Exhibit 99.4

This document, in PDF format, does not comply with the obligations under Directive 2004/109/EC (the “Transparency Directive”) and Delegated Regulation (EU) 2019/815 (the “ESEF Regulation” – European Single Electronic Format). A dedicated XHTML format has been prepared for this purpose, which is the version audited and reviewed by the Board of Statutory Auditors and the Independent Auditors.

Annual Report

as at

31 december 2024

Banca Monte dei Paschi di Siena S.p.a.

Registered office in Piazza Salimbeni 3, Siena, Italy

Share Capital: €7,453,450,788.44 fully paid in

Registered with the Arezzo-Siena Companies’ Register – registration no. and tax code 00884060526

MPS VAT Group - VAT number 01483500524

Member of the Italian Interbank Deposit Protection Fund. Registered with the Register of Banks under no. 5274

Monte dei Paschi di Siena Banking Group, registered with the Register of Banking Groups.

BANCA MONTE DEI PASCHI DI SIENA

Index

| Governing and control bodies | 4 |

| Consolidated Annual Report | 5 |

| Consolidated Report on operations | 6 |

| General accounting standards | 7 |

| Results in brief | 8 |

| Executive summary | 11 |

| Group overview | 13 |

| Shareholders | 14 |

| Information on the BMPS share | 15 |

| Organisational structure | 16 |

| Governance & control systems | 18 |

| Distribution channels | 21 |

| Customer base | 23 |

| Reference context | 24 |

| Significant events in 2024 | 27 |

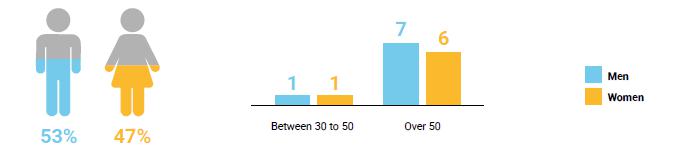

| Human Resources | 30 |

| 2024-2028 Group Business Plan | 34 |

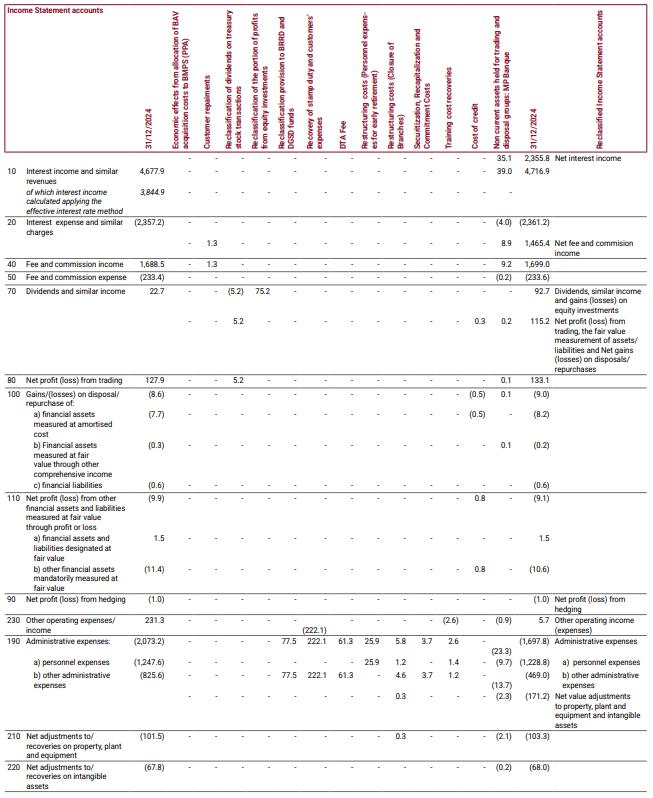

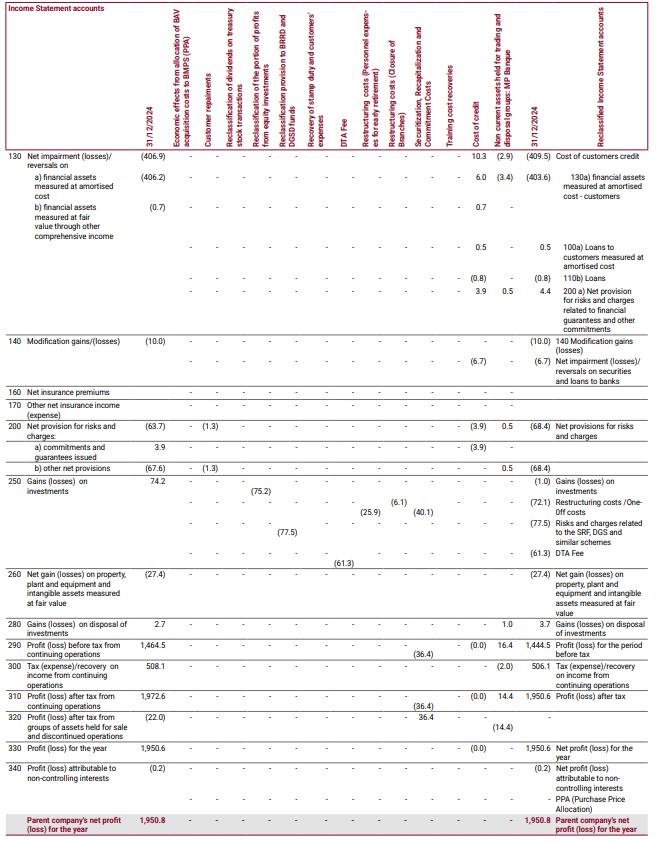

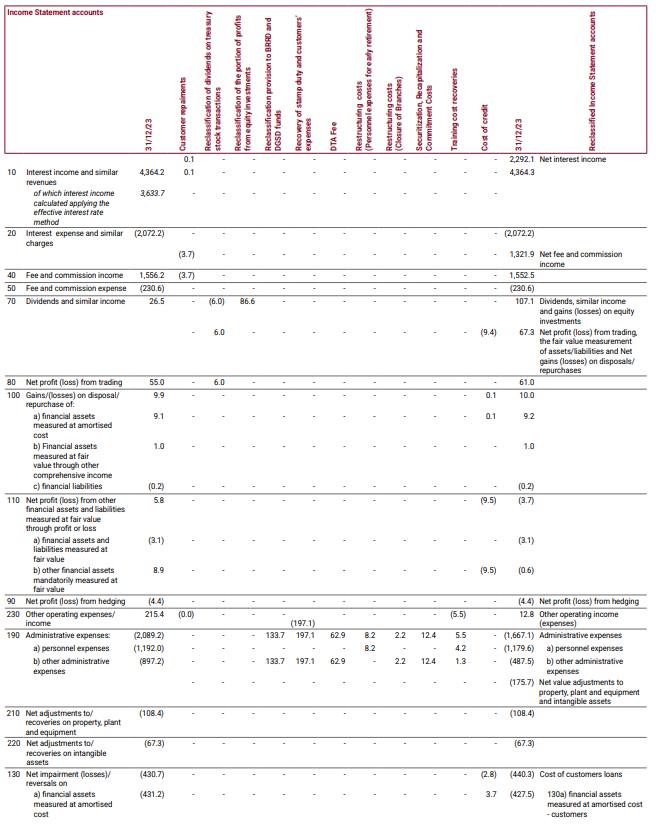

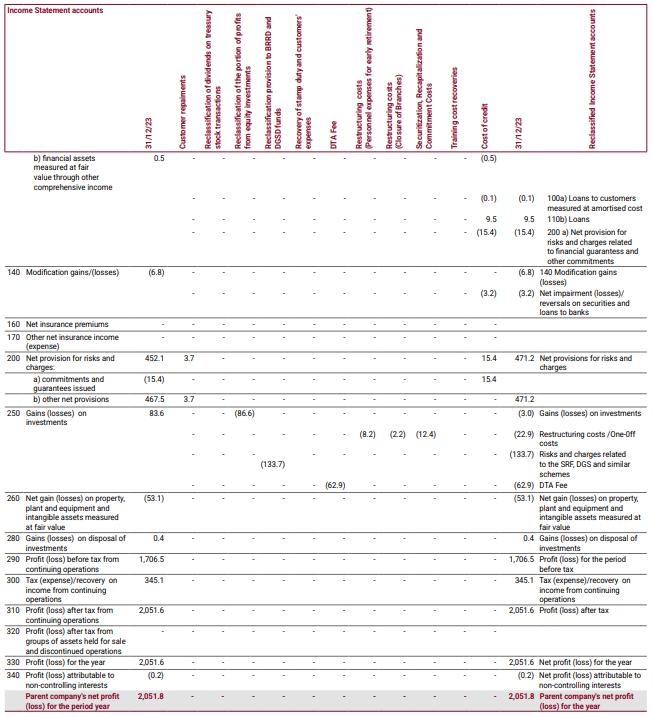

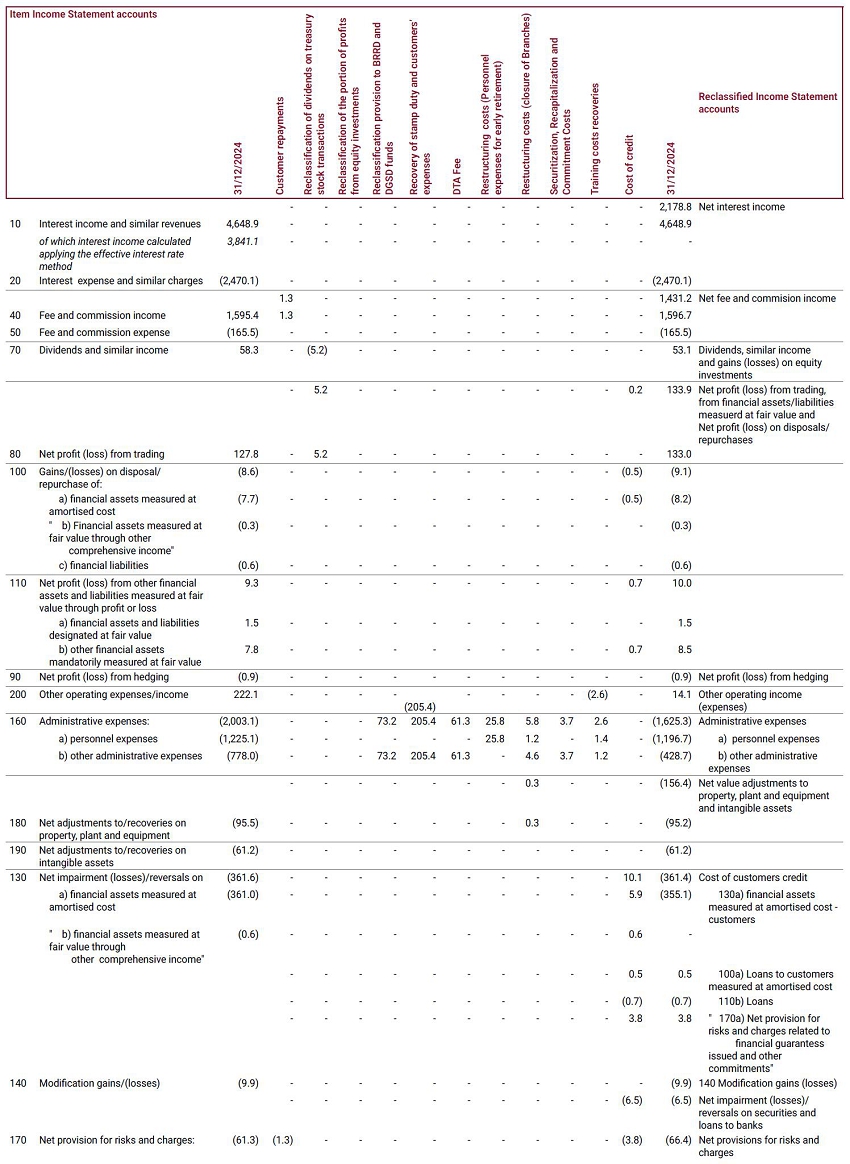

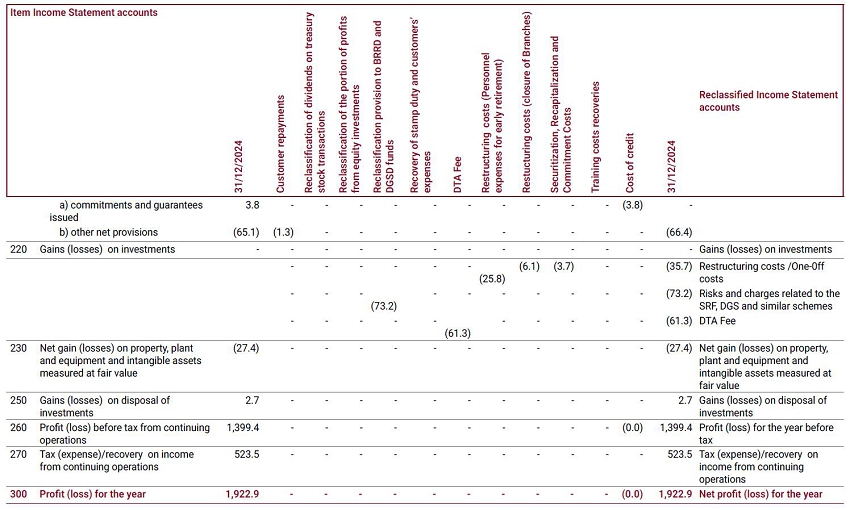

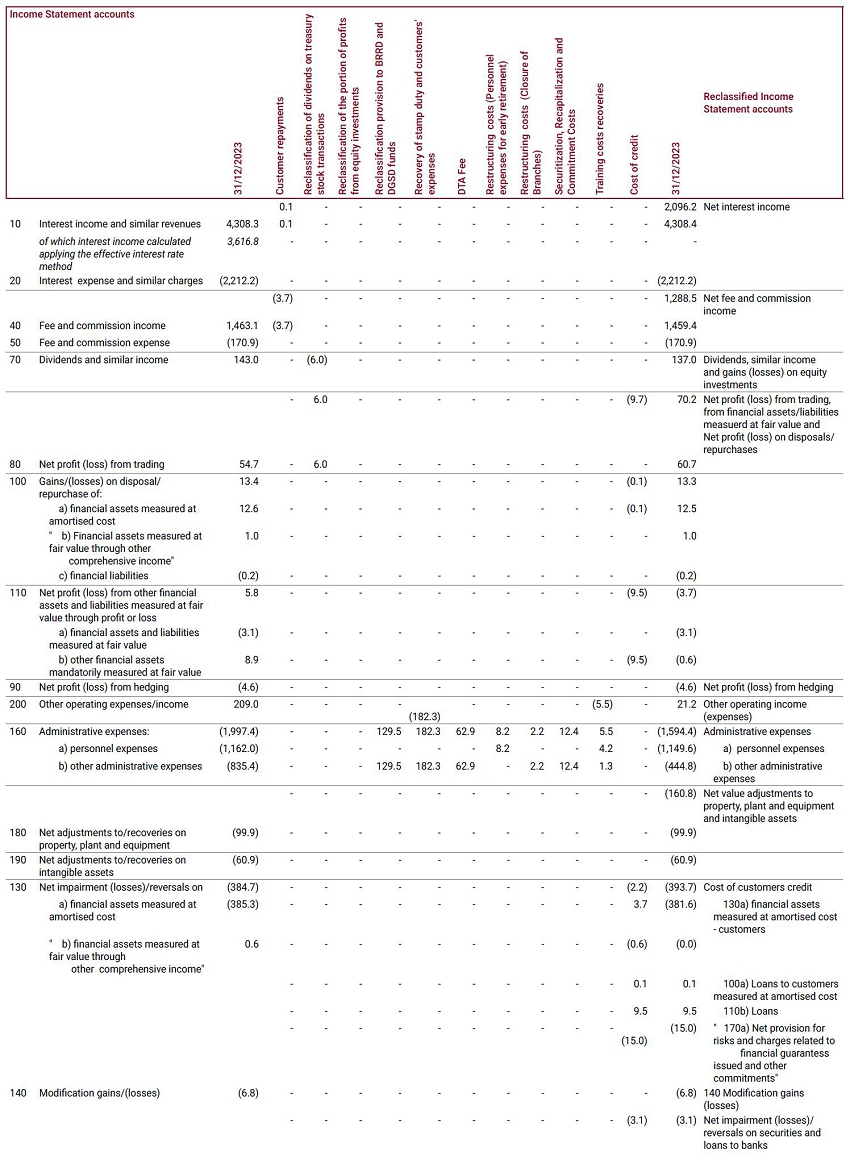

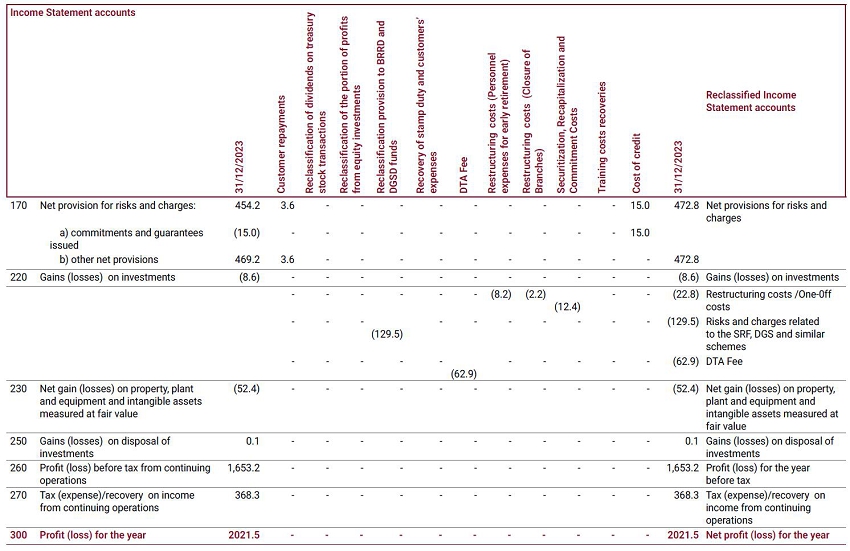

| Income statement and balance sheet reclassification principles | 41 |

| Reclassified income statement | 45 |

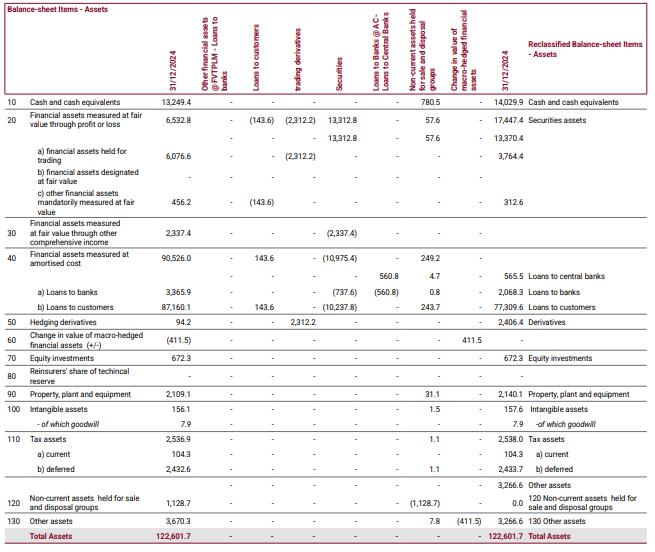

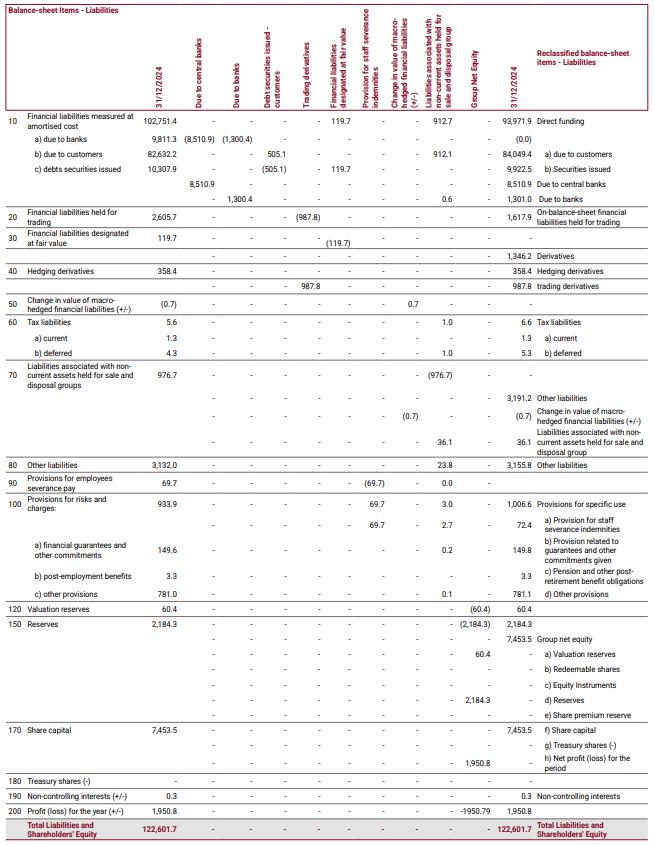

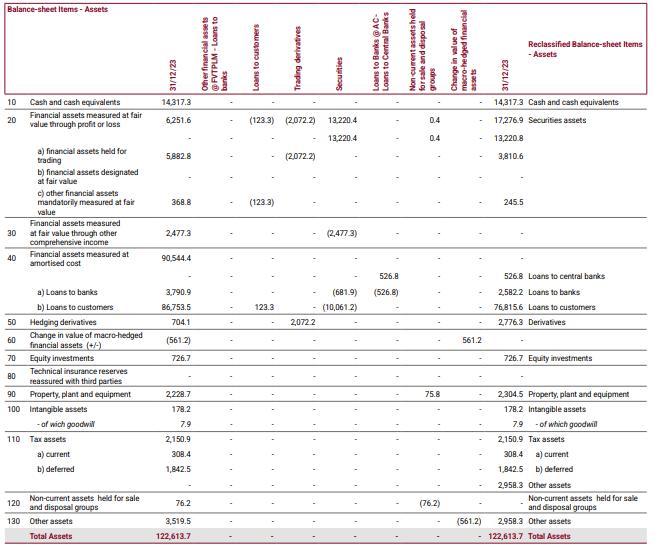

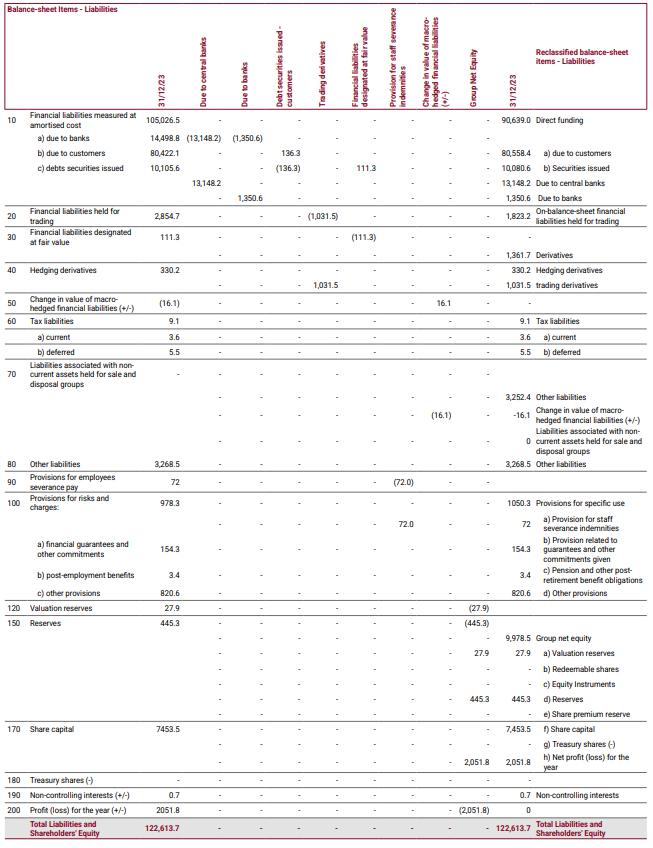

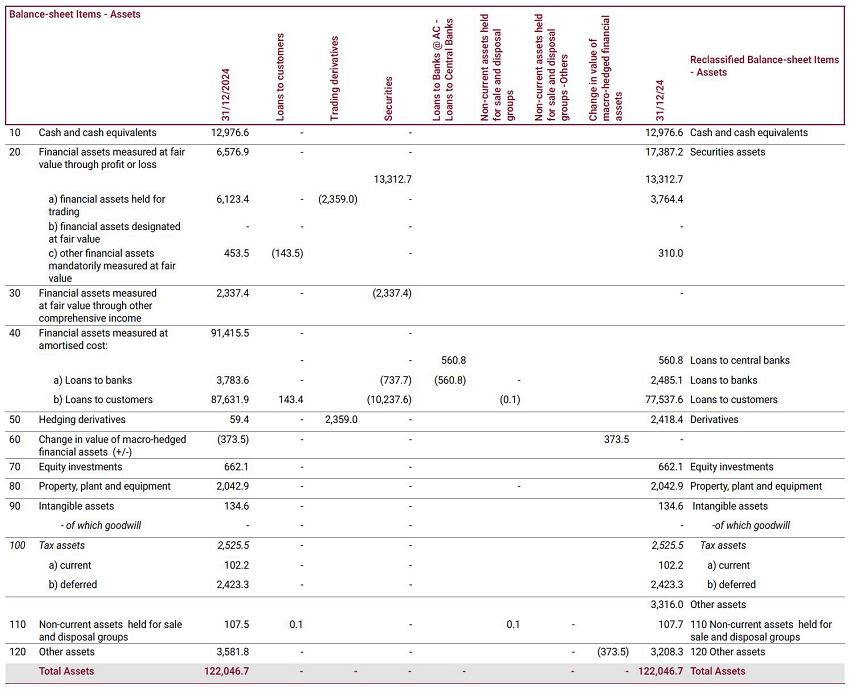

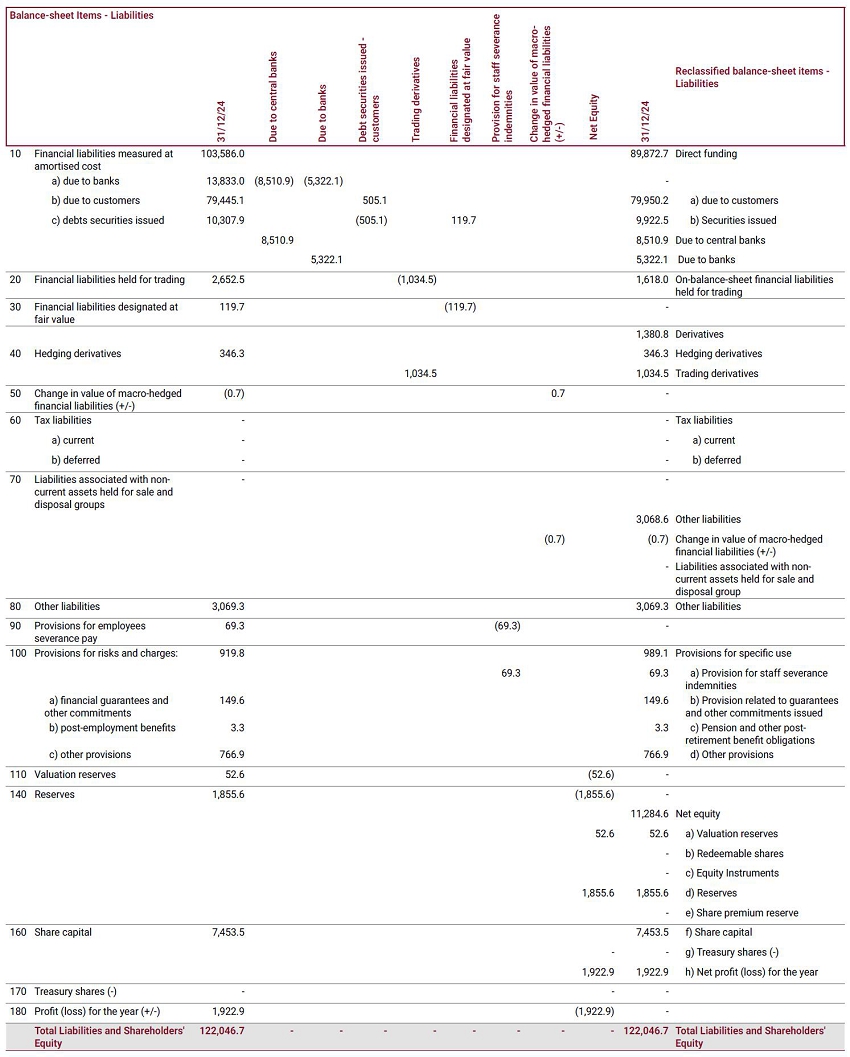

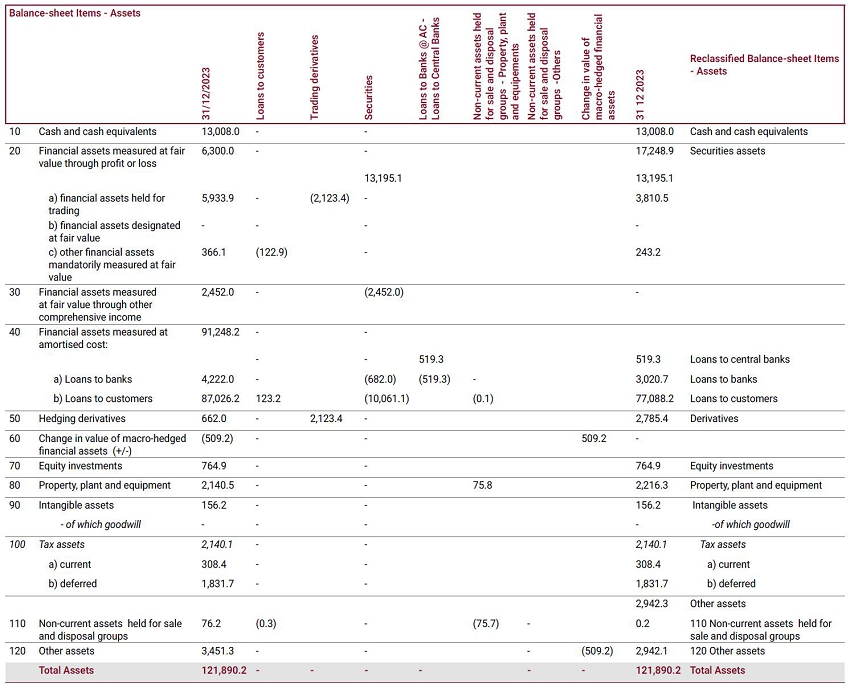

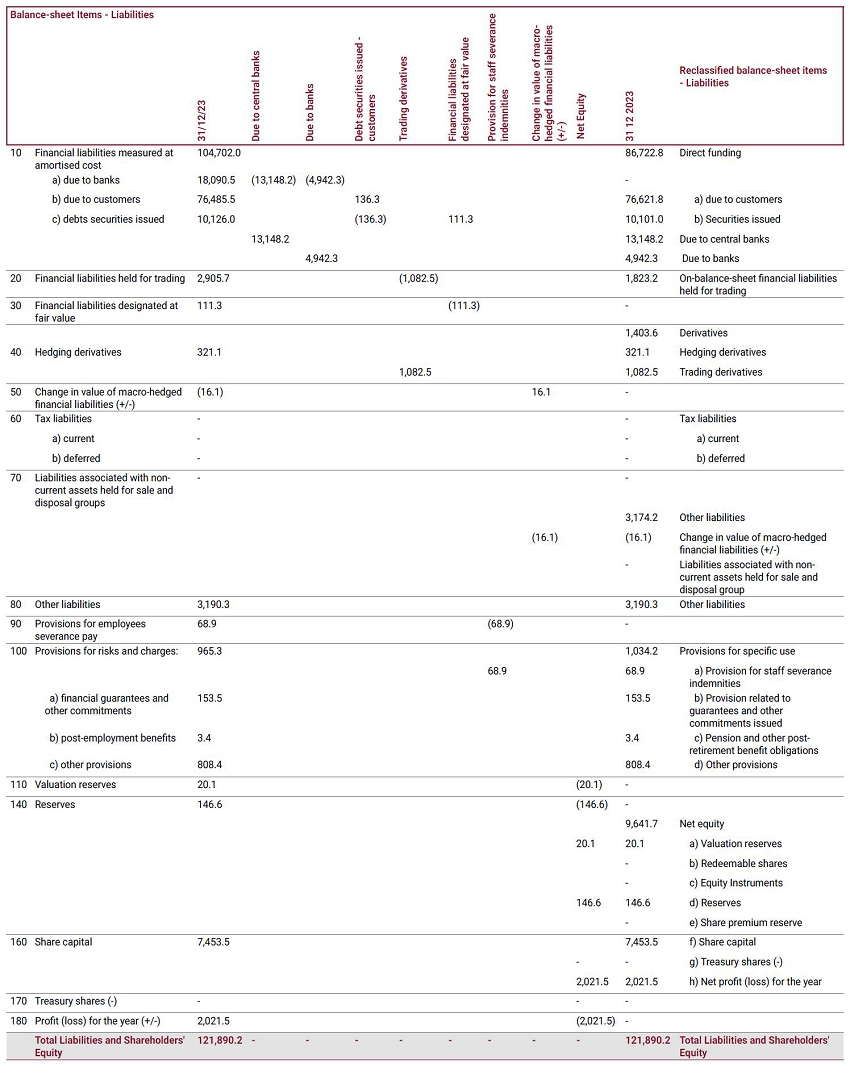

| Reclassified balance sheet | 53 |

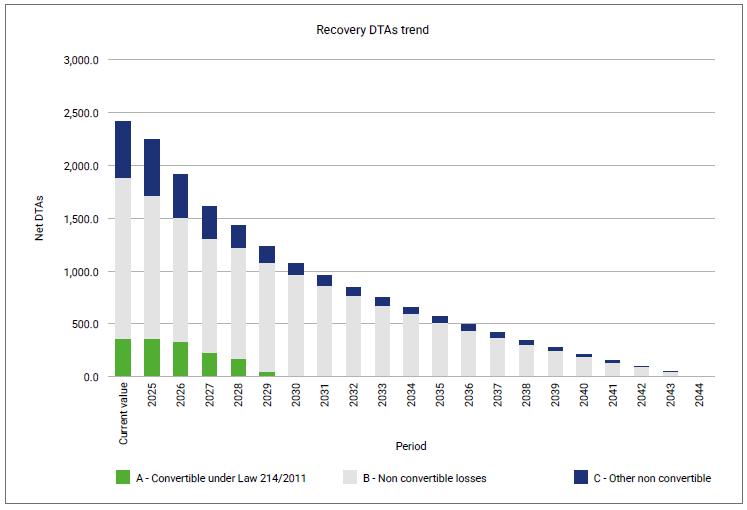

| Tax position of Group | 66 |

| Research, Development and Innovation | 70 |

| Main risks and uncertainties | 72 |

| Financial risks and hedging-related policies | 76 |

| Information on employment law, tax and complaints risks | 79 |

| Inspection activities and procedures of the Supervisory Authorities | 80 |

| Regulatory Developments | 84 |

| Results by Operating Segment | 90 |

| Equity investment management | 116 |

| Prospects and outlook on operations | 117 |

| Sustainability Reporting | 118 |

| Consolidated Financial Statements | 293 |

