Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

First Trust Series Fund

|

|

| Entity Central Index Key |

0001497778

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| C000092932 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Preferred Securitiesand Income Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

FPEAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPEAX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FPEAX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class A |

$69 |

1.40%(1) |

|

|

| Expenses Paid, Amount |

$ 69

|

|

| Expense Ratio, Percent |

1.40%

|

[1] |

| Net Assets |

$ 201,492,012

|

|

| Holdings Count | Holding |

209

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$201,492,012 |

| Total number of portfolio holdings |

209 |

| Portfolio turnover rate |

25% |

|

|

| Holdings [Text Block] |

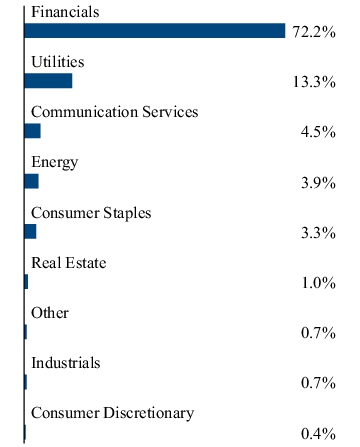

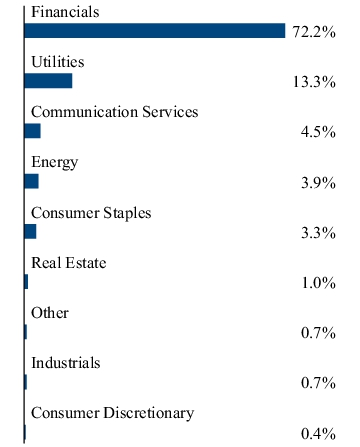

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

|

|

| C000092933 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Preferred Securitiesand Income Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

FPECX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPECX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FPECX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class C |

$106 |

2.15%(1) |

|

|

| Expenses Paid, Amount |

$ 106

|

|

| Expense Ratio, Percent |

2.15%

|

[2] |

| Net Assets |

$ 201,492,012

|

|

| Holdings Count | Holding |

209

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$201,492,012 |

| Total number of portfolio holdings |

209 |

| Portfolio turnover rate |

25% |

|

|

| Holdings [Text Block] |

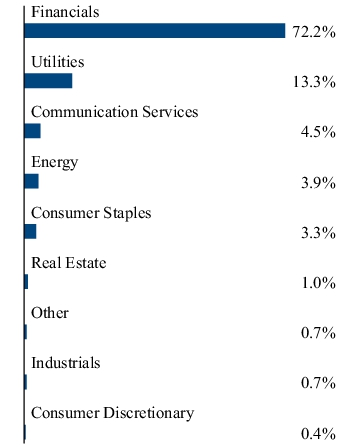

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

|

|

| C000092934 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Preferred Securitiesand Income Fund

|

|

| Class Name |

Class F

|

|

| Trading Symbol |

FPEFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPEFX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FPEFX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class F |

$64 |

1.30%(1) |

|

|

| Expenses Paid, Amount |

$ 64

|

|

| Expense Ratio, Percent |

1.30%

|

[3] |

| Net Assets |

$ 201,492,012

|

|

| Holdings Count | Holding |

209

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$201,492,012 |

| Total number of portfolio holdings |

209 |

| Portfolio turnover rate |

25% |

|

|

| Holdings [Text Block] |

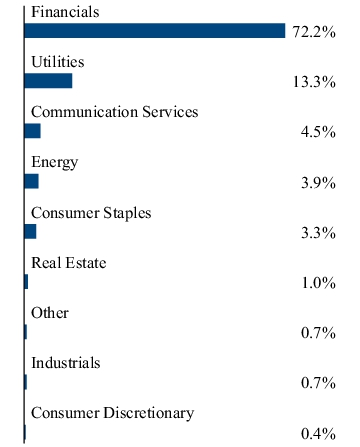

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

|

|

| C000092935 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Preferred Securitiesand Income Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

FPEIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPEIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FPEIX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class I |

