Value of Initial Fixed $100 Investment Based on: | ||||||||||||||||||||||||||||||

(a) |

| (b) |

| (c) |

| (d) |

| (e) |

| (f) |

| (g) |

| (h) |

| (i) |

| (j) |

| (k) | ||||||||||

2025 | $ | 3,565,927 | $ | 5,914,378 | $ | 4,216,572 | $ | (15,220,969) | $ | 2,162,934 | $ | 2,702,319 | $ | 779.13 | $ | 193.94 | $ | 180,942 | $ | 239,352 | ||||||||||

2024 | 6,973,503 | 7,367,614 | 1,815,713 | 2,369,165 | 711.67 | 252.73 | 146,996 | 198,214 | ||||||||||||||||||||||

2023 | 9,795,809 | (3,068,276) | 1,476,243 | 103,495 | 573.22 | 178.75 | 170,553 | 231,787 | ||||||||||||||||||||||

2022 | 4,479,778 | 17,738,024 | 1,419,248 | 3,174,953 | 721.99 | 225.49 | 192,450 | 258,338 | ||||||||||||||||||||||

2021 | 4,057,401 | 29,205,374 | 1,329,348 | 5,540,862 | 473.45 | 415.25 | 59,386 | 86,326 | ||||||||||||||||||||||

| (1) | John Hazen was PEO beginning on November 22, 2024 through the end of fiscal 2025. |

| (2) | James G. Conroy was PEO during fiscal 2025 until November 22, 2024 and during each of fiscal 2024, fiscal 2023, fiscal 2022 and fiscal 2021. |

| (3) | Non-PEO NEOs whose average compensation is reflected in columns (f) and (g) consist of: James M. Watkins, Laurie Grijalva, and Michael A. Love for each of the fiscal years presented; Peter Starrett for fiscal 2025; John Hazen for fiscal 2024, fiscal 2023, fiscal 2022, and fiscal 2021; and Gregory V. Hackman for fiscal 2023, fiscal 2022, and fiscal 2021. |

| (4) | The dollar amounts reported in columns (d), (e), and (g) represent the amounts of CAP to PEO 1, CAP to PEO 2, and Average CAP to Non-PEO NEOs, respectively. CAP does not necessarily represent cash and/or equity value transferred to the PEOs or Non-PEO NEOs without restriction, but rather is a value calculated in accordance with applicable SEC rules. As the Company does not have a defined benefit plan, no adjustments for pension benefits are included in the below tables. Similarly, no adjustments were made for dividends, as the Company has not paid any dividends. No adjustments were made for equity awards that were granted and vested in the same fiscal year, as there were no such equity awards for the fiscal years presented. Additionally, no adjustments were made for equity awards that failed to meet their vesting conditions, as any such equity awards were previously accounted for in prior fiscal years. The following tables reconcile CAP to the SCT Total for the PEOs and the Non-PEO NEOs. |