| Consolidated balance sheet | 294 |

| Consolidated income statement | 296 |

| Consolidated statement of comprehensive income | 298 |

| Consolidated statement of changes in equity – 2024 | 299 |

| Consolidated statement of changes in equity – 2023 | 300 |

| Consolidated cash flow statement - indirect method | 301 |

2

2024 ANNUAL REPORT -

| Notes to the Consolidated Financial Statements | 303 |

| Part A - Accounting policies | 304 |

| Part B - Information on the balance sheet | 388 |

| Part C - Information on the consolidated income statement | 471 |

| Part D - Consolidated statement of comprehensive income | 496 |

| Part E - Information on risks and hedging policies | 497 |

| Part F - Information on consolidated shareholders’ equity | 643 |

| Part G - Business combinations | 648 |

| Part H - Related-party transactions | 649 |

| Part I - Share-Based Payment Agreements | 659 |

| Part L - Segment reporting | 661 |

| Part M - Leasing Information | 665 |

| Public disclosure State by State | 669 |

| Certifications | 673 |

| Independent Auditors’ report on the financial statements | 676 |

| Annexes | 692 |

| Separate Annual report of Banca Monte dei Paschi di Siena | 703 |

| Report on operations | 704 |

| Separate Annual report | 724 |

| Separate Financial statements | 725 |

| Balance Sheet | 726 |

| Income statement | 728 |

| Statement of comprehensive income | 730 |

| Statement of changes in equity - 2024 | 731 |

| Statement of changes in equity – 2023 | 732 |

| Cash flow statement - indirect method | 733 |

| Notes to the separate financial statements | 735 |

| Part A - Accounting policies | 736 |

| Part B - Information on the balance sheet | 816 |

| Part C - Information on the Income Statement | 896 |

| Part D - Statement of Comprehensive Income | 921 |

| Part E - Information on risks and hedging policies | 922 |

| Part F - Information on shareholders’ equity | 1001 |

| Part G - Business combinations | 1004 |

| Part H - Related-party transactions | 1005 |

| Part I - Share-based payments agreement | 1016 |

| Part M - Leasing Information | 1018 |

| Certification | 1023 |

| Independent Auditors’ report on the financial statements | 1025 |

| Report of the Board of Statutory Auditors | 1036 |

| Annexes | 1094 |

3

2024 ANNUAL REPORT - Governing and control bodies

Governing and control bodies

Board of directors

| Nicola MAIONE | Chairperson |

| Gianluca BRANCADORO | Deputy Chairman |

| Luigi LOVAGLIO | Chief Executive Officer |

| Alessandra Giuseppina BARZAGHI | Director |

| Alessandro CALTAGIRONE | Director |

| Paola DE MARTINI | Director |

| Elena DE SIMONE | Director |

| Stefano DI STEFANO | Director |

| Domenico LOMBARDI | Director |

| Paola LUCANTONI | Director |

| Raffaele ORIANI | Director |

| Marcella PANUCCI | Director |

| Francesca PARAMICO RENZULLI | Director |

| Renato SALA | Director |

| Barbara TADOLINI | Director |

