Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Apr. 26, 2025 |

Apr. 27, 2024 |

Apr. 29, 2023 |

Apr. 30, 2022 |

Apr. 24, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Pay Versus Performance | | Summary Compensation Table Total for Whittington ($)(2) | Summary Compensation Table Total for Darrow ($)(2) | Compensation Actually Paid to Whittington ($)(3) | Compensation Actually Paid to Darrow ($)(3) | Average Summary Compensation Table Total for Non-PEO NEOs ($)(2) | Average Compensation Actually Paid to Non-PEO NEOs ($)(3) | Value of Initial Fixed $100 Investment Based On:(4) | | | | | | | | Year(1) | Total Shareholder Return ($) | Peer Group Total Shareholder Return ($)(5) | Net Income

($000) | Sales ($000)(6) | | | FY 2025 | 6,663,764 | N/A | 9,988,446 | | N/A | 1,445,402 | | 1,642,794 | | 203.90 | 192.81 | 99,556 | | 2,109,207 | | | FY 2024 | 5,872,110 | N/A | 7,158,165 | | N/A | 1,509,549 | | 1,754,668 | | 169.85 | | 184.06 | | 122,626 | | 2,047,027 | | | FY 2023 | 5,983,987 | N/A | 6,667,375 | | N/A | 1,549,759 | | 1,683,115 | | 143.95 | | 172.75 | | 150,664 | | 2,349,433 | | | FY 2022 | 5,798,794 | N/A | 3,020,052 | | N/A | 1,662,812 | | 720,942 | | 128.27 | | 174.70 | | 150,017 | | 2,356,811 | | | FY 2021 | N/A | 6,710,425 | N/A | 14,512,272 | 1,755,984 | | 3,279,190 | | 207.10 | | 250.51 | | 106,461 | | 1,734,244 | |

|

|

|

|

|

| Company Selected Measure Name |

Sales

|

|

|

|

|

| Named Executive Officers, Footnote |

The PEO and NEOs for the applicable fiscal years were as follows: a.FY 2025: Melinda D. Whittington served as the company’s PEO for the entirety of FY 2025 and the company’s other NEOs were: Taylor E. Luebke, Michael A. Leggett, Robert Sundy II, Terrence J. Linz, and Robert G. Lucian. b.FY 2024: Melinda D. Whittington served as the company's PEO for the entirety of FY 2024 and the company's other NEOs were: Robert G. Lucian, Rebecca M. Reeder, Robert Sundy II, and Michael A. Leggett. c.FY 2023: Melinda D. Whittington served as the company's PEO for the entirety of FY 2023 and the company's other NEOs were: Robert G. Lucian, Otis S. Sawyer, Michael A. Leggett, and Robert Sundy II. d.FY 2022: Melinda D. Whittington served as the company's PEO for the entirety of FY 2022 and the company's other NEOs were: Robert G. Lucian, Darrell D. Edwards, Otis S. Sawyer, and Raphael Z. Richmond. e.FY 2021: Kurt L. Darrow served as the company's PEO for the entirety of FY 2021 and the company's other NEOs were: Melinda D. Whittington, Darrell D. Edwards, Otis S. Sawyer, and Stephen K. Krull.

|

|

|

|

|

| Peer Group Issuers, Footnote |

The company used the Dow Jones U.S. Furnishings Index for its Total Shareholder Return (“TSR”) Peer Group. This is the same peer group used for purposes of the 2025 Annual Report.

|

|

|

|

|

| Adjustment To PEO Compensation, Footnote |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | CAP Adjustments | | | | | | | | | | | | | Year | Summary Compensation Table Total ($)(a) | Minus

Grant Date Fair Value of Stock Option and Stock Awards Granted in Fiscal Year ($)(b) | Plus

Fair Value at Fiscal Year-End of Outstanding and Unvested Stock Option and Stock Awards Granted in Fiscal Year ($)(c) | Plus/(Minus)

Change in Fair Value of Outstanding and Unvested Stock Option and Stock Awards Granted in Prior Fiscal Years ($)(d) | Plus/(Minus)

Fair Value at Vesting of Stock Option and Stock Awards Granted in Fiscal Year that Vested During Fiscal Year ($)(e) | Plus/(Minus)

