Shareholder Report

|

12 Months Ended |

|

Dec. 31, 2024

USD ($)

Holding

|

Dec. 31, 2023 |

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR/A

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Morgan

Stanley Institutional Fund, Inc.

|

|

| Entity Central Index Key |

0000836487

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Dec. 31, 2024

|

|

| C000085093 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

|

|

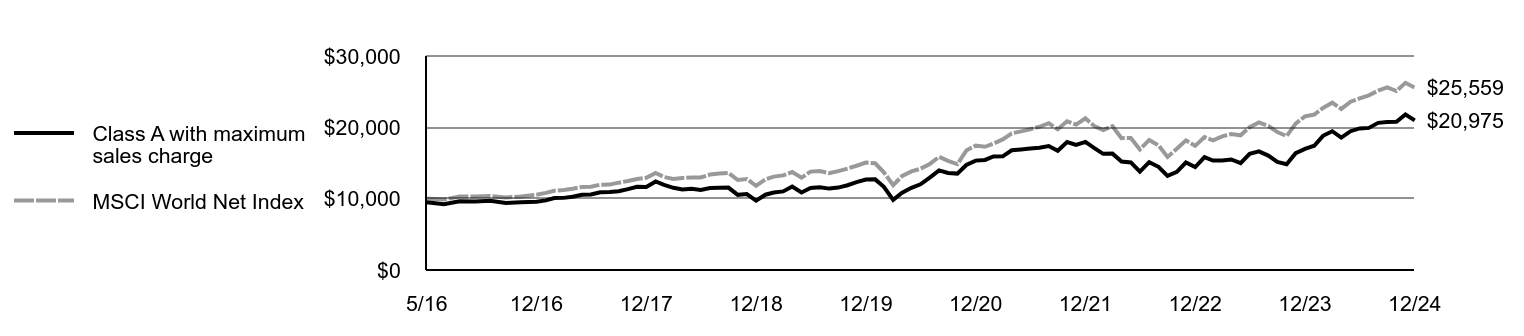

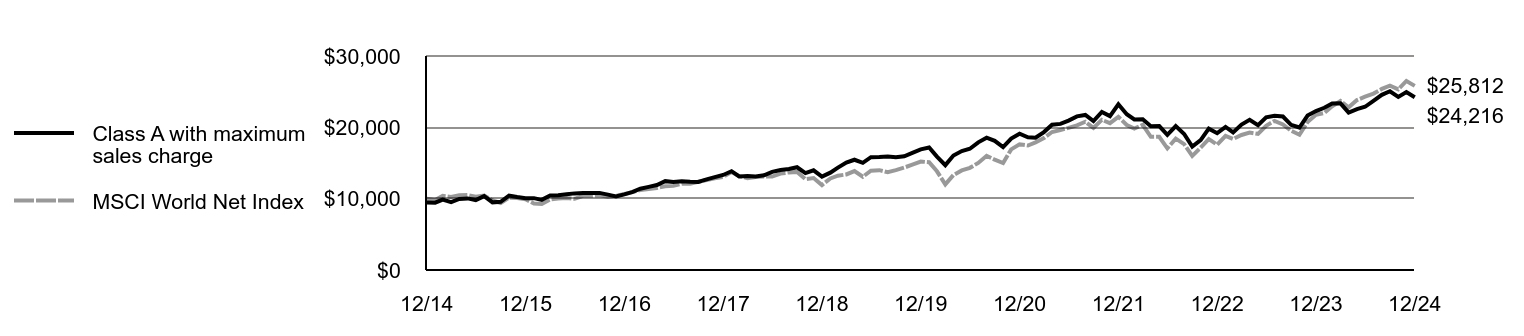

| Class Name |

Class A

|

|

| Trading Symbol |

MAPPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $138 | 1.17% |

|---|

|

|

| Expenses Paid, Amount |

$ 138

|

|

| Expense Ratio, Percent |

1.17%

|

|

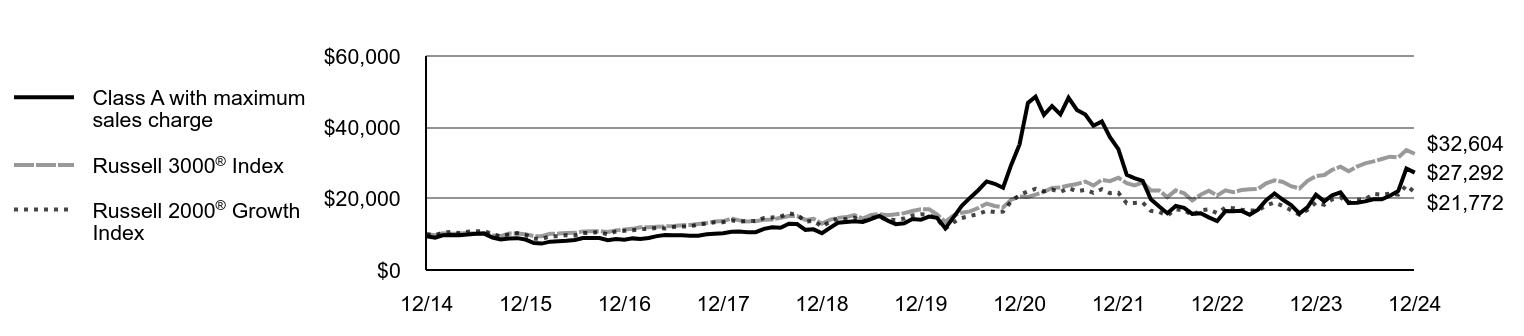

| Factors Affecting Performance [Text Block] |

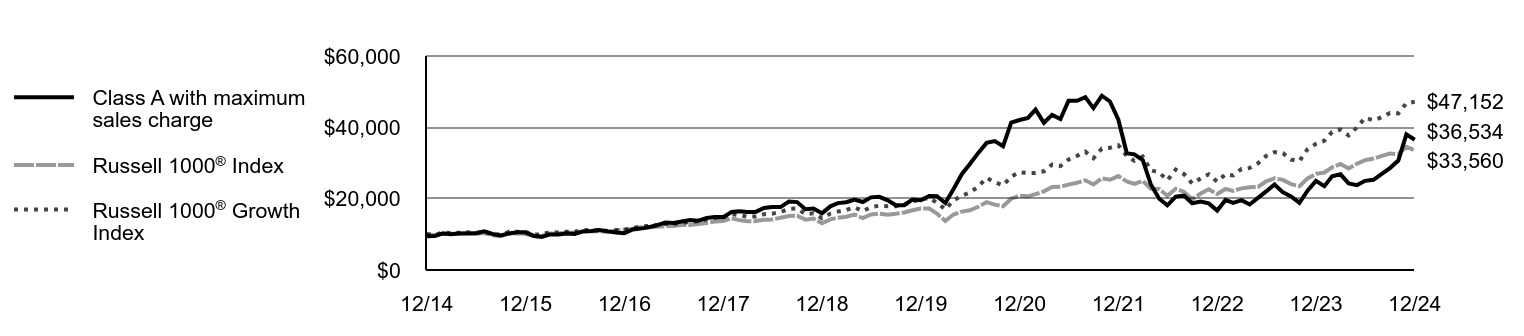

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the Russell 1000® Growth Index: ↑ Stock selection in information technology, led by a position in an enterprise analytics platform and Bitcoin developing company ↑ Average overweight and stock selection in consumer discretionary, led by a food delivery company ↑ No exposure to consumer staples, a sector that underperformed in the index ↓ Stock selection in health care, led lower by a biopharmaceutical royalties acquirer and a next-generation sequencing company (the sequencing company was sold during the period) ↓ Stock selection and average overweight in financials, ↓ Average underweight in information technology, which was one of the stronger performing sectors in the period |

|

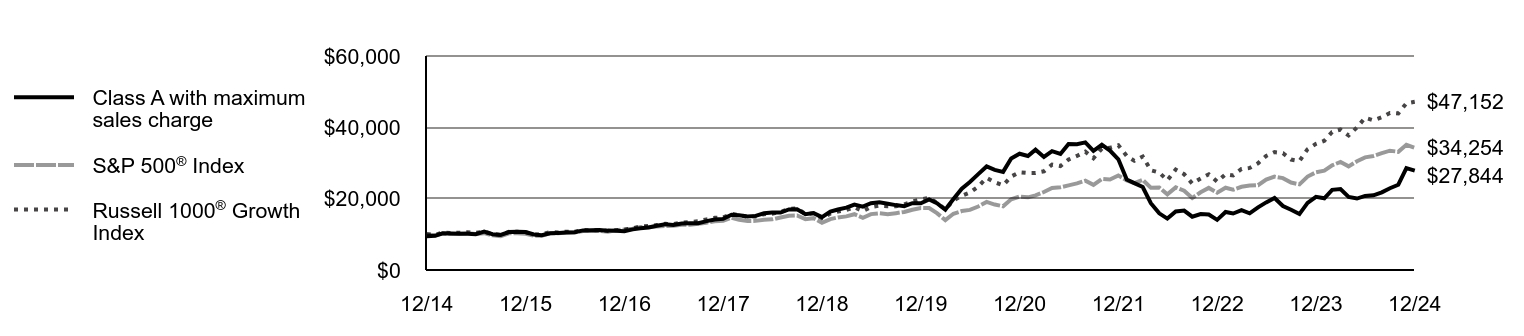

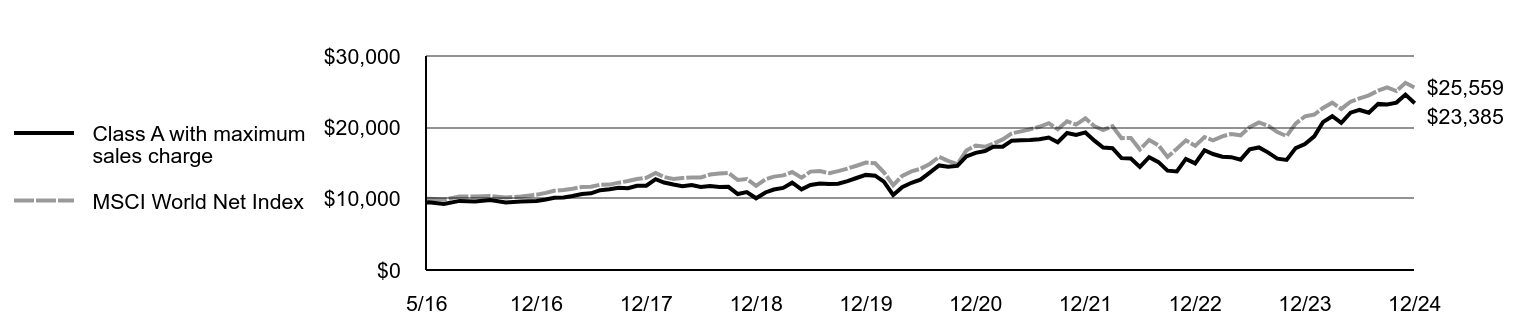

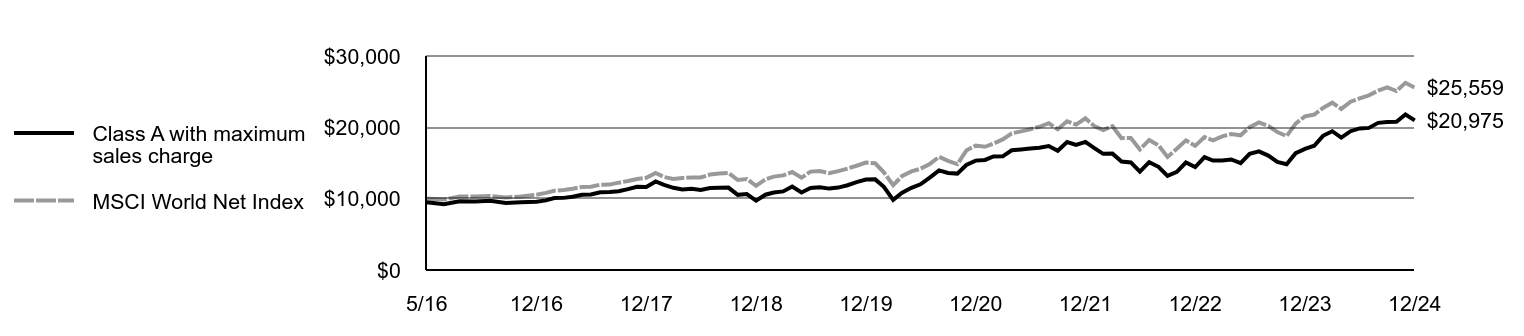

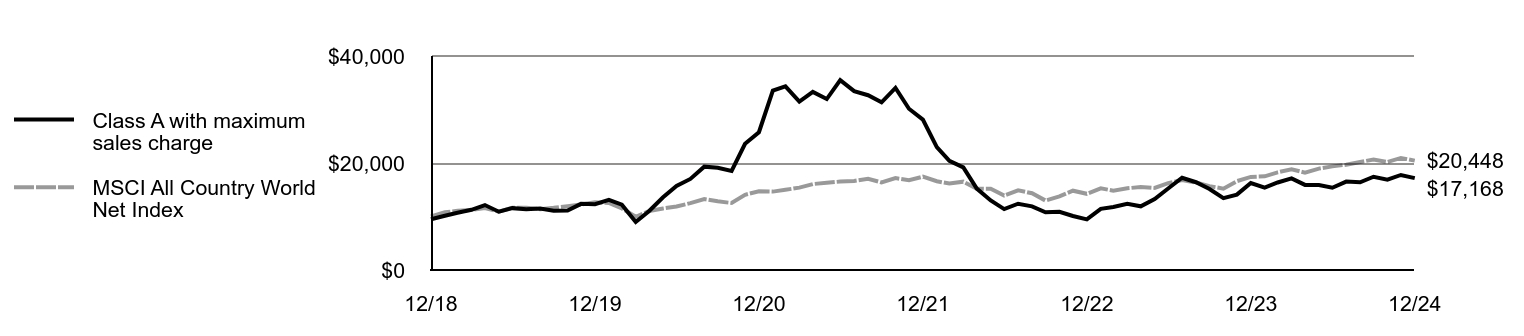

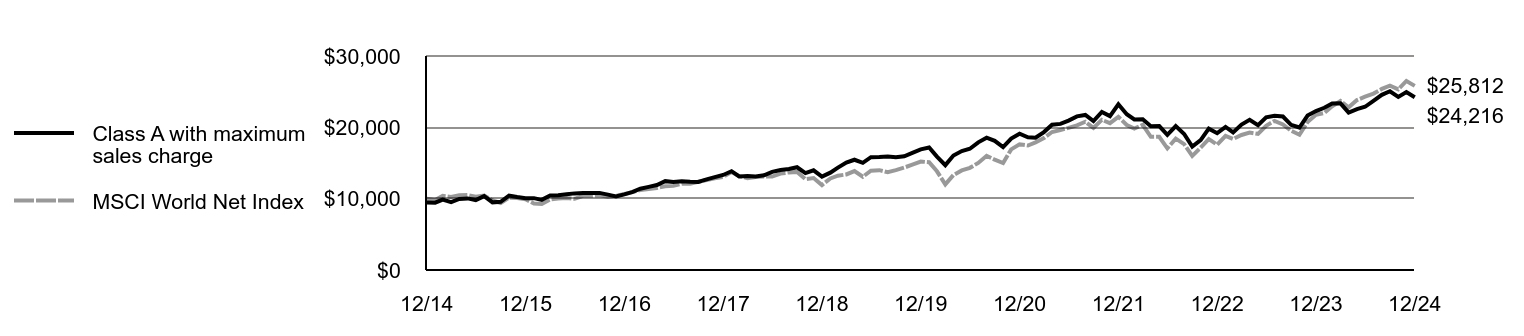

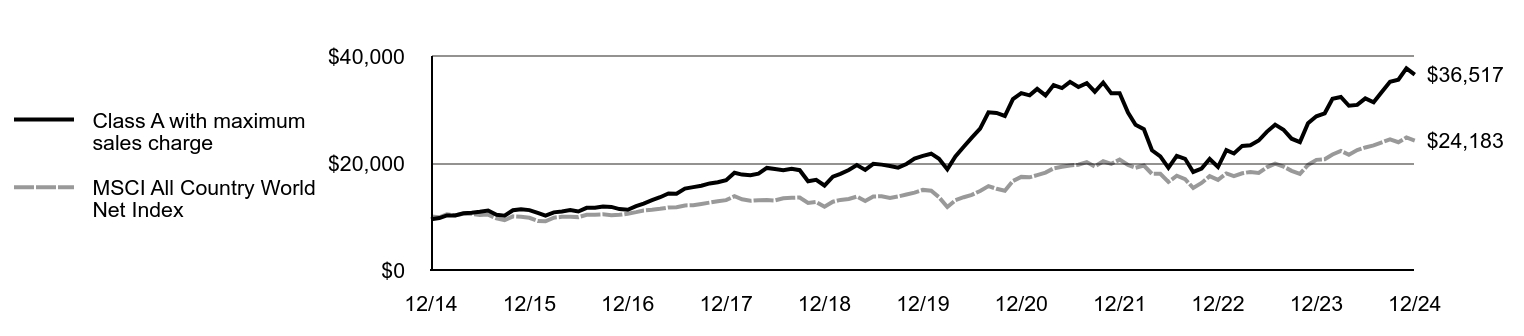

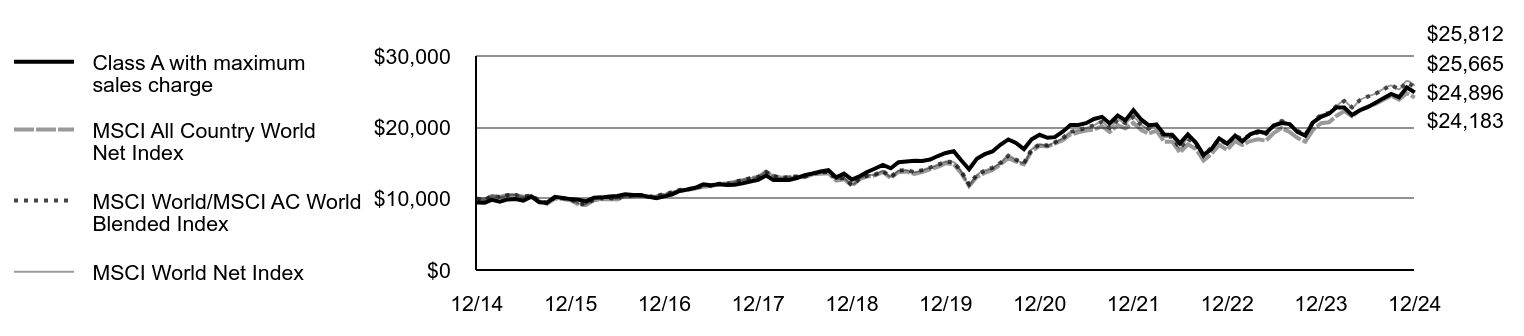

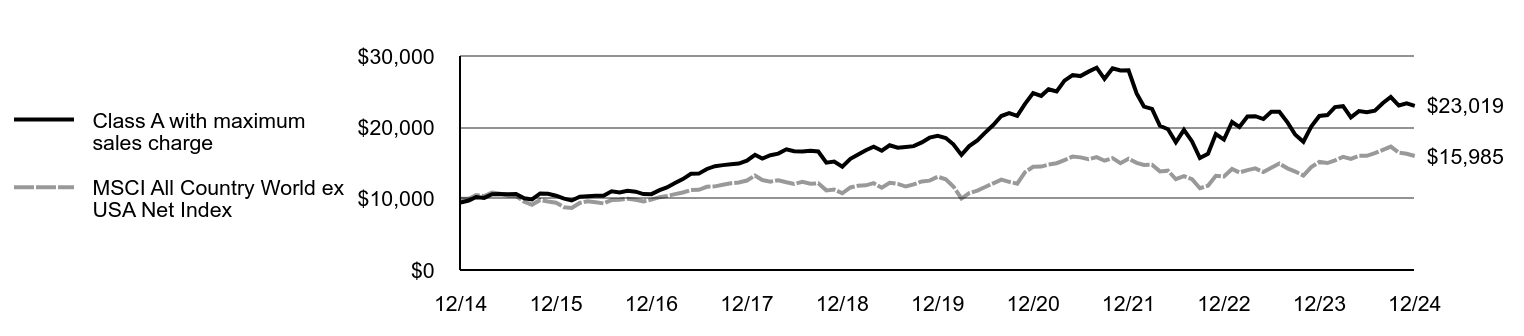

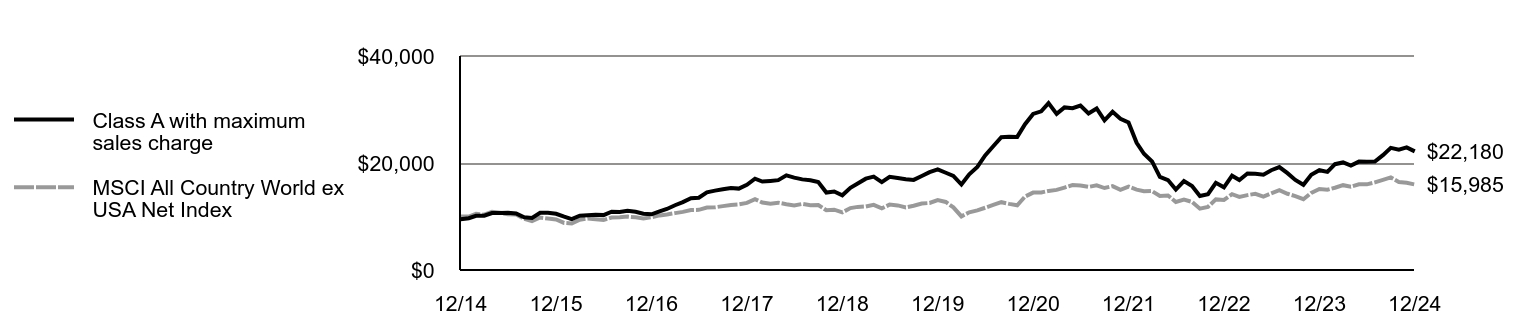

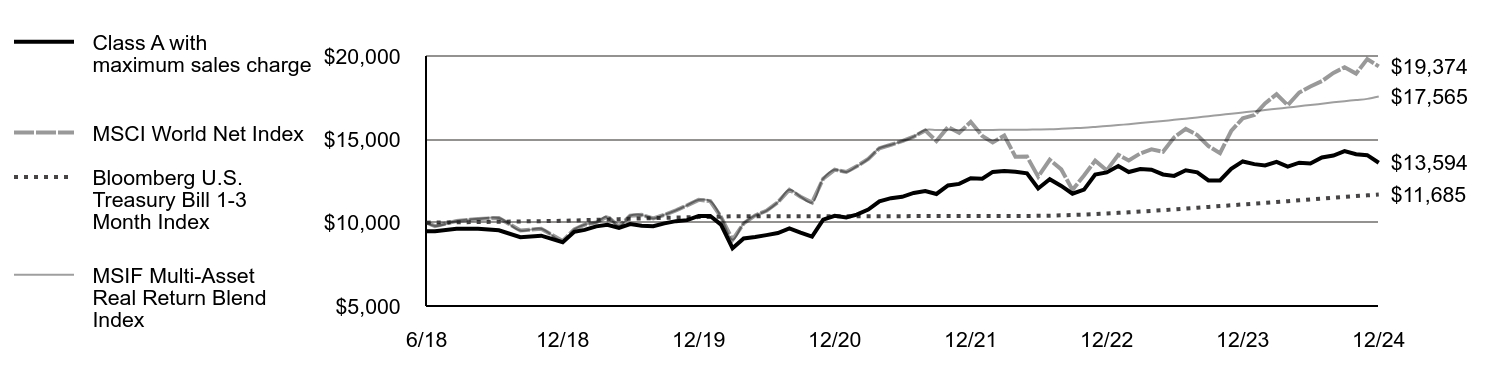

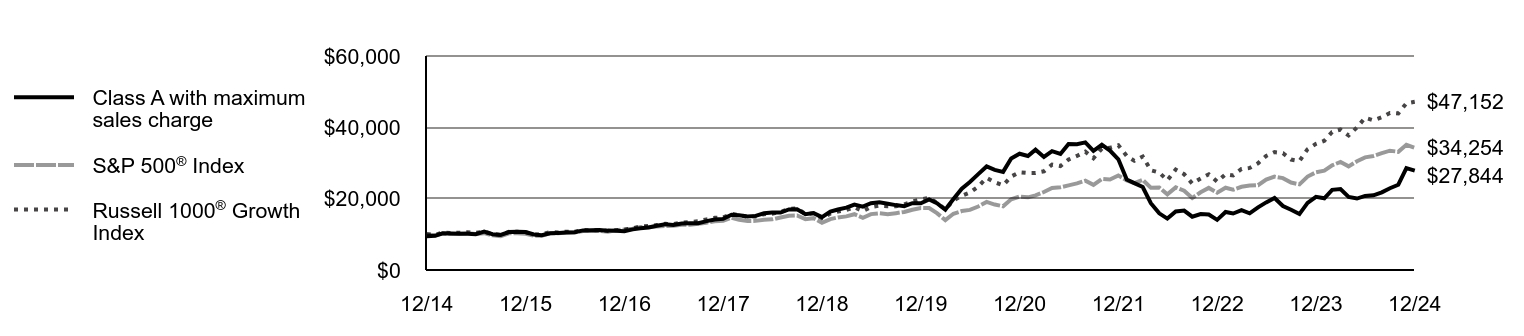

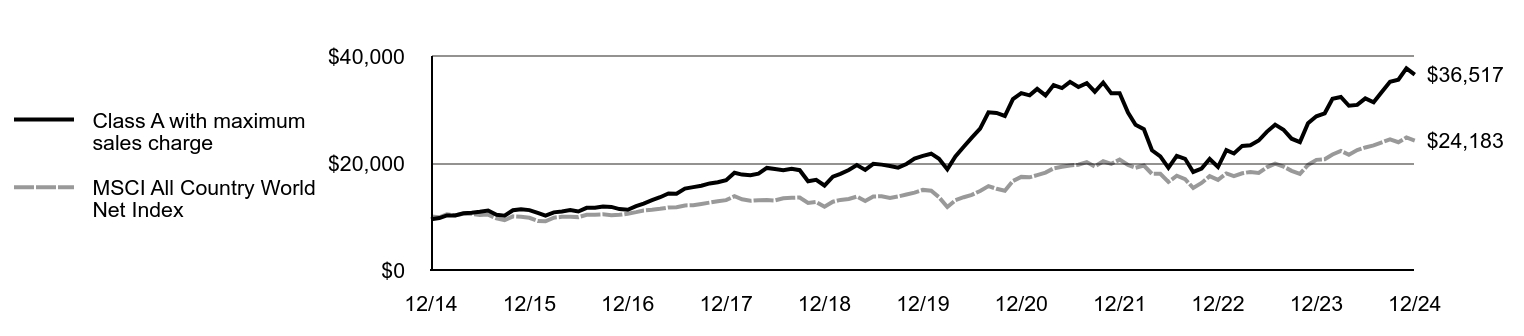

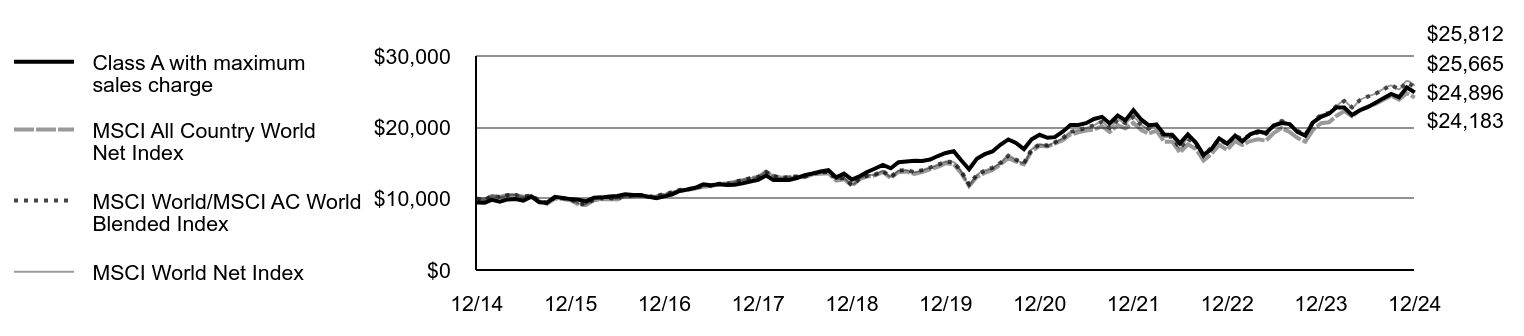

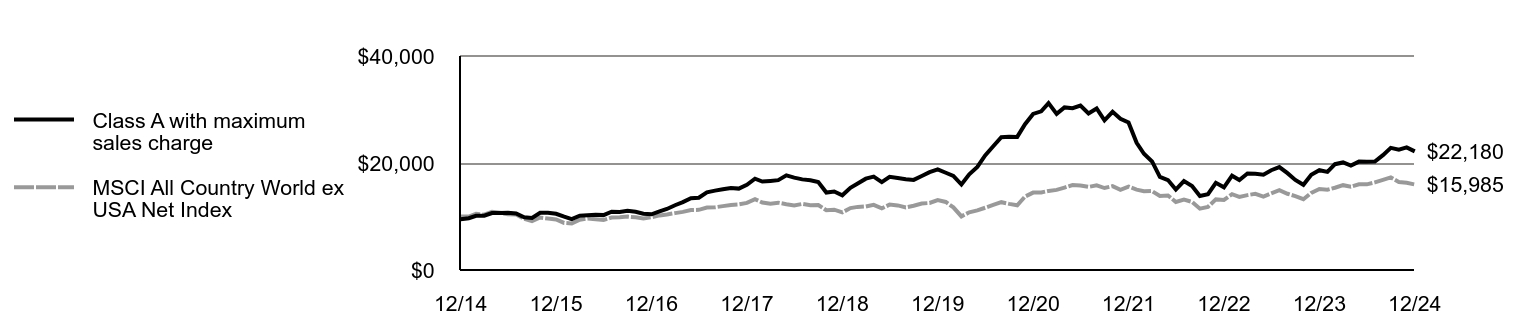

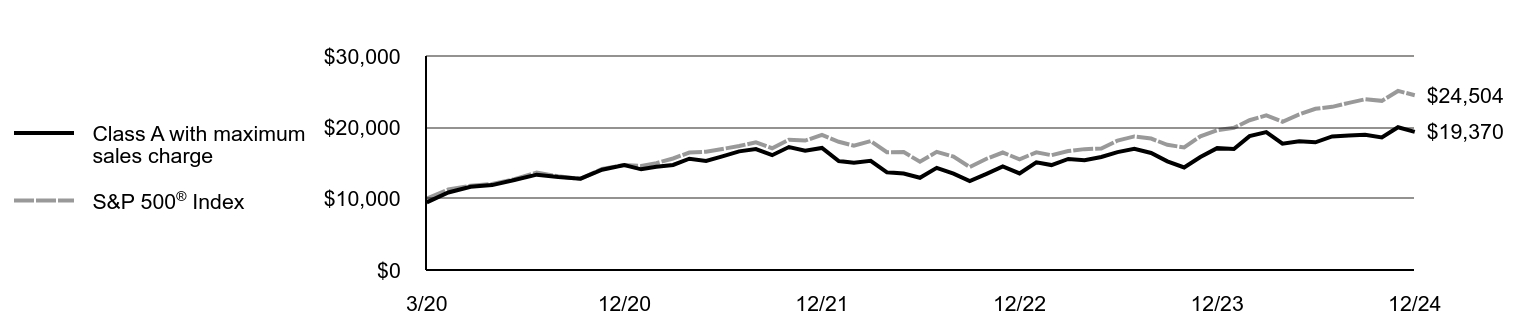

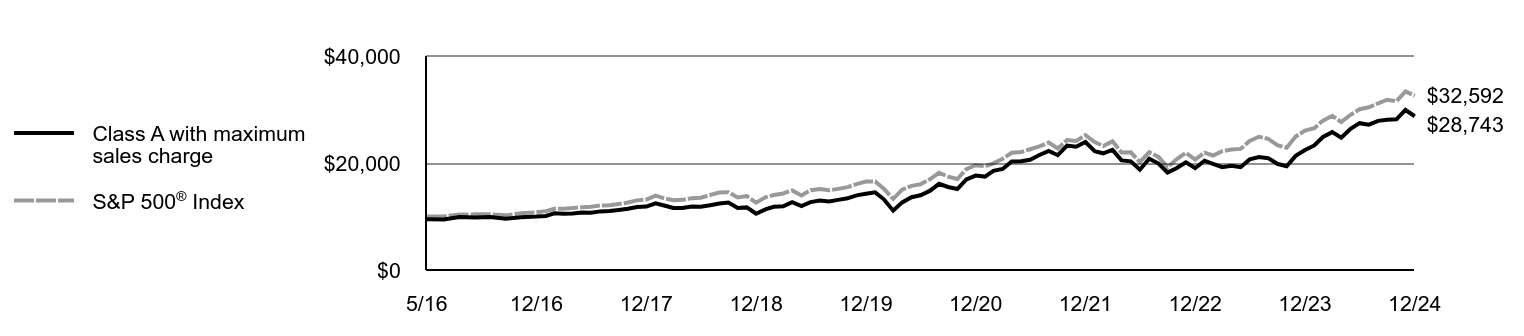

| Line Graph [Table Text Block] |

| Class A with maximum sales charge | S&P 500® Index | Russell 1000® Growth Index |

|---|

12/14 | $9,472 | $10,000 | $10,000 |

|---|

1/15 | $9,580 | $9,700 | $9,847 |

|---|

2/15 | $10,295 | $10,257 | $10,503 |

|---|

3/15 | $10,210 | $10,095 | $10,384 |

|---|

4/15 | $10,170 | $10,192 | $10,436 |

|---|

5/15 | $10,153 | $10,323 | $10,583 |

|---|

6/15 | $10,057 | $10,123 | $10,396 |

|---|

7/15 | $10,749 | $10,335 | $10,749 |

|---|

8/15 | $10,045 | $9,712 | $10,096 |

|---|

9/15 | $9,817 | $9,471 | $9,846 |

|---|

10/15 | $10,634 | $10,270 | $10,694 |

|---|

11/15 | $10,691 | $10,301 | $10,724 |

|---|

12/15 | $10,628 | $10,138 | $10,567 |

|---|

1/16 | $9,967 | $9,635 | $9,977 |

|---|

2/16 | $9,733 | $9,622 | $9,973 |

|---|

3/16 | $10,294 | $10,275 | $10,645 |

|---|

4/16 | $10,375 | $10,315 | $10,548 |

|---|

5/16 | $10,504 | $10,500 | $10,753 |

|---|

6/16 | $10,597 | $10,527 | $10,711 |

|---|

7/16 | $11,109 | $10,915 | $11,216 |

|---|

8/16 | $11,166 | $10,931 | $11,160 |

|---|

9/16 | $11,241 | $10,933 | $11,201 |

|---|

10/16 | $11,040 | $10,733 | $10,938 |

|---|

11/16 | $11,034 | $11,131 | $11,176 |

|---|

12/16 | $10,891 | $11,351 | $11,314 |

|---|

1/17 | $11,389 | $11,566 | $11,696 |

|---|

2/17 | $11,723 | $12,025 | $12,182 |

|---|

3/17 | $11,913 | $12,039 | $12,322 |

|---|

4/17 | $12,392 | $12,163 | $12,604 |

|---|

5/17 | $12,815 | $12,334 | $12,932 |

|---|

6/17 | $12,651 | $12,411 | $12,898 |

|---|

7/17 | $13,005 | $12,666 | $13,241 |

|---|

8/17 | $13,126 | $12,705 | $13,483 |

|---|

9/17 | $13,113 | $12,967 | $13,659 |

|---|

10/17 | $13,703 | $13,270 | $14,188 |

|---|

11/17 | $14,134 | $13,677 | $14,619 |

|---|

12/17 | $14,336 | $13,829 | $14,733 |

|---|

1/18 | $15,471 | $14,621 | $15,776 |

|---|

2/18 | $15,356 | $14,082 | $15,363 |

|---|

3/18 | $15,002 | $13,724 | $14,941 |

|---|

4/18 | $15,172 | $13,777 | $14,994 |

|---|

5/18 | $15,886 | $14,108 | $15,651 |

|---|

6/18 | $16,110 | $14,195 | $15,801 |

|---|

7/18 | $16,112 | $14,724 | $16,265 |

|---|

8/18 | $16,982 | $15,203 | $17,155 |

|---|

9/18 | $17,044 | $15,290 | $17,251 |

|---|

10/18 | $15,628 | $14,245 | $15,708 |

|---|

11/18 | $15,945 | $14,535 | $15,875 |

|---|

12/18 | $14,820 | $13,223 | $14,510 |

|---|

1/19 | $16,349 | $14,282 | $15,814 |

|---|

2/19 | $16,970 | $14,741 | $16,380 |

|---|

3/19 | $17,482 | $15,027 | $16,846 |

|---|

4/19 | $18,341 | $15,636 | $17,607 |

|---|

5/19 | $17,778 | $14,642 | $16,495 |

|---|

6/19 | $18,737 | $15,674 | $17,628 |

|---|

7/19 | $18,983 | $15,899 | $18,026 |

|---|

8/19 | $18,579 | $15,648 | $17,888 |

|---|

9/19 | $18,196 | $15,940 | $17,890 |

|---|

10/19 | $17,901 | $16,286 | $18,394 |

|---|

11/19 | $18,745 | $16,877 | $19,210 |

|---|

12/19 | $18,702 | $17,386 | $19,790 |

|---|

1/20 | $19,769 | $17,379 | $20,232 |

|---|

2/20 | $18,716 | $15,949 | $18,854 |

|---|

3/20 | $16,885 | $13,979 | $17,000 |

|---|

4/20 | $19,886 | $15,771 | $19,515 |

|---|

5/20 | $22,800 | $16,522 | $20,825 |

|---|

6/20 | $24,690 | $16,850 | $21,732 |

|---|

7/20 | $26,875 | $17,801 | $23,404 |

|---|

8/20 | $29,031 | $19,080 | $25,819 |

|---|

9/20 | $28,082 | $18,355 | $24,604 |

|---|

10/20 | $27,508 | $17,867 | $23,769 |

|---|

11/20 | $31,290 | $19,823 | $26,203 |

|---|

12/20 | $32,592 | $20,585 | $27,408 |

|---|

1/21 | $31,948 | $20,377 | $27,205 |

|---|

2/21 | $33,748 | $20,939 | $27,199 |

|---|

3/21 | $31,692 | $21,856 | $27,666 |

|---|

4/21 | $33,313 | $23,022 | $29,548 |

|---|

5/21 | $32,522 | $23,183 | $29,140 |

|---|

6/21 | $35,315 | $23,724 | $30,968 |

|---|

7/21 | $35,260 | $24,288 | $31,988 |

|---|

8/21 | $35,772 | $25,026 | $33,184 |

|---|

9/21 | $33,407 | $23,863 | $31,326 |

|---|

10/21 | $35,105 | $25,534 | $34,039 |

|---|

11/21 | $33,507 | $25,357 | $34,247 |

|---|

12/21 | $31,053 | $26,494 | $34,971 |

|---|

1/22 | $25,364 | $25,123 | $31,970 |

|---|

2/22 | $24,344 | $24,371 | $30,612 |

|---|

3/22 | $23,266 | $25,276 | $31,809 |

|---|

4/22 | $18,732 | $23,071 | $27,968 |

|---|

5/22 | $15,883 | $23,114 | $27,318 |

|---|

6/22 | $14,420 | $21,206 | $25,154 |

|---|

7/22 | $16,393 | $23,161 | $28,173 |

|---|

8/22 | $16,663 | $22,217 | $26,861 |

|---|

9/22 | $14,940 | $20,170 | $24,249 |

|---|

10/22 | $15,681 | $21,804 | $25,667 |

|---|

11/22 | $15,565 | $23,022 | $26,836 |

|---|

12/22 | $14,063 | $21,696 | $24,782 |

|---|

1/23 | $16,274 | $23,059 | $26,847 |

|---|

2/23 | $15,832 | $22,496 | $26,528 |

|---|

3/23 | $16,765 | $23,322 | $28,342 |

|---|

4/23 | $15,906 | $23,686 | $28,621 |

|---|

5/23 | $17,564 | $23,789 | $29,926 |

|---|

6/23 | $18,952 | $25,361 | $31,972 |

|---|

7/23 | $20,204 | $26,176 | $33,050 |

|---|

8/23 | $17,957 | $25,759 | $32,753 |

|---|

9/23 | $16,888 | $24,531 | $30,972 |

|---|

10/23 | $15,685 | $24,015 | $30,531 |

|---|

11/23 | $18,804 | $26,208 | $33,859 |

|---|

12/23 | $20,511 | $27,399 | $35,358 |

|---|

1/24 | $20,106 | $27,859 | $36,240 |

|---|

2/24 | $22,477 | $29,347 | $38,713 |

|---|

3/24 | $22,685 | $30,291 | $39,394 |

|---|

4/24 | $20,511 | $29,054 | $37,723 |

|---|

5/24 | $20,032 | $30,494 | $39,981 |

|---|

6/24 | $20,757 | $31,589 | $42,677 |

|---|

7/24 | $20,941 | $31,973 | $41,951 |

|---|

8/24 | $21,777 | $32,749 | $42,825 |

|---|

9/24 | $22,931 | $33,448 | $44,038 |

|---|

10/24 | $23,901 | $33,145 | $43,893 |

|---|

11/24 | $28,544 | $35,090 | $46,740 |

|---|

12/24 | $27,844 | $34,254 | $47,152 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | 5 Years | 10 Years |

|---|

Class A | 35.75% | 8.29% | 11.39% |

|---|

Class A, with 5.25% maximum front end sales charge | 28.59% | 7.12% | 10.78% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 16.78% |

|---|

|

|

| AssetsNet |

$ 194,996,435

|

|

| Holdings Count | Holding |

28

|

|

| Advisory Fees Paid, Amount |

$ 877,326

|

|

| InvestmentCompanyPortfolioTurnover |

57.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $194,996,435 |

|---|

# of Portfolio Holdings | 28 |

|---|

Portfolio Turnover Rate | 57% |

|---|

Total Advisory Fees Paid | $877,326 |

|---|

|

|

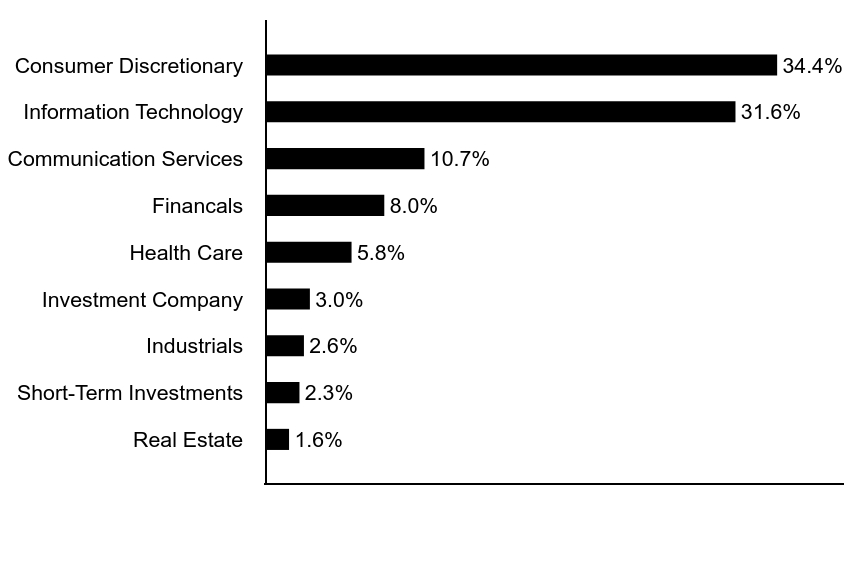

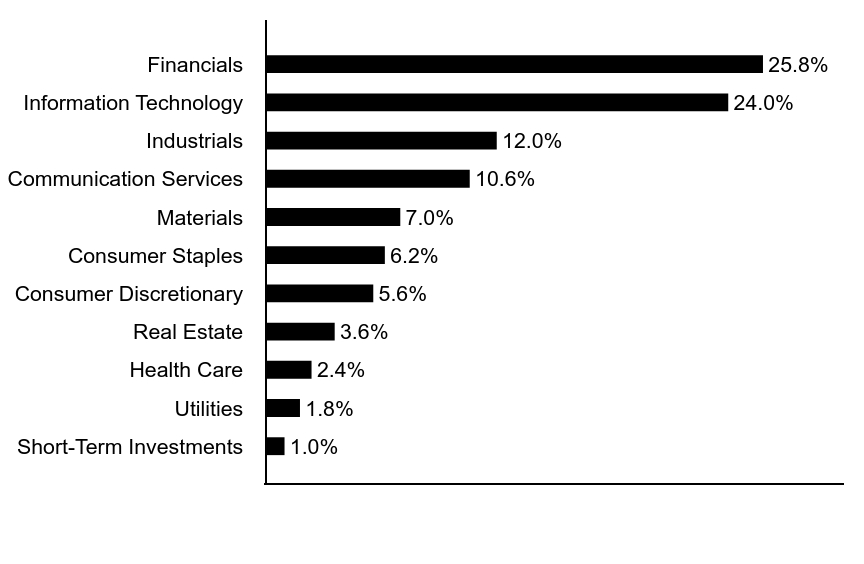

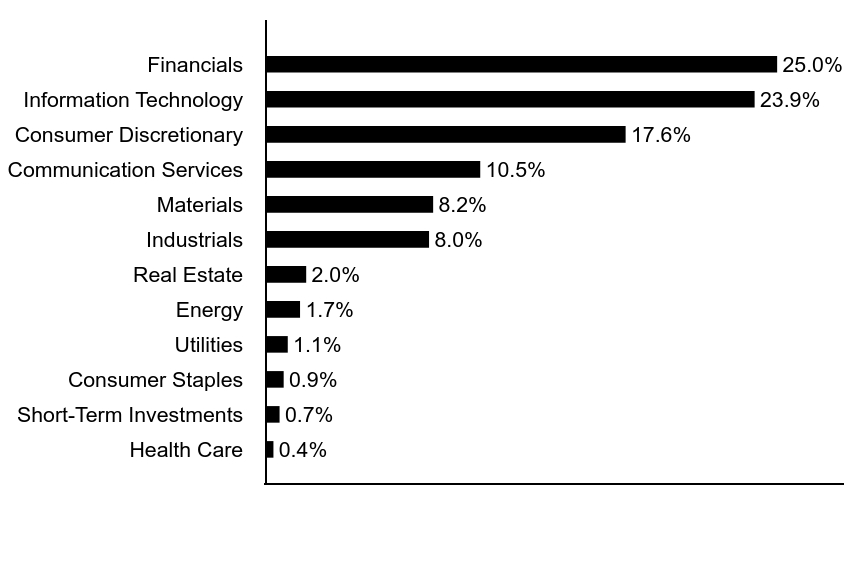

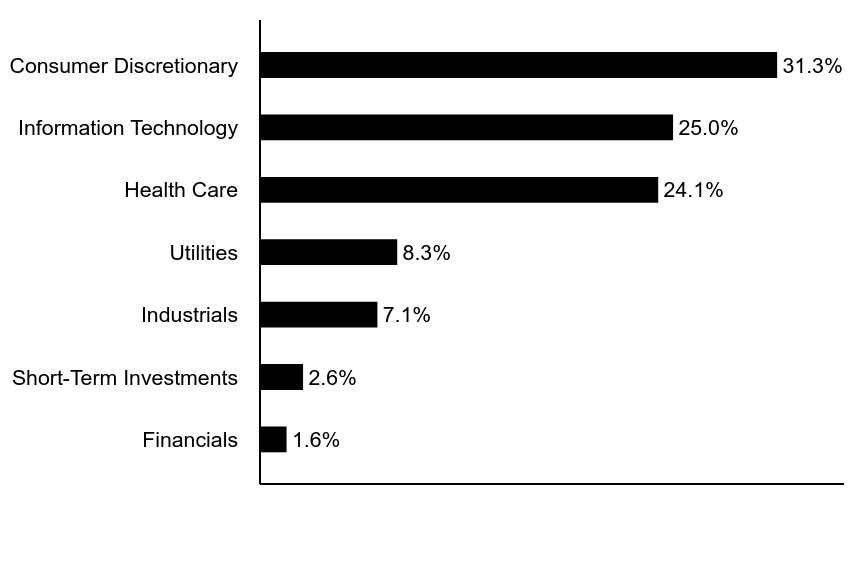

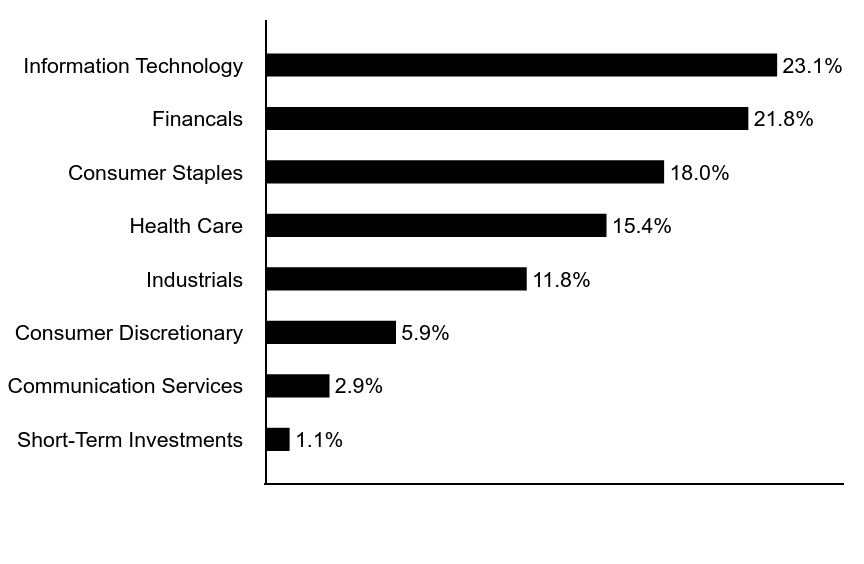

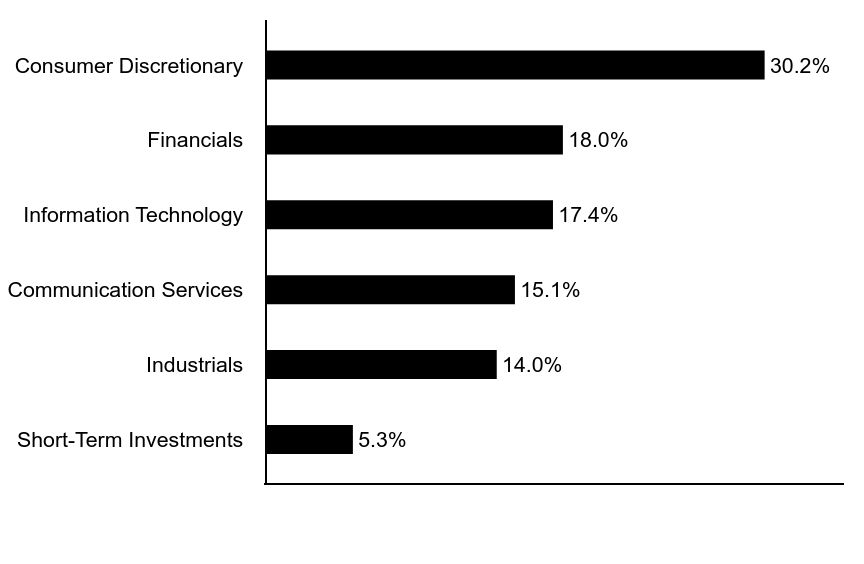

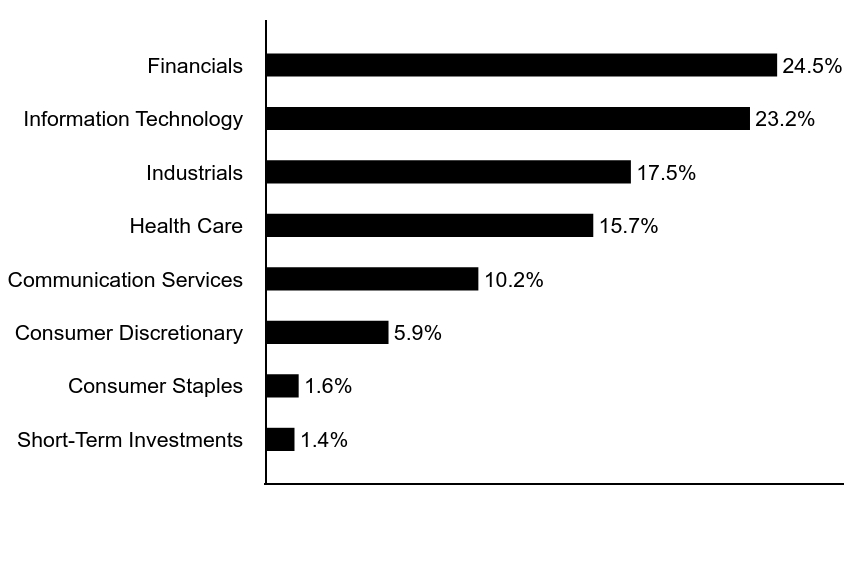

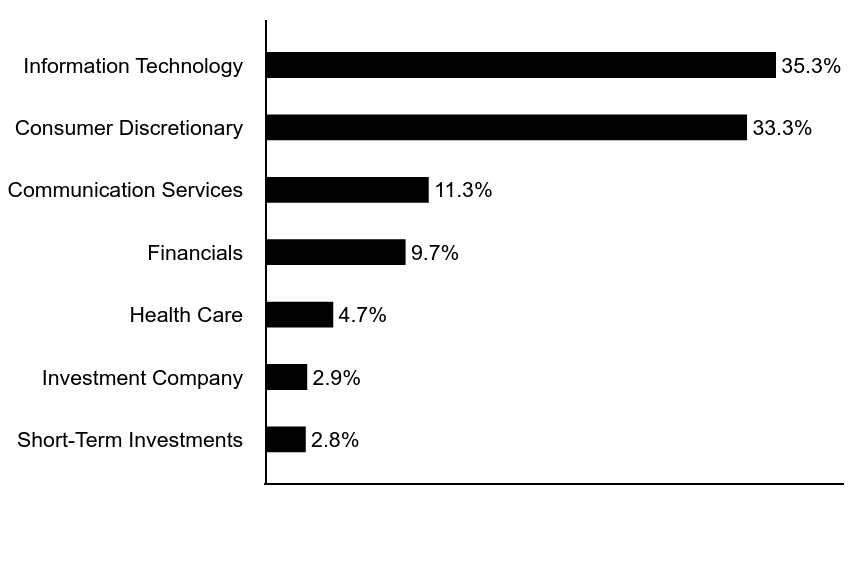

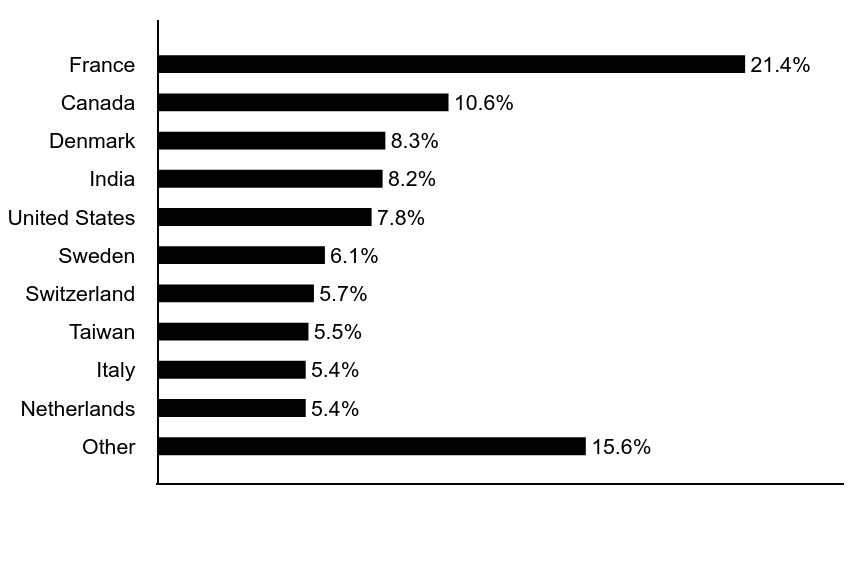

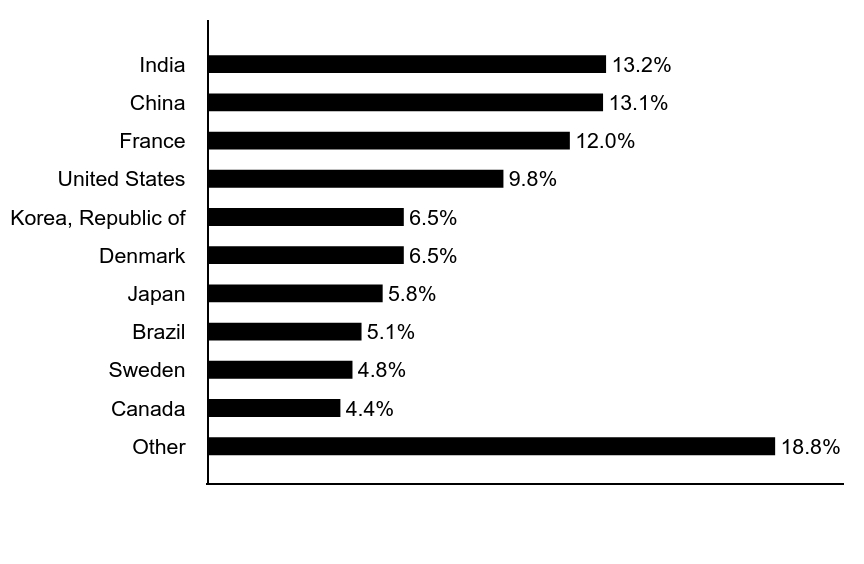

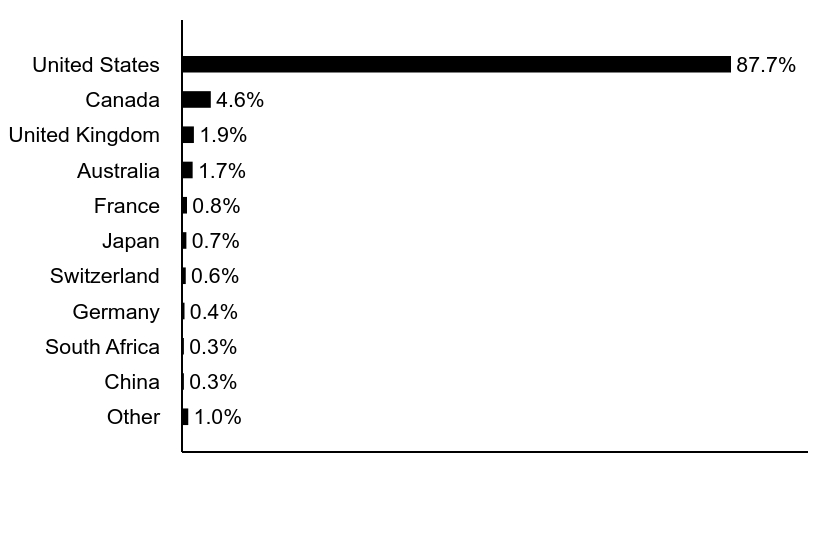

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

|---|

Real Estate | 1.6% | Short-Term Investments | 2.3% | Industrials | 2.6% | Investment Company | 3.0% | Health Care | 5.8% | Financals | 8.0% | Communication Services | 10.7% | Information Technology | 31.6% | Consumer Discretionary | 34.4% |

Top Ten Holdings (% of total investments)Footnote ReferenceaTesla, Inc. | 9.5% | Cloudflare, Inc. | 9.4% | DoorDash, Inc. | 6.4% | Shopify, Inc. | 6.3% | ROBLOX Corp. | 5.4% | Trade Desk, Inc. | 5.3% | MercadoLibre, Inc. | 4.9% | Amazon.com, Inc. | 4.9% | Snowflake, Inc. | 4.9% | Crowdstrike Holdings, Inc. | 3.7% | Total | 60.7% |

| Footnote | Description | Footnotea | Excluding cash equivalents. |

|

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| C000155898 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

|

|

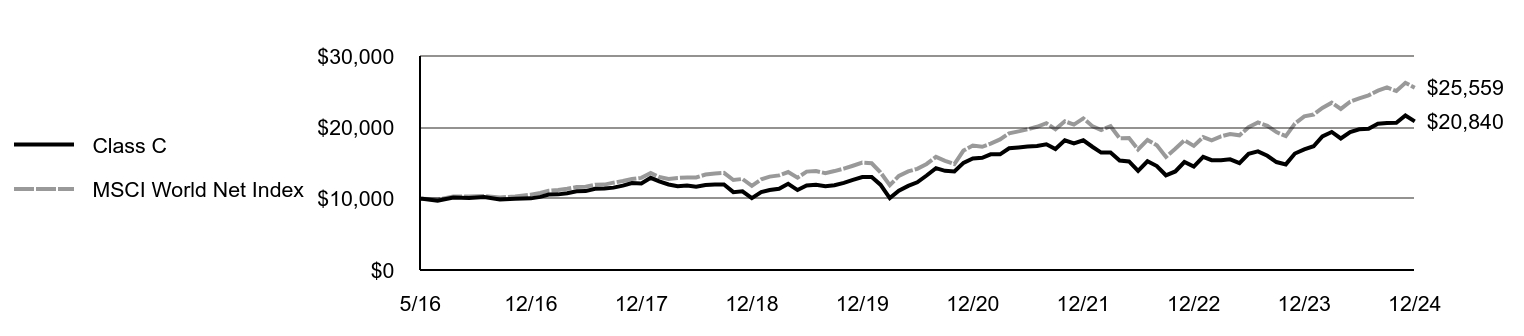

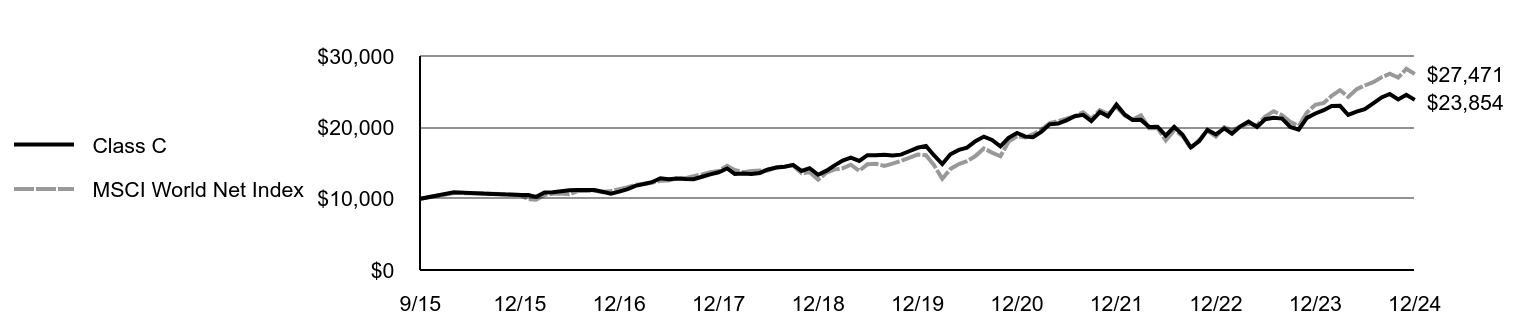

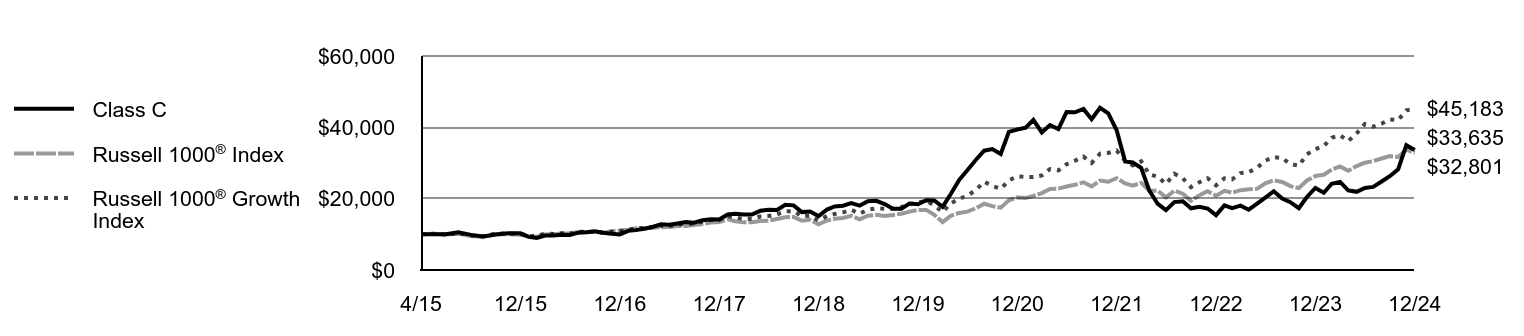

| Class Name |

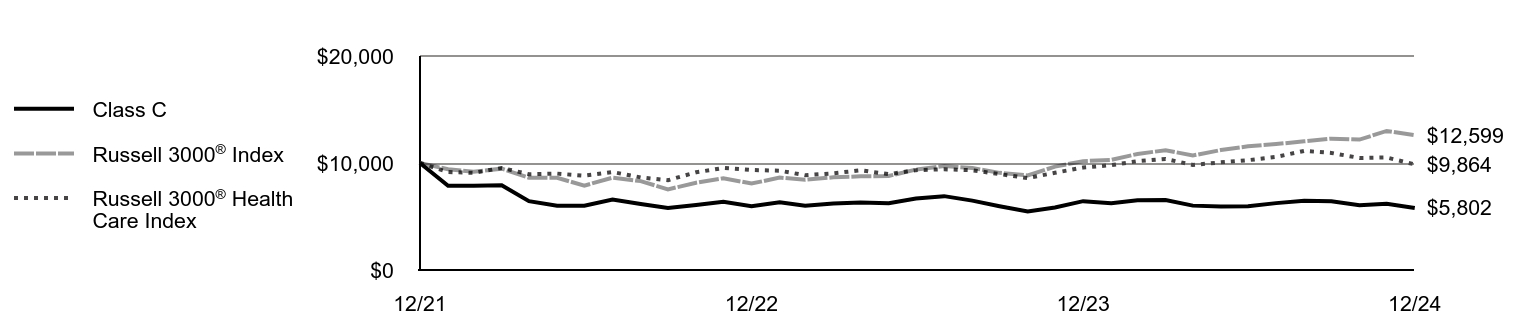

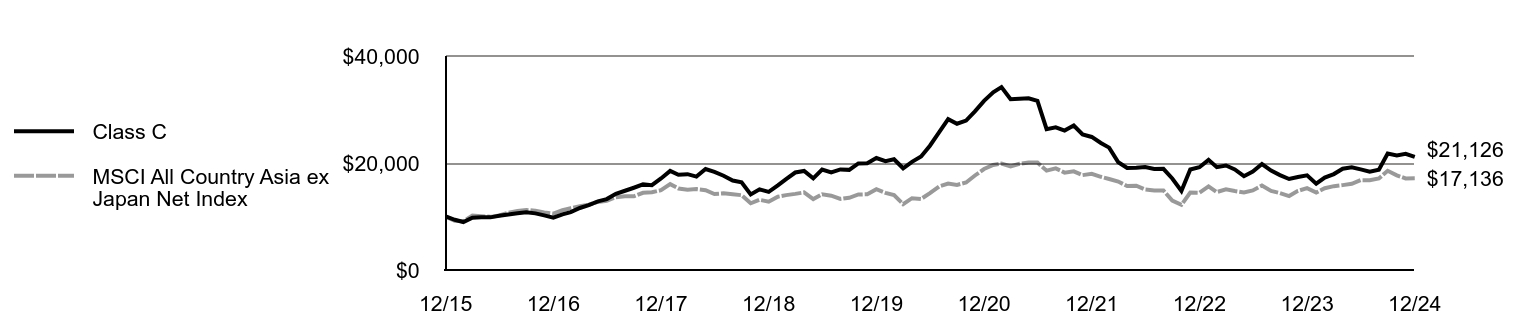

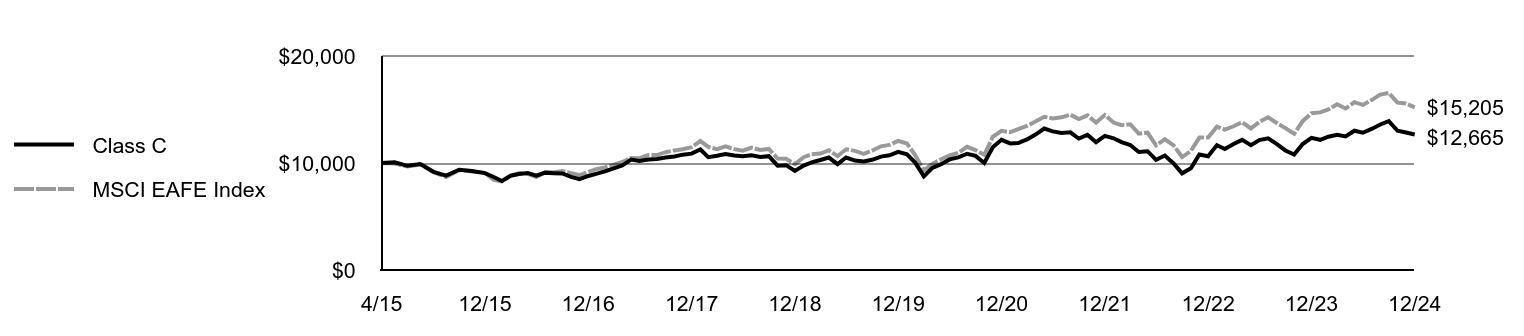

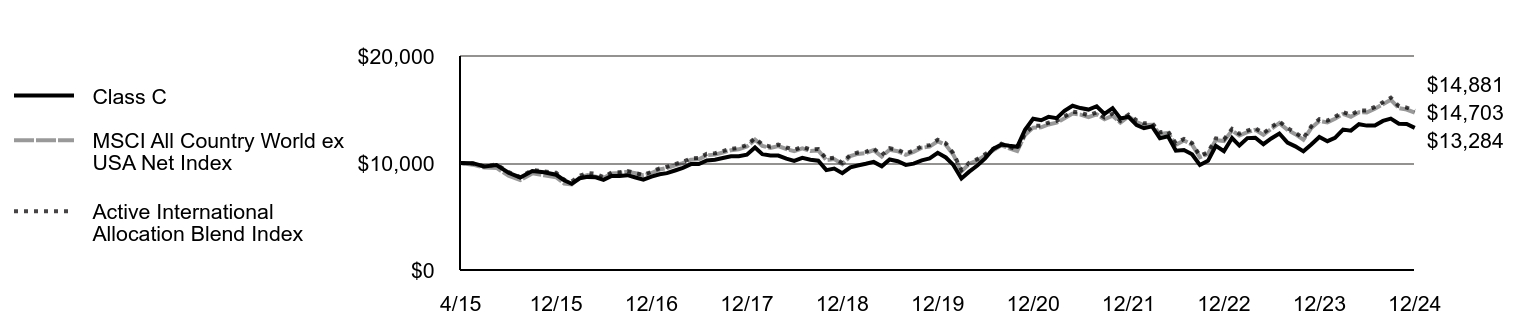

Class C

|

|

| Trading Symbol |

MSPRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class C | $225 | 1.92% |

|---|

|

|

| Expenses Paid, Amount |

$ 225

|

|

| Expense Ratio, Percent |

1.92%

|

|

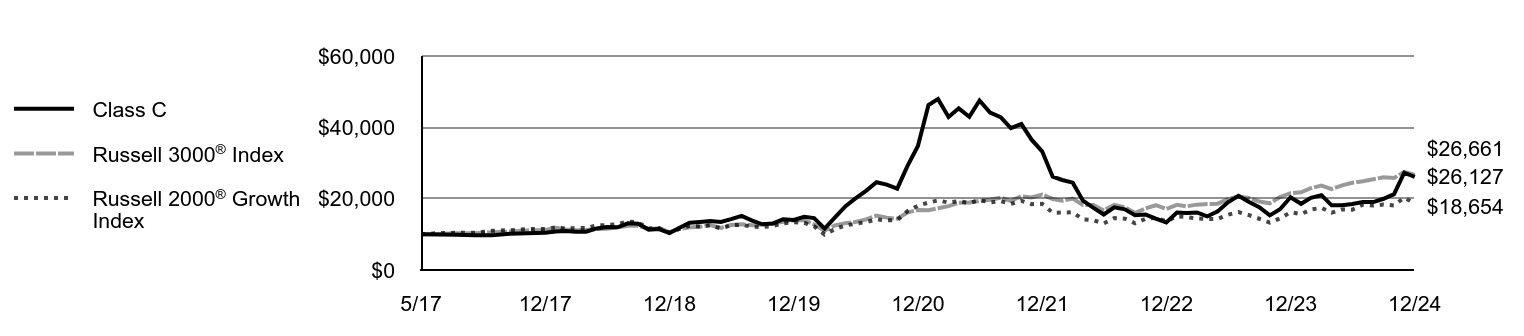

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the Russell 1000® Growth Index: ↑ Stock selection in information technology, led by a position in an enterprise analytics platform and Bitcoin developing company ↑ Average overweight and stock selection in consumer discretionary, led by a food delivery company ↑ No exposure to consumer staples, a sector that underperformed in the index ↓ Stock selection in health care, led lower by a biopharmaceutical royalties acquirer and a next-generation sequencing company (the sequencing company was sold during the period) ↓ Stock selection and average overweight in financials, ↓ Average underweight in information technology, which was one of the stronger performing sectors in the period |

