Exhibit 99.2

English translation for courtesy purposes only. In case of discrepancies between the Italian version and the English version, the Italian version shall prevail

EXEMPTION DOCUMENT

RELATING TO THE OFFER OF ORDINARY SHARES OF BANCA MONTE DEI PASCHI DI SIENA S.P.A. IN THE CONTEXT OF THE PUBLIC EXCHANGE OFFER FOR THE ORDINARY SHARES OF

MEDIOBANCA - BANCA DI CREDITO FINANZIARIO SOCIETÀ PER AZIONI

promoted by

Banca Monte dei Paschi di Siena S.p.A.

The Exemption Document has been prepared pursuant to Annex I of the Commission Delegated Regulation (EU) No. 528/2021 of 16 December 2020 and pursuant to Article 1, paragraph 4, letter (f) and paragraph 5, letter (e) of Regulation (EU) 1129/2017 of 14 June 2017 of the European Parliament and the Council, both applicable pursuant to Article 1, paragraph 6-bis, letter (a) of the same Regulation.

The Exemption Document does not constitute a prospectus within the meaning of Regulation (EU) 2017/1129.

The Exemption Document has not been submitted to CONSOB for review and approval pursuant to Article 20 of Regulation (EU) 2017/1129.

The Exemption Document refers to the promotion by Banca Monte dei Paschi di Siena S.p.A. of a voluntary public exchange offer for a maximum No. 833,279,689 ordinary shares of MEDIOBANCA – Banca di Credito Finanziario Società per Azioni, as well as a maximum of 16,178,862 additional shares of MEDIOBANCA – Banca di Credito Finanziario Società per Azioni that may be allocated under existing incentive plans, announced on 24 January 2025 pursuant to Article 102, paragraph 1, of Legislative Decree No. 58 of 24 February 1998, and Article 37 of the regulation adopted by CONSOB with resolution No. 11971 of 14 May 1999, as subsequently amended and supplemented.

The Offer Document has been approved by CONSOB on 2 July 2025 and published on 3 July 2025.

Disclaimer

The shares to be issued in connection with the Offer may not be offered or sold in the United States except pursuant to an effective registration statement under the U.S. Securities Act of 1933 (the “U.S. Securities Act”) or pursuant to a valid exemption from registration.

The Offer is being made for the shares of the Issuer by the Offeror, each of which is a company incorporated in Italy. Information distributed in connection with the Offer is subject to Italian disclosure requirements that are different from those of the United States. Financial statements and financial information included in the Offer Document or the Exemption Document, if any, have been prepared in accordance with the international accounting standards issued by the International Accounting Standards Board and may not be comparable to the financial statements or financial information of U.S. companies.

It may be difficult for you to enforce your rights and any claim you may have arising under U.S. federal securities laws in respect of the Offer, since the Offeror and the Issuer are located in Italy, and some or all of their officers and directors may be residents of Italy or other countries outside the U.S. You may not be able to sue a company incorporated outside the U.S. or its officers or directors in a non-U.S. court for violations of U.S. securities laws. It may be difficult to compel a company incorporated outside the U.S. and its affiliates to subject themselves to a U.S. court’s judgment.

The Offer will not be submitted to the review or registration procedures of any regulator outside of Italy and has not been approved or recommended by any governmental securities regulator. The Offer will be made in the U.S. pursuant to the exemptions from (i) the “U.S. tender offer rules” under the United States Securities Exchange Act of 1934 (the “U.S. Exchange Act”) provided by Rule 14d-1(c) thereunder and (ii) the registration requirements of the U.S. Securities Act provided by Rule 802 thereunder. These exemptions permit a bidder to satisfy certain substantive and procedural U.S. Exchange Act rules governing tender offers by complying with home jurisdiction law or practice, and exempt the bidder from compliance with certain other U.S. Exchange Act rules. As a result, the Offer will be made in accordance with the applicable regulatory, disclosure and procedural requirements under Italian law, including with respect to withdrawal rights, offer timetable, settlement procedures and timing of payments, that are different from those applicable in the U.S. To the extent that the Offer is subject to the U.S. securities laws, such laws only apply to holders of the Mediobanca Shares in the U.S. and no other person has any claims under such laws.

To the extent permissible under applicable law or regulation in Italy, and pursuant to the exemptions available under Rule 14e-5(b) under the U.S. Exchange Act, the Offeror and its affiliates or brokers (acting as agents for the Offeror or its affiliates, as applicable) may from time to time, and other than pursuant to the Offer, directly or indirectly purchase, or arrange to purchase, the Mediobanca Shares, that are the subject of the Offer or any securities that are convertible into, exchangeable for or exercisable for such shares, including purchases in the open market at prevailing prices or in private transactions at negotiated prices outside the U.S. To the extent information about such purchases or arrangements to purchase is made public in Italy, if any such purchases are made, such information will be disclosed by means of a press release or other means reasonably calculated to inform U.S. shareholders of the Issuer of such information. In addition, the financial advisors to the Offeror, may also engage in ordinary course trading activities in securities of the Issuer, which may include purchases or arrangements to purchase such securities.

Since the announcement of the Offer, the Offeror and certain of its affiliates have engaged, and intend to continue to engage throughout the Acceptance Period, in various asset management, brokerage, banking-related, collateral-taking, estates and trusts services, and custody-related activities involving the Offeror common shares outside the United States. Among other things, the Offeror or one or more of its affiliates intends to engage in trades in the Offeror common shares for the accounts of its customers for the purpose of effecting brokerage transactions for its customers and other customer facilitation transactions in respect of the Offeror common shares. Further, certain of Offeror’s asset

2

management affiliates may buy and sell the Offeror common shares or indices including the Offeror common shares, outside the United States as part of their ordinary, discretionary investment management activities on behalf of their customers. Certain of Offeror’s affiliates may continue to (a) engage in the marketing and sale to customers of funds that include the Offeror common shares, providing investment advice and financial planning guidance to customers that may include information about the Offeror common shares, (b) transact in the Offeror common shares as trustees and/or personal representatives of trusts and estates, (c) provide custody services relating to the Offeror common shares and (d) engage in accepting the Offeror common shares as collateral for loans.

These activities occur outside of the United States and the transactions in the Offeror common shares may be effected on the Euronext Milan, other exchanges or alternative trading systems and in the over-the-counter market.

3

WARNING

This Exemption Document has not been approved by CONSOB, nor any other supervisory authority.

The voluntary public exchange offer referred to in this Exemption Document shall be promoted by Banca Monte dei Paschi di Siena S.p.A. on all the ordinary shares of MEDIOBANCA – Banca di Credito Finanziario Società per Azioni.

The Offer will be made in Italy and will be addressed, on equal terms, to all holders of shares of MEDIOBANCA – Banca di Credito Finanziario Società per Azioni. The Offer will also be made to U.S. persons pursuant to a valid exemption from registration under the U.S. Securities Act. U.S. persons that hold Mediobanca shares may accept the Offer in accordance with the procedures applicable to all other holders of Mediobanca shares.

The Offer will be made in Italy as the shares of MEDIOBANCA – Banca di Credito Finanziario Società per Azioni are listed on Euronext Milan, a regulated market organized and managed by Borsa Italiana S.p.A. and, without prejudice to the following, the Offer is subject to the obligations and procedural requirements provided for by Italian law.

The Offer is not being made or disseminated in Canada, Japan and Australia, or any other country in which such Offer is not authorized or to any person to whom such Offer or solicitation is not permitted by law (the “Excluded Countries”).

Partial or complete copies of any documents to be issued by the Offeror in connection with the Offer shall not be sent, nor shall they be transmitted, or otherwise distributed, directly or indirectly, in the Excluded Countries. Any person receiving such documents shall not distribute, send or dispatch them (whether by post or by any other means or instrumentality of communication or commerce) in the Excluded Countries.

Any acceptances of the Offer resulting from solicitation activities carried out in violation of the above limitations will not be accepted.

This Exemption Document, as well as any other document issued by the Offeror in connection with the Offer, shall not constitute or form part of any offer to purchase or exchange, or any solicitation of offers to sell or exchange, securities in any of the Excluded Countries.

Acceptance to the Offer by persons residing in countries other than Italy may be subject to specific obligations or restrictions provided for by laws or regulations. It is the sole responsibility of the addressees of the Offer to comply with such regulations and, therefore, before accepting the Offer, to verify their existence and applicability by consulting their advisors. The Offeror shall not be held liable for any breach by any person of any of the foregoing limitations.

The Exemption Document is for information purposes only and is not intended to provide, nor it should be understood as a complete and comprehensive description of the Offer, which is contained in the Offer Document (available on the Offeror’s website at www.gruppomps.it/en). The Exemption Document does not constitute an offer to purchase or sell, or a solicitation of an offer to purchase or sell, BMPS securities and must be read in conjunction with the Offer Document. The distribution of this document may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and comply with these restrictions. To the fullest extent permitted by applicable law, the companies involved in the proposed voluntary public exchange offer disclaim any responsibility or liability for violations of such restrictions by any person.

