Exhibit 11(a)

Excerpts from MUFG’s Compliance Policy

(English Translation)

(Objective)

Article 1.

The purpose of this policy is to stipulate the fundamental matters related to the compliance framework.

(Amendment and Abolishment)

Article 2.

The amendments and abolishment of this policy shall be determined by the Executive Committee. However, significant amendments related to the responsibilities of the Board of Directors or Member of the Board of Directors as stipulated in this policy require decision of the Board of Directors..

(Definition)

Article 4.

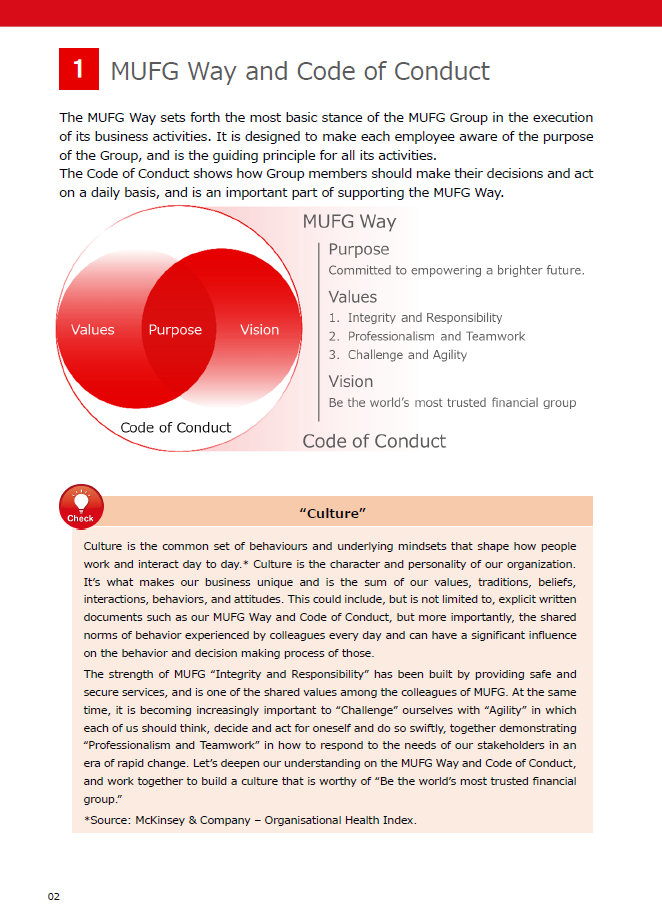

(1)In this policy, “laws and regulations” refers to laws and government ordinances that must be complied in business operations, as well as MUFG’s Articles of Incorporation, Code of Conduct, and other rules, policies and procedures established according to the laws and government ordinances above.

(2)In this policy, "compliance" means understanding the intent and content of laws and regulations correctly and acting appropriately to avoid violating any of them.

(3)In this policy, “affiliates” is a general term for MUFG’s consolidated subsidiaries and affiliated companies accounted for by the equity-method.

(4)In this policy, “MUFG Group” means MUFG and its affiliates.

(Basic Policy and Complianse Standerds)

Article 5.

The "Code of Conduct" shall serve as the basic policy and compliance standards for MUFG.

(Responsibilities of Members of the Board of Directors, Corporate Executives (Shikko Yaku), Executive officers (Shikko Yakuin) and Board of Directors)

Article 6.

(1)Members of the Board of Directors, corporate executives (shikko yaku) and executive officers (shikko yakuin) must execute their duties with the recognition that Compliance is one of the most important management issues, based on the Code of Conduct.

(2)The Board of Directors must establish the necessary framework for compliance and strive to achieve and ensure compliance.

(Responsibility of MUFG Managing Directors)

Article 7.

Managing Directors must implement compliance within their division.

(Responsibility of MUFG Employees)

Article 8.

(1)MUFG employees must ensure compliance while performing their duties, and act in accordance with the “Ethical Framework and Code of Conduct”.

(2)MUFG employees must strive to acquire adequate knowledge of the laws and regulations which are necessary to their business operations.

(Directors in charge of the Global Compliance Division and the Global Financial Crimes Division)

Article 10.

(1)The Directors in charge of the Global Compliance Division and the Global Financial Crimes Division must report matters concerning compliance to the Board of Directors or Executive Committee as necessary.

(2)When there is a risk of an unavoidable conflict of interest with a different division that the director in charge of the Global Compliance Division is also in charge of, to insure the independence of the Global Compliance Division, the managing director of the Global Compliance Division shall report to the President and CEO. The President and CEO will report to the Board of Directors or Executive Committee as necessary. Appropriate action shall also be taken to avoid conflicts of interest in cases other than those mentioned above.

(Division in Charge of Compliance)

Article 11.

