Exhibit 99.2

AngioDynamics Fourth Quarter and Full Year Earnings Presentation July

15, 2025

Forward-Looking Statements 2 Notice Regarding Forward-Looking

Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements regarding AngioDynamics’ expected future financial position, results of operations,

cash flows, business strategy, budgets, projected costs, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements that include the words such as

“expects,” “reaffirms,” “intends,” “anticipates,” “plans,” “projects,” “believes,” “seeks,” “estimates,” “optimistic,” or variations of such words and similar expressions, are forward-looking statements. These forward-looking statements are not

guarantees of future performance and are subject to risks and uncertainties. Investors are cautioned that actual events or results may differ materially from AngioDynamics’ expectations, expressed or implied. Factors that may affect the actual

results achieved by AngioDynamics include, without limitation, the scale and scope of the COVID-19 global pandemic, the ability of AngioDynamics to develop its existing and new products, technological advances and patents attained by

competitors, infringement of AngioDynamics’ technology or assertions that AngioDynamics’ technology infringes the technology of third parties, the ability of AngioDynamics to effectively compete against competitors that have substantially

greater resources, future actions by the FDA or other regulatory agencies, domestic and foreign health care reforms and government regulations, results of pending or future clinical trials, overall economic conditions (including inflation,

tariffs, labor shortages and supply chain challenges including the cost and availability of raw materials), the results of on-going litigation, challenges with respect to third-party distributors or joint venture partners or collaborators, the

results of sales efforts, the effects of product recalls and product liability claims, changes in key personnel, the ability of AngioDynamics to execute on strategic initiatives, the effects of economic, credit and capital market conditions,

general market conditions, market acceptance, foreign currency exchange rate fluctuations, the effects on pricing from group purchasing organizations and competition, the ability of AngioDynamics to obtain regulatory clearances or approval of

its products, or to integrate acquired businesses, as well as the risk factors listed from time to time in AngioDynamics’ SEC filings, including but not limited to its Annual Report on Form 10-K for the year ended May 31, 2024. AngioDynamics

does not assume any obligation to publicly update or revise any forward-looking statements for any reason. In the United States, the NanoKnife System has received a 510(k) clearance by the Food and Drug Administration for use in the surgical

ablation of soft tissue, and is similarly approved for commercialization in Canada, the European Union and Australia. The NanoKnife System has not been cleared for the treatment or therapy of a specific disease or condition. Notice Regarding

Non-GAAP Financial Measures Management uses non-GAAP measures to establish operational goals and believes that non-GAAP measures may assist investors in analyzing the underlying trends in AngioDynamics’ business over time. Investors should

consider these non-GAAP measures in addition to, not as a substitute for or as superior to, financial reporting measures prepared in accordance with GAAP. In this presentation, AngioDynamics has reported pro forma results, adjusted EBITDA

(income before interest, taxes, depreciation and amortization and stock-based compensation); adjusted net income and adjusted earnings per share. Management uses these measures in its internal analysis and review of operational performance.

Management believes that these measures provide investors with useful information in comparing AngioDynamics’ performance over different periods. By using these non-GAAP measures, management believes that investors get a better picture of the

performance of AngioDynamics’ underlying business. Management encourages investors to review AngioDynamics’ financial results prepared in accordance with GAAP to understand AngioDynamics’ performance taking into account all relevant factors,

including those that may only occur from time to time but have a material impact on AngioDynamics’ financial results. Please see the tables that follow for a reconciliation of non-GAAP measures to measures prepared in accordance with GAAP.