Board of statutory auditors

| Enrico CIAI | Chairperson |

| Lavinia LINGUANTI | Standing Auditor |

| Giacomo GRANATA | Standing Auditor |

| Paola Lucia Isabella GIORDANO | Alternate Auditor |

| Pierpaolo COTONE | Alternate Auditor |

General management

| Luigi LOVAGLIO | General Manager |

| Maurizio BAI | Deputy Commercial General Manager |

Financial Reporting Officer

Nicola Massimo Clarelli

Independent Auditors

PricewaterhouseCoopers S.p.A.

4

Consolidated Annual Report

Consolidated Report on operations

2024 ANNUAL REPORT - Consolidated Report on operations

General accounting standards

The Consolidated Report on Operations as at 31 December 2024 provides a snapshot of the activities and results which largely characterised the Group’s operations during the year, both as a whole and in the various business sectors.

In particular, economic and financial indicators, based on accounting data, are those used in internal performance management and management reporting systems, and are consistent with the most commonly used metrics within the banking industry, thereby ensuring the comparability of presented figures.

The income statement and balance sheet have been reclassified based on presentation criteria that are more suitable for representing the contents of the items according to consistent operational criteria.

In addition, the Report incorporates non-financial company information providing the details on the activities, capital, risks and relations that are significant to the Group’s current and future performance. This information is also detailed in corporate communications available on the Banca MPS website www.mps.it, such as: the Report on Corporate Governance and Ownership Structure, the Remuneration Report, Pillar 3 Disclosure.

7

BANCA MONTE DEI PASCHI DI SIENA

Results in brief

Below are the main figures of the income statement and balance sheet of the Montepaschi Group as at 31 December 2024, calculated on the basis of the reclassified financial statements, the methods of which are illustrated in the section “Income statement and balance sheet reclassification principles” of this Report, and compared with what was recorded in the previous year. The Alternative Performance Measures (APMs) identified by the Directors to facilitate the understanding of the economic and financial performance of the Group’s operations are also presented. The APMs, which are built using the reclassified data reported in the Reclassified Income Statement and Reclassified Balance Sheet chapters, are based on accounting data, corresponding to those used in internal performance management and management reporting systems, and consistent with the most commonly used metrics within the banking industry, thereby ensuring the comparability of reported figures. The APMs are not envisaged by the IAS/IFRS international accounting standards and, although they are calculated on financial statement data, they are not audited or reviewed.

