What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

|

Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

|---|---|---|

|

Applied

Finance Dividend Fund

- Institutional Class |

$99 |

0.97% |

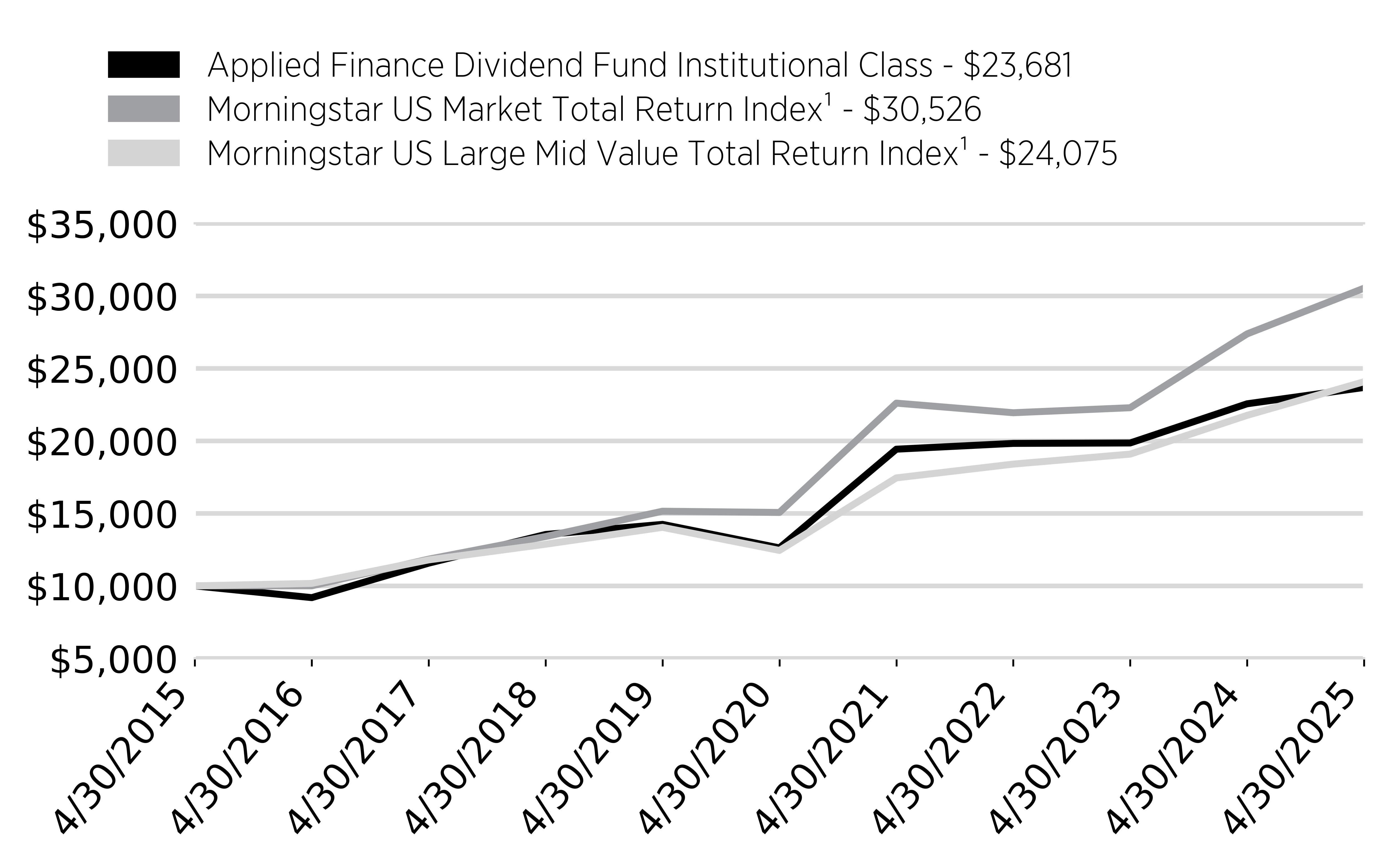

How did the Fund perform?

For the period of May 1, 2024 to April 30, 2025, the Applied Finance Dividend Fund Institutional Class Shares (the “Fund”) returned 4.99%.

In comparison, the Morningstar US Market Total Return Index returned 11.51% and the Morningstar US Large Mid Value Total Return Index returned 10.65% for the same period.

What key factors influenced performance?

US stocks rose gradually from May 2024 through January 2025 before peaking in mid-February. Uncertainty over tariffs and their effect on the economy pushed stocks lower in March and part of April, with indices rebounding by the end of the month.

The performance of the Morningstar US Market Total Return Index was strongest in the Financials and Information Technology sectors. During the 12 months ending April 30, 2025, Growth stocks outperformed Value stocks.

