Confidential Investor Presentation July 2025 ©2025 KARYOPHARM THERAPEUTICS INC. | CONFIDENTIAL & PROPRIETARY

Forward-Looking Statements and Disclaimers 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, statements with respect to the possible achievement of Karyopharm’s discovery and development milestones, our future discovery and development efforts, including regulatory submissions and approvals, our commercialization efforts, our partnerships and collaborations with third parties, our future operating results and financial position, our ability to continue as a going concern, our business strategy, and other objectives for future operations. The words “aim,” “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “seek,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements in this presentation are based on management’s current expectations and beliefs and are subject to a number of important risks, uncertainties and other factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this presentation, including, without limitation, general market conditions, risks and uncertainties related to ongoing and planned research and development activities, including initiating, conducting or completing preclinical studies and clinical trials and the timing and results of such preclinical studies or clinical trials; the delay of any current or planned preclinical studies or clinical trials or the development of Karyopharm’s product candidates; our ability to obtain and maintain sufficient preclinical and clinical supply of current or future product candidates; our ability to successfully demonstrate the safety and efficacy of our product candidates and gain approval of our product candidates on a timely basis, if at all; results from preclinical studies or clinical trials for our product candidates, which may not support further development of such product candidates; actions of regulatory agencies, which may affect the initiation, timing and progress of our current or future clinical trials; our ability to obtain, maintain and enforce patent and other intellectual property protection for current or future product candidates; our ability to obtain and maintain sufficient cash resources to fund our operations; and the impact of international trade policies on our business, including U.S. and China trade policies. These and other risks and uncertainties are described in greater detail under the caption “Risk Factors” of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2025. Any forward-looking statements contained in this presentation represent Karyopharm’s views only as of July 11, 2025 and should not be relied upon as representing our views as of any subsequent date. Except as required by law, Karyopharm explicitly disclaims any obligation to update any forward-looking statements. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and Karyopharm’s own internal estimates and research. While we believe these third-party studies, publications, surveys and other data to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, no independent source has evaluated the reasonableness or accuracy of our internal estimates or research and no reliance should be made on any information or statements made in this presentation relating to or based on such internal estimates and research. This presentation and any oral statements made in connection with this presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there by any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation.

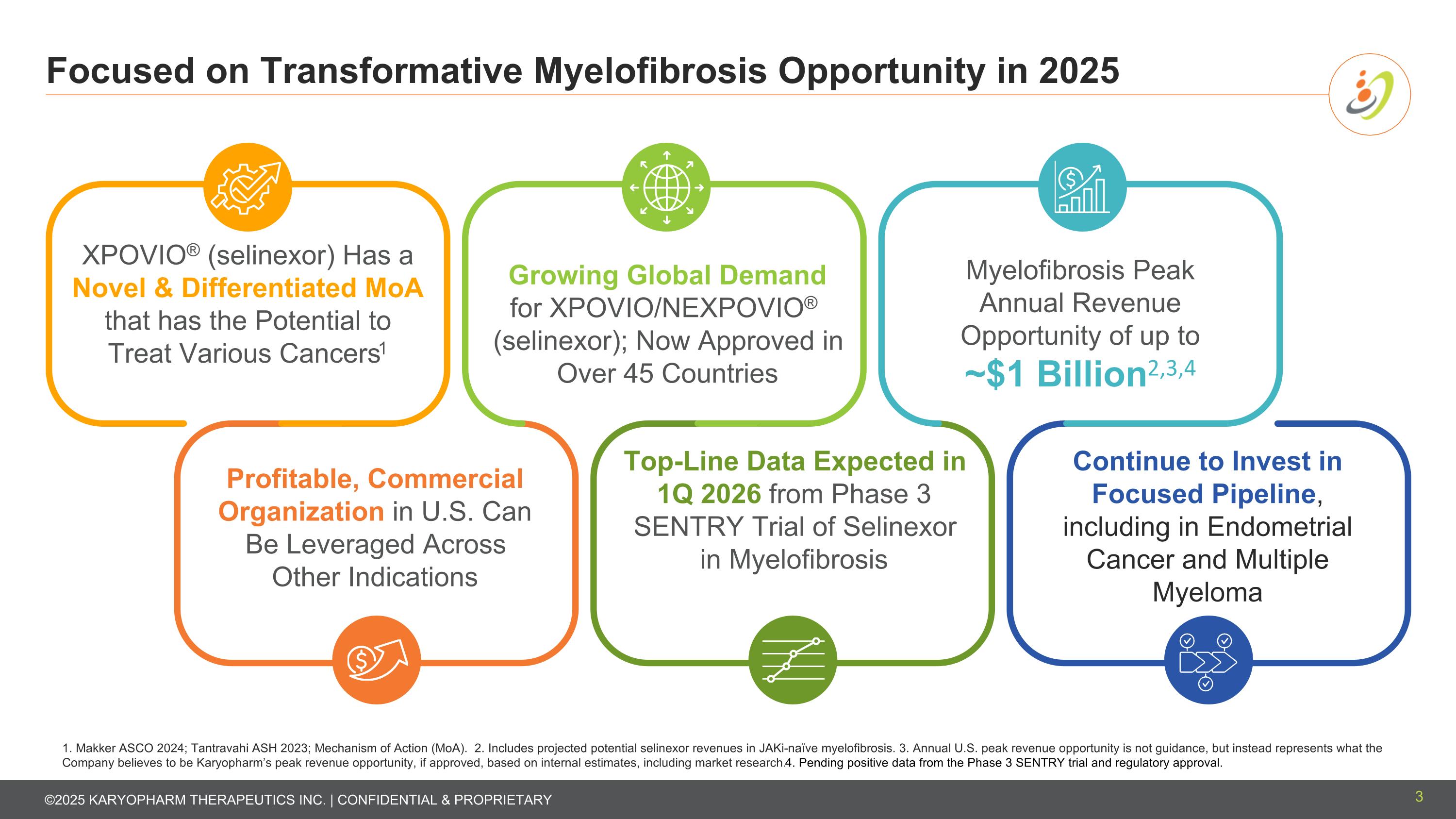

Focused on Transformative Myelofibrosis Opportunity in 2025 3 1. Makker ASCO 2024; Tantravahi ASH 2023; Mechanism of Action (MoA). 2. Includes projected potential selinexor revenues in JAKi-naïve myelofibrosis. 3. Annual U.S. peak revenue opportunity is not guidance, but instead represents what the Company believes to be Karyopharm’s peak revenue opportunity, if approved, based on internal estimates, including market research. 4. Pending positive data from the Phase 3 SENTRY trial and regulatory approval. Continue to Invest in Focused Pipeline, including in Endometrial Cancer and Multiple Myeloma XPOVIO® (selinexor) Has a Novel & Differentiated MoA that has the Potential to Treat Various Cancers1 Growing Global Demand for XPOVIO/NEXPOVIO® (selinexor); Now Approved in Over 45 Countries Myelofibrosis Peak Annual Revenue Opportunity of up to ~$1 Billion2,3,4 Profitable, Commercial Organization in U.S. Can Be Leveraged Across Other Indications Top-Line Data Expected in 1Q 2026 from Phase 3 SENTRY Trial of Selinexor in Myelofibrosis

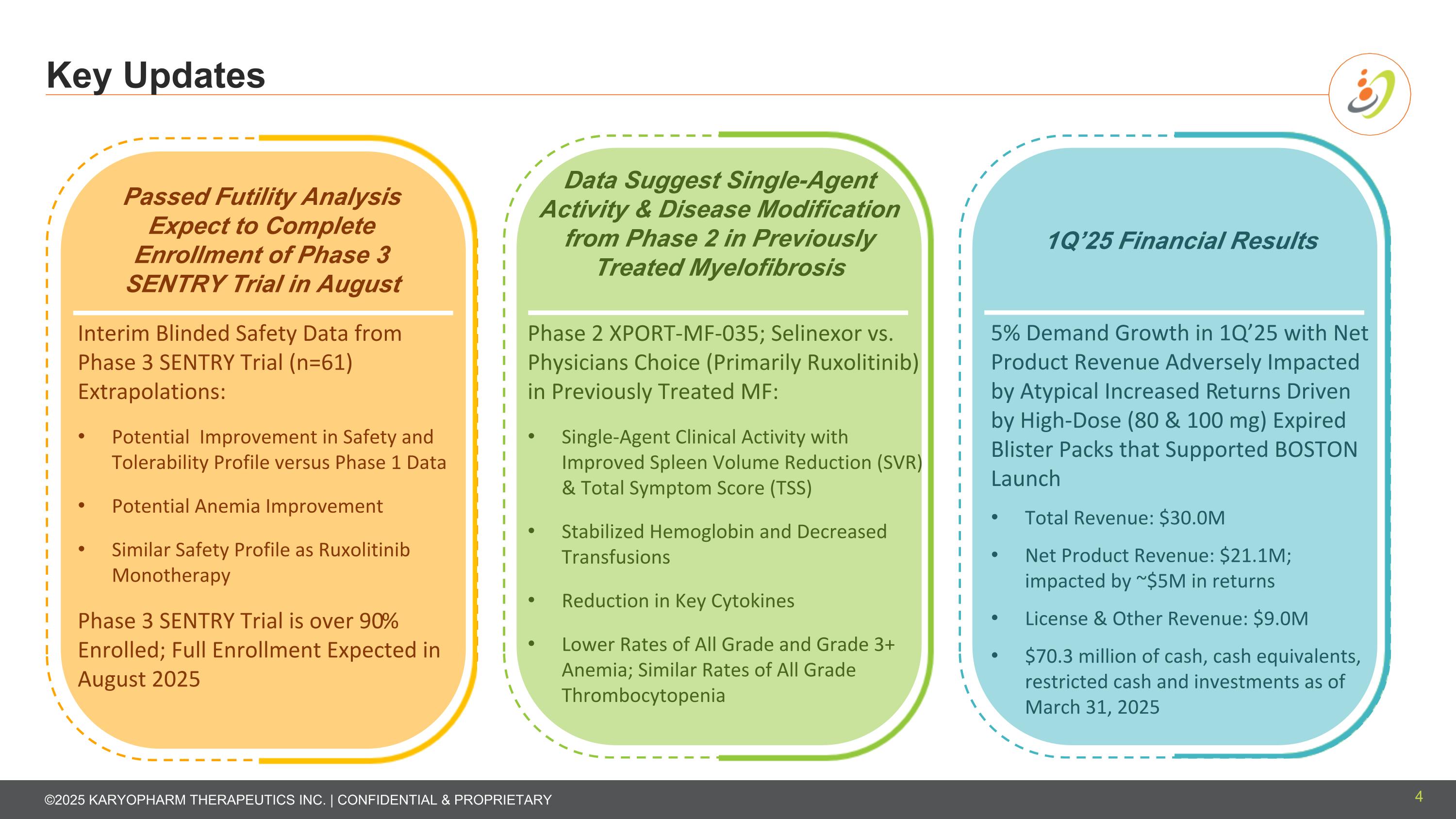

Passed Futility Analysis Expect to Complete Enrollment of Phase 3 SENTRY Trial in August Data Suggest Single-Agent Activity & Disease Modification from Phase 2 in Previously Treated Myelofibrosis 1Q’25 Financial Results Interim Blinded Safety Data from Phase 3 SENTRY Trial (n=61) Extrapolations: Potential Improvement in Safety and Tolerability Profile versus Phase 1 Data Potential Anemia Improvement Similar Safety Profile as Ruxolitinib Monotherapy Phase 3 SENTRY Trial is over 90% Enrolled; Full Enrollment Expected in August 2025 Phase 2 XPORT-MF-035; Selinexor vs. Physicians Choice (Primarily Ruxolitinib) in Previously Treated MF: Single-Agent Clinical Activity with Improved Spleen Volume Reduction (SVR) & Total Symptom Score (TSS) Stabilized Hemoglobin and Decreased Transfusions Reduction in Key Cytokines Lower Rates of All Grade and Grade 3+ Anemia; Similar Rates of All Grade Thrombocytopenia 5% Demand Growth in 1Q’25 with Net Product Revenue Adversely Impacted by Atypical Increased Returns Driven by High-Dose (80 & 100 mg) Expired Blister Packs that Supported BOSTON Launch Total Revenue: $30.0M Net Product Revenue: $21.1M; impacted by ~$5M in returns License & Other Revenue: $9.0M $70.3 million of cash, cash equivalents, restricted cash and investments as of March 31, 2025 Key Updates 4

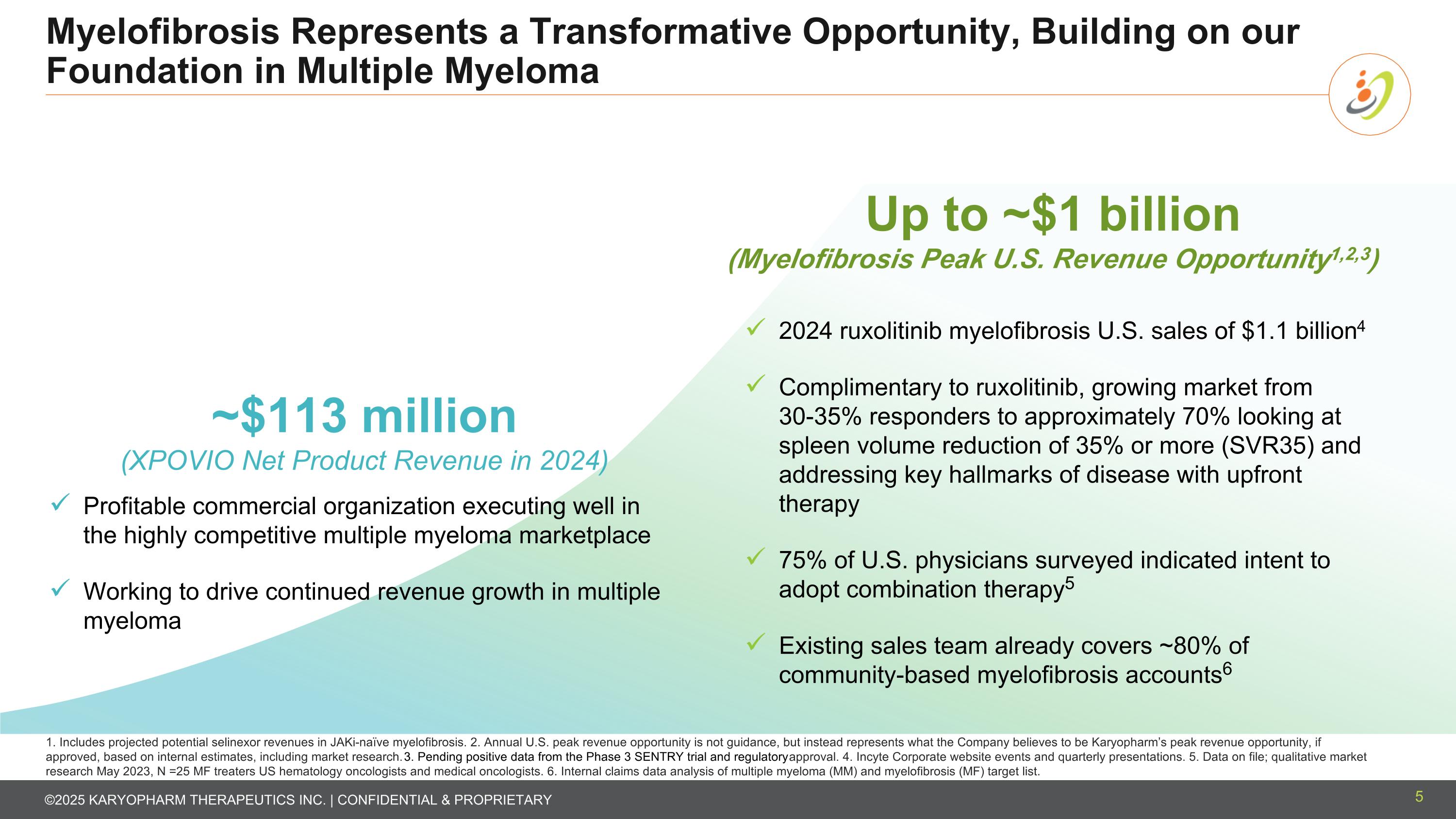

Myelofibrosis Represents a Transformative Opportunity, Building on our Foundation in Multiple Myeloma 5 ~$113 million (XPOVIO Net Product Revenue in 2024) Profitable commercial organization executing well in the highly competitive multiple myeloma marketplace Working to drive continued revenue growth in multiple myeloma Up to ~$1 billion (Myelofibrosis Peak U.S. Revenue Opportunity1,2,3) 2024 ruxolitinib myelofibrosis U.S. sales of $1.1 billion4 Complimentary to ruxolitinib, growing market from 30-35% responders to approximately 70% looking at spleen volume reduction of 35% or more (SVR35) and addressing key hallmarks of disease with upfront therapy 75% of U.S. physicians surveyed indicated intent to adopt combination therapy5 Existing sales team already covers ~80% of community-based myelofibrosis accounts6 1. Includes projected potential selinexor revenues in JAKi-naïve myelofibrosis. 2. Annual U.S. peak revenue opportunity is not guidance, but instead represents what the Company believes to be Karyopharm’s peak revenue opportunity, if approved, based on internal estimates, including market research. 3. Pending positive data from the Phase 3 SENTRY trial and regulatory approval. 4. Incyte Corporate website events and quarterly presentations. 5. Data on file; qualitative market research May 2023, N =25 MF treaters US hematology oncologists and medical oncologists. 6. Internal claims data analysis of multiple myeloma (MM) and myelofibrosis (MF) target list.

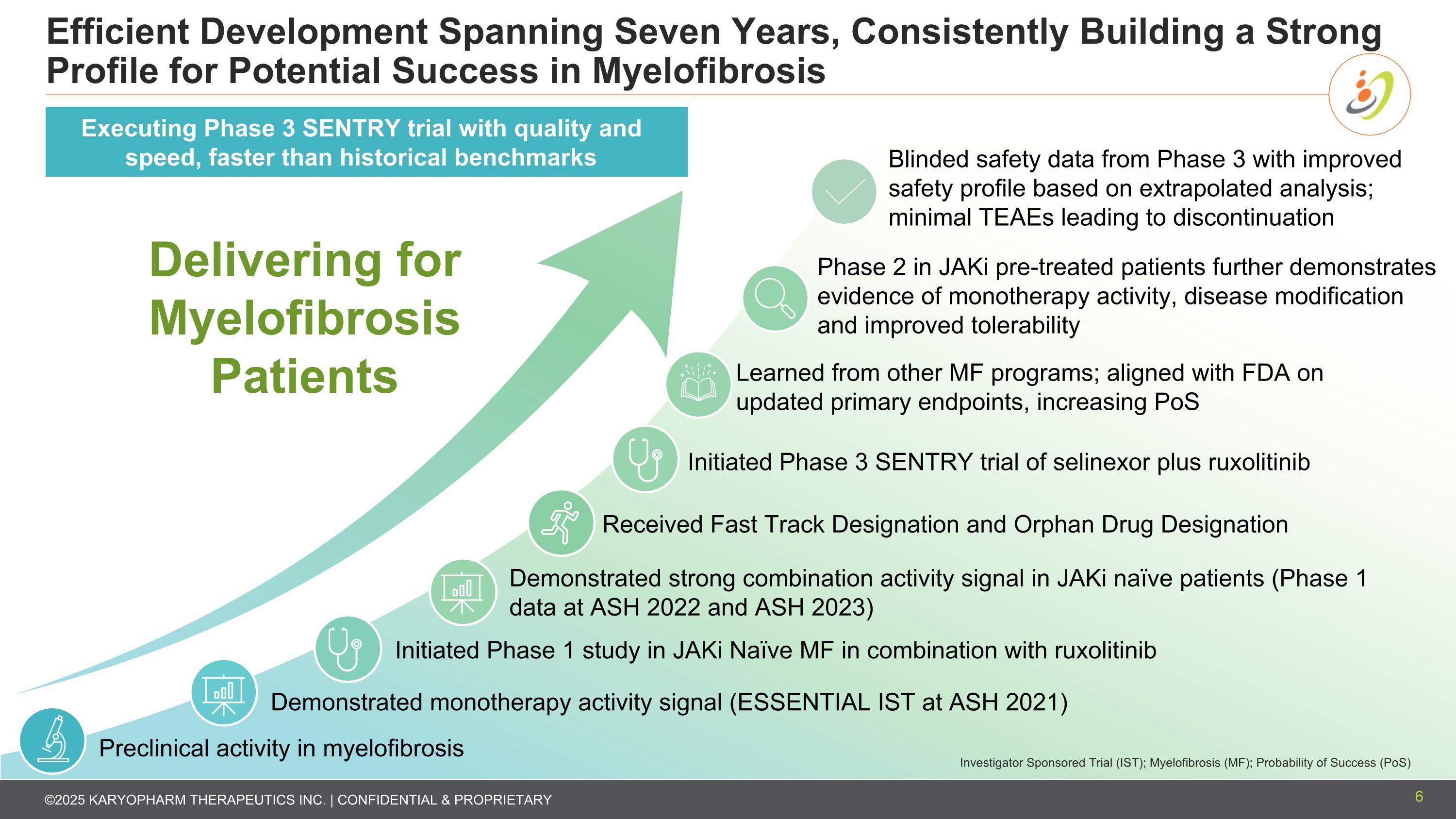

Efficient Development Spanning Seven Years, Consistently Building a Strong Profile for Potential Success in Myelofibrosis Demonstrated monotherapy activity signal (ESSENTIAL IST at ASH 2021) Learned from other MF programs; aligned with FDA on updated primary endpoints, increasing PoS Blinded safety data from Phase 3 with improved safety profile based on extrapolated analysis; minimal TEAEs leading to discontinuation Preclinical activity in myelofibrosis Initiated Phase 1 study in JAKi Naïve MF in combination with ruxolitinib Delivering for Myelofibrosis Patients Received Fast Track Designation and Orphan Drug Designation Demonstrated strong combination activity signal in JAKi naïve patients (Phase 1 data at ASH 2022 and ASH 2023) Initiated Phase 3 SENTRY trial of selinexor plus ruxolitinib Investigator Sponsored Trial (IST); Myelofibrosis (MF); Probability of Success (PoS) Executing Phase 3 SENTRY trial with quality and speed, faster than historical benchmarks Phase 2 in JAKi pre-treated patients further demonstrates evidence of monotherapy activity, disease modification and improved tolerability 6

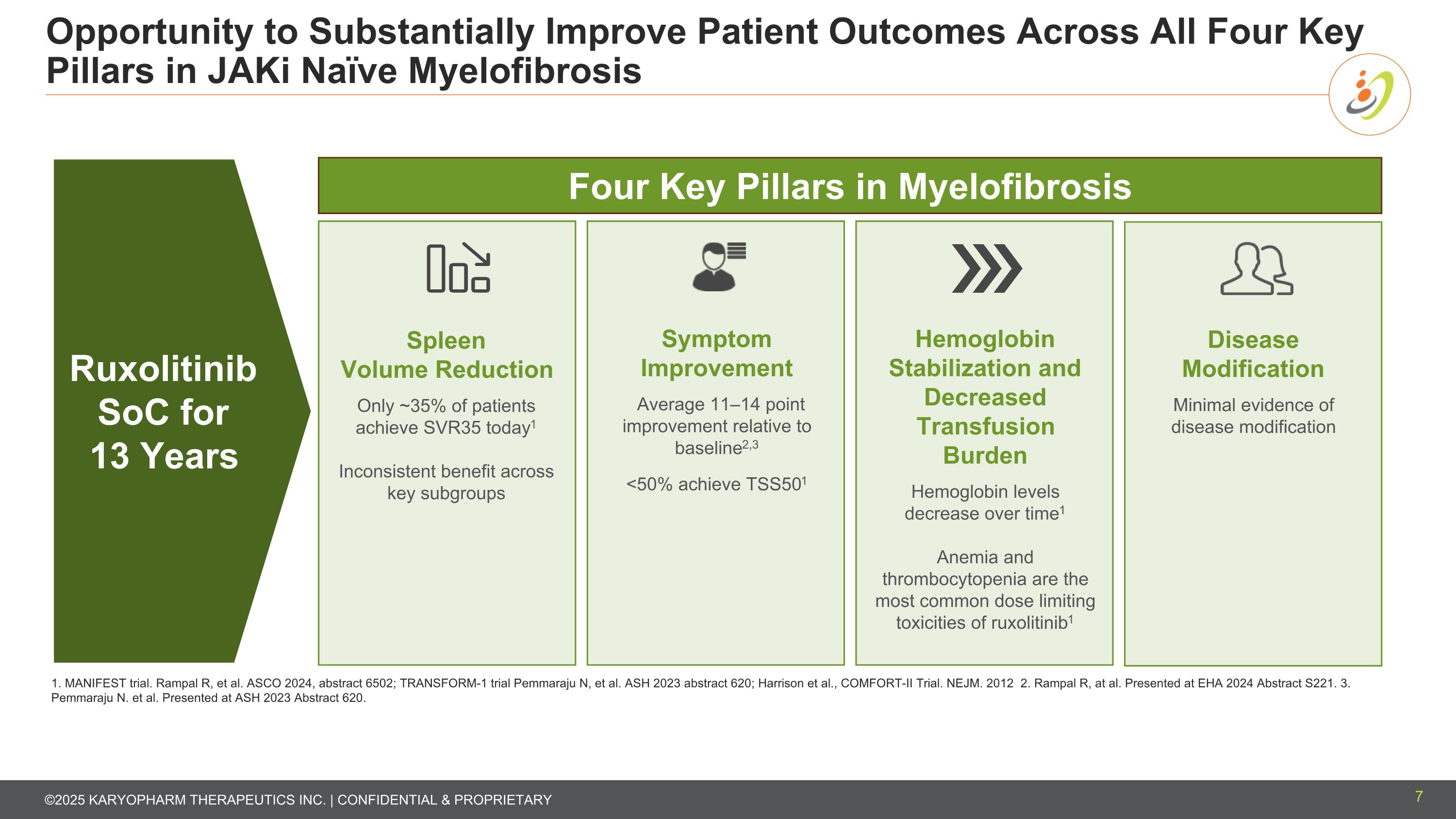

Opportunity to Substantially Improve Patient Outcomes Across All Four Key Pillars in JAKi Naïve Myelofibrosis Spleen Volume Reduction Only ~35% of patients achieve SVR35 today1 Inconsistent benefit across key subgroups Symptom Improvement Average 11–14 point improvement relative to baseline2,3 <50% achieve TSS501 Hemoglobin Stabilization and Decreased Transfusion Burden Hemoglobin levels decrease over time1 Anemia and thrombocytopenia are the most common dose limiting toxicities of ruxolitinib1 1. MANIFEST trial. Rampal R, et al. ASCO 2024, abstract 6502; TRANSFORM-1 trial Pemmaraju N, et al. ASH 2023 abstract 620; Harrison et al., COMFORT-II Trial. NEJM. 2012 2. Rampal R, at al. Presented at EHA 2024 Abstract S221. 3. Pemmaraju N. et al. Presented at ASH 2023 Abstract 620. Disease Modification Minimal evidence of disease modification Four Key Pillars in Myelofibrosis Ruxolitinib SoC for 13 Years 7