These measures take into account the Guidelines provided by the European Securities and Markets Authority (ESMA) on 5 October 2015, which the Italian stock exchange regulator, Consob, incorporated into its supervisory practices (Communication no. 0092543 of 3 December 2015), applicable from 3 July 2016. With reference to the context resulting from the military conflict between Russia and Ukraine, note that, in line with ESMA guidelines, no new indicators were introduced, nor were changes made to the indicators normally used. It should be noted that the definition and calculation methods are provided for each APM; the amounts used are traceable through the information contained in the tables below or in the reclassified financial statements contained in this Consolidated Report on Operations. These formats were constructed on the basis of the financial statements envisaged by Bank of Italy Circular no. 262/2005 and subsequent updates following the same aggregation and classification criteria adopted in the previous year, illustrated in more detail in the section “Income statement and balance sheet reclassification principles” of this Consolidated Report on Operations.

INCOME STATEMENT AND BALANCE SHEET FIGURES

MONTEPASCHI GROUP

| INCOME STATEMENT FIGURES (EUR mln) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Net interest income | 2,355.8 | 2,292.1 | 2.8 | % | ||||||||

| Net fee and commission income | 1,465.3 | 1,321.9 | 10.8 | % | ||||||||

| Other income from banking business | 206.9 | 170.1 | 21.6 | % | ||||||||

| Other operating income and expenses | 5.7 | 12.8 | -55.5 | % | ||||||||

| Total Revenues | 4,033.8 | 3,796.8 | 6.2 | % | ||||||||

| Operating expenses | (1,869.1 | ) | (1,842.8 | ) | 1.4 | % | ||||||

| Cost of customer credit | (409.5 | ) | (440.3 | ) | -7.0 | % | ||||||

| Other value adjustments | (6.7 | ) | (3.2 | ) | n.m. | |||||||

| Net operating income (loss) | 1,748.5 | 1,510.6 | 15.7 | % | ||||||||

| Non-operating items | (304.0 | ) | 195.9 | n.m. | ||||||||

| Parent company’s net profit (loss) for the period | 1,950.8 | 2,051.8 | -4.9 | % | ||||||||

| EARNINGS PER SHARE (EUR) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Basic earnings per share | 1.549 | 1.629 | -4.9 | % | ||||||||

| Diluted earnings per share | 1.549 | 1.629 | -4.9 | % | ||||||||

| BALANCE SHEET FIGURES AND INDICATORS (EUR mln) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Total assets | 122,601.7 | 122,613.7 | 0.0 | % | ||||||||

| Loans to customers | 77,309.6 | 76,815.6 | 0.6 | % | ||||||||

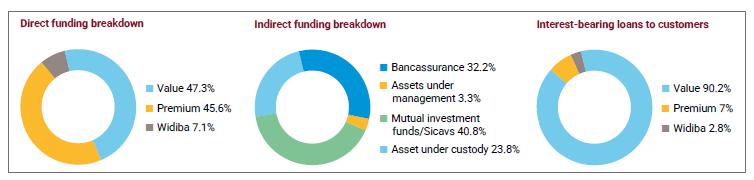

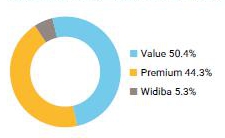

| Direct funding | 93,971.9 | 90,639.0 | 3.7 | % | ||||||||

| Indirect funding | 103,237.8 | 96,844.9 | 6.6 | % | ||||||||

| of which: assets under management | 59,924.0 | 56,887.8 | 5.3 | % | ||||||||

| of which: assets under custody | 43,313.8 | 39,957.1 | 8.4 | % | ||||||||

| Group net equity | 11,649.0 | 9,978.5 | 16.7 | % | ||||||||

| OPERATING STRUCTURE | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Total headcount - end of year | 16,727 | 16,737 | (10 | ) | ||||||||

| Number of branches in Italy | 1,312 | 1,362 | (50 | ) | ||||||||

8

2024 ANNUAL REPORT - Consolidated Report on operations

ALTERNATIVE PERFORMANCE MEASURES

MONTEPASCHI GROUP

| PROFITABILITY RATIOS (%) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Cost/Income ratio | 46.3 | 48.5 | -2.2 | |||||||||

| ROE (on average equity) | 18.0 | 23.0 | -5.0 | |||||||||

| Return on Assets (RoA) ratio | 1.6 | 1.7 | -0.1 | |||||||||

| ROTE (Return on tangible equity) | 18.3 | 23.5 | -5.2 | |||||||||

| CREDIT QUALITY RATIOS (%) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Net NPE ratio | 2.4 | 2.3 | 0.1 | |||||||||

| Gross NPL ratio | 3.8 | 3.6 | 0.2 | |||||||||

| Rate of change of non-performing loans to customers | 3.0 | 5.7 | -2.7 | |||||||||

| Bad loans to custormers/ Loans to Customers | 0.6 | 0.6 | n.m. | |||||||||

| Loans to customers measured at amortised cost - Stage 2/Performing loans to customers measured at amortised cost | 13.4 | 12.8 | 0.6 | |||||||||

| Coverage of non-performing loans to customers | 48.5 | 49.1 | -0.6 | |||||||||

| Coverage of bad loans to customers | 66.5 | 68.1 | -1.6 | |||||||||

| Provisioning | 0.53 | 0.57 | -2.7 | |||||||||

| Texas Ratio | 27.6 | 30.3 | -2.7 | |||||||||

Cost/Income ratio: ratio between Operating expenses (Administrative expenses and Net value adjustments to property, plant and equipment and intangible assets) and Total revenues (for the composition of this aggregate, see the reclassified income statement).

Return On Equity (ROE): ratio between the Group Net profit (loss) for the year and the average between the shareholders’ equity (including Profit and Valuation Reserves) at the end of year and the shareholders’ equity at the end of the previous year.

Return On Assets (ROA): ratio between the Net profit (loss) for the year and Total assets at the end of the year.

Return On Tangible Equity (ROTE): ratio between the Net profit (loss) for the year and the average between the tangible shareholders’ equity1 at the end of year and that at the end of the previous year.

Net NPE Ratio: ratio between net non-performing exposures to customers and total net exposures to customers, both net of assets under disposal (excluding government securities).

Gross NPE Ratio2: gross impact of non-performing loans (NPLs) calculated as the ratio between Gross non-performing loans to customers and banks3, net of disposal groups, and total Gross loans to customers and banks, net of disposal groups.

Rate of change in non-performing loans to customers: represents the annual rate of change in Gross non-performing loans to customers based on the difference between annual balances.

Coverage of non-performing loans to customers and coverage of non-performing loans to customers: the coverage ratio on Non-performing loans and Non-performing loans to customers is calculated as the ratio between the relative loss provisions and the corresponding gross exposures.

Provisioning: ratio between the cost of customer credit and the sum of loans to customers and the value of securities deriving from transfer/securitisation of non-performing loans.

Texas Ratio: ratio between Gross non-performing loans to customers and the sum, in the denominator, of the relative loss provisions and tangible shareholders’ equity.

| 1 | Book value of Group shareholders’ equity inclusive of profit (loss) for the year, net of goodwill and other intangible assets. |

| 2 | EBA Risk Dashboard. |

| 3 | Loans to banks include current accounts and sight deposits with banks and central banks classified as “Cash” under balance sheet assets. |

9

BANCA MONTE DEI PASCHI DI SIENA

REGULATORY MEASURES

MONTEPASCHI GROUP

| CAPITAL RATIOS (%) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Common Equity Tier 1 (CET1) ratio - phase in | 18.3 | 18.1 | 0.2 | |||||||||

| Common Equity Tier 1 (CET1) ratio - fully loaded | 18.2 | 18.1 | 0.1 | |||||||||

| Total Capital ratio - phase in | 20.6 | 21.6 | -1.0 | |||||||||

| Total Capital ratio - fully loaded | 20.5 | 21.6 | -1.1 | |||||||||

| MREL-TREA (total risk exposure amount) | 28.5 | 28.2 | 0.3 | |||||||||

| MREL-LRE (leverage ratio exposure) | 11.2 | 10.8 | 0.4 | |||||||||

| FINANCIAL LEVERAGE INDEX (%) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| Leverage ratio - transitional definition | 7.2 | 7.0 | 0.2 | |||||||||

| Leverage ratio - fully phased | 7.2 | 6.9 | 0.3 | |||||||||

| LIQUIDITY RATIO ( % ) | 31 12 2024 | 31 12 2023 | Chg. | |||||||||

| LCR | 166.5 | 163.3 | 3.2 | |||||||||

| NSFR | 134.1 | 130.1 | 4.0 | |||||||||

| Asset encumbrance ratio | 22.6 | 28.5 | -5.9 | |||||||||

| Loan to deposit ratio | 82.3 | 84.7 | -2.4 | |||||||||

| Spot counterbalancing capacity (bn of Eur) | 33.0 | 29.8 | 3.2 | |||||||||

In determining the capital ratios, the “phase-in” (or “transitional”) version represents the application of calculation rules according to the regulatory framework in force at the reporting date, while the “fully loaded” version incorporates in the calculation the rules as envisaged at full implementation.

Common equity Tier 1 (CET1) ratio: ratio between Common Equity Tier 1 and total Risk-Weighted Assets.

Total Capital ratio: ratio between Own Funds and total Risk-Weighted Assets.

MREL-TREA: calculated as the ratio of the sum of own funds and eligible liabilities to total Risk-Weighted Assets.

MREL-LRE: calculated as the ratio of the sum of own funds and eligible liabilities to the amount of total leverage exposures.

Financial Leverage Ratio: calculated as the ratio between Tier 1 Capital and total exposures, in accordance with the provisions of Article 429 of Regulation 575/2013.

Liquidity Coverage Ratio (LCR): short-term liquidity indicator corresponding to the ratio between the amount of High-Quality Liquid Assets and the total net cash outflows in the subsequent 30 calendar days.

Net Stable Funding Ratio (NSFR): structural 12-month liquidity indicator corresponding to the ratio between the available stable funding amount and the required stable funding amount.

Asset encumbrance ratio: ratio of the total carrying amount of encumbered assets and collateral received reused to total assets and total guarantees received available.

Loan to deposit ratio: ratio between Net Loans to Customers and Direct Funding (due to customers and debt securities issued).

Counterbalancing capacity at spot: sum of items that are certain and free from any commitment that the Group can use to meet its liquidity requirements, consisting of financial and commercial assets eligible for purposes of refinancing operations with the European Central Bank (“ECB”) and assets deposited in the collateralised interbank market (MIC) and not used, to which the haircut, published on a daily basis by the ECB, is prudentially applied.

10

2024 ANNUAL REPORT - Consolidated Report on operations

Executive summary

A summary of the trend in key items of the main aggregates of the Group as at 31 December 2024 is provided below.

| · | Net Interest Income amounted to EUR 2,356 mln, an increase compared to 2023 (+2.8%, equal to EUR +63.7 mln). The growth was mainly driven by the higher contribution from relations with central banks, hedging derivatives and the securities portfolio. In particular, in relations with central banks, a net benefit of EUR 143 mln was recognised as at 31 December 2024, compared to the net cost of EUR 70 mln for 2023. This performance reflects, among other things, the change in the net position vis-à-vis the ECB from an average debit balance of EUR 1.5 bn in 2023 to an average credit balance of EUR 4.9 bn in 2024, thanks to the optimisation of the total cost of funding. This positive trend more than offset the higher cost of bond issues – mainly caused by renewed recourse to the institutional market – and the higher borrowing rates recorded in transactions with customers, especially in the first half of 2024. |

| · | Net Fee and Commission Income, totalling EUR 1,465 mln, showed an increase compared to the same period of the previous year (+10.8%). This trend is mainly attributable to the positive performance in management/brokerage and advisory activities (+19.0%; EUR +113.7 mln) and, to a lesser extent, commercial banking activity (+4.1%; totalling EUR +29.7 mln). In detail, in the first commissions area, the contribution of distribution and portfolio management increased (+30.1%; EUR +109.7 mln) and insurance products (+8.5%; EUR +16.3 mln). In the commercial banking area, commission income on guarantees (EUR +28.9 mln) and other net fee and commission income (EUR +12.4 mln) were partly offset by reduced commissions on current accounts (EUR -16.4 mln) in relation to the Bank’s reduction of service fees applied to customer’s accounts and the ATM and credit card services (EUR -10.1 mln). The result for the fourth quarter of the 2024 financial year showed an increase over the previous quarter (+4.9%) due to growth in commercial banking (+8.1%). |

| · | Other income from banking business, equal to EUR 207 mln, increased by 21.6% compared to the corresponding period of the previous year. The growth is mainly attributable to the contribution of business volumes deriving from the management of transactions with institutional customers and corporate customers, market making activities and a favourable market context. |

| · | Other operating income/expenses amounted to EUR +6 mln, compared to a contribution of EUR +13 mln recorded in 2023. |

| · | As a result of the trends described above, Total revenues amounted to EUR 4,034 mln, an increase of 6.2% compared to the previous year. |

