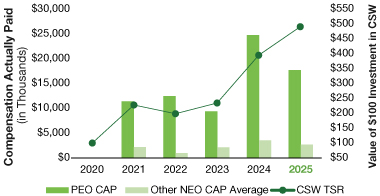

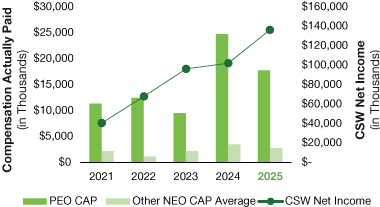

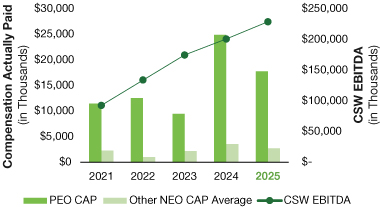

| Year |

Summary Compensation Table Total for PEO (1) ($) |

Compensation Actually Paid to PEO (1)(2) ($) |

Average Summary Compensation Table Total for Non-PEO NEOs (1) ($) |

Average Compensation Actually Paid to Non-PEO NEOs (1)(2) ($) |

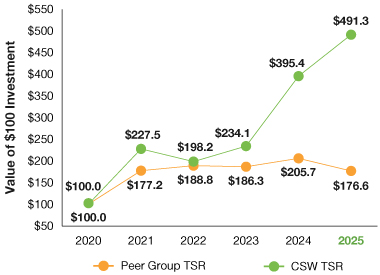

Value of Initial Fixed $100 Investment based on (3) : |

Net Income ($ Thousands) |

EBITDA (4) ($ Thousands) | |||||||||||||||||||||||||||||||||

| TSR ($) |

Peer Group TSR ($) | |||||||||||||||||||||||||||||||||||||||

| 2021 |

|

3,639,862 |

|

11,391,348 |

|

1,091,141 |

|

2,199,938 |

|

227.50 |

|

177.22 |

|

40,099 |

|

91,329 |

||||||||||||||||||||||||

| 2022 |

|

17,043,097 |

|

12,476,830 |

|

1,506,616 |

|

945,584 |

|

198.16 |

|

188.76 |

|

67,319 |

|

133,323 |

||||||||||||||||||||||||

| 2023 |

|

4,276,487 |

|

9,426,129 |

|

1,426,777 |

|

2,102,263 |

|

234.13 |

|

186.26 |

|

96,574 |

|

174,067 |

||||||||||||||||||||||||

| 2024 |

|

5,963,245 |

|

24,801,517 |

|

1,661,475 |

|

3,501,738 |

|

395.35 |

|

205.68 |

|

102,539 |

|

200,013 |

||||||||||||||||||||||||

| 2025 |

|

6,330,479 |

|

17,689,641 |

|

1,715,506 |

|

2,644,990 |

|

491.27 |

|

176.57 |

|

136,652 |

|

227,860 |

||||||||||||||||||||||||

(1) |

The individuals comprising the PEO and Non-PEO NEOs for each year presented are listed below : |

| |

2025 |

2024 |

2023 |

2022 |

2021 | |||||

| PEO: NON-PEO NEOS: |

Joseph Armes James Perry Donal Sullivan Luke Alverson Jeff Underwood |

Joseph Armes James Perry Donal Sullivan Luke Alverson Danielle Garde |

Joseph Armes James Perry Donal Sullivan Luke Alverson Danielle Garde |

Joseph Armes James Perry Donal Sullivan Luke Alverson |

Joseph Armes James Perry Donal Sullivan Craig Foster Luke Alverson Gregg Branning |

(2) |

The amounts shown for CAP have been calculated in accordance with Item 402(v) of Regulation S-K. To calculate CAP for the PEO and Non-PEO NEOs, the following adjustments were made to the Summary Compensation Table (“SCT”) Total in accordance with SEC methodology: |