|

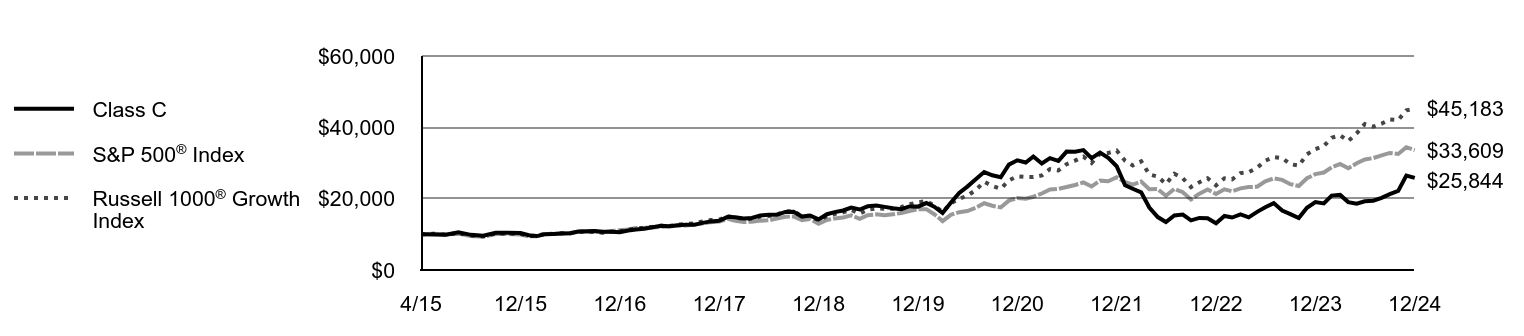

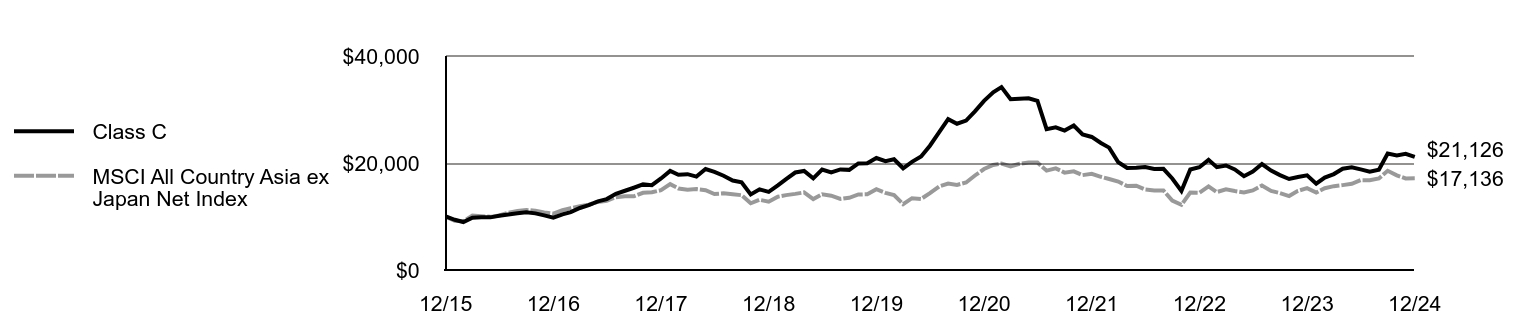

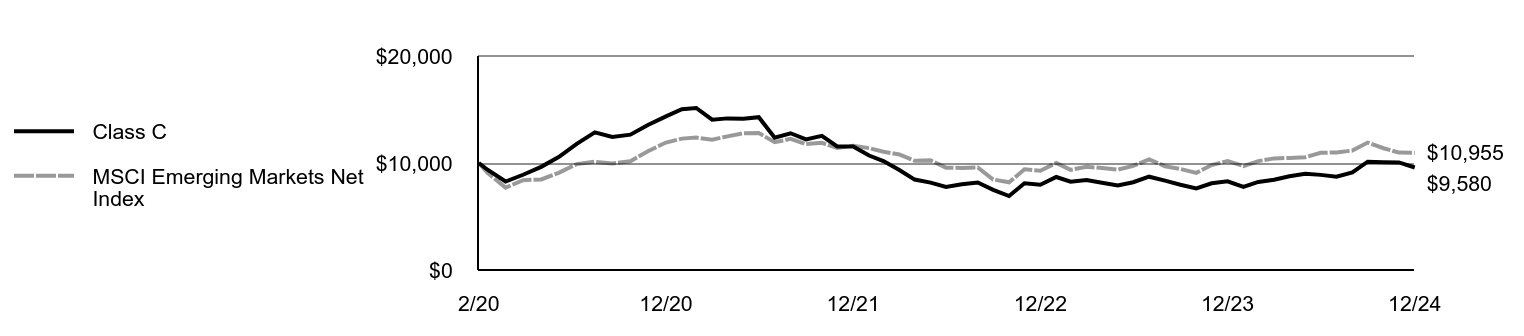

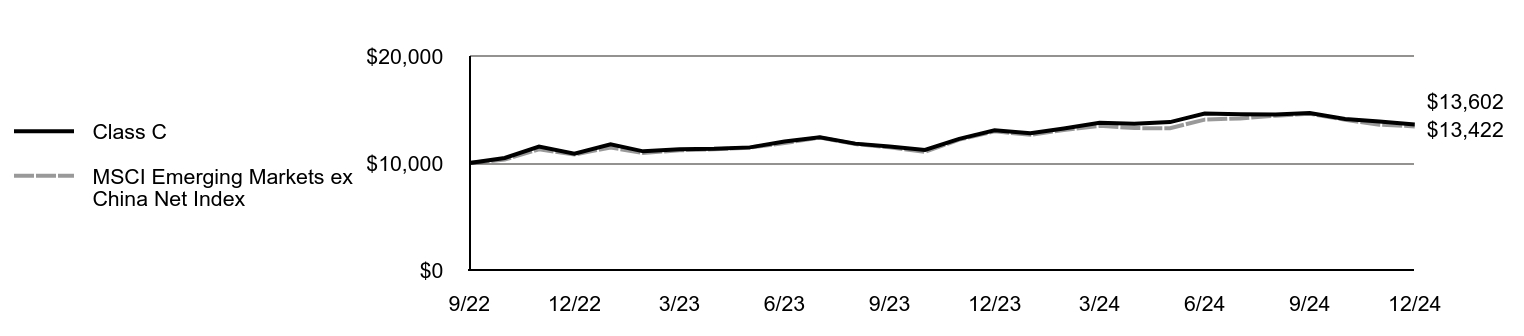

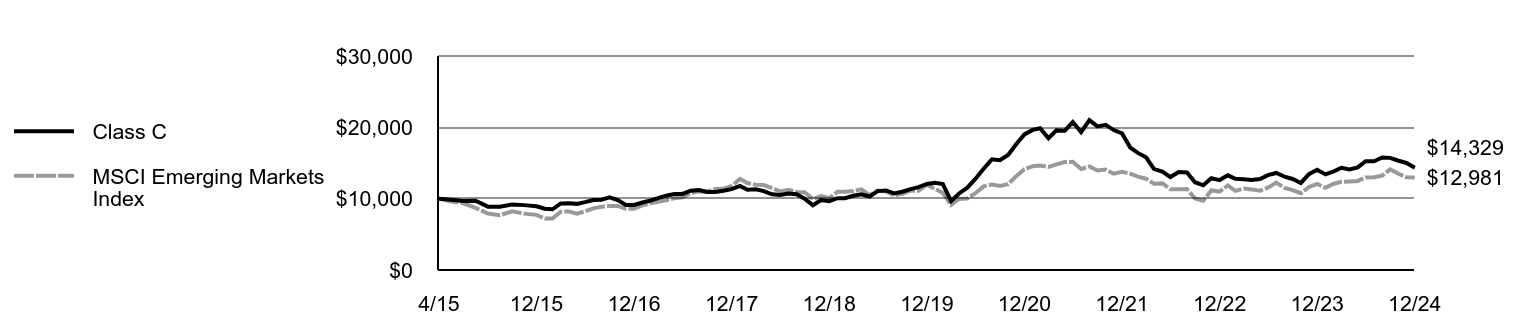

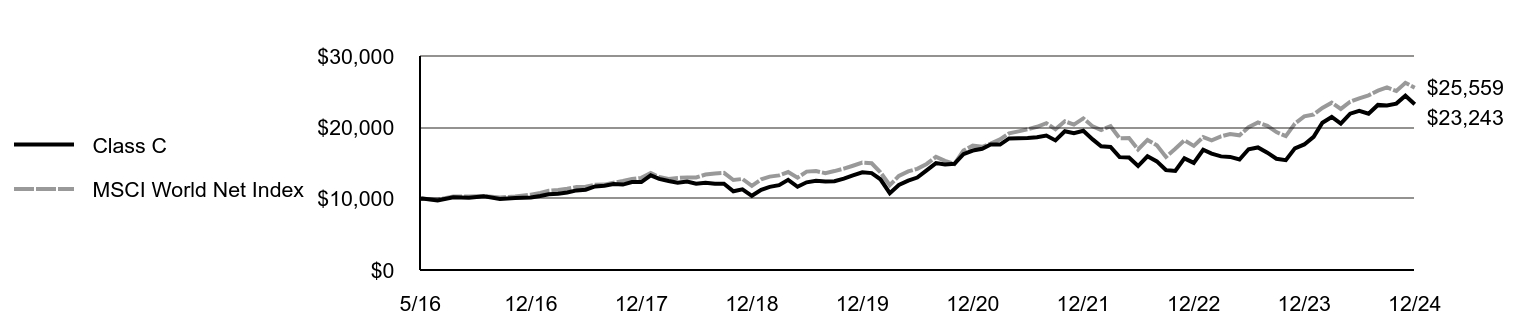

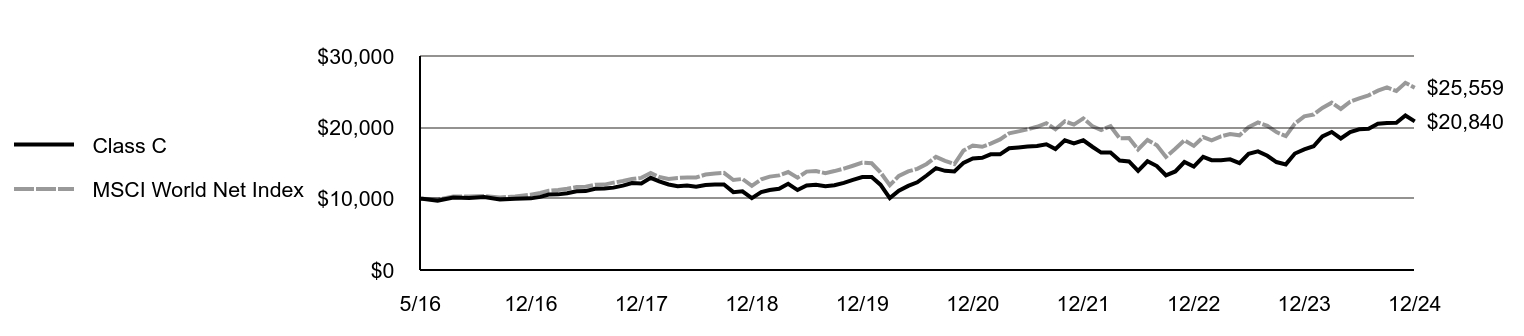

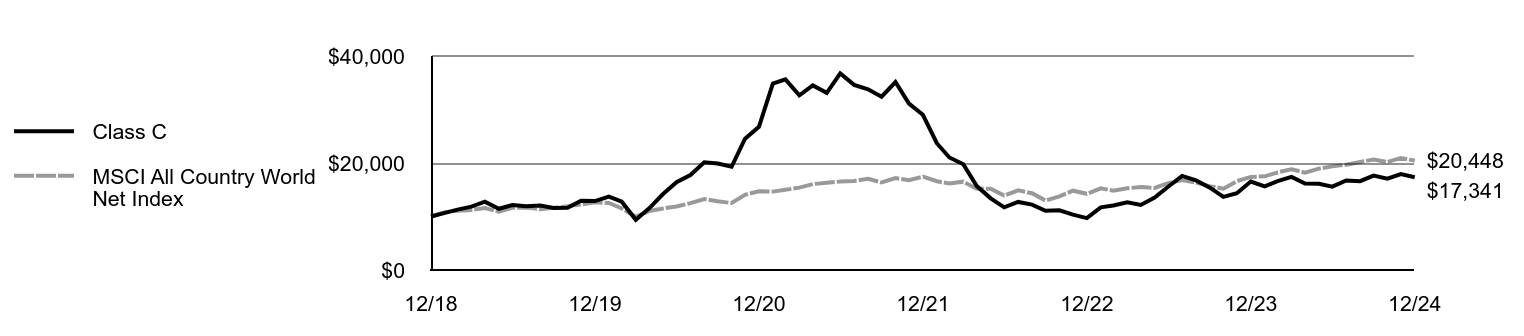

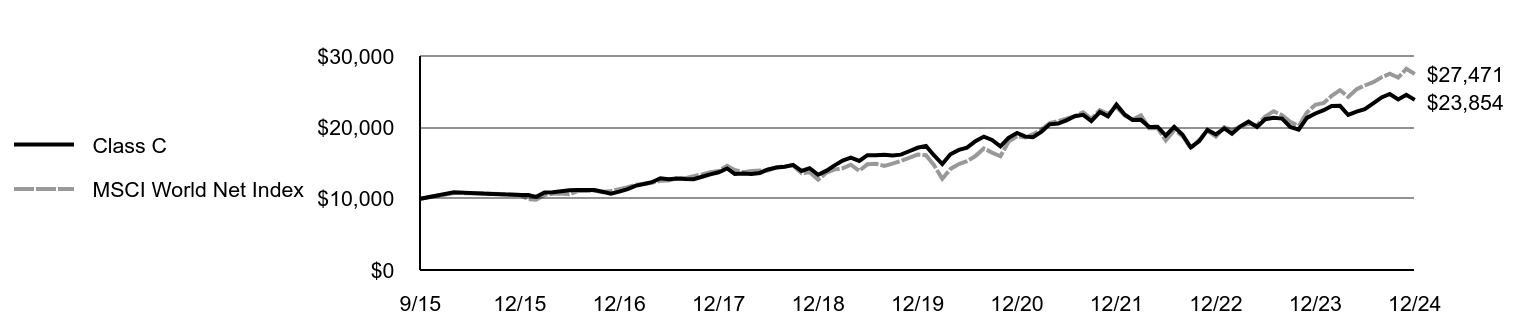

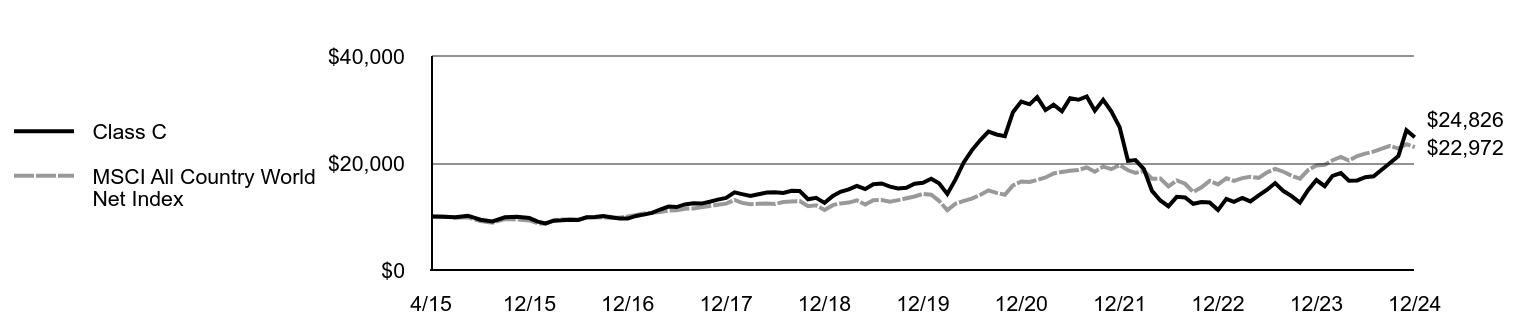

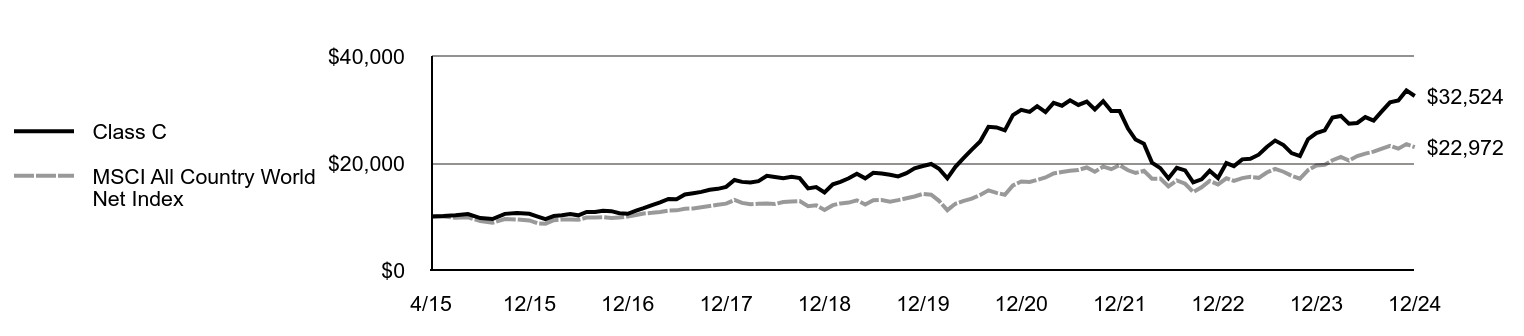

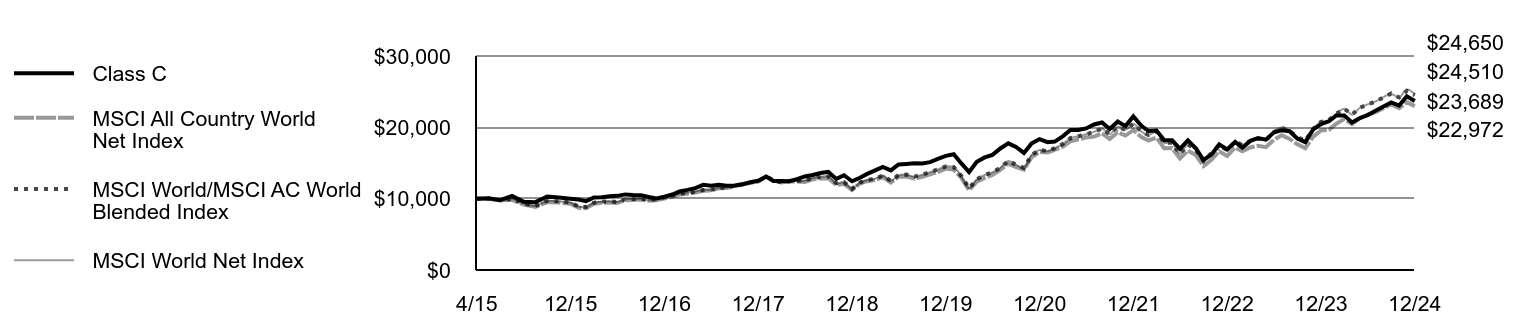

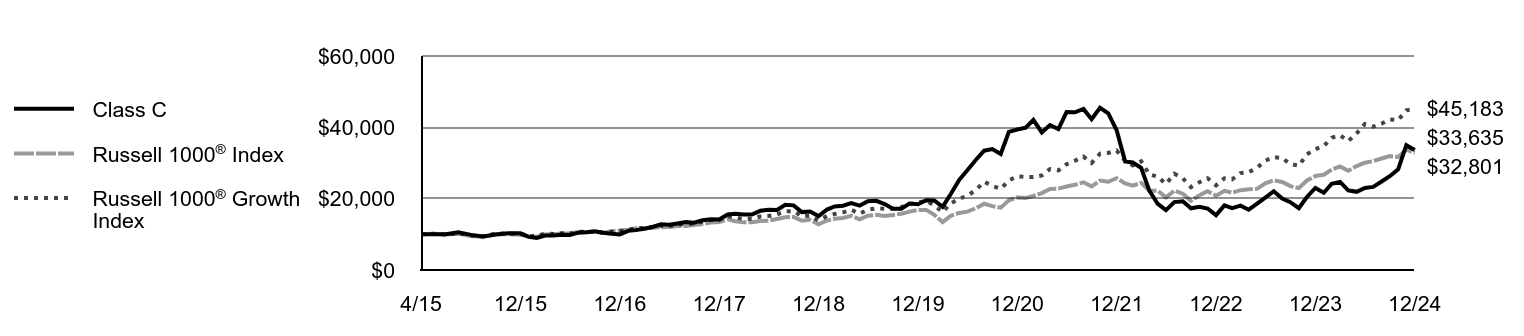

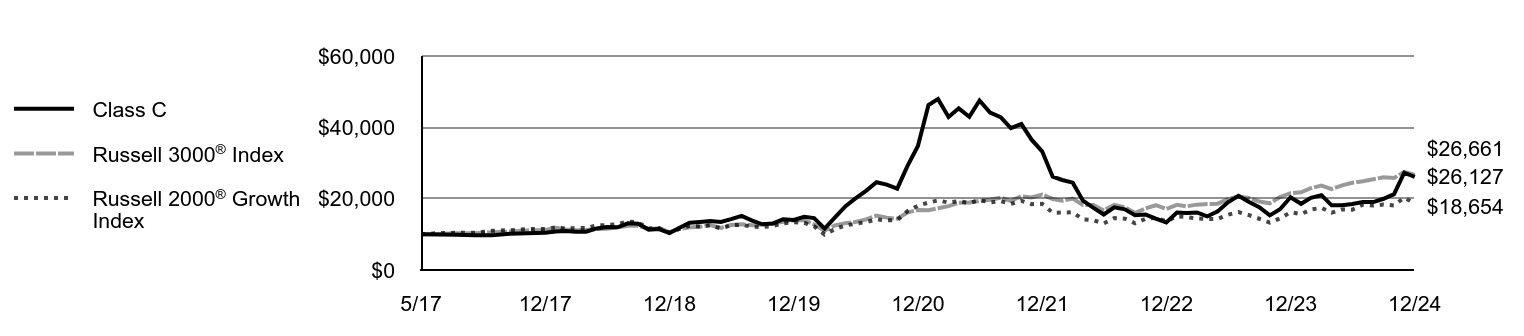

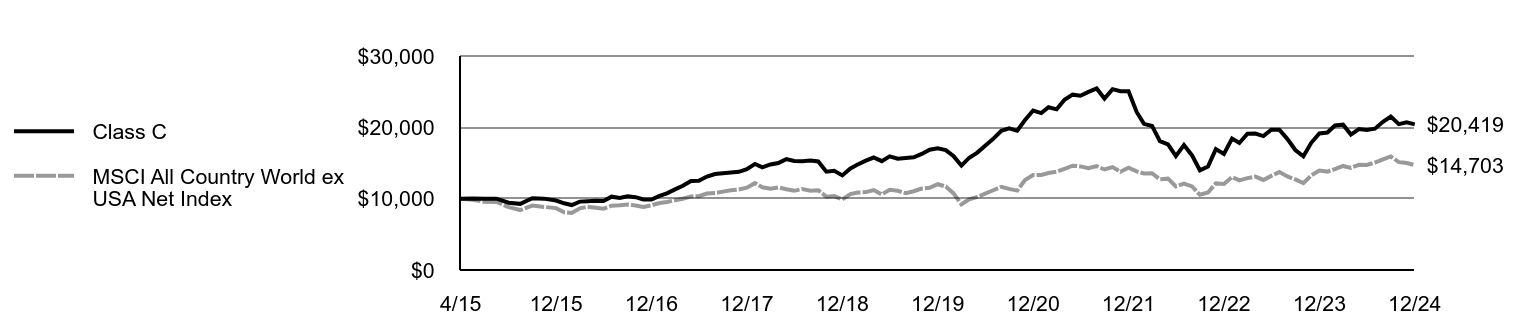

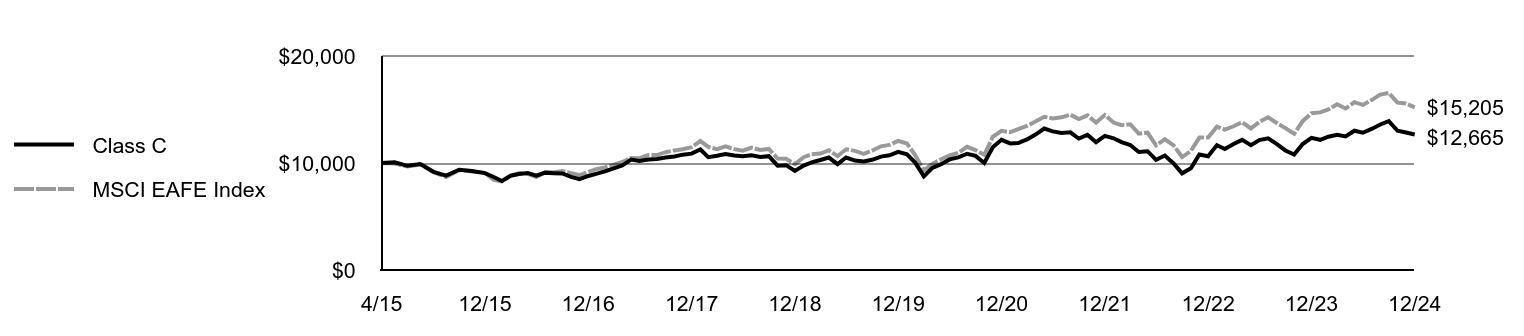

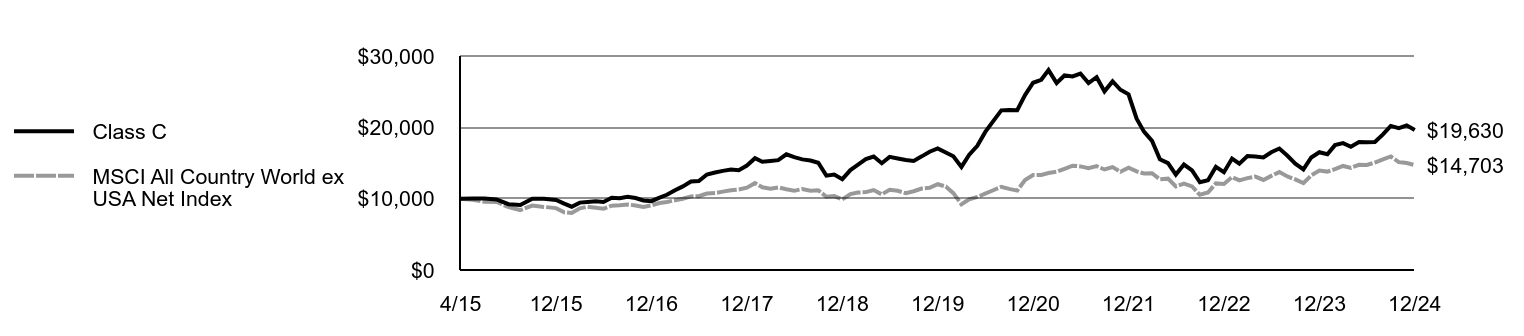

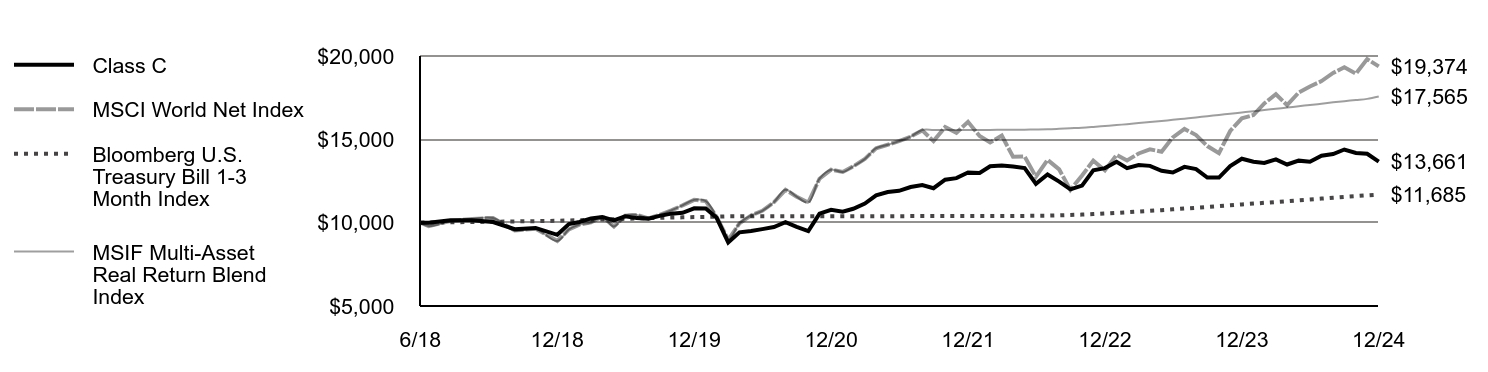

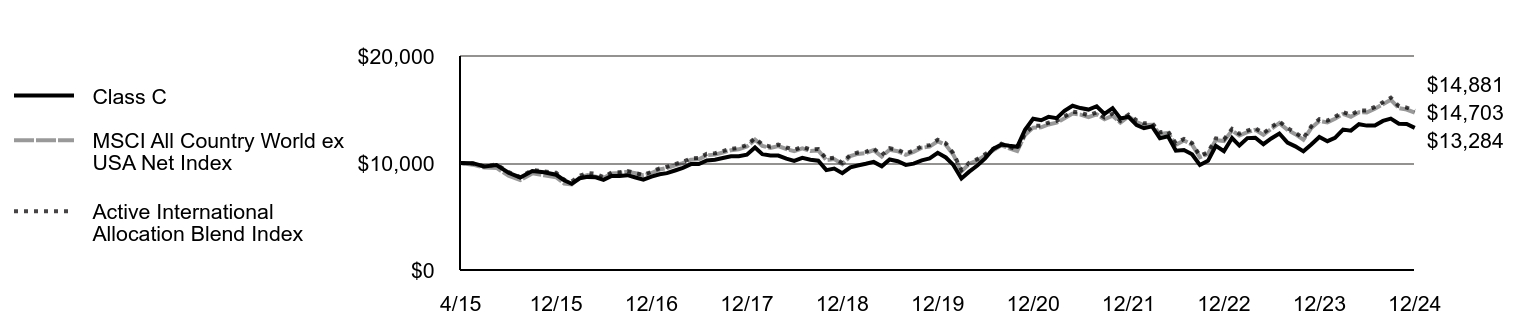

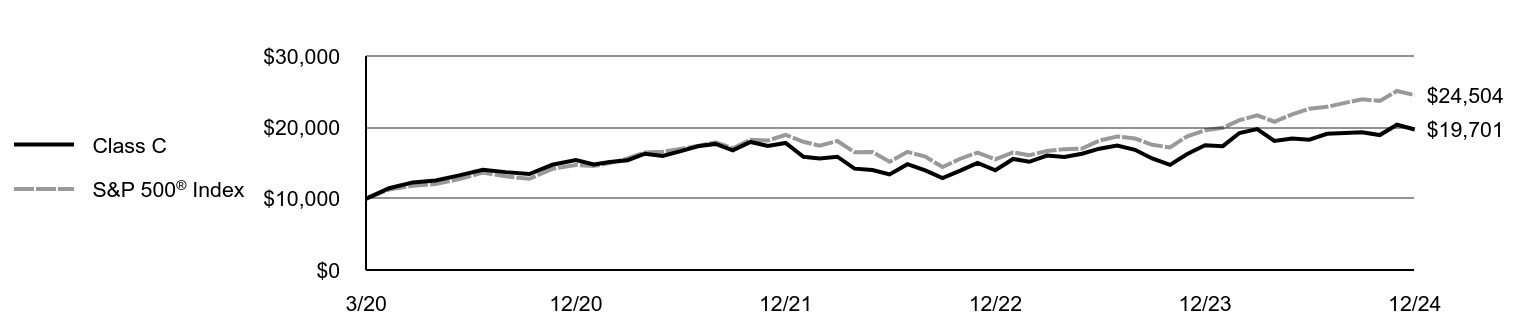

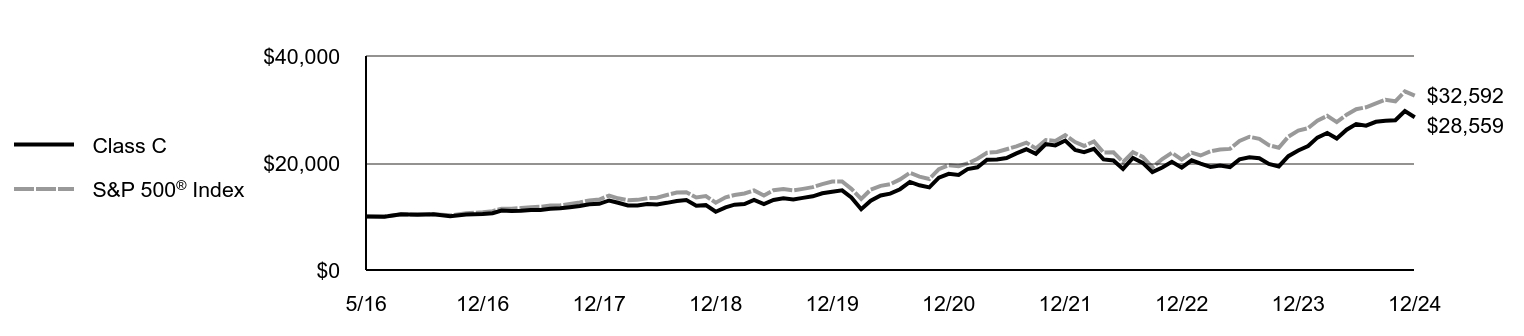

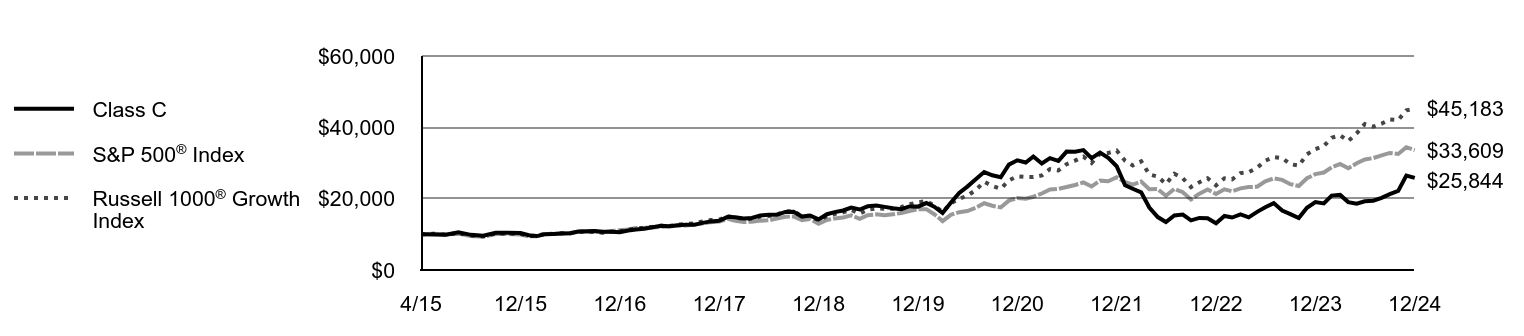

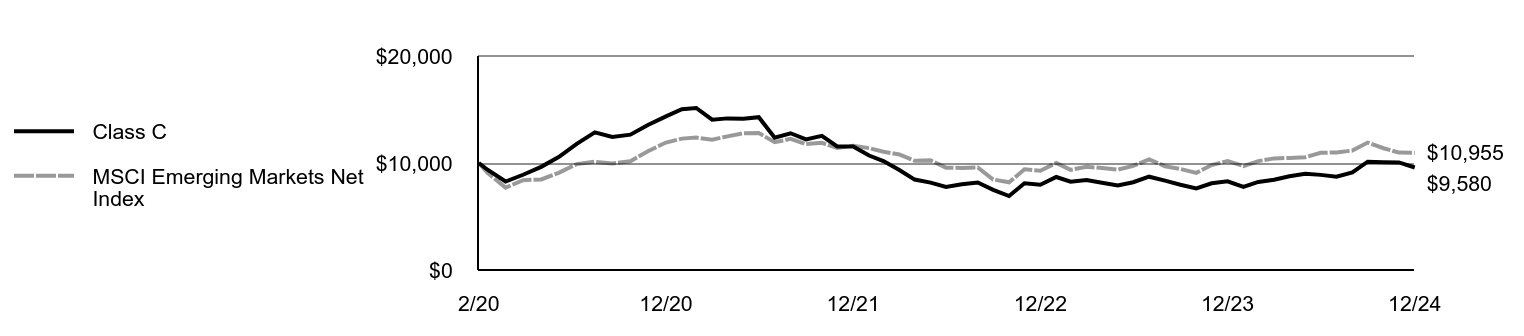

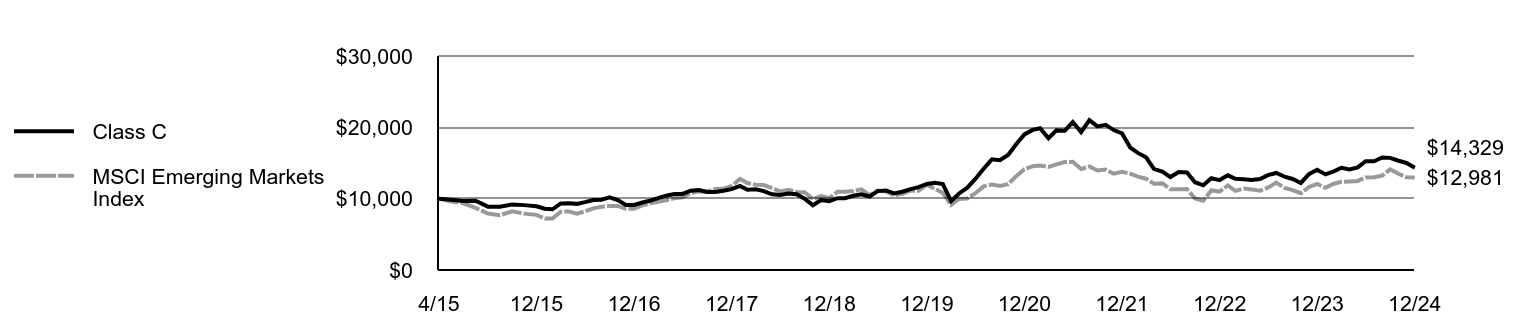

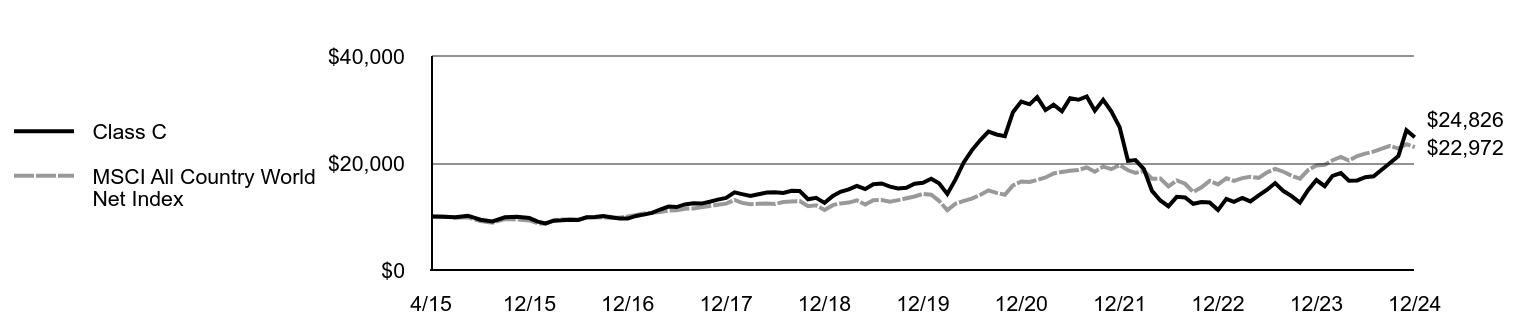

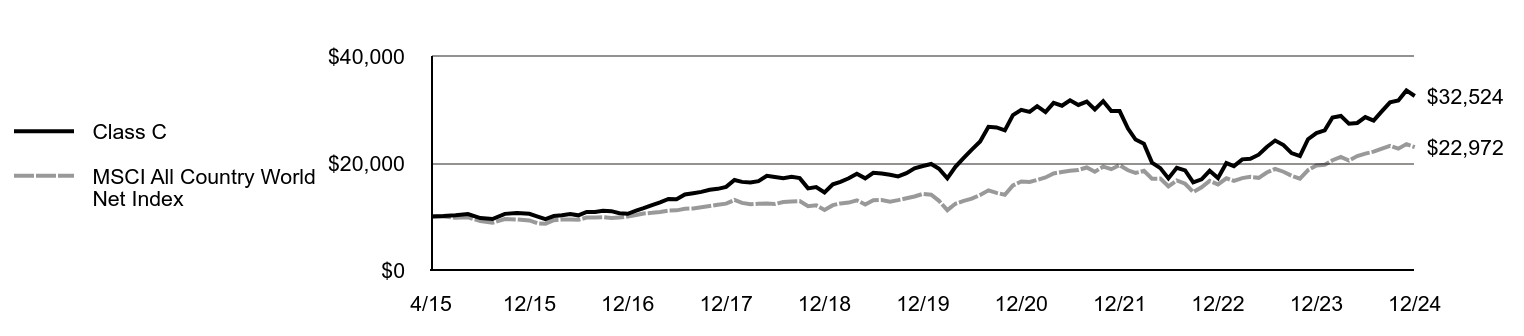

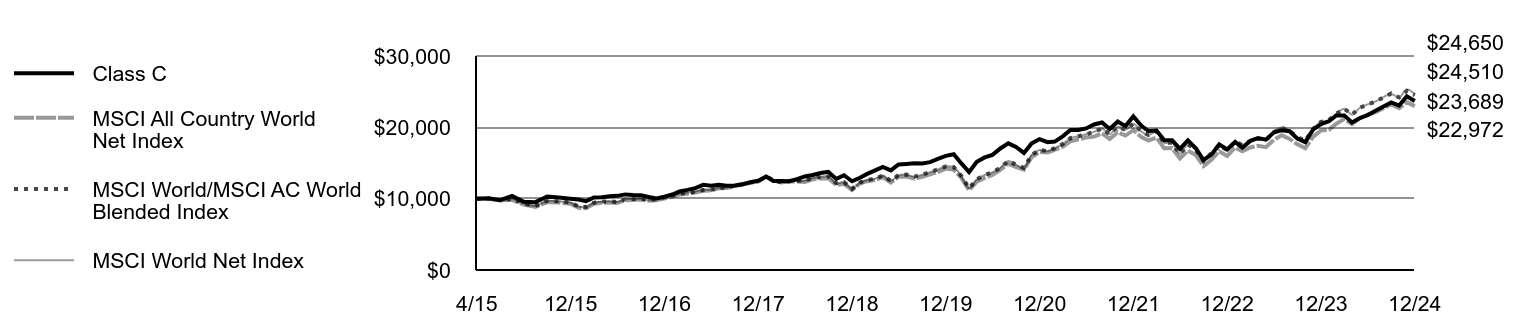

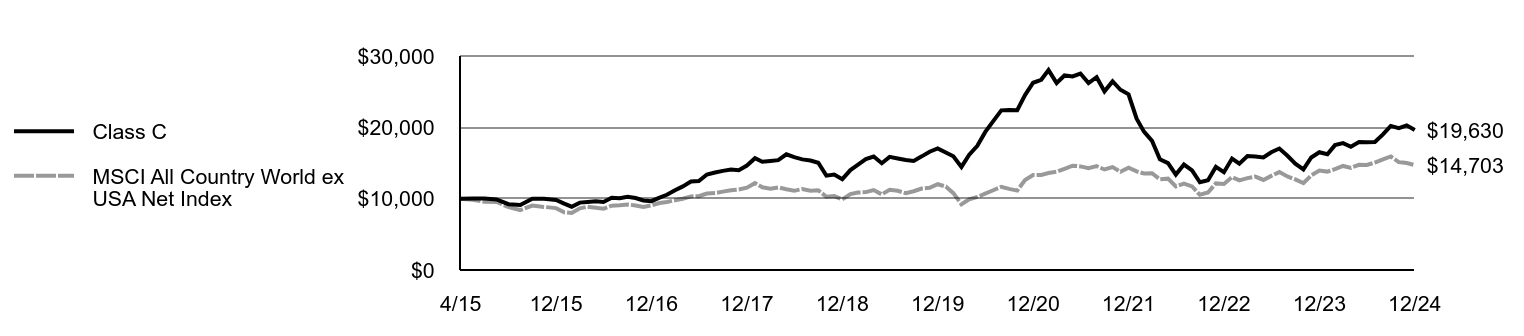

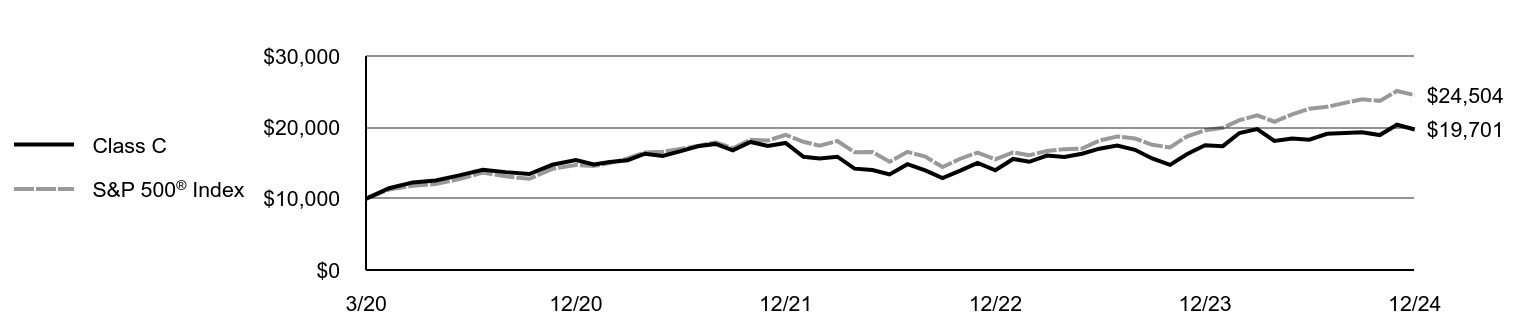

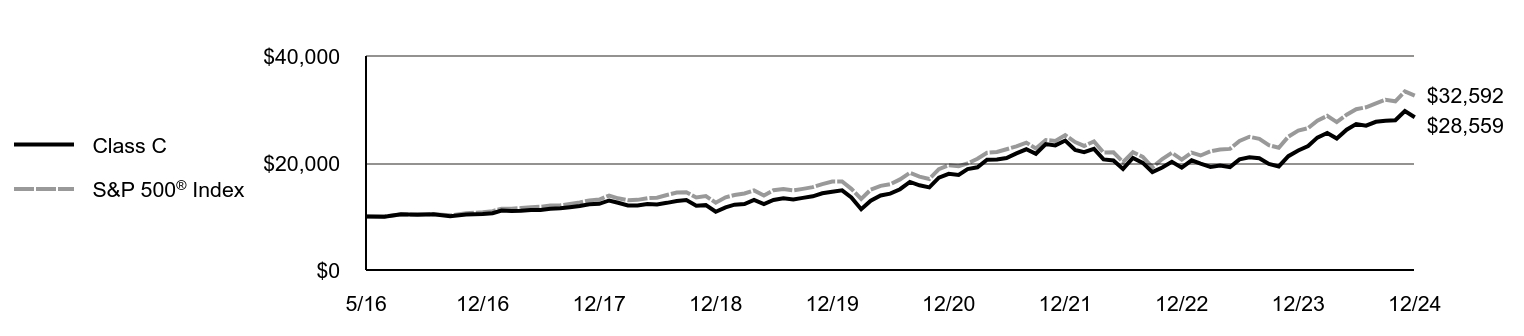

| Line Graph [Table Text Block] |

| Class C | S&P 500® Index | Russell 1000® Growth Index |

|---|

4/15 | $10,000 | $10,000 | $10,000 |

|---|

5/15 | $9,978 | $10,129 | $10,141 |

|---|

6/15 | $9,873 | $9,933 | $9,962 |

|---|

7/15 | $10,548 | $10,141 | $10,300 |

|---|

8/15 | $9,851 | $9,529 | $9,674 |

|---|

9/15 | $9,616 | $9,293 | $9,435 |

|---|

10/15 | $10,414 | $10,077 | $10,248 |

|---|

11/15 | $10,465 | $10,107 | $10,276 |

|---|

12/15 | $10,391 | $9,947 | $10,125 |

|---|

1/16 | $9,740 | $9,454 | $9,560 |

|---|

2/16 | $9,505 | $9,441 | $9,556 |

|---|

3/16 | $10,048 | $10,082 | $10,201 |

|---|

4/16 | $10,120 | $10,121 | $10,107 |

|---|

5/16 | $10,240 | $10,302 | $10,304 |

|---|

6/16 | $10,325 | $10,329 | $10,263 |

|---|

7/16 | $10,813 | $10,710 | $10,748 |

|---|

8/16 | $10,868 | $10,725 | $10,694 |

|---|

9/16 | $10,935 | $10,727 | $10,733 |

|---|

10/16 | $10,727 | $10,531 | $10,481 |

|---|

11/16 | $10,721 | $10,921 | $10,709 |

|---|

12/16 | $10,568 | $11,137 | $10,842 |

|---|

1/17 | $11,049 | $11,348 | $11,207 |

|---|

2/17 | $11,363 | $11,799 | $11,673 |

|---|

3/17 | $11,542 | $11,813 | $11,808 |

|---|

4/17 | $12,003 | $11,934 | $12,078 |

|---|

5/17 | $12,404 | $12,102 | $12,392 |

|---|

6/17 | $12,238 | $12,178 | $12,359 |

|---|

7/17 | $12,571 | $12,428 | $12,688 |

|---|

8/17 | $12,682 | $12,466 | $12,920 |

|---|

9/17 | $12,664 | $12,723 | $13,088 |

|---|

10/17 | $13,221 | $13,020 | $13,596 |

|---|

11/17 | $13,630 | $13,419 | $14,009 |

|---|

12/17 | $13,820 | $13,569 | $14,118 |

|---|

1/18 | $14,902 | $14,345 | $15,118 |

|---|

2/18 | $14,783 | $13,817 | $14,721 |

|---|

3/18 | $14,431 | $13,466 | $14,317 |

|---|

4/18 | $14,590 | $13,517 | $14,367 |

|---|

5/18 | $15,267 | $13,843 | $14,997 |

|---|

6/18 | $15,480 | $13,928 | $15,142 |

|---|

7/18 | $15,468 | $14,446 | $15,586 |

|---|

8/18 | $16,292 | $14,917 | $16,438 |

|---|

9/18 | $16,346 | $15,002 | $16,530 |

|---|

10/18 | $14,976 | $13,977 | $15,052 |

|---|

11/18 | $15,272 | $14,261 | $15,212 |

|---|

12/18 | $14,185 | $12,974 | $13,904 |

|---|

1/19 | $15,639 | $14,013 | $15,154 |

|---|

2/19 | $16,225 | $14,463 | $15,696 |

|---|

3/19 | $16,697 | $14,744 | $16,143 |

|---|

4/19 | $17,509 | $15,341 | $16,872 |

|---|

5/19 | $16,959 | $14,366 | $15,806 |

|---|

6/19 | $17,869 | $15,379 | $16,892 |

|---|

7/19 | $18,095 | $15,600 | $17,273 |

|---|

8/19 | $17,693 | $15,353 | $17,141 |

|---|

9/19 | $17,318 | $15,640 | $17,143 |

|---|

10/19 | $17,029 | $15,979 | $17,626 |

|---|

11/19 | $17,820 | $16,559 | $18,408 |

|---|

12/19 | $17,770 | $17,059 | $18,964 |

|---|

1/20 | $18,771 | $17,052 | $19,387 |

|---|

2/20 | $17,763 | $15,648 | $18,067 |

|---|

3/20 | $16,013 | $13,716 | $16,290 |

|---|

4/20 | $18,850 | $15,474 | $18,700 |

|---|

5/20 | $21,601 | $16,211 | $19,956 |

|---|

6/20 | $23,387 | $16,533 | $20,825 |

|---|

7/20 | $25,439 | $17,465 | $22,427 |

|---|

8/20 | $27,462 | $18,721 | $24,741 |

|---|

9/20 | $26,547 | $18,009 | $23,577 |

|---|

10/20 | $25,993 | $17,531 | $22,776 |

|---|

11/20 | $29,543 | $19,449 | $25,108 |

|---|

12/20 | $30,759 | $20,197 | $26,263 |

|---|

1/21 | $30,136 | $19,993 | $26,069 |

|---|

2/21 | $31,809 | $20,545 | $26,063 |

|---|

3/21 | $29,854 | $21,444 | $26,511 |

|---|

4/21 | $31,368 | $22,589 | $28,314 |

|---|

5/21 | $30,607 | $22,747 | $27,923 |

|---|

6/21 | $33,209 | $23,278 | $29,675 |

|---|

7/21 | $33,140 | $23,831 | $30,653 |

|---|

8/21 | $33,604 | $24,555 | $31,799 |

|---|

9/21 | $31,360 | $23,413 | $30,018 |

|---|

10/21 | $32,935 | $25,054 | $32,618 |

|---|

11/21 | $31,421 | $24,880 | $32,817 |

|---|

12/21 | $29,096 | $25,995 | $33,511 |

|---|

1/22 | $23,760 | $24,650 | $30,635 |

|---|

2/22 | $22,786 | $23,912 | $29,334 |

|---|

3/22 | $21,765 | $24,800 | $30,481 |

|---|

4/22 | $17,517 | $22,637 | $26,800 |

|---|

5/22 | $14,835 | $22,679 | $26,177 |

|---|

6/22 | $13,460 | $20,807 | $24,104 |

|---|

7/22 | $15,293 | $22,725 | $26,997 |

|---|

8/22 | $15,541 | $21,798 | $25,739 |

|---|

9/22 | $13,918 | $19,791 | $23,237 |

|---|

10/22 | $14,605 | $21,393 | $24,595 |

|---|

11/22 | $14,491 | $22,589 | $25,716 |

|---|

12/22 | $13,088 | $21,287 | $23,747 |

|---|

1/23 | $15,135 | $22,625 | $25,726 |

|---|

2/23 | $14,713 | $22,073 | $25,421 |

|---|

3/23 | $15,569 | $22,883 | $27,158 |

|---|

4/23 | $14,763 | $23,240 | $27,426 |

|---|

5/23 | $16,302 | $23,341 | $28,676 |

|---|

6/23 | $17,590 | $24,883 | $30,637 |

|---|

7/23 | $18,753 | $25,683 | $31,669 |

|---|

8/23 | $16,667 | $25,274 | $31,385 |

|---|

9/23 | $15,675 | $24,069 | $29,678 |

|---|

10/23 | $14,558 | $23,563 | $29,256 |

|---|

11/23 | $17,454 | $25,715 | $32,445 |

|---|

12/23 | $19,038 | $26,883 | $33,882 |

|---|

1/24 | $18,662 | $27,335 | $34,727 |

|---|

2/24 | $20,862 | $28,794 | $37,096 |

|---|

3/24 | $21,056 | $29,721 | $37,749 |

|---|

4/24 | $19,038 | $28,507 | $36,148 |

|---|

5/24 | $18,594 | $29,920 | $38,312 |

|---|

6/24 | $19,266 | $30,994 | $40,895 |

|---|

7/24 | $19,437 | $31,371 | $40,200 |

|---|

8/24 | $20,212 | $32,132 | $41,037 |

|---|

9/24 | $21,284 | $32,818 | $42,200 |

|---|

10/24 | $22,185 | $32,521 | $42,060 |

|---|

11/24 | $26,494 | $34,430 | $44,788 |

|---|

12/24 | $25,844 | $33,609 | $45,183 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | 5 Years | Since 4/30/15

(Inception) |

|---|

Class C, with conversion to Class A after 8 years | 34.81% | 7.51% | 10.32% |

|---|

Class C, with 1% maximum contingent deferred sales charge and conversion to Class A after 8 years | 33.81% | 7.51% | 10.32% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.35% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 16.88% |

