Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

American Funds Portfolio Series

|

|

| Entity Central Index Key |

0001537151

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| American Funds® Global Growth Portfolio - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

PGGAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-A (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-A

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class A | $ 18 | 0.36 % * |

|

|

| Expenses Paid, Amount |

$ 18

|

|

| Expense Ratio, Percent |

0.36%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

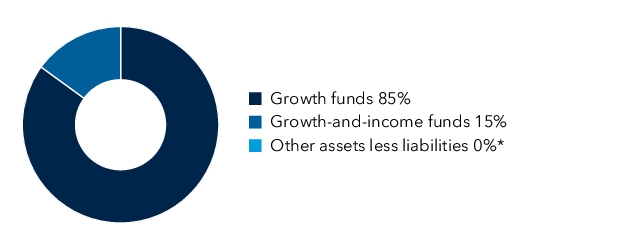

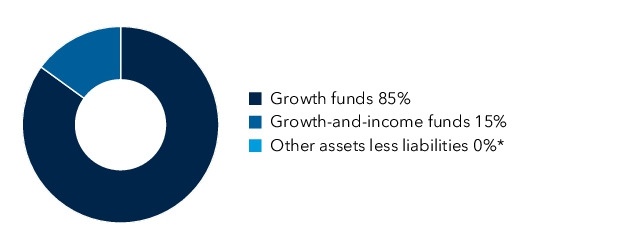

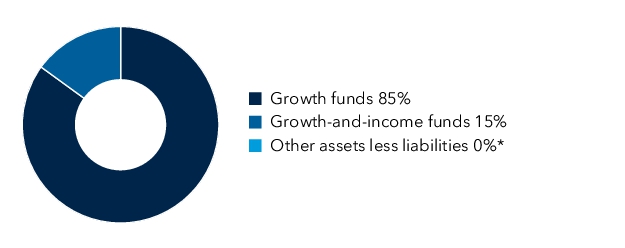

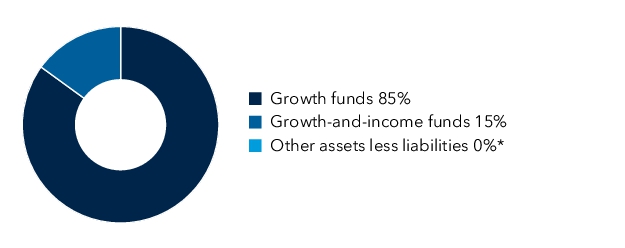

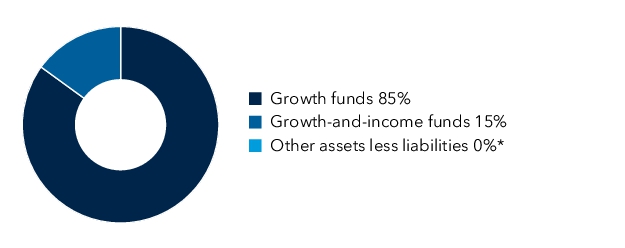

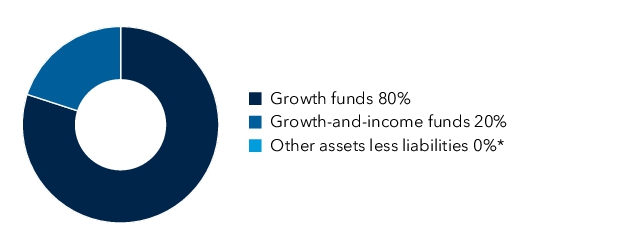

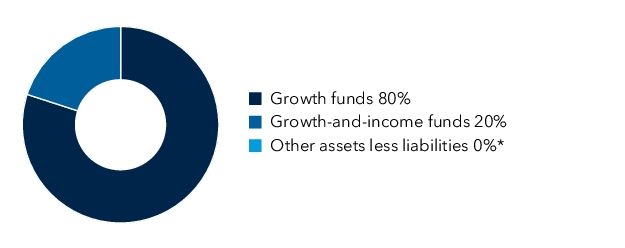

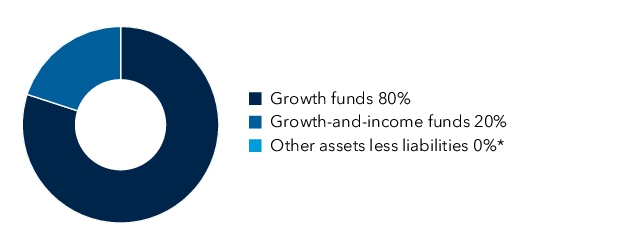

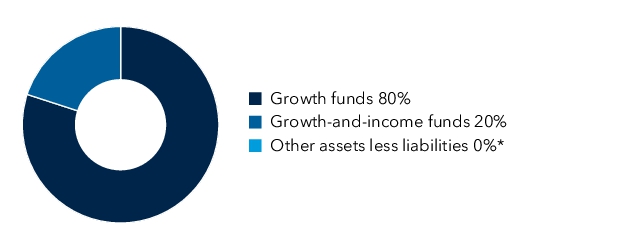

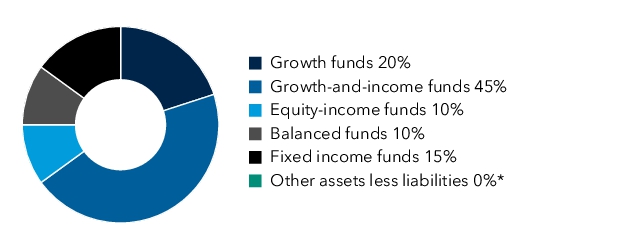