2025 |

2024 |

2023 |

2022 |

2021 |

||||||||||||||||||||||||||||||||||||

| Year |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

||||||||||||||||||||||||||||||

| SCT Total |

|

6,330,479 |

|

|

1,715,506 |

|

|

5,963,245 |

|

|

1,661,475 |

|

|

4,276,487 |

|

|

1,426,777 |

|

|

17,043,097 |

|

|

1,506,616 |

|

|

3,639,862 |

|

|

1,091,141 |

| ||||||||||

| Less: Change in Actuarial Value of Pension Plan Value |

(5,148 |

) |

— |

(3,022 |

) |

— |

13,961 |

— |

6,486 |

— |

(4,664 |

) |

— |

|||||||||||||||||||||||||||

| Less: GDFV of Equity Awards Reported in SCT Total Compensation |

(4,221,414 |

) |

(882,670 |

) |

(3,733,051 |

) |

(781,912 |

) |

(2,251,035 |

) |

(661,237 |

) |

(15,314,974 |

) |

(726,354 |

) |

(1,775,967 |

) |

(420,831 |

) | ||||||||||||||||||||

| Plus: Year End Fair Value of Equity Awards Granted in Covered Year |

5,145,837 |

1,012,317 |

6,923,908 |

1,412,904 |

2,982,181 |

866,910 |

12,266,848 |

593,743 |

3,980,706 |

963,571 |

||||||||||||||||||||||||||||||

| Change in Fair Value of Equity Awards that Vested in Covered Year |

946,913 |

268,780 |

322,469 |

85,356 |

(65,768 |

) |

(5,276 |

) |

(22,956 |

) |

(5,535 |

) |

6,190 |

(2,527 |

) | |||||||||||||||||||||||||

| Change in Fair Value of Outstanding Unvested Equity Awards from Prior Years |

9,492,974 |

351,722 |

15,327,968 |

995,941 |

4,470,303 |

475,088 |

(1,498,186 |

) |

(422,887 |

) |

5,545,221 |

568,584 |

||||||||||||||||||||||||||||

| Calculated CAP |

17,689,641 |

2,644,990 |

24,801,517 |

3,501,738 |

9,426,129 |

2,102,263 |

12,476,830 |

945,584 |

11,391,348 |

2,199,938 |

||||||||||||||||||||||||||||||

| The above equity award values are calculated in accordance with FASB ASC Topic 718. |

(3) |

The Peer Group TSR set forth in this table utilizes a custom peer group, which we also utilize in the stock performance graph required by Item 201(e) of Regulation S-K included in our Annual Report. The comparison assumes $100 was invested for the period starting April 1, 2020, through March 31 of the listed year in each of the Company and in the custom peer group, respectively. |

(4) |

We determined EBITDA to be the most important financial performance measure used to link Company performance to the calculated CAPs of our PEO and Non-PEO NEOs in fiscal 2025. This performance measure may not have been the most important financial performance measure for fiscal years 2021, 2022, 2023 and 2024, and we may determine a different financial performance measure to be the most important financial performance measure in future years. EBITDA is defined for purposes of the AIP as set forth above in the “Compensation Discussion and Analysis” section. See Exhibit A for GAAP reconciliation information. |

(1) |

The individuals comprising the PEO and Non-PEO NEOs for each year presented are listed below : |

| |

2025 |

2024 |

2023 |

2022 |

2021 | |||||

| PEO: NON-PEO NEOS: |

Joseph Armes James Perry Donal Sullivan Luke Alverson Jeff Underwood |

Joseph Armes James Perry Donal Sullivan Luke Alverson Danielle Garde |

Joseph Armes James Perry Donal Sullivan Luke Alverson Danielle Garde |

Joseph Armes James Perry Donal Sullivan Luke Alverson |

Joseph Armes James Perry Donal Sullivan Craig Foster Luke Alverson Gregg Branning |

(2) |

The amounts shown for CAP have been calculated in accordance with Item 402(v) of Regulation S-K. To calculate CAP for the PEO and Non-PEO NEOs, the following adjustments were made to the Summary Compensation Table (“SCT”) Total in accordance with SEC methodology: |

