https://logancapitalfunds.com/regulatory-info. You can also request this information by contacting us at 1-800-617-0004.

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Logan Capital Broad Innovative Growth ETF

|

$96

|

0.90%

|

|

Top Contributors

|

|

|

↑

|

Information Technology

|

|

↑

|

Communication Services

|

|

↑

|

Netflix

|

|

↑

|

AppLovin

|

|

↑

|

Broadcom

|

|

Top Detractors

|

|

|

↓

|

Consumer Staples

|

|

↓

|

Health Care

|

|

↓

|

e.l.f. Beauty

|

|

↓

|

Lincoln Electric

|

|

↓

|

lululemon

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

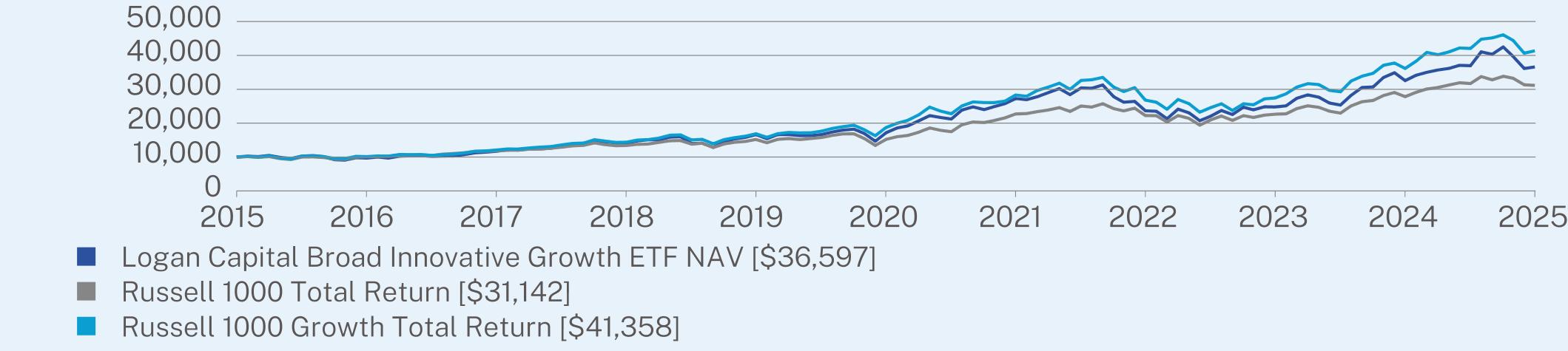

Logan Capital Broad Innovative Growth ETF NAV

|

12.40

|

16.36

|

13.85

|

|

Russell 1000 Total Return

|

11.94

|

15.42

|

12.03

|

|

Russell 1000 Growth Total Return

|

14.41

|

17.20

|

15.25

|

|

Net Assets

|

$68,999,583

|

|

Number of Holdings

|

56

|

|

Net Advisory Fee

|

$460,434

|

|

Portfolio Turnover

|

5%

|

|

30-Day SEC Yield

|

-0.04%

|

|

30-Day SEC Yield Unsubsidized

|

-0.04%

|

|

Top 10 Issuers

|

(%)

|

|

Netflix, Inc.

|

6.2%

|

|

MasterCard, Inc.

|

5.2%

|

|

AppLovin Corp.

|

5.1%

|

|

Amphenol Corp.

|

5.0%

|

|

Broadcom, Inc.

|

5.0%

|

|

Apple, Inc.

|

4.7%

|

|

KLA Corp.

|

4.5%

|

|

Alphabet, Inc.

|

4.3%

|

|

Amazon.com, Inc.

|

4.2%

|

|

Meta Platforms, Inc.

|

4.1%

|

|

Top Sectors

|

(%)

|

|

Information Technology

|

31.1%

|

|

Consumer Discretionary

|

19.1%

|

|

Communication Services

|

16.7%

|

|

Industrials

|

16.4%

|

|

Financials

|

8.5%

|

|

Health Care

|

4.2%

|

|

Materials

|

2.4%

|

|

Consumer Staples

|

1.1%

|

|

Cash & Other

|

0.5%

|