Change in Fair Value as of Vesting Date of Stock Option and Stock Awards Granted in Prior Years for which Applicable Vesting Conditions Were Satisfied During Fiscal Year ($)(f) | Minus

Fair Value as of Prior Fiscal Year-End of Stock Option and Stock Awards Granted in Prior Fiscal Years that Failed to Meet Applicable Vesting Conditions During Fiscal Year ($)(g) | Plus

Dollar Value of Dividends or Other Earnings Paid on Stock Awards in Fiscal Year and Prior to Vesting Date ($)(h) | Equals

Compensation Actually Paid ($) | | | | | | | | | | | | | Melinda D. Whittington | | FY 2025 | 6,663,764 | (4,107,199) | | 4,609,892 | | 1,593,566 | | — | | 1,139,356 | | — | | 89,067 | | 9,988,446 | | | FY 2024 | 5,872,110 | (3,553,220) | | 4,308,474 | | 732,296 | | — | | (257,947) | | — | | 56,452 | | 7,158,165 | | | FY 2023 | 5,983,987 | (3,535,586) | | 4,172,324 | | 111,389 | | — | | (84,103) | | — | | 19,364 | | 6,667,375 | | | FY 2022 | 5,798,794 | (2,699,687) | | 1,399,838 | | (1,115,543) | | — | | (369,278) | | — | | 5,928 | | 3,020,052 | | | Kurt L. Darrow | | FY 2021 | 6,710,425 | (2,855,441) | | 5,256,100 | | 3,860,777 | | — | | 1,534,518 | | — | | 5,893 | | 14,512,272 | | | Non-PEOs (Average)(i) | | FY 2025 | 1,445,402 | (624,236) | | 524,306 | | 178,144 | | 17,274 | | 176,307 | | (88,788) | | 14,385 | | 1,642,794 | | | FY 2024 | 1,509,549 | (698,139) | | 845,458 | | 100,581 | | — | | (15,249) | | — | | 12,468 | | 1,754,668 | | | FY 2023 | 1,549,759 | (657,470) | | 775,876 | | 22,396 | | — | | (13,725) | | — | | 6,279 | | 1,683,115 | | | FY 2022 | 1,662,812 | (535,139) | | 277,482 | | (484,233) | | — | | (201,653) | | — | | 1,673 | | 720,942 | | | FY 2021 | 1,755,984 | | (580,383) | | 1,068,302 | | 770,560 | | — | | 262,213 | | — | | 2,514 | | 3,279,190 | |

b.Represents the grant date fair value of the stock option and stock awards granted during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. c.Represents the fair value as of the indicated fiscal year-end of the outstanding and unvested option awards and stock awards granted during such fiscal year, computed in accordance with the methodology used for financial reporting purposes and, in the case of performance-based share/unit awards, are valued based on the probable outcome of the underlying performance-based vesting conditions as of the applicable fiscal-year end. d.Represents the change in fair value during the indicated fiscal year of the outstanding and unvested option awards and stock awards held by the applicable NEO, granted in previous fiscal years, as of the last day of the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes and, for performance-based share/unit awards, based on the probable outcome of the underlying performance-based vesting conditions as of the last day of the fiscal year. e.Represents the fair value at vesting of the option awards and stock awards that were granted and vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. f.Represents the change in fair value, measured from the prior fiscal year-end to the vesting date, of each option award and stock award that was granted in a prior fiscal year and which vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. g.Represents the fair value as of the last day of the prior fiscal year of the option award and stock awards that were granted in a prior fiscal year and which failed to meet the applicable vesting conditions in the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. h.Represents the dollar value of any cash dividends or other earnings paid on stock awards in the indicated fiscal year and prior to the vesting date that are not otherwise included in the total compensation for the indicated fiscal year. i.See footnote 1 above for the non-PEOs included in the average for each year. As discussed above, Ms. Whittington is included in the average for the non-PEOs for FY 2021.

