| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class A | $49 | 0.98% |

| 1. | Annualized. |

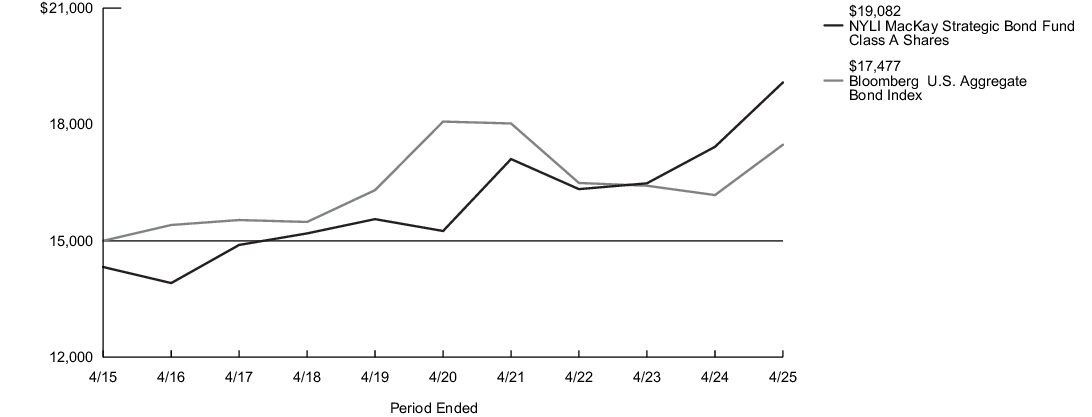

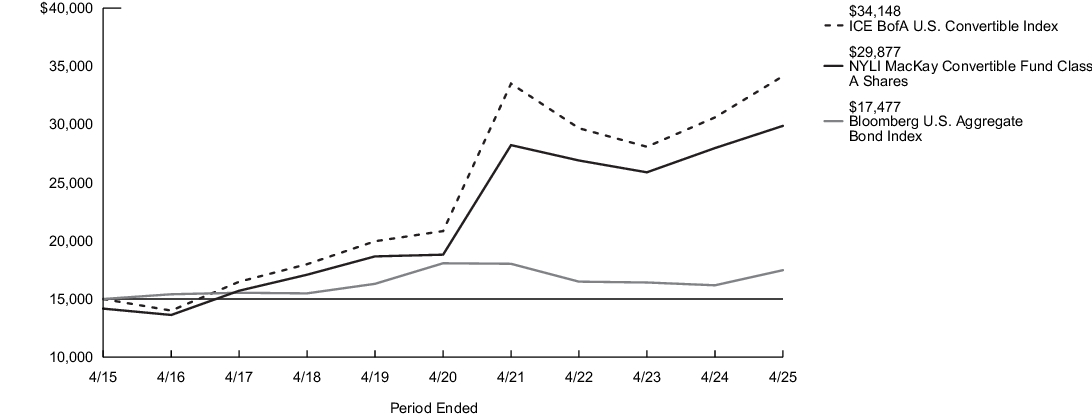

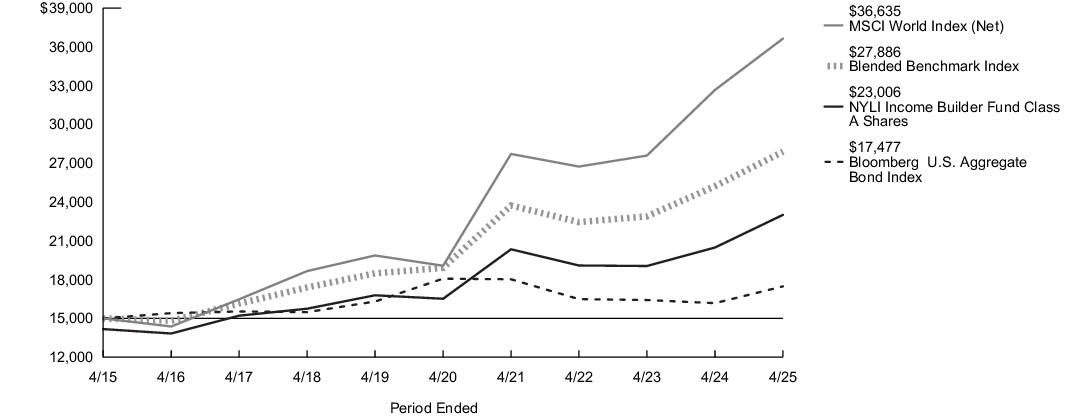

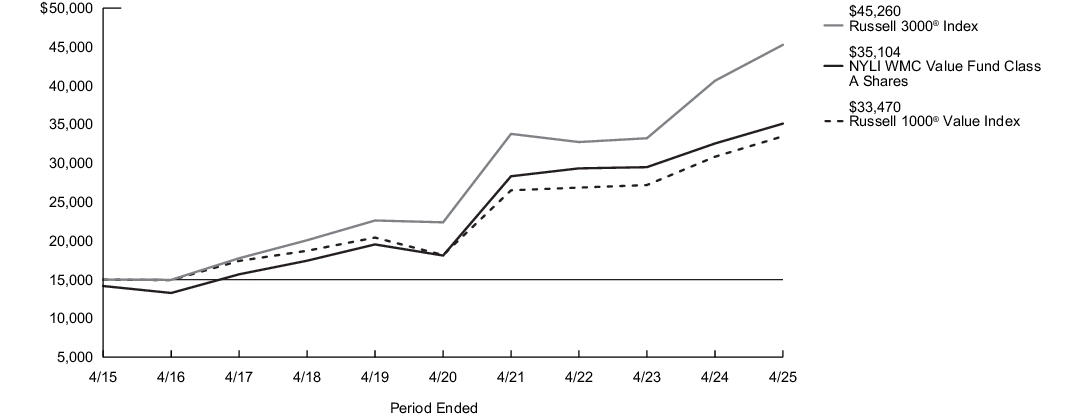

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class A Shares - Including sales charges | 2/28/1997 | (1.55)% | 4.59% | 3.62% | 2.44% |

| Class A Shares - Excluding sales charges | 3.09% | 9.52% | 4.58% | 2.91% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Morningstar Multisector Bond Category Average3 | 2.25% | 7.76% | 4.19% | 3.12% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The Morningstar Multisector Bond Category Average is representative of funds that seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $995,196,754 |

| Total number of portfolio holdings | 548 |

| Portfolio turnover rate | 85% |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

| Corporate Bonds | 28.8% |

| Mortgage-Backed Securities | 26.9% |

| U.S. Government & Federal Agencies | 25.3% |

| Asset-Backed Securities | 11.8% |

| Foreign Government Bonds | 4.1% |

| Loan Assignments | 2.0% |

| Short-Term Investments | 1.4% |

| Common Stocks | 0.0%‡ |

| Other Assets, Less Liabilities | (0.3)% |

| ‡ Less than one-tenth of a percent. |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

