Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

Holdings

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

World Funds Trust

|

|

| Entity Central Index Key |

0001396092

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| Vest US Large Cap 10% Buffer Strategies Fund - Institutional Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 10% Buffer Strategies Fund

|

|

| Class Name |

Institutional Class Shares

|

|

| Trading Symbol |

BUIGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 10% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-10-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-10-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional Class | $47 | 0.96%¹ |

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.96%

|

[1] |

| Net Assets |

$ 367,187,780

|

|

| Holdings Count | Holdings |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,067,437

|

|

| Investment Company, Portfolio Turnover |

68.26%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025)

| |

|---|

Fund Net Assets | $367,187,780 | Number of Holdings | 42 | Total Advisory Fee Paid | $1,067,437 | Portfolio Turnover Rate | 68.26% |

|

|

| Holdings [Text Block] |

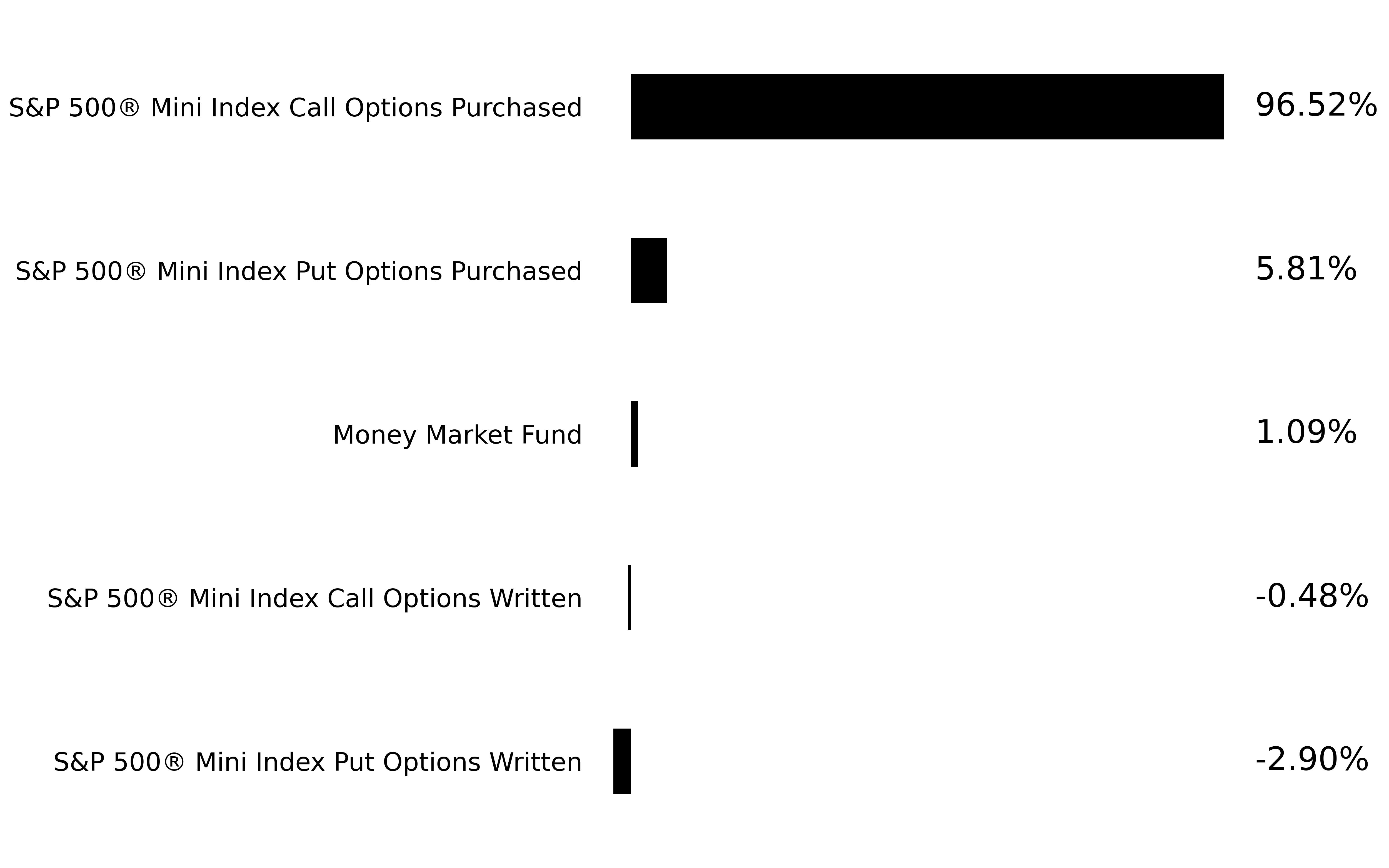

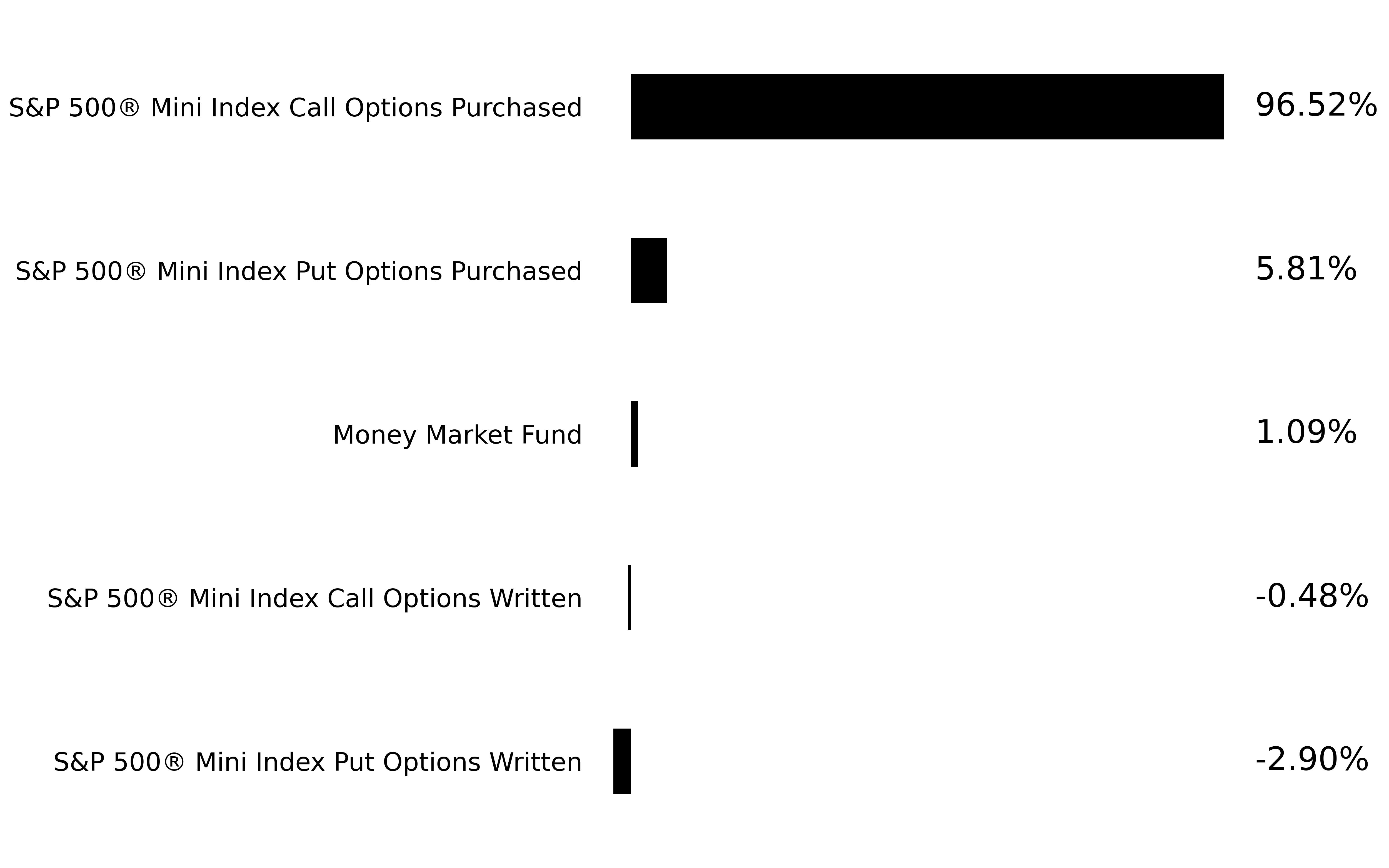

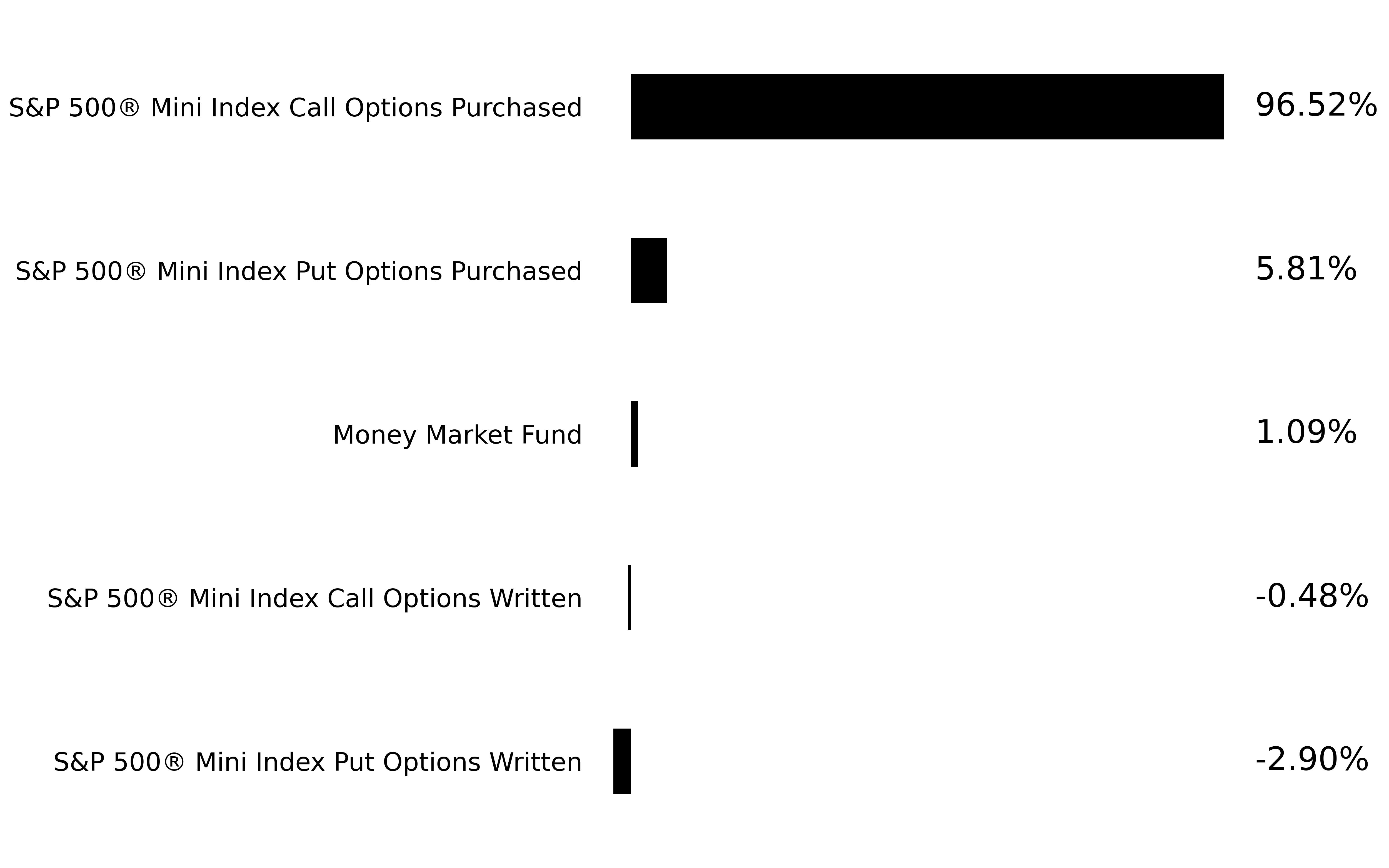

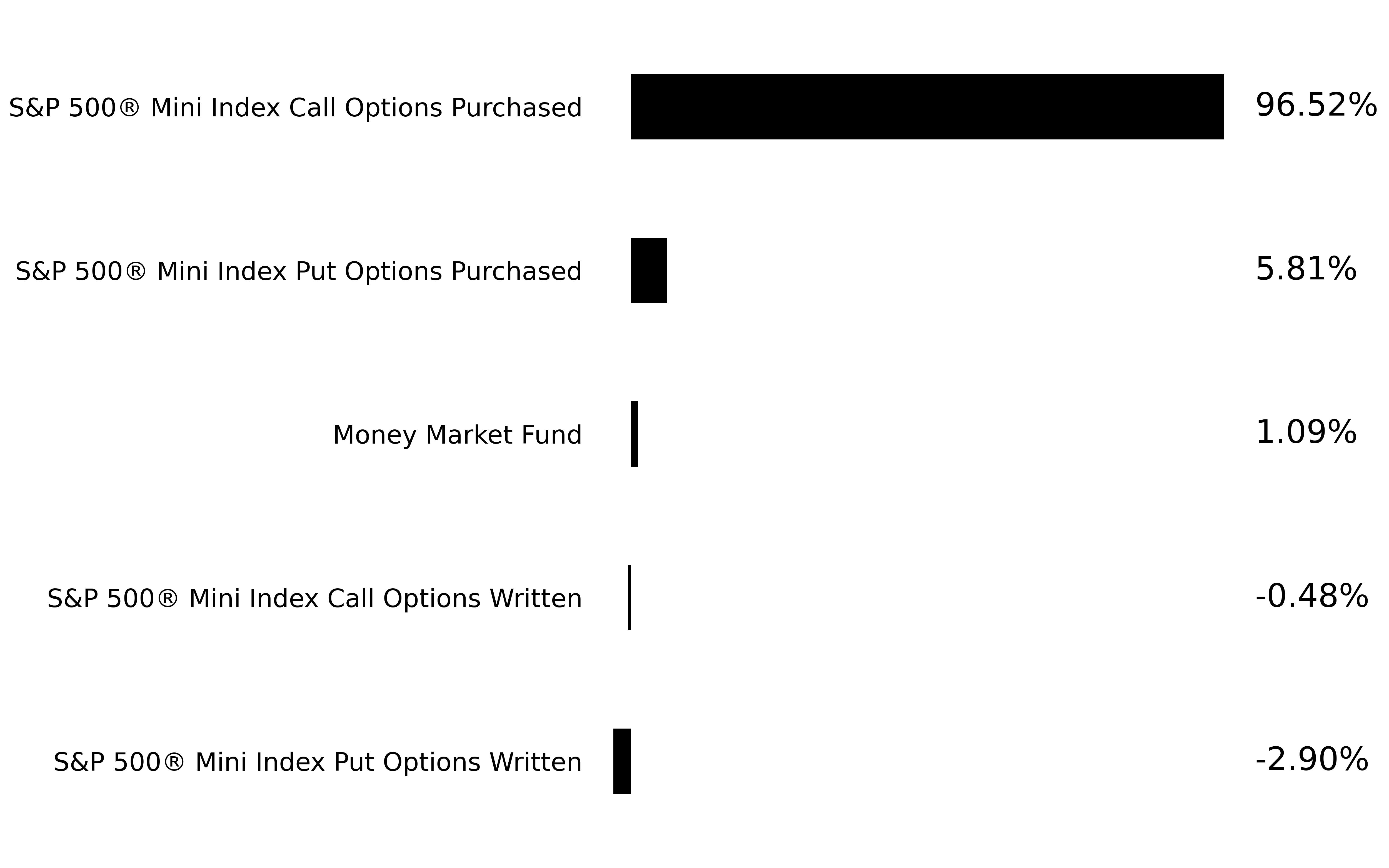

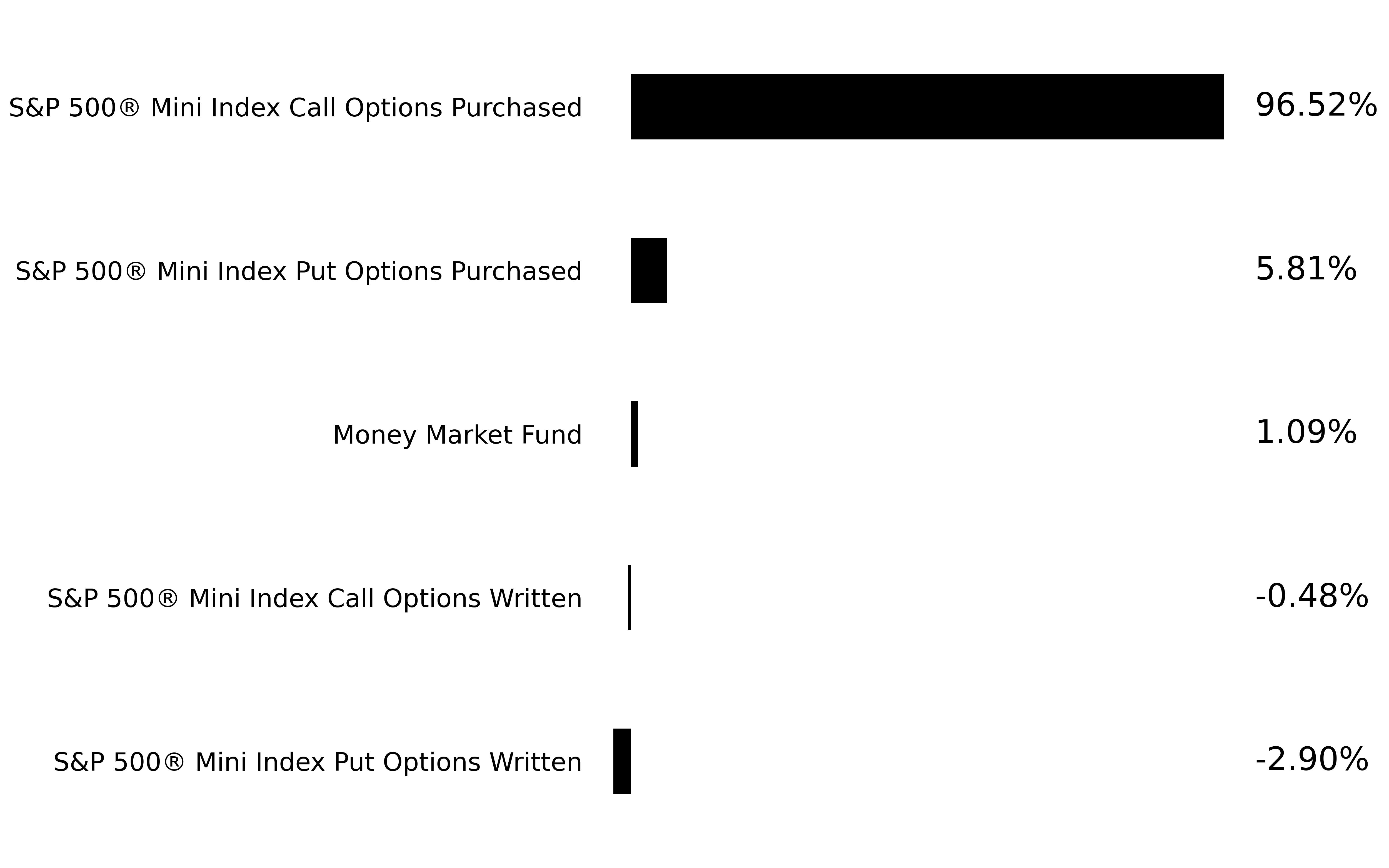

Sector Breakdown | | S&P 500 ® Mini Index Call Options Purchased | | S&P 500 ® Mini Index Put Options Purchased | | S&P 500 ® Mini Index Call Options Written | | S&P 500 ® Mini Index Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 102.33% | Money Market Fund | 1.09% | Options Written | -3.38% |

|

|

| Vest US Large Cap 10% Buffer Strategies Fund - Investor Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 10% Buffer Strategies Fund

|

|

| Class Name |

Investor Class Shares

|

|

| Trading Symbol |

BUMGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 10% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-10-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-10-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Investor Class | $59 | 1.21%¹ |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