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,445,402

|

$ 1,509,549

|

$ 1,549,759

|

$ 1,662,812

|

$ 1,755,984

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 1,642,794

|

1,754,668

|

1,683,115

|

720,942

|

3,279,190

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | CAP Adjustments | | | | | | | | | | | | | Year | Summary Compensation Table Total ($)(a) | Minus

Grant Date Fair Value of Stock Option and Stock Awards Granted in Fiscal Year ($)(b) | Plus

Fair Value at Fiscal Year-End of Outstanding and Unvested Stock Option and Stock Awards Granted in Fiscal Year ($)(c) | Plus/(Minus)

Change in Fair Value of Outstanding and Unvested Stock Option and Stock Awards Granted in Prior Fiscal Years ($)(d) | Plus/(Minus)

Fair Value at Vesting of Stock Option and Stock Awards Granted in Fiscal Year that Vested During Fiscal Year ($)(e) | Plus/(Minus)

Change in Fair Value as of Vesting Date of Stock Option and Stock Awards Granted in Prior Years for which Applicable Vesting Conditions Were Satisfied During Fiscal Year ($)(f) | Minus

Fair Value as of Prior Fiscal Year-End of Stock Option and Stock Awards Granted in Prior Fiscal Years that Failed to Meet Applicable Vesting Conditions During Fiscal Year ($)(g) | Plus

Dollar Value of Dividends or Other Earnings Paid on Stock Awards in Fiscal Year and Prior to Vesting Date ($)(h) | Equals

Compensation Actually Paid ($) | | | | | | | | | | | | | Melinda D. Whittington | | FY 2025 | 6,663,764 | (4,107,199) | | 4,609,892 | | 1,593,566 | | — | | 1,139,356 | | — | | 89,067 | | 9,988,446 | | | FY 2024 | 5,872,110 | (3,553,220) | | 4,308,474 | | 732,296 | | — | | (257,947) | | — | | 56,452 | | 7,158,165 | | | FY 2023 | 5,983,987 | (3,535,586) | | 4,172,324 | | 111,389 | | — | | (84,103) | | — | | 19,364 | | 6,667,375 | | | FY 2022 | 5,798,794 | (2,699,687) | | 1,399,838 | | (1,115,543) | | — | | (369,278) | | — | | 5,928 | | 3,020,052 | | | Kurt L. Darrow | | FY 2021 | 6,710,425 | (2,855,441) | | 5,256,100 | | 3,860,777 | | — | | 1,534,518 | | — | | 5,893 | | 14,512,272 | | | Non-PEOs (Average)(i) | | FY 2025 | 1,445,402 | (624,236) | | 524,306 | | 178,144 | | 17,274 | | 176,307 | | (88,788) | | 14,385 | | 1,642,794 | | | FY 2024 | 1,509,549 | (698,139) | | 845,458 | | 100,581 | | — | | (15,249) | | — | | 12,468 | | 1,754,668 | | | FY 2023 | 1,549,759 | (657,470) | | 775,876 | | 22,396 | | — | | (13,725) | | — | | 6,279 | | 1,683,115 | | | FY 2022 | 1,662,812 | (535,139) | | 277,482 | | (484,233) | | — | | (201,653) | | — | | 1,673 | | 720,942 | | | FY 2021 | 1,755,984 | | (580,383) | | 1,068,302 | | 770,560 | | — | | 262,213 | | — | | 2,514 | | 3,279,190 | |

b.Represents the grant date fair value of the stock option and stock awards granted during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. c.Represents the fair value as of the indicated fiscal year-end of the outstanding and unvested option awards and stock awards granted during such fiscal year, computed in accordance with the methodology used for financial reporting purposes and, in the case of performance-based share/unit awards, are valued based on the probable outcome of the underlying performance-based vesting conditions as of the applicable fiscal-year end. d.Represents the change in fair value during the indicated fiscal year of the outstanding and unvested option awards and stock awards held by the applicable NEO, granted in previous fiscal years, as of the last day of the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes and, for performance-based share/unit awards, based on the probable outcome of the underlying performance-based vesting conditions as of the last day of the fiscal year. e.Represents the fair value at vesting of the option awards and stock awards that were granted and vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. f.Represents the change in fair value, measured from the prior fiscal year-end to the vesting date, of each option award and stock award that was granted in a prior fiscal year and which vested during the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. g.Represents the fair value as of the last day of the prior fiscal year of the option award and stock awards that were granted in a prior fiscal year and which failed to meet the applicable vesting conditions in the indicated fiscal year, computed in accordance with the methodology used for financial reporting purposes. h.Represents the dollar value of any cash dividends or other earnings paid on stock awards in the indicated fiscal year and prior to the vesting date that are not otherwise included in the total compensation for the indicated fiscal year. i.See footnote 1 above for the non-PEOs included in the average for each year. As discussed above, Ms. Whittington is included in the average for the non-PEOs for FY 2021.