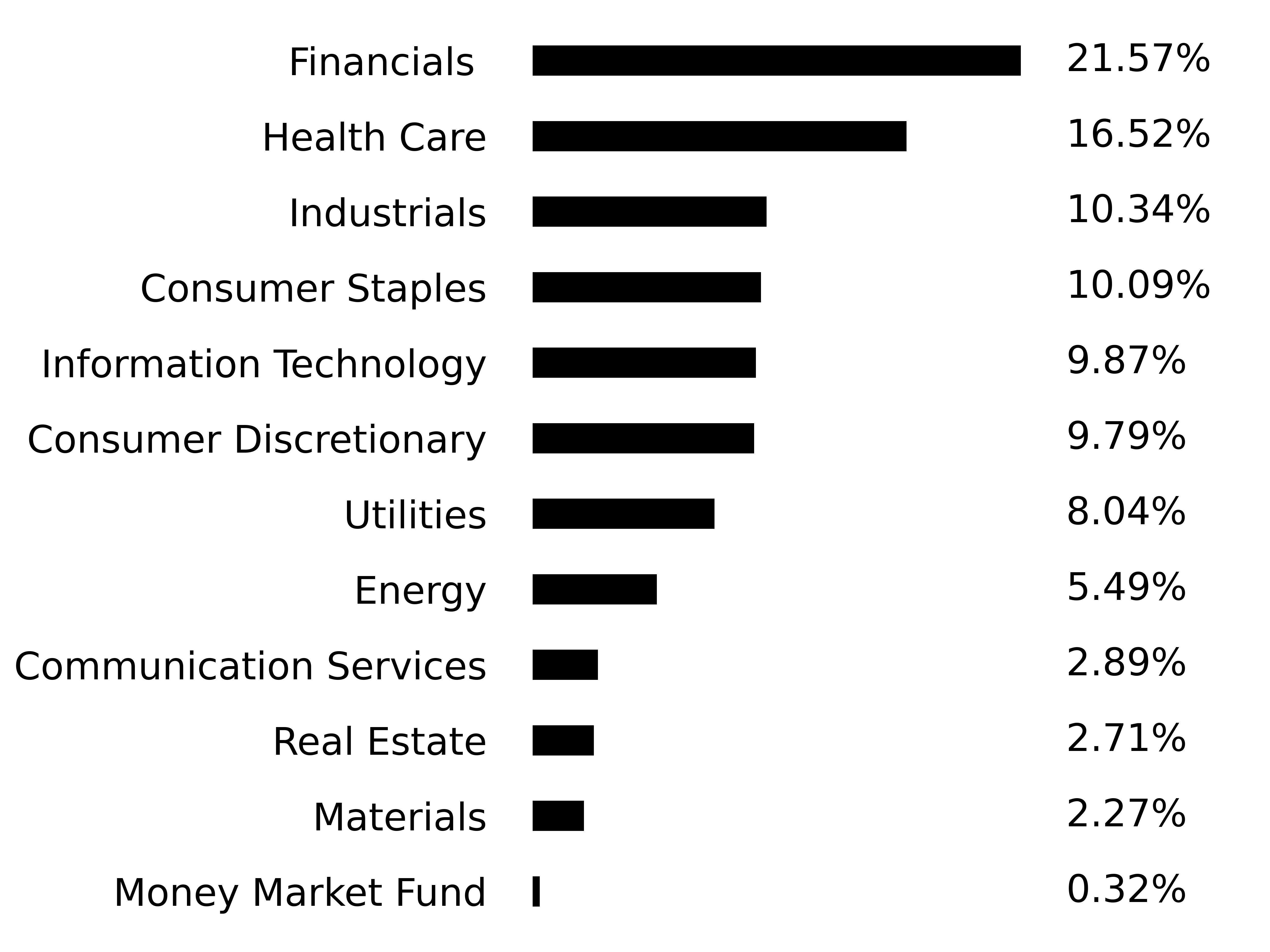

The Fund’s holdings focus on dividend income and capital appreciation. The Fund’s emphasis on dividend-paying stocks lowered performance relative to the Morningstar US Market Total Return Index. Health Care, Utilities and Financials sectors were leading contributors to the Fund’s performance, while Information Technology, Consumer Staples and Materials sectors were leading detractors relative to the Morningstar US Market Total Return Index. Underperformance was generally due to stock selection.

Cumulative Performance

(based on a hypothetical $10,000 investment)

Annual Performance

Average Annual Total Return

|

|

1

Year |

5

Year |

10

Year |

|---|---|---|---|

|

Applied

Finance Dividend Fund - Institutional Class |

4.99% |

13.42% |

9.00% |

|

Morningstar

US Market Total Return Index¹ |

11.51% |

15.18% |

11.81% |

|

Morningstar

US Large Mid Value Total Return Index¹ |

10.65% |

14.11% |

9.18% |

Key Fund Statistics

(as of April 30, 2025)

|

Fund

Net Assets |

$25,241,800 |

|

Number

of Holdings |

39 |

|

Total

Advisory Fee Paid |

$58,064 |

|

Portfolio

Turnover Rate |

12.78% |

Sector Breakdown

|

Top

Ten Holdings |

|

|---|---|

|

JPMorgan

Chase & Co. |

|

|

The

Travelers Companies, Inc |

|

|

Eli

Lilly & Co. |

|

|

Verizon

Communications, Inc. |

|

|

Abbvie,

Inc. |

|

|

Ingredion,

Inc. |

|

|

Hasbro,

Inc. |

|

|

UGI

Corp. |

|

|

Marathon

Petroleum Corp. |

|

|

Johnson

& Johnson |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

|

Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

|---|---|---|

|

Applied

Finance Dividend Fund

- Investor Class |

$125 |

1.22% |

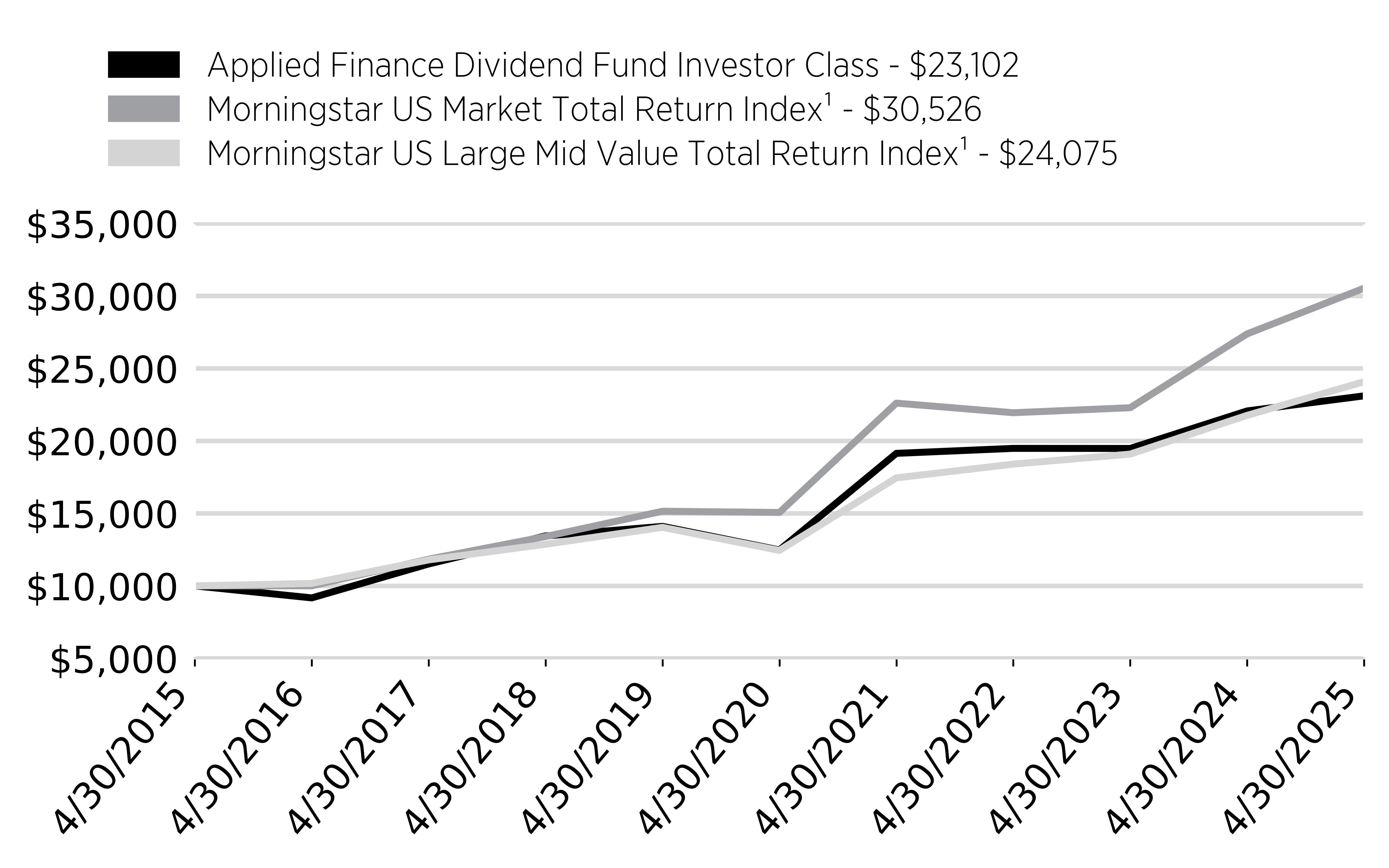

How did the Fund perform?

For the period of May 1, 2024 to April 30, 2025, the Applied Finance Dividend Fund Investor Class Shares (the “Fund”) returned 4.71%.

In comparison, the Morningstar US Market Total Return Index returned 11.51% and the Morningstar US Large Mid Value Total Return Index returned 10.65% for the same period.

What key factors influenced performance?

US stocks rose gradually from May 2024 through January 2025 before peaking in mid-February. Uncertainty over tariffs and their effect on the economy pushed stocks lower in March and part of April, with indices rebounding by the end of the month.

The performance of the Morningstar US Market Total Return Index was strongest in the Financials and Information Technology sectors. During the 12 months ending April 30, 2025, Growth stocks outperformed Value stocks.