1.21%

|

[2] |

| Net Assets |

$ 367,187,780

|

|

| Holdings Count | Holdings |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,067,437

|

|

| Investment Company, Portfolio Turnover |

68.26%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025)

| |

|---|

Fund Net Assets | $367,187,780 | Number of Holdings | 42 | Total Advisory Fee Paid | $1,067,437 | Portfolio Turnover Rate | 68.26% |

|

|

| Holdings [Text Block] |

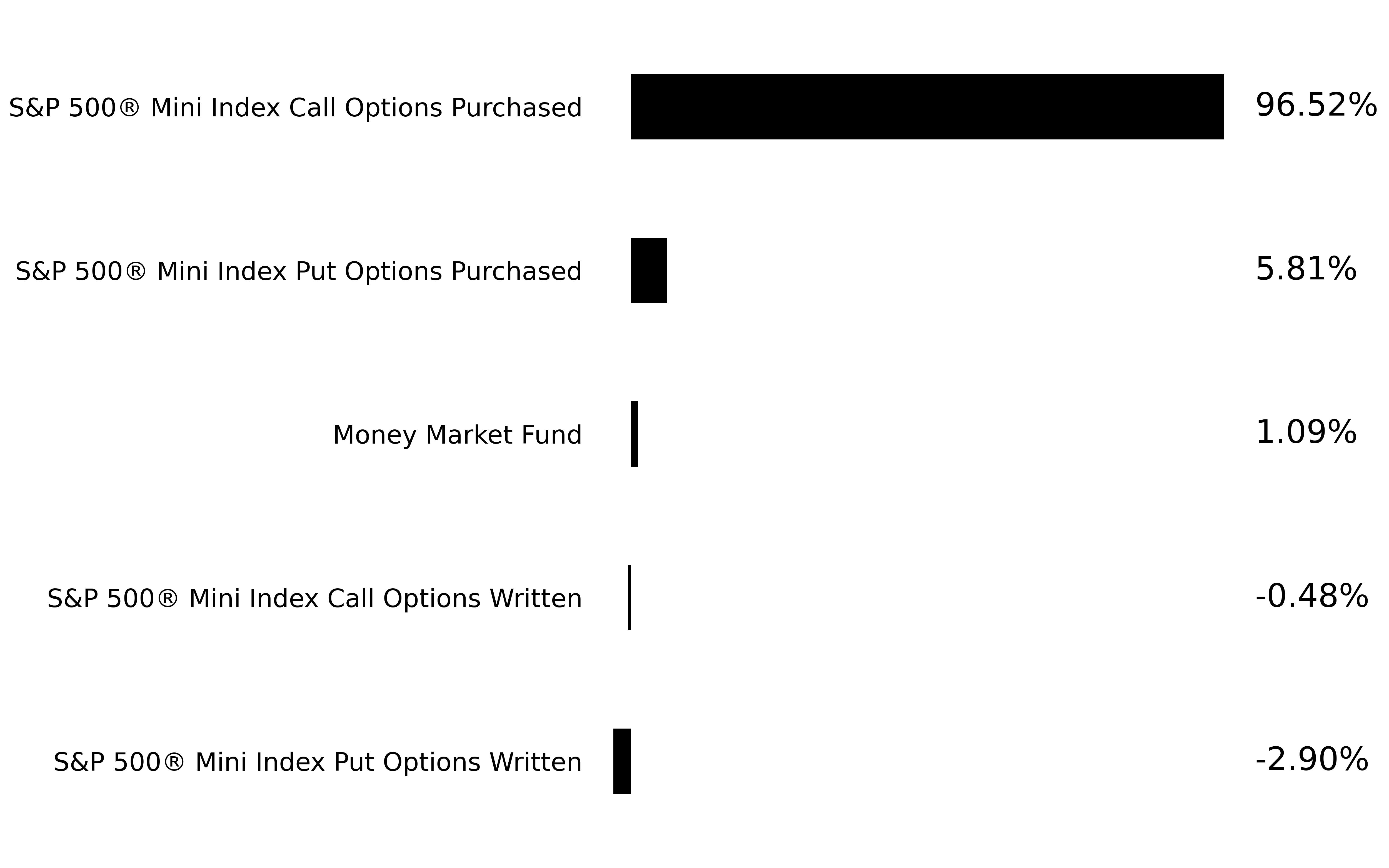

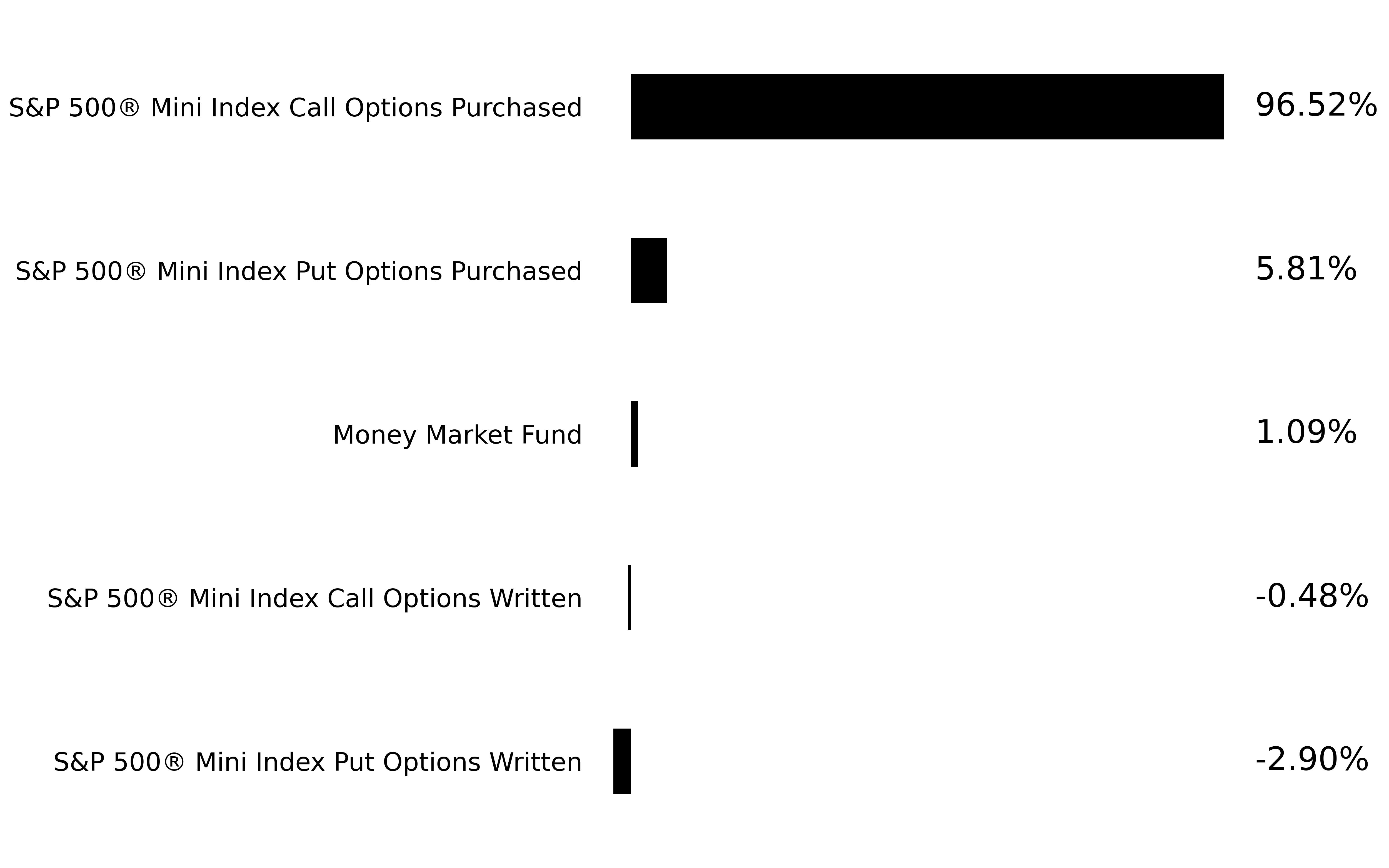

Sector Breakdown | | S&P 500 ® Mini Index Call Options Purchased | | S&P 500 ® Mini Index Put Options Purchased | | S&P 500 ® Mini Index Call Options Written | | S&P 500 ® Mini Index Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 102.33% | Money Market Fund | 1.09% | Options Written | -3.38% |

|

|

| Vest US Large Cap 10% Buffer Strategies Fund - Class A Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 10% Buffer Strategies Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

BUAGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 10% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-10-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-10-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $59 | 1.21%¹ |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

1.21%

|

[3] |

| Net Assets |

$ 367,187,780

|

|

| Holdings Count | Holdings |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,067,437

|

|

| Investment Company, Portfolio Turnover |

68.26%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025)

| |

|---|

Fund Net Assets | $367,187,780 | Number of Holdings | 42 | Total Advisory Fee Paid | $1,067,437 | Portfolio Turnover Rate | 68.26% |

|

|

| Holdings [Text Block] |

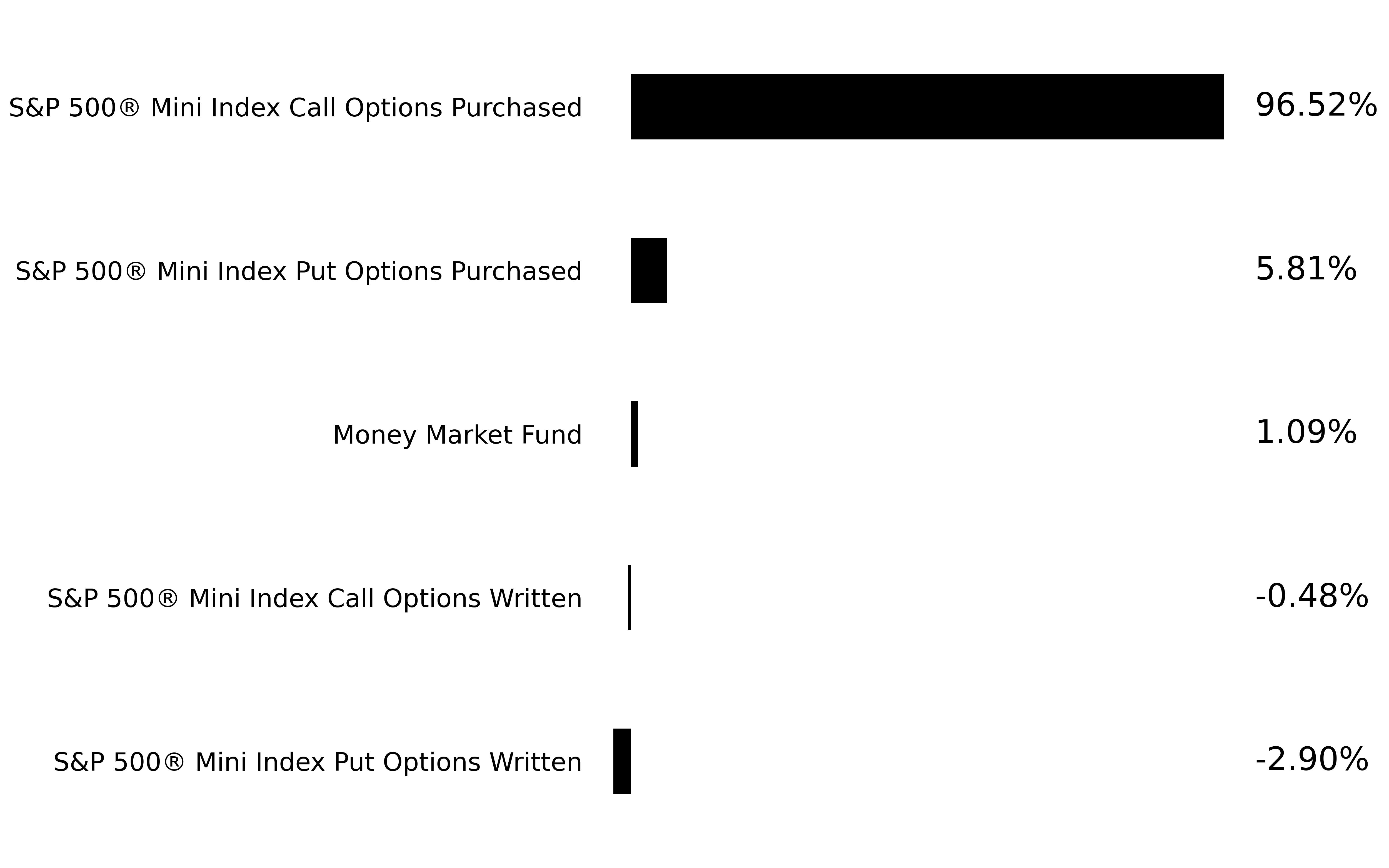

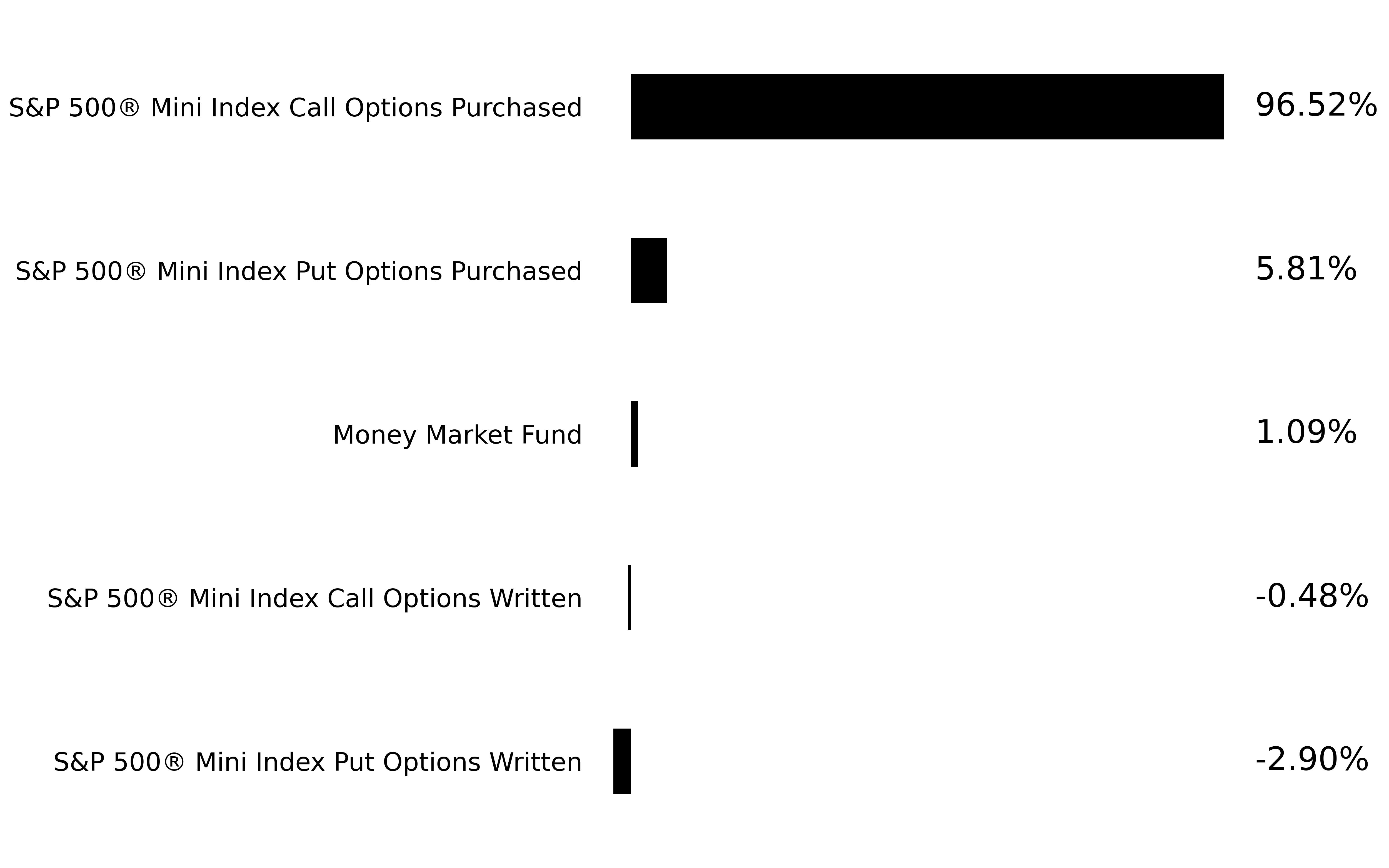

Sector Breakdown | | S&P 500 ® Mini Index Call Options Purchased | | S&P 500 ® Mini Index Put Options Purchased | | S&P 500 ® Mini Index Call Options Written | | S&P 500 ® Mini Index Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 102.33% | Money Market Fund | 1.09% | Options Written | -3.38% |

|

|

| Vest US Large Cap 10% Buffer Strategies Fund - Class C Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 10% Buffer Strategies Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

BUCGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 10% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-10-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-10-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class C | $96 | 1.96%¹ |

|

|

| Expenses Paid, Amount |

$ 96

|

|

| Expense Ratio, Percent |

1.96%

|

[4] |

| Net Assets |

$ 367,187,780

|

|

| Holdings Count | Holdings |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,067,437

|

|

| Investment Company, Portfolio Turnover |

68.26%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025)

| |

|---|

Fund Net Assets | $367,187,780 | Number of Holdings | 42 | Total Advisory Fee Paid | $1,067,437 | Portfolio Turnover Rate | 68.26% |

|

|

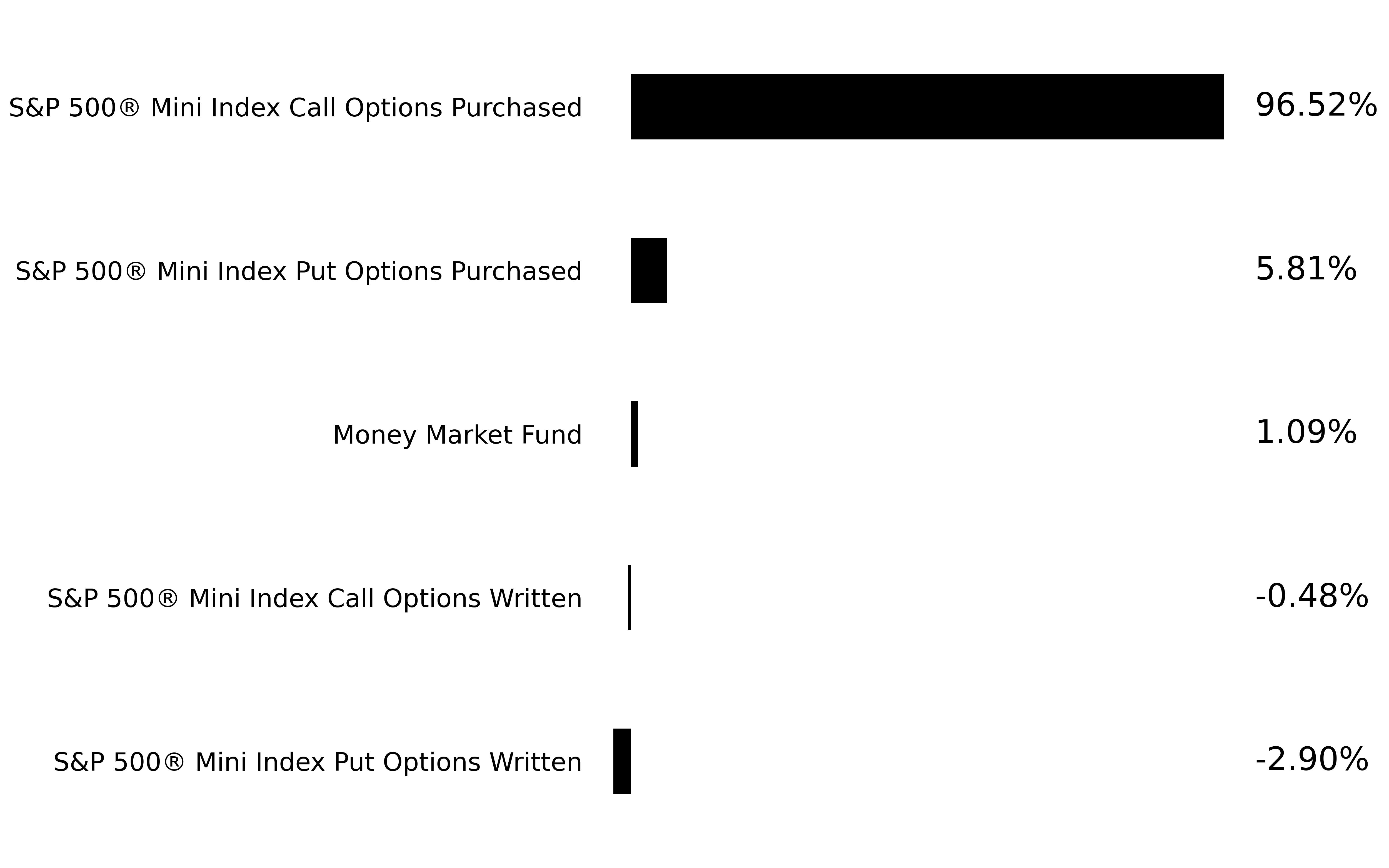

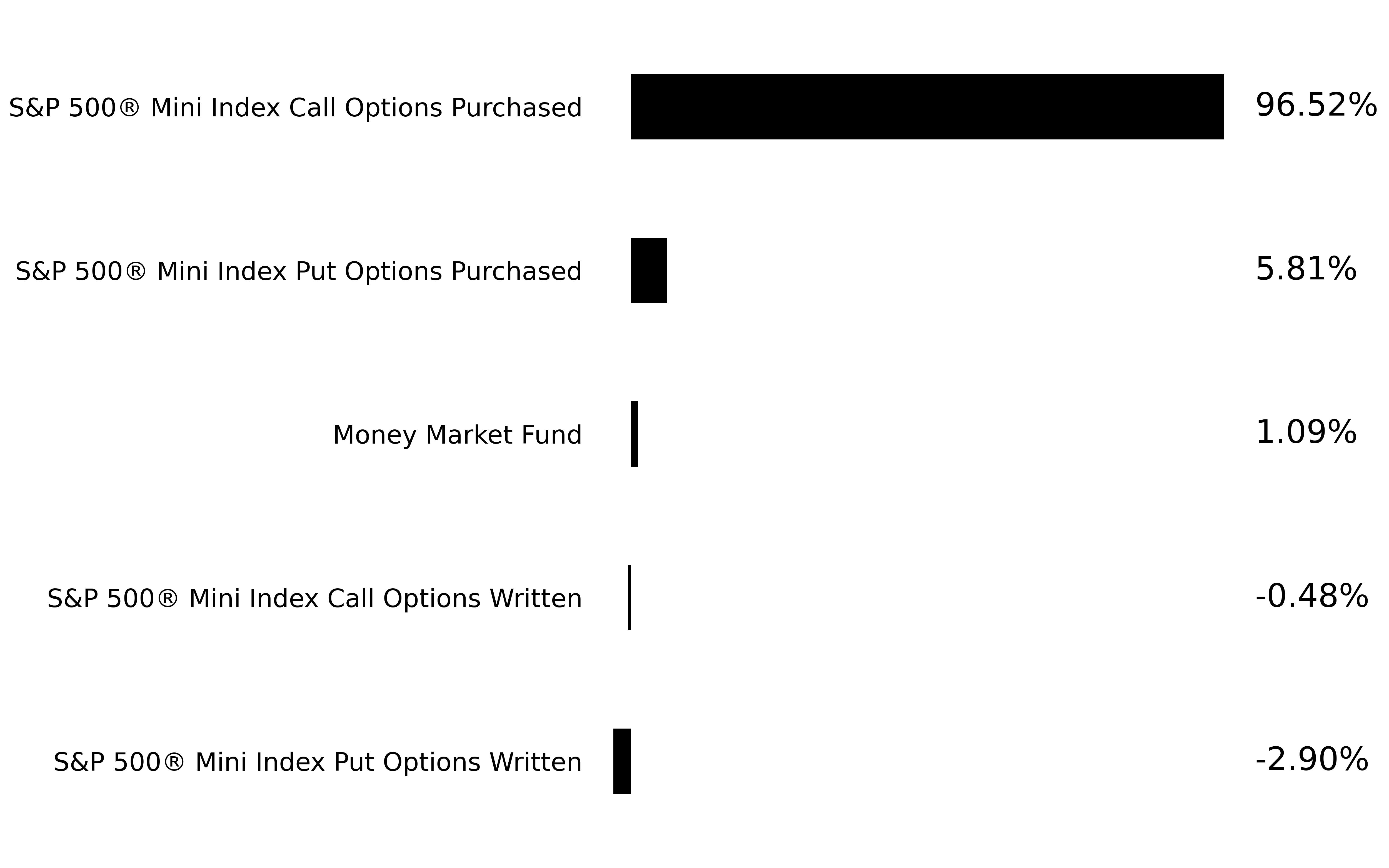

| Holdings [Text Block] |

Sector Breakdown | | S&P 500 ® Mini Index Call Options Purchased | | S&P 500 ® Mini Index Put Options Purchased | | S&P 500 ® Mini Index Call Options Written | | S&P 500 ® Mini Index Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 102.33% | Money Market Fund | 1.09% | Options Written | -3.38% |

|

|

| Vest US Large Cap 10% Buffer Strategies Fund - Class R Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 10% Buffer Strategies Fund

|

|

| Class Name |

Class R Shares

|

|

| Trading Symbol |

BURGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 10% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-10-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-10-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R | $25 | 0.50%¹ |

|

|

| Expenses Paid, Amount |

$ 25

|

|

| Expense Ratio, Percent |

0.50%

|

[5] |

| Net Assets |

$ 367,187,780

|

|

| Holdings Count | Holdings |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,067,437

|

|

| Investment Company, Portfolio Turnover |

68.26%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025)

| |

|---|

Fund Net Assets | $367,187,780 | Number of Holdings | 42 | Total Advisory Fee Paid | $1,067,437 | Portfolio Turnover Rate | 68.26% |

|

|

| Holdings [Text Block] |

Sector Breakdown | | S&P 500 ® Mini Index Call Options Purchased | | S&P 500 ® Mini Index Put Options Purchased | | S&P 500 ® Mini Index Call Options Written | | S&P 500 ® Mini Index Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 102.33% | Money Market Fund | 1.09% | Options Written | -3.38% |

|

|

| Vest US Large Cap 10% Buffer Strategies Fund - Class Y Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 10% Buffer Strategies Fund

|

|

| Class Name |

Class Y Shares

|

|

| Trading Symbol |

BUYGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 10% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-10-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-10-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class Y | $35 | 0.71%¹ |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.71%

|

[6] |

| Net Assets |

$ 367,187,780

|

|

| Holdings Count | Holdings |

42

|

|

| Advisory Fees Paid, Amount |

$ 1,067,437

|

|

| Investment Company, Portfolio Turnover |

68.26%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025)

| |

|---|

Fund Net Assets | $367,187,780 | Number of Holdings | 42 | Total Advisory Fee Paid | $1,067,437 | Portfolio Turnover Rate | 68.26% |

|

|

| Holdings [Text Block] |

Sector Breakdown | | S&P 500 ® Mini Index Call Options Purchased | | S&P 500 ® Mini Index Put Options Purchased | | S&P 500 ® Mini Index Call Options Written | | S&P 500 ® Mini Index Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 102.33% | Money Market Fund | 1.09% | Options Written | -3.38% |

|

|

| Vest US Large Cap 20% Buffer Strategies Fund - Institutional Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 20% Buffer Strategies Fund

|

|

| Class Name |

Institutional Class Shares

|

|

| Trading Symbol |

ENGIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 20% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-20-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-20-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional Class | $47 | 0.96%¹ |

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.96%

|

[7] |

| Net Assets |

$ 112,777,654

|

|

| Holdings Count | Holdings |

39

|

|

| Advisory Fees Paid, Amount |

$ 334,705

|

|

| Investment Company, Portfolio Turnover |

75.14%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $112,777,654 | Number of Holdings | 39 | Total Advisory Fee Paid | $334,705 | Portfolio Turnover Rate | 75.14% |