$53 |

1.08%(1) |

|

|

| Expenses Paid, Amount |

$ 53

|

|

| Expense Ratio, Percent |

1.08%

|

[4] |

| Net Assets |

$ 201,492,012

|

|

| Holdings Count | Holding |

209

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$201,492,012 |

| Total number of portfolio holdings |

209 |

| Portfolio turnover rate |

25% |

|

|

| Holdings [Text Block] |

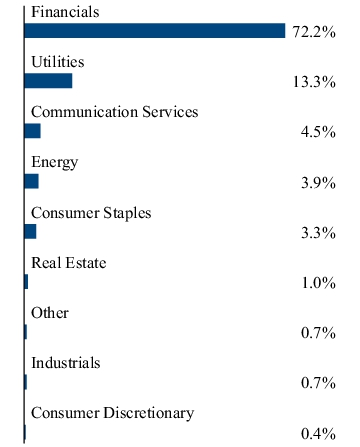

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

|

|

| C000092936 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Preferred Securitiesand Income Fund

|

|

| Class Name |

Class R3

|

|

| Trading Symbol |

FPERX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Preferred Securities and Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FPERX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FPERX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Preferred Securities and Income Fund - Class R3 |

$82 |

1.65%(1) |

|

|

| Expenses Paid, Amount |

$ 82

|

|

| Expense Ratio, Percent |

1.65%

|

[5] |

| Net Assets |

$ 201,492,012

|

|

| Holdings Count | Holding |

209

|

|

| Investment Company Portfolio Turnover |

25.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$201,492,012 |

| Total number of portfolio holdings |

209 |

| Portfolio turnover rate |

25% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bank of America Corp., 6.63% |

2.5% |

| Wells Fargo & Co., Series L, 7.50% |

2.3% |

| Barclays PLC, 8.00% |

2.1% |

| JPMorgan Chase & Co., Series NN, 6.88% |

1.7% |

| Credit Agricole S.A., 6.70% |

1.5% |

| Land O'Lakes, Inc., 8.00% |

1.4% |

| BNP Paribas S.A., 8.50% |

1.4% |

| Hartford Financial Services Group (The), Inc., 6.71%, 02/12/47 |

1.3% |

| Charles Schwab (The) Corp., Series H, 4.00% |

1.3% |

| Lloyds Banking Group PLC, 8.00% |

1.3% |

|

|

| C000092938 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust/Confluence Small Cap Value Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

FOVAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust/Confluence Small Cap Value Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FOVAX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FOVAX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust/Confluence Small Cap Value Fund - Class A |

$75 |

1.60%(1) |

|

|

| Expenses Paid, Amount |

$ 75

|

|

| Expense Ratio, Percent |

1.60%

|

[6] |

| Net Assets |

$ 17,766,167

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$17,766,167 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate |

13% |

|

|

| Holdings [Text Block] |

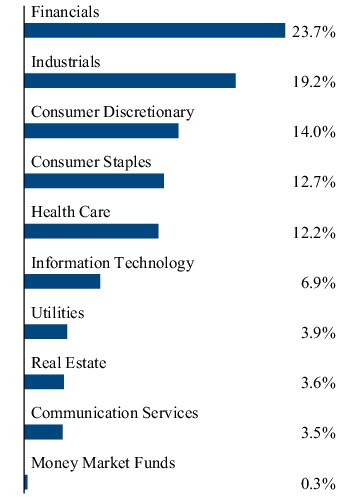

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| SJW Group |

3.9% |

| Baldwin Insurance (The) Group, Inc. |

3.9% |

| JBT Marel Corp. |

3.8% |

| Hagerty, Inc., Class A |

3.8% |

| I3 Verticals, Inc., Class A |

3.8% |

| Altus Group Ltd. |

3.6% |

| Sapiens International Corp., N.V. |

3.5% |

| Cavco Industries, Inc. |

3.5% |

| TripAdvisor, Inc. |

3.5% |

| J&J Snack Foods Corp. |

3.5% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| SJW Group |

3.9% |

| Baldwin Insurance (The) Group, Inc. |

3.9% |

| JBT Marel Corp. |

3.8% |

| Hagerty, Inc., Class A |

3.8% |

| I3 Verticals, Inc., Class A |

3.8% |

| Altus Group Ltd. |

3.6% |

| Sapiens International Corp., N.V. |

3.5% |

| Cavco Industries, Inc. |

3.5% |

| TripAdvisor, Inc. |

3.5% |

| J&J Snack Foods Corp. |

3.5% |

|

|

| C000092939 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust/Confluence Small Cap Value Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

FOVCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust/Confluence Small Cap Value Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FOVCX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FOVCX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust/Confluence Small Cap Value Fund - Class C |

$110 |

2.35%(1) |

|

|

| Expenses Paid, Amount |

$ 110

|

|

| Expense Ratio, Percent |

2.35%

|

[7] |

| Net Assets |

$ 17,766,167

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$17,766,167 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate |

13% |

|

|

| Holdings [Text Block] |

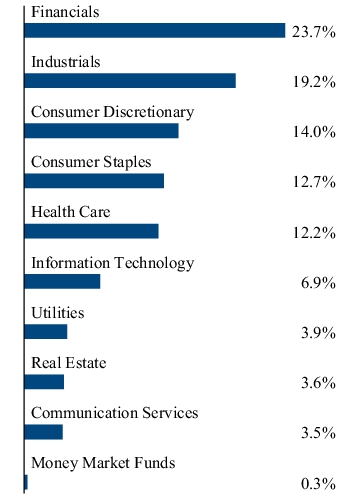

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| SJW Group |

3.9% |

| Baldwin Insurance (The) Group, Inc. |

3.9% |

| JBT Marel Corp. |

3.8% |

| Hagerty, Inc., Class A |

3.8% |

| I3 Verticals, Inc., Class A |

3.8% |

| Altus Group Ltd. |

3.6% |

| Sapiens International Corp., N.V. |

3.5% |

| Cavco Industries, Inc. |

3.5% |

| TripAdvisor, Inc. |

3.5% |

| J&J Snack Foods Corp. |

3.5% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| SJW Group |

3.9% |

| Baldwin Insurance (The) Group, Inc. |

3.9% |

| JBT Marel Corp. |

3.8% |

| Hagerty, Inc., Class A |

3.8% |

| I3 Verticals, Inc., Class A |

3.8% |

| Altus Group Ltd. |

3.6% |

| Sapiens International Corp., N.V. |

3.5% |

| Cavco Industries, Inc. |

3.5% |

| TripAdvisor, Inc. |

3.5% |

| J&J Snack Foods Corp. |

3.5% |

|

|

| C000092941 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust/Confluence Small Cap Value Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

FOVIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust/Confluence Small Cap Value Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FOVIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FOVIX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust/Confluence Small Cap Value Fund - Class I |

$63 |

1.35%(1) |

|

|

| Expenses Paid, Amount |

$ 63

|

|

| Expense Ratio, Percent |

1.35%

|

[8] |

| Net Assets |

$ 17,766,167

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$17,766,167 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate |

13% |

|

|

| Holdings [Text Block] |

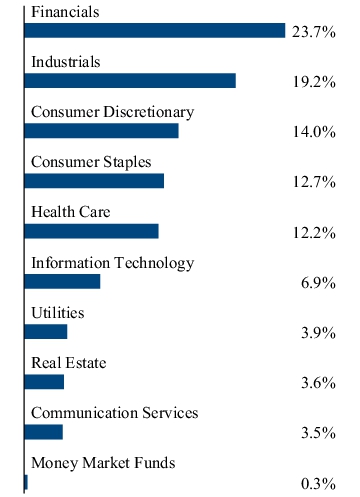

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| SJW Group |

3.9% |

| Baldwin Insurance (The) Group, Inc. |

3.9% |

| JBT Marel Corp. |

3.8% |

| Hagerty, Inc., Class A |

3.8% |

| I3 Verticals, Inc., Class A |

3.8% |

| Altus Group Ltd. |

3.6% |

| Sapiens International Corp., N.V. |

3.5% |

| Cavco Industries, Inc. |

3.5% |

| TripAdvisor, Inc. |

3.5% |

| J&J Snack Foods Corp. |

3.5% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| SJW Group |

3.9% |

| Baldwin Insurance (The) Group, Inc. |

3.9% |

| JBT Marel Corp. |

3.8% |

| Hagerty, Inc., Class A |

3.8% |

| I3 Verticals, Inc., Class A |

3.8% |

| Altus Group Ltd. |

3.6% |

| Sapiens International Corp., N.V. |

3.5% |

| Cavco Industries, Inc. |

3.5% |

| TripAdvisor, Inc. |

3.5% |

| J&J Snack Foods Corp. |

3.5% |

|

|

| C000118178 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Short Duration High Income Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

FDHAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Short Duration High Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FDHAX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FDHAX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Short Duration High Income Fund - Class A |

$63 |

1.25%(1) |

|

|

| Expenses Paid, Amount |

$ 63

|

|

| Expense Ratio, Percent |

1.25%

|

[9] |

| Net Assets |

$ 68,352,076

|

|

| Holdings Count | Holding |

222

|

|

| Investment Company Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$68,352,076 |

| Total number of portfolio holdings |

222 |

| Portfolio turnover rate |

45% |

|

|

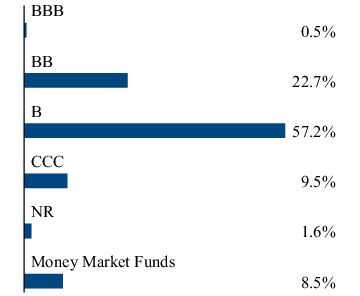

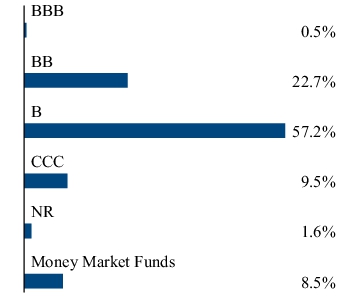

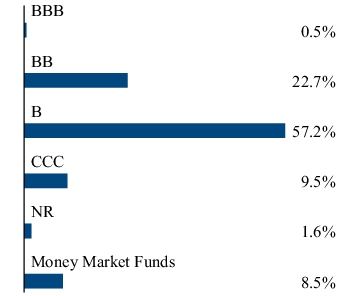

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of April 30, 2025) The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund. Fund Allocation

| Corporate Bonds and Notes |

47.4% |

| Senior Floating-Rate Loan Interests |

35.4% |

| Foreign Corporate Bonds and Notes |

9.1% |

| Money Market Funds |

8.5% |

| Common Stocks |

0.0% |

| Rights |

0.0% |

| Net Other Assets and Liabilities |

(0.4)% |

Credit Quality(2) Any amount shown as 0.0% represents less than 0.1%. (2) The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Quality Explanation [Text Block] |

The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated.

|

|

| C000121471 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Short Duration High Income Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

FDHCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Short Duration High Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FDHCX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FDHCX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Short Duration High Income Fund - Class C |

$100 |

2.00%(1) |

|

|

| Expenses Paid, Amount |

$ 100

|

|

| Expense Ratio, Percent |

2.00%

|

[10] |

| Net Assets |

$ 68,352,076

|

|

| Holdings Count | Holding |

222

|

|

| Investment Company Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$68,352,076 |

| Total number of portfolio holdings |

222 |

| Portfolio turnover rate |

45% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund.

Fund Allocation

| Corporate Bonds and Notes |

47.4% |

| Senior Floating-Rate Loan Interests |

35.4% |

| Foreign Corporate Bonds and Notes |

9.1% |

| Money Market Funds |

8.5% |

| Common Stocks |

0.0% |

| Rights |

0.0% |

| Net Other Assets and Liabilities |

(0.4)% |

Credit Quality(2)

Any amount shown as 0.0% represents less than 0.1%.

