Shareholder Report |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Apr. 30, 2025

USD ($)

Holding

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Report [Line Items] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Document Type | N-CSRS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amendment Flag | false | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Registrant Name | Advisors' Inner Circle Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Entity Central Index Key | 0000878719 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Entity Investment Company Type | N-1A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Document Period End Date | Apr. 30, 2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| C000099791 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Report [Line Items] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fund Name | Loomis Sayles Full Discretion Institutional Securitized Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class Name | Institutional Class Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No Trading Symbol [Flag] | true | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual or Semi-Annual Statement [Text Block] | This semi-annual shareholder report contains important information about Institutional Class Shares of the Loomis Sayles Full Discretion Institutional Securitized Fund (the "Fund") for the period from November 1, 2024 to April 30, 2025. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Report Annual or Semi-Annual | Semi-Annual Shareholder Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional Information [Text Block] | You can find additional information about the Fund at https://info.loomissayles.com/full-discretion-funds. You can also request this information by contacting us at 1-800-343-2029. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional Information Phone Number | 1-800-343-2029 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional Information Website | https://info.loomissayles.com/full-discretion-funds | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses [Text Block] | What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses Paid, Amount | $ 10 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expense Ratio, Percent | 0.20% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AssetsNet | $ 410,356,043 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Holdings Count | Holding | 238 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advisory Fees Paid, Amount | $ 0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| InvestmentCompanyPortfolioTurnover | 23.00% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

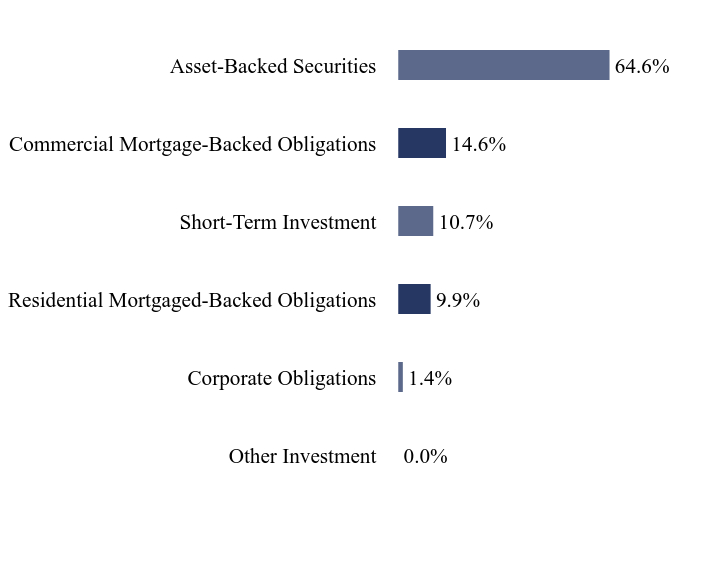

| Holdings [Text Block] | Asset WeightingsFootnote Reference*

Top Ten Holdings

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Material Fund Change [Text Block] | Material Fund ChangesThere were no material changes during the reporting period. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Updated Prospectus Phone Number | 1-800-343-2029 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Updated Prospectus Web Address | https://info.loomissayles.com/full-discretion-funds |

| X | ||||||||||

- Definition Boolean flag that is true when the XBRL content amends previously-filed or accepted submission. No definition available.

|

| X | ||||||||||

- Definition For the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD. No definition available.

|

| X | ||||||||||

- Definition The type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'. No definition available.

|

| X | ||||||||||

- Definition A unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition One of: N-1A (Mutual Fund), N-1 (Open-End Separate Account with No Variable Annuities), N-2 (Closed-End Investment Company), N-3 (Separate Account Registered as Open-End Management Investment Company), N-4 (Variable Annuity UIT Separate Account), N-5 (Small Business Investment Company), N-6 (Variable Life UIT Separate Account), S-1 or S-3 (Face Amount Certificate Company), S-6 (UIT, Non-Insurance Product). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition The exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Boolean flag that is true only for a security having no trading symbol. No definition available.

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- References Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

- Definition Amount of net assets (liabilities). Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

|

| X | ||||||||||

- Definition Percentage of lesser of purchase or sale of portfolio securities to average value of portfolio securities owned. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

|

| X | ||||||||||

- Details

|