|---|

|

|

| Performance Inception Date |

Apr. 30, 2015

|

|

| AssetsNet |

$ 194,996,435

|

|

| Holdings Count | Holding |

28

|

|

| Advisory Fees Paid, Amount |

$ 877,326

|

|

| InvestmentCompanyPortfolioTurnover |

57.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $194,996,435 |

|---|

# of Portfolio Holdings | 28 |

|---|

Portfolio Turnover Rate | 57% |

|---|

Total Advisory Fees Paid | $877,326 |

|---|

|

|

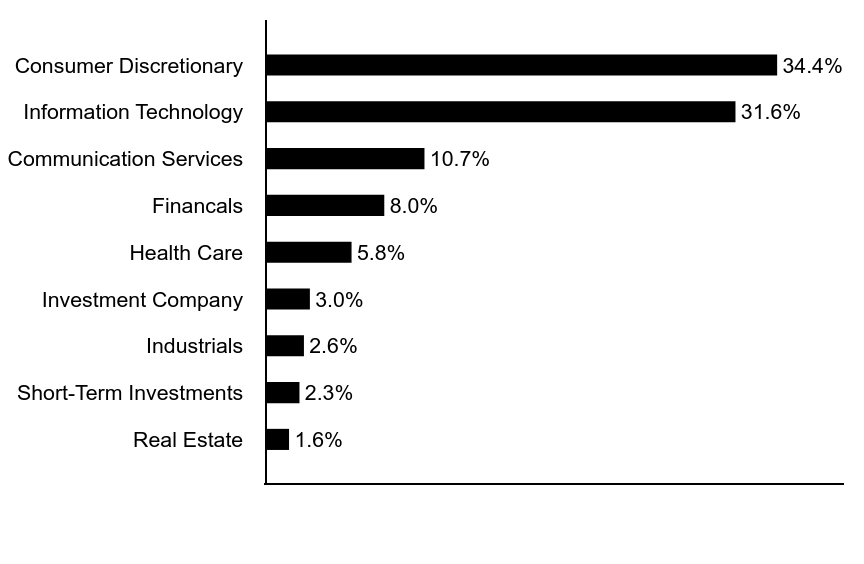

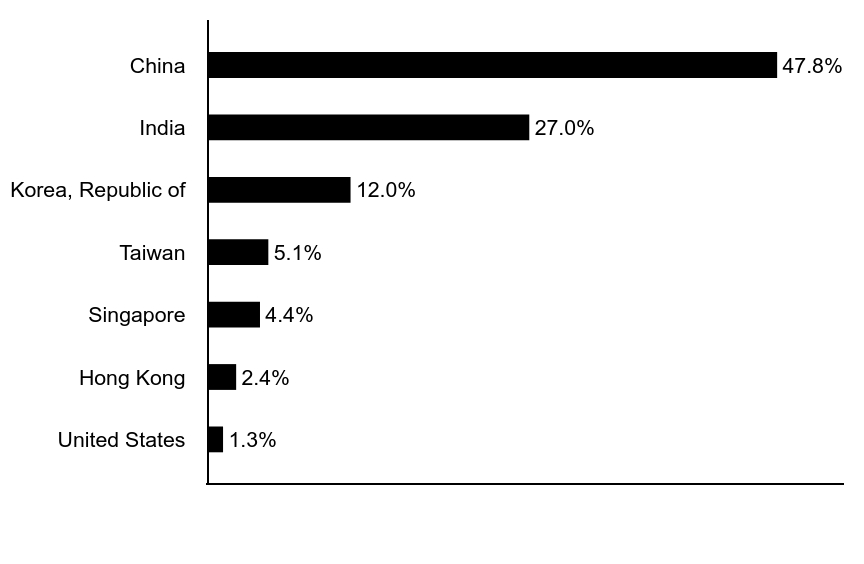

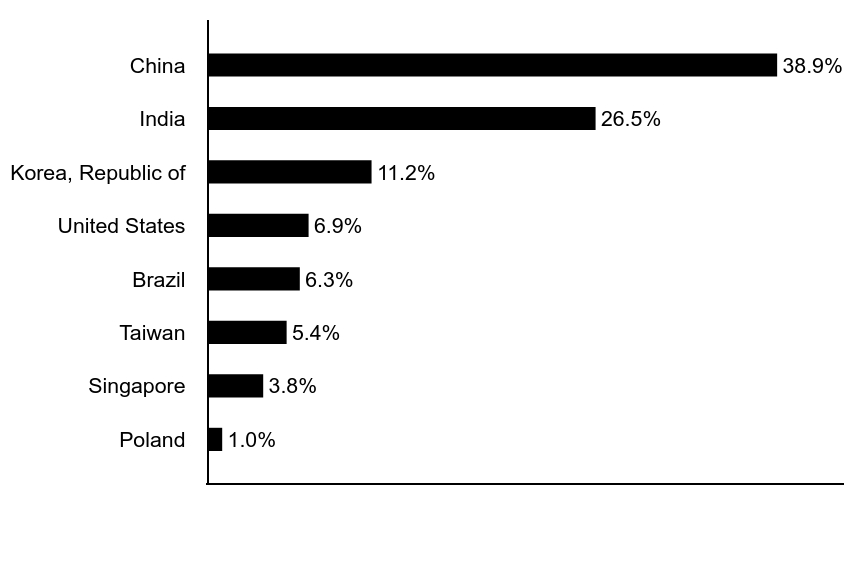

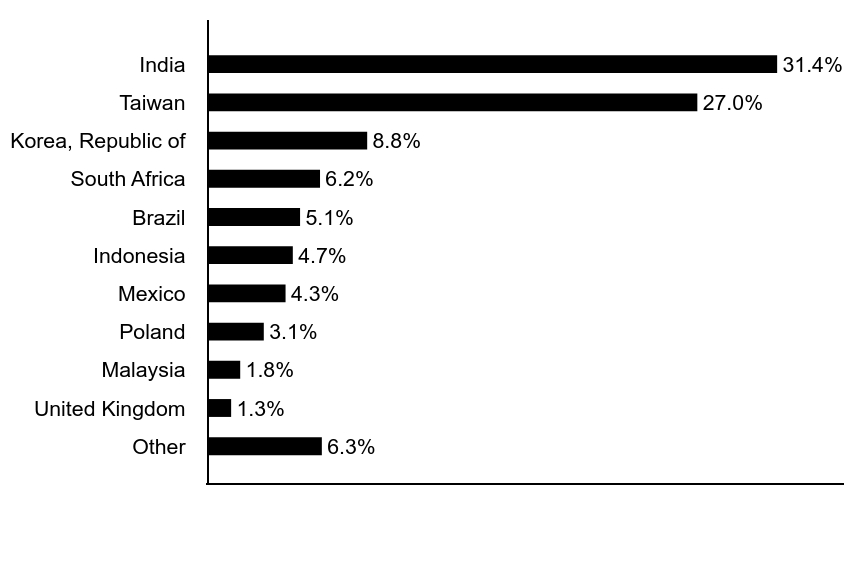

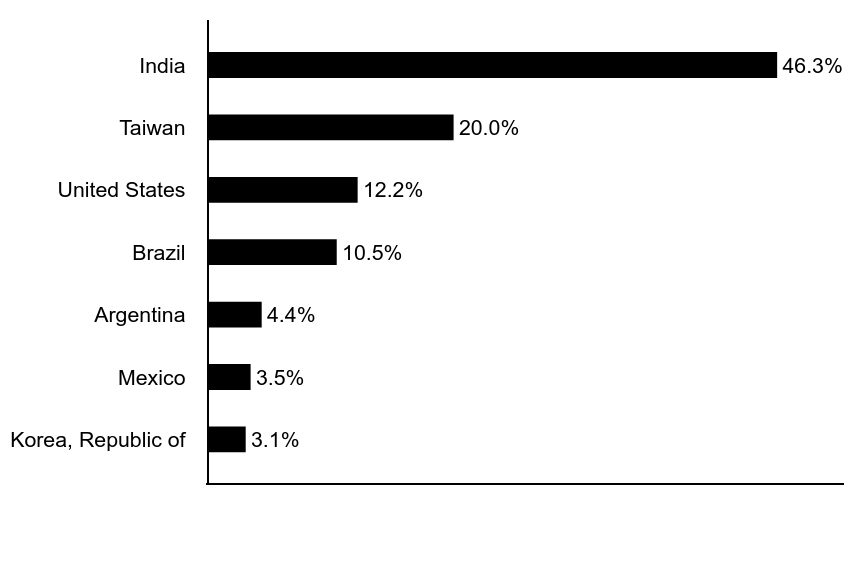

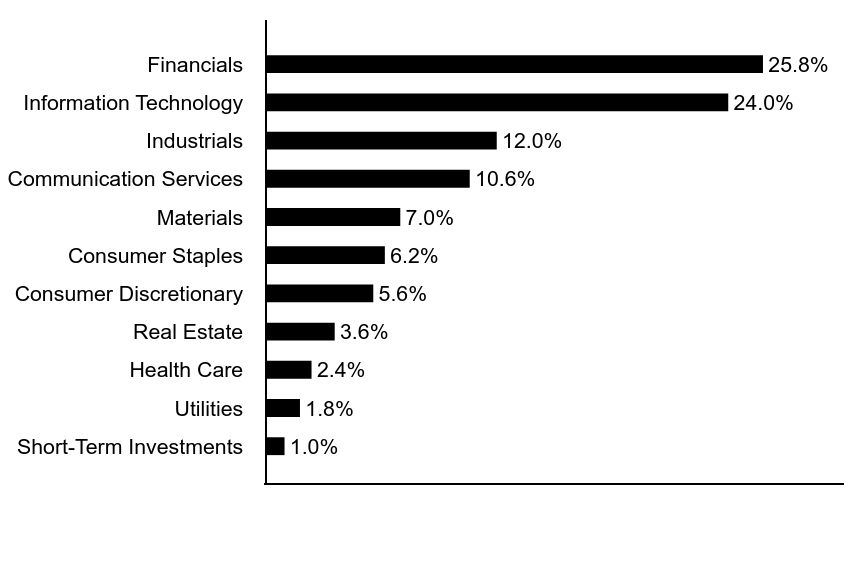

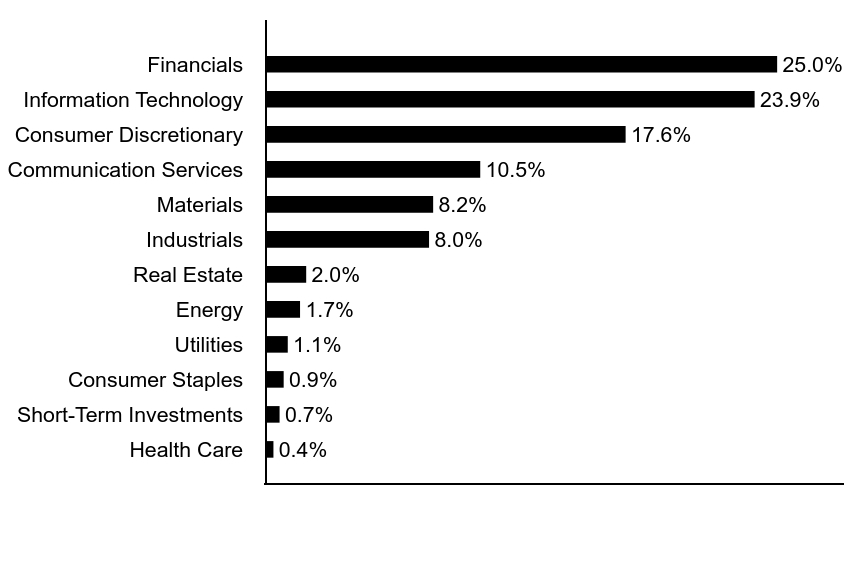

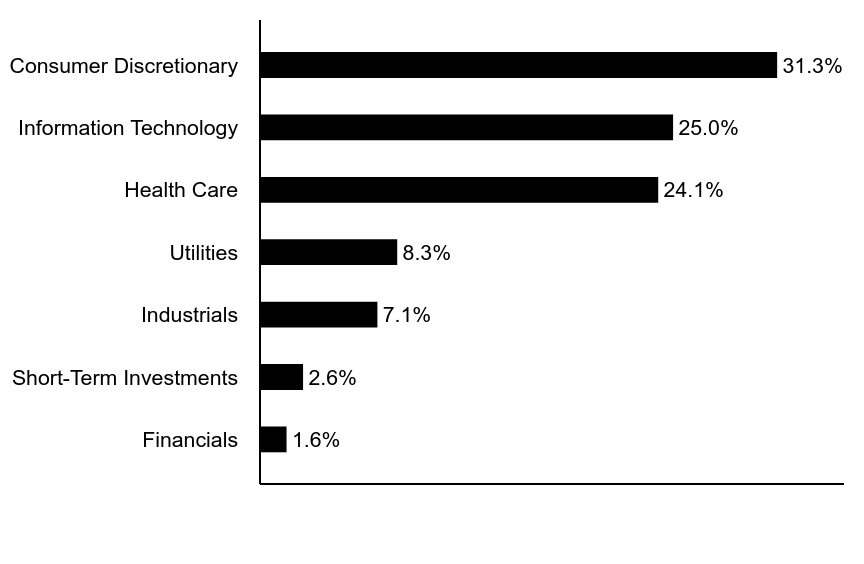

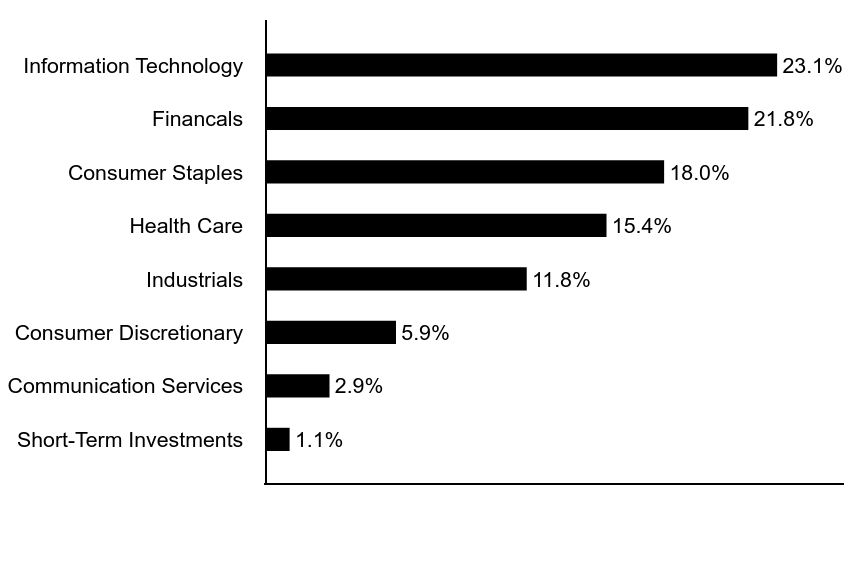

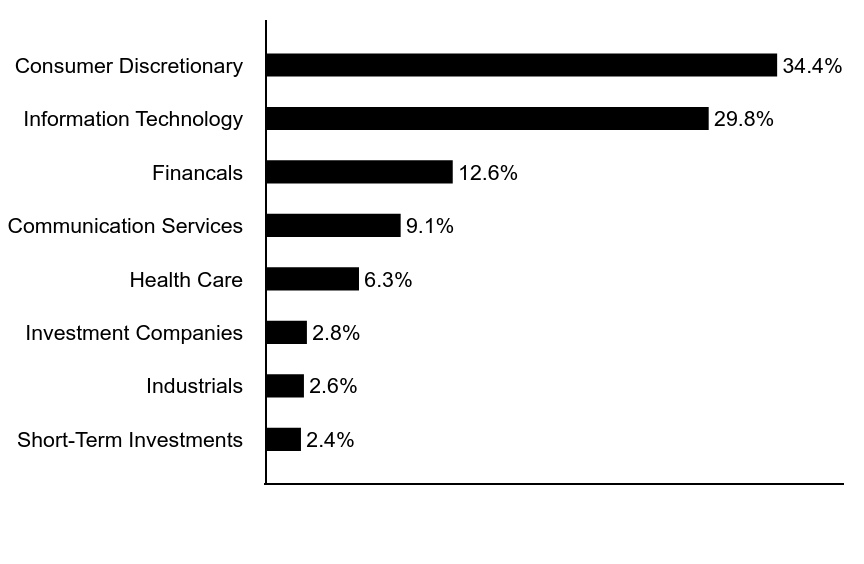

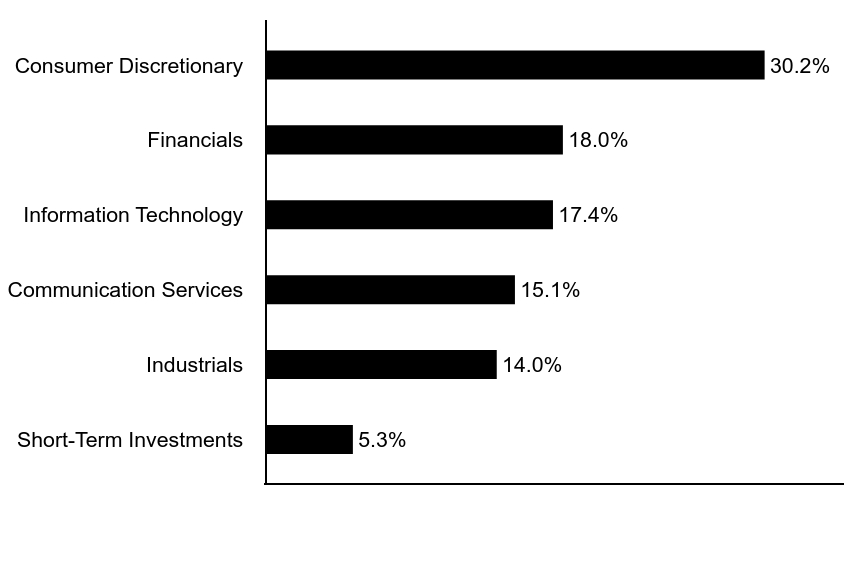

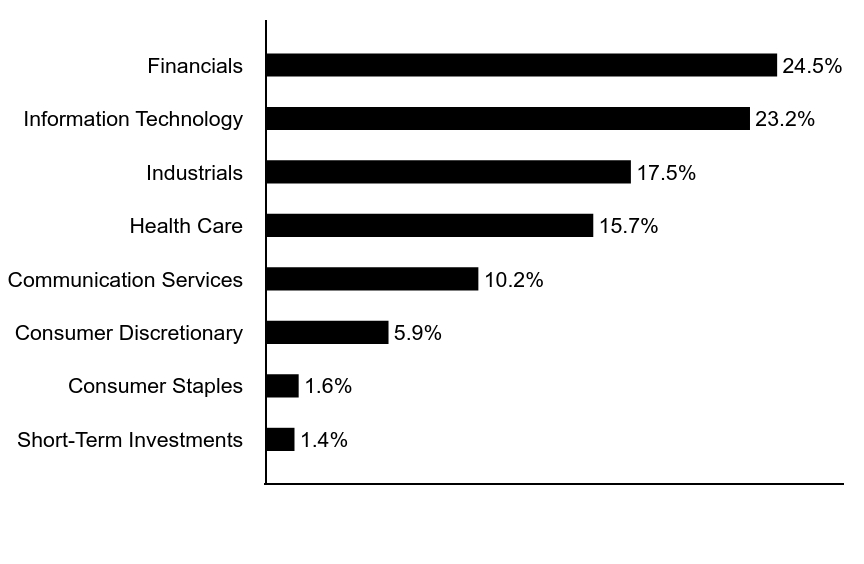

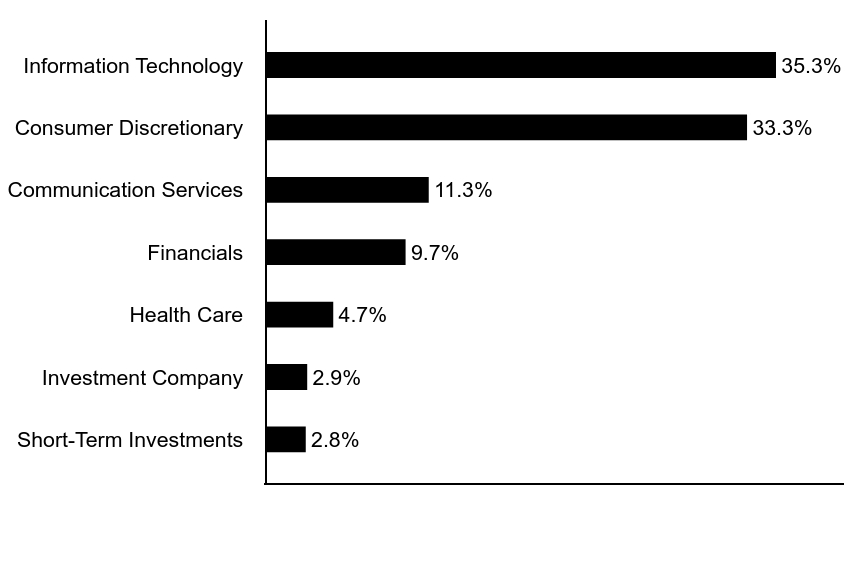

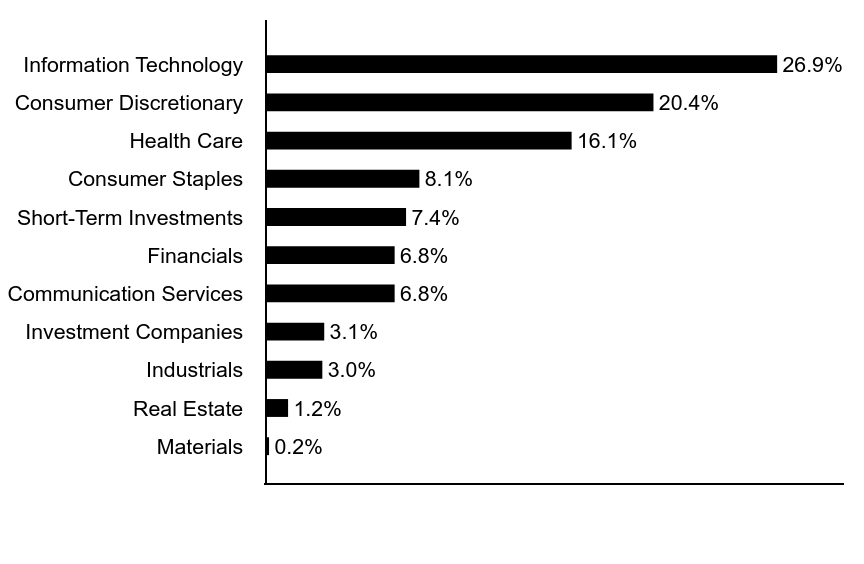

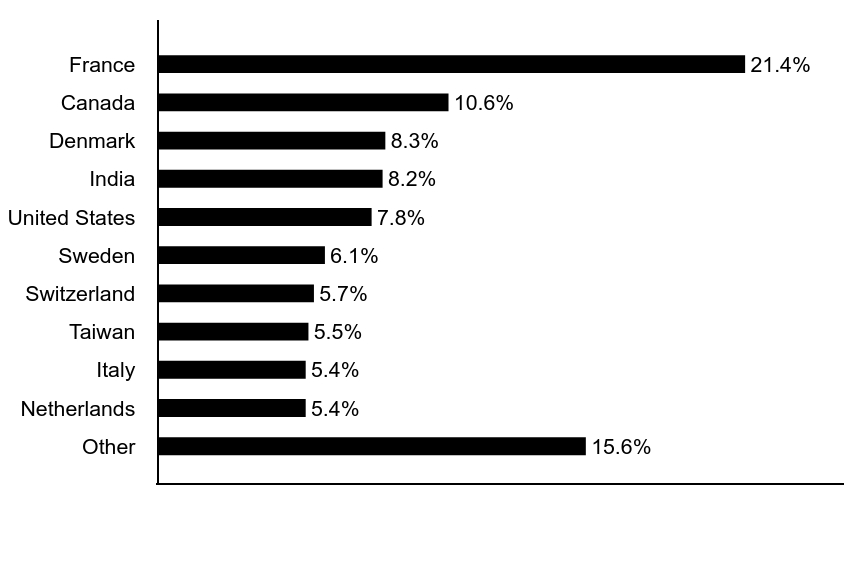

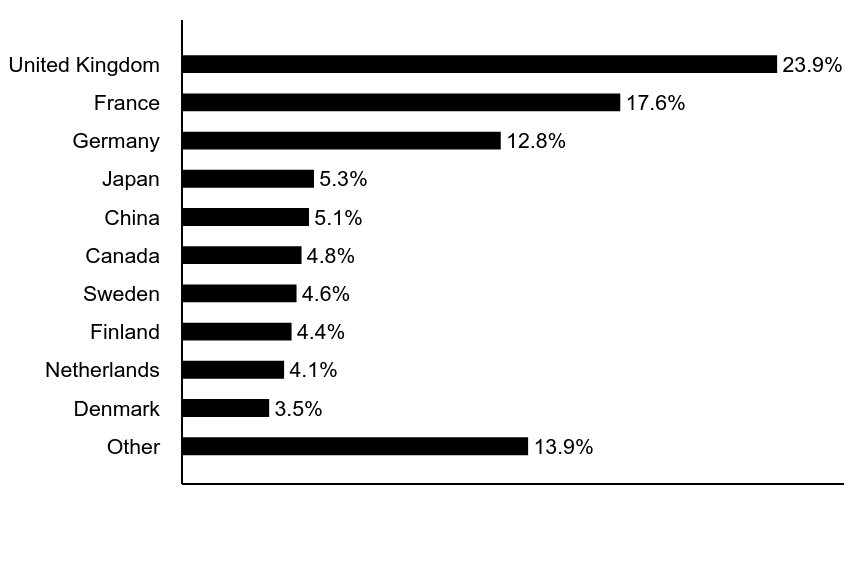

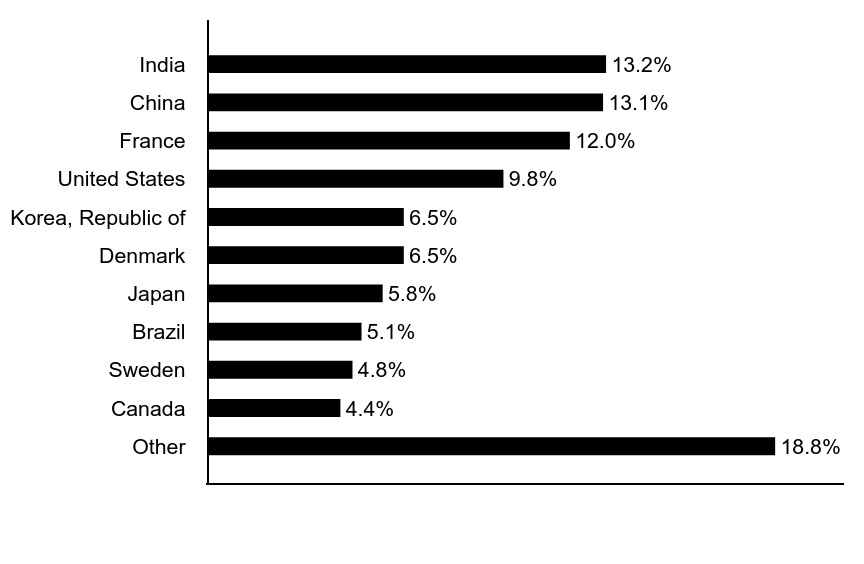

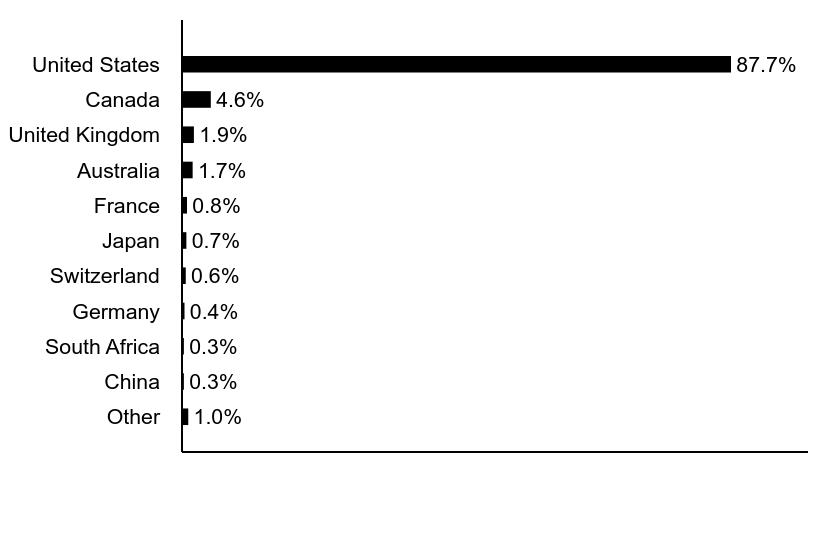

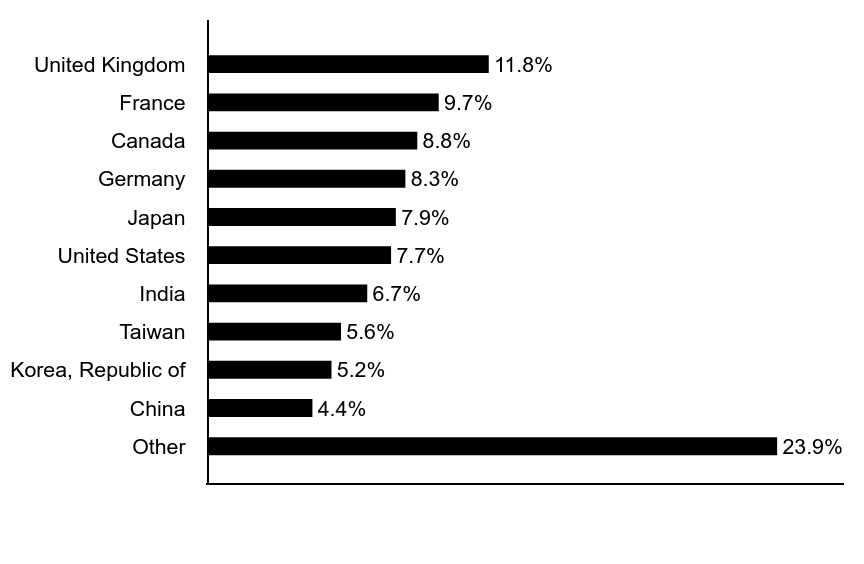

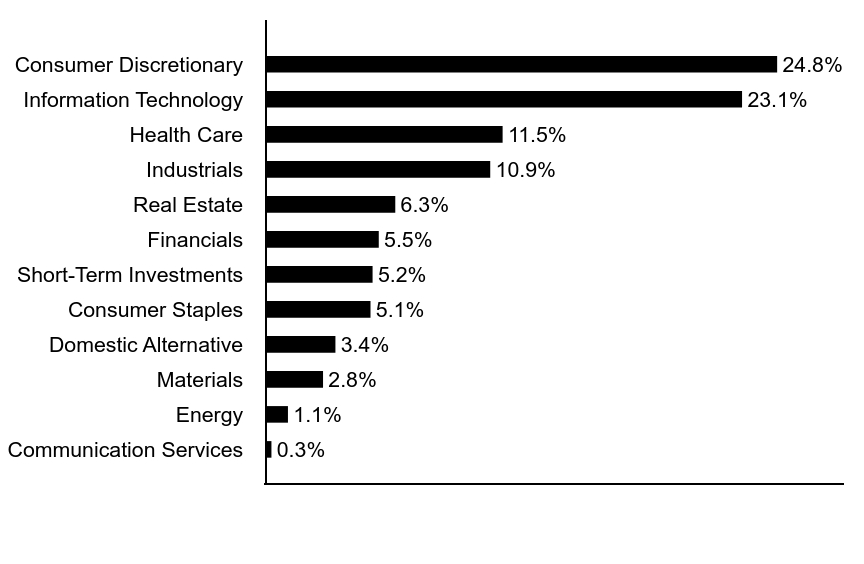

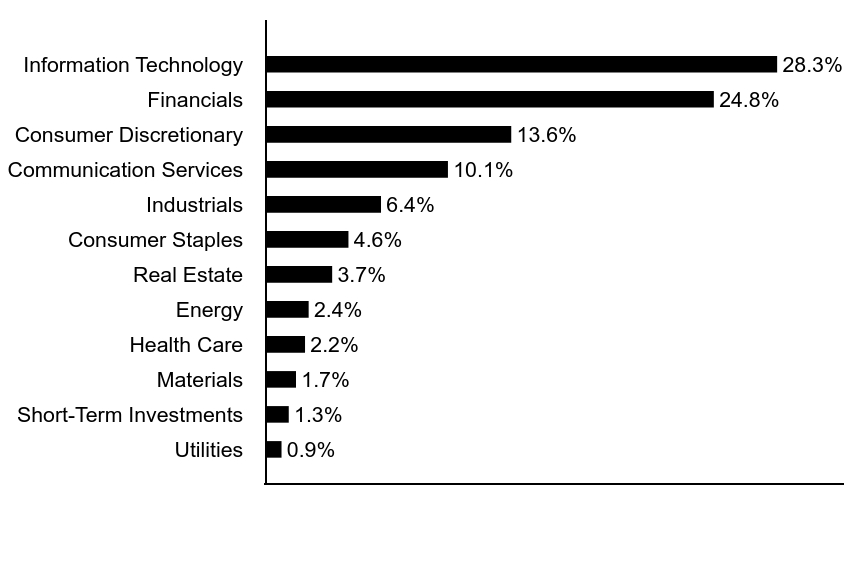

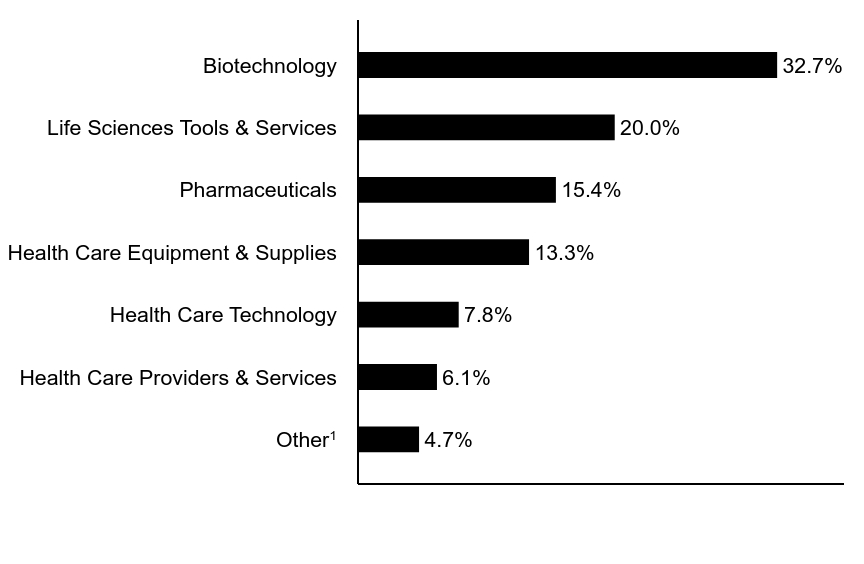

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

|---|

Real Estate | 1.6% | Short-Term Investments | 2.3% | Industrials | 2.6% | Investment Company | 3.0% | Health Care | 5.8% | Financals | 8.0% | Communication Services | 10.7% | Information Technology | 31.6% | Consumer Discretionary | 34.4% |

Top Ten Holdings (% of total investments)Footnote ReferenceaTesla, Inc. | 9.5% | Cloudflare, Inc. | 9.4% | DoorDash, Inc. | 6.4% | Shopify, Inc. | 6.3% | ROBLOX Corp. | 5.4% | Trade Desk, Inc. | 5.3% | MercadoLibre, Inc. | 4.9% | Amazon.com, Inc. | 4.9% | Snowflake, Inc. | 4.9% | Crowdstrike Holdings, Inc. | 3.7% | Total | 60.7% |

| Footnote | Description | Footnotea | Excluding cash equivalents. |

|

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| C000085091 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

|

|

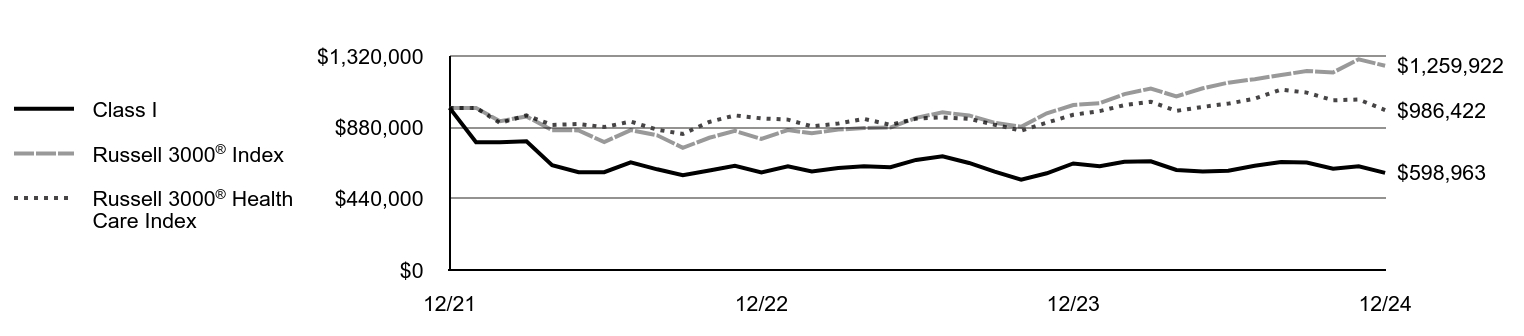

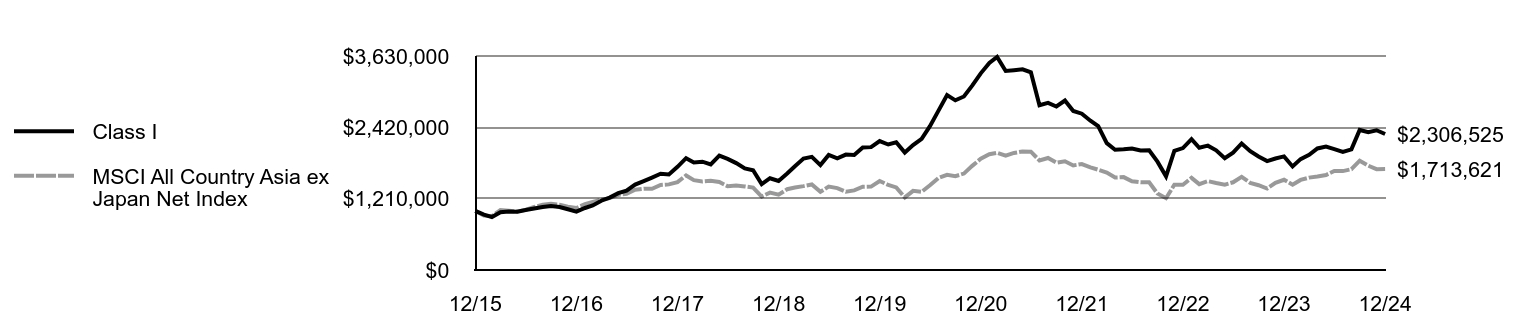

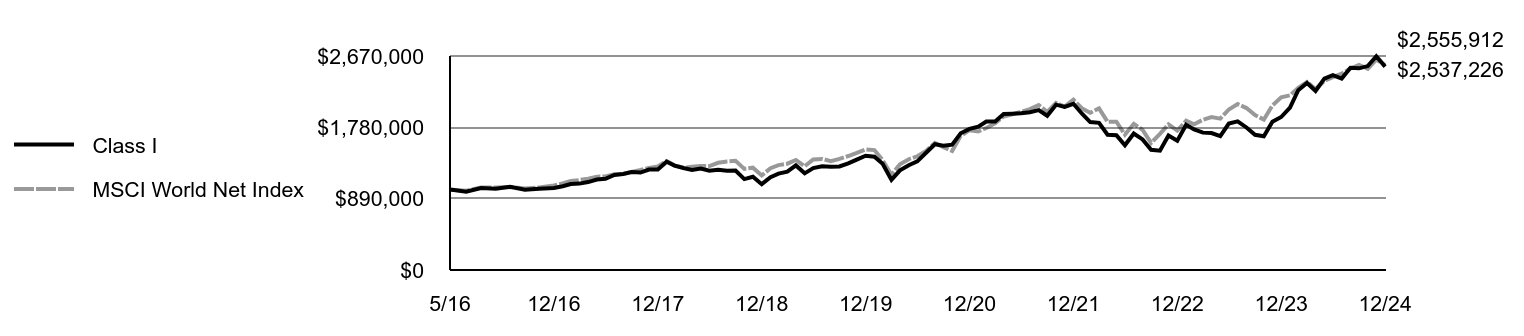

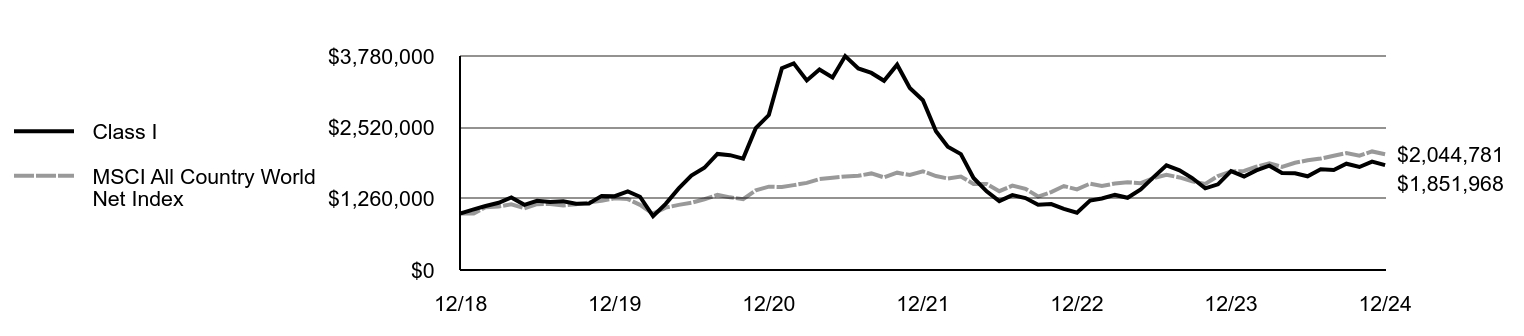

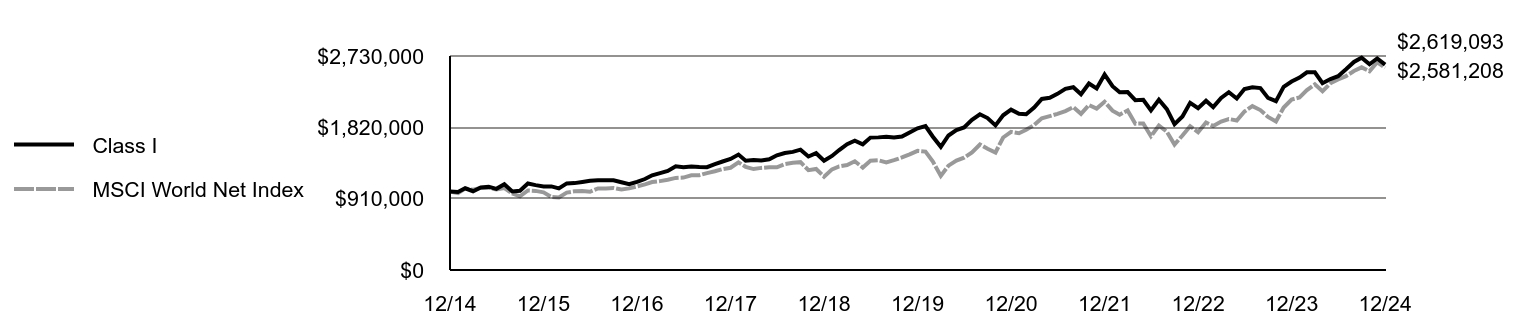

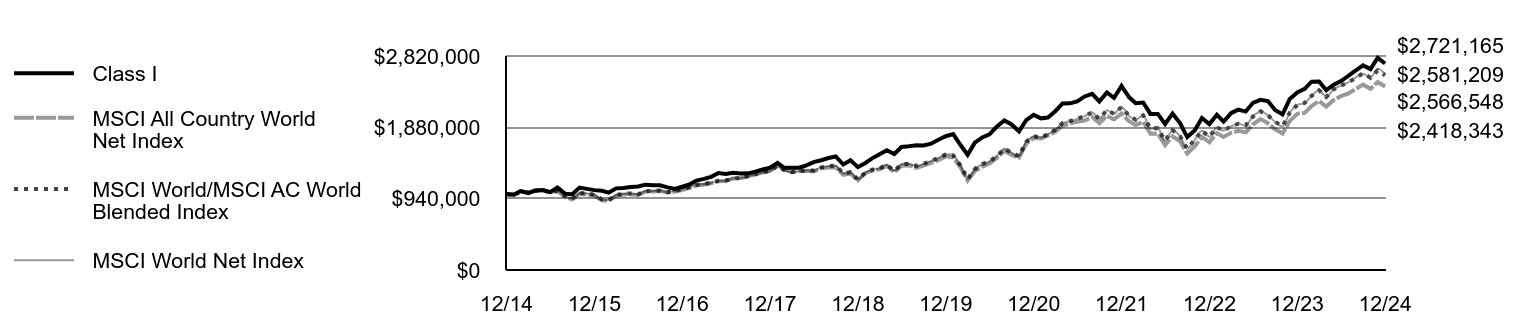

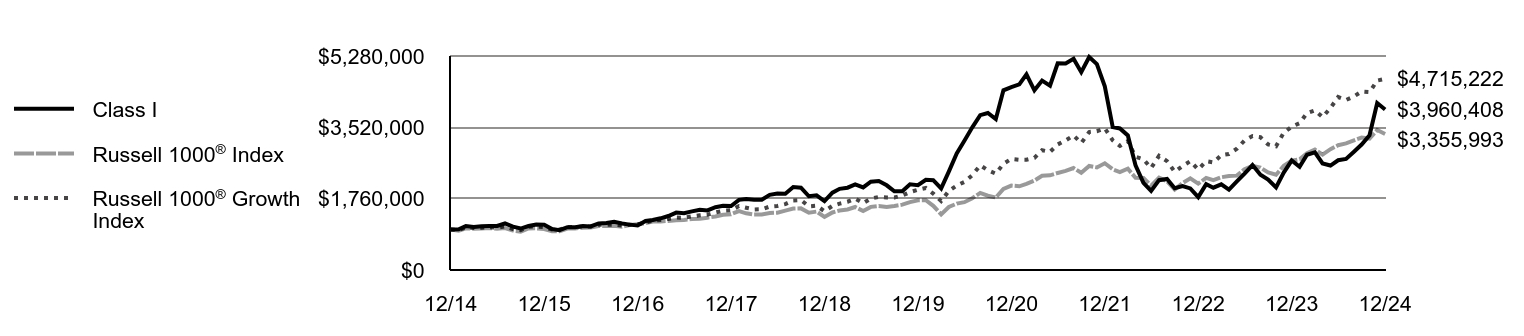

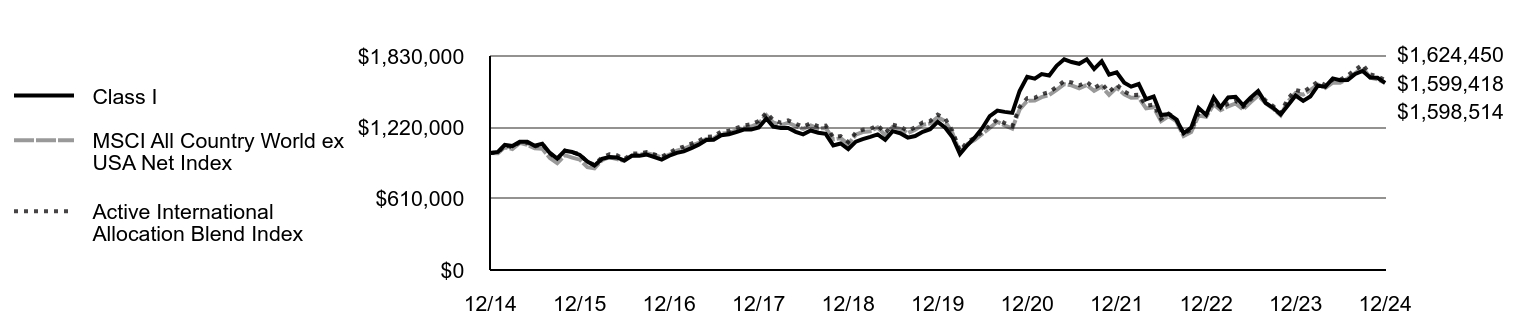

| Class Name |

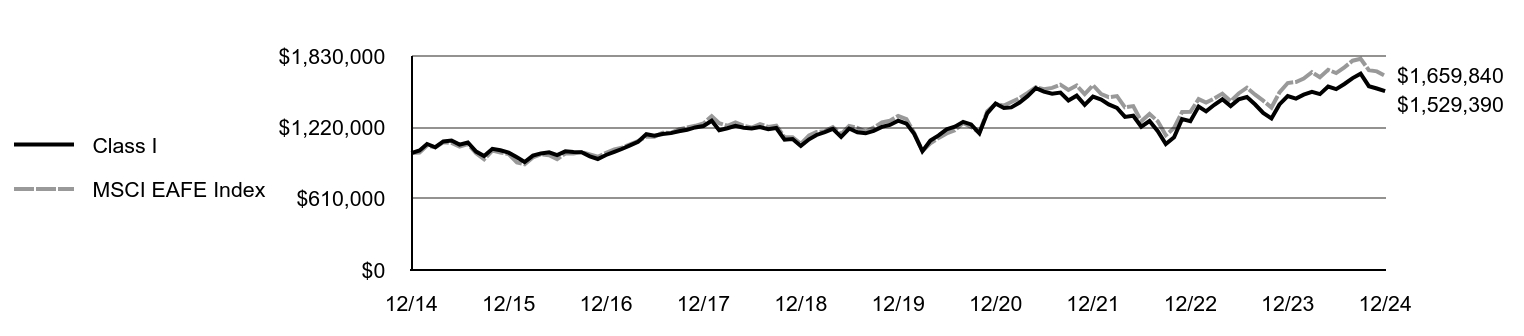

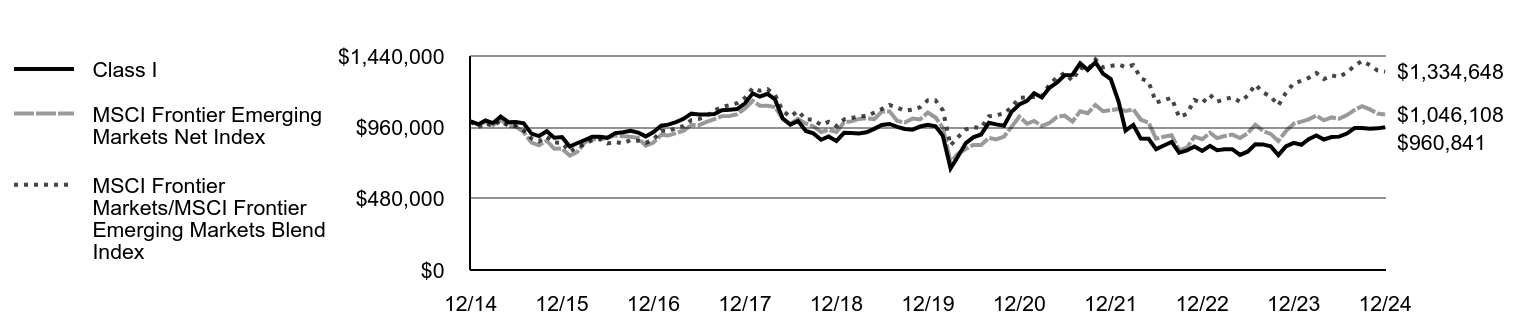

Class I

|

|

| Trading Symbol |

MPAIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $100 | 0.85% |

|---|

|

|

| Expenses Paid, Amount |

$ 100

|

|

| Expense Ratio, Percent |

0.85%

|

|

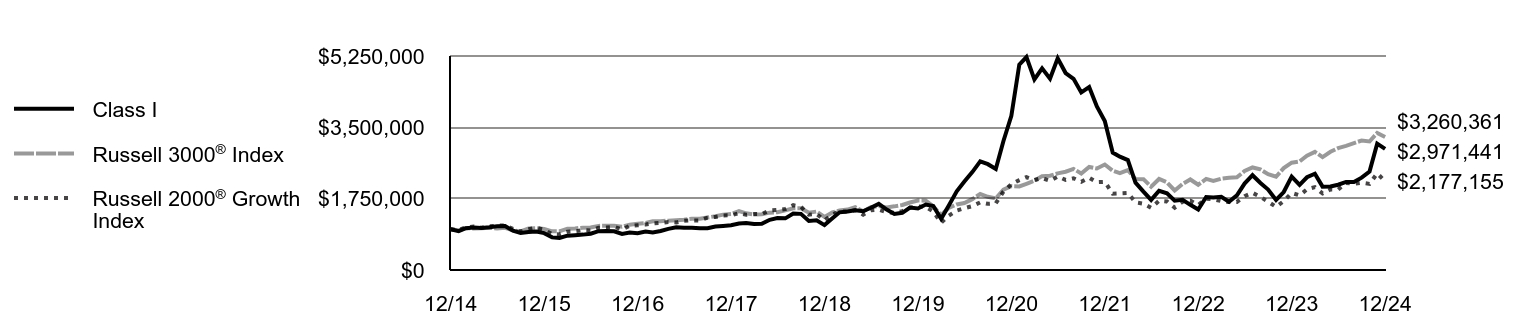

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the Russell 1000® Growth Index: ↑ Stock selection in information technology, led by a position in an enterprise analytics platform and Bitcoin developing company ↑ Average overweight and stock selection in consumer discretionary, led by a food delivery company ↑ No exposure to consumer staples, a sector that underperformed in the index ↓ Stock selection in health care, led lower by a biopharmaceutical royalties acquirer and a next-generation sequencing company (the sequencing company was sold during the period) ↓ Stock selection and average overweight in financials, ↓ Average underweight in information technology, which was one of the stronger performing sectors in the period |