The Exemption Document contains statements regarding the prospects and development of the Bank, including the expected benefits from the acquisition of MEDIOBANCA – Banca di Credito Finanziario Società per Azioni. Such statements are sometimes identified by the use of forward-looking, conditional and predictive terms such as “consider”, “anticipate”, “think”, “aim”, “expect”, “intend”,

4

“estimate”, “believe”, “desire”, “should” or “could” or the negative of these terms, or any other similar variation or terminology. This information is not historical data and should not be interpreted as a guarantee that the facts and data presented will occur. This information is based on data, assumptions and estimates, considered reasonable by the Bank. It is subject to change or modification due to uncertainties related in particular to the economic, financial, competitive and regulatory context.

The Exemption Document contains information about the Offeror’s markets and competitive positions, including information about the size and growth prospects of such markets and the Bank’s market shares. In addition to the Bank’s estimates, the Banks’s statements are based on data published by the Group’s competitors, suppliers and customers. Some of the information contained in the Exemption Document is publicly available information that the Bank believes to be reliable, but has not been independently verified. The Offeror cannot guarantee that a third party using different methods to collect, analyse or calculate data on business segments would obtain the same results. The Bank makes no representation or warranty as to the accuracy of this information. This information may prove to be inaccurate or out of date. The Bank undertakes no obligation to publish updates to this information, except as required by law or regulations.

The following documentation is incorporated by reference in the Exemption Document, pursuant to Article 19 of the Prospectus Regulation:

| (i) | BMPS 2024 Consolidated Financial Statements, available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html; |

| (ii) | Mediobanca 2024/2025 Half-Year Financial Report, available on the Issuer’s website at https://www.mediobanca.com/en/investor-relations/results-and-financial-statements/results.html; |

| (iii) | Mediobanca 2023/2024 Consolidated Financial Statements, available on the Issuer’s website at https://www.mediobanca.com/en/investor-relations/results-and-financial-statements/results.html; |

| (iv) | BMPS Consolidated Interim Report as of 31 March 2025, available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html; |

| (v) | Mediobanca 2024/2025 Nine-Month Press Release, available on the Issuer’s website at https://www.mediobanca.com/en/investor-relations/results-and-financial-statements/results.html; |

| (vi) | The Offer Document, available on the Offeror’s website at https://www.gruppomps.it/en/corporate-governance/voluntary-public-exchange-offer.html; |

| (vii) | The Explanatory Report of the Offeror’s Board of Directors on the proposal to grant the Delegation, prepared pursuant to Article 70 of the Issuers’ Regulation and in accordance with Annex 3A – Schedule No. 3 to the same regulation, and the supplementary note to the aforementioned Explanatory Report, prepared by BMPS upon request from CONSOB pursuant to Article 114, paragraph 5, of the TUF, both available on the Offeror’s website at https://www.gruppomps.it/en/corporate-governance/shareholders-meeting-and-bod/shareholders-meeting-and-bod.html; |

| (viii) | The Information Document prepared by the Offeror pursuant to Article 70, paragraph 6, of the Issuers’ Regulation, to which is attached the appraisal issued by KPMG Advisory S.p.A., in its capacity as Independent Expert pursuant to Article 2343-ter, paragraph 2, letter b), of the Italian Civil Code, available on the Offeror’s website at https://www.gruppomps.it/en/corporate-governance/shareholders-meeting-and-bod/shareholders-meeting-and-bod.html; |

| (ix) | The Information Document prepared by the Offeror pursuant to Article 5 of the regulation on related parties transaction approved by CONSOB with Resolution No. 17221 of 12 March 2010 (the “Regulation on Related Parties Transaction”) and in accordance with Annex 4 of said |

5

| regulation, as well as paragraph 4.6.1, of the BMPS Regulation, in relation to the Capital Increase Reserved to the Offer as a transaction with related parties, available on the Offeror’s website at https://www.gruppomps.it/en/corporate-governance/voluntary-public-exchange-offer.html; |

| (x) | The Explanatory Report of the Offeror’s Board of Directors prepared pursuant to Article 2441, paragraph 6, of the Italian Civil Code and Article 70, paragraph 7, letter a) of the Issuers’ Regulation relating to the exercise of the Delegation granted by the Shareholders’ Meeting of BMPS, in extraordinary session, on 17 April 2025, pursuant to Article 2443 of the Italian Civil Code, together with the fairness opinion on the issue price of the shares resulting from the Capital Increase Reserved to the Offer issued by the Independent Auditor on 26 June 2025, and the update of the appraisal issued by KPMG Advisory S.p.A. on 14 March 2025, in its capacity as Independent Expert pursuant to Article 2343-ter, paragraph 2, letter b), of the Italian Civil Code, available on the Offeror’s website at https://www.gruppomps.it/en/corporate-governance/voluntary-public-exchange-offer.html. |

| (xi) | The 2024-2028 Business Plan, available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/business-plans-and-capital-increases.html; |

| (xii) | The “One Brand – One Culture” business plan of the Mediobanca Group for the 2025-2028 period, approved by the Issuer’s Board of Directors on 26 June 2025 and available on the Mediobanca’s website at https://www.mediobanca.com/en/investor-relations/one-brand-one-culture-strategic-plan-rolling-to-fy28.html. |

Considering the scale of the Offer, its promotion constitutes a “significant financial commitment” pursuant to Article 18, paragraph 4 of the Delegated Regulation 2019/980. In accordance with the provisions of Article 4 of the Delegated Regulation (EU) No. 2021/528, the Exemption Document contains certain supplementary information relating to Mediobanca.

The information relating to Mediobanca included in the Exemption Document has been extracted from public information made available by Mediobanca, including those provided in Mediobanca 2023/2024 Consolidated Financial Statements, in Mediobanca 2024/2025 Half-Year Financial Report and in Mediobanca 2024/2025 Nine-Month Press Release, as published on the Issuer’s website at https://www.mediobanca.com/en/investor-relations/results-and-financial-statements/results.html. The Offeror cannot guarantee the accuracy of such information, for which Mediobanca is solely responsible and which has not been verified or reviewed by the Offeror or the Independent Auditor.

The additional information relating to Mediobanca and the Mediobanca Group available to the Offeror is provided in Chapter 2 (“Information on the Offeror and the Issuer”) and Chapter 5 (“Impact of the Transaction on the Offeror”); this information is considered relevant by BMPS as it details the main aspects relating to the business, shareholding structure, corporate governance and financial position of Mediobanca, and outlines the expected effects of the Transaction on the Issuer.

Capitalized terms not otherwise defined in the Exemption Document shall have the same meaning ascribed to them in the Offer Document.

6

TABLE OF CONTENTS

| WARNING | 4 | |||

| 1. | PERSONS RESPONSIBLE FOR DRAWING UP THE EXEMPTION DOCUMENT, THIRD PARTY INFORMATION AND EXPERTS REPORTS | 10 | ||

| 1.1 | Identification of persons responsible for drawing up the exemption document | 10 | ||

| 1.2 | Responsibility statement | 10 | ||

| 1.3 | Expert’s statement or report | 10 | ||

| 1.4 | Information sourced by third parties | 10 | ||

| 1.5 | Regulatory statements | 10 | ||

| 2. | INFORMATION ON THE OFFEROR AND THE ISSUER | 11 | ||

| 2.1 | Information on the Offeror | 11 | ||

| 2.1.1 | General information | 11 | ||

| 2.1.2 | Business overview | 11 | ||

| 2.1.3 | Investments | 14 | ||

| 2.1.4 | Corporate Governance | 15 | ||

| 2.1.5 | Financial information | 19 | ||

| 2.1.6 | Legal and arbitration proceedings | 20 | ||

| 2.1.7 | Summary of information disclosed under Regulation (EU) No. 596/2014 of the European Parliament and of the Council | 20 | ||

| 2.2 | Information on the Issuer | 24 | ||

| 2.2.1 | General information | 24 | ||

| 2.2.2 | Business overview | 25 | ||

| 2.2.3 | Investments | 30 | ||

| 2.2.4 | Corporate Governance | 31 | ||

| 2.2.5 | Financial information | 33 | ||

| 2.2.6 | Legal and arbitration proceedings | 35 | ||

| 2.2.7 | Summary of information disclosed under Regulation (EU) No. 596/2014 of the European Parliament and of the Council | 35 | ||

| 3. | DESCRIPTION OF THE TRANSACTION | 40 | ||

| 3.1 | Purpose and objectives of the Offer | 40 | ||

| 3.2 | Conditions of the Offer | 40 | ||

| 3.2.1 | Information on the procedures and terms of the Offer and on the governing law of the agreement executing the Offer | 40 | ||

