Shareholder Report

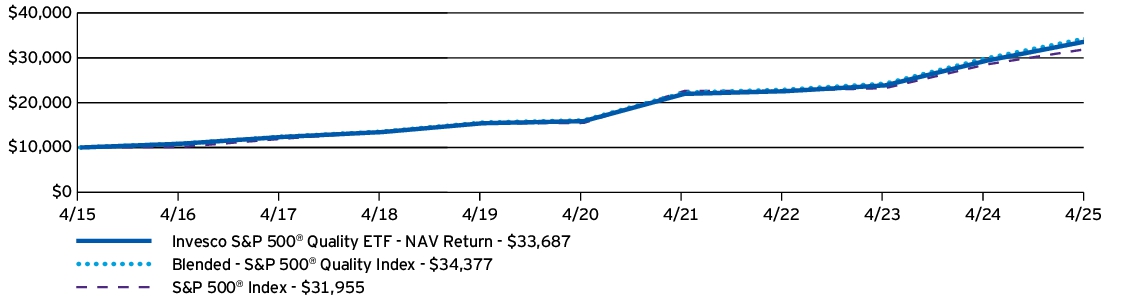

|

12 Months Ended |

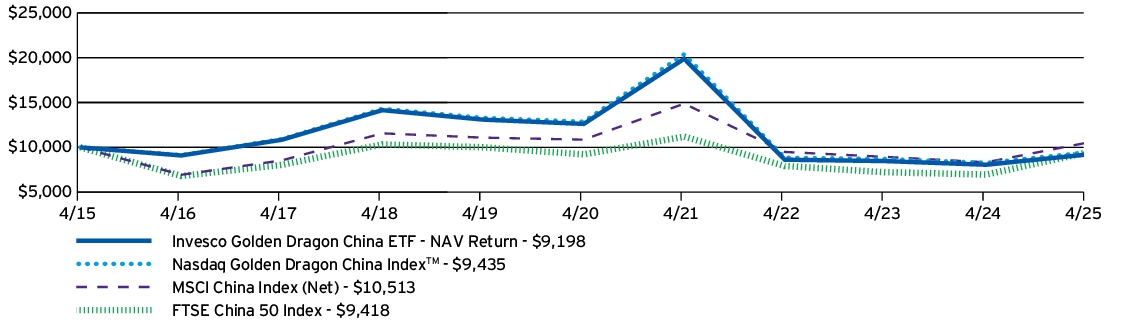

|

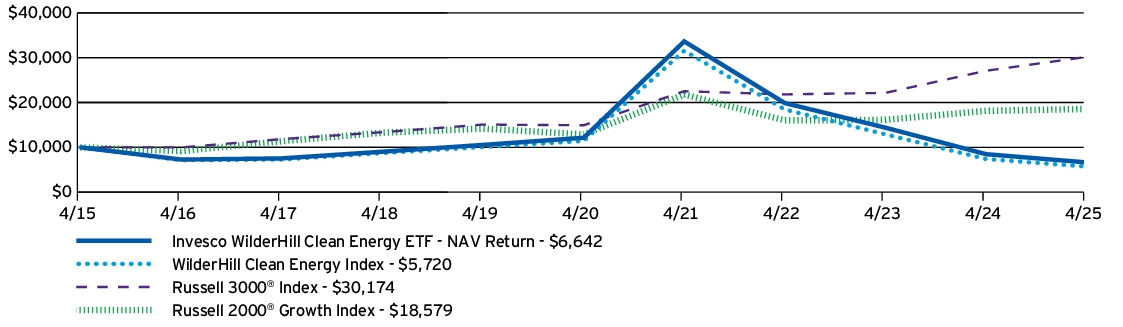

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Invesco Exchange-Traded Fund Trust

|

|

| Entity Central Index Key |

0001209466

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| C000008290 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Bloomberg MVP Multi-factor ETF

|

|

| Class Name |

Invesco Bloomberg MVP Multi-factor ETF

|

|

| Trading Symbol |

BMVP

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Bloomberg MVP Multi-factor ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Bloomberg MVP Multi-factor ETF |

$31 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 31

|

|

| Expense Ratio, Percent |

0.29%

|

|

| Factors Affecting Performance [Text Block] |

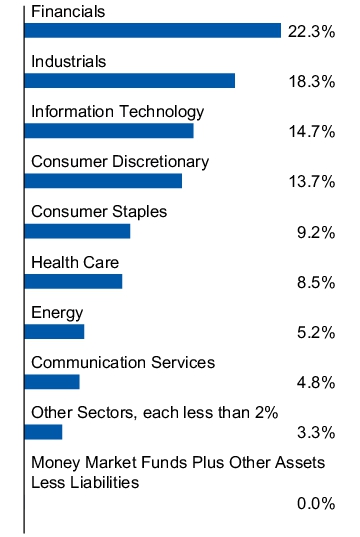

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities began the period with strong performance but experienced a more challenging environment near the end of the period due to uncertainty regarding global trade and tariff policy. The Fund's multi-factor security selection and equal weighting methodology led it to be underweight mega-capitalization information technology and communication services securities, creating a performance headwind relative to the S&P 500® Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Bloomberg MVP Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 10.44%, differed from the return of the Index, 10.79%, primarily due to fees and expenses incurred by the Fund during the period. What contributed to performance?

Sector Allocations | Financials sector, followed by the utilities and real estate sectors, respectively. Positions | Targa Resources Corp., an energy company (no longer held at fiscal year-end), and Entergy Corp., a utilities company (no longer held at fiscal year-end). What detracted from performance?

Sector Allocations | Materials sector. Positions | Elevance Health, Inc., a health care company (no longer held at fiscal year-end), and Raymond James Financial, Inc., a financials company (no longer held at fiscal year-end).