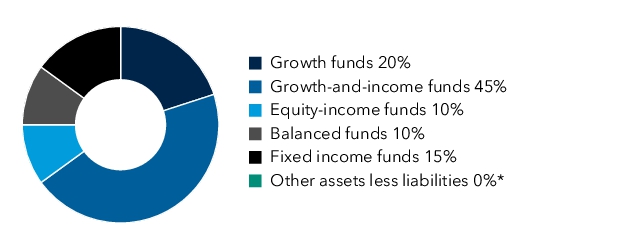

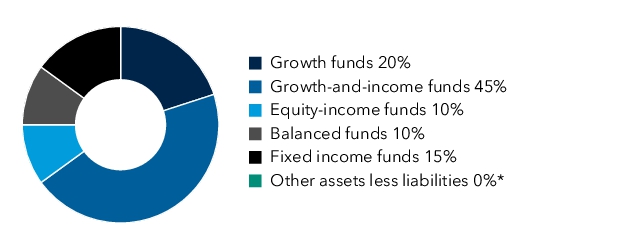

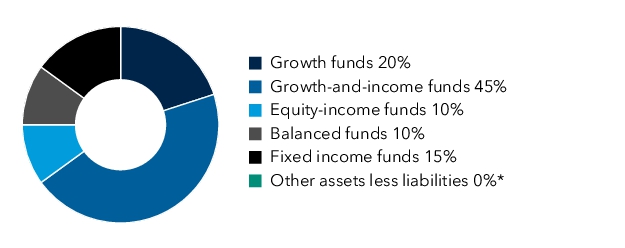

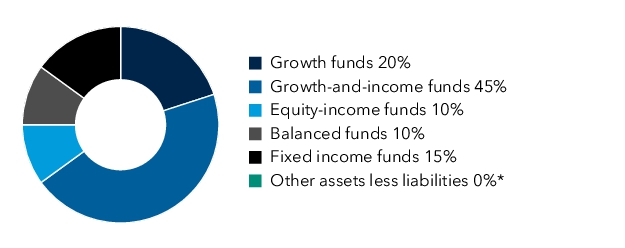

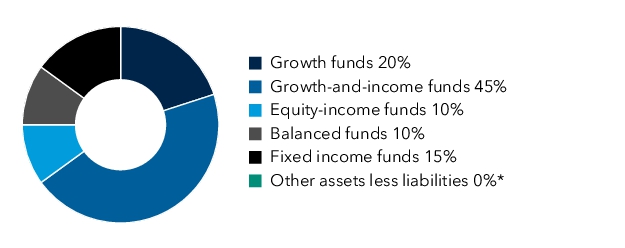

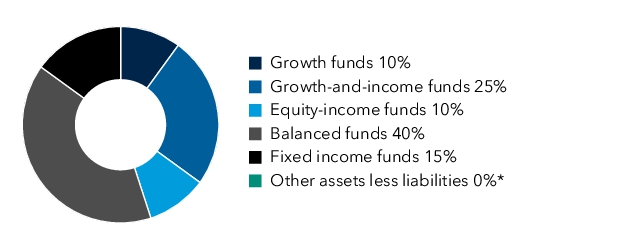

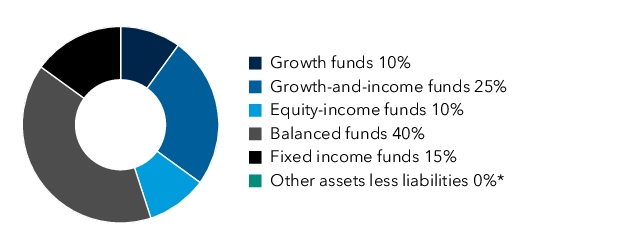

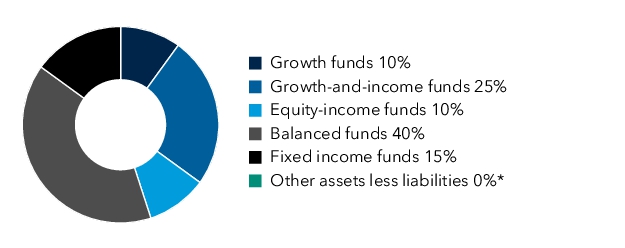

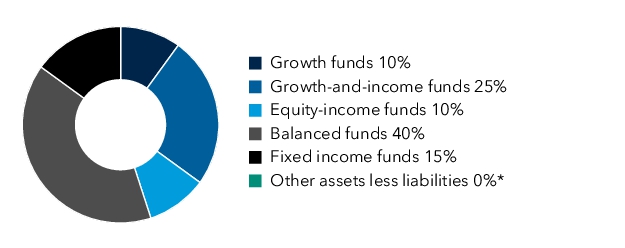

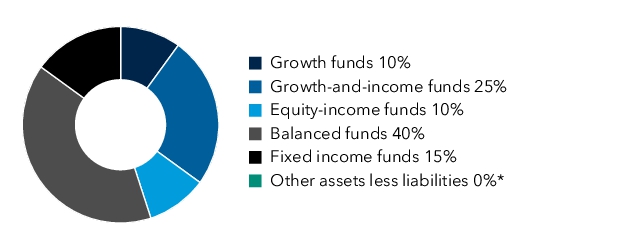

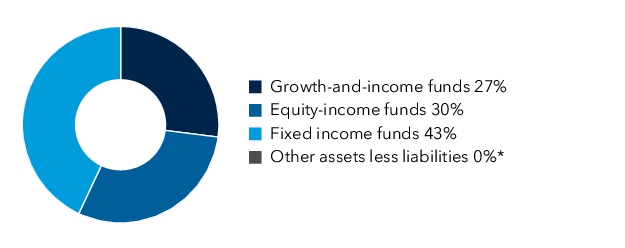

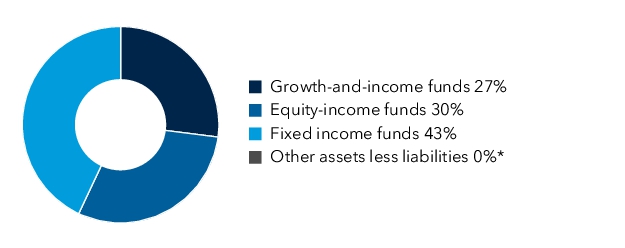

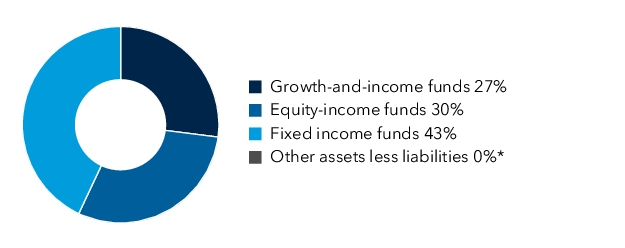

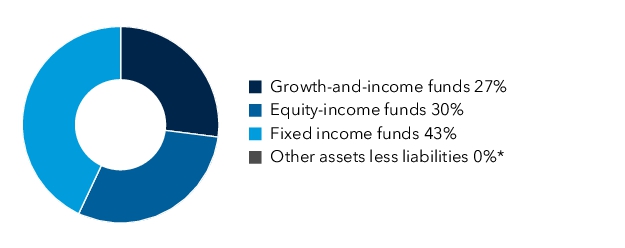

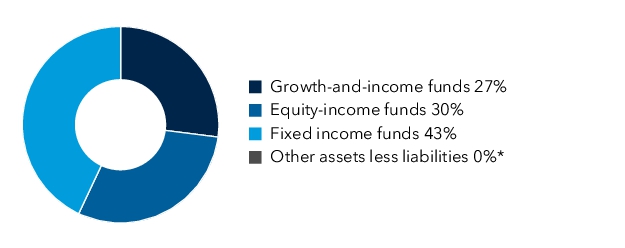

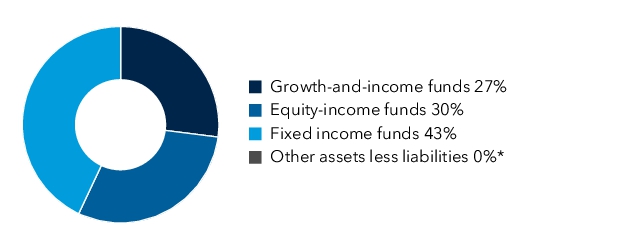

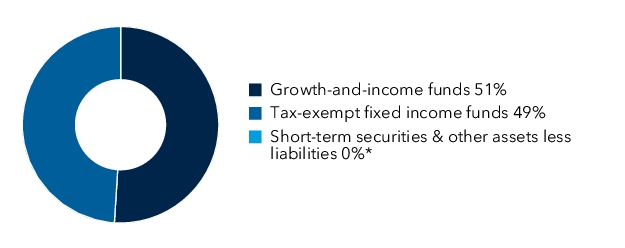

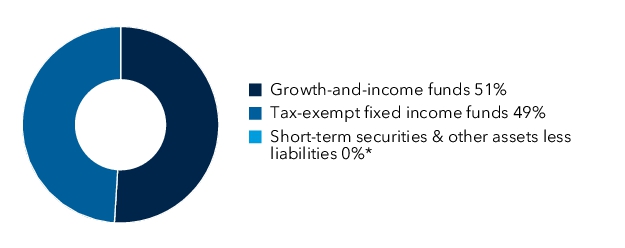

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

GGPCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-C (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-C

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class C | $ 55 | 1.11 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 55