| 3.2.2 | Conditions of Effectiveness of the Offer | 41 | ||

| The effectiveness of the Offer is subject to the fulfillment (or waiver by the Offeror as provided below) of each condition of the effectiveness indicated in Warning A.1 of the Offer Document (the “Conditions of Effectiveness”), acknowledging that they are indicated in a chronological order that is not binding: | 41 | |||

| 3.2.3 | Break-up fees or other penalties due if the Offer is not completed | 43 | ||

| 3.2.4 | Notifications and authorizations required for the purposes of the Offer | 43 | ||

| 3.2.5 | Financing of the Offer | 50 | ||

| 3.2.6 | Timetable of the Offer | 50 | ||

| 3.3 | Risk factors related to the Transaction | 50 | ||

| 3.3.1 | Risks related to the information about Mediobanca contained in the Exemption Document | 50 | ||

| 3.3.2 | Risks related to the non-fulfillment of the Conditions of Effectiveness of the Offer | 51 | ||

| 3.3.3 | Risks related to completion of the Offer | 51 | ||

7

| 3.3.4 | Risks associated with the expansion of revenue sources and expected synergies | 52 | ||

| 3.3.5 | Risks related to the valuation methods used to determine the Pre-Adjustment Consideration | 53 | ||

| 3.3.6 | Risks related to the inclusion of pro-forma financial information concerning the acquisition of Mediobanca | 54 | ||

| 3.3.7 | Risks related to forecasts and estimates | 56 | ||

| 3.3.8 | Risks related to the non-comparability of future results after 31 December 2024 | 57 | ||

| 3.3.9 | Risks related to the national and international macroeconomic context | 57 | ||

| 3.3.10 | Risks related to potential conflicts of interest arising from related party transactions | 57 | ||

| 3.3.11 | Risks related to prominence statements | 58 | ||

| 3.4 | Conflict of interests | 58 | ||

| 3.5 | Offer Consideration | 59 | ||

| 3.5.1 | Addressees of the Offer or of the allotment of the equity securities connected with the Offer | 59 | ||

| 3.5.2 | Consideration offered for each equity security and, in particular, the Exchange Ratio and the amount of any cash payment | 59 | ||

| 3.5.3 | Information concerning to any contingent consideration agreed in the context of the Offer | 60 | ||

| 3.5.4 | Valuation methods and the assumptions employed to determine the Consideration offered for each equity security, in particular regarding the Exchange Ratio | 60 | ||

| 3.5.5 | Any appraisals or reports prepared by independent experts to determine the Consideration and information on where these appraisals or reports may be found for perusal | 61 | ||

| 4. | EQUITY SECURITIES OFFERED TO THE PUBLIC | 62 | ||

| 4.1 | Risk factors related to the equity securities | 62 | ||

| 4.1.1 | Risks related to the dilution of the Bank’s share capital | 62 | ||

| 4.1.2 | Risks related to exceptional or significant events affecting the estimated value of the Shares Subject to the offer pursuant to Article 2343-ter of the Italian Civil Code and the possible unavailability of the BMPS Shares | 62 | ||

| 4.1.3 | Management of Fractional Shares | 64 | ||

| 4.1.4 | Risks related to the liquidity and volatility of the BMPS Shares | 64 | ||

| 4.1.5 | Risks related to the markets on which the Offer is not promoted in the absence of authorizations for the competent authorities | 65 | ||

| 4.2 | Working capital statement | 65 | ||

| 4.3 | Information concerning the equity securities to be offered and/or admitted to trading | 66 | ||

| 4.3.1 | General information | 66 | ||

| 4.3.2 | Statements of the resolutions, authorizations and approvals by virtue of which the Shares are issued | 66 | ||

| 4.3.3 | Description of any restrictions on the free transferability of the equity securities | 67 | ||

| 4.3.4 | Indication of public takeover bids by third parties in respect of the Offeror’s shares during the last financial year and the current financial year | 67 | ||

| 4.4 | Admission to trading and dealing arrangements | 67 | ||

| 4.4.1 | Whether the equity securities offered are or will be the object of an | |||

8

| application for admission to trading, with a view to their distribution in a regulated market or other third country markets | 67 | |||

| 4.4.2 | Regulated markets or equivalent third country markets as defined in Article 1, point b) of Delegated Regulation (EU) 2019/980, on which, to the knowledge of the Offeror, the Shares are already admitted to trading | 67 | ||

| 4.4.3 | Details of the entities that have given a firm commitment to act as intermediaries in secondary trading, providing liquidity through bid and offer rates, and description of the main terms of their commitment | 67 | ||

| 4.4.4 | Description of lock-up agreements | 67 | ||

| 4.5 | Dilution | 67 | ||

| 4.6 | Advisors | 69 | ||

| 5. | IMPACT OF THE TRANSACTION ON THE OFFEROR | 70 | ||

| 5.1 | Strategies and objectives | 70 | ||

| 5.2 | Material contracts | 73 | ||

| 5.3 | Disinvestment | 73 | ||

| 5.4 | Corporate governance | 73 | ||

| 5.5 | Shareholding | 74 | ||

| 5.6 | Pro-forma financial information | 74 | ||

| 6. | DOCUMENTS AVAILABLE | 75 | ||

| 7. | DEFINITIONS | 77 | ||

9

| 1. | PERSONS RESPONSIBLE FOR DRAWING UP THE EXEMPTION DOCUMENT, THIRD PARTY INFORMATION AND EXPERTS REPORTS |

| 1.1 | Identification of persons responsible for drawing up the exemption document |

Responsibility for the accuracy and completeness of the information and data contained in the Exemption Document is undertaken by Banca Monte dei Paschi di Siena S.p.A. (the “Offeror”, “BMPS” or the “Bank”), with registered office in Siena - Piazza Salimbeni No. 3, in its capacity as Offeror and issuer of the BMPS shares which constitutes the Consideration (the “BMPS Shares”).

| 1.2 | Responsibility statement |

The Offeror represents that, to the best of its knowledge, the information contained in the Exemption Document is in accordance with the facts and that the Exemption Document makes no omission likely to affect its import.

| 1.3 | Expert’s statement or report |

Not applicable.

| 1.4 | Information sourced by third parties |

Where information contained in the Exemption Document has been sourced from third parties, it has been accurately reproduced and, as far as the Offeror is able to ascertain from information published by that third parties, no facts have been omitted which would render the reproduced information inaccurate or misleading. The source of third-party information is identified where used.

With particular reference to the Transaction, the Exemption Document contains information derived from the documentation made available to the public by MEDIOBANCA – Banca di Credito Finanziario Società per Azioni (the “Issuer” or “Mediobanca”), available on the Issuer’s website at www.mediobanca.com/en.

| 1.5 | Regulatory statements |

The Offeror represents that:

| (i) | the Exemption Document does not constitute a prospectus within the meaning of Regulation (EU) 2017/1129; |

| (ii) | the Exemption Document has not been subject to the scrutiny and approval by CONSOB in accordance with Article 20 of Regulation (EU) 2017/1129. |

10

| 2. | INFORMATION ON THE OFFEROR AND THE ISSUER |

| 2.1 | Information on the Offeror |

| 2.1.1 | General information |

| 2.1.1.1 | Legal and commercial name |

The Offeror is named Banca Monte dei Paschi di Siena S.p.A.

| 2.1.1.2 | Additional information |

The Offeror is incorporated as a joint-stock company (società per azioni), is registered with the Companies’ Register of Arezzo – Siena under number 00884060526 and operates under the laws of the Republic of Italy. Its legal entity identifier (LEI) is: J4CP7MHCXR8DAQMKIL78.

The Offeror’s registered office is in Siena, Piazza Salimbeni No. 3, phone No. (+39) 0577 294111.

It should be noted that, as of the Exemption Document Date, the BMPS Shares are admitted to trading on the Italian regulated market named as Euronext Milan, organized and managed by Borsa Italiana S.p.A. (“Euronext Milan”).

The Offeror’s website is www.gruppomps.it/en. The information available on the website is not part of the Exemption Document, unless such information has been incorporated by reference in the Exemption Document.

| 2.1.1.3 | Names of the auditors for the period covered by the financial statements and the name of the professional body which they are members of |

The Independent Auditor responsible for auditing BMPS’ financial statements are PricewaterhouseCoopers S.p.A., with registered office in Piazza Tre Torri No. 2, Milan, registered with the Register of Statutory Auditors pursuant to Articles 6, et seq., of Legislative Decree No. 39 of 2010, as amended by Legislative Decree No. 135 of 2016, with registration number 119644.

| 2.1.2 | Business overview |

| 2.1.2.1 | Principal activities, including the main categories of products sold and/or services performed in the last financial year |

The Offeror is authorized by the Bank of Italy to carry out the banking business in accordance with Italian law.