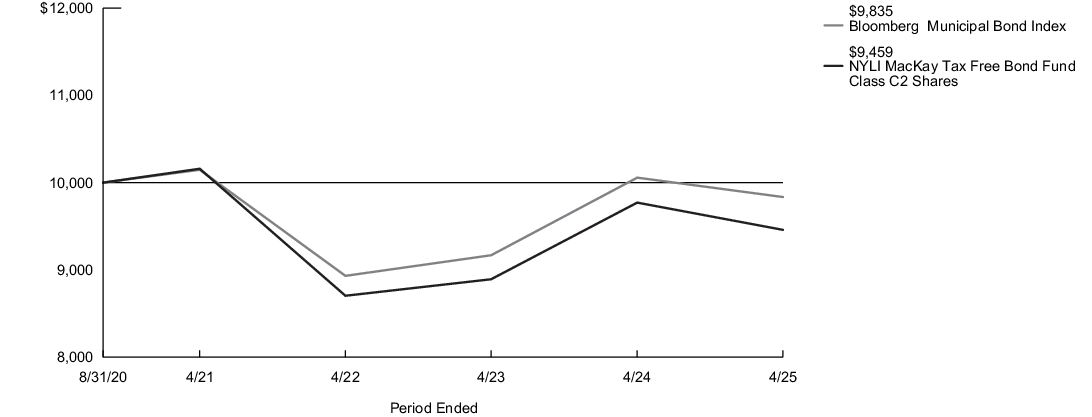

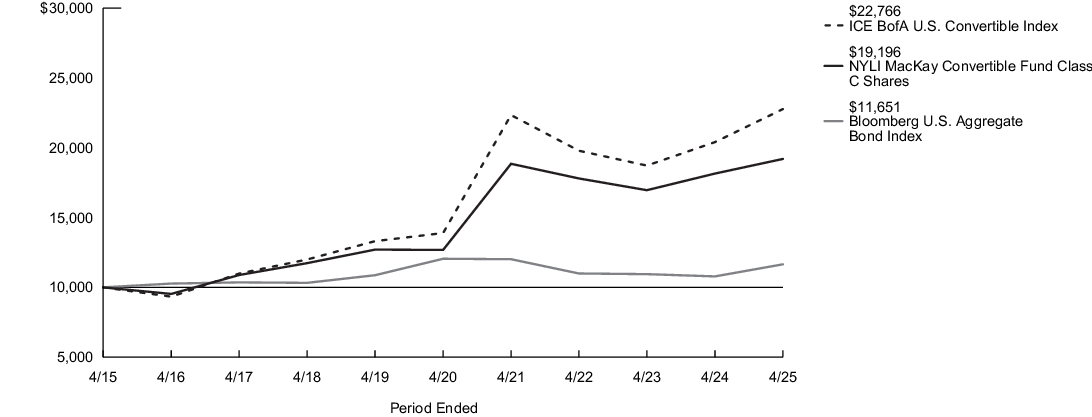

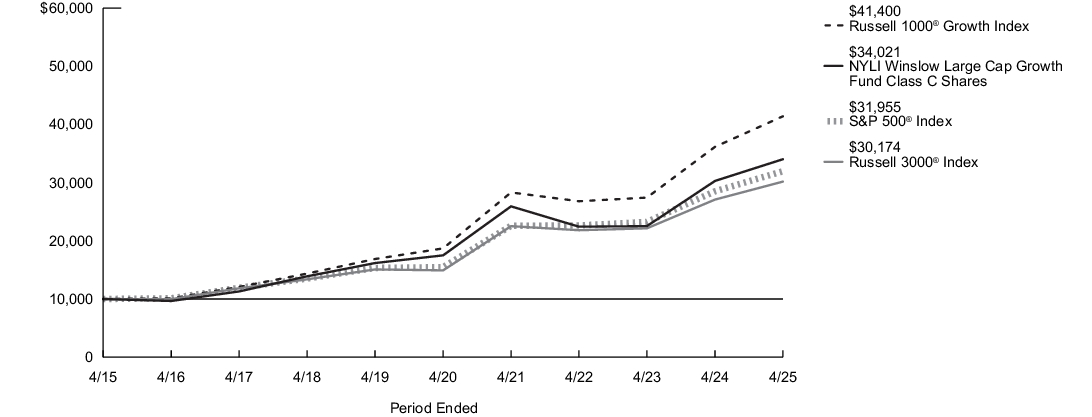

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

| Class C | $99 | 1.97% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

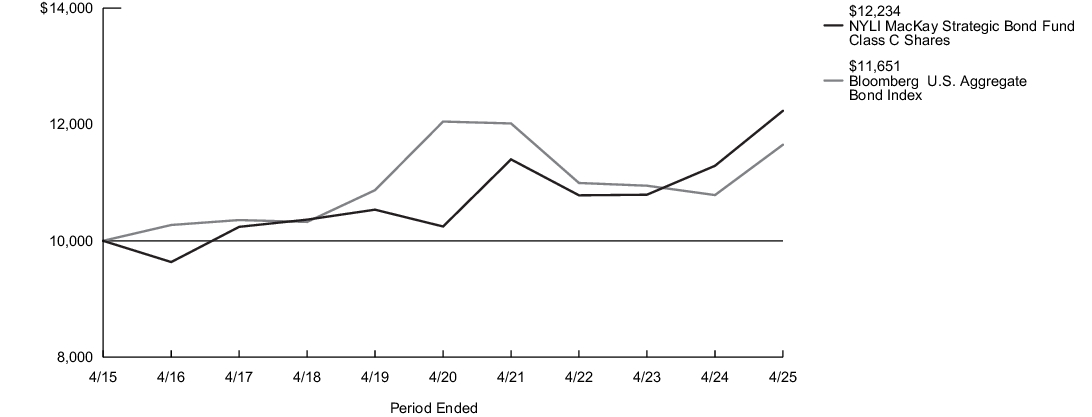

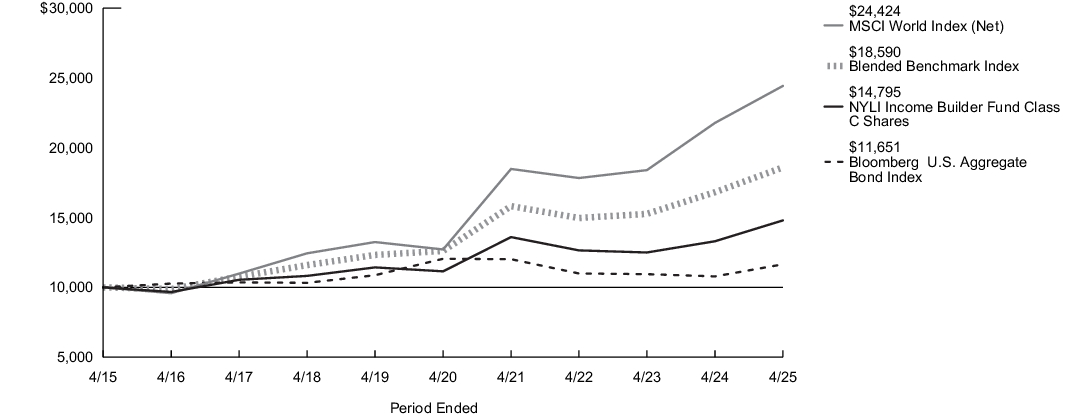

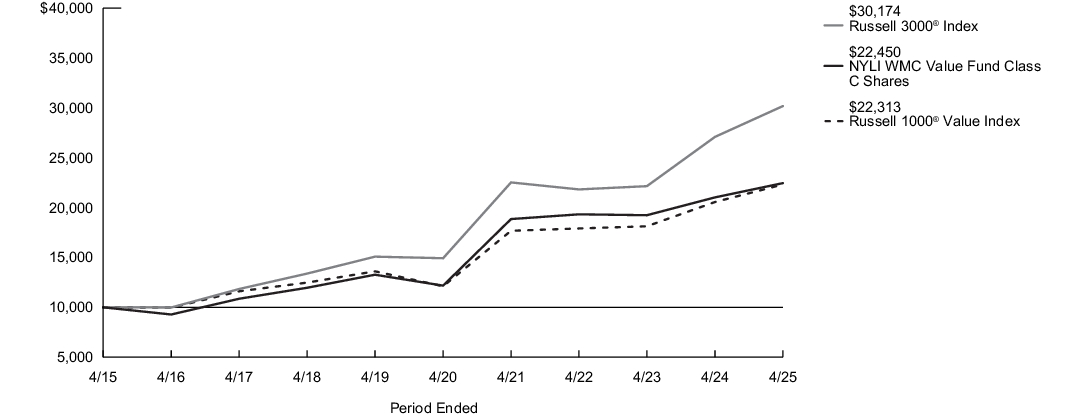

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class C Shares - Including sales charges | 9/1/1998 | 1.60% | 7.37% | 3.61% | 2.04% |

| Class C Shares - Excluding sales charges | 2.60% | 8.37% | 3.61% | 2.04% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Morningstar Multisector Bond Category Average3 | 2.25% | 7.76% | 4.19% | 3.12% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The Morningstar Multisector Bond Category Average is representative of funds that seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $995,196,754 |

| Total number of portfolio holdings | 548 |

| Portfolio turnover rate | 85% |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

| Corporate Bonds | 28.8% |

| Mortgage-Backed Securities | 26.9% |

| U.S. Government & Federal Agencies | 25.3% |

| Asset-Backed Securities | 11.8% |

| Foreign Government Bonds | 4.1% |

| Loan Assignments | 2.0% |

| Short-Term Investments | 1.4% |

| Common Stocks | 0.0%‡ |

| Other Assets, Less Liabilities | (0.3)% |

| ‡ Less than one-tenth of a percent. |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

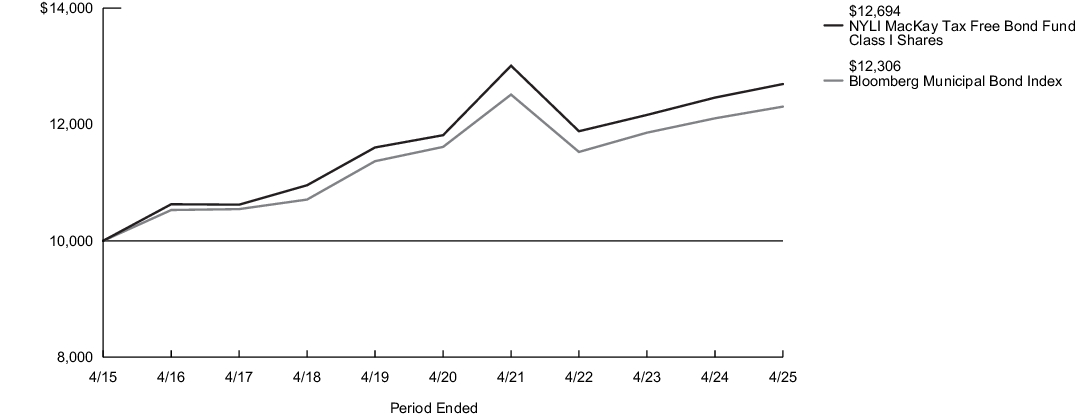

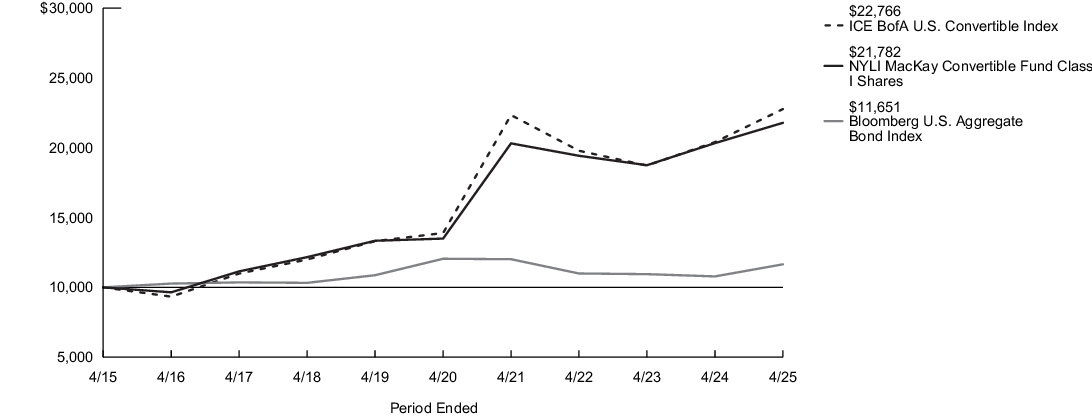

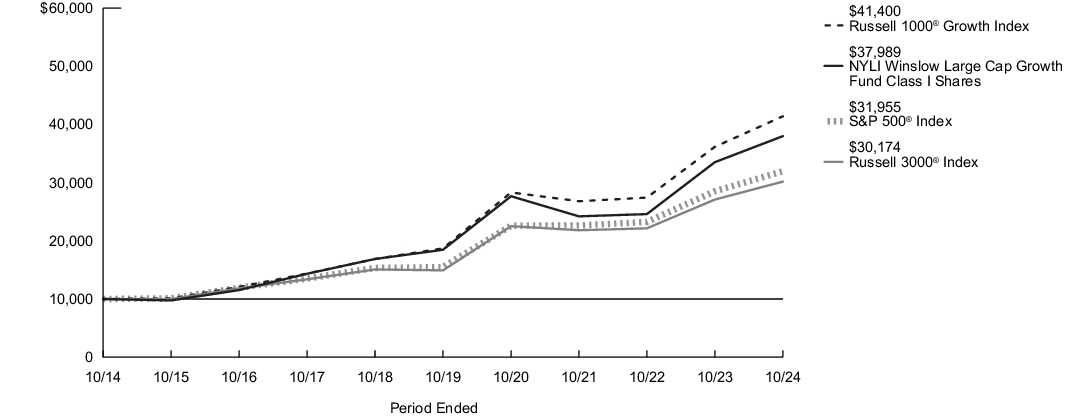

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

| Class I | $35 | 0.70% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

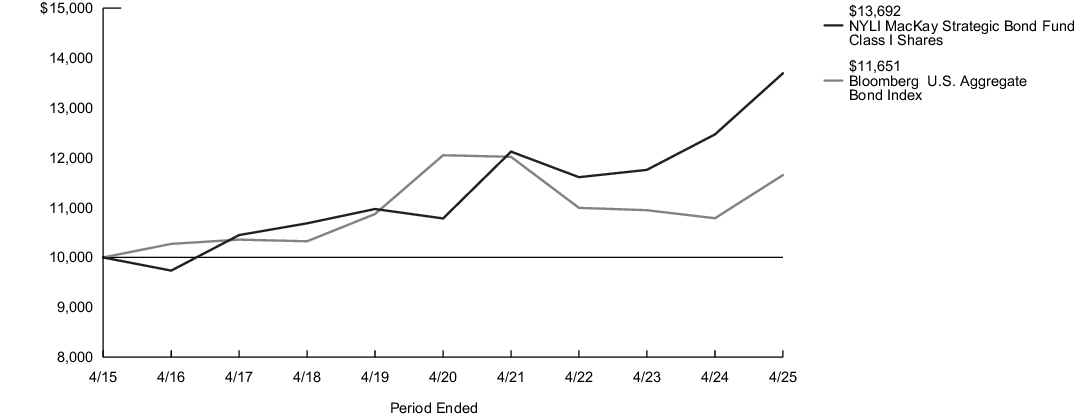

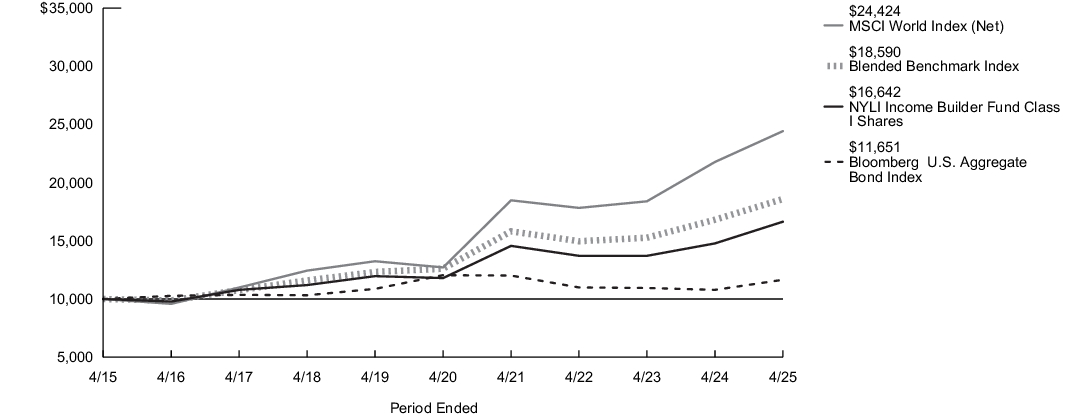

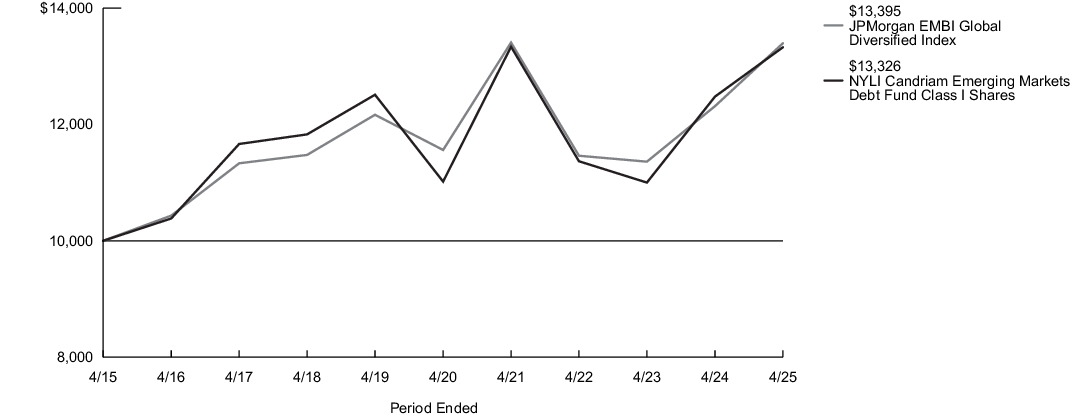

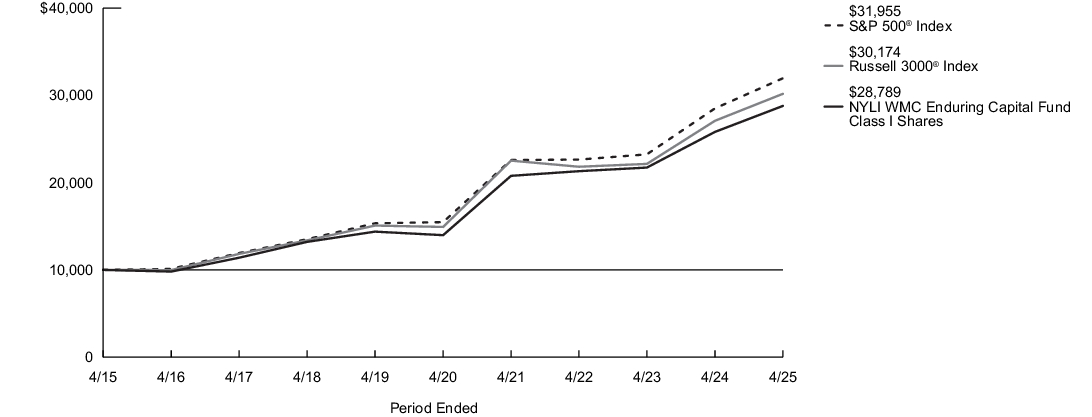

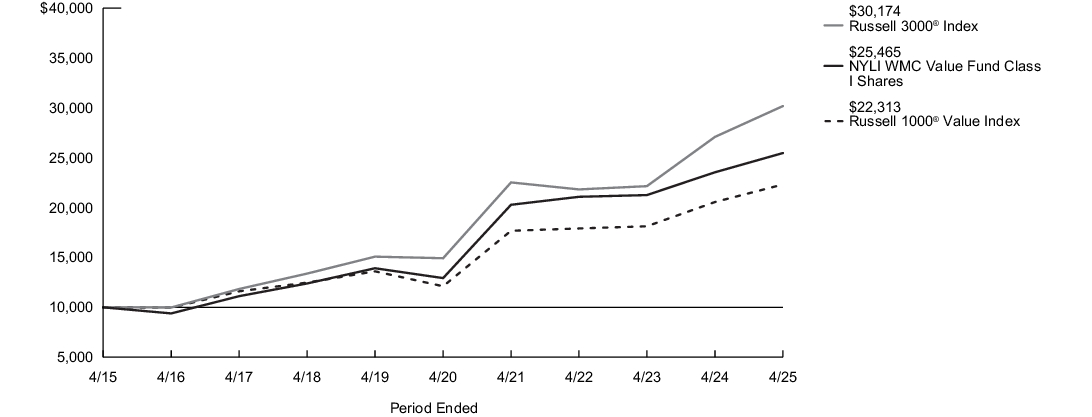

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class I Shares | 1/2/2004 | 3.22% | 9.82% | 4.89% | 3.19% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Morningstar Multisector Bond Category Average3 | 2.25% | 7.76% | 4.19% | 3.12% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The Morningstar Multisector Bond Category Average is representative of funds that seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $995,196,754 |