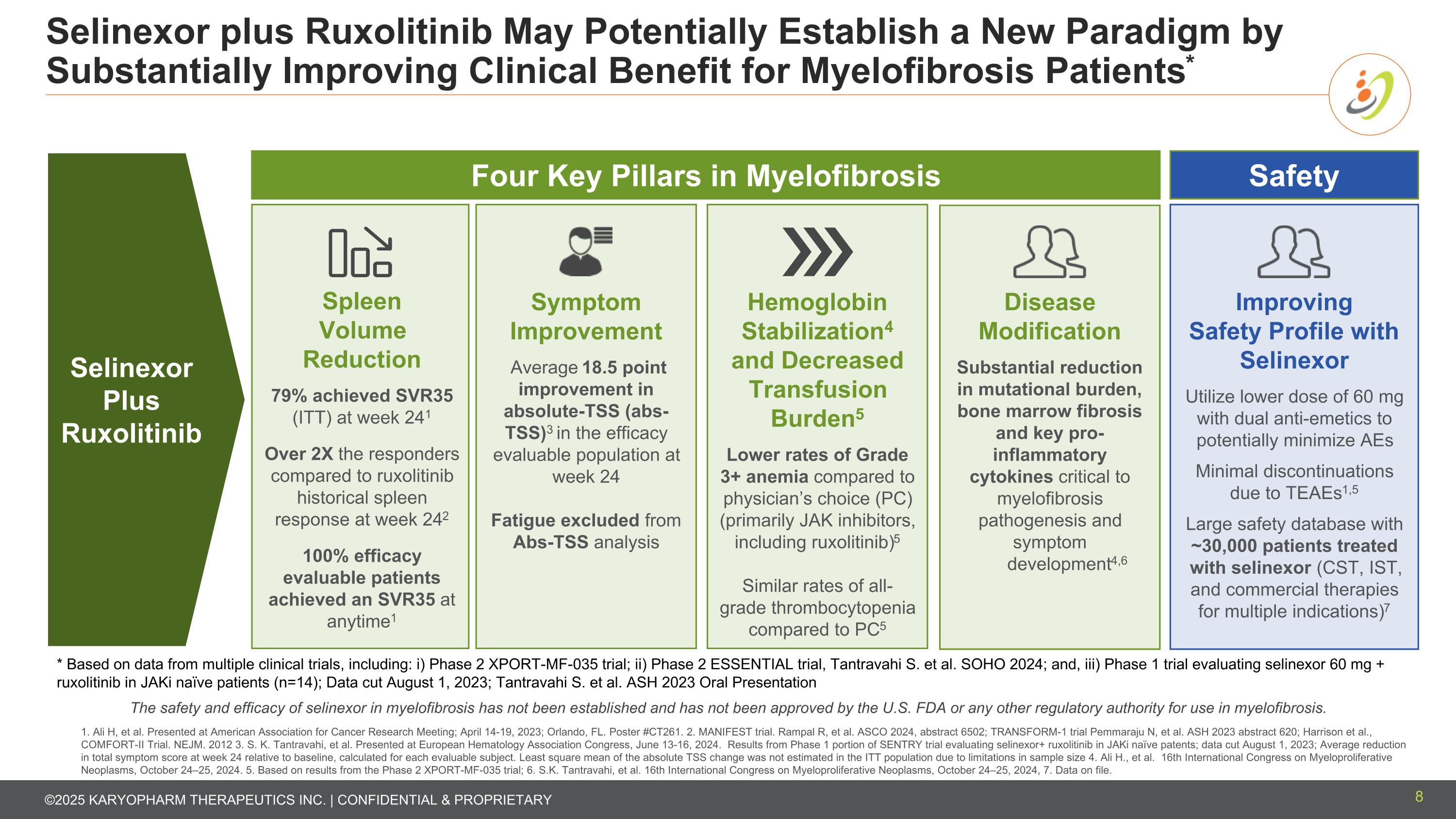

Selinexor plus Ruxolitinib May Potentially Establish a New Paradigm by Substantially Improving Clinical Benefit for Myelofibrosis Patients* 8 Spleen Volume Reduction 79% achieved SVR35 (ITT) at week 241 Over 2X the responders compared to ruxolitinib historical spleen response at week 242 100% efficacy evaluable patients achieved an SVR35 at anytime1 Symptom Improvement Average 18.5 point improvement in absolute-TSS (abs-TSS)3 in the efficacy evaluable population at week 24 Fatigue excluded from Abs-TSS analysis Hemoglobin Stabilization4 and Decreased Transfusion Burden5 Lower rates of Grade 3+ anemia compared to physician’s choice (PC) (primarily JAK inhibitors, including ruxolitinib)5 Similar rates of all-grade thrombocytopenia compared to PC5 Improving Safety Profile with Selinexor Utilize lower dose of 60 mg with dual anti-emetics to potentially minimize AEs Minimal discontinuations due to TEAEs1,5 Large safety database with ~30,000 patients treated with selinexor (CST, IST, and commercial therapies for multiple indications)7 1. Ali H, et al. Presented at American Association for Cancer Research Meeting; April 14-19, 2023; Orlando, FL. Poster #CT261. 2. MANIFEST trial. Rampal R, et al. ASCO 2024, abstract 6502; TRANSFORM-1 trial Pemmaraju N, et al. ASH 2023 abstract 620; Harrison et al., COMFORT-II Trial. NEJM. 2012 3. S. K. Tantravahi, et al. Presented at European Hematology Association Congress, June 13-16, 2024. Results from Phase 1 portion of SENTRY trial evaluating selinexor+ ruxolitinib in JAKi naïve patents; data cut August 1, 2023; Average reduction in total symptom score at week 24 relative to baseline, calculated for each evaluable subject. Least square mean of the absolute TSS change was not estimated in the ITT population due to limitations in sample size 4. Ali H., et al. 16th International Congress on Myeloproliferative Neoplasms, October 24–25, 2024. 5. Based on results from the Phase 2 XPORT-MF-035 trial; 6. S.K. Tantravahi, et al. 16th International Congress on Myeloproliferative Neoplasms, October 24–25, 2024, 7. Data on file. * Based on data from multiple clinical trials, including: i) Phase 2 XPORT-MF-035 trial; ii) Phase 2 ESSENTIAL trial, Tantravahi S. et al. SOHO 2024; and, iii) Phase 1 trial evaluating selinexor 60 mg + ruxolitinib in JAKi naïve patients (n=14); Data cut August 1, 2023; Tantravahi S. et al. ASH 2023 Oral Presentation The safety and efficacy of selinexor in myelofibrosis has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in myelofibrosis. Disease Modification Substantial reduction in mutational burden, bone marrow fibrosis and key pro-inflammatory cytokines critical to myelofibrosis pathogenesis and symptom development4,6 Four Key Pillars in Myelofibrosis Safety Selinexor Plus Ruxolitinib

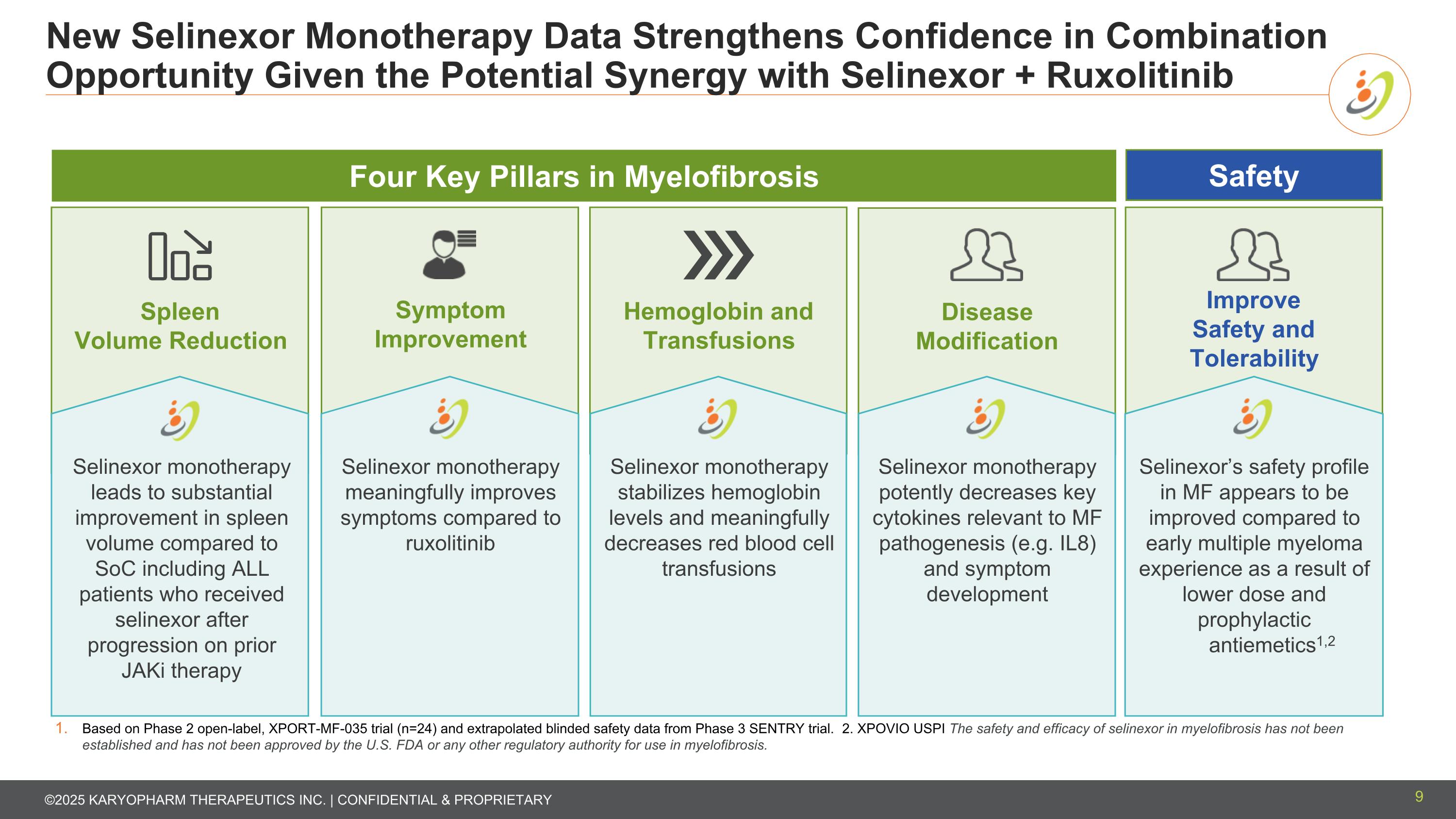

New Selinexor Monotherapy Data Strengthens Confidence in Combination Opportunity Given the Potential Synergy with Selinexor + Ruxolitinib Based on Phase 2 open-label, XPORT-MF-035 trial (n=24) and extrapolated blinded safety data from Phase 3 SENTRY trial. 2. XPOVIO USPI The safety and efficacy of selinexor in myelofibrosis has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in myelofibrosis. Spleen Volume Reduction Symptom Improvement Hemoglobin and Transfusions Improve Safety and Tolerability Disease Modification Selinexor monotherapy leads to substantial improvement in spleen volume compared to SoC including ALL patients who received selinexor after progression on prior JAKi therapy Selinexor monotherapy meaningfully improves symptoms compared to ruxolitinib Selinexor monotherapy stabilizes hemoglobin levels and meaningfully decreases red blood cell transfusions Selinexor monotherapy potently decreases key cytokines relevant to MF pathogenesis (e.g. IL8) and symptom development Selinexor’s safety profile in MF appears to be improved compared to early multiple myeloma experience as a result of lower dose and prophylactic antiemetics1,2 Four Key Pillars in Myelofibrosis Safety 9

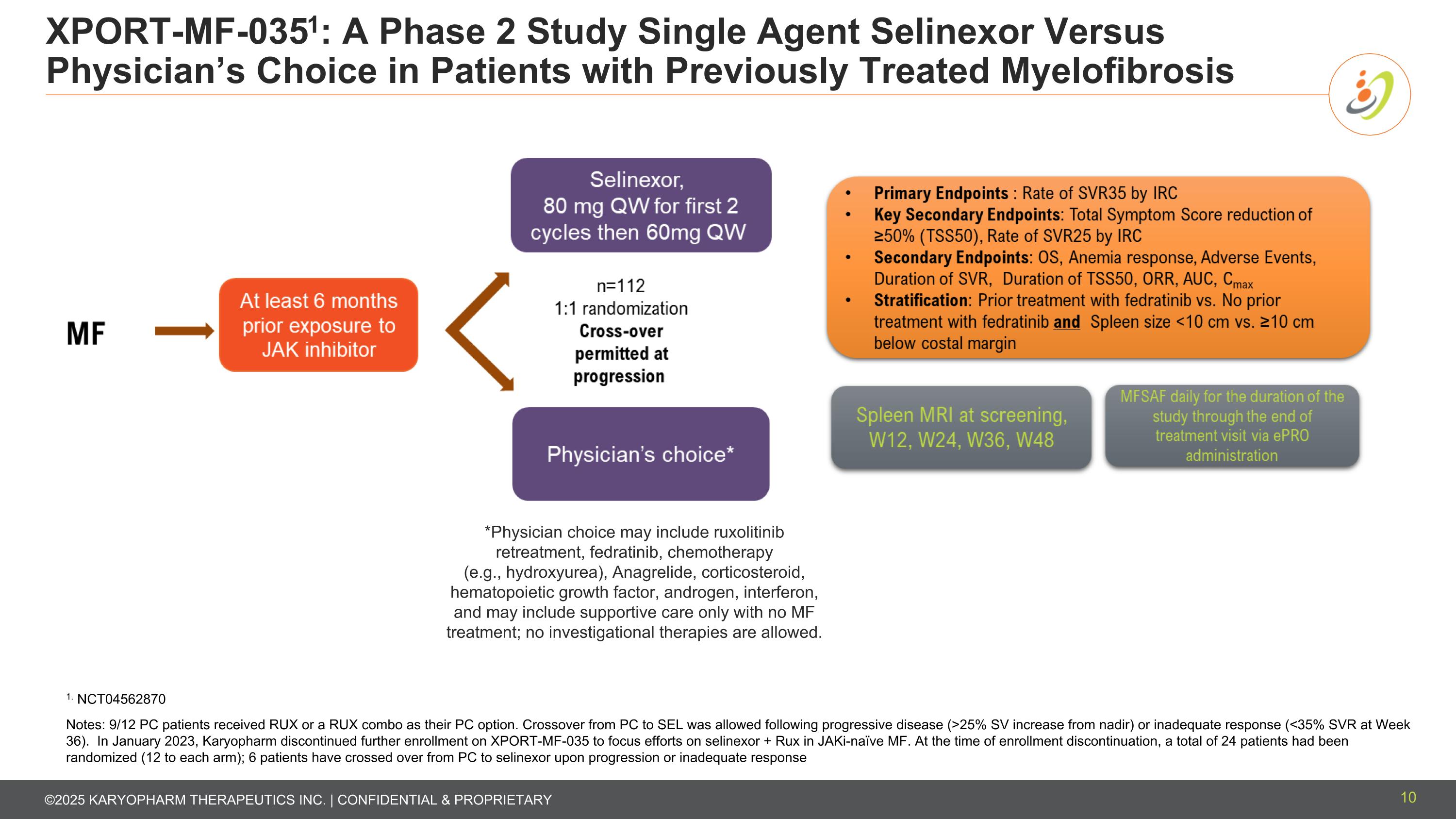

XPORT-MF-0351: A Phase 2 Study Single Agent Selinexor Versus Physician’s Choice in Patients with Previously Treated Myelofibrosis *Physician choice may include ruxolitinib retreatment, fedratinib, chemotherapy (e.g., hydroxyurea), Anagrelide, corticosteroid, hematopoietic growth factor, androgen, interferon, and may include supportive care only with no MF treatment; no investigational therapies are allowed. 1. NCT04562870 Notes: 9/12 PC patients received RUX or a RUX combo as their PC option. Crossover from PC to SEL was allowed following progressive disease (>25% SV increase from nadir) or inadequate response (<35% SVR at Week 36). In January 2023, Karyopharm discontinued further enrollment on XPORT-MF-035 to focus efforts on selinexor + Rux in JAKi-naïve MF. At the time of enrollment discontinuation, a total of 24 patients had been randomized (12 to each arm); 6 patients have crossed over from PC to selinexor upon progression or inadequate response 10

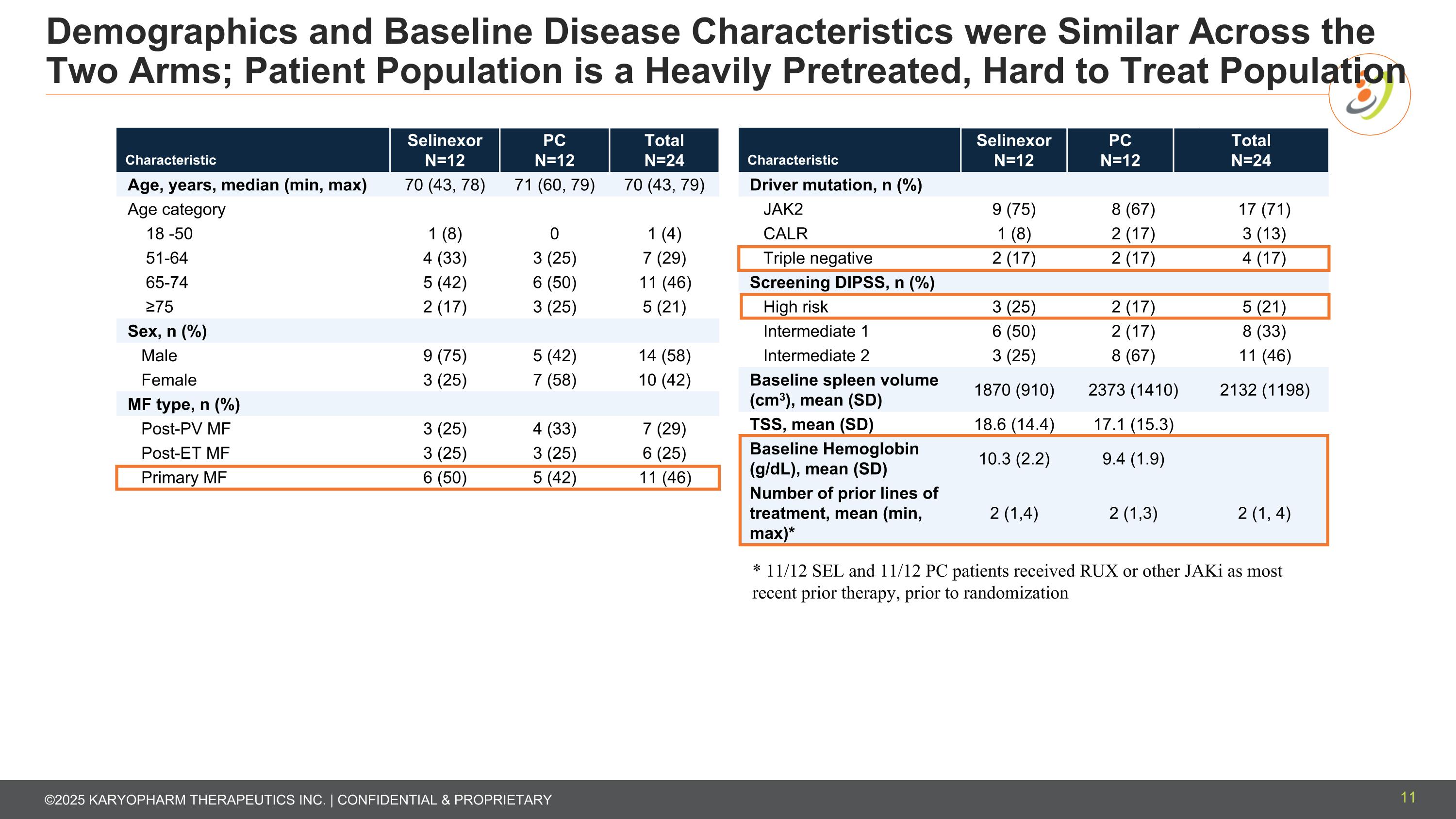

Demographics and Baseline Disease Characteristics were Similar Across the Two Arms; Patient Population is a Heavily Pretreated, Hard to Treat Population Characteristic Selinexor N=12 PC N=12 Total N=24 Age, years, median (min, max) 70 (43, 78) 71 (60, 79) 70 (43, 79) Age category 18 -50 1 (8) 0 1 (4) 51-64 4 (33) 3 (25) 7 (29) 65-74 5 (42) 6 (50) 11 (46) ≥75 2 (17) 3 (25) 5 (21) Sex, n (%) Male 9 (75) 5 (42) 14 (58) Female 3 (25) 7 (58) 10 (42) MF type, n (%) Post-PV MF 3 (25) 4 (33) 7 (29) Post-ET MF 3 (25) 3 (25) 6 (25) Primary MF 6 (50) 5 (42) 11 (46) Characteristic Selinexor N=12 PC N=12 Total N=24 Driver mutation, n (%) JAK2 9 (75) 8 (67) 17 17 (71) CALR 1 (8) 2 (17) 3 3 (13) Triple negative 2 (17) 2 (17) 4 4 (17) Screening DIPSS, n (%) High risk 3 (25) 2 (17) 5 5 (21) Intermediate 1 6 (50) 2 (17) 8 8 (33) Intermediate 2 3 (25) 8 (67) 11 11 (46) Baseline spleen volume (cm3), mean (SD) 1870 (910) 2373 (1410) 2132 (1198) TSS, mean (SD) 18.6 (14.4) 17.1 (15.3) Baseline Hemoglobin (g/dL), mean (SD) 10.3 (2.2) 9.4 (1.9) Number of prior lines of treatment, mean (min, max)* 2 (1,4) 2 (1,3) 2 (1, 4) * 11/12 SEL and 11/12 PC patients received RUX or other JAKi as most recent prior therapy, prior to randomization 11

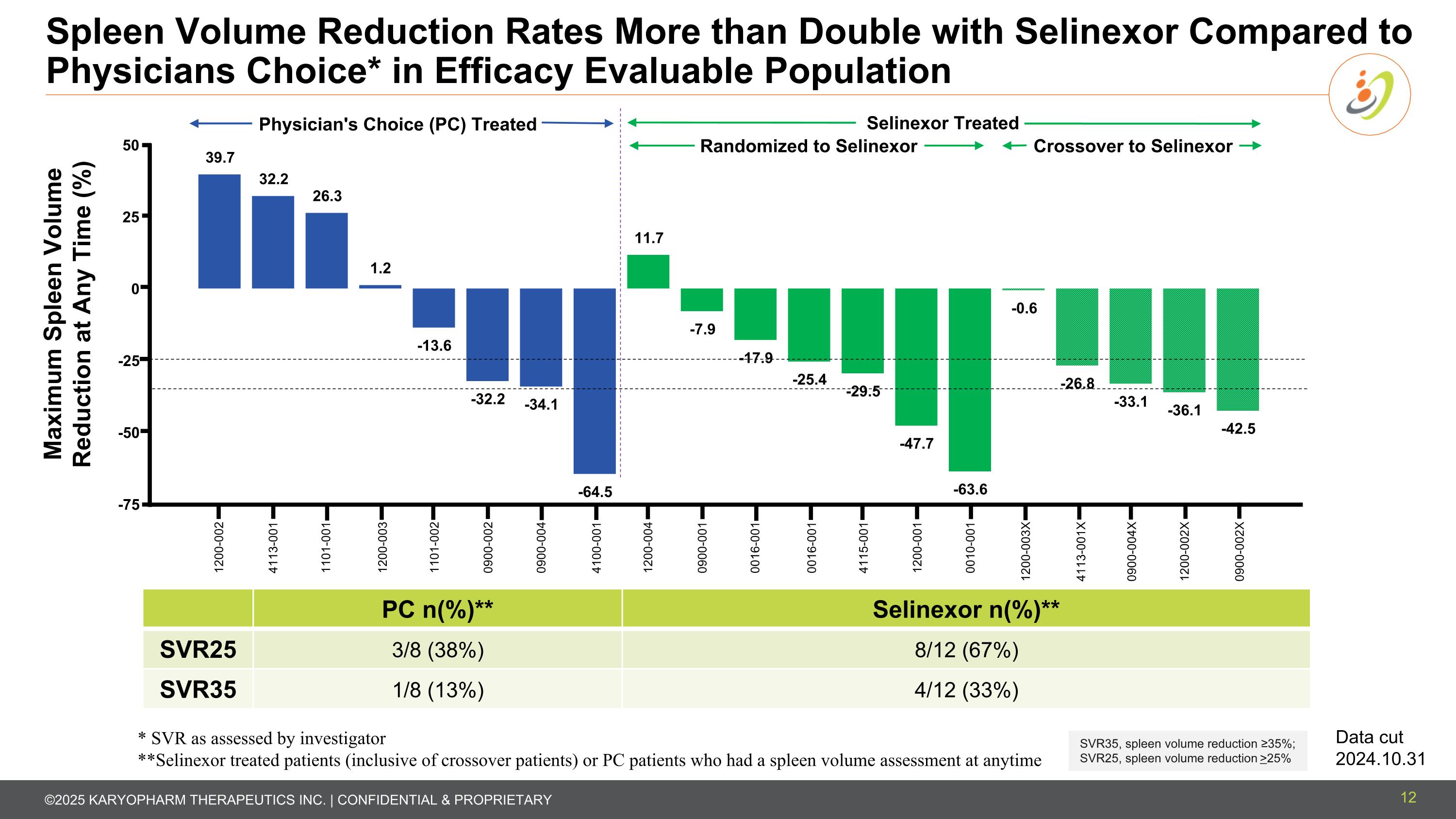

Spleen Volume Reduction Rates More than Double with Selinexor Compared to Physicians Choice* in Efficacy Evaluable Population 12 PC n(%)** Selinexor n(%)** SVR25 3/8 (38%) 8/12 (67%) SVR35 1/8 (13%) 4/12 (33%) SVR35, spleen volume reduction ≥35%; SVR25, spleen volume reduction >25% Maximum Spleen Volume Reduction at Any Time (%) 1200-002 4113-001 1101-001 1200-003 4100-001 1101-002 0900-002 0900-004 1200-004 0900-001 0016-001 0016-001 1200-003X 4115-001 1200-001 0010-001 4113-001X 0900-004X 1200-002X Selinexor Treated Physician's Choice (PC) Treated Data cut 2024.10.31 * SVR as assessed by investigator **Selinexor treated patients (inclusive of crossover patients) or PC patients who had a spleen volume assessment at anytime 0900-002X Randomized to Selinexor Crossover to Selinexor

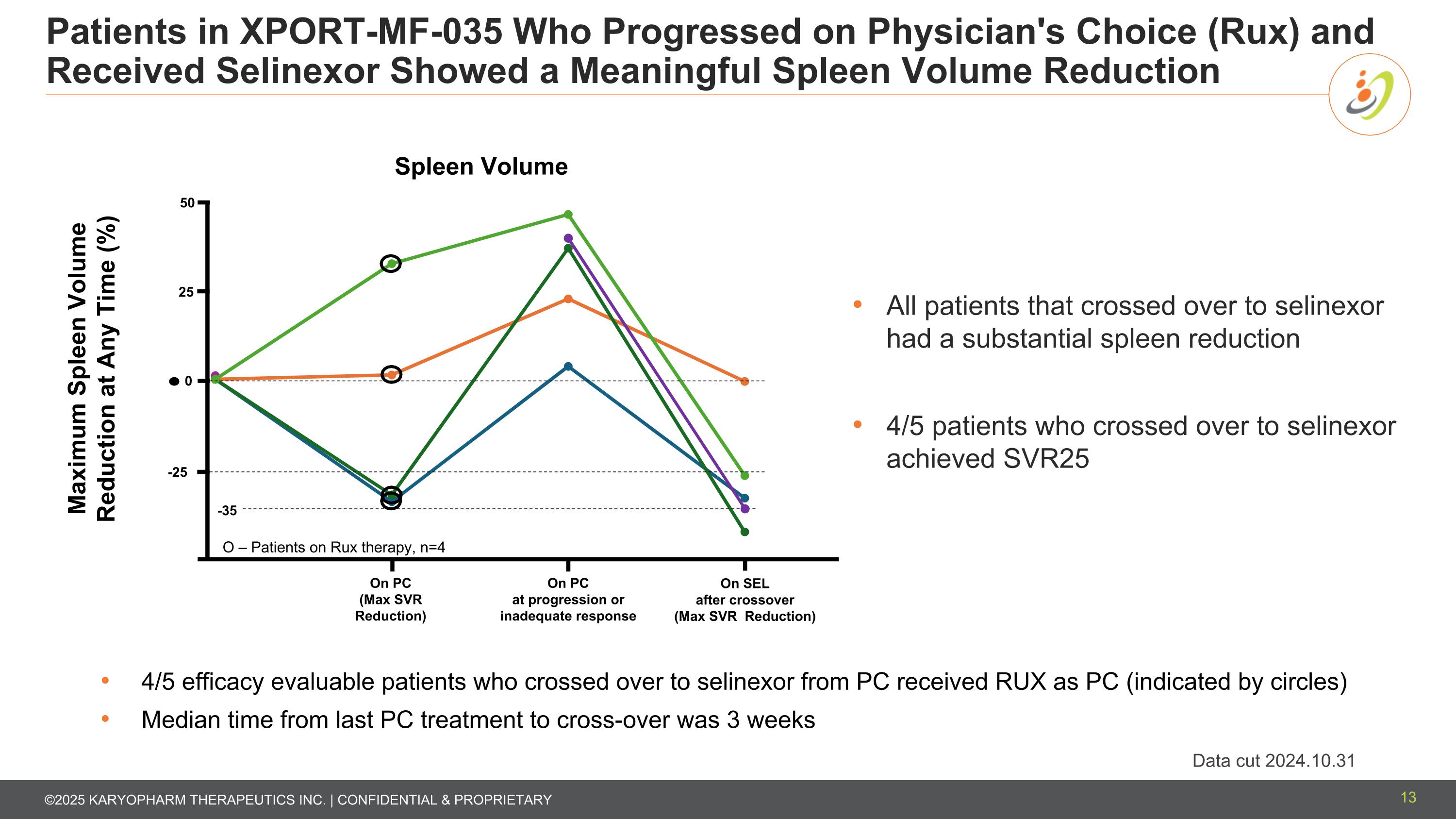

Patients in XPORT-MF-035 Who Progressed on Physician's Choice (Rux) and Received Selinexor Showed a Meaningful Spleen Volume Reduction 13 -25 -35 0 25 50 On PC (Max SVR Reduction) On PC at progression or inadequate response On SEL after crossover (Max SVR Reduction) Maximum Spleen Volume Reduction at Any Time (%) All patients that crossed over to selinexor had a substantial spleen reduction 4/5 patients who crossed over to selinexor achieved SVR25 O – Patients on Rux therapy, n=4 4/5 efficacy evaluable patients who crossed over to selinexor from PC received RUX as PC (indicated by circles) Median time from last PC treatment to cross-over was 3 weeks Data cut 2024.10.31