BMPS carries out the banking business through the collection of savings and granting credit, in various forms, mainly in Italy, both directly and through subsidiaries. To this end, it may, in compliance with the provisions in force and after obtaining the necessary authorizations, carry out, either directly or through subsidiaries, all banking and financial transactions and services, set up and manage supplementary pension schemes, and carry out any other activity permitted to credit institutions, including the issue of bonds and the granting of loans governed by special laws, instrumental and in any case connected with the pursuit of the corporate purpose.

The Offeror is the parent company of the BMPS Group (the “BMPS Group” or the “Group”) and, in addition to the banking business, performs the functions of guidance, governance and unified control over the financial and instrumental subsidiaries.

11

In particular, the Offeror, as the parent bank, exercises – pursuant to Article 61, paragraph 4, of the TUB – the management and coordination of the companies belonging to the BMPS Group, issuing specific provisions for this purpose, including for the execution of instructions issued by the supervisory authorities and in the interest of the stability of the BMPS Group.

The Group’s business focuses on traditional retail and commercial banking services, mainly in Italy. The Group is also active in business areas such as factoring, corporate finance, including specialized activities such as structured finance.

The Group also operates through a strategic partnership with AXA, in the bancassurance sector, in the life, non-life and supplementary pension fields, while its asset management business consists of offering investment products from independent third parties, including, in particular, Anima Holding S.p.A.

More specifically, the Group, which employed 16,727 people as of 31 December 2024, operates in various strategic areas of the financial sector, offering a wide range of products and services, mainly targeting the following consumer groups:

| · | Retail: individuals and households, to whom it offers savings solutions, investment products, mortgages, personal loans and innovative payment instruments; |

| · | Private Banking: individuals with significant assets, to whom it offers personalized asset management services and advanced financial advice; |

| · | Businesses: small and medium-sized companies, to whom it offers financing services, liquidity management, factoring and dedicated insurance products; |

| · | Large Corporate: large companies, for which it offers a customized commercial offering characterized by high value-added financial services, lending, deposit-taking and cash flow management operations. |

The Group integrates traditional business models, and operates through its network of branches and specialist centers, with an innovative system of digital and self-service services, enhanced by the expertise of the network of financial advisors of the controlled Bank Widiba S.p.A. (an online bank part of the BMPS Group).

The foreign operations focus on supporting the internationalization processes of corporate customers and cover the main foreign financial markets.

| Company | Activity |

|

BMPS operates in various segments of the banking and financial sector, from traditional banking, including factoring products, to special-purpose loans, asset management, bancassurance and investment banking. The Bank performs management, coordination and control functions over the companies of the Group, within the general guidelines established by the Board of Directors and in accordance with the instructions provided by the Bank of Italy in the interest of the stability of the Group. |

|

Monte Paschi Fiduciaria offers its services to private individuals and companies seeking the highest levels of confidentiality in relation to their interests and business through the use of fiduciary mandates. In addition, Montepaschi Fiduciaria can also act as a trust company for the management of the assets of a trustee or protector. |

12

|

Widiba (WIse-DIalog-Bank) is the Group’s bank that integrates a self-service offering with the expertise of the BMPS network of financial advisors. |

|

Monte Paschi Banque S.A. is the Group’s bank that supports the trade and investments of Italian companies abroad. In June 2025, BMPS entered into a binding agreement for the sale of its subsidiary Monte Paschi Banque S.A. to a private equity fund. |

In addition to the above, there are companies operating in the agricultural sector, both in wine production and agri-food, with a real estate component for agritourism and accommodation activities (MPS Tenimenti Poggio Bonelli and Chigi Saracini Società Agricola S.p.A.) and food storage and warehousing services for third parties (Magazzini Generali Fiduciari di Mantova S.p.A.).

Intercompany relations are managed on the basis of a “Group Operating Regulation” that governs and coordinates the activities of the BMPS Group and ensures the achievement of results through defined rules and clear mechanisms for the allocation of management responsibilities, in compliance with the instructions issued by the supervisory authorities in the interest of the stability of the BMPS Group.

Intercompany transactions mainly concern financial support provided by the Bank, as Parent Company, to other companies, mostly in the form of deposits and outsourcing services relating to ancillary activities provided by the Bank (administrative services and property management).

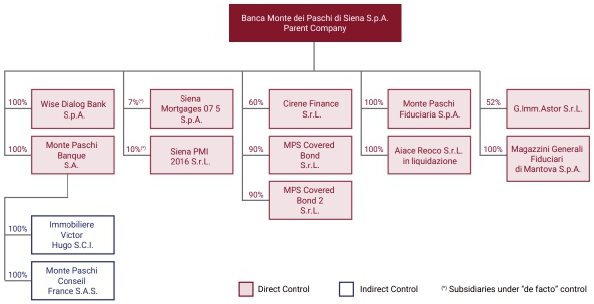

The following chart shows the BMPS Group as of the Exemption Document Date.

| 2.1.2.2 | Any significant changes having an impact on the operations and principal activities since the end of the period covered by the latest published audited financial statements |

Without prejudice to what has been already mentioned in relation to the promotion of the Offer, after 31 December 2024 and until the Exemption Document Date, there were no changes that had an impact on the operations and principal activities of the BMPS Group.

For a complete description of significant events after the end of the 2024 financial year, please refer to (i) the

13

Paragraph entitled “Significant events after the end of 2024 financial year” (pages 32 and 33), of the BMPS 2024 Consolidated Financial Statements; and (ii) in the Paragraphs “Significant events in the first three months of 2025” (page 14) and “Significant events after the end of the first three months of 2025” (page 15) of the BMPS Consolidated Interim Report as of 31 March 2025, both incorporated by reference in this Exemption Document pursuant to Article 19 of the Prospectus Regulation and available on the Offeror’s website at the https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html.

| 2.1.2.3 | Brief description of the principal markets, including a breakdown of total revenues by operating segment and geographic market for the last financial year |

Based on the Group’s reporting criteria, which also take into account the Bank’s organizational structure, BMPS has defined the following operating segments in which it operates:

Retail Banking: which includes the economic/financial results of retail customers (customers in the “value” and “premium” segments) and of the online bank Banca Widiba (network of financial advisors and self-service channel);

Wealth Management: which includes the economic/financial results of private customers and the subsidiary MPS Fiduciaria;

Corporate Banking: which includes the economic/financial results of corporate customers (SME, corporate client and small business segments) and the foreign branch;

Large Corporate and Investment Banking: which includes the economic/financial results of large corporate customers and the business units “Corporate Finance and Investment Banking” and “Global Market”;

Corporate Center: which includes elisions against intercompany items and the results of the following business centers:

| · | non-performing customers, centrally managed by the Non-Performing Loans Unit; |

| · | companies consolidated using the net equity method and those held for sale; |

| · | operating branches such as proprietary finance, treasury and capital management; |

| · | service structures that support the Group’s activities, with particular regard to the development and management of information systems. |

The breakdown of the Group’s revenues by operating segment can be found (i) in Paragraph “Results by Operating Segment” (pages 94 – 119) of BMPS 2024 Consolidated Financial Statements; and (ii) in Paragraph “Results by Operating Segment” (pages 92 – 104) of the BMPS Consolidated Interim Report as of 31 March 2025, both documents incorporated by reference in this Exemption Document pursuant to Article 19 of the Prospectus Regulation and available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html.

With regard to the geographic breakdown of revenues, it should be noted that almost all of the Group’s revenues derive from Italy; revenues generated by the foreign network, which includes, in particular, the subsidiary MP Banque SA, in the process of being divested, represent approximately 1% of the Group’s total revenues as of 31 December 2024.

| 2.1.3 | Investments |

| 2.1.3.1 | Material investments made since the date of the last published financial statements, and which are in progress and/or for which firm commitments have already been made by the Offeror, together |

14

| with the anticipated source of funds |

In the period between 1 January 2025 and the Exemption Document Date, the Offeror implemented the investment plan set out in the 2024-2028 Business Plan, as disclosed in the press release published on 6 August 2024 - relating to the consolidated results of the BMPS Group as of 30 June 2024 and the approval of the 2024-2028 Business Plan (available on the BMPS website at https://www.gruppomps.it/en/media-and-news/press-releases/pr-financial-results-2q-1h-06082024.html) - as well as in the presentation “A Clear and Simple Commercial Bank, Revolving Around Customers, Combining Technology With Human Touch, 2Q-24 & 1H-24 Results & Business Plan 2024-2028” (incorporated by reference in the Exemption Document pursuant to Article 19 of the Prospectus Regulation and available on BMPS’ website at https://www.gruppomps.it/en/investor-relations/business-plans-and-capital-increases.html).