|

|

| Expense Ratio, Percent |

1.11%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

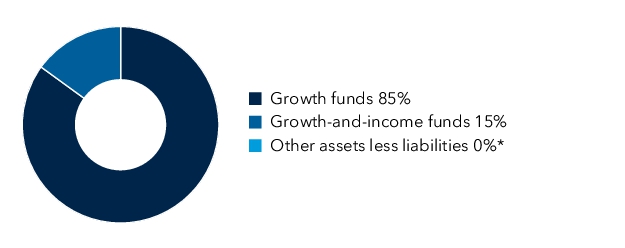

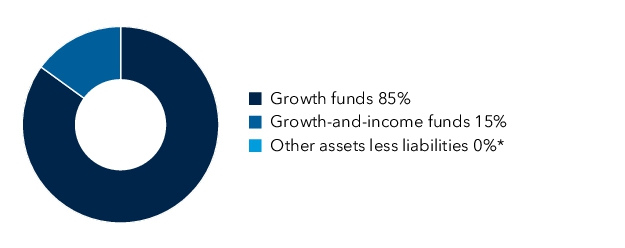

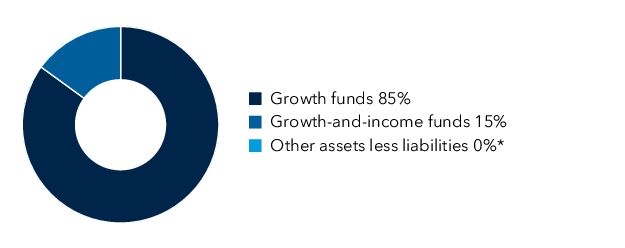

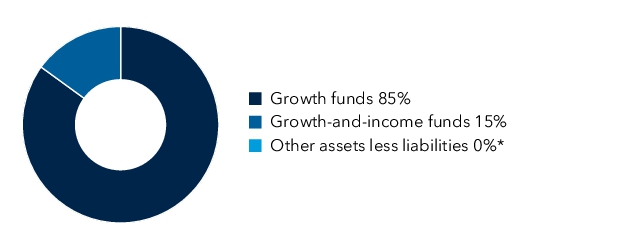

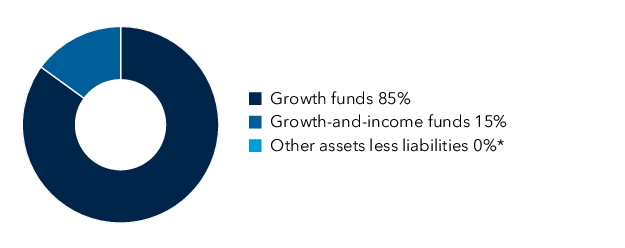

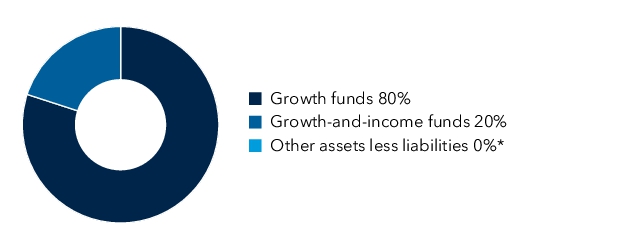

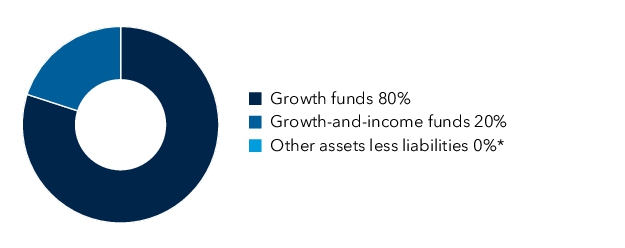

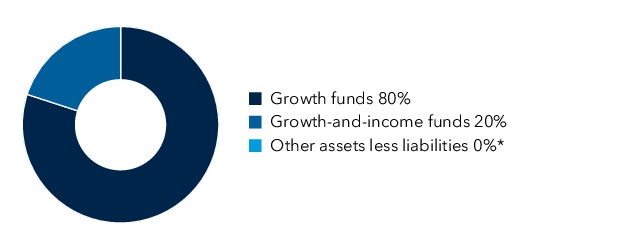

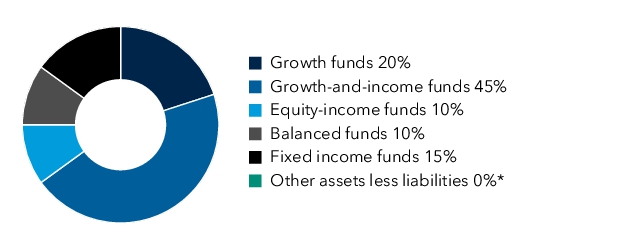

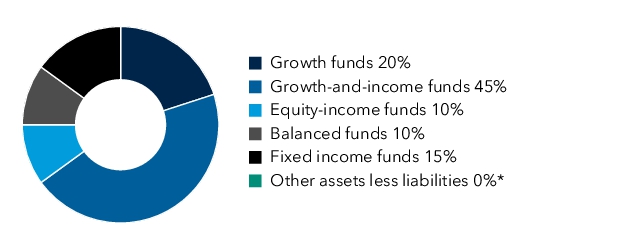

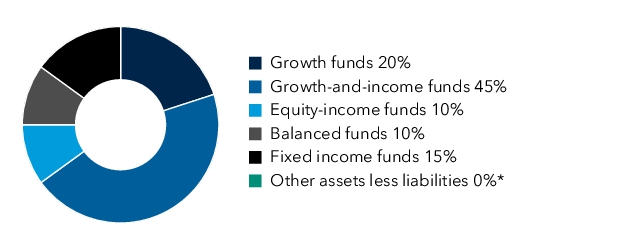

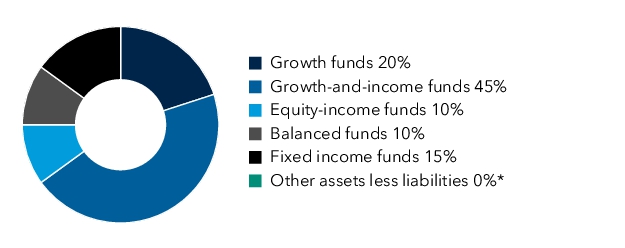

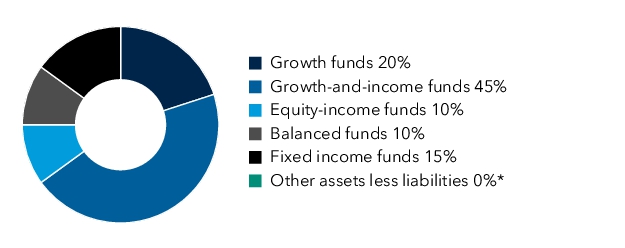

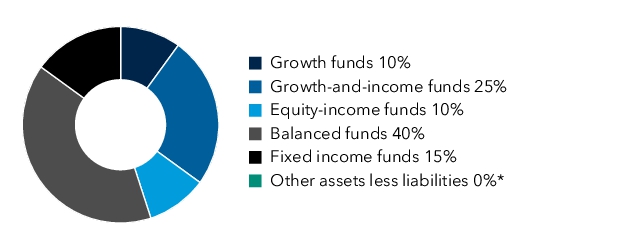

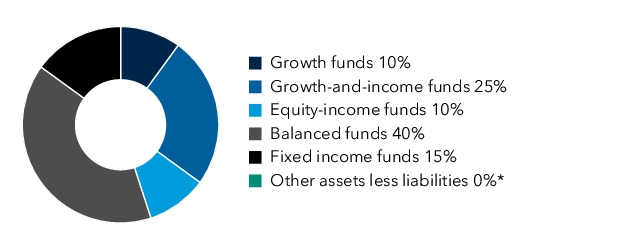

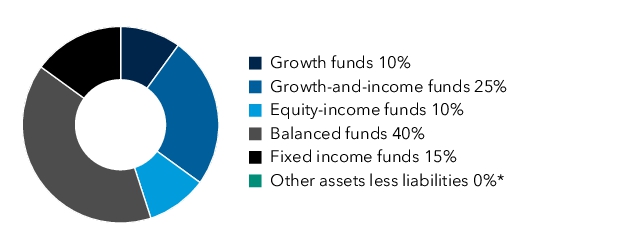

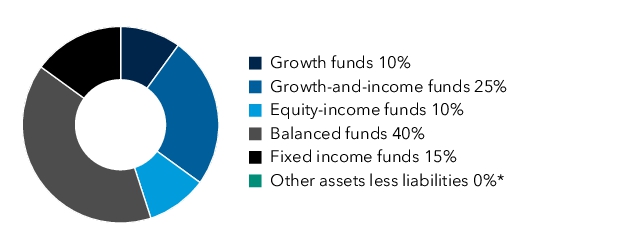

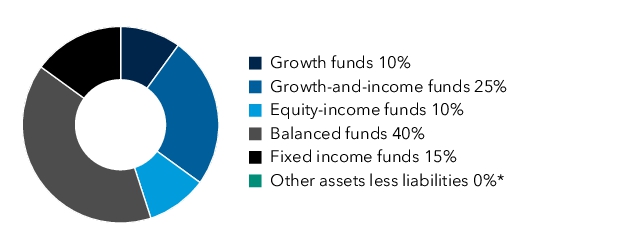

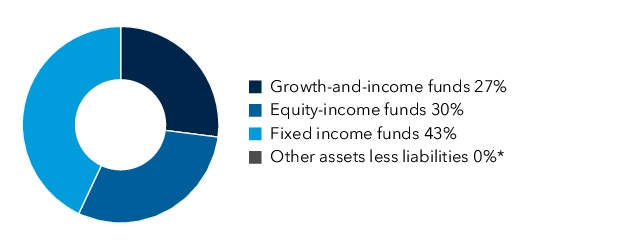

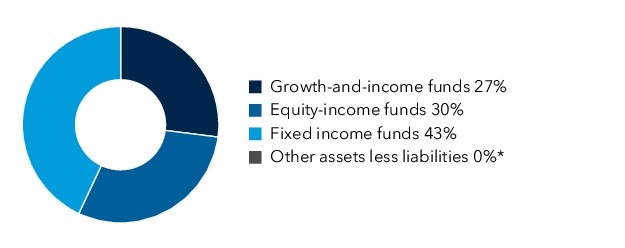

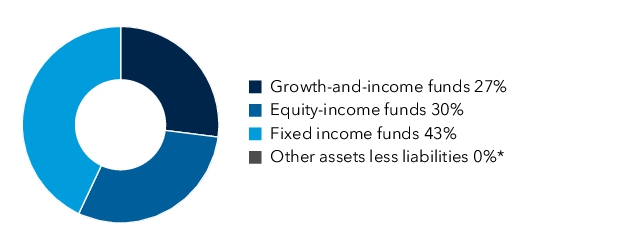

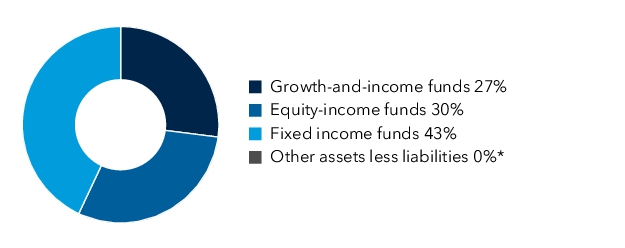

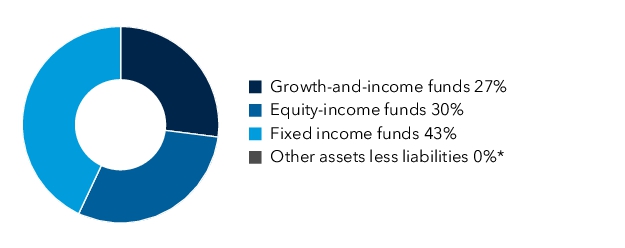

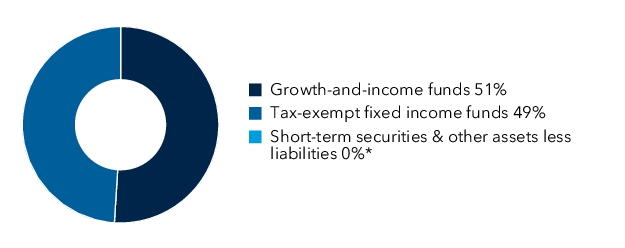

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class T |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class T

