtec Global Limited (the “Company”) was incorporated in the British Virgin Islands on October 31, 2023 with registered office at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands while principal place of business of the Company at No. 43-2, Jalan Besar Kepong, Pekan Kepong, 52100 Kuala Lumpur, Malaysia.

The group structure which represents the operating subsidiaries and dormant companies as of the reporting date is as follow:

Details of the Company and its subsidiaries (collectively, the “Group”) are shown in the table below:

| Percentage of effective ownership | ||||||||||||||

| June 30, | ||||||||||||||

| Name | Date of incorporation | 2025 | 2024 | Place of incorporation | Principal activities | |||||||||

| % | % | |||||||||||||

| Sagtec Global Limited | ||||||||||||||

| Sagtec Group Sdn Bhd | ||||||||||||||

| CL Technologies (International) Sdn Bhd | ||||||||||||||

The Group develops IT products, services, and solutions using the subscription as a service model, generating stable and sustainable revenue from our SaaS offerings.

As described above, the Company, through a series of transactions which is accounted for as a reorganization of entities under a common control (the “Reorganization”), will become the ultimate parent of its subsidiaries.

Through the reorganization, the Company will be the holding company of its subsidiaries. Accordingly, the consolidated financial statements will be prepared on a consolidated basis by applying the principle of common control as if the reorganization has been completed at the beginning of the first reporting period.

Based on the above, the Group concluded that the Company and its subsidiaries are effectively controlled by the shareholder before and after the Reorganization and the Reorganization is considered under common control. The transactions above were accounted for as a recapitalization. The consolidation of the Company and its subsidiaries has been accounted for at carrying value and prepared on the basis as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying consolidated financial statements.

F-6

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES |

BASIS OF PREPARATION

The unaudited interim condensed consolidated financial statements have been prepared in accordance with the historical cost basis, except as disclosed in the accounting policies below, and are drawn up in accordance with the provisions of the International Financial Reporting Standards (“IFRSs”) as issued by the International Accounting Standards Board (“IASB”) for the six months ended June 30, 2025 and 2024.

These unaudited interim condensed consolidated financial statements for the six months ended June 30, 2025 and 2024 should be read in conjunction with the Group’s last audited annual consolidated financial statements for the years ended December 31, 2024 and 2023. They do not include all the information and disclosures required for a complete set of financial statements prepared in accordance with IFRS Accounting Standard. However, selected explanatory notes are included to explain events and transactions that are significant to an understanding of the changes in the Group’s financial position and performance since last annual consolidated financial statements.

Historical cost is generally based on the fair value of the consideration given in exchange for goods and services.

These unaudited interim condensed consolidated financial statements were approved by the board of directors of the Company on June 30, 2025.

The board of directors has the power to amend the financial statements after issue.

ADOPTION OF NEW AND REVISED STANDARDS

On January 1, 2023, the Group has adopted the new or amended IFRS and interpretations issued by the IFRS interpretations Committee (IFRS IC) that are mandatory for application for the fiscal year. Changes to the Group’s accounting policies have been made as required, in accordance with the transitional provisions in the respective IFRS and IFRS IC.

The adoption of these new or amended IFRS and IFRS IC did not result in substantial changes to the Group’s accounting policies and had no material effect on the amounts reported for the current or prior financial years.

F-7

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

COMMON CONTROL & MERGER ACCOUNTING

The acquisition of entities, businesses or assets under common control are accounted for in accordance with merger accounting.

The combined financial statements incorporate the financial statements of the combined entities or businesses in which the common control combination occurs as if they had been combined from the date when the combining entities or businesses first came under the control of the controlling party.

The combined financial statements have prepared using uniform accounting policies for like transactions and other events in similar circumstances.

All intra-group balances, transactions, income and expenses are eliminated in full on combination and the combined financial statements reflect external transactions only.

The net assets of the combined entities or businesses are combined using the existing carrying amounts from the controlling party’s perspective. No amount is recognized in respect of goodwill or excess of the acquirer’s interest in the net fair value of acquiree’s identifiable assets, liabilities and contingent liabilities over the acquisition cost at the time of common control combination. All differences between the cost of acquisition (fair value of consideration paid) and the amounts at which the assets and liabilities are recorded, arising from common control combination, have been recognized directly in equity as part of the capital reserve.

The combined statements of profit or loss and other comprehensive income include the results of each of the combining entities or businesses from the earliest date presented or since the date when the combined entities or businesses first came under the common control, where this is a shorter period, regardless of the date of the common control combination.

Subsidiaries

Subsidiaries are entities controlled by the Group. The Group controls and entity when it is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. The financial statements of subsidiaries are included in the unaudited interim condensed consolidated financial statements from the date that control commences until the date that control ceases.

Loss of control

Upon the loss of control, the Group derecognizes the assets and liabilities of the subsidiary, any NCI, and the other components of equity related to the subsidiary. Any surplus or deficit arising on the loss of control is recognized in profit or loss. If the Group retains any interest in the former subsidiary, then such interest is measured at fair value at the date that control is lost.

F-8

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

CONVENIENCE TRANSLATION

Translations of amounts in the unaudited interim condensed consolidated statement of financial position, unaudited interim condensed consolidated statements of profit or loss and other comprehensive income, and unaudited interim condensed consolidated statement of cash flows from RM into USD as of and for the year ended June 30, 2025 are solely for the convenience of the reader. Unless otherwise noted, all translations from RM into USD for the fiscal year ended June 30, 2025 were calculated at of = or an average rate of = .

FINANCIAL ASSETS

Classification and measurement

Financial assets are recognized when a Group entity becomes a party to the contractual provisions of the instrument. All regular way purchases or sales of financial assets are recognized and derecognized on a trade date basis. Regular way purchases or sales are purchases or sales of financial assets that require delivery of assets within the time frame established by regulation or convention in the market place.