| · | Operating expenses came to EUR 1,869 mln, an increase compared to 31 December 2023, (+1.4%) due to the impact on Personnel expenses of the renewal of the National Collective Labour Agreement, partially offset by the continued optimisation of Other administrative expenses (-3.8% compared to 2023). In particular, within the aggregate, Personnel expenses, which amounted to EUR 1,229 mln, are higher than those recorded in the corresponding period of the previous year (+4.2%), as a consequence of the increased costs resulting from renewal of the banking industry National Collective Labour Agreement in November 2023. Other administrative expenses, equal to EUR 469 mln, were down compared to 31 December 2023 (-3.8%), also due to the implementation of a rigorous expenditure management process and the focus on cost optimisation actions. Net value adjustments to property, plant and equipment and intangible assets amounted to EUR 171 mln, down 2.5% compared to the previous year. |

| · | The Cost of Customer Credit stood at EUR 410 mln, down slightly compared to the figure of EUR 440 mln recorded in the same period of the previous year. The Provisioning Rate came to 53 bps (57 bps as at 31 December 2023). |

| · | The Net Operating Income as at 31 December 2024 stood at EUR 1,748 mln, a notable increase from the figure of EUR 1,511 mln as at 31 December 2023. |

| · | In addition to the changes in these economic aggregates, there were non-operating components amounting to EUR -304 mln as at 31 December 2024 (EUR +196 mln in the corresponding period of 2023). Non-operating components include: Net Provisions for Risks and Charges, equal to EUR -68 mln (EUR +471 mln as at 31 December 2023); Other gains/losses from equity investments of EUR -1 mln (EUR -3 mln as at 31 December 2023); Restructuring costs/One-off costs amounted to EUR -72 mln, (EUR -23 mln as at 31 December 2023); costs related to the SRF (Single Resolution Fund), DGS (Deposit Guarantee Systems) and similar schemes, amounting to EUR -78 mln (EUR -134 mln as at 31 December 2023); The DTA fee amounted to EUR -61 mln (EUR -63 mln as at 31 December 2023); Net gains (losses) on property, plant and equipment and intangible assets measured at fair value for EUR -27 mln (EUR -53 mln as at 31 December 2023); Gains/losses on disposal of investments of EUR +4 mln (EUR +0.4 mln as at 31 December 2023). |

11

BANCA MONTE DEI PASCHI DI SIENA

| · | As a result of these trends, combined with the positive impact of Income taxes of for the year of EUR 506 mln (compared to a positive contribution of EUR 345 mln as at 31 December 2023), the Group recorded a Profit for the period attributable to the Parent Company of EUR 1,951 mln, compared to a profit of EUR 2,052 mln in 2023. |

| · | As at 31 December 2024, the volume of Group Total Funding amounted to EUR 197.2 bn, an increase of EUR 4.3 bn compared to 30 September 2024, on both Direct Funding (EUR +2.7 bn, of which EUR +2.1 bn related to current accounts) and Indirect Funding (EUR +1.6 bn). In particular, with regard to Direct Funding, growth was recorded in the technical forms of current accounts (EUR +2.1 bn), bonds (EUR +0.8 bn) and other forms of direct funding (EUR +0.5 bn), while repurchase agreements decreased (EUR -0.8 bn). Remaining substantially stable were term deposits (EUR +0.1 bn). Indirect Funding was up by EUR 1.6 bn compared to 30 September 2024 for assets under management (EUR +0.5 bn) and assets under custody (EUR +1.1 bn). Both components benefited, in particular, from a positive market effect. |

| · | Compared to 31 December 2023, Total Funding increased by EUR 9.7 bn, driven mainly by Indirect Funding (EUR +6.4 bn) and, to a lesser extent, also by Direct Funding (EUR +3.3 bn). Within Funding, there was an increase in indirect funding of EUR 6.4 bn, due to both the growth in assets under management (EUR +3.0 bn), mainly linked to a positive market effect, and the increase in assets under custody (EUR +3.4 bn). The trend in Direct Funding is linked to an increase in current accounts (EUR +1.7 bn), time deposits (EUR +1.2 bn), other forms of direct funding (EUR +0.3 bn) and finally repurchase agreements (EUR +0.2 bn). Bonds, on the other hand, declined slightly (EUR -0.2 bn). |

| · | Loans to customers amounted to EUR 77.3 bn as at 31 December 2024, slightly up from 30 September 2024 (EUR +0.7 bn), due to mortgages (EUR +0.3 bn) and other loans (EUR +0.8 bn), while current accounts (EUR -0.2 bn) and repurchase agreements (EUR -0.2 bn) declined slightly. The aggregate was up (EUR +0.5 bn) compared to 31 December 2023. |

| · | As at 31 December 2024, the coverage ratio non-performing loans stood at 48.5%, down from 30 September 2024, when it was 49.9%, following the deconsolidation of the transferred portfolios (characterised by above-average coverage levels), which took place in the last quarter of the year. This effect concerns, in particular, the coverage percentage of Bad loans, which fell from 68.4% to 66.5%; On the other hand, the coverage ratio of Unlikely to pay loans increased from 37.7% to 38.8% and that of Non-performing past due loans rose from 22.8% to 26.3%. |

| · | The coverage ratio of non-performing loans to customers is higher than at 31 December 2023 (when it was 49.1%). At individual administrative status level, the changes refer to the coverage ratio for Non-performing past due loans (which went from 68.1% to 66.5%). Meanwhile the coverage ratio rose for Bad loans (rising from 37.6% to 38.8%) and for Non-performing past due loans (going from 21.7% to 26.3%). |

In terms of capital ratios, the Common Equity Tier 1 Ratio stood at 18.3% as at 31 December 2024 (compared to 18.2% as at 30 September 2024 and 18.1% as at 31 December 2023) deducting from capital the dividends for the year determined assuming a pay out ratio of 75% of pre-tax profit, and the Total Capital Ratio stood at 20.6% (compared to 21.4% as at 30 September 2024 and 21.6% as at 31 December 2023).

12

2024 ANNUAL REPORT - Consolidated Report on operations

Group overview

The Montepaschi Group is the banking hub led by Banca Monte dei Paschi di Siena S.p.a., listed on the Electronic Stock Exchange (Mercato Telematico Azionario) organised and managed by Borsa Italiana S.p.A., with registered office in Piazza Salimbeni 3, Siena, whose activities are focused on traditional retail & commercial banking services carried out mainly in Italy.

The Group is also active in business areas such as factoring, corporate finance and investment banking. The insurance-pension sector is covered by a strategic partnership with AXA while asset management activities are based on the offer of investment products of independent third parties.

The Group combines traditional services offered through the network of branches and specialised centres with an innovative self-service and digital services system enhanced by the skills of the Widiba financial advisor network.

Foreign banking operations are focused on supporting the internationalisation processes of corporate clients in all major foreign financial markets.

| COMPANY | ACTIVITIES | |

| Banca Monte dei Paschi di Siena operates in the different segments of banking and finance, from traditional banking including leasing and factoring products, to special purpose loans, assets under management, bancassurance and investment banking. The Bank performs functions of direction, coordination and control over the Group’s companies, as part of the more general guidelines set out by the Board of Directors in compliance with the instructions provided by the Bank of Italy in the interest of the Banking Group’s stability. | |

| Monte Paschi Fiduciaria offers its services to private parties and companies that wish to leverage the utmost confidentiality in relation to their interests and business, through the instrument of the fiduciary mandate. In addition, Monte Paschi Fiduciaria can also take on the role of Trust Company for the administration of assets as trustee or guardian (or protector). | |

| Widiba (WIse-DIalog-BAnking) is the Group’s bank that integrates a self-service offer with the competencies of MPS’s financial advisor network. | |

| Monte Paschi Banque SA is the Group’s bank that supports commercial trade and investments by Italian companies abroad. |

In addition to the above, there are also companies operating in the agricultural sector, both wine and food, with a real estate component destined for agritourism and accommodation activities (MPS Tenimenti Poggio Bonelli and Chigi Saracini Società Agricola S.p.A.) and food custodian and storage services for third parties (Magazzini Generali).

Intragroup transactions primarily regard the financial support from the Parent Company to other companies, for the most part in the form of deposits and outsourced services relative to the auxiliary activities provided by the Parent Company (administrative services and property administration).

The description of the main transactions carried out by the Parent Company with its subsidiaries and associates is provided in Part H of the Notes to the Separate Financial Statements of the Parent Company.

13

BANCA MONTE DEI PASCHI DI SIENA

Shareholders

As at 31 December 2024, the Parent Company Banca Monte dei Paschi di Siena S.p.A. share capital amounted to EUR 7,453,450,788.44, broken down into 1,259,689,706 ordinary shares.

According to the communications received pursuant to the applicable legislation and based on other information available, as well as based on information on Consob’s institutional website, the entities that, as at 31 December 2024, directly and/or indirectly hold ordinary shares representing a shareholding exceeding 3% of the share capital of the Issuer and which do not fall under the cases of exemption set forth in Article 119-bis of the Issuers’ Regulations are as follows:

BMPS main shareholders as at 31 December 2024

| Shareholder | % of outstanding ordinary shares | |||

| Ministry of Economy and Finance | 11.731 | % | ||

| Francesco Gaetano Caltagirone Groupè* | 5.026 | % | ||

| Banco BPM Spa | 5.003 | % | ||

| Anima Holding Spa | 3.992 | % | ||

| Delfin Sàrl | 3.509 | % | ||

* Holdings held through Ausonia S.r.l., Esperia 15 S.r.l., MK 87 S.r.l., Istituto Finanziario 2012 S.p.A., Gamma S.r.l., Azufin S.p.A., VM 2006 S.r.l., Mantegna 87 S.r.l., Calt 2004 S.r.l., Finanziaria Italia 2005 S.p.A.

The main changes during 2024, as well as immediately after the end of the financial year, are shown below:

| · | through the completion of two “Accelerated Book Building - ABB” transactions reserved to Italian and foreign institutional investors, announced respectively on 26 March 2024 and 13 November 2024, the Ministry of Economy and Finance (MEF) reduced its stake from 39.232% to 26.732% and from 26.732% to 11.731%; |

| · | Following the second ABB transaction in November, Delfin Sarl, Banco BPM, Anima Holding S.p.A. (already holder of a stake of approximately 1%) and the Francesco Gaetano Caltagirone Group hold respectively the following stakes in BMPS: 3.509%, 5.003%, 3.992% and 3.645%; |

| · | on 2 December 2024, the Francesco Gaetano Caltagirone Group increased its stake in the Bank’s share capital from 3.645% to 5.026%; |

| · | subsequently, on 6 January 2025, Delfin Sàrl announced that it had increased its stake in the Bank’s share capital from 3.509% to 9.780%. |

14

2024 ANNUAL REPORT - Consolidated Report on operations

Information on the BMPS share

The BMPS share closed the fourth quarter of 2024 at EUR 6.81, with period growth of +31.3%, while the FTSE All Share Banks index showed an increase of +3.6% and the FTSE MIB rose by +0.2%. The average daily trading volume of MPS shares was around 15.2 mln over the quarter

SHARE PRICE SUMMARY STATISTICS (from 30/09/2024 to 31/12/2024)

| Average | 5.72 | |||

| Minimum | 4.79 | |||

| Maximum | 6.81 |

Rating

The ratings assigned by the rating agencies are provided below:

| Rating Agencies | Short-term debt | Outlook | Long-term debt | Outlook | Latest update | |||||

| Moody’s | (P)NP | - | Ba2* | Stable | 15/05/24 | |||||

| Fitch | B | - | BB+ | Positive | 25/10/24 | |||||

| Mornigstar DBRS | R-3 | positive | BB (high) | Positive | 15/04/24 |

* Long-Term Senior Unsecured Debt Rating

| · | On 25 October 2024, Fitch Ratings (Fitch) upgraded the Bank’s ratings by 1 notch, among others raising the Long-Term Issuer Default Rating to “BB+” from “B”, and the standalone Viability Rating to “bb+” from “bb”. The outlook was improved to positive from stable. |

| · | On 15 May 2024, the rating agency Moody’s Investors Service (Moody’s) upgraded the Bank’s ratings by 1 notch, bringing the standalone Baseline Credit Assessment rating to “ba2” from “ba3”, the long-term deposit rating to “Baa3” from “Ba1”, and the long-term senior unsecured debt to “Ba2” from “Ba3”. The outlook on the long-term ratings of deposits and unsecured senior debt was raised to stable. On 31 January 2025, the latter, following the announcement of 24 January 2025 to launch a voluntary public exchange offer on Mediobanca’s shares, was upgraded to positive. |

| · | On 15 April 2024, the rating agency DBRS Ratings GmbH (“Morningstar DBRS”) upgraded the Bank’s ratings by 2 notches, bringing the standalone Intrinsic Assessment rating, the long-term issuer rating and the long-term senior debt rating to “BB (high)” from “BB (low)”, and the long-term deposit rating to “BBB (low)” from “BB”. The subordinated debt rating upgraded by 3 notches to “BB (low)” from “B” (low). The outlook was improved to positive from stable. |

15

BANCA MONTE DEI PASCHI DI SIENA

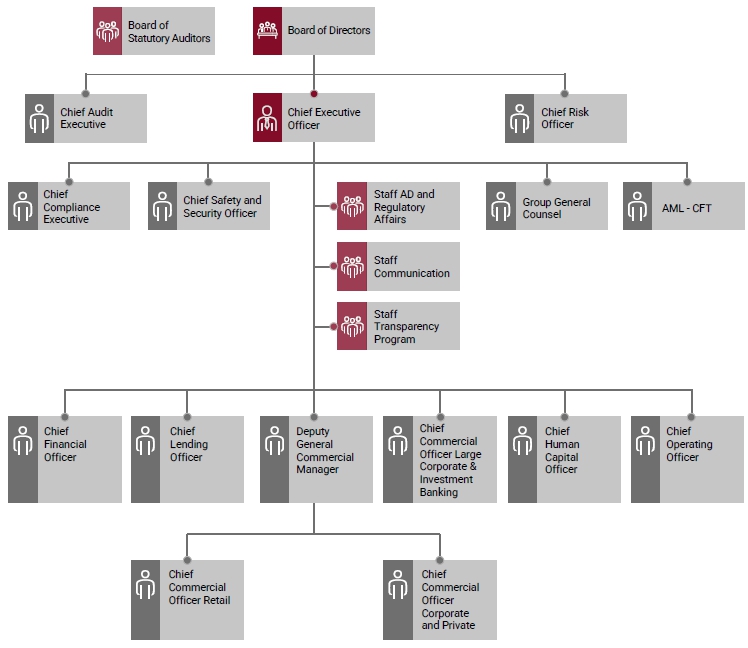

Organisational structure

Through its Head Office, Banca Monte dei Paschi di Siena performs functions of direction, coordination and control over the Group’s companies, as part of the more general guidelines set out by the Board of Directors and in the interest of the Group’s stability.