|

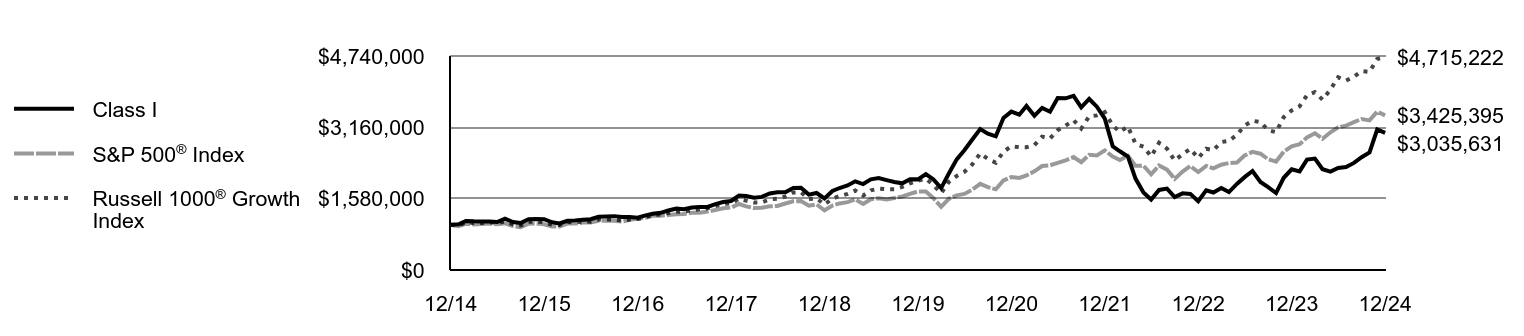

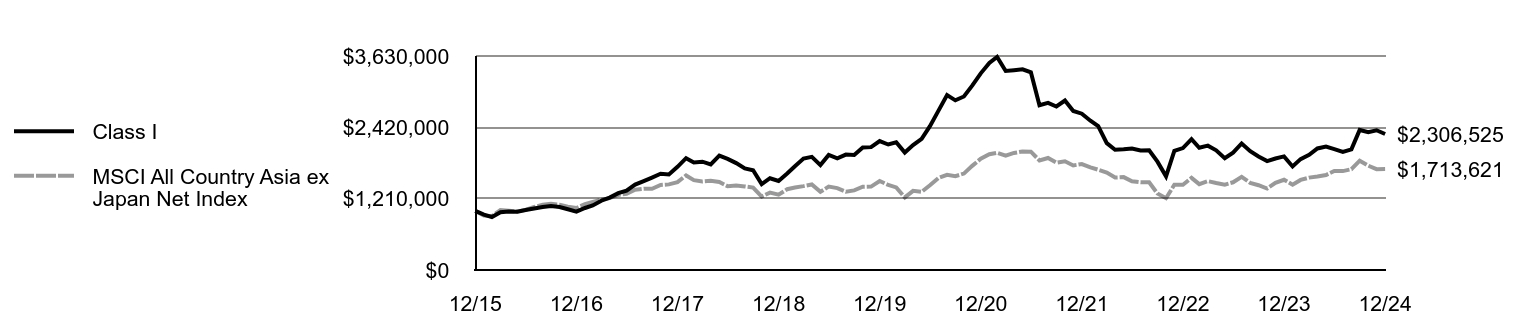

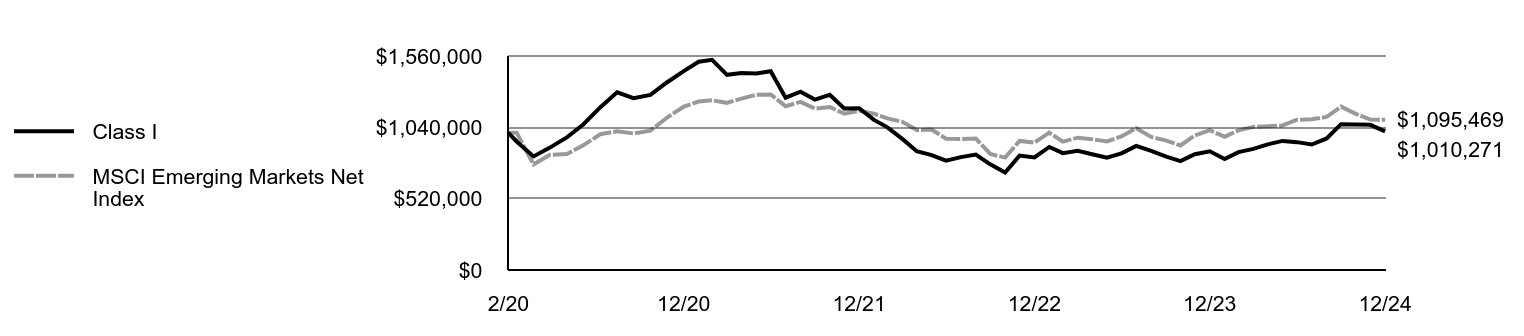

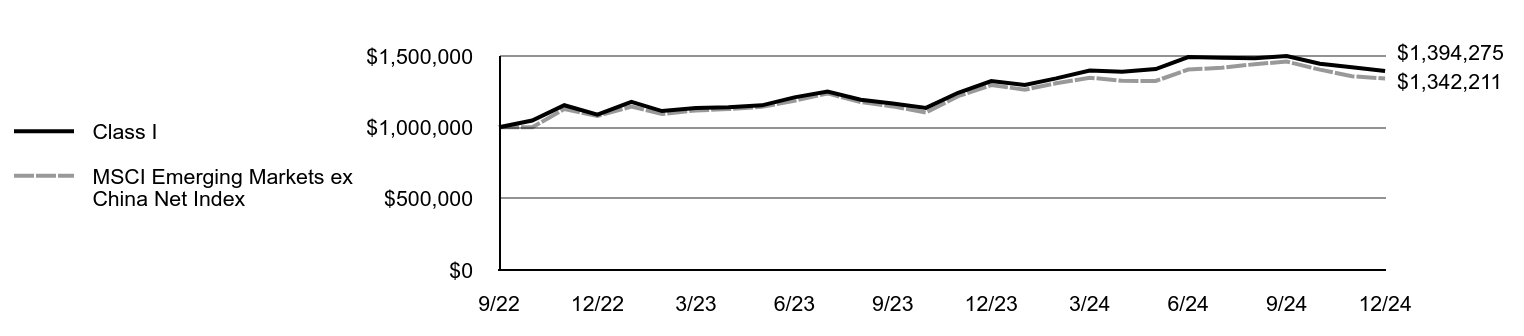

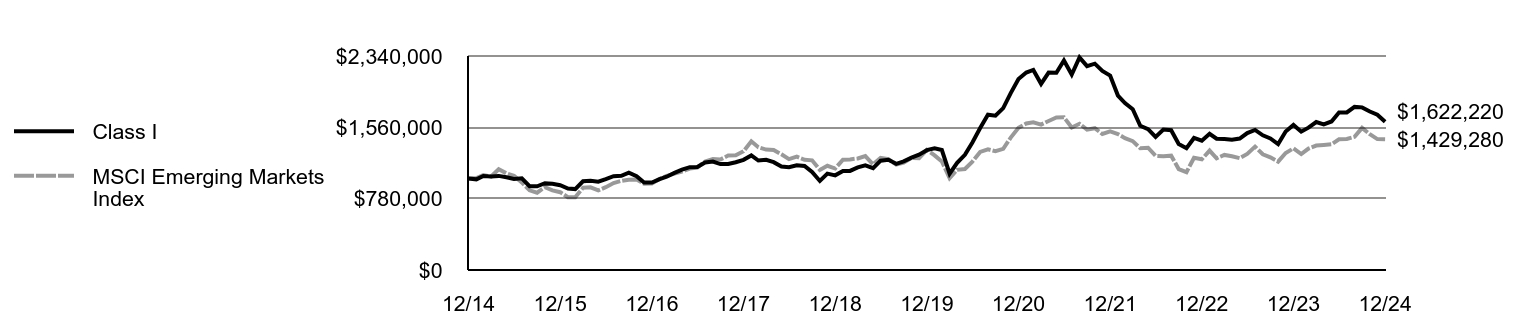

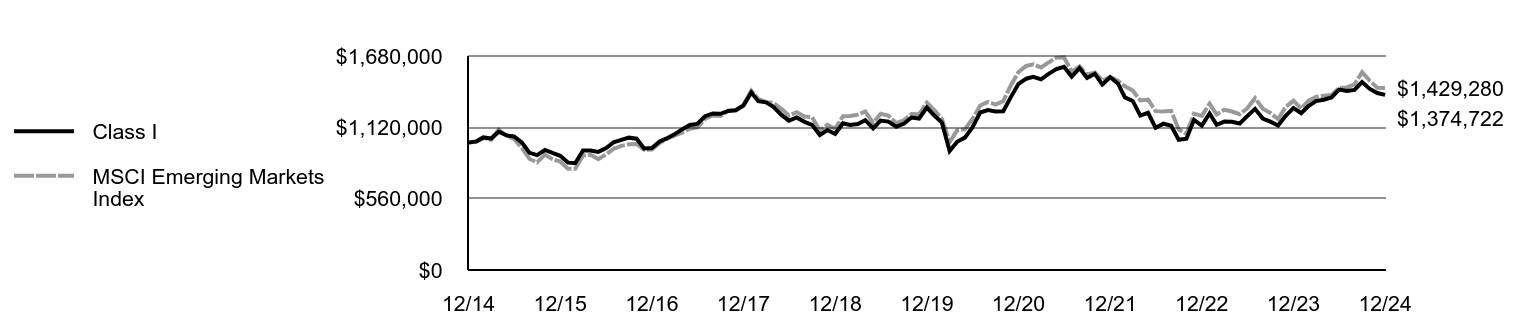

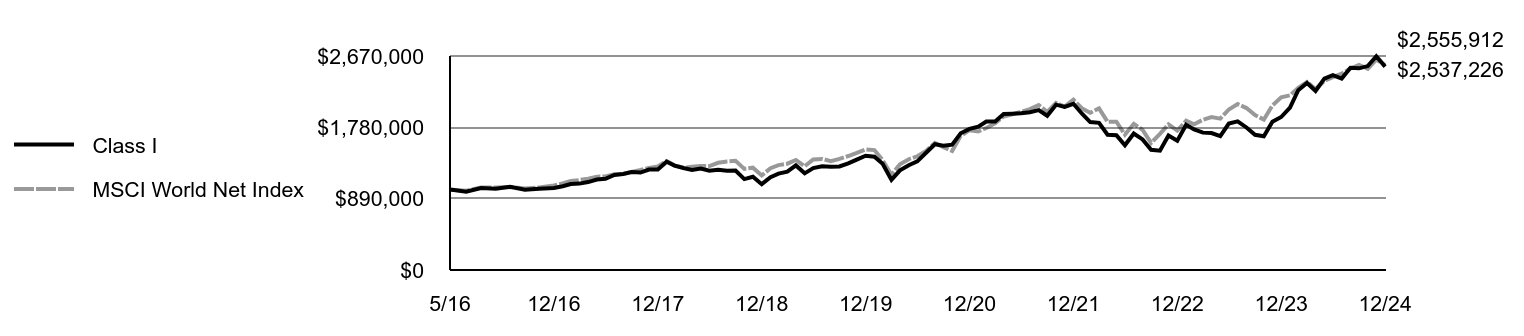

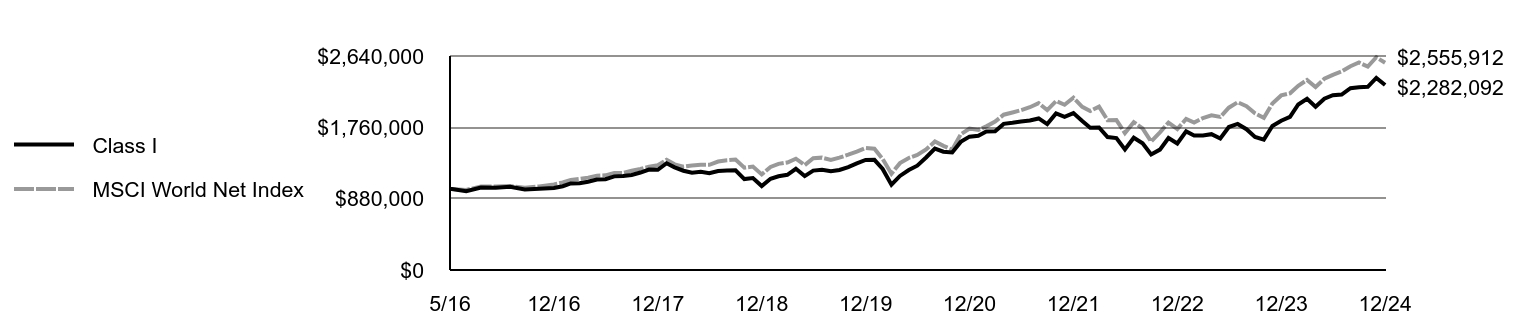

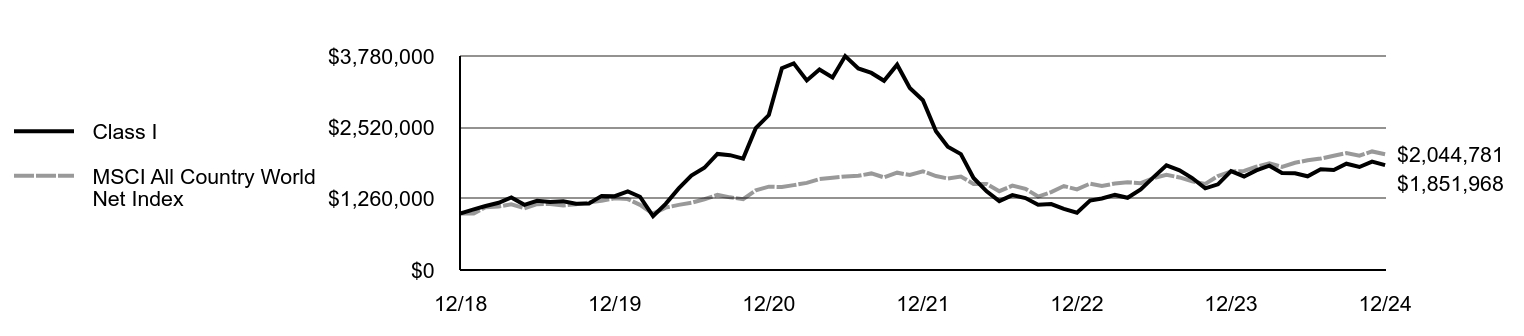

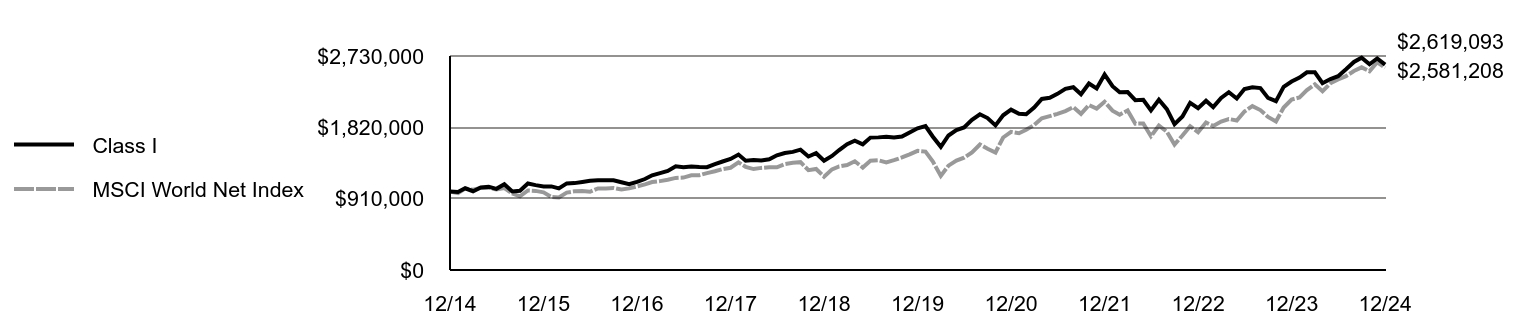

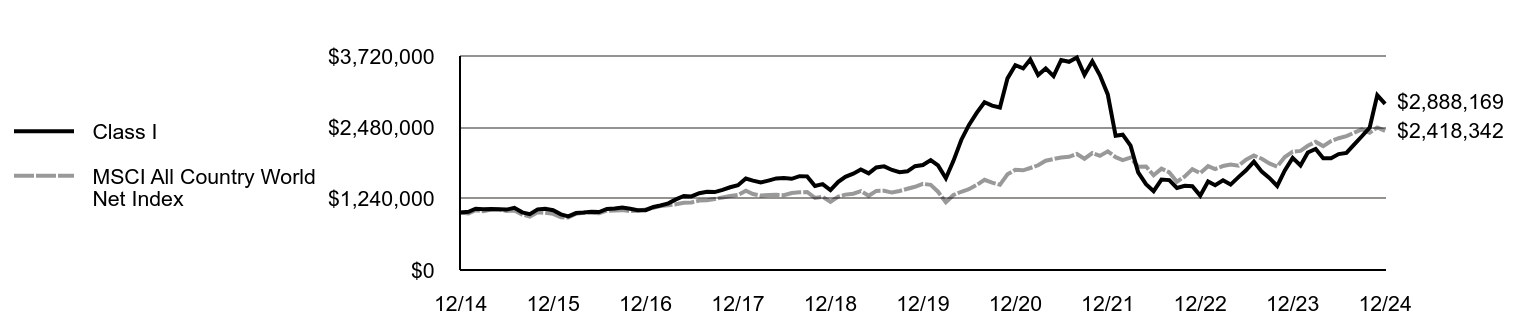

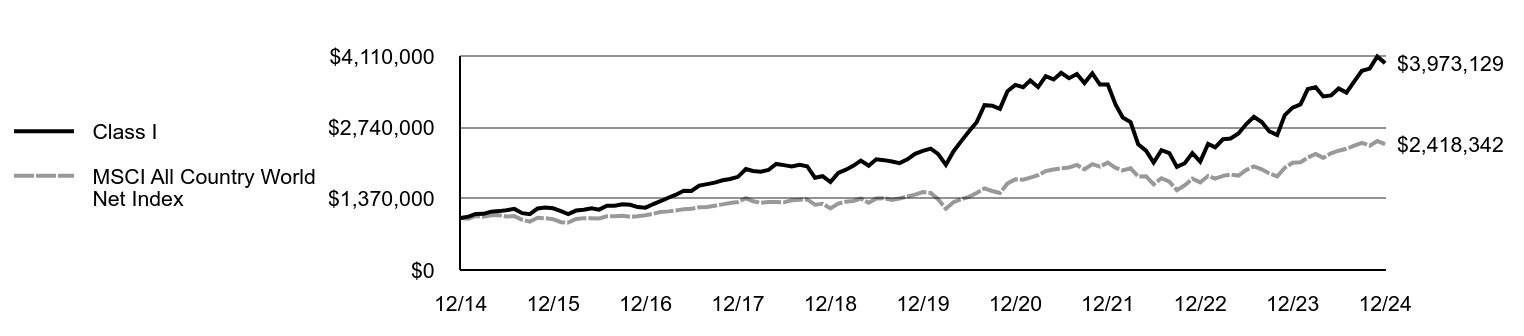

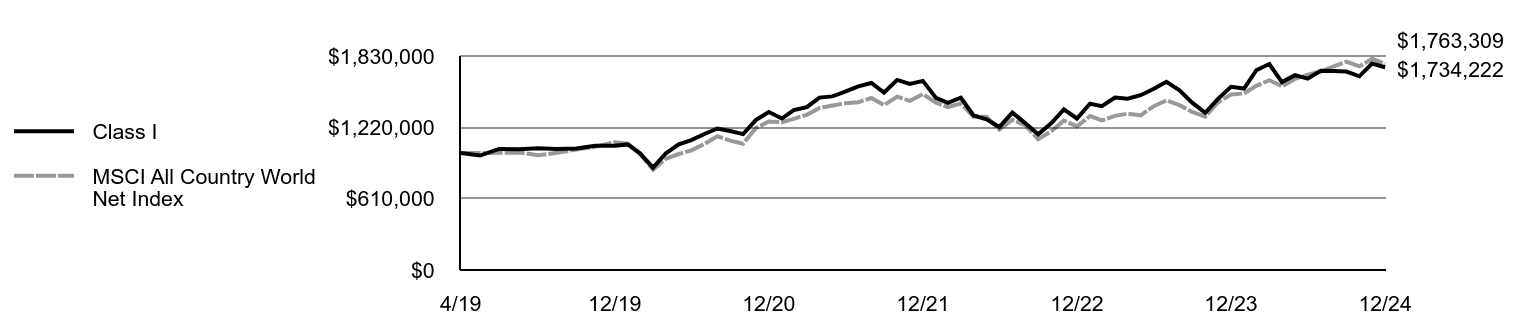

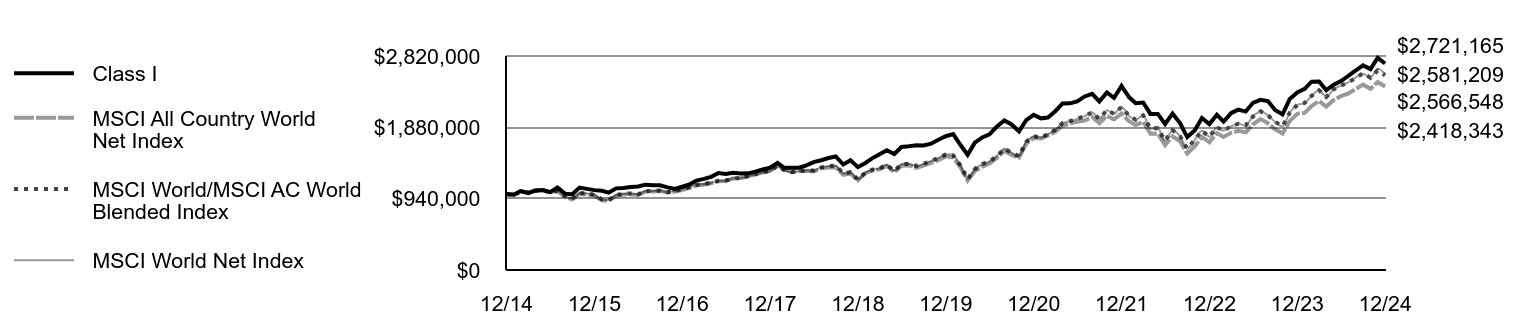

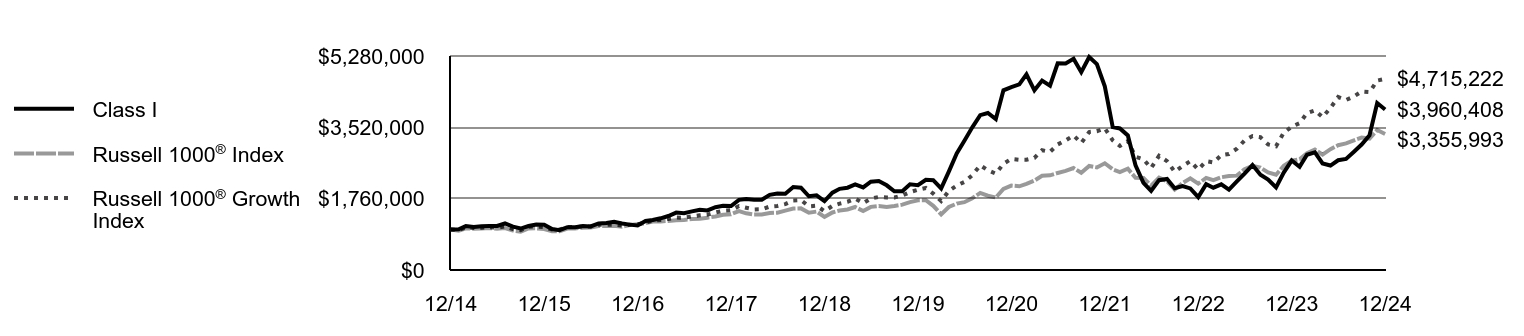

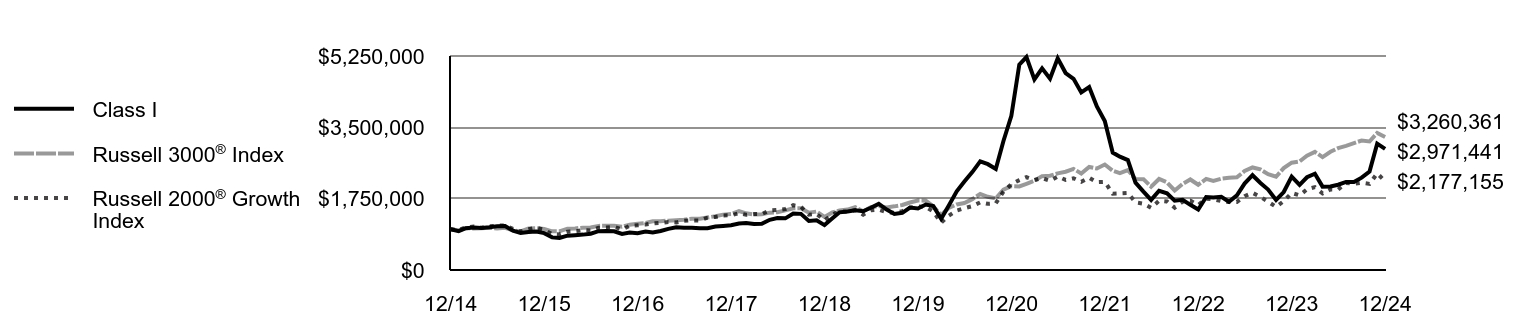

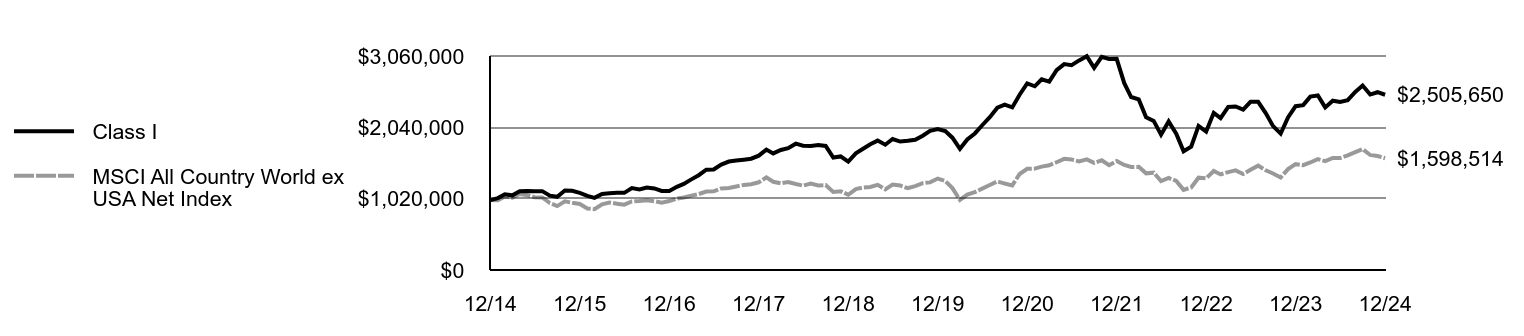

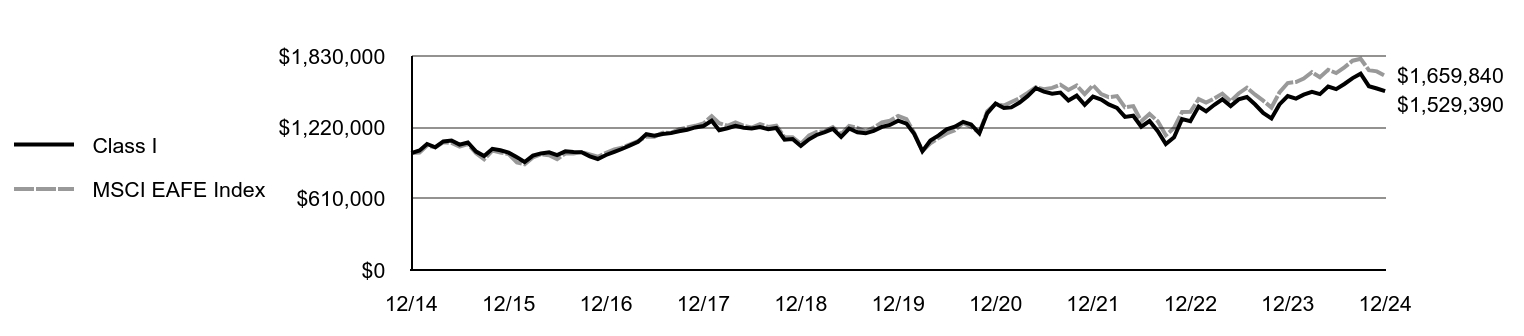

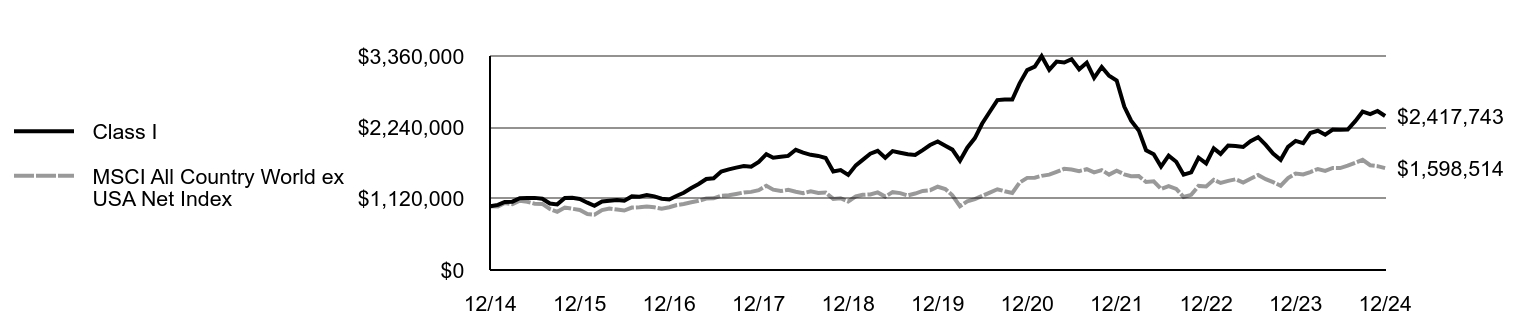

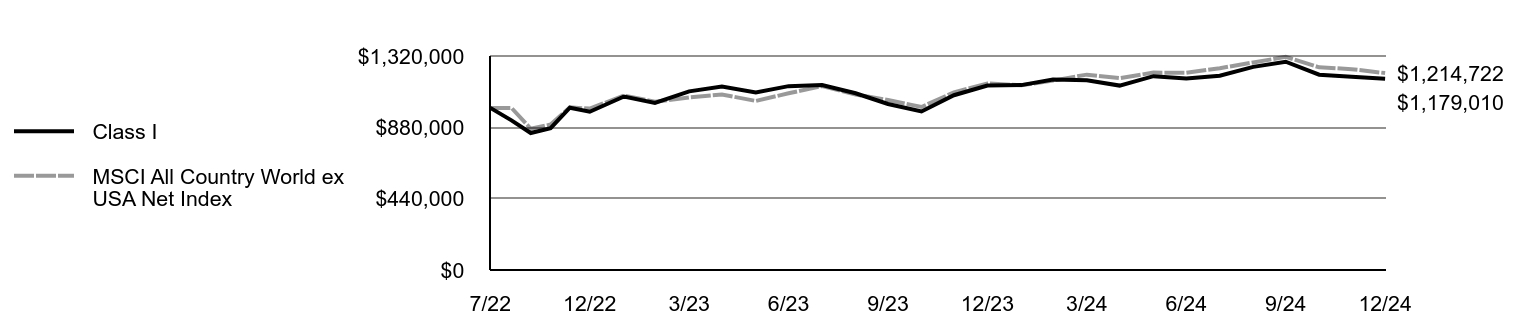

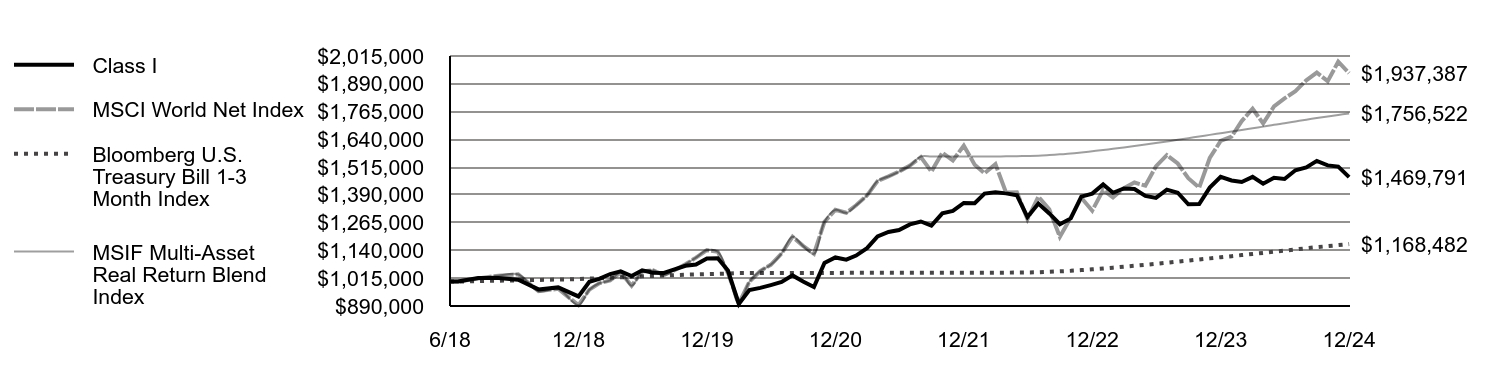

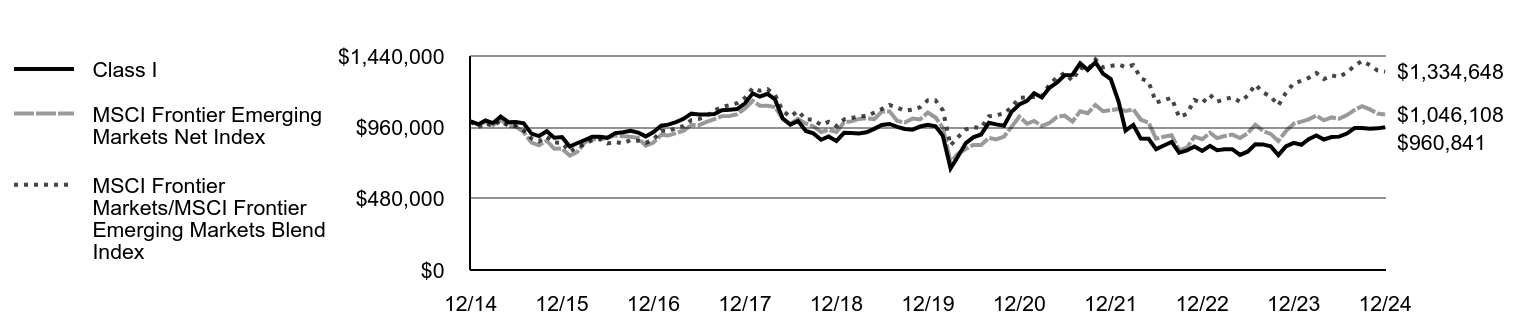

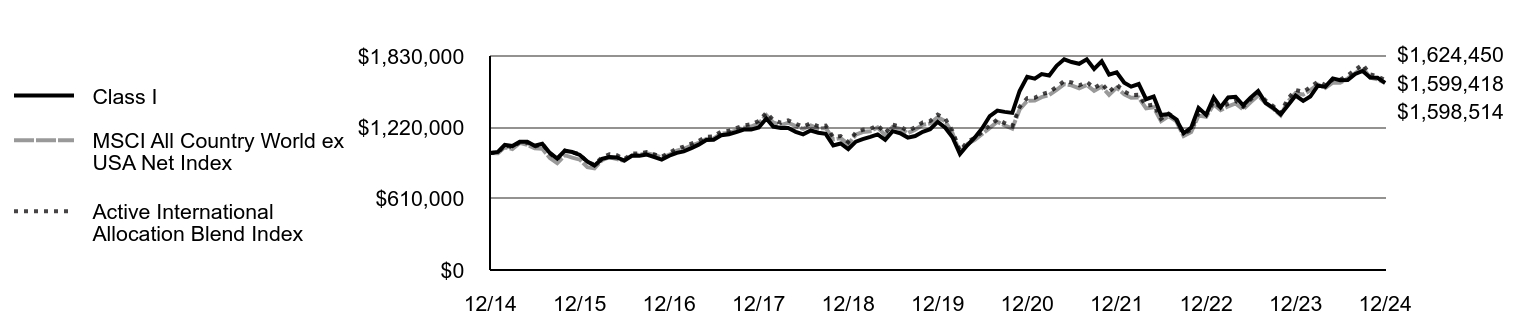

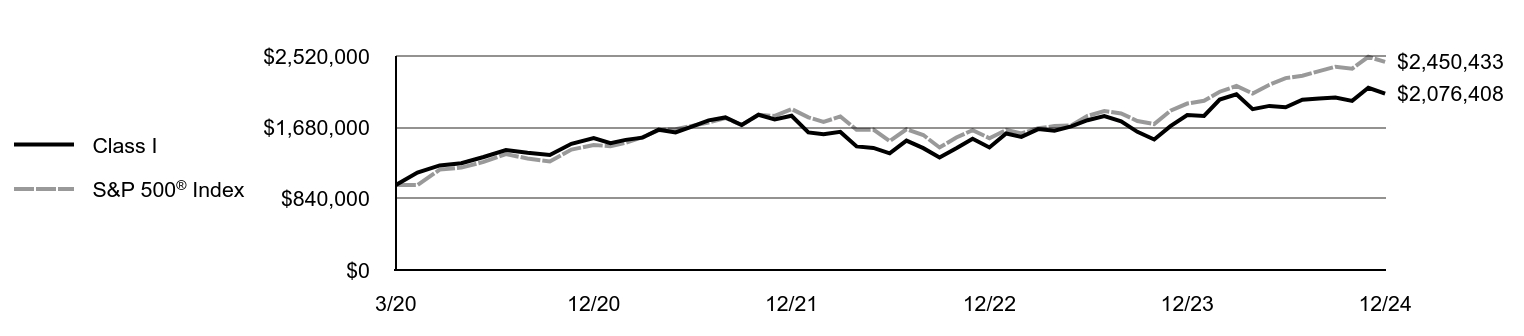

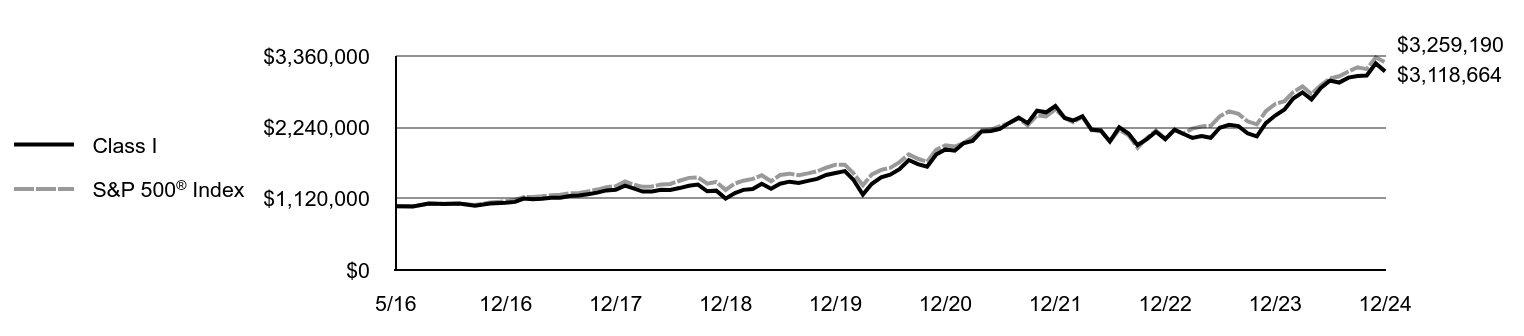

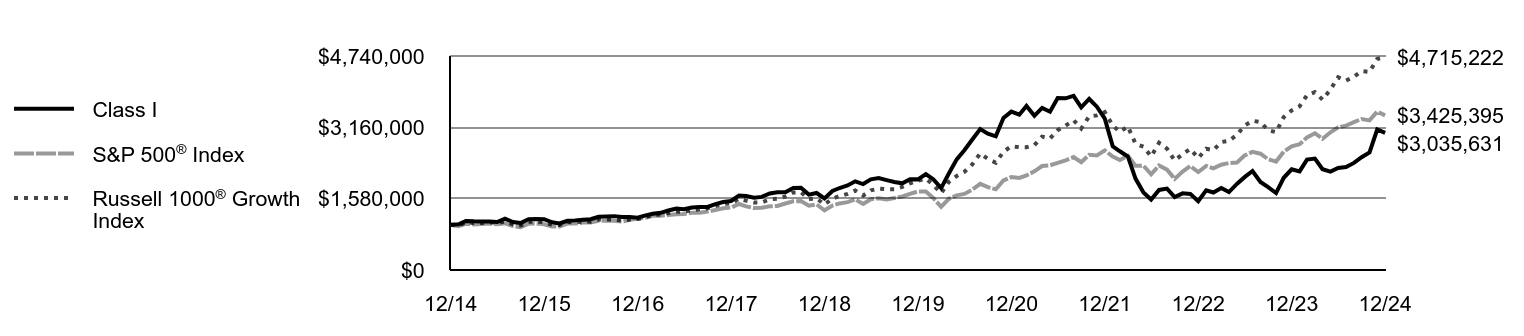

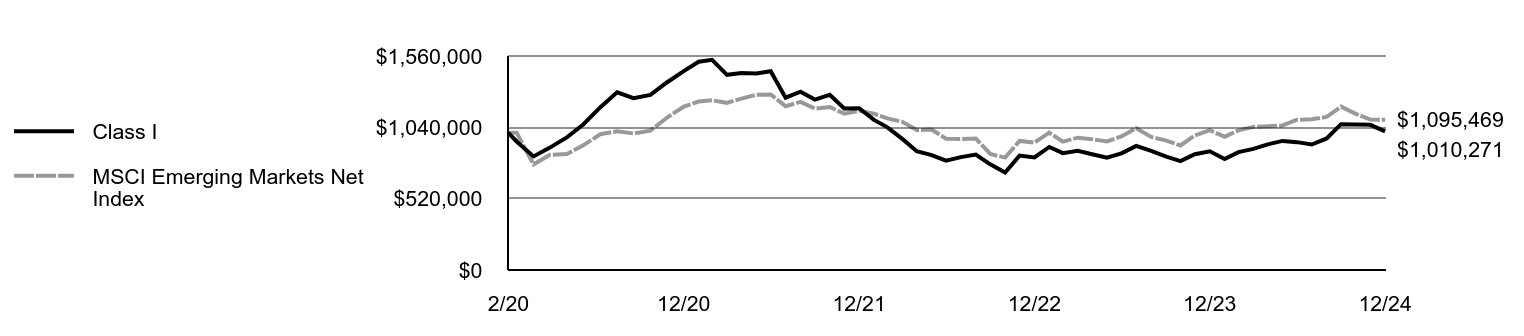

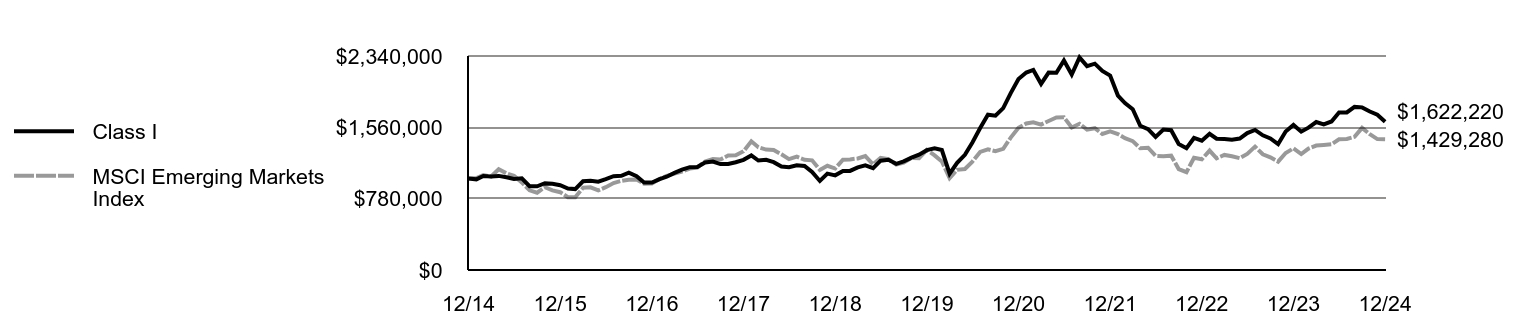

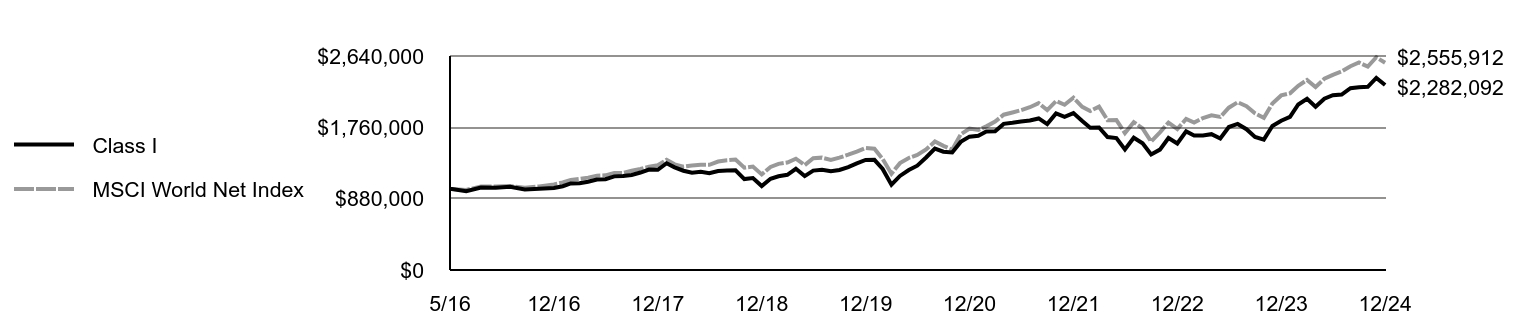

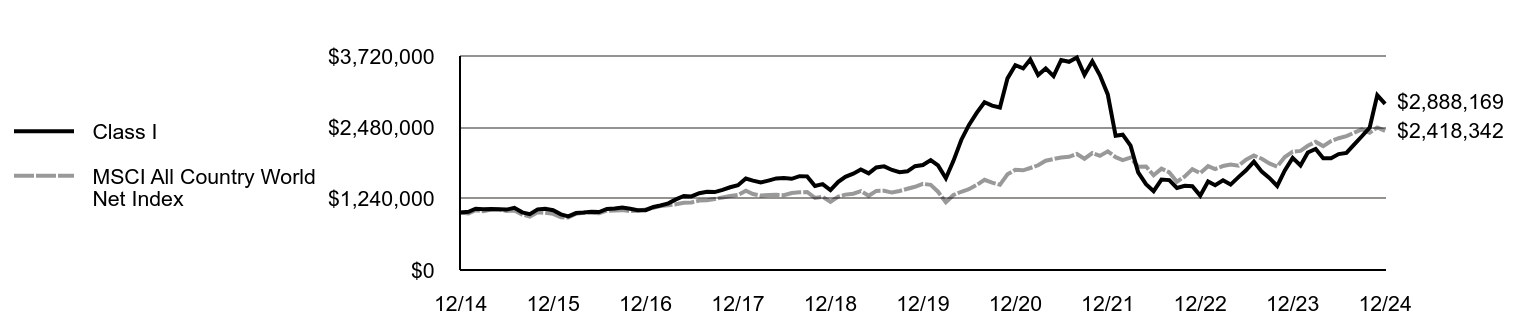

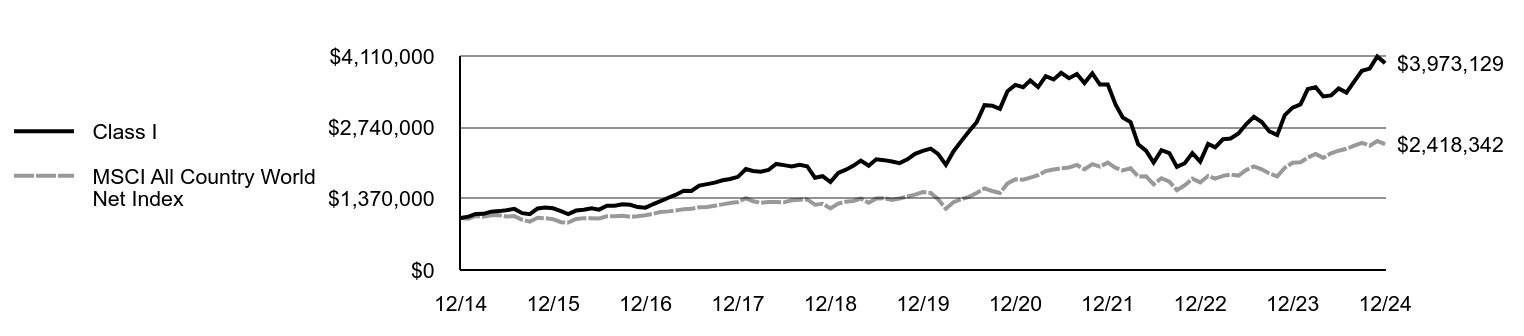

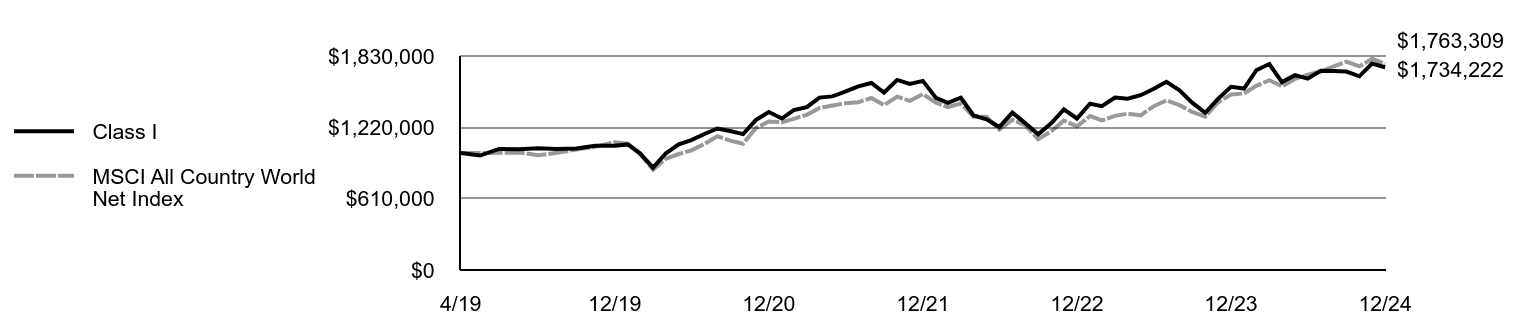

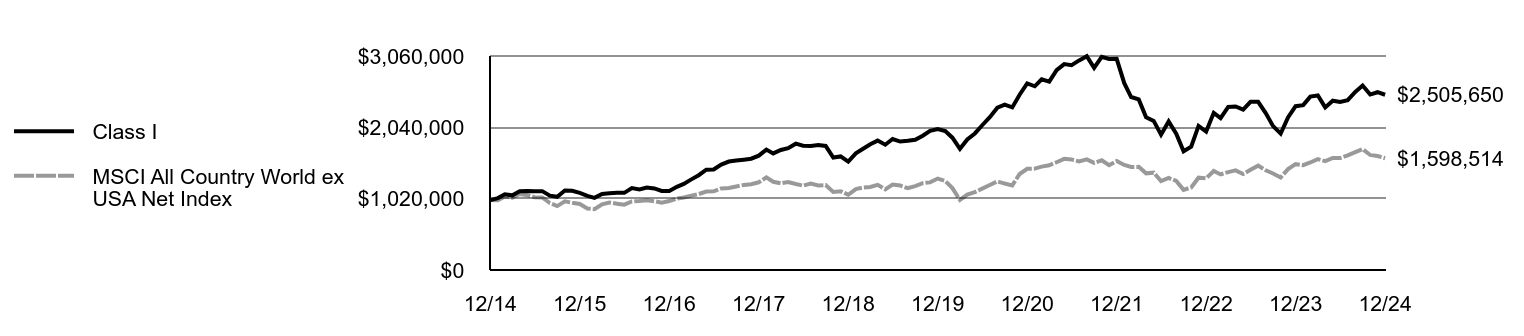

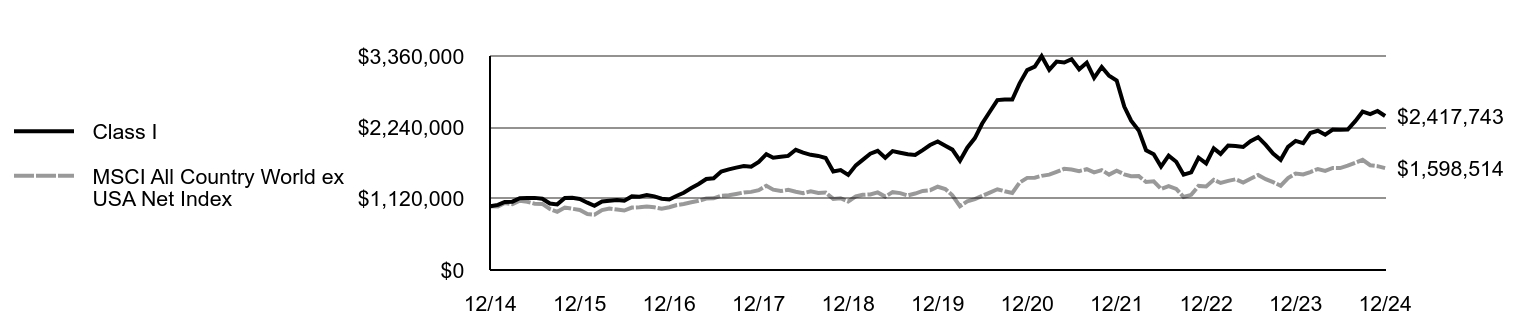

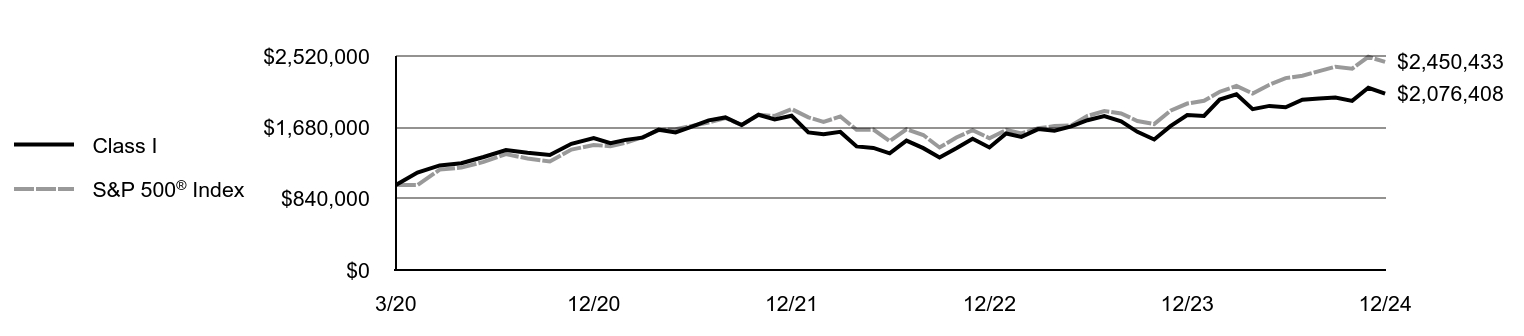

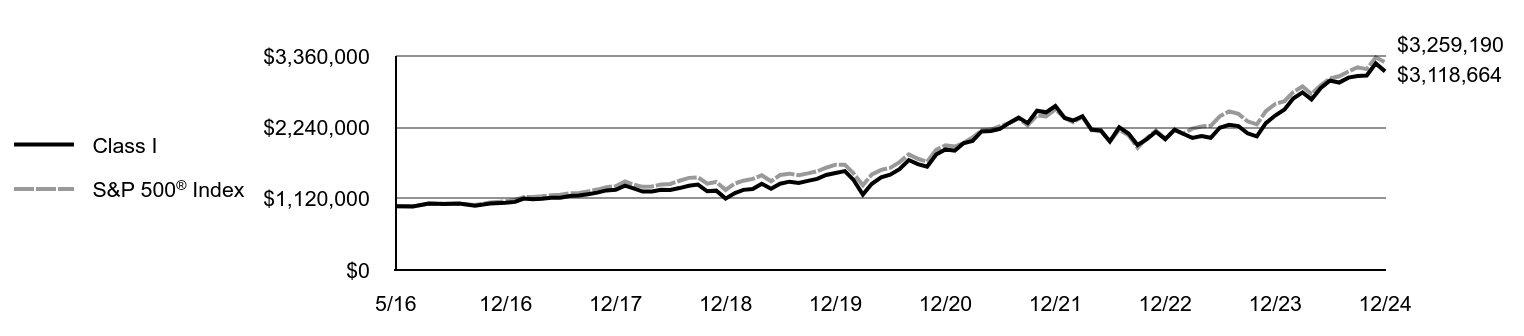

| Line Graph [Table Text Block] |

| Class I | S&P 500® Index | Russell 1000® Growth Index |

|---|

12/14 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

1/15 | $1,011,289 | $969,981 | $984,687 |

|---|

2/15 | $1,087,344 | $1,025,727 | $1,050,322 |

|---|

3/15 | $1,078,431 | $1,009,506 | $1,038,376 |

|---|

4/15 | $1,074,272 | $1,019,190 | $1,043,577 |

|---|

5/15 | $1,073,084 | $1,032,296 | $1,058,266 |

|---|

6/15 | $1,062,983 | $1,012,313 | $1,039,623 |

|---|

7/15 | $1,136,478 | $1,033,522 | $1,074,878 |

|---|

8/15 | $1,062,751 | $971,166 | $1,009,602 |

|---|

9/15 | $1,038,775 | $947,136 | $984,626 |

|---|

10/15 | $1,125,689 | $1,027,030 | $1,069,408 |

|---|

11/15 | $1,132,282 | $1,030,085 | $1,072,410 |

|---|

12/15 | $1,125,630 | $1,013,838 | $1,056,673 |

|---|

1/16 | $1,055,803 | $963,527 | $997,681 |

|---|

2/16 | $1,031,235 | $962,227 | $997,256 |

|---|

3/16 | $1,090,717 | $1,027,503 | $1,064,512 |

|---|

4/16 | $1,099,122 | $1,031,487 | $1,054,791 |

|---|

5/16 | $1,113,992 | $1,050,010 | $1,075,275 |

|---|

6/16 | $1,124,337 | $1,052,731 | $1,071,051 |

|---|

7/16 | $1,178,662 | $1,091,544 | $1,121,607 |

|---|

8/16 | $1,185,235 | $1,093,076 | $1,116,035 |

|---|

9/16 | $1,193,124 | $1,093,283 | $1,120,117 |

|---|

10/16 | $1,172,088 | $1,073,340 | $1,093,813 |

|---|

11/16 | $1,172,088 | $1,113,091 | $1,117,613 |

|---|

12/16 | $1,157,327 | $1,135,093 | $1,131,448 |

|---|

1/17 | $1,210,987 | $1,156,621 | $1,169,576 |

|---|

2/17 | $1,246,098 | $1,202,546 | $1,218,155 |

|---|

3/17 | $1,266,634 | $1,203,949 | $1,232,245 |

|---|

4/17 | $1,318,307 | $1,216,313 | $1,260,426 |

|---|

5/17 | $1,363,354 | $1,233,430 | $1,293,201 |

|---|

6/17 | $1,346,793 | $1,241,129 | $1,289,794 |

|---|

7/17 | $1,383,960 | $1,266,650 | $1,324,076 |

|---|

8/17 | $1,397,946 | $1,270,527 | $1,348,348 |

|---|

9/17 | $1,397,280 | $1,296,736 | $1,365,879 |

|---|

10/17 | $1,459,884 | $1,326,995 | $1,418,803 |

|---|

11/17 | $1,506,505 | $1,367,694 | $1,461,906 |

|---|

12/17 | $1,528,373 | $1,382,901 | $1,473,287 |

|---|

1/18 | $1,650,215 | $1,462,078 | $1,577,634 |

|---|

2/18 | $1,638,102 | $1,408,190 | $1,536,267 |

|---|

3/18 | $1,600,338 | $1,372,403 | $1,494,138 |

|---|

4/18 | $1,619,577 | $1,377,669 | $1,499,358 |

|---|

5/18 | $1,695,817 | $1,410,846 | $1,565,077 |

|---|

6/18 | $1,720,756 | $1,419,530 | $1,580,146 |

|---|

7/18 | $1,720,947 | $1,472,355 | $1,626,533 |

|---|

8/18 | $1,814,343 | $1,520,333 | $1,715,466 |

|---|

9/18 | $1,821,583 | $1,528,986 | $1,725,054 |

|---|

10/18 | $1,670,267 | $1,424,480 | $1,570,788 |

|---|

11/18 | $1,705,724 | $1,453,508 | $1,587,472 |

|---|

12/18 | $1,585,560 | $1,322,270 | $1,450,985 |

|---|

1/19 | $1,749,557 | $1,428,231 | $1,581,409 |

|---|

2/19 | $1,816,063 | $1,474,089 | $1,637,991 |

|---|

3/19 | $1,871,233 | $1,502,733 | $1,684,613 |

|---|

4/19 | $1,963,434 | $1,563,578 | $1,760,724 |

|---|

5/19 | $1,903,730 | $1,464,216 | $1,649,493 |

|---|

6/19 | $2,007,268 | $1,567,408 | $1,762,775 |

|---|

7/19 | $2,034,475 | $1,589,935 | $1,802,580 |

|---|

8/19 | $1,991,397 | $1,564,750 | $1,788,774 |

|---|

9/19 | $1,950,587 | $1,594,027 | $1,788,996 |

|---|

10/19 | $1,920,357 | $1,628,553 | $1,839,431 |

|---|

11/19 | $2,011,046 | $1,687,668 | $1,921,034 |

|---|

12/19 | $2,007,316 | $1,738,605 | $1,978,994 |

|---|

1/20 | $2,122,086 | $1,737,924 | $2,023,234 |

|---|

2/20 | $2,010,397 | $1,594,859 | $1,885,449 |

|---|

3/20 | $1,813,979 | $1,397,874 | $1,699,966 |

|---|

4/20 | $2,136,721 | $1,577,072 | $1,951,512 |

|---|

5/20 | $2,450,220 | $1,652,185 | $2,082,526 |

|---|

6/20 | $2,654,340 | $1,685,042 | $2,173,209 |

|---|

7/20 | $2,890,042 | $1,780,054 | $2,340,414 |

|---|

8/20 | $3,122,663 | $1,908,005 | $2,581,926 |

|---|

9/20 | $3,020,987 | $1,835,507 | $2,460,447 |

|---|

10/20 | $2,960,136 | $1,786,694 | $2,376,885 |

|---|

11/20 | $3,367,608 | $1,982,273 | $2,620,259 |

|---|

12/20 | $3,508,593 | $2,058,487 | $2,740,768 |

|---|

1/21 | $3,440,480 | $2,037,705 | $2,720,489 |

|---|

2/21 | $3,635,087 | $2,093,895 | $2,719,859 |

|---|

3/21 | $3,414,533 | $2,185,598 | $2,766,587 |

|---|

4/21 | $3,589,679 | $2,302,241 | $2,954,822 |

|---|

5/21 | $3,505,349 | $2,318,321 | $2,913,953 |

|---|

6/21 | $3,806,989 | $2,372,442 | $3,096,768 |

|---|

7/21 | $3,802,124 | $2,428,799 | $3,198,826 |

|---|

8/21 | $3,858,884 | $2,502,648 | $3,318,426 |

|---|

9/21 | $3,604,274 | $2,386,250 | $3,132,575 |

|---|

10/21 | $3,788,339 | $2,553,435 | $3,403,905 |

|---|

11/21 | $3,617,248 | $2,535,743 | $3,424,717 |

|---|

12/21 | $3,352,619 | $2,649,385 | $3,497,125 |

|---|

1/22 | $2,740,419 | $2,512,287 | $3,196,984 |

|---|

2/22 | $2,629,564 | $2,437,066 | $3,061,197 |

|---|

3/22 | $2,514,714 | $2,527,553 | $3,180,943 |

|---|

4/22 | $2,025,354 | $2,307,145 | $2,796,807 |

|---|

5/22 | $1,717,755 | $2,311,378 | $2,731,788 |

|---|

6/22 | $1,559,962 | $2,120,588 | $2,515,400 |

|---|

7/22 | $1,773,682 | $2,316,116 | $2,817,301 |

|---|

8/22 | $1,803,643 | $2,221,660 | $2,686,059 |

|---|

9/22 | $1,616,887 | $2,017,049 | $2,424,932 |

|---|

10/22 | $1,697,782 | $2,180,352 | $2,566,666 |

|---|

11/22 | $1,685,797 | $2,302,198 | $2,683,621 |

|---|

12/22 | $1,524,097 | $2,169,558 | $2,478,172 |

|---|

1/23 | $1,763,418 | $2,305,880 | $2,684,721 |

|---|

2/23 | $1,716,813 | $2,249,619 | $2,652,836 |

|---|

3/23 | $1,817,580 | $2,332,212 | $2,834,174 |

|---|

4/23 | $1,725,631 | $2,368,614 | $2,862,136 |

|---|

5/23 | $1,905,751 | $2,378,910 | $2,992,588 |

|---|

6/23 | $2,056,901 | $2,536,097 | $3,197,237 |

|---|

7/23 | $2,192,936 | $2,617,569 | $3,304,952 |

|---|

8/23 | $1,949,837 | $2,575,893 | $3,275,277 |

|---|

9/23 | $1,833,955 | $2,453,080 | $3,097,155 |

|---|

10/23 | $1,704,218 | $2,401,500 | $3,053,059 |

|---|

11/23 | $2,043,046 | $2,620,818 | $3,385,876 |

|---|

12/23 | $2,229,464 | $2,739,884 | $3,535,809 |

|---|

1/24 | $2,185,379 | $2,785,926 | $3,623,998 |

|---|

2/24 | $2,444,853 | $2,934,682 | $3,871,252 |

|---|

3/24 | $2,467,526 | $3,029,104 | $3,939,403 |

|---|

4/24 | $2,231,983 | $2,905,381 | $3,772,310 |

|---|

5/24 | $2,179,081 | $3,049,444 | $3,998,140 |

|---|

6/24 | $2,259,694 | $3,158,864 | $4,267,741 |

|---|

7/24 | $2,281,107 | $3,197,315 | $4,195,145 |

|---|

8/24 | $2,371,797 | $3,274,872 | $4,282,521 |

|---|

9/24 | $2,497,756 | $3,344,813 | $4,403,847 |

|---|

10/24 | $2,604,820 | $3,314,481 | $4,389,274 |

|---|

11/24 | $3,111,173 | $3,509,044 | $4,673,964 |

|---|

12/24 | $3,035,631 | $3,425,395 | $4,715,222 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | 5 Years | 10 Years |

|---|

Class I | 36.16% | 8.62% | 11.74% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 16.78% |

|---|

|

|

| AssetsNet |

$ 194,996,435

|

|

| Holdings Count | Holding |

28

|

|

| Advisory Fees Paid, Amount |

$ 877,326

|

|

| InvestmentCompanyPortfolioTurnover |

57.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $194,996,435 |

|---|

# of Portfolio Holdings | 28 |

|---|

Portfolio Turnover Rate | 57% |

|---|

Total Advisory Fees Paid | $877,326 |

|---|

|

|

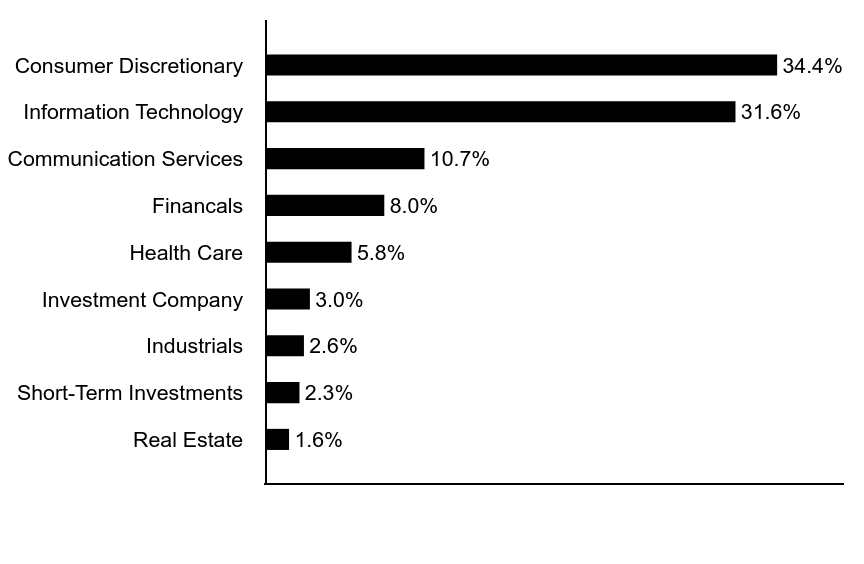

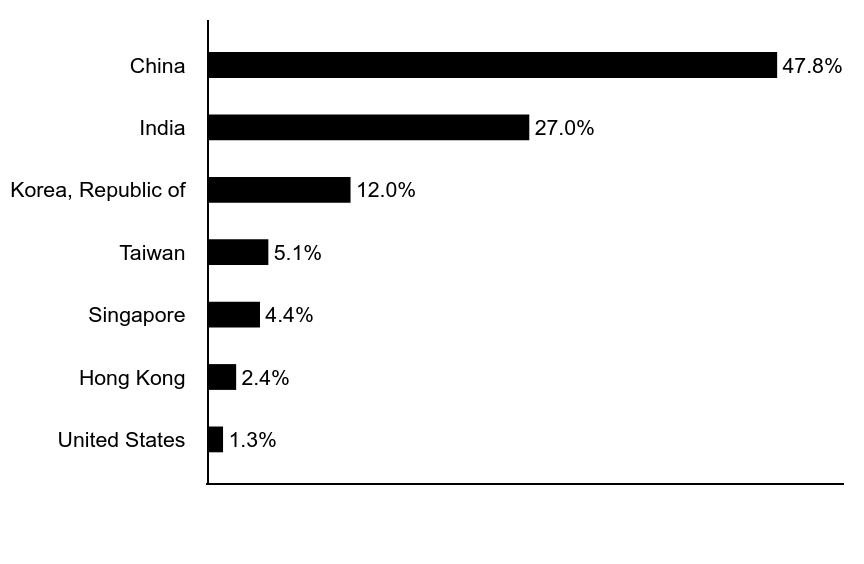

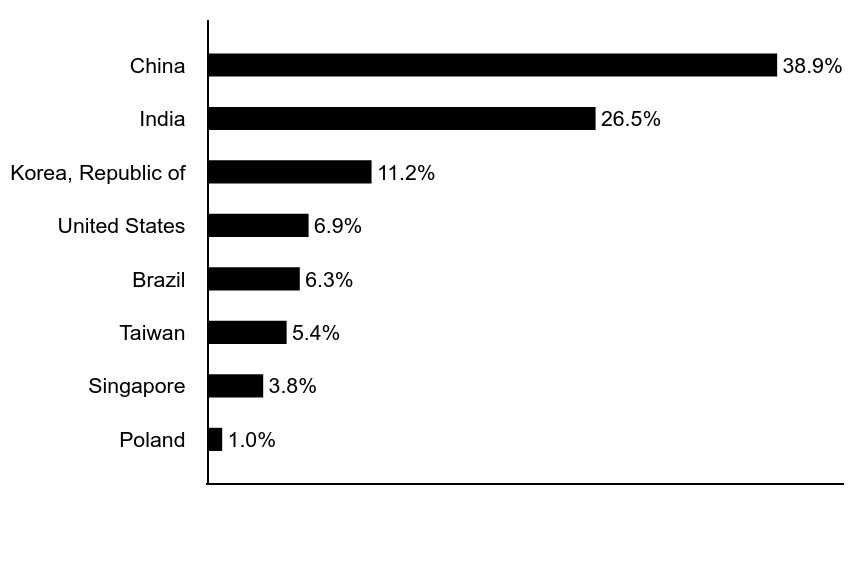

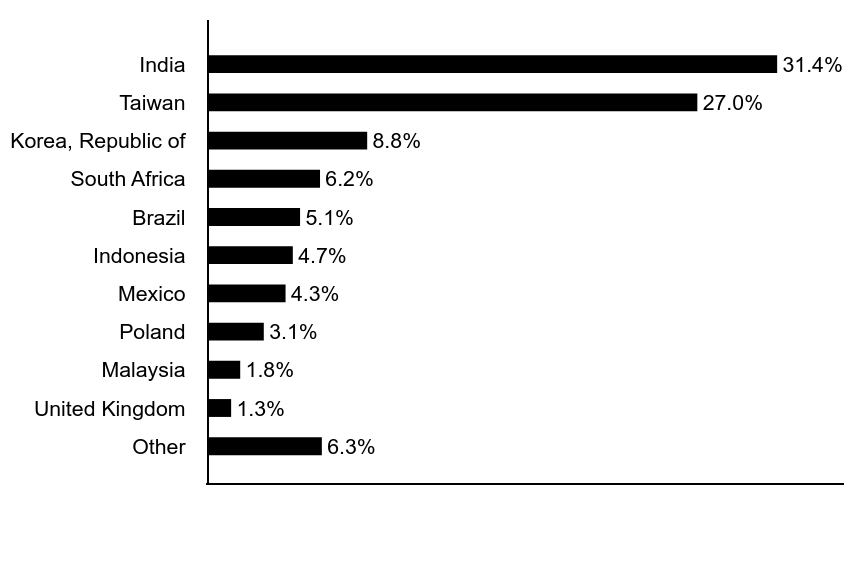

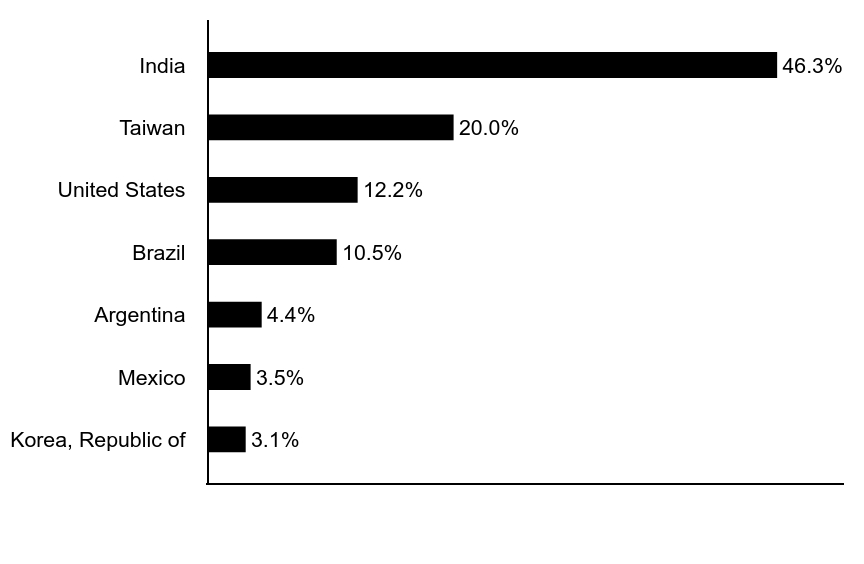

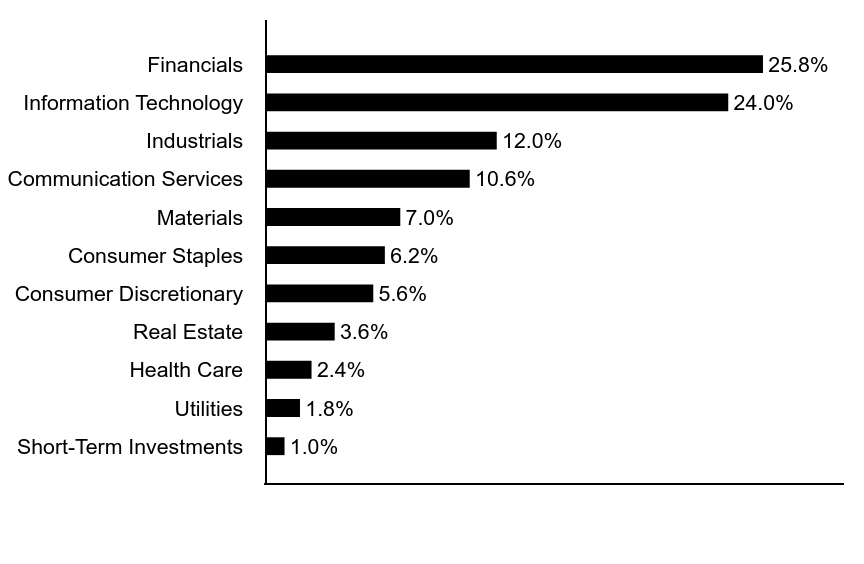

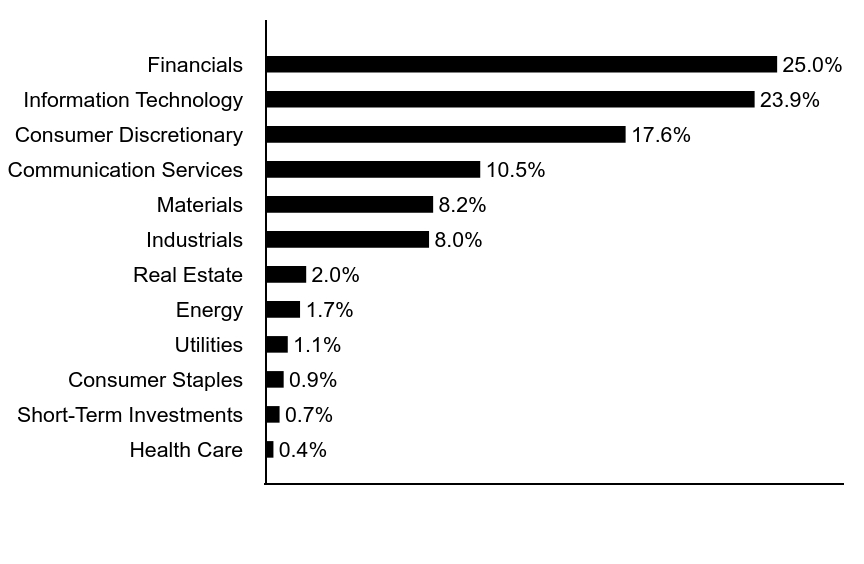

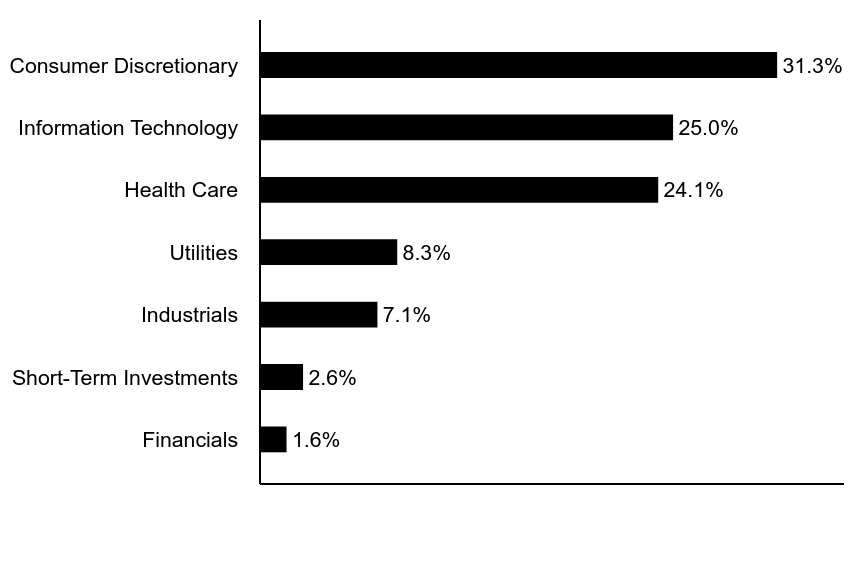

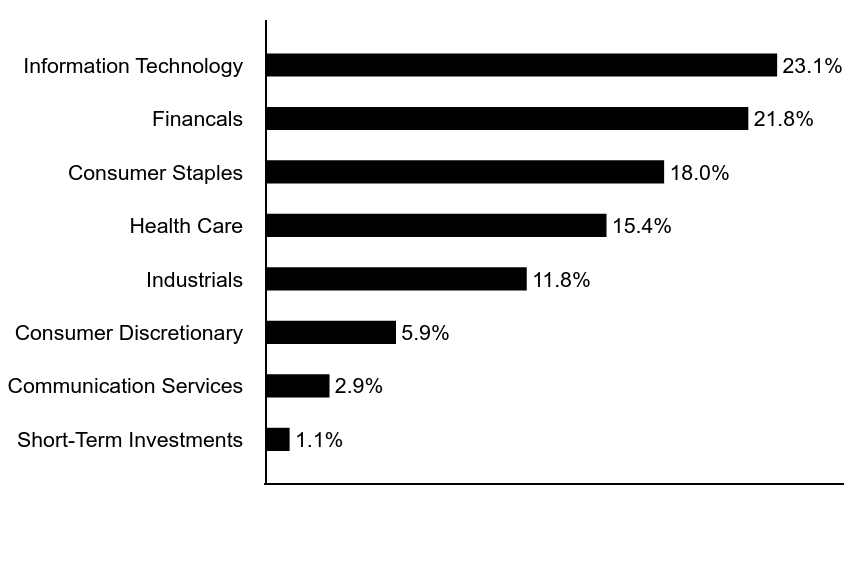

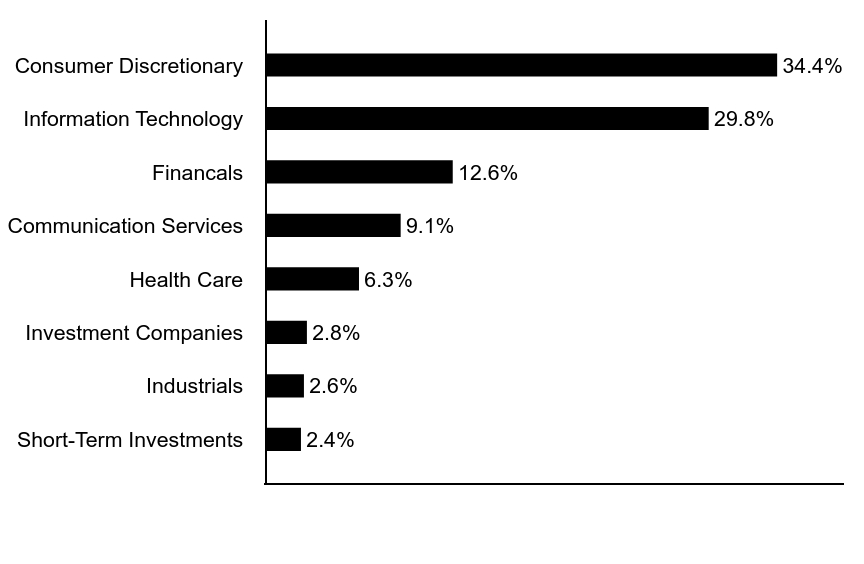

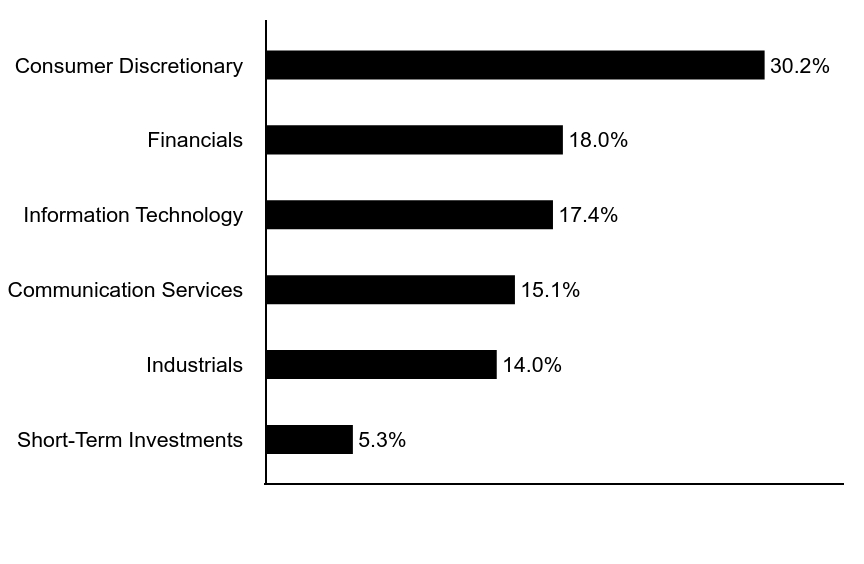

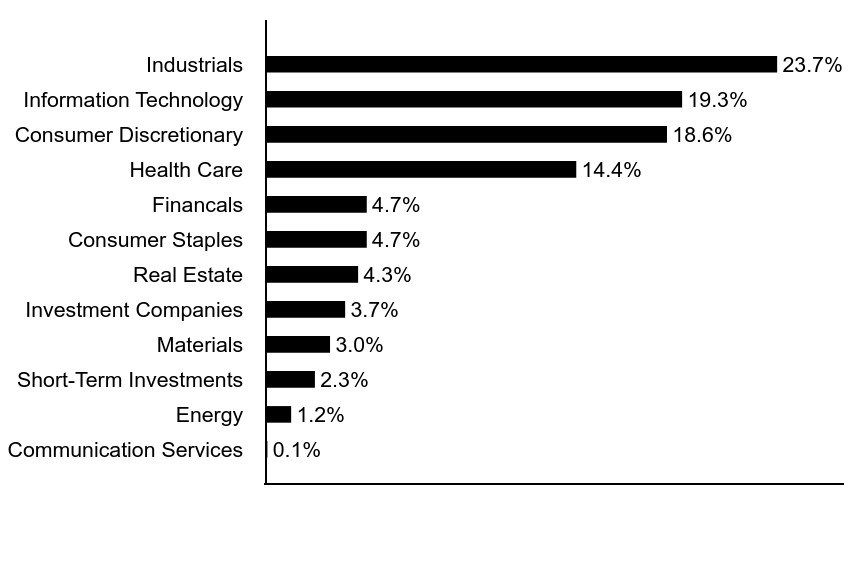

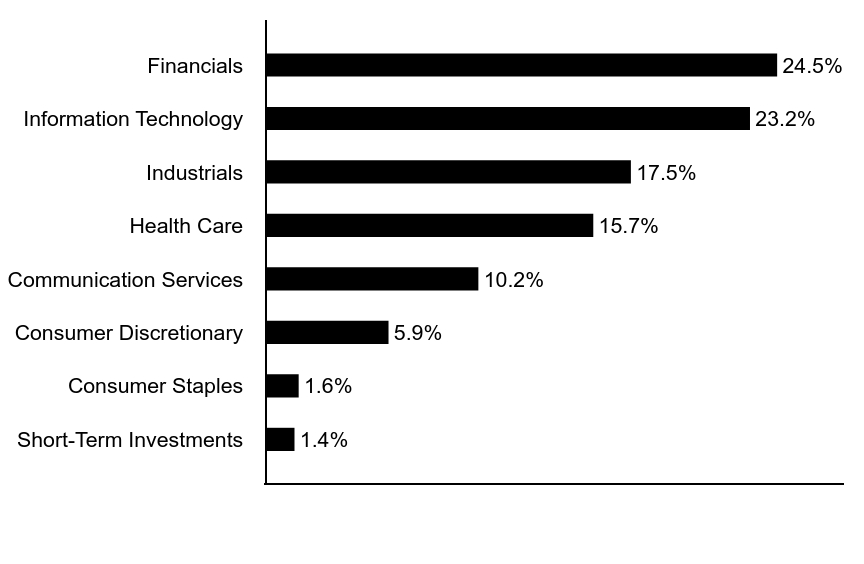

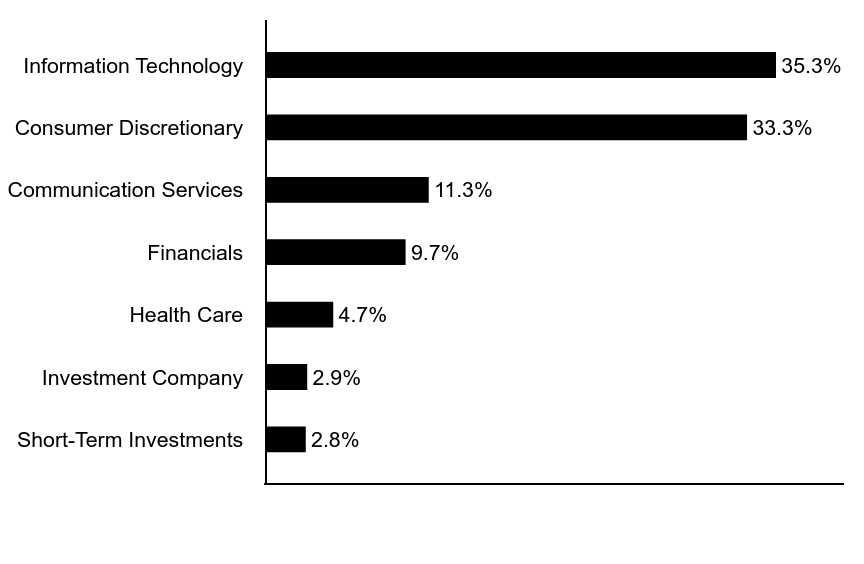

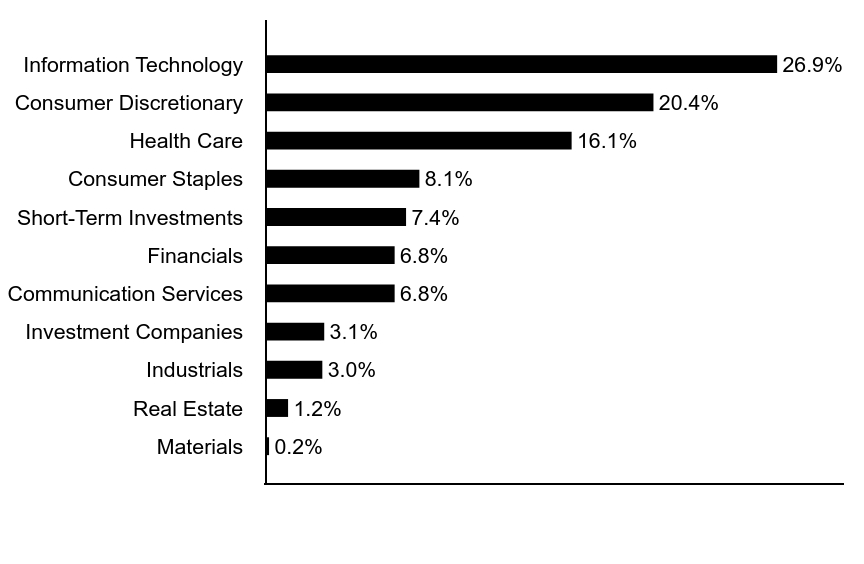

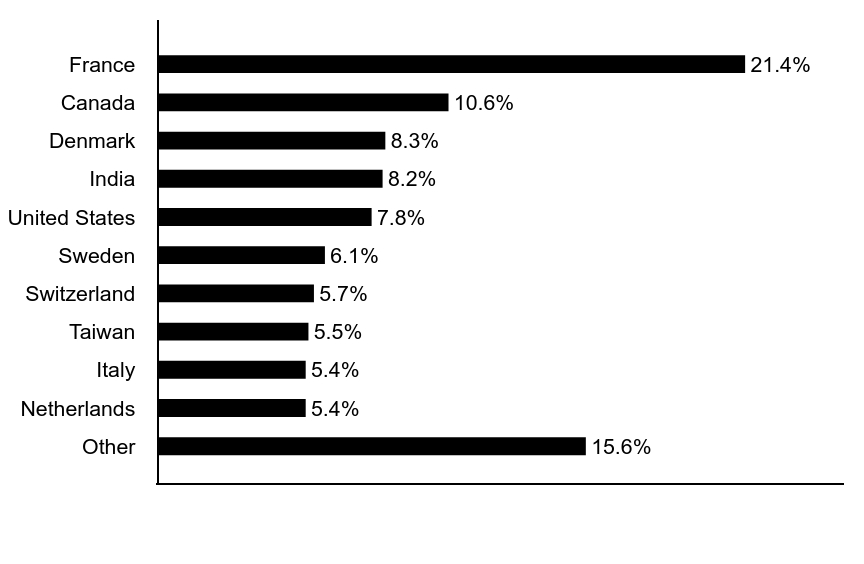

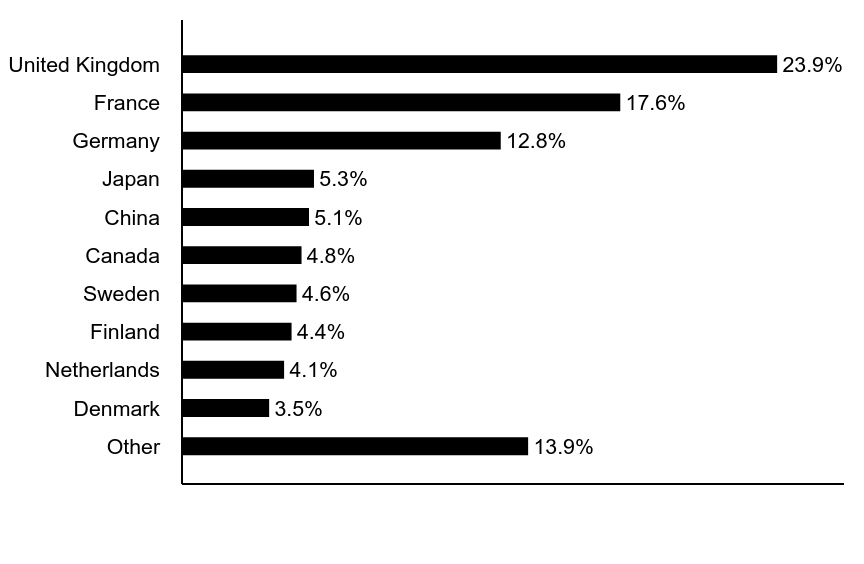

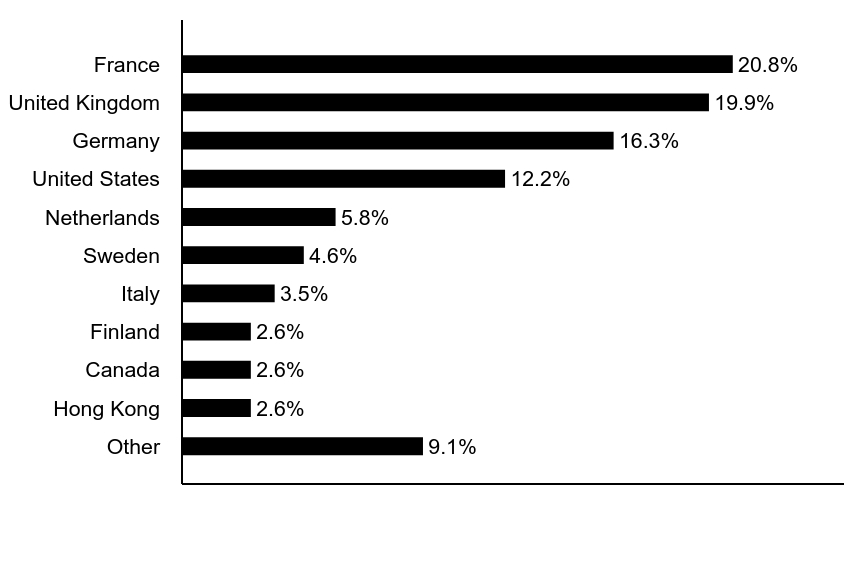

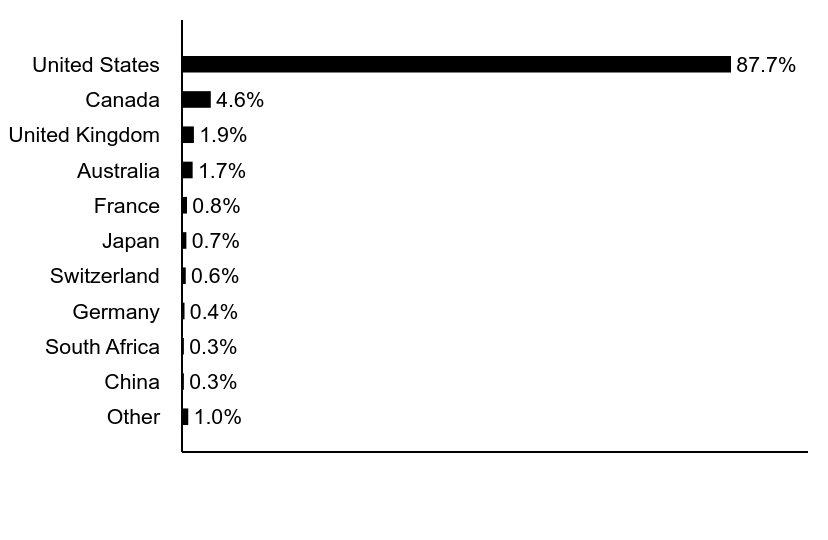

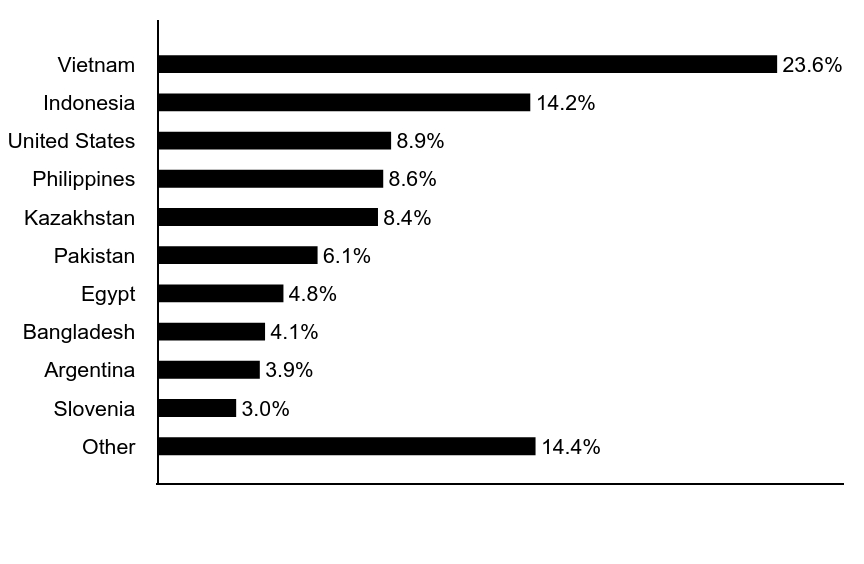

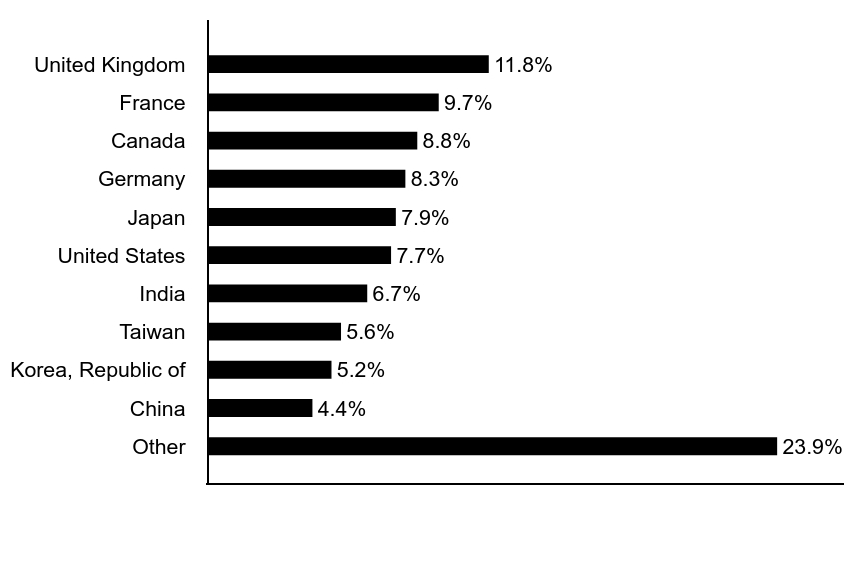

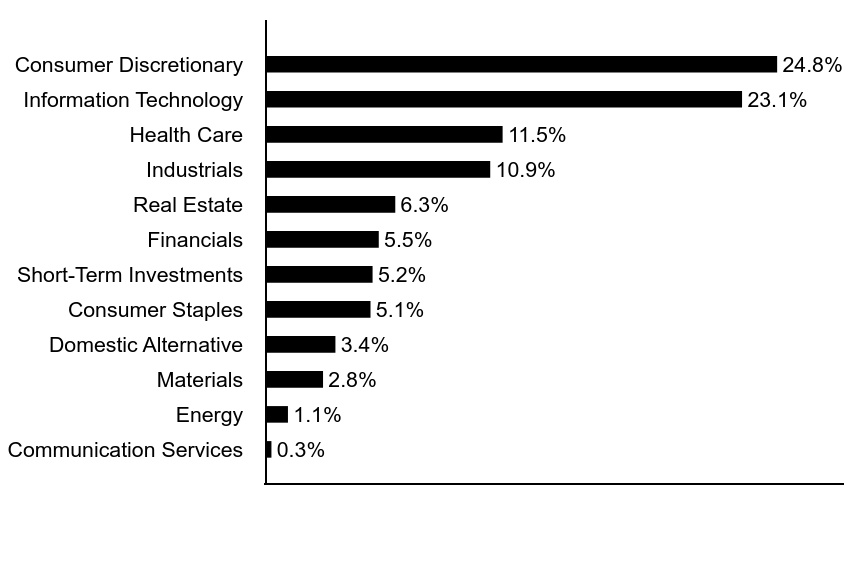

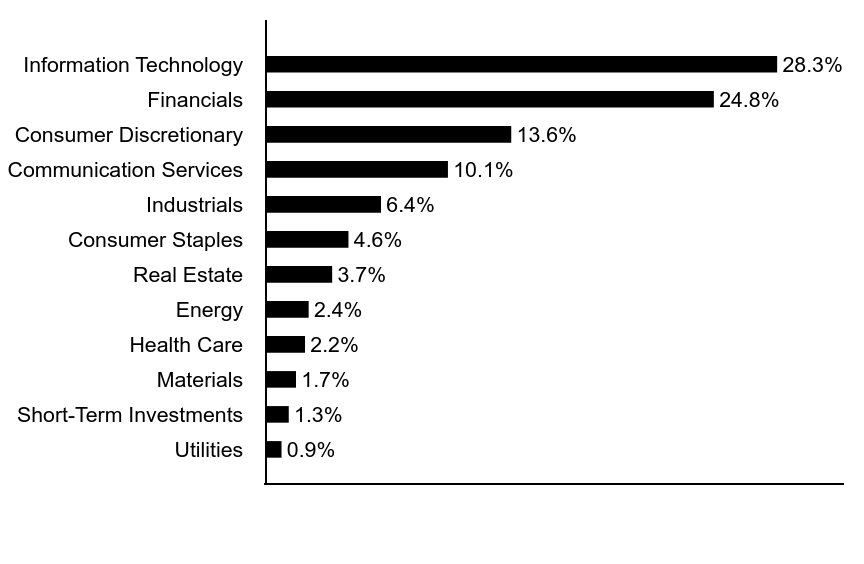

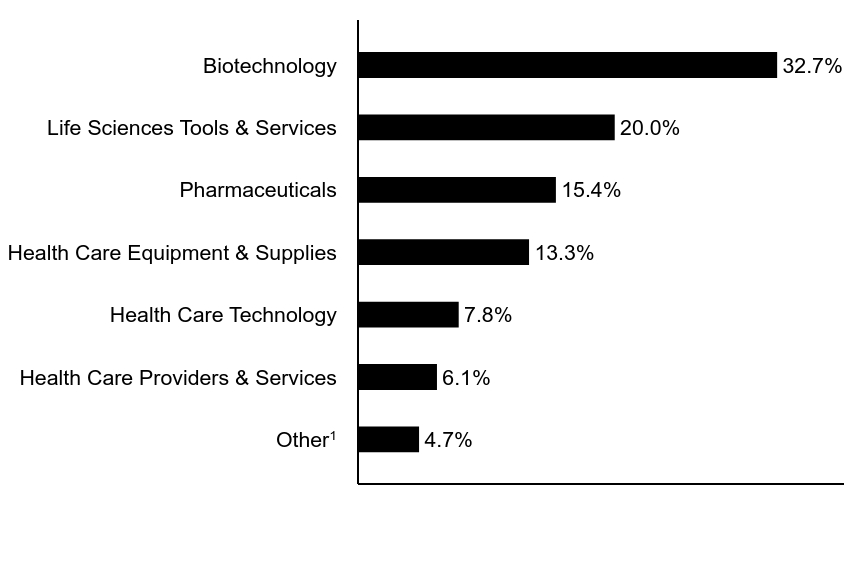

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

|---|

Real Estate | 1.6% | Short-Term Investments | 2.3% | Industrials | 2.6% | Investment Company | 3.0% | Health Care | 5.8% | Financals | 8.0% | Communication Services | 10.7% | Information Technology | 31.6% | Consumer Discretionary | 34.4% |