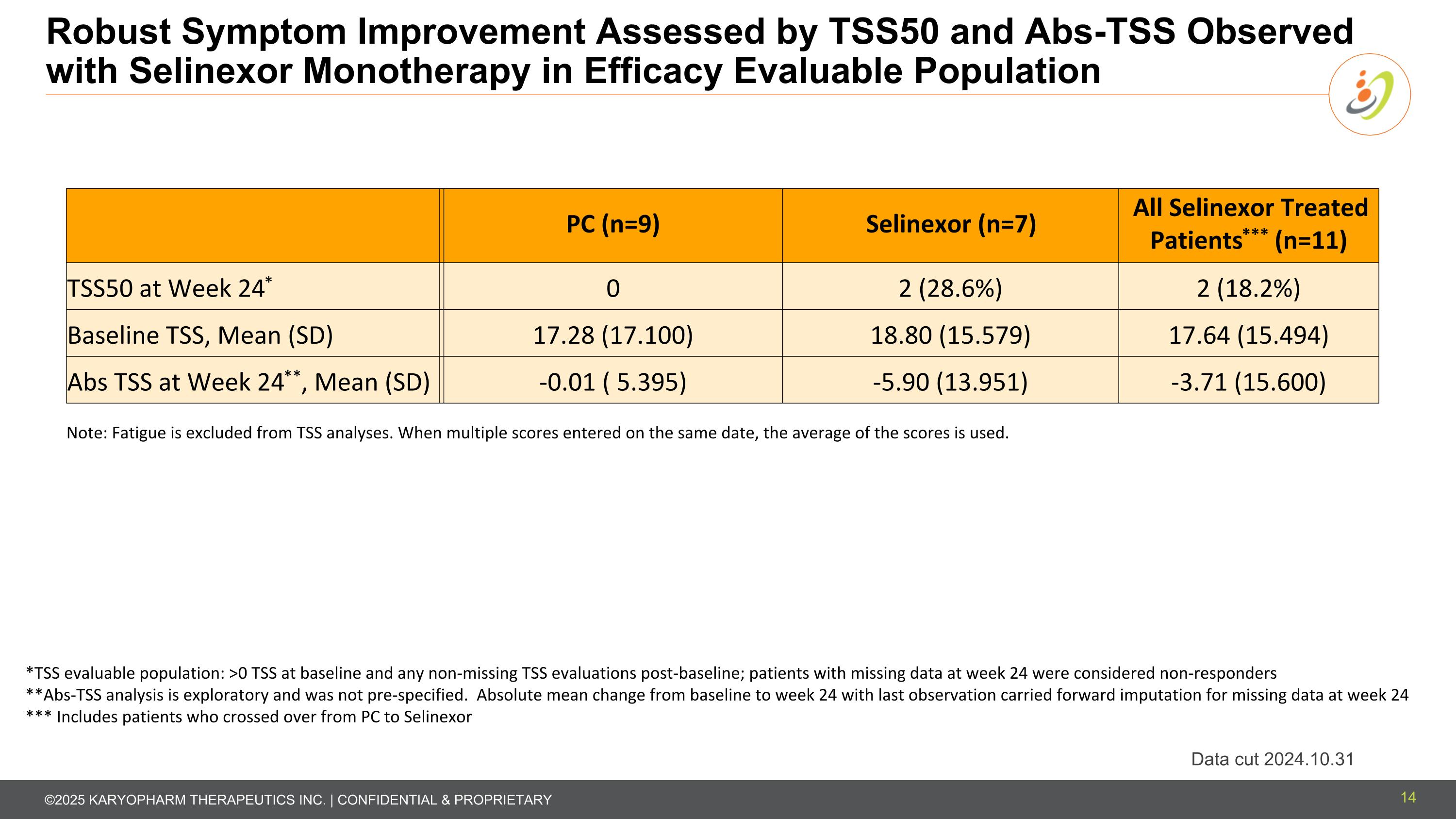

Robust Symptom Improvement Assessed by TSS50 and Abs-TSS Observed with Selinexor Monotherapy in Efficacy Evaluable Population Data cut 2024.10.31 *TSS evaluable population: >0 TSS at baseline and any non-missing TSS evaluations post-baseline; patients with missing data at week 24 were considered non-responders **Abs-TSS analysis is exploratory and was not pre-specified. Absolute mean change from baseline to week 24 with last observation carried forward imputation for missing data at week 24 *** Includes patients who crossed over from PC to Selinexor PC (n=9) Selinexor (n=7) All Selinexor Treated Patients*** (n=11) TSS50 at Week 24* 0 2 (28.6%) 2 (18.2%) Baseline TSS, Mean (SD) 17.28 (17.100) 18.80 (15.579) 17.64 (15.494) Abs TSS at Week 24**, Mean (SD) -0.01 ( 5.395) -5.90 (13.951) -3.71 (15.600) Note: Fatigue is excluded from TSS analyses. When multiple scores entered on the same date, the average of the scores is used. 14

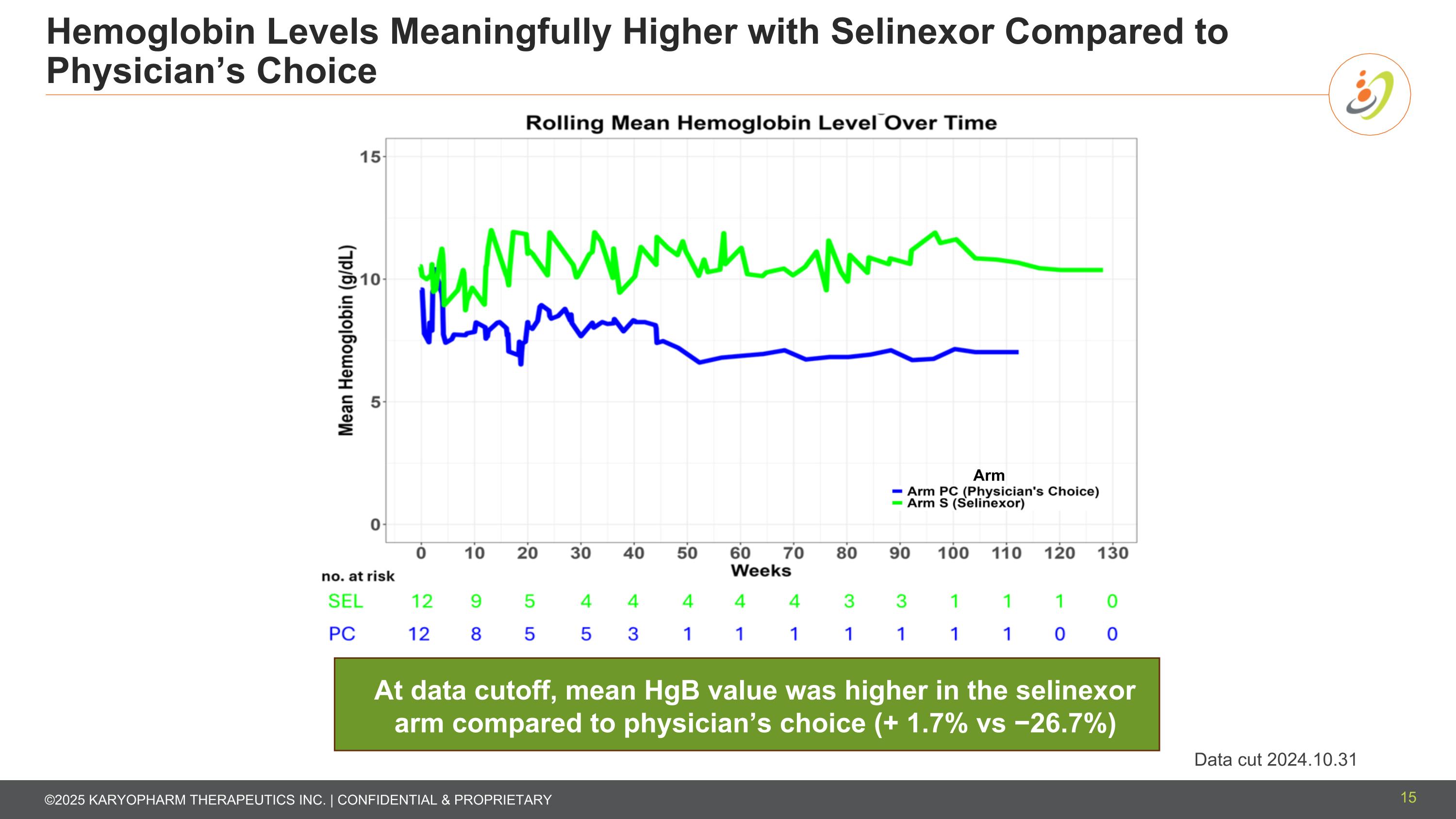

Hemoglobin Levels Meaningfully Higher with Selinexor Compared to Physician’s Choice Data cut 2024.10.31 At data cutoff, mean HgB value was higher in the selinexor arm compared to physician’s choice (+ 1.7% vs −26.7%) 15 Arm

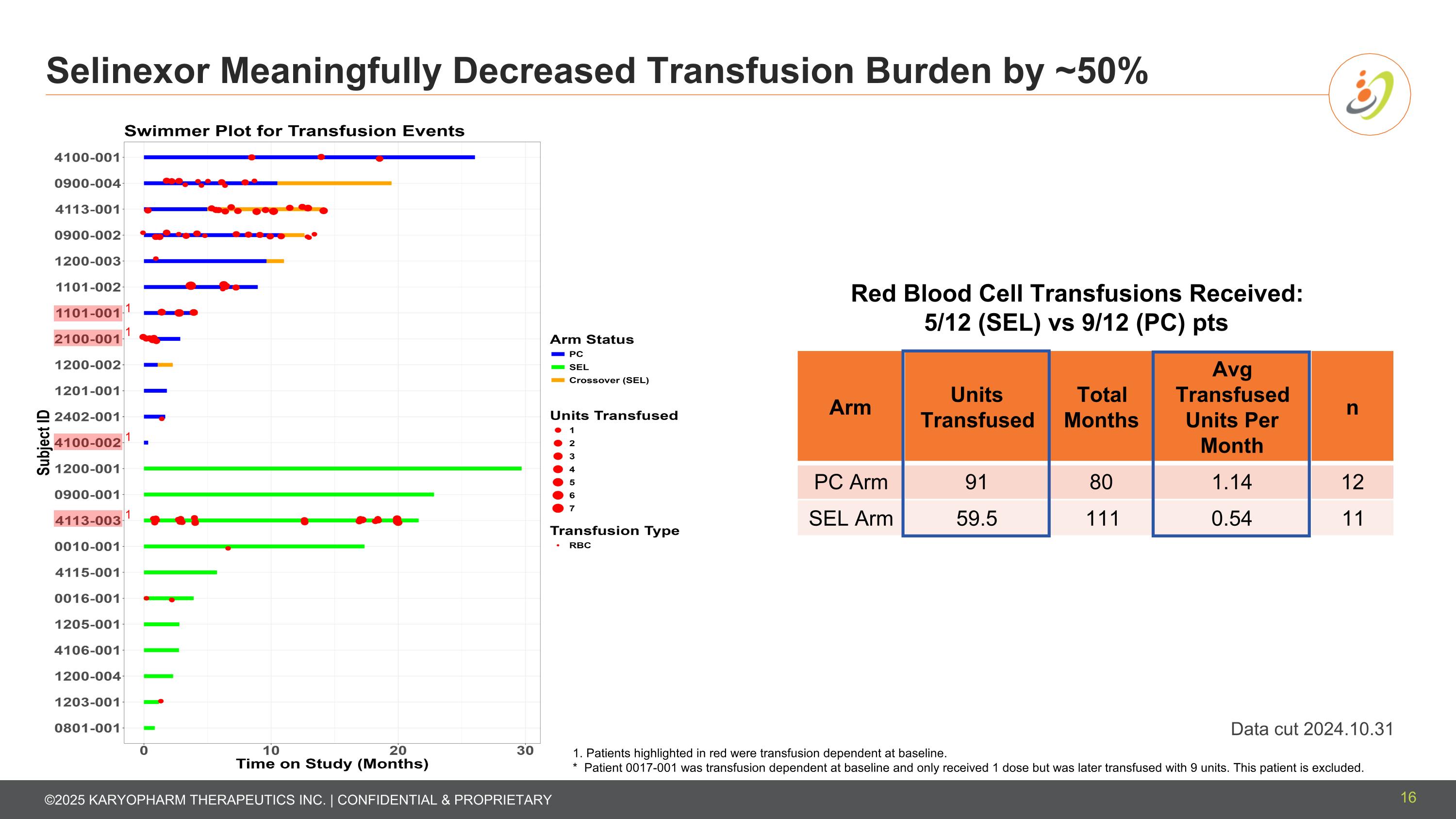

Selinexor Meaningfully Decreased Transfusion Burden by ~50% 16 Data cut 2024.10.31 * Patient 0017-001 only got 1 dose but was later transfused with 9 units. This patient is excluded. Red Blood Cell Transfusions Received: 5/12 (SEL) vs 9/12 (PC) pts Arm Units Transfused Total Months Avg Transfused Units Per Month n PC Arm 91 80 1.14 12 SEL Arm 59.5 111 0.54 11 1. Patients highlighted in red were transfusion dependent at baseline. * Patient 0017-001 was transfusion dependent at baseline and only received 1 dose but was later transfused with 9 units. This patient is excluded. 1 1 1 1

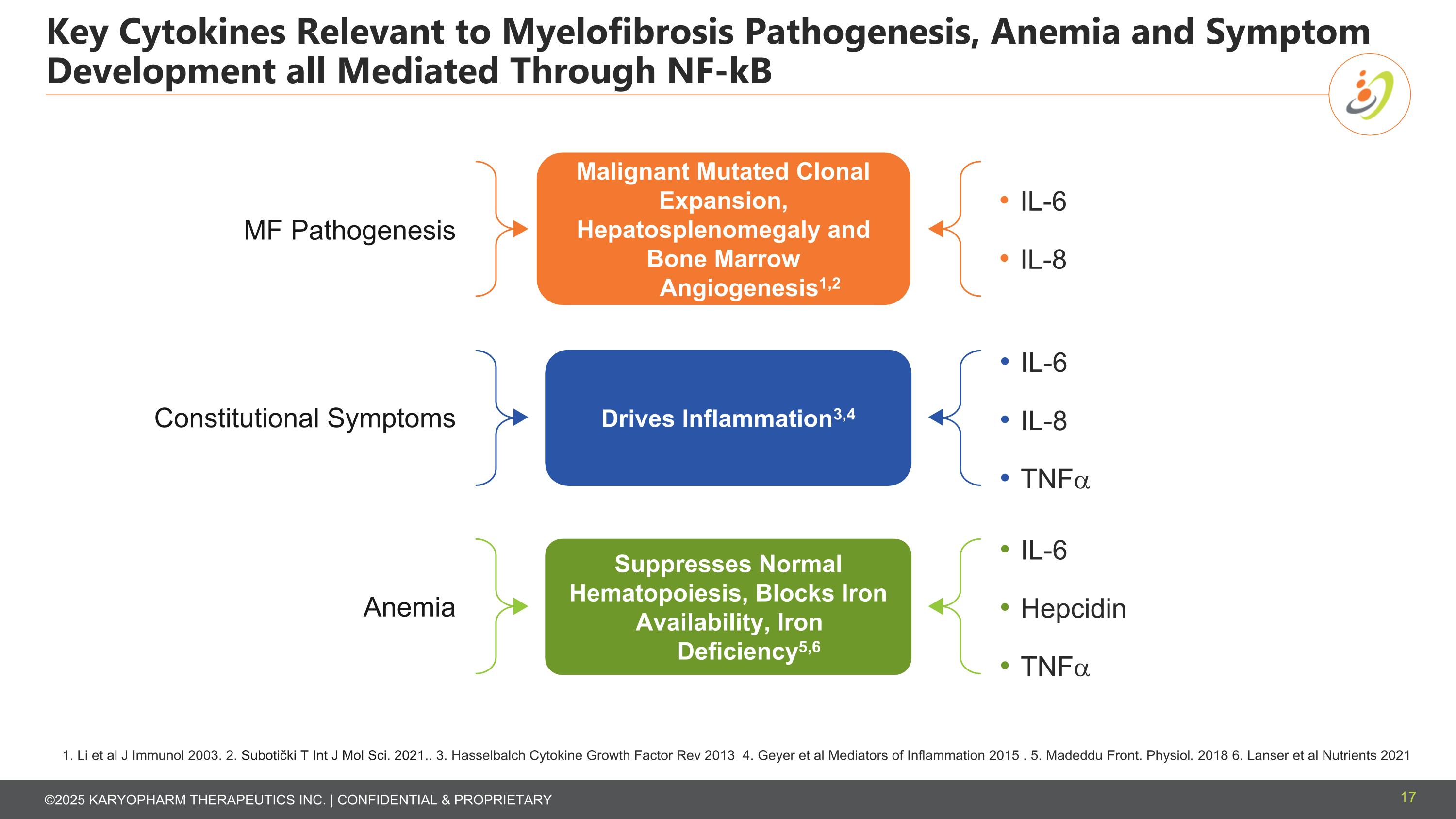

Key Cytokines Relevant to Myelofibrosis Pathogenesis, Anemia and Symptom Development all Mediated Through NF-kB 1. Li et al J Immunol 2003. 2. Subotički T Int J Mol Sci. 2021.. 3. Hasselbalch Cytokine Growth Factor Rev 2013 4. Geyer et al Mediators of Inflammation 2015 . 5. Madeddu Front. Physiol. 2018 6. Lanser et al Nutrients 2021 17 IL-6 IL-8 MF Pathogenesis Constitutional Symptoms IL-6 IL-8 TNFa Anemia IL-6 Hepcidin TNFa Malignant Mutated Clonal Expansion, Hepatosplenomegaly and Bone Marrow Angiogenesis1,2 Drives Inflammation3,4 Suppresses Normal Hematopoiesis, Blocks Iron Availability, Iron Deficiency5,6

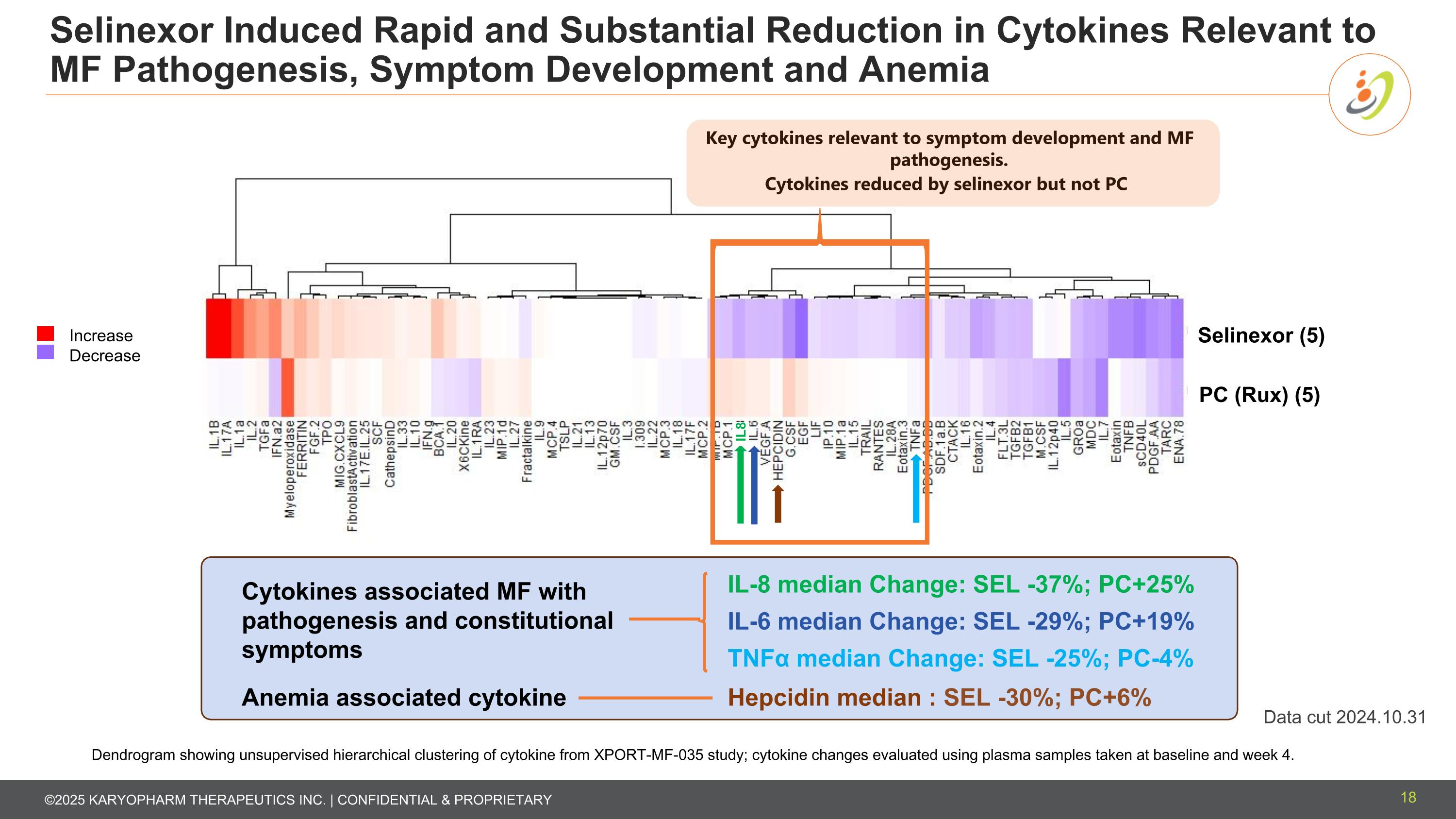

Selinexor Induced Rapid and Substantial Reduction in Cytokines Relevant to MF Pathogenesis, Symptom Development and Anemia 18 PC (Rux) (5) Cytokines reduced by selinexor but not PC Selinexor (5) Increase Decrease IL8 Key cytokines relevant to symptom development and MF pathogenesis. Dendrogram showing unsupervised hierarchical clustering of cytokine from XPORT-MF-035 study; cytokine changes evaluated using plasma samples taken at baseline and week 4. IL-6 median Change: SEL -29%; PC+19% IL-8 median Change: SEL -37%; PC+25% TNFα median Change: SEL -25%; PC-4% Hepcidin median : SEL -30%; PC+6% Cytokines associated MF with pathogenesis and constitutional symptoms Anemia associated cytokine Data cut 2024.10.31

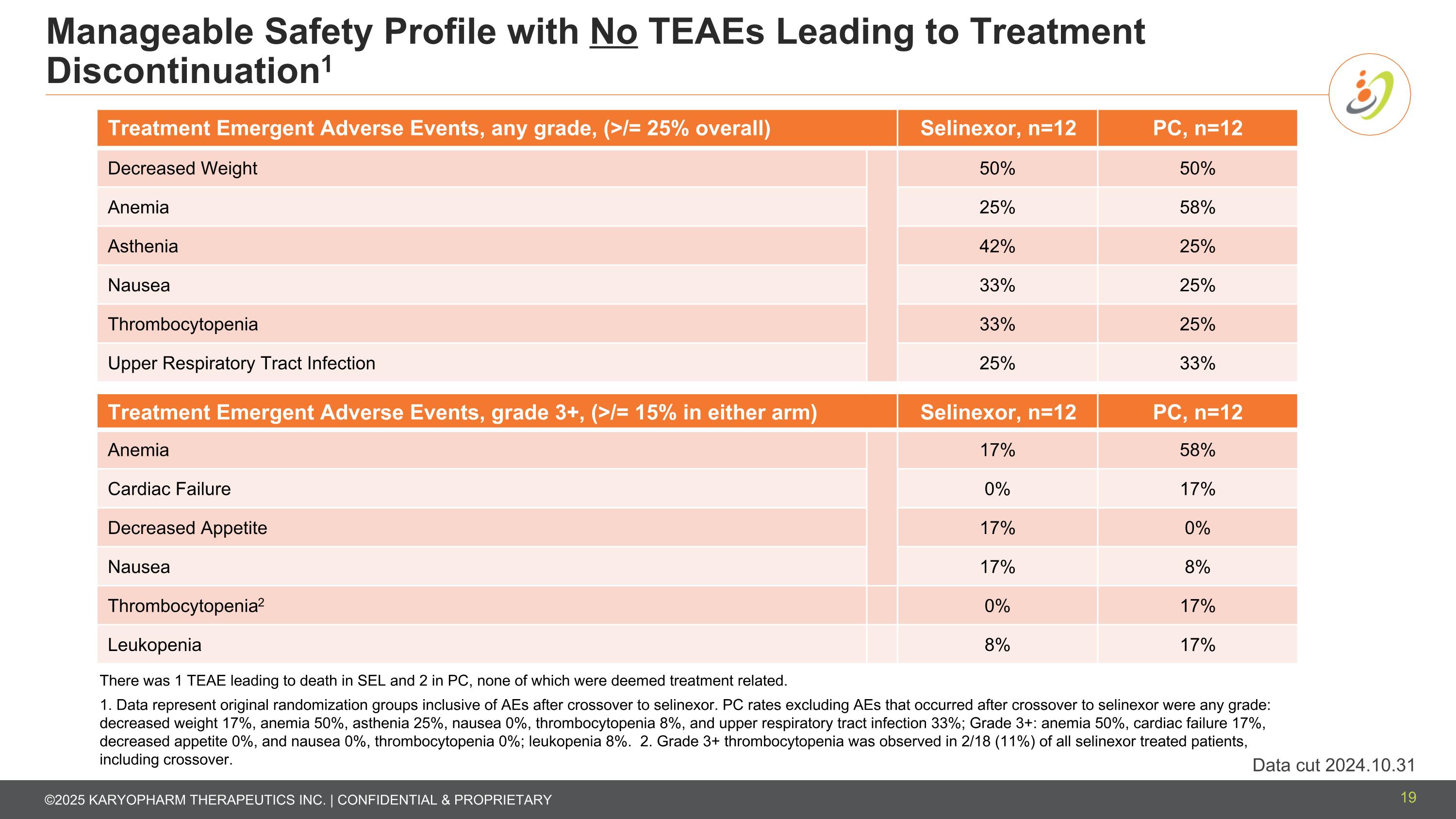

Manageable Safety Profile with No TEAEs Leading to Treatment Discontinuation1 Treatment Emergent Adverse Events, any grade, (>/= 25% overall) Selinexor, n=12 PC, n=12 Decreased Weight 50% 50% Anemia 25% 58% Asthenia 42% 25% Nausea 33% 25% Thrombocytopenia 33% 25% Upper Respiratory Tract Infection 25% 33% Treatment Emergent Adverse Events, grade 3+, (>/= 15% in either arm) Selinexor, n=12 PC, n=12 Anemia 17% 58% Cardiac Failure 0% 17% Decreased Appetite 17% 0% Nausea 17% 8% Thrombocytopenia2 0% 17% Leukopenia 8% 17% There was 1 TEAE leading to death in SEL and 2 in PC, none of which were deemed treatment related. 1. Data represent original randomization groups inclusive of AEs after crossover to selinexor. PC rates excluding AEs that occurred after crossover to selinexor were any grade: decreased weight 17%, anemia 50%, asthenia 25%, nausea 0%, thrombocytopenia 8%, and upper respiratory tract infection 33%; Grade 3+: anemia 50%, cardiac failure 17%, decreased appetite 0%, and nausea 0%, thrombocytopenia 0%; leukopenia 8%. 2. Grade 3+ thrombocytopenia was observed in 2/18 (11%) of all selinexor treated patients, including crossover. 19 Data cut 2024.10.31