Financial assets are initially measured at fair value except for trade receivables arising from contracts with customers which are initially measured in accordance with IFRS 15 Revenue from Contracts with Customers (“IFRS 15”). Transaction costs that are directly attributable to the acquisition of financial assets (other than financial assets at fair value through profit or loss (“FVTPL”)) are added to the fair value of the financial assets, as appropriate, on initial recognition. Transaction costs directly attributable to the acquisition of financial assets at fair value through profit or loss are recognized immediately in consolidated statement of profit or loss. The Group classifies its financial assets at fair value through other comprehensive income, fair value through profit and loss and amortized cost.

The classification depends on the Group’s business model for managing the financial assets as well as the contractual terms of the cash flows of the financial assets.

| 1. | Financial assets at Fair Value through Profit or Loss (FVTPL) are initially recorded at fair value and transaction costs are expensed in the statements of income and comprehensive income. Realized and unrealized gains and income arising from changes in the fair value of the financial asset held at FVTPL are included in the statements of income and comprehensive income in the period in which they arise. There are no financial assets classified as FVTPL |

| 2. | Financial assets at Fair Value through Other Comprehensive Income (FVTOCI) are initially recognized at fair value plus transaction costs. Subsequently they are measured at fair value, with gains and losses arising from changes in fair value recognized in other comprehensive income. There is no subsequent reclassification of fair value gains and losses to profit or loss following the derecognition of the investment. There are no financial assets classified as FVTOCI. |

| 3. | Financial assets at amortized cost are initially recognized at fair value, net of transaction costs, and subsequently carried at amortized cost less any impairment. They are classified as current assets or non- current assets based on their maturity date. The Company has classified trade receivables, other receivables and amounts due from related parties at amortized cost. |

F-9

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

Impairment

The Group assesses at end of each reporting period whether there is objective evidence that a financial asset or group of financial assets is impaired.

The Group recognizes expected credit losses (“ECL”) for accounts receivable based on the simplified approach. The simplified approach to the recognition of expected losses does not require the Company to track the changes in credit risk; rather, the Company recognizes a loss allowance based on lifetime expected credit losses at each reporting date from the date of the accounts receivable.

The Group recognizes a loss allowance for other receivable, amount due from director, shareholders and related parties based on 12 months expected credit losses at each reporting date.

The Group measures expected credit loss by considering the risk of default over the contract period and incorporates forward-looking information into its measurement. ECLs are a probability-weighted estimate of credit losses.

ECLs are measured as the difference in the present value of the contractual cash flows that are due to the Company under the contract, and the cash flows that the Company expects to receive. The Company assesses all information available, including past due status, and forward looking macro- economic factors in the measurement of the ECLs associated with its assets carried at amortized cost.

The maximum period considered when estimating ECLs is the maximum contractual period over which the Company is exposed to credit risk.

Derecognition of financial assets

The Group derecognizes a financial asset only when the contractual rights to the cash flow from the asset expire, or when it transfers the financial asset and substantially all the risks and rewards of ownership of asset to another entity.

On derecognition of a financial asset measured at amortized cost, the difference between the asset’s carrying amount and the sum of the consideration received and receivable is recognized in profit or loss.

FINANCIAL LIABILITIES

Financial liabilities are classified as either financial liabilities at FVTPL or at amortized cost. The Group determines the classification of its financial liabilities at initial recognition.

Financial liabilities are classified as measured at amortized cost, net of transaction costs unless classified as FVTPL. The Group trade payables, other payables and accrued liabilities, amounts due to related parties, lease liabilities and bank loans are classified as measured at amortized cost.

Derecognition of financial liabilities

The Group derecognizes financial liabilities when, and only when, the Group’s obligation are discharged, cancelled or expired. The difference between the carrying amount of the financial liability derecognized and the consideration paid and payable is recognized in profit or loss.

F-10

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

PLANT AND EQUIPMENT

Plant and equipment is recognized and

subsequently measured at cost less accumulated depreciation and any accumulated impairment losses, if any. When components of property

and equipment have different useful lives they are accounted for separately.

| Computer and handphone | ||

| Equipment and machine | ||

| License | ||

| Right-of-use assets | ||

| Renovation |

Plant and equipment is derecognized upon disposal or when no future economic benefits are expected from its use. Any gain or loss arising from derecognition of the asset, being the difference between the net disposal proceeds and the carrying amount, is recognized in profit or loss.

IMPAIRMENT OF NON-FINANCIAL ASSETS

Impairment of assets are reviewed at the end of each reporting period for impairment when there is an indication that the assets might be impaired. Impairment is measured by comparing the carrying values of the assets with their recoverable amounts. When the carrying amount of an asset exceeds its recoverable amount, the asset is written down to its recoverable amount and an impairment loss shall be recognized. The recoverable amount of an asset is the higher of the asset’s fair value less costs to sell and its value in use, which is measured by reference to discounted future cash flows using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. An impairment loss is recognized in profit or loss.

When there is a change in the estimates used to determine the recoverable amount, a subsequent increase in the recoverable amount of an asset is treated as a reversal of the previous impairment loss and is recognized to the extent of the carrying amount of the asset that would have been determined (net of amortization and depreciation) had no impairment loss been recognized. The reversal is recognized in profit or loss immediately.

LEASES

The Group as leasee

The Group assesses whether a contract is or contains a lease, at inception of the contract. The Group recognizes a right-of-use asset and corresponding lease liability with respect to all lease arrangements in which it is the lessee, except for low-value assets and short-term leases with 12 months or less. For these leases, the Group recognizes the lease payments as an operating expense on a straight-line method over the term of the lease unless another systematic basis is more representative of the time pattern in which economic benefits from the leased assets are consumed.

The Group recognizes a right-of-use asset and a lease liability at the lease commencement date. The right-of-use assets and the associated lease liabilities are presented as a separate line item in the statements of financial position.

F-11

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

Right-of-use asset

The right-of-use asset is initially measured at cost. Cost includes the initial amount of the corresponding lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred, less any incentives received.