Top Ten Holdings (% of total investments)Footnote ReferenceaTesla, Inc. | 9.5% | Cloudflare, Inc. | 9.4% | DoorDash, Inc. | 6.4% | Shopify, Inc. | 6.3% | ROBLOX Corp. | 5.4% | Trade Desk, Inc. | 5.3% | MercadoLibre, Inc. | 4.9% | Amazon.com, Inc. | 4.9% | Snowflake, Inc. | 4.9% | Crowdstrike Holdings, Inc. | 3.7% | Total | 60.7% |

| Footnote | Description | Footnotea | Excluding cash equivalents. |

|

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

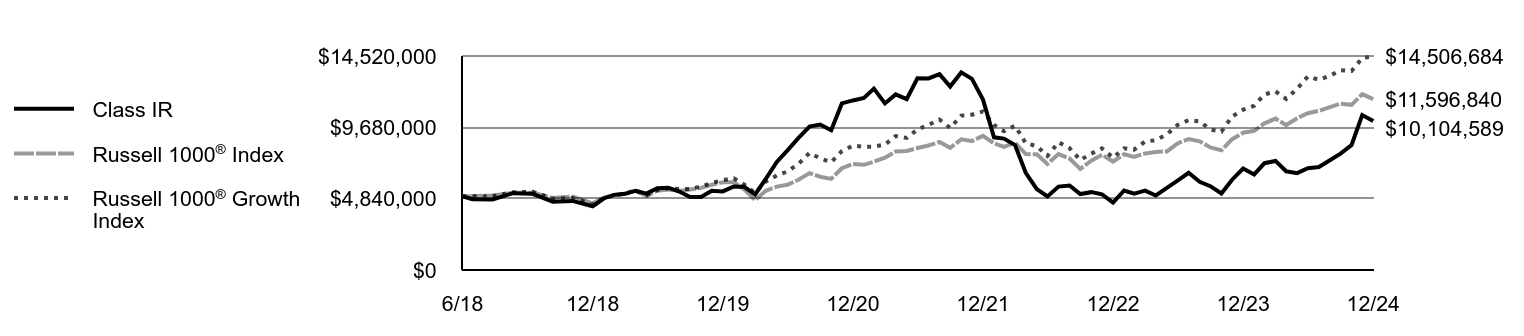

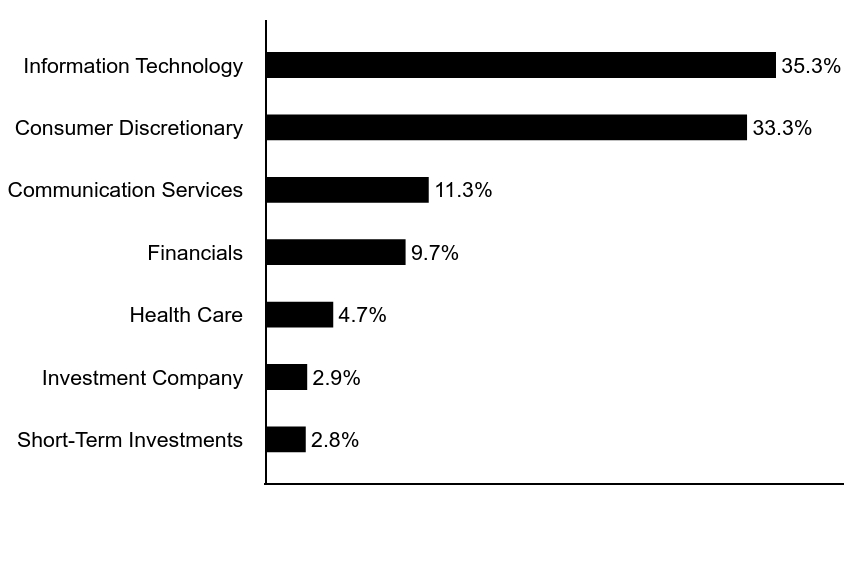

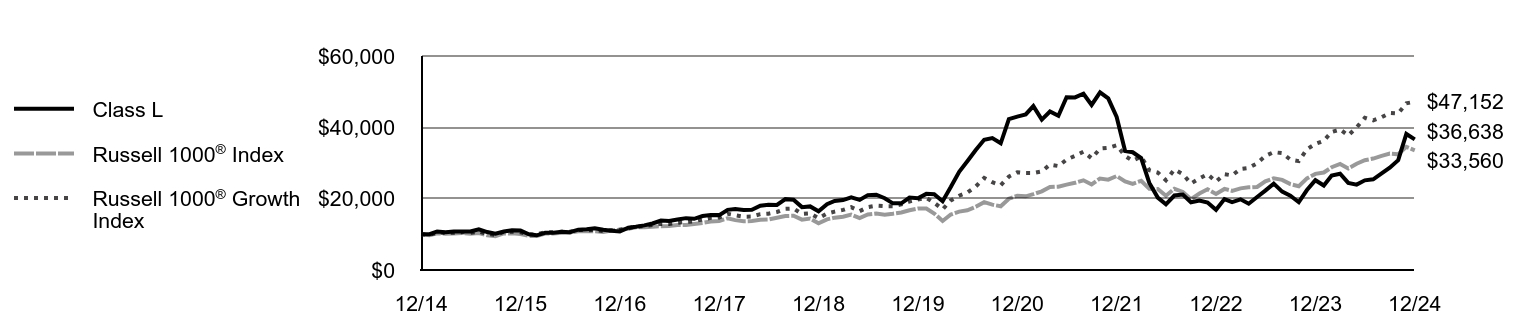

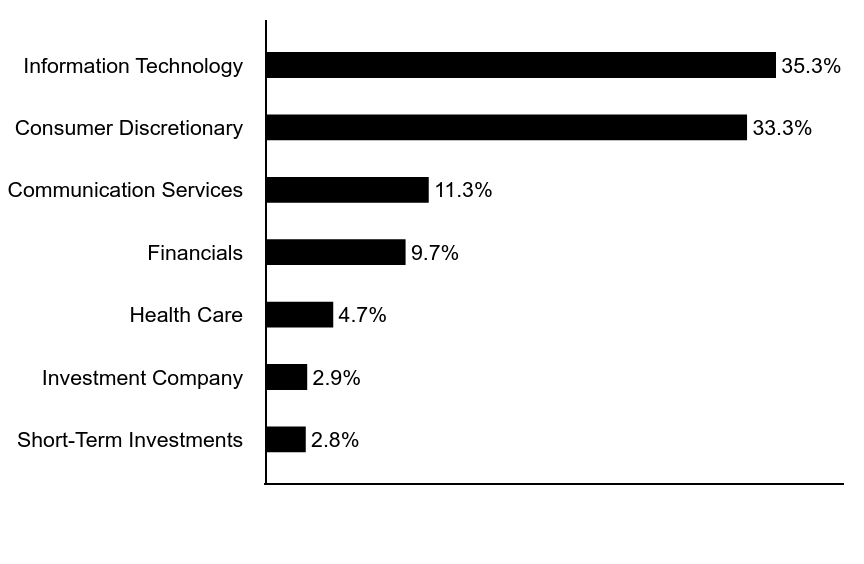

| C000085092 |

|

|

| Shareholder Report [Line Items] |

|

|

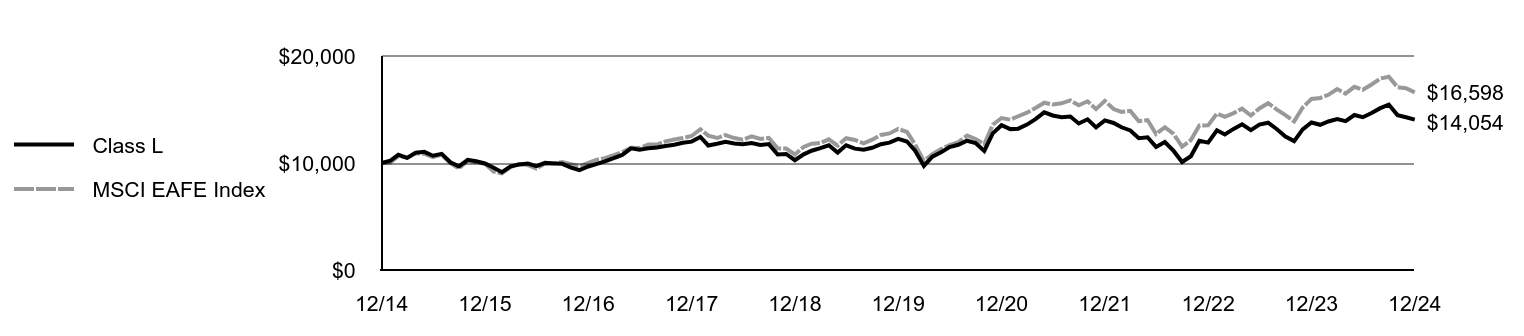

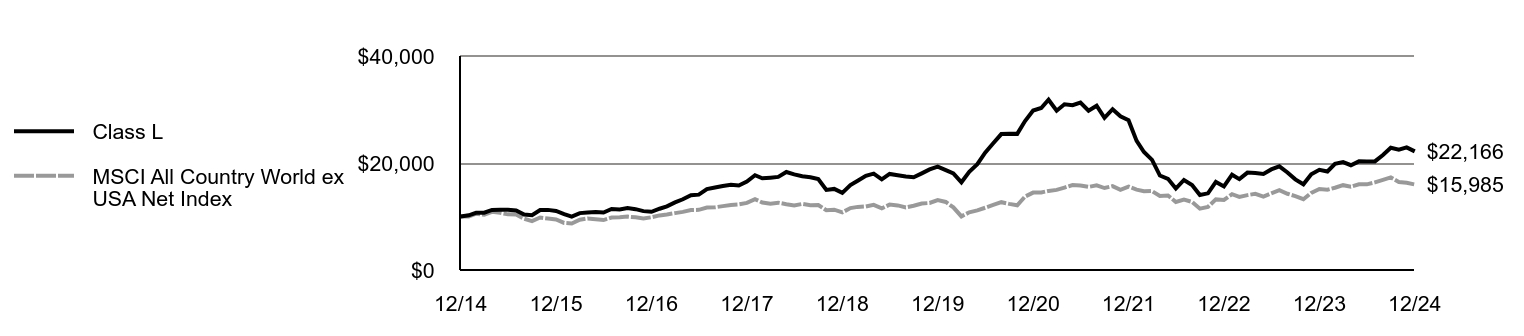

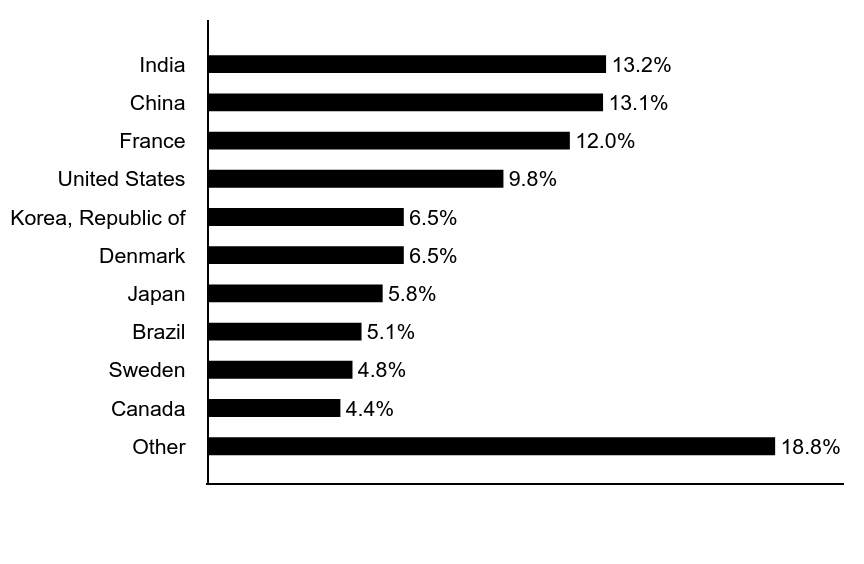

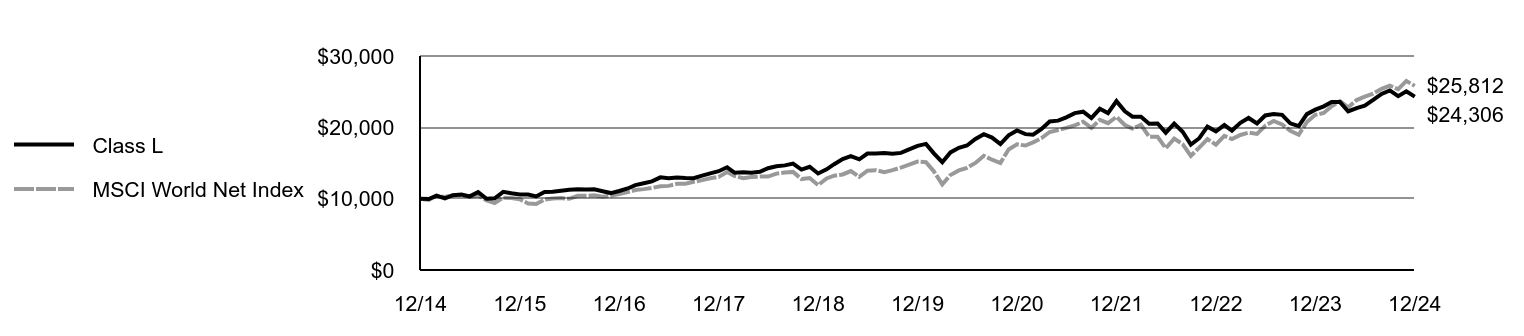

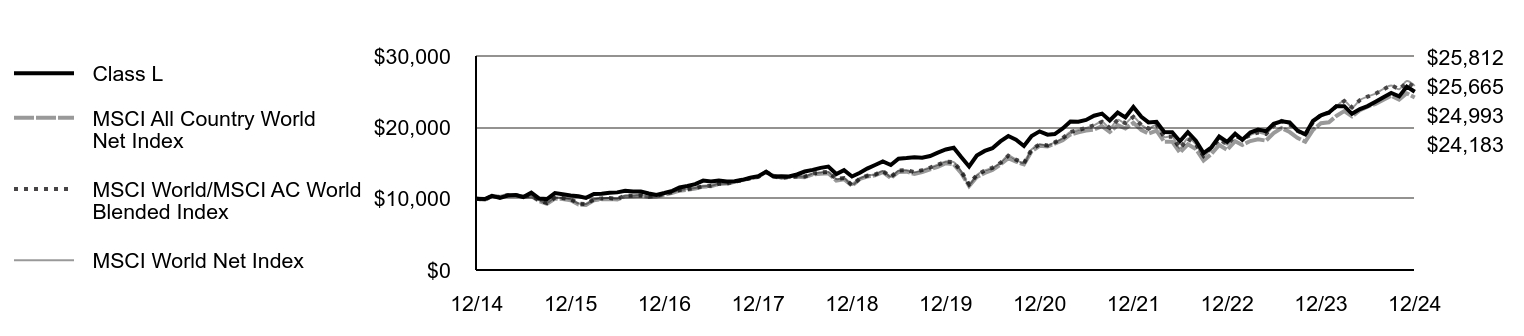

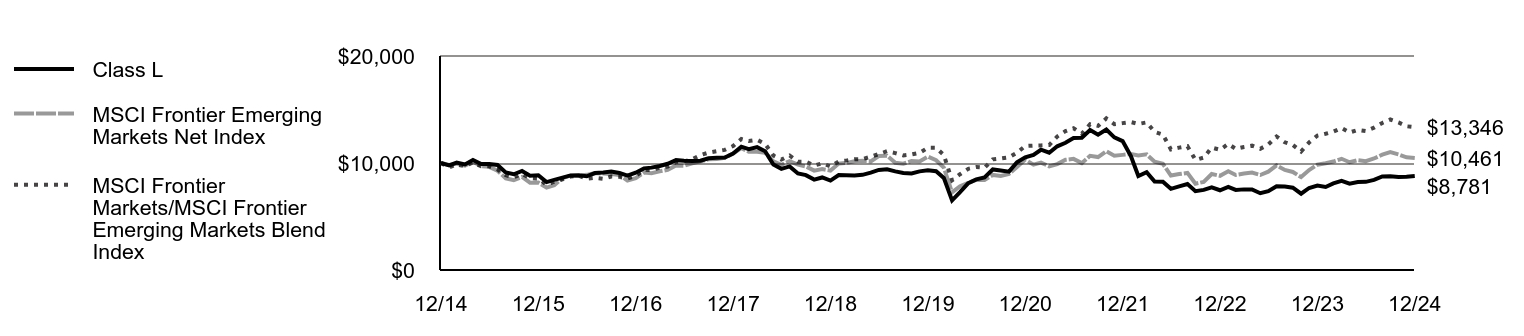

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

|

|

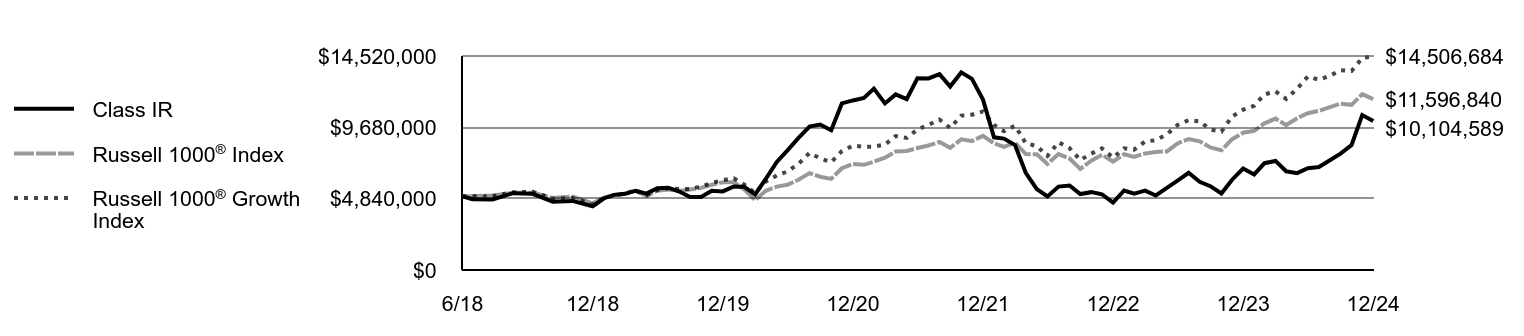

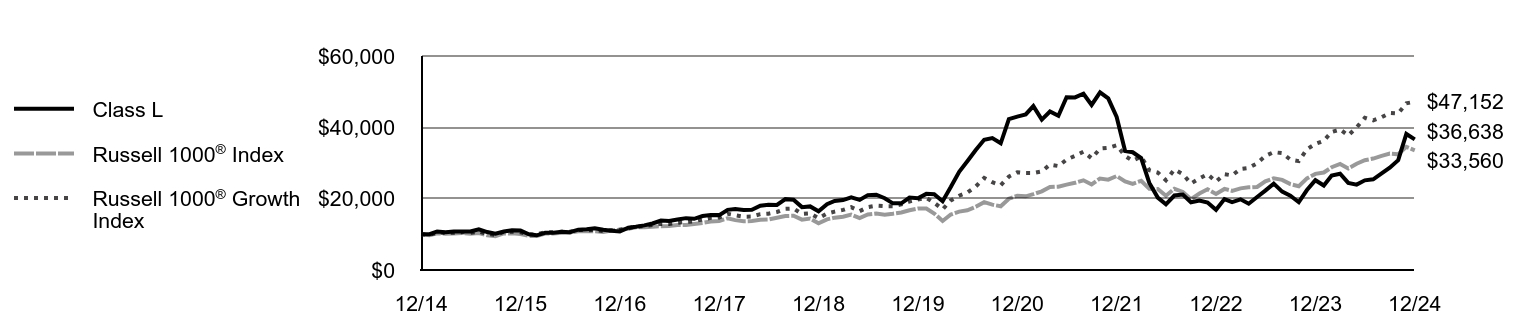

| Class Name |

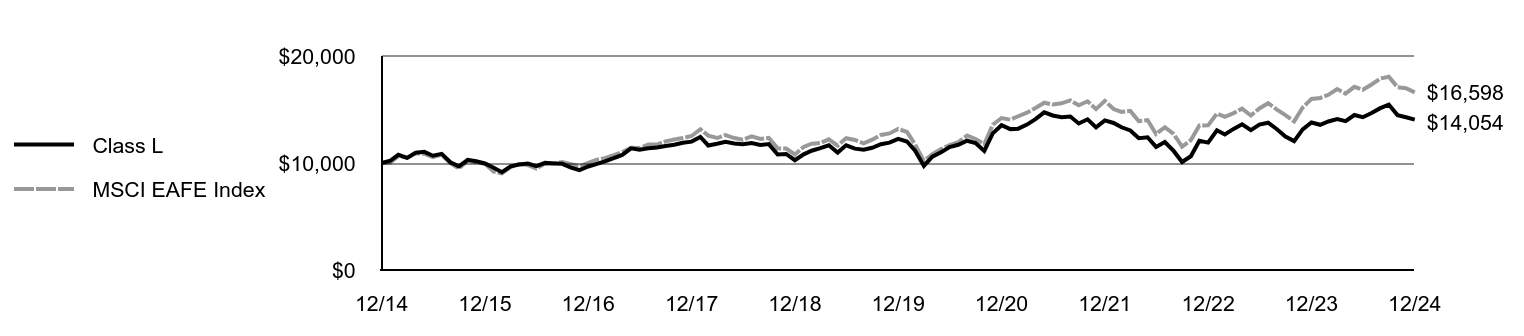

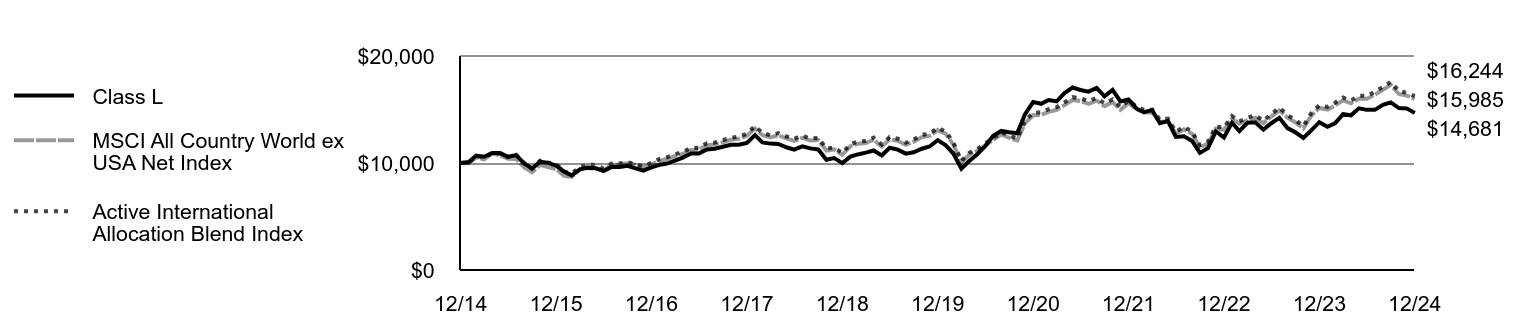

Class L

|

|

| Trading Symbol |

MAPLX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class L | $117 | 0.99% |

|---|

|

|

| Expenses Paid, Amount |

$ 117

|

|

| Expense Ratio, Percent |

0.99%

|

|

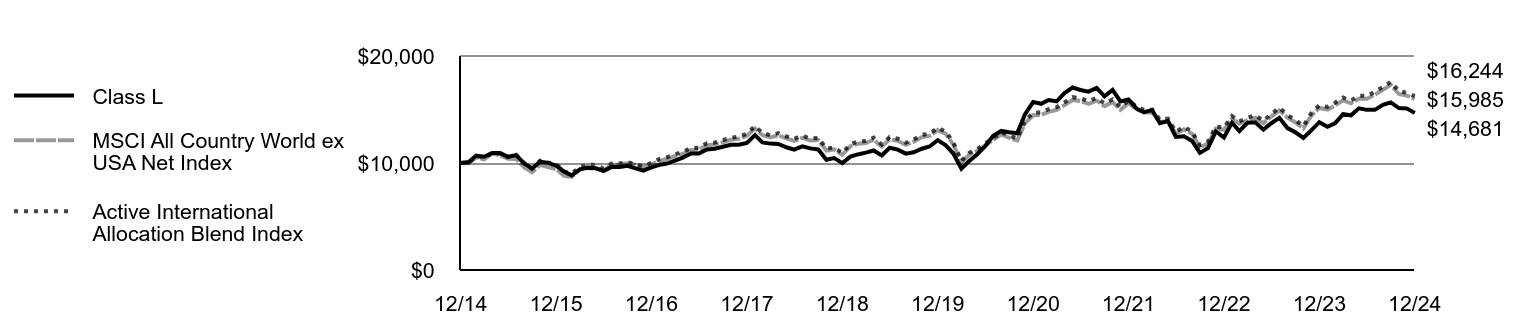

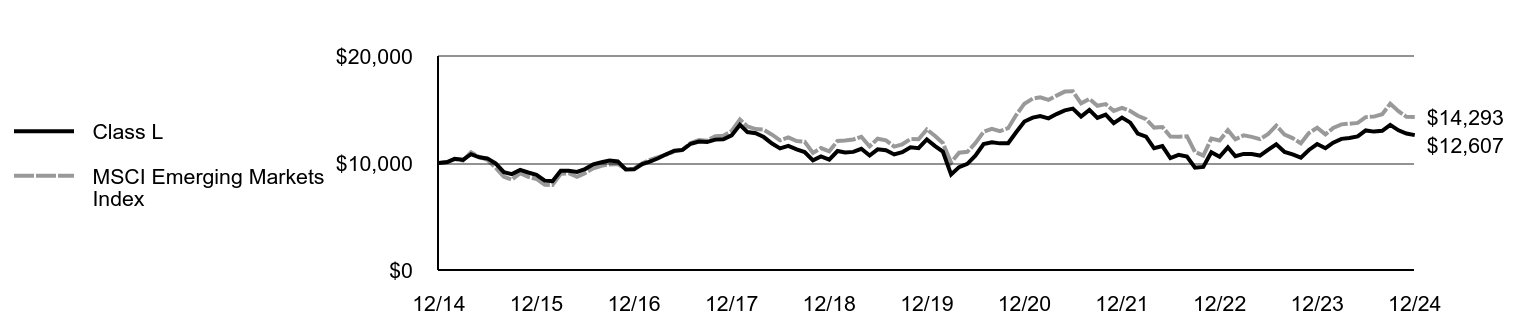

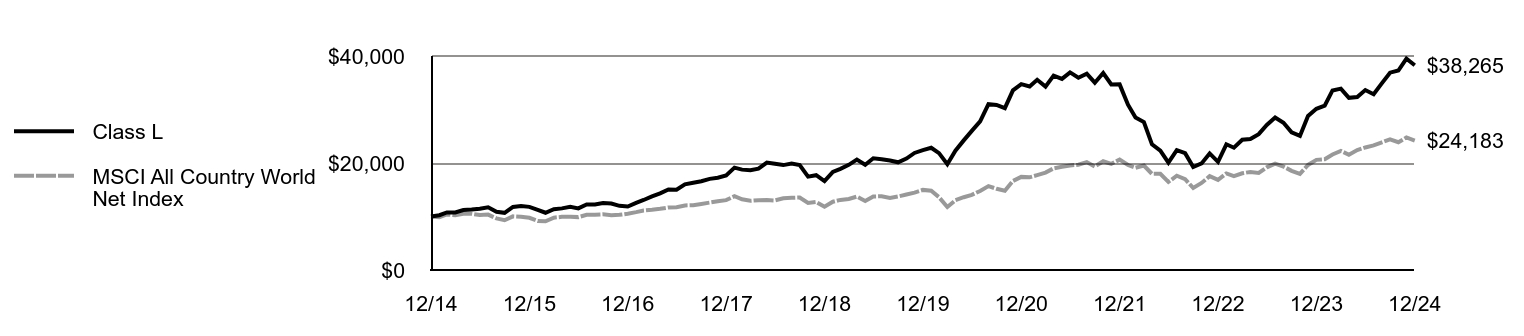

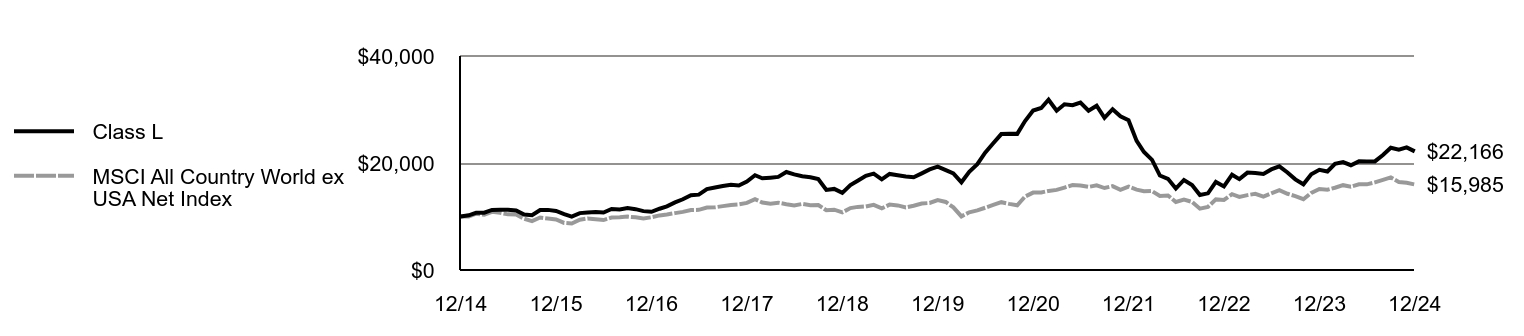

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the Russell 1000® Growth Index: ↑ Stock selection in information technology, led by a position in an enterprise analytics platform and Bitcoin developing company ↑ Average overweight and stock selection in consumer discretionary, led by a food delivery company ↑ No exposure to consumer staples, a sector that underperformed in the index ↓ Stock selection in health care, led lower by a biopharmaceutical royalties acquirer and a next-generation sequencing company (the sequencing company was sold during the period) ↓ Stock selection and average overweight in financials, ↓ Average underweight in information technology, which was one of the stronger performing sectors in the period |

|

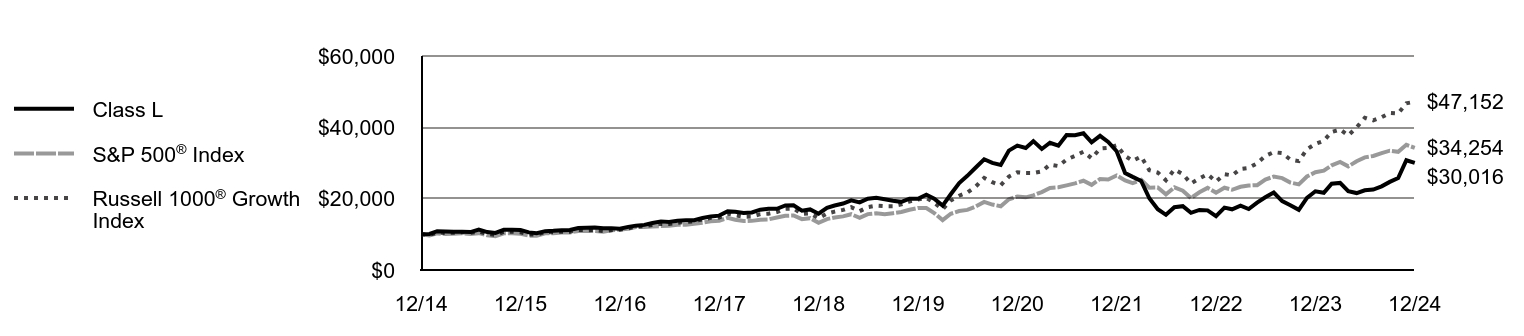

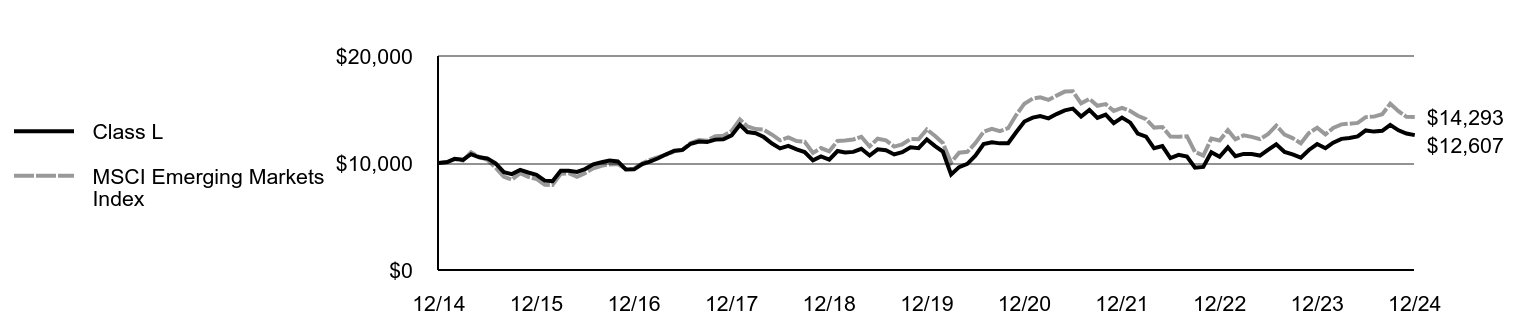

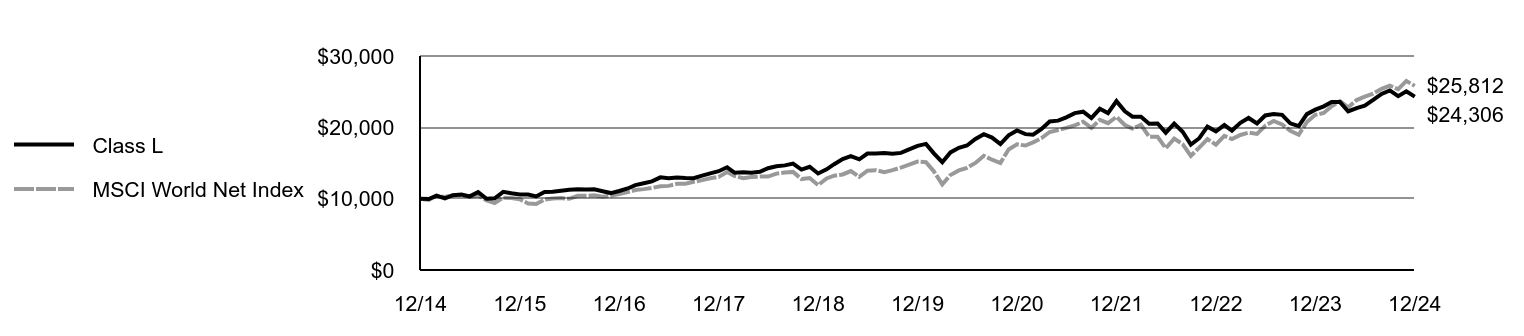

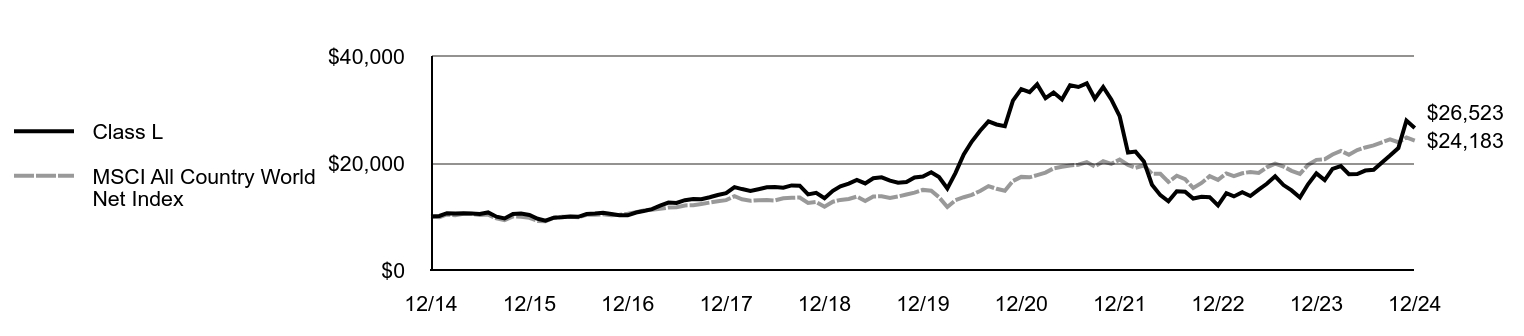

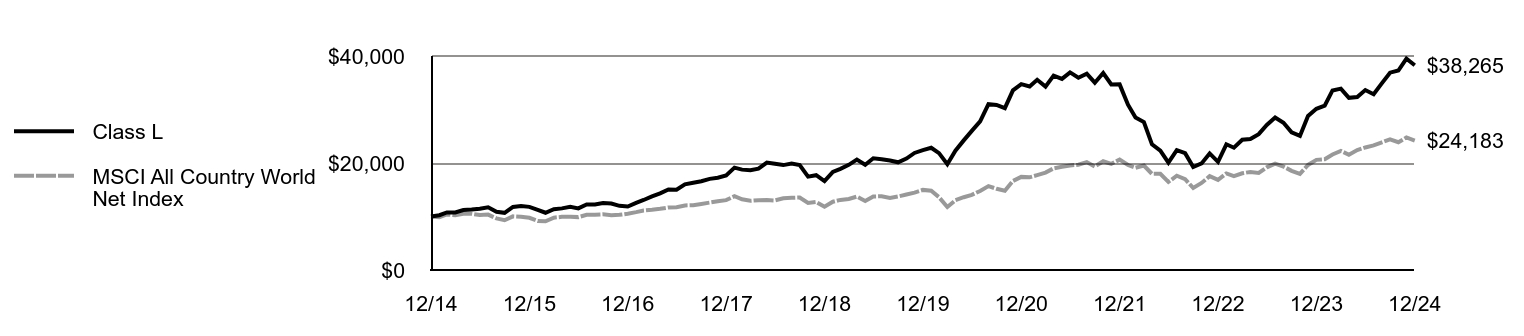

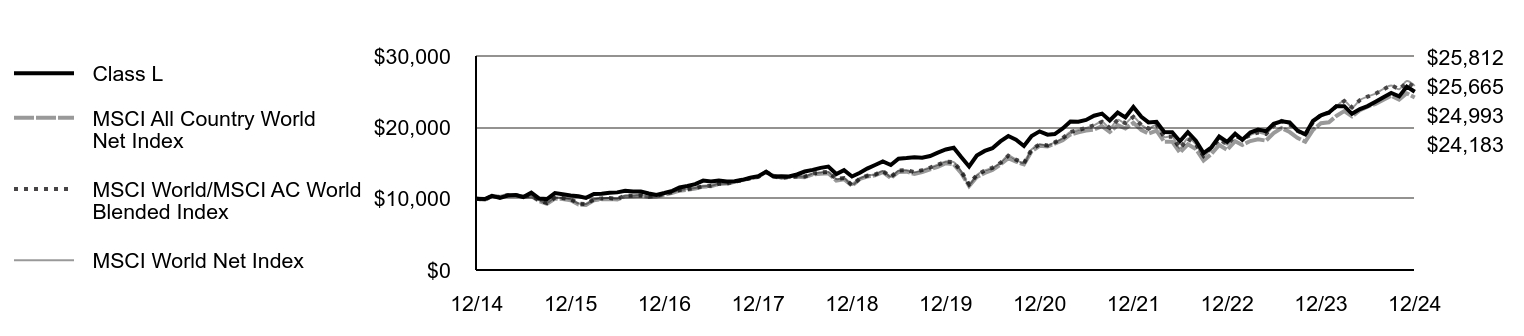

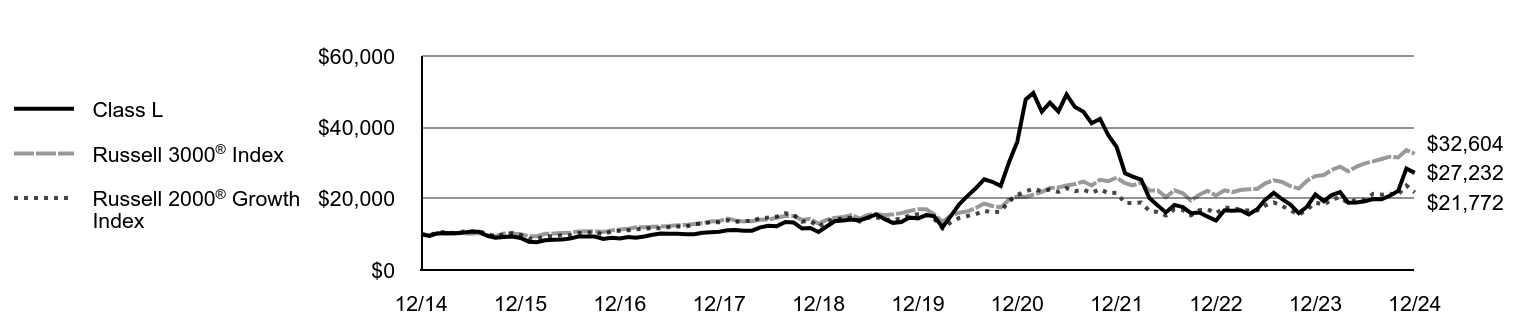

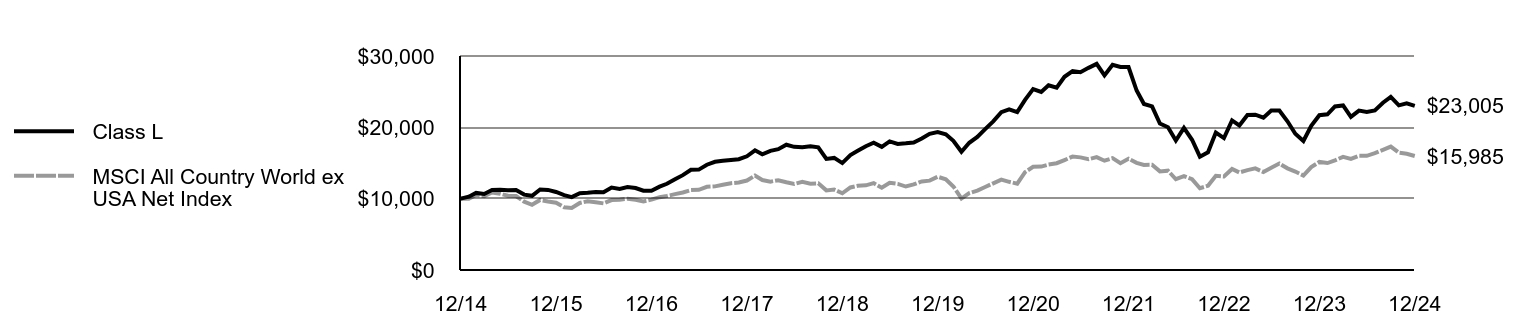

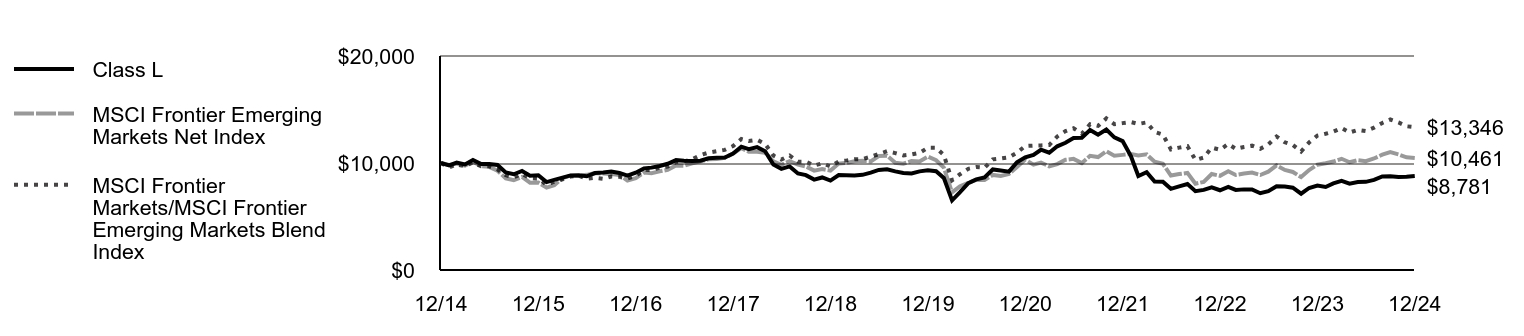

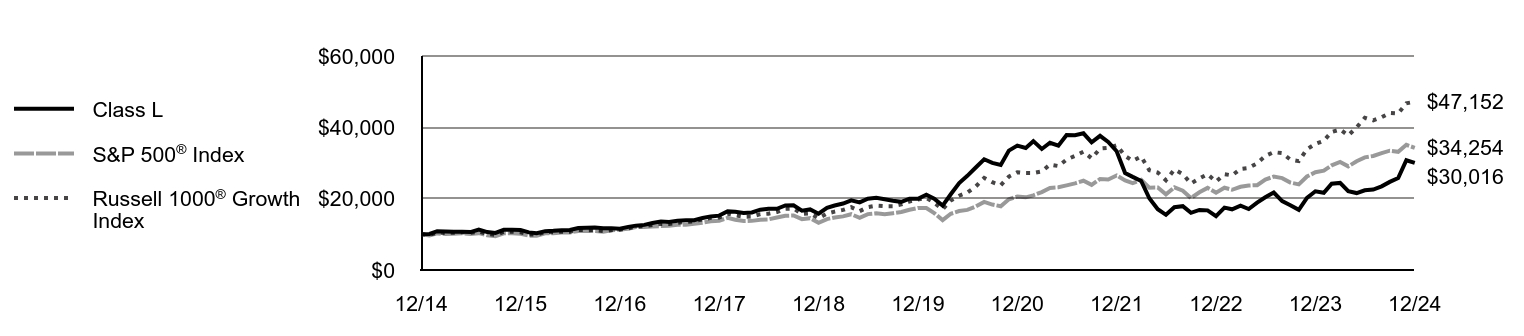

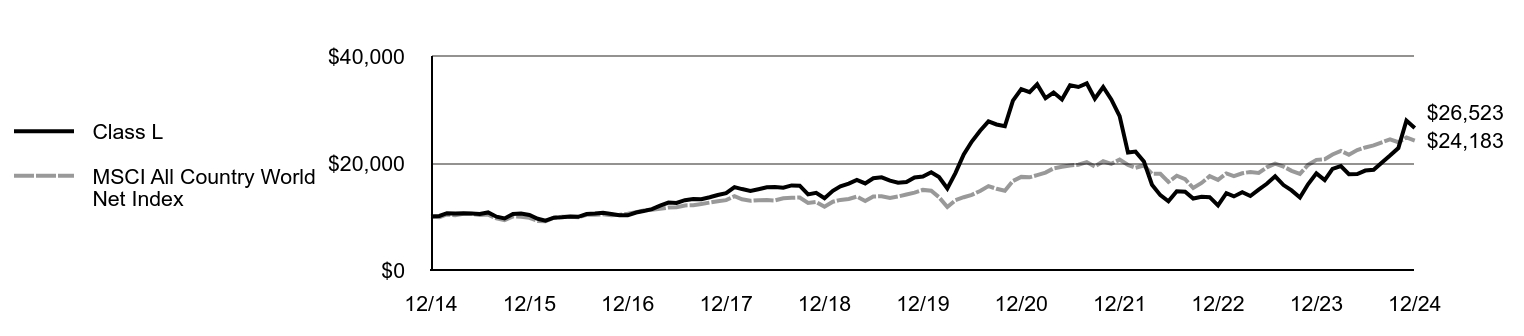

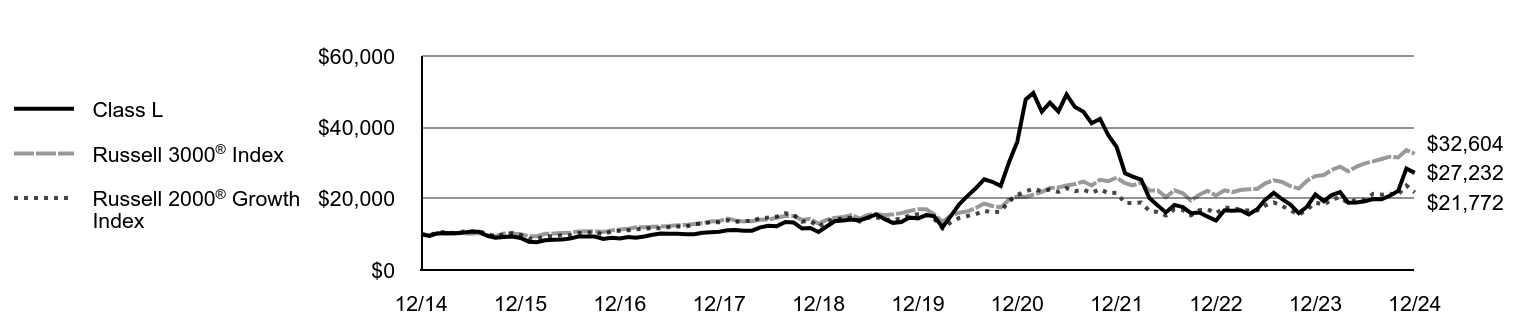

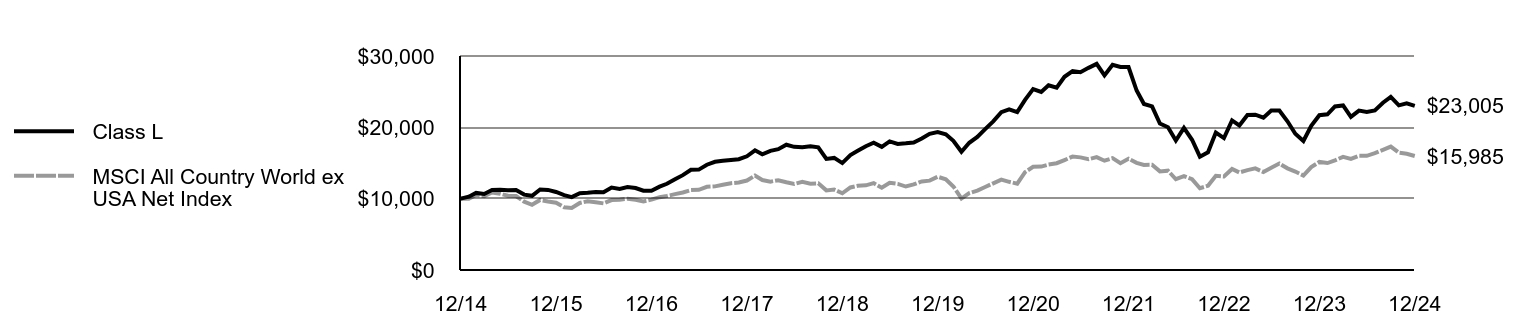

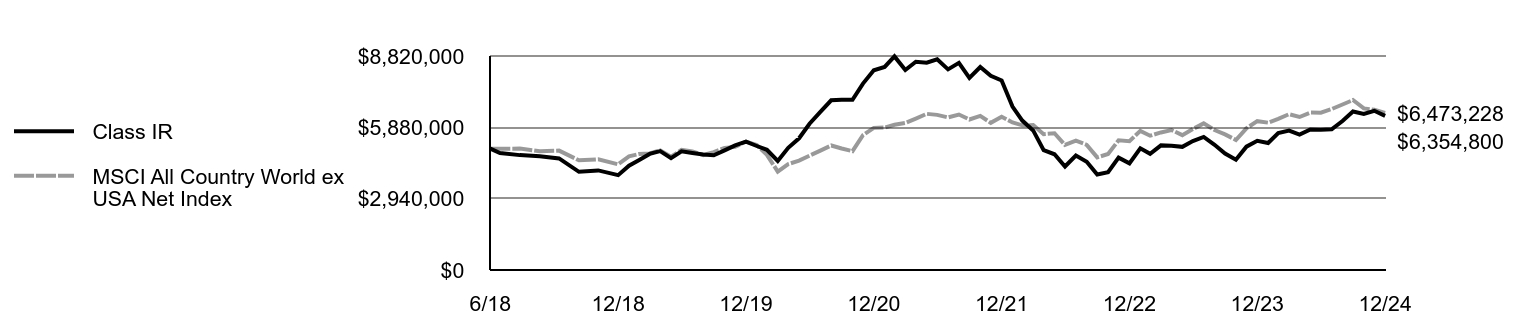

| Line Graph [Table Text Block] |

| Class L | S&P 500® Index | Russell 1000® Growth Index |

|---|

12/14 | $10,000 | $10,000 | $10,000 |

|---|

1/15 | $10,113 | $9,700 | $9,847 |

|---|

2/15 | $10,874 | $10,257 | $10,503 |

|---|

3/15 | $10,785 | $10,095 | $10,384 |

|---|

4/15 | $10,749 | $10,192 | $10,436 |

|---|

5/15 | $10,731 | $10,323 | $10,583 |

|---|

6/15 | $10,630 | $10,123 | $10,396 |

|---|

7/15 | $11,361 | $10,335 | $10,749 |

|---|

8/15 | $10,624 | $9,712 | $10,096 |

|---|

9/15 | $10,384 | $9,471 | $9,846 |

|---|

10/15 | $11,253 | $10,270 | $10,694 |

|---|

11/15 | $11,313 | $10,301 | $10,724 |

|---|

12/15 | $11,247 | $10,138 | $10,567 |

|---|

1/16 | $10,549 | $9,635 | $9,977 |

|---|

2/16 | $10,303 | $9,622 | $9,973 |

|---|

3/16 | $10,898 | $10,275 | $10,645 |

|---|

4/16 | $10,982 | $10,315 | $10,548 |

|---|

5/16 | $11,124 | $10,500 | $10,753 |

|---|

6/16 | $11,227 | $10,527 | $10,711 |

|---|

7/16 | $11,770 | $10,915 | $11,216 |

|---|

8/16 | $11,836 | $10,931 | $11,160 |

|---|

9/16 | $11,915 | $10,933 | $11,201 |

|---|

10/16 | $11,705 | $10,733 | $10,938 |

|---|

11/16 | $11,705 | $11,131 | $11,176 |

|---|

12/16 | $11,552 | $11,351 | $11,314 |

|---|

1/17 | $12,088 | $11,566 | $11,696 |

|---|

2/17 | $12,439 | $12,025 | $12,182 |

|---|

3/17 | $12,651 | $12,039 | $12,322 |

|---|

4/17 | $13,160 | $12,163 | $12,604 |

|---|

5/17 | $13,610 | $12,334 | $12,932 |

|---|

6/17 | $13,438 | $12,411 | $12,898 |

|---|

7/17 | $13,816 | $12,666 | $13,241 |

|---|

8/17 | $13,949 | $12,705 | $13,483 |

|---|

9/17 | $13,942 | $12,967 | $13,659 |

|---|

10/17 | $14,568 | $13,270 | $14,188 |

|---|

11/17 | $15,027 | $13,677 | $14,619 |

|---|

12/17 | $15,245 | $13,829 | $14,733 |

|---|

1/18 | $16,455 | $14,621 | $15,776 |

|---|

2/18 | $16,341 | $14,082 | $15,363 |

|---|

3/18 | $15,964 | $13,724 | $14,941 |

|---|

4/18 | $16,149 | $13,777 | $14,994 |

|---|

5/18 | $16,910 | $14,108 | $15,651 |

|---|

6/18 | $17,152 | $14,195 | $15,801 |

|---|

7/18 | $17,154 | $14,724 | $16,265 |

|---|

8/18 | $18,087 | $15,203 | $17,155 |

|---|

9/18 | $18,152 | $15,290 | $17,251 |

|---|

10/18 | $16,648 | $14,245 | $15,708 |

|---|

11/18 | $16,988 | $14,535 | $15,875 |

|---|

12/18 | $15,795 | $13,223 | $14,510 |

|---|

1/19 | $17,425 | $14,282 | $15,814 |

|---|

2/19 | $18,090 | $14,741 | $16,380 |

|---|

3/19 | $18,633 | $15,027 | $16,846 |

|---|

4/19 | $19,547 | $15,636 | $17,607 |

|---|

5/19 | $18,951 | $14,642 | $16,495 |

|---|

6/19 | $19,985 | $15,674 | $17,628 |

|---|

7/19 | $20,249 | $15,899 | $18,026 |

|---|

8/19 | $19,819 | $15,648 | $17,888 |

|---|

9/19 | $19,419 | $15,940 | $17,890 |

|---|

10/19 | $19,109 | $16,286 | $18,394 |

|---|

11/19 | $20,008 | $16,877 | $19,210 |

|---|

12/19 | $19,970 | $17,386 | $19,790 |

|---|

1/20 | $21,117 | $17,379 | $20,232 |

|---|

2/20 | $19,993 | $15,949 | $18,854 |

|---|

3/20 | $18,039 | $13,979 | $17,000 |

|---|

4/20 | $21,248 | $15,771 | $19,515 |

|---|

5/20 | $24,364 | $16,522 | $20,825 |

|---|

6/20 | $26,396 | $16,850 | $21,732 |

|---|

7/20 | $28,735 | $17,801 | $23,404 |

|---|

8/20 | $31,044 | $19,080 | $25,819 |

|---|

9/20 | $30,036 | $18,355 | $24,604 |

|---|

10/20 | $29,428 | $17,867 | $23,769 |

|---|

11/20 | $33,476 | $19,823 | $26,203 |

|---|

12/20 | $34,877 | $20,585 | $27,408 |

|---|

1/21 | $34,196 | $20,377 | $27,205 |

|---|

2/21 | $36,125 | $20,939 | $27,199 |

|---|

3/21 | $33,929 | $21,856 | $27,666 |

|---|

4/21 | $35,671 | $23,022 | $29,548 |

|---|

5/21 | $34,836 | $23,183 | $29,140 |

|---|

6/21 | $37,827 | $23,724 | $30,968 |

|---|

7/21 | $37,770 | $24,288 | $31,988 |

|---|

8/21 | $38,329 | $25,026 | $33,184 |

|---|

9/21 | $35,801 | $23,863 | $31,326 |

|---|

10/21 | $37,624 | $25,534 | $34,039 |

|---|

11/21 | $35,922 | $25,357 | $34,247 |

|---|

12/21 | $33,294 | $26,494 | $34,971 |

|---|

1/22 | $27,207 | $25,123 | $31,970 |

|---|

2/22 | $26,107 | $24,371 | $30,612 |

|---|

3/22 | $24,958 | $25,276 | $31,809 |

|---|

4/22 | $20,100 | $23,071 | $27,968 |

|---|

5/22 | $17,042 | $23,114 | $27,318 |

|---|

6/22 | $15,473 | $21,206 | $25,154 |

|---|

7/22 | $17,592 | $23,161 | $28,173 |

|---|

8/22 | $17,891 | $22,217 | $26,861 |

|---|

9/22 | $16,042 | $20,170 | $24,249 |

|---|

10/22 | $16,842 | $21,804 | $25,667 |

|---|

11/22 | $16,722 | $23,022 | $26,836 |

|---|

12/22 | $15,113 | $21,696 | $24,782 |

|---|

1/23 | $17,489 | $23,059 | $26,847 |

|---|

2/23 | $17,021 | $22,496 | $26,528 |

|---|

3/23 | $18,020 | $23,322 | $28,342 |

|---|

4/23 | $17,097 | $23,686 | $28,621 |

|---|

5/23 | $18,879 | $23,789 | $29,926 |

|---|

6/23 | $20,383 | $25,361 | $31,972 |

|---|

7/23 | $21,735 | $26,176 | $33,050 |

|---|

8/23 | $19,321 | $25,759 | $32,753 |

|---|

9/23 | $18,171 | $24,531 | $30,972 |

|---|

10/23 | $16,870 | $24,015 | $30,531 |

|---|

11/23 | $20,231 | $26,208 | $33,859 |

|---|

12/23 | $22,076 | $27,399 | $35,358 |

|---|

1/24 | $21,634 | $27,859 | $36,240 |

|---|

2/24 | $24,199 | $29,347 | $38,713 |

|---|

3/24 | $24,414 | $30,291 | $39,394 |

|---|

4/24 | $22,088 | $29,054 | $37,723 |

|---|

5/24 | $21,570 | $30,494 | $39,981 |

|---|

6/24 | $22,354 | $31,589 | $42,677 |

|---|

7/24 | $22,569 | $31,973 | $41,951 |

|---|

8/24 | $23,466 | $32,749 | $42,825 |

|---|

9/24 | $24,704 | $33,448 | $44,038 |

|---|

10/24 | $25,766 | $33,145 | $43,893 |

|---|

11/24 | $30,770 | $35,090 | $46,740 |

|---|

12/24 | $30,016 | $34,254 | $47,152 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | 5 Years | 10 Years |

|---|

Class L | 35.97% | 8.49% | 11.62% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 16.78% |

|---|

|

|

| AssetsNet |

$ 194,996,435

|

|

| Holdings Count | Holding |

28

|

|

| Advisory Fees Paid, Amount |

$ 877,326

|

|

| InvestmentCompanyPortfolioTurnover |

57.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $194,996,435 |

|---|

# of Portfolio Holdings | 28 |

|---|

Portfolio Turnover Rate | 57% |

|---|

Total Advisory Fees Paid | $877,326 |

|---|

|

|

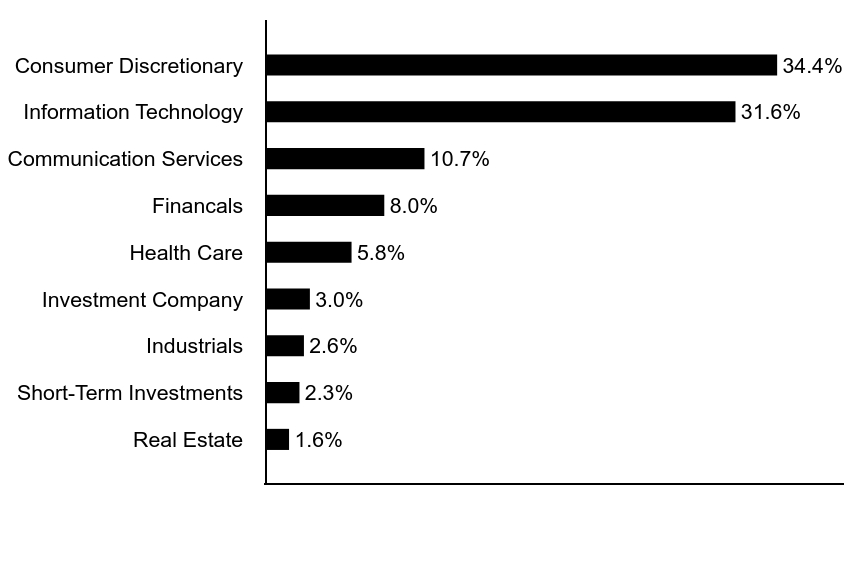

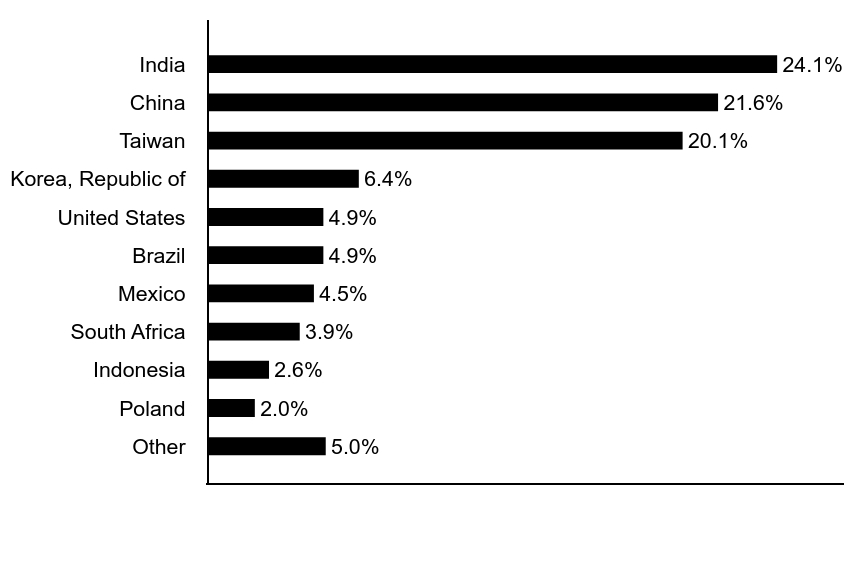

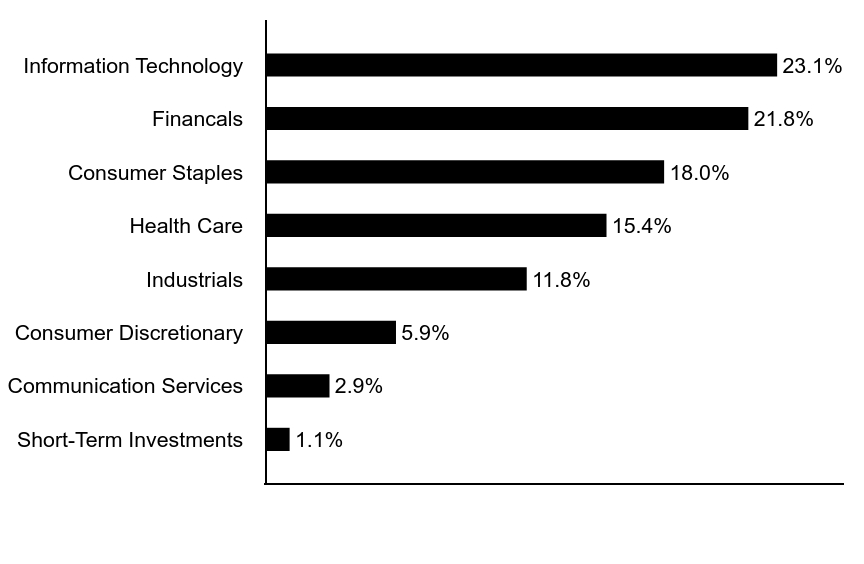

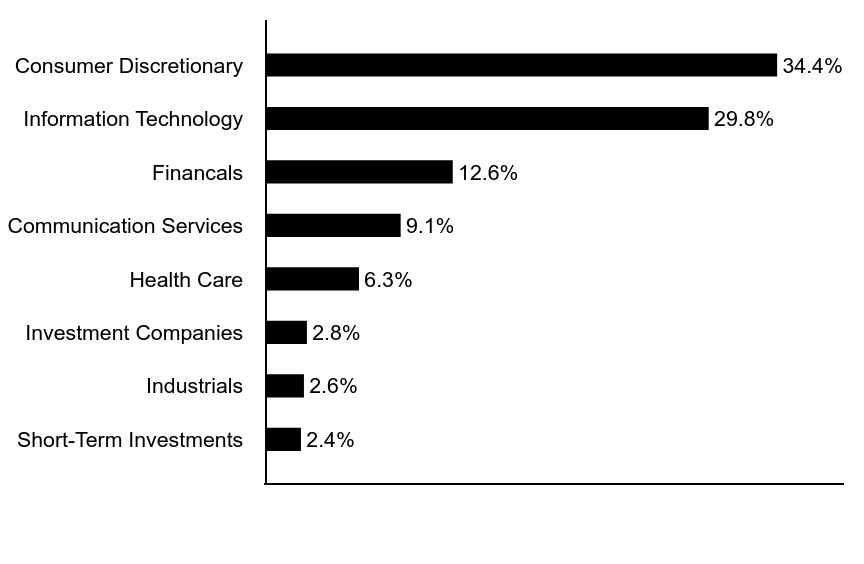

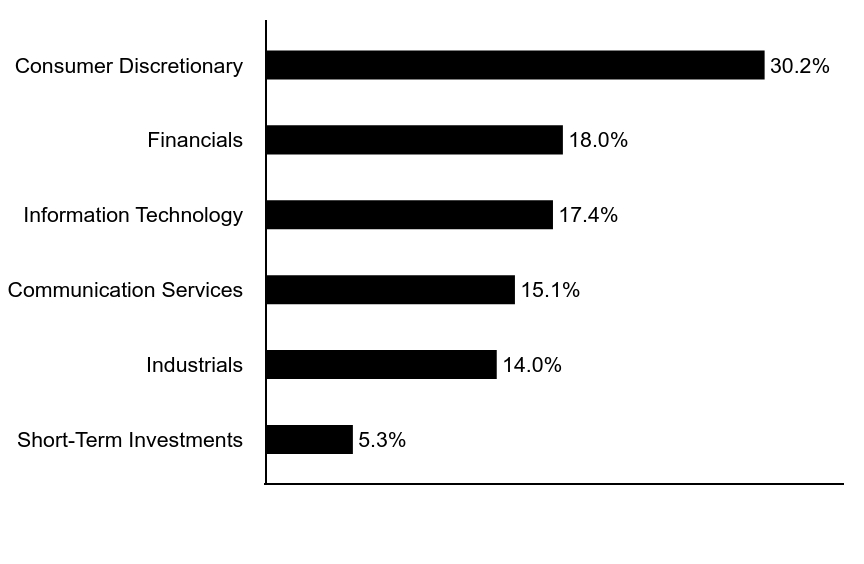

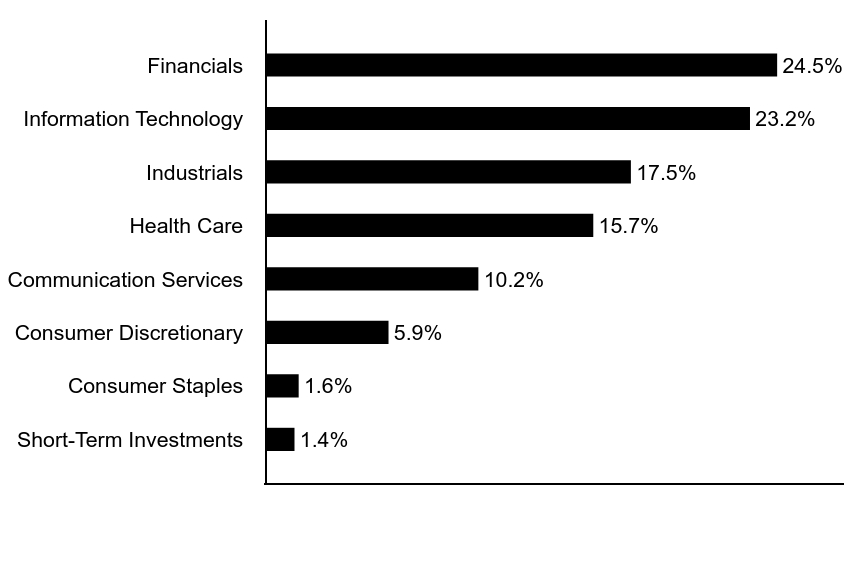

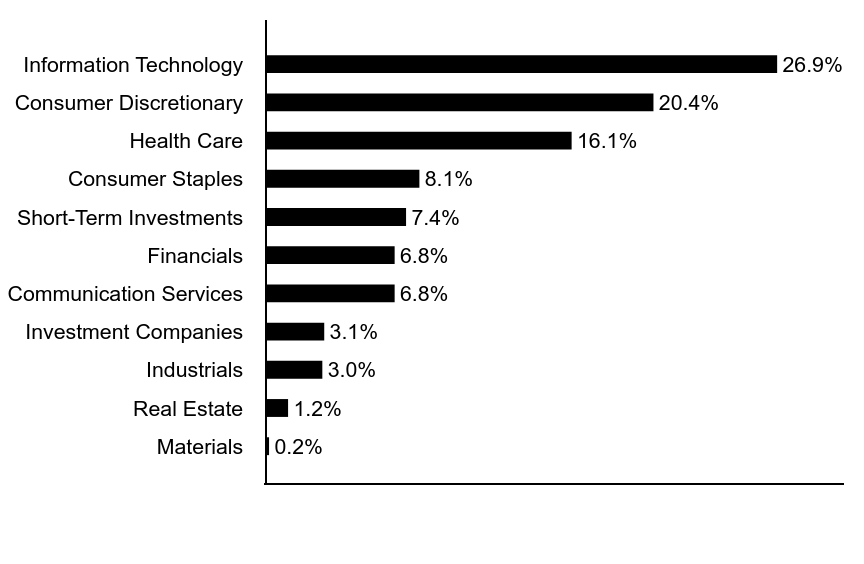

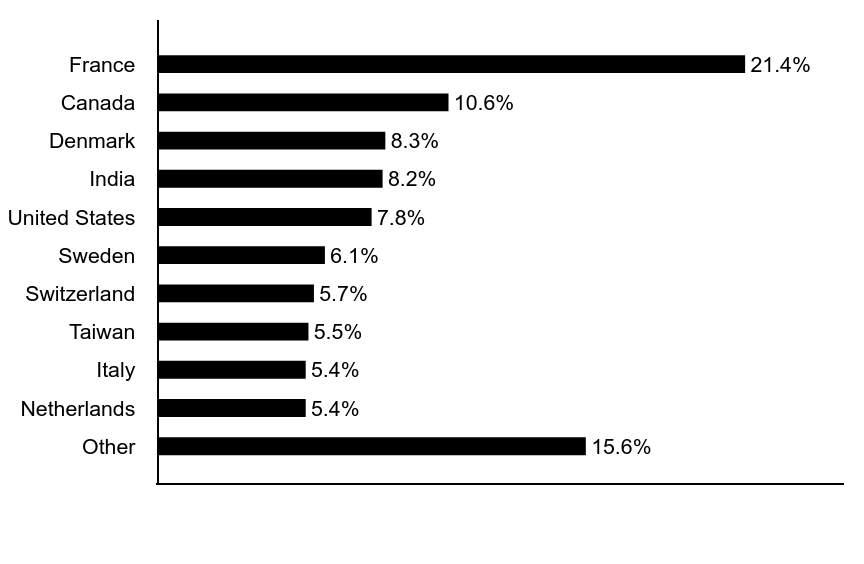

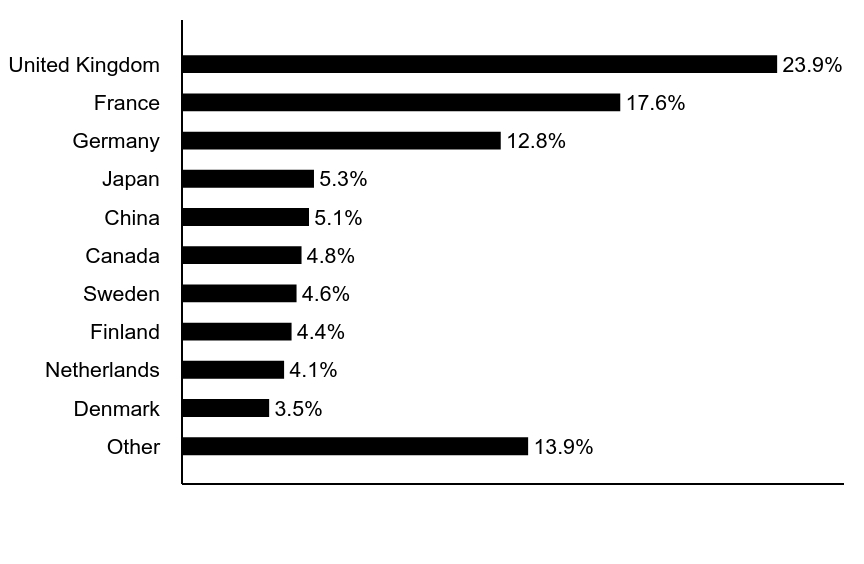

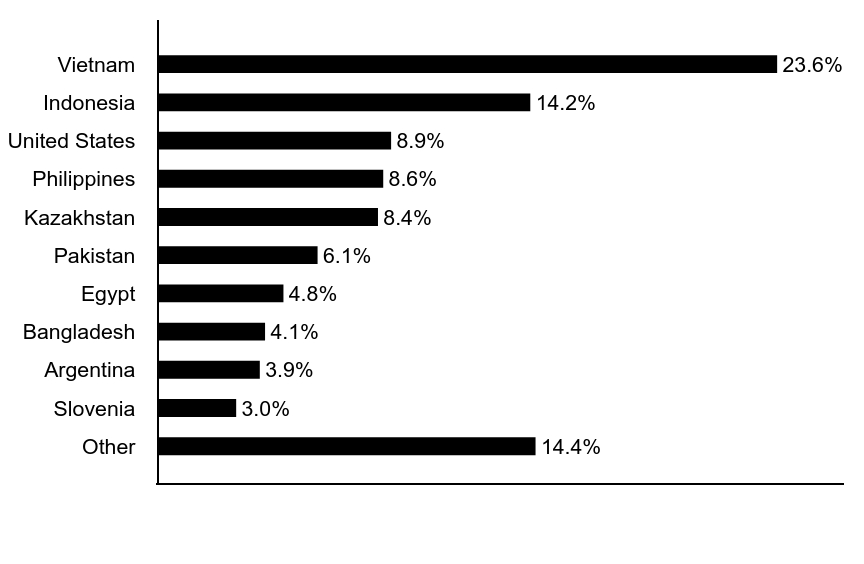

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

|---|

Real Estate | 1.6% | Short-Term Investments | 2.3% | Industrials | 2.6% | Investment Company | 3.0% | Health Care | 5.8% | Financals | 8.0% | Communication Services | 10.7% | Information Technology | 31.6% | Consumer Discretionary | 34.4% |