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

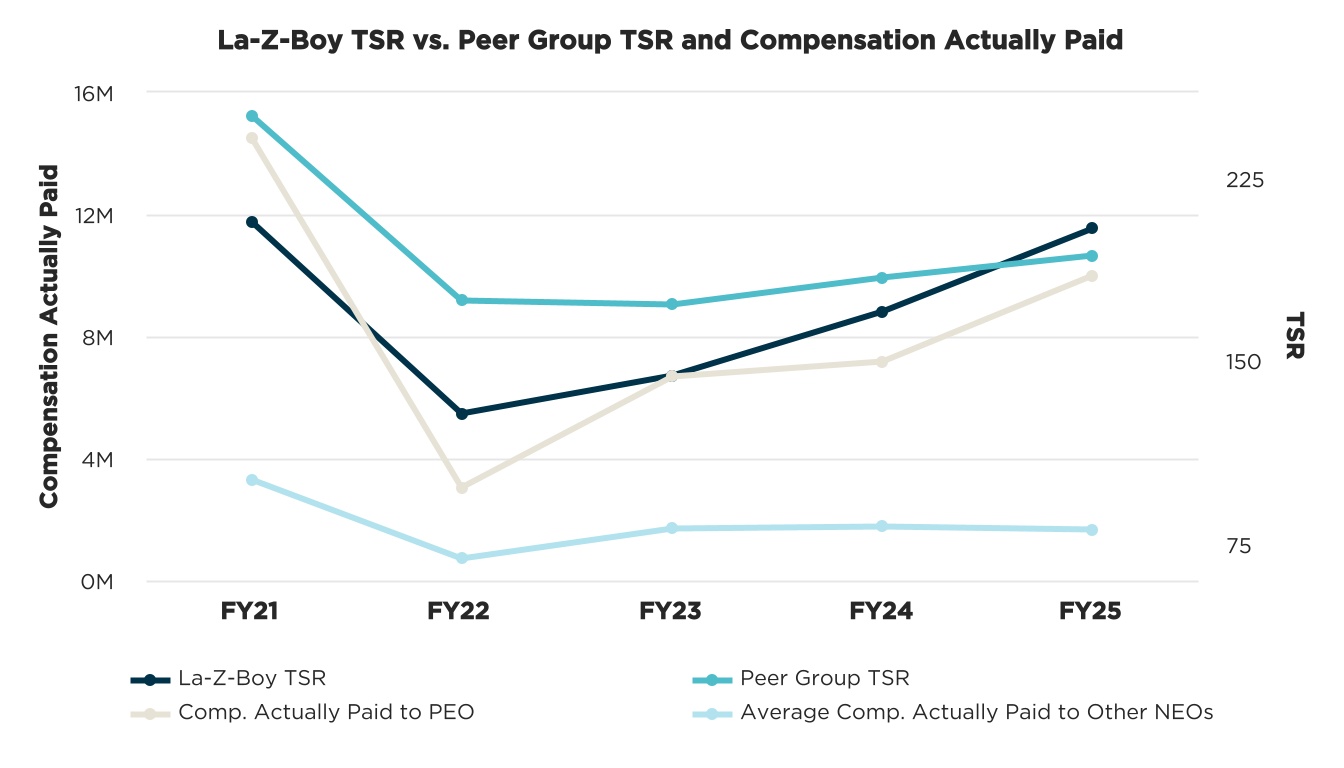

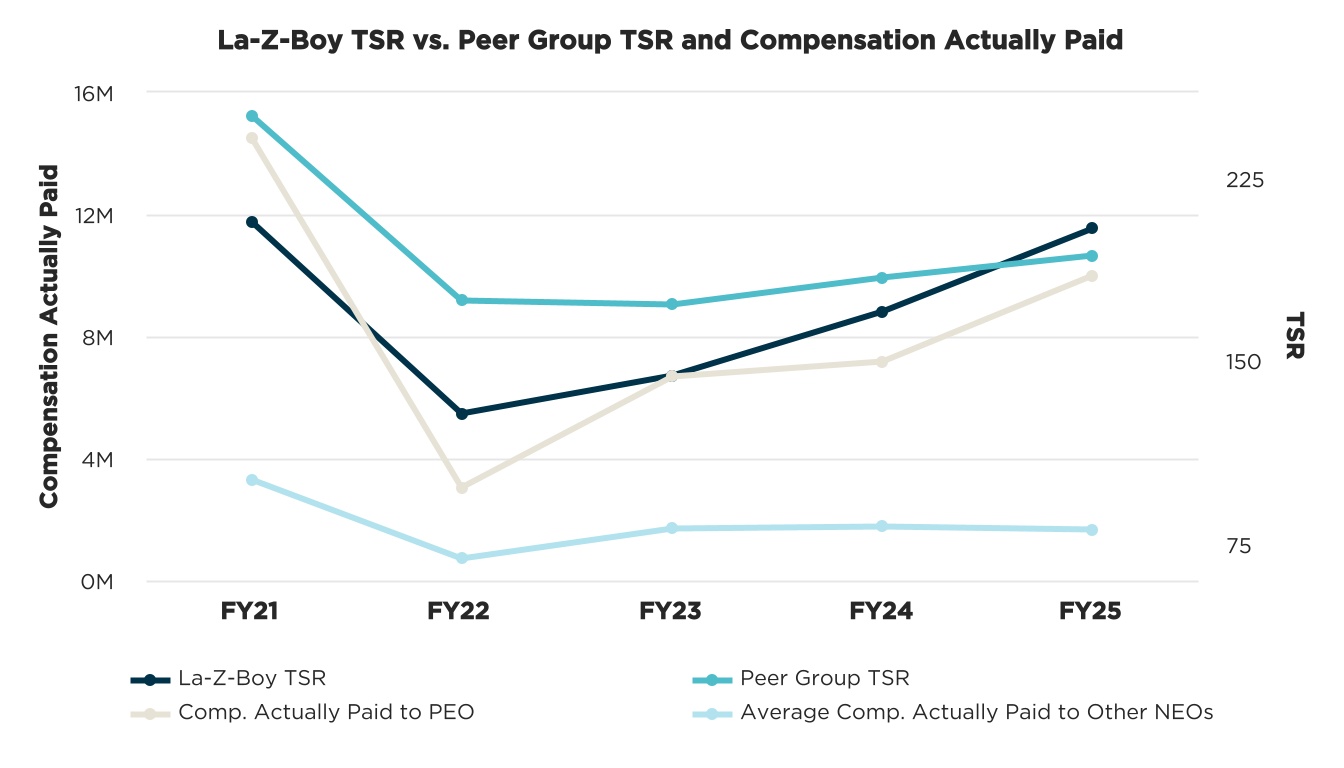

We believe the “Compensation Actually Paid” in each of the years reported above and over the five-year cumulative period are reflective of the Compensation Committee’s philosophy to create and reinforce a pay for performance culture as the “Compensation Actually Paid” fluctuated year-over-year, primarily due to our stock performance and our varying levels of achievement against pre-established performance goals under our MIP and long-term equity incentive program, including sales, operating margin, operating cash flow, and relative TSR. TSR: Company versus Peer Group and Compensation Actually Paid As shown in the chart below, our five-year cumulative TSR for the period of FY 2021 through FY 2025 is slightly less than the TSR for companies included in our peer group TSR for FY 2021 through FY 2024 and slightly above our peer group TSR in FY 2025. As this chart demonstrates, Compensation Actually Paid for our PEOs and our other NEOs was generally aligned with our TSR during the applicable period.