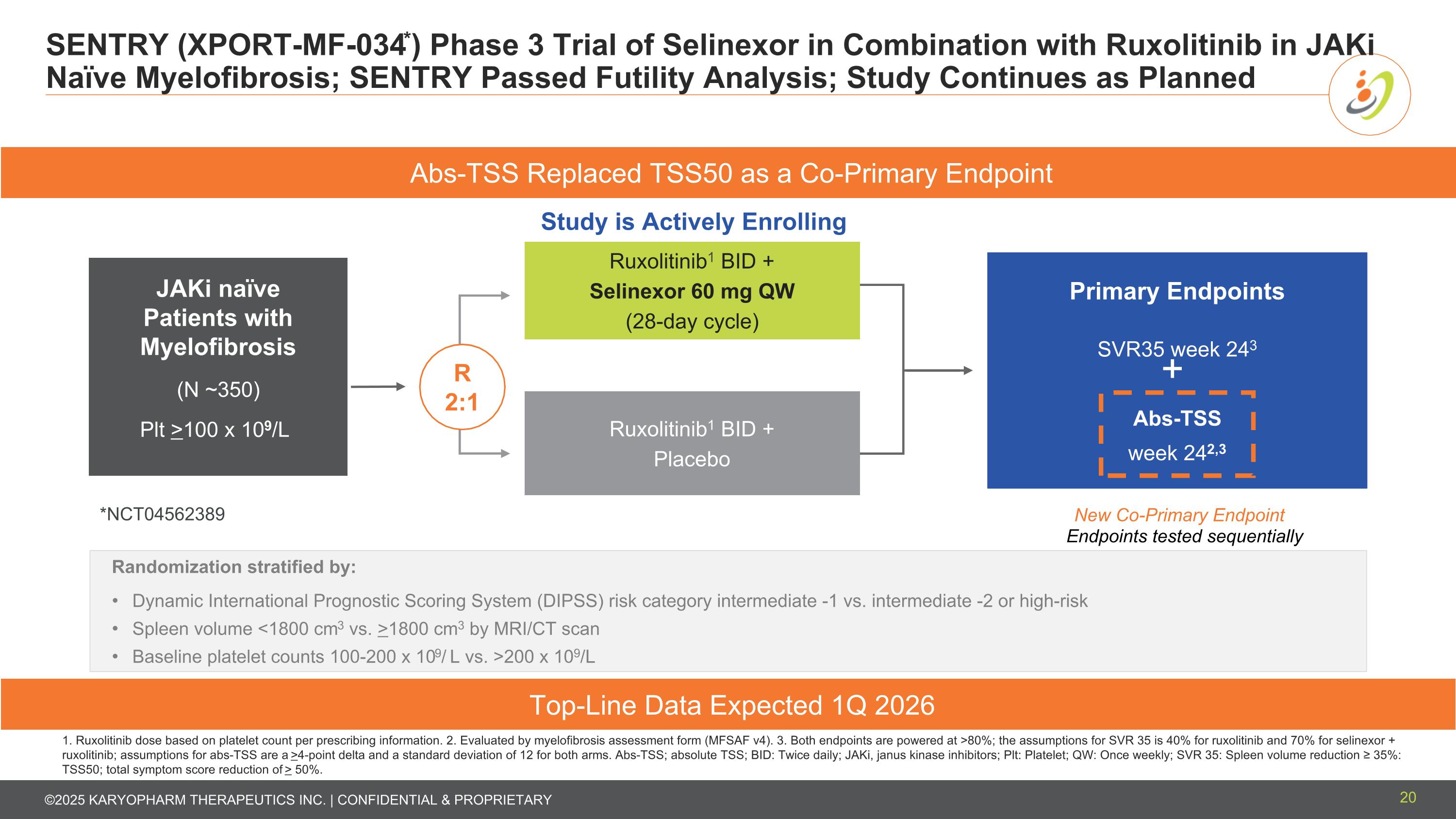

SENTRY (XPORT-MF-034*) Phase 3 Trial of Selinexor in Combination with Ruxolitinib in JAKi Naïve Myelofibrosis; SENTRY Passed Futility Analysis; Study Continues as Planned 20 1. Ruxolitinib dose based on platelet count per prescribing information. 2. Evaluated by myelofibrosis assessment form (MFSAF v4). 3. Both endpoints are powered at >80%; the assumptions for SVR 35 is 40% for ruxolitinib and 70% for selinexor + ruxolitinib; assumptions for abs-TSS are a >4-point delta and a standard deviation of 12 for both arms. Abs-TSS; absolute TSS; BID: Twice daily; JAKi, janus kinase inhibitors; Plt: Platelet; QW: Once weekly; SVR 35: Spleen volume reduction ≥ 35%: TSS50; total symptom score reduction of > 50%. Randomization stratified by: Dynamic International Prognostic Scoring System (DIPSS) risk category intermediate -1 vs. intermediate -2 or high-risk Spleen volume <1800 cm3 vs. >1800 cm3 by MRI/CT scan Baseline platelet counts 100-200 x 109/ L vs. >200 x 109/L Top-Line Data Expected 1Q 2026 Study is Actively Enrolling Primary Endpoints SVR35 week 243 Abs-TSS week 242,3 Ruxolitinib1 BID + Selinexor 60 mg QW (28-day cycle) Ruxolitinib1 BID + Placebo *NCT04562389 JAKi naïve Patients with Myelofibrosis (N ~350) Plt >100 x 109/L Endpoints tested sequentially R 2:1 Abs-TSS Replaced TSS50 as a Co-Primary Endpoint + New Co-Primary Endpoint

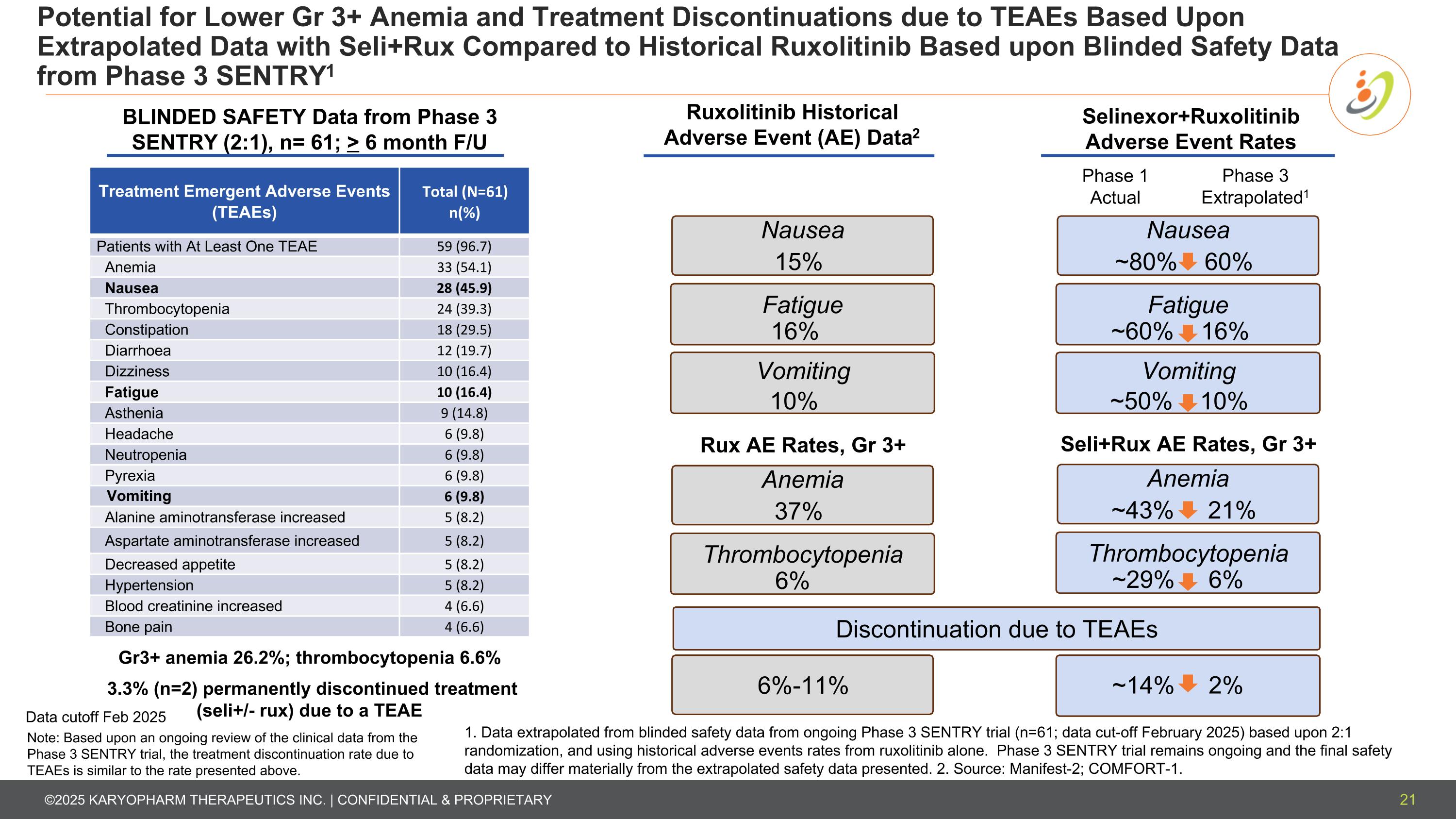

Potential for Lower Gr 3+ Anemia and Treatment Discontinuations due to TEAEs Based Upon Extrapolated Data with Seli+Rux Compared to Historical Ruxolitinib Based upon Blinded Safety Data from Phase 3 SENTRY1 Treatment Emergent Adverse Events (TEAEs) Total (N=61) n(%) Patients with At Least One TEAE 59 (96.7) Anemia 33 (54.1) Nausea 28 (45.9) Thrombocytopenia 24 (39.3) Constipation 18 (29.5) Diarrhoea 12 (19.7) Dizziness 10 (16.4) Fatigue 10 (16.4) Asthenia 9 (14.8) Headache 6 (9.8) Neutropenia 6 (9.8) Pyrexia 6 (9.8) Vomiting 6 (9.8) Alanine aminotransferase increased 5 (8.2) Aspartate aminotransferase increased 5 (8.2) Decreased appetite 5 (8.2) Hypertension 5 (8.2) Blood creatinine increased 4 (6.6) Bone pain 4 (6.6) 1. Data extrapolated from blinded safety data from ongoing Phase 3 SENTRY trial (n=61; data cut-off February 2025) based upon 2:1 randomization, and using historical adverse events rates from ruxolitinib alone. Phase 3 SENTRY trial remains ongoing and the final safety data may differ materially from the extrapolated safety data presented. 2. Source: Manifest-2; COMFORT-1. BLINDED SAFETY Data from Phase 3 SENTRY (2:1), n= 61; > 6 month F/U Nausea Vomiting ~80% 60% ~50% 10% Selinexor+Ruxolitinib Adverse Event Rates Gr3+ anemia 26.2%; thrombocytopenia 6.6% 3.3% (n=2) permanently discontinued treatment (seli+/- rux) due to a TEAE 21 Fatigue ~60% 16% Phase 1 Actual Phase 3 Extrapolated1 Seli+Rux AE Rates, Gr 3+ Anemia ~43% 21% Thrombocytopenia ~29% 6% Ruxolitinib Historical Adverse Event (AE) Data2 Nausea Vomiting 15% 10% Fatigue 16% Rux AE Rates, Gr 3+ Anemia 37% Thrombocytopenia 6% 6%-11% ~14% 2% Discontinuation due to TEAEs Data cutoff Feb 2025 Note: Based upon an ongoing review of the clinical data from the Phase 3 SENTRY trial, the treatment discontinuation rate due to TEAEs is similar to the rate presented above.

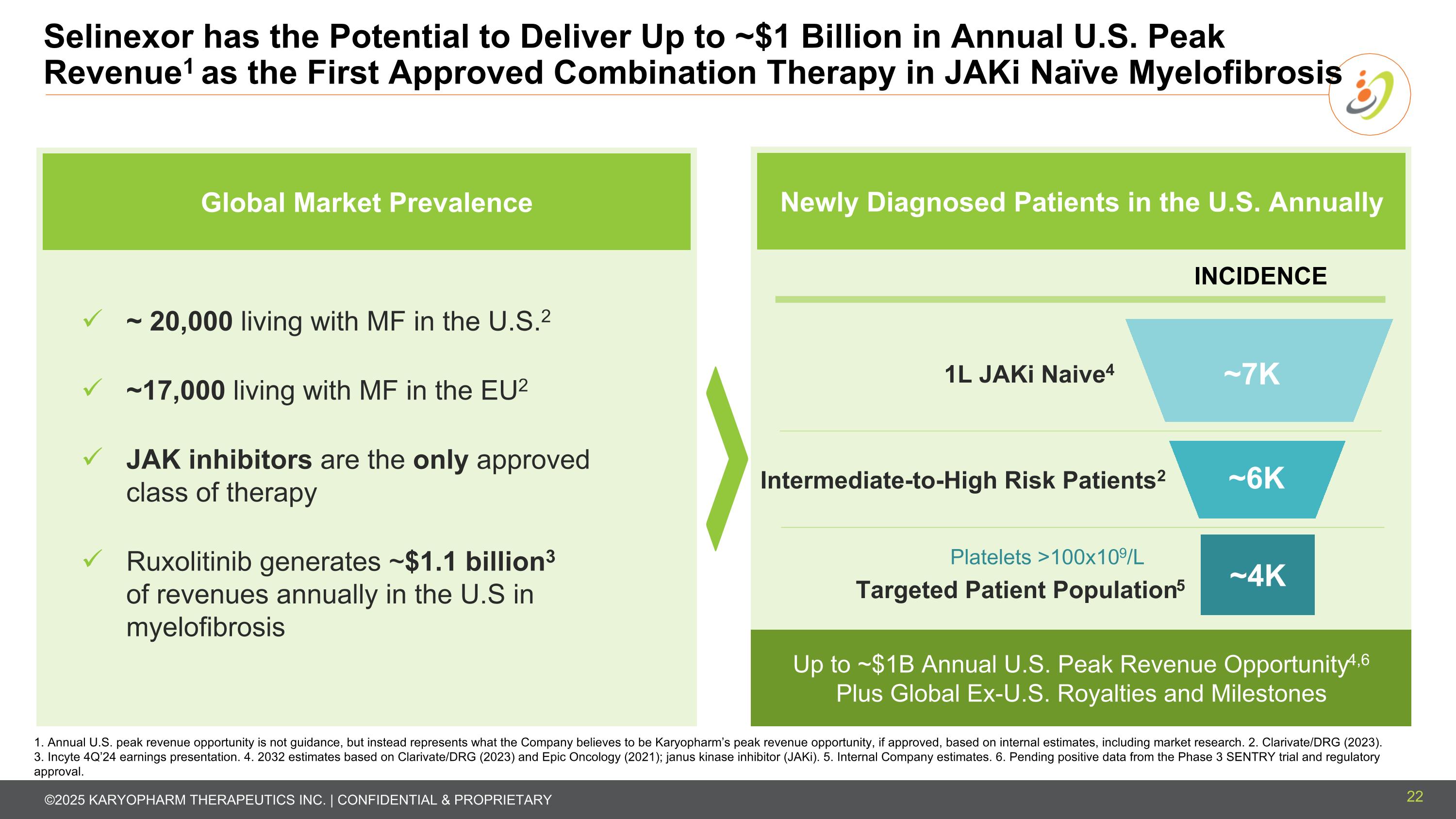

Selinexor has the Potential to Deliver Up to ~$1 Billion in Annual U.S. Peak Revenue1 as the First Approved Combination Therapy in JAKi Naïve Myelofibrosis 22 1. Annual U.S. peak revenue opportunity is not guidance, but instead represents what the Company believes to be Karyopharm’s peak revenue opportunity, if approved, based on internal estimates, including market research. 2. Clarivate/DRG (2023). 3. Incyte 4Q’24 earnings presentation. 4. 2032 estimates based on Clarivate/DRG (2023) and Epic Oncology (2021); janus kinase inhibitor (JAKi). 5. Internal Company estimates. 6. Pending positive data from the Phase 3 SENTRY trial and regulatory approval. 1L JAKi-Naive1 Intermediate-to-High Risk Patients2 ~4K Platelets >100x109/L ~7K ~6K INCIDENCE Newly Diagnosed Patients in the U.S. Annually Up to ~$1B Annual U.S. Peak Revenue Opportunity4,6 Plus Global Ex-U.S. Royalties and Milestones Targeted Patient Population5 1L JAKi Naive4 Global Market Prevalence ~ 20,000 living with MF in the U.S.2 ~17,000 living with MF in the EU2 JAK inhibitors are the only approved class of therapy Ruxolitinib generates ~$1.1 billion3 of revenues annually in the U.S in myelofibrosis

Financial update

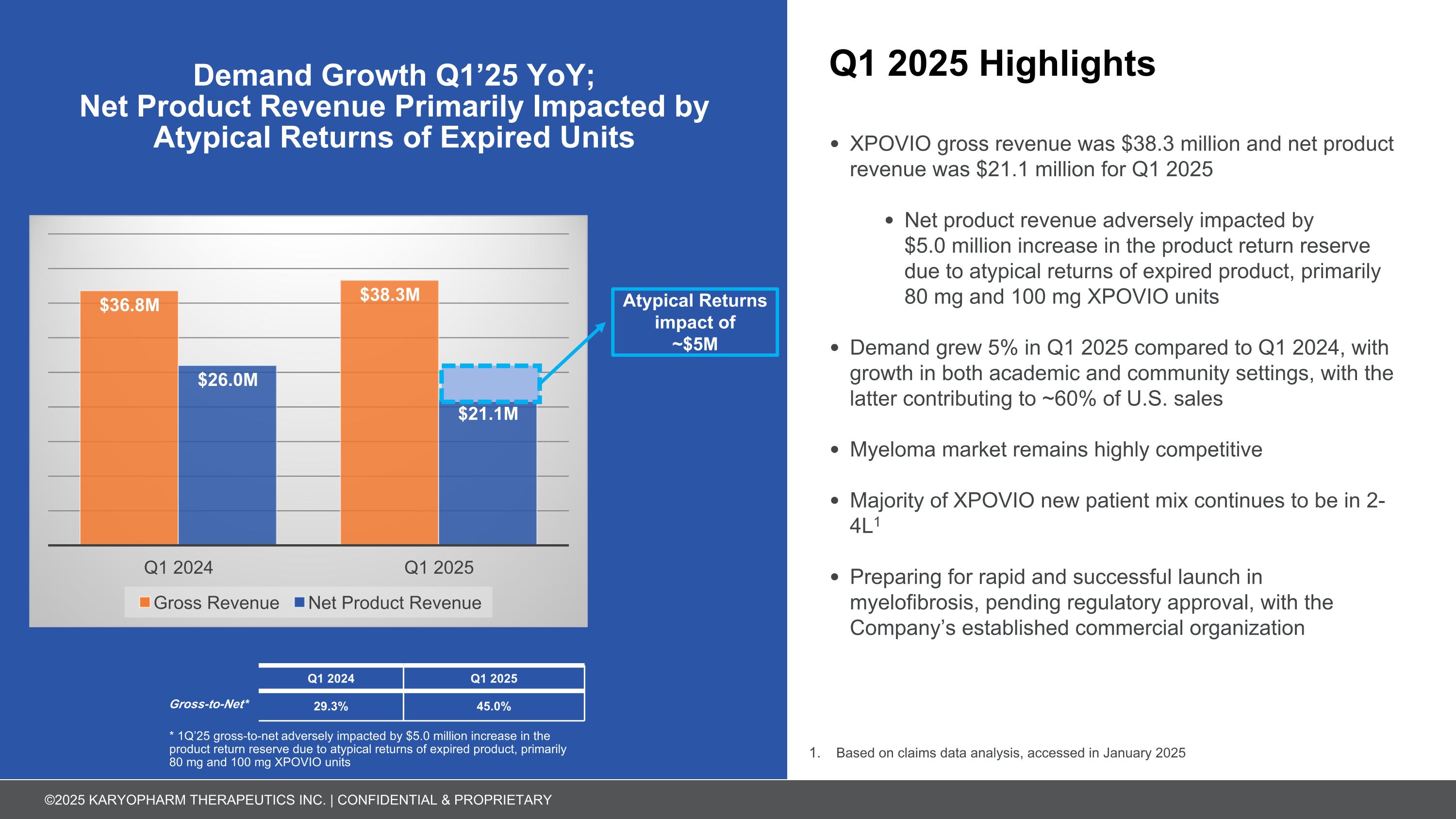

Q1 2025 Highlights XPOVIO gross revenue was $38.3 million and net product revenue was $21.1 million for Q1 2025 Net product revenue adversely impacted by $5.0 million increase in the product return reserve due to atypical returns of expired product, primarily 80 mg and 100 mg XPOVIO units Demand grew 5% in Q1 2025 compared to Q1 2024, with growth in both academic and community settings, with the latter contributing to ~60% of U.S. sales Myeloma market remains highly competitive Majority of XPOVIO new patient mix continues to be in 2-4L1 Preparing for rapid and successful launch in myelofibrosis, pending regulatory approval, with the Company’s established commercial organization Demand Growth Q1’25 YoY; Net Product Revenue Primarily Impacted by Atypical Returns of Expired Units Atypical Returns impact of ~$5M Based on claims data analysis, accessed in January 2025 Q1 2024 Q1 2025 Gross-to-Net* 29.3% 45.0% * 1Q’25 gross-to-net adversely impacted by $5.0 million increase in the product return reserve due to atypical returns of expired product, primarily 80 mg and 100 mg XPOVIO units

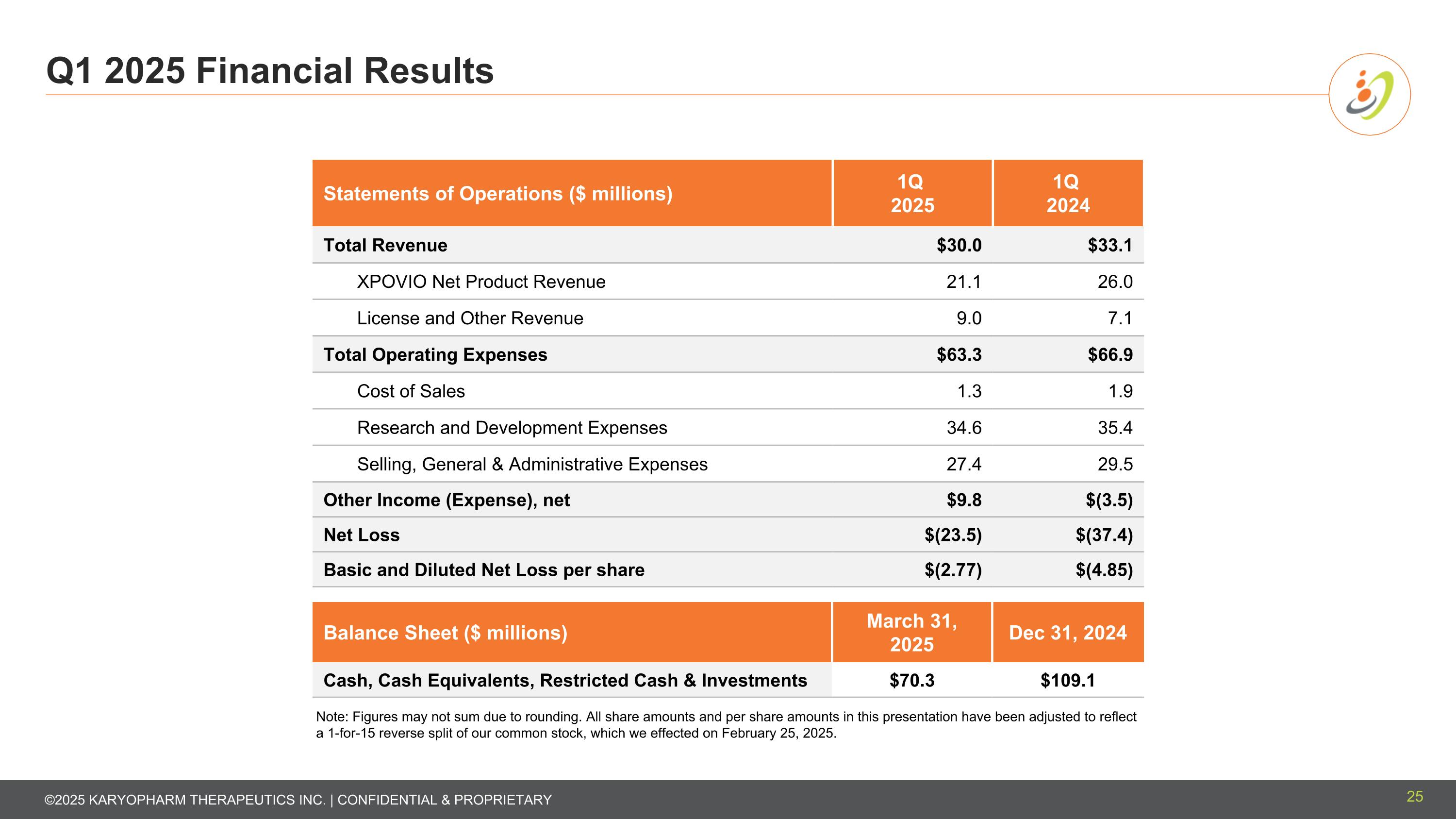

Q1 2025 Financial Results Statements of Operations ($ millions) 1Q 2025 1Q 2024 Total Revenue $30.0 $33.1 XPOVIO Net Product Revenue 21.1 26.0 License and Other Revenue 9.0 7.1 Total Operating Expenses $63.3 $66.9 Cost of Sales 1.3 1.9 Research and Development Expenses 34.6 35.4 Selling, General & Administrative Expenses 27.4 29.5 Other Income (Expense), net $9.8 $(3.5) Net Loss $(23.5) $(37.4) Basic and Diluted Net Loss per share $(2.77) $(4.85) Balance Sheet ($ millions) March 31, 2025 Dec 31, 2024 Cash, Cash Equivalents, Restricted Cash & Investments $70.3 $109.1 Note: Figures may not sum due to rounding. All share amounts and per share amounts in this presentation have been adjusted to reflect a 1-for-15 reverse split of our common stock, which we effected on February 25, 2025. 25

APPENDIX ©2025 KARYOPHARM THERAPEUTICS INC. | CONFIDENTIAL & PROPRIETARY

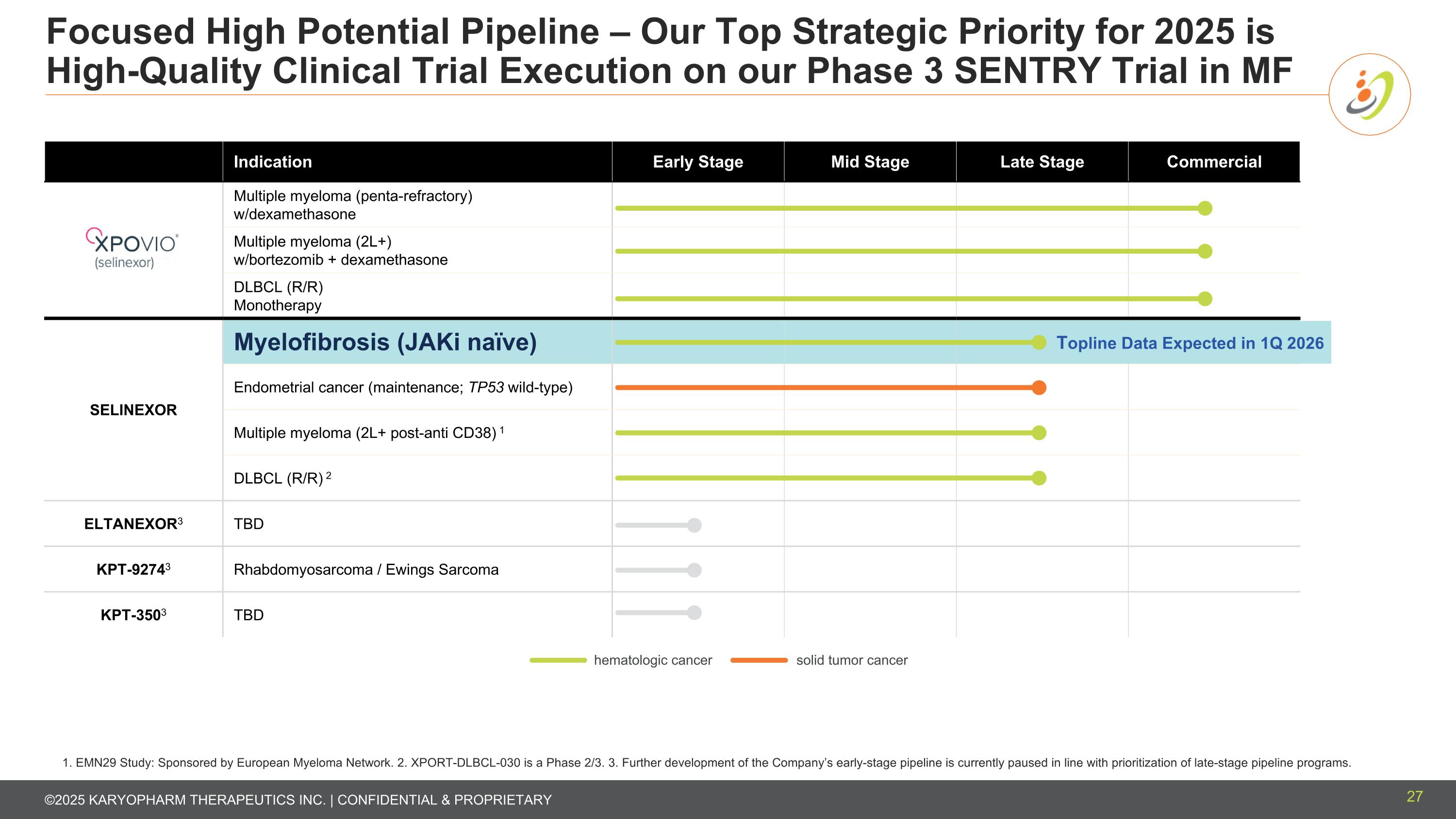

Focused High Potential Pipeline – Our Top Strategic Priority for 2025 is High-Quality Clinical Trial Execution on our Phase 3 SENTRY Trial in MF 27 1. EMN29 Study: Sponsored by European Myeloma Network. 2. XPORT-DLBCL-030 is a Phase 2/3. 3. Further development of the Company’s early-stage pipeline is currently paused in line with prioritization of late-stage pipeline programs. Indication Early Stage Mid Stage Late Stage Commercial Multiple myeloma (penta-refractory) w/dexamethasone Multiple myeloma (2L+) w/bortezomib + dexamethasone DLBCL (R/R) Monotherapy SELINEXOR Myelofibrosis (JAKi naïve) Endometrial cancer (maintenance; TP53 wild-type) Multiple myeloma (2L+ post-anti CD38) 1 DLBCL (R/R) 2 ELTANEXOR3 TBD KPT-92743 Rhabdomyosarcoma / Ewings Sarcoma KPT-3503 TBD solid tumor cancer hematologic cancer Topline Data Expected in 1Q 2026