The right-of-use asset is subsequently measured at cost less accumulated depreciation and any impairment losses, and adjustment for any remeasurement of the lease liability. The depreciation starts from the commencement date of the lease. If the lease transfers ownership of the underlying asset to the Group or the cost of the right-of-use asset reflects that the Group expects to exercise a purchase option, the related right-of-use asset is depreciated over the useful life of the underlying asset. Otherwise, the Group depreciates the right-of-use asset to the earlier of the end of the useful life of the right-of-use asset or the end of the lease term. The estimated useful lives of the right-of-use assets are determined on the same basis as those plant and equipment.

Lease liability

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted by using the rate implicit in the lease. If this rate cannot be readily determined, the Group uses its incremental borrowing rate.

The lease liability is subsequently measured at amortized cost using the effective interest method. It is remeasured when there is a change in the future lease payments (other than lease modification that is not accounted for as a separate lease) with the corresponding adjustment is made to the carrying amount of the right-of-use asset, or is recognized in profit or loss if the carrying amount has been reduced to zero.

PROVISIONS

Provisions are recognized when the Group has a present obligation (legal or constructive) as a result of past events, when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and when a reliable estimate of the amount can be made. Provisions are reviewed at the end of each reporting period and adjusted to reflect the current best estimate. Where the effect of the time value of money is material, the provision is the present value of the estimated expenditure required to settle the obligation. The discount rate shall be a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability. The unwinding of the discount is recognized as interest expense in profit or loss.

Provision for warranties

The Group provides warranties for general repairs of defects. Provisions related to these assurance-type warranties are recognized when the product is sold. Initial recognition is based on historical experience. The estimate of warranty-related costs is revised annually.

F-12

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

REVENUE RECOGNITION

Revenue is derived principally from services, tangible products, rental and others.

Revenue from services

Revenue from services is recognized over time in the year in which the services rendered.

A receivable is recognized when the services are rendered as this is the point in time that the consideration is unconditional because only the passage of time is required before the payment is due.

| 1. | Subscription services from Speed + Pos software and QR ordering system revenue measured on time elapsed. |

| 2. | Software consultant and development services revenue measured on contract milestone. |

| 3. | Social media management services revenue measured on time elapsed. |

| 4. | Data management and analysis services revenue measured on time elapsed. |

Revenue from tangible products

Revenue from tangible products is recognized at a point in time when the goods have been delivered to the customer and upon its acceptance, and it is probable that the Group will collect the considerations to which it would be entitled to in exchange for the goods sold.

Revenue from rental of machinery

Revenue from rental is recognized at a point in time, measured through time lapsed results in entitlement to collection of revenue.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise cash in hand, bank balances, demand deposits, and short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value with original maturity periods of three months or less.

Bank overdrafts are presented as current borrowings in the statements of financial position.

SHARE CAPITAL

Ordinary shares are classified as equity. Incremental costs directly attributable to the issuance of new ordinary shares are deducted against the share capital account.

F-13

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

INCOME TAX

Current tax assets and liabilities are the expected amount of income tax recoverable or payable to the taxation authorities, measured using tax rates and tax laws that have been enacted or substantively enacted at the end of the reporting period and are recognized in profit or loss except to the extent that the tax relates to items recognized outside profit or loss (either in other comprehensive income or directly in equity).

Deferred taxes are recognized using the liability method for temporary differences other than those that arise from the initial recognition of an asset or liability in a transaction which is not a business combination and at the time of the transaction, affects neither accounting profit nor taxable profit.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the period when the asset is realized or the liability is settled, based on the period.

Deferred tax assets are recognized for all deductible temporary differences, unused tax losses and unused tax credits to the extent that it is probable that future taxable profits will be available against which the deductible temporary differences, unused tax losses and unused tax credits can be utilized. The carrying amounts of deferred tax assets are reviewed at the end of each reporting period and reduced to the extent that it is no longer probable that the related tax benefits will be realized.

Current and deferred tax items are recognized in correlation to the underlying transactions either in profit or loss, other comprehensive income or directly in equity.

Current tax assets and liabilities or deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when the deferred taxes relate to the same taxable entity (or on different tax entities but they intend to settle current tax assets and liabilities on a net basis) and the same taxation authority.

EMPLOYEE BENEFITS

Defined contribution plan

The Company participates in Employees Provident Fund (EPF), Malaysia’s national defined contribution plan, employees are required to contribute a specified percentage of their monthly salary to the EPF, which is deducted from their salaries each month. The company also contributes a specified percentage based on the employees’ monthly salaries, as mandated by the EPF regulations. The Company’s contributions are recognized as an expense in the period when employees render related services, and this expense is recorded in the profit or loss statement under employee benefits expense. A liability is recognized for unpaid contributions at the end of each reporting period, representing amounts due to the EPF but not yet paid. Contributions are measured at the statutory rates applicable during the period. In the financial statements, the total amount of contributions made to the EPF during the reporting period is disclosed in the notes under employee benefits.

Actuarial risk (that benefits will be less than expected) and investment risk (that assets invested will be insufficient to meet expected benefits) fall, in substance, on the employee.

F-14

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

DEFERRED OFFERING COSTS

Deferred offering costs are specific expenses incurred during the process of preparing for an offering of securities, including legal, accounting, underwriting, and other fees directly associated with the offering. These costs are initially recorded as an asset when incurred, provided it is probable that the offering will be successfully completed, and are capitalized as “Deferred Offering Costs” on the statement of financial position. Only direct and incremental costs clearly attributable to the offering are capitalized, while general and administrative expenses not directly related to the offering process are expensed as incurred. Upon successful completion of the offering, deferred offering costs are reclassified from the statement of financial position to the statement of comprehensive income and recognized as a reduction of the proceeds from the offering within equity. If it becomes probable that the offering will not be completed, all deferred offering costs are expensed immediately in the period this determination is made.