|

|

|

|

|

| Compensation Actually Paid vs. Net Income |

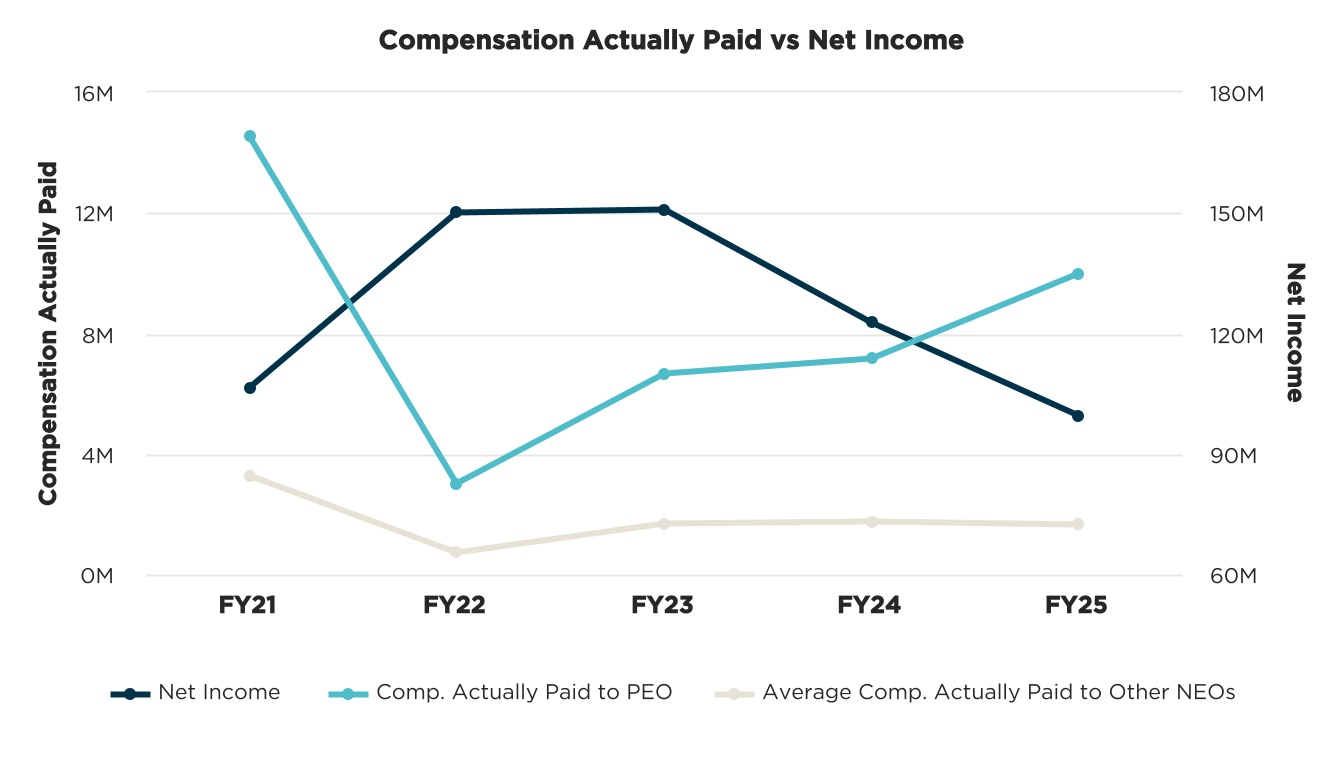

Compensation Actually Paid versus Net Income The chart below demonstrates the relationship between Compensation Actually Paid amounts for our PEOs and our other NEOs and our net income. Net income is not a direct component of our executive compensation program, although it is correlated with other components of our executive compensation program, such as our operating margin metric. Variations in the Compensation Actually Paid amounts for our PEOs and other NEOs are due in large part to the significant emphasis the company places on long-term equity incentives, the value of which fluctuates based on the vesting level of our performance-based equity awards and changes in stock price over time.