|

|

| Trading Symbol |

TPGGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class T |

$ 5 |

0.11 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 5

|

|

| Expense Ratio, Percent |

0.11%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

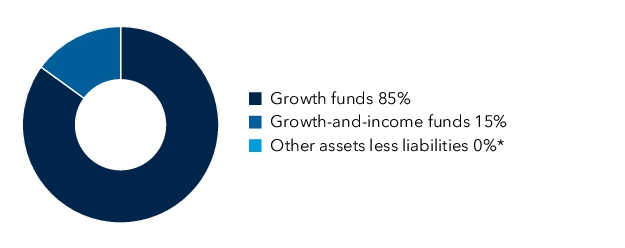

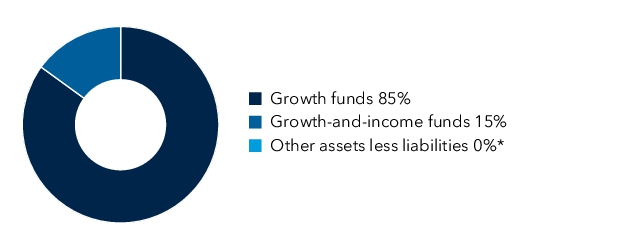

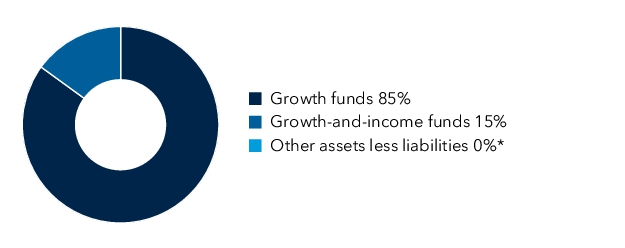

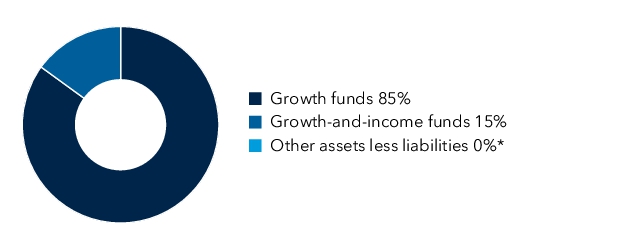

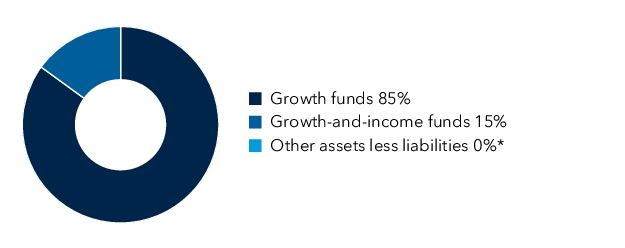

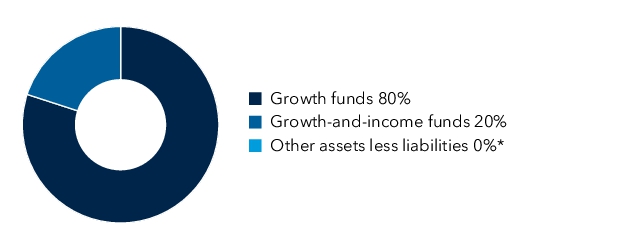

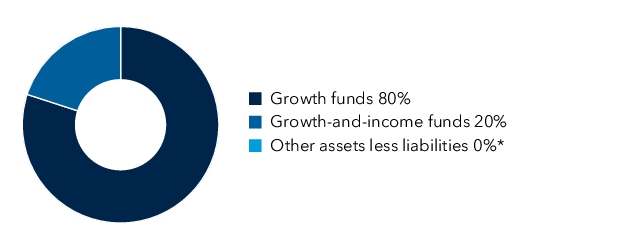

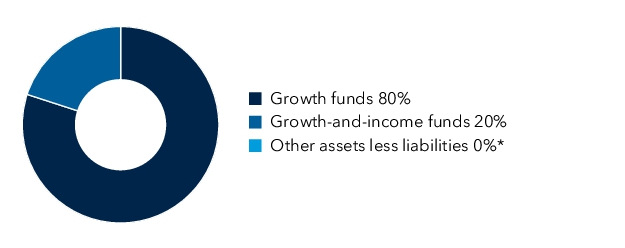

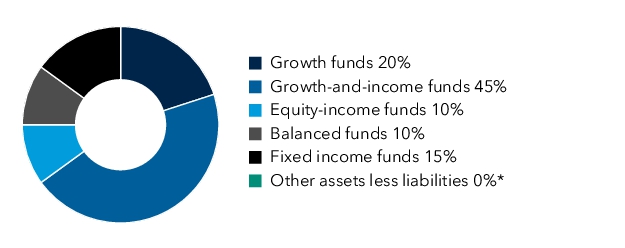

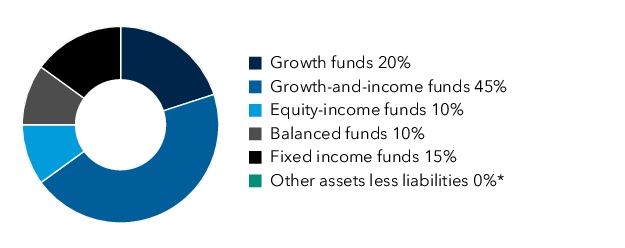

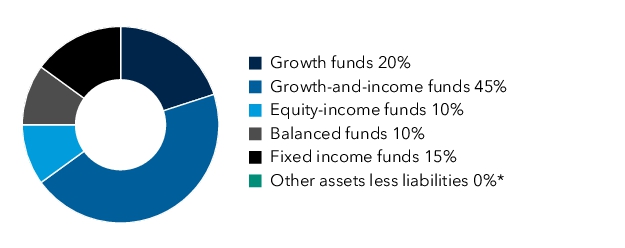

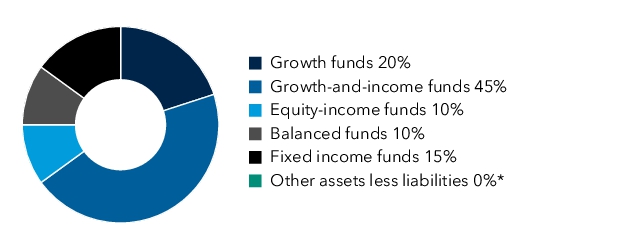

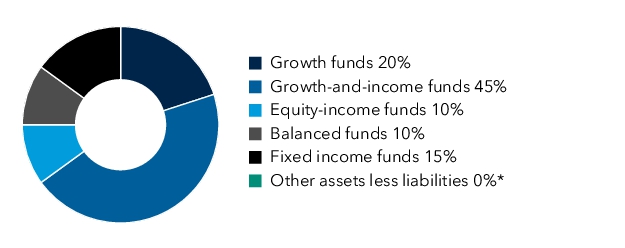

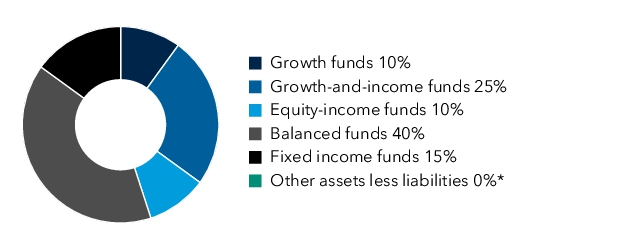

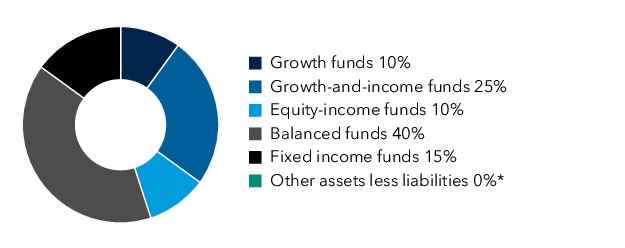

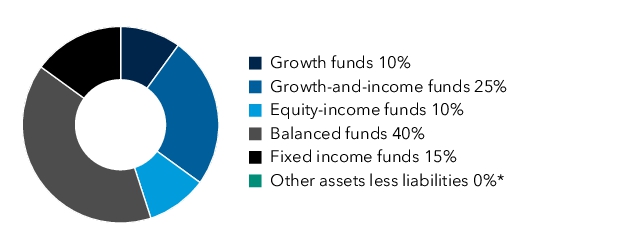

