|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

The Acquirers Fund

|

$76

|

0.79%

|

|

|

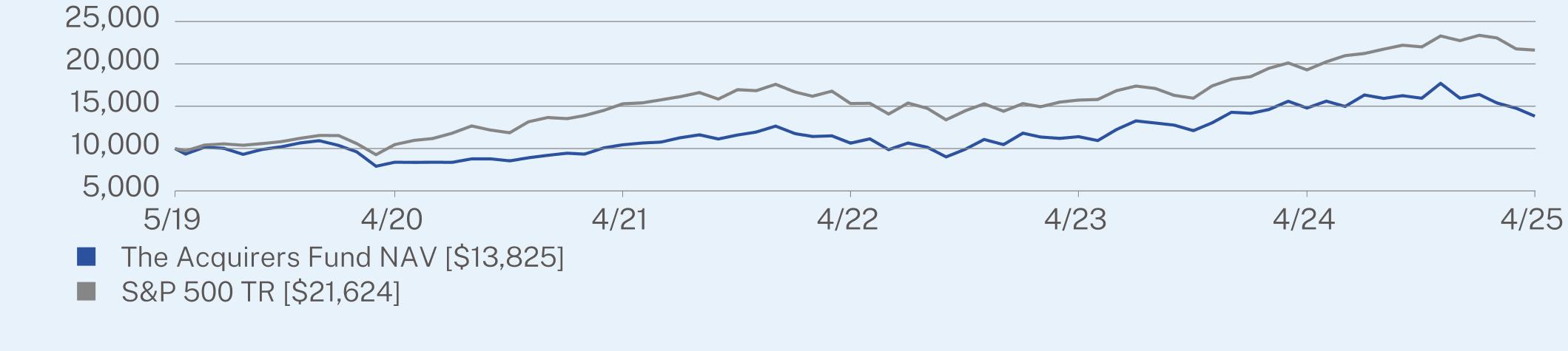

1 Year

|

5 Year

|

Since Inception

(05/14/2019) |

|

The Acquirers Fund NAV

|

-6.53

|

10.51

|

5.58

|

|

S&P 500 TR

|

12.10

|

15.61

|

13.80

|

|

Net Assets

|

$33,821,441

|

|

Number of Holdings

|

32

|

|

Net Advisory Fee

|

$364,102

|

|

Portfolio Turnover

|

179%

|

|

Top 10 Issuers

|

(% of the net assets)

|

|

National Beverage Corporation

|

4.0%

|

|

Domino’s Pizza, Inc.

|

3.7%

|

|

Steel Dynamics, Inc.

|

3.7%

|

|

Altria Group, Inc.

|

3.7%

|

|

Green Brick Partners, Inc.

|

3.6%

|

|

CF Industries Holdings, Inc.

|

3.6%

|

|

Atkore, Inc.

|

3.6%

|

|

Bath & Body Works, Inc.

|

3.6%

|

|

PulteGroup, Inc.

|

3.5%

|

|

Nucor Corporation

|

3.5%

|