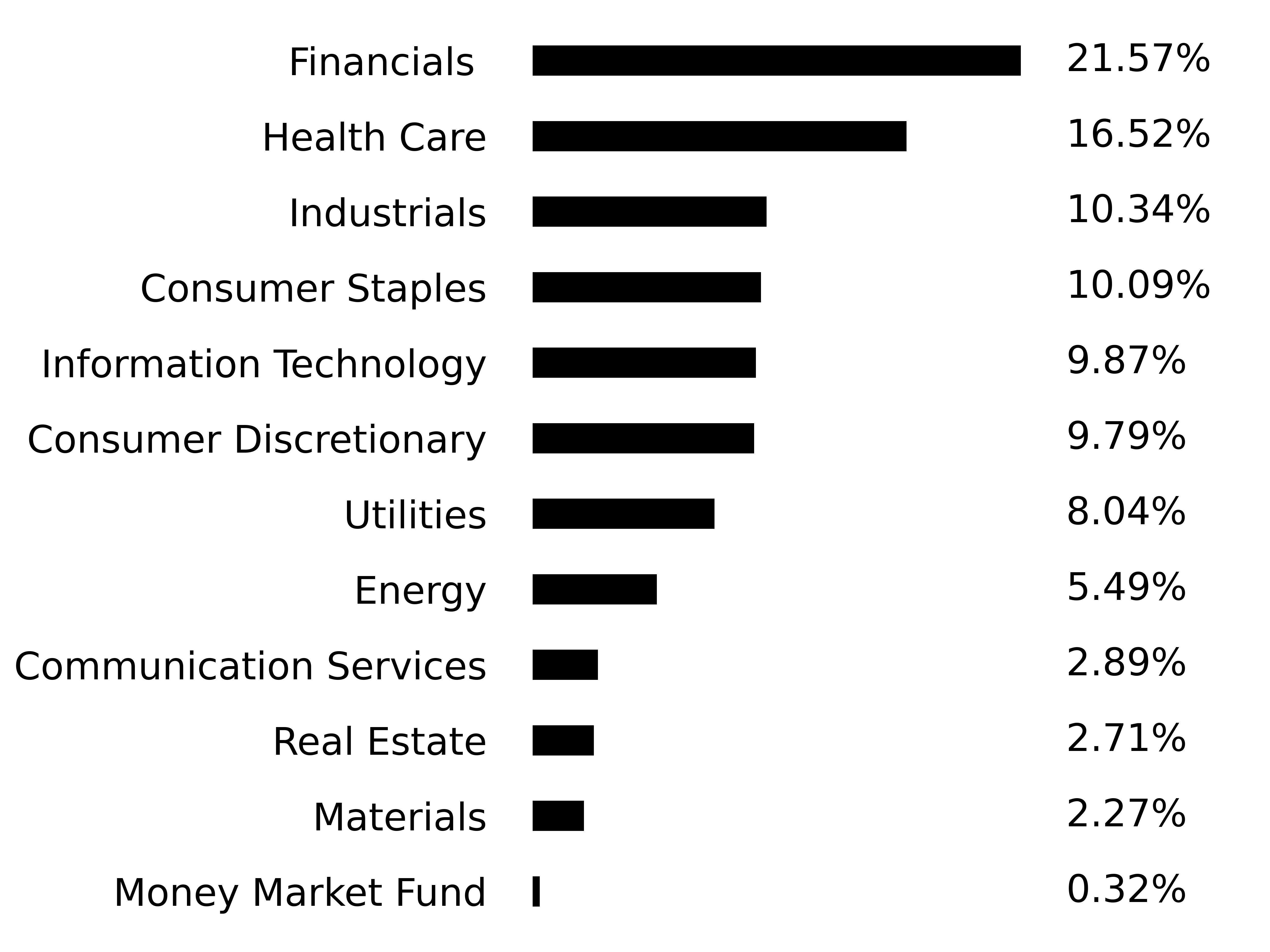

The Fund’s holdings focus on dividend income and capital appreciation. The Fund’s emphasis on dividend-paying stocks lowered performance relative to the Morningstar US Market Total Return Index. Health Care, Utilities and Financials sectors were leading contributors to the Fund’s performance, while Information Technology, Consumer Staples and Materials sectors were leading detractors relative to the Morningstar US Market Total Return Index. Underperformance was generally due to stock selection.

Cumulative Performance

(based on a hypothetical $10,000 investment)

Annual Performance

Average Annual Total Return

|

|

1

Year |

5

Year |

10

Year |

|---|---|---|---|

|

Applied

Finance Dividend Fund - Investor Class |

4.71% |

13.11% |

8.73% |

|

Morningstar

US Market Total Return Index¹ |

11.51% |

15.18% |

11.81% |

|

Morningstar

US Large Mid Value Total Return Index¹ |

10.65% |

14.11% |

9.18% |

Key Fund Statistics

(as of April 30, 2025)

