What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

FIRE Funds™ Wealth Builder ETF | $0 | 0.00% |

Key Fund Statistics

(as of April 30, 2025)

Fund Net Assets (in thousands) | $3,334 |

Number of Holdings | 17 |

Total Advisory Fee Paid | 0 |

Portfolio Turnover Rate | 21% |

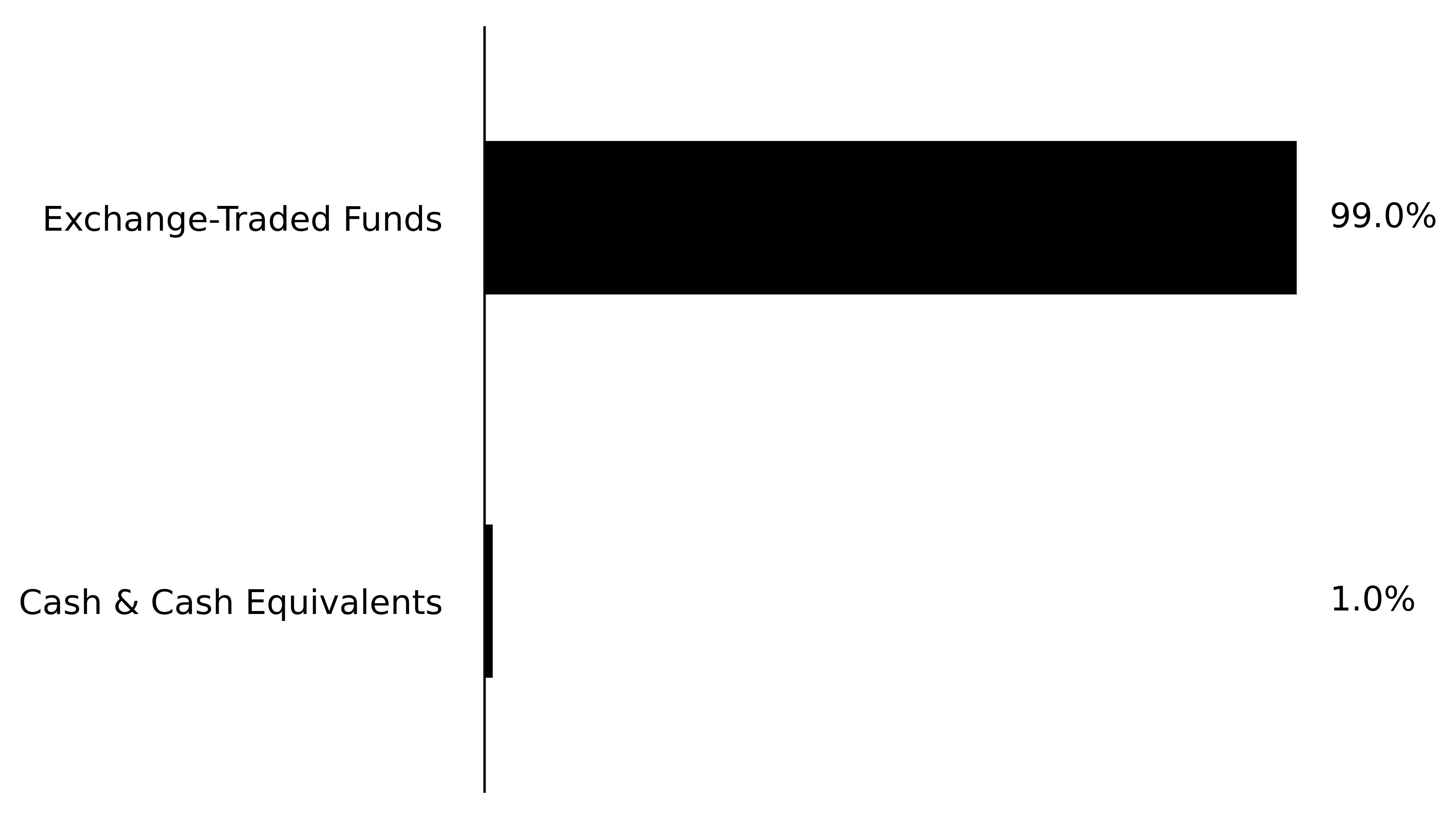

Sector Breakdown

(% of Total Net Assets)

What did the Fund invest in?