| Total number of portfolio holdings | 548 |

| Portfolio turnover rate | 85% |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

| Corporate Bonds | 28.8% |

| Mortgage-Backed Securities | 26.9% |

| U.S. Government & Federal Agencies | 25.3% |

| Asset-Backed Securities | 11.8% |

| Foreign Government Bonds | 4.1% |

| Loan Assignments | 2.0% |

| Short-Term Investments | 1.4% |

| Common Stocks | 0.0%‡ |

| Other Assets, Less Liabilities | (0.3)% |

| ‡ Less than one-tenth of a percent. |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

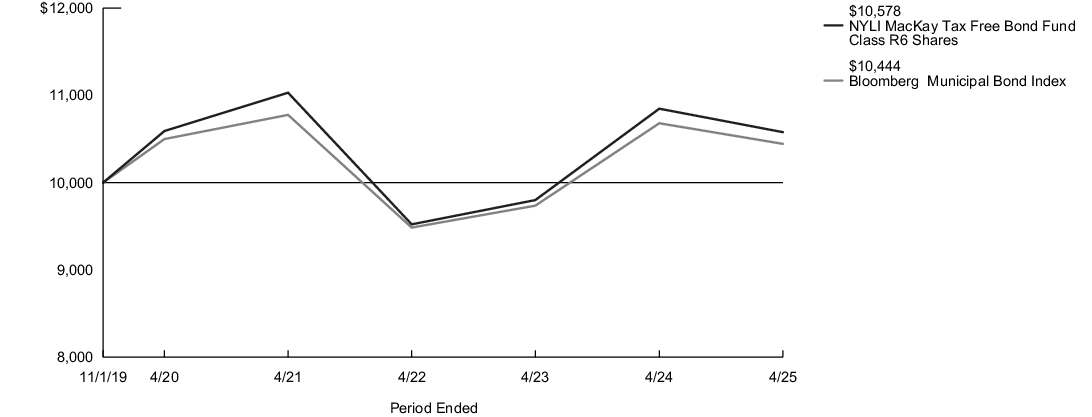

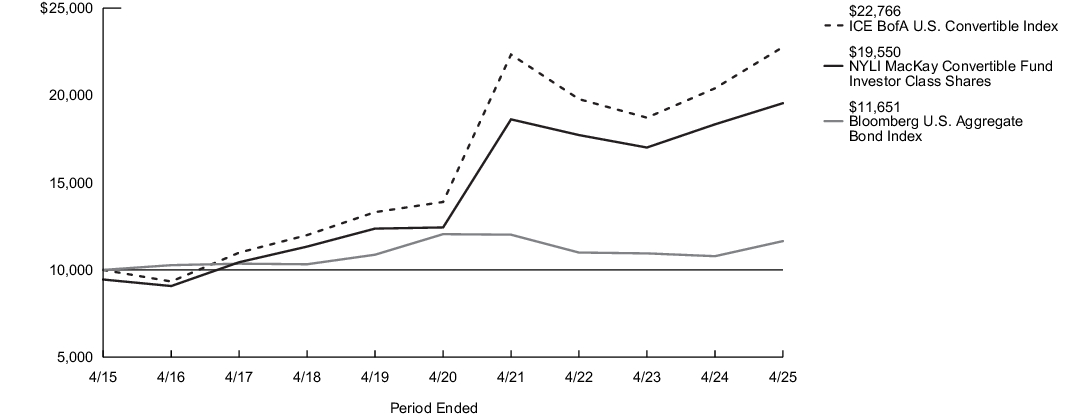

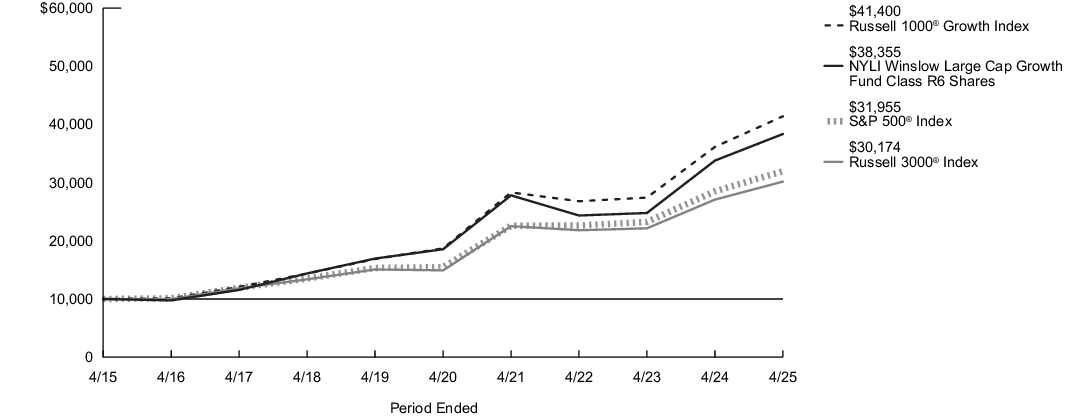

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

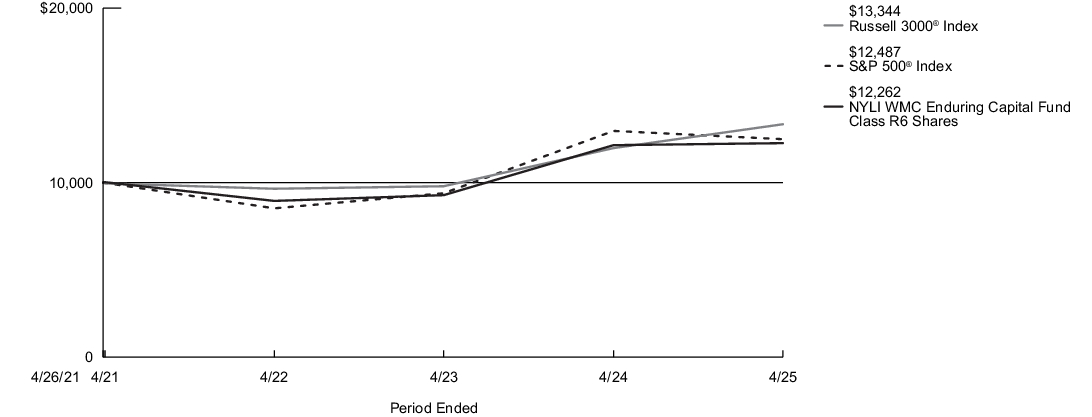

| Class R6 | $32 | 0.63% |

| 1. | Annualized. |

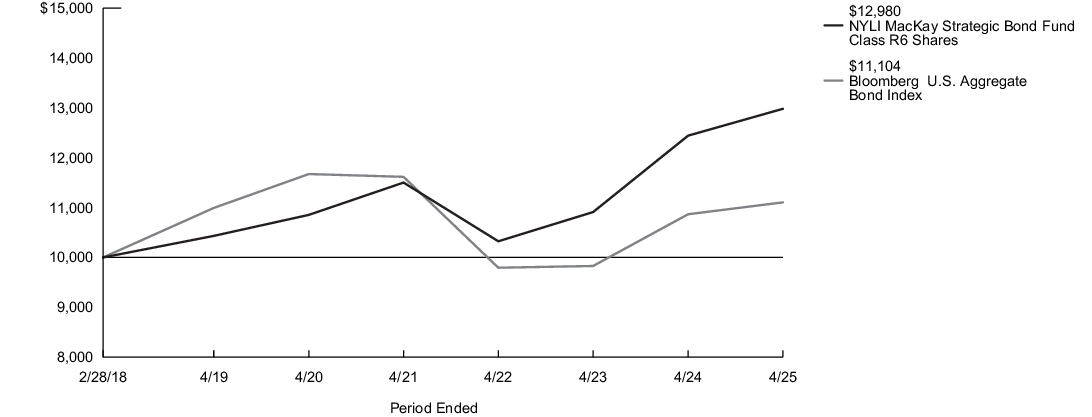

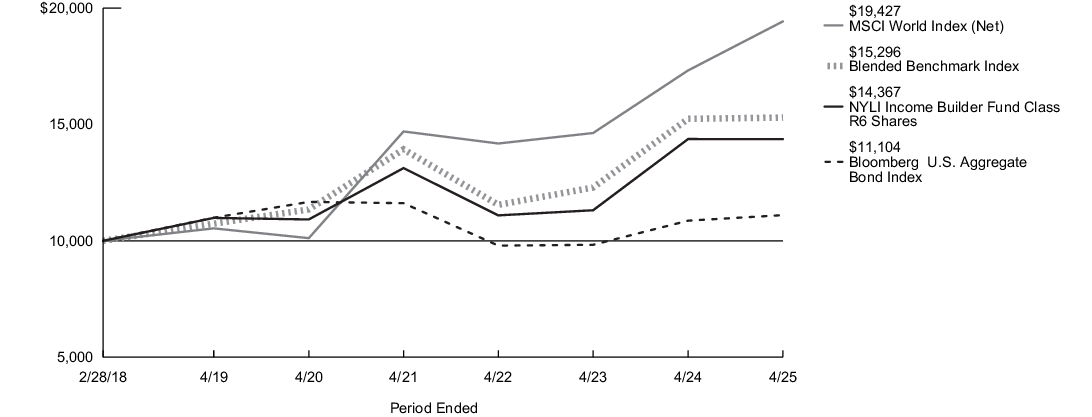

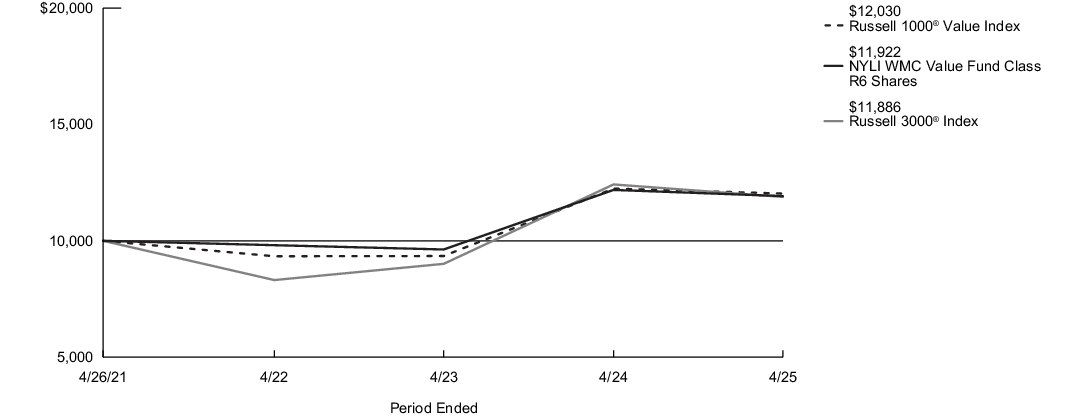

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Since Inception |

| Class R6 Shares | 2/28/2018 | 3.25% | 9.85% | 5.05% | 3.65% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.69% | |

| Morningstar Multisector Bond Category Average3 | 2.25% | 7.76% | 4.19% | 2.94% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The Morningstar Multisector Bond Category Average is representative of funds that seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $995,196,754 |

| Total number of portfolio holdings | 548 |

| Portfolio turnover rate | 85% |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

| Corporate Bonds | 28.8% |

| Mortgage-Backed Securities | 26.9% |

| U.S. Government & Federal Agencies | 25.3% |

| Asset-Backed Securities | 11.8% |

| Foreign Government Bonds | 4.1% |

| Loan Assignments | 2.0% |

| Short-Term Investments | 1.4% |

| Common Stocks | 0.0%‡ |

| Other Assets, Less Liabilities | (0.3)% |

| ‡ Less than one-tenth of a percent. |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