|

Fund

Net Assets |

$25,241,800 |

|

Number

of Holdings |

39 |

|

Total

Advisory Fee Paid |

$58,064 |

|

Portfolio

Turnover Rate |

12.78% |

Sector Breakdown

|

Top

Ten Holdings |

|

|---|---|

|

JPMorgan

Chase & Co. |

|

|

The

Travelers Companies, Inc |

|

|

Eli

Lilly & Co. |

|

|

Verizon

Communications, Inc. |

|

|

Abbvie,

Inc. |

|

|

Ingredion,

Inc. |

|

|

Hasbro,

Inc. |

|

|

UGI

Corp. |

|

|

Marathon

Petroleum Corp. |

|

|

Johnson

& Johnson |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

|

Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

|---|---|---|

|

Applied

Finance Explorer Fund

- Institutional Class |

$84 |

0.84% |

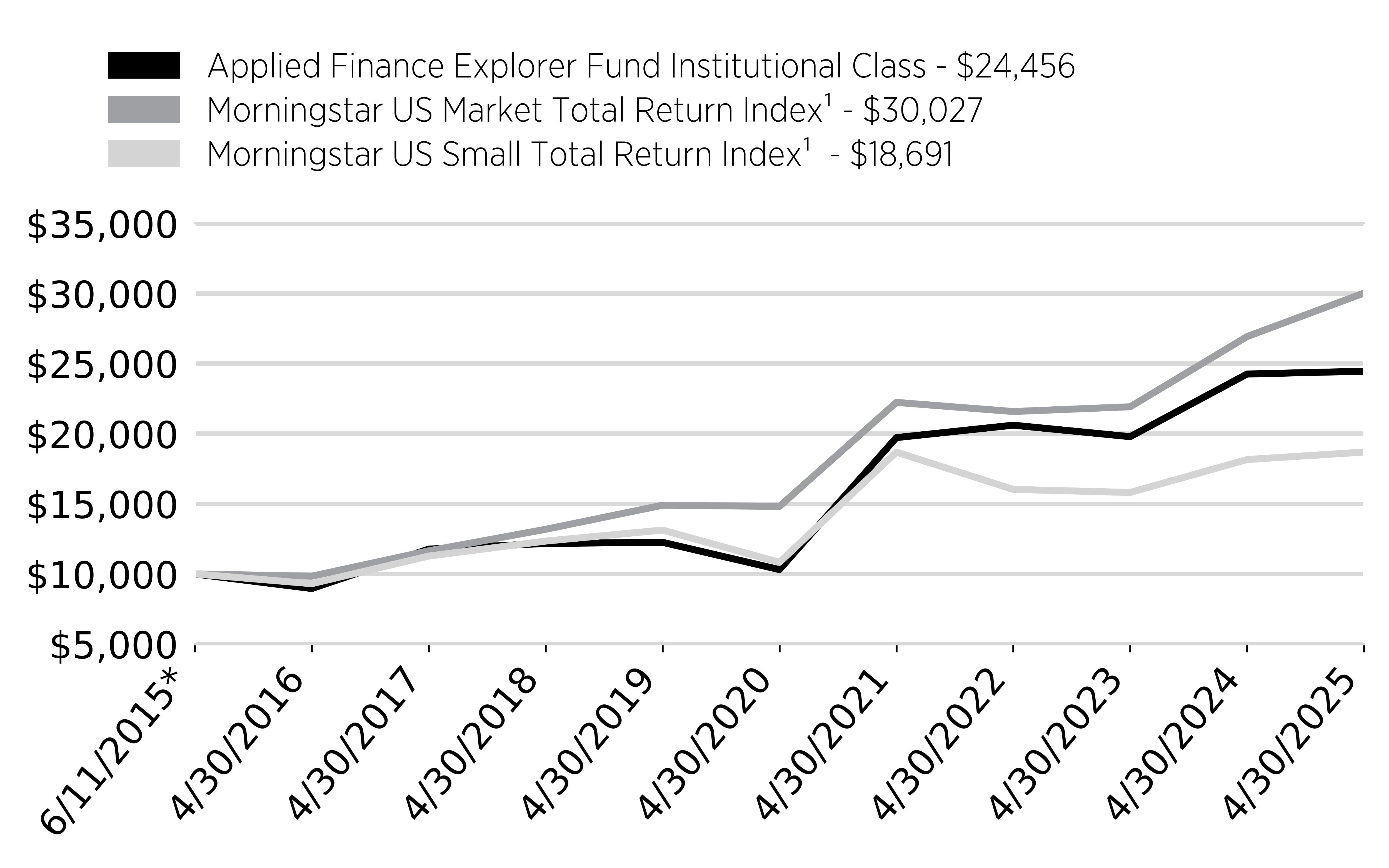

How did the Fund perform?

For the period of May 1, 2024 to April 30, 2025, the Applied Finance Explorer Fund Institutional Class Shares (the “Fund”) returned 0.83%.

In comparison, the Morningstar US Market Total Return Index returned 11.51% and the Morningstar US Small Total Return Index returned 2.94% for the same period.

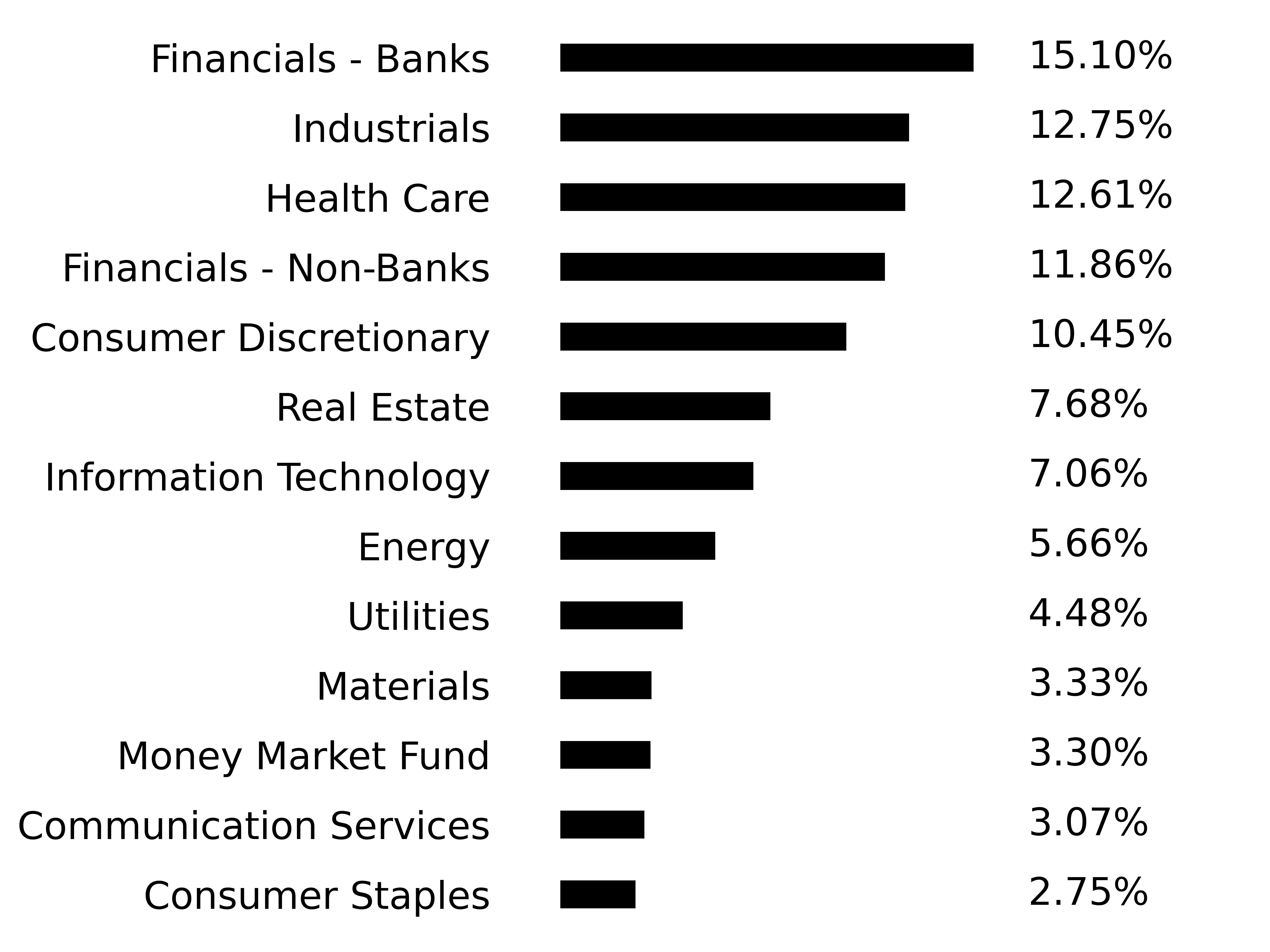

What key factors influenced performance?

US stocks rose gradually from May 2024 through January 2025 before peaking in mid-February. Uncertainty over tariffs and their effect on the economy pushed stocks lower in March and part of April, with indices rebounding by the end of the month.

The performance of the Morningstar US Market Total Return Index was strongest in the Financials and Information Technology sectors. During the 12 months ending April 30, 2025, Growth stocks outperformed Value stocks.

The Fund’s holdings consist of US small-cap stocks. The Fund’s emphasis on small-cap stocks lowered performance relative to the Morningstar US Market Total Return Index. Financials and Utilities sectors were leading contributors to the Fund’s performance, while Energy, Information Technology and Industrials sectors were leading detractors relative to the Morningstar US Market Total Return Index. Underperformance was generally due to stock selection.

Cumulative Performance

(based on a hypothetical $10,000 investment)

| * | Inception |

Annual Performance

Average Annual Total Return

|

|

1

Year |

5

Year |

Since

Inception |

|---|---|---|---|

|

Applied

Finance Explorer Fund - Institutional Class |

0.83% |

18.85% |

9.47% |

|

Morningstar

US Market Total Return Index¹ |

11.51% |

15.18% |

11.76% |

|

Morningstar

US Small Total Return Index¹ |

2.94% |

11.53% |

6.53% |

Key Fund Statistics

(as of April 30, 2025)