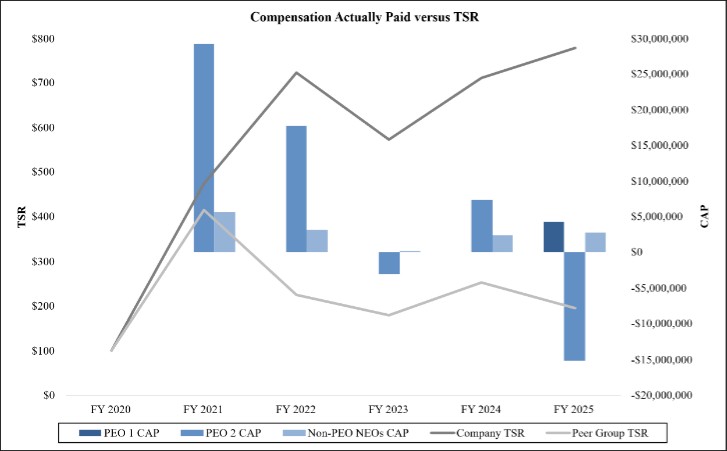

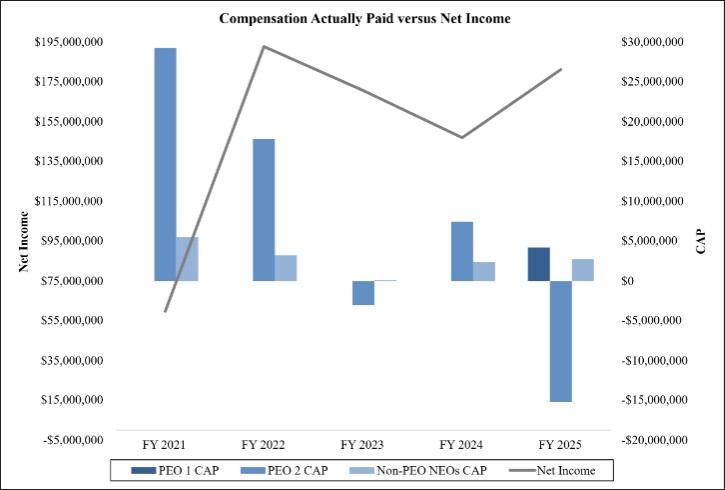

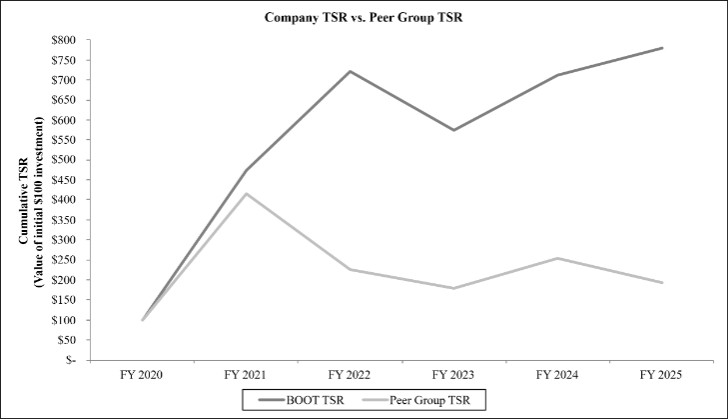

| (5) | Total Stockholder Return (“TSR”) and peer group TSR reflect our TSR compared to that of a peer group of similarly-sized (based on EBIT, market capitalization, and revenue sizes, as well as total shareholder return) publicly-traded companies in similar business sectors, most notably specialty retail, used by our Compensation Committee in making executive compensation determinations and described under “Compensation Discussion and Analysis.” Information regarding the peer group is set forth under “Company TSR Compared to Peer Group TSR.” The dollar amounts in columns (h) and (i) represent the value at the end of the applicable year of an assumed $100 investment in, respectively, our common stock and the peer group on the last trading day before the earliest fiscal year the peer group company is included, assuming reinvestment of dividends. |

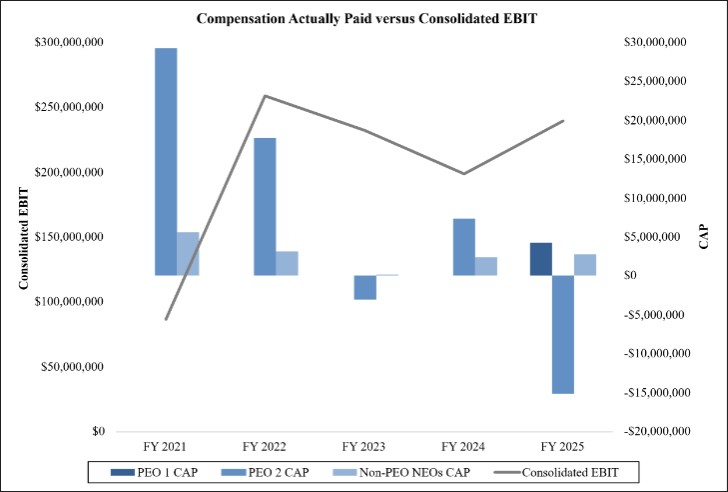

| (6) | In accordance with SEC rules, the table must include, in addition to relative TSR and Net Income, a Company-Selected Measure (“CSM”). We have included Consolidated EBIT, a non-GAAP financial measure that is defined for this purpose as earnings before income taxes, excluding certain one-time selling, general, and administrative expenses. As discussed above under “Compensation Discussion and Analysis,” Consolidated EBIT is a key measure used in determining compensation of our NEOs. |

| (1) | John Hazen was PEO beginning on November 22, 2024 through the end of fiscal 2025. |

| (2) | James G. Conroy was PEO during fiscal 2025 until November 22, 2024 and during each of fiscal 2024, fiscal 2023, fiscal 2022 and fiscal 2021. |

| (3) | Non-PEO NEOs whose average compensation is reflected in columns (f) and (g) consist of: James M. Watkins, Laurie Grijalva, and Michael A. Love for each of the fiscal years presented; Peter Starrett for fiscal 2025; John Hazen for fiscal 2024, fiscal 2023, fiscal 2022, and fiscal 2021; and Gregory V. Hackman for fiscal 2023, fiscal 2022, and fiscal 2021. |