In this regard, it should be noted that the budget allocated to support the project initiatives for the year 2025 was approved by the Offeror’s Board of Directors on 12 December 2024. The investments will be financed by the Issuer using resources already available as of the Exemption Document Date.

As of the Exemption Document Date, the implementation of the investments in the 2024-2028 Business Plan is consistent with the expectations.

For further information on the material investments made by the BMPS Group, please refer to the BMPS 2024 Consolidated Financial Statements and the BMPS Consolidated Interim Report as of 31 March 2025, incorporated by reference in the Exemption Document pursuant to Article 19 of the Prospectus Regulation.

| 2.1.4 | Corporate Governance |

| 2.1.4.1 | Members of the administrative and supervisory bodies |

Board of Directors

As of the Exemption Document Date, the Offeror’s Board of Directors is composed of 15 members:

| (i) | 9 of whom were elected by the Offeror’s shareholders’ meeting, in ordinary session, on 20 April 2023 for the renewal of the Board of Directors, namely, Mr. Nicola Maione, Mr. Gianluca Brancadoro, Mr. Luigi Lovaglio, Mrs. Alessandra Giuseppina Barzaghi, Mrs. Paola De Martini, Mr. Stefano Di Stefano, Mr. Domenico Lombardi, Mrs. Paola Lucantoni and Mr. Renato Sala; |

| (ii) | 1 named by the Shareholders’ Meeting on 11 April 2024, namely, Raffaele Oriani, to replace the resigning director Mr. Marco Giorgino, who resigned on 13 November 2023; |

| (iii) | 5 of whom, namely Mr. Alessandro Caltagirone, Mrs. Elena De Simone, Mrs. Marcella Panucci, Mrs. Francesca Paramico Renzulli and Mrs. Barbara Tadolini, appointed by the Offeror’s shareholders’ meeting, in ordinary session, on 17 April 2025 to restore the number of 15 members, as resolved by the Shareholders’ Meeting of 20 April 2023 and reduced as a result of the resignation of directors Mr. Paolo Fabris de Fabris, Mrs. Lucia Foti Belligambi, Mrs. Laura Martiniello, Mrs. Annapaola Negri-Clementi, Mrs. Donatella Visconti, on 17 December 2024. |

The directors will remain in office for a period of three financial years from the start of the board’s term of office and, therefore, until the approval of the financial statements for the year ending 31 December 2025.

The following table shows the composition of the Offeror’s Board of Directors as of the Exemption Document Date:

15

| Name and surname | Position Held | End of current term of office |

| Nicola Maione | Chairman – Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Gianluca Brancadoro | Vice-Chairman – Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Luigi Lovaglio | Chief Executive Officer – General Manager | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Alessandra Giuseppina Barzaghi | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Alessandro Caltagirone | Director | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Paola De Martini | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Elena De Simone | Director | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Stefano Di Stefano | Director | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Domenico Lombardi | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Paola Lucantoni | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Raffaele Oriani | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Marcella Panucci | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Francesca Paramico Renzulli | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Renato Sala | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Barbara Tadolini | Independent Director (*) | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

(*) Independent director pursuant to the combined provisions of BMPS’ by-laws, Ministerial Decree 169/2020, the TUF and the Corporate Governance Code.

The Directors are domiciled for the purposes of their office at the address listed in the Companies’ Register of Arezzo – Siena.

For information regarding the Board of Directors of BMPS, please refer to the Report on Corporate

16

Governance and Shareholding Structure, prepared in accordance with Article 123-bis of the TUF and available on the Offeror’s website at https://www.gruppomps.it/en/corporate-governance/governance-model.html.

Board of Statutory Auditors

As of the Exemption Document Date, the Offeror’s Board of Statutory Auditors was appointed on 20 April 2023 (with the exception of Mr. Giacomo Granata and Mrs. Paola Lucia Isabella Giordano, appointed on 11 April 2024) and will expire on the date of the Offeror’s Shareholders’ Meeting called to approve the financial statements for the year ending 31 December 2025.

The following table shows the composition of the Offeror’s Board of Statutory Auditors as of the Exemption Document Date:

| Name and surname | Position held | End of current term of office |

| Enrico Ciai | Chairman of the Board of Statutory Auditors | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Lavinia Linguanti | Standing Statutory Auditor | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Giacomo Granata | Standing Statutory Auditor | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Pierpaolo Cotone | Alternate Statutory Auditor | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

| Paola Lucia Isabella Giordano | Alternate Statutory Auditor | Shareholders’ meeting called to approve the financial statements as of 31 December 2025 |

The Offeror’s Statutory Auditors are domiciled for the purposes of their office at the address listed in the Companies’ Register of Arezzo – Siena.

For information regarding the Board of Statutory Auditors of BMPS, please refer to the Report on Corporate Governance and Shareholding Structure, prepared in accordance with Article 123-bis of the TUF and available on the Offeror’s website at https://www.gruppomps.it/en/corporate-governance/governance-model.html.

| 2.1.4.2 | Identity of major shareholders |

As of the Exemption Document Date, based on the communications received pursuant to Article 120 of the TUF and Part III, Title III, Chapter I, Section I of the Issuers’ Regulation, as well as on other information available to the Offeror, the shareholders holding a stake in the share capital or voting rights exceeding 3% of the ordinary share capital of the Offeror are indicated in the table below.

| Declarant or subject at the top of the ownership chain | Direct shareholder | % of share capital and voting rights |

| Delfin S.A.R.L. | Delfin S.A.R.L. | 9.780%(*) |

17

| Banco BPM S.p.A. | Banco BPM S.p.A. | 5.004% |

| Anima Holding S.p.A. | 3.992% | |

| Total | 8.996% | |

| Italian Ministry of Economy and Finance | Italian Ministry of Economy and Finance | 11.731% |

| Caltagirone Francesco Gaetano | Ausonia S.r.l. | 0.056% |

| Esperia 15 S.r.l. | 0.056% | |

| MK 87 S.r.l. | 0.040% | |

| Istituto Finanziario 2012 S.p.A. | 0.556% | |

| Gamma S.r.l. | 0.992% | |

| Azufin S.p.A. | 1.191% | |

| VM 2006 S.r.l. | 1.746% | |

| Mantegna 87 S.r.l. | 0.103% | |

| Calt 2004 S.r.l. | 0.127% | |

| Finanziaria Italia 2005 S.r.l. | 0.159% | |

| Total | 5.026%(*) |

(*) Please note that, based on the communications made to the Offeror by the depositary intermediaries for the purpose of exercising voting rights at the BMPS’ shareholders’ meeting, in ordinary and extraordinary session, held on 17 April 2024, the shareholder Delfin S.A.R.L. has disclosed that it holds shares with voting rights equal to 9.866% of the Offeror’s share capital and Mr. Francesco Gaetano Caltagirone has disclosed that he holds (through various companies controlled by him) shares with voting rights equal to a total of 9.963% of the Offeror’s share capital.

The percentages listed in the table above, as published on CONSOB’s website and resulting from the communications made by the shareholders pursuant to Article 120 of the TUF, may not be updated and/or consistent with the data processed and published by other sources (including the Offeror’s website), in cases where shareholding did not trigger any shareholders’ communication obligation.

| 2.1.4.3 | Number of employees |

As of the Exemption Document Date, the Group employs 16,635 people.

18

| 2.1.5 | Financial information |

| 2.1.5.1 | Financial statements |

As of the Exemption Document Date, the most recent consolidated annual financial statements prepared by the Offeror refer to the year ended 31 December 2024 (the “BMPS 2024 Consolidated Financial Statements”).

The BMPS 2024 Consolidated Financial Statements, approved by the Offeror’s Board of Directors on 6 March 2025 and reviewed by the BMPS Shareholders’ meeting, in ordinary session, also contain the Independent Auditor’s report, incorporated by reference in the Exemption Document pursuant to Article 19 of the Prospectus Regulation and available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html.

The following table shows the range of pages where the various parts of the BMPS 2024 Consolidated Financial Statements that are incorporated by reference can be found.

| Section | pages | |

| Consolidated balance sheet | 298 – 299 | |

| Consolidated income statement | 300 – 301 | |

| Consolidated statement of changes in equity | 303 – 304 | |

| Consolidated cash flow statement – indirect method | 305 – 306 | |

| Notes to the consolidated financial statements | 307 – 672 | |

| Independent Auditors’ report on the financial statements | 681 – 696 |

On 8 May 2025, the Board of Directors reviewed and approved the BMPS Consolidated Interim Report as of 31 March 2025, which also contains the limited audit report of the Independent Auditor. The BMPS Consolidated Interim Report as of 31 March 2025 is incorporated by reference in the Exemption Document pursuant to Article 19 of the Prospectus Regulation and available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html.