(as of April 30, 2025)

Top Ten Holdings | (% of Total Net Assets) |

|---|---|

Sofi Select 500 ETF | |

Madison Aggregate Bond ETF | |

Madison Short-Term Strategic Income ETF | |

Carbon Collective Short Duration Green Bond ETF | |

STKD Bitcoin & Gold ETF | |

SPDR Gold MiniShares Trust | |

Academy Veteran Impact ETF | |

Cambria Chesapeake Pur Trend ETF | |

Fundstrat Granny Shots US Large Cap ETF | |

Residential REIT ETF |

What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

FIRE Funds™ Income Target ETF | $0 | 0.00% |

Key Fund Statistics

(as of April 30, 2025)

Fund Net Assets (in thousands) | $1,138 |

Number of Holdings | 13 |

Total Advisory Fee Paid | $0 |

Portfolio Turnover Rate | 49% |

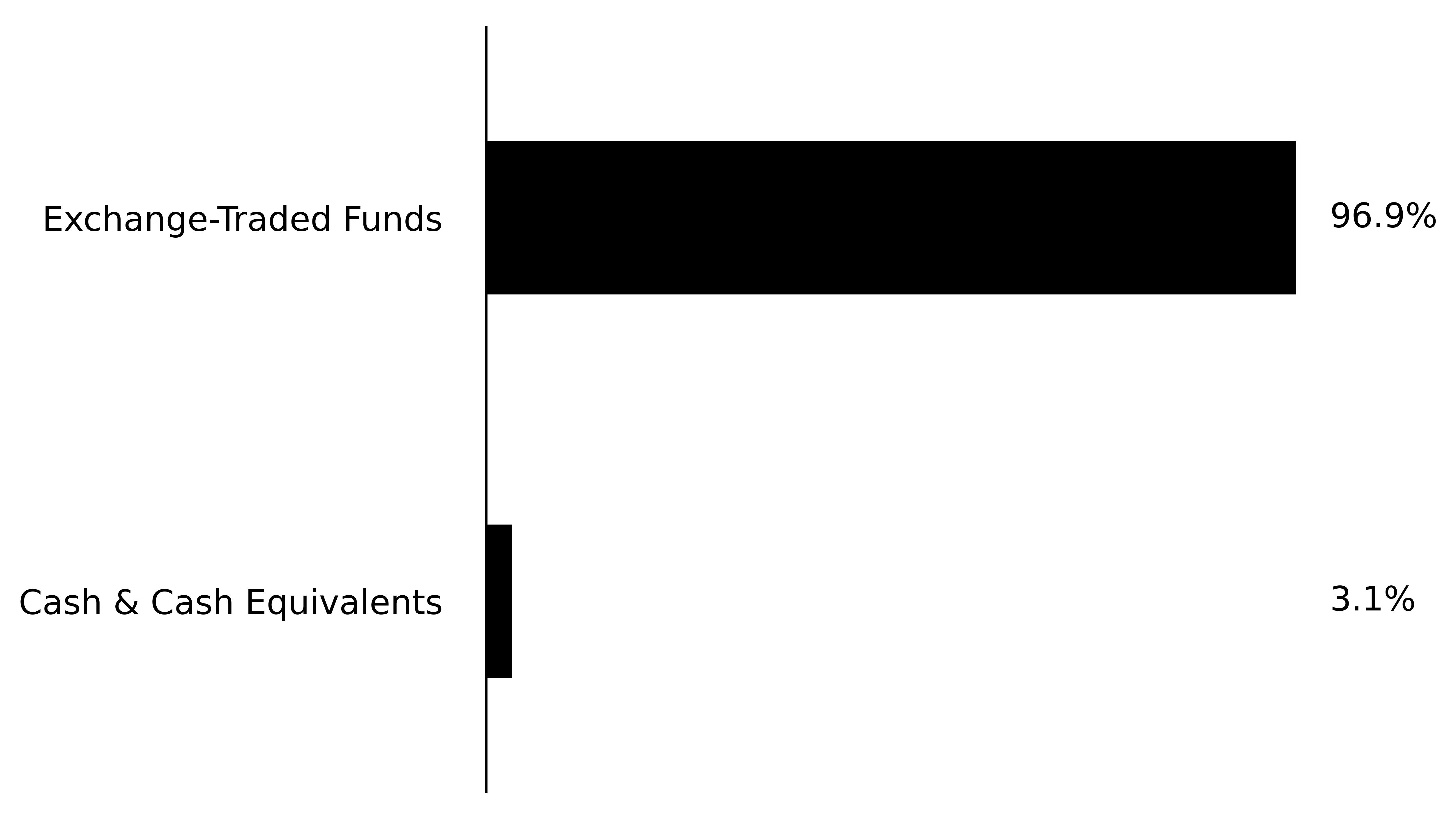

Sector Breakdown

(% of Total Net Assets)

What did the Fund invest in?

(as of April 30, 2025)

Top Ten Holdings | (% of Total Net Assets) |

|---|---|

Carbon Collective Short Duration Green Bond ETF | |

Madison Short-Term Strategic Income ETF | |

FolioBeyond Alternative Income and Interest Rate Hedge ETF | |

Academy Veteran Impact ETF | |

Cambria Tail Risk ETF | |

Nicholas Fixed Income Alternative ETF | |

YieldMax

Gold Miners Option Income Strategy ETF | |

Defiance Nasdaq 100 Enhanced Options & 0DTE Income ETF | |

SoFi Enhanced Yield ETF | |

YieldMax Ultra Option Income Strategy ETF |