|

Fund

Net Assets |

$731,052,738 |

|

Number

of Holdings |

140 |

|

Total

Advisory Fee Paid |

$4,557,935 |

|

Portfolio

Turnover Rate |

37.29% |

Sector Breakdown

|

Top

Ten Holdings |

|

|---|---|

|

Federated

Treasury Obligations Fund - Institutional Class |

|

|

StoneX

Group, Inc. |

|

|

Stride,

Inc. |

|

|

Sterling

Infrastructure, Inc. |

|

|

Pathward

Financial, Inc. |

|

|

Comfort

Systems USA, Inc. |

|

|

Enova

International, Inc. |

|

|

SLM

Corp. |

|

|

OSI

Systems, Inc. |

|

|

Performance

Food Group Co. |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

|

Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

|---|---|---|

|

Applied

Finance Explorer Fund

- Investor Class |

$109 |

1.09% |

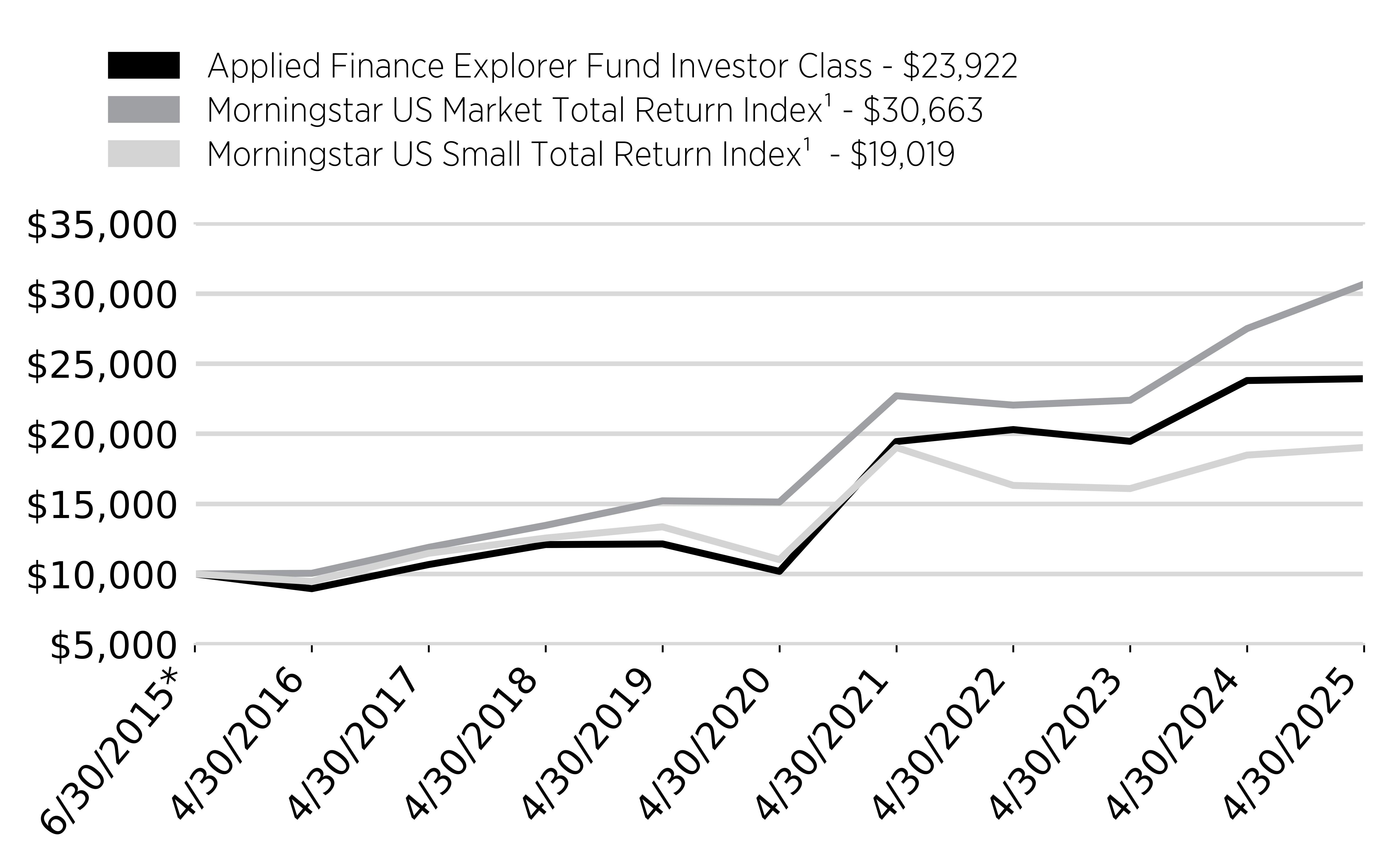

How did the Fund perform?

For the period of May 1, 2024 to April 30, 2025, the Applied Finance Explorer Fund Investor Class Shares (the “Fund”) returned 0.55%.

In comparison, the Morningstar US Market Total Return Index returned 11.51% and the Morningstar US Small Total Return Index returned 2.94% for the same period.

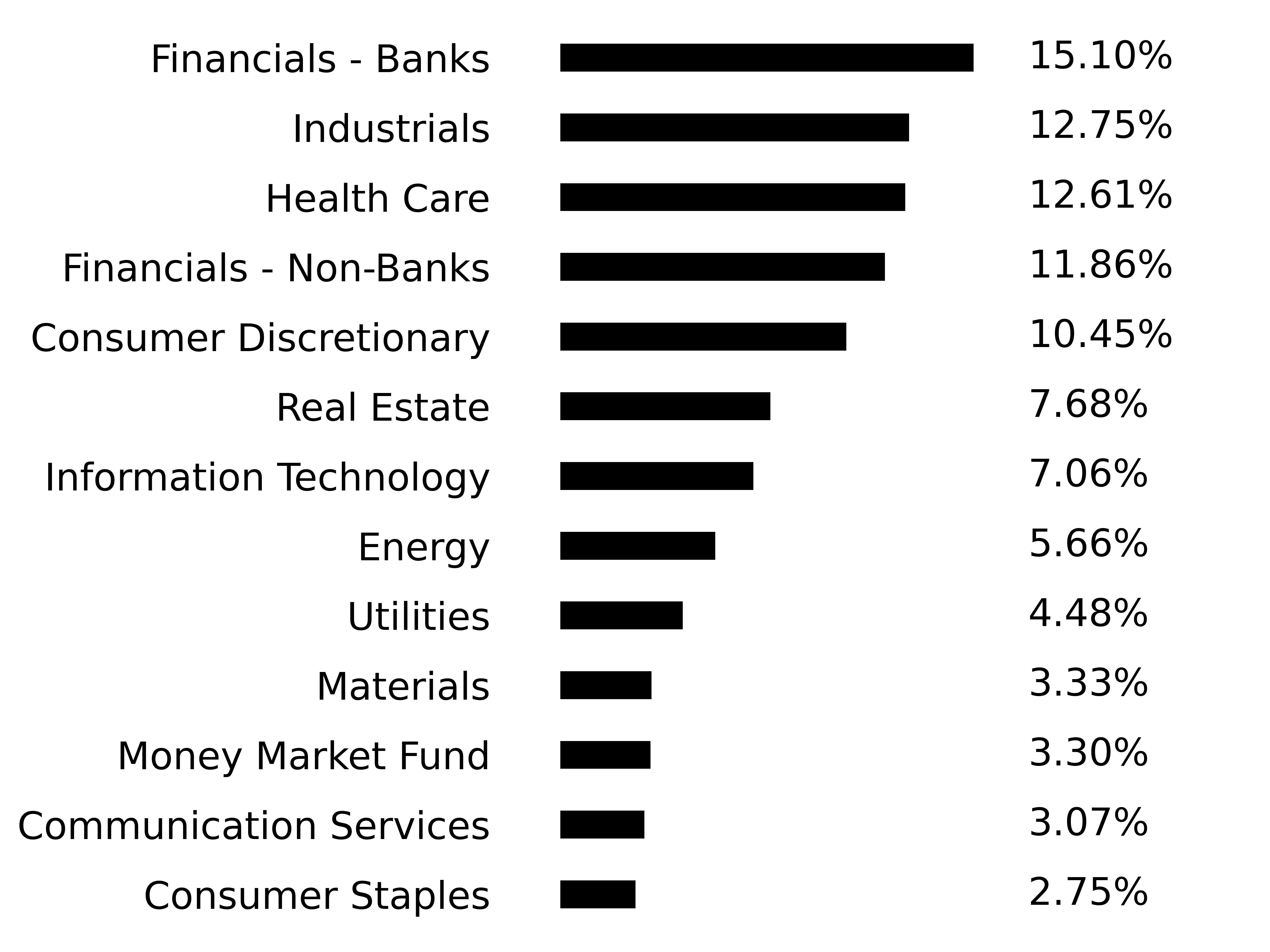

What key factors influenced performance?