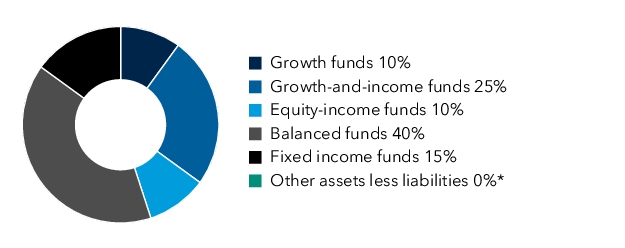

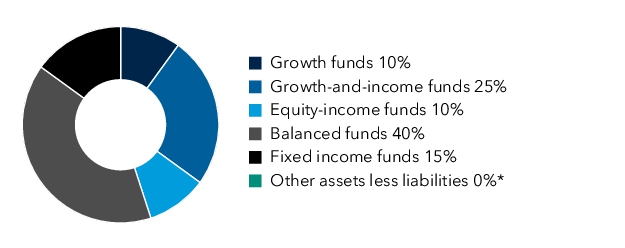

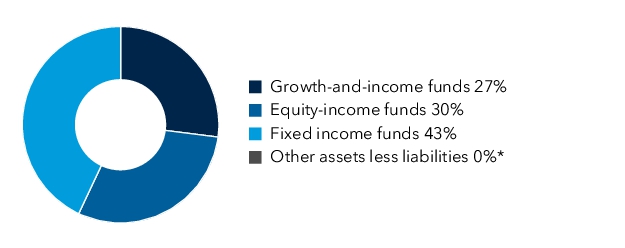

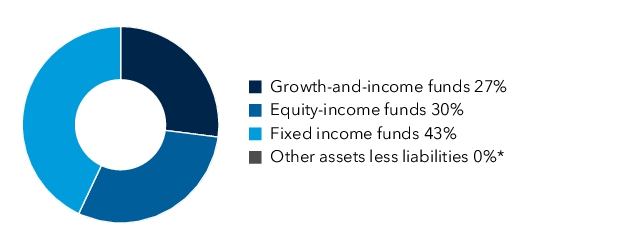

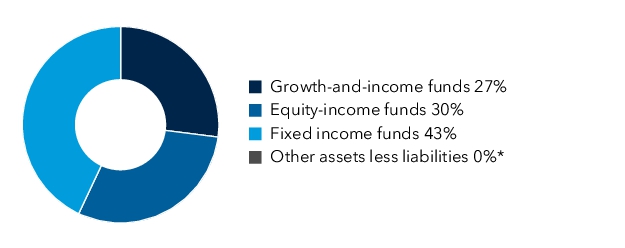

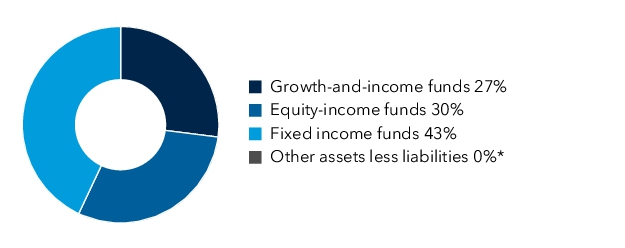

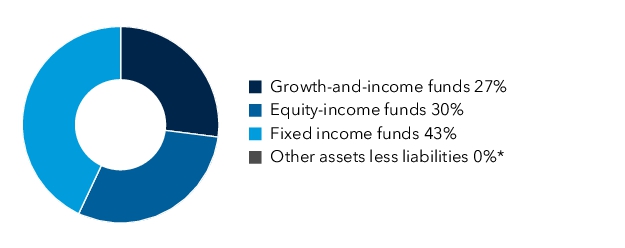

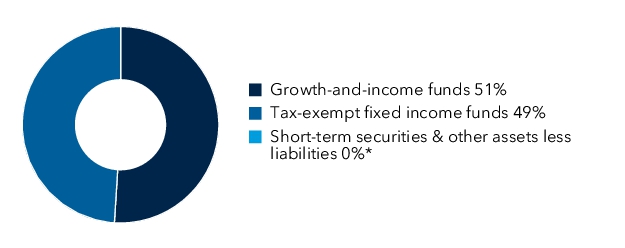

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class F1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class F-1

|

|

| Trading Symbol |

PGGFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F1 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F1

|

|

| Expenses [Text Block] |

What were the fund c os ts for the last six months? (based on a hy pot hetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class F-1 |

$ 19 |

0.38 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.38%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