Organisational chart of the Parent Company’s Head Office as at 31 December 2024

The year 2024 was characterised by the completion of the organisational path envisaged in the 2022-2026 business plan on General Management, Territorial Offices and the Commercial Network, as well as some minor organisational interventions.

In January 2024, 50 branches were closed, with the existing customers and relationships being transferred to the same number of merging branches.

In February 2024, a number of steps were taken to optimise the General Management, and in particular, the establishment of the Deputy General Commercial Management to which the Chief Commercial Officer Retail and the Chief Commercial Officer Corporate and Private report.

16

2024 ANNUAL REPORT - Consolidated Report on operations

In April 2024, some optimisation work was carried out on product specialists and small business customers, in particular:

| · | centralisation of agrifood specialists and wealth management specialists in the “Enterprise Products, Facilitated Finance and GCO” and “Private” functions respectively, reporting to the Chief Commercial Officer Corporate and Private; |

| · | establishment of 132 specialised centres called “small business districts”, reporting directly to the Territorial Corporate and Private Departments, dedicated to the management of small business customers previously handled in the branches, and at the same time bringing POE (small business operators) customers back to the branch value line. |

In June 2024, the AML-CFT function previously allocated to the Chief Risk Officer was transferred to report directly to the Chief Executive Officer.

In July 2024, the transfer of responsibilities related to the Banking Recovery and Resolution Directive (BRRD) from the Transparency Programme staff to the Capital Planning, BRRD, Studies and Research function within the Chief Financial Officer’s department took place.

With respect to Network processes, actions continued to improve the quality of work, free up more time that could be dedicated to sales activities and increase customer service quality, while reducing service response/provision times by streamlining “administrative” activities and document management costs, with a significant effort toward increasing digitalisation of processes.

17

BANCA MONTE DEI PASCHI DI SIENA

Governance & control systems

Corporate governance

The Parent Company’s corporate governance takes into account the objective of creating a system of coordinated rules and units capable of guaranteeing transparent and accurate management of relations with shareholders as well as between them and the directors and top management.

The Parent Company’s bodies work so as to pursue the overall proper functioning of the business.

By means of a fair and transparent corporate governance system and a shared Code of Ethics, the Parent Company has set rules to ensure that the legitimate expectations of all stakeholders, particularly with regard to environmental, social and governance sustainability profiles, are integrated into the company’s objectives and strategies.

The overall corporate governance system refers to the current code, banking and financial supervisory regulations, the Corporate Governance Code to ensure a clear separation of roles and responsibilities, the appropriate balancing of powers, balanced composition of corporate bodies, effective controls, monitoring of business risks, adequacy of information flows and corporate social responsibility.

The Bank adopts the traditional administration and control model characterised by the presence of a Board of Directors and a Board of Statutory Auditors, appointed by the Shareholders’ Meeting. In addition, there are: In addition, the CEO, who is also the General Manager, and five Board committees, specifically, the Risk and Sustainability Committee, the Appointments Committee, the Remuneration Committee and the Related-Party Transactions Committee and the IT and Digitalisation Committee.

In compliance with the provisions of Italian Legislative Decree no. 231/2001, the Parent Company has also established a 231 Supervisory Body entrusted with the task of supervising the functioning and observance of the Model 231 (namely a compliance model under Law 231) as well as managing its updating.

The Parent Company decided to assign the role of the 231 Supervisory Body to an ad hoc collective body separate from the Board of Statutory Auditors, which is “mixed” in nature and consists of three members, including two outside professionals and one board member who meets the requirements of independence.

The Parent Company’s internal control system is meant to ensure that risks are identified, measured, managed and monitored in such a way so as to enable sound, proper business management in line with pre-established objectives.

Further information on governance, including with regard to the concept of diversity in corporate bodies, is available in the “Report on Corporate Governance and Ownership Structure”, available on the Parent Company’s website (https://gruppomps.it/en/corporate-governance/corporate-governance-report.html).

Risk governance

Risk governance strategies are defined in line with the Group Business Model, medium-term 2024-2028 Business Plan objectives and external regulatory and legal requirements.

Policies relating to the assumption, management, coverage, monitoring and control of risks are defined by the Board of Directors of the Parent Company. Specifically, the Board of Directors periodically defines and approves strategic risk management guidelines and quantitatively expresses the Group’s overall risk appetite.

In fact, the Parent Company’s Board of Directors defines the overall Risk Appetite Framework (RAF) for the Group and approves the “Group Risk Appetite Statement” (RAS) at least once per year.

The RAF Governance process is centralised within the Parent Company, which outlines its relevant perimeter at Group level and defines its structure in Group companies, according to the risks assumed, size and operational complexity of each legal entity. The RAF defines the roles of corporate bodies and functions involved in defining the “risk appetite” and the procedures to be implemented if it becomes necessary to restore the level of risk to the objective or within the pre-established limits.

The RAS represents an essential element in defining the Group’s risk strategy. The RAS is the formal document that contains the explicit declaration of the risk/return objectives/limits (overall, by type and broken down by individual companies/business units) that the Bank intends to assume to pursue its strategies. Therefore, with the RAS, the risk objectives/restrictions are identified and the indicators are broken down by Business Unit/Legal Entity (known as “cascading down” of the Risk Appetite). The objective is to increase the Group’s Risk Culture and fully instil accountability in all relevant business units with regard to achievement of the risk appetite objectives, as required by the regulations and recommended by best practices.

18

2024 ANNUAL REPORT - Consolidated Report on operations

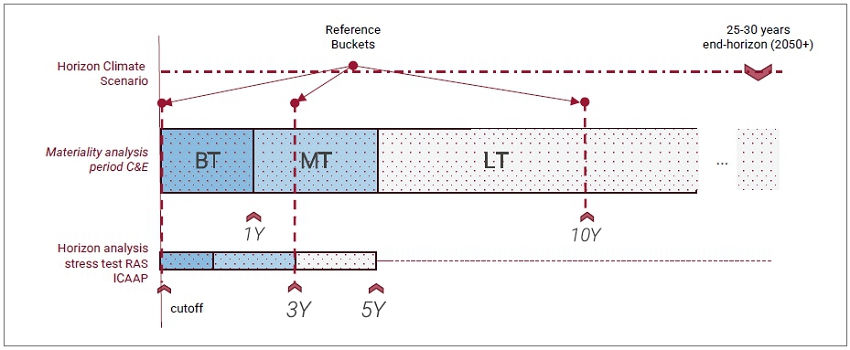

The Risk Appetite Process is structured so as to ensure consistency with the ICAAP and ILAAP as well as with Planning and Budget and Recovery processes, in terms of governance, roles, responsibilities, metrics, stress testing methods and monitoring of key risk indicators.

In compliance with the guidelines set forth by the Basel Committee and best practices, prudential supervisory provisions for banks require credit institutions to carry out adequate stress testing exercises.

The Group regularly conducts stress tests on all risk factors. Stress tests are used to assess the Group’s capacity to absorb large potential losses in adverse yet plausible market situations, so as to identify the measures necessary to reduce the risk profile and preserve assets.

The Group’s methodological approach to stress-testing is based upon the identification of the main risk factors, both Pillar 1 and Pillar 2, with the objective of selecting events or combinations of events (scenarios) which reveal specific vulnerabilities at Group level.

The results from the stress tests are submitted to the Top Management and Board of Directors. They are formally reviewed by the Board of Directors as part of the approval of the Annual ICAAP/ILAAP Report, with a view to self-assessing the Group’s current and prospective capital adequacy and liquidity and during the year according to a pre-defined internal Stress Test Programme approved by the Board.

Group risk governance is provided centrally by the Parent Company’s Board of Directors, which also supervises and is responsible for the updating and issue of internal policies and the main internal regulations in order to promote and guarantee a continuously greater and more widespread risk culture at all levels of the organisation. Awareness of risks and the correct knowledge and application of the internal processes and models governing those risks - first and foremost for those validated for regulatory purposes - are fundamental requirements for effective, sound and prudent business management.

The Risk Control Function is specifically assigned the task of monitoring the Key Risk Indicators (KRIs), drawing up a periodic report for the Board of Directors and implementing the escalation/authorisation processes in the event that thresholds are exceeded.

The incorporation of macro risk and risk-adjusted performance indicators, consistent with the RAF, within staff remuneration and incentive policies represents an additional tool to promote awareness of the behaviours of all resources and the cultivation of a healthy risk culture.

In reference to the Group’s Risk Culture, during 2024 initiatives were pursued regarding corporate bodies (board induction cycles on specific issues) as well as general training initiatives (online tools) for all personnel in the areas of risk management and mitigation. In collaboration with the Chief Human Capital Officer Department, the Chief Risk Officer Department continued, following on from the previous year, the project aimed at all Group personnel on the topic of “Risk Culture”, through a programme of online classes and eLearning tools in which risk-related issues were presented both in terms of the frameworks adopted by the Bank and in relation to situations reflecting the Bank’s typical operations. Particular attention was paid to new staff in the CRO Department through the provision of a training course structured in several sessions, both in-person and online. The interventions and their contents were then made available on the e-learning platform to enable wider use of the material.

Furthermore, during 2024 internal initiatives proceeded to ensure continued compliance with national and international regulatory provisions.

The ICAAP and ILAAP packages were sent to the Regulator in accordance with the ECB’s regulatory prescriptions regarding the “Technical implementation of the EBA Guidelines on ICAAP/ILAAP information for SREP Purposes” (Supervisory Review and Evaluation Process), as well as in line with the “ECB Guide to the Internal Capital and Liquidity Adequacy Assessment Process (ICAAP/ILAAP)”, issued in November 2018.

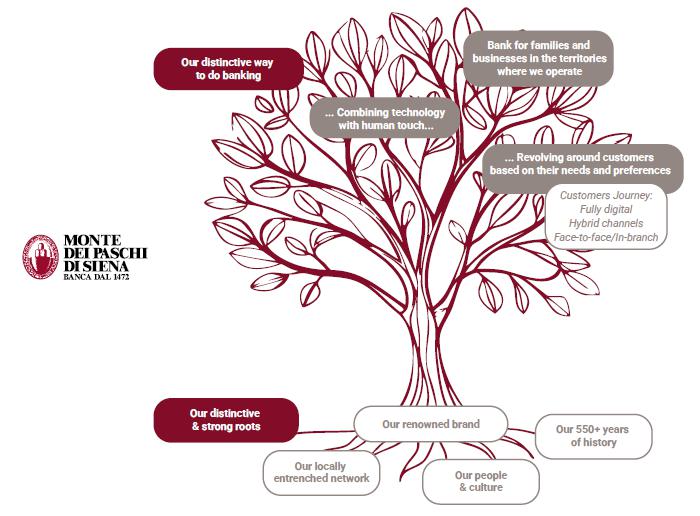

In 2024, the Montepaschi Group unveiled its 2024-2028 Business Plan aimed at creating a future-ready bank capable of successfully meeting the evolving needs of customers through a process of corporate and technological innovation supported by a comprehensive investment plan, making the most of the Bank’s talented resources, further enhancing the sustainability of the business, strengthening the balance sheet and focusing on distribution and value creation for all BMPS stakeholders.

The Montepaschi Group is one of the Italian banks subject to the ECB’s Single Supervisory Mechanism.

19

BANCA MONTE DEI PASCHI DI SIENA

Compliance systems

Within the broader internal control system, the Compliance Function of the Parent Company autonomously and independently governs non-compliance risk at Group level, periodically reporting to Top Management and Supervisory Authorities on the overall status of compliance of systems, processes and operations.

During 2024, with a view to constantly improving efficiency and keeping up to date with the changing external regulatory framework, the organisational structure of the function was changed. In particular, the former structure that dealt with ICT and Outsourcing issues was reallocated within the DPO (Data Protection Officer) and ICT Advisory staff, while the Control structure on the same issues was upgraded, placing it under the “Compliance, Methodologies and Controls” function. This organisational reorganisation responds to the provisions of the Compliance Plan 2024, with reference to the 40th update of Circular 285/2013. The initiative also responded to the need to strengthen ICT and outsourcing oversight in relation to the upcoming effectiveness (January 2025) of the new EU Digital Operational Resilience Act (DORA) rules for the Financial Sector.

