Exhibit (a)(1)(B)

LETTER OF TRANSMITTAL

to Tender Shares of Common Stock

of

GMS INC.

a Delaware corporation

at

$110.00 PER SHARE

Pursuant to the Offer to Purchase

Dated July 14, 2025

by

GOLD ACQUISITION SUB, INC.,

an indirect wholly owned subsidiary of

THE HOME DEPOT, INC.

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT ONE MINUTE AFTER 11:59 P.M.,

EASTERN TIME, ON FRIDAY, AUGUST 8, 2025, UNLESS THE OFFER IS EXTENDED OR EARLIER

TERMINATED

(SUCH DATE AND TIME, AS IT MAY BE EXTENDED, THE “EXPIRATION TIME”).

The Depositary for the Offer is:

Broadridge Corporate Issuer Solutions, LLC

If delivering by mail: | If delivering by hand, express mail, courier, or other expedited service: | ||

Broadridge, Inc. Attention: BCIS Re-Organization Dept. P.O. Box 1317 Brentwood, NY 11717-0718 | Broadridge, Inc. Attention: BCIS IWS 51 Mercedes Way Edgewood, NY 11717 | ||

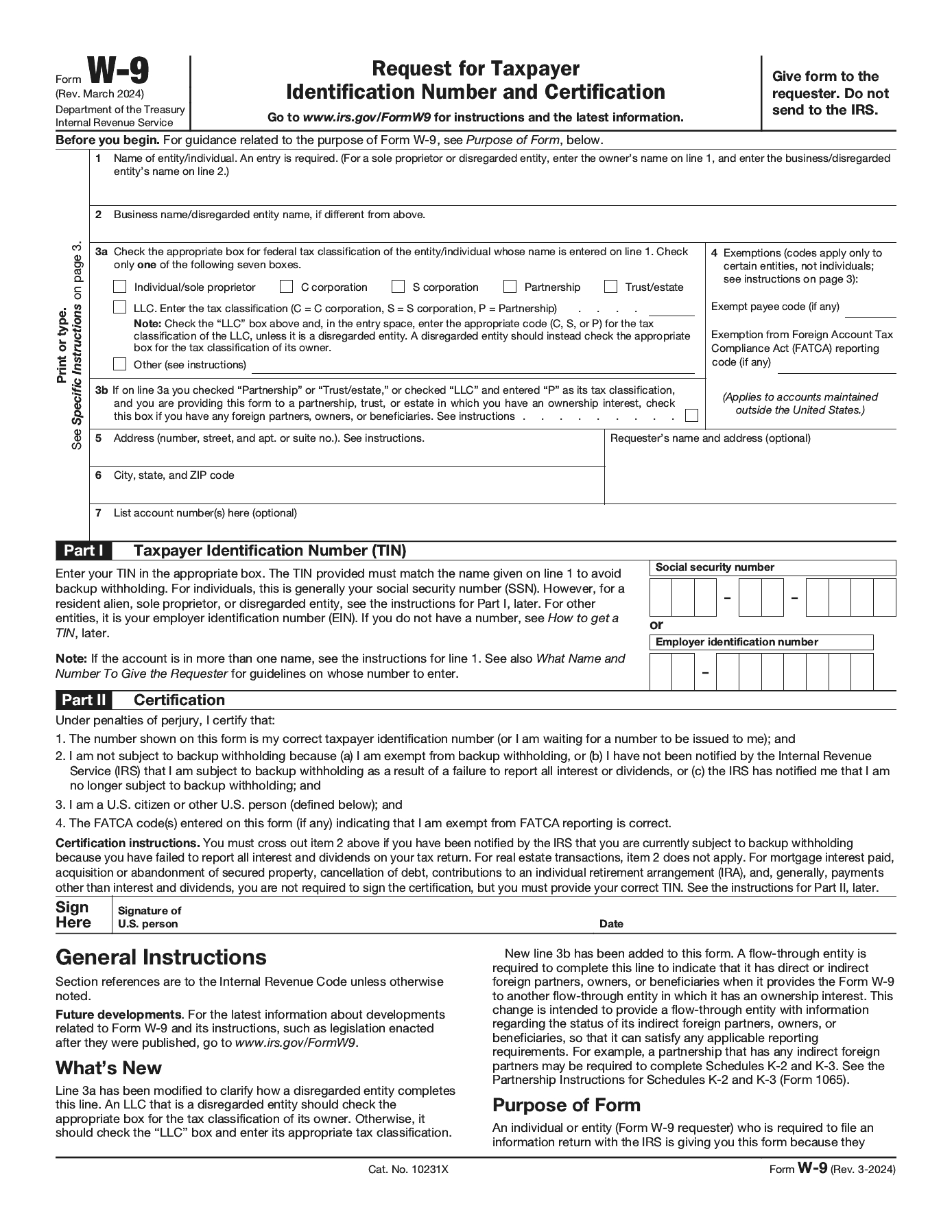

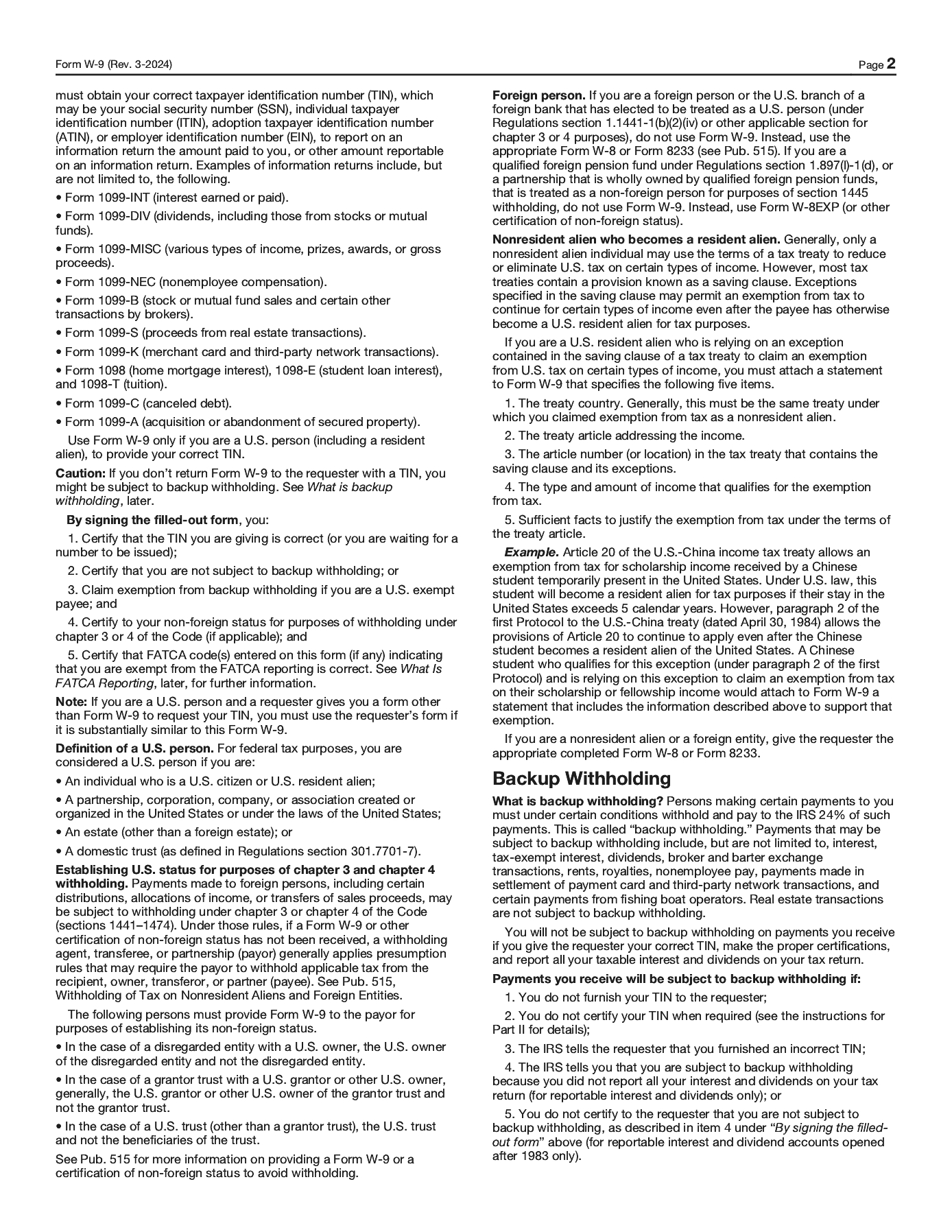

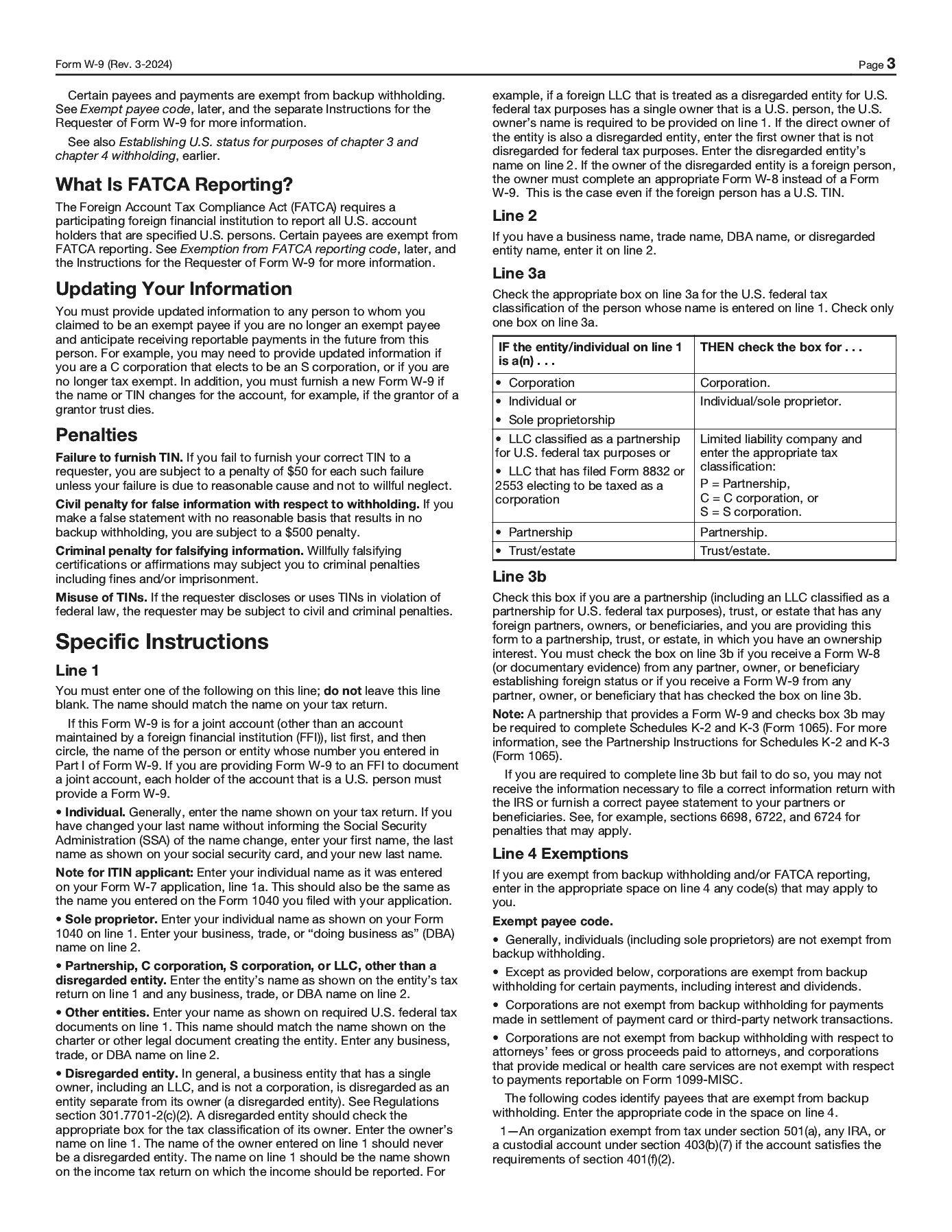

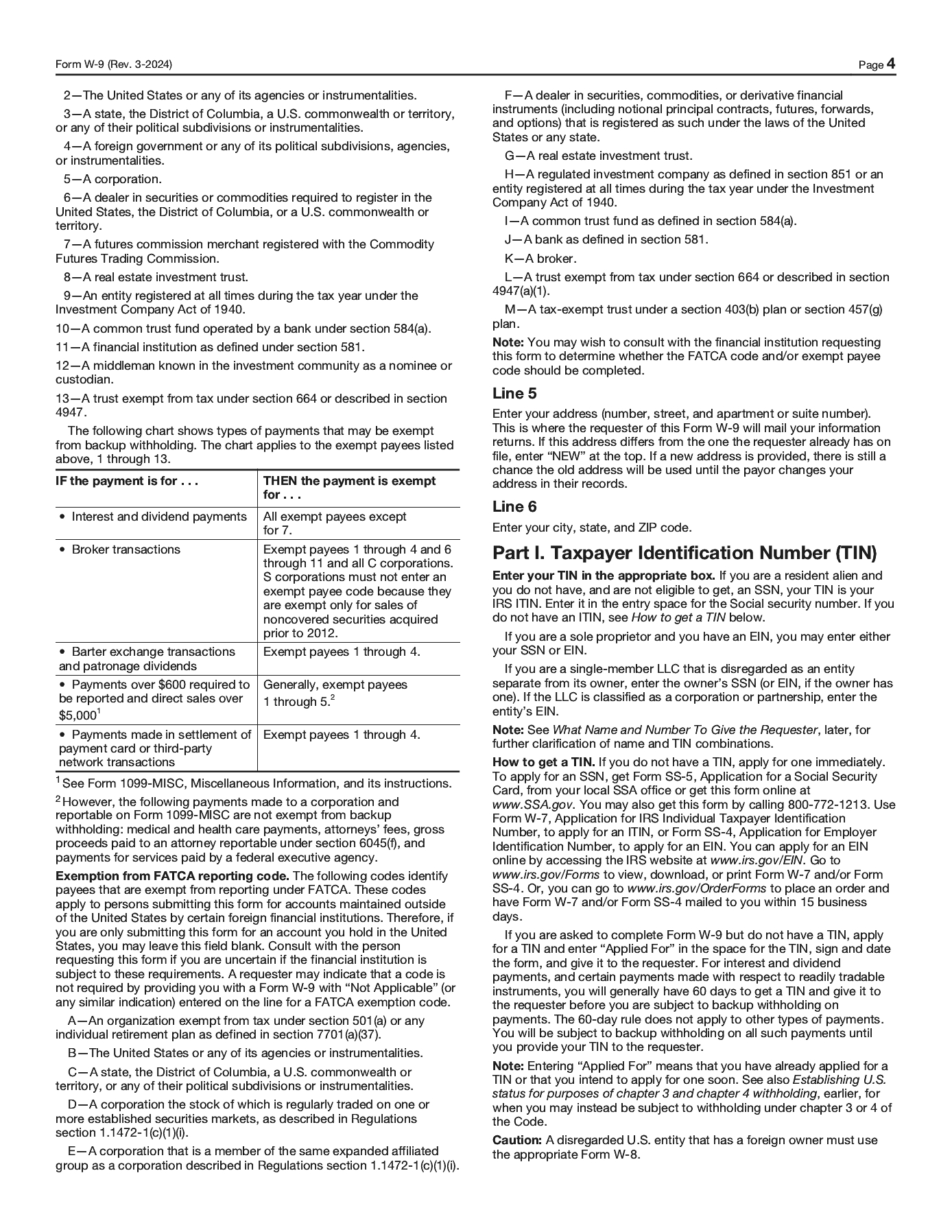

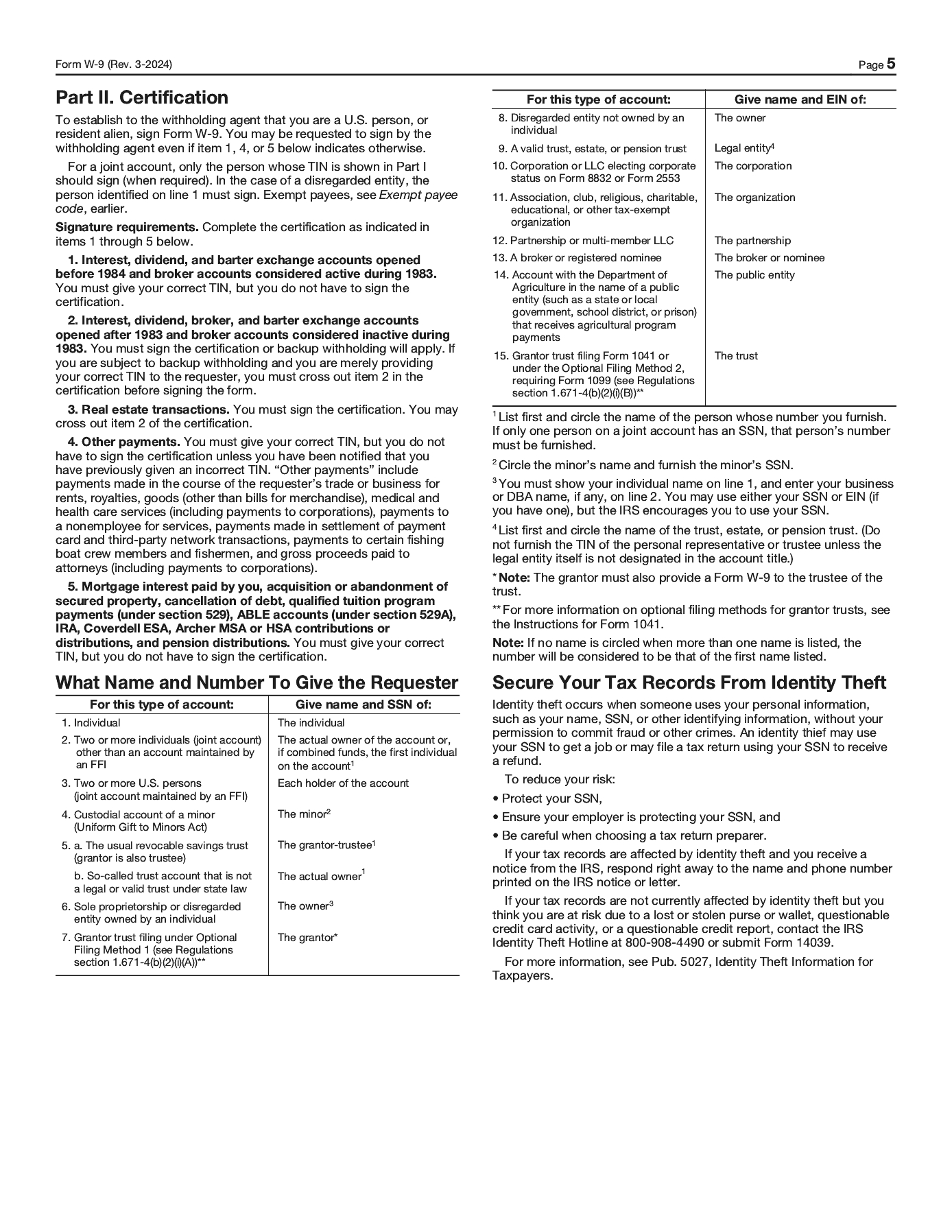

Delivery of this Letter of Transmittal to an address other than as set forth above will not constitute a valid delivery to the Depositary (as defined below). You must sign this Letter of Transmittal in the appropriate space provided therefor below, with signature guaranteed, if required, and complete and sign the IRS Form W-9 included in this Letter of Transmittal or the