Top Ten Holdings (% of total investments)Footnote ReferenceaTesla, Inc. | 9.5% | Cloudflare, Inc. | 9.4% | DoorDash, Inc. | 6.4% | Shopify, Inc. | 6.3% | ROBLOX Corp. | 5.4% | Trade Desk, Inc. | 5.3% | MercadoLibre, Inc. | 4.9% | Amazon.com, Inc. | 4.9% | Snowflake, Inc. | 4.9% | Crowdstrike Holdings, Inc. | 3.7% | Total | 60.7% |

| Footnote | Description | Footnotea | Excluding cash equivalents. |

|

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

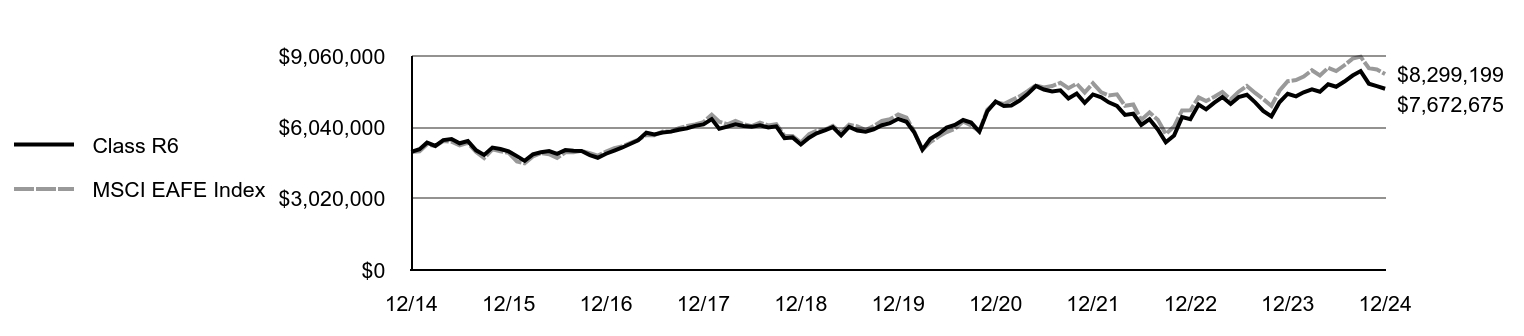

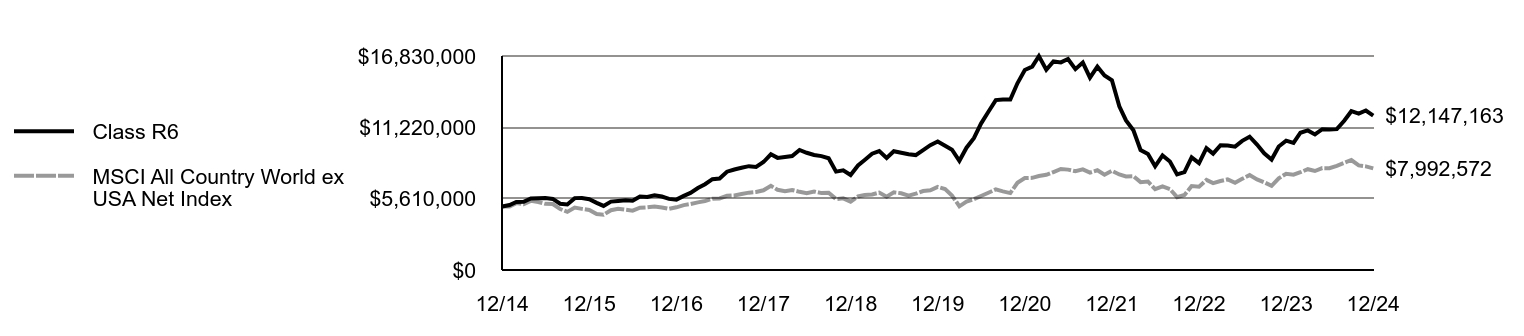

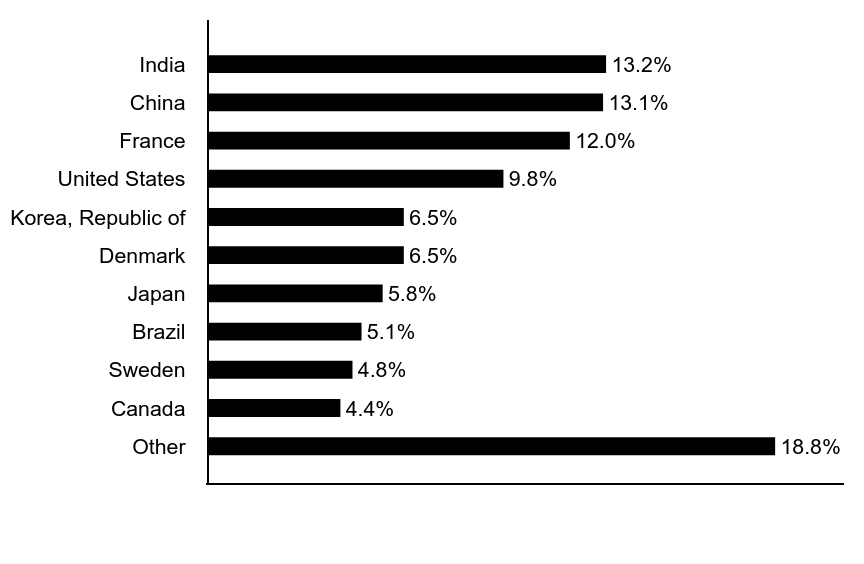

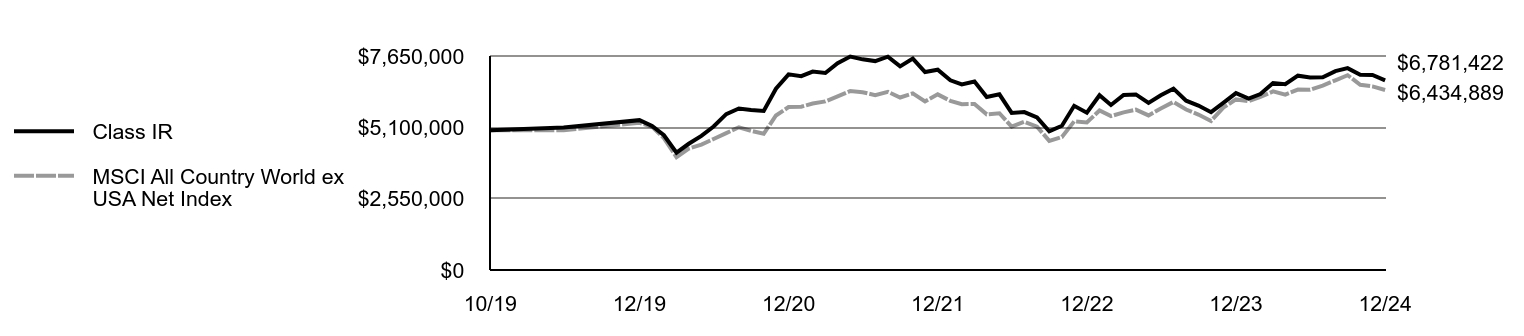

| C000126919 |

|

|

| Shareholder Report [Line Items] |

|

|

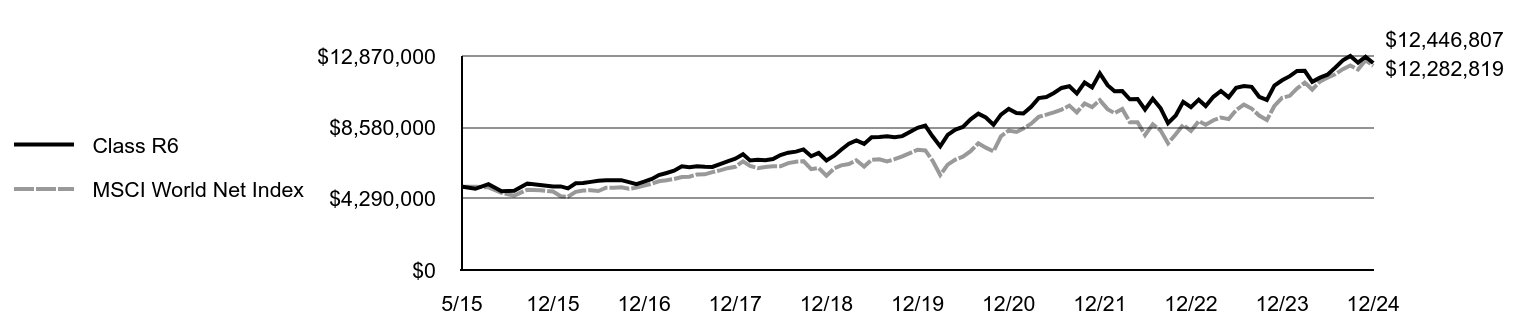

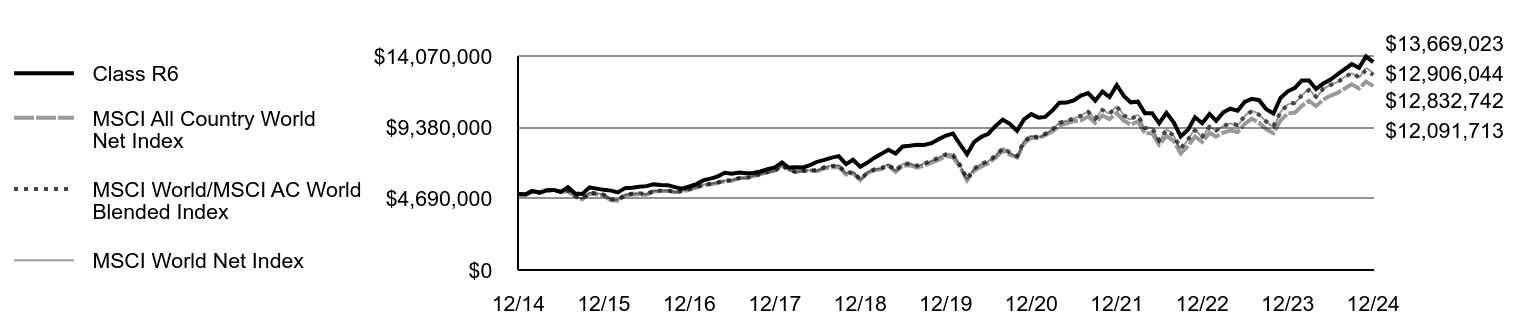

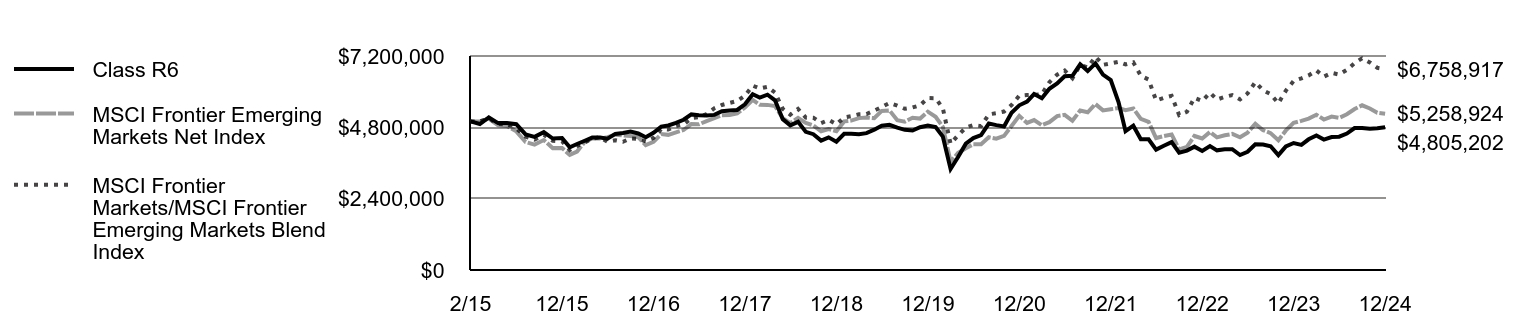

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

|

|

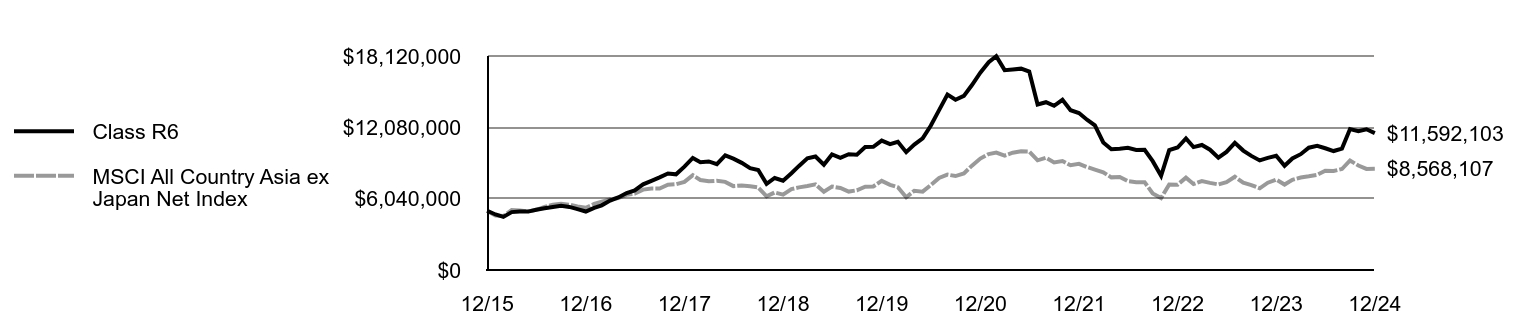

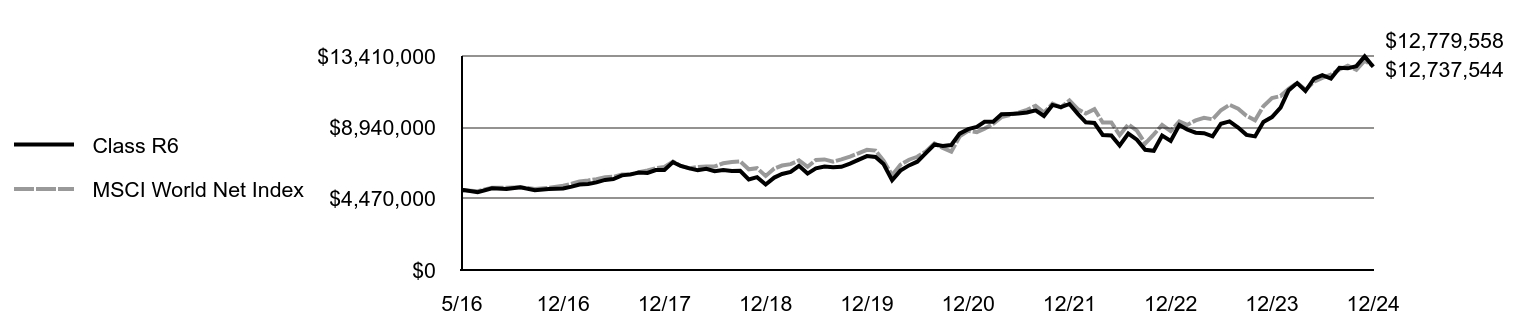

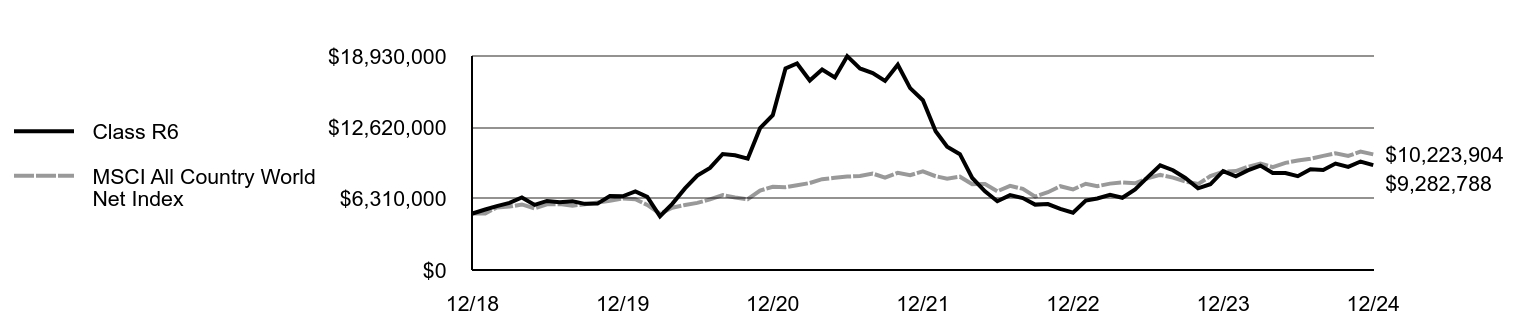

| Class Name |

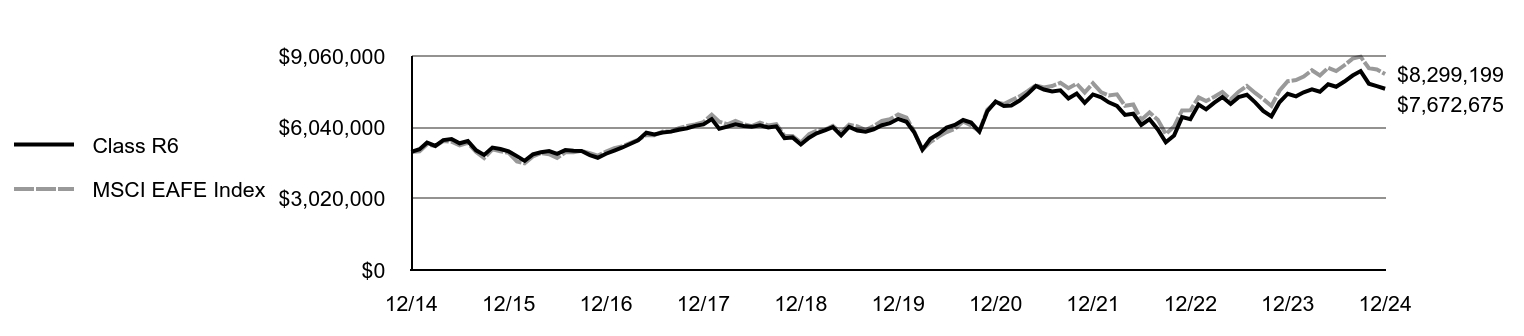

Class R6

|

|

| Trading Symbol |

MADSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R6 | $96 | 0.81% |

|---|

|

|

| Expenses Paid, Amount |

$ 96

|

|

| Expense Ratio, Percent |

0.81%

|

|

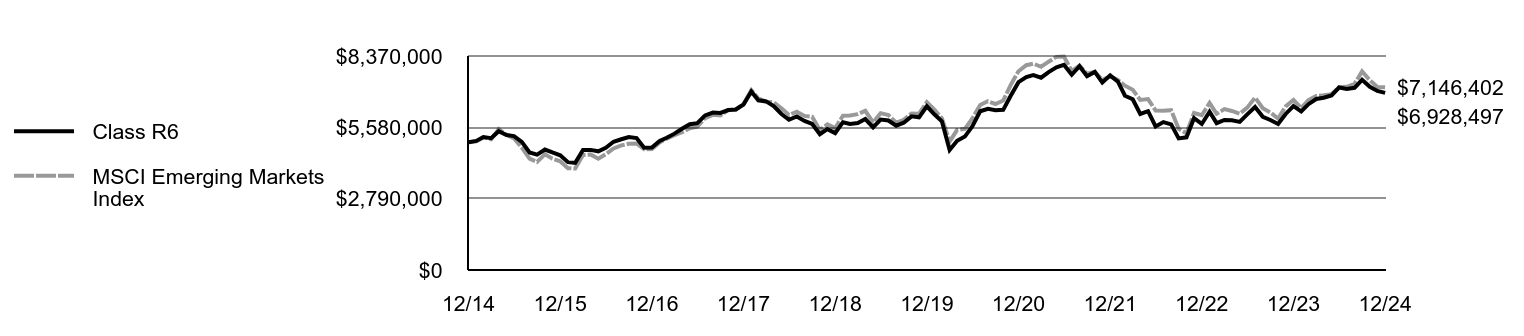

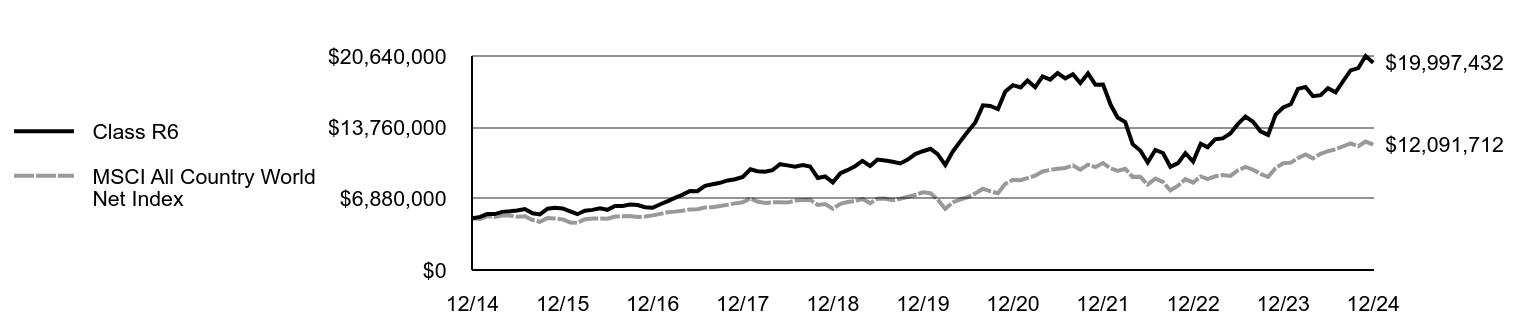

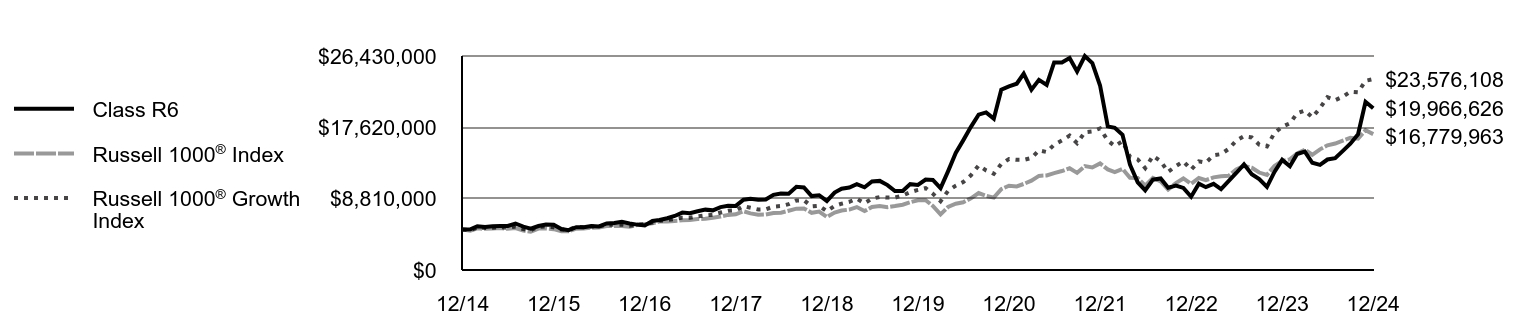

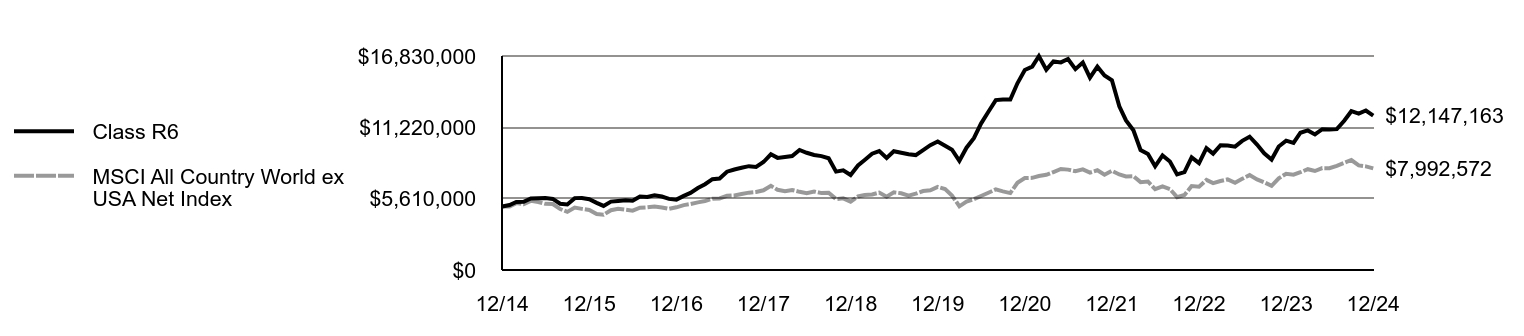

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the Russell 1000® Growth Index: ↑ Stock selection in information technology, led by a position in an enterprise analytics platform and Bitcoin developing company ↑ Average overweight and stock selection in consumer discretionary, led by a food delivery company ↑ No exposure to consumer staples, a sector that underperformed in the index ↓ Stock selection in health care, led lower by a biopharmaceutical royalties acquirer and a next-generation sequencing company (the sequencing company was sold during the period) ↓ Stock selection and average overweight in financials, ↓ Average underweight in information technology, which was one of the stronger performing sectors in the period |

