|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Class

|

$92

|

0.92%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

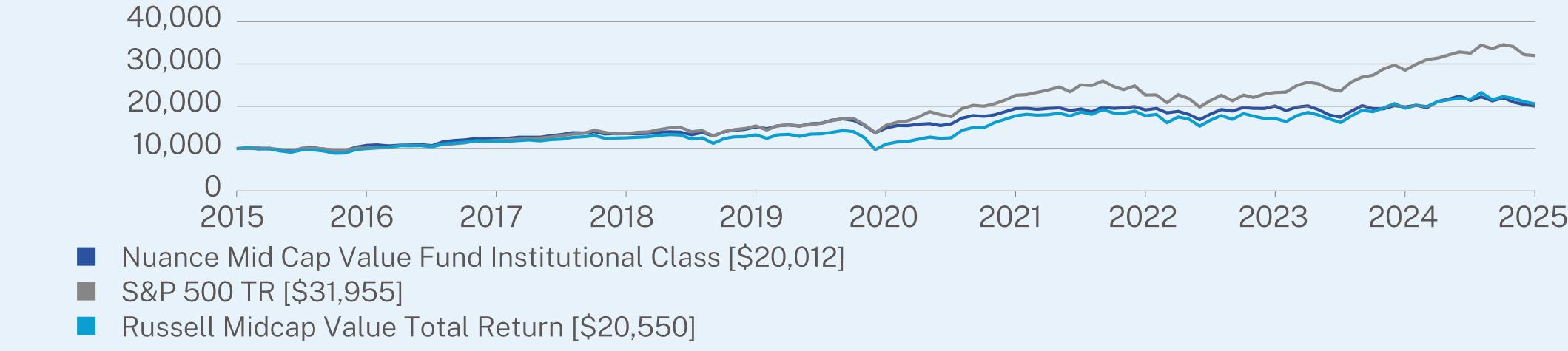

Institutional Class (without sales charge)

|

1.01

|

6.16

|

7.18

|

|

S&P 500 TR

|

12.10

|

15.61

|

12.32

|

|

Russell Midcap Value Total Return

|

5.24

|

13.24

|

7.47

|

|

Net Assets

|

$540,286,596

|

|

Number of Holdings

|

57

|

|

Net Advisory Fee

|

$11,258,109

|

|

Portfolio Turnover

|

74%

|

|

Top Holdings

|

(%)

|

|

Estee Lauder Companies, Inc.

|

7.0%

|

|

Henkel AG & Co. KGaA

|

6.0%

|

|

Qiagen NV

|

5.6%

|

|

California Water Service Group

|

4.5%

|

|

Globe Life, Inc.

|

4.0%

|

|

Hologic, Inc.

|

4.0%

|

|

Marten Transport Ltd.

|

4.0%

|

|

Werner Enterprises, Inc.

|

3.6%

|

|

Northern Trust Corp.

|

3.5%

|

|

Solventum Corp.

|

3.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Class

|

$118

|

1.18%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

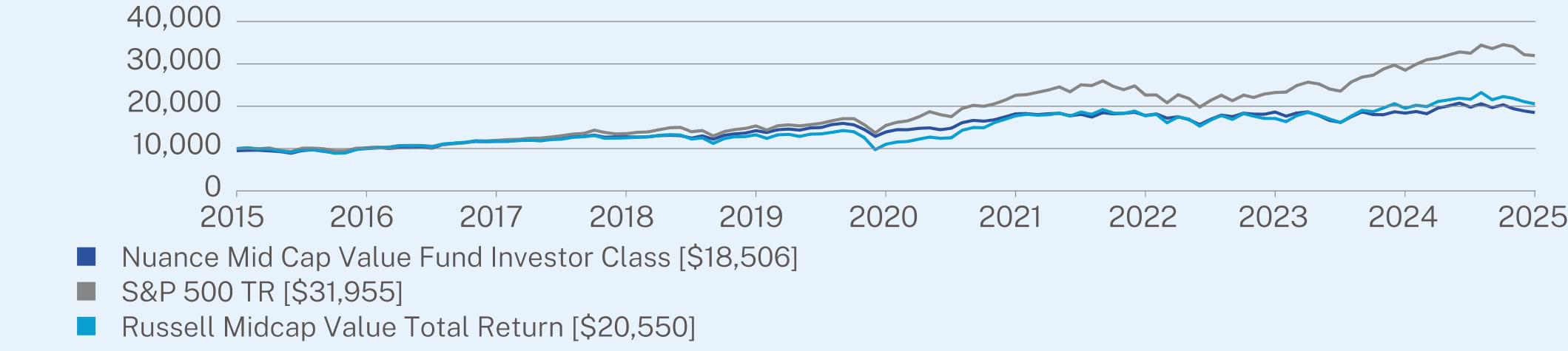

Investor Class (without sales charge)