(2) The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Quality Explanation [Text Block] |

The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated.

|

|

| C000121472 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Short Duration High Income Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

FDHIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Short Duration High Income Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/FDHIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/FDHIX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Short Duration High Income Fund - Class I |

$50 |

1.00%(1) |

|

|

| Expenses Paid, Amount |

$ 50

|

|

| Expense Ratio, Percent |

1.00%

|

[11] |

| Net Assets |

$ 68,352,076

|

|

| Holdings Count | Holding |

222

|

|

| Investment Company Portfolio Turnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$68,352,076 |

| Total number of portfolio holdings |

222 |

| Portfolio turnover rate |

45% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund.

Fund Allocation

| Corporate Bonds and Notes |

47.4% |

| Senior Floating-Rate Loan Interests |

35.4% |

| Foreign Corporate Bonds and Notes |

9.1% |

| Money Market Funds |

8.5% |

| Common Stocks |

0.0% |

| Rights |

0.0% |

| Net Other Assets and Liabilities |

(0.4)% |

Credit Quality(2)

Any amount shown as 0.0% represents less than 0.1%.

(2) The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Quality Explanation [Text Block] |

The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

The ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated.

|

|

| C000232962 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Managed Municipal Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

CWAAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Managed Municipal Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/CWAAX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/CWAAX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Managed Municipal Fund - Class A |

$14(1) |

0.90%(2) |

| (1) |

Class A Shares commenced investment operations on March 4, 2025. Had the class been in operation for a complete six months, the cost of a $10,000 investment would have been higher.

|

| (2) |

Annualized.

|

|

|

| Expenses Paid, Amount |

$ 14

|

[12] |

| Expense Ratio, Percent |

0.90%

|

[13] |

| Net Assets |

$ 70,078,815

|

|

| Holdings Count | Holding |

134

|

|

| Investment Company Portfolio Turnover |

15.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$70,078,815 |

| Total number of portfolio holdings |

134 |

| Portfolio turnover rate |

15% |

|

|

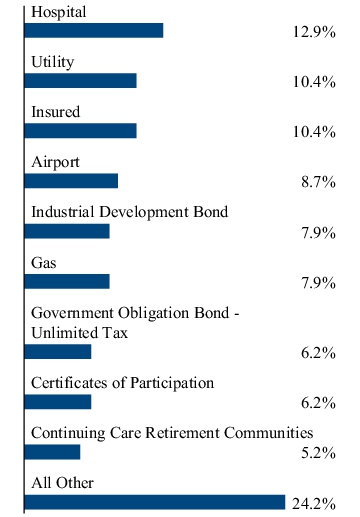

| Holdings [Text Block] |

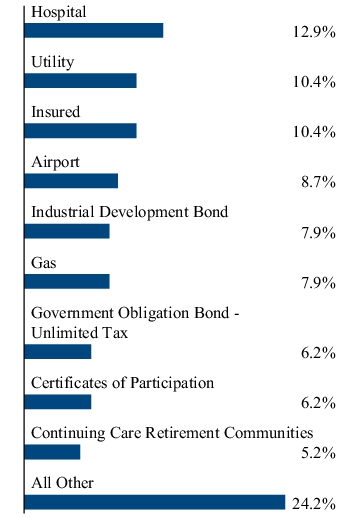

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Credit Quality(1)

| AAA |

4.6 |

| AA |

35.5 |

| A |

32.8 |

| BBB |

12.5 |

| BB |

3.0 |

| Not Rated |

11.6 |

Sector Allocation

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Quality Explanation [Text Block] |

The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO.

|

|

| C000232961 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Managed Municipal Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

CWAIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Managed Municipal Fund (the “Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/MF/CWAIX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/MF/CWAIX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Managed Municipal Fund - Class I |

$32 |

0.65%(1) |

|

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.65%

|

[14] |

| Net Assets |

$ 70,078,815

|

|

| Holdings Count | Holding |

134

|

|

| Investment Company Portfolio Turnover |

15.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of April 30, 2025)

| Fund net assets |

$70,078,815 |

| Total number of portfolio holdings |

134 |

| Portfolio turnover rate |

15% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of April 30, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| AAA |

4.6 |

| AA |

35.5 |

| A |

32.8 |

| BBB |

12.5 |

| BB |

3.0 |

| Not Rated |

11.6 |

Sector Allocation

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Quality Explanation [Text Block] |

The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO.

|

|

|

|