|

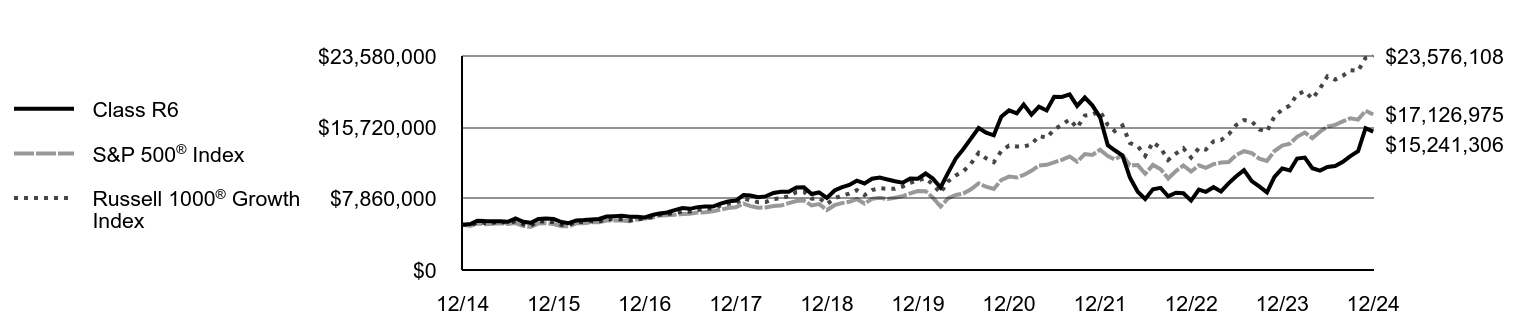

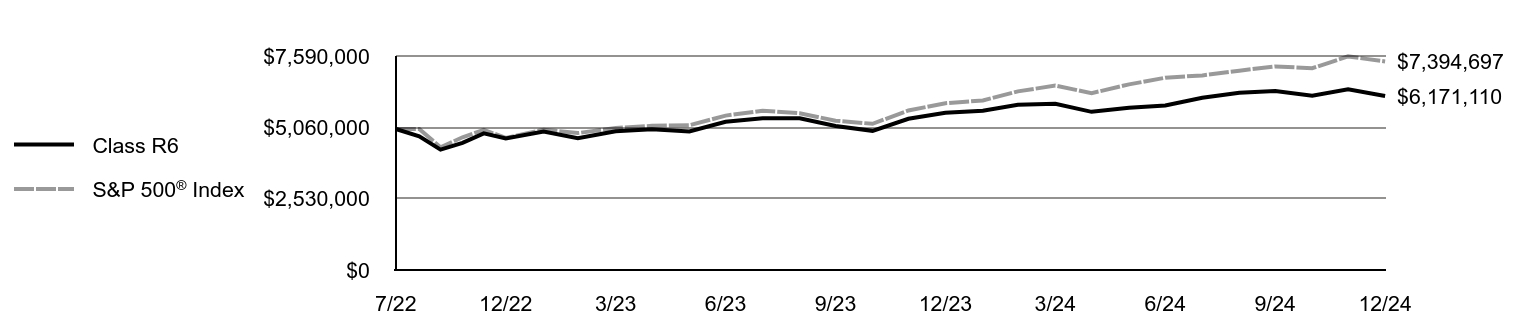

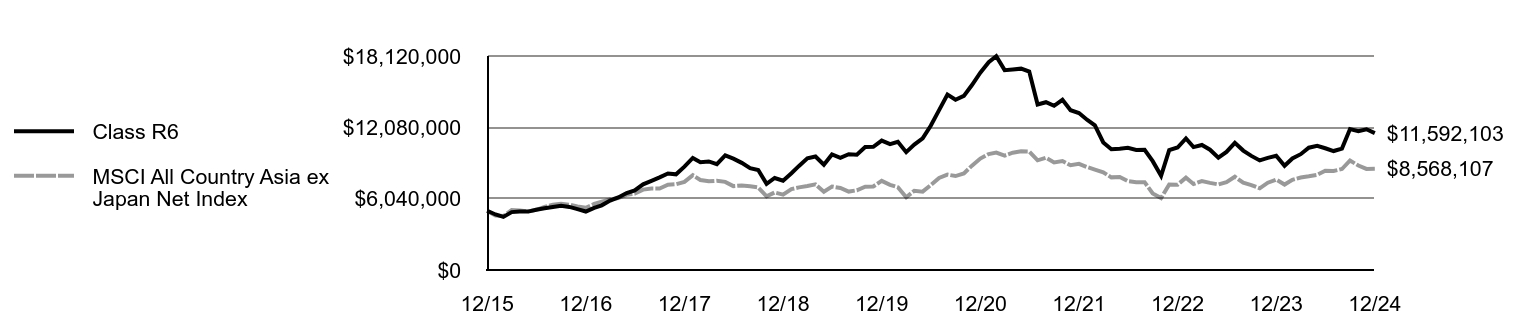

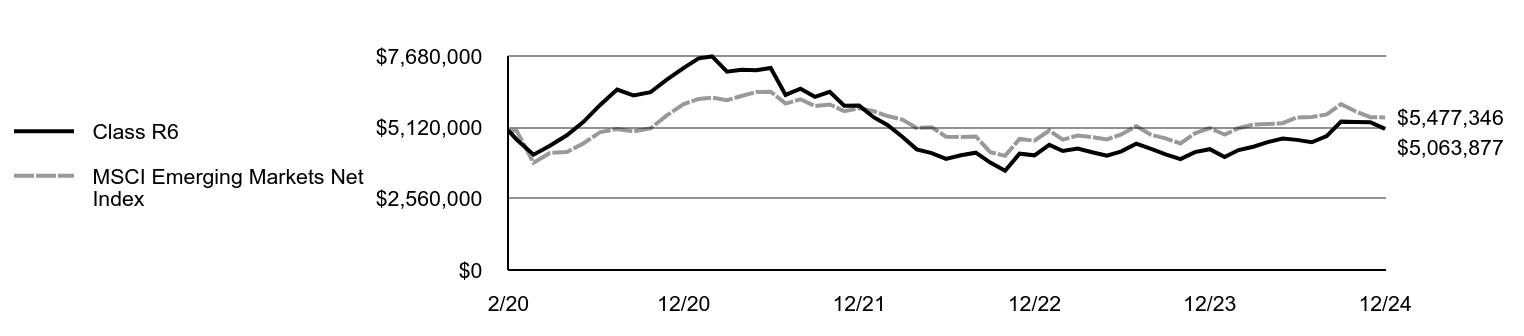

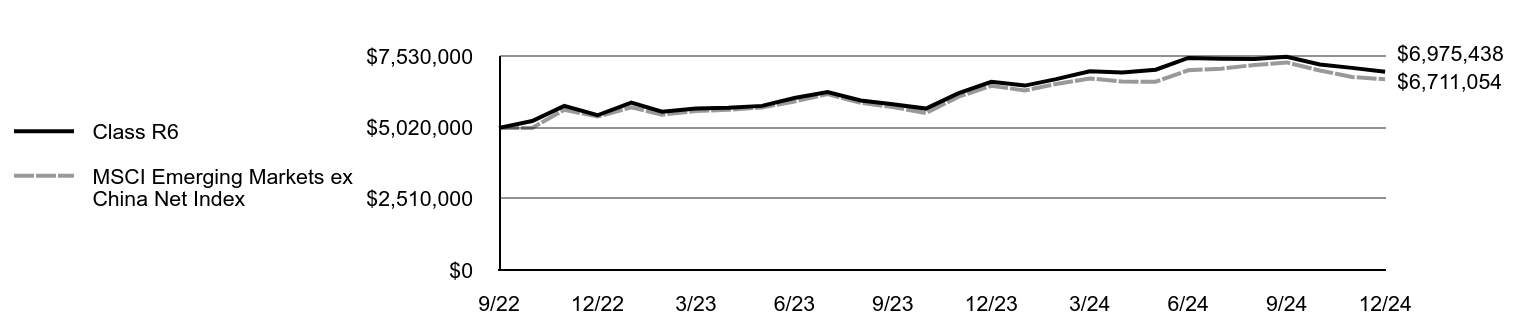

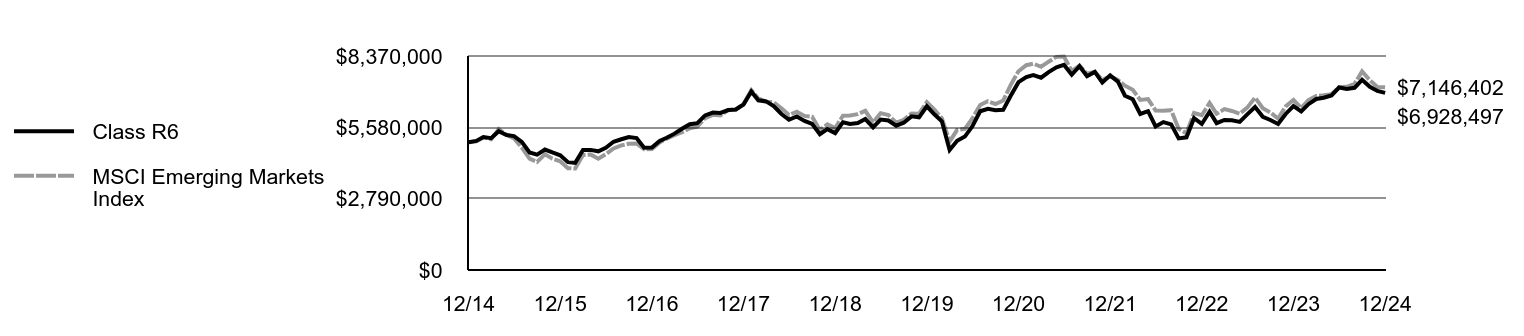

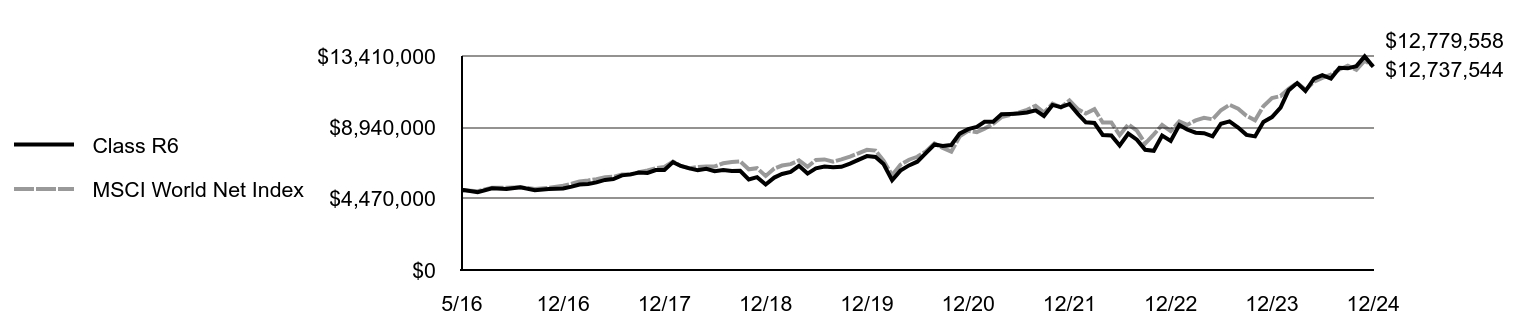

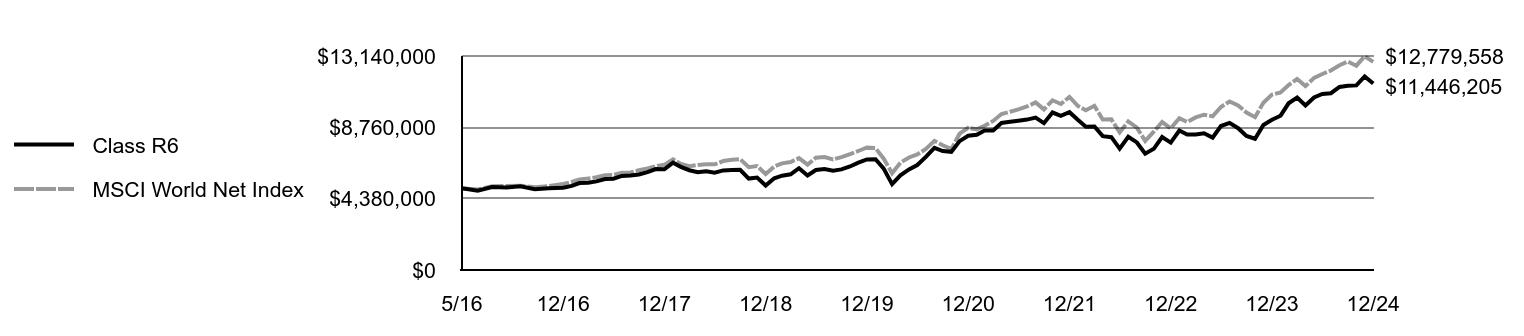

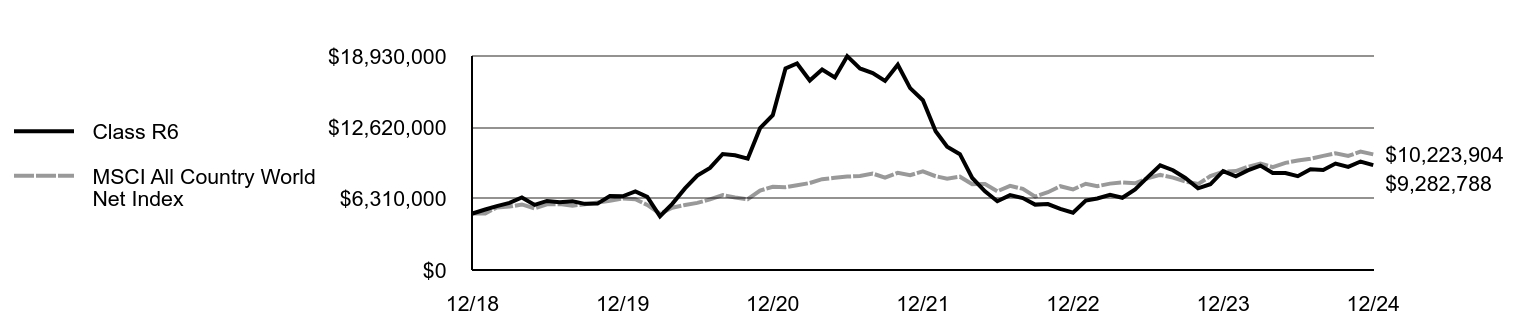

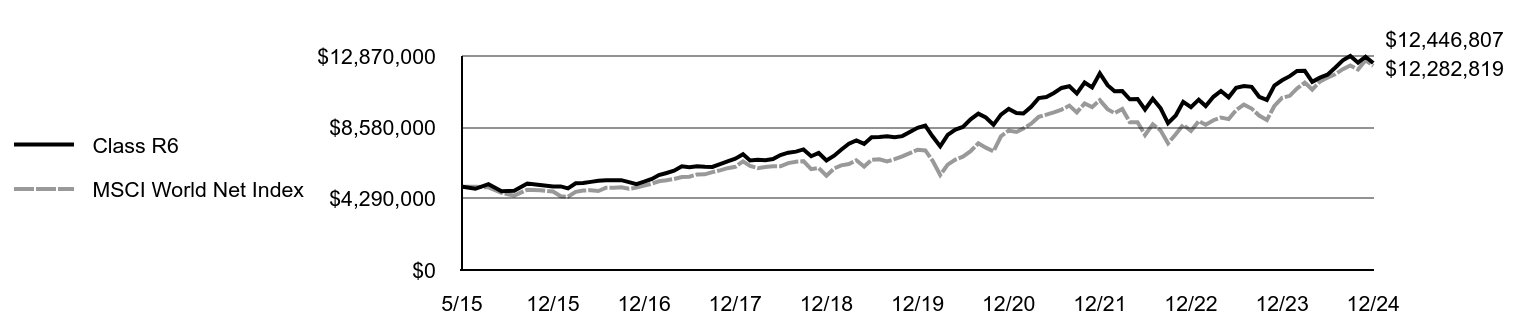

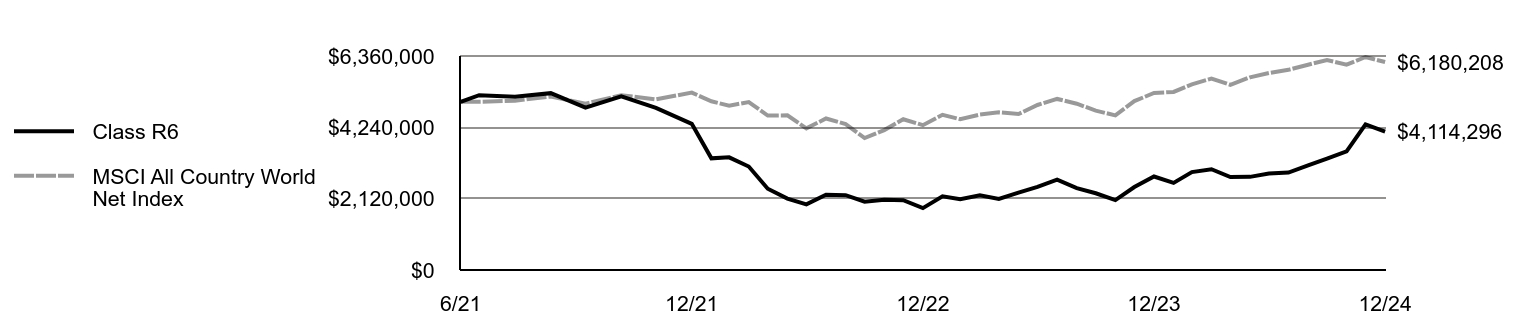

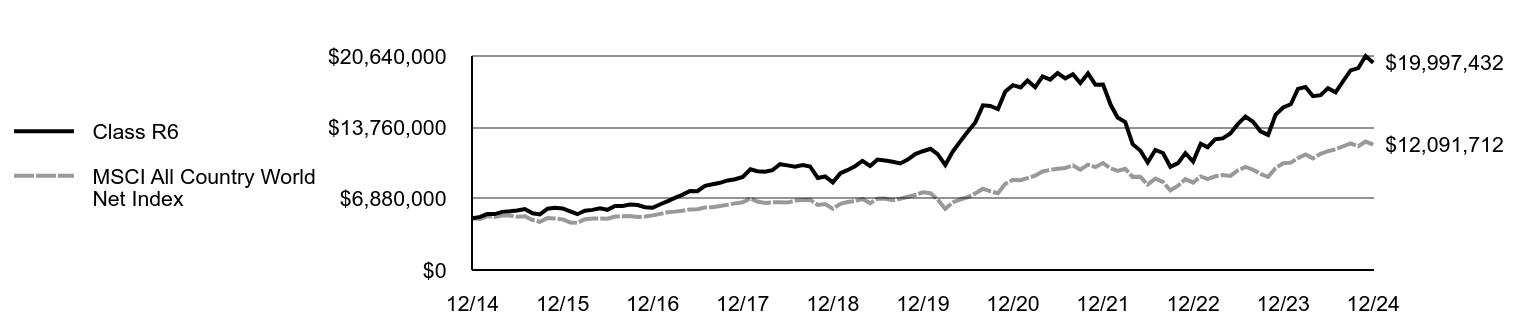

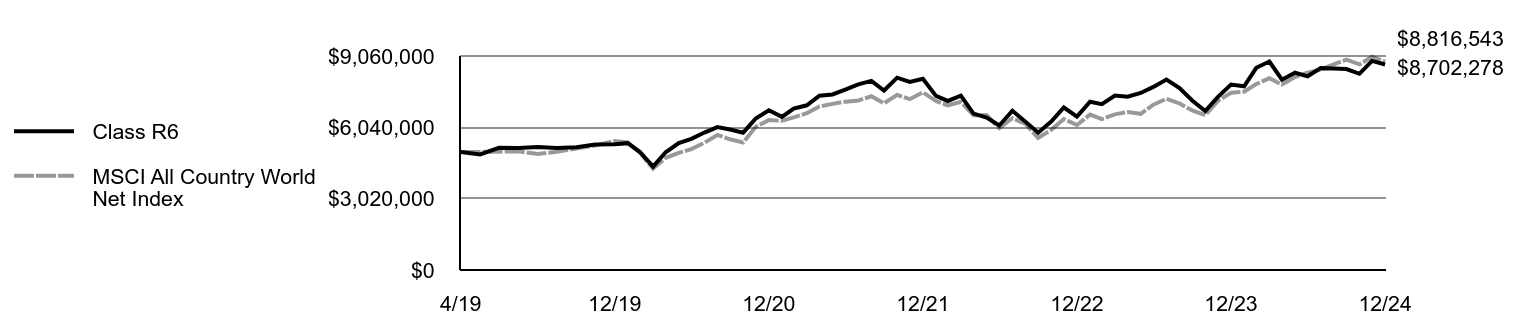

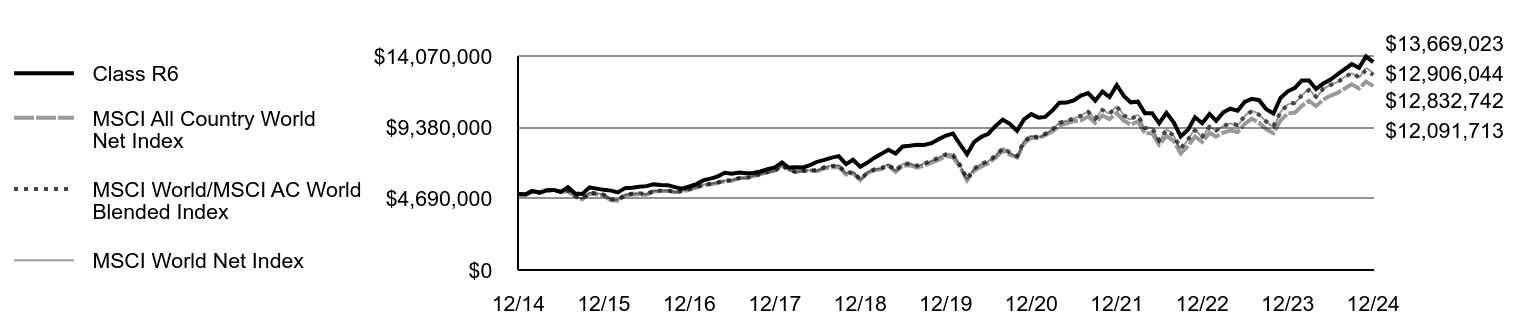

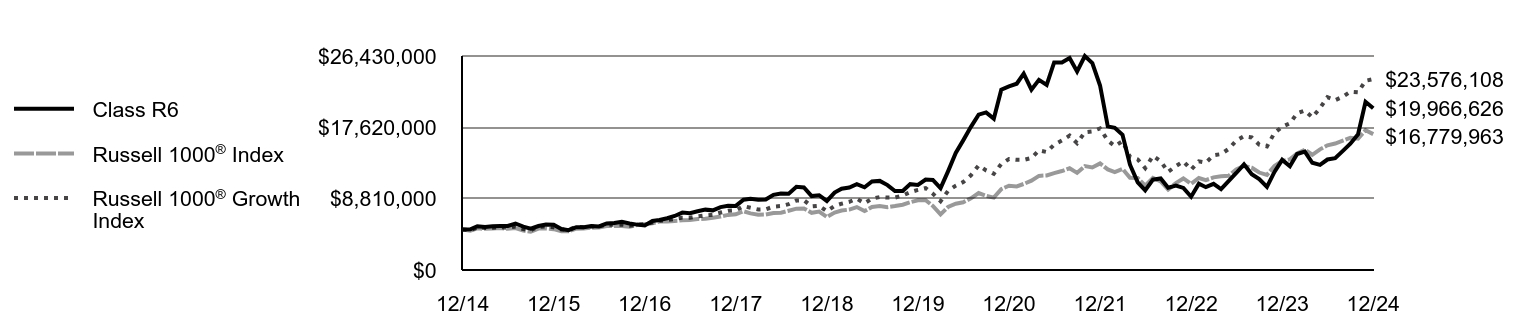

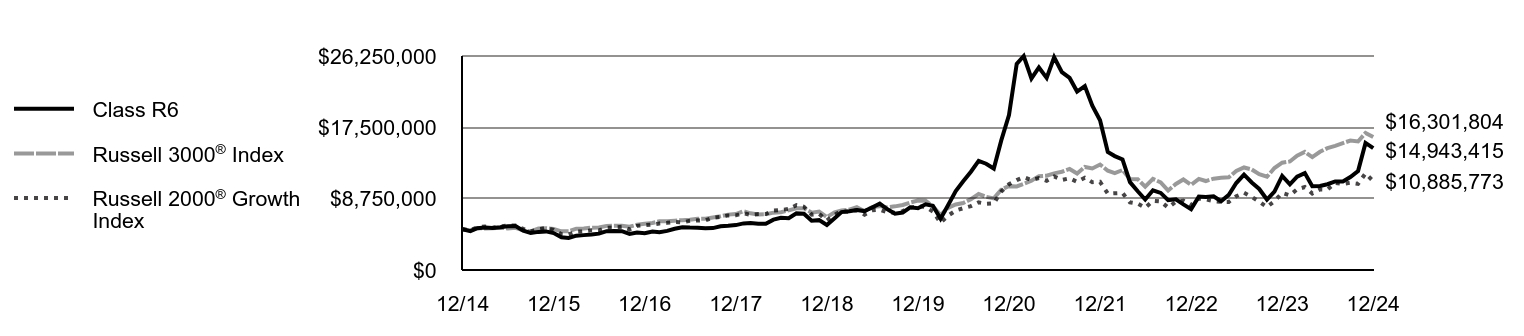

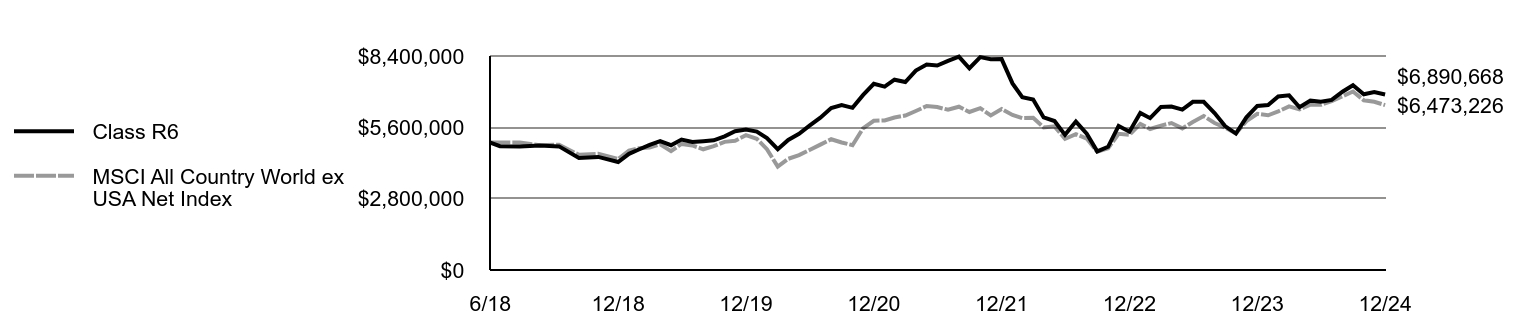

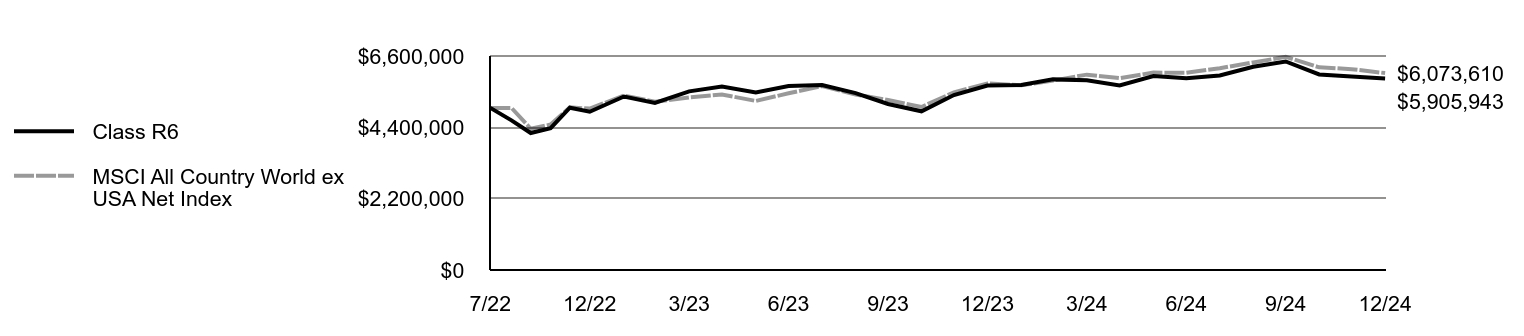

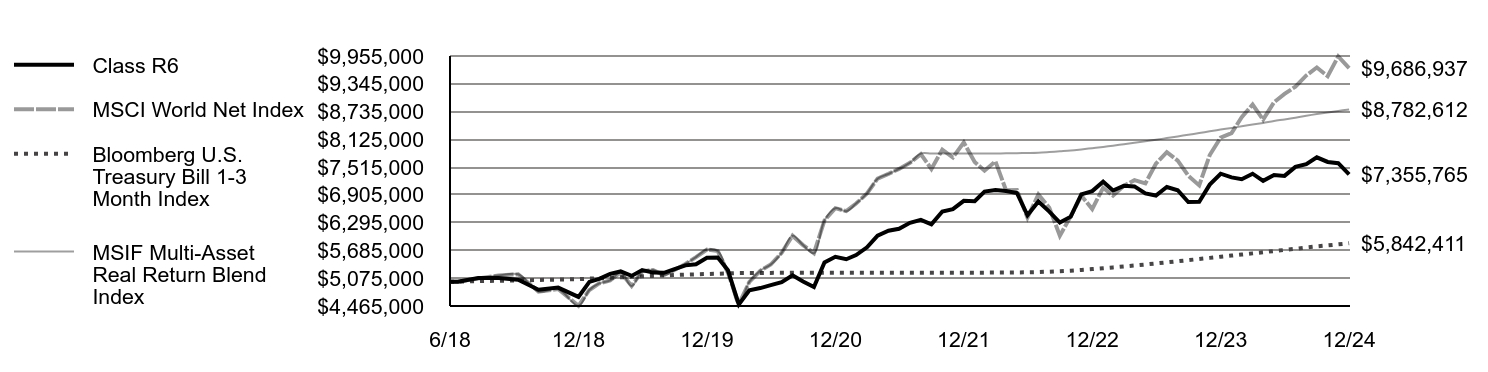

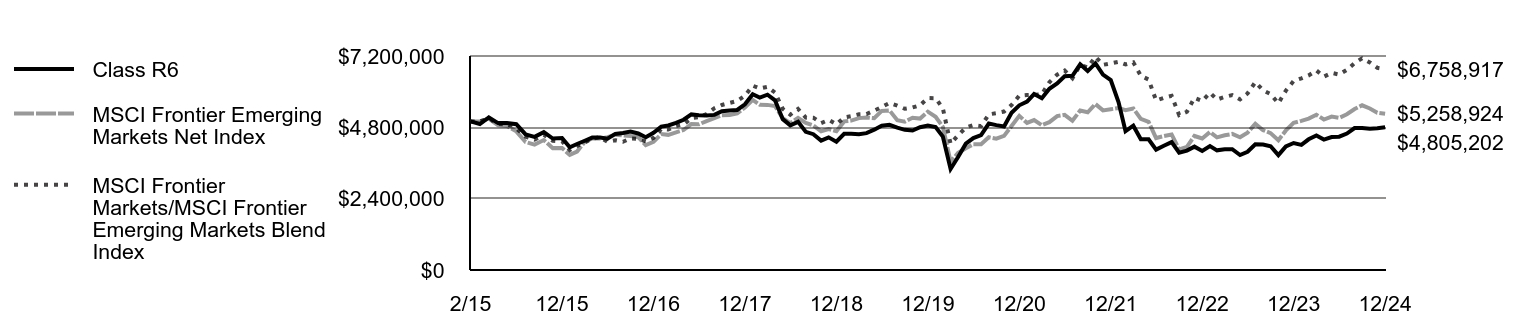

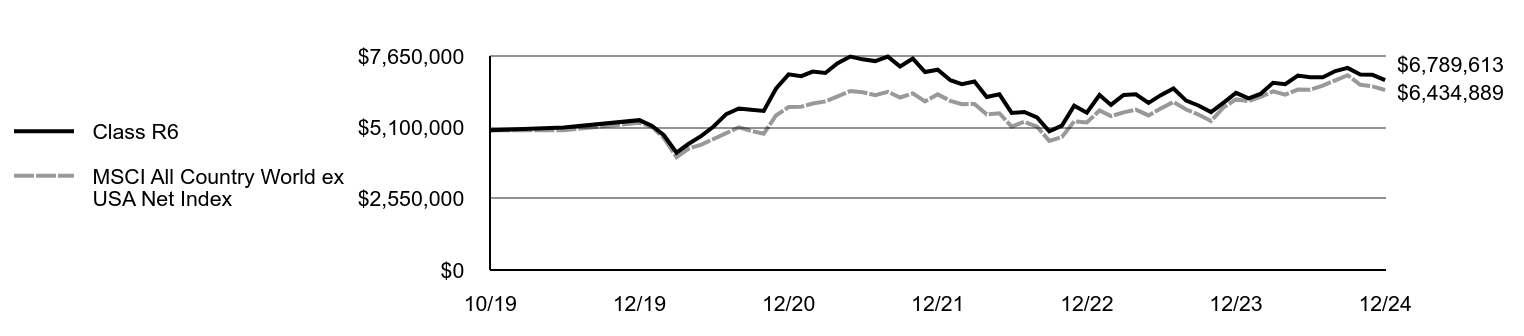

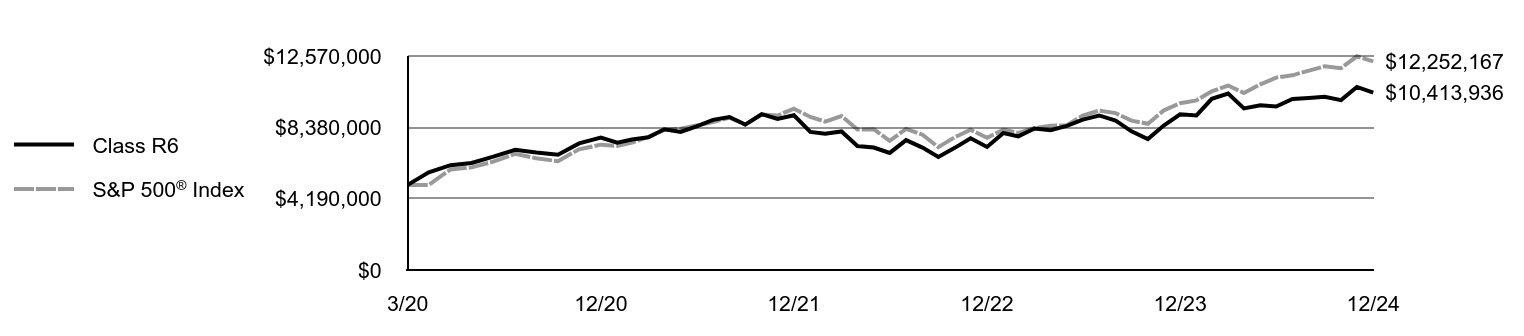

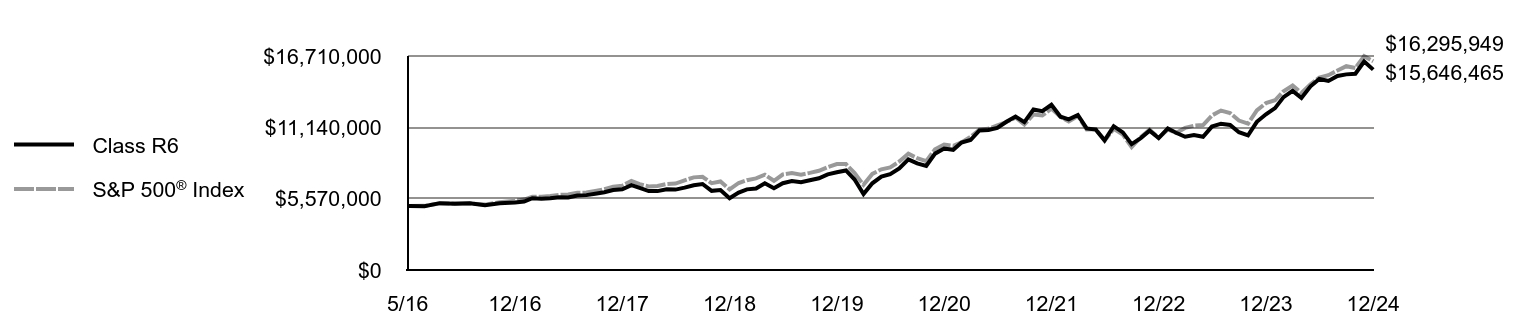

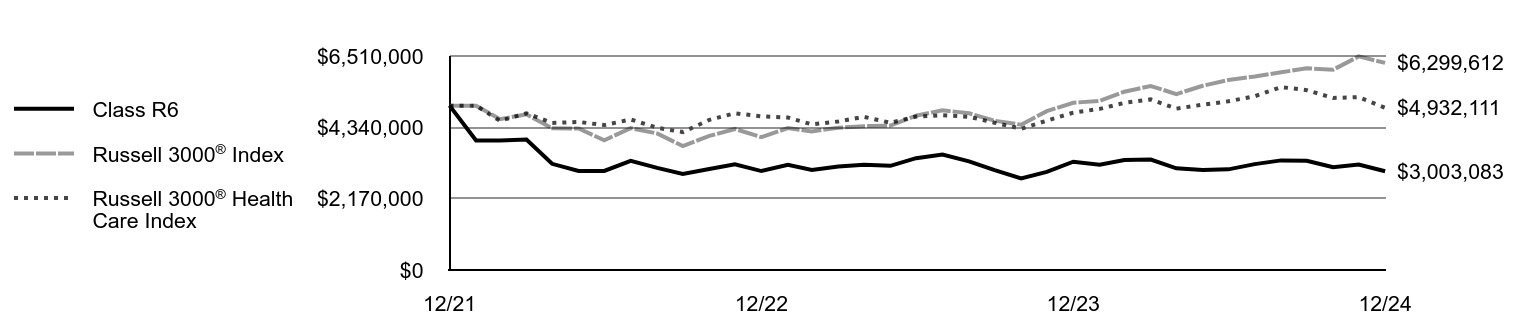

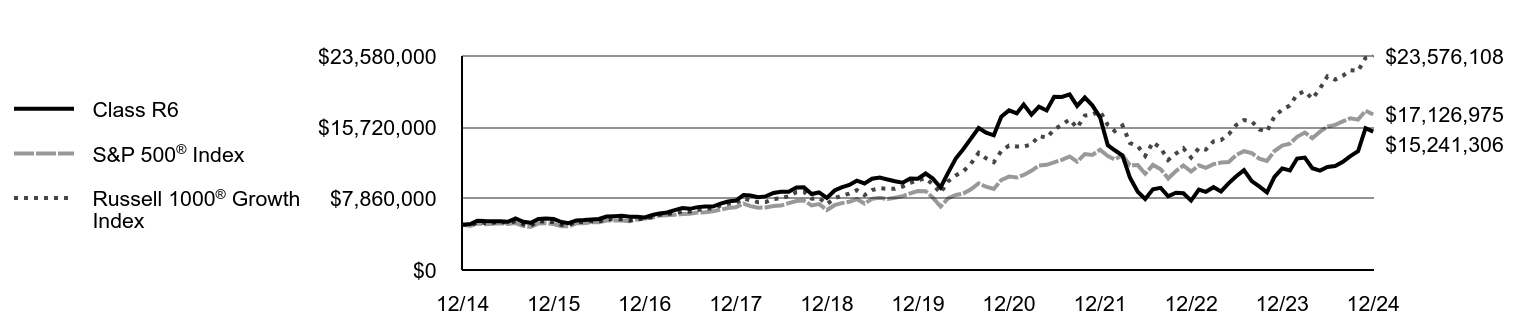

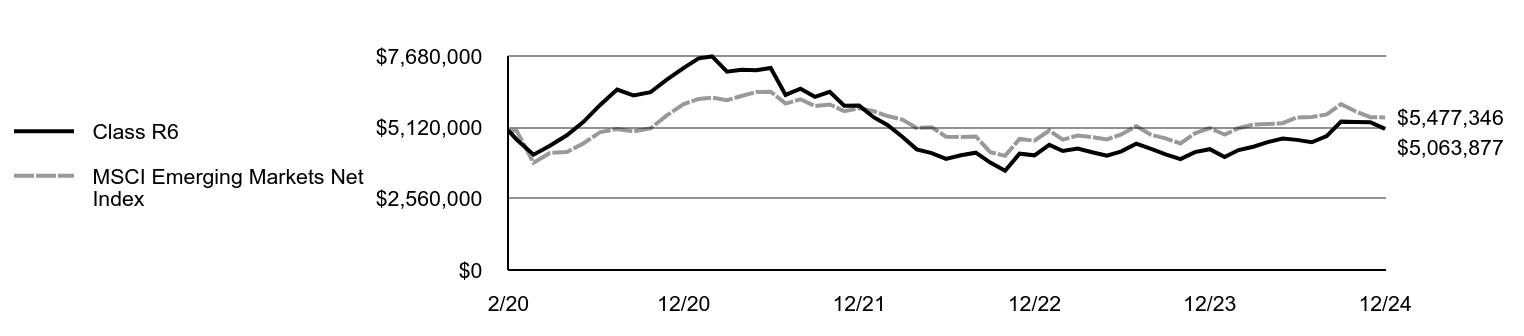

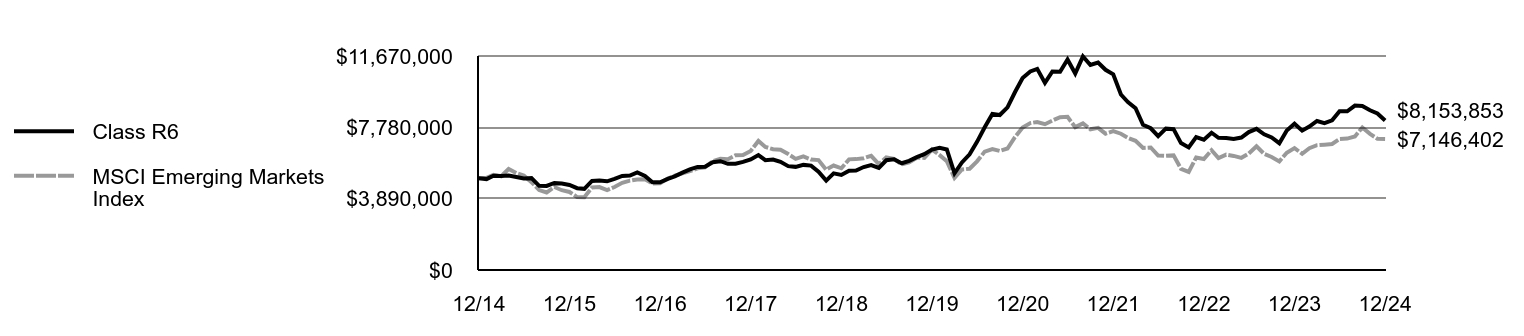

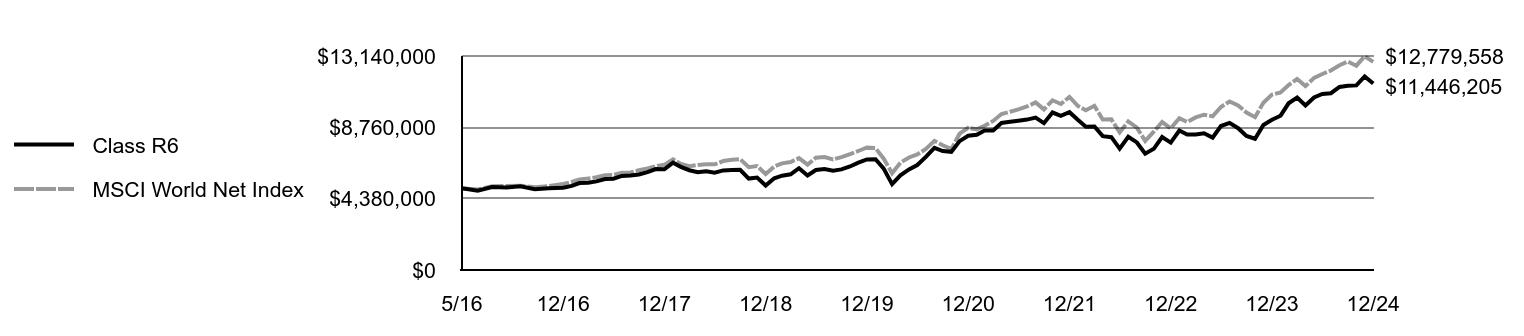

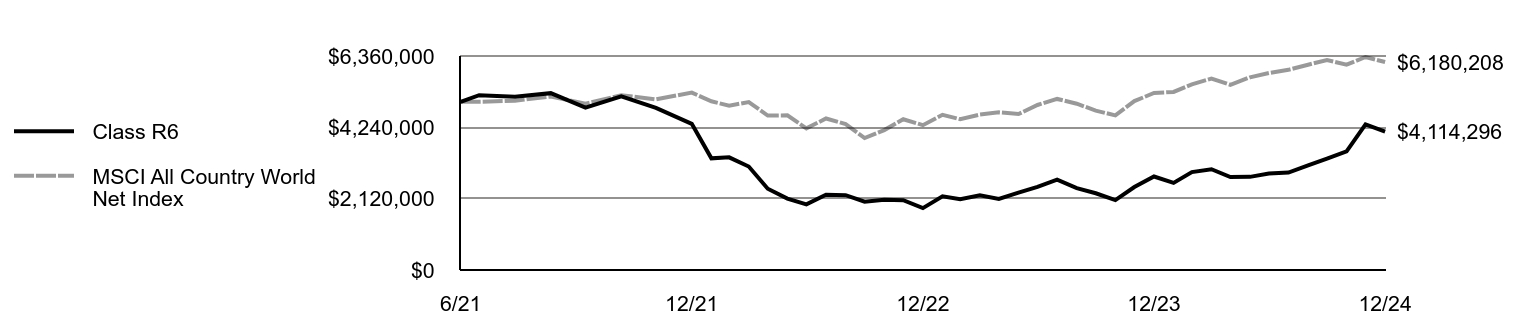

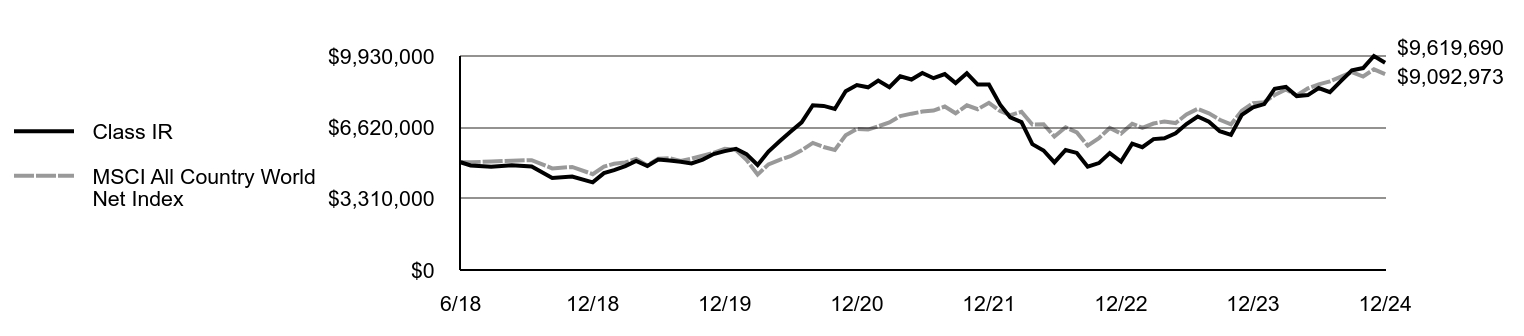

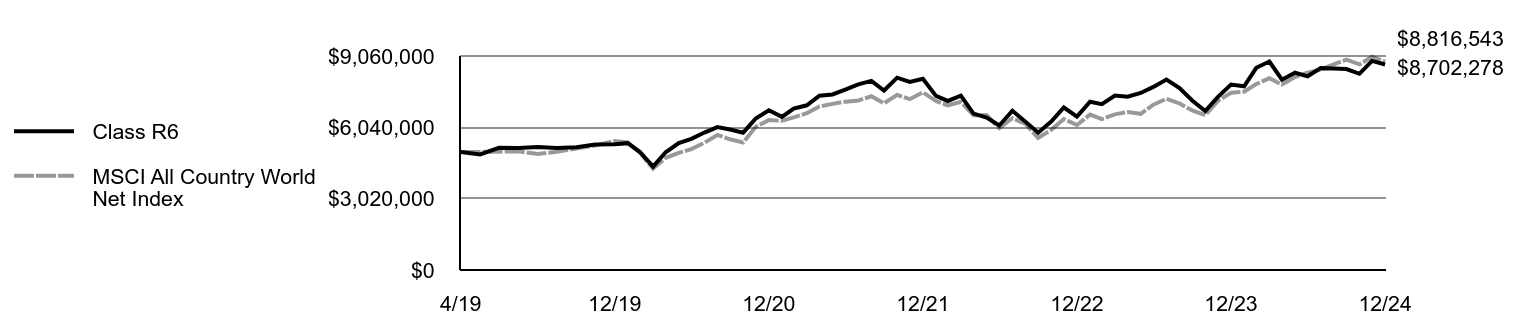

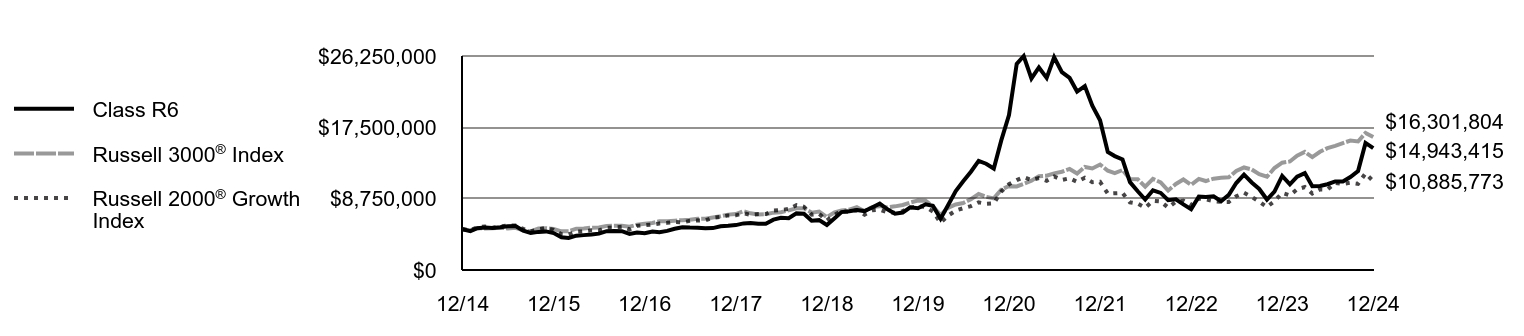

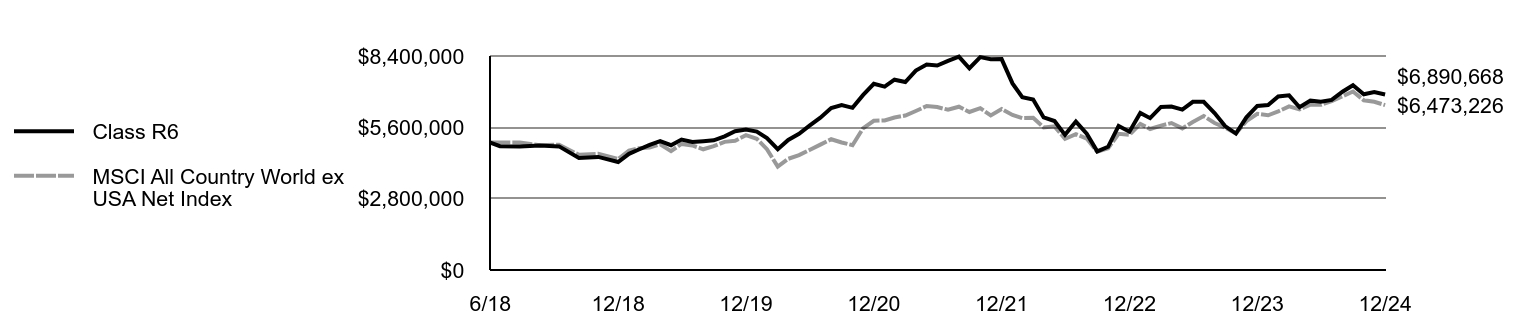

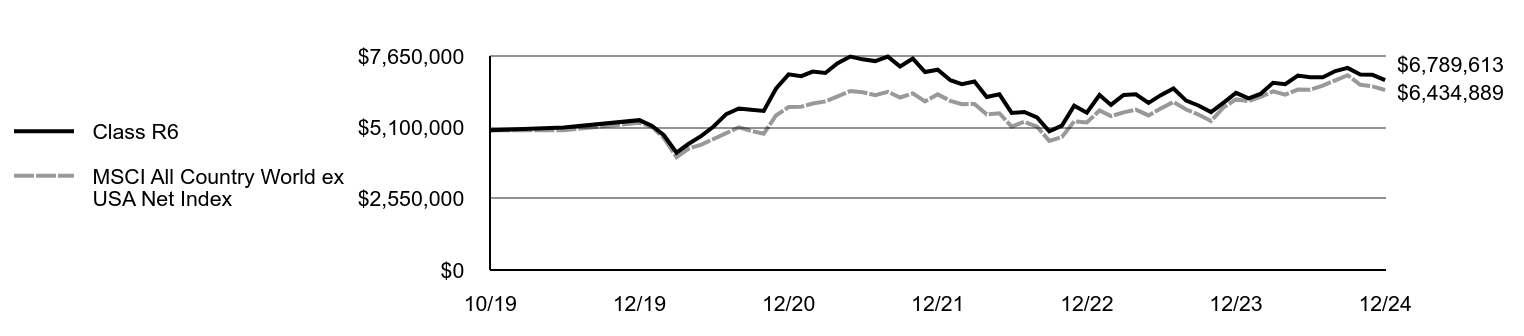

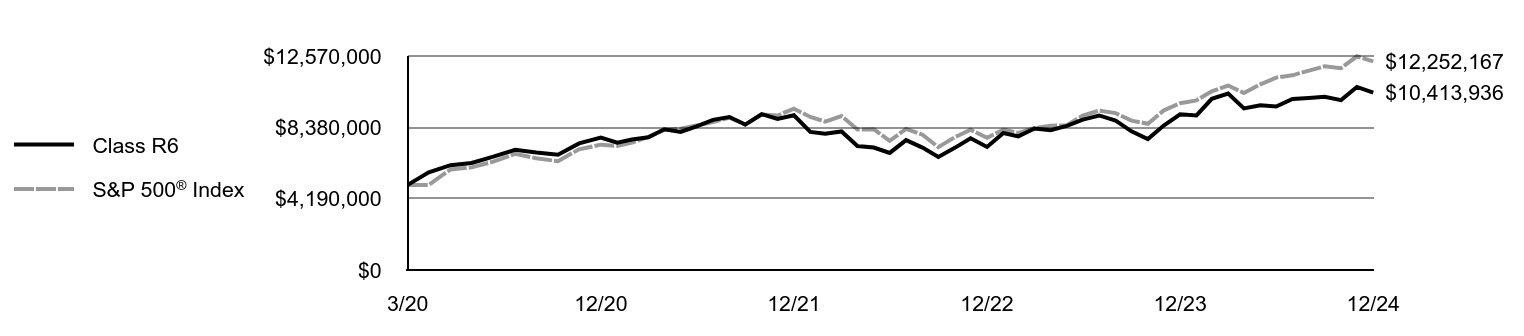

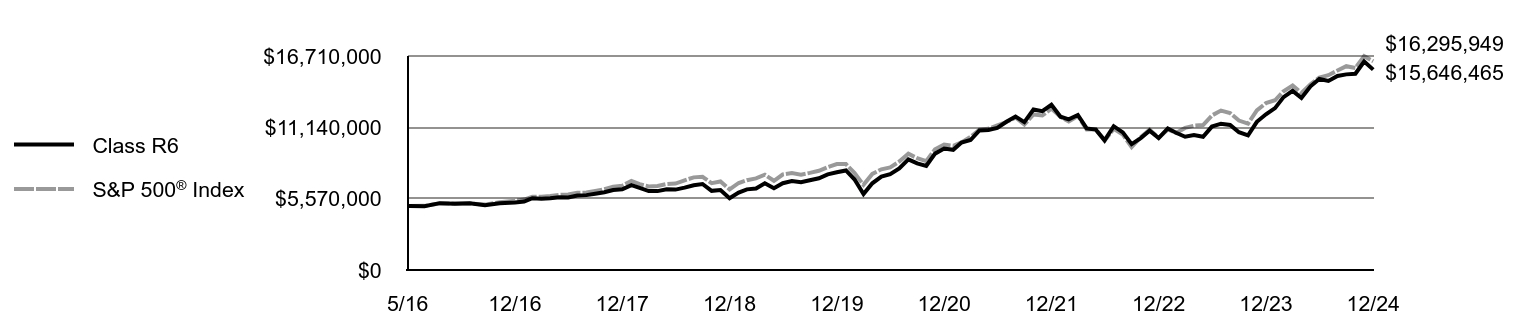

| Line Graph [Table Text Block] |

| Class R6 | S&P 500® Index | Russell 1000® Growth Index |

|---|

12/14 | $5,000,000 | $5,000,000 | $5,000,000 |

|---|

1/15 | $5,056,413 | $4,849,904 | $4,923,436 |

|---|

2/15 | $5,436,461 | $5,128,635 | $5,251,609 |

|---|

3/15 | $5,394,893 | $5,047,528 | $5,191,882 |

|---|

4/15 | $5,374,109 | $5,095,950 | $5,217,884 |

|---|

5/15 | $5,365,202 | $5,161,481 | $5,291,331 |

|---|

6/15 | $5,314,727 | $5,061,564 | $5,198,115 |

|---|

7/15 | $5,683,327 | $5,167,610 | $5,374,388 |

|---|

8/15 | $5,314,825 | $4,855,829 | $5,048,008 |

|---|

9/15 | $5,194,986 | $4,735,678 | $4,923,131 |

|---|

10/15 | $5,629,400 | $5,135,152 | $5,347,041 |

|---|

11/15 | $5,662,355 | $5,150,423 | $5,362,050 |

|---|

12/15 | $5,632,340 | $5,069,192 | $5,283,363 |

|---|

1/16 | $5,280,117 | $4,817,637 | $4,988,406 |

|---|

2/16 | $5,157,323 | $4,811,137 | $4,986,278 |

|---|

3/16 | $5,457,844 | $5,137,516 | $5,322,559 |

|---|

4/16 | $5,499,852 | $5,157,433 | $5,273,956 |

|---|

5/16 | $5,570,943 | $5,250,051 | $5,376,373 |

|---|

6/16 | $5,622,645 | $5,263,654 | $5,355,257 |

|---|

7/16 | $5,897,386 | $5,457,718 | $5,608,036 |

|---|

8/16 | $5,930,241 | $5,465,381 | $5,580,173 |

|---|

9/16 | $5,972,952 | $5,466,414 | $5,600,586 |

|---|

10/16 | $5,864,532 | $5,366,700 | $5,469,067 |

|---|

11/16 | $5,864,532 | $5,565,456 | $5,588,064 |

|---|

12/16 | $5,789,373 | $5,675,463 | $5,657,239 |

|---|

1/17 | $6,057,645 | $5,783,106 | $5,847,880 |

|---|

2/17 | $6,236,493 | $6,012,730 | $6,090,776 |

|---|

3/17 | $6,339,164 | $6,019,744 | $6,161,224 |

|---|

4/17 | $6,597,500 | $6,081,566 | $6,302,132 |

|---|

5/17 | $6,822,716 | $6,167,151 | $6,466,004 |

|---|

6/17 | $6,739,916 | $6,205,643 | $6,448,969 |

|---|

7/17 | $6,929,062 | $6,333,248 | $6,620,378 |

|---|

8/17 | $6,995,656 | $6,352,635 | $6,741,738 |

|---|

9/17 | $6,992,326 | $6,483,678 | $6,829,394 |

|---|

10/17 | $7,308,645 | $6,634,977 | $7,094,014 |

|---|

11/17 | $7,541,723 | $6,838,471 | $7,309,528 |

|---|

12/17 | $7,654,609 | $6,914,505 | $7,366,434 |

|---|

1/18 | $8,260,139 | $7,310,388 | $7,888,170 |

|---|

2/18 | $8,203,148 | $7,040,948 | $7,681,336 |

|---|

3/18 | $8,014,365 | $6,862,015 | $7,470,689 |

|---|

4/18 | $8,110,538 | $6,888,345 | $7,496,789 |

|---|

5/18 | $8,491,665 | $7,054,230 | $7,825,383 |

|---|

6/18 | $8,616,333 | $7,097,648 | $7,900,730 |

|---|

7/18 | $8,617,288 | $7,361,777 | $8,132,667 |

|---|

8/18 | $9,087,782 | $7,601,663 | $8,577,332 |

|---|

9/18 | $9,123,974 | $7,644,931 | $8,625,271 |

|---|

10/18 | $8,367,564 | $7,122,399 | $7,853,939 |

|---|

11/18 | $8,541,167 | $7,267,542 | $7,937,361 |

|---|

12/18 | $7,940,527 | $6,611,349 | $7,254,926 |

|---|

1/19 | $8,764,045 | $7,141,155 | $7,907,044 |

|---|

2/19 | $9,096,475 | $7,370,445 | $8,189,956 |

|---|

3/19 | $9,372,240 | $7,513,666 | $8,423,067 |

|---|

4/19 | $9,836,885 | $7,817,891 | $8,803,620 |

|---|

5/19 | $9,538,454 | $7,321,079 | $8,247,465 |

|---|

6/19 | $10,055,986 | $7,837,041 | $8,813,874 |

|---|

7/19 | $10,191,980 | $7,949,676 | $9,012,899 |

|---|

8/19 | $9,976,657 | $7,823,750 | $8,943,871 |

|---|

9/19 | $9,772,666 | $7,970,136 | $8,944,981 |

|---|

10/19 | $9,621,562 | $8,142,767 | $9,197,155 |

|---|

11/19 | $10,074,874 | $8,438,340 | $9,605,169 |

|---|

12/19 | $10,056,145 | $8,693,027 | $9,894,968 |

|---|

1/20 | $10,633,642 | $8,689,618 | $10,116,172 |

|---|

2/20 | $10,071,545 | $7,974,296 | $9,427,243 |

|---|

3/20 | $9,089,801 | $6,989,368 | $8,499,832 |

|---|

4/20 | $10,706,792 | $7,885,361 | $9,757,562 |

|---|

5/20 | $12,277,583 | $8,260,926 | $10,412,628 |

|---|

6/20 | $13,305,528 | $8,425,212 | $10,866,046 |

|---|

7/20 | $14,483,621 | $8,900,269 | $11,702,070 |

|---|

8/20 | $15,650,165 | $9,540,025 | $12,909,631 |

|---|

9/20 | $15,141,968 | $9,177,536 | $12,302,234 |

|---|

10/20 | $14,837,819 | $8,933,470 | $11,884,427 |

|---|

11/20 | $16,882,158 | $9,911,364 | $13,101,295 |

|---|

12/20 | $17,590,829 | $10,292,437 | $13,703,838 |

|---|

1/21 | $17,250,439 | $10,188,527 | $13,602,446 |

|---|

2/21 | $18,227,032 | $10,469,475 | $13,599,297 |

|---|

3/21 | $17,120,767 | $10,927,992 | $13,832,936 |

|---|

4/21 | $18,004,158 | $11,511,206 | $14,774,110 |

|---|

5/21 | $17,582,724 | $11,591,604 | $14,569,765 |

|---|

6/21 | $19,094,214 | $11,862,208 | $15,483,840 |

|---|

7/21 | $19,069,901 | $12,143,994 | $15,994,130 |

|---|

8/21 | $19,357,611 | $12,513,240 | $16,592,132 |

|---|

9/21 | $18,081,151 | $11,931,252 | $15,662,877 |

|---|

10/21 | $19,005,065 | $12,767,177 | $17,019,525 |

|---|

11/21 | $18,145,987 | $12,678,714 | $17,123,583 |

|---|

12/21 | $16,824,456 | $13,246,924 | $17,485,624 |

|---|

1/22 | $13,747,785 | $12,561,435 | $15,984,919 |

|---|

2/22 | $13,194,283 | $12,185,328 | $15,305,983 |

|---|

3/22 | $12,615,849 | $12,637,763 | $15,904,717 |

|---|

4/22 | $10,162,490 | $11,535,727 | $13,984,036 |

|---|

5/22 | $8,616,675 | $11,556,891 | $13,658,941 |

|---|

6/22 | $7,828,807 | $10,602,942 | $12,576,998 |

|---|

7/22 | $8,900,905 | $11,580,580 | $14,086,503 |

|---|

8/22 | $9,050,500 | $11,108,302 | $13,430,297 |

|---|

9/22 | $8,118,025 | $10,085,243 | $12,124,661 |

|---|

10/22 | $8,521,931 | $10,901,758 | $12,833,328 |

|---|

11/22 | $8,462,093 | $11,510,992 | $13,418,104 |

|---|

12/22 | $7,649,346 | $10,847,792 | $12,390,859 |

|---|

1/23 | $8,855,155 | $11,529,401 | $13,423,605 |

|---|

2/23 | $8,616,505 | $11,248,096 | $13,264,182 |

|---|

3/23 | $9,125,205 | $11,661,061 | $14,170,870 |

|---|

4/23 | $8,660,467 | $11,843,072 | $14,310,682 |

|---|

5/23 | $9,571,103 | $11,894,550 | $14,962,939 |

|---|

6/23 | $10,324,733 | $12,680,485 | $15,986,187 |

|---|

7/23 | $11,009,281 | $13,087,846 | $16,524,758 |

|---|

8/23 | $9,790,912 | $12,879,467 | $16,376,384 |

|---|

9/23 | $9,213,129 | $12,265,401 | $15,485,773 |

|---|

10/23 | $8,553,702 | $12,007,502 | $15,265,294 |

|---|

11/23 | $10,261,931 | $13,104,092 | $16,929,379 |

|---|

12/23 | $11,191,408 | $13,699,419 | $17,679,045 |

|---|

1/24 | $10,971,599 | $13,929,628 | $18,119,989 |

|---|

2/24 | $12,277,892 | $14,673,408 | $19,356,262 |

|---|

3/24 | $12,390,936 | $15,145,519 | $19,697,014 |

|---|

4/24 | $11,210,249 | $14,526,907 | $18,861,550 |

|---|

5/24 | $10,946,478 | $15,247,219 | $19,990,700 |

|---|

6/24 | $11,348,414 | $15,794,322 | $21,338,705 |

|---|

7/24 | $11,455,179 | $15,986,576 | $20,975,724 |

|---|

8/24 | $11,913,637 | $16,374,358 | $21,412,605 |

|---|

9/24 | $12,541,662 | $16,724,067 | $22,019,235 |

|---|

10/24 | $13,081,764 | $16,572,403 | $21,946,368 |

|---|

11/24 | $15,625,266 | $17,545,222 | $23,369,819 |

|---|

12/24 | $15,241,306 | $17,126,975 | $23,576,108 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | 5 Years | 10 Years |

|---|

Class R6 | 36.19% | 8.67% | 11.79% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 16.78% |

|---|

|

|

| AssetsNet |

$ 194,996,435

|

|

| Holdings Count | Holding |

28

|

|

| Advisory Fees Paid, Amount |

$ 877,326

|

|

| InvestmentCompanyPortfolioTurnover |

57.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $194,996,435 |

|---|

# of Portfolio Holdings | 28 |

|---|

Portfolio Turnover Rate | 57% |

|---|

Total Advisory Fees Paid | $877,326 |

|---|

|

|

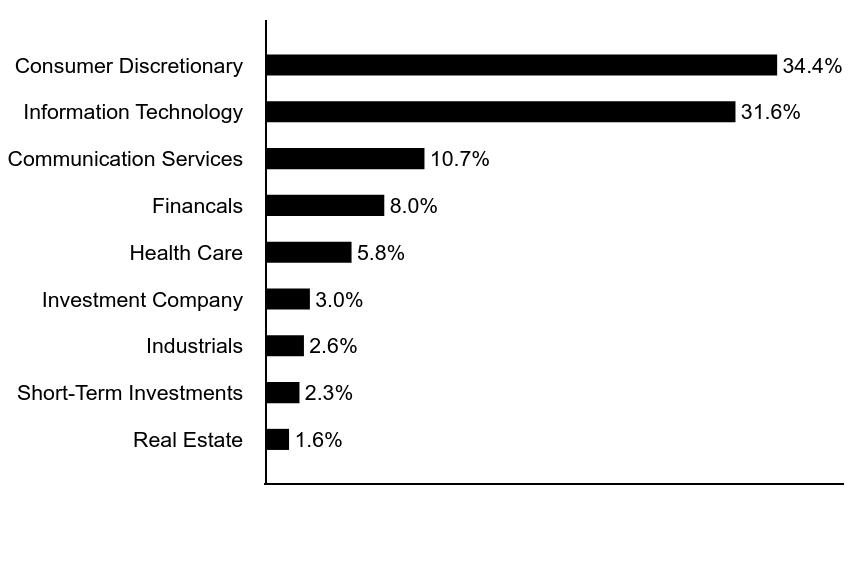

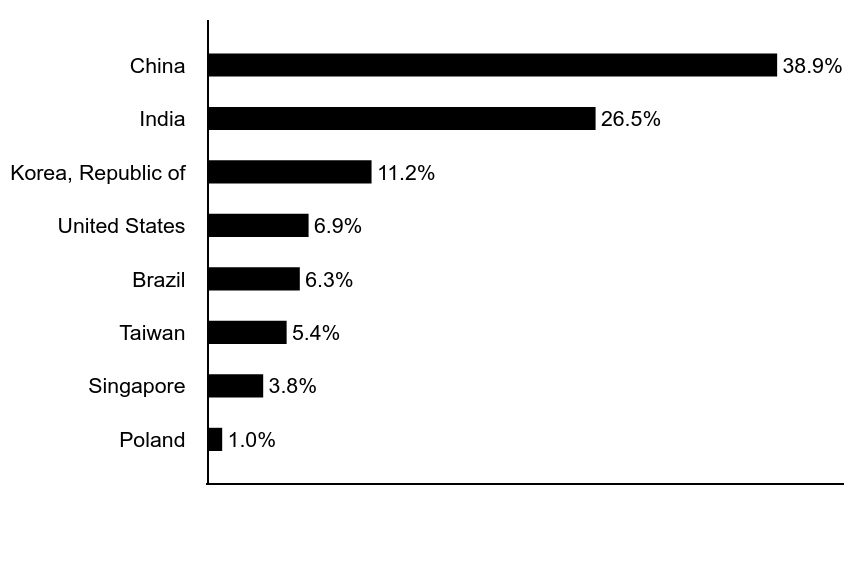

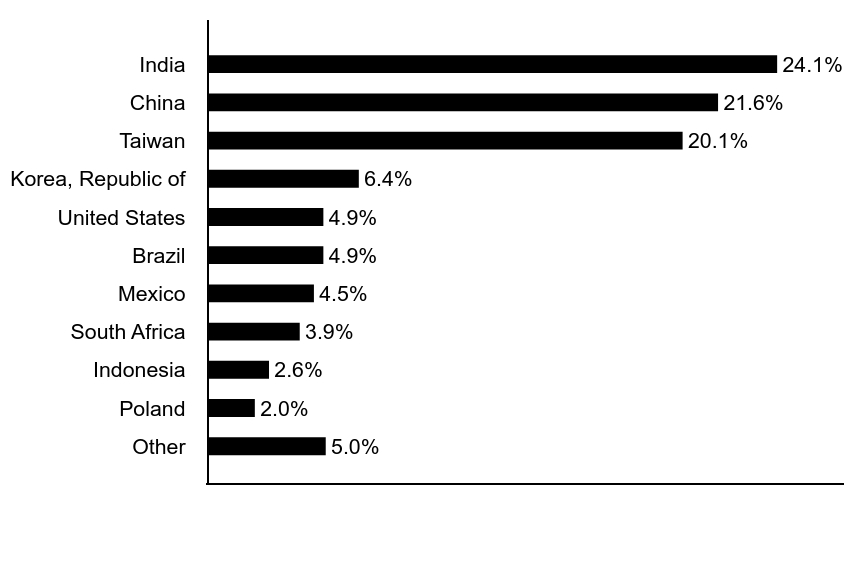

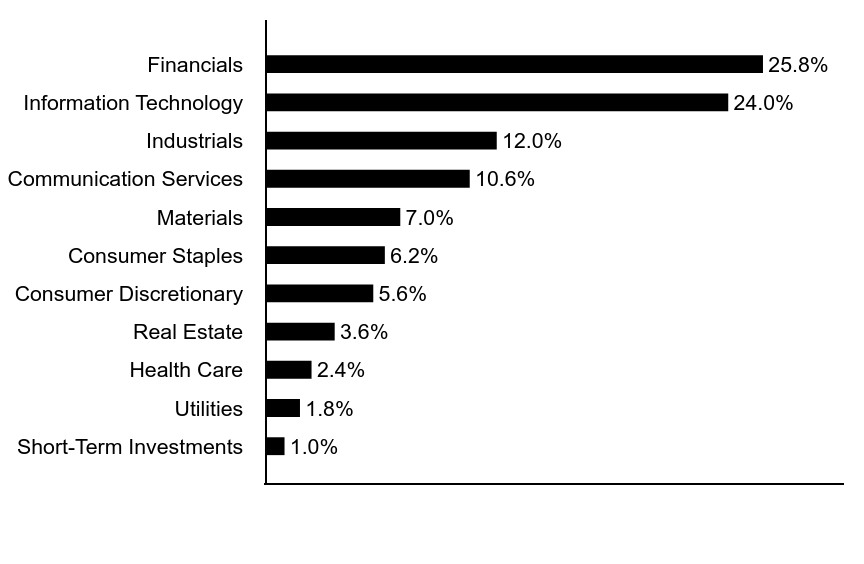

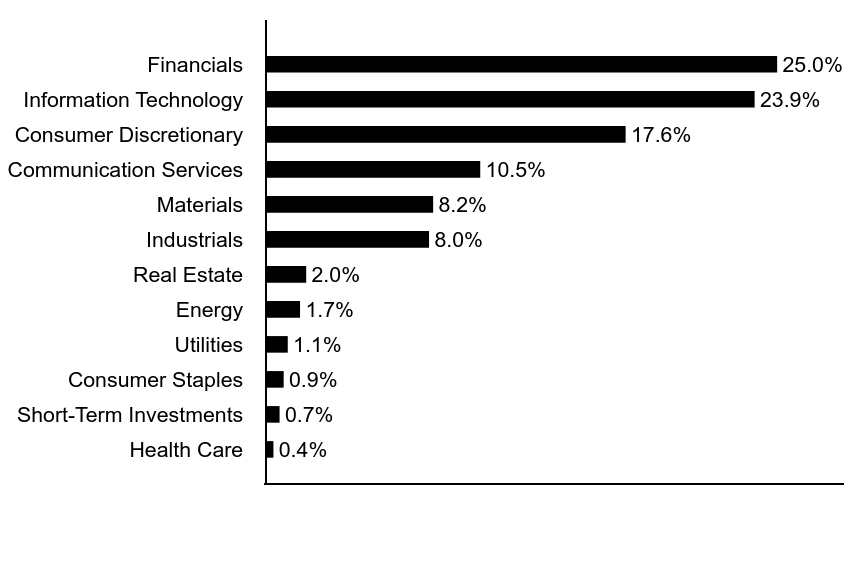

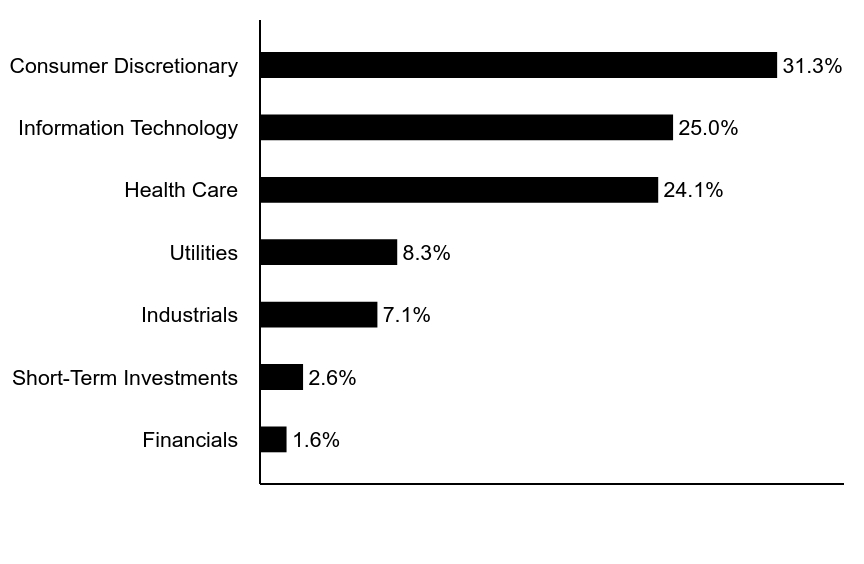

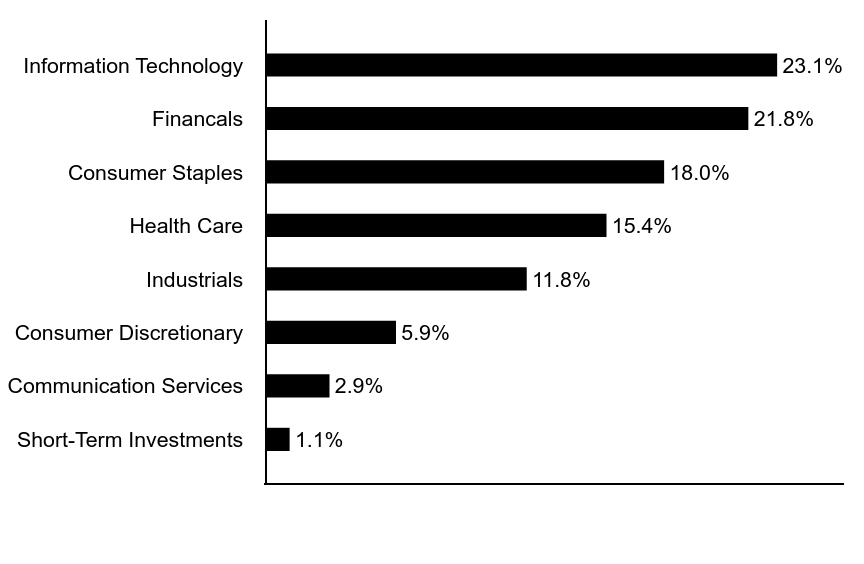

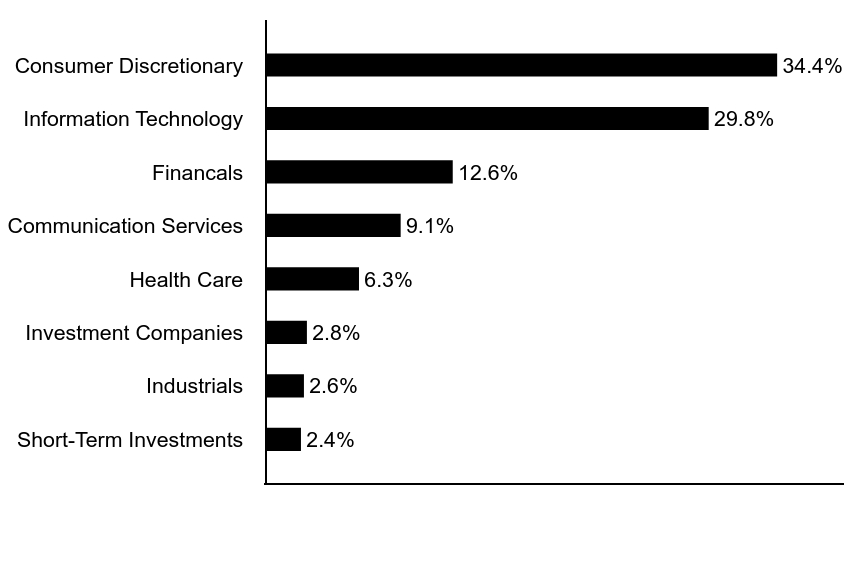

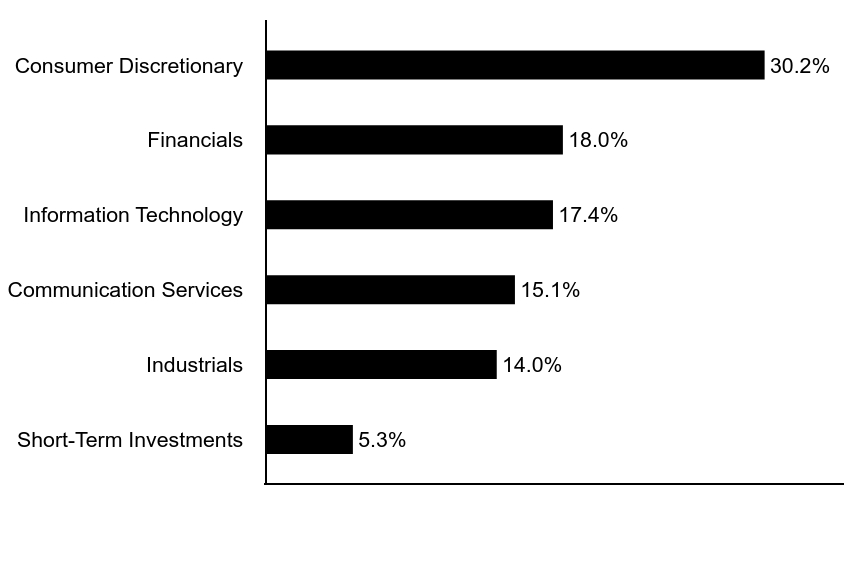

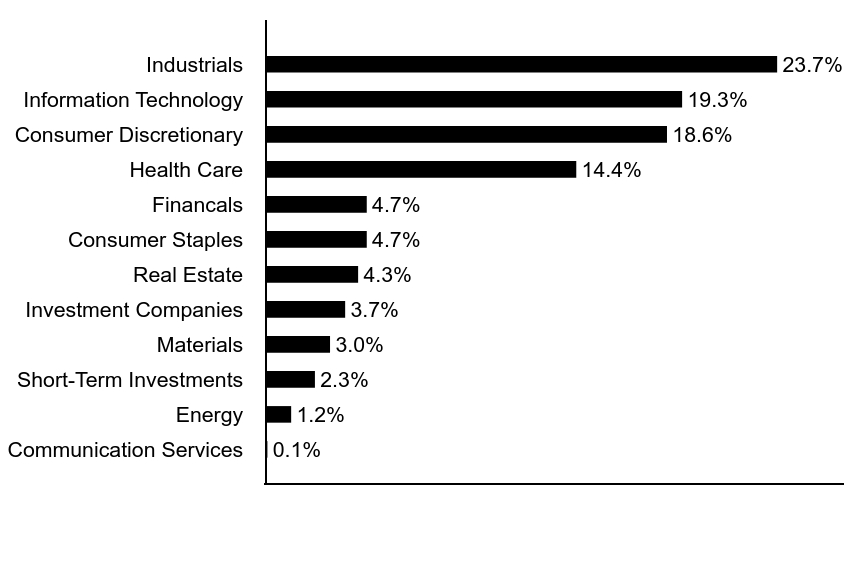

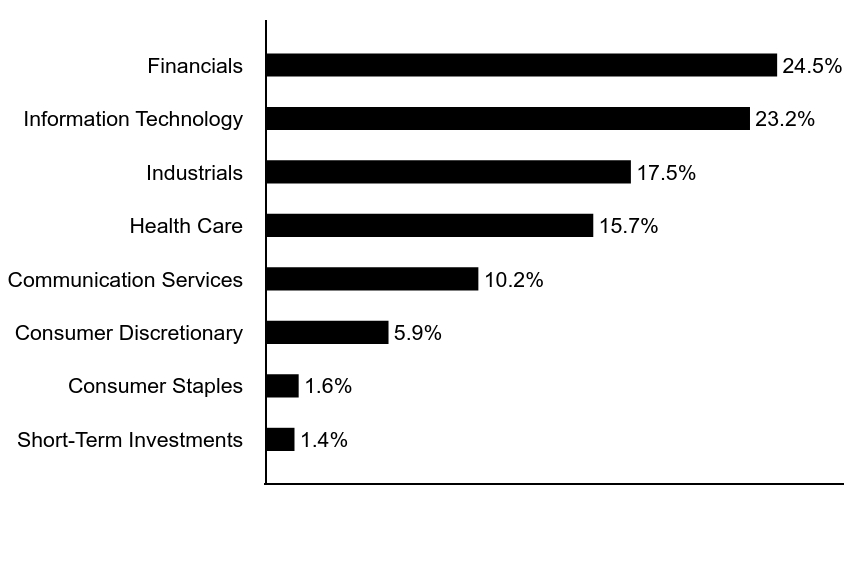

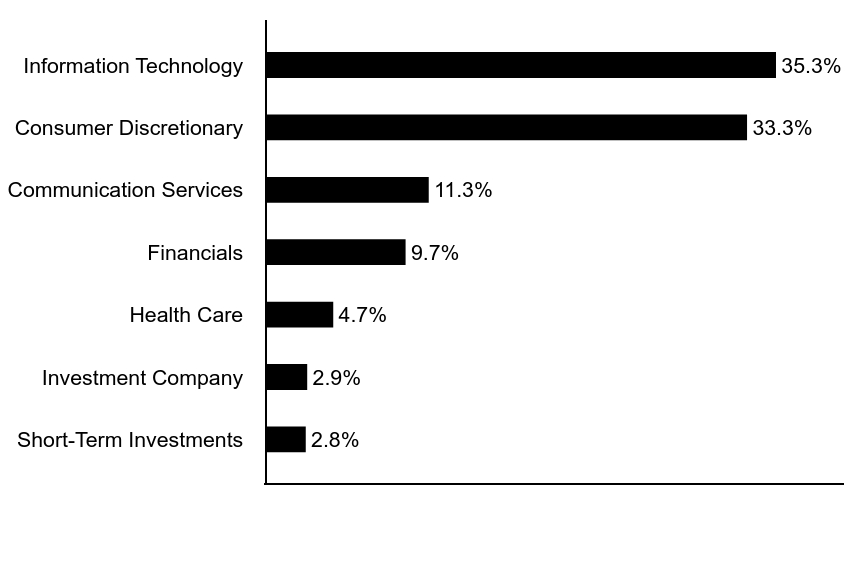

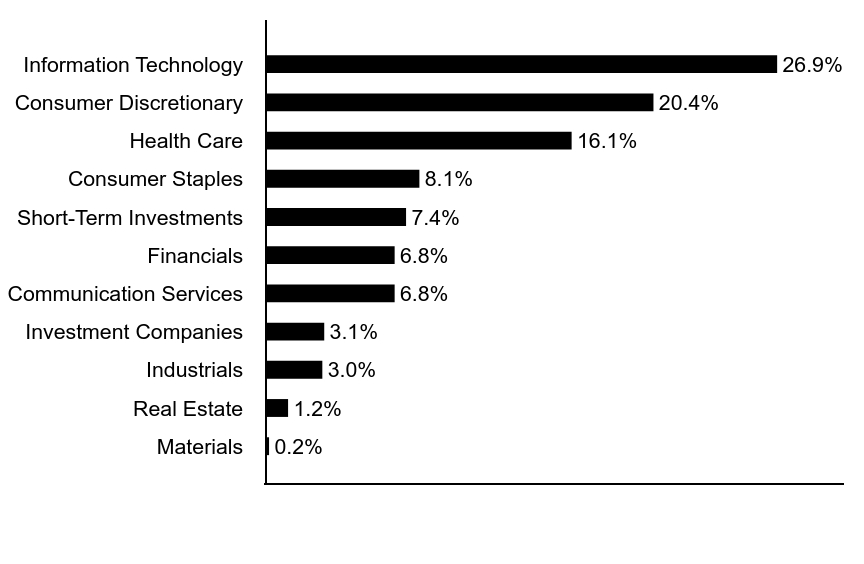

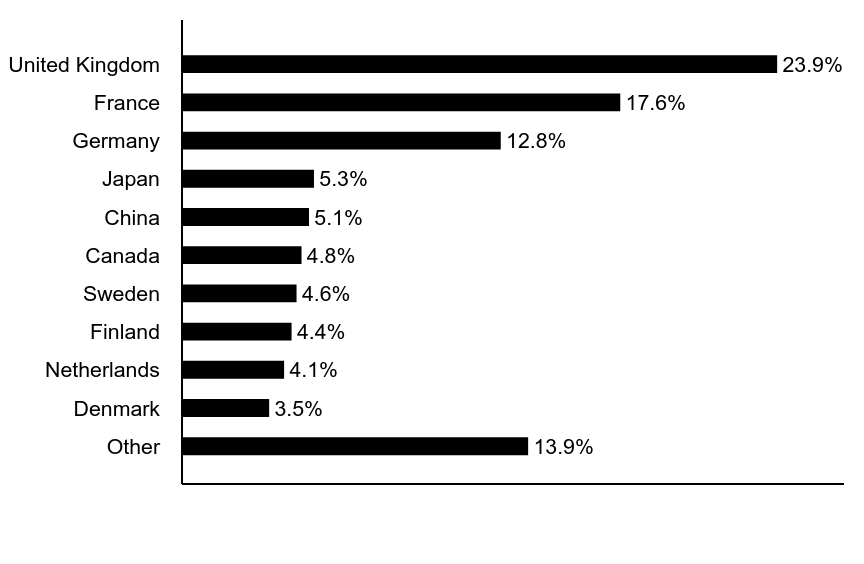

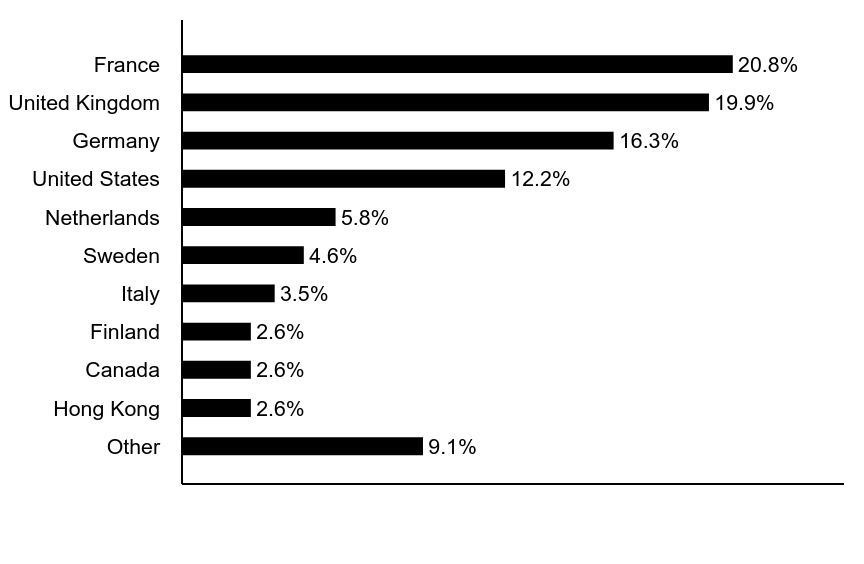

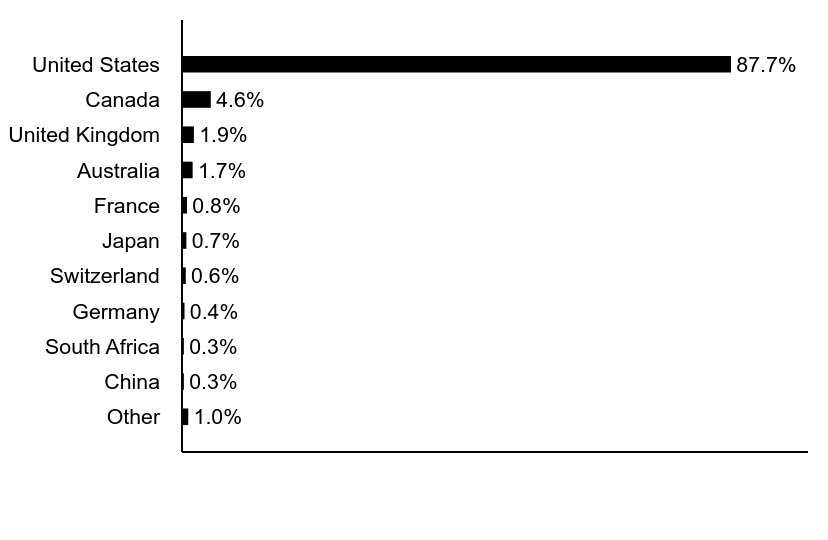

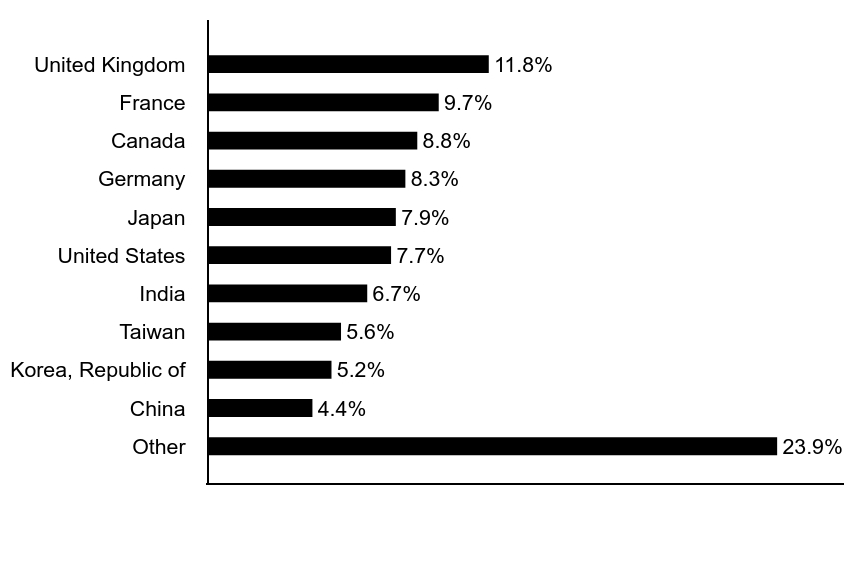

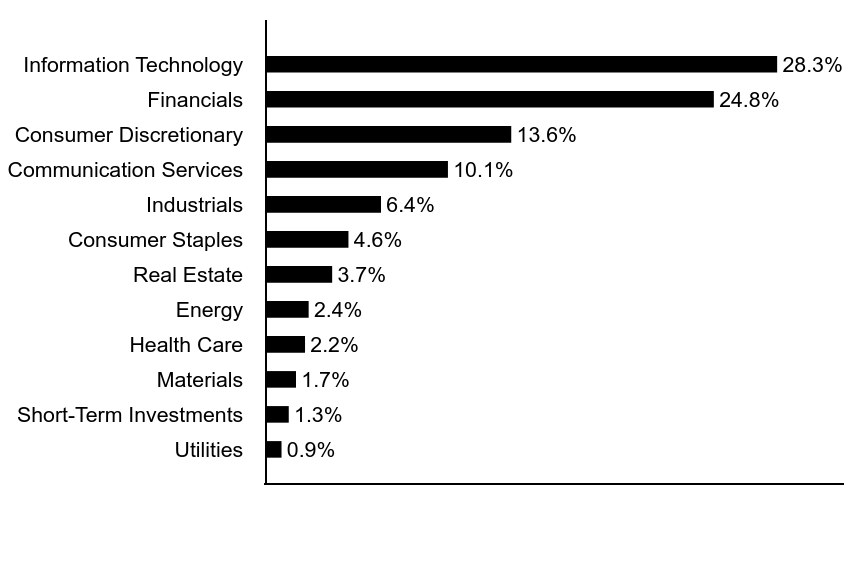

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

|---|

Real Estate | 1.6% | Short-Term Investments | 2.3% | Industrials | 2.6% | Investment Company | 3.0% | Health Care | 5.8% | Financals | 8.0% | Communication Services | 10.7% | Information Technology | 31.6% | Consumer Discretionary | 34.4% |

Top Ten Holdings (% of total investments)Footnote ReferenceaTesla, Inc. | 9.5% | Cloudflare, Inc. | 9.4% | DoorDash, Inc. | 6.4% | Shopify, Inc. | 6.3% | ROBLOX Corp. | 5.4% | Trade Desk, Inc. | 5.3% | MercadoLibre, Inc. | 4.9% | Amazon.com, Inc. | 4.9% | Snowflake, Inc. | 4.9% | Crowdstrike Holdings, Inc. | 3.7% | Total | 60.7% |

| Footnote | Description | Footnotea | Excluding cash equivalents. |

|

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| C000236926 |

|

|

| Shareholder Report [Line Items] |

|

|

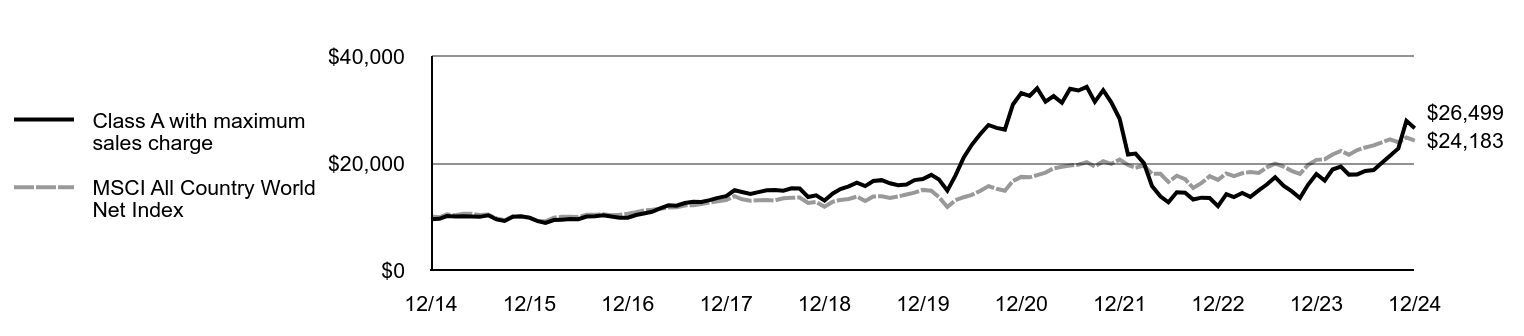

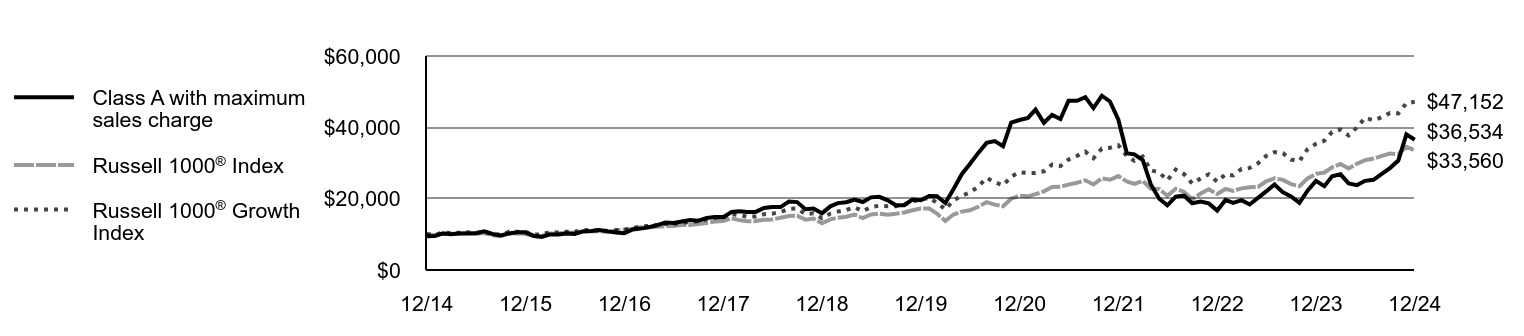

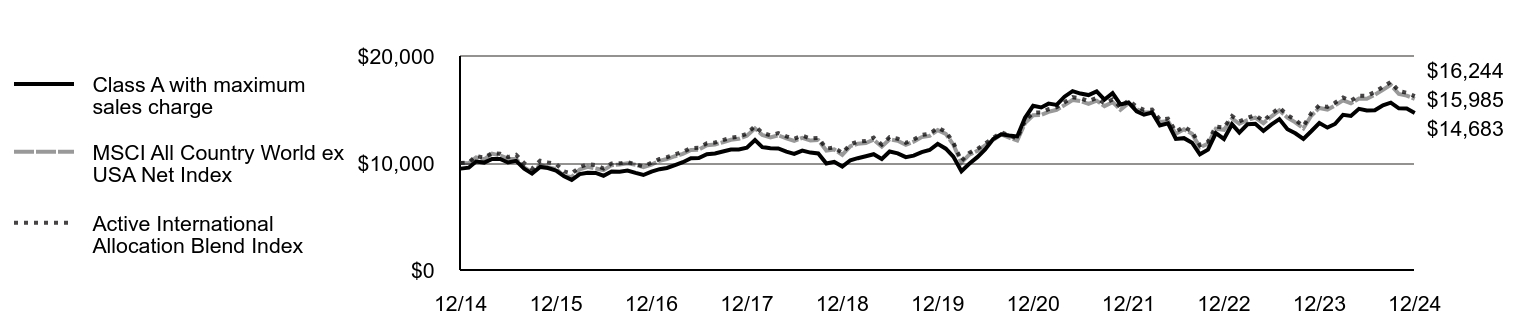

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

MSCUX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $110 | 1.05% |

|---|

|

|

| Expenses Paid, Amount |

$ 110

|

|

| Expense Ratio, Percent |

1.05%

|

|

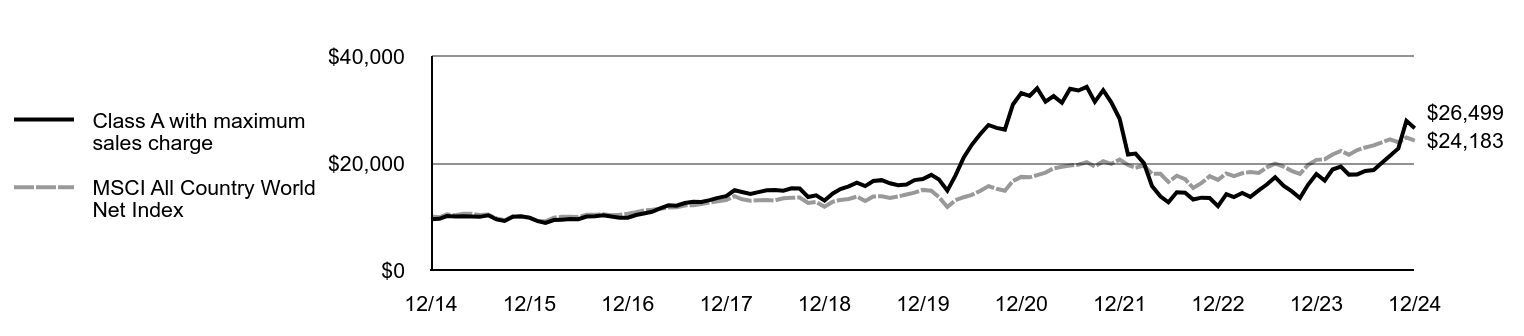

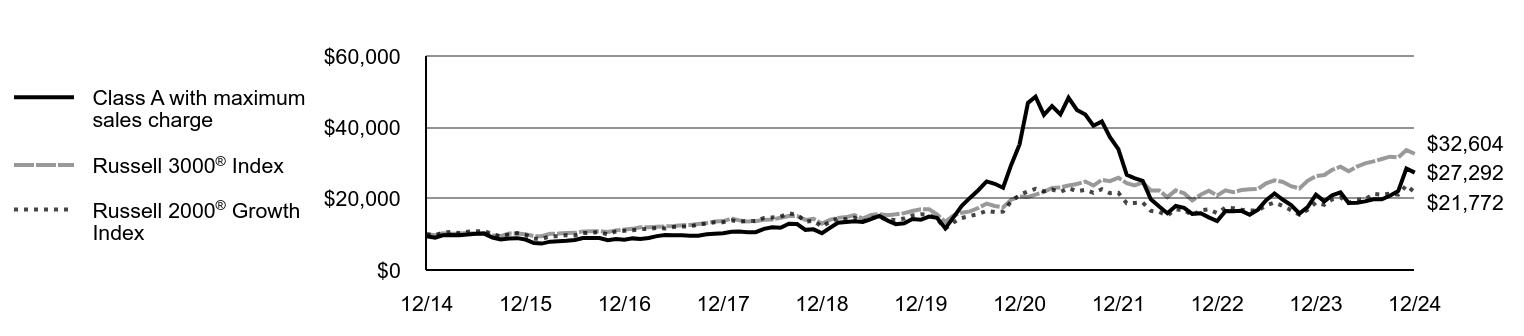

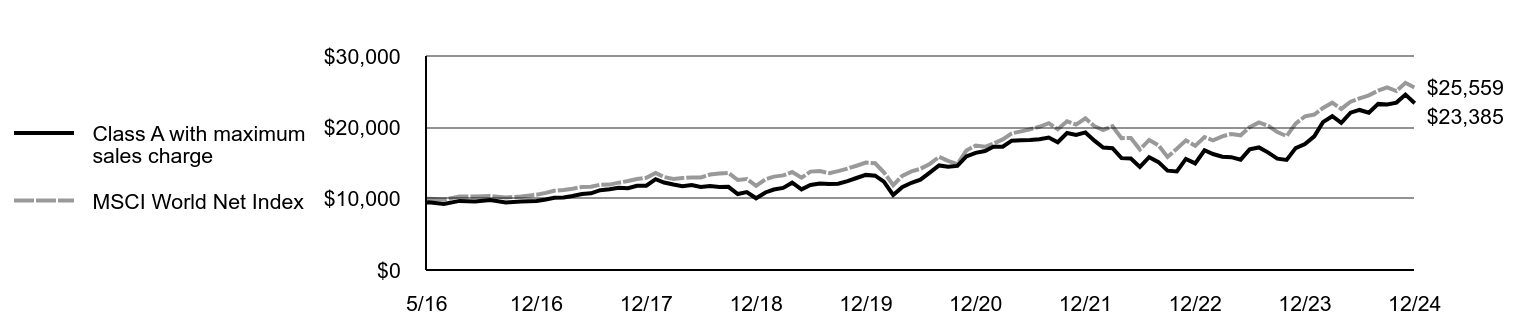

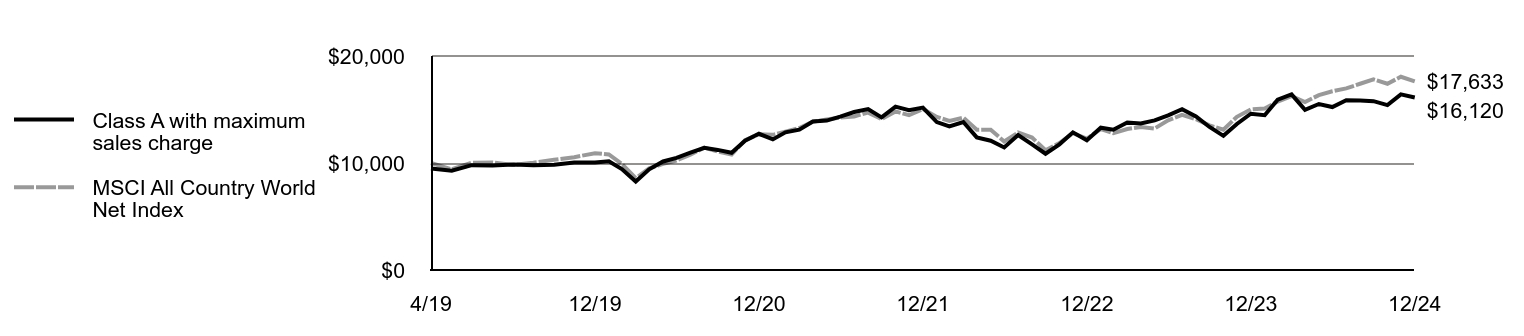

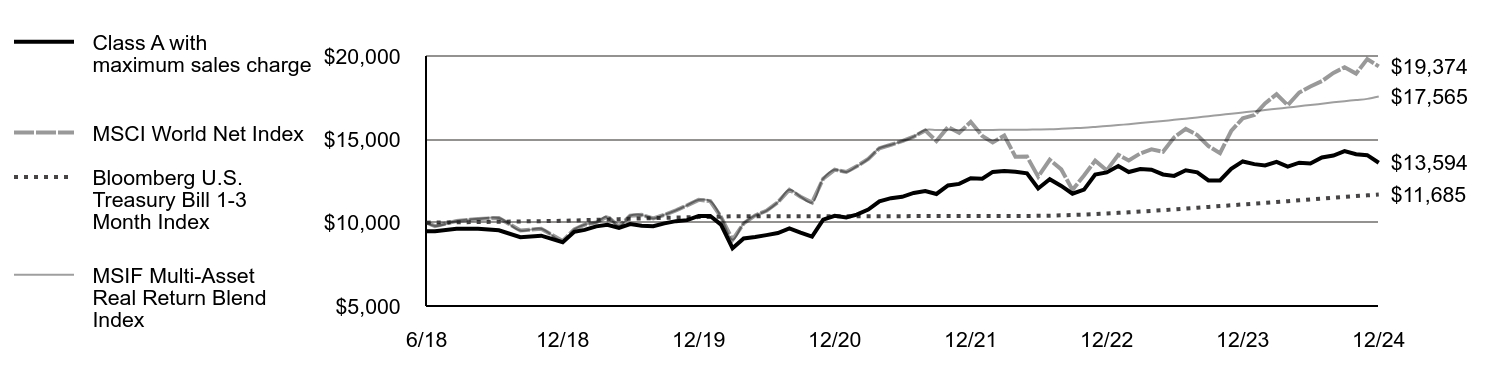

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index: ↓ Stock selection in information technology (IT), financials and health care was the primary detractor ↓ The portfolio’s tilt toward software and IT services significantly lagged semiconductors and hardware. The relative performance impact of the “Magnificent Seven” was notable: the Portfolio owned Microsoft and Alphabet, but the Fund’s high quality bar and strict valuation discipline precluded it from owning the other five, which detracted significantly. ↓ Stock selection in financials lagged due to the strength of banks’ performance in the Index ↓ Consumer staples weakness was primarily down to Constellation Brands, which suffered due to Mexican tariff fears ↑ Financials sector overweight, consumer discretionary sector underweight ↑ Not owning low quality, cyclical sectors, specifically materials, energy and real estate |