FOREIGN CURRENCY TRANSACTIONS

The functional currency used by the Company is Malaysia Ringgit. Consequently, operations in currencies other than the Malaysian Ringgit are considered to be denominated in foreign currency and are recorded at the exchange rates in force on the dates of the operations.

At year-end, monetary assets and liabilities denominated in foreign currency are converted by applying the exchange rate on the statement of financial position date. The profits or losses revealed are charged directly to the profit and loss account for the year in which they occur. Non-monetary items in foreign currency measured in terms of historical cost are converted at the exchange rate on the date of the transaction.

The exchange differences of the monetary items that arise both when liquidating them and when converting them at the closing exchange rate, are recognized in the results of the year, except those that are part of the investment of a business abroad, which are recognized directly in equity net of taxes until the time of its disposal.

EARNINGS PER SHARE

Basic income per share is calculated by dividing the income attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding in the period. For all periods presented, the income attributable to ordinary shareholders equals the reported income attributable to owners of the Company.

Diluted income per share is calculated by the treasury stock method. Under the treasury stock method, the weighted average number of ordinary shares outstanding for the calculation of diluted income per share assumes that the proceeds to be received on the exercise of dilutive share options and warrants are used to repurchase ordinary shares at the average market price during the period.

The Company has no potentially dilutive securities, such as options or warrants, currently issued and outstanding, as of June 30, 2025 and December 31, 2024.

SEGMENT REPORTING

Operating segments are reported in a manner consistent with the internal reporting provided for decision maker, whose members are responsible for allocating resources and assessing the performance of the operating segments.

F-15

SAGTEC GLOBAL LIMITED

AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICIES (cont.) |

BORROWING AND BORROWING COSTS

Borrowings are classified as current liabilities unless the Group has the unconditional right to postpone settlement for at least 12 months after the statement of financial position date, in which case they are classified as non-current liabilities.

Borrowings are initially recorded at fair value, net of any transaction costs. They are then measured at amortized cost. The difference between the initial proceeds (after deducting transaction costs) and the repayment amount is recognized in profit or loss over the term of the borrowings using the effective interest rate method.

Borrowing costs are recognized in profit or loss using the effective interest method except for borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset form part of the cost of that asset.

| 3 | CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY |

The preparation of these unaudited interim condensed consolidated financial statements in conformity with IFRS require the directors of the Company to make judgements, estimates and assumptions that affect the application of policies and reported amounts of assets, liabilities, income and expenses. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis of making the judgements about carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods.

The directors have considered the development, selection and disclosure of the Group’s critical accounting judgements and estimates. The key assumptions concerning the future and other key sources of estimation uncertainty at the end of the reporting period, that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are described below:-

Useful lives of plant and equipment

The Group’s management determines the estimated useful lives and the related depreciation charge for the Group’s plant and equipment. This estimate is based on the historical experience of the actual useful lives of plant and equipment of similar nature and functions. Management will increase the depreciation charge where useful lives are less than previously estimated lives, or will write off or write down technically obsolete or non-strategic assets that have been abandoned or sold. Actual economic lives may differ from estimated useful lives. Periodic review could result in a change in depreciable lives and therefore depreciation charge in the future periods.

Impairment of Trade Receivables

The Group uses the simplified approach to estimate a lifetime expected credit loss allowance for all trade receivables. The Group develops the expected loss rates based on the payment profiles of past sales and the corresponding historical credit losses, and adjusts for qualitative and quantitative reasonable and supportable forward-looking information. If the expectation is different from the estimation, such difference will impact the carrying value of trade receivables.

F-16

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 4 | ISSUANCE OF SHARES |

| Number of shares | RM | |||||||

| Balance as at December 31, 2023 | ||||||||

| Issuance of shares from Sagtec Global Limited | ||||||||

| Balance as at December 31, 2024 | ||||||||

| Proceeds from issuance of Class A ordinary shares upon the completion of IPO | ||||||||

| Balance as at June 30, 2025 | ||||||||

00) per shares, raising gross proceeds of RM

As of the reporting date, the offering-related expenses had not yet been finalized, and therefore the full amount of gross proceeds has been presented within equity.

The Group will record the offering expenses as a deduction from equity in the subsequent reporting period, in accordance with IAS 32 – Financial Instruments: Presentation, which requires directly attributable transaction costs of an equity transaction to be accounted for as a deduction from equity, net of any related tax benefits.

| 5 | ACQUISITION OF CL TECHNOLOGIES (INTERNATIONAL) SDN. BHD. |

On January 1, 2024, the Company completed

the acquisition of CL Technologies (International) Sdn. Bhd. (CL Tech), a company located in Malaysia that provides food and beverage

software and server hosting services. The acquisition was made pursuant to a share purchase agreement dated January 1, 2024, between

the Company, and Kevin Ng Chen Lok and other individual non-controlling shareholders, collectively the

As part of the restructuring of the Company, the

acquisition of entities, business or assets under common control are accounted for in accordance with merger accounting. The

difference between the consideration paid and the share capital of the acquired entity is reflected within equity as a merger reserve.

| RM | Convenience Translation USD | |||||||

| Cash consideration | ||||||||

| Book value of | ( | ) | ( | ) | ||||

| Bargain purchase accounted as merger reserve in equity | ||||||||

| 6 | ACQUISITIONS OF SAGTEC GROUP SDN. BHD. |

On January 1, 2024, the Company completed

the acquisition of Sagtec Group Sdn. Bhd. (Sagtec Group), a company located in Malaysia that provides Food and beverage SAAS services.