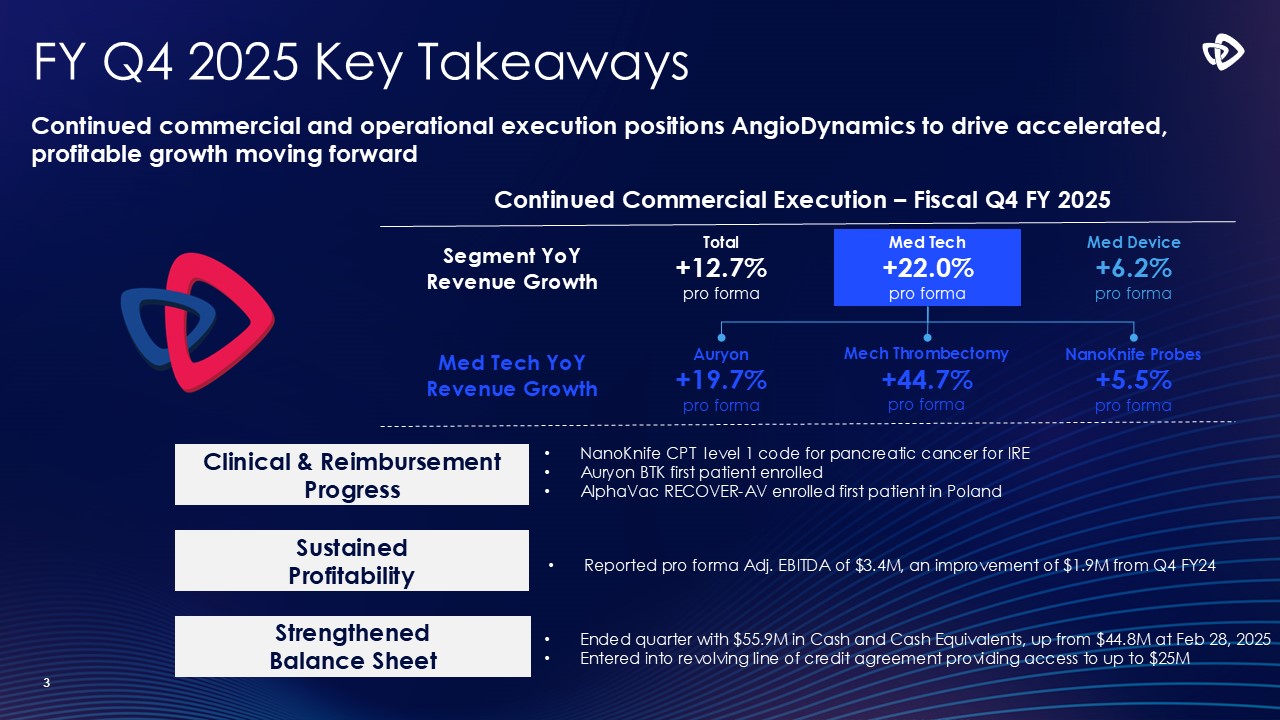

FY Q4 2025 Key Takeaways 3 NanoKnife CPT level 1 code for pancreatic

cancer for IRE Auryon BTK first patient enrolled AlphaVac RECOVER-AV enrolled first patient in Poland Continued commercial and operational execution positions AngioDynamics to drive accelerated, profitable growth moving forward Continued

Commercial Execution – Fiscal Q4 FY 2025 Total +12.7% pro forma Segment YoY Revenue Growth Med Tech +22.0% pro forma Med Device +6.2% pro forma Auryon +19.7% pro forma Med Tech YoY Revenue Growth Mech Thrombectomy +44.7%

pro forma NanoKnife Probes +5.5% pro forma Sustained Profitability Strengthened Balance Sheet Clinical & Reimbursement Progress Ended quarter with $55.9M in Cash and Cash Equivalents, up from $44.8M at Feb 28, 2025 Entered

into revolving line of credit agreement providing access to up to $25M Reported pro forma Adj. EBITDA of $3.4M, an improvement of $1.9M from Q4 FY24

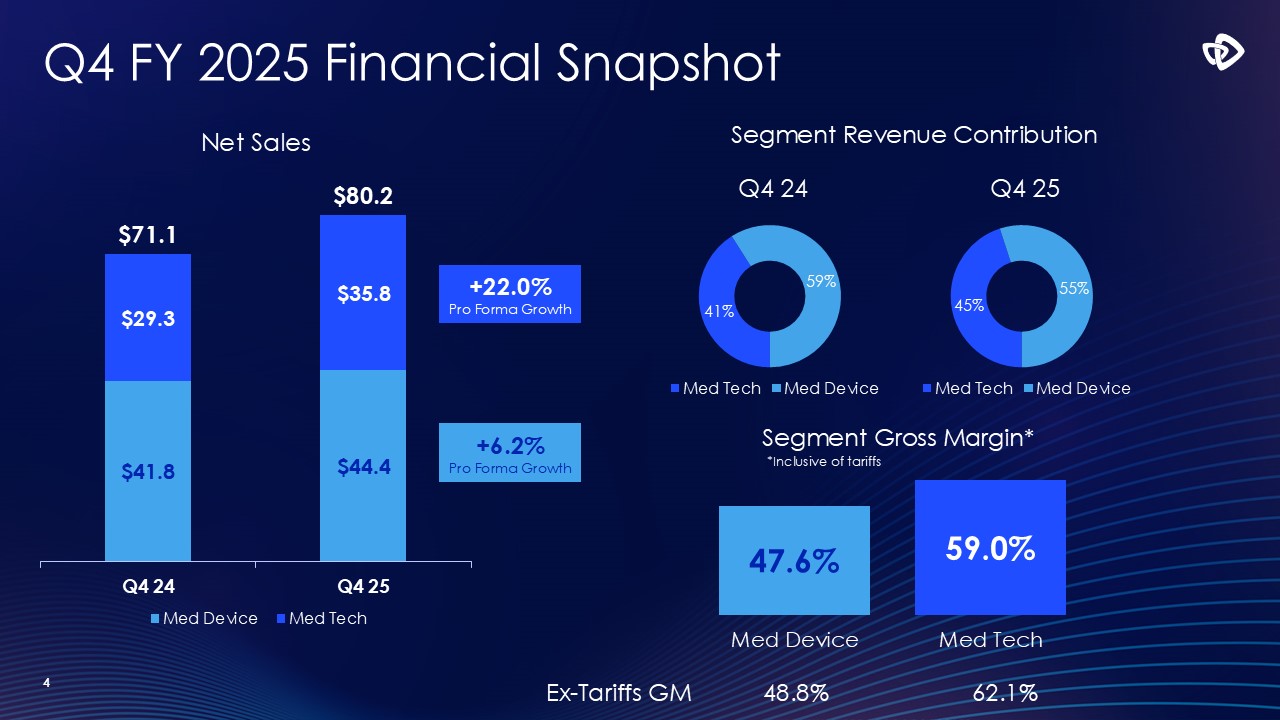

4 +6.2% Pro Forma Growth +22.0% Pro Forma Growth Segment Revenue

Contribution Segment Gross Margin* 47.6% 59.0% Med Device Med Tech Q4 FY 2025 Financial Snapshot *Inclusive of tariffs Ex-Tariffs GM 48.8% 62.1%