|

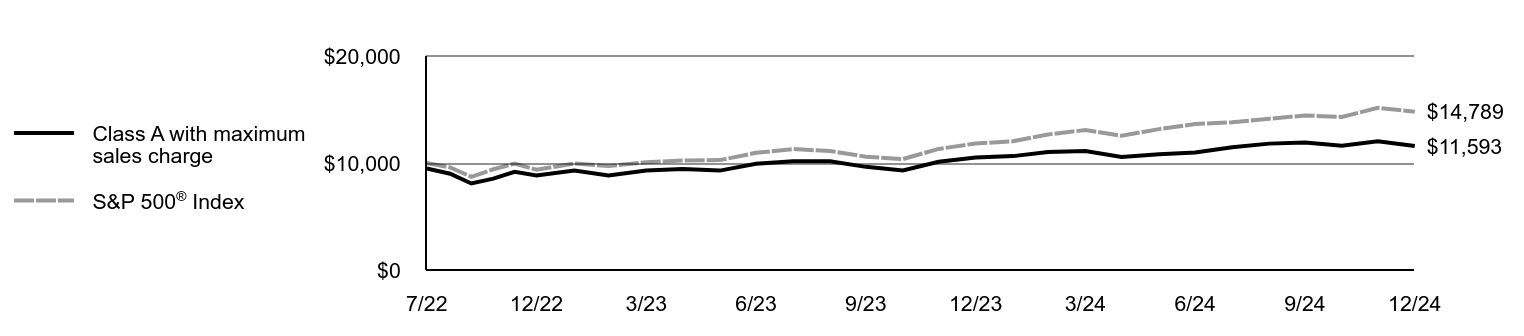

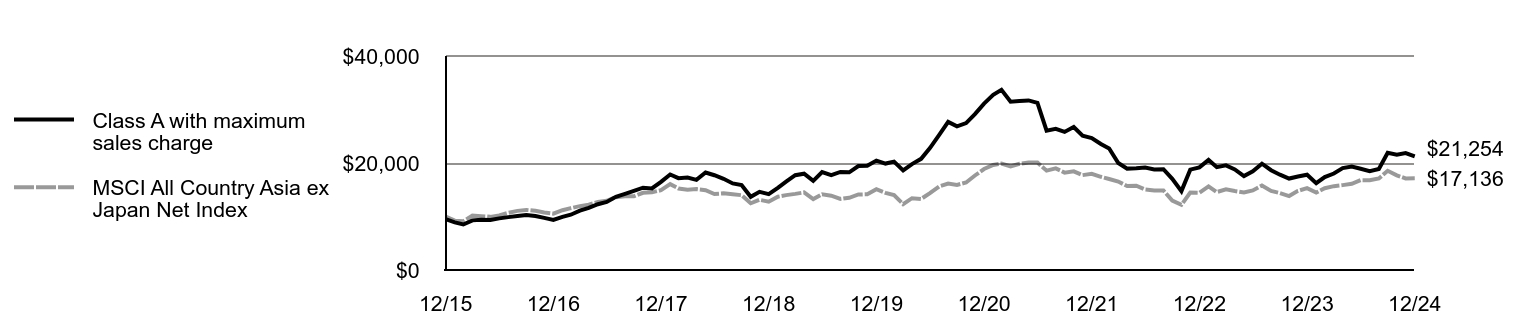

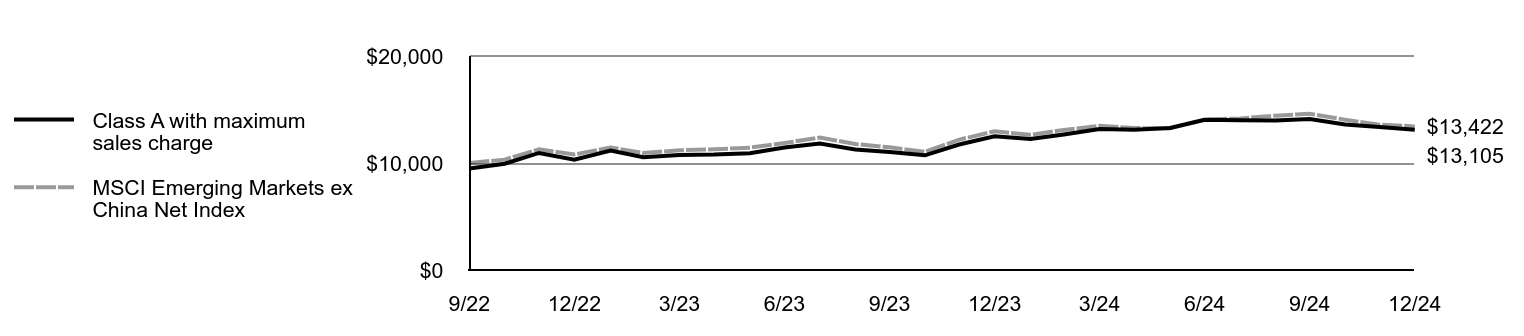

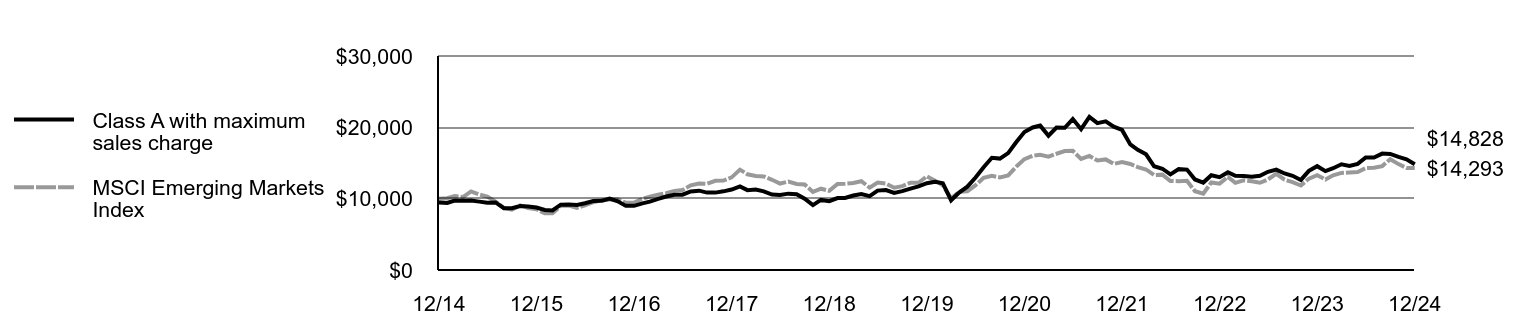

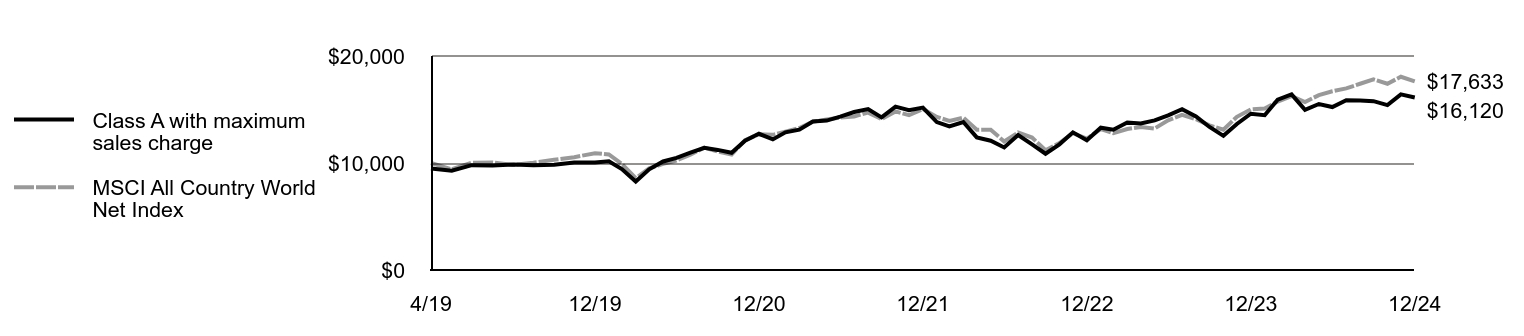

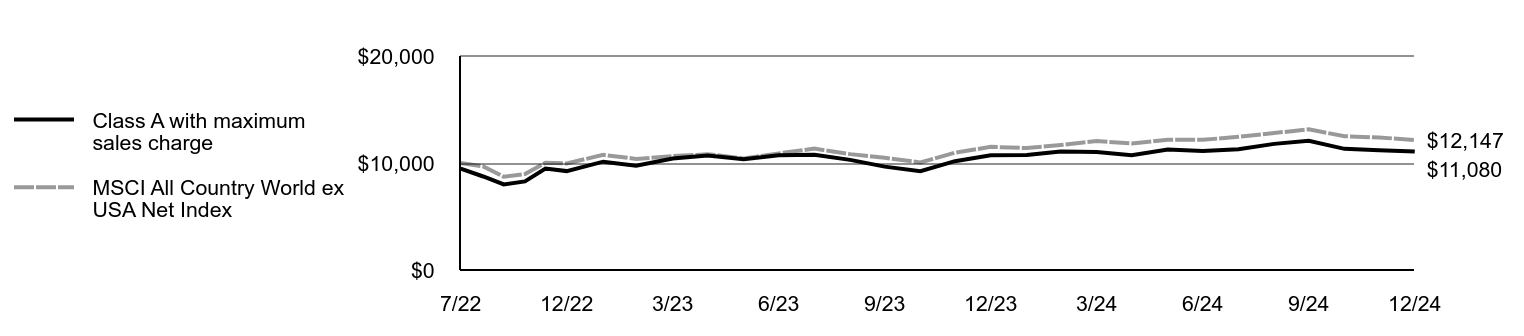

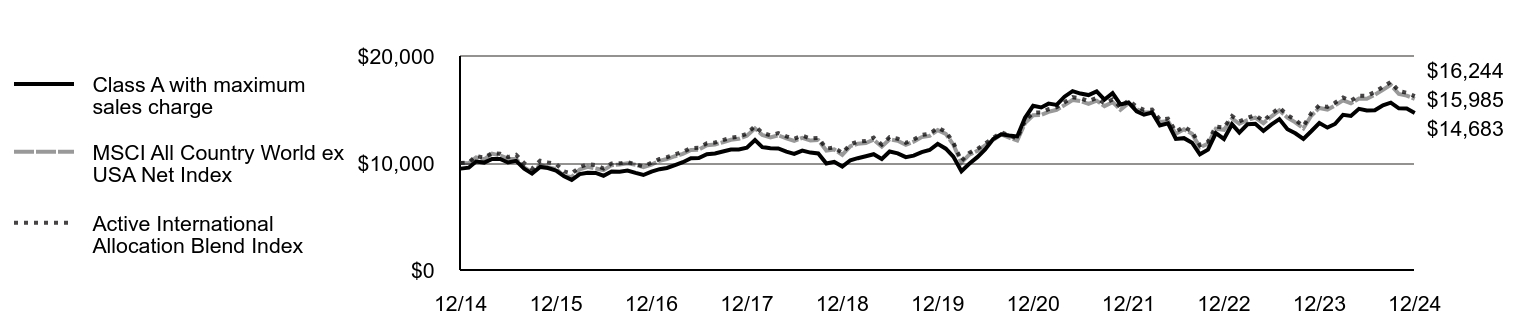

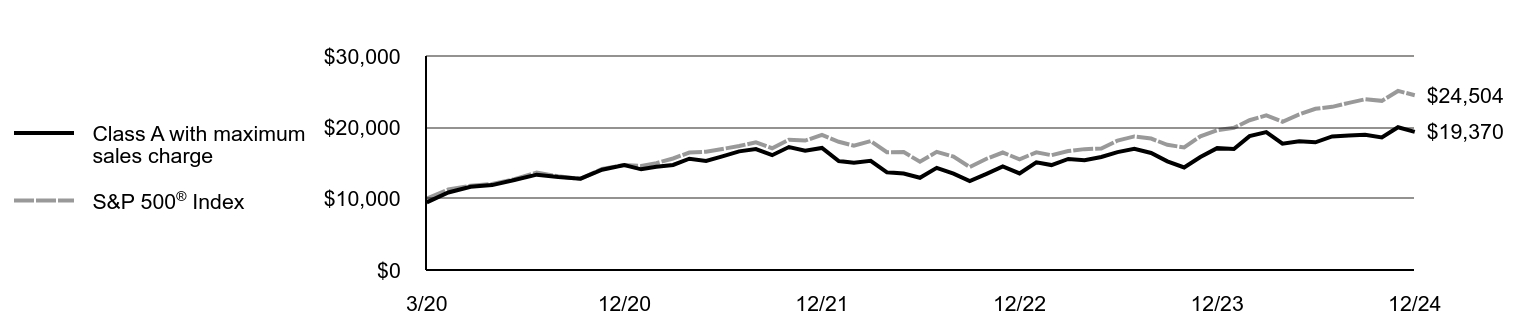

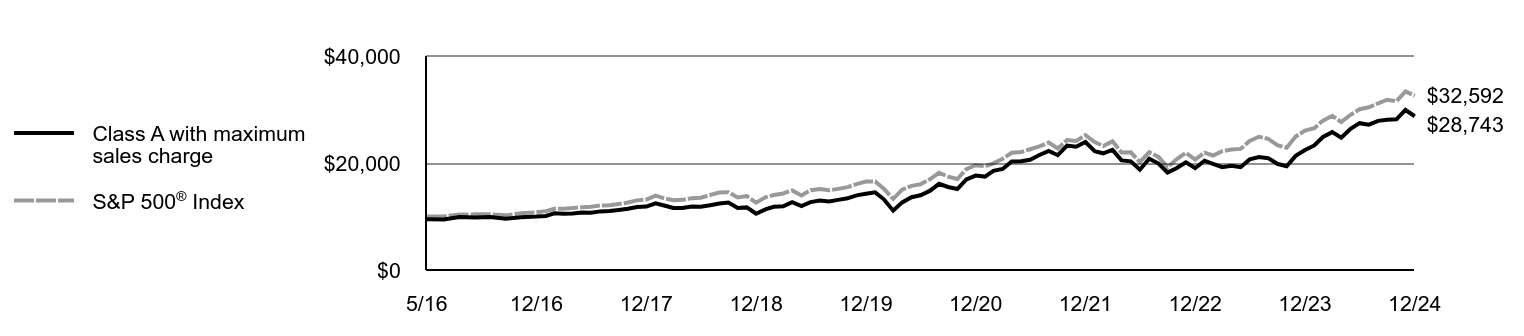

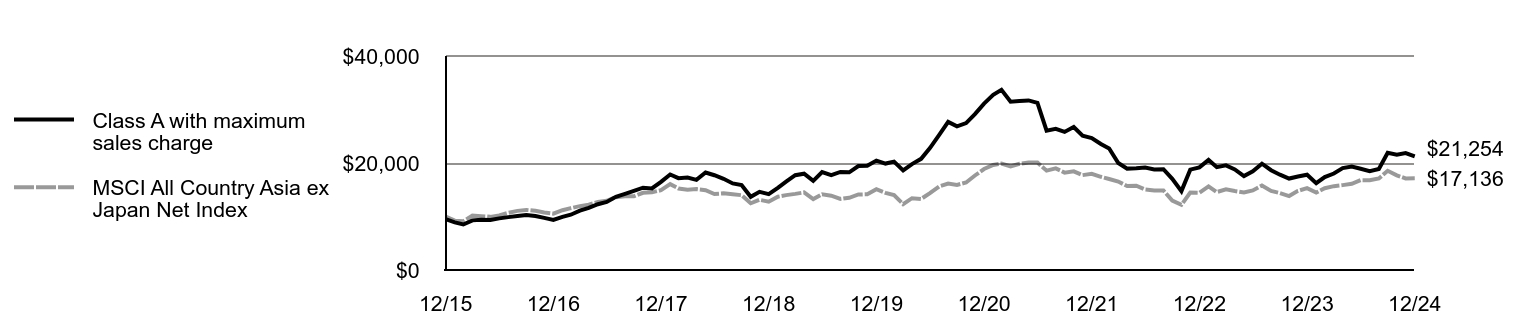

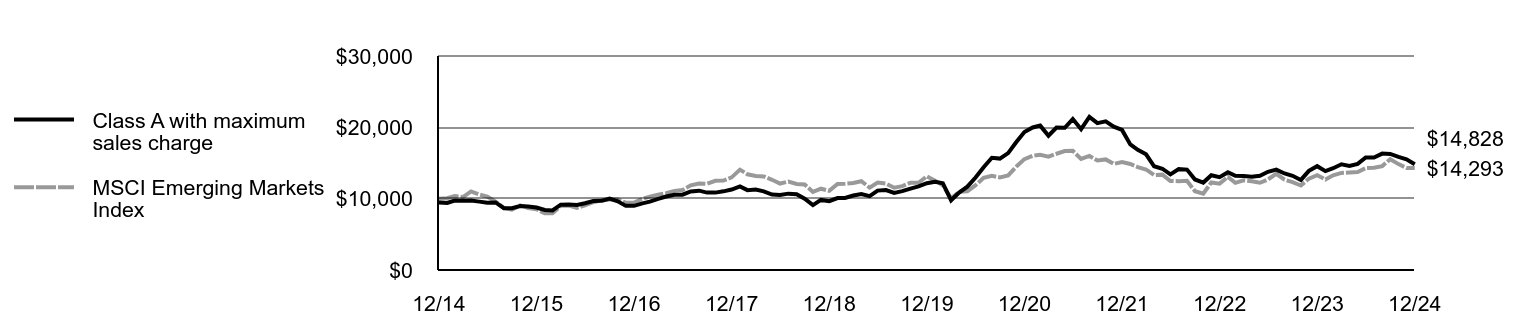

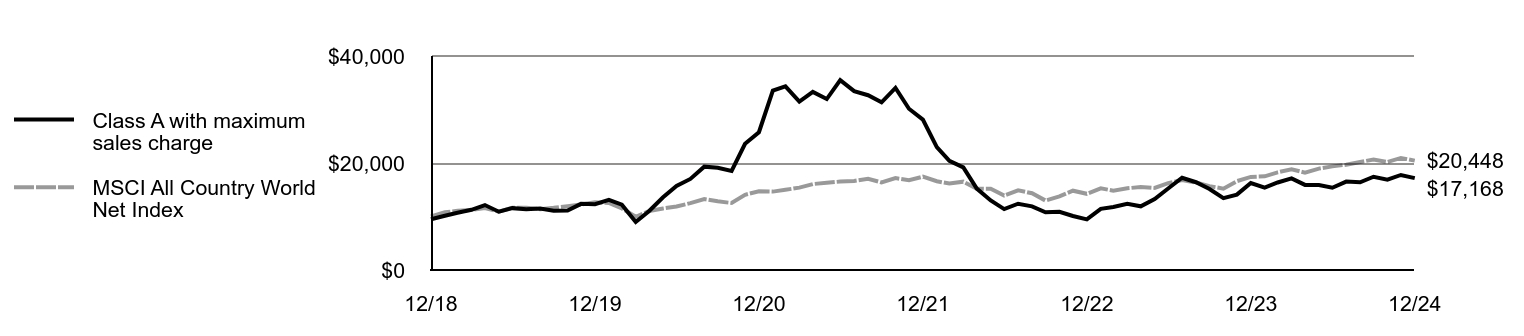

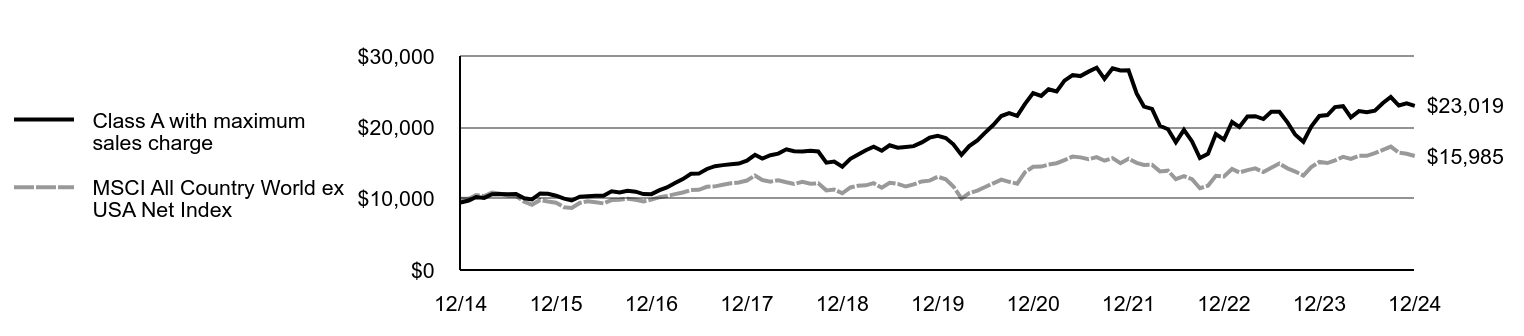

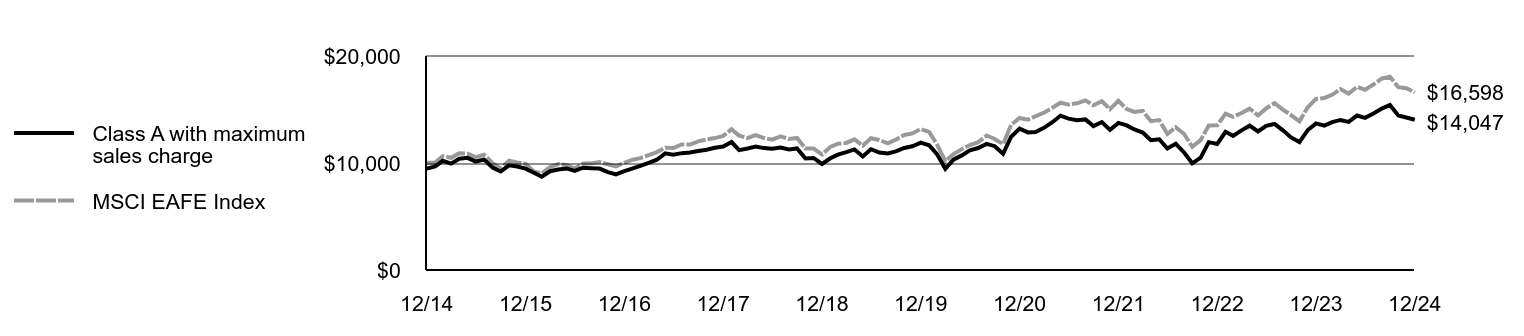

| Line Graph [Table Text Block] |

| Class A with maximum sales charge | S&P 500® Index |

|---|

7/22 | $9,479 | $10,000 |

|---|

8/22 | $8,995 | $9,592 |

|---|

9/22 | $8,085 | $8,709 |

|---|

10/22 | $8,540 | $9,414 |

|---|

11/22 | $9,175 | $9,940 |

|---|

12/22 | $8,825 | $9,367 |

|---|

1/23 | $9,289 | $9,956 |

|---|

2/23 | $8,844 | $9,713 |

|---|

3/23 | $9,308 | $10,069 |

|---|

4/23 | $9,431 | $10,227 |

|---|

5/23 | $9,289 | $10,271 |

|---|

6/23 | $9,924 | $10,950 |

|---|

7/23 | $10,161 | $11,302 |

|---|

8/23 | $10,152 | $11,122 |

|---|

9/23 | $9,640 | $10,591 |

|---|

10/23 | $9,308 | $10,369 |

|---|

11/23 | $10,114 | $11,316 |

|---|

12/23 | $10,519 | $11,830 |

|---|

1/24 | $10,643 | $12,028 |

|---|

2/24 | $11,035 | $12,671 |

|---|

3/24 | $11,112 | $13,078 |

|---|

4/24 | $10,557 | $12,544 |

|---|

5/24 | $10,825 | $13,166 |

|---|

6/24 | $10,988 | $13,639 |

|---|

7/24 | $11,476 | $13,805 |

|---|

8/24 | $11,811 | $14,139 |

|---|

9/24 | $11,926 | $14,441 |

|---|

10/24 | $11,610 | $14,311 |

|---|

11/24 | $12,040 | $15,151 |

|---|

12/24 | $11,593 | $14,789 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | Since 7/29/22

(Inception) |

|---|

Class A | 10.21% | 8.66% |

|---|

Class A, with 5.25% maximum front end sales charge | 4.41% | 6.28% |

|---|

S&P 500® Index | 25.02% | 17.52% |

|---|

|

|

| Performance Inception Date |

Jul. 29, 2022

|

|

| AssetsNet |

$ 1,369,354

|

|

| Holdings Count | Holding |

36

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $1,369,354 |

|---|

# of Portfolio Holdings | 36 |

|---|

Portfolio Turnover Rate | 43% |

|---|

Total Advisory Fees Paid (Net of Waivers) | $0 |

|---|

|

|

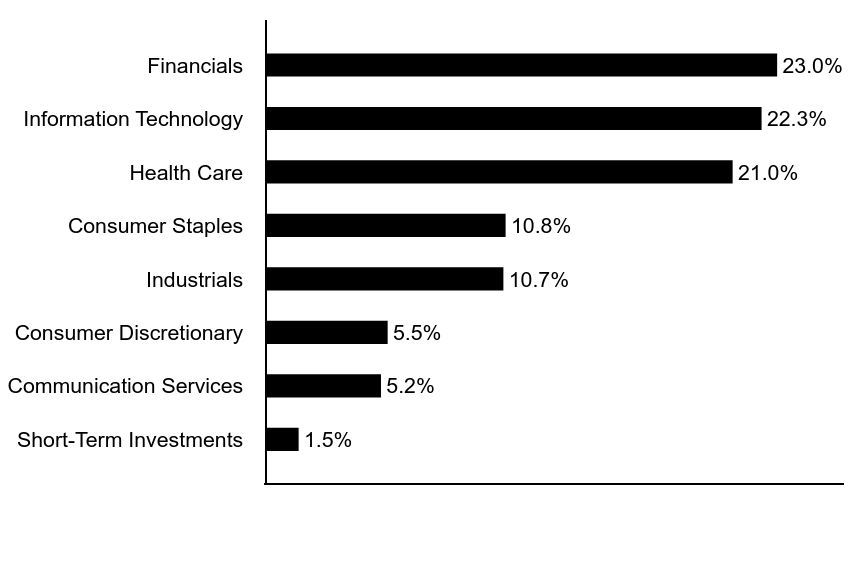

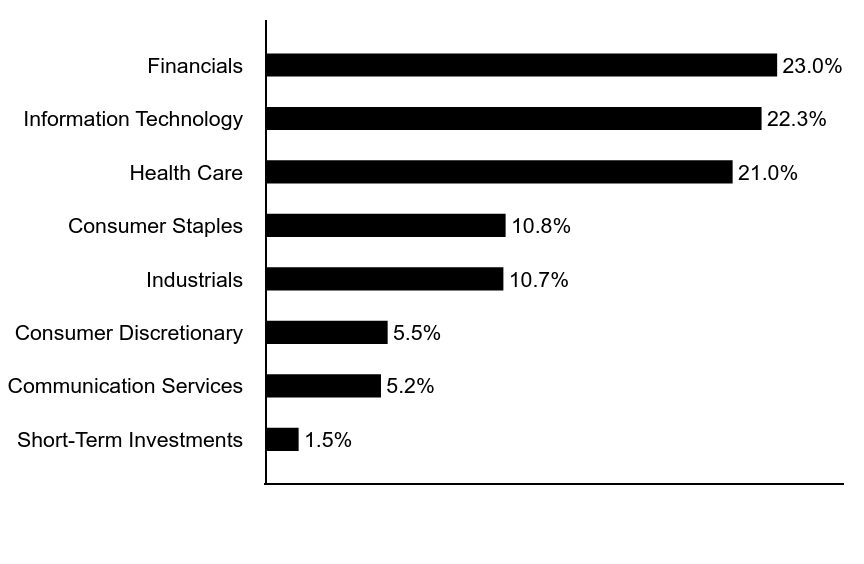

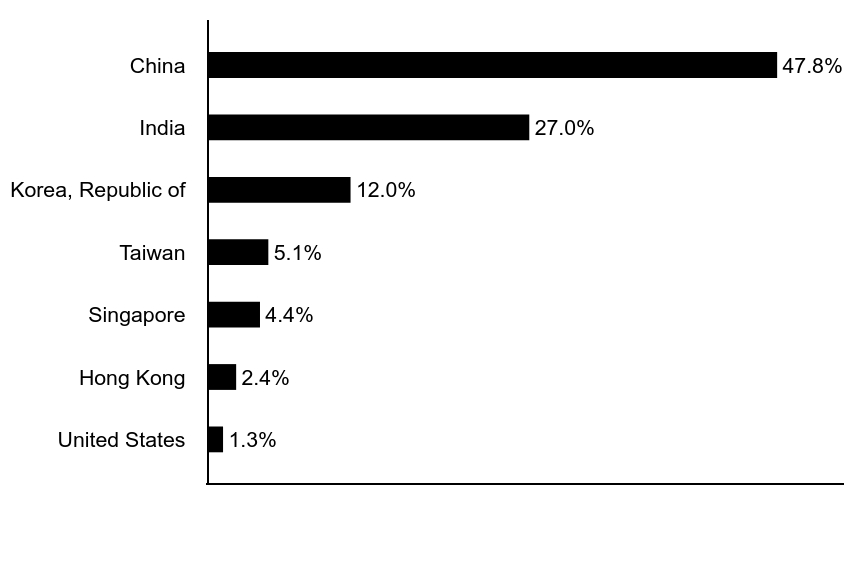

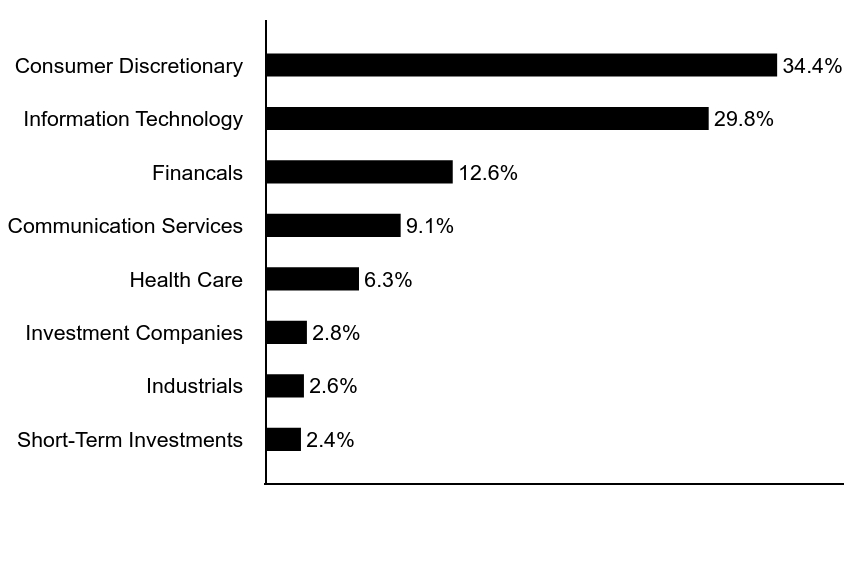

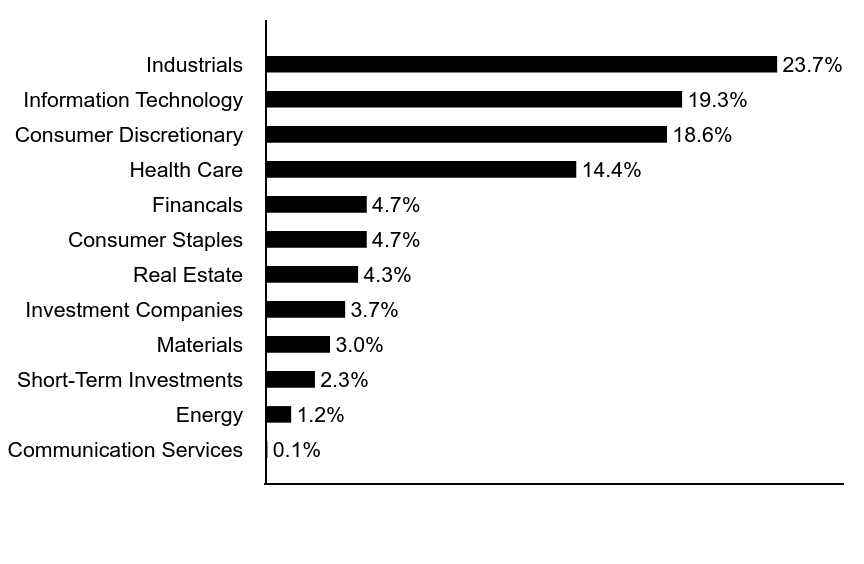

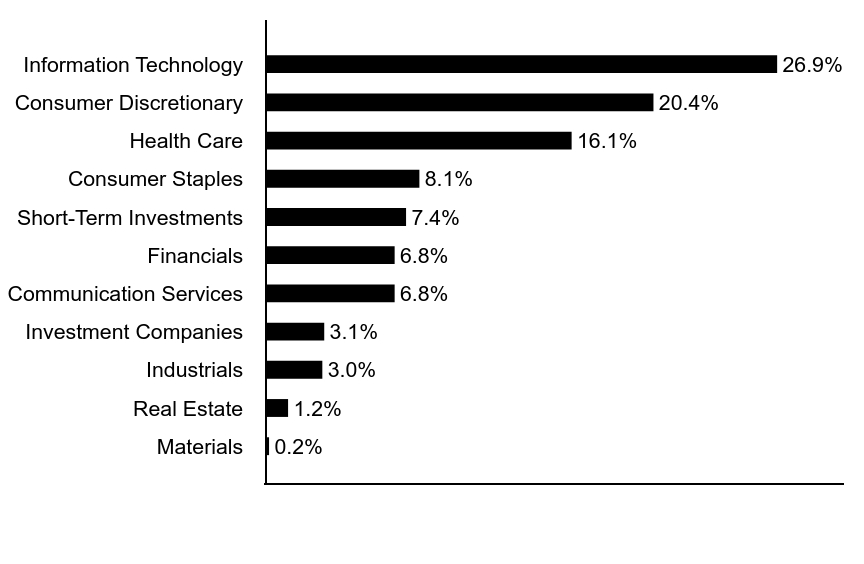

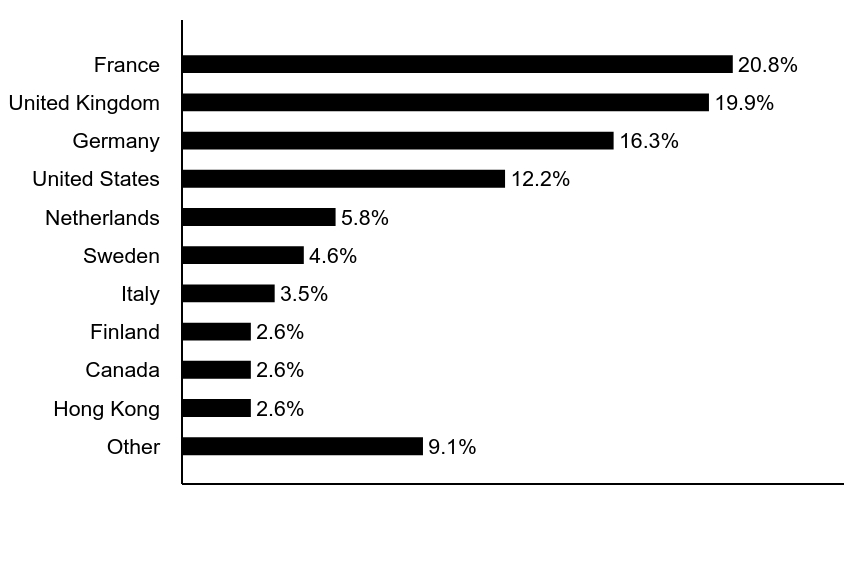

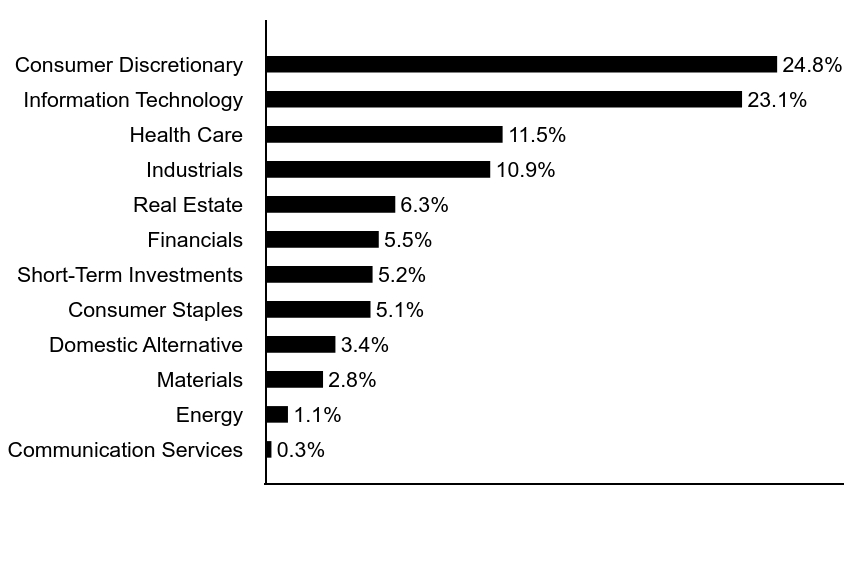

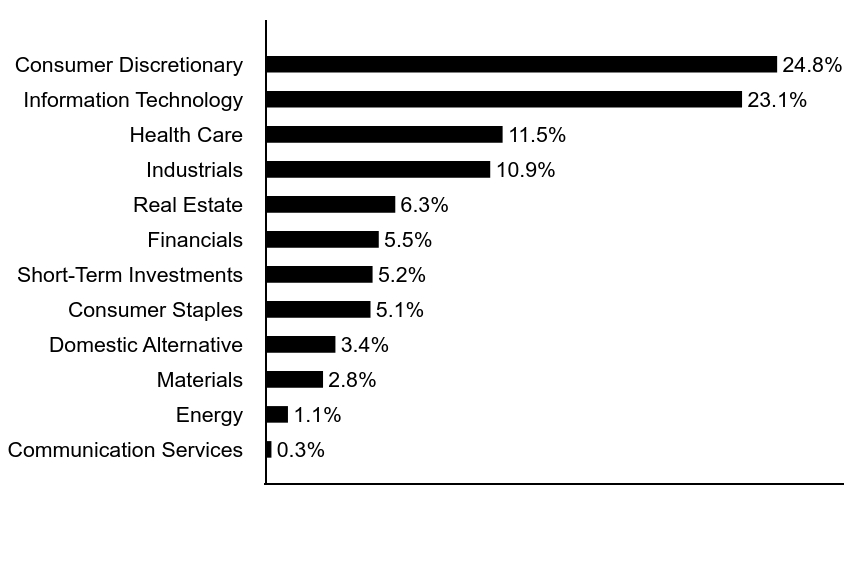

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

|---|

Short-Term Investments | 1.5% | Communication Services | 5.2% | Consumer Discretionary | 5.5% | Industrials | 10.7% | Consumer Staples | 10.8% | Health Care | 21.0% | Information Technology | 22.3% | Financials | 23.0% |

Top Ten Holdings (% of total investments)Footnote ReferenceaMicrosoft Corp. | 7.2% | Visa, Inc. | 6.5% | Alphabet, Inc. | 5.2% | Accenture PLC | 4.6% | Aon PLC | 4.1% | Texas Instruments, Inc. | 3.9% | Procter & Gamble Co. | 3.9% | Intercontinental Exchange, Inc. | 3.5% | Thermo Fisher Scientific, Inc. | 3.3% | Automatic Data Processing, Inc. | 3.2% | Total | 45.4% |

| Footnote | Description | Footnotea | Excluding cash equivalents. |

|

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| C000236923 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

|

|

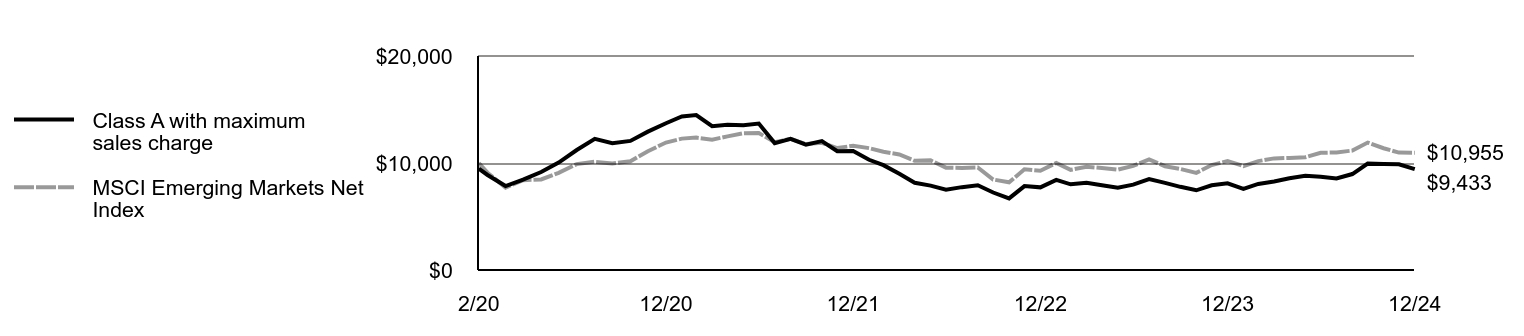

| Class Name |

Class C

|

|

| Trading Symbol |

MSBWX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class C | $188 | 1.80% |

|---|

|

|

| Expenses Paid, Amount |

$ 188

|

|

| Expense Ratio, Percent |

1.80%

|

|

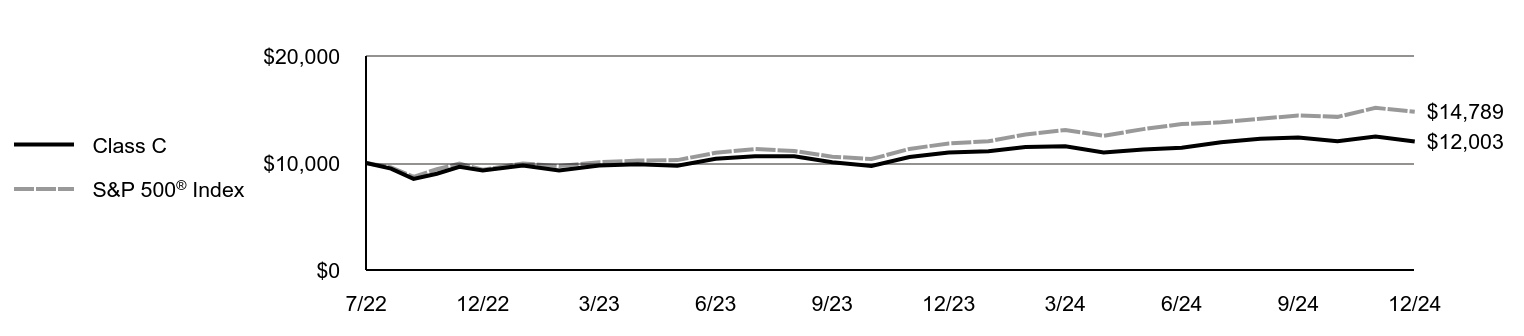

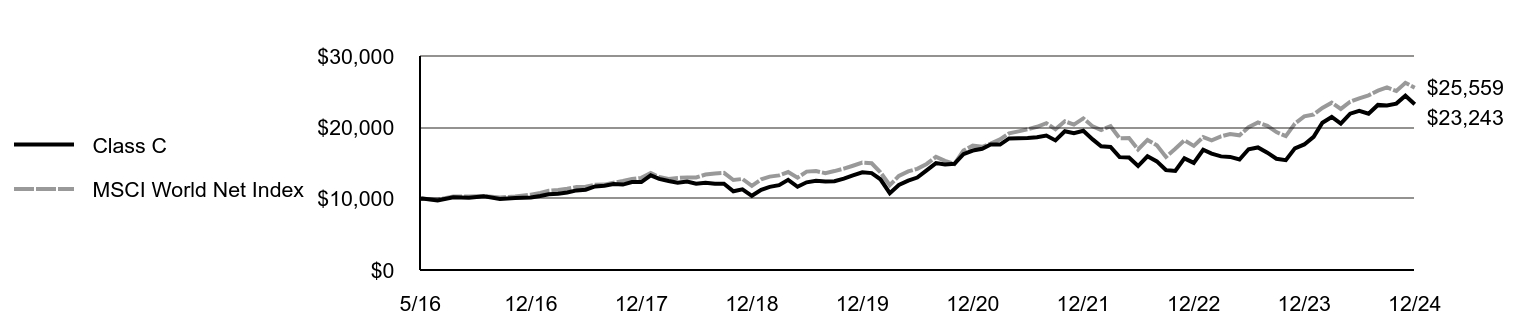

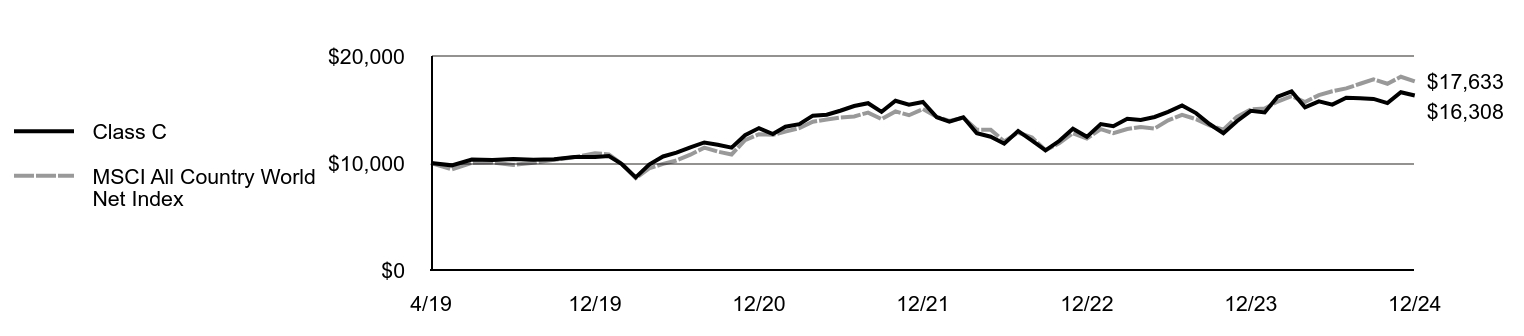

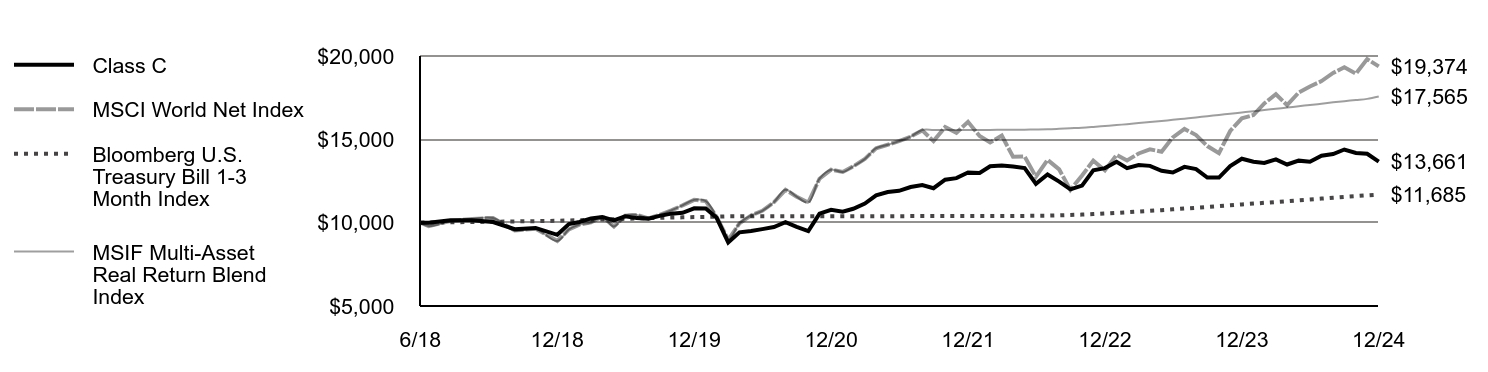

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index: ↓ Stock selection in information technology (IT), financials and health care was the primary detractor ↓ The portfolio’s tilt toward software and IT services significantly lagged semiconductors and hardware. The relative performance impact of the “Magnificent Seven” was notable: the Portfolio owned Microsoft and Alphabet, but the Fund’s high quality bar and strict valuation discipline precluded it from owning the other five, which detracted significantly. ↓ Stock selection in financials lagged due to the strength of banks’ performance in the Index ↓ Consumer staples weakness was primarily down to Constellation Brands, which suffered due to Mexican tariff fears ↑ Financials sector overweight, consumer discretionary sector underweight ↑ Not owning low quality, cyclical sectors, specifically materials, energy and real estate |

|

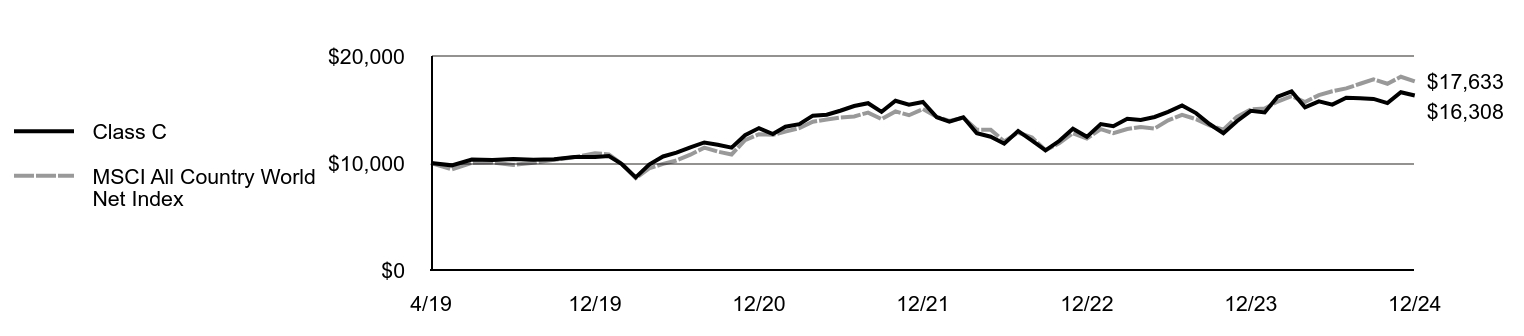

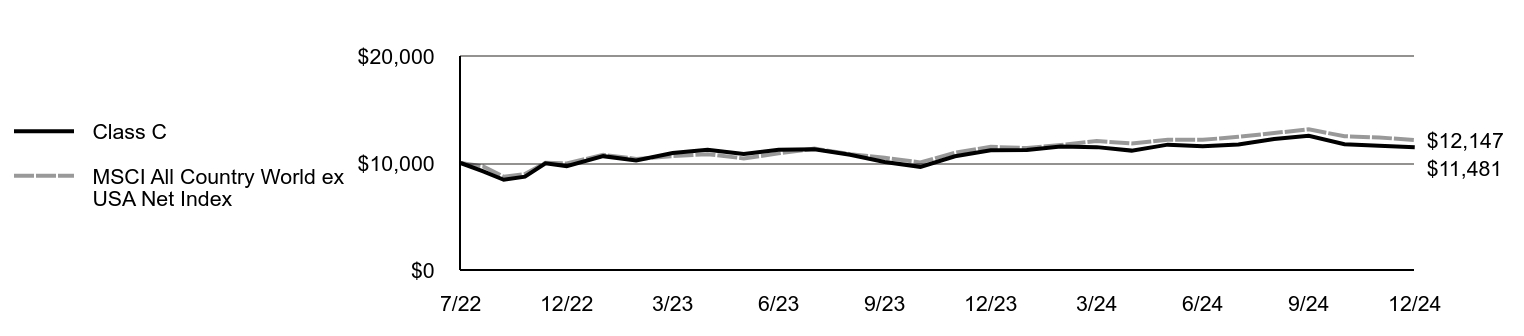

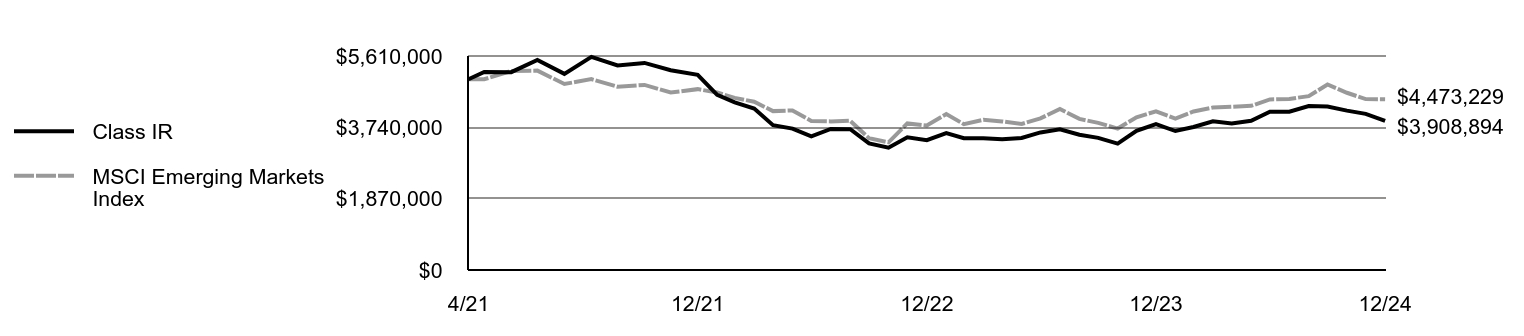

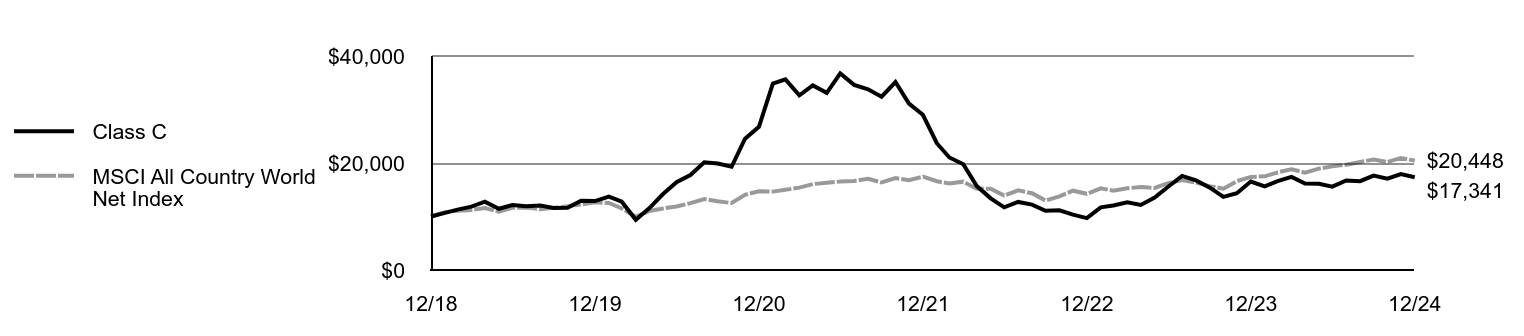

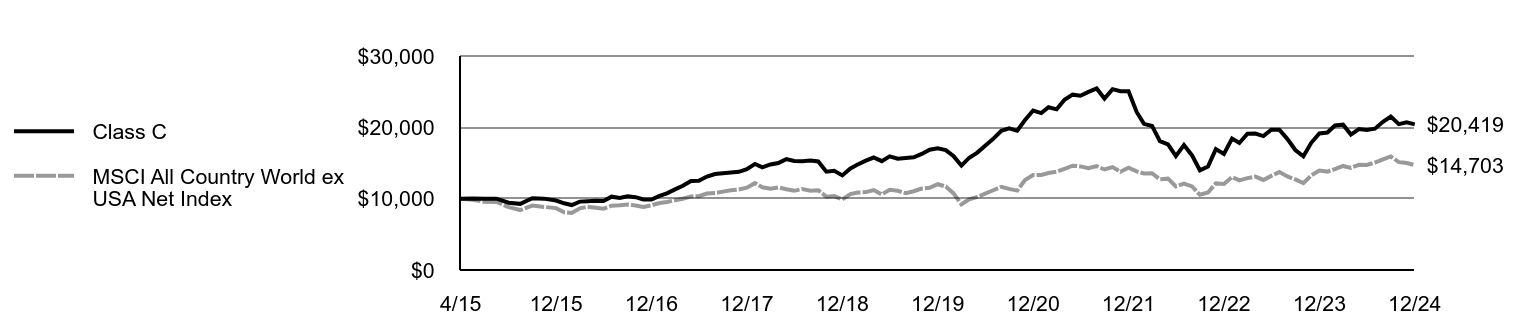

| Line Graph [Table Text Block] |

| Class C | S&P 500® Index |

|---|

7/22 | $10,000 | $10,000 |

|---|

8/22 | $9,480 | $9,592 |

|---|

9/22 | $8,520 | $8,709 |

|---|

10/22 | $9,000 | $9,414 |

|---|

11/22 | $9,650 | $9,940 |

|---|

12/22 | $9,290 | $9,367 |

|---|

1/23 | $9,760 | $9,956 |

|---|

2/23 | $9,290 | $9,713 |

|---|

3/23 | $9,770 | $10,069 |

|---|

4/23 | $9,890 | $10,227 |

|---|

5/23 | $9,740 | $10,271 |

|---|

6/23 | $10,400 | $10,950 |

|---|

7/23 | $10,640 | $11,302 |

|---|

8/23 | $10,630 | $11,122 |

|---|

9/23 | $10,080 | $10,591 |

|---|

10/23 | $9,730 | $10,369 |

|---|

11/23 | $10,560 | $11,316 |

|---|

12/23 | $10,981 | $11,830 |

|---|

1/24 | $11,102 | $12,028 |

|---|

2/24 | $11,503 | $12,671 |

|---|

3/24 | $11,573 | $13,078 |

|---|

4/24 | $10,991 | $12,544 |

|---|

5/24 | $11,262 | $13,166 |

|---|

6/24 | $11,423 | $13,639 |

|---|

7/24 | $11,934 | $13,805 |

|---|

8/24 | $12,265 | $14,139 |

|---|

9/24 | $12,385 | $14,441 |

|---|

10/24 | $12,044 | $14,311 |

|---|

11/24 | $12,486 | $15,151 |

|---|

12/24 | $12,003 | $14,789 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | Since 7/29/22

(Inception) |

|---|

Class C | 9.31% | 7.82% |

|---|

Class C, with 1% maximum contingent deferred sales charge | 8.31% | 7.82% |

|---|

S&P 500® Index | 25.02% | 17.52% |

|---|

|

|

| Performance Inception Date |

Jul. 29, 2022

|

|

| AssetsNet |

$ 1,369,354

|

|

| Holdings Count | Holding |

36

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $1,369,354 |

|---|

# of Portfolio Holdings | 36 |

|---|

Portfolio Turnover Rate | 43% |

|---|

Total Advisory Fees Paid (Net of Waivers) | $0 |

|---|

|

|

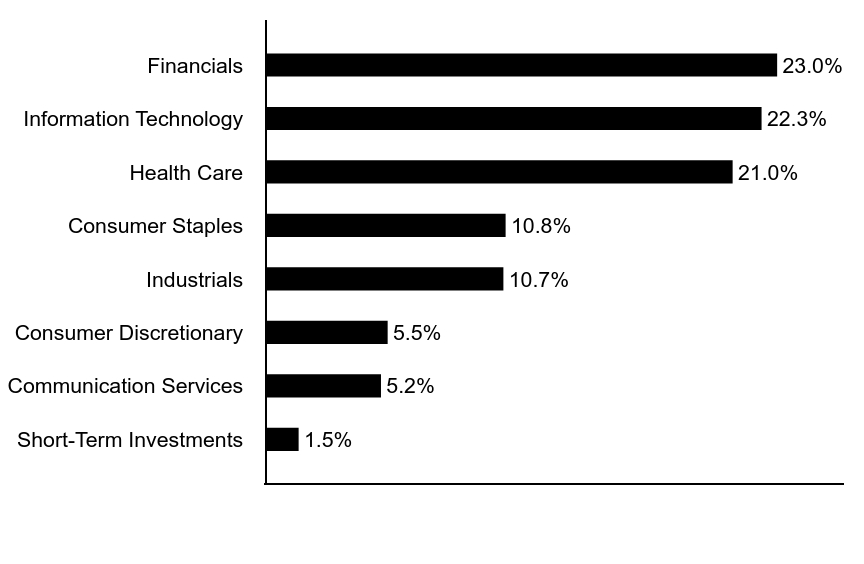

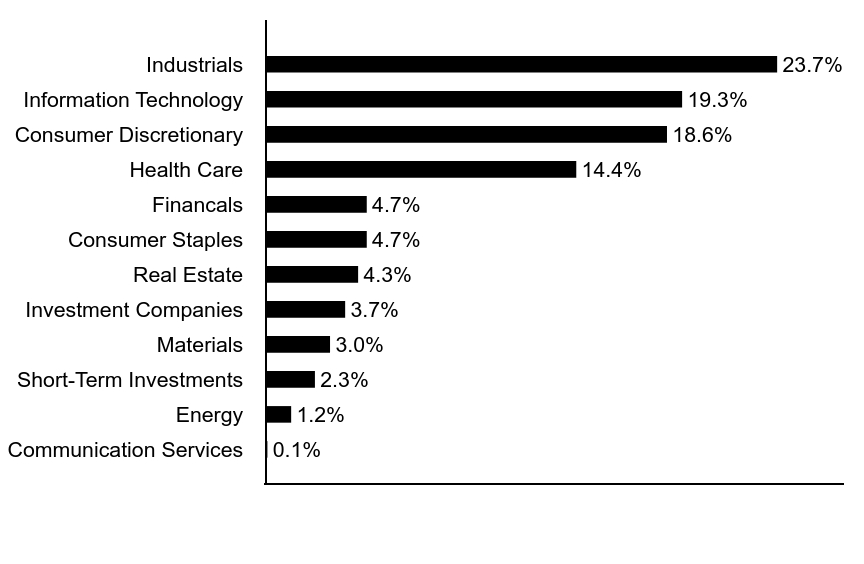

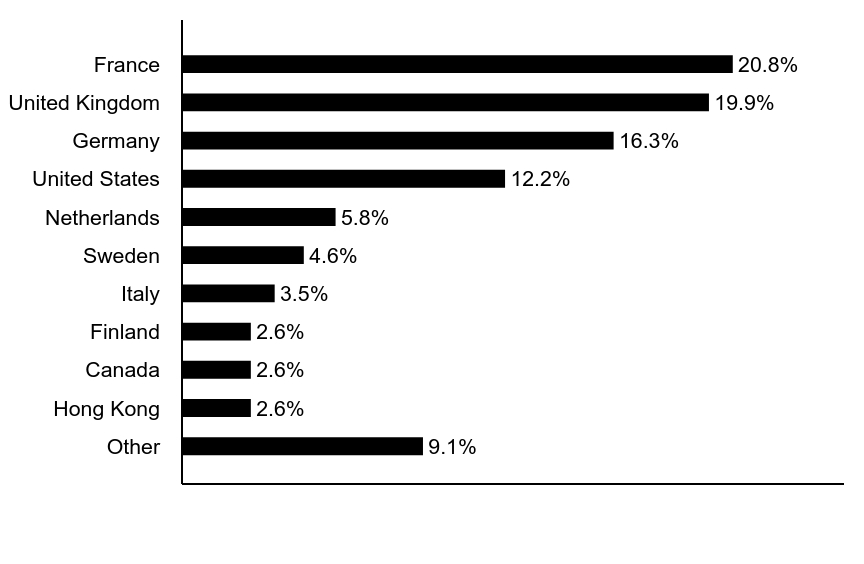

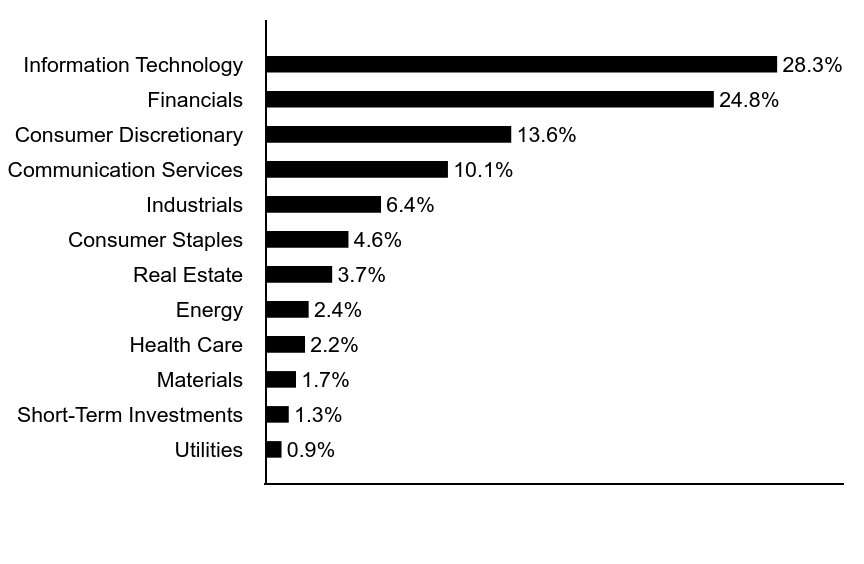

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

|---|

Short-Term Investments | 1.5% | Communication Services | 5.2% | Consumer Discretionary | 5.5% | Industrials | 10.7% | Consumer Staples | 10.8% | Health Care | 21.0% | Information Technology | 22.3% | Financials | 23.0% |

Top Ten Holdings (% of total investments)Footnote ReferenceaMicrosoft Corp. | 7.2% | Visa, Inc. | 6.5% | Alphabet, Inc. | 5.2% | Accenture PLC | 4.6% | Aon PLC | 4.1% | Texas Instruments, Inc. | 3.9% | Procter & Gamble Co. | 3.9% | Intercontinental Exchange, Inc. | 3.5% | Thermo Fisher Scientific, Inc. | 3.3% | Automatic Data Processing, Inc. | 3.2% | Total | 45.4% |

| Footnote | Description | Footnotea | Excluding cash equivalents. |

|

|

| Material Fund Change [Text Block] |

|

|

| Updated Prospectus Web Address |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| C000236924 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

MSBVX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio for the period of January 1, 2024 to December 31, 2024.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

|

|

| Additional Information Phone Number |

1-800-869-6397

|

|

| Additional Information Website |

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; font-weight: 400; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left;">www.morganstanley.com/im/shareholderreports</span>

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $74 | 0.70% |

|---|

|

|

| Expenses Paid, Amount |

$ 74

|

|

| Expense Ratio, Percent |

0.70%

|

|

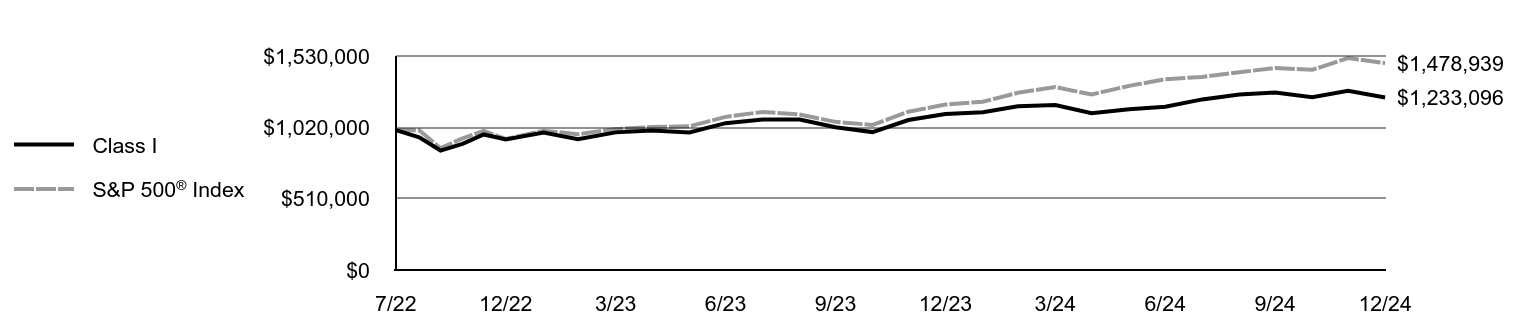

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected its performance?Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index: ↓ Stock selection in information technology (IT), financials and health care was the primary detractor ↓ The portfolio’s tilt toward software and IT services significantly lagged semiconductors and hardware. The relative performance impact of the “Magnificent Seven” was notable: the Portfolio owned Microsoft and Alphabet, but the Fund’s high quality bar and strict valuation discipline precluded it from owning the other five, which detracted significantly. ↓ Stock selection in financials lagged due to the strength of banks’ performance in the Index ↓ Consumer staples weakness was primarily down to Constellation Brands, which suffered due to Mexican tariff fears ↑ Financials sector overweight, consumer discretionary sector underweight ↑ Not owning low quality, cyclical sectors, specifically materials, energy and real estate |

|

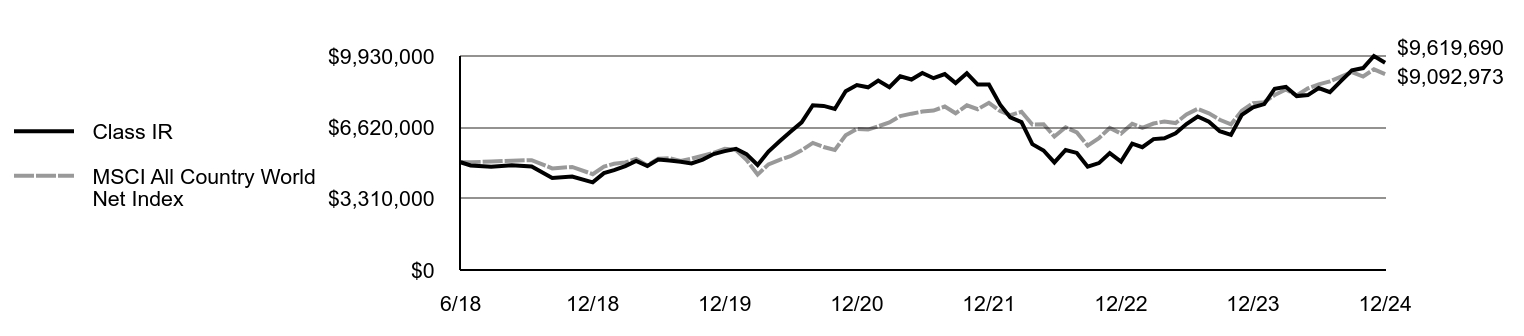

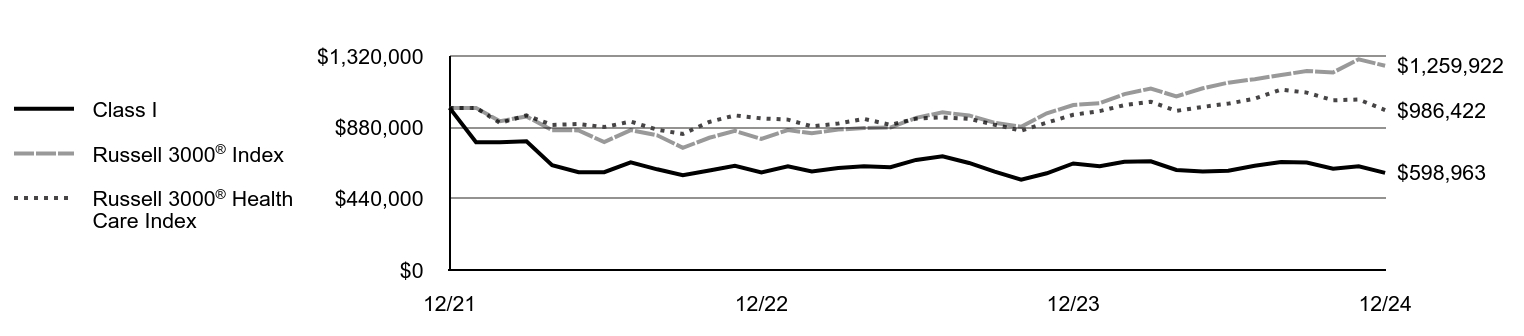

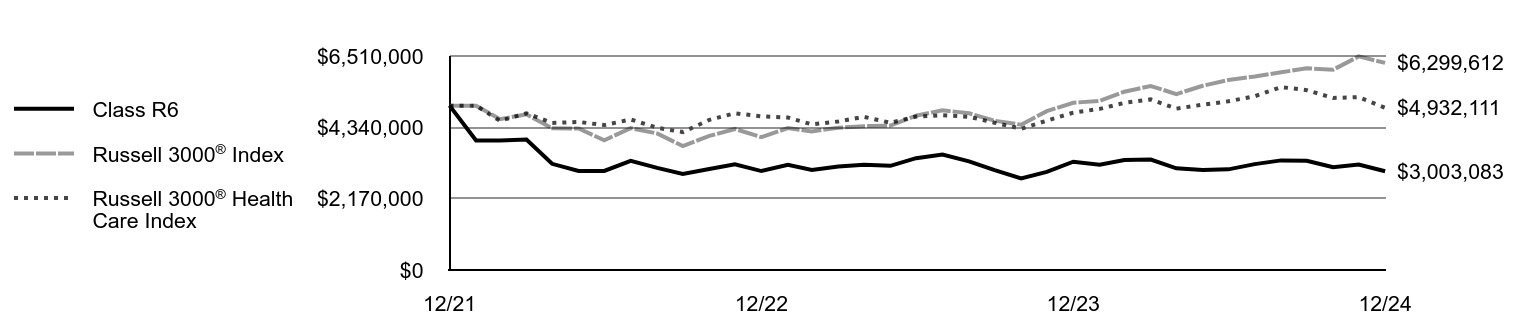

| Line Graph [Table Text Block] |

| Class I | S&P 500® Index |

|---|

7/22 | $1,000,000 | $1,000,000 |

|---|

8/22 | $949,000 | $1,000,000 |

|---|

9/22 | $854,000 | $870,875 |

|---|

10/22 | $902,000 | $941,383 |

|---|

11/22 | $969,000 | $993,991 |

|---|

12/22 | $933,000 | $936,723 |

|---|

1/23 | $982,000 | $995,581 |

|---|

2/23 | $935,000 | $971,289 |

|---|

3/23 | $984,000 | $1,006,950 |

|---|

4/23 | $997,000 | $1,022,667 |

|---|

5/23 | $983,000 | $1,027,112 |

|---|

6/23 | $1,050,000 | $1,094,978 |

|---|

7/23 | $1,076,000 | $1,130,155 |

|---|

8/23 | $1,076,000 | $1,112,161 |

|---|

9/23 | $1,021,000 | $1,059,135 |

|---|

10/23 | $986,000 | $1,036,865 |

|---|

11/23 | $1,072,000 | $1,131,557 |

|---|

12/23 | $1,115,319 | $1,182,965 |

|---|

1/24 | $1,128,488 | $1,202,844 |

|---|

2/24 | $1,170,021 | $1,267,070 |

|---|

3/24 | $1,179,138 | $1,307,838 |

|---|

4/24 | $1,120,384 | $1,254,420 |

|---|

5/24 | $1,149,761 | $1,316,620 |

|---|

6/24 | $1,166,982 | $1,363,863 |

|---|

7/24 | $1,219,658 | $1,380,464 |

|---|

8/24 | $1,255,114 | $1,413,950 |

|---|

9/24 | $1,268,283 | $1,444,148 |

|---|

10/24 | $1,234,854 | $1,431,051 |

|---|

11/24 | $1,281,452 | $1,515,056 |

|---|

12/24 | $1,233,096 | $1,478,939 |

|---|

|

|

| Average Annual Return [Table Text Block] |

AATR | 1 Year | Since 7/29/22

(Inception) |

|---|

Class I | 10.56% | 9.03% |

|---|

S&P 500® Index | 25.02% | 17.52% |

|---|

|

|

| Performance Inception Date |

Jul. 29, 2022

|

|

| AssetsNet |

$ 1,369,354

|

|

| Holdings Count | Holding |

36

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

43.00%

|

|

| Additional Fund Statistics [Text Block] |

Total Net Assets | $1,369,354 |

|---|

# of Portfolio Holdings | 36 |

|---|

Portfolio Turnover Rate | 43% |

|---|

Total Advisory Fees Paid (Net of Waivers) | $0 |

|---|

|

|

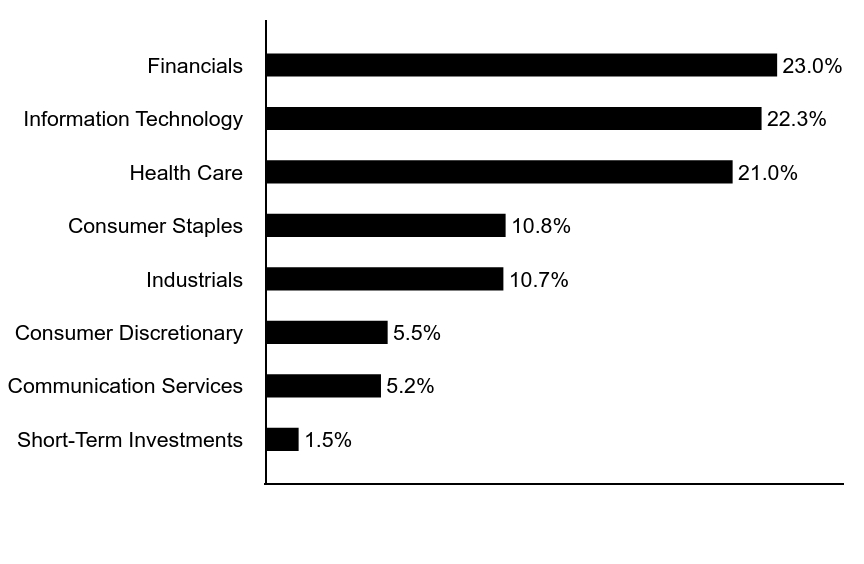

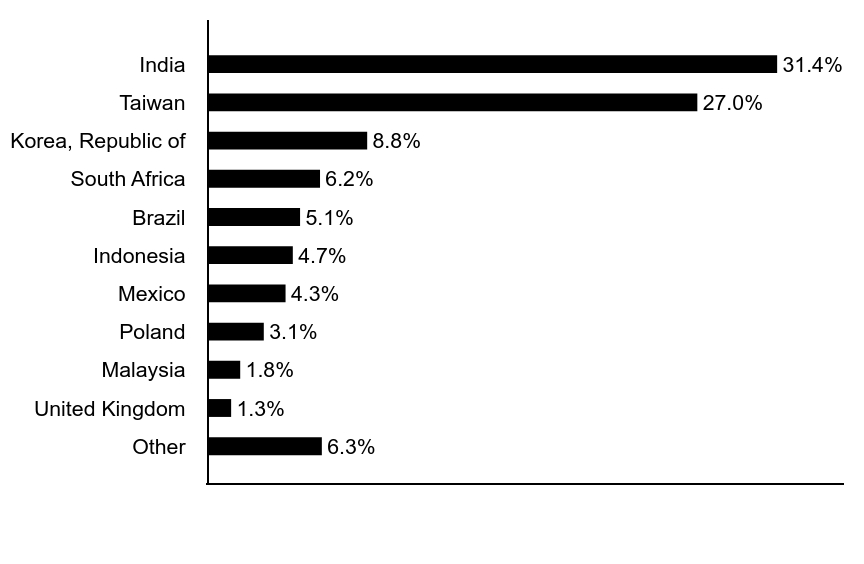

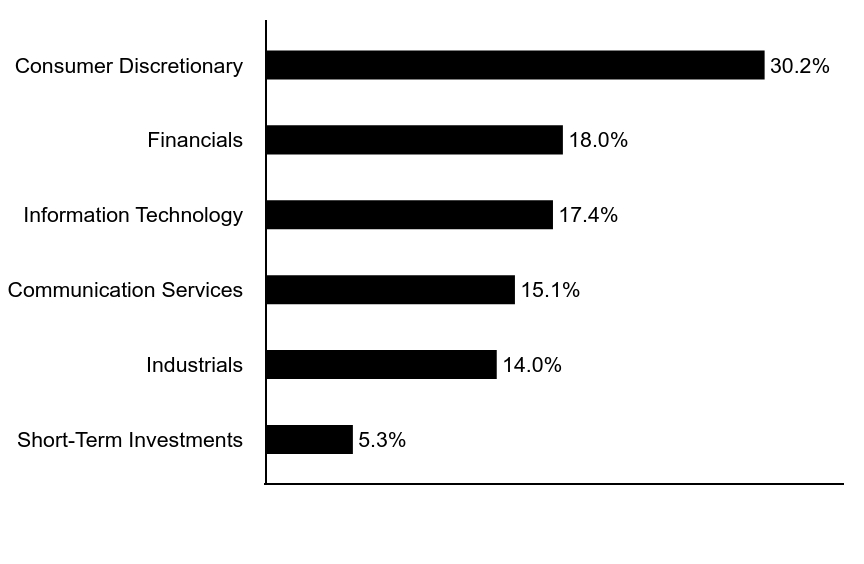

| Holdings [Text Block] |

Sector Allocation (% of total investments)Value | Value |

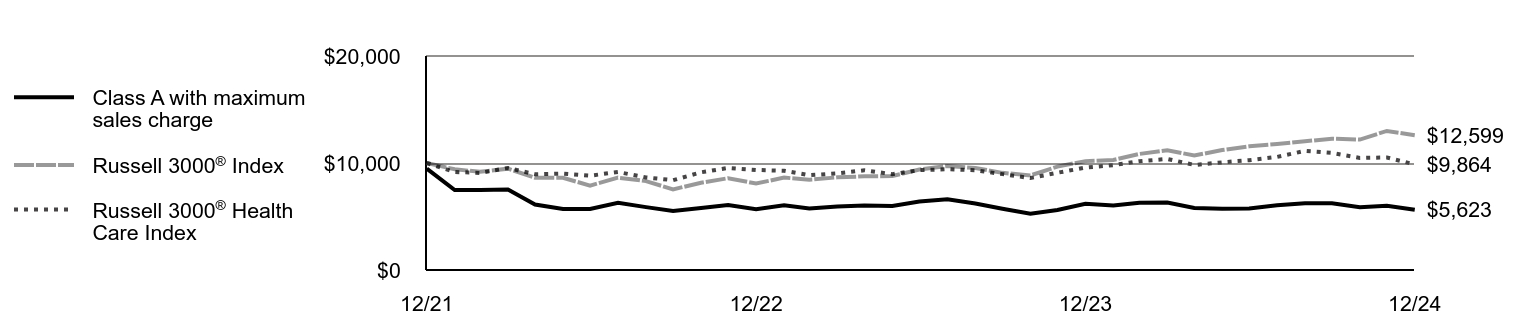

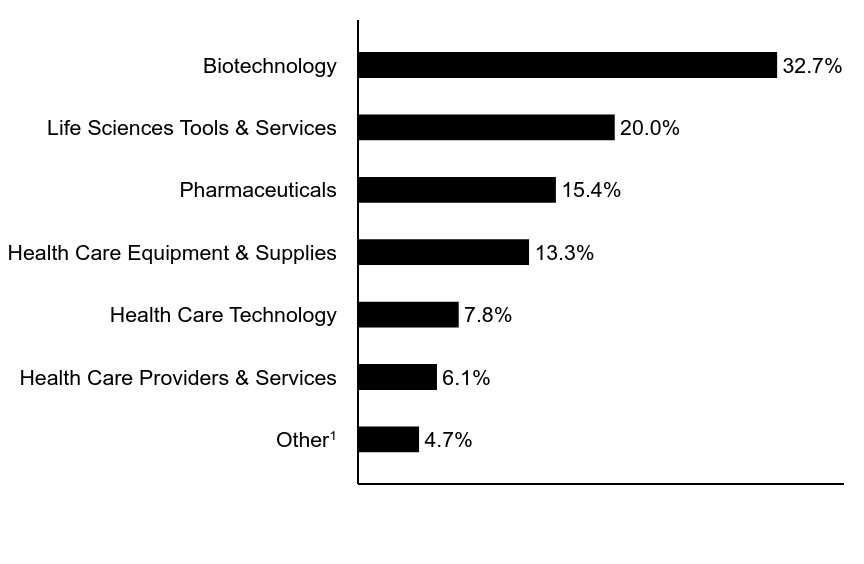

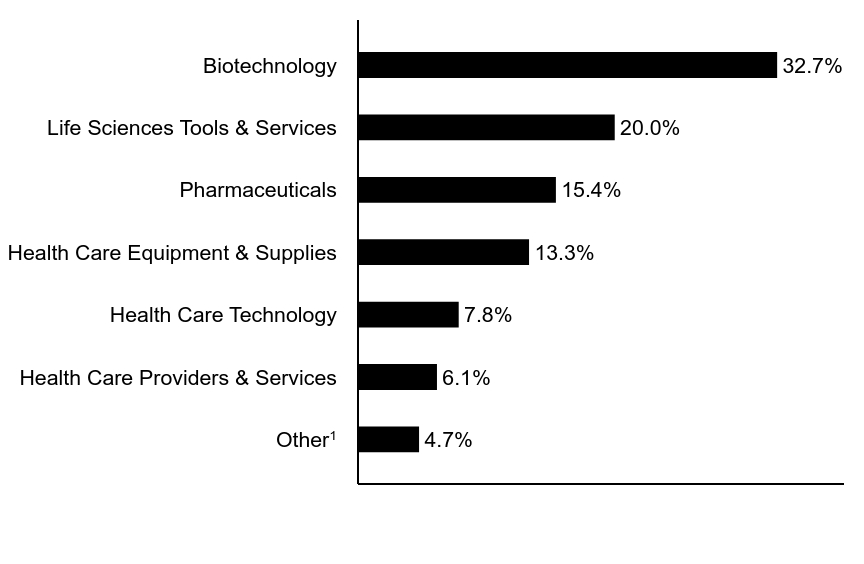

|---|