US stocks rose gradually from May 2024 through January 2025 before peaking in mid-February. Uncertainty over tariffs and their effect on the economy pushed stocks lower in March and part of April, with indices rebounding by the end of the month.

The performance of the Morningstar US Market Total Return Index was strongest in the Financials and Information Technology sectors. During the 12 months ending April 30, 2025, Growth stocks outperformed Value stocks.

The Fund’s holdings consist of US small-cap stocks. The Fund’s emphasis on small-cap stocks lowered performance relative to the Morningstar US Market Total Return Index. Financials and Utilities sectors were leading contributors to the Fund’s performance, while Energy, Information Technology and Industrials sectors were leading detractors relative to the Morningstar US Market Total Return Index. Underperformance was generally due to stock selection.

Cumulative Performance

(based on a hypothetical $10,000 investment)

| * | Inception |

Annual Performance

Average Annual Total Return

|

|

1

Year |

5

Year |

Since

Inception |

|---|---|---|---|

|

Applied

Finance Explorer Fund - Investor Class |

0.55% |

18.62% |

9.27% |

|

Morningstar

US Market Total Return Index¹ |

11.51% |

15.18% |

12.07% |

|

Morningstar

US Small Total Return Index¹ |

2.94% |

11.53% |

6.76% |

Key Fund Statistics

(as of April 30, 2025)

|

Fund

Net Assets |

$731,052,738 |

|

Number

of Holdings |

140 |

|

Total

Advisory Fee Paid |

$4,557,935 |

|

Portfolio

Turnover Rate |

37.29% |

Sector Breakdown

|

Top

Ten Holdings |

|

|---|---|

|

Federated

Treasury Obligations Fund - Institutional Class |

|

|

StoneX

Group, Inc. |

|

|

Stride,

Inc. |

|

|

Sterling

Infrastructure, Inc. |

|

|

Pathward

Financial, Inc. |

|

|

Comfort

Systems USA, Inc. |

|

|

Enova

International, Inc. |

|

|

SLM

Corp. |

|

|

OSI

Systems, Inc. |

|

|

Performance

Food Group Co. |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

|

Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

|---|---|---|

|

Applied

Finance Select Fund

- Institutional Class |

$76 |

0.76% |

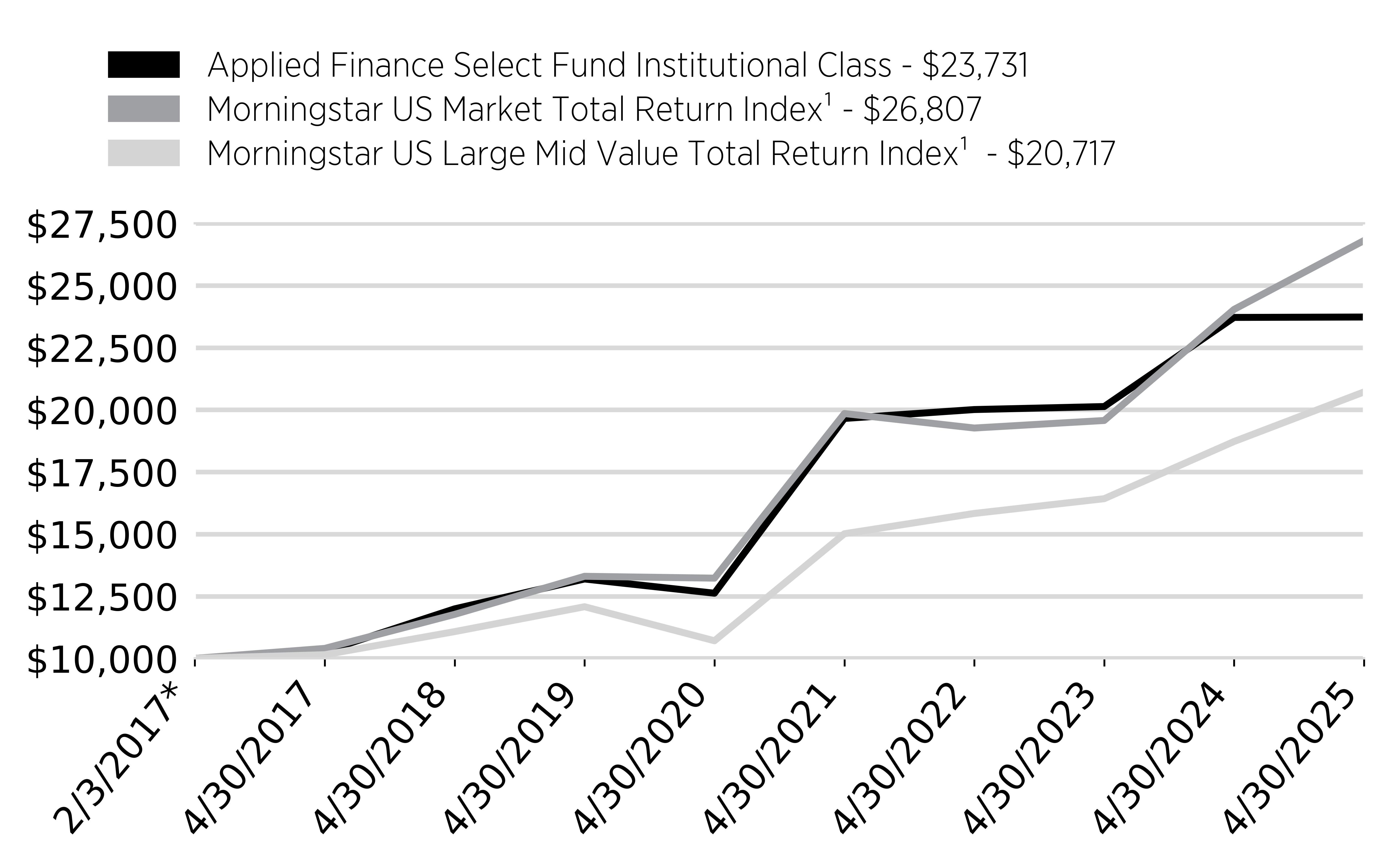

How did the Fund perform?

For the period of May 1, 2024 to April 30, 2025, the Applied Finance Select Fund Institutional Class Shares (the “Fund”) returned 0.07%.

In comparison, the Morningstar US Market Total Return Index returned 11.51% and the Morningstar US Large Mid Value Total Return Index returned 10.65% for the same period.

What key factors influenced performance?

US stocks rose gradually from May 2024 through January 2025 before peaking in mid-February. Uncertainty over tariffs and their effect on the economy pushed stocks lower in March and part of April, with indices rebounding by the end of the month.

The performance of the Morningstar US Market Total Return Index was strongest in the Financials and Information Technology sectors. During the 12 months ending April 30, 2025, Growth stocks outperformed Value stocks.