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

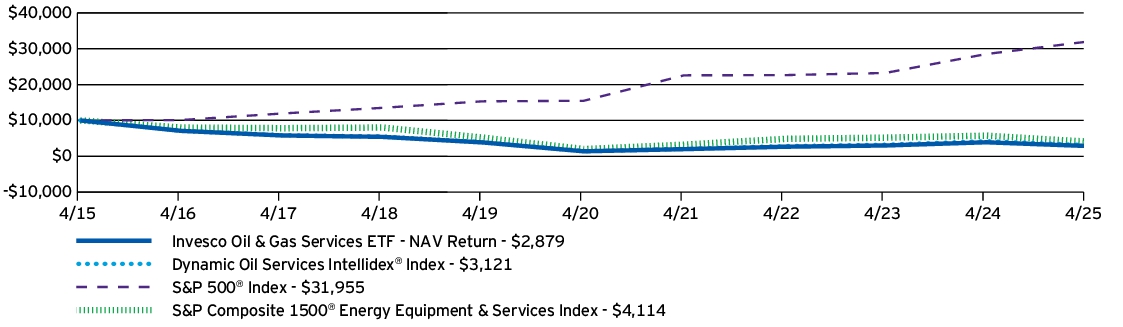

| Line Graph [Table Text Block] |

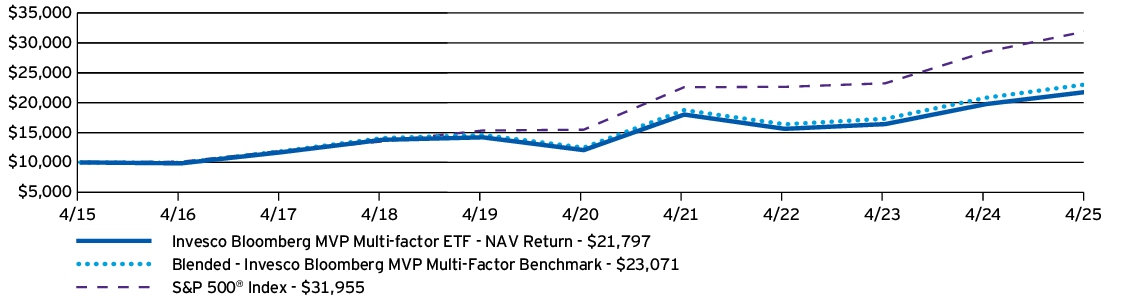

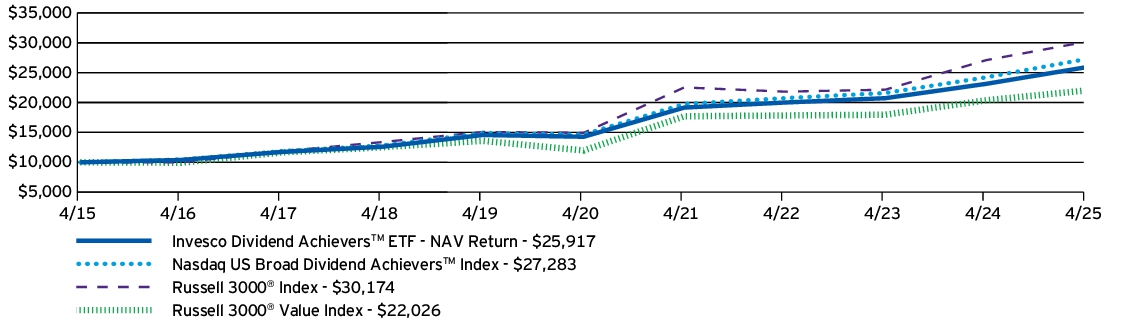

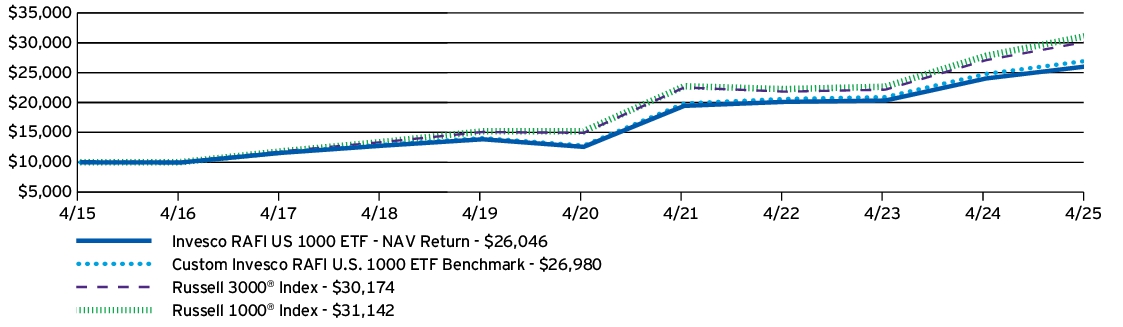

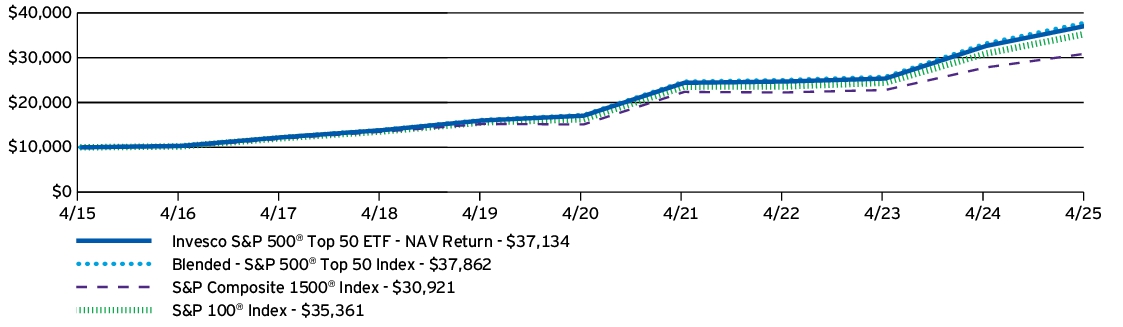

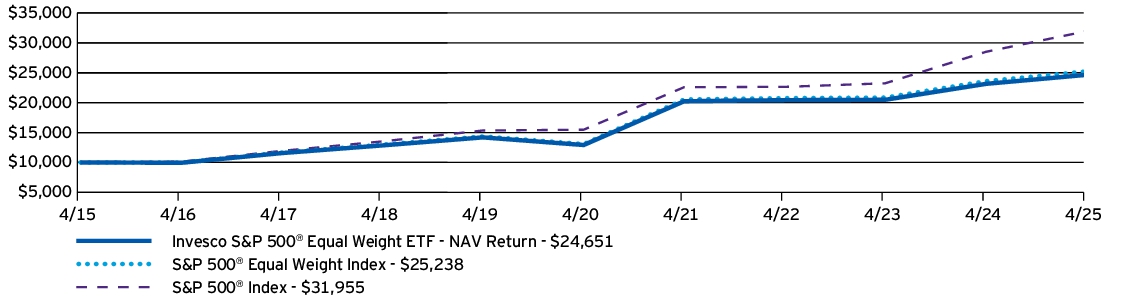

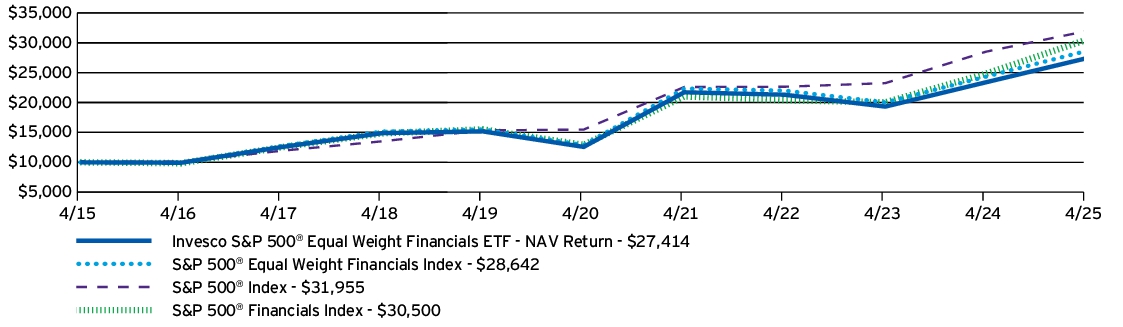

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Bloomberg MVP Multi-factor ETF — NAV Return |

10.44% |

12.60% |

8.10% |

| Blended - Invesco Bloomberg MVP Multi-Factor Benchmark |

10.79% |

13.09% |

8.72% |

| S&P 500® Index |

12.10% |

15.61% |

12.32% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg MVP Index to the S&P 500® Index to reflect that the S&P 500® Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Material Change Date |