The acquisition was made pursuant to a share purchase agreement dated January 1, 2024, between the Company, and Kevin Ng Chen Lok

and other individual non-controlling shareholders, collectively the

As part of the restructuring of the Company, the

acquisition of entities, business or assets under common control are accounted for in accordance with merger accounting. The

difference between the consideration paid and the share capital of the acquired entity is reflected within equity as a merger reserve.

| RM | Convenience Translation USD | |||||||

| Cash consideration | ||||||||

| Book value of | ( | ) | ( | ) | ||||

| Bargain purchase accounted as merger reserve in equity | ||||||||

F-17

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 7 | PLANT AND EQUIPMENT |

| As of January 1, 2024 | Addition | As of December 31, 2024 | Addition | Disposal | As of June 30, 2025 | As of June 30, 2025 | ||||||||||||||||||||||

| RM | RM | RM | RM | RM | RM | Convenience Translation USD | ||||||||||||||||||||||

| Plant and equipment, at cost | ||||||||||||||||||||||||||||

| Equipment & Machine | ( | ) | ||||||||||||||||||||||||||

| Computer & Handphone | ||||||||||||||||||||||||||||

| License | ||||||||||||||||||||||||||||

| Renovation | ||||||||||||||||||||||||||||

| Total cost | ( | ) | ||||||||||||||||||||||||||

| As of January 1, 2024 | Depreciation for the year | As of December 31, 2024 | Depreciation for the year | Disposal for the year | As of June 30, 2025 | As of June 30, 2025 | ||||||||||||||||||||||

| RM | RM | RM | RM | RM | RM | Convenience Translation USD | ||||||||||||||||||||||

| Accumulated Depreciation | ||||||||||||||||||||||||||||

| Equipment & Machine | ( | ) | ||||||||||||||||||||||||||

| Computer & Handphone | ||||||||||||||||||||||||||||

| License | ||||||||||||||||||||||||||||

| Renovation | ||||||||||||||||||||||||||||

| Total accumulated depreciation | ( | ) | ||||||||||||||||||||||||||

| As of December 31, 2024 | As of June 30, 2025 | As of June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Carrying Amount | ||||||||||||

| Equipment & Machine | ||||||||||||

| Computer & Handphone | ||||||||||||

| License | ||||||||||||

| Renovation | ||||||||||||

| Total carrying amount | ||||||||||||

F-18

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 8 | RIGHT OF USE ASSETS |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Right-Of-Use Assets, cost | ||||||||||||

| As at beginning of the year/period | ||||||||||||

| Add: New lease recognized | ||||||||||||

| Less: Termination | ( | ) | ( | ) | ||||||||

| As at end of the year/period | ||||||||||||

| Right-Of-Use Assets, accumulated amortization | ||||||||||||

| As at beginning of the year/period | ||||||||||||

| Amortization of the year | ||||||||||||

| Less: Termination | ( | ) | ( | ) | ||||||||

| As at end of the year/period | ||||||||||||

| Right-Of-Use Assets, carrying amount | ||||||||||||

| As at beginning of the year/period | ||||||||||||

| As at end of the year/period | ||||||||||||

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Lease Liability | ||||||||||||

| As at beginning of the year/period | ||||||||||||

| Add: New lease recognized | ||||||||||||

| Add: Imputed interest | ||||||||||||

| Less: Principal repayment | ( | ) | ( | ) | ( | ) | ||||||

| Termination | ( | ) | ( | ) | ||||||||

| As at end of the year/period | ||||||||||||

| Lease liability current portion | ||||||||||||

| Lease liability non-current portion | ||||||||||||

| Maturities of Lease | ||||||||||||

| Year ending December 31, 2025 | - | - | ||||||||||

| Year ending December 31, 2026 | - | - | ||||||||||

| Year ending December 31, 2027 | - | - | ||||||||||

| Year ending December 31, 2028 | - | - | ||||||||||

| Year ending December 31, 2029 | - | - | ||||||||||

| After December 31, 2029 | - | - | ||||||||||

| - | - | |||||||||||

| Maturities of Lease | ||||||||||||

| Period ending June 30, 2026 | - | |||||||||||

| Period ending June 30, 2027 | - | |||||||||||

| Period ending June 30, 2028 | - | |||||||||||

| Period ending June 30, 2029 | - | |||||||||||

| Period ending June 30, 2030 | - | |||||||||||

| After June 30, 2030 | - | |||||||||||

| - | ||||||||||||

F-19

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 9 | TRADE RECEIVABLES AND TRADE PAYABLES |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Trade receivables, gross | ||||||||||||

| Third parties | ||||||||||||

| Trade receivables, net | ||||||||||||

Trade receivables are non-interest bearing, generally on

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Trade payables, gross | ||||||||||||

| Third parties | ||||||||||||

| Trade payables, net | ||||||||||||

Trade payables are non-interest bearing, generally on

| 10 | OTHER RECEIVABLES AND OTHER PAYABLES |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Prepayments, deposits & other receivables | ||||||||||||

| Rental deposit | ||||||||||||

| Utility deposit | ||||||||||||

| Other deposits | ||||||||||||

| Other receivables | ||||||||||||

| Deferred offering costs | ||||||||||||

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Accrued liabilities & other payables | ||||||||||||

| Employee benefits payable | ||||||||||||

| Lease payable | ||||||||||||

| Accrued operating expenses | ||||||||||||

| Utilities payable | ||||||||||||

F-20

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 11 | CASH AND SHORT-TERM DEPOSITS |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Cash | ||||||||||||

| Pledged Deposits | ||||||||||||

| Total | ||||||||||||

Pledged deposits are fixed deposit pledged to

banks with maturity less than

For the purpose of presenting the consolidated statement of cash flows, cash and cash equivalents comprise the following at the end of the financial year

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Cash and short-term deposits | ||||||||||||

| Pledged Deposits | ( | ) | ( | ) | ( | ) | ||||||

| Bank Overdraft | ( | ) | ( | ) | ( | ) | ||||||

| Total | ||||||||||||

| 12 | RELATED PARTIES DISCLOSURES |

| a. |

| For the six months ended June 30, | ||||||||||||

| 2024 | 2025 | 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Payments made on behalf by director | ||||||||||||

| Employee benefit expenses charged from related parties | ||||||||||||

| Selling and administrative expenses charged from related parties | ||||||||||||

Related parties comprise mainly shareholders or companies controlled by director or shareholders.