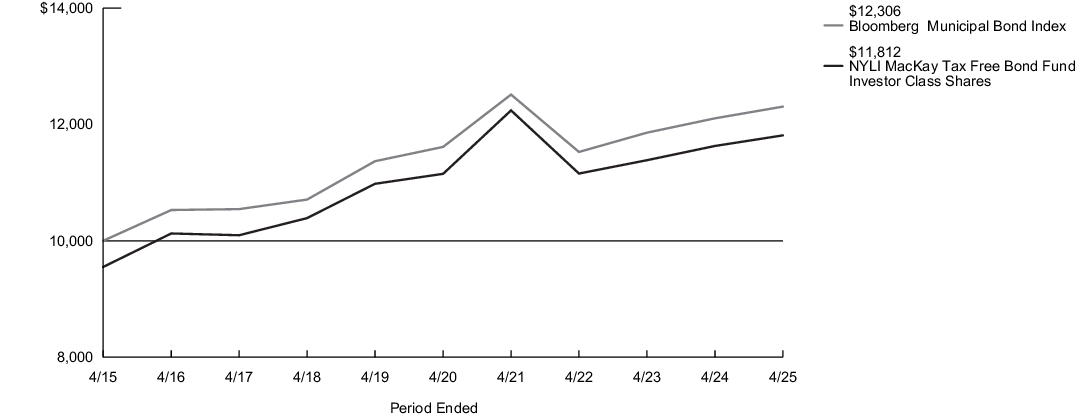

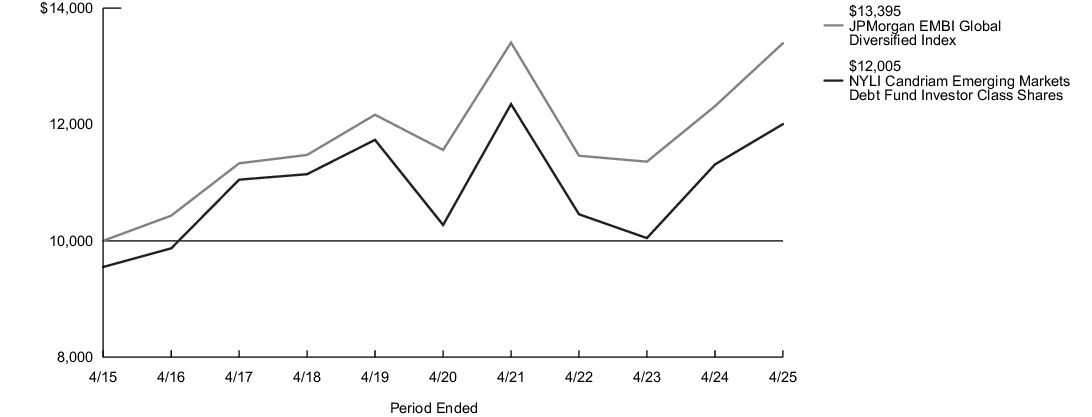

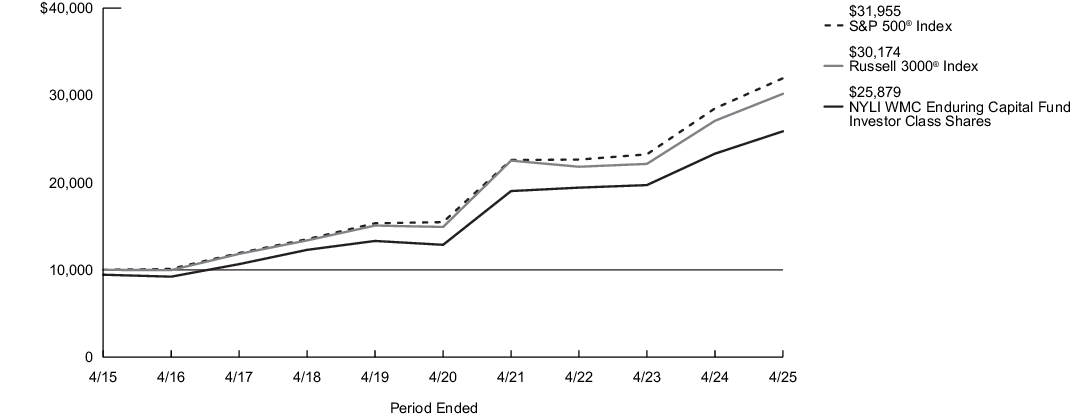

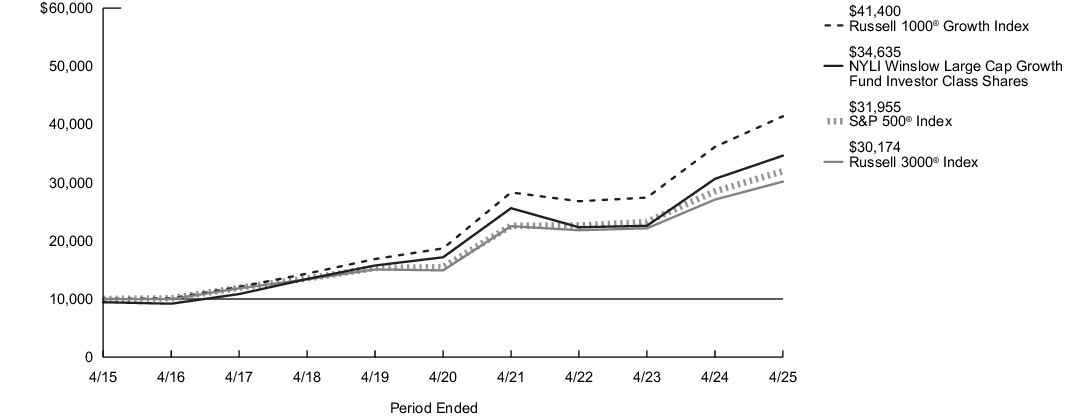

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

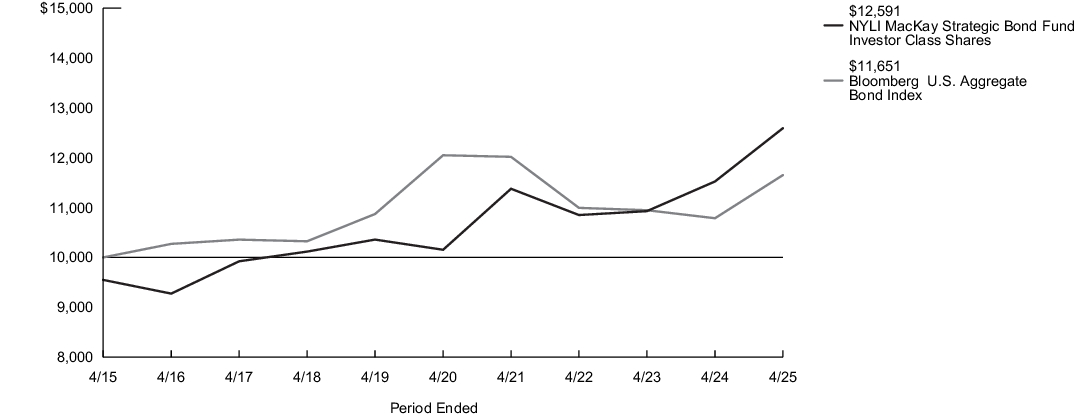

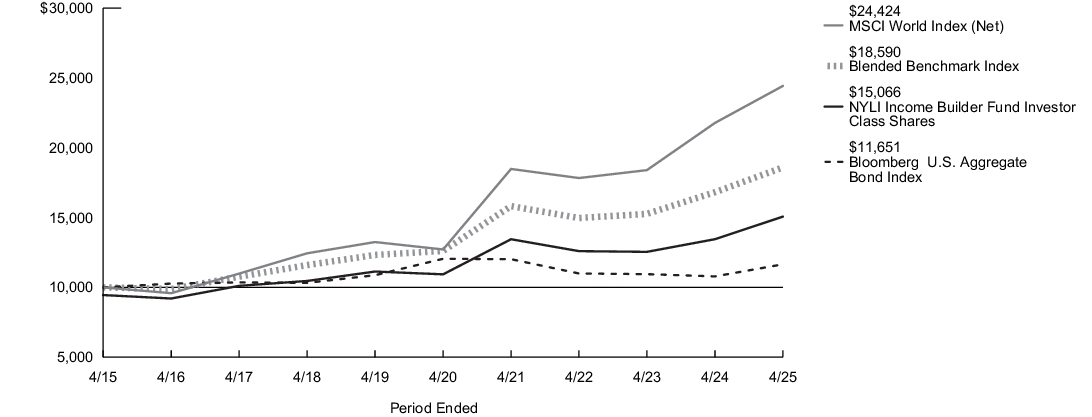

| Investor Class | $62 | 1.22% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Investor Class Shares - Including sales charges | 2/28/2008 | (1.08)% | 4.90% | 3.44% | 2.33% |

| Investor Class Shares - Excluding sales charges | 3.04% | 9.27% | 4.40% | 2.80% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Morningstar Multisector Bond Category Average3 | 2.25% | 7.76% | 4.19% | 3.12% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The Morningstar Multisector Bond Category Average is representative of funds that seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $995,196,754 |

| Total number of portfolio holdings | 548 |

| Portfolio turnover rate | 85% |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

| Corporate Bonds | 28.8% |

| Mortgage-Backed Securities | 26.9% |

| U.S. Government & Federal Agencies | 25.3% |

| Asset-Backed Securities | 11.8% |

| Foreign Government Bonds | 4.1% |

| Loan Assignments | 2.0% |

| Short-Term Investments | 1.4% |

| Common Stocks | 0.0%‡ |

| Other Assets, Less Liabilities | (0.3)% |

| ‡ Less than one-tenth of a percent. |

| U.S. Treasury Notes, 3.75%-4.625%, due 4/30/27-2/15/35 | 22.3% |

| Connecticut Avenue Securities Trust, 6.053%-14.204%, due 9/25/31-1/25/45 | 3.9% |

| FHLMC STACR REMIC Trust, 6.004%-11.454%, due 8/25/33-1/25/51 | 3.5% |

| GNMA, (zero coupon)-4.50%, due 7/20/44-2/16/66 | 3.1% |

| UMBS, 30 Year, 2.00%-5.50%, due 3/1/52-5/1/54 | 2.5% |

| Flagship Credit Auto Trust, 1.59%-6.30%, due 3/16/26-4/15/30 | 2.0% |

| FHLMC, (zero coupon)-9.304%, due 5/25/44-8/15/56 | 1.5% |

| Exeter Automobile Receivables Trust, 3.04%-10.45%, due 12/15/28-9/15/32 | 1.4% |

| Wells Fargo Commercial Mortgage Trust, 2.70%-5.122%, due 12/15/39-1/15/60 | 1.3% |