Aug. 28, 2023

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

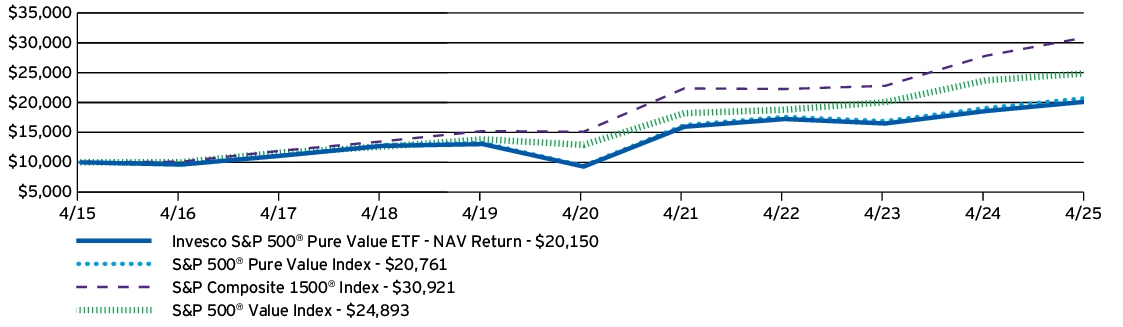

| Net Assets |

$ 109,074,816

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 301,388

|

|

| Investment Company Portfolio Turnover |

154.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$109,074,816 |

| Total number of portfolio holdings |

58 |

| Total advisory fees paid |

$301,388 |

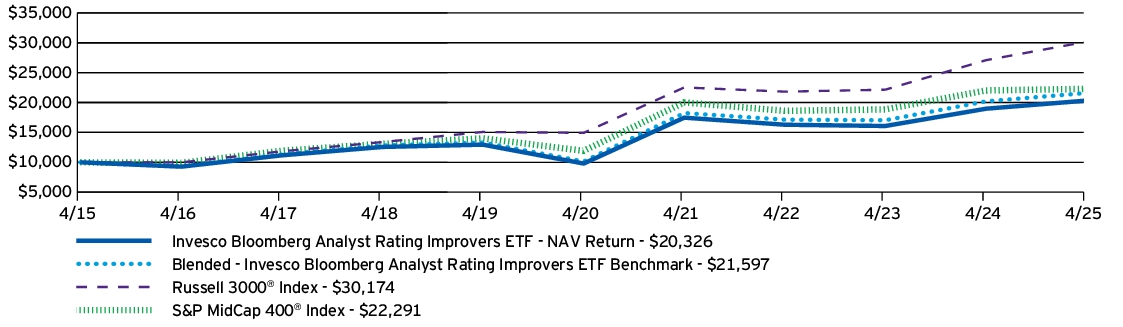

| Portfolio turnover rate |

154% |

|

|

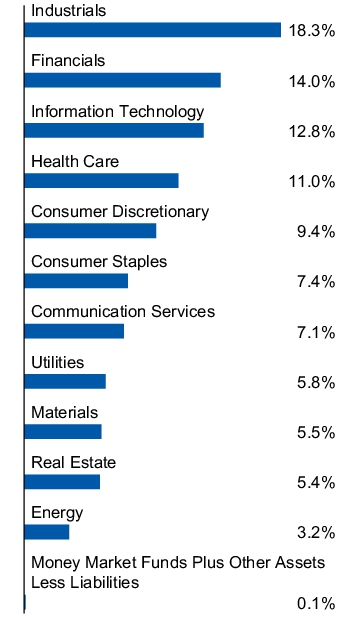

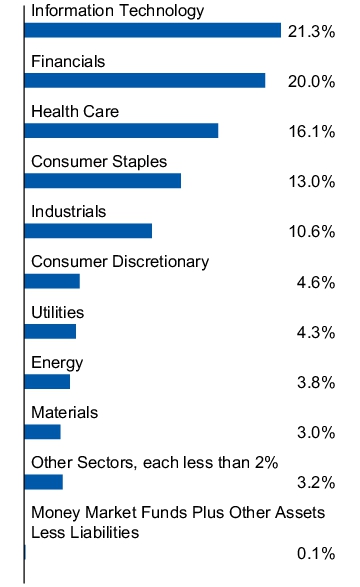

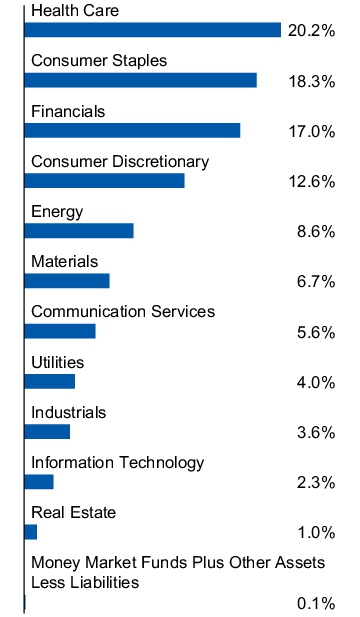

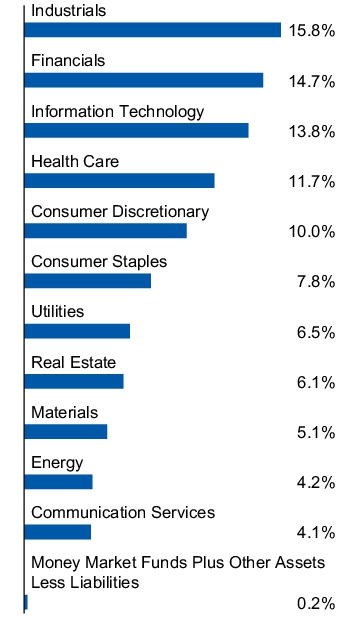

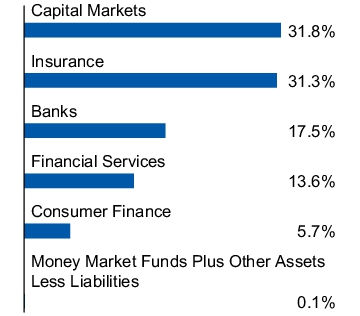

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| Vistra Corp. |

2.08% |

| Kroger Co. (The) |

2.01% |

| TJX Cos., Inc. (The) |

1.99% |

| Quest Diagnostics, Inc. |

1.98% |

| Cencora, Inc. |

1.98% |

| Republic Services, Inc. |

1.95% |

| Cardinal Health, Inc. |

1.93% |

| Waste Management, Inc. |

1.90% |

| Motorola Solutions, Inc. |

1.89% |

| Kellanova |

1.89% |

| * Excluding money market fund holdings, if any. |

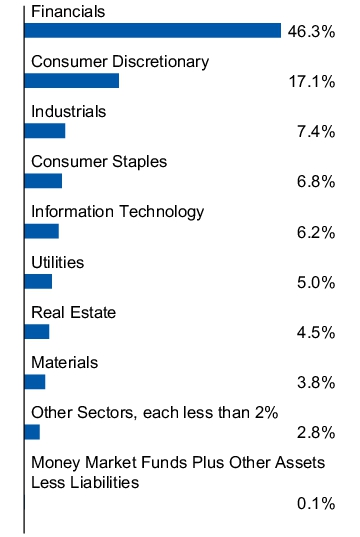

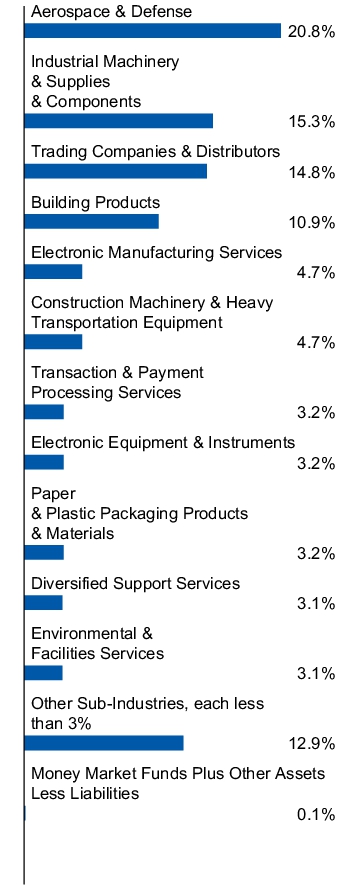

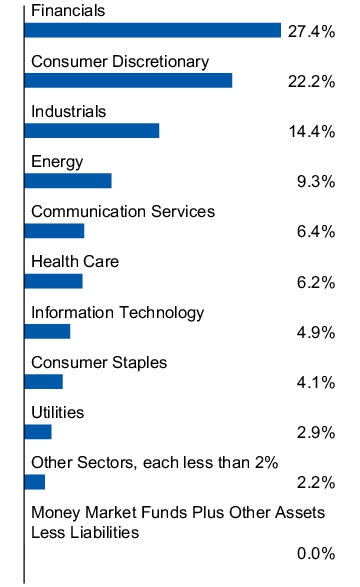

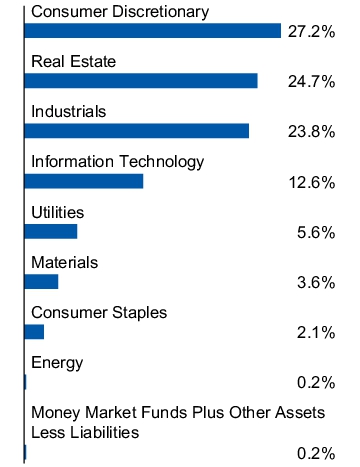

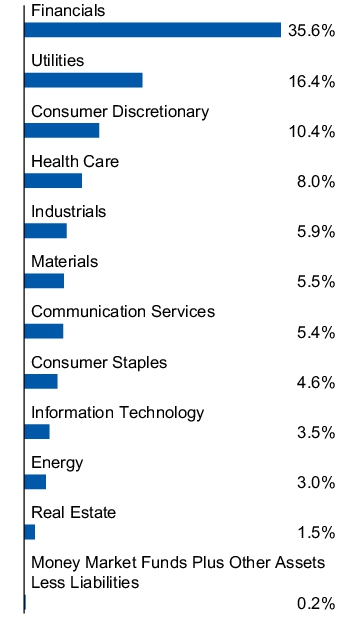

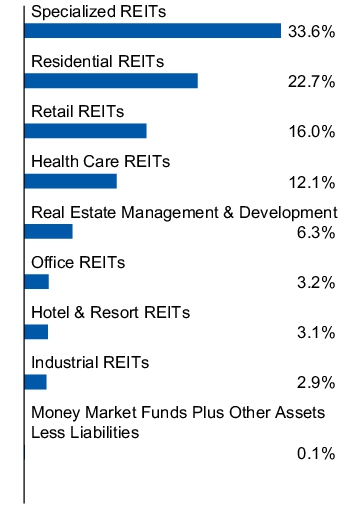

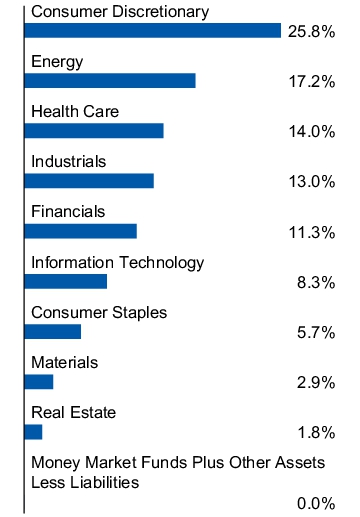

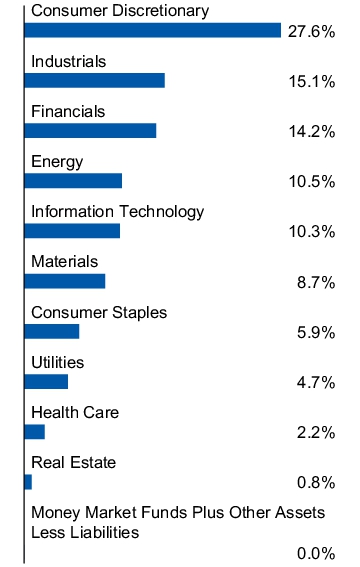

| Sector allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Vistra Corp. |

2.08% |

| Kroger Co. (The) |

2.01% |

| TJX Cos., Inc. (The) |

1.99% |

| Quest Diagnostics, Inc. |

1.98% |

| Cencora, Inc. |

1.98% |

| Republic Services, Inc. |

1.95% |

| Cardinal Health, Inc. |

1.93% |

| Waste Management, Inc. |

1.90% |

| Motorola Solutions, Inc. |

1.89% |

| Kellanova |

1.89% |

| * Excluding money market fund holdings, if any. |

|

|

|

| Material Fund Change [Text Block] |

How Has The Fund Changed Over The Past Year? This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903. The Fund's net expense ratio decreased from the prior fiscal year end as a result of a change in the Fund's investment advisory agreement which became effective on August 28, 2023.

|

|

| Material Fund Change Expenses [Text Block] |

The Fund's net expense ratio decreased from the prior fiscal year end as a result of a change in the Fund's investment advisory agreement which became effective on August 28, 2023.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

|

|

| Updated Prospectus Phone Number |

(800) 983-0903

|

|

| Updated Prospectus Web Address |

invesco.com/reports

|

|

| C000008291 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Momentum ETF

|

|

| Class Name |

Invesco S&P SmallCap Momentum ETF

|

|

| Trading Symbol |

XSMO

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco S&P SmallCap Momentum ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco S&P SmallCap Momentum ETF |

$36 |

0.35% |

|

|

| Expenses Paid, Amount |

$ 36

|

|

| Expense Ratio, Percent |

0.35%

|

|

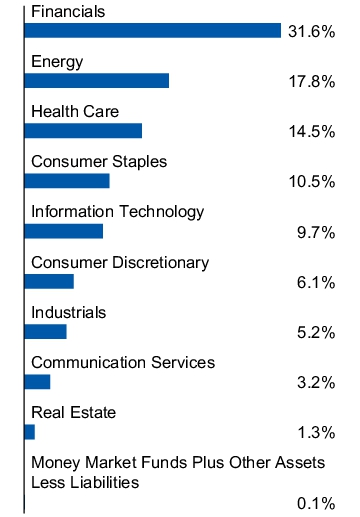

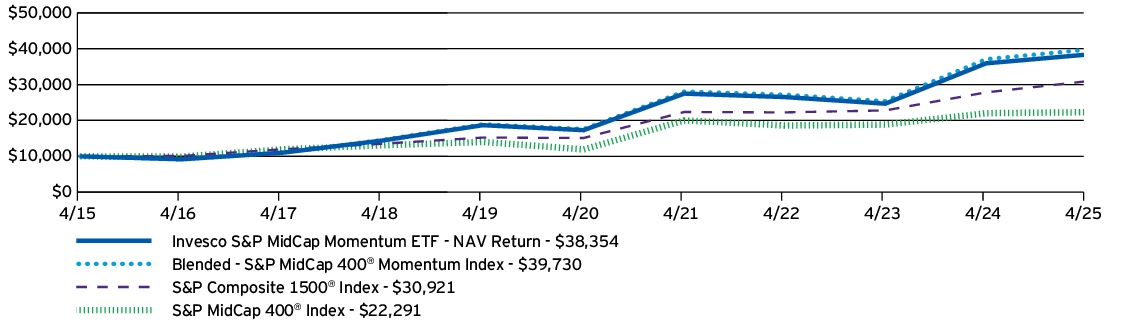

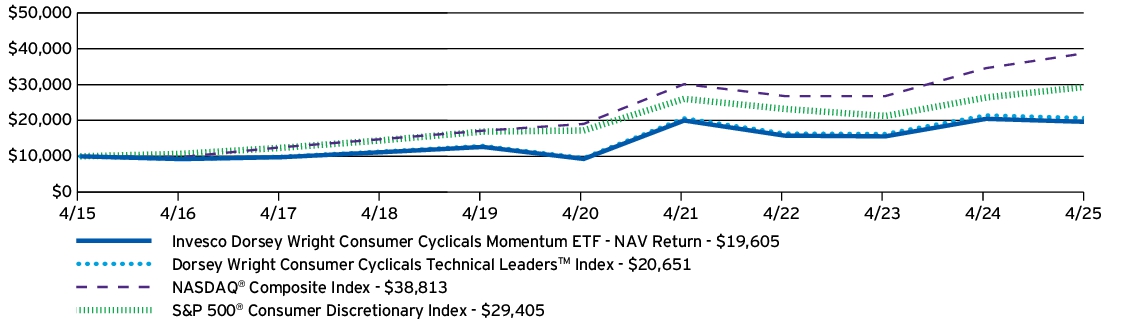

| Factors Affecting Performance [Text Block] |

How Did The Fund Perform During The Period?