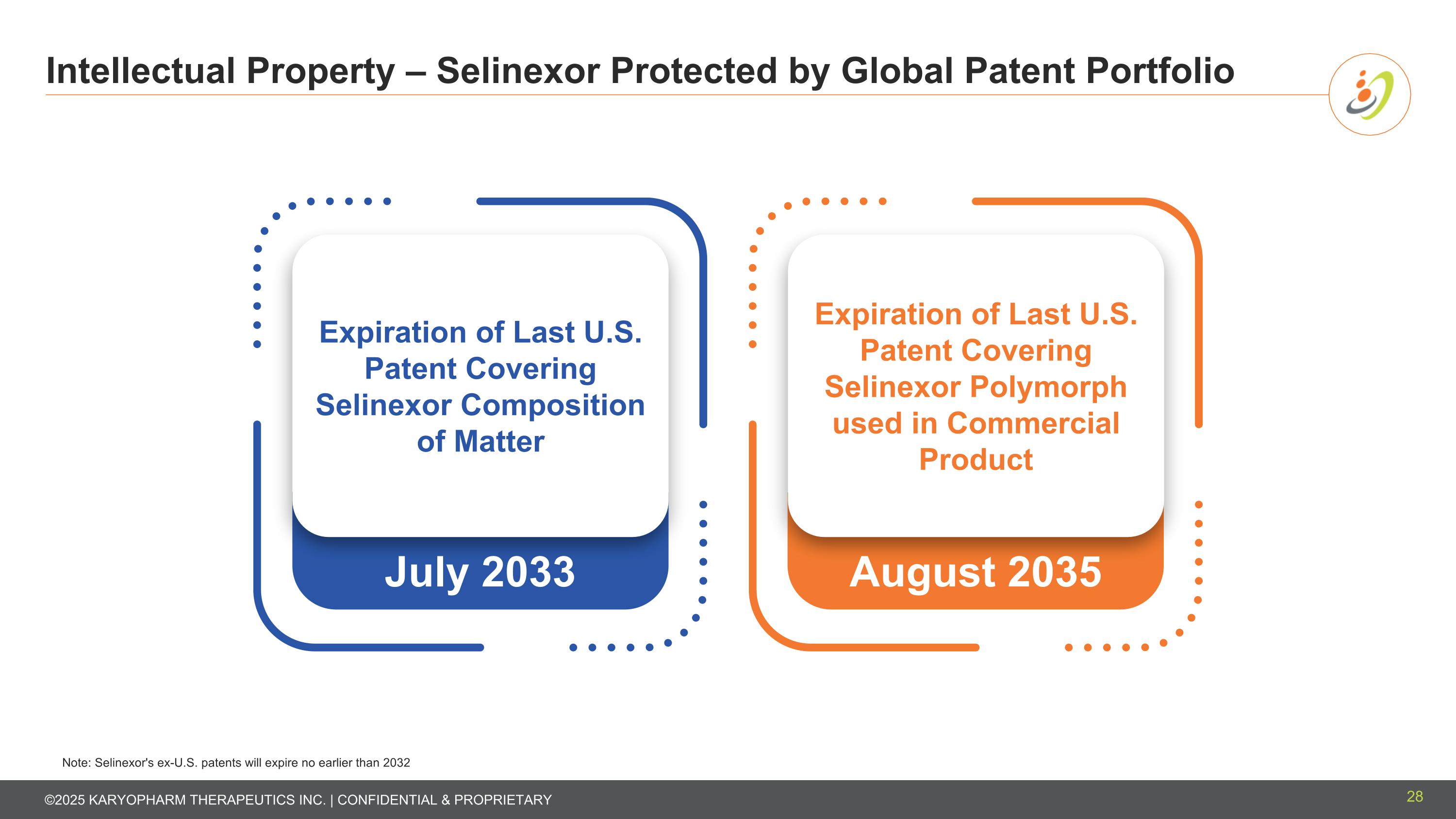

Intellectual Property – Selinexor Protected by Global Patent Portfolio 28 August 2035 July 2033 Note: Selinexor's ex-U.S. patents will expire no earlier than 2032 Expiration of Last U.S. Patent Covering Selinexor Composition of Matter Expiration of Last U.S. Patent Covering Selinexor Polymorph used in Commercial Product

MYELOFIBROSIS

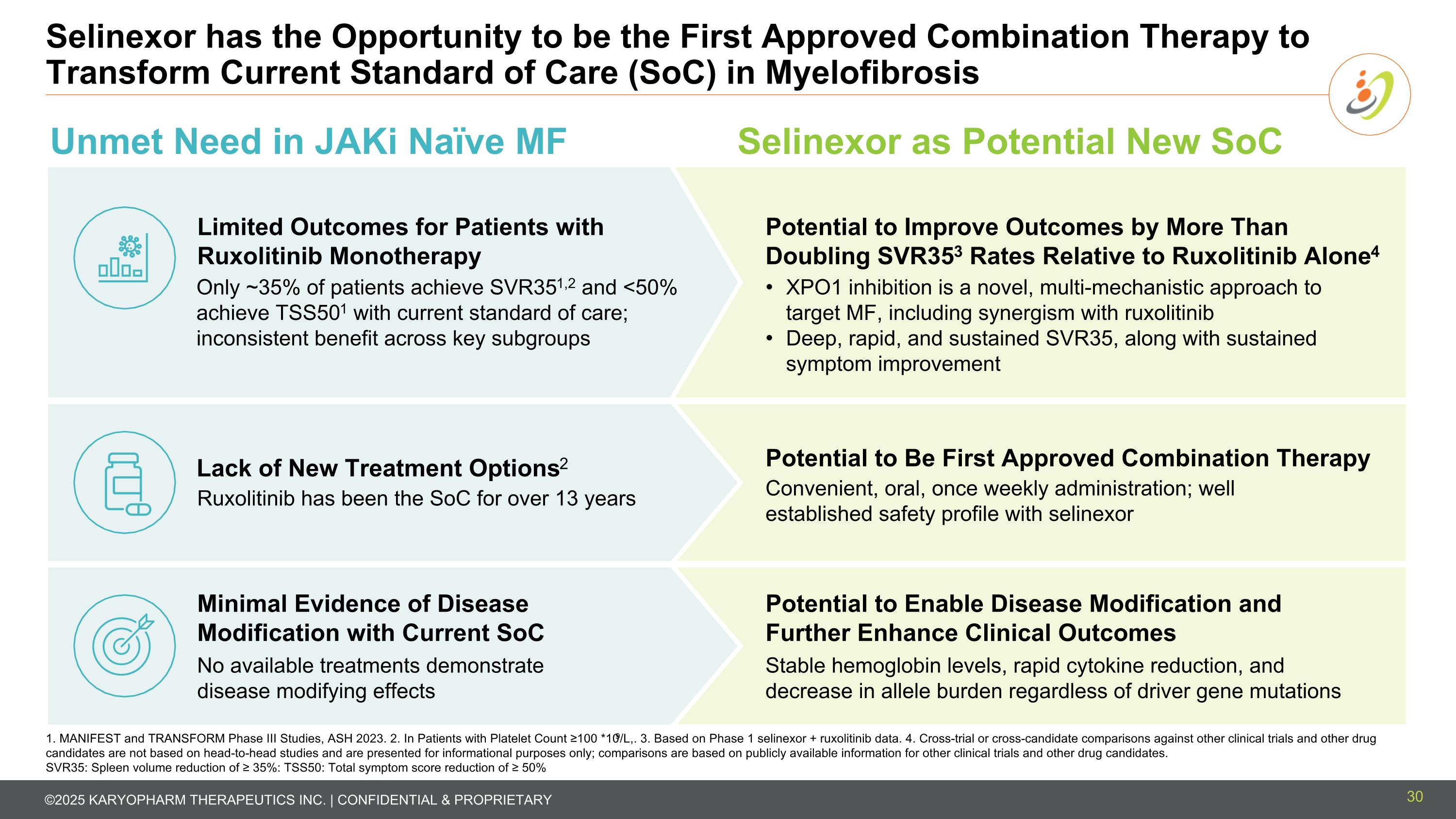

Selinexor has the Opportunity to be the First Approved Combination Therapy to Transform Current Standard of Care (SoC) in Myelofibrosis Unmet Need in JAKi Naïve MF Selinexor as Potential New SoC Limited Outcomes for Patients with Ruxolitinib Monotherapy Only ~35% of patients achieve SVR351,2 and <50% achieve TSS501 with current standard of care; inconsistent benefit across key subgroups Lack of New Treatment Options2 Ruxolitinib has been the SoC for over 13 years No available treatments demonstrate disease modifying effects Minimal Evidence of Disease Modification with Current SoC XPO1 inhibition is a novel, multi-mechanistic approach to target MF, including synergism with ruxolitinib Deep, rapid, and sustained SVR35, along with sustained symptom improvement Stable hemoglobin levels, rapid cytokine reduction, and decrease in allele burden regardless of driver gene mutations Potential to Enable Disease Modification and Further Enhance Clinical Outcomes 1. MANIFEST and TRANSFORM Phase III Studies, ASH 2023. 2. In Patients with Platelet Count ≥100 *109/L,. 3. Based on Phase 1 selinexor + ruxolitinib data. 4. Cross-trial or cross-candidate comparisons against other clinical trials and other drug candidates are not based on head-to-head studies and are presented for informational purposes only; comparisons are based on publicly available information for other clinical trials and other drug candidates. SVR35: Spleen volume reduction of ≥ 35%: TSS50: Total symptom score reduction of ≥ 50% Potential to Be First Approved Combination Therapy Convenient, oral, once weekly administration; well established safety profile with selinexor Potential to Improve Outcomes by More Than Doubling SVR353 Rates Relative to Ruxolitinib Alone4 30

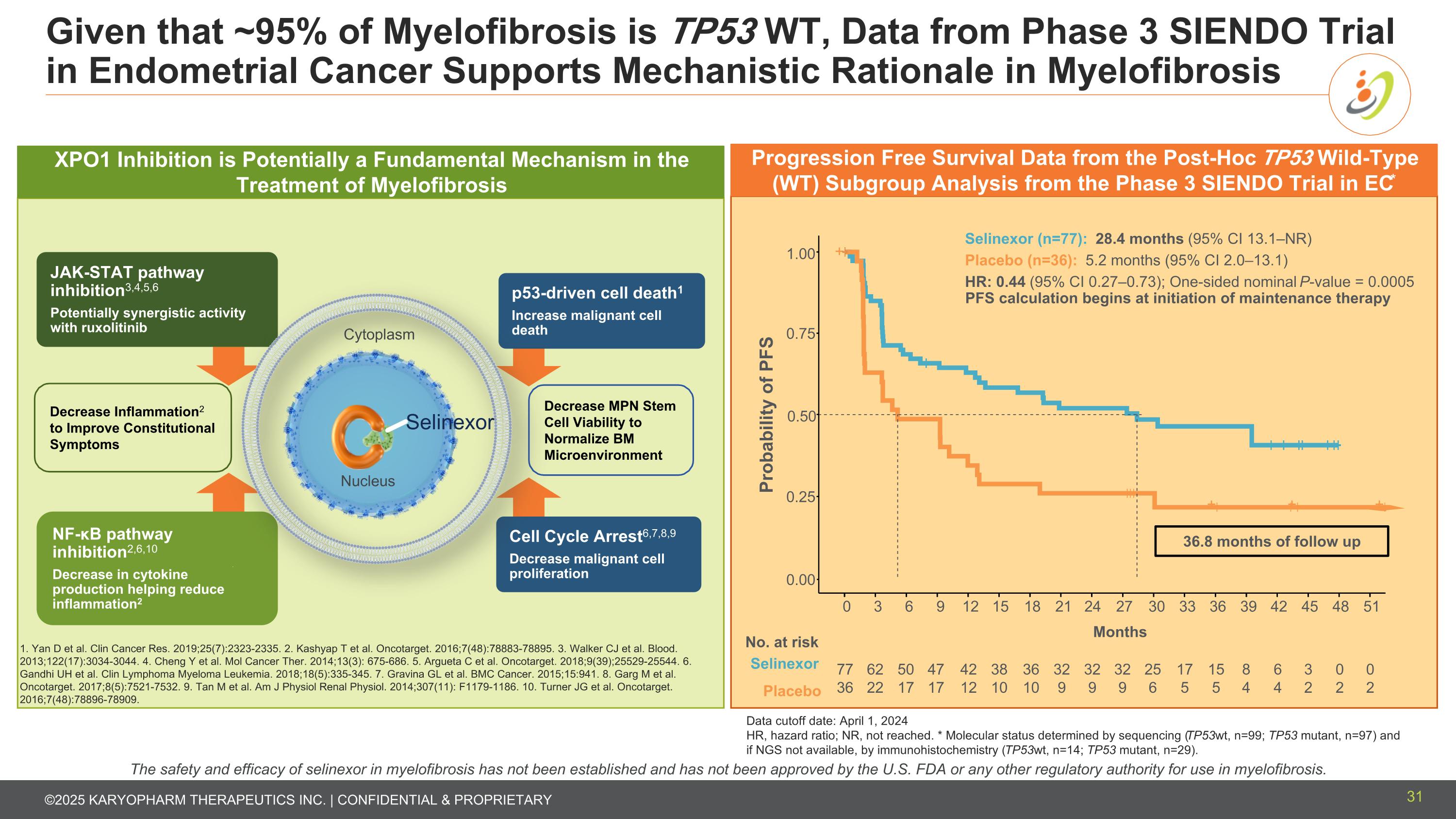

Given that ~95% of Myelofibrosis is TP53 WT, Data from Phase 3 SIENDO Trial in Endometrial Cancer Supports Mechanistic Rationale in Myelofibrosis Data cutoff date: April 1, 2024 HR, hazard ratio; NR, not reached. * Molecular status determined by sequencing (TP53wt, n=99; TP53 mutant, n=97) and if NGS not available, by immunohistochemistry (TP53wt, n=14; TP53 mutant, n=29). + + + + 0.00 0.25 0.50 0.75 1.00 0 3 6 9 12 15 18 21 24 27 30 33 36 39 42 45 48 51 Probability of PFS Months No. at risk Selinexor Placebo 77 36 62 22 50 17 47 17 42 12 38 10 36 10 32 9 32 9 25 6 17 5 32 9 15 5 8 4 6 4 3 2 0 2 0 2 Selinexor (n=77): 28.4 months (95% CI 13.1–NR) Placebo (n=36): 5.2 months (95% CI 2.0–13.1) HR: 0.44 (95% CI 0.27–0.73); One-sided nominal P-value = 0.0005 PFS calculation begins at initiation of maintenance therapy 36.8 months of follow up Progression Free Survival Data from the Post-Hoc TP53 Wild-Type (WT) Subgroup Analysis from the Phase 3 SIENDO Trial in EC* The safety and efficacy of selinexor in myelofibrosis has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in myelofibrosis. Decrease MPN Stem Cell Viability to Normalize BM Microenvironment Decrease Inflammation2 to Improve Constitutional Symptoms p53-driven cell death1 Increase malignant cell death Cell Cycle Arrest6,7,8,9 Decrease malignant cell proliferation NF-κB pathway inhibition2,6,10 Decrease in cytokine production helping reduce inflammation2 JAK-STAT pathway inhibition3,4,5,6 Potentially synergistic activity with ruxolitinib Selinexor Cytoplasm Nucleus XPO1 Inhibition is Potentially a Fundamental Mechanism in the Treatment of Myelofibrosis 1. Yan D et al. Clin Cancer Res. 2019;25(7):2323-2335. 2. Kashyap T et al. Oncotarget. 2016;7(48):78883-78895. 3. Walker CJ et al. Blood. 2013;122(17):3034-3044. 4. Cheng Y et al. Mol Cancer Ther. 2014;13(3): 675-686. 5. Argueta C et al. Oncotarget. 2018;9(39);25529-25544. 6. Gandhi UH et al. Clin Lymphoma Myeloma Leukemia. 2018;18(5):335-345. 7. Gravina GL et al. BMC Cancer. 2015;15:941. 8. Garg M et al. Oncotarget. 2017;8(5):7521-7532. 9. Tan M et al. Am J Physiol Renal Physiol. 2014;307(11): F1179-1186. 10. Turner JG et al. Oncotarget. 2016;7(48):78896-78909. 31

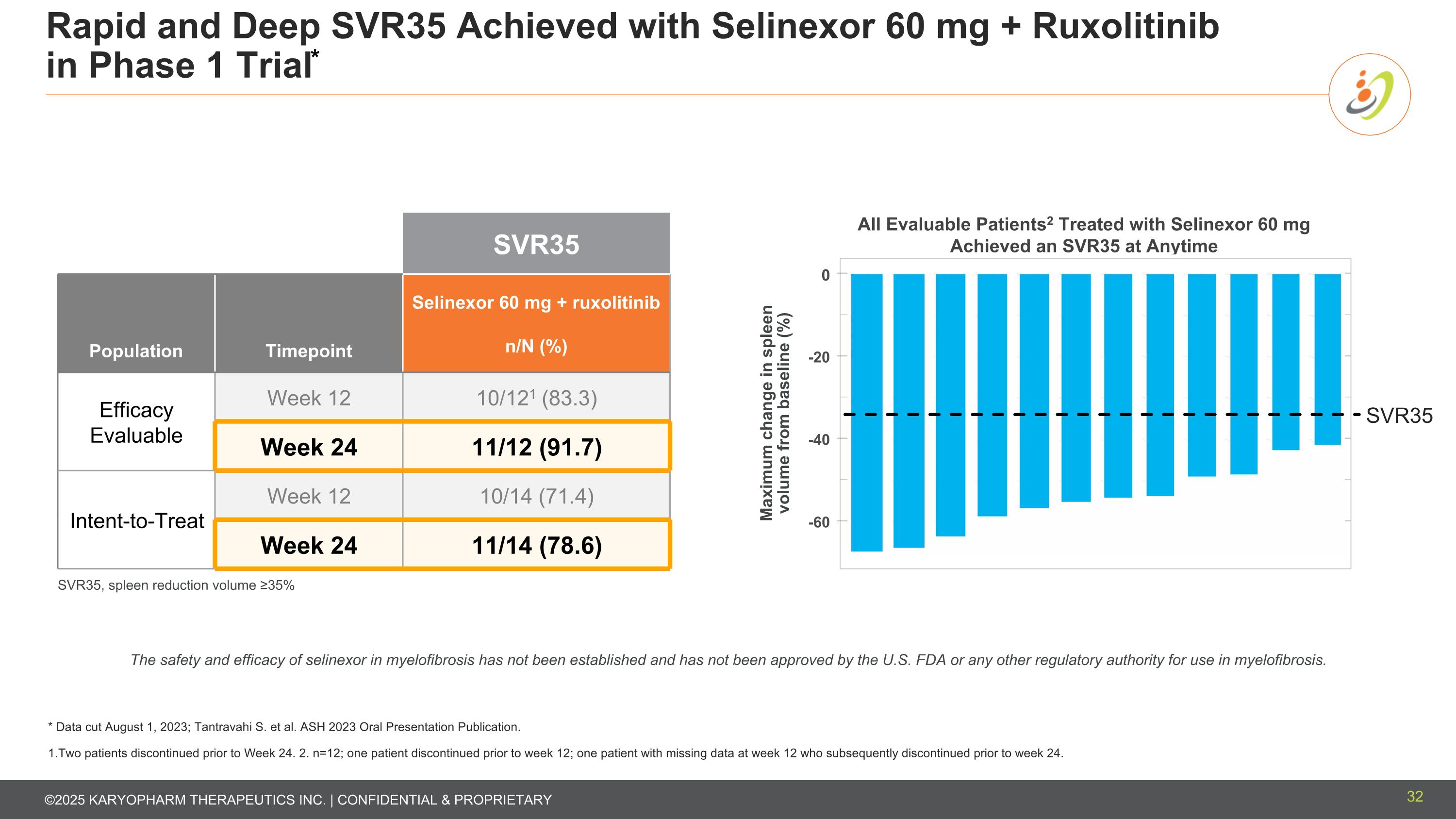

Rapid and Deep SVR35 Achieved with Selinexor 60 mg + Ruxolitinib in Phase 1 Trial* SVR35 Population Timepoint Selinexor 60 mg + ruxolitinib n/N (%) Efficacy Evaluable Week 12 10/121 (83.3) Week 24 11/12 (91.7) Intent-to-Treat Week 12 10/14 (71.4) Week 24 11/14 (78.6) All Evaluable Patients2 Treated with Selinexor 60 mg Achieved an SVR35 at Anytime Maximum change in spleen volume from baseline (%) 0 -20 -40 -60 SVR35 The safety and efficacy of selinexor in myelofibrosis has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in myelofibrosis. * Data cut August 1, 2023; Tantravahi S. et al. ASH 2023 Oral Presentation Publication. 1.Two patients discontinued prior to Week 24. 2. n=12; one patient discontinued prior to week 12; one patient with missing data at week 12 who subsequently discontinued prior to week 24. SVR35, spleen reduction volume ≥35% 32

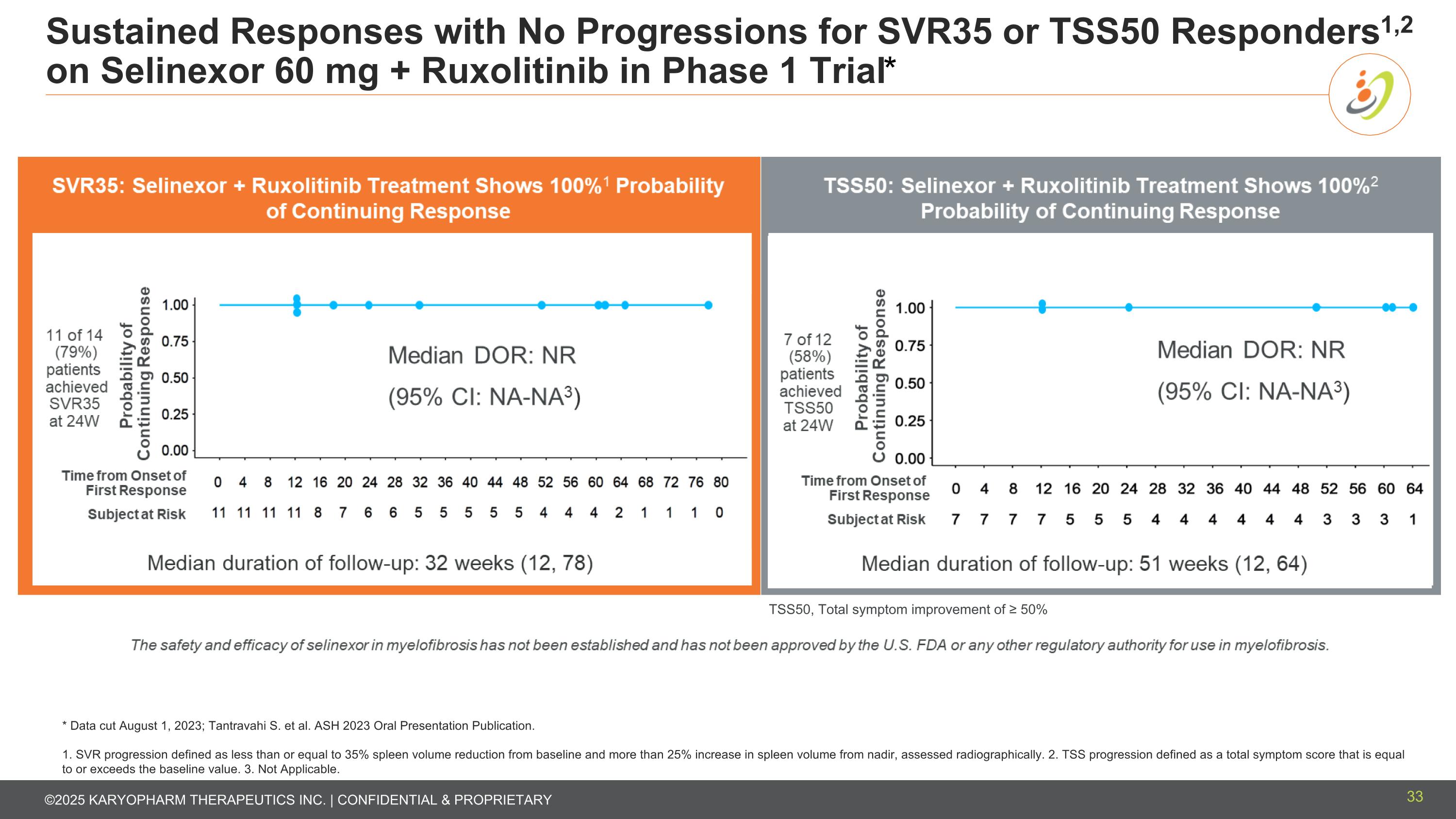

Sustained Responses with No Progressions for SVR35 or TSS50 Responders1,2 on Selinexor 60 mg + Ruxolitinib in Phase 1 Trial* * Data cut August 1, 2023; Tantravahi S. et al. ASH 2023 Oral Presentation Publication. 1. SVR progression defined as less than or equal to 35% spleen volume reduction from baseline and more than 25% increase in spleen volume from nadir, assessed radiographically. 2. TSS progression defined as a total symptom score that is equal to or exceeds the baseline value. 3. Not Applicable. TSS50, Total symptom improvement of ≥ 50% 33

Incorporating Absolute TSS* as a Co-primary Endpoint, a Comprehensive Assessment of Symptom Improvement, Increases Confidence in SENTRY 1. Results from Phase 1 portion of SENTRY trial evaluating selinexor+ ruxolitinib in JAKi naïve patents; data cut August 1, 2023. 2. Average reduction in total symptom score at week 24 relative to baseline, calculated for each evaluable subject. Least square mean of the absolute TSS change was not estimated in the ITT population due to limitations in sample size. Strong understanding of absolute change in symptom improvement with ruxolitinib monotherapy in JAKi naïve myelofibrosis patients based on recent Phase 3 data Robust endpoint supported by the FDA, investigators, and patient advocacy groups when comparing to active control arm Promising evidence of improvement in absolute change in total symptom score (Abs-TSS)1,2 from Phase 1 trial of selinexor in combination with ruxolitinib Building on impressive SVR35 results, including Abs-TSS as a co-primary endpoint, further increases overall confidence in SENTRY trial * Abs-TSS measures the average improvement in patient symptom scores over 24 weeks relative to the patient’s baseline symptom score. 34

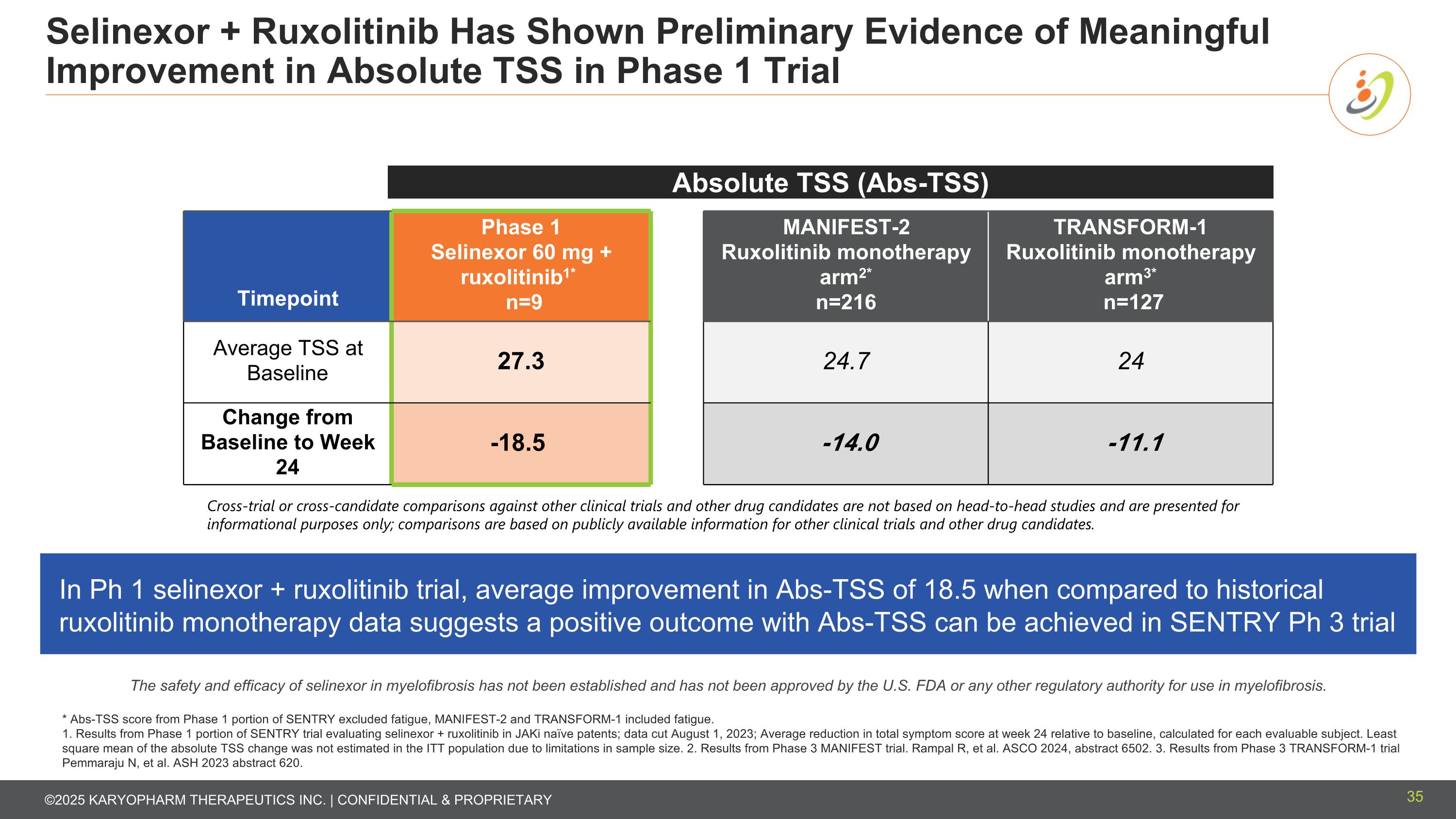

Selinexor + Ruxolitinib Has Shown Preliminary Evidence of Meaningful Improvement in Absolute TSS in Phase 1 Trial * Abs-TSS score from Phase 1 portion of SENTRY excluded fatigue, MANIFEST-2 and TRANSFORM-1 included fatigue. 1. Results from Phase 1 portion of SENTRY trial evaluating selinexor + ruxolitinib in JAKi naïve patents; data cut August 1, 2023; Average reduction in total symptom score at week 24 relative to baseline, calculated for each evaluable subject. Least square mean of the absolute TSS change was not estimated in the ITT population due to limitations in sample size. 2. Results from Phase 3 MANIFEST trial. Rampal R, et al. ASCO 2024, abstract 6502. 3. Results from Phase 3 TRANSFORM-1 trial Pemmaraju N, et al. ASH 2023 abstract 620. In Ph 1 selinexor + ruxolitinib trial, average improvement in Abs-TSS of 18.5 when compared to historical ruxolitinib monotherapy data suggests a positive outcome with Abs-TSS can be achieved in SENTRY Ph 3 trial Timepoint Phase 1 Selinexor 60 mg + ruxolitinib1* n=9 MANIFEST-2 Ruxolitinib monotherapy arm2* n=216 TRANSFORM-1 Ruxolitinib monotherapy arm3* n=127 Average TSS at Baseline 27.3 24.7 24 Change from Baseline to Week 24 -18.5 -14.0 -11.1 Cross-trial or cross-candidate comparisons against other clinical trials and other drug candidates are not based on head-to-head studies and are presented for informational purposes only; comparisons are based on publicly available information for other clinical trials and other drug candidates. Absolute TSS (Abs-TSS) The safety and efficacy of selinexor in myelofibrosis has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in myelofibrosis. 35