| b. |

| For the six months ended June 30, | ||||||||||||

| 2024 | 2025 | 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Ng Chen Lok, Chairman, CEO & Director | ||||||||||||

| - Director fee | ||||||||||||

| Zuria Hajar Bt Mohd Adnan, CFO & Director | ||||||||||||

| - Salary | ||||||||||||

| - Employer Contribution to Defined Contribution Plan | ||||||||||||

| - Employer Contribution to Insurance Scheme | ||||||||||||

| Loong Xin Yee, COO | ||||||||||||

| Tan Kim Chuan, CTO | ||||||||||||

| - Salary | ||||||||||||

| - Employer Contribution to Defined Contribution Plan | ||||||||||||

| - Employer Contribution to Insurance Scheme | ||||||||||||

| Lai Fuu Sing, Independent Director | ||||||||||||

| - Director fee | ||||||||||||

| Pan Seng Wee, Independent Director | ||||||||||||

| - Director fee | ||||||||||||

| Robert Michael Harrison Jr, Independent Director | ||||||||||||

| - Director fee | ||||||||||||

F-21

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 13 | PROVISIONS |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| As at beginning of the year/period | ||||||||||||

| Add: Provision for warranty during the year/period | ||||||||||||

| Less: Unclaimed warranty during the year/period | ( | ) | ( | ) | ( | ) | ||||||

| As at end of the year/period | ||||||||||||

The Group provides a one-year warranty on all food kiosk ordering machines and power bank charging station sold, covering defects in materials and workmanship. The Group anticipates the utilization of provision within one year, any unutilized provision for warranty will be adjusted toward year end of each reporting period.

| 14 | BANK BORROWINGS AND BANK OVERDRAFT |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Current | ||||||||||||

| Bank overdraft | ||||||||||||

| Bank borrowings | ||||||||||||

| Non-current | ||||||||||||

| Bank borrowings | ||||||||||||

Bank overdraft

The bank overdraft is secured by the Group’s fixed deposits.

The weightage average effective interest rate is

Bank borrowing

| Maturities of Bank Borrowing | ||||||||||||

| Year ending December 31, 2025 | ||||||||||||

| Year ending December 31, 2026 | ||||||||||||

| Year ending December 31, 2027 | ||||||||||||

| Year ending December 31, 2028 | ||||||||||||

| Year ending December 31, 2029 | ||||||||||||

| After December 31, 2029 | ||||||||||||

| Maturities of Bank Borrowing | ||||||||||||

| Period ending June 30, 2026 | ||||||||||||

| Period ending June 30, 2027 | ||||||||||||

| Period ending June 30, 2028 | ||||||||||||

| Period ending June 30, 2029 | ||||||||||||

| Period ending June 30, 2030 | ||||||||||||

| After June 30, 2030 | ||||||||||||

F-22

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 14 | BANK BORROWINGS AND BANK OVERDRAFT (cont.) |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Fair value of non-current borrowing | ||||||||||||

| Undrawn borrowing facility | ||||||||||||

| Weighted average interest rate | % | % | % | |||||||||

All borrowings by the company are personally guaranteed by the director. In the event the company is unable to meet its loan obligations, the director will be held accountable and responsible for repaying the loans.

Reconciliation of liabilities arising from financing activities

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Bank borrowing | ||||||||||||

| As at beginning of the year/period | ||||||||||||

| Proceeds from borrowing | ||||||||||||

| Scheduled repayment | ( | ) | ( | ) | ( | ) | ||||||

| Non-cash changes | ||||||||||||

| Finance cost | ||||||||||||

| As at end of the year/period | ||||||||||||

| Lease liability | ||||||||||||

| As at beginning of the year/period | ||||||||||||

| Scheduled repayment | ( | ) | ( | ) | ( | ) | ||||||

| Non-cash changes | ||||||||||||

| Addition during the year | ||||||||||||

| Imputed interest | ||||||||||||

| Termination | ( | ) | ( | ) | ||||||||

| As at end of the year/period | ||||||||||||

| Amount due from/(to) director | ||||||||||||

| As at beginning of the year/period | ( | ) | ||||||||||

| (Repayment)/Advance | ( | ) | ||||||||||

| As at end of the year/period | ||||||||||||

F-23

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 15 | INCOME TAX |

| As of | ||||||||||||||||

| June 30, 2024 |

December 31, 2024 |

June 30, 2025 |

June 30, 2025 |

|||||||||||||

| RM | RM | RM | Convenience Translation USD |

|||||||||||||

| Tax payable | ||||||||||||||||

| As at beginning of the year/period | ||||||||||||||||

| Tax expenses | ||||||||||||||||

| Tax payment | ( |

) | ( |

) | ( |

) | ||||||||||

| As at end of the year/period | ||||||||||||||||

| Deferred tax liabilities | ||||||||||||||||

| Accelerated tax depreciation | ||||||||||||||||

| As at beginning of the year/period | ||||||||||||||||

| Tax expenses | ( |

) | ||||||||||||||

| As at end of the year/period | ||||||||||||||||

| Income tax expenses | ||||||||||||||||

| - Current year | ||||||||||||||||

| - Origination of temporary differences | ( |

) | ||||||||||||||

| Total income tax expenses | ||||||||||||||||

A reconciliation between tax expense and the product of accounting profit multiplied by applicable corporate tax rate for the financial years ended June 30, 2024, December 31, 2024 and June 30, 2025 were as follows:

| As of | ||||||||||||||||

| June 30, 2024 | December 31, 2024 | June 30, 2025 | June 30, 2025 | |||||||||||||

| RM | RM | RM | Convenience Translation USD | |||||||||||||

| Tax reconciliation | ||||||||||||||||

| Profit before tax | ||||||||||||||||

| Tax calculated at tax rate of | ||||||||||||||||

| Effects of: | ||||||||||||||||

| - Lower domestic tax rate applicable to respective profits** | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| - Different tax rates in jurisdiction* | ( | ) | ( | ) | ||||||||||||

| - Non-allowable expenditure | ||||||||||||||||

| - Income not subject to tax | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| - Utilization of previously unrecognized capital allowance | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Tax expenses | ||||||||||||||||

| * | |

| ** | The Company’s subsidiaries formed in Malaysia and is subject to the corporate tax on taxable income derived from its activities conducted in Malaysia. The first RM |