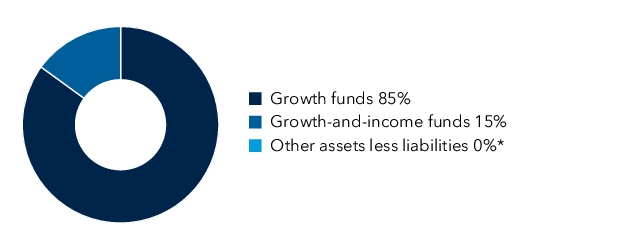

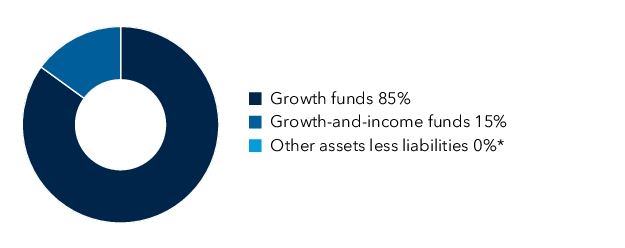

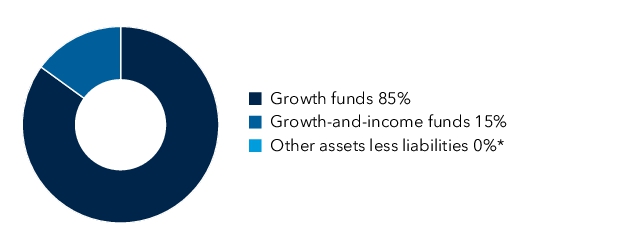

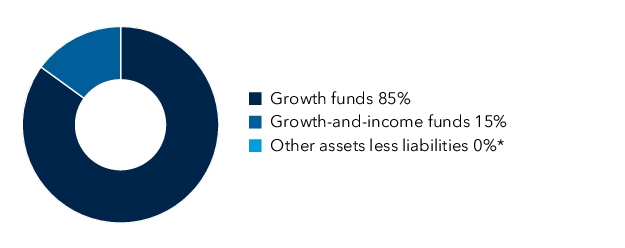

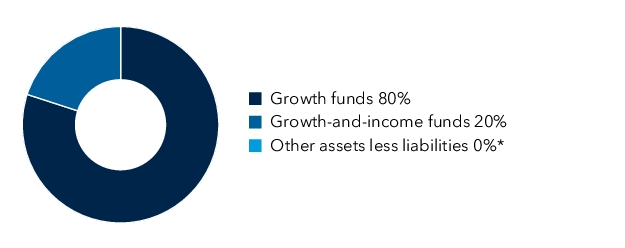

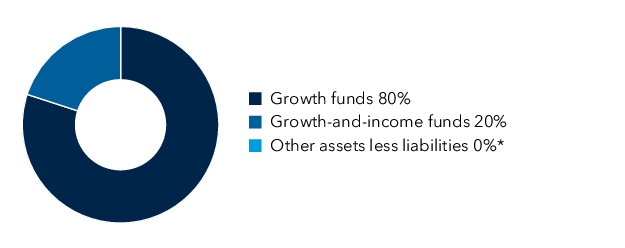

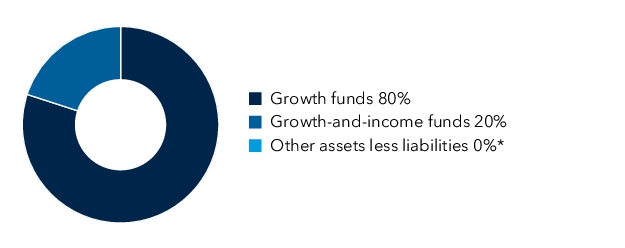

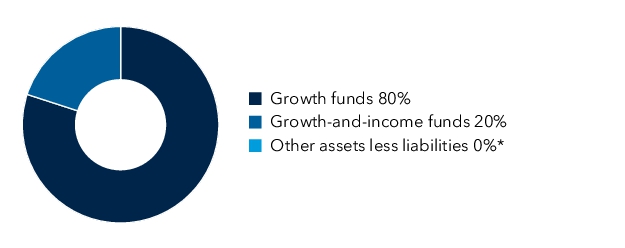

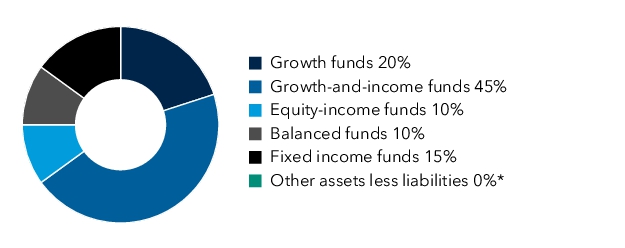

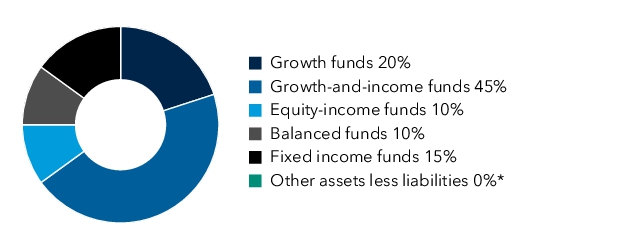

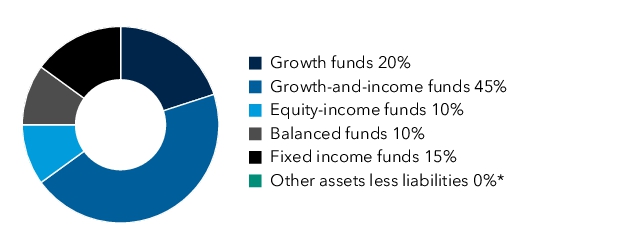

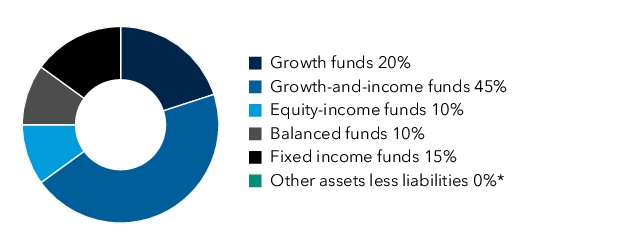

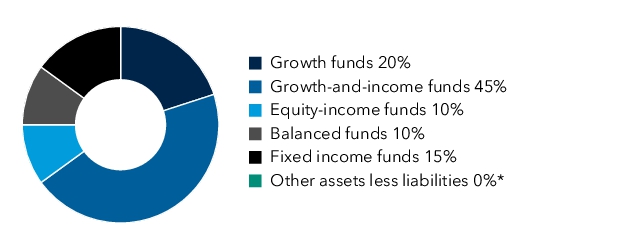

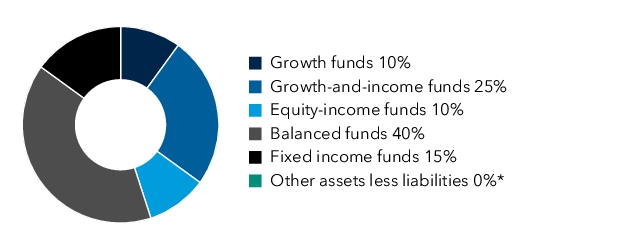

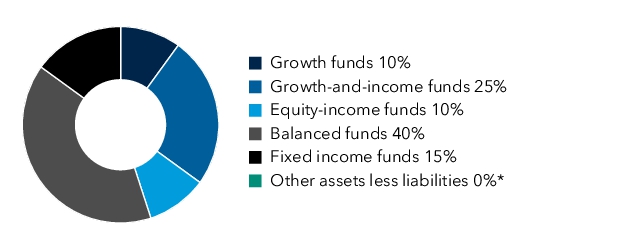

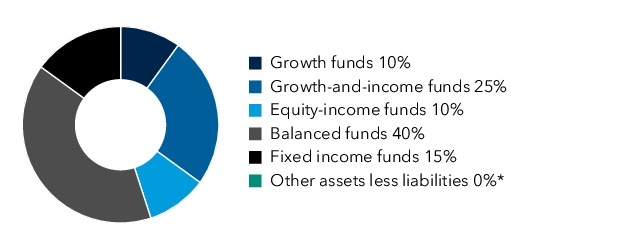

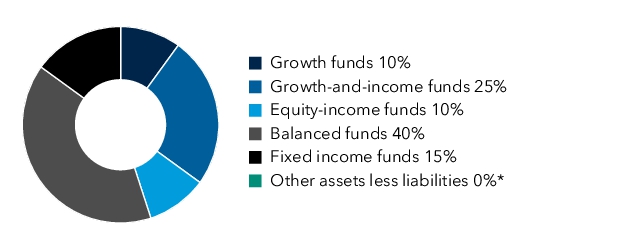

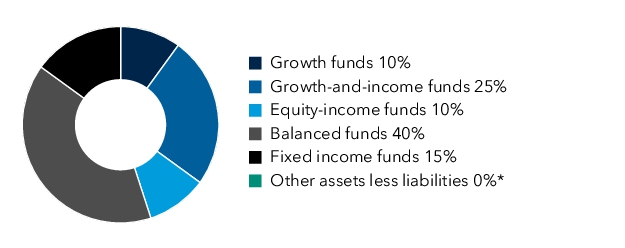

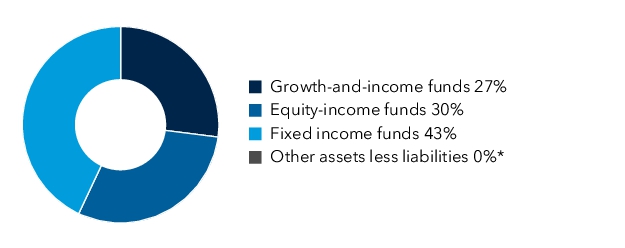

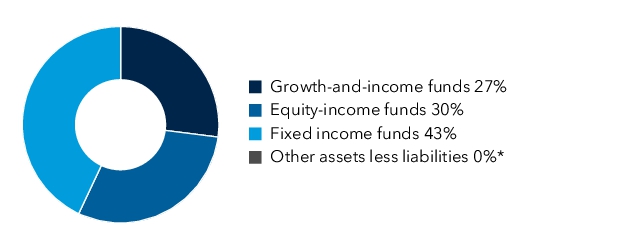

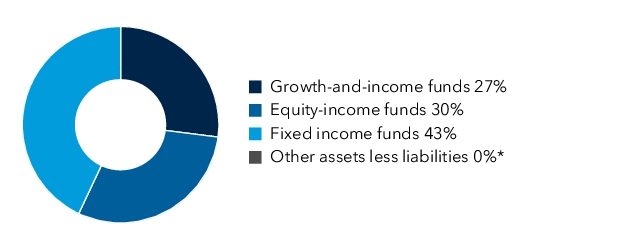

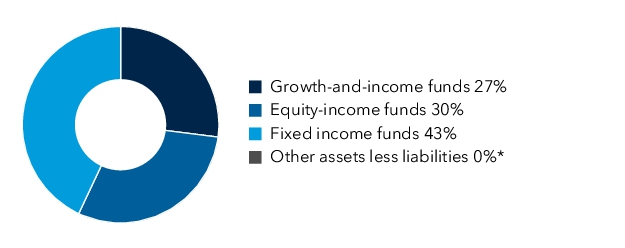

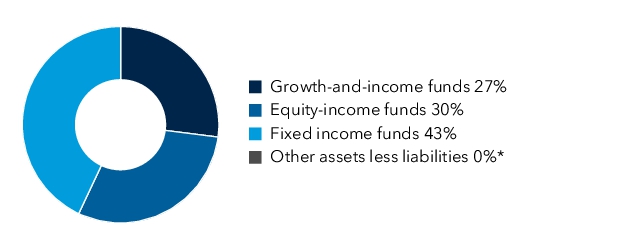

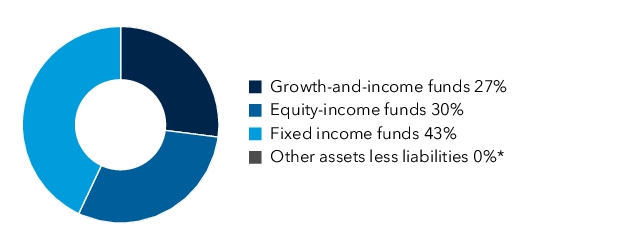

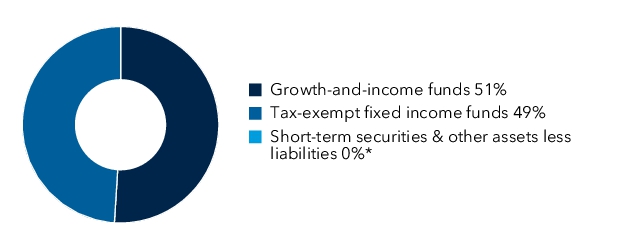

Portfolio holdings by fund type (percent of net assets) *Less than 1%.

|

|

| American Funds® Global Growth Portfolio - Class F2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class F-2

|

|

| Trading Symbol |

PGWFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F2 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F2

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-2 | $ 6 | 0.12 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 6

|

|

| Expense Ratio, Percent |

0.12%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

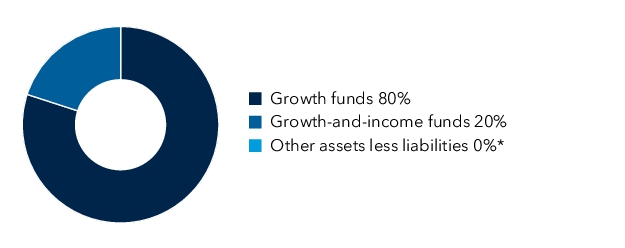

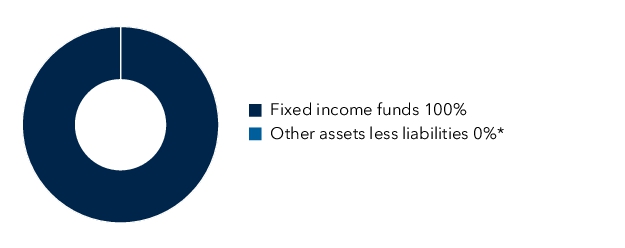

Portfolio hold in gs by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class F3 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class F-3

|

|

| Trading Symbol |

PGXFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F3 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F3

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 in ve stment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class F-3 |

$ 0* |

0.01 % † |

* Amount less than $1. † Annualized. |

|

| Expenses Paid, Amount |

$ 0

|

[2] |

| Expense Ratio, Percent |

0.01%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class 529-A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class 529-A

|

|

| Trading Symbol |

CPGAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529A nta cting us at (800) 421-4225.

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529A

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-A | $ 19 | 0.39 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.39%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class 529-C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class 529-C

|

|

| Trading Symbol |

CPGCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529C (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529C

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-C |

$ 56 |

1.14 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 56

|

|

| Expense Ratio, Percent |

1.14%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

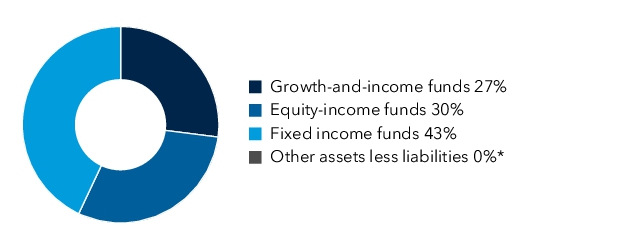

Portfolio hol di ngs by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class 529-E |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class 529-E

|

|