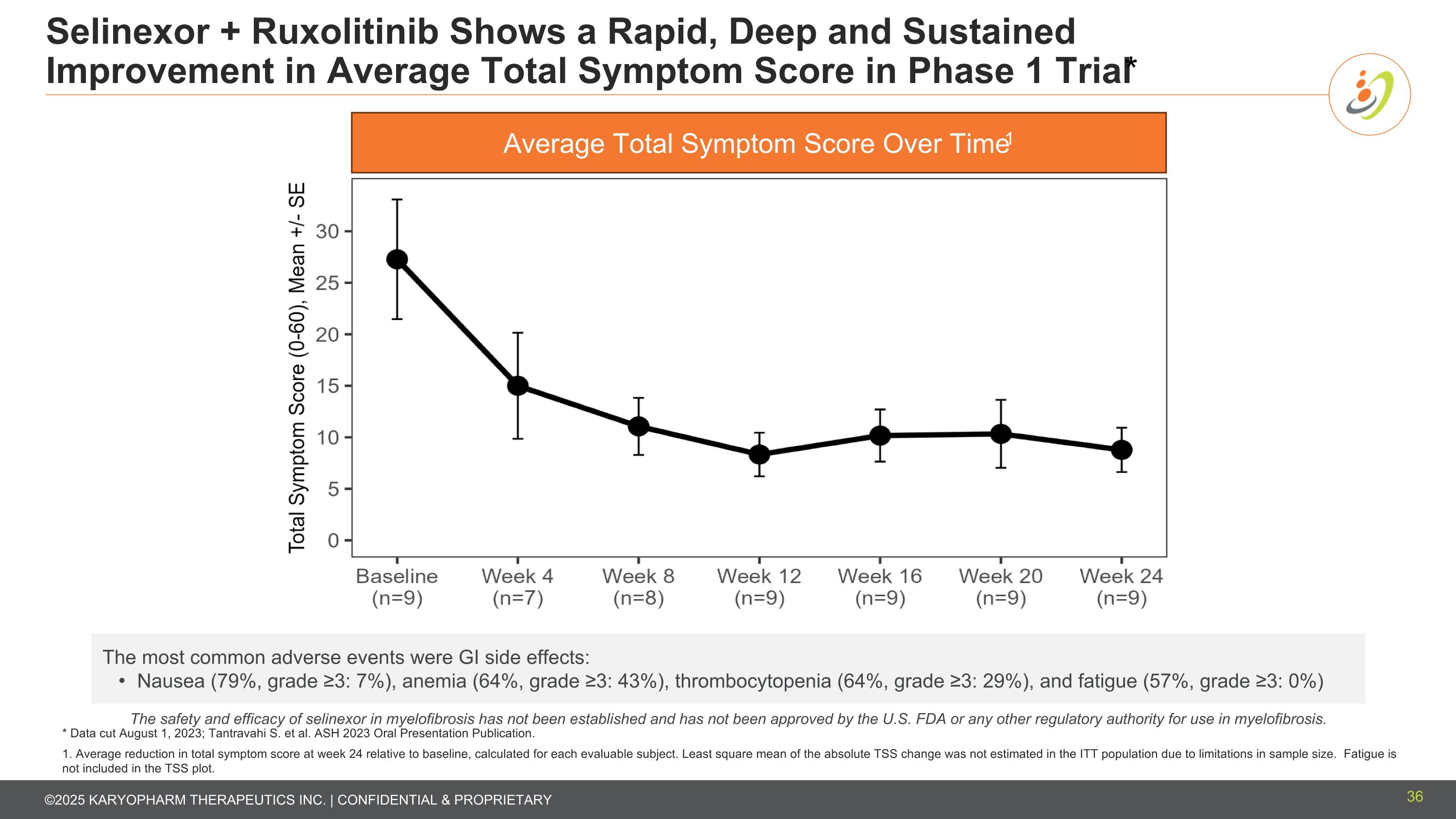

Selinexor + Ruxolitinib Shows a Rapid, Deep and Sustained Improvement in Average Total Symptom Score in Phase 1 Trial* * Data cut August 1, 2023; Tantravahi S. et al. ASH 2023 Oral Presentation Publication. 1. Average reduction in total symptom score at week 24 relative to baseline, calculated for each evaluable subject. Least square mean of the absolute TSS change was not estimated in the ITT population due to limitations in sample size. Fatigue is not included in the TSS plot. Average Total Symptom Score Over Time1 The safety and efficacy of selinexor in myelofibrosis has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in myelofibrosis. The most common adverse events were GI side effects: Nausea (79%, grade ≥3: 7%), anemia (64%, grade ≥3: 43%), thrombocytopenia (64%, grade ≥3: 29%), and fatigue (57%, grade ≥3: 0%) 36

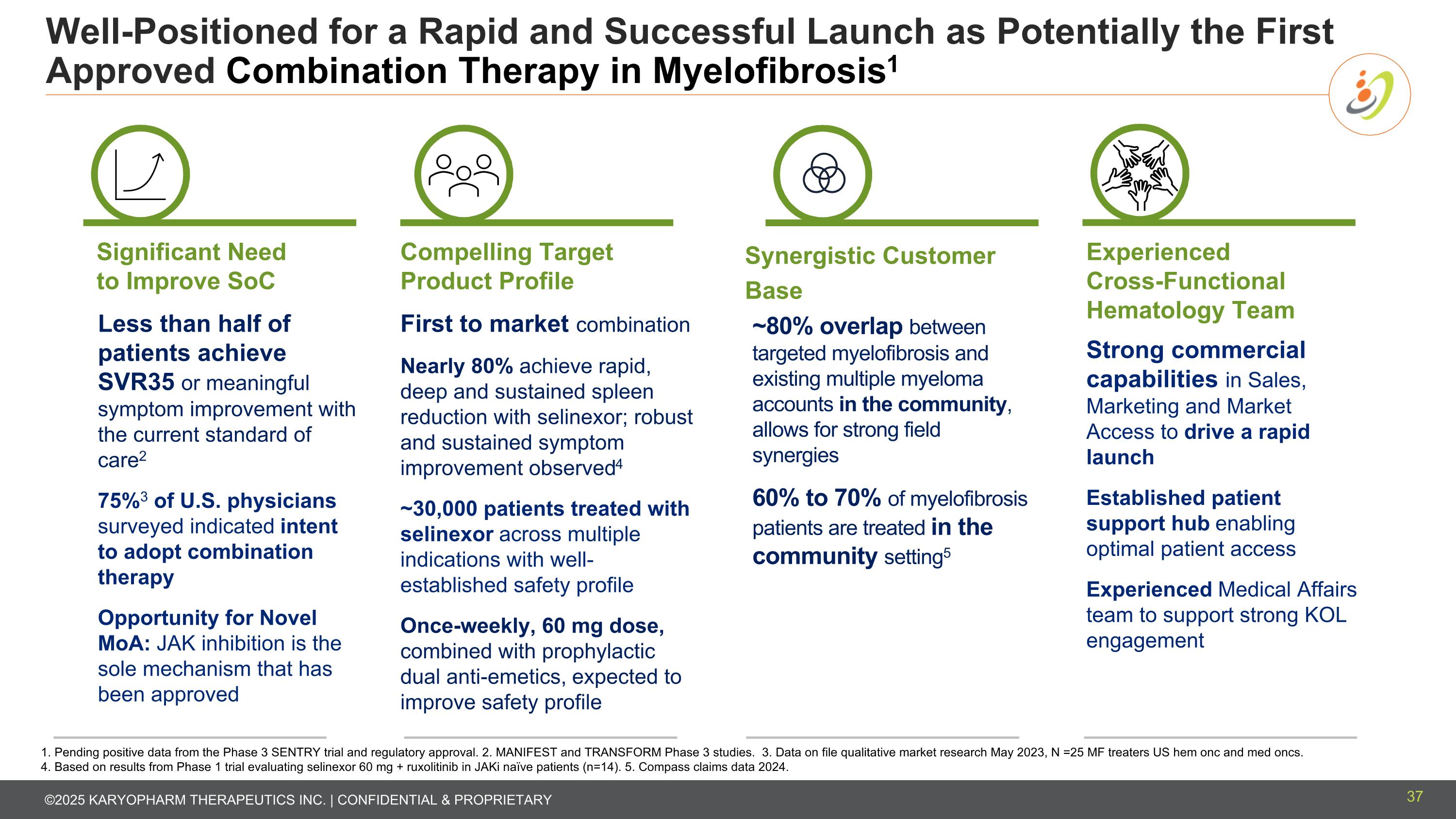

Well-Positioned for a Rapid and Successful Launch as Potentially the First Approved Combination Therapy in Myelofibrosis1 1. Pending positive data from the Phase 3 SENTRY trial and regulatory approval. 2. MANIFEST and TRANSFORM Phase 3 studies. 3. Data on file qualitative market research May 2023, N =25 MF treaters US hem onc and med oncs. 4. Based on results from Phase 1 trial evaluating selinexor 60 mg + ruxolitinib in JAKi naïve patients (n=14). 5. Compass claims data 2024. ~80% overlap between targeted myelofibrosis and existing multiple myeloma accounts in the community, allows for strong field synergies 60% to 70% of myelofibrosis patients are treated in the community setting5 Experienced Cross-Functional Hematology Team Strong commercial capabilities in Sales, Marketing and Market Access to drive a rapid launch Established patient support hub enabling optimal patient access Experienced Medical Affairs team to support strong KOL engagement Compelling Target Product Profile First to market combination Nearly 80% achieve rapid, deep and sustained spleen reduction with selinexor; robust and sustained symptom improvement observed4 ~30,000 patients treated with selinexor across multiple indications with well-established safety profile Once-weekly, 60 mg dose, combined with prophylactic dual anti-emetics, expected to improve safety profile Less than half of patients achieve SVR35 or meaningful symptom improvement with the current standard of care2 75%3 of U.S. physicians surveyed indicated intent to adopt combination therapy Opportunity for Novel MoA: JAK inhibition is the sole mechanism that has been approved Significant Need to Improve SoC Synergistic Customer Base 37

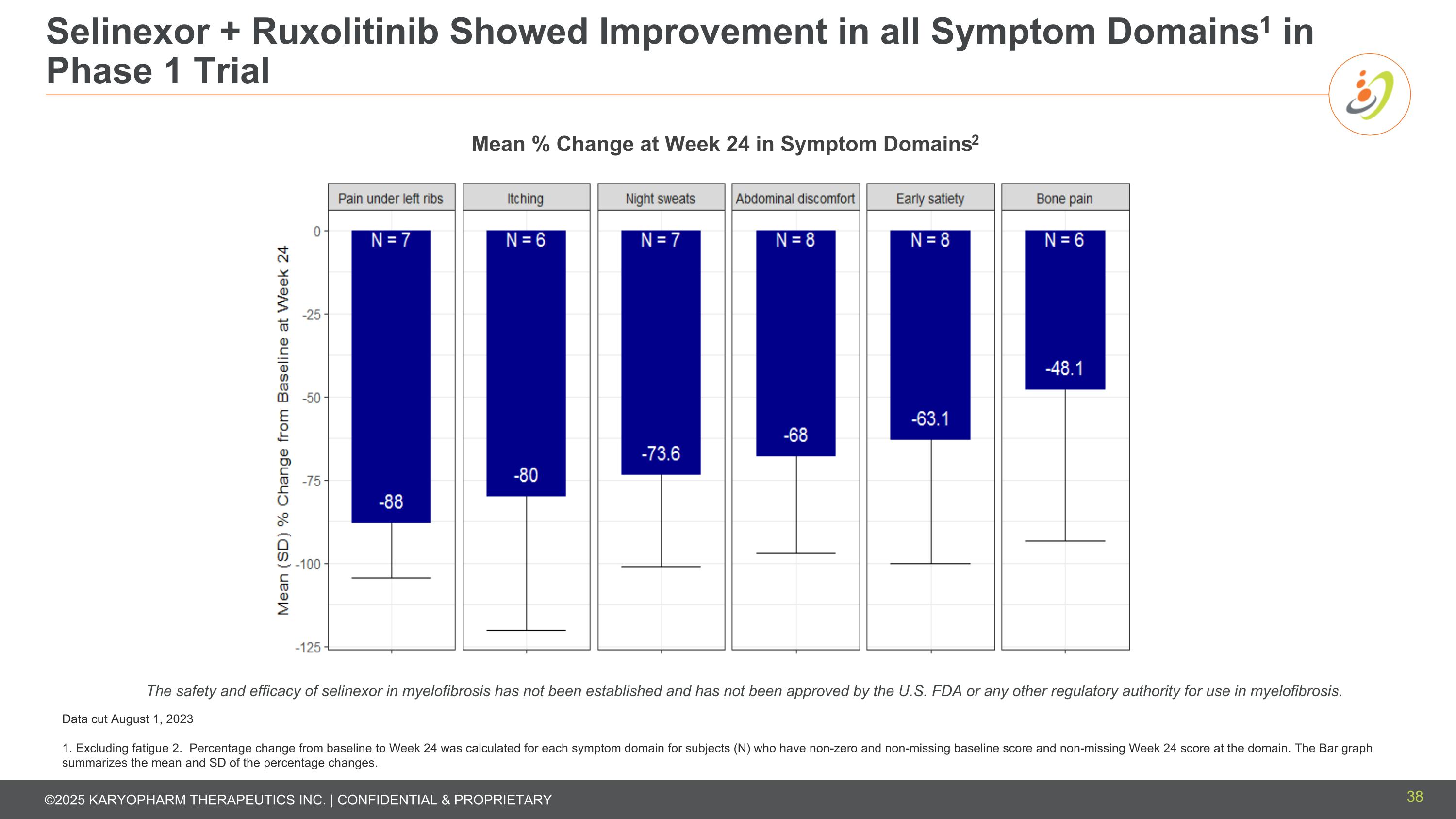

Selinexor + Ruxolitinib Showed Improvement in all Symptom Domains1 in Phase 1 Trial Data cut August 1, 2023 1. Excluding fatigue 2. Percentage change from baseline to Week 24 was calculated for each symptom domain for subjects (N) who have non-zero and non-missing baseline score and non-missing Week 24 score at the domain. The Bar graph summarizes the mean and SD of the percentage changes. Mean % Change at Week 24 in Symptom Domains2 The safety and efficacy of selinexor in myelofibrosis has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in myelofibrosis. 38

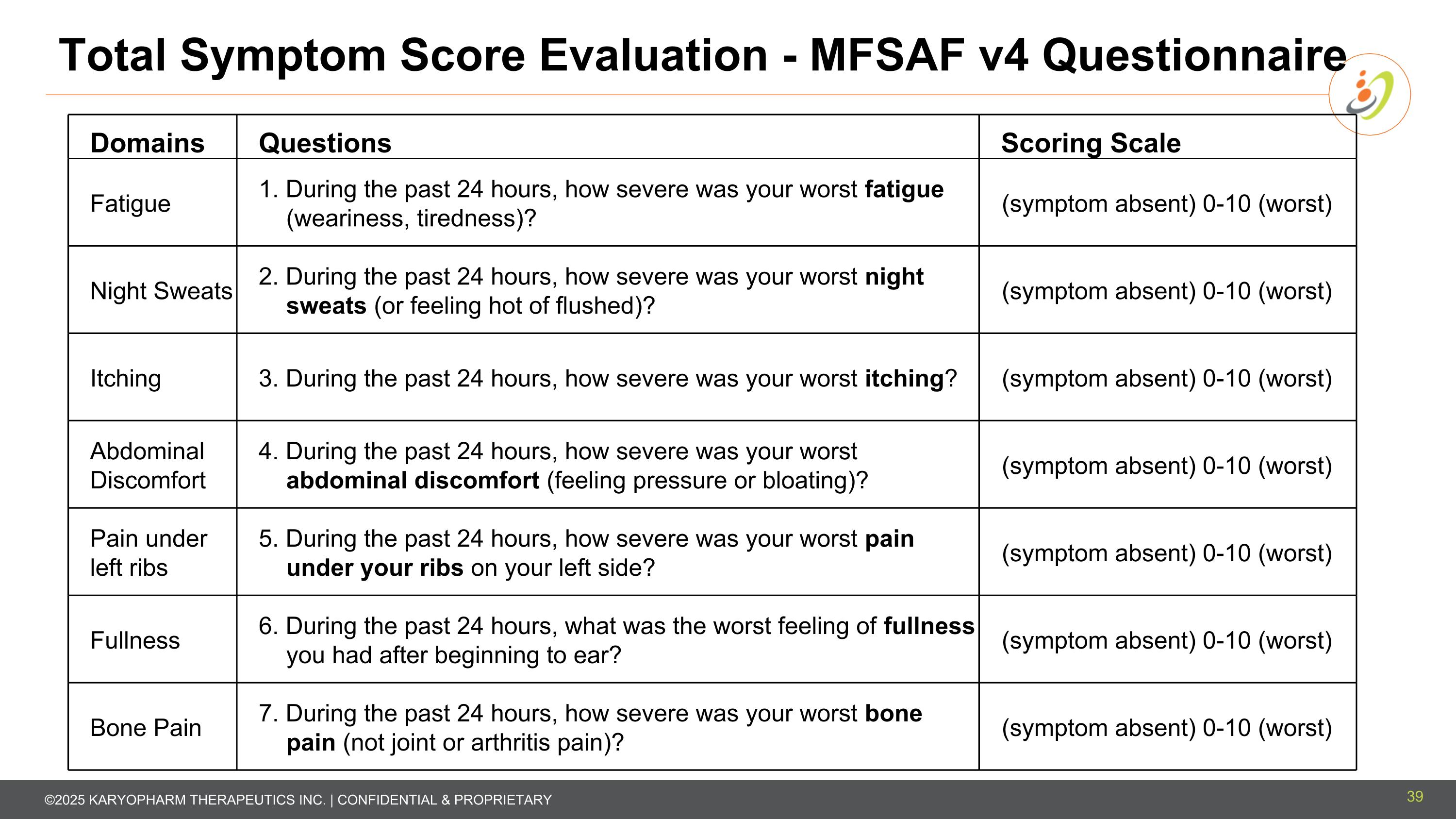

Domains Questions Scoring Scale Fatigue 1. During the past 24 hours, how severe was your worst fatigue (weariness, tiredness)? (symptom absent) 0-10 (worst) Night Sweats 2. During the past 24 hours, how severe was your worst night sweats (or feeling hot of flushed)? (symptom absent) 0-10 (worst) Itching 3. During the past 24 hours, how severe was your worst itching? (symptom absent) 0-10 (worst) Abdominal Discomfort 4. During the past 24 hours, how severe was your worst abdominal discomfort (feeling pressure or bloating)? (symptom absent) 0-10 (worst) Pain under left ribs 5. During the past 24 hours, how severe was your worst pain under your ribs on your left side? (symptom absent) 0-10 (worst) Fullness 6. During the past 24 hours, what was the worst feeling of fullness you had after beginning to ear? (symptom absent) 0-10 (worst) Bone Pain 7. During the past 24 hours, how severe was your worst bone pain (not joint or arthritis pain)? (symptom absent) 0-10 (worst) Total Symptom Score Evaluation - MFSAF v4 Questionnaire 39

Endometrial cancer

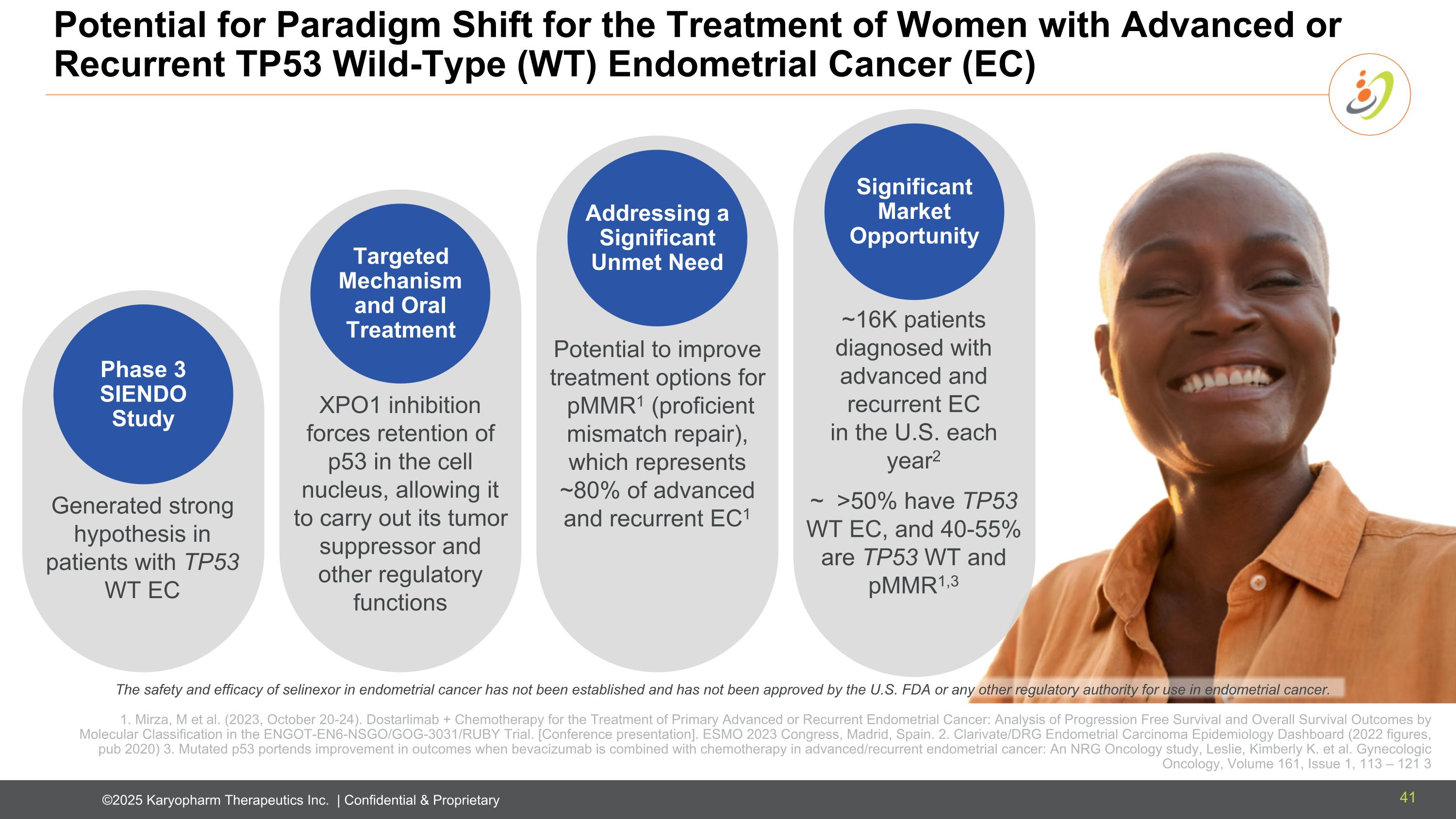

XPO1 inhibition forces retention of p53 in the cell nucleus, allowing it to carry out its tumor suppressor and other regulatory functions Generated strong hypothesis in patients with TP53 WT EC Potential to improve treatment options for pMMR1 (proficient mismatch repair), which represents ~80% of advanced and recurrent EC1 Potential for Paradigm Shift for the Treatment of Women with Advanced or Recurrent TP53 Wild-Type (WT) Endometrial Cancer (EC) The safety and efficacy of selinexor in endometrial cancer has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in endometrial cancer. Phase 3 SIENDO Study Targeted Mechanism and Oral Treatment Addressing a Significant Unmet Need Significant Market Opportunity ~16K patients diagnosed with advanced and recurrent EC in the U.S. each year2 ~ >50% have TP53 WT EC, and 40-55% are TP53 WT and pMMR1,3 1. Mirza, M et al. (2023, October 20-24). Dostarlimab + Chemotherapy for the Treatment of Primary Advanced or Recurrent Endometrial Cancer: Analysis of Progression Free Survival and Overall Survival Outcomes by Molecular Classification in the ENGOT-EN6-NSGO/GOG-3031/RUBY Trial. [Conference presentation]. ESMO 2023 Congress, Madrid, Spain. 2. Clarivate/DRG Endometrial Carcinoma Epidemiology Dashboard (2022 figures, pub 2020) 3. Mutated p53 portends improvement in outcomes when bevacizumab is combined with chemotherapy in advanced/recurrent endometrial cancer: An NRG Oncology study, Leslie, Kimberly K. et al. Gynecologic Oncology, Volume 161, Issue 1, 113 – 121 3 41

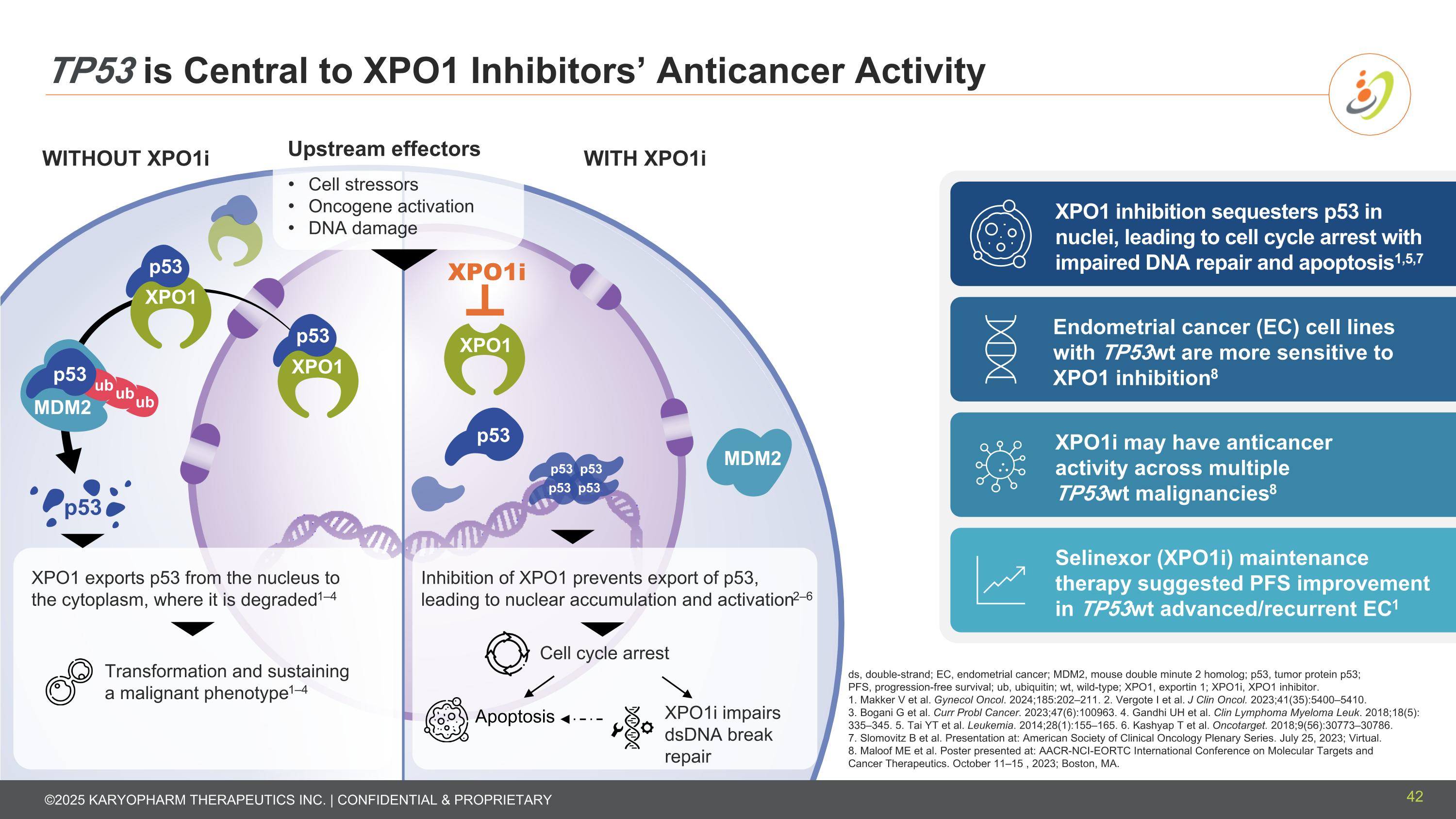

WITHOUT XPO1i WITH XPO1i TP53 is Central to XPO1 Inhibitors’ Anticancer Activity Cell stressors Oncogene activation DNA damage XPO1 inhibition sequesters p53 in nuclei, leading to cell cycle arrest with impaired DNA repair and apoptosis1,5,7 XPO1i may have anticancer activity across multiple TP53wt malignancies8 Endometrial cancer (EC) cell lines with TP53wt are more sensitive to XPO1 inhibition8 Selinexor (XPO1i) maintenance therapy suggested PFS improvement in TP53wt advanced/recurrent EC1 ds, double-strand; EC, endometrial cancer; MDM2, mouse double minute 2 homolog; p53, tumor protein p53; PFS, progression-free survival; ub, ubiquitin; wt, wild-type; XPO1, exportin 1; XPO1i, XPO1 inhibitor. 1. Makker V et al. Gynecol Oncol. 2024;185:202–211. 2. Vergote I et al. J Clin Oncol. 2023;41(35):5400–5410. 3. Bogani G et al. Curr Probl Cancer. 2023;47(6):100963. 4. Gandhi UH et al. Clin Lymphoma Myeloma Leuk. 2018;18(5): 335–345. 5. Tai YT et al. Leukemia. 2014;28(1):155–165. 6. Kashyap T et al. Oncotarget. 2018;9(56):30773–30786. 7. Slomovitz B et al. Presentation at: American Society of Clinical Oncology Plenary Series. July 25, 2023; Virtual. 8. Maloof ME et al. Poster presented at: AACR-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics. October 11–15 , 2023; Boston, MA. Inhibition of XPO1 prevents export of p53, leading to nuclear accumulation and activation2–6 Cell cycle arrest XPO1i impairs dsDNA break repair Apoptosis XPO1 exports p53 from the nucleus to the cytoplasm, where it is degraded1–4 Transformation and sustaining a malignant phenotype1–4 Upstream effectors 42