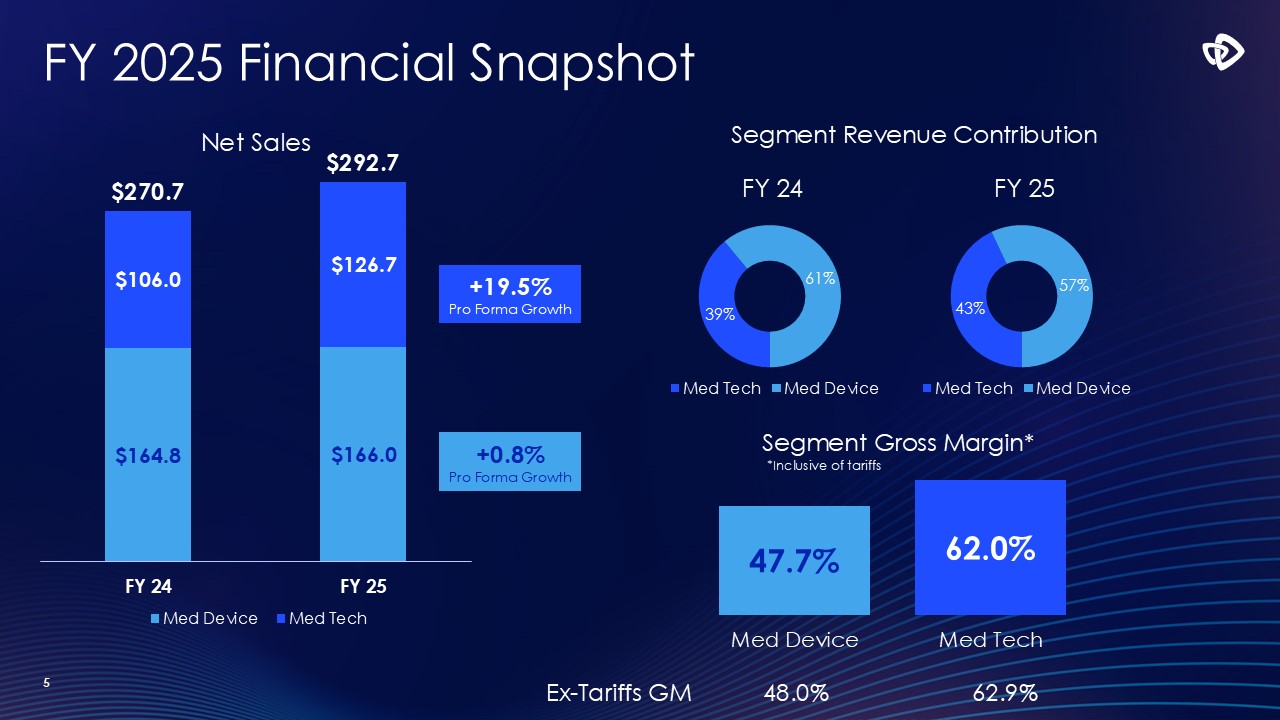

5 +0.8% Pro Forma Growth +19.5% Pro Forma Growth Segment Revenue

Contribution Segment Gross Margin* 47.7% 62.0% Med Device Med Tech FY 2025 Financial Snapshot Ex-Tariffs GM 48.0% 62.9% *Inclusive of tariffs

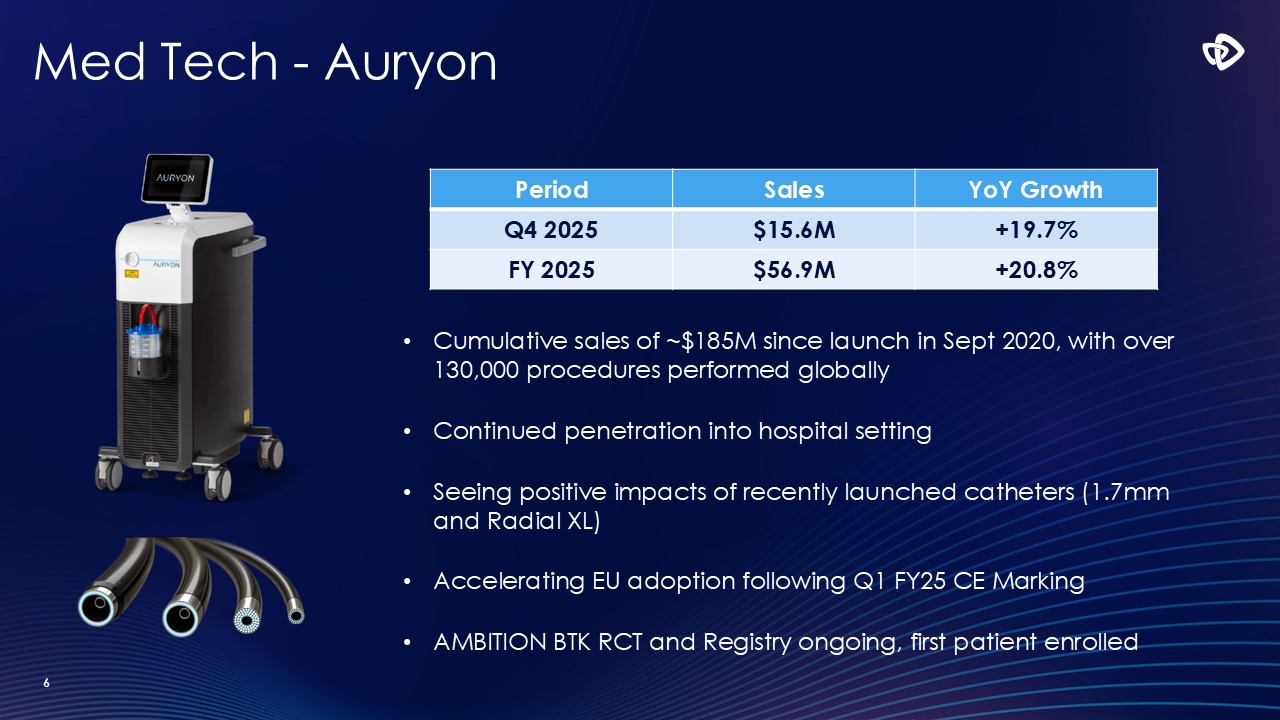

Med Tech - Auryon 6 Cumulative sales of ~$185M since launch in Sept

2020, with over 130,000 procedures performed globally Continued penetration into hospital setting Seeing positive impacts of recently launched catheters (1.7mm and Radial XL) Accelerating EU adoption following Q1 FY25 CE Marking AMBITION