| CF Hippolyta Issuer LLC, 1.69%-2.60%, due 7/15/60-3/15/61 | 1.0% |

| * Excluding short-term investments |

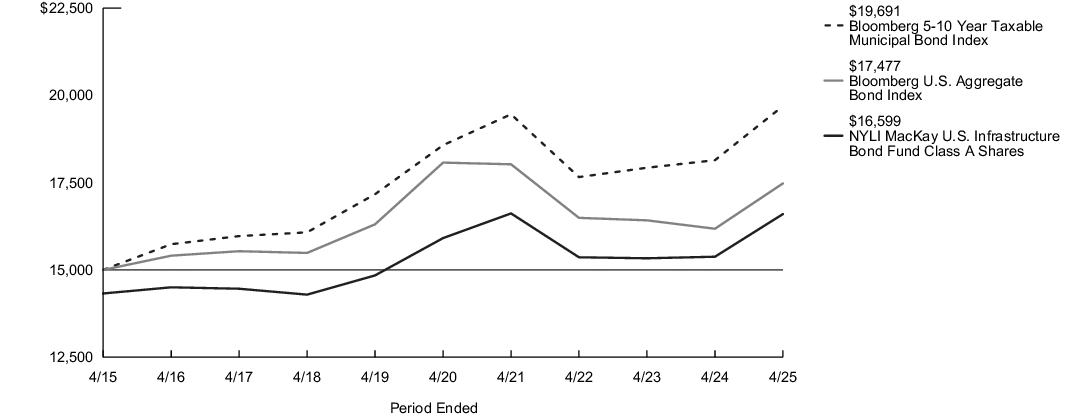

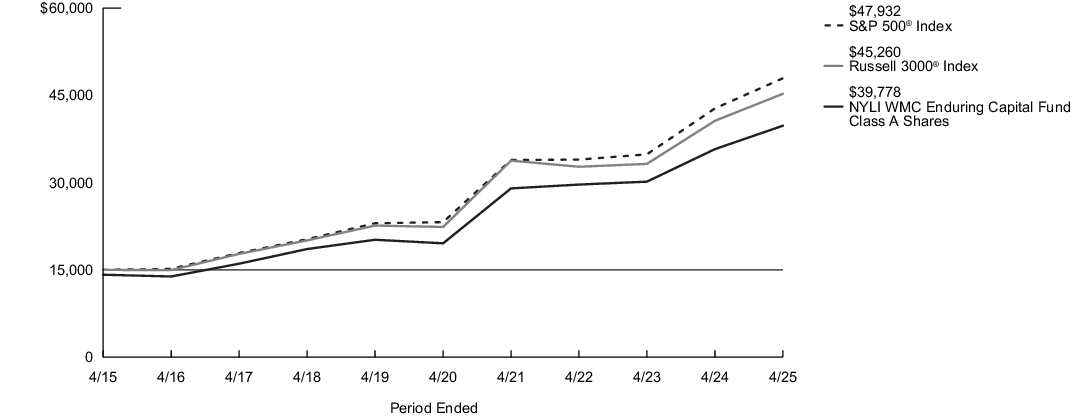

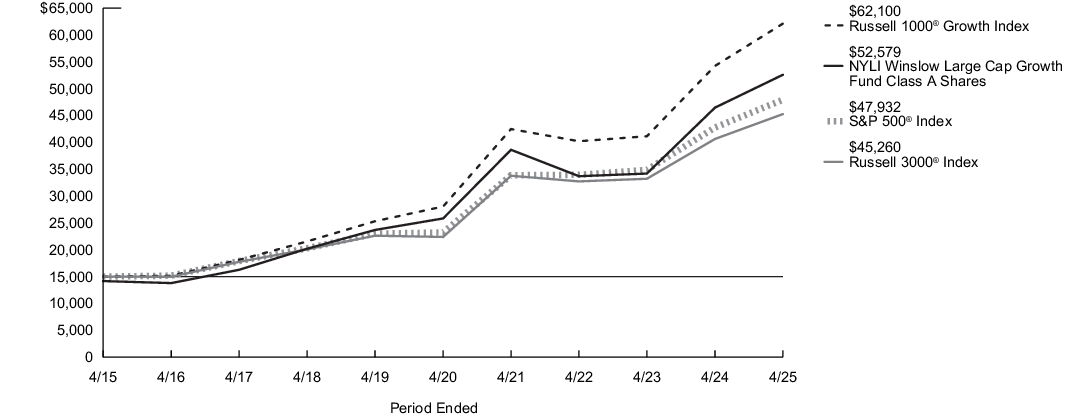

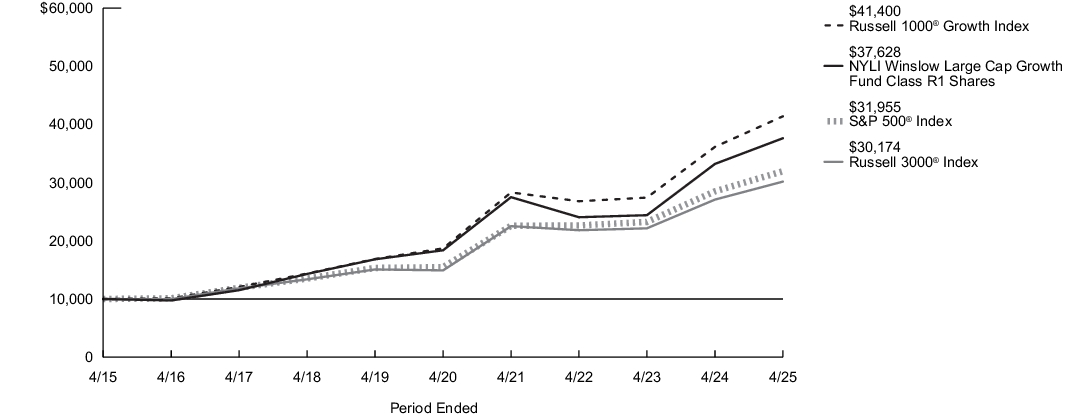

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

| Class A | $43 | 0.85% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

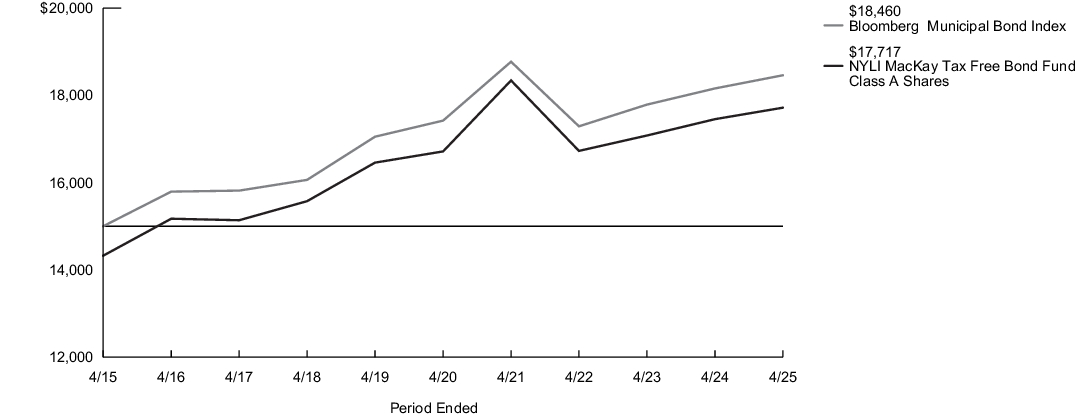

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class A Shares - Including sales charges | 1/3/1995 | (0.12)% | 4.70% | (0.08)% | 1.02% |

| Class A Shares - Excluding sales charges | 2.97% | 7.94% | 0.85% | 1.48% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Bloomberg 5-10 Year Taxable Municipal Bond Index3 | 3.44% | 8.53% | 1.18% | 2.76% | |

| Morningstar Intermediate Core Bond Category Average4 | 2.53% | 7.90% | (0.29)% | 1.48% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. |

| 3. |

The Bloomberg 5-10 Year Taxable Municipal Bond Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is the 5-10 year component of the Bloomberg Taxable Municipal Bond Index. |

| 4. |

The Morningstar Intermediate Core Bond Category Average is representative of funds that invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $1,522,704,914 |

| Total number of portfolio holdings | 386 |

| Portfolio turnover rate | 45% |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

| Municipal Bonds | 91.2% |

| Corporate Bonds | 6.8% |

| Short-Term Investment | 4.5% |

| Closed-End Fund | 0.2% |

| U.S. Government & Federal Agencies | 0.0%‡ |

| Other Assets, Less Liabilities | (2.7)% |

| ‡ Less than one-tenth of a percent. |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

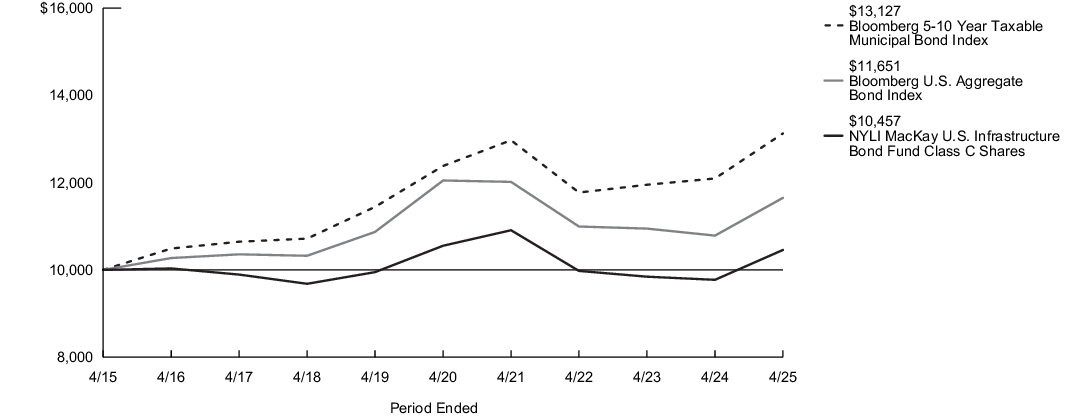

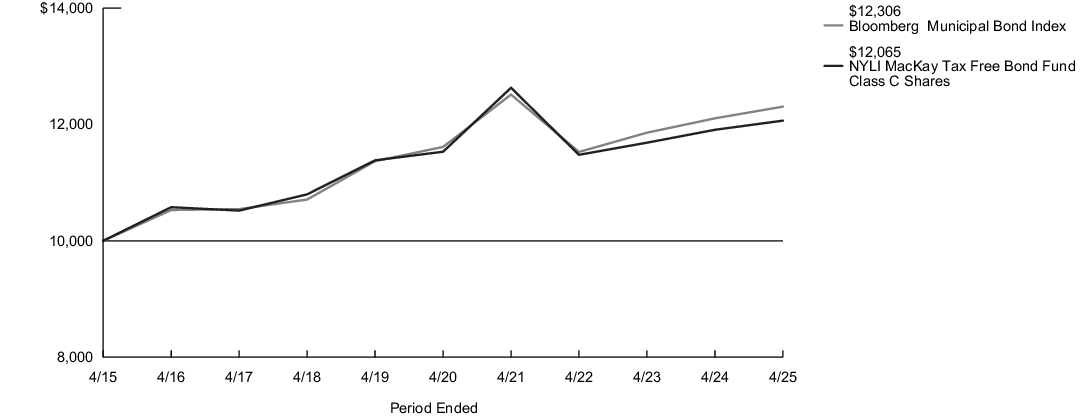

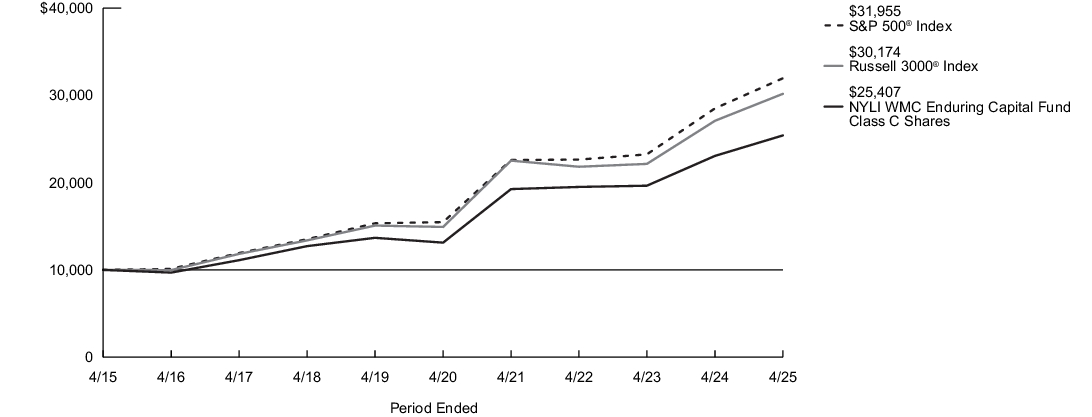

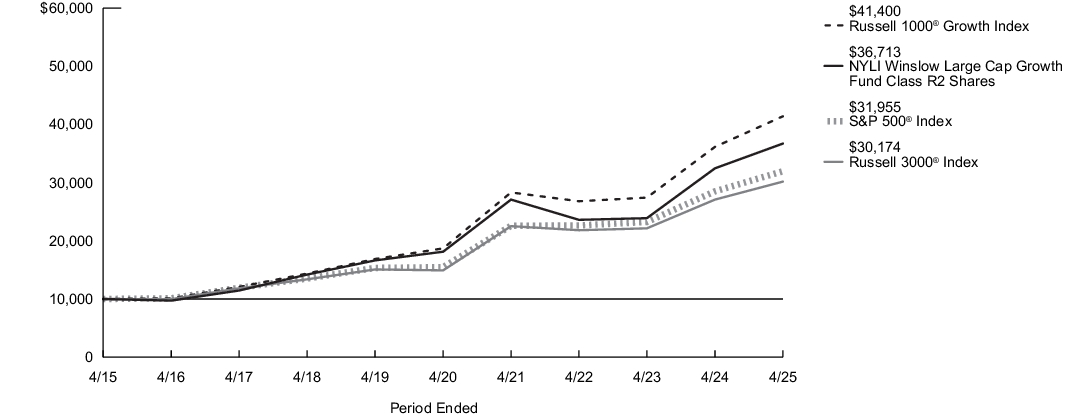

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

| Class C | $94 | 1.86% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class C Shares - Including sales charges | 9/1/1998 | 1.46% | 6.00% | (0.18)% | 0.45% |

| Class C Shares - Excluding sales charges | 2.46% | 7.00% | (0.18)% | 0.45% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Bloomberg 5-10 Year Taxable Municipal Bond Index3 | 3.44% | 8.53% | 1.18% | 2.76% | |

| Morningstar Intermediate Core Bond Category Average4 | 2.53% | 7.90% | (0.29)% | 1.48% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. |

| 3. |

The Bloomberg 5-10 Year Taxable Municipal Bond Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is the 5-10 year component of the Bloomberg Taxable Municipal Bond Index. |

| 4. |

The Morningstar Intermediate Core Bond Category Average is representative of funds that invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $1,522,704,914 |

| Total number of portfolio holdings | 386 |

| Portfolio turnover rate | 45% |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

| Municipal Bonds | 91.2% |

| Corporate Bonds | 6.8% |

| Short-Term Investment | 4.5% |

| Closed-End Fund | 0.2% |

| U.S. Government & Federal Agencies | 0.0%‡ |

| Other Assets, Less Liabilities | (2.7)% |

| ‡ Less than one-tenth of a percent. |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