In addition, design and regulatory compliance activities were followed up, with particular reference to:

| · | project activities aimed at adapting to the provisions of the DORA (Digital Operational Resilience Act) Regulation on the resilience of ICT systems, from the point of view of achieving regulatory compliance, with the revision of responsibilities and the updating of relevant company documents; |

| · | Follow-up of activities related to the implementation of the ESG Programme with implications for investment services, corporate governance, labour law and prudential supervision, in order to oversee its regulatory compliance; |

| · | definition of an Anti-Financial Crime framework for the MPS Group, with the aim of identifying measures, strategies, policies and procedures to prevent, deter, detect, investigate and combat all forms of financial crime. |

Lastly, additional activities were also carried out during the year, particularly in matters related to:

| · | improvement of the effectiveness of Compliance activities, with the development of digitalisation solutions; |

| · | the implementation of further continuous monitoring tools, including the development of Robotic Process Automation (RPA) solutions for repetitive tasks and the testing of application solutions of Generative Artificial Intelligence (AI) tools. |

20

2024 ANNUAL REPORT - Consolidated Report on operations

Distribution channels

The Group operates with a view to developing and rationalising its distribution network, by combining regional coverage with the strengthening of innovative channels.

Traditional domestic branches are flanked by specialised sales, which handle relational follow-up and the specific management of particular customer segments (e.g. Small and Medium Companies, Private, Institutions, etc.) and by 567 Financial Advisors (566 as at 31 December 2023) who carry out their activities by having offices open to the public distributed throughout the country.

MONTEPASCHI GROUP - DISTRIBUTION NETWORK ITALY AS AT 31/12/2024

| Domestic | Client Centres (**) | Financial | |||||||||||||||||||||||||

| branches | Family | Advisory | |||||||||||||||||||||||||

| Area | (*)(**) | Inc. | Imprese | Office | Private | Tot. | Inc. | Offices | Inc. | ||||||||||||||||||

| Emilia Romagna | 83 | 6.3 | % | 5 | 6 | 11 | 8.7 | % | 6 | 5.7 | % | ||||||||||||||||

| Friuli Venezia Giulia | 32 | 2.4 | % | 3 | 1 | 4 | 3.1 | % | 3 | 290.0 | % | ||||||||||||||||

| Liguria | 17 | 1.3 | % | 1 | 1 | 2 | 1.6 | % | 4 | 3.8 | % | ||||||||||||||||

| Lombardia | 182 | 13.9 | % | 10 | 1 | 7 | 18 | 14.2 | % | 10 | 9.5 | % | |||||||||||||||

| Piemonte | 31 | 2.4 | % | 2 | 1 | 3 | 2.4 | % | 2 | 1.9 | % | ||||||||||||||||

| Trentino Alto Adige | 2 | 0.2 | % | 1 | 1.0 | % | |||||||||||||||||||||

| Valle d’Aosta | 2 | 0.2 | % | ||||||||||||||||||||||||

| Veneto | 172 | 13.1 | % | 13 | 1 | 6 | 20 | 15.7 | % | 5 | 4.8 | % | |||||||||||||||

| Northern Italy | 521 | 39.7 | % | 34 | 2 | 22 | 58 | 45.7 | % | 31 | 29.5 | % | |||||||||||||||

| Abruzzo | 27 | 2.1 | % | 2 | 1 | 3 | 2.4 | % | 2 | 1.9 | % | ||||||||||||||||

| Lazio | 109 | 8.3 | % | 5 | 2 | 3 | 10 | 7.9 | % | 11 | 10.5 | % | |||||||||||||||

| Marche | 34 | 2.6 | % | 4 | 1 | 5 | 3.9 | % | 3 | 2.9 | % | ||||||||||||||||

| Molise | 3 | 0.2 | % | 0 | 1 | 1.0 | % | ||||||||||||||||||||

| Toscana | 287 | 21.9 | % | 11 | 1 | 8 | 20 | 15.7 | % | 8 | 7.6 | % | |||||||||||||||

| Umbria | 30 | 2.3 | % | 2 | 2 | 4 | 3.1 | % | 4 | 3.8 | % | ||||||||||||||||

| Central Italy | 490 | 37.3 | % | 24 | 3 | 15 | 42 | 33.1 | % | 29 | 27.6 | % | |||||||||||||||

| Basilicata | 10 | 0.8 | % | 2 | 1.9 | % | |||||||||||||||||||||

| Calabria | 37 | 2.8 | % | 1 | 1 | 0.8 | % | 3 | 2.9 | % | |||||||||||||||||

| Campania | 76 | 5.8 | % | 4 | 1 | 3 | 8 | 6.3 | % | 16 | 15.2 | % | |||||||||||||||

| Puglia | 78 | 5.9 | % | 6 | 4 | 10 | 7.9 | % | 15 | 14.3 | % | ||||||||||||||||

| Sardegna | 10 | 0.8 | % | 1 | 1 | 2 | 1.6 | % | 2 | 1.9 | % | ||||||||||||||||

| Sicilia | 90 | 6.9 | % | 3 | 3 | 6 | 4.7 | % | 7 | 6.7 | % | ||||||||||||||||

| Southern Italy and island | 301 | 22.9 | % | 15 | 1 | 11 | 27 | 21.3 | % | 45 | 42.9 | % | |||||||||||||||

| Total | 1,312 | 100.0 | % | 73 | 6 | 48 | 127 | 100.0 | % | 105 | 100.0 | % | |||||||||||||||

(*) Reports to the Bank of Italy Supervisory Authority relating to Banca MPS

(**) of which no. 7 reports to the Bank of Italy Supervisory Authority as centre and branch did not coincide.

21

BANCA MONTE DEI PASCHI DI SIENA

At the end of 2024, the Italian Network had 1,312 branches registered with the Supervisory Authority, with a reduction of 50 branches compared to 31 December 2023, as a result of the closure of these aforementioned branches in January 2024.

At the end of January 2025, there were 1,258 domestic branches4, following the closure of 53 branches and the issuance of a licence relating to a specialised centre no longer consubstantial with a branch.

The Parent Company decided to carry out this closure in January, in order to minimize operational potential risks arising from the migration of data in the same date of the accounting closure of the year, and not to create potential inconvenience to customers during year-end holidays.

These closures were made in line with commitments related to State Aid received in 2017.

The Group also makes use of 127 Specialised Centres (also 127 as at 31 December 2023), of which 73 are dedicated to Businesses, 48 to Private customers and 6 to the Family Office.

The Group’s ATM network comprises a total of 2,476 machines (-66 units compared to 31 December 2023), of which 1,993 coincide with traditional branches (1,591 of these are located on premises with an independent entrance also accessible outside of branch hours) and 483 are installed in public places with high operational potential, of which 77 in institutions/companies. There are 1,321 ATM machines with “cash in” functions (of which 917 located in the Self Area, 391 in branches, 1 in institutions/companies and 12 installed in public places).

The Group has an international presence with a Foreign Network geographically distributed in major financial and economic markets and in several emerging countries with high growth rate, with significant trading relations with Italy, currently structured as follows:

| · | 7 representative offices in target areas of Europe, North Africa, India and China; |

| · | 1 foreign-registered bank, namely Monte Paschi Banque S.A., operating in France (in the process of being divested). |

In addition to its physical presence across the country, the Parent Company offers banking services to Customers through electronic channels with internet banking products for Retail and Corporate customers. As at 31 December 2024, there were 1,563,215 active users (+91,214 compared to 31 December 2023), of which 1,434,631related to retail customers and 128,584 to corporate customers.

| 4 | In terms of reports to the Bank of Italy’s Supervisory Institute relating to Banca MPS. |

22

2024 ANNUAL REPORT - Consolidated Report on operations

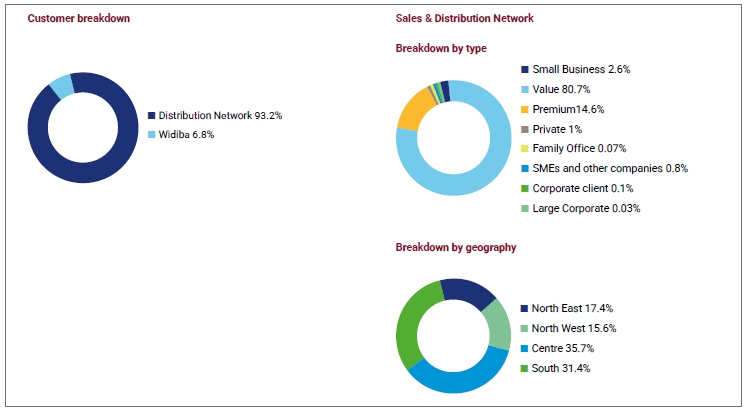

Customer base

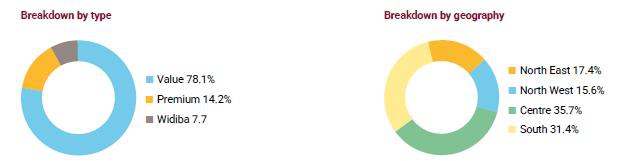

As at 31 December 2024, the Group5 had around 3.6 mln customers, substantially stable compared the previous year. Customers as at 31 December 2024 are broken down as follows:

| · | About EUR 3.3 mln (substantially stable compared to 31 December 2023) is managed by the Sales and Distribution Network of the Parent Company Banca Monte dei Paschi di Siena; |

| · | About 0.3 mln (essentially stable compared to 31 December 2023) are managed exclusively by Widiba, the Group’s online bank. |

At the end of 2024, the Retention and Acquisition indicators6 stood at 94.9% and 4.6% respectively, showing an improvement compared to 2023 (when they were 94.3% and 4.0%, respectively).

| 5 | Intended as the sum of the total MPS and Widiba Network, excluding the customers of the other Group companies. |

| 6 | The indicators refer only to the Parent Company and have been cleared of the effect of the migration of customers to Widiba. |

23

BANCA MONTE DEI PASCHI DI SIENA

Reference context

The international scenario

In 2024, economic activity continued to expand, albeit with differing trends between areas. In the US, activity remained robust, while it showed fragility in the euro area, where persistent weakness in manufacturing was compounded by recent signs of a slowdown in services. In China, domestic demand was still affected by the crisis in the real estate market. The recomposition of headline inflation continued due to falling energy prices, although oil and natural gas prices have risen slightly since last autumn. The main monetary authorities have initiated monetary easing, albeit at differing paces. The escalation of international tensions has affected the dynamics of world trade. The global economy remains affected by geopolitics (i.e. Ukraine and the Middle East) and uncertainty over the economic policies to be undertaken by the new US administration.

The US showed a consistent expansion, with GDP growing at around 3% QoQ annualised in the middle quarters of the year before slowing down at the end of the year (+2.3% QoQ after annualising the preliminary figure in the fourth quarter). The disinflationary process that had gained momentum in the middle months of the year has weakened recently: the general price index approached the 3% trend at year-end 2024; core inflation7 stabilised slightly above 3% YoY during the year. The labour market, despite some tensions, showed solidity (unemployment has remained just above 4% since spring; new jobs rose at the end of the year) allowing a cautious approach to the Fed in the rate cut process started in September. The newly elected President Trump announced on the campaign trail a number of policy measures such as: the extension of tariffs on foreign imports (first and foremost for China, Canada and Mexico), control of irregular immigration, deregulation of corporations, reform of federal government agencies, tax reduction measures, exit from climate policies; the President also advanced aims of territorial control (i.e. Greenland, Panama, Canada). The translation, albeit only partial, of these announcements into actual measures may have an impact on US and global growth and inflation dynamics.

In the euro area, despite a GDP growth that surprised on the upside in the third quarter (+0.4% QoQ), the business cycle remained weak, registering a zero expansion on a cyclical basis in the fourth quarter (preliminary figure). Activity was kept up by the buoyancy of services, but the manufacturing sector confirmed its fragilities; The slowdown in global trade and, more recently, uncertainties related to US protectionist announcements have conditioned the foreign demand component especially of those countries most exposed to trade with the US. The German economy contracted for the second year in a row. The crisis in the political governance of some major countries in the area (Germany, France) has not yet been overcome. Inflation, which has fallen since the beginning of the year to 1.7% YoY in September, has recently shown signs of a recovery already anticipated by the ECB, which has therefore not changed its monetary easing stance. In December, the general price index still rose to 2.4% YoY; the underlying component remained stable (at 2.7% YoY). The labour market showed resilience with unemployment barely moving from around 6.3% since the summer.

As part of the new European economic governance approved last April, the EU Commission examined the medium-term (four- to seven-year) structural budget plans drawn up by individual countries8, after checking their consistency with the reference trajectories sent in June. All the submitted plans (except those of the Netherlands and Hungary) received a positive assessment. The Commission also examined the national budgetary planning documents for 2025 of the member countries, assessing their alignment with the country-specific recommendations sent to each country, as well as their consistency with the public finance targets set out in their structural plans: Only eight countries, including Italy, were in line with the Council’s recommendations. The implementation of individual states’ Recovery and Resilience Plans continued: since 10 October, EUR 39 bn has been disbursed in funding related to individual countries’ NRRPs, bringing the total disbursements to EUR 306 bn. In September, Mario Draghi presented the report on the competitiveness of the EU economy outlining the guidelines for a common EU economic policy strategy.