BTK RCT and Registry ongoing, first patient enrolled Period Sales YoY Growth Q4 2025 $15.6M +19.7% FY 2025 $56.9M +20.8%

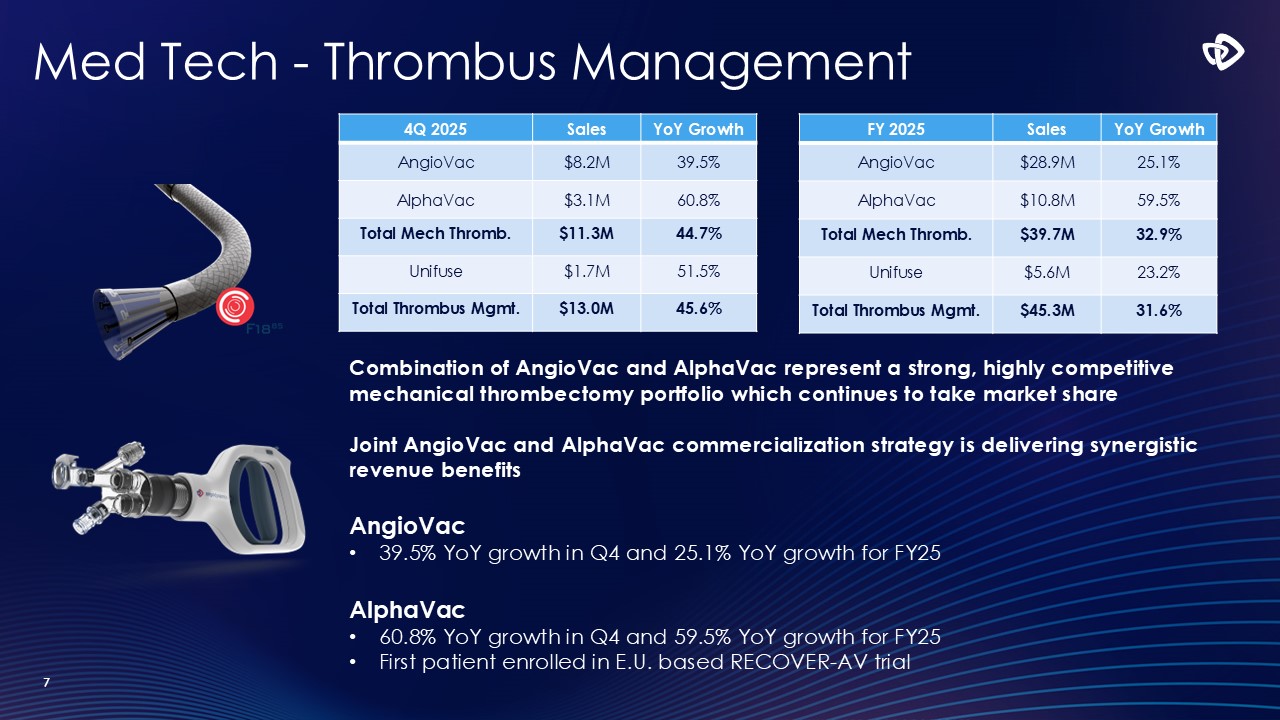

Med Tech - Thrombus Management 7 Combination of AngioVac and AlphaVac

represent a strong, highly competitive mechanical thrombectomy portfolio which continues to take market share Joint AngioVac and AlphaVac commercialization strategy is delivering synergistic revenue benefits AngioVac 39.5% YoY growth in Q4

and 25.1% YoY growth for FY25 AlphaVac 60.8% YoY growth in Q4 and 59.5% YoY growth for FY25 First patient enrolled in E.U. based RECOVER-AV trial 4Q 2025 Sales YoY Growth AngioVac $8.2M 39.5% AlphaVac $3.1M 60.8% Total Mech

Thromb. $11.3M 44.7% Unifuse $1.7M 51.5% Total Thrombus Mgmt. $13.0M 45.6% FY 2025 Sales YoY Growth AngioVac $28.9M 25.1% AlphaVac $10.8M 59.5% Total Mech Thromb. $39.7M 32.9% Unifuse $5.6M 23.2% Total Thrombus