The following table shows the range of pages where the various parts of the BMPS Consolidated Interim Report as of 31 March 2025 that are incorporated by reference can be found.

| Section | pages | |

| Consolidated balance sheet | 18 – 19 | |

| Consolidated income statement | 20 – 21 | |

| Consolidated statement of changes in equity | 23 – 24 | |

| Consolidated cash flow statement – indirect method | 25 | |

| Explanatory Notes | 26 – 110 | |

| Independent Auditors’ report | 112 – 114 |

| 2.1.5.2 | Accounting standards |

BMPS 2024 Consolidated Financial Statements and the BMPS Consolidated Interim Report as of 31 March

19

2025 have been prepared in accordance with IFRS and IAS issued by the IASB – International Accounting Standards Board, as well as with the related interpretations provided by the IFRIC – International Financial Reporting Interpretations Committee, as adopted by the European Union.

| 2.1.5.3 | Significant changes in the financial position which has occurred since the end of the last financial period and trends that are reasonably likely to have a material effect on the current financial year |

From 31 December 2024 to the Exemption Document Date, there have been no significant changes in the financial position or trends that are reasonably likely to have a material effect on the current financial year.

For a description of the trends expected by the Bank, please refer to (i) Paragraph “Prospects and outlook on operations” (page 121) of the BMPS 2024 Consolidated Financial Statements; and (ii) Paragraph “Prospects and outlook on operations” (page 105) of the BMPS Consolidated Interim Report as of 31 March 2025, both incorporated by reference in the Exemption Document pursuant to Article 19 of the Prospectus Regulation and available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html.

| 2.1.6 | Legal and arbitration proceedings |

As of the Exemption Document Date, the Offeror is not a party to any administrative, legal or arbitration proceedings that it believes could have significant effects on the BMPS Group or the Mediobanca Group.

As of 31 March 2025, the following proceedings were pending:

| · | legal disputes with a total claim amount, if quantified, equal to Euro 3,091.4 million, of which approximately Euro 1,581.9 million as claims relating to disputes classified as having a “probable” risk of losing, for which provisions of Euro 458.4 million have been recorded, and approximately Euro 1,509.5 million as claims attributed to disputes classified as having a “possible” risk of losing; |

| · | out-of-court claims for a total claim amount, if quantified, equal to approximately Euro 55.9 million, of which approximately Euro 42.0 million classified as having a “probable” risk of losing and approximately Euro 13.9 million as having a “possible” risk of losing; |

| · | employment disputes as defendant with a total claim amount, if quantified, equal to approximately Euro 38.3 million, of which (i) approximately Euro 29.4 million as a claim relating to disputes classified as having a “probable” risk of losing for which provisions equal to approximately Euro 12.3 million have been recorded; and (ii) approximately Euro 8.9 million as claims attributed to passive disputes classified as having a “possible” risk of losing; |

| · | tax disputes with a total claim amount, if quantified, equal to approximately Euro 35.5 million, of which (i) approximately Euro 12.1 million as a claim relating to disputes classified as having a “probable” risk of losing, for which provisions equal to approximately Euro 12.0 million have been recorded; and (ii) approximately Euro 23.3 million as claims attributed to disputes classified as having a “possible” risk of losing. |

For a complete description of the legal and arbitration proceedings, please refer to the “Main types of legal, employment and tax risks” of the BMPS 2024 Consolidated Financial Statements (pages 620 – 635) and the BMPS Consolidated Interim Report as of 31 March 2025 (pages 82 – 85), incorporated by reference in the Exemption Document pursuant to Article 19 of the Prospectus Regulation and available on the Offeror’s website at https://www.gruppomps.it/en/investor-relations/financial-results/financial-results.html.

| 2.1.7 | Summary of information disclosed under Regulation (EU) No. 596/2014 of the European Parliament |

20

| and of the Council |

The following is a summary of the information disclosed by the Offeror over the last 12 months pursuant to Regulation (EU) No. 596/2014 of the European Parliament and of the Council of 16 April 2014, which appear to be relevant for the purposes of this Exemption Document.

Each of the press releases mentioned below is available for consultation on the Offeror’s website (www.gruppomps.it/en).

Press releases relating to extraordinary transactions

| · | 2 July 2025: the Offeror announces that it has obtained unconditional approval for the acquisition of control of Mediobanca from the Italian Competition and Market Authority pursuant to Law No. 287 of 10 October 1990 and the consequent fulfilment of the Antitrust Condition. |

| · | 2 July 2025: the Offeror announces that, by resolution No. 23623 dated 2 July 2025, CONSOB has approved the Offer Document pursuant to Article 102, paragraph 4, of the TUF. |

| · | 27 June 2025: the Offeror announces the registration with the Arezzo-Siena Companies’ Register of the minutes of the BMPS Board of Directors’ meeting held on 26 June 2025, specifying that BMPS’ shareholders representing, at the date of the resolution, at least one-twentieth of the share capital, in the amount prior to the capital increase, may exercise the rights referred to in Article 2443, paragraph 4, of the Italian Civil Code, within thirty days from the aforementioned registration. |

| · | 26 June 2025: the Offeror announces that the Board of Directors has resolved, in execution of the Delegation, to increase the share capital against payment for a total of Euro 13,194,910,000, plus share premium, through the issuance of No. 2,230,000,000 ordinary shares, in one or more tranches and in divisible form, with the exclusion of the option right pursuant to Article 2441, paragraph 4, first sentence, of the Italian Civil Code, in service of the Offer. In the context of the resolution to increase the share capital, the Board of Directors of BMPS also provided the information required by Article 2343-quater, paragraph 3, letters a), b), c) and e), of the Italian Civil Code. |

| · | 25 June 2025: the Offeror announces that it has successfully completed the placement of a Tier 2 subordinated issue with maturity in October 2035 and an early redemption option in October 2030, for an amount of Euro 500 million. The coupon has been set at 4.375% per annum. |

| · | 25 June 2025: the Offeror announces that the ECB has granted the necessary authorization for the acquisition of a controlling shareholding in the Issuer and in its subsidiaries Mediobanca Premier S.p.A. and Compass Banca S.p.A. |

| · | 20 June 2025: the Offeror announces, pursuant to Article 41, paragraph 2, letter c) of the Issuers’ Regulations, the purchase of 70,000 shares of the Issuer in exercise of a call option acquired on 3 January 2025 by a customer of the Bank as part of the ordinary course of Markets operations and the termination of a securities lending position, hedging the risk arising from the above transaction with the customer, for 38,004 shares of the Issuer. |

| · | 11 June 2025: the Offeror announces that it has successfully completed the placement of an issuance of Conditional Pass Through (“CPT”) European Covered Bond due 18 January 2031, reserved to institutional investors, for an amount equal to Euro 750 million. The coupon has been set at 2.750% per annum. |

| · | 21 May 2025: the Offeror announces that it has successfully completed the placement of a new issuance of Senior Preferred Unsecured bonds, with a fixed rate, a maturity of 6 years (due 2031) and an early redemption option after 5 years, for an amount of Euro 500 million. The coupon has been set at 3.50%. |

21

| · | 20 May 2025: the Offeror announces a technical adjustment to the Consideration of the Offer to reflect the payment of: (i) the Offeror’s dividend, approved by the shareholders’ meeting on 17 April 2025, and (ii) the interim dividend approved by Mediobanca’s Board of Directors on 8 May 2025, based on Mediobanca’s results as of 31 December 2024. The technical adjustment is equal to 0.23 BMPS shares for a total No. 2.533 BMPS shares for each Mediobanca share tendered in acceptance of the Offer. |

| · | 20 May 2025: the Offeror announces that it has obtained prior authorization from the Italian Insurance Supervisory Authority (“IVASS”) pursuant to Article 68 of Legislative Decree No. 209 of 7 September 2005 for the acquisition by BMPS of an indirect qualifying holding, through Mediobanca, in Assicurazioni Generali S.p.A. |

| · | 14 April 2025: the Offeror announces that the Presidency of the Council of Ministers has resolved, in accordance with the proposal of the Italian Ministry of Economy and Finance, not to exercise the special powers pursuant to Law Decree No. 21 of 15 March 2012, converted into Law No. 56 of 11 May 2012, with regard to the Offer. |

| · | 8 April 2025: the Offeror announces that it has received from the European Central Bank the authorizations for the purpose of classifying the shares resulting from the Capital Increase Reserved to the Offer as Common Equity Tier 1 (CET1) capital. |

| · | 13 February 2025: BMPS announces that it has filed with CONSOB the offer document relating to the Offer, pursuant to Article 102, paragraph 3, of the TUF and Article 37-ter of the Issuers’ Regulation. |