appropriate IRS Form W-8, if required. The instructions set forth in this Letter of Transmittal should be read carefully before you tender any of your Shares (as defined below) into the Offer (as defined below).

All questions regarding the Offer should be directed to the Information Agent, D.F. King & Co., Inc. (the “Information Agent”), at (800) 331-7543 (toll free in the United States) or the address set forth on the back page of the Offer to Purchase.

If you would like additional copies of this Letter of Transmittal or any of the other offering documents, you should contact the Information Agent at (800) 331-7543 (toll free in the United States).

This Letter of Transmittal is being delivered to you in connection with the offer by Gold Acquisition Sub, Inc., a Delaware corporation (“Purchaser”) and an indirect wholly owned subsidiary of The Home Depot, Inc., a Delaware corporation (“Parent”), to purchase all of the outstanding shares of common stock, par value $0.001 per share (each, a “Share” and, collectively, “Shares”), of GMS Inc., a Delaware corporation (“GMS”), for $110.00 per Share in cash, without interest and subject to any required withholding of taxes (the “Offer Price”), and upon the terms and subject to the conditions set forth in this Letter of Transmittal and the related Offer to Purchase by Purchaser, dated July 14, 2025 (the “Offer to Purchase”, which, together with this Letter of Transmittal, as each may be amended or supplemented from time to time, constitutes the “Offer”). The Offer expires at one minute following 11:59 P.M., Eastern Time, on Friday, August 8, 2025 (the “Expiration Time”, unless Purchaser shall have extended the period during which the Offer is open in accordance with the Merger Agreement, in which event “Expiration Time” will mean the latest time and date at which the Offer, so extended by Purchaser, will expire).

The Offer is being made to all holders of Shares. The Offer is not being made to (and no tenders will be accepted from or on behalf of) holders of Shares in any jurisdiction in which the making of the Offer or acceptance thereof would not be in compliance with the securities, “blue sky” or other laws of such jurisdiction.