Mgmt. $45.3M 31.6%

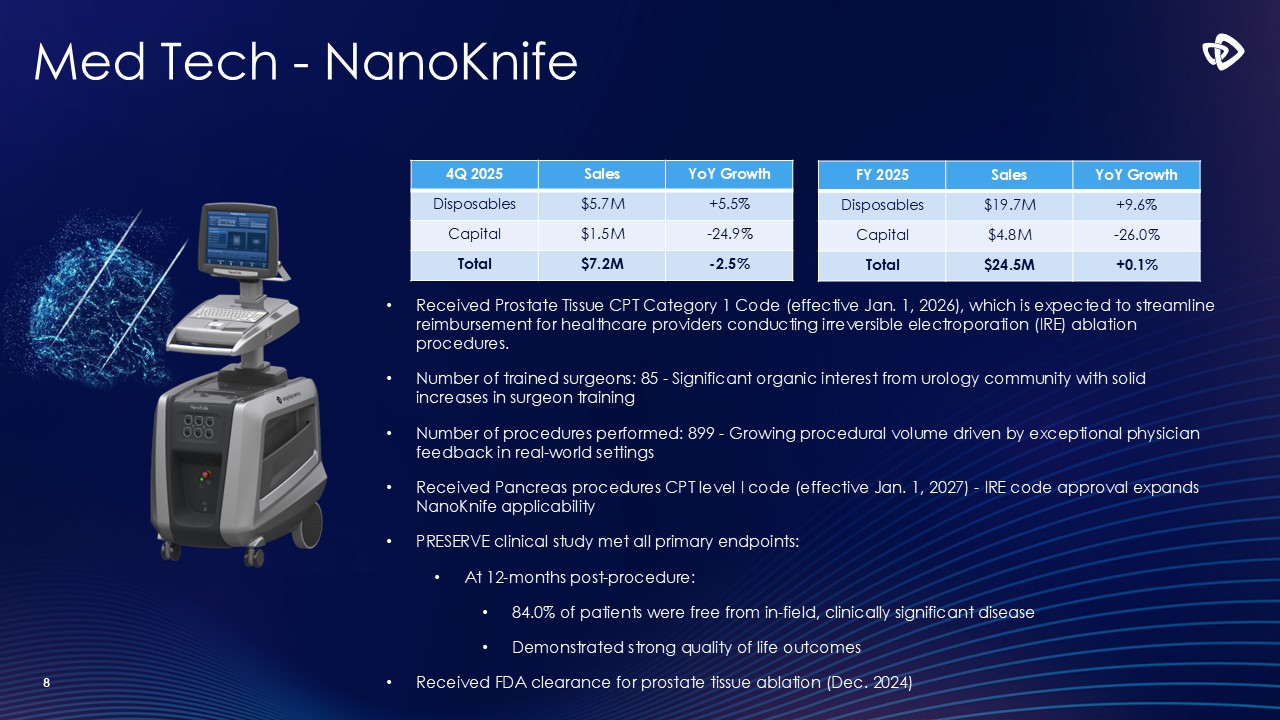

Med Tech - NanoKnife 8 4Q 2025 Sales YoY

Growth Disposables $5.7M +5.5% Capital $1.5M -24.9% Total $7.2M -2.5% FY 2025 Sales YoY Growth Disposables $19.7M +9.6% Capital $4.8M -26.0% Total $24.5M +0.1% Received Prostate Tissue CPT Category 1 Code (effective Jan.

1, 2026), which is expected to streamline reimbursement for healthcare providers conducting irreversible electroporation (IRE) ablation procedures. Number of trained surgeons: 85 - Significant organic interest from urology community with solid

increases in surgeon training Number of procedures performed: 899 - Growing procedural volume driven by exceptional physician feedback in real-world settings Received Pancreas procedures CPT level I code (effective Jan. 1, 2027) - IRE code

approval expands NanoKnife applicability PRESERVE clinical study met all primary endpoints: At 12-months post-procedure: 84.0% of patients were free from in-field, clinically significant disease Demonstrated strong quality of life

outcomes Received FDA clearance for prostate tissue ablation (Dec. 2024)

Med Device 9 4Q 2025 Sales YoY Growth Core

Peripheral $21.5M +8.5% Venous / EVLT $7.3M +14.3% Ports $9.1M -3.5% Solero Microwave $4.9M +5.8% Alatus and Isoloc Balloons $1.0M -8.5% Other Med Device $0.6M +33.5% Total $44.4M +6.2% FY 2025 Sales YoY Growth Core

Peripheral $78.3M +2.6% Venous / EVLT $27.5M +3.3% Ports $36.0M -0.7% Solero Microwave $18.4M -4.1% Alatus and Isoloc Balloons $4.0M -8.7% Other Med Device $1.8M -7.3% Total $166.0M +0.8%

Fiscal Year 2026 Guidance 10 Metric Guidance* (Issued Jul. 15,

2025) Tariff Guidance Impact* Full Year Net Sales $305M - $310M Limited Impact Med Tech Net Sales 12 – 15% YoY growth Limited Impact Med Device Net Sales Flat Limited Impact Gross Margin 53.5% - 55.5% Absent Tariffs: 55.0% -

56.0% Pro Forma Adjusted EBITDA $3.0M - $8.0M Absent Tariffs: $7.5M - $10.5M Adjusted EPS ($0.35) - ($0.25) Absent Tariffs: ($0.30) – ($0.25) Free Cash Flow Positive for Full Year FY26 Absent Tariffs: Up to +$5M *Based on tariff