| Trading Symbol |

CGGEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529E (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529E

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-E | $ 31 | 0.63 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 31

|

|

| Expense Ratio, Percent |

0.63%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

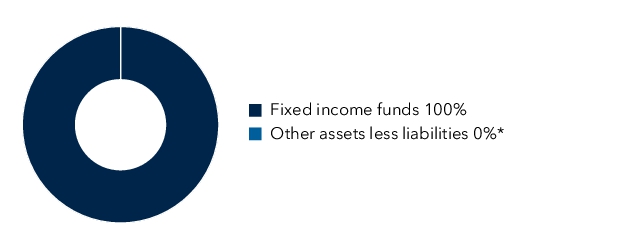

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class 529-T |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class 529-T

|

|

| Trading Symbol |

TGPPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-T | $ 7 | 0.15 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 7

|

|

| Expense Ratio, Percent |

0.15%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class 529-F-1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class 529-F-1

|

|

| Trading Symbol |

CGGFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F1 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F1

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-F-1 |

$ 9 |

0.18 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 9

|

|

| Expense Ratio, Percent |

0.18%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class 529-F-2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class 529-F-2

|

|

| Trading Symbol |

FGGPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F2 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F2

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-F-2 |

$ 6 |

0.13 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 6

|

|

| Expense Ratio, Percent |

0.13%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class 529-F-3 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class 529-F-3

|

|

| Trading Symbol |

FGPPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F3 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F3

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class 529-F-3 | $ 3 | 0.06 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 3

|

|

| Expense Ratio, Percent |

0.06%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

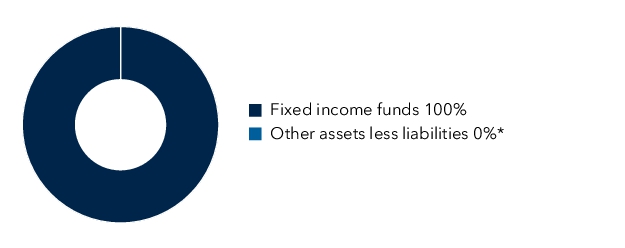

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Global Growth Portfolio - Class ABLE-A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class ABLE-A

|

|

| Trading Symbol |

CGGGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-ABLEA (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-ABLEA

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class ABLE-A |

$ 13 |

0.26 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 13

|

|

| Expense Ratio, Percent |

0.26%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class ABLE-F-2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class ABLE-F-2

|

|

| Trading Symbol |

CGHGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-ABLEF2 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-ABLEF2

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class ABLE-F-2 |

$ 3 |

0.06 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 3

|

|

| Expense Ratio, Percent |

0.06%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class R-1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-1

|

|

| Trading Symbol |

RGGAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R1 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R1