| · | 10 February 2025: BMPS, in line with the funding plan and having received authorization from the Single Resolution Board, announces the exercise, on 2 March 2025, of the option to repay in full and in advance the senior bond named “€750,000,000 Fixed to Floating Rate Callable Senior Notes due 2 March 2026” and having ISIN code XS2593107258. |

| · | 24 January 2025: BMPS, pursuant to Article 102, paragraph 1 of the TUF and Article 37 of the Issuers’ Regulation, announces that it decided, on 23 January 2025, to launch a voluntary public exchange offer pursuant to and for the purposes of Articles 102 and 106, paragraph 4, of the TUF, with respect to all of the ordinary shares of Mediobanca. |

| · | 3 January 2025: BMPS, in line with the funding plan and having received authorization from the European Central Bank, announces the exercise, on 22 January 2025, of the option to early redeem the Tier 2 subordinated bond named “€400,000,000 8.000 per cent. Reset Callable Subordinated Notes” with ISIN code XS2106849727. |

| · | 20 November 2024: BMPS announces that it has successfully completed the placement of a new Senior Preferred Unsecured bond issuance with a 6-year maturity (due 2030) and an early redemption option after 5 years, for an amount of Euro 750 million. The transaction collected orders of up to Euro 2.4 billion, allowing the coupon to be set at 3.625%. |

| · | 9 July 2024: BMPS announces the successful placement of a 6-year Social Conditional Pass Through European Covered Bond issuance with Italian and foreign institutional investors for an amount of Euro 750 million. Orders exceeding Euro 1.2 billion were collected, allowing the coupon to be set at 3.3750%. |

Press releases relating to corporate financial events

| · | 27 May 2025: the Offeror announces that Moody’s Ratings has upgraded the Bank’s ratings, raising the long-term rating on senior unsecured debt to “Ba1” (from “Ba2”) and the long-term rating on deposits to “Baa2” (from “Baa3”). The Baseline Credit Assessment (“BCA”) has also been upgraded to “ba1” (from “ba2”). The outlook for BMPS’ long-term deposits and senior unsecured debt has been confirmed as “positive”. |

| · | 9 May 2025: the Offeror announces that the Board of Directors has approved the results as of 31 March |

22

2025.

| · | 3 April 2025: the Offeror announces that the rating agency DBRS Ratings GmbH has upgraded the Long-Term Issuer rating, the Long-Term Senior Debt rating and the standalone Intrinsic Assessment rating to investment grade at “BBB (low)” and, at the same time, the Long-Term Deposit rating has been upgraded to “BBB”. The outlook has been confirmed as “positive”. |

| · | 6 March 2025: Offeror’s Board of Directors announces that it has approved the draft financial statements of the Bank and the consolidated financial statements of the BMPS Group as of 31 December 2024, confirming the preliminary results already approved by the Board and announced to the market on 6 February 2025. The Board of Directors also resolved to propose to the next Shareholders’ Meeting the distribution of a cash dividend per share equal to Euro 0.86, gross of withholding taxes required by law, for a total amount equal to approximately Euro 1,083 million. |

| · | 6 February 2025: The Board of Directors of the Offeror announces that it has reviewed and approved the preliminary consolidated results as of 31 December 2024. The year ended with a net profit of Euro 1,951 million and gross operating profit of Euro 2,165 million (+10.8% y/y), with revenues of Euro 4,034 million, up 6.2% y/y, and operating expenses of Euro 1,869 million (+1.4% y/y). |

| · | 31 January 2025: BMPS announces that Moody’s Ratings has upgraded its long-term outlook on the Bank’s deposit and senior unsecured debt ratings from stable to positive, confirming all of the Bank’s ratings. The agency’s decision follows BMPS’ announcement of the Offer. |

| · | 11 December 2024: BMPS announces that it has received notification of the European Central Bank’s final decision regarding the capital requirements to be met on a consolidated basis from 1 January 2025, following the conclusion of the annual review and prudential assessment process conducted in 2024. The additional capital requirement “P2R” improved by 25 bps compared to 2024 levels (2.75%), standing at 2.50%. The minimum total Common Equity Tier 1 ratio stands at 8.78%. The Pillar II Capital Guidance “P2G”, set at 1.15%, is unchanged from 2024 levels. Compared to the final 2023 decision, the European Central Bank has removed the requirement for prior authorization for the distribution of dividends. |

| · | 8 November 2024: the Board of Directors of BMPS reviewed and approved the consolidated results as of 30 September 2024. The first nine months of the year ended with a net profit of Euro 1,566 million (+68.6% y/y); the nine-month gross operating profit amounted to Euro 1,645 million (+13.7% y/y), with total revenues equal to Euro 3,037 million (+8.3% y/y) and operating expenses equal to Euro 1,392 million (+2.5% y/y). |

| · | 25 October 2024: Fitch Ratings upgraded the Bank’s ratings by one notch, raising the Long-Term Issuer Default Rating to “BB+” from “BB” and the Viability Rating to “bb+” from “bb”. Outlook improved from “stable” to “positive”. |

| · | 6 August 2024: The Board of Directors of BMPS reviewed and approved the consolidated results as of 30 June 2024. The first six months of the year closed with a net profit of Euro 1,159 million (+87.3% y/y), including a positive net tax effect of Euro 457 million. EBITDA for the half-year amounted to Euro 1,106 million, with total revenues of Euro 2,031 million (+9.7% y/y) and operating expenses of Euro 925 million (+1.2% y/y). At the same meeting, the Board of Directors approved the 2024-2028 Business Plan, with an update of the financial targets, following the achievement of the main objectives of the previous 2022-2026 Plan, and the strategic guidelines to strengthen the positioning of “Clear and Simple Commercial Bank” through a digital-driven transformation and increasing specialization of the service model for households and businesses. |

Press releases relating to the governance of the Offeror

| · | 17 April 2025: the Offeror announces that the shareholders’ meeting, both in ordinary and |

23

| extraordinary session, has (i) approved BMPS’ financial statements for the year ended 31 December 2024; (ii) approved the distribution of a dividend of Euro 0.86 per share; (iii) confirmed the appointment of the directors co-opted on 25 December 2024; (iv) approved the granting of the Delegation to the Board of Directors pursuant to Article 2443 of the Italian Civil Code to proceed with the Capital Increase Reserved to the Offer. |

| · | 18 March 2025: the Board of Directors of the Offeror announces the convening of BMPS shareholders’ meeting, both in ordinary and extraordinary session, for 17 April 2025, at 10:00 a.m., on single call. |

| · | 6 February 2025: the Board of Directors of BMPS, following the reinstatement of the relevant members through the co-opting of five new directors, resolved on the new composition of the Board Committees and appointed the relevant members. |

| · | 24 January 2025: the Board of Directors of BMPS, as the competent body pursuant to Ministerial Decree No. 169/2020, verified, with regard to each director appointed by co-optation on 27 December 2024, that they meet the requirements and comply with the eligibility criteria set forth in current legislation and the By-laws. The Board of Directors continues to be composed primarily of independent directors. |

| · | 27 December 2024: the Board of Directors of BMPS, with a unanimous vote and the approval of the Board of Statutory Auditors, pursuant to Article 2386 of the Italian Civil Code, appointed by co-optation Alessandro Caltagirone (non-independent), Elena De Simone (non-independent), Marcella Panucci (independent), Francesca Renzulli (independent) and Barbara Tadolini (independent), following the resignation of five directors indicated in the list submitted by the Italian Ministry of Economy and Finance on 27 March 2023. The new directors will remain in office until the next Shareholders’ Meeting. |

| · | 18 December 2024: BMPS announces that, on 17 December 2024, five independent directors who had been appointed by the Italian Ministry of Economy and Finance in the list submitted on 27 March 2023 resigned from office, namely: Paolo Fabris De Fabris, Lucia Foti Belligambi, Laura Martiniello, Annapaola Negri-Clementi and Donatella Visconti. The Board of Directors will promptly integrate the composition of the management body, in accordance with the relevant regulatory provisions. |

| · | 12 December 2024: upon request of the independent directors, the Board of Directors of BMPS unanimously appointed – with the abstention of the interested person – the Independent Director Mrs. Paola De Martini, as Lead Independent Director of BMPS. She will remain in office until the expiry of the current Board of Directors of BMPS, and therefore until the Shareholders’ Meeting called to approve the financial statements for the year ending 31 December 2025. |

| 2.2 | Information on the Issuer |

| 2.2.1 | General information |

| 2.2.1.1 | Legal and commercial name |

The Issuer is named Mediobanca – Banca di Credito Finanziario Società per Azioni.

| 2.2.1.2 | Additional information |

Mediobanca is incorporated as a joint-stock company (società per azioni), is registered with the Companies’ Register of Milan under number 00714490158 and operates under the laws of the Republic of Italy. Its legal entity identifier (LEI) is: PSNL19R2RXX5U3QWHI44.