related assumptions as of July 15, 2025

Appendix 11

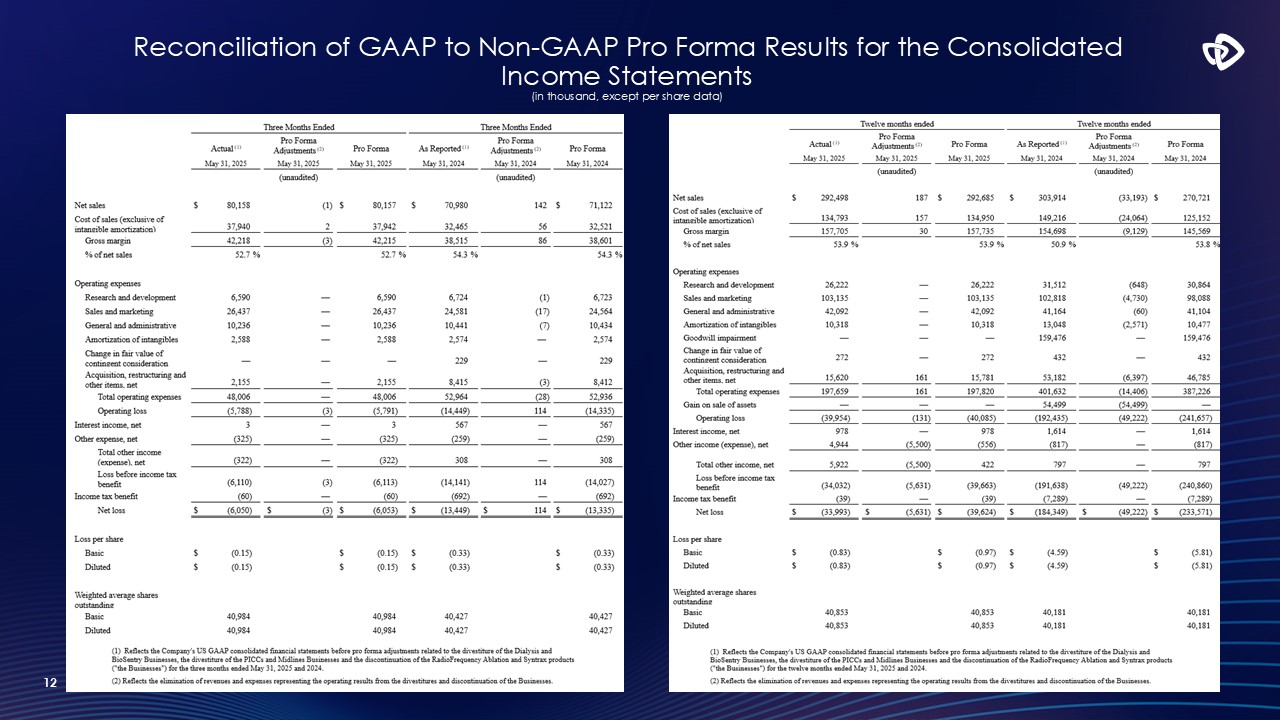

Reconciliation of GAAP to Non-GAAP Pro Forma Results for the Consolidated

Income Statements (in thousand, except per share data) 12

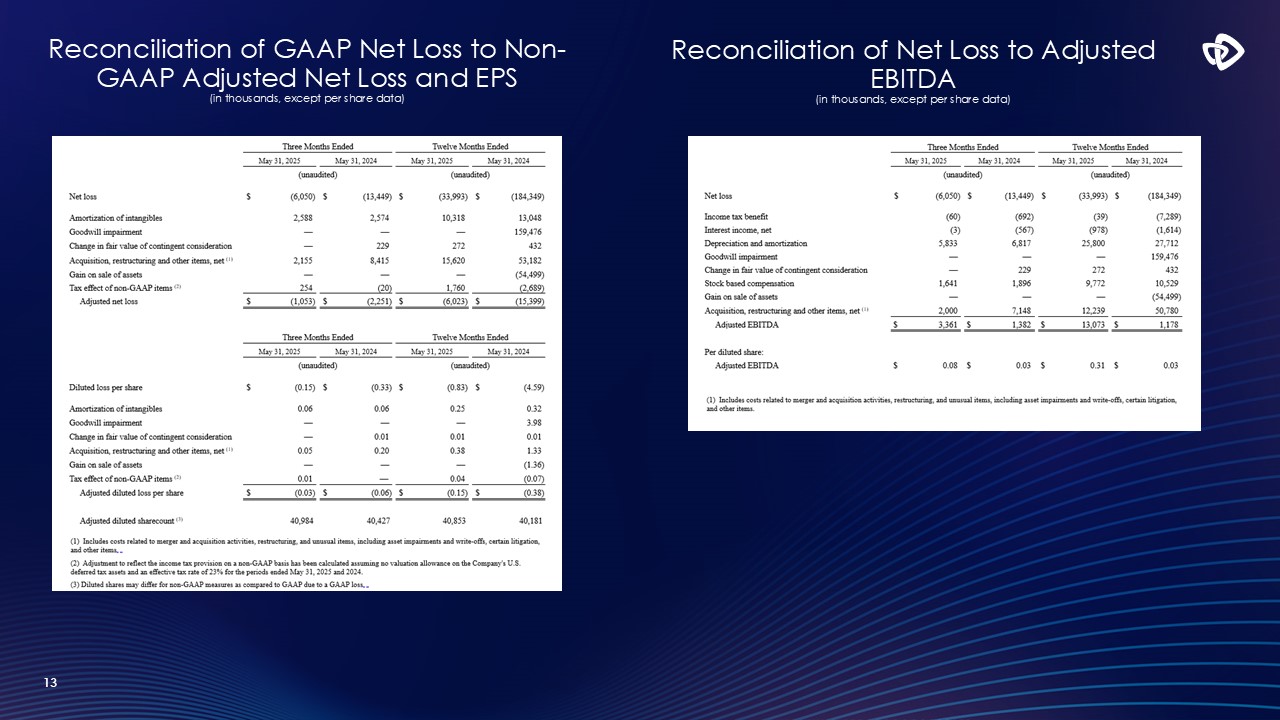

Reconciliation of GAAP Net Loss to Non-GAAP Adjusted Net Loss and EPS (in

thousands, except per share data) 13 Reconciliation of Net Loss to Adjusted EBITDA (in thousands, except per share data)