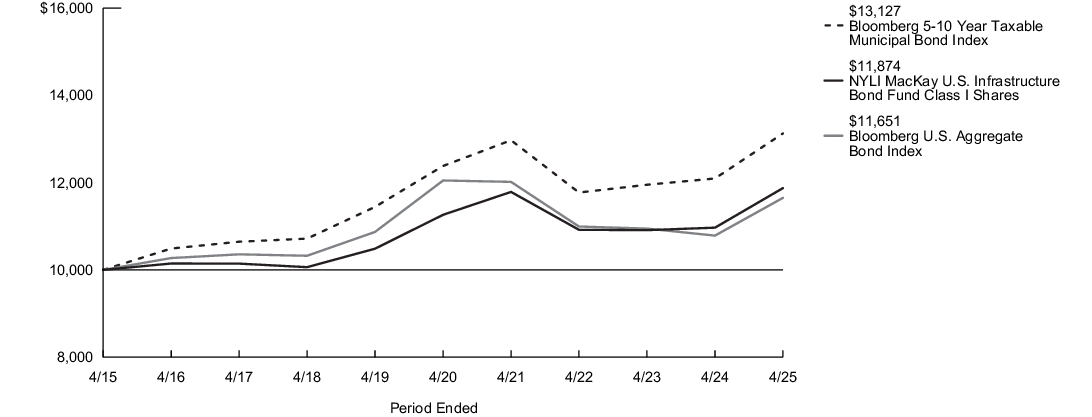

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

| Class I | $30 | 0.60% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class I Shares | 1/2/2004 | 3.06% | 8.26% | 1.06% | 1.73% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Bloomberg 5-10 Year Taxable Municipal Bond Index3 | 3.44% | 8.53% | 1.18% | 2.76% | |

| Morningstar Intermediate Core Bond Category Average4 | 2.53% | 7.90% | (0.29)% | 1.48% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. |

| 3. |

The Bloomberg 5-10 Year Taxable Municipal Bond Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is the 5-10 year component of the Bloomberg Taxable Municipal Bond Index. |

| 4. |

The Morningstar Intermediate Core Bond Category Average is representative of funds that invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $1,522,704,914 |

| Total number of portfolio holdings | 386 |

| Portfolio turnover rate | 45% |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

| Municipal Bonds | 91.2% |

| Corporate Bonds | 6.8% |

| Short-Term Investment | 4.5% |

| Closed-End Fund | 0.2% |

| U.S. Government & Federal Agencies | 0.0%‡ |

| Other Assets, Less Liabilities | (2.7)% |

| ‡ Less than one-tenth of a percent. |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

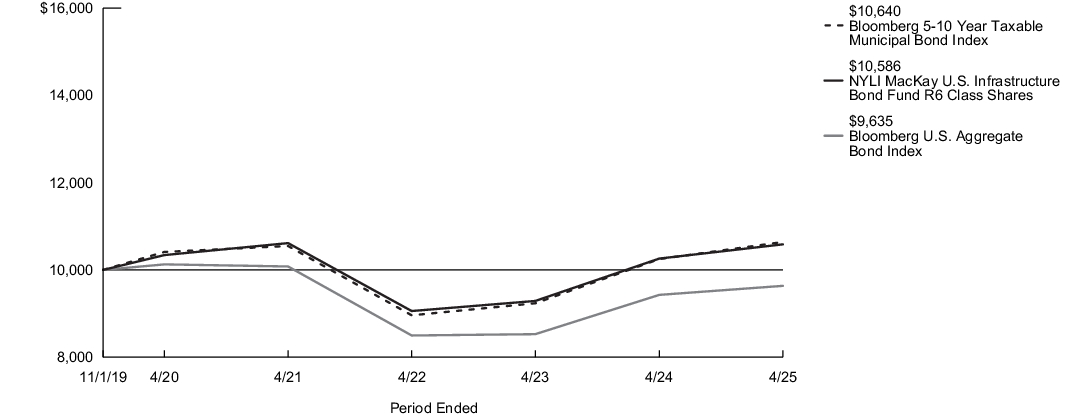

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class R6 | $26 | 0.51% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Since Inception |

| Class R6 Shares | 11/1/2019 | 3.11% | 8.34% | 1.13% | 1.11% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 0.25% | |

| Bloomberg 5-10 Year Taxable Municipal Bond Index3 | 3.44% | 8.53% | 1.18% | 1.53% | |

| Morningstar Intermediate Core Bond Category Average4 | 2.53% | 7.90% | (0.29)% | 0.23% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. |

| 3. |

The Bloomberg 5-10 Year Taxable Municipal Bond Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is the 5-10 year component of the Bloomberg Taxable Municipal Bond Index. |

| 4. |

The Morningstar Intermediate Core Bond Category Average is representative of funds that invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $1,522,704,914 |

| Total number of portfolio holdings | 386 |

| Portfolio turnover rate | 45% |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

| Municipal Bonds | 91.2% |

| Corporate Bonds | 6.8% |

| Short-Term Investment | 4.5% |

| Closed-End Fund | 0.2% |

| U.S. Government & Federal Agencies | 0.0%‡ |

| Other Assets, Less Liabilities | (2.7)% |

| ‡ Less than one-tenth of a percent. |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

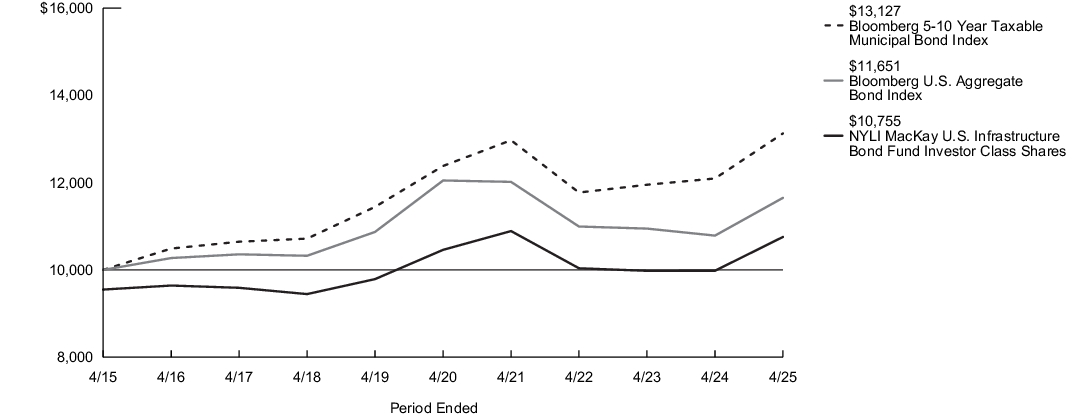

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

| Investor Class | $56 | 1.11% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Investor Class Shares - Including sales charges | 2/28/2008 | 0.26% | 5.06% | (0.36)% | 0.73% |

| Investor Class Shares - Excluding sales charges | 2.83% | 7.75% | 0.56% | 1.20% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| Bloomberg 5-10 Year Taxable Municipal Bond Index3 | 3.44% | 8.53% | 1.18% | 2.76% | |

| Morningstar Intermediate Core Bond Category Average4 | 2.53% | 7.90% | (0.29)% | 1.48% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. |

| 3. |

The Bloomberg 5-10 Year Taxable Municipal Bond Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is the 5-10 year component of the Bloomberg Taxable Municipal Bond Index. |

| 4. |

The Morningstar Intermediate Core Bond Category Average is representative of funds that invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $1,522,704,914 |

| Total number of portfolio holdings | 386 |

| Portfolio turnover rate | 45% |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

| Municipal Bonds | 91.2% |

| Corporate Bonds | 6.8% |

| Short-Term Investment | 4.5% |

| Closed-End Fund | 0.2% |

| U.S. Government & Federal Agencies | 0.0%‡ |

| Other Assets, Less Liabilities | (2.7)% |

| ‡ Less than one-tenth of a percent. |

| State of Illinois, 3.45%-7.35%, due 6/15/29-12/1/38 | 3.5% |

| State of California, 4.875%-7.55%, due 9/1/29-10/1/41 | 3.1% |

| Commonwealth of Massachusetts, 2.663%-5.50%, due 7/15/29-9/1/39 | 2.8% |

| City of Los Angeles, 3.258%-5.50%, due 5/15/30-6/1/36 | 2.4% |

| New York City Transitional Finance Authority, 2.60%-5.65%, due 5/1/30-11/1/36 | 2.4% |

| State of Connecticut, 2.677%-5.099%, due 5/15/30-3/15/34 | 2.2% |

| District of Columbia, 5.153%-7.625%, due 5/1/31-10/1/35 | 2.0% |

| Alameda Corridor Transportation Authority, (zero coupon)-6.60%, due 10/1/29-10/1/33 | 1.9% |

| State of Hawaii, 1.718%-4.936%, due 10/1/30-10/1/38 | 1.9% |

| City of New York, 1.623%-5.75%, due 8/1/28-2/1/38 | 1.8% |

| * Excluding short-term investments |

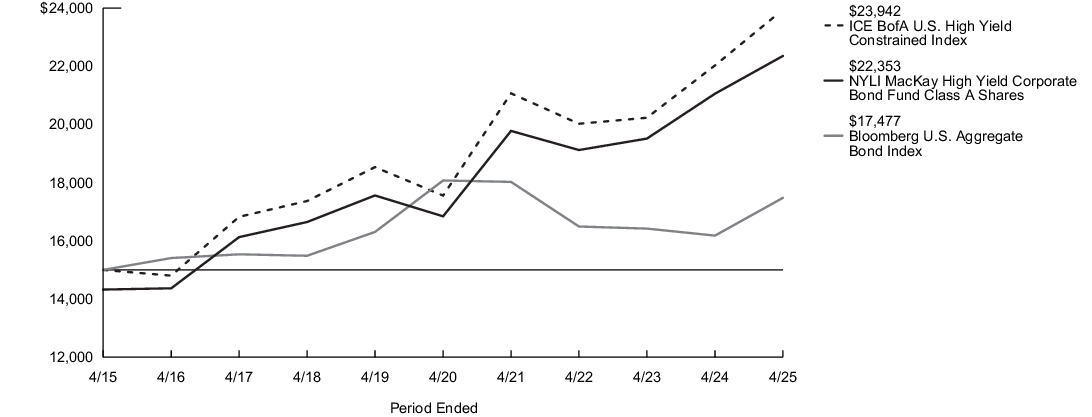

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class A | $49 | 0.98% |

| 1. | Annualized. |

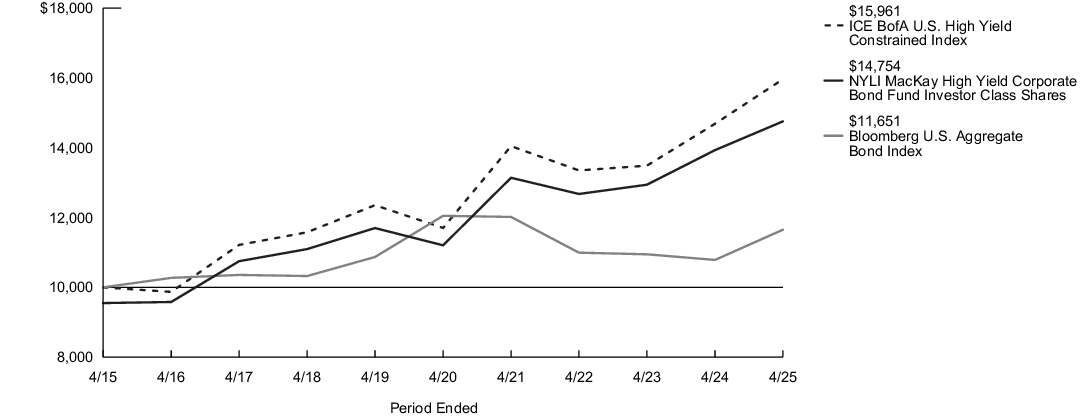

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class A Shares - Including sales charges | 1/3/1995 | (3.36)% | 1.38% | 4.86% | 4.07% |

| Class A Shares - Excluding sales charges | 1.20% | 6.16% | 5.83% | 4.55% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 6.40% | 4.79% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 6.00% | 4.08% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

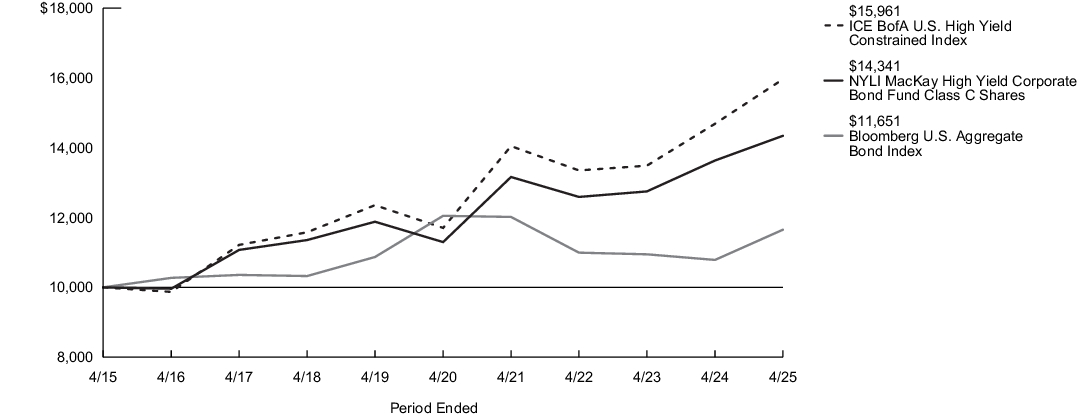

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class C | $95 | 1.91% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class C Shares - Including sales charges | 9/1/1998 | (0.26)% | 4.19% | 4.89% | 3.67% |

| Class C Shares - Excluding sales charges | 0.73% | 5.19% | 4.89% | 3.67% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 6.40% | 4.79% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 6.00% | 4.08% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