F-24

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 16 | RESERVES |

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Bargain purchase accounted as merger reserve in equity from acquisition of CL Technologies (International) Sdn Bhd | ||||||||||||

| Bargain purchase accounted as merger reserve in equity from acquisition of Sagtec Group Sdn Bhd | ||||||||||||

| 17 | REVENUE |

| For the six months ended June 30, | ||||||||||||

| 2024 | 2025 | 2025 | ||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Revenue from services | ||||||||||||

| Revenue from tangible products | ||||||||||||

| Revenue from non-related parties | ||||||||||||

| Total revenue | ||||||||||||

| Revenue from services | ||||||||||||

| Performance obligation satisfied over time | ||||||||||||

| Subscription services | ||||||||||||

| Software consultation and development services | ||||||||||||

| Social media management services | ||||||||||||

| Data management & analysis services | ||||||||||||

| Revenue from tangible products | ||||||||||||

| Performance obligation satisfied at point in time | ||||||||||||

| Food ordering kiosk with screen | ||||||||||||

| Power bank charging station | ||||||||||||

| Total revenue | ||||||||||||

Transaction price allocated to remaining performance obligation

Management expects that the transaction price allocated to remaining unsatisfied (or partially unsatisfied) performance obligation as at June 30, 2024 and 2025 may be recognized as revenue in the next reporting periods as follows:

| As of | ||||||||||||||||

| June 30, 2024 | December 31, 2024 | June 30, 2025 | June 30, 2025 | |||||||||||||

| RM | RM | RM | Convenience Translation USD | |||||||||||||

| Unsatisfied and partially unsatisfied performance obligation | ||||||||||||||||

Unsatisfied performance obligation solely consists of deferred revenue, money received for goods or services not yet delivered or performed.

F-25

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 18 | COST OF SALES |

| For the six months ended June 30, | ||||||||||||

| 2024 | 2025 | 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Purchases | ||||||||||||

| Commissions | ||||||||||||

| Marketing | ||||||||||||

| Depreciation of plant and equipment | ||||||||||||

| Software development | ||||||||||||

| Server maintenance | ||||||||||||

| Employee benefit expenses | ||||||||||||

| Total | ||||||||||||

| 19 | EXPENSES BY NATURE |

| For the six months ended June 30, | ||||||||||||

| 2024 | 2025 | 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Employee benefit expenses | ||||||||||||

| - Director emoluments | ||||||||||||

| - Staff costs | ||||||||||||

| - Employer Contribution to Defined Contribution Plan | ||||||||||||

| - Employer Contribution to Insurance Scheme | ||||||||||||

| Depreciation of plant and equipment | ||||||||||||

| Amortization of ROU | ||||||||||||

| 20 | FAIR VALUE OF ASSETS & LIABILITIES |

Asset and liabilities not measured at fair value

Cash and bank balance, other receivables and payables carrying amounts of these balances approximate their fair values due to the short-term nature of these balances.

Trade receivables and trade payables carrying amounts (including trade balances due from/to related parties) approximate their fair values as they are subject to normal trade credit terms.

Bank borrowings carrying amounts approximate their fair values as they are subject to interest rates close to market rate of interests for similar arrangements with financial institutions.

F-26

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 21 | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT |

The Company activities expose it to various risks, including market risk (comprising currency risk and interest rate risk), credit risk, and liquidity risk. The Company overall risk management strategy aims to minimize any adverse effects from the unpredictability of financial markets on its financial performance.

| As of | ||||||||||||

| December 31, 2024 |

June 30, 2025 |

June 30, 2025 |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Financial assets at amortized cost | ||||||||||||

| Cash | ||||||||||||

| Trade receivables | ||||||||||||

| Other receivables | ||||||||||||

| Fixed deposits | ||||||||||||

| Financial liabilities at amortized cost | ||||||||||||

| Trade payables | ||||||||||||

| Other payables & accrued liabilities | ||||||||||||

| Bank and other borrowings | ||||||||||||

| Lease liabilities | ||||||||||||

| Amount due to director | ||||||||||||

Foreign Currency Risk

The Group expose to foreign currency risk due to transactions and balances denominated in currencies other than the functional currency of the respective entities of the Group, with the primary risk arising from the Chinese Renminbi (“RMB”). The Group closely monitor foreign currency risk on an ongoing basis to ensure that our net exposure remains at an acceptable level.

The company is subject to minimal foreign currency risk due to its foreign supplier policy of making prepayments in advance of delivery, thus eliminating the need for credit terms.

Interest Rate Risk

The Group exposed to interest rate risk arise mainly from interest-bearing bank loans. The interest rates and repayment terms of these loans are disclosed in Note 14 of the financial statements. Currently, The Group does not have an interest rate hedging policy. The sensitivity analysis below is based on our exposure to interest rates for non-derivative instruments at the end of the reporting period.

We use a 50-basis point increase

or decrease to report interest rate risk internally to key management personnel, as this represents management’s assessment of

a reasonably possible change in interest rates. If interest rates on loans had been 50 basis points higher or lower, with all other

variables held constant, our profit would decrease or increase by approximately RM

F-27

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 21 | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (cont.) |

Liquidity Risk

Liquidity risk arises mainly due to general

funding and business activities. The Group practices prudent risk management by maintaining sufficient cash balances and the availability

of funding through certain committed credit facilities. The table below analyses non-derivative financial liabilities of the Group into

relevant maturity groupings based on the remaining period from the statement of financial position date to the contractual maturity date.