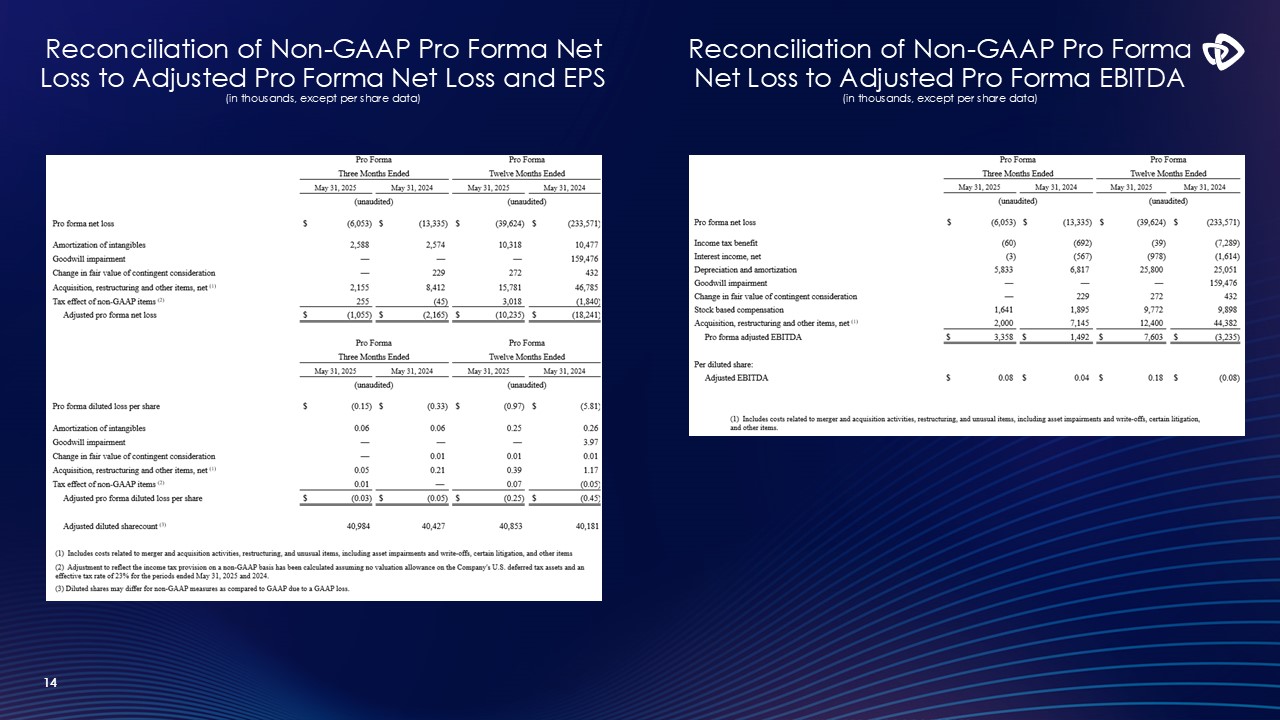

Reconciliation of Non-GAAP Pro Forma Net Loss to Adjusted Pro Forma Net

Loss and EPS(in thousands, except per share data) 14 Reconciliation of Non-GAAP Pro Forma Net Loss to Adjusted Pro Forma EBITDA (in thousands, except per share data)