24

Mediobanca’s registered office is in Piazzetta Enrico Cuccia 1, 20121 Milan, phone No. (+39) 02-88291.

It should be noted that, as of the Exemption Document Date, the Mediobanca Shares are admitted to trading on Euronext Milan.

Mediobanca’s website is www.mediobanca.com/en.

| 2.2.1.3 | Names of the auditors for the period covered by the financial statements and the name of the professional body which they are members of |

The independent auditor responsible for auditing Mediobanca’s financial statements is EY S.p.A., with registered office in via Meravigli 12, Milan, registered with the Register of Statutory Auditors pursuant to Articles 6, et seq., of Legislative Decree No. 39 of 2010, as amended by Legislative Decree No. 135 of 2016, with registration number 70945.

| 2.2.2 | Business overview |

| 2.2.2.1 | Principal activities, including the main categories of products sold and/or services performed in the last financial year |

The information relating to Mediobanca’s principal activities included in the Exemption Document has been extracted from public information made available by Mediobanca, including that provided in Mediobanca 2023/2024 Consolidated Financial Statements, Mediobanca 2024/2025 Half-Year Financial Report and Mediobanca 2024/2025 Nine-Month Press Release, as published on the Issuer’s website at https://www.mediobanca.com/en/investor-relations/results-and-financial-statements/results.html. The Offeror cannot provide any guarantee as to the accuracy of such information, for which Mediobanca is solely responsible and which has not been verified or reviewed by the Offeror.

The Issuer is authorized by the Bank of Italy to carry out the banking business in accordance with Italian law.

Pursuant to Article 3 of its By-laws, Mediobanca’s corporate purpose consists of the collection of savings and the granting credit in all its forms, with particular reference to medium/long-term loans to businesses.

In compliance with current regulations, Mediobanca may carry out banking, financial and intermediation transactions and provide banking, financial and intermediation services, as well as any other activity instrumental or connected with the pursuit of its corporate purpose.

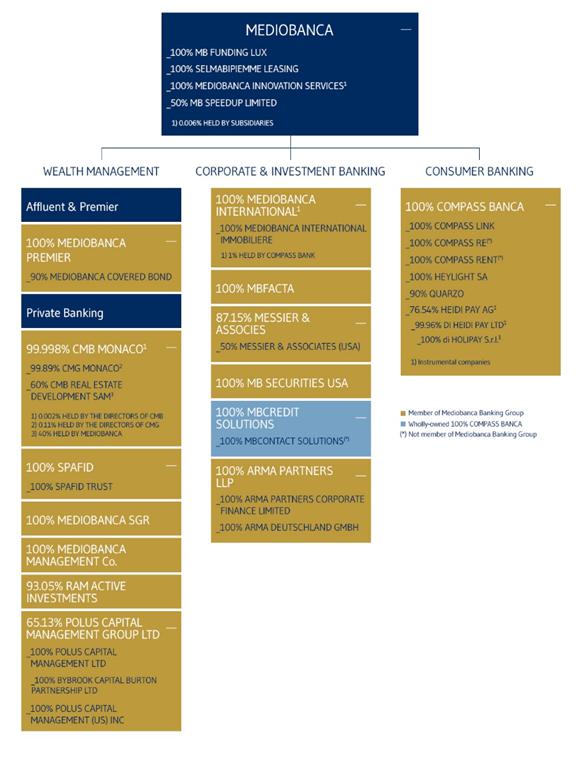

Mediobanca’s main activities are divided into the following segments:

| · | Wealth Management (WM): which includes asset management activities for various categories of customers and asset management, as described on page 198 of Mediobanca 2024/2025 Half-Year Financial Report; |

| · | Corporate & Investment Banking (CIB): includes services for corporate customers in the areas of Wholesale Banking (lending, Capital Market activities, Advisory, Trading on behalf of customers and proprietary trading, as described on page 198 of Mediobanca 2024/2025 Half-Year Financial Report); |

| · | Consumer Finance (CF): includes a range of consumer credit products as described on page 198 of Mediobanca 2024/2025 Half-Year Financial Report; |

| · | Insurance – Principal Investing (PI): includes the Group’s portfolio of equity investments and shares as described on page 198 of Mediobanca 2024/2025 Half-Year Financial Report; and |

| · | Holding Functions: include all activities described on page 199 of the Mediobanca 2024/2025 Half-Year Financial Report. |

25

The Issuer is the parent bank of the Mediobanca Group and, as such, in addition to the banking business, it performs, pursuant to Article 61, paragraph 1, of the TUB, the functions of management and coordination as well as unified control over the banking, financial and instrumental subsidiaries that are part of the Mediobanca Group.

Within the scope of its management and coordination powers, the Issuer provides instructions to the members of the Mediobanca Group, including for the implementation of instructions issued by the supervisory authorities and in the interests of the stability of the Mediobanca Group itself.

The Issuer also exercises management and coordination activities pursuant to Articles 2497, et seq., of the Italian Civil Code with respect to Italian companies belonging to the Mediobanca Group and directly or indirectly controlled by the Issuer.

The table below lists the companies directly or indirectly controlled by or affiliated with the Issuer and included in the Mediobanca Group’s scope of consolidation, taken from the Mediobanca 2024/2025 Half-Year Financial Report, indicating their names and registered offices.

| Denomination | Registered Office | |

| Spafid S.p.A. | Foro Buonaparte, 10 20121, Milan, Italy | |

| Mediobanca Innovation Services – S.c.p.A. | Via Siusi, 7 20132, Milan, Italy | |

| CMB Monaco S.A.M. | 17 Avenue des Spélugues, 98000 Monaco | |

| CMG Monaco S.A.M. | 17 Avenue des Spélugues, 98000 Monaco | |

| Mediobanca International (Luxembourg) S.A. | 4, Boulevard Joseph II, L – 1840, Luxembourg, Grand Duchy of Luxembourg | |

| Compass Banca S.p.A. | Via Caldera, 21 20153, Milan, Italy | |

| Mediobanca Premier S.p.A. | Viale Luigi Bodio, 37 20158, Milan, Italy | |

| MBCredit Solutions S.p.A. | Via Caldera, 21 20153, Milan, Italy | |

| Selmabipiemme Leasing S.p.A. | Via Siusi, 7 20132, Milan, Italy | |

| MB Funding Luxembourg S.A. | 28, Boulevard F. W. Raiffeisen, L – 2411, Luxembourg, Grand Duchy of Luxembourg | |

| Mediobanca Securities USA L.L.C. | National Registered Agents, Inc., 1209 Orange Street, Wilmington, DE 19801 | |

| Mb Facta S.p.A. | Via Siusi, 7 20132, Milan, Italy | |

| Quarzo S.r.l. | Via Filippo Turati, 29 20121, Milan, Italy | |

| Mediobanca Covered Bond S.r.l. | Via Filippo Turati, 29 20121, Milan, Italy | |

| Compass Re (Luxembourg) S.A. | 4, Boulevard Joseph II, L – 1840, Luxembourg, Grand Duchy of Luxembourg | |

| Mediobanca International Immobiliere S. A R.L. | 4, boulevard Joseph II, L – 1840, Luxembourg, Grand Duchy of Luxembourg | |

| Polus Capital Management Group Limited | Asticus Building, 21 Palmer Street, London, United Kingdom, SW1H 0AD | |

| Polus Capital Management Limited | Asticus Building, 21 Palmer Street, London, United |

26

| Kingdom, SW1H 0AD | ||

| Polus Capital Management (US) Inc. | The Corporation Trust Company, Corporation Trust Center 1209 Orange St., Wilmington, DE 19801 | |

| Polus Capital Management Investments Limited | Asticus Building, 21 Palmer Street, London, United Kingdom, SW1H 0AD | |

| Polus Investment Managers Limited | Asticus Building, 21 Palmer Street, London, United Kingdom, SW1H 0AD | |

| Bybrook Capital Burton Partnership (GP) Limited | South Church Street, Ugland House, P. O. Box 309, C/O Maples Corporate Services Limited, South Church Street, George Town, Grand Cayman Ky1-1104, Cayman Islands | |

| Spafid Trust S.r.l. | Foro Buonaparte, 10 20121, Milan, Italy | |

| Mediobanca Management Company S.A. | 2, Boulevard de la Foire, L – 1528, Luxembourg, Grand Duchy of Luxembourg | |

| Mediobanca Sgr S.p.A. | Foro Buonaparte, 10 20121, Milan, Italy | |

| RAM Active Investments S.A. | Rue du Rhône 8, 1204 Geneve, Switzerland | |

| Messier et Associes S.A.S. | 23 Avenue D’Iéna – 75116 Paris, France | |

| Messier et Associes L.L.C. | 1450 Broadway Avenue, 38th Floor, New-York, NY 10018, USA | |