|

|

| Holdings [Text Block] |

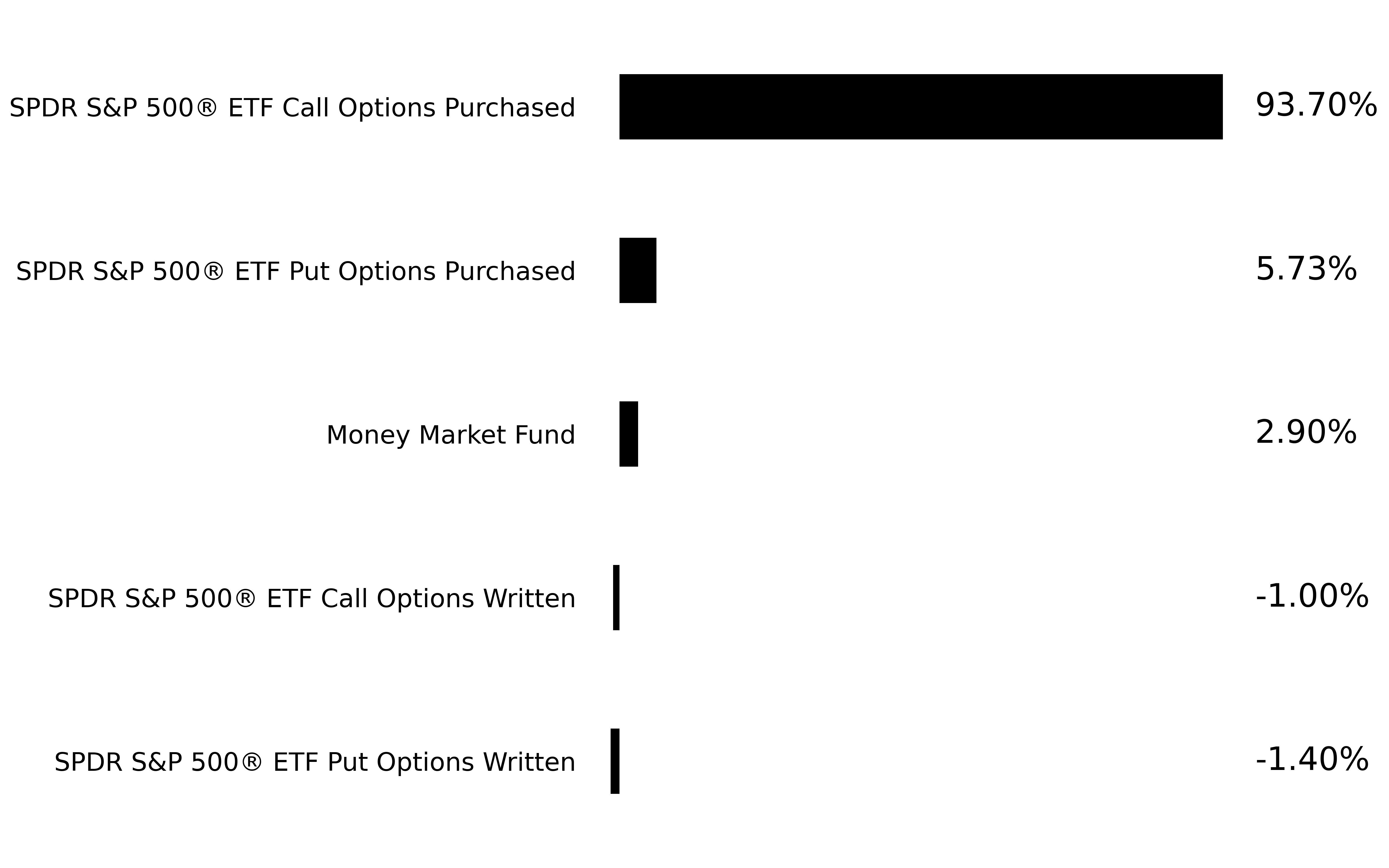

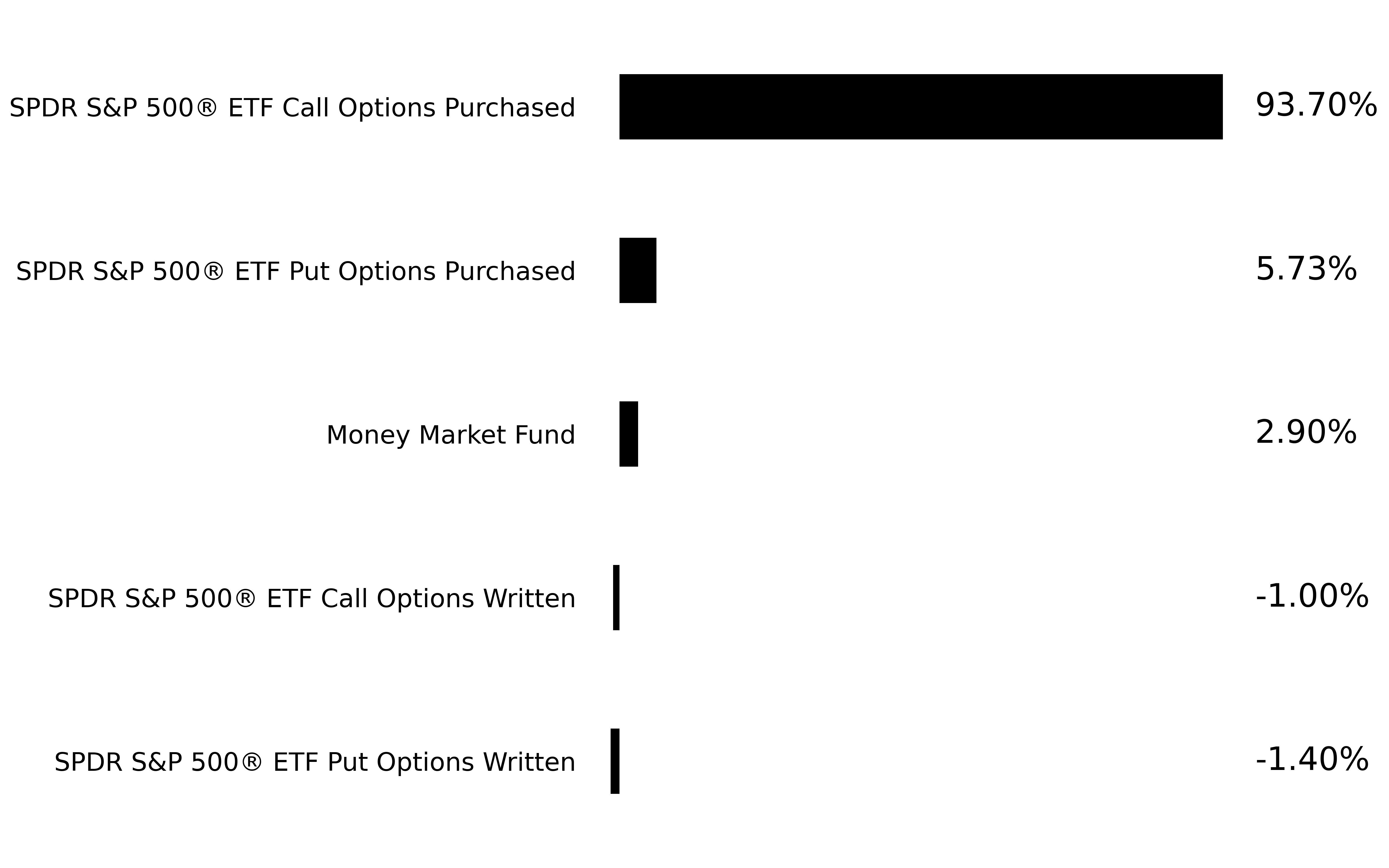

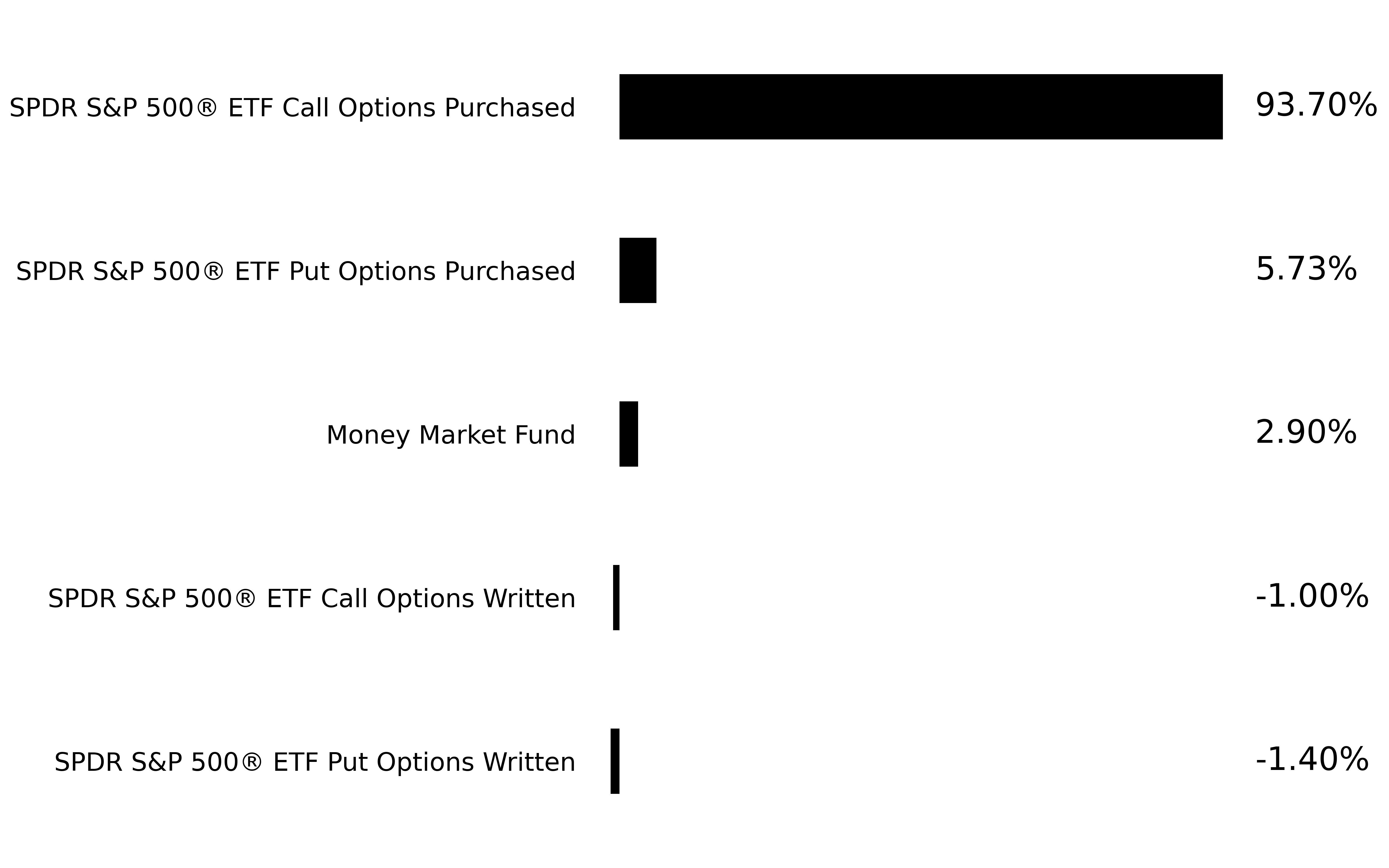

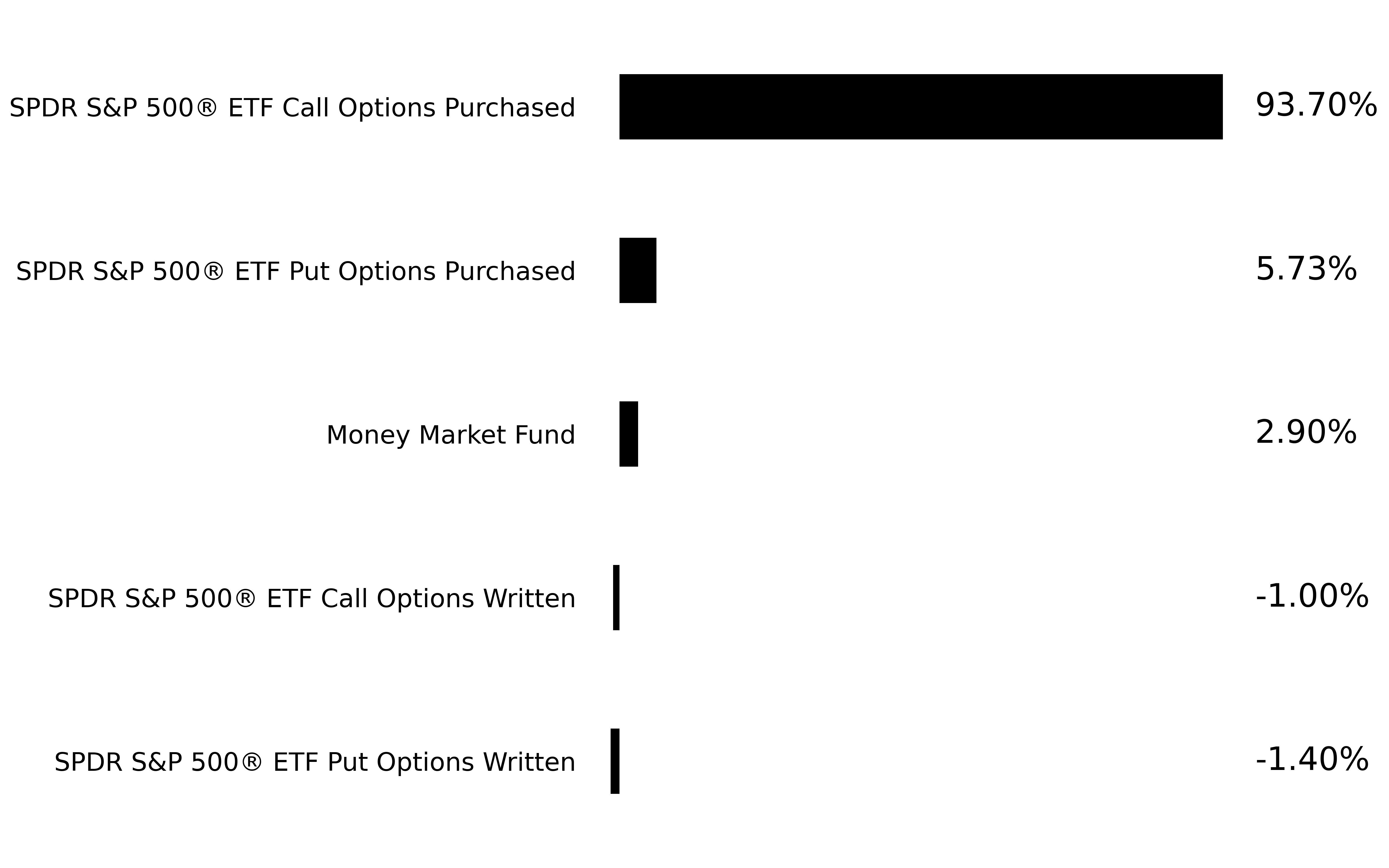

Sector Breakdown | | SPDR S&P 500 ® ETF Call Options Purchased | | SPDR S&P 500 ® ETF Put Options Purchased | | SPDR S&P 500 ® ETF Call Options Written | | SPDR S&P 500 ® ETF Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 99.43% | Money Market Fund | 2.90% | Options Written | -2.40% |

|

|

| Vest US Large Cap 20% Buffer Strategies Fund - Investor Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 20% Buffer Strategies Fund

|

|

| Class Name |

Investor Class Shares

|

|

| Trading Symbol |

ENGLX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 20% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-20-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-20-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Investor Class | $60 | 1.21%¹ |

|

|

| Expenses Paid, Amount |

$ 60

|

|

| Expense Ratio, Percent |

1.21%

|

[8] |

| Net Assets |

$ 112,777,654

|

|

| Holdings Count | Holdings |

39

|

|

| Advisory Fees Paid, Amount |

$ 334,705

|

|

| Investment Company, Portfolio Turnover |

75.14%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $112,777,654 | Number of Holdings | 39 | Total Advisory Fee Paid | $334,705 | Portfolio Turnover Rate | 75.14% |

|

|

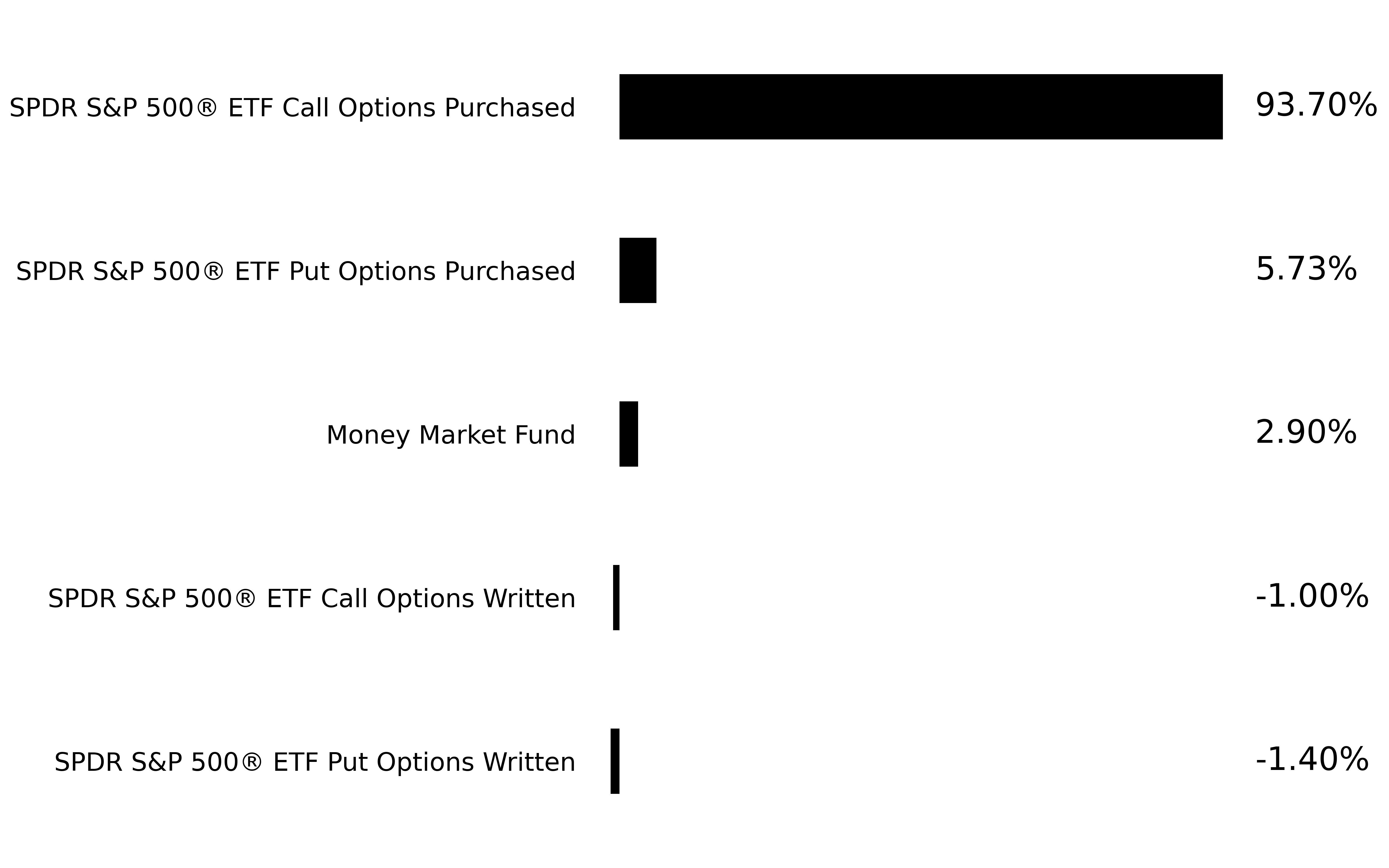

| Holdings [Text Block] |

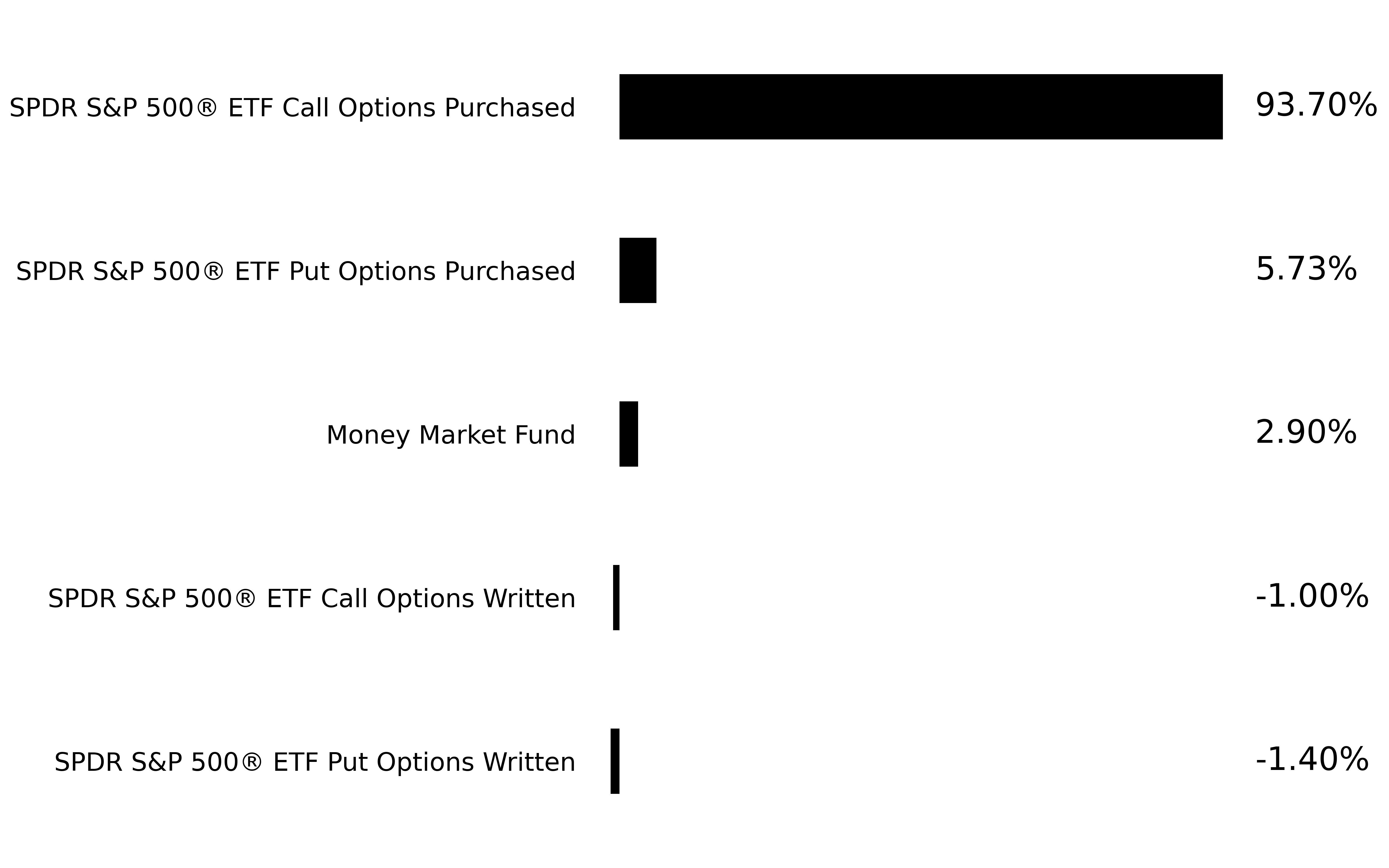

Sector Breakdown | | SPDR S&P 500 ® ETF Call Options Purchased | | SPDR S&P 500 ® ETF Put Options Purchased | | SPDR S&P 500 ® ETF Call Options Written | | SPDR S&P 500 ® ETF Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 99.43% | Money Market Fund | 2.90% | Options Written | -2.40% |

|

|

| Vest US Large Cap 20% Buffer Strategies Fund - Class A Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 20% Buffer Strategies Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

ENGAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 20% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-20-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-20-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $60 | 1.21%¹ |

|

|

| Expenses Paid, Amount |

$ 60

|

|

| Expense Ratio, Percent |

1.21%

|

[9] |

| Net Assets |

$ 112,777,654

|

|

| Holdings Count | Holdings |

39

|

|

| Advisory Fees Paid, Amount |

$ 334,705

|

|

| Investment Company, Portfolio Turnover |

75.14%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $112,777,654 | Number of Holdings | 39 | Total Advisory Fee Paid | $334,705 | Portfolio Turnover Rate | 75.14% |

|

|

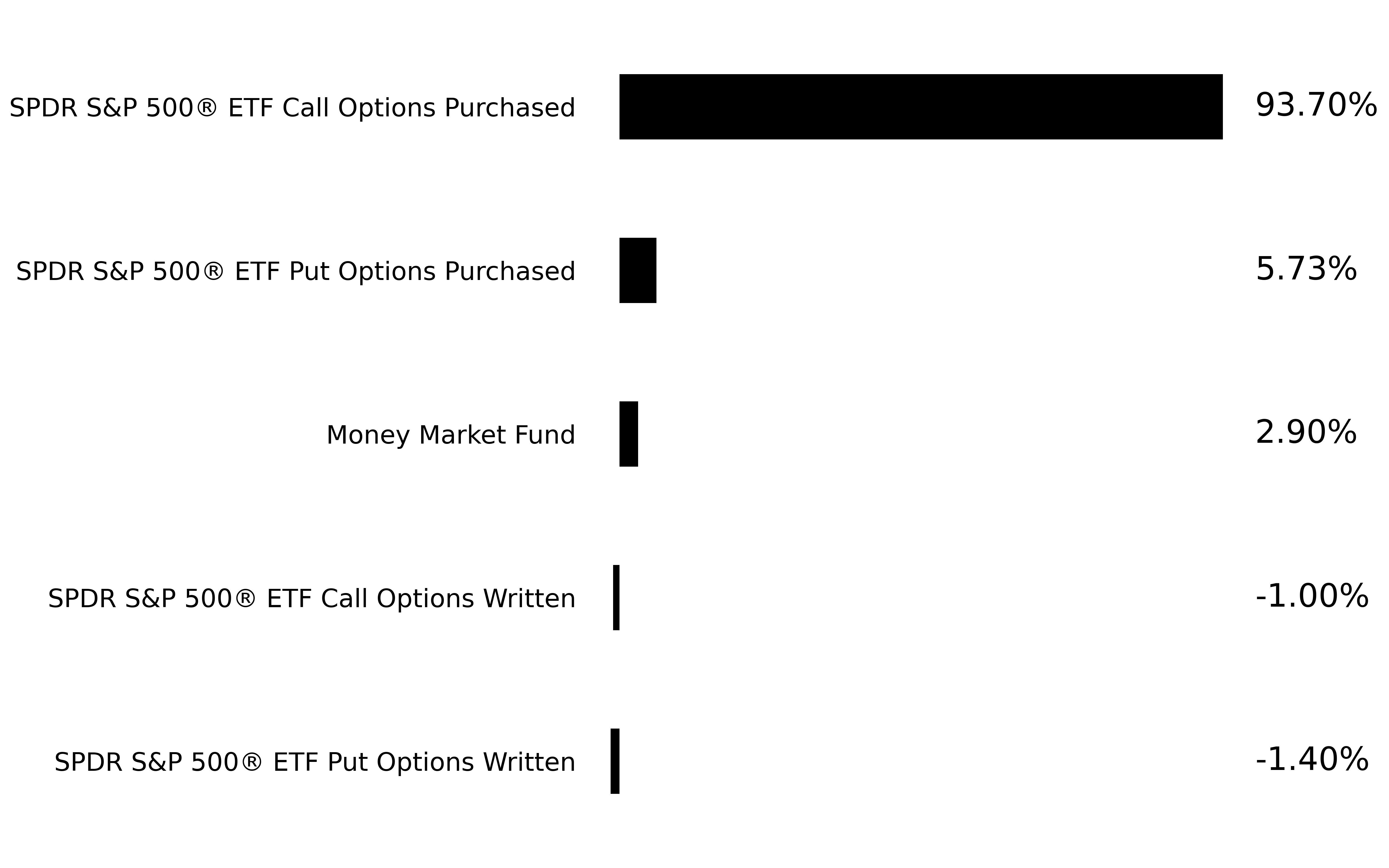

| Holdings [Text Block] |

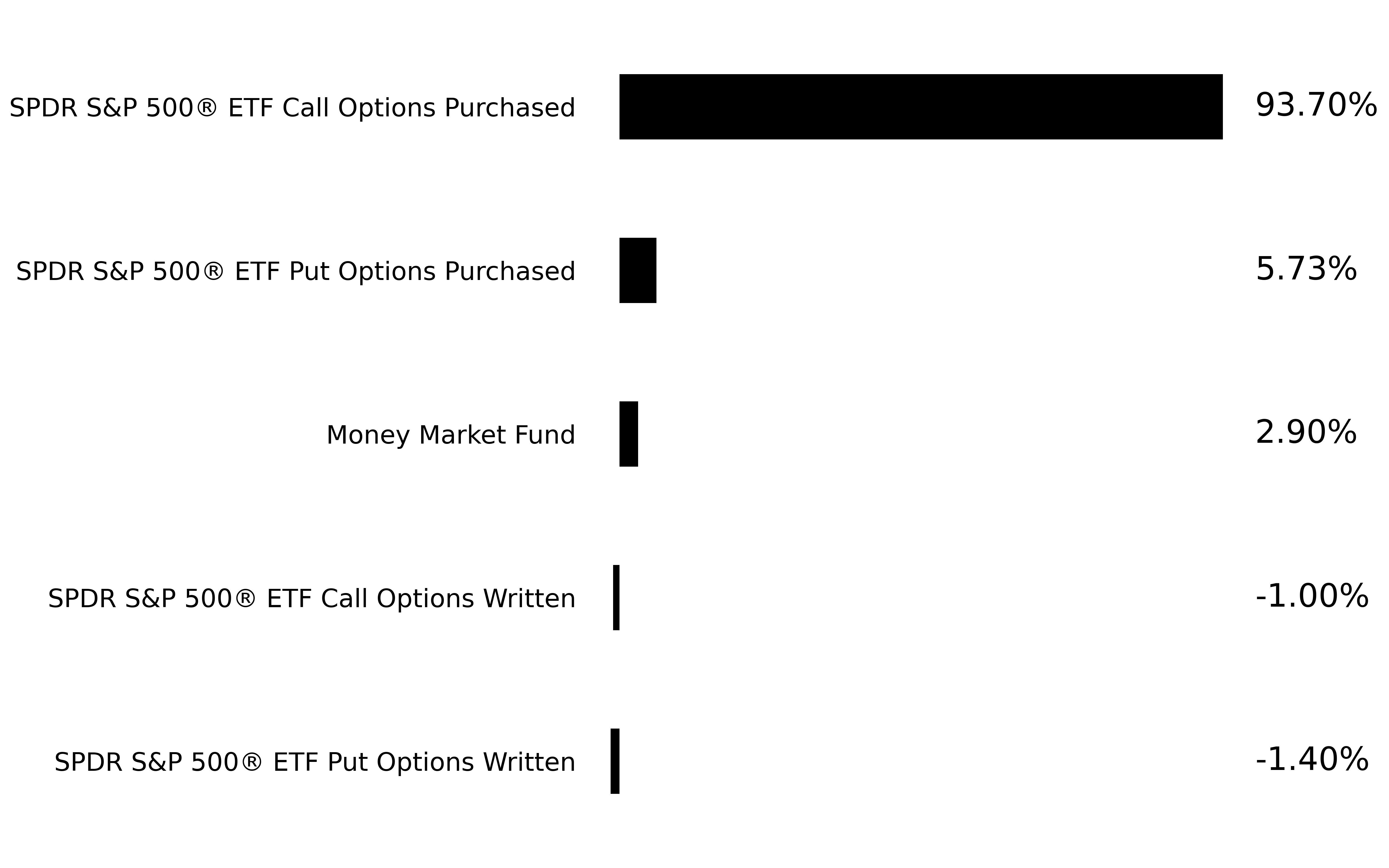

Sector Breakdown | | SPDR S&P 500 ® ETF Call Options Purchased | | SPDR S&P 500 ® ETF Put Options Purchased | | SPDR S&P 500 ® ETF Call Options Written | | SPDR S&P 500 ® ETF Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 99.43% | Money Market Fund | 2.90% | Options Written | -2.40% |

|

|

| Vest US Large Cap 20% Buffer Strategies Fund - Class C Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 20% Buffer Strategies Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

ENGCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 20% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-20-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-20-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class C | $97 | 1.96%¹ |

|

|

| Expenses Paid, Amount |

$ 97

|

|

| Expense Ratio, Percent |

1.96%

|

[10] |

| Net Assets |

$ 112,777,654

|

|

| Holdings Count | Holdings |

39

|

|

| Advisory Fees Paid, Amount |

$ 334,705

|

|

| Investment Company, Portfolio Turnover |

75.14%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $112,777,654 | Number of Holdings | 39 | Total Advisory Fee Paid | $334,705 | Portfolio Turnover Rate | 75.14% |

|

|

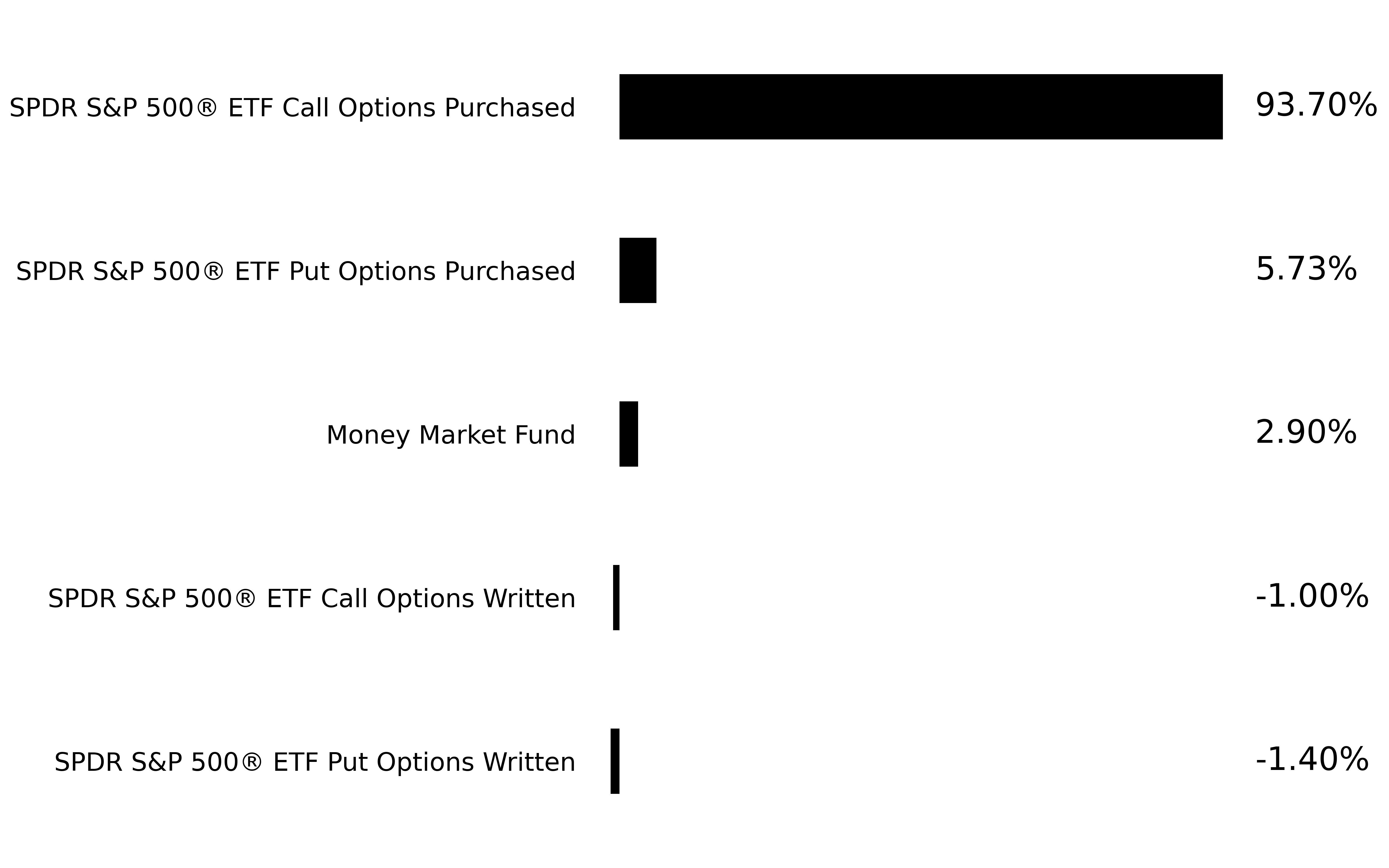

| Holdings [Text Block] |

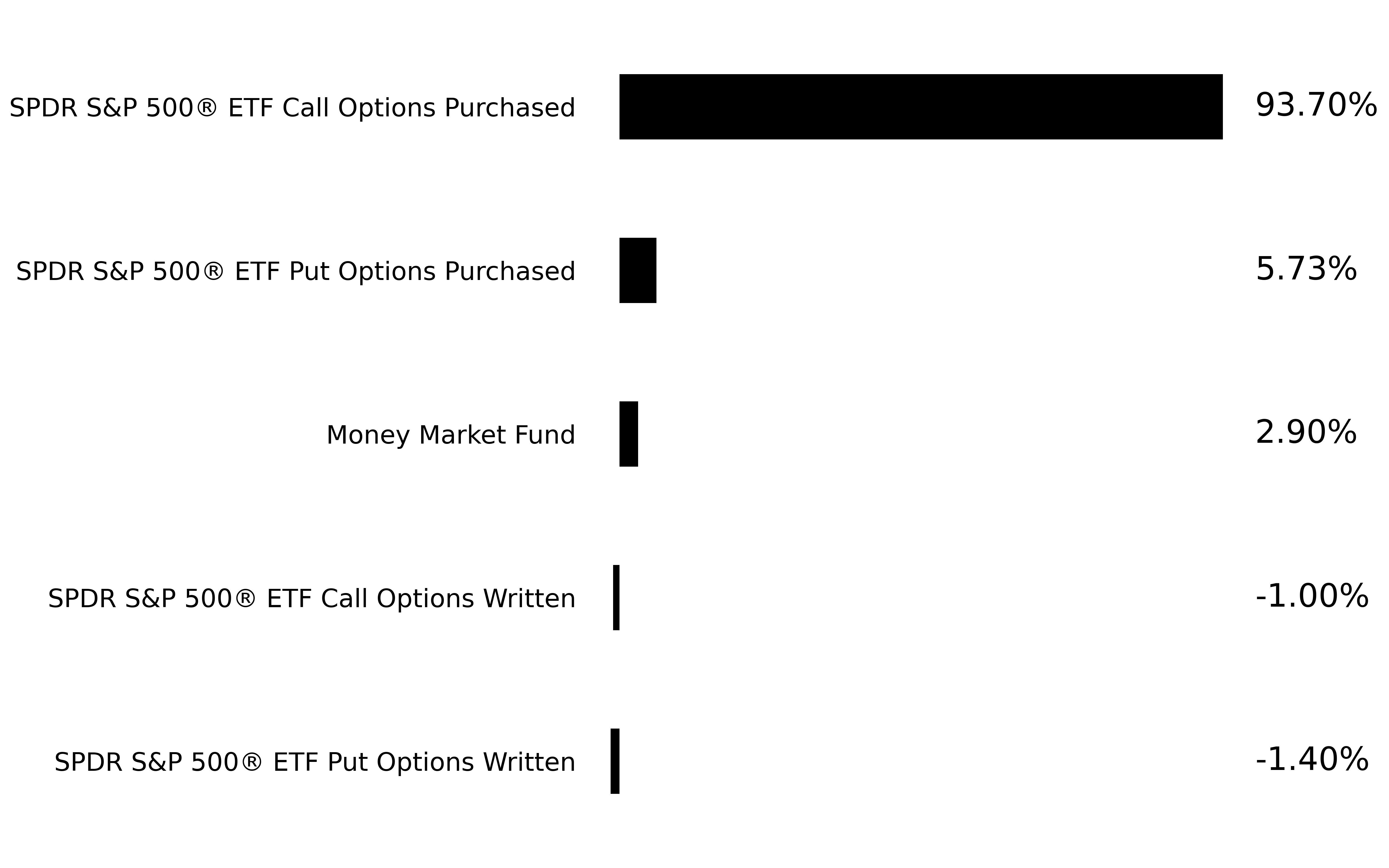

Sector Breakdown | | SPDR S&P 500 ® ETF Call Options Purchased | | SPDR S&P 500 ® ETF Put Options Purchased | | SPDR S&P 500 ® ETF Call Options Written | | SPDR S&P 500 ® ETF Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 99.43% | Money Market Fund | 2.90% | Options Written | -2.40% |

|

|

| Vest US Large Cap 20% Buffer Strategies Fund - Class R Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 20% Buffer Strategies Fund

|

|

| Class Name |

Class R Shares

|

|

| Trading Symbol |

ENGRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 20% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-20-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-20-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R | $24 | 0.49%¹ |

|

|

| Expenses Paid, Amount |

$ 24

|

|

| Expense Ratio, Percent |

0.49%

|

[11] |

| Net Assets |

$ 112,777,654

|

|

| Holdings Count | Holdings |

39

|

|

| Advisory Fees Paid, Amount |

$ 334,705

|

|

| Investment Company, Portfolio Turnover |

75.14%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $112,777,654 | Number of Holdings | 39 | Total Advisory Fee Paid | $334,705 | Portfolio Turnover Rate | 75.14% |

|

|

| Holdings [Text Block] |

Sector Breakdown | | SPDR S&P 500 ® ETF Call Options Purchased | | SPDR S&P 500 ® ETF Put Options Purchased | | SPDR S&P 500 ® ETF Call Options Written | | SPDR S&P 500 ® ETF Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 99.43% | Money Market Fund | 2.90% | Options Written | -2.40% |

|

|

| Vest US Large Cap 20% Buffer Strategies Fund - Class Y Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest US Large Cap 20% Buffer Strategies Fund

|

|

| Class Name |

Class Y Shares

|

|

| Trading Symbol |

ENGYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest US Large Cap 20% Buffer Strategies Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/buffer-20-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/buffer-20-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class Y | $35 | 0.71%¹ |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.71%

|

[12] |

| Net Assets |

$ 112,777,654

|

|

| Holdings Count | Holdings |

39

|

|

| Advisory Fees Paid, Amount |

$ 334,705

|

|

| Investment Company, Portfolio Turnover |

75.14%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $112,777,654 | Number of Holdings | 39 | Total Advisory Fee Paid | $334,705 | Portfolio Turnover Rate | 75.14% |

|

|

| Holdings [Text Block] |

Sector Breakdown | | SPDR S&P 500 ® ETF Call Options Purchased | | SPDR S&P 500 ® ETF Put Options Purchased | | SPDR S&P 500 ® ETF Call Options Written | | SPDR S&P 500 ® ETF Put Options Written | | | |