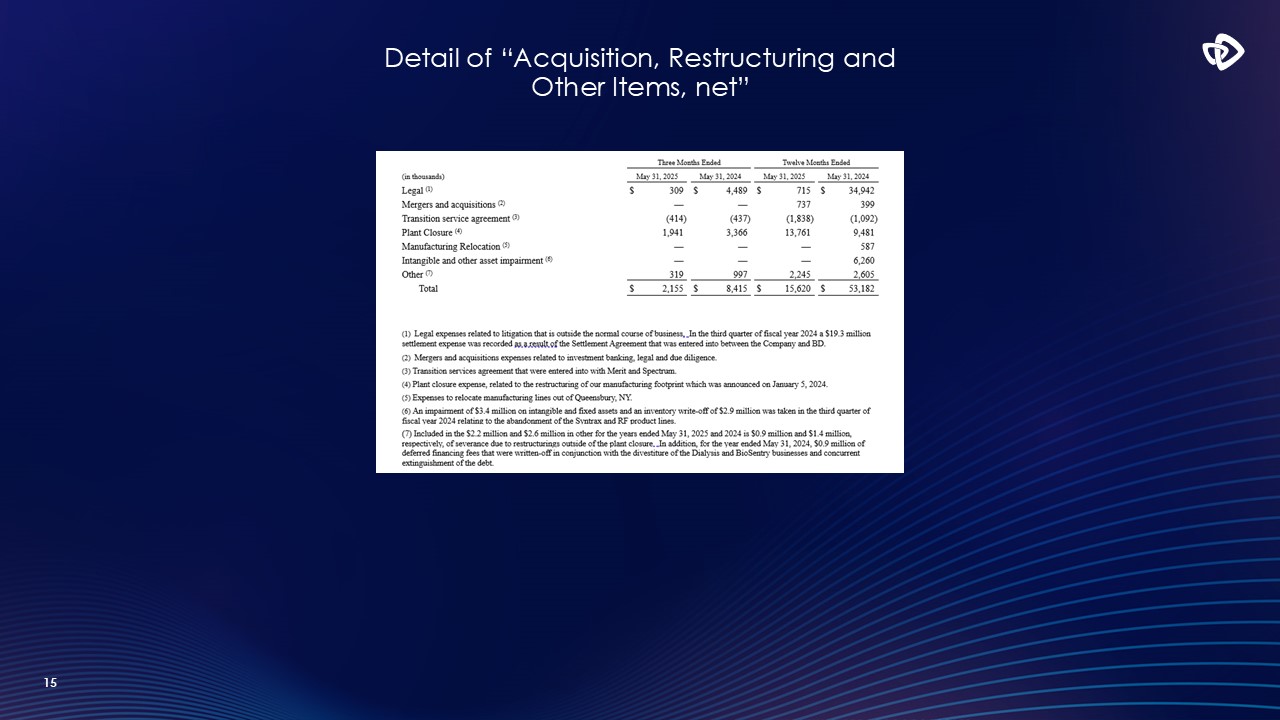

15 Detail of “Acquisition, Restructuring and Other Items, net”

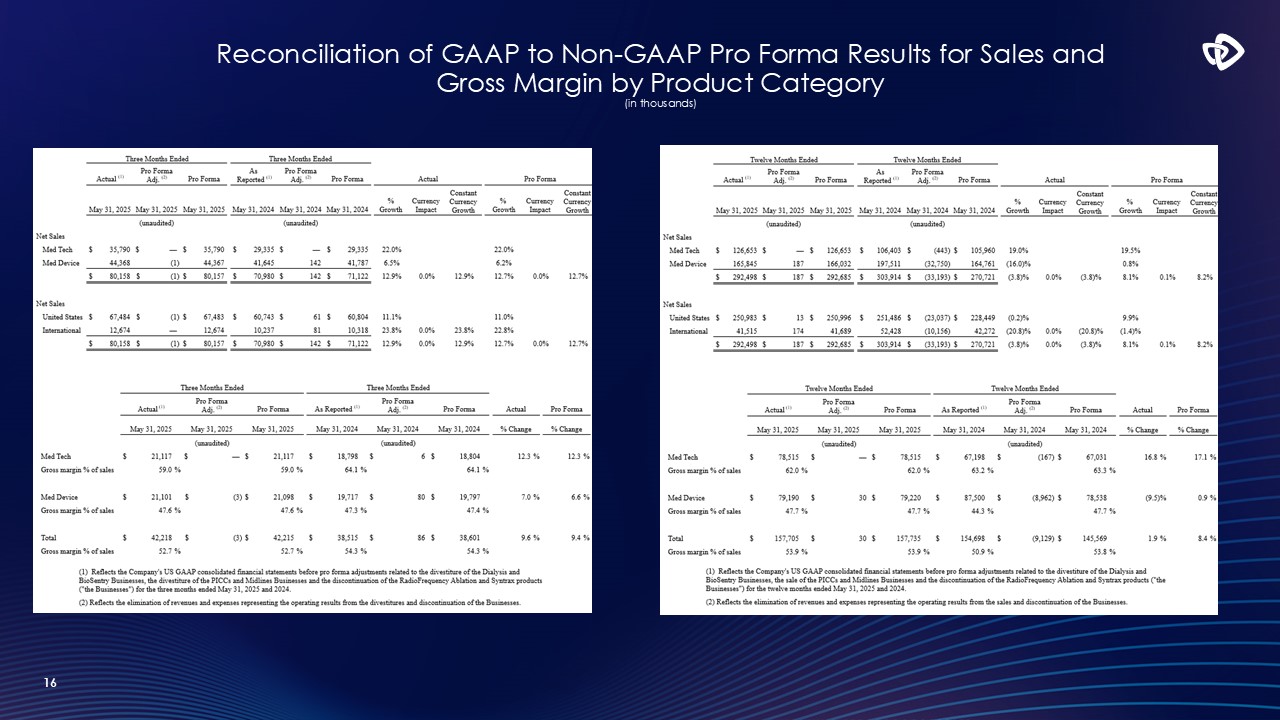

16 Reconciliation of GAAP to Non-GAAP Pro Forma Results for Sales and

Gross Margin by Product Category (in thousands)

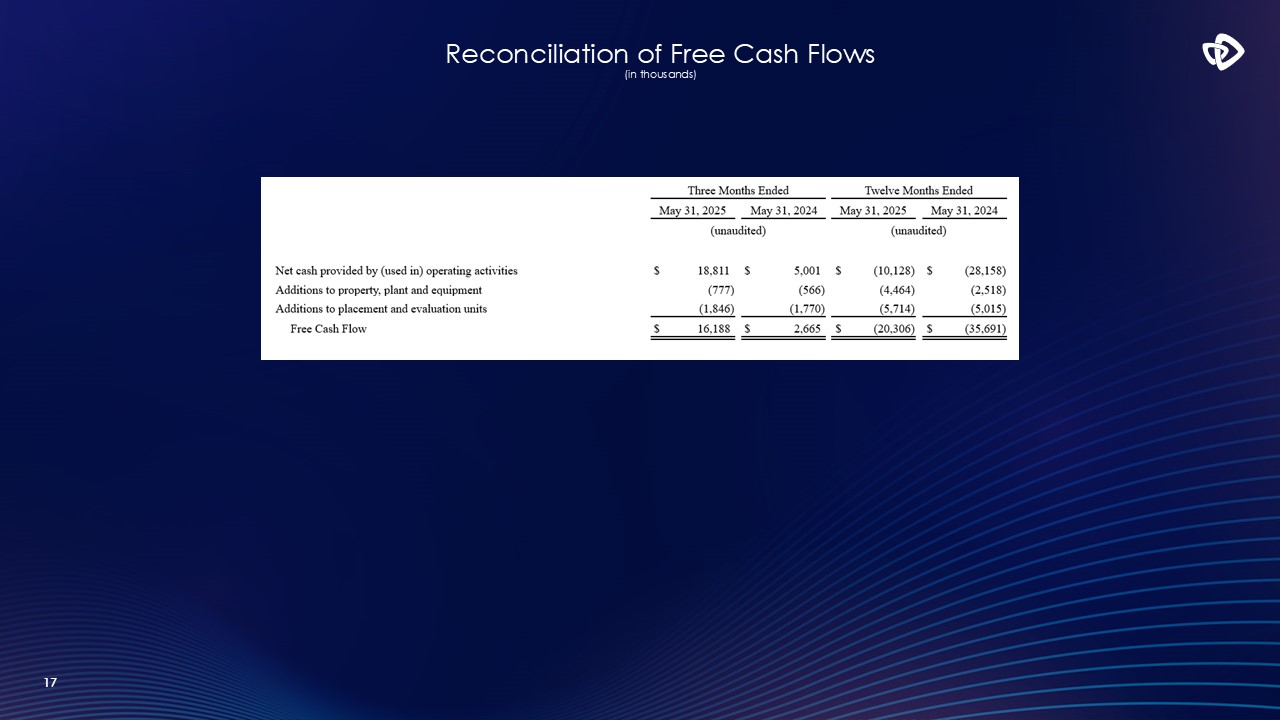

17 Reconciliation of Free Cash Flows (in thousands)