| (5) | Total Stockholder Return (“TSR”) and peer group TSR reflect our TSR compared to that of a peer group of similarly-sized (based on EBIT, market capitalization, and revenue sizes, as well as total shareholder return) publicly-traded companies in similar business sectors, most notably specialty retail, used by our Compensation Committee in making executive compensation determinations and described under “Compensation Discussion and Analysis.” Information regarding the peer group is set forth under “Company TSR Compared to Peer Group TSR.” The dollar amounts in columns (h) and (i) represent the value at the end of the applicable year of an assumed $100 investment in, respectively, our common stock and the peer group on the last trading day before the earliest fiscal year the peer group company is included, assuming reinvestment of dividends. |

PEO 1 SCT Total to CAP Reconciliation

Fiscal 2025 | |||

SCT Total | $ | 3,565,927 | |

Less: Grant Date Fair Value of Option and Stock Awards Granted in Fiscal Year | 1,850,221 | ||

Plus: Year-End Fair Value of Outstanding and Unvested Equity Awards Granted in Fiscal Year | 2,109,234 | ||

Plus: Change in Fair Value of Outstanding and Unvested Equity Awards from Prior Fiscal Years | 155,754 | ||

Plus: Change in Fair Value of Vested Equity Awards Granted from Prior Fiscal Years | 235,878 | ||

CAP | $ | 4,216,572 | |

PEO 2 SCT Total to CAP Reconciliation

Fiscal 2025 | Fiscal 2024 | Fiscal 2023 | Fiscal 2022 | Fiscal 2021 | |||||||||||

SCT Total | $ | 5,914,378 | $ | 6,973,503 | $ | 9,795,809 | $ | 4,479,778 | $ | 4,057,401 | |||||

Less: Grant Date Fair Value of Option and Stock Awards Granted in Fiscal Year | 5,250,100 | 4,899,980 | 8,200,025 | 1,600,078 | 1,440,564 | ||||||||||

Plus: Year-End Fair Value of Outstanding and Unvested Equity Awards Granted in Fiscal Year | - | 6,766,392 | 3,795,733 | 986,054 | 5,717,764 | ||||||||||

Plus: Change in Fair Value of Outstanding and Unvested Equity Awards from Prior Fiscal Years | - | 2,045,422 | (6,212,364) | 12,759,978 | 19,900,201 | ||||||||||

Plus: Fair Value of Equity Awards Granted in Fiscal Year that Vested During Fiscal Year | - | - | |||||||||||||

Plus: Change in Fair Value of Vested Equity Awards Granted from Prior Fiscal Years | 892,225 | (3,517,723) | (2,247,429) | 1,112,292 | 970,572 | ||||||||||

Less: Fair Value as of Prior Fiscal Year-End of Equity Awards that Failed to Meet Applicable Vesting Conditions | 16,777,472 | - | |||||||||||||

CAP | $ | (15,220,969) | $ | 7,367,614 | $ | (3,068,276) | $ | 17,738,024 | $ | 29,205,374 | |||||

Tabular Disclosure of Most Important Compensation-Related Measures

The following table sets forth an unranked list of the most important measures, including the CSM, used by the Company to link CAP for the PEOs and each of the Non-PEO NEOs to Company performance for fiscal 2025 as described in more detail above under “Compensation Discussion and Analysis”:

PEOs | Non-PEO NEOs | ||||||||||

John Hazen | James G. Conroy | James M. Watkins | Peter Starrett (1) | Laurie Grijalva | Michael A. Love | ||||||

Consolidated EBIT | X | X | X | X | X | ||||||

Earnings per Diluted Share | X | X | X | X | X | ||||||

Revenue | X | X | X | X | X | ||||||

Consolidated Merchandise Margin | X | ||||||||||

Consolidated Exclusive Brand Sales Penetration | X | X | X | ||||||||

| (1) | As discussed in the “Compensation Discussion and Analysis,” Mr. Starrett was appointed Executive Chairman effective November 22, 2024, and as the Executive Chairman, he is not eligible to participate in the Annual Cash Incentive Bonus Plan. Additionally, he did not receive a fiscal 2025 performance share unit grant. Accordingly, except with respect to stock price as it relates to his restricted stock unit grants, Mr. Starrett’s fiscal 2025 compensation was not directly tied to the Company’s most importance compensation-related measures. |