Among the emerging countries, China hit the government’s 2024 GDP growth target of approx. 5%, but its annual expansion was among the lowest in decades. In the last quarter, GDP growth exceeded expectations (+5.4% p.a.), benefiting from government and Chinese Central Bank policy measures adopted since September, which consolidated the financial framework (debt, stock market, bank balance sheets). Weak domestic demand, influenced by the housing crisis, helped to keep inflation just above zero. Foreign demand has balanced the overcapacity not absorbed domestically, although, the announcements of new duties on products exported to the US are gradually pushing China to reposition exports to other (primarily Asian) markets. In Russia, in the face of sustained growth from the war economy, macroeconomic imbalances have widened. In India, GDP, while slowing down, is expected to expand at an annual rate of more than 6%. Pressures increased with those emerging currencies that are more exposed to the US.

| 7 | Index adjusted for the price components of food and energy goods (typically more volatile). |

| 8 | According to the new European fiscal governance, the reference trajectory is the multi-year net expenditure path sent by the Commission to countries whose debt or deficit exceeds the thresholds set by the Maastricht Treaty (60% and 3% of GDP, respectively). Such a path should be able to put the debt ratio on a plausibly downward trajectory or keep it at prudent levels; should also bring or maintain the deficit below 3% of GDP in the medium term. |

24

2024 ANNUAL REPORT - Consolidated Report on operations

Italy: economic context

In Italy, growth gradually slowed down during 2024. Manufacturing suffered from falling external demand affected by Germany’s difficulties, while exports slowed down on fears of tariffs. Investment in construction recorded growth in the public component stimulated by the NRRP, which offset the decline in the residential component. The summer rebound in consumption, boosted by low inflation, has resettled. The number of employed people increased, helping to contain unemployment. Annual inflation was below the European average, although it increased slightly at the end of the year (to 1.3% YoY in December); core inflation remained moderate and relatively higher in services. Signs of recovery in the real estate market came in the second half of the year.

The Government’s action in 2024 included a series of measures in the area of taxation, through the changes to the Super-bonus and building bonus and the revision of the IRPEF and IRAP regimes (made structural by the Budget Law 2025), and in the area of business crisis and insolvency, with the supplementary and corrective provisions made to the Code and in the area of two-year composition with creditors. Some of the measures adopted have had an impact on the banking system, in particular with regard to changes, including retroactive ones, concerning the time profiles of tax credits deriving from the so-called ‘building bonuses’ (Superbonus, Bonus Barriere, Sismabonus, etc.), in particular by lengthening (up to 10 years) the time for recovery.

Of note is the introduction of the new “Transition 5.0 Plan”, a programme that aims to support investments in digitalisation and the green transition of companies through an innovative tax credit scheme. Also active, from 1 October 2024, is the “New Sabatini Capitalisation” which aims to support the capitalisation processes of micro, small and medium-sized enterprises, established in corporate form. Among the measures contained in the Budget Law 2025, approved in December, is the provision on the postponement of deductions of write-downs and losses on receivables and goodwill related to DTAs (deferred tax assets), for the two-year period 2025-2026.

| · | Among the European directives transposed during the year, the following should be noted: (i) the approval of Legislative Decree No. 116 of 30 July 2024 , aimed at transposing the (EU) “Secondary Market Directive” or “SMD”), concerning managers and purchasers of non performing loans, which aims to increase the level of harmonisation within the single market; (ii) the approval, within the framework of the regulation of corporate sustainability reporting, of Legislative Decree No. 125, transposing the (EU) “Corporate Sustainability Reporting Directive” (CSRD). |

| · | On 24 May 2024, the Council of Ministers approved the European Delegated Act 2024, currently under discussion in Parliament, which provides for the transposition of various Directives and Regulations, some of which are of interest to the banking system (e.g. on credit agreements and financial services contracts concluded remotely, green and eco-sustainable bonds energy efficiency, administrative cooperation in the field of taxation, markets in financial instruments, delegation agreements, liquidity risk management, reporting for supervisory purposes, provision of custodian and depositary services, lending by alternative investment funds, minimum own funds requirement and eligible liabilities). |

Concerning the NRRP, on 18 November 2024 the European Council gave the green light to a request by the government to amend the Plan. The request concerned the adjustment of 21 measures; in some cases, the deadlines for targets and objectives were changed. As part of the Recovery and Resilience Facility, Italy also collected the sixth instalment in December, amounting to EUR 8.7 bn (of which EUR 1.8 bn in the form of grants), bringing the total disbursements received to date to EUR 122 bn. In October 2024, the Ministry for Business and Made inItaly opened a new window for the submission of applications for subsidies for the development of greater energy efficiency and to make production processes more sustainable.

25

BANCA MONTE DEI PASCHI DI SIENA

Financial markets and monetary policy

After a positive start to the year, the stock markets showed high volatility during 2024, reacting to escalating geopolitical tensions. After the summer slumps, the markets started to rise again, helped by monetary easing and the improvement of some economic indicators that dispelled recession fears. In the last quarter of the year, Trump’s election victory further supported US stock markets and, at the same time, conditioned the performance of those of countries exposed to the potential introduction of new tariffs by the US. In Europe, uncertainty over the political governance of some accession countries (e.g. France, Germany) further increased volatility. From the beginning of the year until 31 December 2024, the FTSE Mib gained over 12%; The rise of the Euro Stoxx was more limited (approx. +8%). The rise in the S&P500 was striking (over +23%), while the Nikkei also did well (over +19%). China’s Shanghai Shenzhen CSI 300, which had been suffering for most of 2024, reversed its trend since the end of September in the wake of the adoption/announcement of new domestic growth stimulus measures (close to +15% annual increase).

The upward phase of yields, which had reversed in the summer on inflation targeting expectations and monetary rate cuts, substantially resumed in the last quarter of 2024. The possible slowdown in the return of US inflation, conditioned by the economic policies announced by Trump and the resilience of the US economy, supported the treasury yield back to annual highs in December; This bullish movement partially extended to its German counterpart, whose dynamics were more correlated to Germany’s difficulties. Political/fiscal uncertainties weighed on the rise of the French 10-year bond yield. As at 31 December 2024, the US 10-year rate stood at 4.57% and the German rate at 2.37% (-69 basis points and +34 basis points, respectively, compared to 2023 year-end levels). The Italian 10-year rate from the second half of 2024 showed a down-ward trend and, although it rose in December, it closed the year at 3.52% (-18 basis points from its year-end 2023 values). The BTP-Bund spread, despite some volatility, narrowed during the year, settling at around 116 basis points at 31 December 2024 (-52 basis points compared to year-end 2023); the spread benefited from the ratings of Fitch and DBRS, which in October, while confirming Italy’s BBB rating, improved its outlook from stable to positive.

After the summer, the Federal Reserve began the phase of monetary easing: in September reduced interest rates (-50 basis points) for the first time after four years of stability; It subsequently made further reductions of 25 basis points at both its November and December meetings, thus lowering the cost of money in the range of 4.25-4.50%. However, due to the upside risks on domestic inflation and the robustness of the US economy and labour market, the rate cut decision was not unanimously supported by the FOMC members at the year-end meeting9. At its first meeting in 2025, the Fed confirmed its cautious stance by deciding to leave rates unchanged. The markets, for the most part, have been affected by an extension of the current pause in the monetary rate reduction process to the first half of 2025.

The ECB, having made significant changes to the operational framework for the implementation of monetary policy in March10, started a cycle of rate cuts in mid-year, making cuts of 25 basis points at its meetings in June, September, October and December. As a result, the Monetary Authority raised the rate on the main refinancing operations to 3.15%, the rate on deposits with the ECB to 3.00% and the rate on the marginal lending operations to 3.40% at the end of 2024. At the December meeting the possibility of a 50 basis point cut in key interest rates was discussed, on the strength of a disinflationary process well under way, but a unanimous consensus prevailed among ECB members towards a more cautious solution. Monetary easing continued in early 2025 with the ECB, which at its January meeting, as expected, unanimously cut monetary rates by a further 25 bps (bringing the deposit rate to 2.75%), showing its confidence in achieving the inflation target in the short term. Regarding the macro picture, the Authority confirmed the downside risks on growth. The ECB will continue to follow a data-dependent approach in calibrating the correct monetary policy (which is still referred to as ‘restrictive’) in meeting after meeting. The markets expect a continuation of the rate cuts at the upcoming meetings.

The recomposition of the ECB balance sheet continued. The portfolios of the APP (Asset Purchase Programme) and the PEPP (Pandemic Emergency Purchase Programme) are shrinking at a measured and predictable pace, as the Eurosystem no longer reinvests the repaid principal on maturing securities. On 18 December 2024, with the repayment of the remaining amounts received by the banks under the targeted longer-term refinancing operations, this part of the balance sheet normalisation process came to an end.

| 9 | The Fed’s Federal Open Market Committee. |

| 10 | In particular, the Governing Council decided that it would continue to direct the stance of monetary policy through the interest rate on deposits with the central bank and that the spread between this rate and the main refinancing operations rate would be reduced to 15 basis points as from 18 September 2024. |

26

2024 ANNUAL REPORT - Consolidated Report on operations

Significant events in 2024

On 7 February 2024, the Parent Company announced new top management appointments in a number of key functions with the enhancement of the assets of internal resources. More specifically, in addition to the appointment of Maurizio Bai as Deputy General Manager, Fiorella Ferri was appointed as Chief Human Capital Officer, Alessandro Giacometti as Chief Operating Officer, Vittorio Calvanico as Chief Safety Officer, and finally Marco Tiezzi assumed the role of Chief Commercial Officer Retail.

On 29 February 2024, Standard Ethics improved the short-term outlook of Banca Monte dei Paschi di Siena, from “Stable” to “Positive”. The ratings agency highlighted the Bank’s commitment to the integration of ESG criteria, confirming the “EE” rating and anticipating a potential upgrade to “EE+” within 12-24 months, following the implementation of the 2022-2026 Business Plan and the new Sustainability Plan.

On 8 March 2024, Banca MPS successfully completed the placement of a new senior preferred unsecured bond issue with a 5 year maturity (with early repayment option after 4 years), for an amount of EUR 500 mln and a coupon set at 4.75%.

On 11 April 2024, the Ordinary Shareholders’ Meeting of Banca Monte dei Paschi di Siena was held, which included, among other resolutions, the 2023 Financial Statements, payment of the dividend, the remuneration policies, incentive plans and the appointments of Raffaele Oriani as director, Giacomo Granata as acting statutory auditor and Paola Lucia Giordano as alternate statutory auditor.

On 16 April 2024, Banca MPS successfully completed the placement of a covered bond issue, the first after the transposition of the European harmonisation directive on covered bonds, with a maturity of five years, aimed at Italian and foreign institutional investors, for an amount of EUR 750 mln and a coupon set at 3.5%.

On 22 May 2024 (ex-dividend date 20 May and record date 21 May), the dividend for 2023 was paid for a total of EUR 314,922,426.50, corresponding to 0.25 eurocents for each of the 1,259,689,706 ordinary shares without par value outstanding at the record date.

On 13 June 2024, the Parent Company’s Board of Directors approved an exclusive agreement with a private equity fund for the sale of 100% of the subsidiary Monte Paschi Banque S.A. On 9 December 2024, the parties signed an agreement that allowed them to initiate the trade union consultation, required by the French Commercial Code, which is obligatory in order to be able to sign the sale and purchase agreement once it has been finalised. The procedure involves the subsidiary and consists in informing the works council (‘Comité Social et Economique’ or ‘CSE’) in advance of the planned transaction, the reasons for it and any impact on employees. Upon completion of the trade union consultation and once the relevant non-binding opinion of the CSE has been obtained, the Parent Company will be able to proceed with the transaction, which is expected to be finalised during 2025.

On 9 July 2024, Banca MPS successfully completed the placement of its first Social Conditional Pass Through (“CPT” European Covered Bond issue with a maturity of 6 years (16 July 2030), targeting Italian and foreign institutional investors, for a total of EUR 750 mln and fixed coupon of 3.375%.

On 5 August 2024, the Parent Company approved the 2024-2028 Business Plan, with an update of the financial targets, after overshooting the main objectives of the previous 2022-2026 Plan, and the strategic guidelines to strengthen its positioning as a “Clear and Simple Commercial Bank” through a digital-driven transformation and a growing specialisation of the service model for households and businesses.

On 7 November 2024, the Parent Company signed contracts for the non-recourse sale of a portfolio of impaired loans as part of the so-called “Bricks” project for a total gross exposure of approximately EUR 0.3 bn, of which EUR 0.2 bn related to secured bad loans and EUR 0.1 bn related to unsecured bad loans. The deconsolidation of the portfolio took place in December 2024.

On 20 November 2024, Banca MPS successfully completed the placement of a new Senior Preferred Unsecured bond issue, with a term of 6 years (maturing in 2030) and with an early redemption option after 5 years, for an amount of EUR 750 mln and a coupon set at 3.625%.

On 11 December 2024, the Bank received notification of the European Central Bank’s final decision regarding the capital requirements to be met on a consolidated basis as of 1 January 2025, at the conclusion of the annual prudential review and assessment process conducted in 2024. The additional “P2R” capital requirement improved by 25 bps from 2024 levels (2.75%) to 2.50%.

The overall minimum Common Equity Tier 1 ratio stands at 8.78%, the sum of Pillar 1 - P1R (4.50%), Pillar 2 - P2R (1.41%) and Combined Buffer Requirement - CBR (2.87%). The Pillar 2 Capital Guidance “P2G”, set at 1.15%, is unchanged from 2024 levels.

27

BANCA MONTE DEI PASCHI DI SIENA

Compared to the 2023 Final Decision, the ECB removed the prior authorisation requirement for the distribution of dividends.

On 12 December 2024, the Board of Directors of Banca MPS unanimously appointed - with the abstention of the interested party - the independent Director, Ms. Paola De Martini, as Lead Independent Director of the Bank.

On 17 December 2024 , the independent directors Paolo Fabris De Fabris, Lucia Foti Belligambi, Laura Martiniello, Annapaola Negri-Clementi and Donatella Visconti - indicated by the Ministry of Economy and Finance in the list presented on 27 March 2023 - resigned.