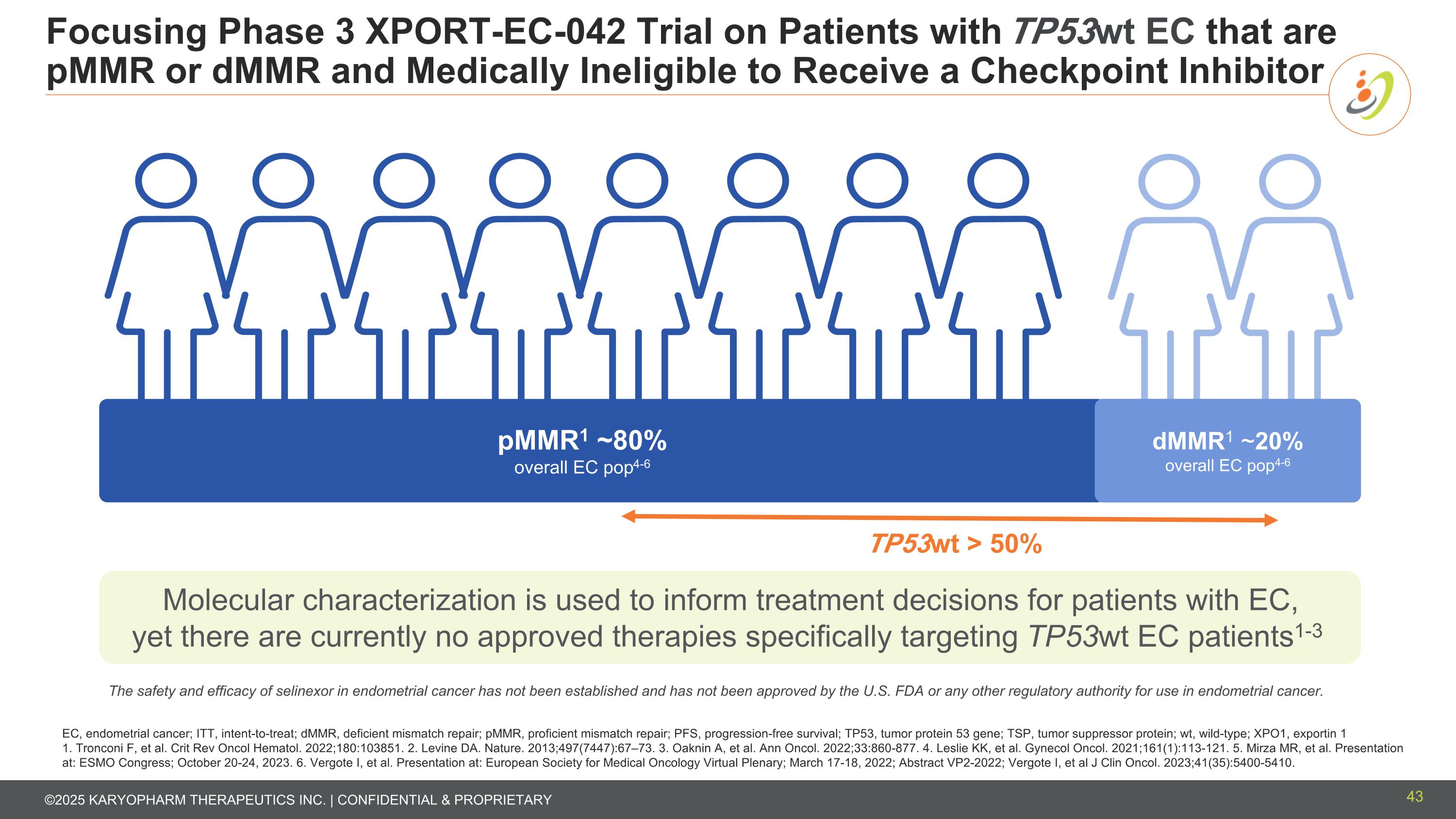

Focusing Phase 3 XPORT-EC-042 Trial on Patients with TP53wt EC that are pMMR or dMMR and Medically Ineligible to Receive a Checkpoint Inhibitor EC, endometrial cancer; ITT, intent-to-treat; dMMR, deficient mismatch repair; pMMR, proficient mismatch repair; PFS, progression-free survival; TP53, tumor protein 53 gene; TSP, tumor suppressor protein; wt, wild-type; XPO1, exportin 1 1. Tronconi F, et al. Crit Rev Oncol Hematol. 2022;180:103851. 2. Levine DA. Nature. 2013;497(7447):67–73. 3. Oaknin A, et al. Ann Oncol. 2022;33:860-877. 4. Leslie KK, et al. Gynecol Oncol. 2021;161(1):113-121. 5. Mirza MR, et al. Presentation at: ESMO Congress; October 20-24, 2023. 6. Vergote I, et al. Presentation at: European Society for Medical Oncology Virtual Plenary; March 17-18, 2022; Abstract VP2-2022; Vergote I, et al J Clin Oncol. 2023;41(35):5400-5410. TP53wt > 50% Molecular characterization is used to inform treatment decisions for patients with EC, yet there are currently no approved therapies specifically targeting TP53wt EC patients1-3 pMMR1 ~80% overall EC pop4-6 dMMR1 ~20% overall EC pop4-6 The safety and efficacy of selinexor in endometrial cancer has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in endometrial cancer. 43

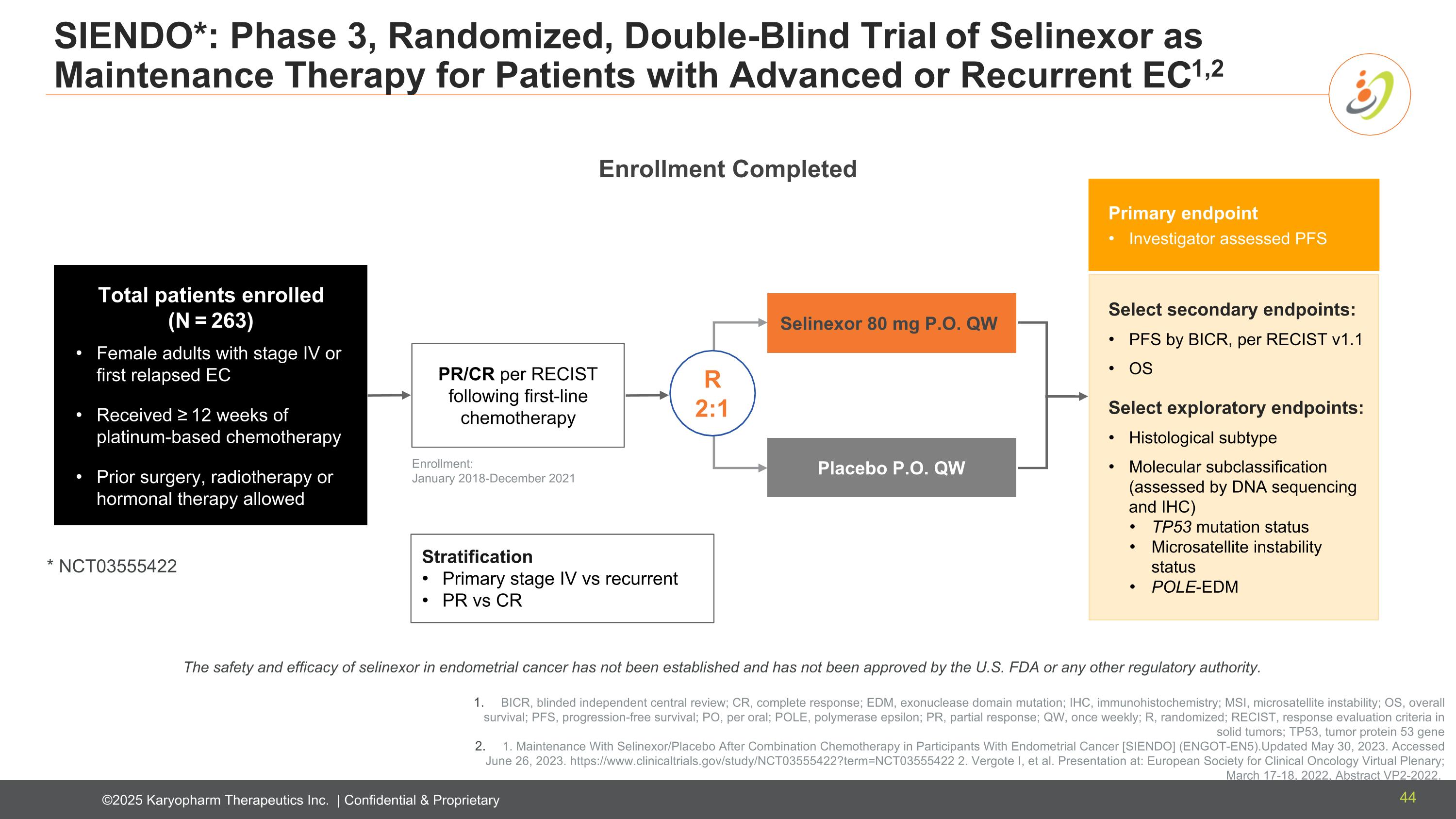

Stratification Primary stage IV vs recurrent PR vs CR Total patients enrolled (N = 263) Female adults with stage IV or first relapsed EC Received ≥ 12 weeks of platinum-based chemotherapy Prior surgery, radiotherapy or hormonal therapy allowed Enrollment: January 2018-December 2021 SIENDO*: Phase 3, Randomized, Double-Blind Trial of Selinexor as Maintenance Therapy for Patients with Advanced or Recurrent EC1,2 Primary endpoint Investigator assessed PFS Select secondary endpoints: PFS by BICR, per RECIST v1.1 OS Select exploratory endpoints: Histological subtype Molecular subclassification (assessed by DNA sequencing and IHC) TP53 mutation status Microsatellite instability status POLE-EDM Selinexor 80 mg P.O. QW Placebo P.O. QW R 2:1 PR/CR per RECIST following first-line chemotherapy * NCT03555422 Enrollment Completed BICR, blinded independent central review; CR, complete response; EDM, exonuclease domain mutation; IHC, immunohistochemistry; MSI, microsatellite instability; OS, overall survival; PFS, progression-free survival; PO, per oral; POLE, polymerase epsilon; PR, partial response; QW, once weekly; R, randomized; RECIST, response evaluation criteria in solid tumors; TP53, tumor protein 53 gene 1. Maintenance With Selinexor/Placebo After Combination Chemotherapy in Participants With Endometrial Cancer [SIENDO] (ENGOT-EN5).Updated May 30, 2023. Accessed June 26, 2023. https://www.clinicaltrials.gov/study/NCT03555422?term=NCT03555422 2. Vergote I, et al. Presentation at: European Society for Clinical Oncology Virtual Plenary; March 17-18, 2022, Abstract VP2-2022. The safety and efficacy of selinexor in endometrial cancer has not been established and has not been approved by the U.S. FDA or any other regulatory authority. 44

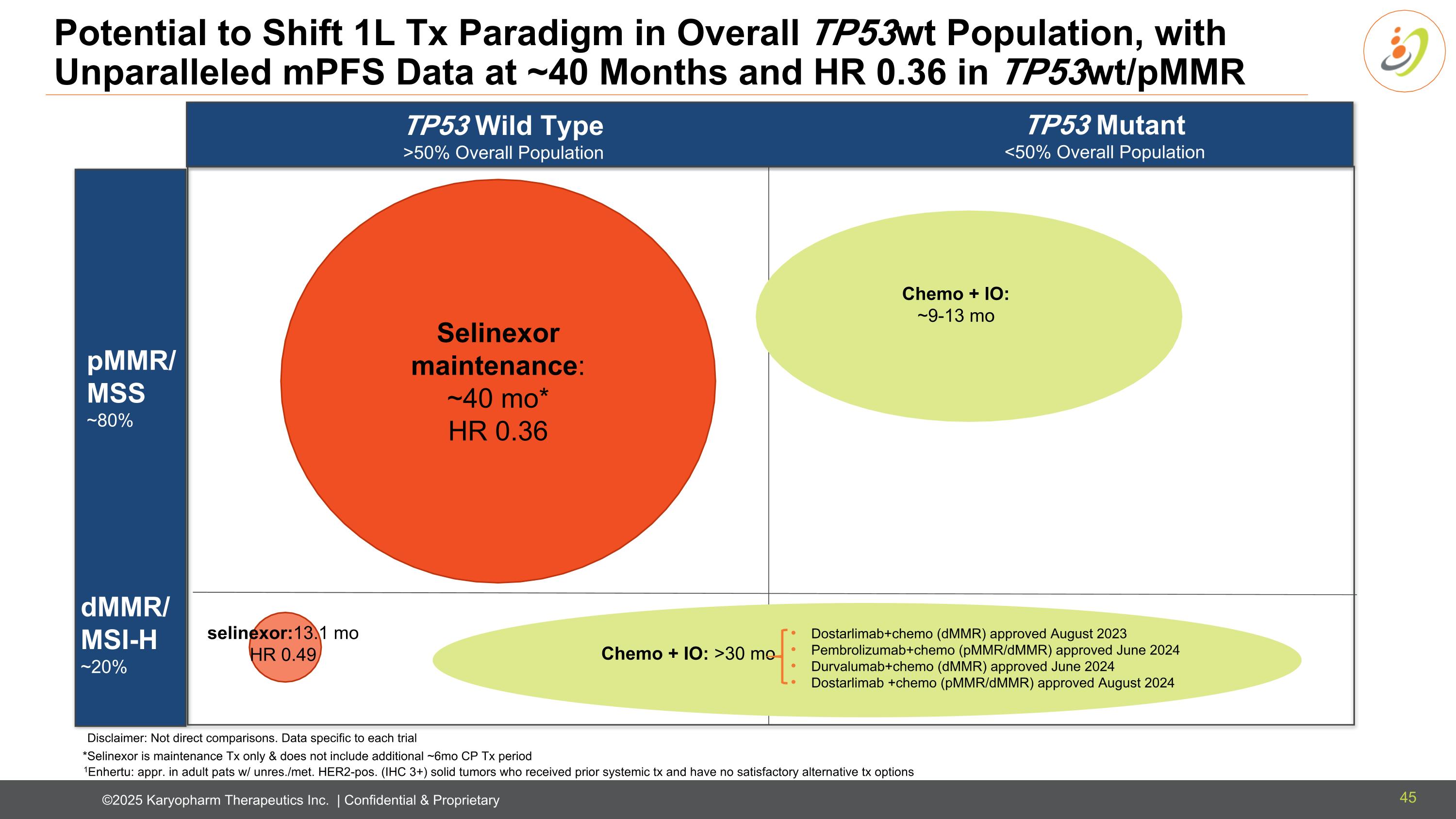

Potential to Shift 1L Tx Paradigm in Overall TP53wt Population, with Unparalleled mPFS Data at ~40 Months and HR 0.36 in TP53wt/pMMR TP53 Wild Type >50% Overall Population TP53 Mutant <50% Overall Population dMMR/MSI-H ~20% pMMR/MSS ~80% SELINEXOR *Selinexor is maintenance Tx only & does not include additional ~6mo CP Tx period Selinexor maintenance: ~40 mo* HR 0.36 Chemo + IO: ~9-13 mo selinexor:13.1 mo HR 0.49 1Enhertu: appr. in adult pats w/ unres./met. HER2-pos. (IHC 3+) solid tumors who received prior systemic tx and have no satisfactory alternative tx options Chemo + IO: >30 mo Disclaimer: Not direct comparisons. Data specific to each trial Dostarlimab+chemo (dMMR) approved August 2023 Pembrolizumab+chemo (pMMR/dMMR) approved June 2024 Durvalumab+chemo (dMMR) approved June 2024 Dostarlimab +chemo (pMMR/dMMR) approved August 2024 45

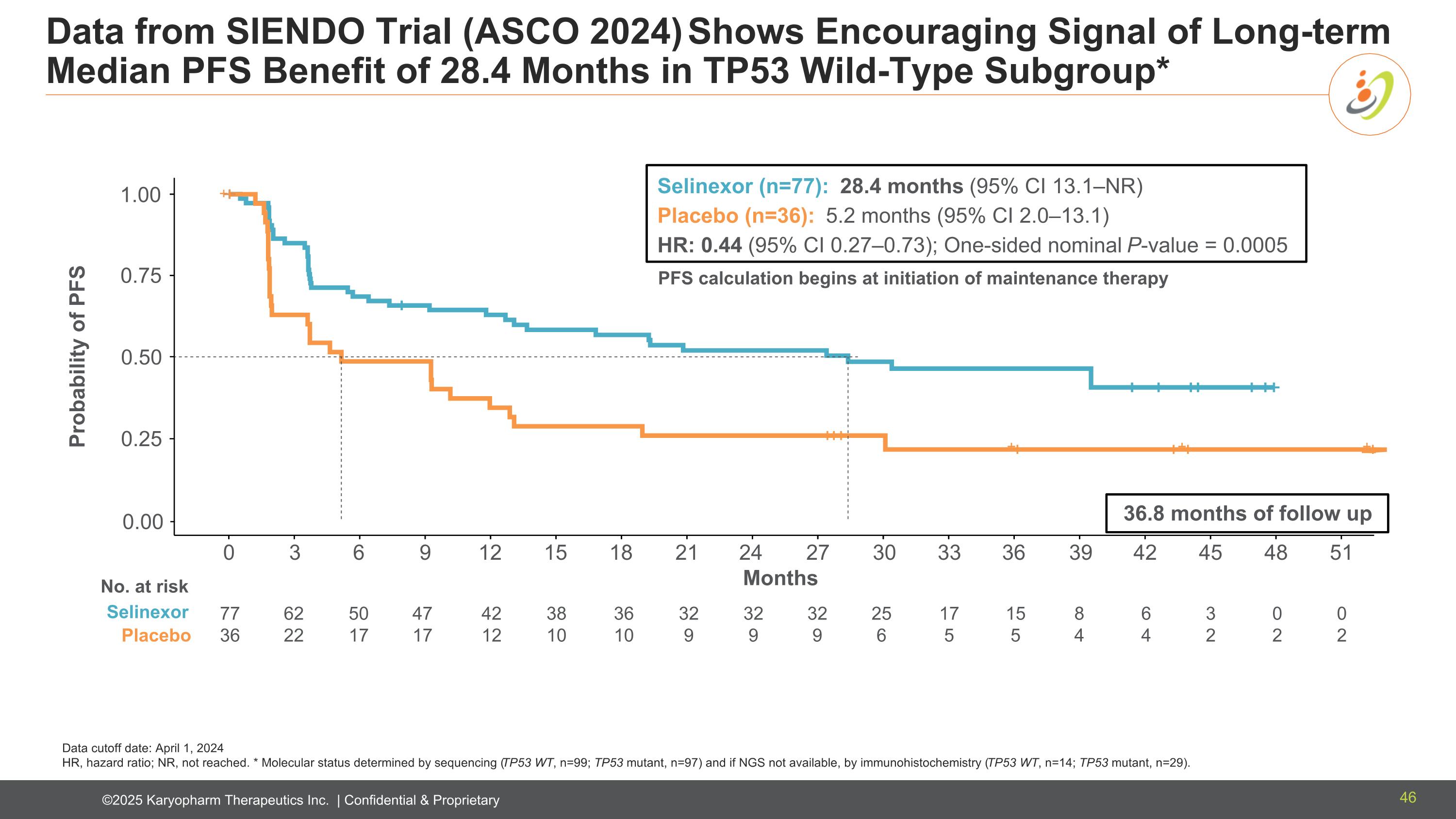

Data from SIENDO Trial (ASCO 2024) Shows Encouraging Signal of Long-term Median PFS Benefit of 28.4 Months in TP53 Wild-Type Subgroup* Data cutoff date: April 1, 2024 HR, hazard ratio; NR, not reached. * Molecular status determined by sequencing (TP53 WT, n=99; TP53 mutant, n=97) and if NGS not available, by immunohistochemistry (TP53 WT, n=14; TP53 mutant, n=29). + + + + 0.00 0.25 0.50 0.75 1.00 0 3 6 9 12 15 18 21 24 27 30 33 36 39 42 45 48 51 Probability of PFS Months No. at risk Selinexor Placebo 77 36 62 22 50 17 47 17 42 12 38 10 36 10 32 9 32 9 25 6 17 5 32 9 15 5 8 4 6 4 3 2 0 2 0 2 Selinexor (n=77): 28.4 months (95% CI 13.1–NR) Placebo (n=36): 5.2 months (95% CI 2.0–13.1) HR: 0.44 (95% CI 0.27–0.73); One-sided nominal P-value = 0.0005 PFS calculation begins at initiation of maintenance therapy 36.8 months of follow up 46

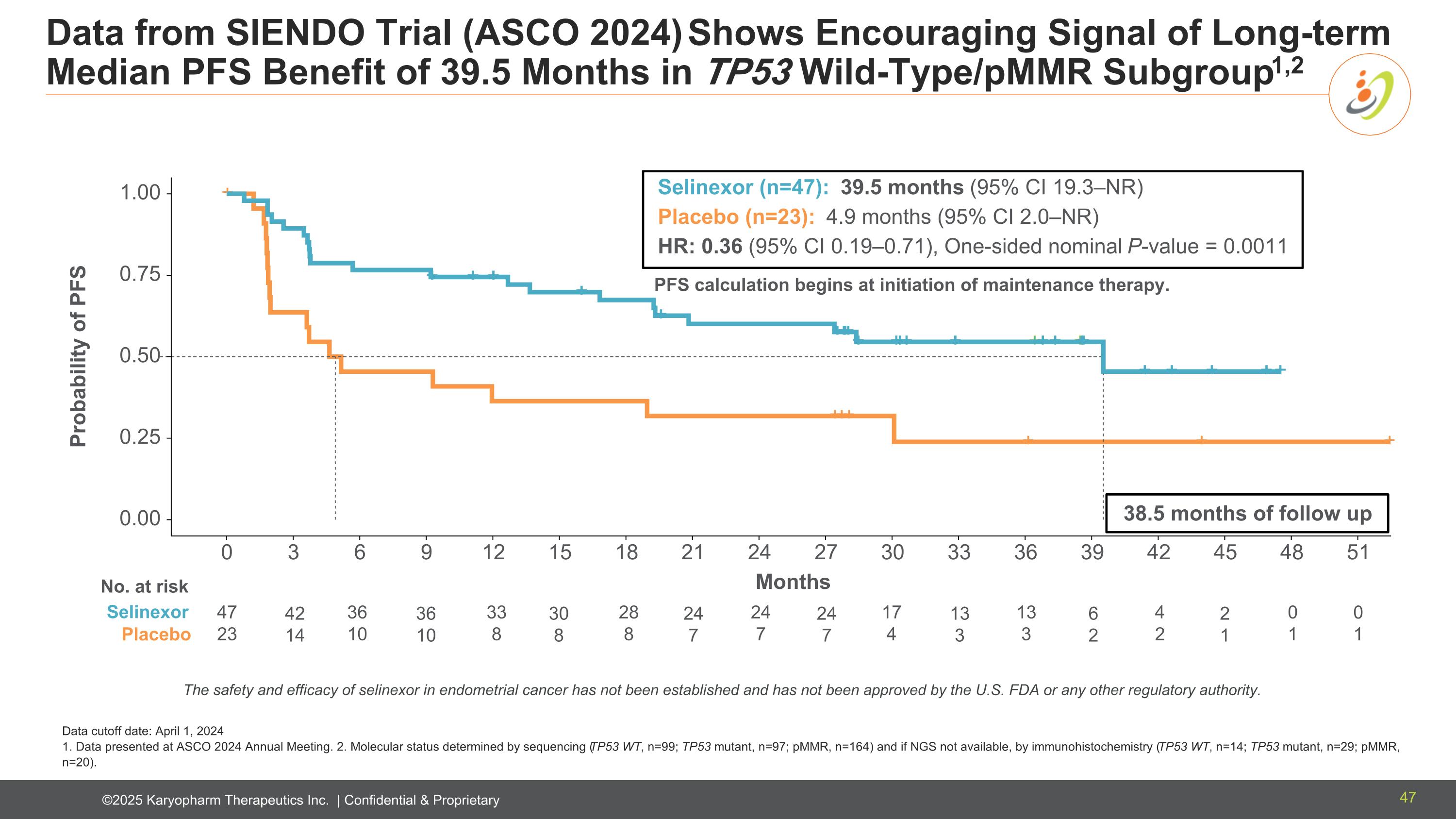

Data from SIENDO Trial (ASCO 2024) Shows Encouraging Signal of Long-term Median PFS Benefit of 39.5 Months in TP53 Wild-Type/pMMR Subgroup1,2 Data cutoff date: April 1, 2024 1. Data presented at ASCO 2024 Annual Meeting. 2. Molecular status determined by sequencing (TP53 WT, n=99; TP53 mutant, n=97; pMMR, n=164) and if NGS not available, by immunohistochemistry (TP53 WT, n=14; TP53 mutant, n=29; pMMR, n=20). 0.00 0.25 0.50 0.75 1.00 0 3 6 9 12 15 18 21 24 27 30 33 36 39 42 45 48 51 + + Selin e xor Placebo Selinexor (n=47): 39.5 months (95% CI 19.3–NR) Placebo (n=23): 4.9 months (95% CI 2.0–NR) HR: 0.36 (95% CI 0.19–0.71), One-sided nominal P-value = 0.0011 Probability of PFS 38.5 months of follow up Months 47 23 36 10 33 8 28 8 24 7 17 4 13 3 4 2 0 1 PFS calculation begins at initiation of maintenance therapy. No. at risk Selinexor Placebo 42 14 36 10 30 8 24 7 13 3 24 7 6 2 2 1 0 1 The safety and efficacy of selinexor in endometrial cancer has not been established and has not been approved by the U.S. FDA or any other regulatory authority. 47