• During the fiscal year ended April 30, 2025, U.S. small cap equities showed strong performance subsequent to the conclusion of the U.S. election but struggled near the end of the period due to uncertainty regarding global trade and tariff policy. The Fund's focus on momentum securities, or those with relatively stronger price returns over a trailing twelve-month period, was a notable driver of its relative outperformance versus the S&P SmallCap 600® Index during the period as investors continued to favor the momentum factor.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the S&P SmallCap 600® Momentum Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index.

• For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 8.11%, differed from the return of the Index, 8.51%, primarily due to fees and expenses incurred by the Fund during the period.

What contributed to performance?

Sector Allocations | Consumer discretionary sector, followed by the health care and financials sectors, respectively.

Positions | Mueller Industries, Inc., an industrials company (no longer held at fiscal year-end), and Stride, Inc., a consumer discretionary company.

What detracted from performance?

Sector Allocations | Real estate sector, followed by the materials and energy sectors, respectively.

Positions | Alpha Metallurgical Resources, Inc., a materials company (no longer held at fiscal year-end), and Innovative Industrial Properties Inc., a real estate company (no longer held at fiscal year-end).

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

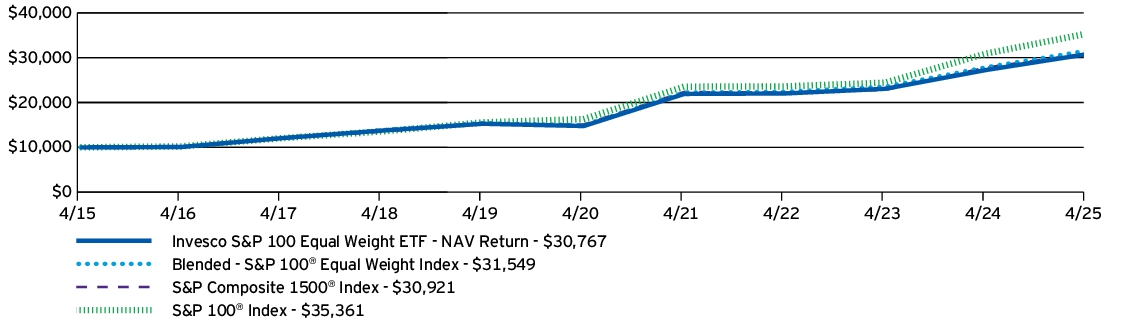

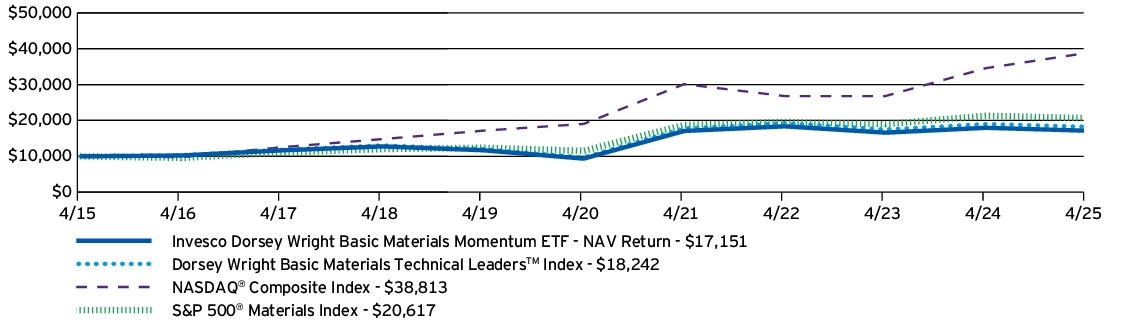

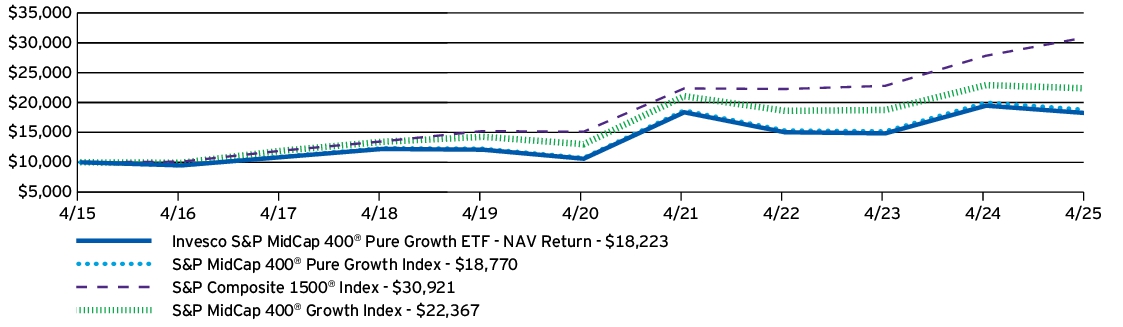

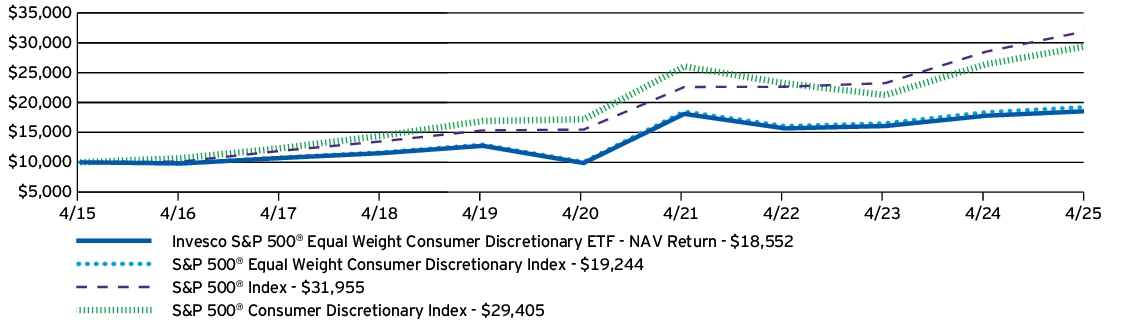

| Line Graph [Table Text Block] |

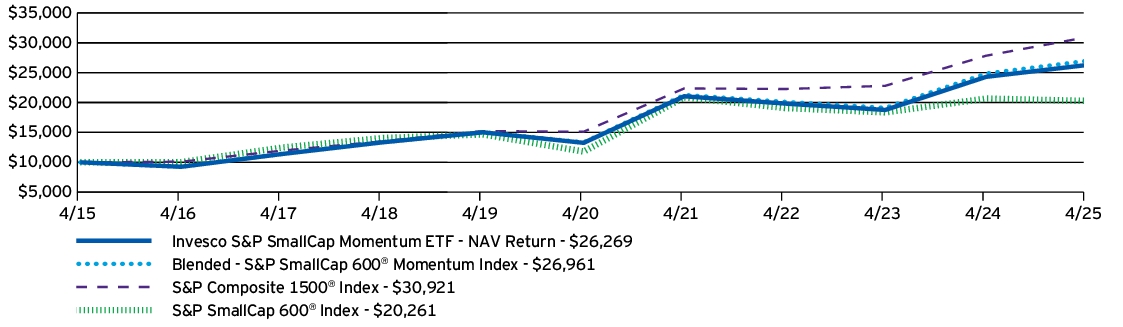

How Has The Fund Historically Performed?

Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco S&P SmallCap Momentum ETF — NAV Return |

8.11% |

14.66% |

10.14% |

| Blended - S&P SmallCap 600® Momentum Index |

8.51% |

15.12% |

10.43% |

| S&P Composite 1500® Index |

11.12% |

15.39% |

11.95% |

| S&P SmallCap 600® Index |

-1.93% |

11.42% |

7.32% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P SmallCap 600® Momentum Index to the S&P Composite 1500® Index to reflect that the S&P Composite 1500® Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 1,385,545,122

|

|

| Holdings Count | Holding |

120

|

|

| Advisory Fees Paid, Amount |

$ 3,248,566

|

|

| Investment Company Portfolio Turnover |

115.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund?