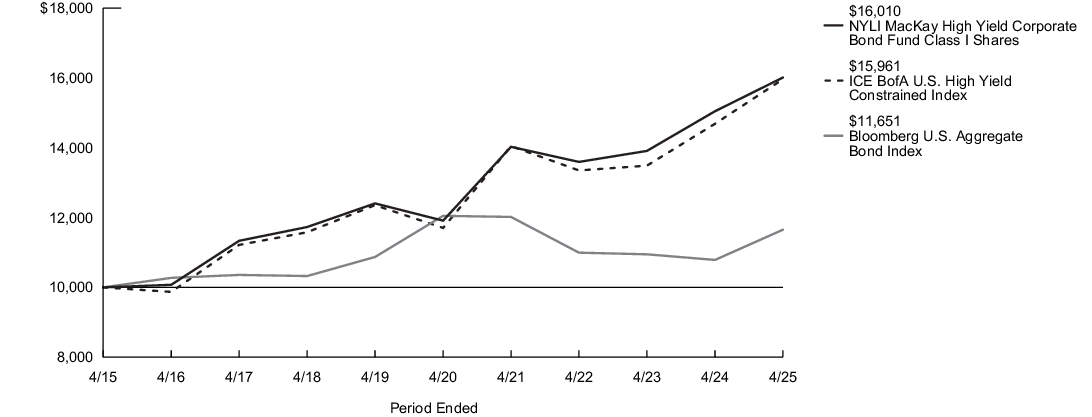

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class I | $36 | 0.73% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class I Shares | 1/2/2004 | 1.32% | 6.42% | 6.09% | 4.82% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 6.40% | 4.79% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 6.00% | 4.08% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

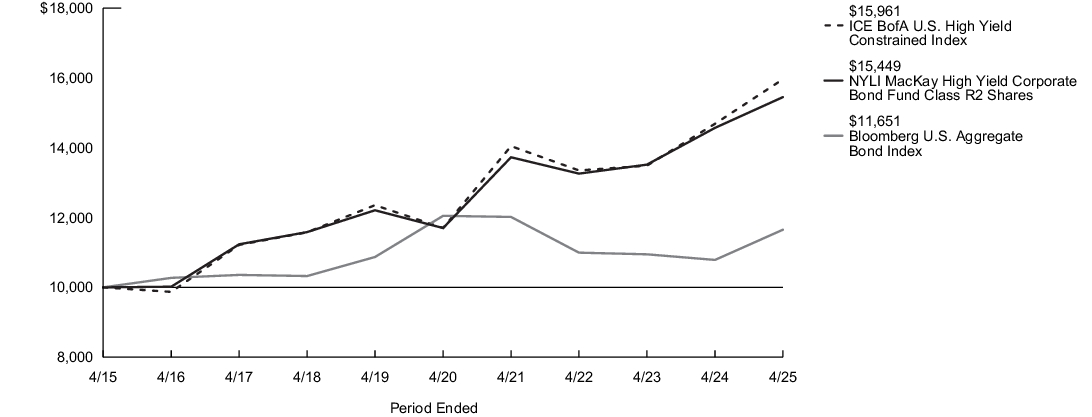

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class R2 | $54 | 1.08% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class R2 Shares | 5/1/2008 | 1.14% | 6.05% | 5.72% | 4.45% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 6.40% | 4.79% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 6.00% | 4.08% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

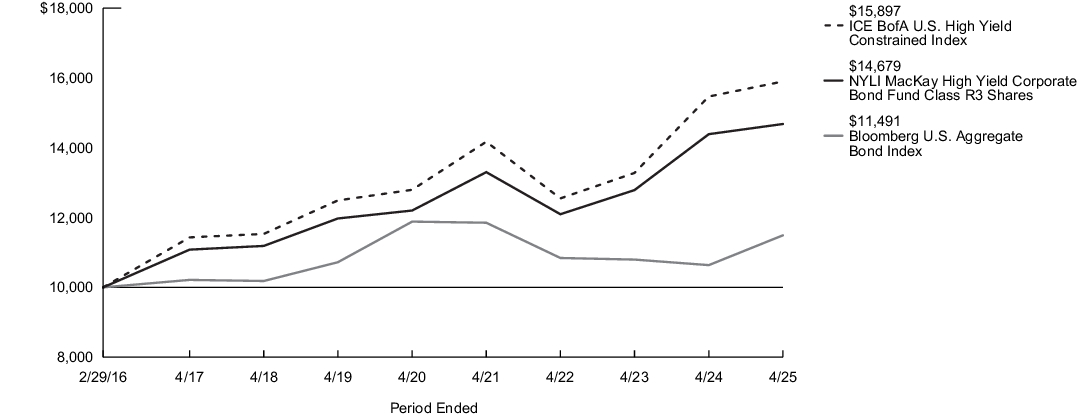

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

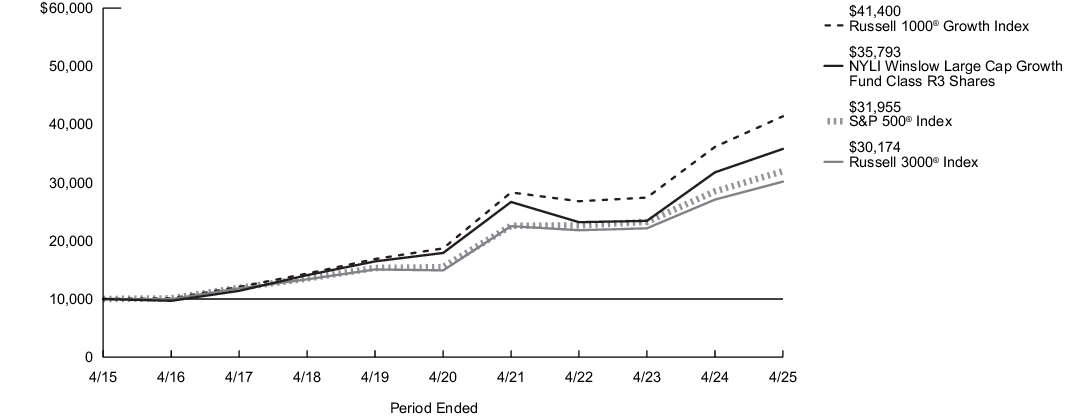

| Class R3 | $66 | 1.33% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Since Inception |

| Class R3 Shares | 2/29/2016 | 1.02% | 5.80% | 5.42% | 5.37% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.53% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 6.40% | 6.34% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 6.00% | 5.19% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

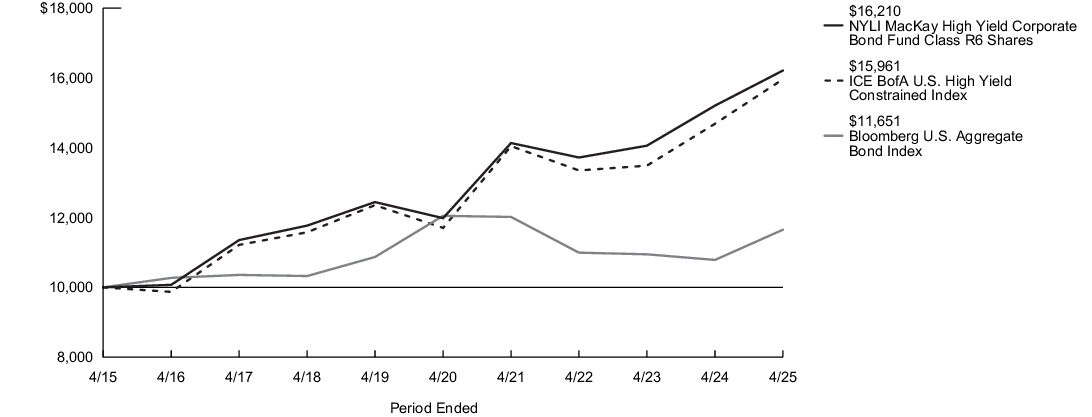

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class R6 | $28 | 0.56% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class R6 Shares | 6/17/2013 | 1.40% | 6.61% | 6.23% | 4.95% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 6.40% | 4.79% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 6.00% | 4.08% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Investor Class | $58 | 1.16% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Investor Class Shares - Including sales charges | 2/28/2008 | (2.95)% | 1.68% | 4.69% | 3.97% |

| Investor Class Shares - Excluding sales charges | 1.09% | 5.91% | 5.66% | 4.45% | |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (0.67)% | 1.54% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 6.40% | 4.79% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 6.00% | 4.08% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

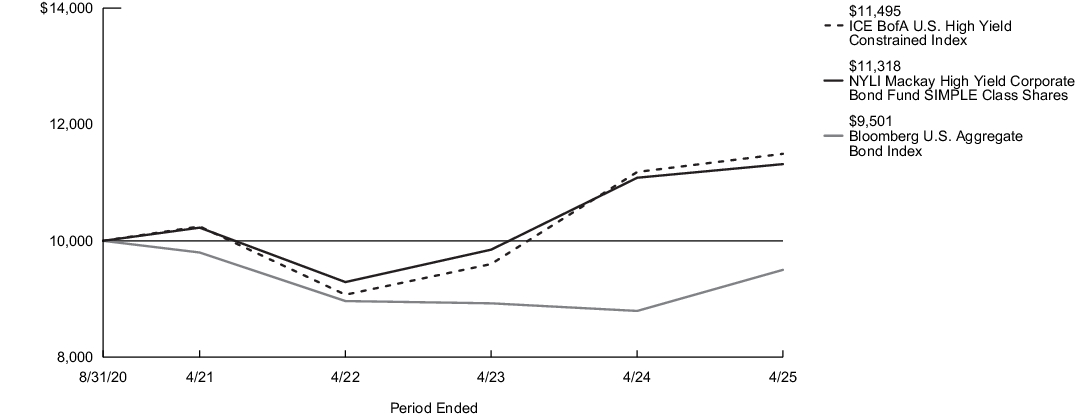

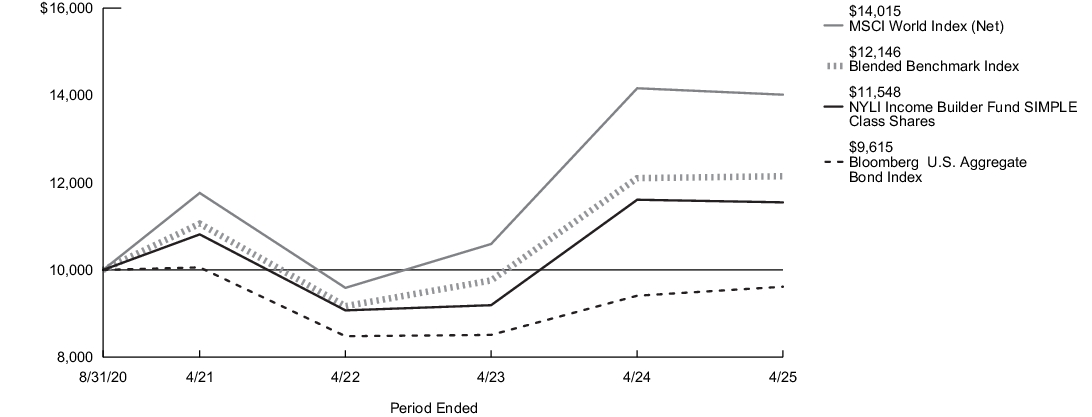

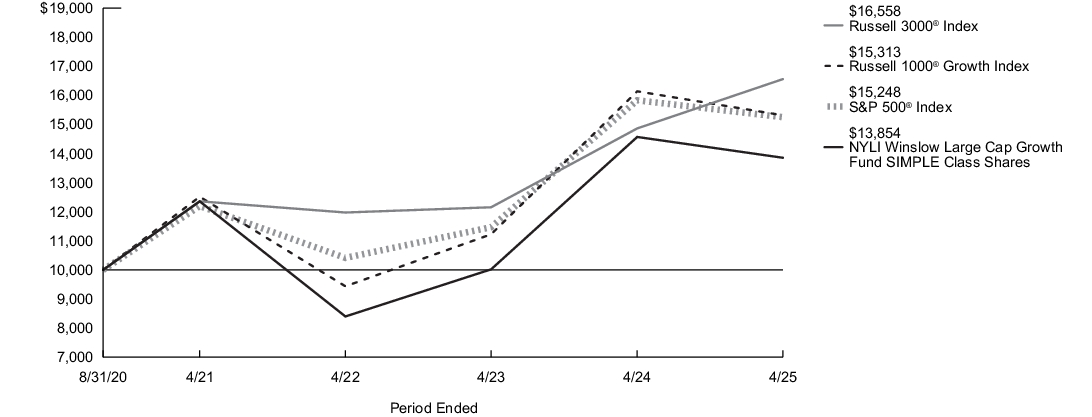

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

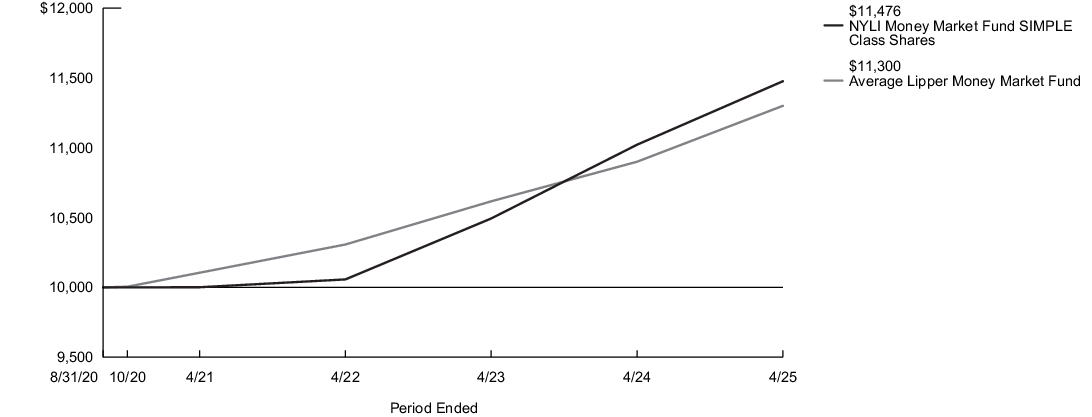

| SIMPLE Class | $59 | 1.18% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Since Inception |