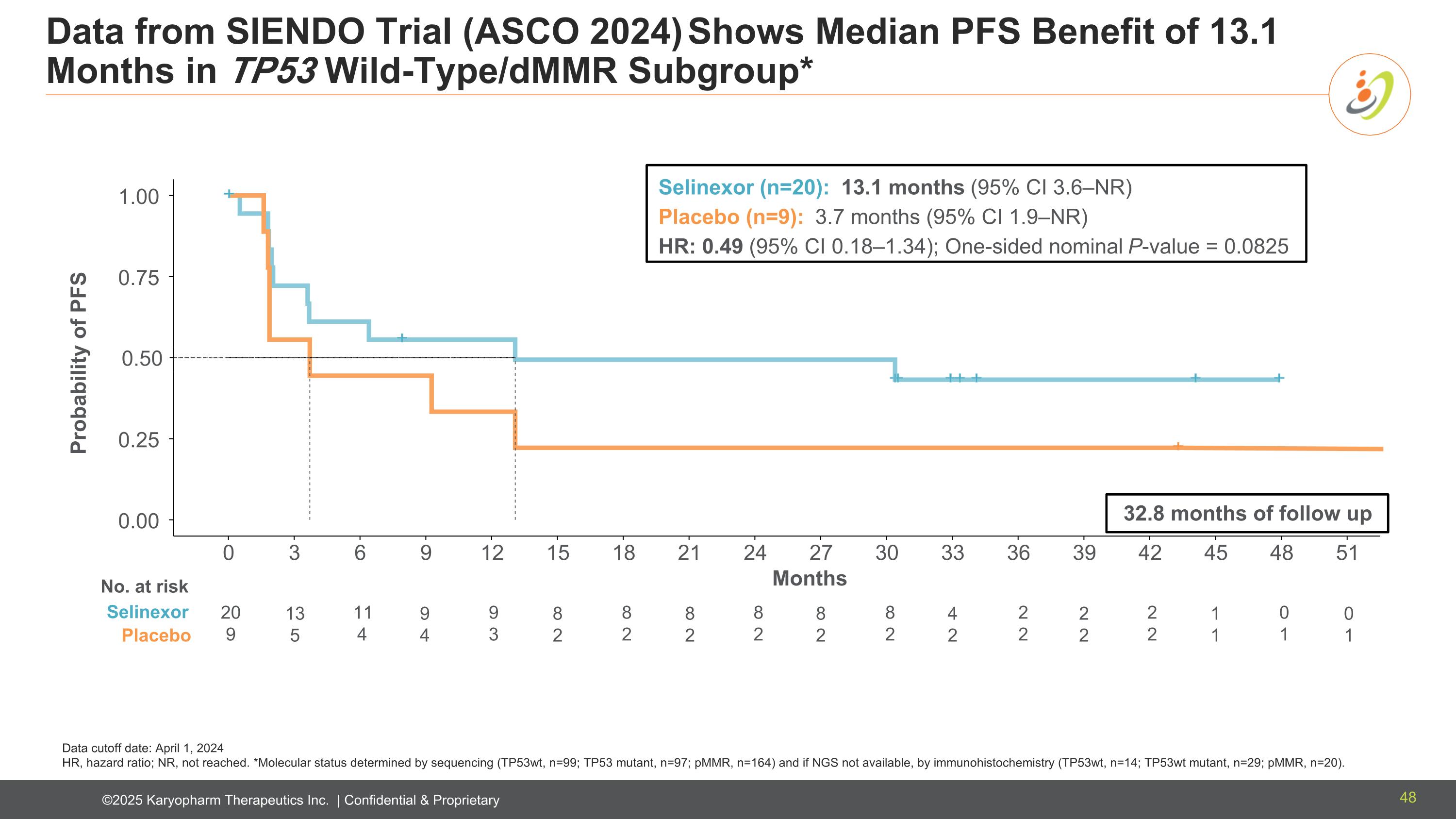

Data from SIENDO Trial (ASCO 2024) Shows Median PFS Benefit of 13.1 Months in TP53 Wild-Type/dMMR Subgroup* Data cutoff date: April 1, 2024 HR, hazard ratio; NR, not reached. *Molecular status determined by sequencing (TP53wt, n=99; TP53 mutant, n=97; pMMR, n=164) and if NGS not available, by immunohistochemistry (TP53wt, n=14; TP53wt mutant, n=29; pMMR, n=20). TP53wt/dMMR* subgroup 0.00 0.25 0.75 1.00 0 3 6 9 12 15 18 21 24 27 30 33 36 39 42 45 48 51 + + Selin e xor Placebo Probability of PFS Months 20 9 11 4 9 3 8 2 8 2 8 2 2 2 2 2 0 1 Selinexor (n=20): 13.1 months (95% CI 3.6–NR) Placebo (n=9): 3.7 months (95% CI 1.9–NR) HR: 0.49 (95% CI 0.18–1.34); One-sided nominal P-value = 0.0825 0.50 No. at risk Selinexor Placebo 32.8 months of follow up 13 5 9 4 8 2 8 2 4 2 8 2 2 2 1 1 0 1 48

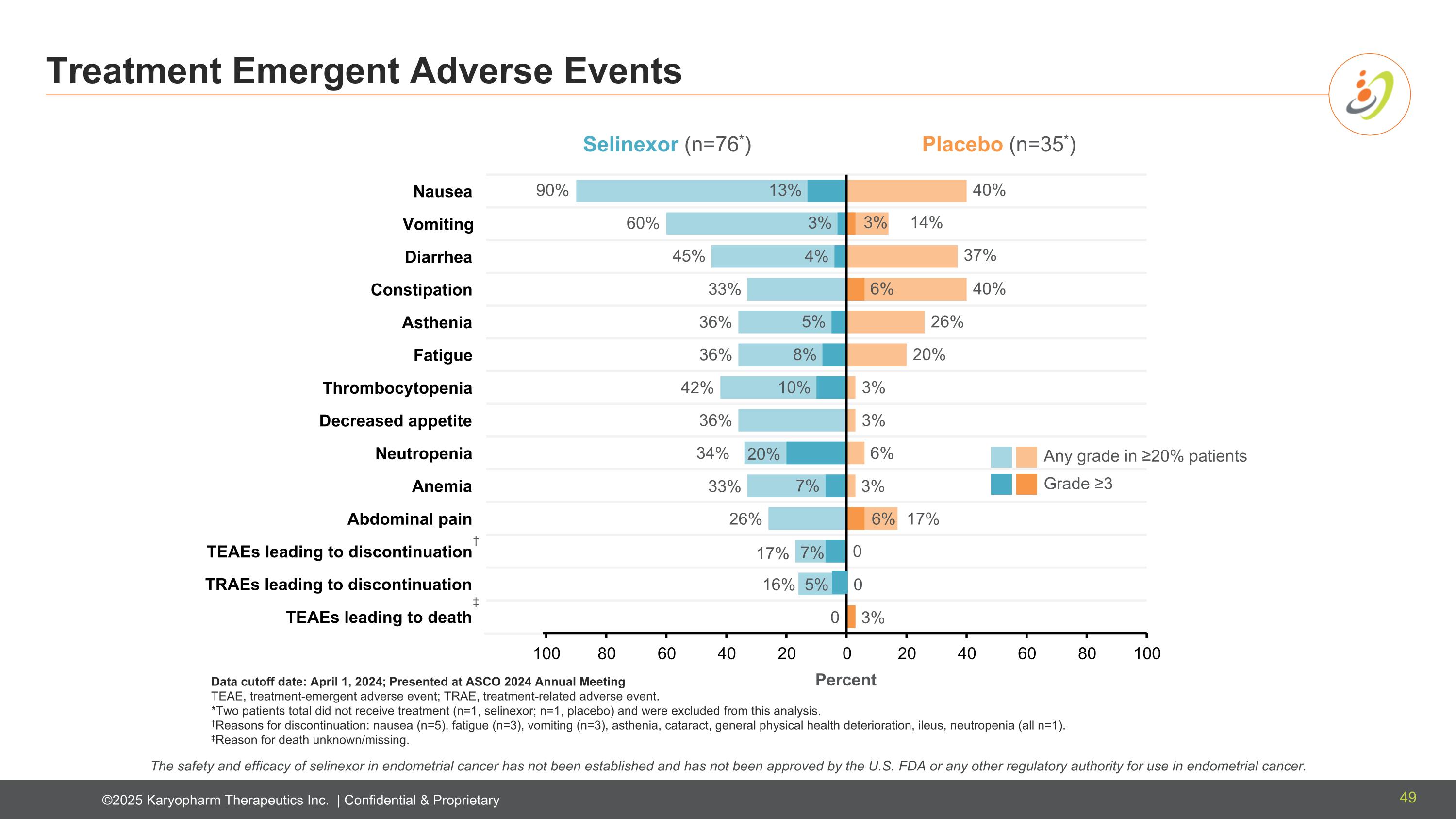

Treatment Emergent Adverse Events Data cutoff date: April 1, 2024; Presented at ASCO 2024 Annual Meeting TEAE, treatment-emergent adverse event; TRAE, treatment-related adverse event. *Two patients total did not receive treatment (n=1, selinexor; n=1, placebo) and were excluded from this analysis. †Reasons for discontinuation: nausea (n=5), fatigue (n=3), vomiting (n=3), asthenia, cataract, general physical health deterioration, ileus, neutropenia (all n=1). ‡Reason for death unknown/missing. Selinexor (n=76*) Placebo (n=35*) 90% 60% 45% 33% 36% 36% 42% 36% 34% 33% 26% 17% 0 16% 5% 40% 14% 37% 40% 26% 20% 3% 3% 6% 3% 17% 3% 0 0 3% 6% 6% 13% 3% 4% 5% 8% 10% 20% 7% 7% Any grade in ≥20% patients Grade ≥3 † ‡ Percent The safety and efficacy of selinexor in endometrial cancer has not been established and has not been approved by the U.S. FDA or any other regulatory authority for use in endometrial cancer. 49

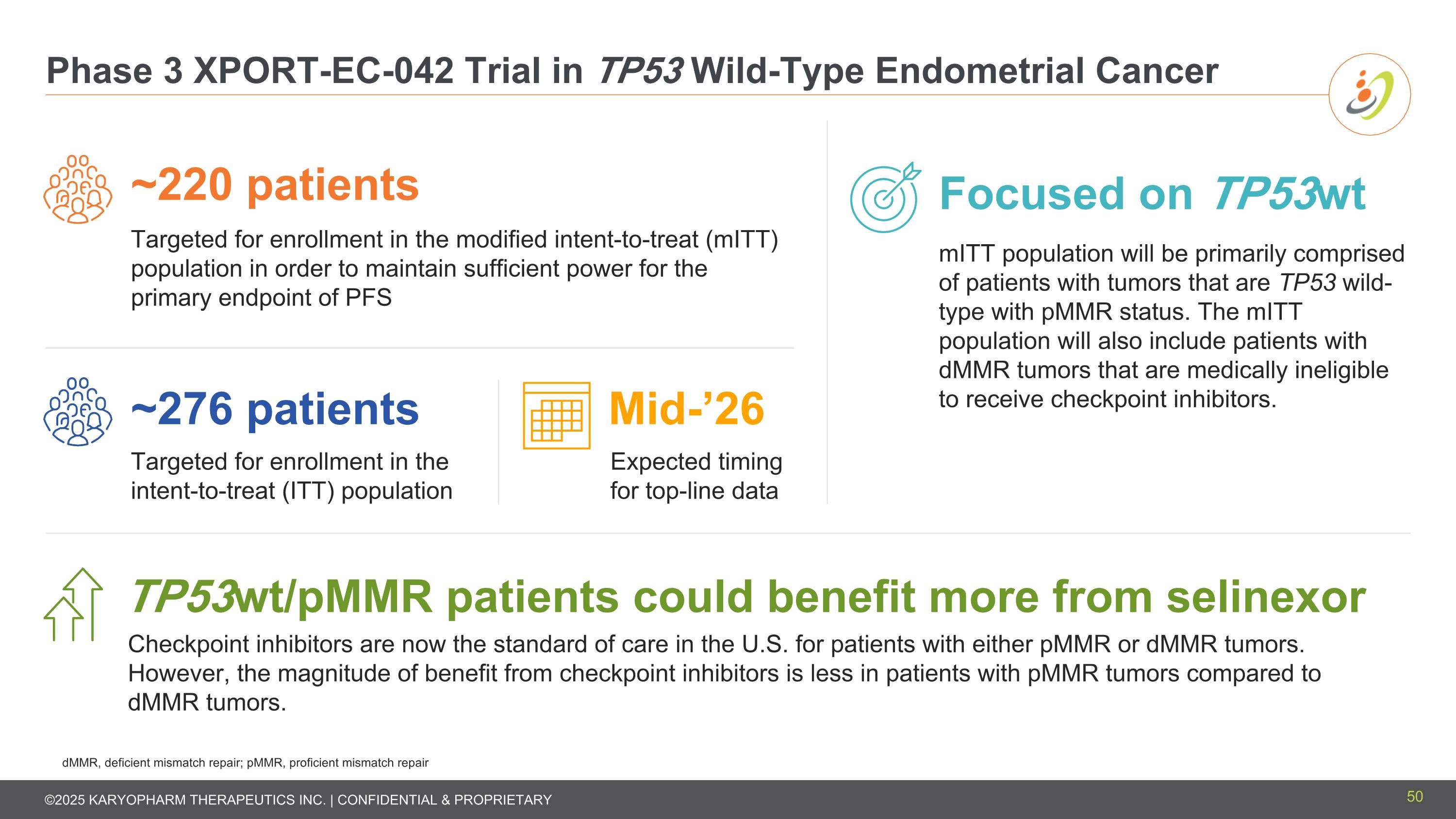

Phase 3 XPORT-EC-042 Trial in TP53 Wild-Type Endometrial Cancer ~276 patients Targeted for enrollment in the intent-to-treat (ITT) population Mid-’26 Expected timing for top-line data ~220 patients Targeted for enrollment in the modified intent-to-treat (mITT) population in order to maintain sufficient power for the primary endpoint of PFS Focused on TP53wt mITT population will be primarily comprised of patients with tumors that are TP53 wild-type with pMMR status. The mITT population will also include patients with dMMR tumors that are medically ineligible to receive checkpoint inhibitors. TP53wt/pMMR patients could benefit more from selinexor Checkpoint inhibitors are now the standard of care in the U.S. for patients with either pMMR or dMMR tumors. However, the magnitude of benefit from checkpoint inhibitors is less in patients with pMMR tumors compared to dMMR tumors. dMMR, deficient mismatch repair; pMMR, proficient mismatch repair 50

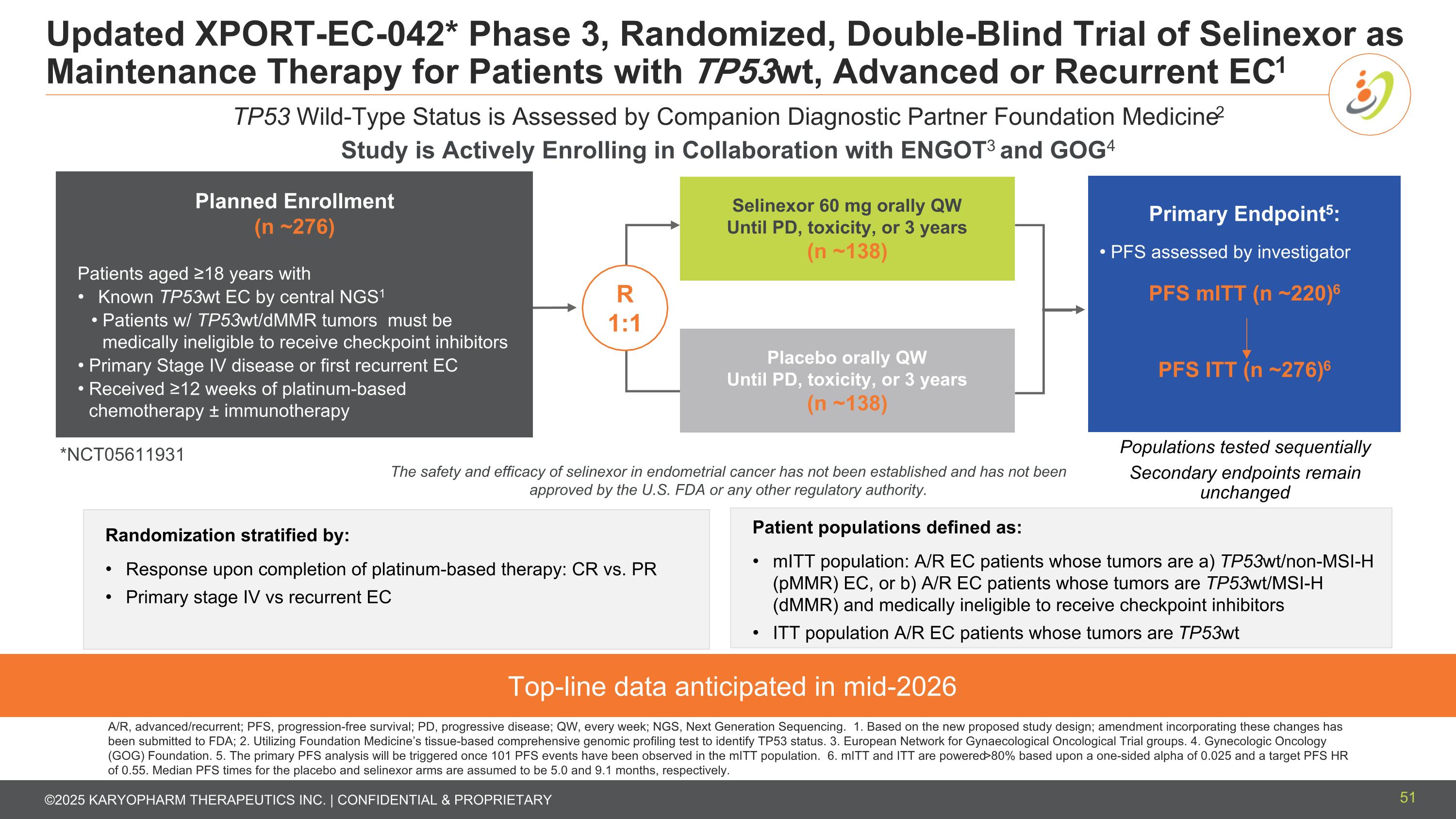

Updated XPORT-EC-042* Phase 3, Randomized, Double-Blind Trial of Selinexor as Maintenance Therapy for Patients with TP53wt, Advanced or Recurrent EC1 Top-line data anticipated in mid-2026 TP53 Wild-Type Status is Assessed by Companion Diagnostic Partner Foundation Medicine2 Planned Enrollment (n ~276) Patients aged ≥18 years with Known TP53wt EC by central NGS1 Patients w/ TP53wt/dMMR tumors must be medically ineligible to receive checkpoint inhibitors Primary Stage IV disease or first recurrent EC Received ≥12 weeks of platinum-based chemotherapy ± immunotherapy Selinexor 60 mg orally QW Until PD, toxicity, or 3 years (n ~138) Placebo orally QW Until PD, toxicity, or 3 years (n ~138) R 1:1 Primary Endpoint5: PFS assessed by investigator PFS mITT (n ~220)6 PFS ITT (n ~276)6 Randomization stratified by: Response upon completion of platinum-based therapy: CR vs. PR Primary stage IV vs recurrent EC Populations tested sequentially Secondary endpoints remain unchanged Patient populations defined as: mITT population: A/R EC patients whose tumors are a) TP53wt/non-MSI-H (pMMR) EC, or b) A/R EC patients whose tumors are TP53wt/MSI-H (dMMR) and medically ineligible to receive checkpoint inhibitors ITT population A/R EC patients whose tumors are TP53wt A/R, advanced/recurrent; PFS, progression-free survival; PD, progressive disease; QW, every week; NGS, Next Generation Sequencing. 1. Based on the new proposed study design; amendment incorporating these changes has been submitted to FDA; 2. Utilizing Foundation Medicine’s tissue-based comprehensive genomic profiling test to identify TP53 status. 3. European Network for Gynaecological Oncological Trial groups. 4. Gynecologic Oncology (GOG) Foundation. 5. The primary PFS analysis will be triggered once 101 PFS events have been observed in the mITT population. 6. mITT and ITT are powered >80% based upon a one-sided alpha of 0.025 and a target PFS HR of 0.55. Median PFS times for the placebo and selinexor arms are assumed to be 5.0 and 9.1 months, respectively. *NCT05611931 The safety and efficacy of selinexor in endometrial cancer has not been established and has not been approved by the U.S. FDA or any other regulatory authority. Study is Actively Enrolling in Collaboration with ENGOT3 and GOG4 51

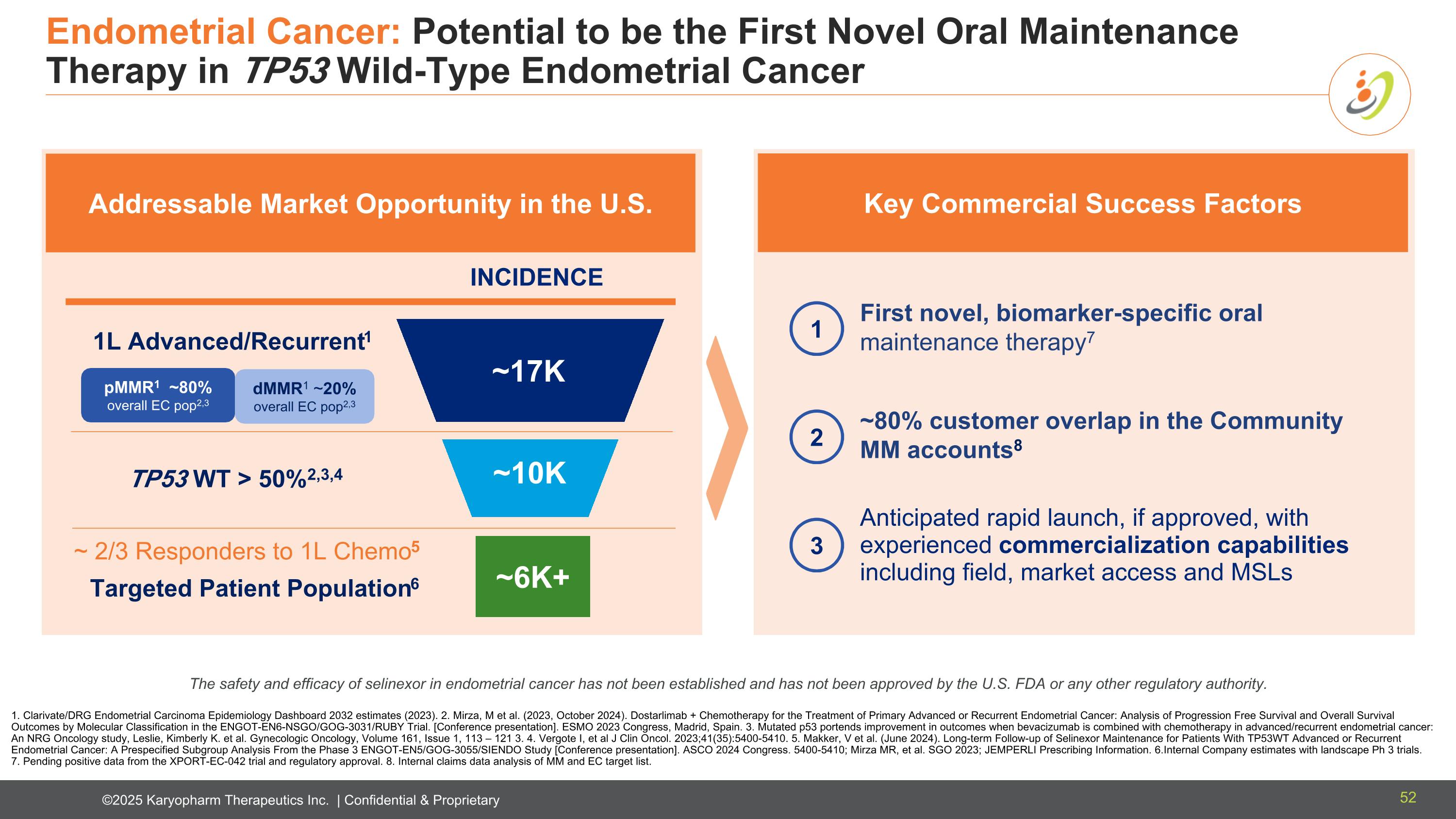

Endometrial Cancer: Potential to be the First Novel Oral Maintenance Therapy in TP53 Wild-Type Endometrial Cancer Anticipated rapid launch, if approved, with experienced commercialization capabilities including field, market access and MSLs First novel, biomarker-specific oral maintenance therapy7 ~80% customer overlap in the Community MM accounts8 Key Commercial Success Factors 1. Clarivate/DRG Endometrial Carcinoma Epidemiology Dashboard 2032 estimates (2023). 2. Mirza, M et al. (2023, October 2024). Dostarlimab + Chemotherapy for the Treatment of Primary Advanced or Recurrent Endometrial Cancer: Analysis of Progression Free Survival and Overall Survival Outcomes by Molecular Classification in the ENGOT-EN6-NSGO/GOG-3031/RUBY Trial. [Conference presentation]. ESMO 2023 Congress, Madrid, Spain. 3. Mutated p53 portends improvement in outcomes when bevacizumab is combined with chemotherapy in advanced/recurrent endometrial cancer: An NRG Oncology study, Leslie, Kimberly K. et al. Gynecologic Oncology, Volume 161, Issue 1, 113 – 121 3. 4. Vergote I, et al J Clin Oncol. 2023;41(35):5400-5410. 5. Makker, V et al. (June 2024). Long-term Follow-up of Selinexor Maintenance for Patients With TP53WT Advanced or Recurrent Endometrial Cancer: A Prespecified Subgroup Analysis From the Phase 3 ENGOT-EN5/GOG-3055/SIENDO Study [Conference presentation]. ASCO 2024 Congress. 5400-5410; Mirza MR, et al. SGO 2023; JEMPERLI Prescribing Information. 6.Internal Company estimates with landscape Ph 3 trials. 7. Pending positive data from the XPORT-EC-042 trial and regulatory approval. 8. Internal claims data analysis of MM and EC target list. INCIDENCE ~17K pMMR1 ~80% overall EC pop2,3 dMMR1 ~20% overall EC pop2,3 1L Advanced/Recurrent1 ~10K TP53 WT > 50%2,3,4 ~6K+ Targeted Patient Population6 ~ 2/3 Responders to 1L Chemo5 Addressable Market Opportunity in the U.S. 1 3 2 The safety and efficacy of selinexor in endometrial cancer has not been established and has not been approved by the U.S. FDA or any other regulatory authority. 52

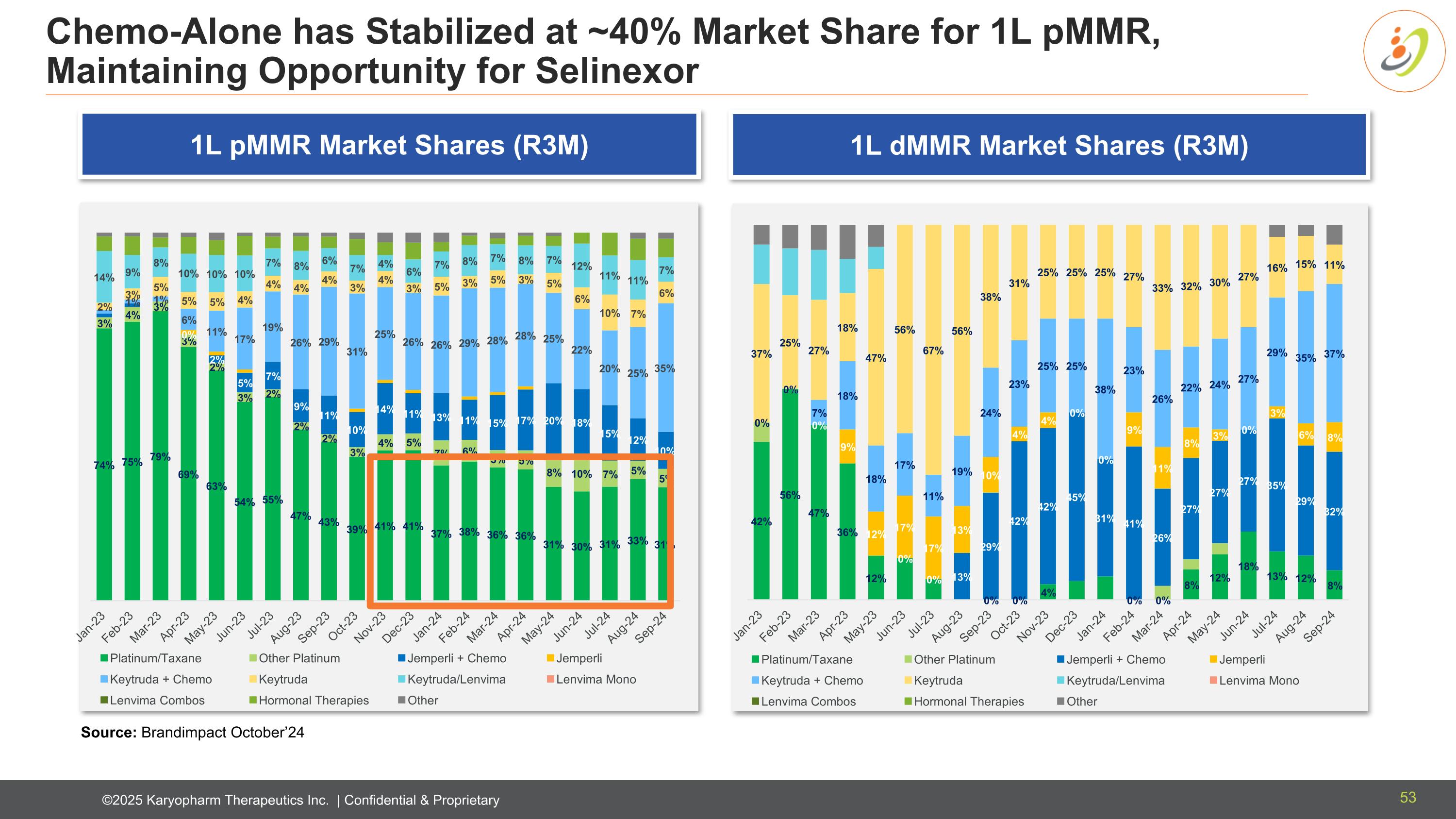

Chemo-Alone has Stabilized at ~40% Market Share for 1L pMMR, Maintaining Opportunity for Selinexor Source: Brandimpact October’24 1L pMMR Market Shares (R3M) 1L dMMR Market Shares (R3M) 53