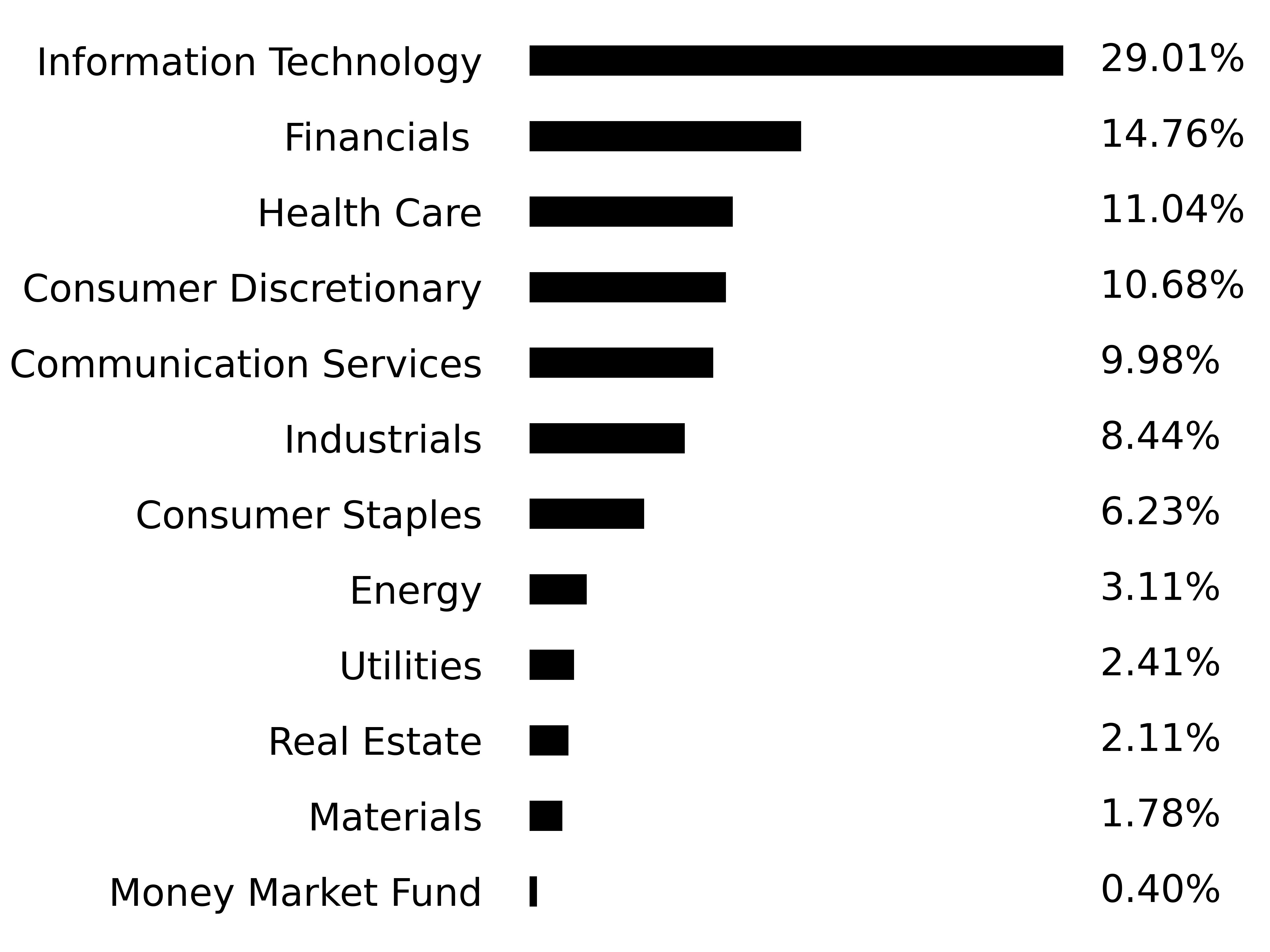

The Fund’s holdings focus on large-cap stocks in the US universe. The Fund’s emphasis on Value oriented stocks lowered performance relative to the Morningstar US Market Total Return Index. Information Technology, Consumer Staples and Consumer Discretionary sectors were leading detractors relative to the Morningstar US Market Total Return Index. Underperformance was generally due to stock selection.

Cumulative Performance

(based on a hypothetical $10,000 investment)

| * | Inception |

Annual Performance

Average Annual Total Return

|

|

1

Year |

5

Year |

Since

Inception |

|---|---|---|---|

|

Applied

Finance Select Fund - Institutional Class |

0.07% |

13.46% |

11.06% |

|

Morningstar

US Market Total Return Index¹ |

11.51% |

15.18% |

12.72% |

|

Morningstar

US Large Mid Value Total Return Index¹ |

10.65% |

14.11% |

9.25% |

Key Fund Statistics

(as of April 30, 2025)