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Options Purchased | 99.43% | Money Market Fund | 2.90% | Options Written | -2.40% |

|

|

| Vest S&P 500 Dividend Aristocrats Target Income Fund - Institutional Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest S&P 500® Dividend Aristocrats Target Income Fund

|

|

| Class Name |

Institutional Class Shares

|

|

| Trading Symbol |

KNGIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest S&P 500® Dividend Aristocrats Target Income Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional Class | $47 | 0.96%¹ |

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.96%

|

[13] |

| Net Assets |

$ 53,344,440

|

|

| Holdings Count | Holdings |

100

|

|

| Advisory Fees Paid, Amount |

$ 80,307

|

|

| Investment Company, Portfolio Turnover |

190.21%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $53,344,440 | Number of Holdings | 100 | Total Advisory Fee Paid | $80,307 | Portfolio Turnover Rate | 190.21% |

|

|

| Holdings [Text Block] |

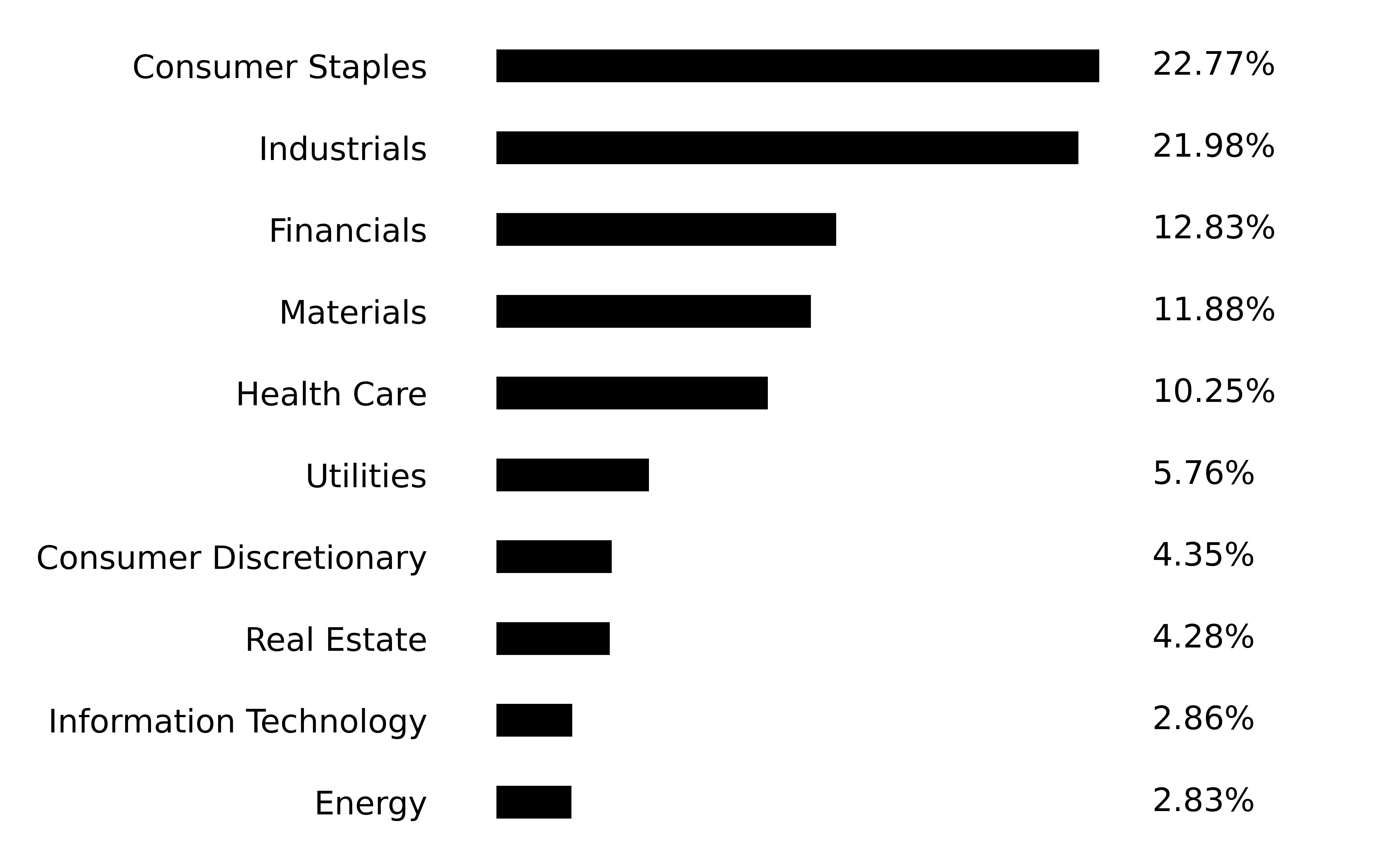

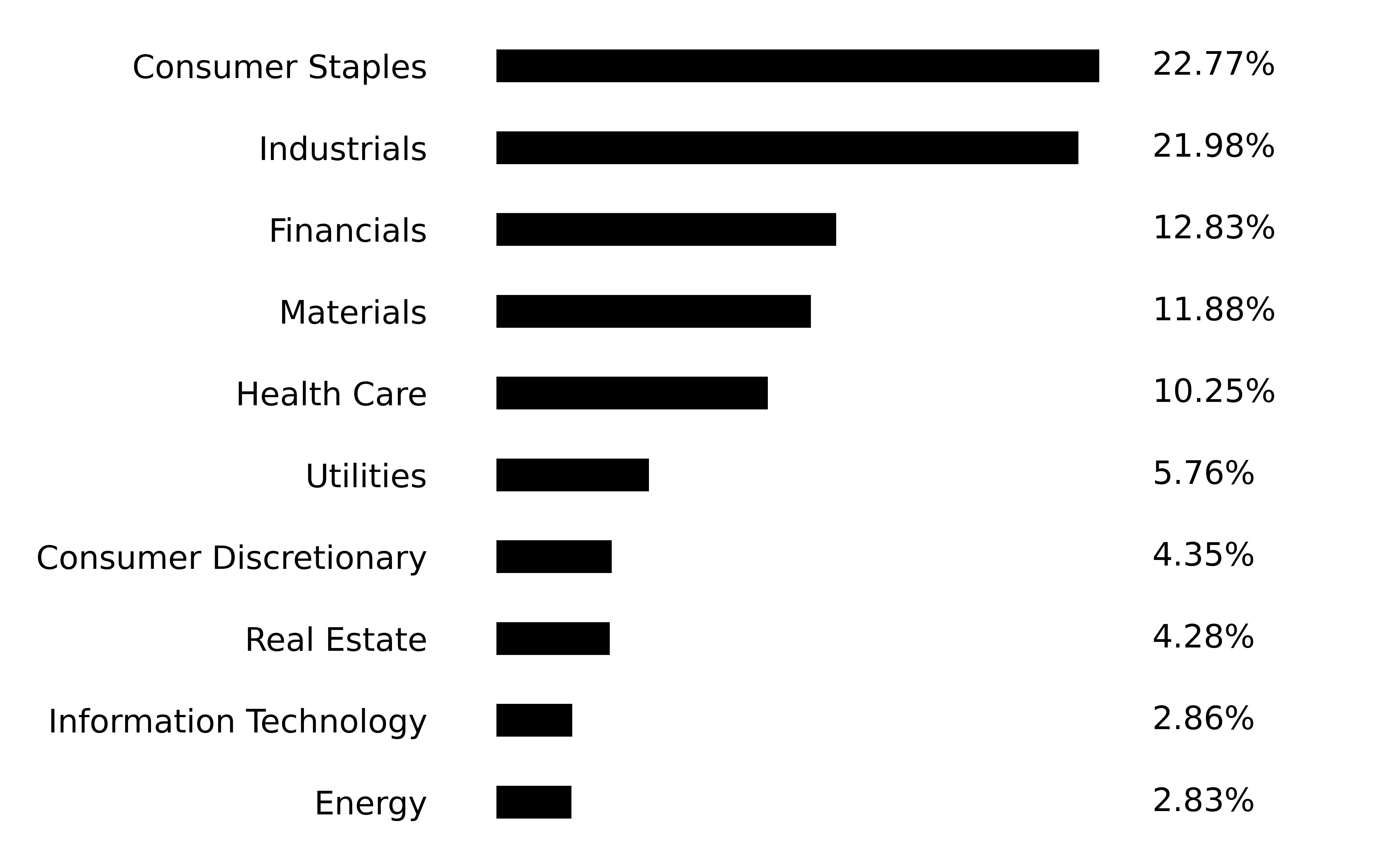

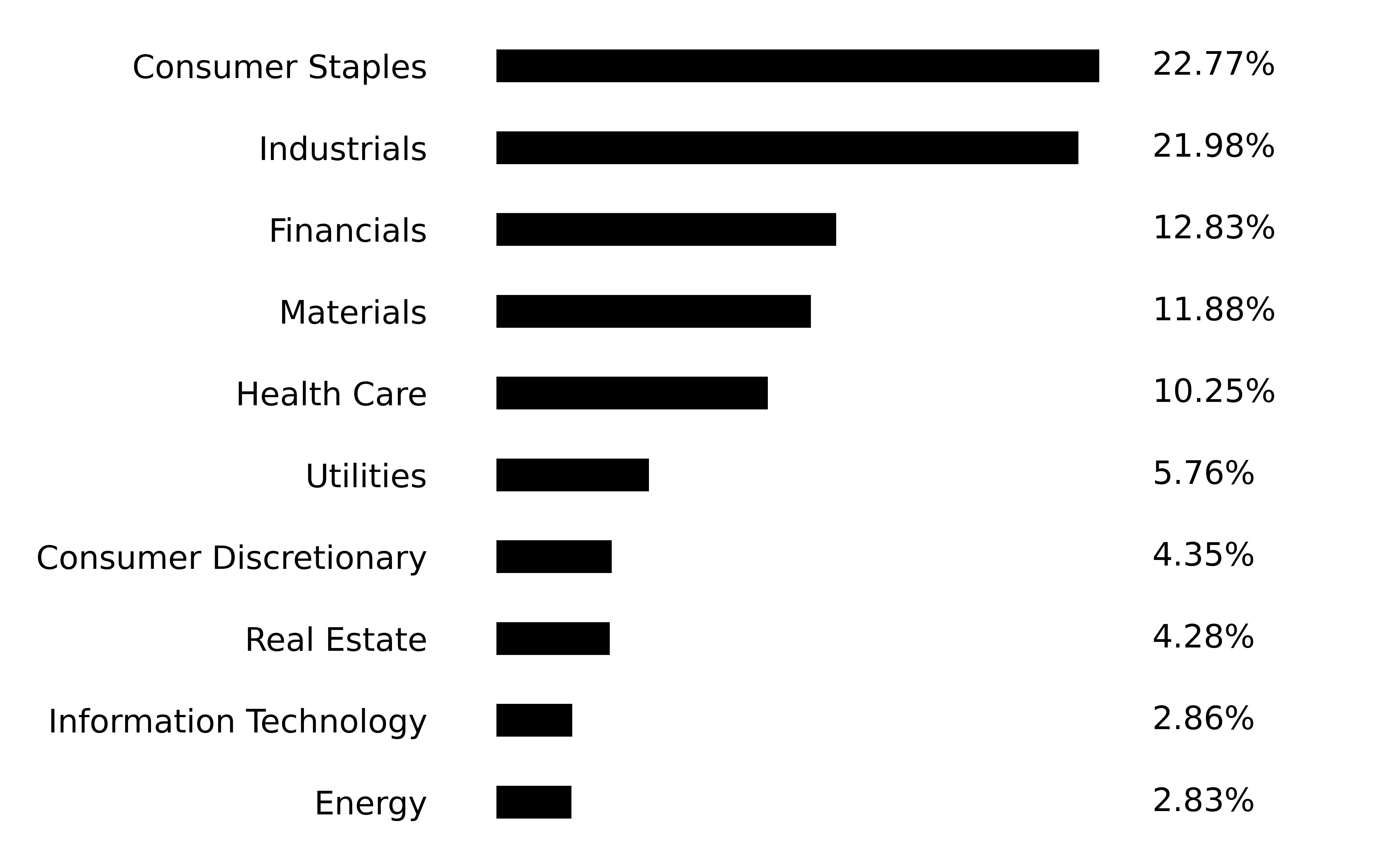

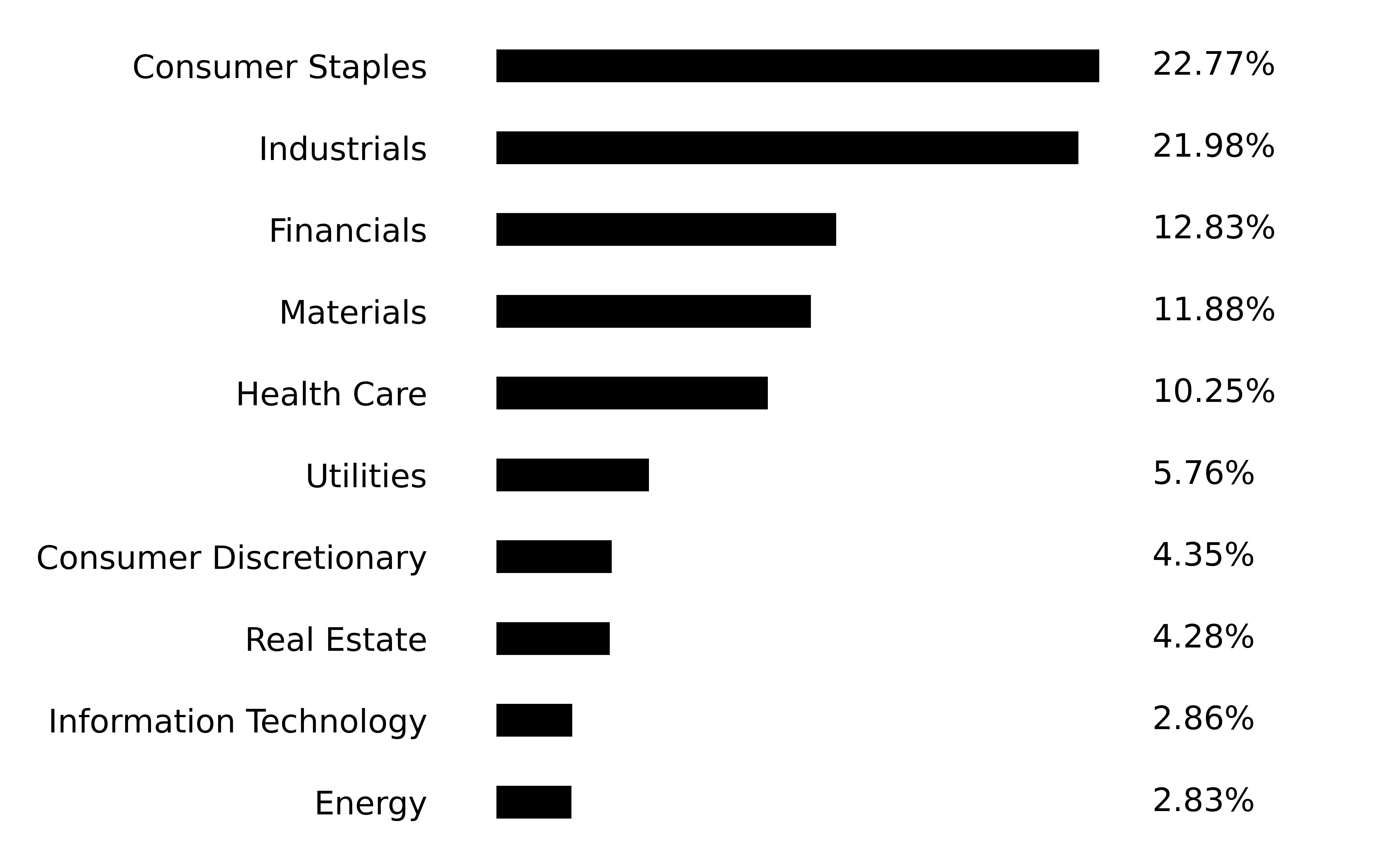

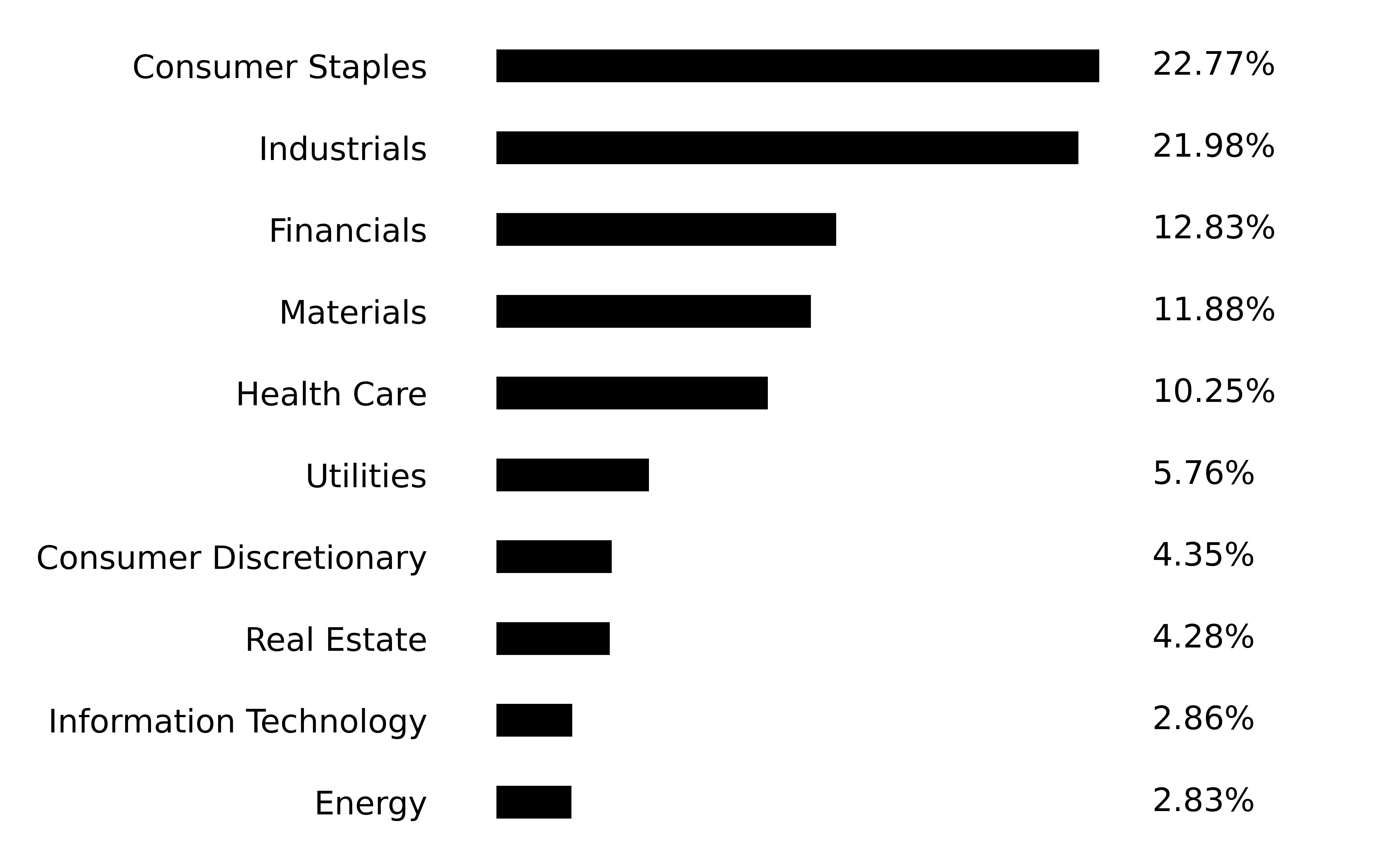

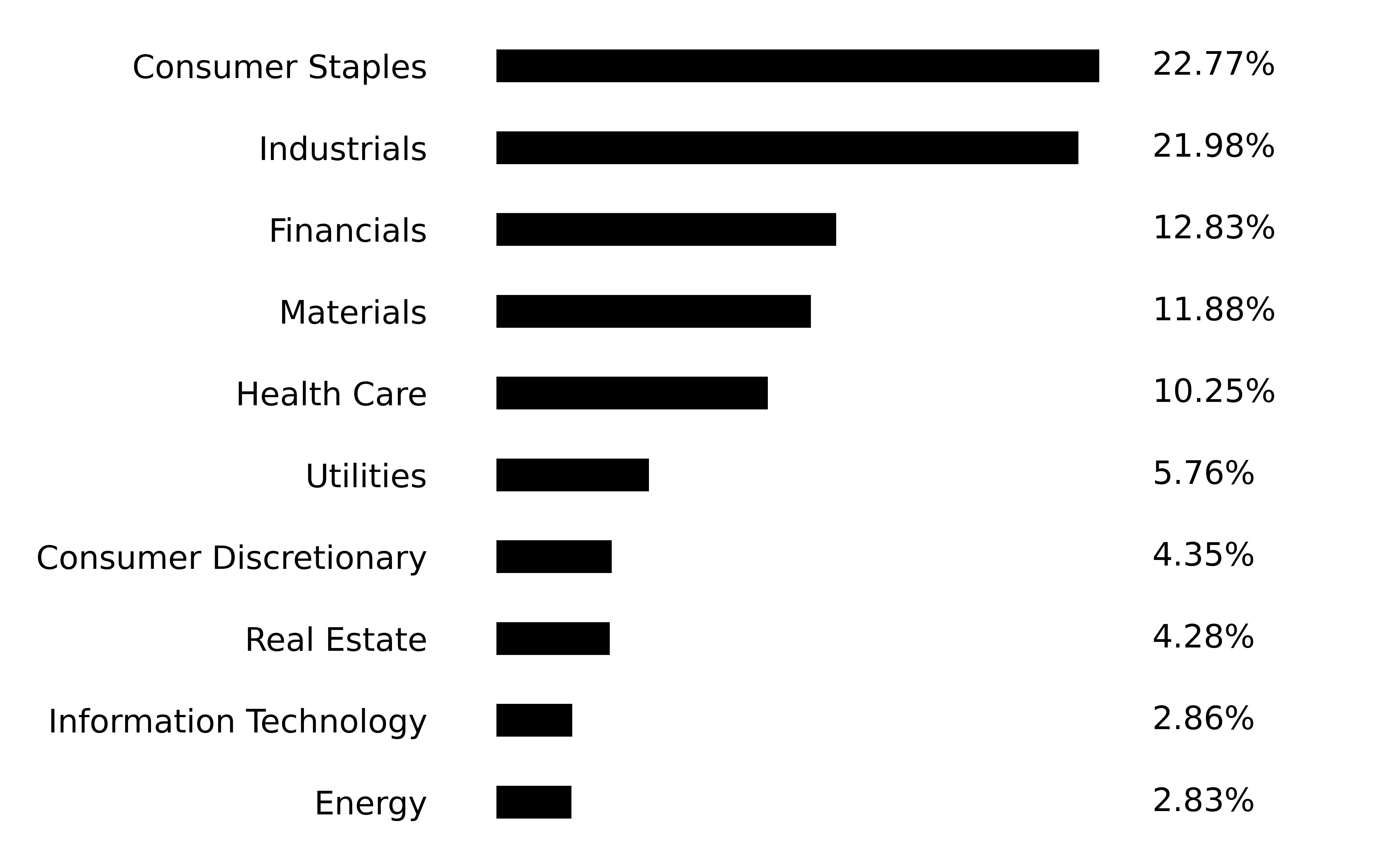

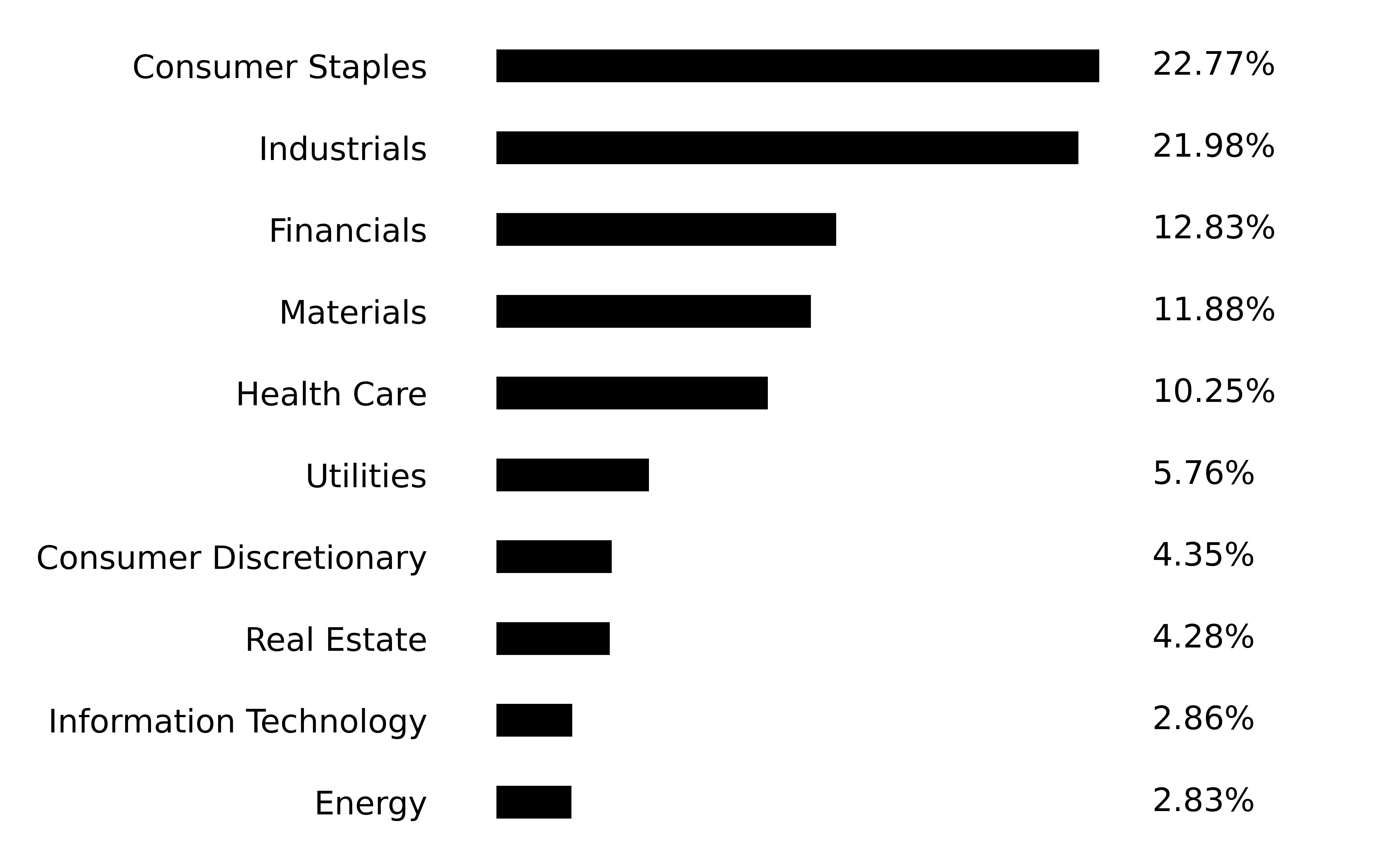

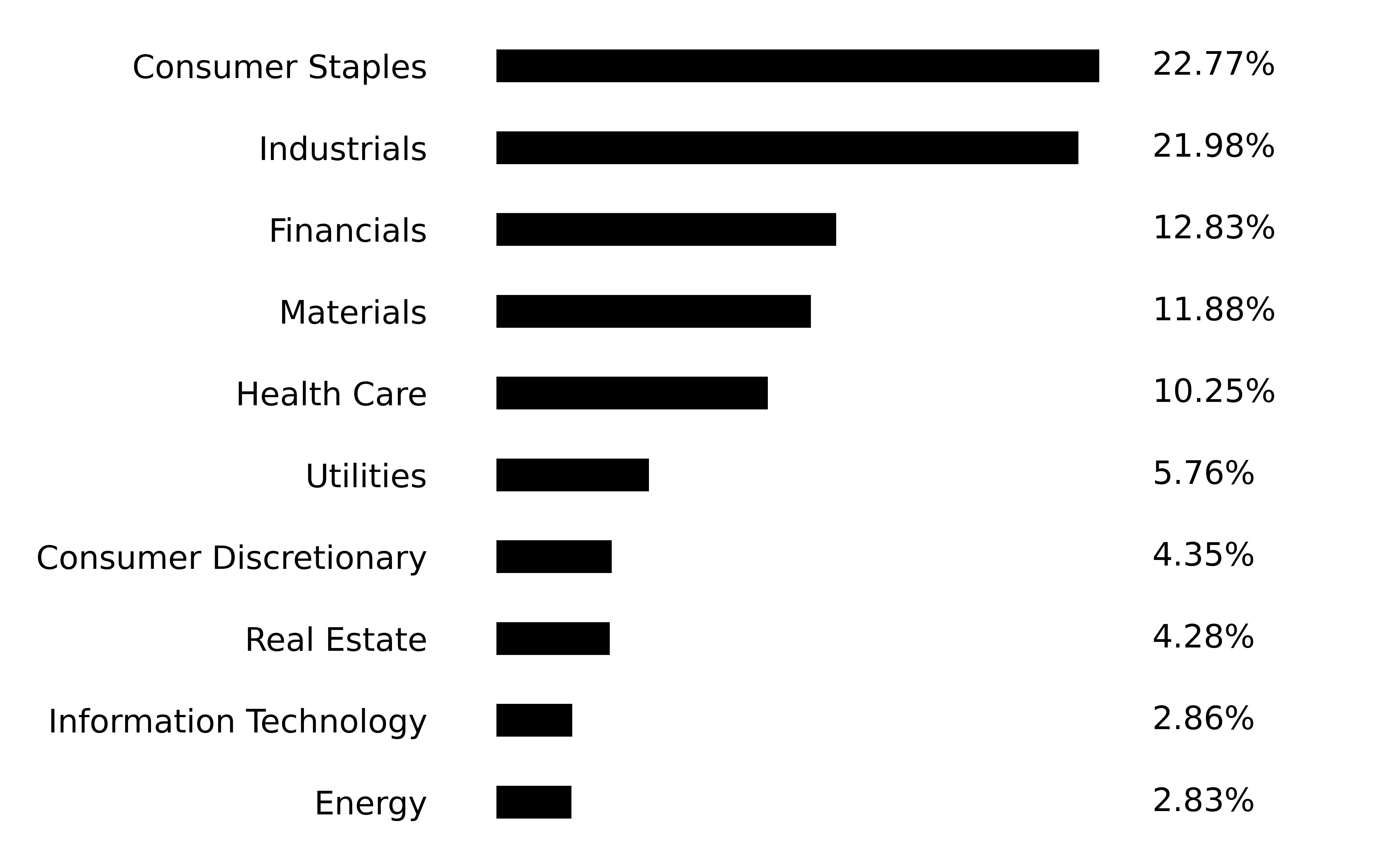

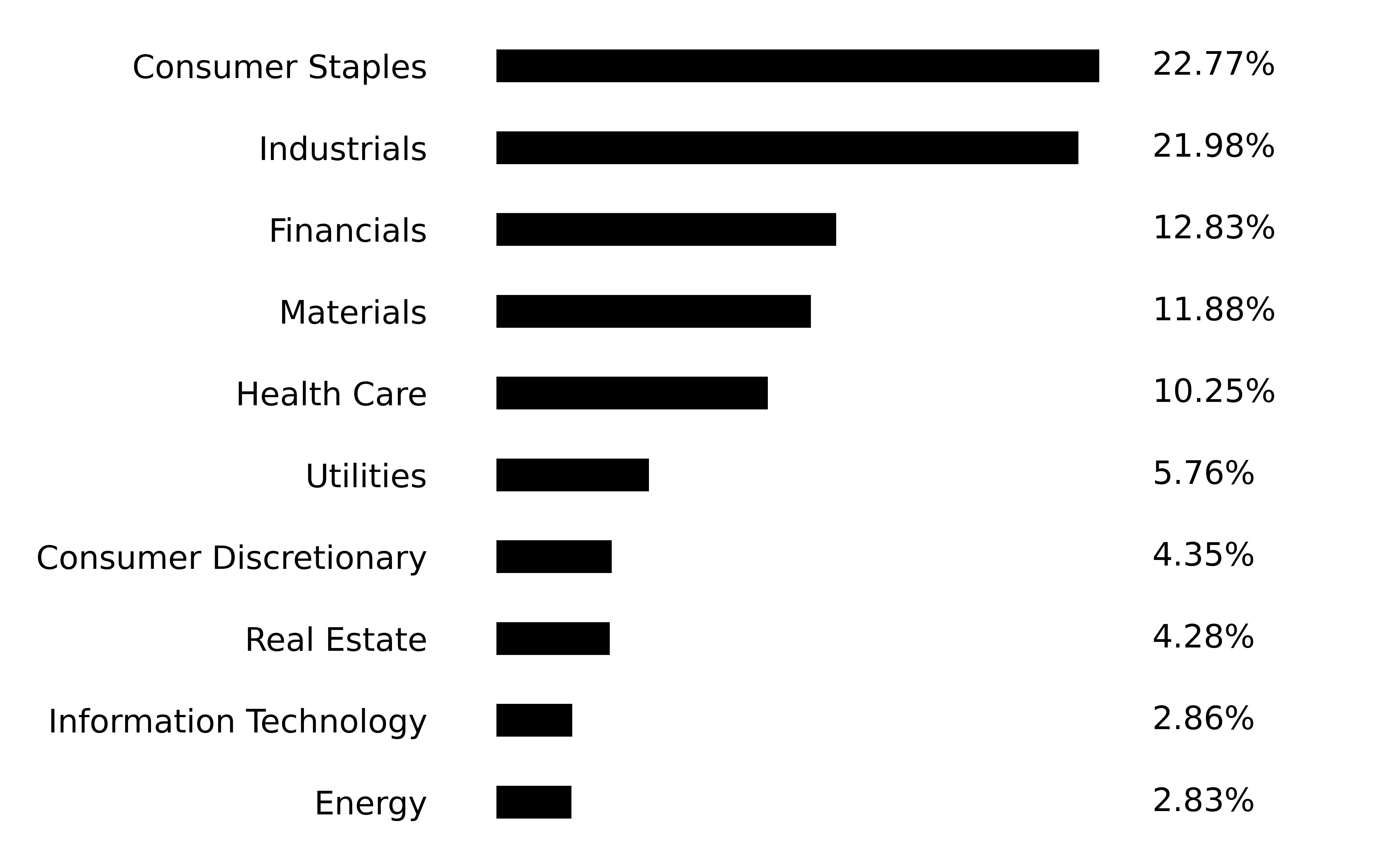

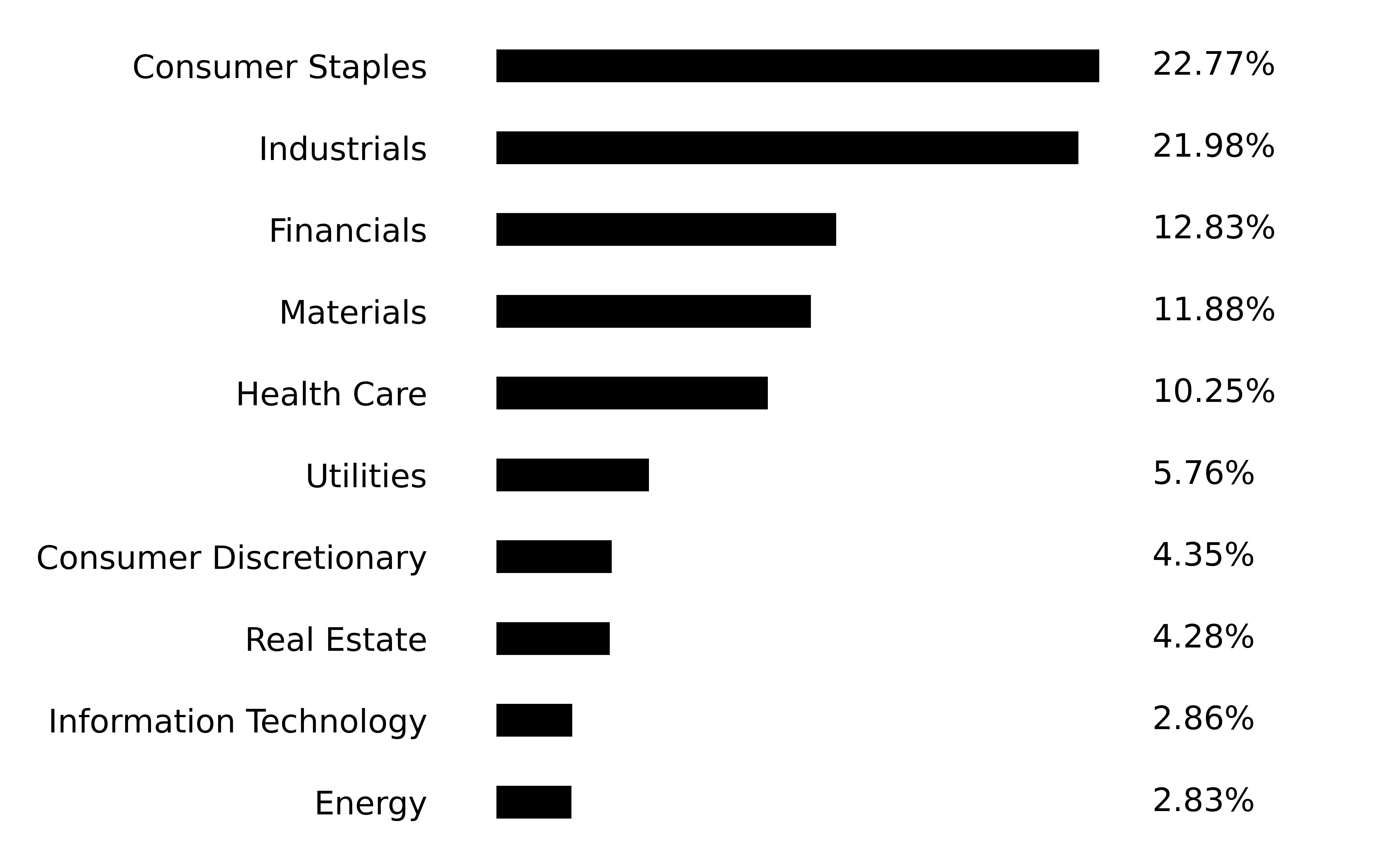

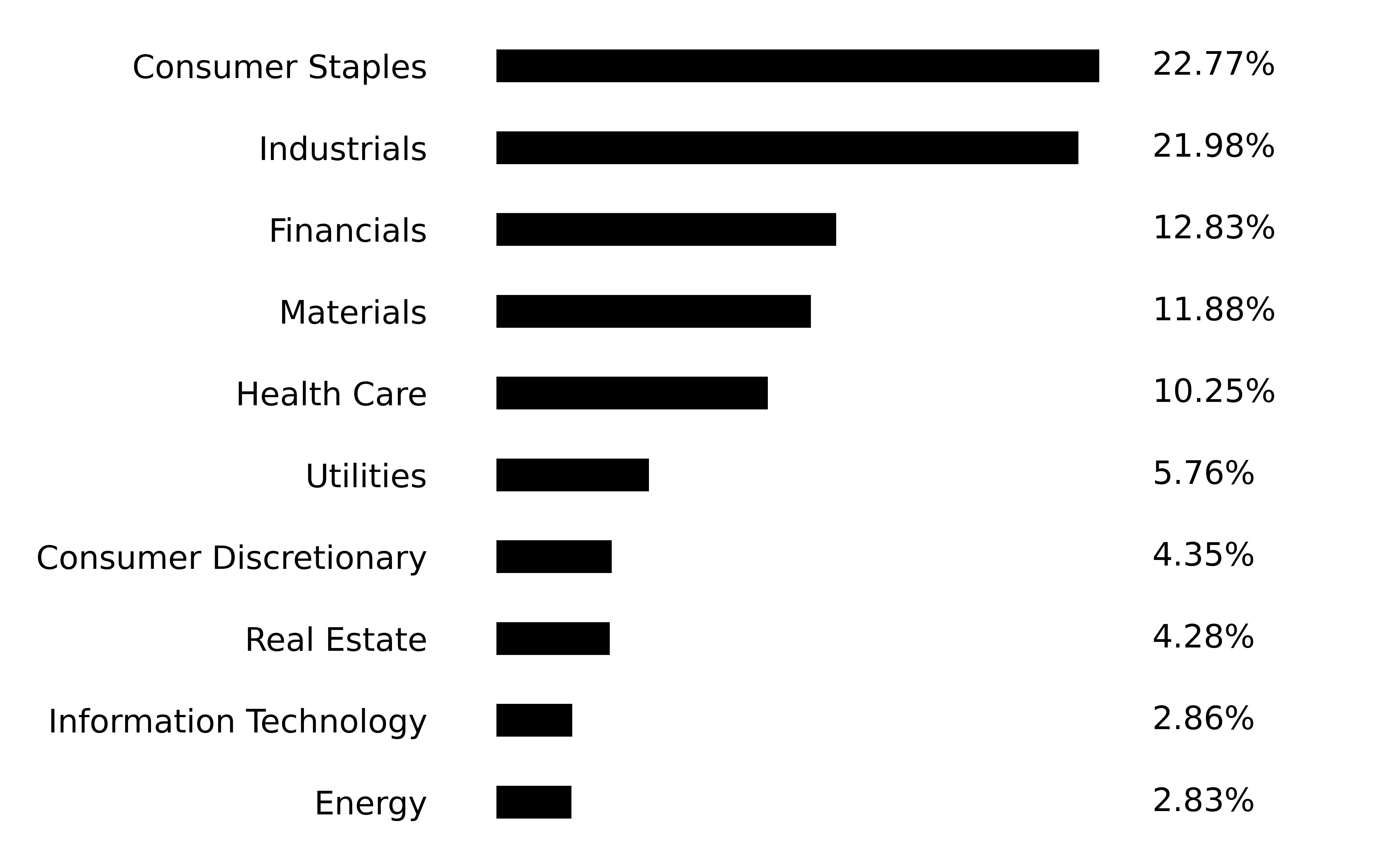

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings |

|

|---|

Abbvie, Inc. | 1.57% | PPG Industries, Inc. | 1.53% | S&P 500 Global, Inc. | 1.52% | A O Smith Corp. | 1.52% | Nucor Corp. | 1.52% | The Sherwin-Williams Co. | 1.52% | Ecolab, Inc. | 1.51% | Albemarle Corp. | 1.50% | Cardinal Health, Inc. | 1.50% | T Rowe Price Group, Inc. | 1.46% |

|

|

| Vest S&P 500 Dividend Aristocrats Target Income Fund - Investor Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest S&P 500® Dividend Aristocrats Target Income Fund

|

|

| Class Name |

Investor Class Shares

|

|

| Trading Symbol |

KNGLX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest S&P 500® Dividend Aristocrats Target Income Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Investor Class | $59 | 1.21%¹ |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

1.21%

|

[14] |

| Net Assets |

$ 53,344,440

|

|

| Holdings Count | Holdings |

100

|

|

| Advisory Fees Paid, Amount |

$ 80,307

|

|

| Investment Company, Portfolio Turnover |

190.21%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $53,344,440 | Number of Holdings | 100 | Total Advisory Fee Paid | $80,307 | Portfolio Turnover Rate | 190.21% |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings |

|

|---|

Abbvie, Inc. | 1.57% | PPG Industries, Inc. | 1.53% | S&P 500 Global, Inc. | 1.52% | A O Smith Corp. | 1.52% | Nucor Corp. | 1.52% | The Sherwin-Williams Co. | 1.52% | Ecolab, Inc. | 1.51% | Albemarle Corp. | 1.50% | Cardinal Health, Inc. | 1.50% | T Rowe Price Group, Inc. | 1.46% |

|

|

| Vest S&P 500 Dividend Aristocrats Target Income Fund - Class A Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest S&P 500® Dividend Aristocrats Target Income Fund

|

|

| Class Name |

Class A Shares

|

|

| Trading Symbol |

KNGAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest S&P 500® Dividend Aristocrats Target Income Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $59 | 1.21%¹ |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

1.21%

|

[15] |

| Net Assets |

$ 53,344,440

|

|

| Holdings Count | Holdings |

100

|

|

| Advisory Fees Paid, Amount |

$ 80,307

|

|

| Investment Company, Portfolio Turnover |

190.21%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $53,344,440 | Number of Holdings | 100 | Total Advisory Fee Paid | $80,307 | Portfolio Turnover Rate | 190.21% |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings |

|

|---|

Abbvie, Inc. | 1.57% | PPG Industries, Inc. | 1.53% | S&P 500 Global, Inc. | 1.52% | A O Smith Corp. | 1.52% | Nucor Corp. | 1.52% | The Sherwin-Williams Co. | 1.52% | Ecolab, Inc. | 1.51% | Albemarle Corp. | 1.50% | Cardinal Health, Inc. | 1.50% | T Rowe Price Group, Inc. | 1.46% |

|

|

| Vest S&P 500 Dividend Aristocrats Target Income Fund - Class C Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest S&P 500® Dividend Aristocrats Target Income Fund

|

|

| Class Name |

Class C Shares

|

|

| Trading Symbol |

KNGCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest S&P 500® Dividend Aristocrats Target Income Fund for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class C | $95 | 1.96%¹ |

|

|

| Expenses Paid, Amount |

$ 95

|

|

| Expense Ratio, Percent |

1.96%

|

[16] |

| Net Assets |

$ 53,344,440

|

|

| Holdings Count | Holdings |

100

|

|

| Advisory Fees Paid, Amount |

$ 80,307

|

|

| Investment Company, Portfolio Turnover |

190.21%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $53,344,440 | Number of Holdings | 100 | Total Advisory Fee Paid | $80,307 | Portfolio Turnover Rate | 190.21% |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings |

|

|---|

Abbvie, Inc. | 1.57% | PPG Industries, Inc. | 1.53% | S&P 500 Global, Inc. | 1.52% | A O Smith Corp. | 1.52% | Nucor Corp. | 1.52% | The Sherwin-Williams Co. | 1.52% | Ecolab, Inc. | 1.51% | Albemarle Corp. | 1.50% | Cardinal Health, Inc. | 1.50% | T Rowe Price Group, Inc. | 1.46% |

|

|

| Vest S&P 500 Dividend Aristocrats Target Income Fund - Class R Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest

S&P 500® Dividend Aristocrats Target Income Fund

|

|

| Class Name |

Class R Shares

|

|

| Trading Symbol |

KNGRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual shareholder report contains important information about the Vest S&P 500® Dividend Aristocrats Target Income Fund for

the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details. You can also contact us at (855)

505-8378.

|

|

| Additional Information Phone Number |

(855)

505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R | $24 | 0.49%¹ |

|

|

| Expenses Paid, Amount |

$ 24

|

|

| Expense Ratio, Percent |

0.49%

|

[17] |

| Net Assets |

$ 53,344,440

|

|

| Holdings Count | Holdings |

100

|

|

| Advisory Fees Paid, Amount |

$ 80,307

|

|

| Investment Company, Portfolio Turnover |

190.21%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $53,344,440 | Number of Holdings | 100 | Total Advisory Fee Paid | $80,307 | Portfolio Turnover Rate | 190.21% |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings |

|

|---|

Abbvie, Inc. | 1.57% | PPG Industries, Inc. | 1.53% | S&P 500 Global, Inc. | 1.52% | A O Smith Corp. | 1.52% | Nucor Corp. | 1.52% | The Sherwin-Williams Co. | 1.52% | Ecolab, Inc. | 1.51% | Albemarle Corp. | 1.50% | Cardinal Health, Inc. | 1.50% | T Rowe Price Group, Inc. | 1.46% |

|

|

| Vest S&P 500 Dividend Aristocrats Target Income Fund - Class Y Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest

S&P 500® Dividend Aristocrats Target Income Fund

|

|

| Class Name |

Class Y Shares

|

|

| Trading Symbol |

KNGYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual shareholder report contains important information about the Vest S&P 500® Dividend Aristocrats Target Income Fund for

the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details. You can also contact us at (855)

505-8378.

|

|

| Additional Information Phone Number |

(855)

505-8378

|

|

| Additional Information Website |

www.vestfin.com/mutual-funds/sp-500-dividend-aristocrats-target-income-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class Y | $35 | 0.71%¹ |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.71%

|

[18] |

| Net Assets |

$ 53,344,440

|

|

| Holdings Count | Holdings |

100

|

|

| Advisory Fees Paid, Amount |

$ 80,307

|

|

| Investment Company, Portfolio Turnover |

190.21%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | $53,344,440 | Number of Holdings | 100 | Total Advisory Fee Paid | $80,307 | Portfolio Turnover Rate | 190.21% |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings |

|

|---|

Abbvie, Inc. | 1.57% | PPG Industries, Inc. | 1.53% | S&P 500 Global, Inc. | 1.52% | A O Smith Corp. | 1.52% | Nucor Corp. | 1.52% | The Sherwin-Williams Co. | 1.52% | Ecolab, Inc. | 1.51% | Albemarle Corp. | 1.50% | Cardinal Health, Inc. | 1.50% | T Rowe Price Group, Inc. | 1.46% |

|

|

| Vest Bitcoin Strategy Managed Volatility Fund - Institutional Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest Bitcoin Strategy Managed Volatility Fund

|

|

| Class Name |

Institutional Class Shares

|

|

| Trading Symbol |

BTCVX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest Bitcoin Strategy Managed Volatility Fund (Consolidated) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/products/bitcoin-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/products/bitcoin-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Institutional Class | $54 | 0.99%¹ |

|

|