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

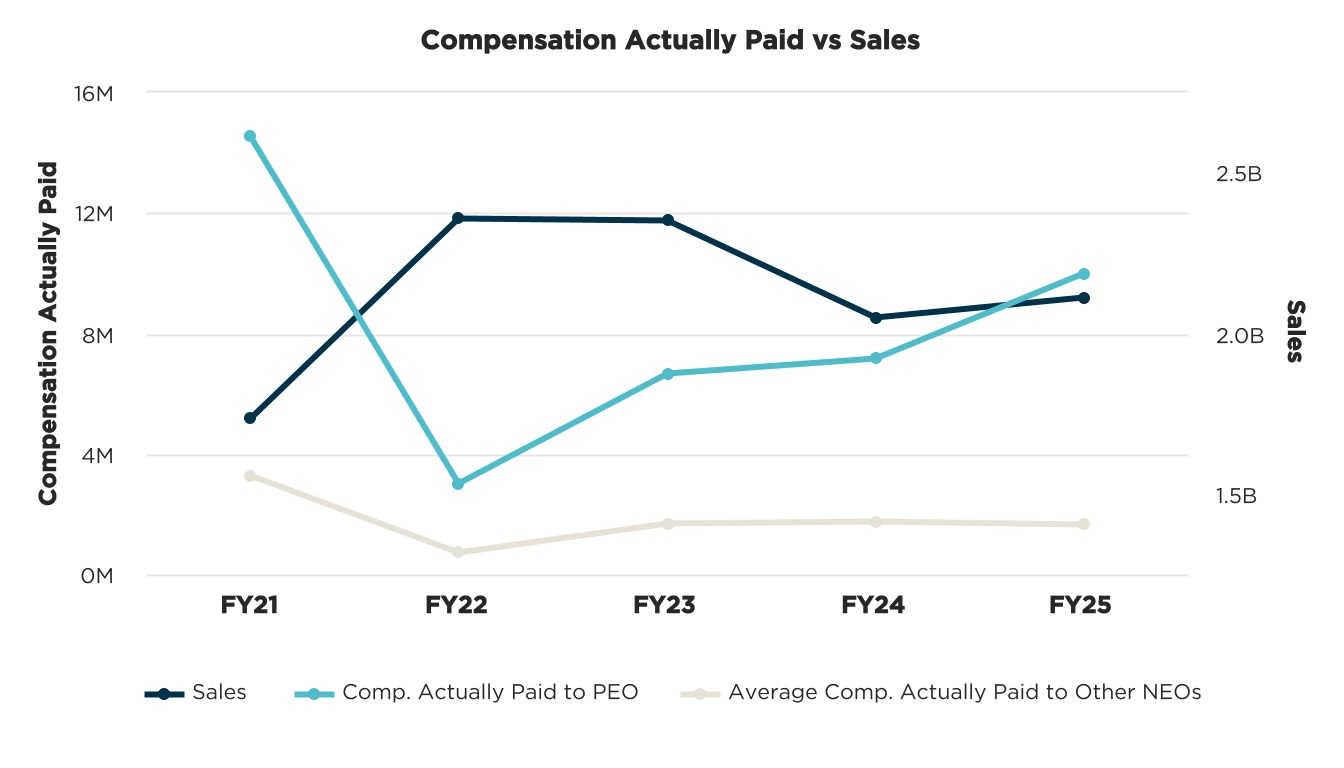

Compensation Actually Paid versus Sales (Company Selected Measure) The chart below demonstrates the relationship between Compensation Actually Paid amounts for our PEOs and each of our other NEOs and our sales for the applicable fiscal year. Variations in the Compensation Actually Paid amounts for our PEOs and other NEOs are due in large part to the significant emphasis the company places on long-term equity incentives, the value of which fluctuates based on the vesting level of our performance-based equity awards and changes in stock price over time.

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

We believe the “Compensation Actually Paid” in each of the years reported above and over the five-year cumulative period are reflective of the Compensation Committee’s philosophy to create and reinforce a pay for performance culture as the “Compensation Actually Paid” fluctuated year-over-year, primarily due to our stock performance and our varying levels of achievement against pre-established performance goals under our MIP and long-term equity incentive program, including sales, operating margin, operating cash flow, and relative TSR. TSR: Company versus Peer Group and Compensation Actually Paid As shown in the chart below, our five-year cumulative TSR for the period of FY 2021 through FY 2025 is slightly less than the TSR for companies included in our peer group TSR for FY 2021 through FY 2024 and slightly above our peer group TSR in FY 2025. As this chart demonstrates, Compensation Actually Paid for our PEOs and our other NEOs was generally aligned with our TSR during the applicable period.