(as of April 30, 2025)

| Fund net assets |

$1,385,545,122 |

| Total number of portfolio holdings |

120 |

| Total advisory fees paid |

$3,248,566 |

| Portfolio turnover rate |

115% |

|

|

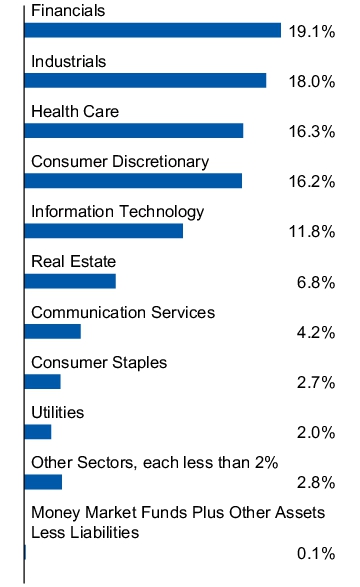

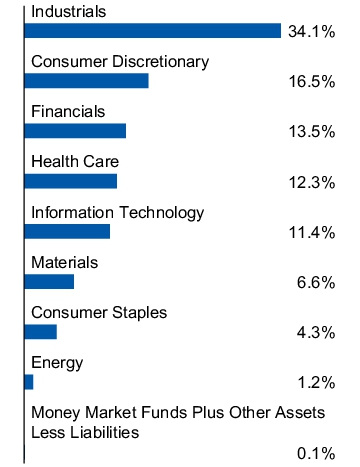

| Holdings [Text Block] |

What Comprised The Fund's Holdings?

(as of April 30, 2025)

Top ten holdings*

(% of net assets)

| Corcept Therapeutics, Inc. |

3.06% |

| Brinker International, Inc. |

2.72% |

| ADMA Biologics, Inc. |

2.33% |

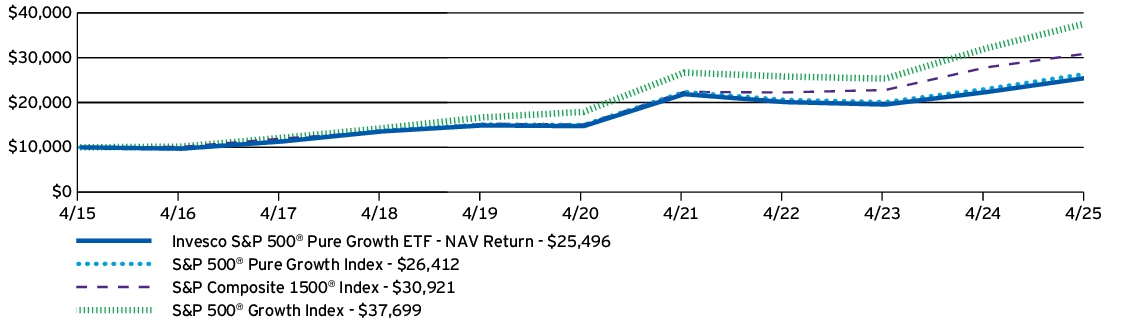

| Mr. Cooper Group, Inc. |

2.10% |

| Stride, Inc. |

2.07% |

| ACI Worldwide, Inc. |

1.96% |

| Armstrong World Industries, Inc. |

1.91% |

| Jackson Financial, Inc., Class A |

1.86% |

| Group 1 Automotive, Inc. |

1.77% |

| InterDigital, Inc. |

1.75% |

| * Excluding money market fund holdings, if any. |

|

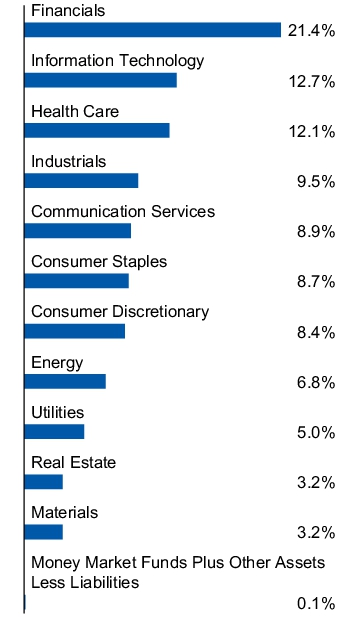

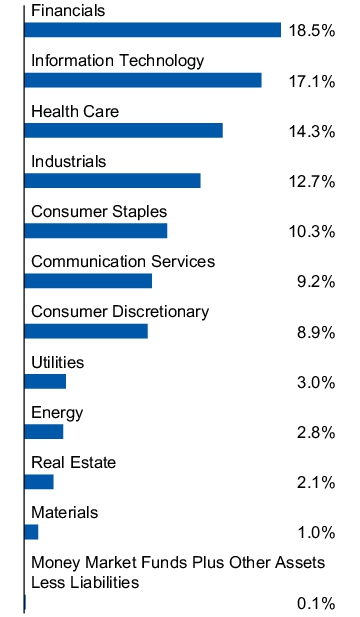

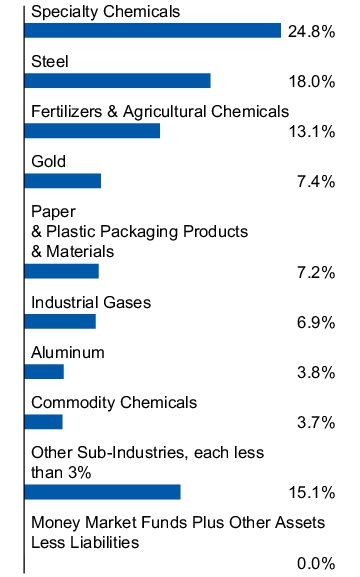

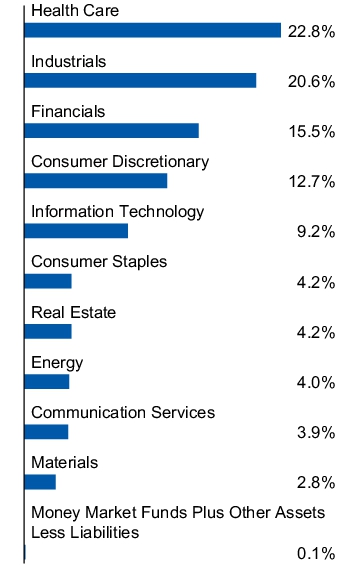

Sector allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Corcept Therapeutics, Inc. |

3.06% |

| Brinker International, Inc. |

2.72% |

| ADMA Biologics, Inc. |

2.33% |

| Mr. Cooper Group, Inc. |

2.10% |

| Stride, Inc. |

2.07% |

| ACI Worldwide, Inc. |

1.96% |

| Armstrong World Industries, Inc. |

1.91% |

| Jackson Financial, Inc., Class A |

1.86% |

| Group 1 Automotive, Inc. |

1.77% |

| InterDigital, Inc. |

1.75% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008292 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco S&P SmallCap Value with Momentum ETF

|

|

| Class Name |

Invesco S&P SmallCap Value with Momentum ETF

|

|

| Trading Symbol |

XSVM

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco S&P SmallCap Value with Momentum ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco S&P SmallCap Value with Momentum ETF |

$35 |

0.36% |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.36%

|

|

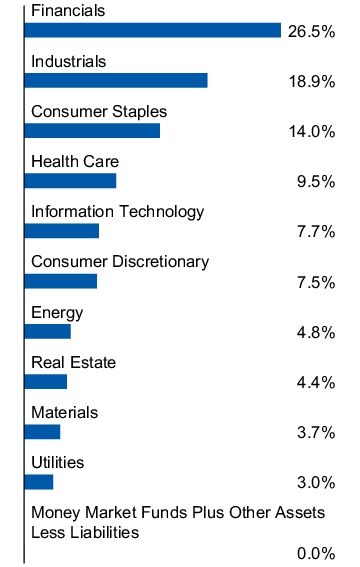

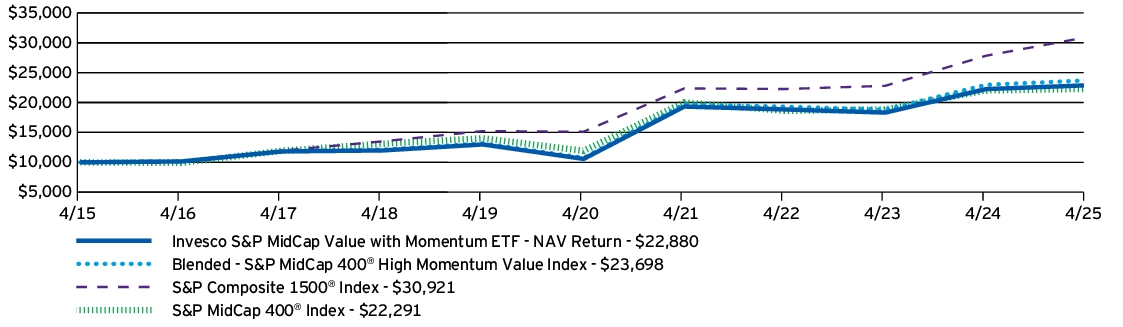

| Factors Affecting Performance [Text Block] |

How Did The Fund Perform During The Period?

• During the fiscal year ended April 30, 2025, U.S. small cap equities showed strong performance subsequent to the conclusion of the U.S. election but struggled near the end of the period due to uncertainty regarding global trade and tariff policy. The Fund underperformed the S&P SmallCap 600® Index due to its focus on value securities, which underperformed U.S. small cap equities during the period. Poor security selection results in the consumer discretionary, materials, and industrials sectors were also notable drivers of relative underperformance.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the S&P SmallCap 600® High Momentum Value Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index.

• For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, -8.07%, differed from the return of the Index, -7.70%, primarily due to fees and expenses incurred by the Fund during the period.

What contributed to performance?

Sector Allocations | Financials sector, followed by the communication services and consumer staples sectors, respectively.

Positions | StoneX Group Inc., a financials company, and Telephone and Data Systems, Inc., a communication services company (no longer held at fiscal year-end).

What detracted from performance?

Sector Allocations | Consumer discretionary sector, followed by the energy and materials sectors, respectively.