| Expenses Paid, Amount |

$ 54

|

|

| Expense Ratio, Percent |

0.99%

|

[19] |

| Net Assets |

$ 16,087,691

|

|

| Holdings Count | Holdings |

1

|

[20] |

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company, Portfolio Turnover |

203.15%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | 16,087,691 | Number of Holdings | 1¹ | Total Advisory Fee Paid | $0 | Portfolio Turnover Rate | 203.15% |

| 1 |

Excludes derivatives held by the Fund. |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Money Market Fund | 87.72% | Cash | 13.17% | Derivatives | 1.30% | Liabilities in Excess of Other Assets | -2.19% |

|

|

| Vest Bitcoin Strategy Managed Volatility Fund - Investor Class Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest Bitcoin Strategy Managed Volatility Fund

|

|

| Class Name |

Investor Class Shares

|

|

| Trading Symbol |

BTCLX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest Bitcoin Strategy Managed Volatility Fund (Consolidated) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/products/bitcoin-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/products/bitcoin-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Investor Class | $68 | 1.24%¹ |

|

|

| Expenses Paid, Amount |

$ 68

|

|

| Expense Ratio, Percent |

1.24%

|

[21] |

| Net Assets |

$ 16,087,691

|

|

| Holdings Count | Holdings |

1

|

[22] |

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company, Portfolio Turnover |

203.15%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | 16,087,691 | Number of Holdings | 1¹ | Total Advisory Fee Paid | $0 | Portfolio Turnover Rate | 203.15% |

| 1 |

Excludes derivatives held by the Fund. |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Money Market Fund | 87.72% | Cash | 13.17% | Derivatives | 1.30% | Liabilities in Excess of Other Assets | -2.19% |

|

|

| Vest Bitcoin Strategy Managed Volatility Fund - Class R Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest Bitcoin Strategy Managed Volatility Fund

|

|

| Class Name |

Class R Shares

|

|

| Trading Symbol |

BTCRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest Bitcoin Strategy Managed Volatility Fund (Consolidated) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/products/bitcoin-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/products/bitcoin-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R | $27 | 0.49%¹ |

|

|

| Expenses Paid, Amount |

$ 27

|

|

| Expense Ratio, Percent |

0.49%

|

[23] |

| Net Assets |

$ 16,087,691

|

|

| Holdings Count | Holdings |

1

|

[24] |

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company, Portfolio Turnover |

203.15%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | 16,087,691 | Number of Holdings | 1¹ | Total Advisory Fee Paid | $0 | Portfolio Turnover Rate | 203.15% |

| 1 |

Excludes derivatives held by the Fund. |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Money Market Fund | 87.72% | Cash | 13.17% | Derivatives | 1.30% | Liabilities in Excess of Other Assets | -2.19% |

|

|

| Vest Bitcoin Strategy Managed Volatility Fund - Class Y Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Vest Bitcoin Strategy Managed Volatility Fund

|

|

| Class Name |

Class Y Shares

|

|

| Trading Symbol |

BTCYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Vest Bitcoin Strategy Managed Volatility Fund (Consolidated) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.vestfin.com/products/bitcoin-fund#fund-details. You can also contact us at (855) 505-8378.

|

|

| Additional Information Phone Number |

(855) 505-8378

|

|

| Additional Information Website |

www.vestfin.com/products/bitcoin-fund#fund-details

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class Y | $49 | 0.89%¹ |

|

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

0.89%

|

[25] |

| Net Assets |

$ 16,087,691

|

|

| Holdings Count | Holdings |

1

|

[26] |

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company, Portfolio Turnover |

203.15%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of April 30, 2025) | |

|---|

Fund Net Assets | 16,087,691 | Number of Holdings | 1¹ | Total Advisory Fee Paid | $0 | Portfolio Turnover Rate | 203.15% |

| 1 |

Excludes derivatives held by the Fund. |

|

|

| Holdings [Text Block] |

Sector Breakdown

|

|

| Largest Holdings [Text Block] |

Portfolio Composition |

|

|---|

Money Market Fund | 87.72% | Cash | 13.17% | Derivatives | 1.30% | Liabilities in Excess of Other Assets | -2.19% |

|

|

|

|