|

0.76

|

5.86

|

6.90

|

|

Investor Class (with sales charge)

|

-4.28

|

4.78

|

6.35

|

|

S&P 500 TR

|

12.10

|

15.61

|

12.32

|

|

Russell Midcap Value Total Return

|

5.24

|

13.24

|

7.47

|

|

Net Assets

|

$540,286,596

|

|

Number of Holdings

|

57

|

|

Net Advisory Fee

|

$11,258,109

|

|

Portfolio Turnover

|

74%

|

|

Top Holdings

|

(%)

|

|

Estee Lauder Companies, Inc.

|

7.0%

|

|

Henkel AG & Co. KGaA

|

6.0%

|

|

Qiagen NV

|

5.6%

|

|

California Water Service Group

|

4.5%

|

|

Globe Life, Inc.

|

4.0%

|

|

Hologic, Inc.

|

4.0%

|

|

Marten Transport Ltd.

|

4.0%

|

|

Werner Enterprises, Inc.

|

3.6%

|

|

Northern Trust Corp.

|

3.5%

|

|

Solventum Corp.

|

3.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

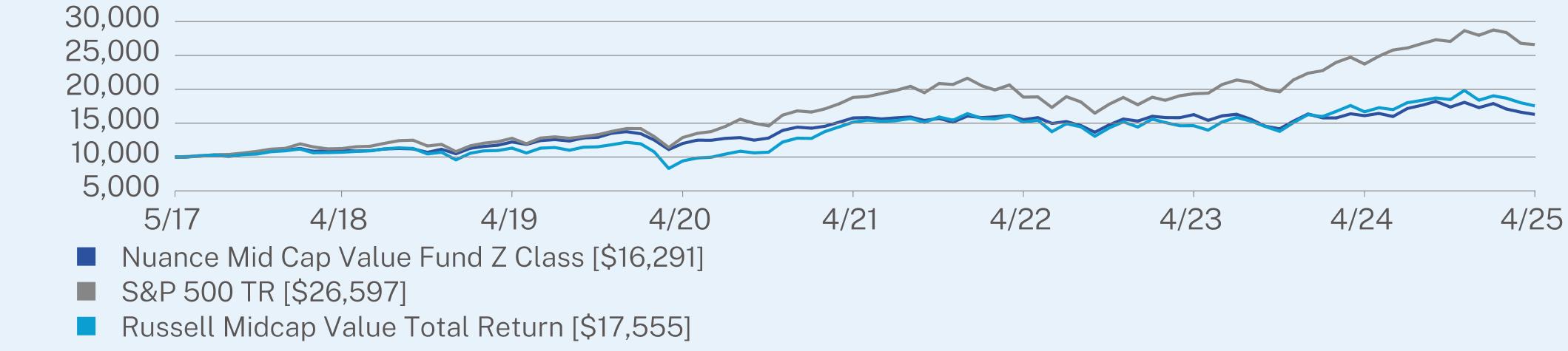

Z Class

|

$78

|

0.78%

|

|

|

1 Year

|

5 Year

|

Since Inception

(05/08/2017) |

|

Z Class (without sales charge)

|

1.17

|

6.30

|

6.31

|

|

S&P 500 TR

|

12.10

|

15.61

|

13.04

|

|

Russell Midcap Value Total Return

|

5.24

|

13.24

|

7.31

|

|

Net Assets

|

$540,286,596

|

|

Number of Holdings

|

57

|

|

Net Advisory Fee

|

$11,258,109

|

|

Portfolio Turnover

|

74%

|

|

Top Holdings

|

(%)

|

|

Estee Lauder Companies, Inc.

|

7.0%

|

|

Henkel AG & Co. KGaA

|

6.0%

|

|

Qiagen NV

|

5.6%

|

|

California Water Service Group

|

4.5%

|

|

Globe Life, Inc.

|

4.0%

|

|

Hologic, Inc.

|

4.0%

|

|

Marten Transport Ltd.

|

4.0%

|

|

Werner Enterprises, Inc.

|

3.6%

|

|

Northern Trust Corp.

|

3.5%

|

|

Solventum Corp.

|

3.5%

|