Positions | Par Pacific Holdings, Inc., an energy company (no longer held at fiscal year-end), and Caleres, Inc., a consumer discretionary company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

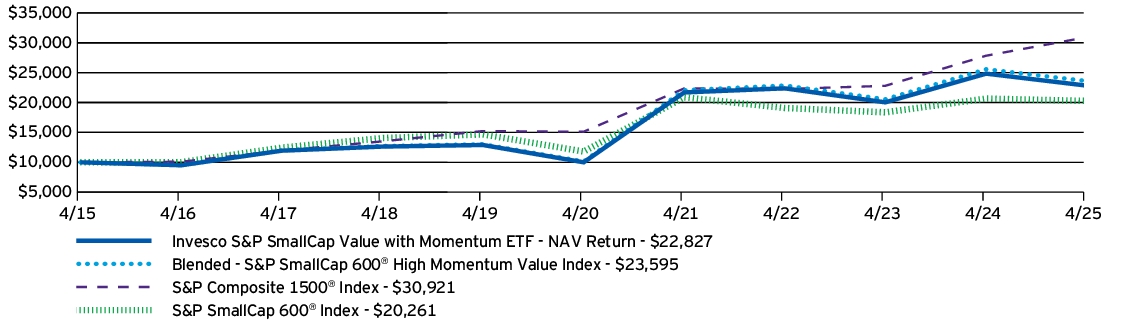

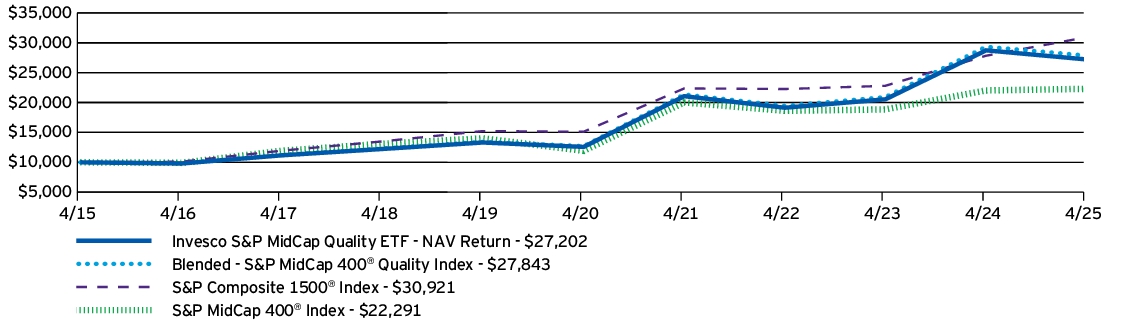

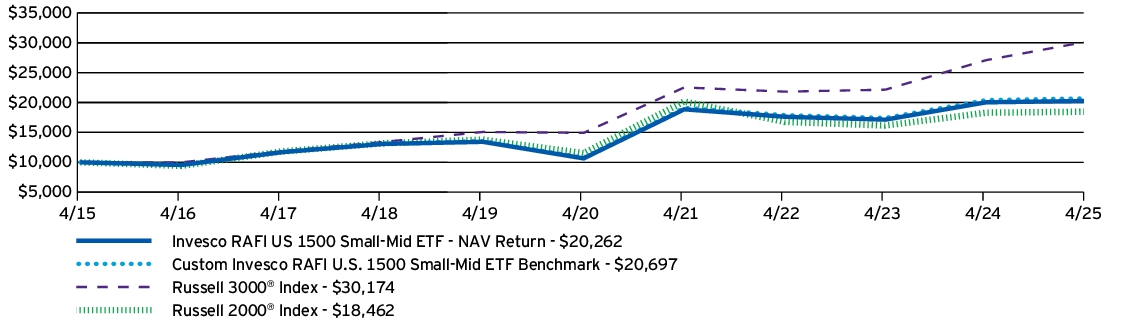

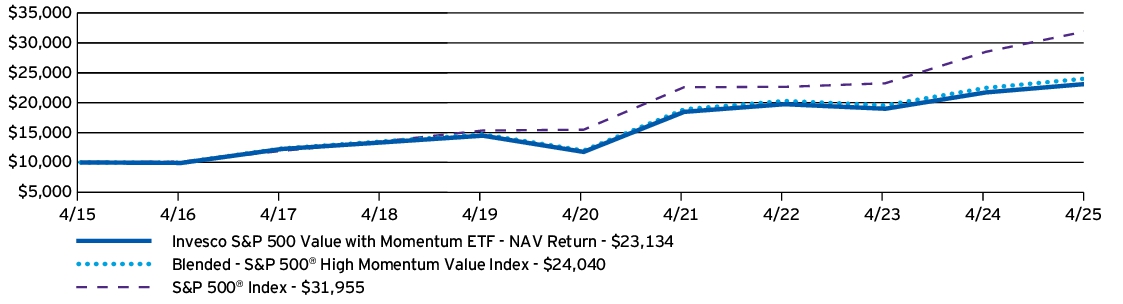

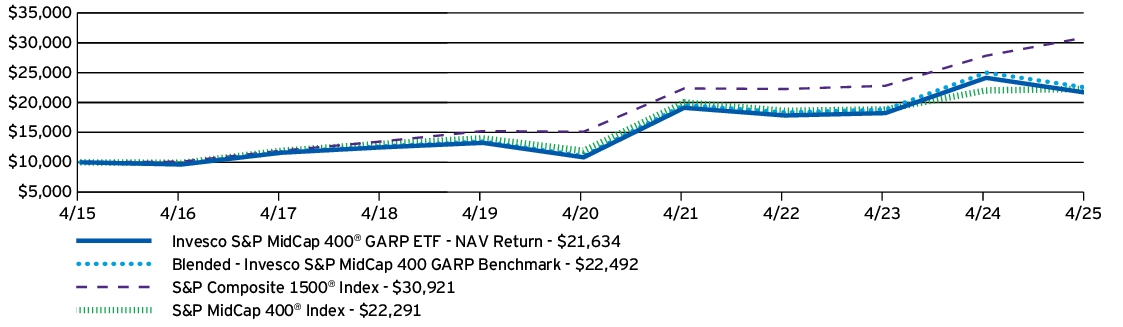

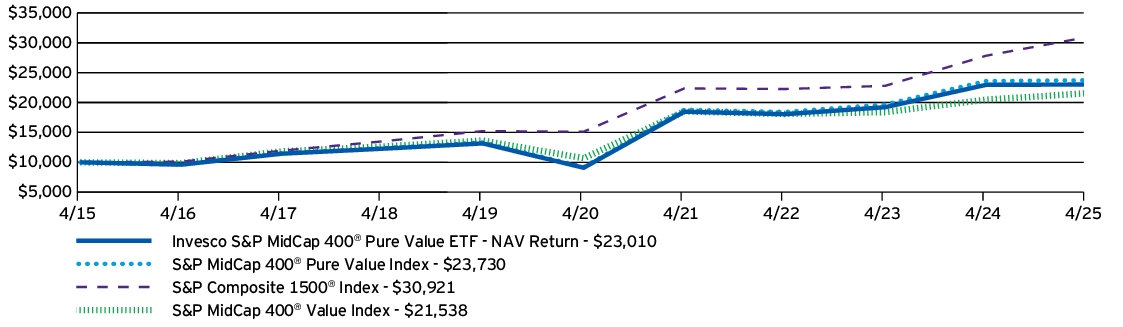

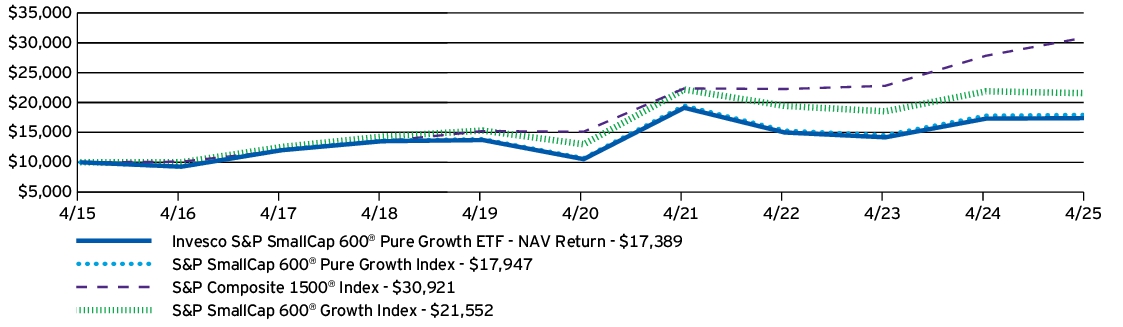

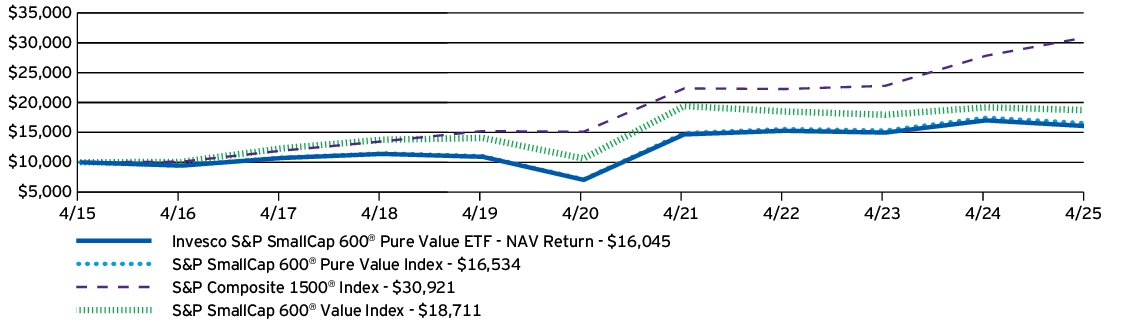

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed?

Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco S&P SmallCap Value with Momentum ETF — NAV Return |

-8.07% |

17.94% |

8.60% |

| Blended - S&P SmallCap 600® High Momentum Value Index |

-7.70% |

18.40% |

8.96% |

| S&P Composite 1500® Index |

11.12% |

15.39% |

11.95% |

| S&P SmallCap 600® Index |

-1.93% |

11.42% |

7.32% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P SmallCap 600® High Momentum Value Index to the S&P Composite 1500® Index to reflect that the S&P Composite 1500® Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 573,223,772

|

|

| Holdings Count | Holding |

121

|

|

| Advisory Fees Paid, Amount |

$ 2,225,771

|

|

| Investment Company Portfolio Turnover |

87.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund?