| SIMPLE Class Shares | 8/31/2020 | 1.07% | 5.85% | 3.71% |

| Bloomberg U.S. Aggregate Bond Index2 | 2.57% | 8.02% | (1.09)% | |

| ICE BofA U.S. High Yield Constrained Index3 | 1.67% | 8.69% | 4.38% | |

| Morningstar High Yield Bond Category Average4 | 1.47% | 7.52% | 3.88% |

| 1. |

Not annualized. |

| 2. |

The Fund has selected the Bloomberg U.S. Aggregate Bond Index to represent a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities. |

| 3. |

The ICE BofA U.S. High Yield Constrained Index, which is generally representative of the market sectors or types of investments in which the Fund invests, is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the ICE BofA U.S. High Yield Constrained Index have maturities of one year or more and have a credit rating lower than BBB-/Baa3, but are not in default. No single issuer may constitute greater than 2% of the ICE BofA U.S. High Yield Constrained Index. |

| 4. |

The Morningstar High Yield Bond Category Average is representative of funds that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These funds primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB and below. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

| Fund's net assets | $11,114,470,812 |

| Total number of portfolio holdings | 633 |

| Portfolio turnover rate | 15% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

| Corporate Bonds | 85.2% |

| Loan Assignments | 7.7% |

| Common Stocks | 0.6% |

| Convertible Bonds | 0.5% |

| Exchange-Traded Funds | 0.4% |

| Preferred Stocks | 0.3% |

| Other Assets, Less Liabilities | 5.3% |

| TransDigm, Inc., 4.625%-7.125%, due 11/15/27-1/15/33 | 2.3% |

| CCO Holdings LLC, 4.25%-5.375%, due 5/1/27-1/15/34 | 2.1% |

| Yum! Brands, Inc., 3.625%-5.375%, due 1/15/30-4/1/32 | 1.2% |

| Churchill Downs, Inc., 4.75%-6.75%, due 4/1/27-5/1/31 | 1.2% |

| Hilton Domestic Operating Co., Inc., 4.00%-5.875%, due 5/1/28-3/15/33 | 1.1% |

| Jane Street Group, 6.125%-7.125%, due 4/30/31-5/1/33 | 1.0% |

| LifePoint Health, Inc., 5.375%-11.00%, due 1/15/29-6/1/32 | 1.0% |

| Mineral Resources Ltd., 8.00%-9.25%, due 5/1/27-5/1/30 | 1.0% |

| 1011778 B.C. Unlimited Liability Co., 3.875%-6.125%, due 1/15/28-10/15/30 | 0.9% |

| Great Outdoors Group LLC, 7.572%, due 1/23/32 | 0.9% |

| * Excluding short-term investments |

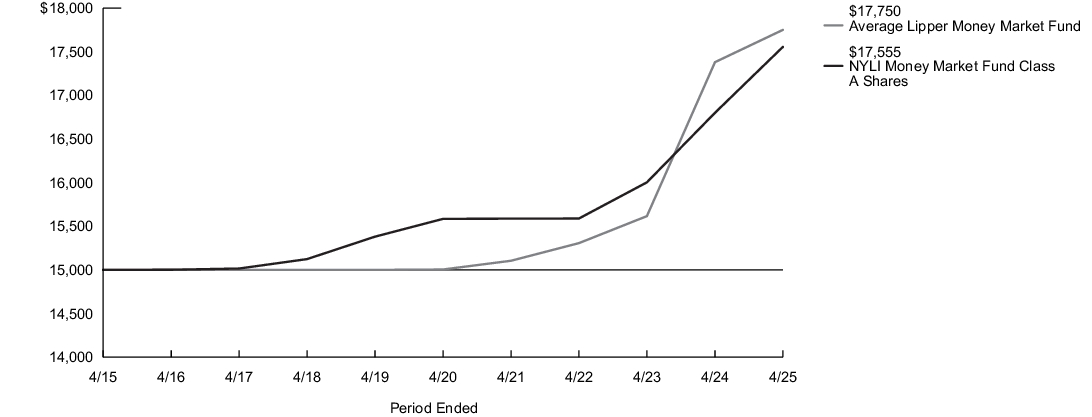

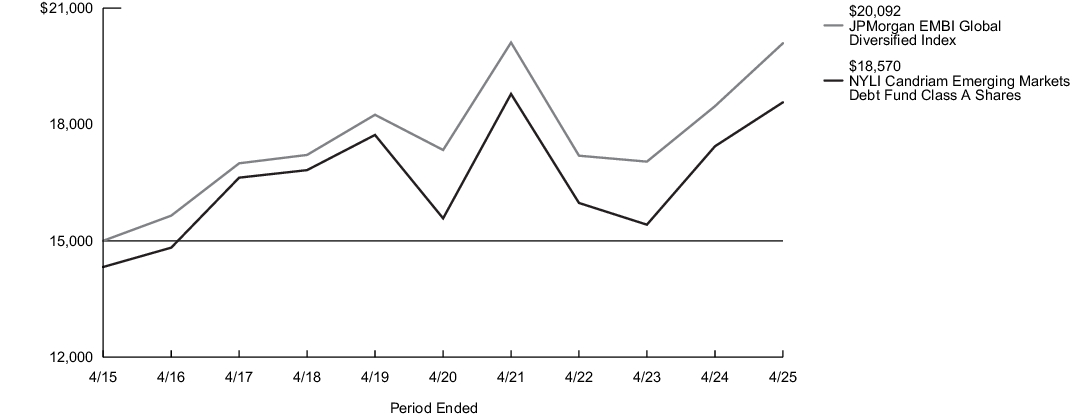

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1 |

| Class A | $26 | 0.51% |

| 1. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

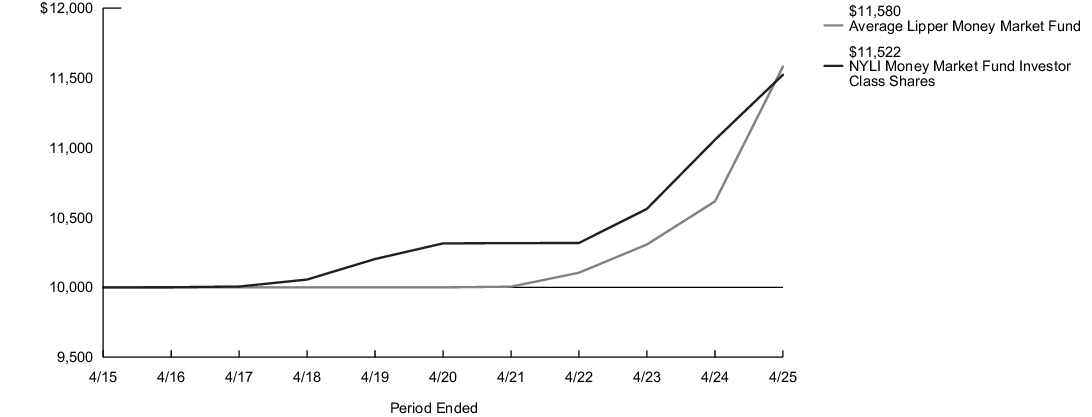

| Class A Shares | 1/3/1995 | 2.00% | 4.49% | 2.41% | 1.59% |

| Average Lipper Money Market Fund2 | 2.05% | 4.57% | 2.48% | 1.70% |

| 1. |

Not annualized. |

| 2. |

The Average Lipper Money Market Fund is an equally weighted performance average adjusted for capital gains distributions and income dividends of all of the money market funds in the Lipper Universe. Lipper Inc., a wholly-owned subsidiary of Reuters Group PLC, is an independent monitor of mutual fund performance. Lipper averages are not class specific. Lipper returns are unaudited. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

| Fund's net assets | $575,375,870 |

| Total number of portfolio holdings | 23 |

| Commercial Paper | 43.7% |

| Repurchase Agreements | 32.2% |

| U.S. Treasury Debt | 24.1% |

| Other Assets, Less Liabilities | 0.0%‡ |

| ‡ Less than one-tenth of a percent. |

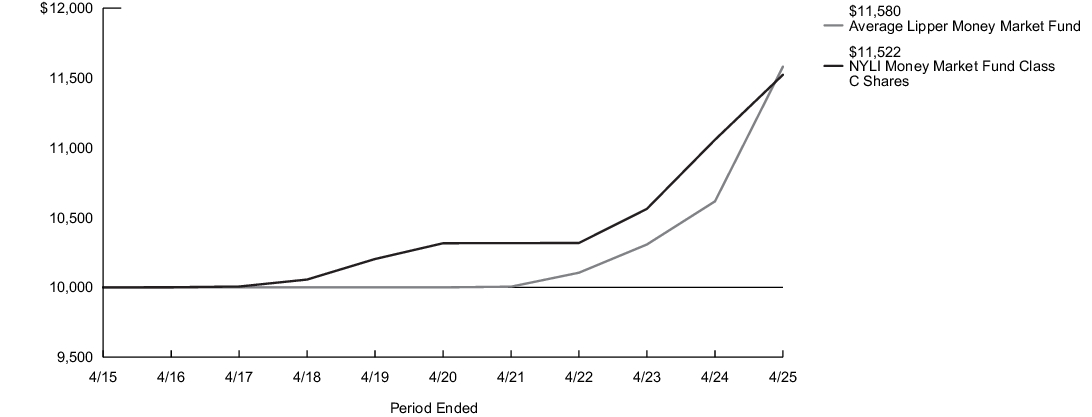

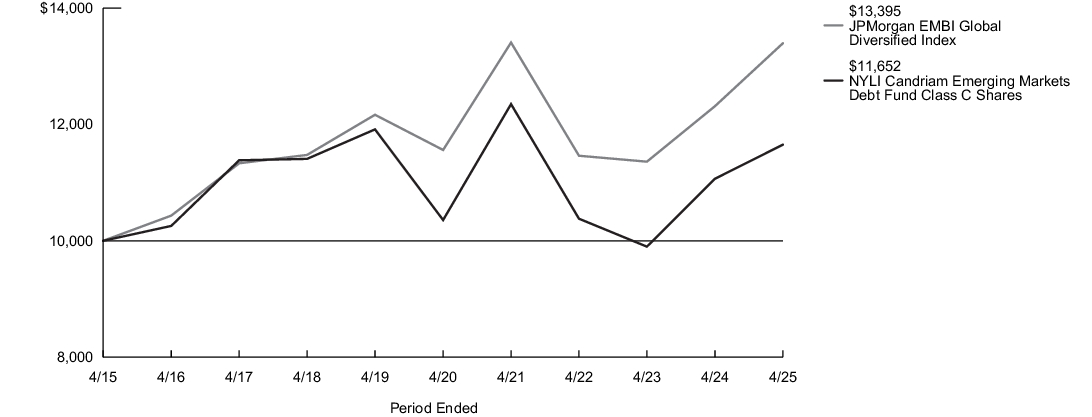

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment1,2 |

| Class C | $40 | 0.79% |

| 1. | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 2. | Annualized. |

| Average Annual Total Returns for the Period Ended April 30, 2025 | Inception Date |

Six Months1 |

One Year |

Five Years |

Ten Years |

| Class C Shares | 9/1/1998 | 1.86% | 4.20% | 2.24% | 1.43% |

| Average Lipper Money Market Fund2 | 2.05% | 4.57% | 2.48% | 1.70% |

| 1. |

Not annualized. |

| 2. |

The Average Lipper Money Market Fund is an equally weighted performance average adjusted for capital gains distributions and income dividends of all of the money market funds in the Lipper Universe. Lipper Inc., a wholly-owned subsidiary of Reuters Group PLC, is an independent monitor of mutual fund performance. Lipper averages are not class specific. Lipper returns are unaudited. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

| Fund's net assets | $575,375,870 |

| Total number of portfolio holdings | 23 |

| Commercial Paper | 43.7% |

| Repurchase Agreements | 32.2% |

| U.S. Treasury Debt | 24.1% |

| Other Assets, Less Liabilities | 0.0%‡ |

| ‡ Less than one-tenth of a percent. |