|

|

|

|

|

| Tabular List, Table |

Sales •Operating Margin •Operating Cash Flow •Relative TSR •Stock Price (through the use of equity-based awards)

|

|

|

|

|

| Total Shareholder Return Amount |

$ 203.90

|

169.85

|

143.95

|

128.27

|

207.10

|

| Peer Group Total Shareholder Return Amount |

192.81

|

184.06

|

172.75

|

174.70

|

250.51

|

| Net Income (Loss) |

$ 99,556,000

|

$ 122,626,000

|

$ 150,664,000

|

$ 150,017,000

|

$ 106,461,000

|

| Company Selected Measure Amount |

2,109,207,000

|

2,047,027,000

|

2,349,433,000

|

2,356,811,000

|

1,734,244,000

|

| PEO Name |

Melinda D. Whittington

|

Melinda D. Whittington

|

Melinda D. Whittington

|

Melinda D. Whittington

|

Kurt L. Darrow

|

| Additional 402(v) Disclosure |

Amounts reported in this column represent (i) the total compensation reported in the Summary Compensation Table for the applicable year(s) in which the individual served as PEO (in the case of Ms. Whittington and Mr. Darrow) and (ii) the average of the total compensation reported in the Summary Compensation Table for the applicable fiscal year for the company’s NEOs reported for the applicable year other than the PEOs for such years. (3)To calculate compensation actually paid, adjustments were made to the amounts reported in the Summary Compensation Table for the applicable years. A reconciliation of the adjustments for Ms. Whittington and Mr. Darrow (in the applicable year(s) in which such individuals served as PEO) and for the average of the other NEOs is set forth following the footnotes to this table. (4)Pursuant to the rules of the SEC, the comparison assumes $100 was invested on April 25, 2020 in our common stock. Historic stock price performance is not necessarily indicative of future stock price performance.For FY 2025, the Compensation Committee determined that sales continues to be viewed as a core driver of the company’s performance and stockholder value creation and is used as a component in the company’s FY 2025 MIP and FY 2025 - 2027 long-term equity incentive program. Sales is measured on a GAAP basis and does not reflect any adjustments. Please see the Compensation Discussion and Analysis for further information regarding the use of sales in the company's executive compensation program.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Sales

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Operating Margin

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Operating Cash Flow

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Relative TSR

|

|

|

|

|

| Measure:: 5 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Stock Price (through the use of equity-based awards)

|

|

|

|

|

| Whittington [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

$ 6,663,764

|

$ 5,872,110

|

$ 5,983,987

|

$ 5,798,794

|

|

| PEO Actually Paid Compensation Amount |

9,988,446

|

7,158,165

|

6,667,375

|

3,020,052

|

|

| Darrow [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

|

|

$ 6,710,425

|

| PEO Actually Paid Compensation Amount |

|

|

|

|

14,512,272

|

| PEO | Whittington [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

4,609,892

|

4,308,474

|

4,172,324

|

1,399,838

|

|

| PEO | Whittington [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,593,566

|

732,296

|

111,389

|

(1,115,543)

|

|

| PEO | Whittington [Member] | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

|

| PEO | Whittington [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,139,356

|

(257,947)

|

(84,103)

|

(369,278)

|

|

| PEO | Whittington [Member] | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

|

| PEO | Whittington [Member] | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

89,067

|

56,452

|

19,364

|

5,928

|

|

| PEO | Whittington [Member] | Year-End Fair Value Of Equity Awards Granted In Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(4,107,199)

|

(3,553,220)

|

(3,535,586)

|

(2,699,687)

|

|

| PEO | Darrow [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

5,256,100

|

| PEO | Darrow [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

3,860,777

|

| PEO | Darrow [Member] | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

0

|

| PEO | Darrow [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

1,534,518

|

| PEO | Darrow [Member] | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

0

|

| PEO | Darrow [Member] | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

5,893

|

| PEO | Darrow [Member] | Year-End Fair Value Of Equity Awards Granted In Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

|

(2,855,441)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

524,306

|

845,458

|

775,876

|

277,482

|

1,068,302

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

178,144

|

100,581

|

22,396

|

(484,233)

|

770,560

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

17,274

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

176,307

|

(15,249)

|

(13,725)

|

(201,653)

|

262,213

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(88,788)

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

14,385

|

12,468

|

6,279

|

1,673

|

2,514

|

| Non-PEO NEO | Year-End Fair Value Of Equity Awards Granted In Covered Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (624,236)

|

$ (698,139)

|

$ (657,470)

|

$ (535,139)

|

$ (580,383)

|