(as of April 30, 2025)

| Fund net assets |

$573,223,772 |

| Total number of portfolio holdings |

121 |

| Total advisory fees paid |

$2,225,771 |

| Portfolio turnover rate |

87% |

|

|

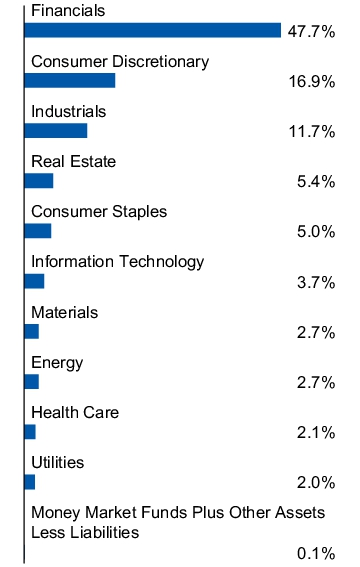

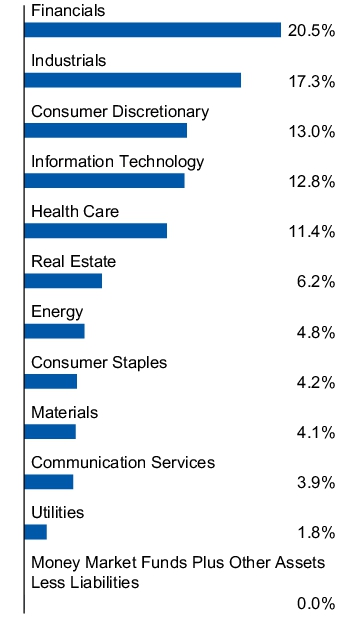

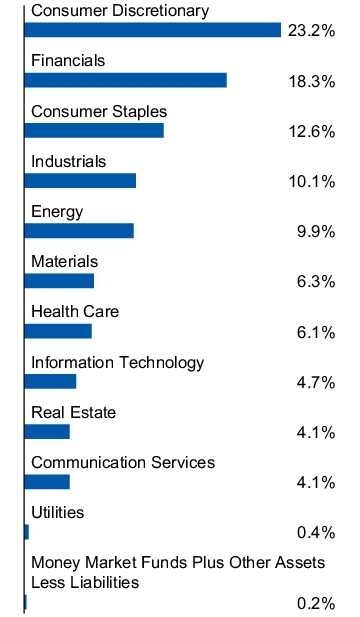

| Holdings [Text Block] |

What Comprised The Fund's Holdings?

(as of April 30, 2025)

Top ten holdings*

(% of net assets)

| StoneX Group, Inc. |

2.17% |

| EZCORP, Inc., Class A |

1.92% |

| World Kinect Corp. |

1.88% |

| Fresh Del Monte Produce, Inc. |

1.53% |

| Lincoln National Corp. |

1.53% |

| Sonic Automotive, Inc., Class A |

1.51% |

| Universal Corp. |

1.48% |

| Group 1 Automotive, Inc. |

1.40% |

| Select Medical Holdings Corp. |

1.34% |

| SiriusPoint Ltd. |

1.32% |

| * Excluding money market fund holdings, if any. |

|

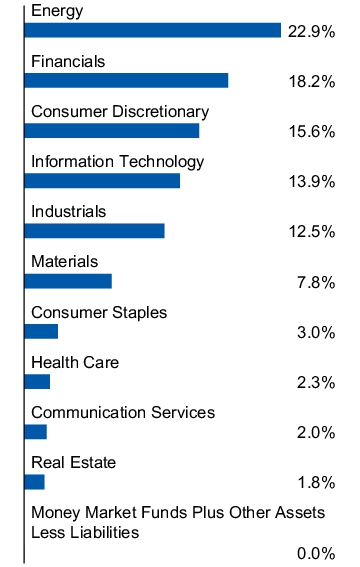

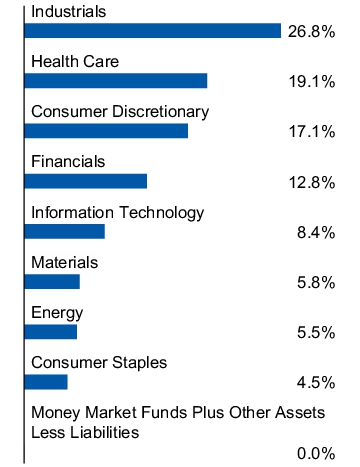

Sector allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| StoneX Group, Inc. |

2.17% |

| EZCORP, Inc., Class A |

1.92% |

| World Kinect Corp. |

1.88% |

| Fresh Del Monte Produce, Inc. |

1.53% |

| Lincoln National Corp. |

1.53% |

| Sonic Automotive, Inc., Class A |

1.51% |

| Universal Corp. |

1.48% |

| Group 1 Automotive, Inc. |

1.40% |

| Select Medical Holdings Corp. |

1.34% |

| SiriusPoint Ltd. |

1.32% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008293 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Biotechnology & Genome ETF

|

|

| Class Name |

Invesco Biotechnology & Genome ETF

|

|

| Trading Symbol |

PBE

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Biotechnology & Genome ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Biotechnology & Genome ETF |

$59 |

0.58% |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

0.58%

|

|

| Factors Affecting Performance [Text Block] |

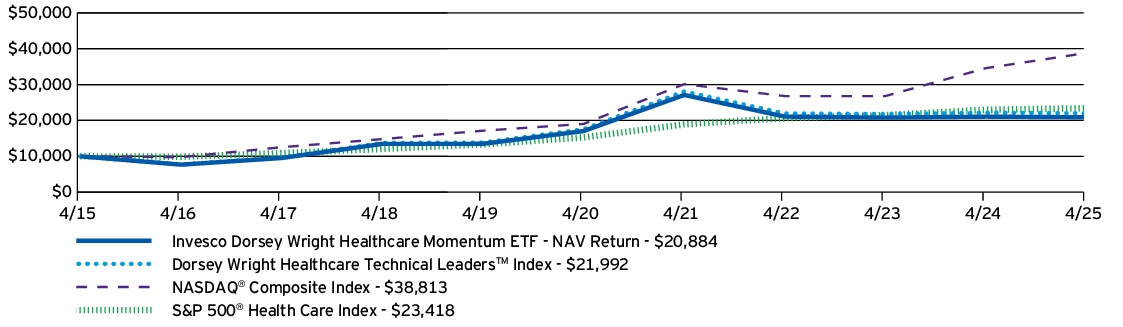

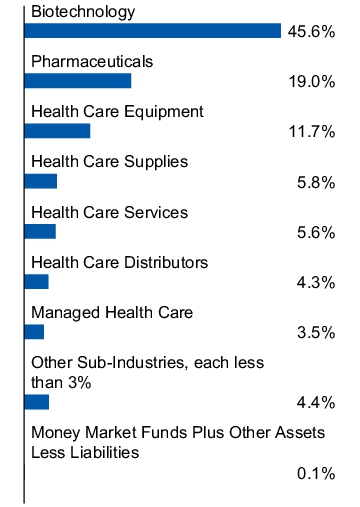

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy. During the period, the health care sector underperformed the broader stock market. In addition to the Fund's focus on health care stocks, its multi-factor methodology created a performance headwind compared to the S&P Composite 1500® Biotechnolgy Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Dynamic Biotech & Genome Intellidex® Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 2.51%, differed from the return of the Index, 3.02%, primarily due to fees and expenses incurred by the Fund during the period. What contributed to performance?

Sub-Industry Allocations | Biotechnology sub-industry, followed by the health care services sub-industry. Positions | TG Therapeutics, Inc., a biotechnology company, and Gilead Sciences, Inc., a biotechnology company. What detracted from performance?

Sub-Industry Allocations | Life sciences tools & services sub-industry, followed by the pharmaceuticals sub-industry. Positions | Biogen Inc., a biotechnology company, and Myriad Genetics, Inc., a biotechnology company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

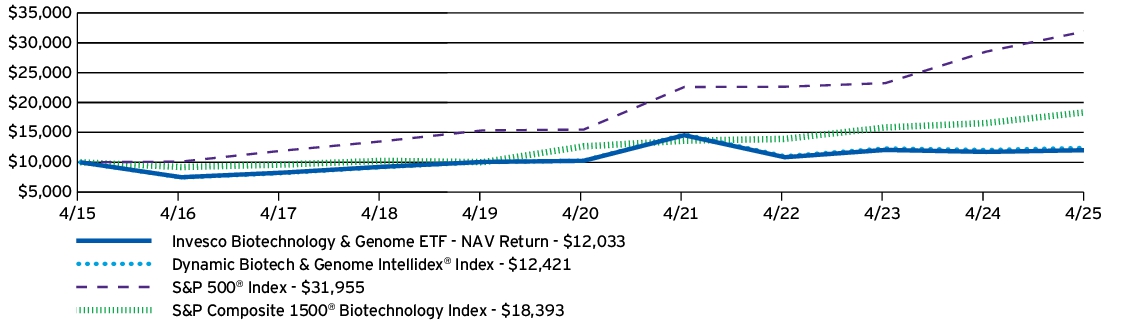

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Biotechnology & Genome ETF — NAV Return |