2025 |

2024 |

2023 |

2022 |

2021 |

||||||||||||||||||||||||||||||||||||

| Year |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

||||||||||||||||||||||||||||||

| SCT Total |

|

6,330,479 |

|

|

1,715,506 |

|

|

5,963,245 |

|

|

1,661,475 |

|

|

4,276,487 |

|

|

1,426,777 |

|

|

17,043,097 |

|

|

1,506,616 |

|

|

3,639,862 |

|

|

1,091,141 |

| ||||||||||

| Less: Change in Actuarial Value of Pension Plan Value |

(5,148 |

) |

— |

(3,022 |

) |

— |

13,961 |

— |

6,486 |

— |

(4,664 |

) |

— |

|||||||||||||||||||||||||||

| Less: GDFV of Equity Awards Reported in SCT Total Compensation |

(4,221,414 |

) |

(882,670 |

) |

(3,733,051 |

) |

(781,912 |

) |

(2,251,035 |

) |

(661,237 |

) |

(15,314,974 |

) |

(726,354 |

) |

(1,775,967 |

) |

(420,831 |

) | ||||||||||||||||||||

| Plus: Year End Fair Value of Equity Awards Granted in Covered Year |

5,145,837 |

1,012,317 |

6,923,908 |

1,412,904 |

2,982,181 |

866,910 |

12,266,848 |

593,743 |

3,980,706 |

963,571 |

||||||||||||||||||||||||||||||

| Change in Fair Value of Equity Awards that Vested in Covered Year |

946,913 |

268,780 |

322,469 |

85,356 |

(65,768 |

) |

(5,276 |

) |

(22,956 |

) |

(5,535 |

) |

6,190 |

(2,527 |

) | |||||||||||||||||||||||||

| Change in Fair Value of Outstanding Unvested Equity Awards from Prior Years |

9,492,974 |

351,722 |

15,327,968 |

995,941 |

4,470,303 |

475,088 |

(1,498,186 |

) |

(422,887 |

) |

5,545,221 |

568,584 |

||||||||||||||||||||||||||||

| Calculated CAP |

17,689,641 |

2,644,990 |

24,801,517 |

3,501,738 |

9,426,129 |

2,102,263 |

12,476,830 |

945,584 |

11,391,348 |

2,199,938 |

||||||||||||||||||||||||||||||

(2) |

The amounts shown for CAP have been calculated in accordance with Item 402(v) of Regulation S-K. To calculate CAP for the PEO and Non-PEO NEOs, the following adjustments were made to the Summary Compensation Table (“SCT”) Total in accordance with SEC methodology: |

2025 |

2024 |

2023 |

2022 |

2021 |

||||||||||||||||||||||||||||||||||||

| Year |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

PEO ($) |

Non-PEO NEO Average ($) |

||||||||||||||||||||||||||||||

| SCT Total |

|

6,330,479 |

|

|

1,715,506 |

|

|

5,963,245 |

|

|

1,661,475 |

|

|

4,276,487 |

|

|

1,426,777 |

|

|

17,043,097 |

|

|

1,506,616 |

|

|

3,639,862 |

|

|

1,091,141 |

| ||||||||||

| Less: Change in Actuarial Value of Pension Plan Value |

(5,148 |

) |

— |

(3,022 |

) |

— |

13,961 |

— |

6,486 |

— |

(4,664 |

) |

— |

|||||||||||||||||||||||||||

| Less: GDFV of Equity Awards Reported in SCT Total Compensation |

(4,221,414 |

) |

(882,670 |

) |

(3,733,051 |

) |

(781,912 |

) |

(2,251,035 |

) |

(661,237 |

) |

(15,314,974 |

) |

(726,354 |

) |

(1,775,967 |

) |

(420,831 |

) | ||||||||||||||||||||

| Plus: Year End Fair Value of Equity Awards Granted in Covered Year |

5,145,837 |

1,012,317 |

6,923,908 |

1,412,904 |

2,982,181 |

866,910 |

12,266,848 |

593,743 |

3,980,706 |

963,571 |

||||||||||||||||||||||||||||||

| Change in Fair Value of Equity Awards that Vested in Covered Year |

946,913 |

268,780 |

322,469 |

85,356 |

(65,768 |

) |

(5,276 |

) |

(22,956 |

) |

(5,535 |

) |

6,190 |

(2,527 |

) | |||||||||||||||||||||||||

| Change in Fair Value of Outstanding Unvested Equity Awards from Prior Years |

9,492,974 |

351,722 |

15,327,968 |

995,941 |

4,470,303 |

475,088 |

(1,498,186 |

) |

(422,887 |

) |

5,545,221 |

568,584 |

||||||||||||||||||||||||||||

| Calculated CAP |

17,689,641 |

2,644,990 |

24,801,517 |

3,501,738 |

9,426,129 |

2,102,263 |

12,476,830 |

945,584 |

11,391,348 |

2,199,938 |

||||||||||||||||||||||||||||||

| TSR |

| EBITDA |

| Cash Flow from Operations |