|

Fund

Net Assets |

$570,963,822 |

|

Number

of Holdings |

51 |

|

Total

Advisory Fee Paid |

$2,998,846 |

|

Portfolio

Turnover Rate |

27.63% |

Sector Breakdown

|

Top

Ten Holdings |

|

|---|---|

|

KLA

Corp. |

|

|

Applied

Materials, Inc. |

|

|

Cisco

Systems, Inc. |

|

|

Roper

Technologies, Inc. |

|

|

International

Business Machines Corp. |

|

|

Adobe,

Inc. |

|

|

Apple,

Inc. |

|

|

Oracle

Corp. |

|

|

HP,

Inc. |

|

|

Verizon

Communications, Inc. |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

|

Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

|---|---|---|

|

Applied

Finance Select Fund

- Investor Class |

$101 |

1.01% |

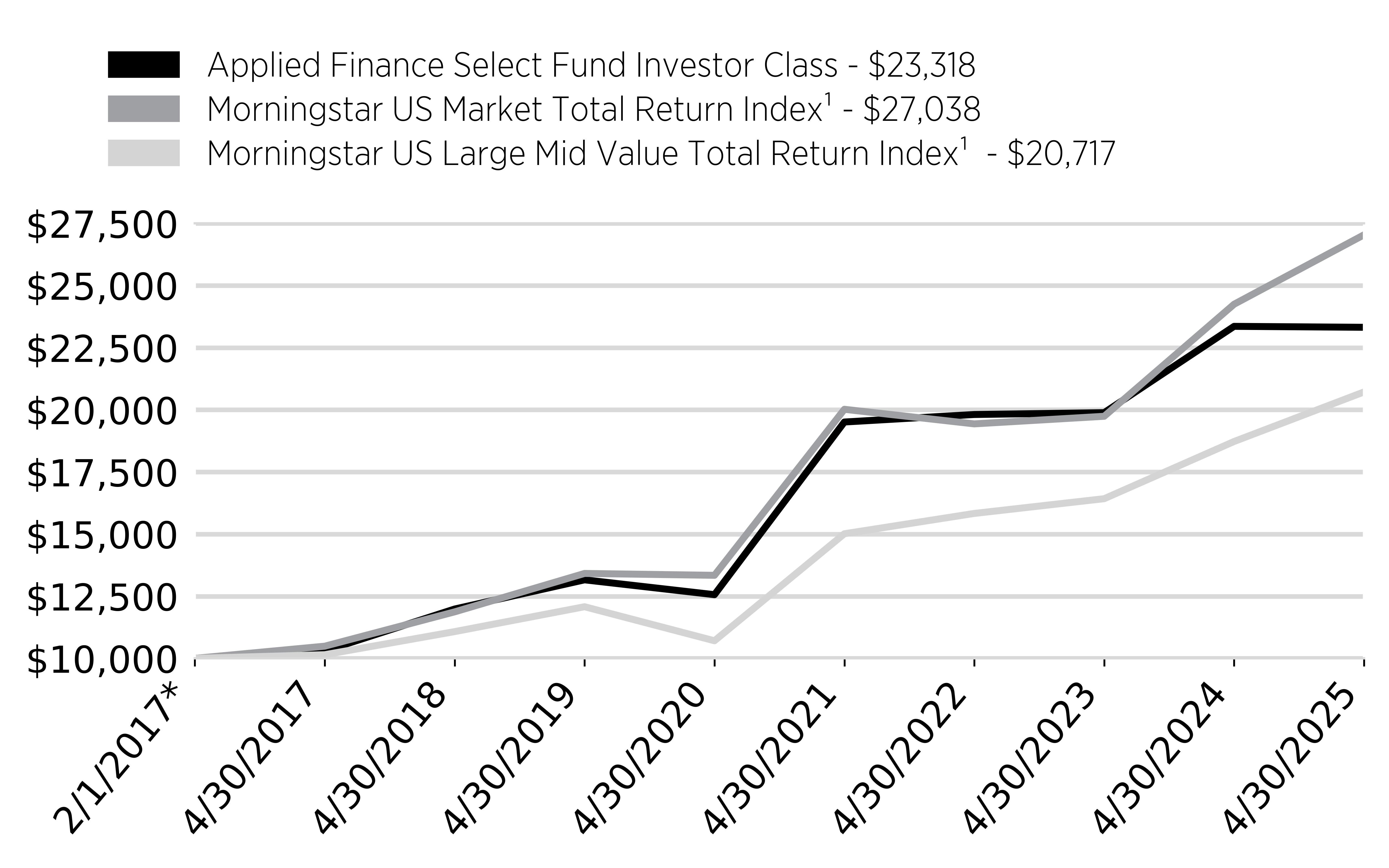

How did the Fund perform?

For the period of May 1, 2024 to April 30, 2025, the Applied Finance Select Fund Investor Class Shares (the “Fund”) returned -0.16%.

In comparison, the Morningstar US Market Total Return Index returned 11.51% and the Morningstar US Large Mid Value Total Return Index returned 10.65% for the same period.

What key factors influenced performance?

US stocks rose gradually from May 2024 through January 2025 before peaking in mid-February. Uncertainty over tariffs and their effect on the economy pushed stocks lower in March and part of April, with indices rebounding by the end of the month.

The performance of the Morningstar US Market Total Return Index was strongest in the Financials and Information Technology sectors. During the 12 months ending April 30, 2025, Growth stocks outperformed Value stocks.

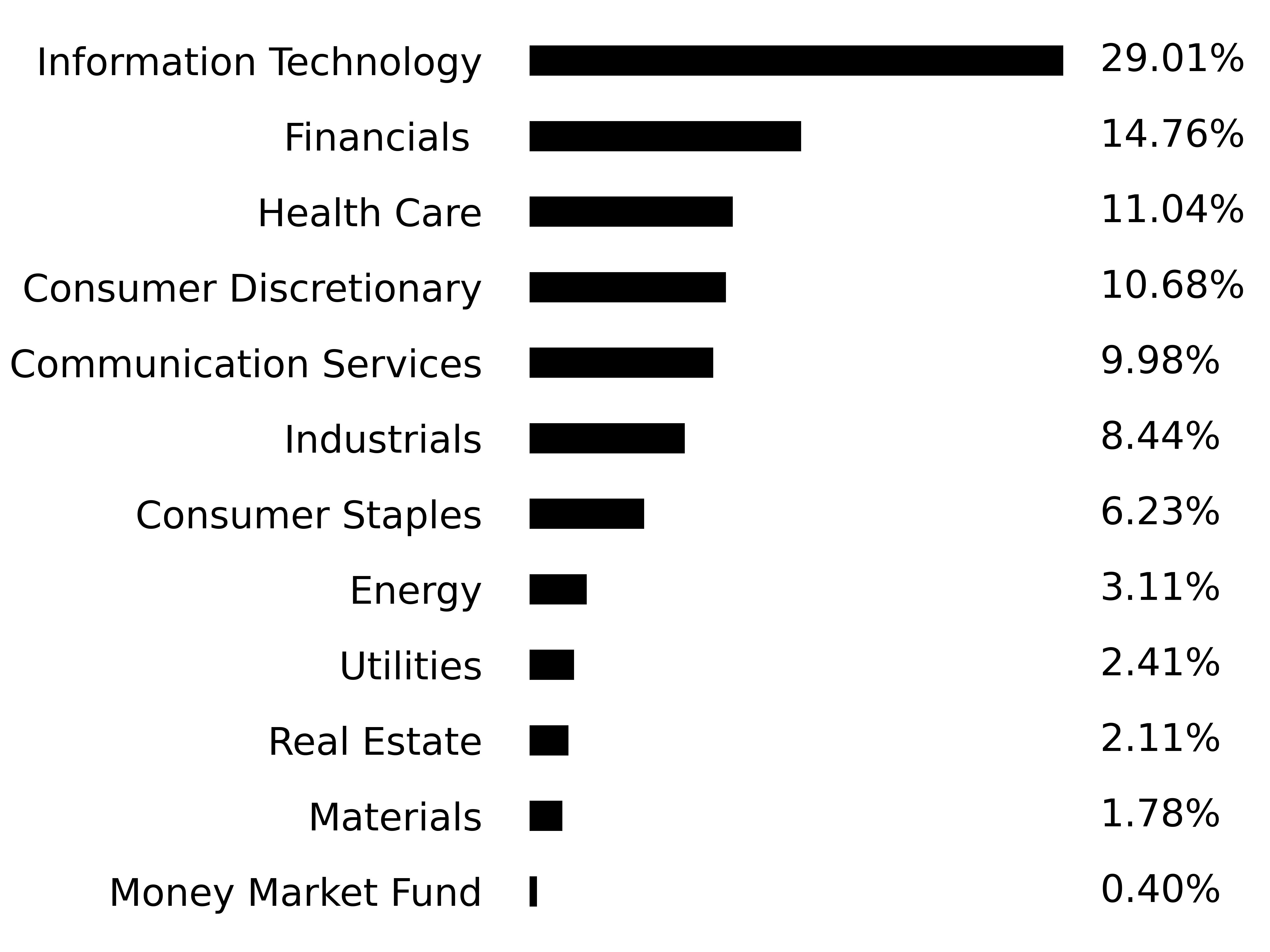

The Fund’s holdings focus on large-cap stocks in the US universe. The Fund’s emphasis on Value oriented stocks lowered performance relative to the Morningstar US Market Total Return Index. Information Technology, Consumer Staples and Consumer Discretionary sectors were leading detractors relative to the Morningstar US Market Total Return Index. Underperformance was generally due to stock selection.

Cumulative Performance

(based on a hypothetical $10,000 investment)

| * | Inception |

Annual Performance

Average Annual Total Return

|

|

1

Year |

5

Year |

Since

Inception |

|---|---|---|---|

|

Applied

Finance Select Fund - Investor Class |

-0.16% |

13.17% |

10.82% |

|

Morningstar

US Market Total Return Index¹ |

11.51% |

15.18% |

12.83% |

|

Morningstar

US Large Mid Value Total Return Index¹ |

10.65% |

14.11% |

9.24% |

Key Fund Statistics

(as of April 30, 2025)

|

Fund

Net Assets |

$570,963,822 |

|

Number

of Holdings |

51 |

|

Total

Advisory Fee Paid |

$2,998,846 |

|

Portfolio

Turnover Rate |

27.63% |

Sector Breakdown

|

Top

Ten Holdings |

|

|---|---|

|

KLA

Corp. |

|

|

Applied

Materials, Inc. |

|

|

Cisco

Systems, Inc. |

|

|

Roper

Technologies, Inc. |

|

|

International

Business Machines Corp. |

|

|

Adobe,

Inc. |

|

|

Apple,

Inc. |

|

|

Oracle

Corp. |

|

|

HP,

Inc. |

|

|

Verizon

Communications, Inc. |