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Bank borrowings | ||||||||||||

| Repayment within: | ||||||||||||

| Less than 1 year | ||||||||||||

| Between 1 and 2 years | ||||||||||||

| Between 2 and 5 years | ||||||||||||

| Over 5 years | ||||||||||||

| Bank overdraft | ||||||||||||

| Repayment within less than 1 year | ||||||||||||

| Lease liabilities | ||||||||||||

| Repayment within: | ||||||||||||

| Less than 1 year | ||||||||||||

| Between 1 and 2 years | ||||||||||||

| Between 2 and 5 years | ||||||||||||

| Over 5 years | ||||||||||||

| Trade payable | ||||||||||||

| Repayment within less than 1 year | ||||||||||||

| Other payable | ||||||||||||

| Repayment within less than 1 year | ||||||||||||

| Amount due to director | ||||||||||||

| Repayment within less than 1 year | ||||||||||||

Credit Risk

Credit risk primarily arises from the possibility of customers failing to fulfill their payment obligations for the services provided. The Group addresses this risk by conducting thorough customer screening and segmentation based on creditworthiness, setting appropriate credit limits, and enforcing stringent payment terms such as upfront payments and short billing cycles.

Expected credit losses are measured as

the difference in the present value of the contractual cash flows that are due to the Company under the contract, and the cash flows that

the Company expects to receive.

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Trade receivable | ||||||||||||

| Collection within less than 1 year | ||||||||||||

| Other receivables | ||||||||||||

| Collection within less than 1 year | ||||||||||||

F-28

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 21 | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (cont.) |

Capital Risk Management

The Group manages its capital to ensure that entities within our Company will be able to maintain an optimal capital structure so as to support our businesses and maximize shareholders value. To achieve this objective, we may make adjustments to the capital structure in view of changes in economic conditions, such as adjusting the amount of dividend payment, returning of capital to shareholders or issuing new shares.

The Group manage its capital based on

debt-to-equity ratio that complies with debt covenants and regulatory, if any. The debt-to-equity ratio is calculated as net debt divided

by total equity.

| As of | ||||||||||||

| December 31, 2024 | June 30, 2025 | June 30, 2025 | ||||||||||

| RM | RM | Convenience Translation USD | ||||||||||

| Net debt | ||||||||||||

| Total equity | ||||||||||||

| Total capital | ||||||||||||

| Gearing ratio | % | % | % | |||||||||

| 22 | CONCENTRATIONS OF RISK |

Customer Concentration

For the period ended June 30,

2024, the Company generated total revenue of RM

For the period ended June 30,

2025, the Company generated total revenue of RM

| For the six months ended June 30, | ||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Revenues | Percentage of revenues | Trade receivables | ||||||||||||||||||||||

| RM | RM | % | % | RM | RM | |||||||||||||||||||

| SM Prominent Sdn Bhd | ||||||||||||||||||||||||

| KLC Ventures Sdn Bhd | ||||||||||||||||||||||||

| Dencity Group Sdn Bhd | ||||||||||||||||||||||||

| Rams Solutions Sdn Bhd | ||||||||||||||||||||||||

| Total | ||||||||||||||||||||||||

Vendor Concentration

For the period ended June 30, 2024, the Company incurred cost of sale

of RM

For the period ended June 30,

2025, the Company incurred cost of sale of RM

| For the six months ended June 30, | ||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Cost of sale | Percentage of cost of sales | Accounts payable, trade | ||||||||||||||||||||||

| RM | RM | % | % | RM | RM | |||||||||||||||||||

| Vendor A | ||||||||||||||||||||||||

| Vendor B | ||||||||||||||||||||||||

| Total | ||||||||||||||||||||||||

F-29

SAGTEC GLOBAL LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 23 | OPERATING SEGMENTS |

Directors determine the basis of operating segments by analyzing the Group’s various revenue streams. They consider the nature of these revenues, the markets served, and the internal reporting structure. By segmenting the Group into distinct operating units, each with unique financial metrics and strategic goals, directors gain clearer insights into performance. This segmentation informs business decisions and resource allocation, allowing directors to target investments, manage costs, and optimize operations effectively for each segment.

The Group’s operations are located in Malaysia.

All of the Group’s revenue from external customers based on the location of the Group’s operations is from Malaysia.

| For the six months ended June 30, 2024 | ||||||||||||||||||||||||

| SAAS Business | Software Customization | Data Analysis & Hosting Services | Outright Purchase | Others | Total | |||||||||||||||||||

| RM | RM | RM | RM | RM | RM | |||||||||||||||||||

| Revenue | ||||||||||||||||||||||||

| Cost of Revenue | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Gross Profit | ( | ) | ( | ) | ||||||||||||||||||||

| Selling & Administrative Expenses | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||

| Income from operations | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

| Segment depreciation | ||||||||||||||||||||||||

| Segment amortization | ||||||||||||||||||||||||

| Segment Assets | ||||||||||||||||||||||||

| Segment Liabilities | ||||||||||||||||||||||||

| For the six months ended June 30, 2025 | ||||||||||||||||||||||||

| SAAS Business | Software Customization | Data Analysis & Hosting Services | Outright Purchase | Others | Total | |||||||||||||||||||

| RM | RM | RM | RM | RM | RM | |||||||||||||||||||

| Revenue | ||||||||||||||||||||||||

| Cost of Revenue | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Gross Profit/(Loss) | ( | ) | ||||||||||||||||||||||

| Selling & Administrative Expenses | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||

| Income from operations | ( | ) | ( | ) | ||||||||||||||||||||

| Segment depreciation | ||||||||||||||||||||||||

| Segment amortization | ||||||||||||||||||||||||

| Segment Assets | ||||||||||||||||||||||||

| Segment Liabilities | ||||||||||||||||||||||||

| 24 | SUBSEQUENT EVENTS |

The Company has evaluated subsequent events through the date the financial statements were available to be issued. Based on this evaluation, there are no subsequent events that require disclosure or adjustment to the financial statements as of the reporting date.

F-30