(1)The Global Compliance Division is in charge of overseeing the overall compliance framework.

* * *

(4)When the Global Compliance Division receives reports of problems or possible problems relating to compliance, or when it discovers such problems itself, it must take necessary actions.

Article 11. ii

The Global Financial Crimes Division is in charge of overseeing the Group’s measures and management systems concerning global financial crimes, including money laundering prevention, economic sanctions measures, and bribery and corruption prevention.

(Person in Change of Complianse Matters)

Article 12.

The head of each business group overseeing compliance in each business group shall be the person in charge of compliance matters of the business group. The person in charge of compliance matters of the business group oversees their business group and is responsible for any compliance related planning and supervision within their jurisdiction.

(Group Chief Compliance Officer)

Article 13.

(1)A Group Chief Compliance Officer (CCO) (primarily the responsibility of the Global Compliance Division and the Global Financial Crimes Division) will be appointed based on Article 19 Paragraph 2 of the Organizational Regulations. When there is no appointed Group CCO, the director overseeing the Global Compliance Division will act as CCO.

(2)The Group CCO (or in cases where there is no Group CCO, the CCO) shall oversee the coordination of division compliance officers (defined in Article 14), the chief compliance officer of each company in the MUFG Group, and any persons filling both those roles, as well as provide necessary guidance, advice and instruction based on the management agreement.

(3)The Group CCO (or in cases where there is no Group CCO, the CCO) can request reports on compliance matters from the specified compliance officers responsible (defined in Article 12).

* * *

(Compliance Officers)

Article 14.

(1)A chief manager in each division shall be appointed as compliance officer. Each managing director may appoint a person equivalent to a chief manager as division compliance officer. In such cases, the managing director should report to the Global Compliance Division in the Corporate Center, the compliance officer responsible for each business group (defined in Article 12), or the Global Compliance Division.

(2)The division compliance officer is responsible for the strengthening of compliance in each division and for planning and supervising compliance related issues regarding business matters under their jurisdiction. Furthermore, the compliance officer

will carry out duties including the management and compliance checking of documents, gathering information concerning the establishment and revision of laws relating to the duties of each division, working to improve general compliance conditions, and will play a central role in implementing compliance measures in each division.

(Responsibilities of Managing Directors)

Article 15.

When the managing director receives reports of problems or possible problems relating to compliance from the division compliance officer, or when they discover such problems themselves, they must consult with the managing director of the Global Compliance Division as well as provide orders and instructions to the division compliance officer. Furthermore, in each business group, they must report to the compliance officer responsible.

(Compliance Reporting System)

Article 16.

(1)Employees and staff must report to their supervisors and the Compliance Officers stipulated in Article 14 if they discover compliance issues or potential issues.

(2)Those who receive reports must respond sincerely to resolve the issues. Additionally, they must strive to handle the information about the reporter strictly.

(3)When the compliance officers receive reports of or otherwise detect violations of laws and regulations, or possible violations, they must report directly to the Global Compliance Division or the Global Financial Crimes Division and the managing director of their division. In cases where the managing director is involved in inappropriate conduct or behavior (including cases where such involvement is suspected or where a determination as to such involvement is difficult to make), such reports must be made to the Global Compliance Division or the Global Financial Crimes Division.

(4)When a MUFG employee does not wish to report to their senior managers and the division compliance officer due to said officer being complicit in a violation of laws and regulations or the possibility thereof, or when no response or remediation is made despite an employee having made a report, the employee can report directly to the Global Compliance Division. In each business group, reports can be made to necessary parties other than those mentioned above, based on the instructions of the compliance officer responsible (defined in Article 12).

(5)When a report of a problem or possible problem relating to compliance are made, it shall be prohibited to take any action to seek or identify the person who made the report or take any adverse employment action against such person for making the report.

Excerpts from MUFG’s Compliance Manual

(English Translation)

III.Specific issues

(5)Conflicts of interest

When a conflict of interest arises in connection with an operation involving any of the MUFG Group companies, Directors or employees, on one hand, and a customer or other third-party, the Director or employee, the MUFG Group company to which such Director or employee belongs, or any other MUFG Group company, on the other, the MUFG Group company, Director or employee must perform the operation in a proper manner.

Excerpts from MUFG’s Regulations for Corporate Executives

(English Translation)

(Prohibition of Conflict of Interest Transactions)

Article 23.

When Corporate Executives intends to engage in a transaction with the corporation for their own benefit or for the benefit of a third party, they must disclose the material facts concerning such transaction to the Board of Directors and obtain its approval.

Excerpts from MUFG’s Rules of Employment

(English Translation)

(Disciplinary Action)

Article 49.

The company will take disciplinary action when employees take the following prohibited actions:

(17)If an employee violated the rules of employment or any other applicable internal rules.