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-1 |

$ 52 |

1.05 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 52

|

|

| Expense Ratio, Percent |

1.05%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class R-2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-2

|

|

| Trading Symbol |

RGGBX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R2 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R2

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-2 |

$ 54 |

1.10 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 54

|

|

| Expense Ratio, Percent |

1.10%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Global Growth Portfolio - Class R-2E |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-2E

|

|

| Trading Symbol |

REBGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R2E (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R2E

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-2E |

$ 41 |

0.82 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.82%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds Global Growth Portfolio - Class R-3 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-3

|

|

| Trading Symbol |

RGLCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R3 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R3

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-3 |

$ 32 |

0.65 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 32

|

|

| Expense Ratio, Percent |

0.65%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds Global Growth Portfolio - Class R-4 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-4

|

|

| Trading Symbol |

RGGEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R4 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R4

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-4 |

$ 18 |

0.36 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 18

|

|

| Expense Ratio, Percent |

0.36%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio hol di ngs by fund type (per cent of net assets)

|

|

| American Funds Global Growth Portfolio - Class R-5E |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-5E

|

|

| Trading Symbol |

RGTFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R5E (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R5E

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-5E |

$ 7 |

0.15 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 7

|

|

| Expense Ratio, Percent |

0.15%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds Global Growth Portfolio - Class R-5 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-5

|

|

| Trading Symbol |

RGGFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R5 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R5

|

|

| Expenses [Text Block] |

What were th e fun d costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R-5 |

$ 3 |

0.07 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 3

|

|

| Expense Ratio, Percent |

0.07%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 5,902 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate |

4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds Global Growth Portfolio - Class R-6 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Global Growth Portfolio

|

|

| Class Name |

Class R-6

|

|

| Trading Symbol |

RGGGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Global Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R6 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R6

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class R-6 | $ 0* | 0.01 % † |

* Amount less than $1. † Annualized. |

|

| Expenses Paid, Amount |

$ 0

|

[2] |

| Expense Ratio, Percent |

0.01%

|

[1] |

| Net Assets |

$ 5,902,000,000

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 5,902 | | Total number of portfolio holdings | 8 | | Portfolio turnover rate | 4 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets) |

|

| American Funds® Growth Portfolio - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

GWPAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-A (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-A

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class A |

$ 17 |

0.35 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.35%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

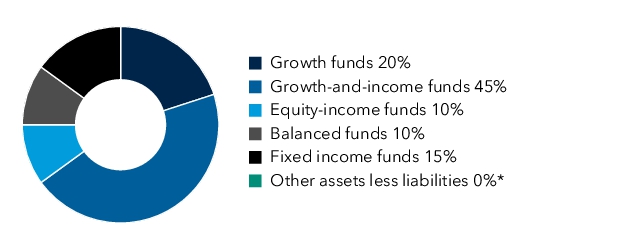

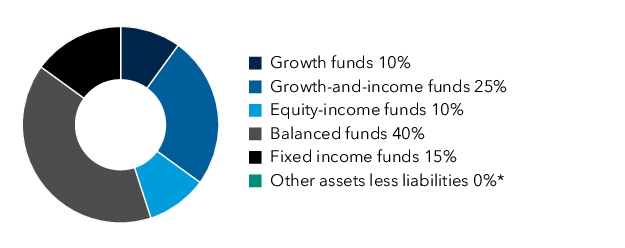

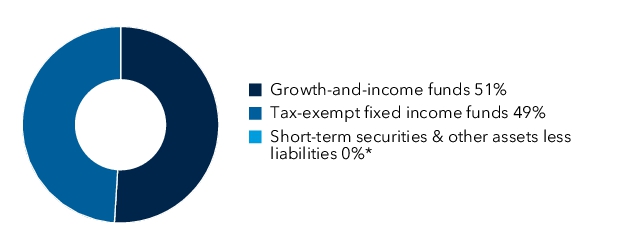

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

GWPCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-C |

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-C

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class C |

$ 54 |

1.10 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 54

|

|

| Expense Ratio, Percent |

1.10%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class T |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class T

|

|

| Trading Symbol |

TGGPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class T |

$ 5 |

0.10 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 5

|

|

| Expense Ratio, Percent |

0.10%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class F-1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class F-1

|

|

| Trading Symbol |

GWPFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F1 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F1

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class F-1 |

$ 19 |

0.38 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.38%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class F-2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class F-2

|

|

| Trading Symbol |

GWPEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F2 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F2

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class F-2 |

$ 5 |

0.11 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 5

|

|

| Expense Ratio, Percent |

0.11%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class F-3 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class F-3

|

|

| Trading Symbol |

GWPDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F3 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F3

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class F-3 |

$ 0* |

0.01 % † |

* Amount less than $1. † Annualized. |

|

| Expenses Paid, Amount |

$ 0

|

[2] |

| Expense Ratio, Percent |

0.01%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class 529-A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class 529-A

|

|

| Trading Symbol |

CGPAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529A (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529A

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-A |

$ 19 |

0.39 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.39%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

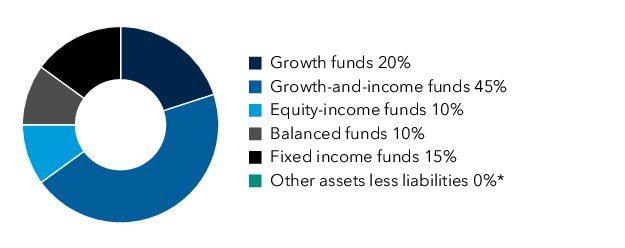

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class 529-C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class 529-C

|

|

| Trading Symbol |

CGPCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529C |

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529C

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-C |

$ 57 |

1.15 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 57

|

|

| Expense Ratio, Percent |

1.15%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds® Growth Portfolio - Class 529-E |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class 529-E

|

|

| Trading Symbol |

CGPEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529E (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529E

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-E |

$ 31 |

0.62 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 31

|

|

| Expense Ratio, Percent |

0.62%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds Growth Portfolio - Class 529-T |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class 529-T

|

|

| Trading Symbol |

TPGTX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-T |

$ 7 |

0.15 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 7

|

|

| Expense Ratio, Percent |

0.15%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Fund Growth Portfolio - Class 529-F-1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class 529-F-1

|

|

| Trading Symbol |

CGPFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F1 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F1

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-F-1 |

$ 9 |

0.18 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 9

|

|

| Expense Ratio, Percent |

0.18%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Fund Growth Portfolio - Class 529-F-2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class 529-F-2

|

|

| Trading Symbol |

FGPGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F2 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F2

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-F-2 |

$ 6 |

0.12 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 6

|

|

| Expense Ratio, Percent |

0.12%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Fund Growth Portfolio - Class 529-F-3 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class 529-F-3

|

|

| Trading Symbol |

FPGGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-529F3 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-529F3

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class 529-F-3 |

$ 3 |

0.06 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 3

|

|

| Expense Ratio, Percent |

0.06%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Fund Growth Portfolio - Class ABLE-A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class ABLE-A

|

|

| Trading Symbol |

CGQGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-ABLEA (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-ABLEA

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class ABLE-A |

$ 12 |

0.25 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.25%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Fund Growth Portfolio - Class ABLE-F-2 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class ABLE-F-2

|

|

| Trading Symbol |

CGRGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about American Funds Growth Portfolio (the "fund") for the period from November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-ABLEF2 (800) 421-4225 .

|

|

| Additional Information Phone Number |

(800) 421-4225

|

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-ABLEF2

|

|

| Expenses [Text Block] |

What were the fund costs for the last six months ? ( based on a hypothetical $10,000 investment)

Share class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class ABLE-F-2 |

$ 2 |

0.05 % * |

*Annualized.

|

|

| Expenses Paid, Amount |

$ 2

|

|

| Expense Ratio, Percent |

0.05%

|

[1] |

| Net Assets |

$ 19,922,000,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) |

$ 19,922 |

| Total number of portfolio holdings |

7 |

| Portfolio turnover rate |

0 % |

|

|

| Holdings [Text Block] |

Portfolio holdings by fund type (percent of net assets)

|

|

| American Funds Growth Portfolio Class R-1 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

American Funds® Growth Portfolio

|

|

| Class Name |

Class R-1

|

|

| Trading Symbol |

RGWAX

|

|

| Annual or Semi-Annual Statement [Text Block] |