2.51% |

3.26% |

1.87% |

| Dynamic Biotech & Genome Intellidex® Index |

3.02% |

3.85% |

2.19% |

| S&P 500® Index |

12.10% |

15.61% |

12.32% |

| S&P Composite 1500® Biotechnology Index |

11.03% |

7.73% |

6.28% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Biotechnology Index to the S&P 500® Index to reflect that the S&P 500® Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 221,283,667

|

|

| Holdings Count | Holding |

33

|

|

| Advisory Fees Paid, Amount |

$ 1,272,494

|

|

| Investment Company Portfolio Turnover |

94.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$221,283,667 |

| Total number of portfolio holdings |

33 |

| Total advisory fees paid |

$1,272,494 |

| Portfolio turnover rate |

94% |

|

|

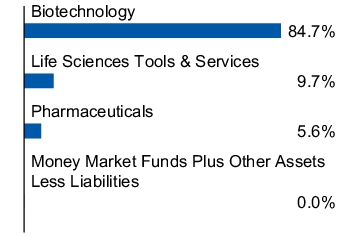

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| Natera, Inc. |

5.18% |

| Gilead Sciences, Inc. |

5.11% |

| Neurocrine Biosciences, Inc. |

4.97% |

| Amgen, Inc. |

4.93% |

| TG Therapeutics, Inc. |

4.55% |

| United Therapeutics Corp. |

4.54% |

| Biogen, Inc. |

4.52% |

| Regeneron Pharmaceuticals, Inc. |

4.43% |

| Illumina, Inc. |

4.34% |

| Protagonist Therapeutics, Inc. |

3.81% |

| * Excluding money market fund holdings, if any. |

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Natera, Inc. |

5.18% |

| Gilead Sciences, Inc. |

5.11% |

| Neurocrine Biosciences, Inc. |

4.97% |

| Amgen, Inc. |

4.93% |

| TG Therapeutics, Inc. |

4.55% |

| United Therapeutics Corp. |

4.54% |

| Biogen, Inc. |

4.52% |

| Regeneron Pharmaceuticals, Inc. |

4.43% |

| Illumina, Inc. |

4.34% |

| Protagonist Therapeutics, Inc. |

3.81% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008294 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Food & Beverage ETF

|

|

| Class Name |

Invesco Food & Beverage ETF

|

|

| Trading Symbol |

PBJ

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Food & Beverage ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Food & Beverage ETF |

$61 |

0.61% |

|

|

| Expenses Paid, Amount |

$ 61

|

|

| Expense Ratio, Percent |

0.61%

|

|

| Factors Affecting Performance [Text Block] |

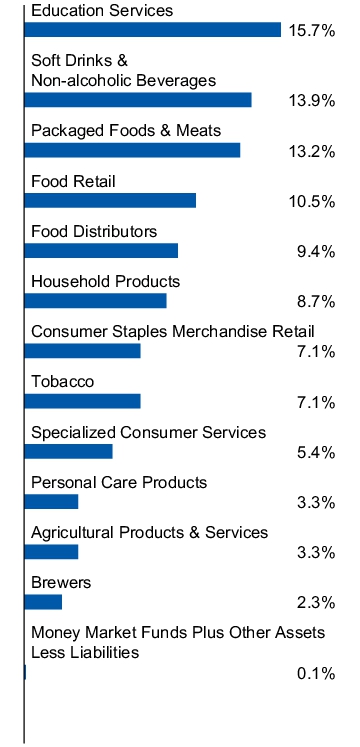

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy. During the period, the consumer staples sector underperformed the broader stock market. In addition to the Fund's focus on consumer staples stocks, its multi-factor methodology led to an overweight in restaurants, which created a performance headwind compared to the S&P Composite 1500® Food Beverage & Tobacco Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Dynamic Food & Beverage Intellidex® Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 0.66%, differed from the return of the Index, 1.32%, primarily due to fees and expenses incurred by the Fund during the period. What contributed to performance?

Sub-Industry Allocations | Food retail sub-industry, followed by the soft drinks & non-alcoholic beverages and packaged foods & meats sub-industries, respectively. Positions | Sprouts Farmers Market, Inc., a food retail company, and Pilgrim's Pride Corp., a packaged food & meats company. What detracted from performance?

Sub-Industry Allocations | Restaurants sub-industry, followed by the distillers & vintners and agricultural products & services sub-industries, respectively. Positions | Constellation Brands, Inc., Class A, a distillers & vintners company (no longer held at fiscal year-end), and Shake Shack, Inc., Class A, a restaurants company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

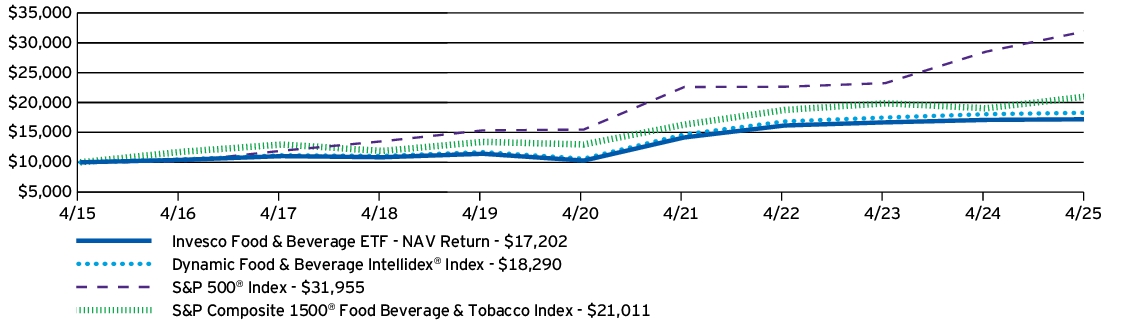

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Food & Beverage ETF — NAV Return |

0.66% |

10.84% |

5.57% |

| Dynamic Food & Beverage Intellidex® Index |

1.32% |

11.51% |

6.22% |

| S&P 500® Index |

12.10% |

15.61% |

12.32% |

| S&P Composite 1500® Food Beverage & Tobacco Index |

10.39% |

10.10% |

7.71% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Food Beverage & Tobacco Index to the S&P 500® Index to reflect that the S&P 500® Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 101,566,340

|

|

| Holdings Count | Holding |

33

|

|

| Advisory Fees Paid, Amount |

$ 546,797

|

|

| Investment Company Portfolio Turnover |

139.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$101,566,340 |

| Total number of portfolio holdings |

33 |

| Total advisory fees paid |

$546,797 |

| Portfolio turnover rate |

139% |

|

|

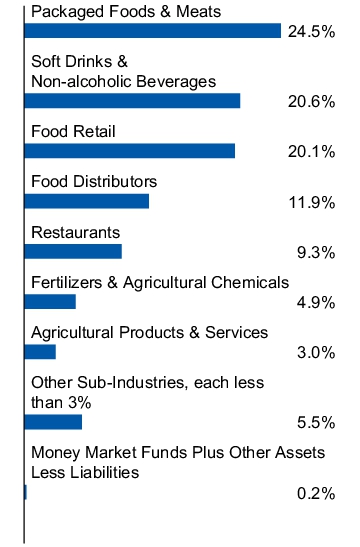

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| Monster Beverage Corp. |

5.71% |

| Kroger Co. (The) |

5.46% |

| Coca-Cola Co. (The) |

5.03% |

| DoorDash, Inc., Class A |

5.00% |

| Keurig Dr Pepper, Inc. |

4.91% |

| Corteva, Inc. |

4.88% |

| Sysco Corp. |

4.75% |

| General Mills, Inc. |

4.56% |

| Natural Grocers by Vitamin Cottage, Inc. |

3.22% |

| Sprouts Farmers Market, Inc. |

3.19% |

| * Excluding money market fund holdings, if any. |

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Monster Beverage Corp. |

5.71% |

| Kroger Co. (The) |

5.46% |

| Coca-Cola Co. (The) |

5.03% |

| DoorDash, Inc., Class A |

5.00% |

| Keurig Dr Pepper, Inc. |

4.91% |

| Corteva, Inc. |

4.88% |

| Sysco Corp. |

4.75% |

| General Mills, Inc. |

4.56% |

| Natural Grocers by Vitamin Cottage, Inc. |

3.22% |

| Sprouts Farmers Market, Inc. |

3.19% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008295 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Leisure and Entertainment ETF

|

|

| Class Name |

Invesco Leisure and Entertainment ETF

|

|

| Trading Symbol |

PEJ

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Leisure and Entertainment ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Leisure and Entertainment ETF |

$60 |

0.57% |

|

|

| Expenses Paid, Amount |

$ 60

|

|

| Expense Ratio, Percent |

0.57%

|

|

| Factors Affecting Performance [Text Block] |

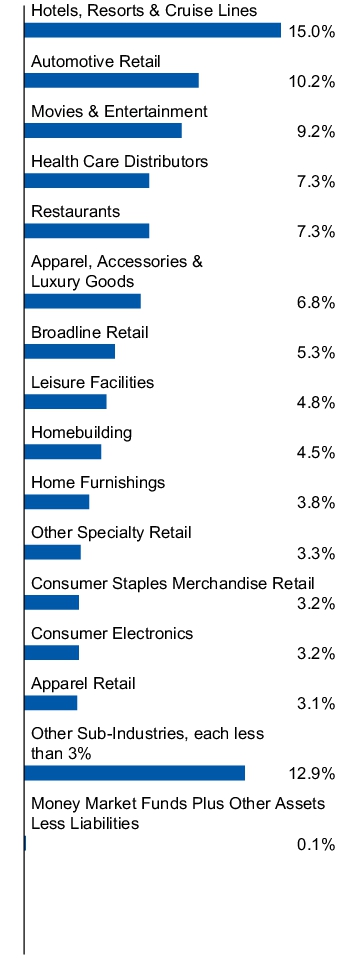

How Did The Fund Perform During The Period?

• During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy. During the period, the consumer discretionary sector underperformed the broader stock market. Despite the Fund's focus on consumer discretionary stocks, its multi-factor methodology led to an overweight in movies & entertainment, which performed well relative to other leisure sub-industries in the S&P Composite 1500® Hotels Restaurants & Leisure Index.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Dynamic Leisure & Entertainment Intellidex® Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index.

• For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 8.91%, differed from the return of the Index, 9.51%, primarily due to fees and expenses incurred by the Fund during the period.

What contributed to performance?

Sub-Industry Allocations | Movies & entertainment sub-industry, followed by the hotels, resorts & cruise lines and broadcasting sub-industries, respectively.

Positions | Brinker International, Inc., a restaurants company, and Royal Caribbean Group Ltd., a hotels, resorts & cruise lines company.

What detracted from performance?

Sub-Industry Allocations | Interactive media & services sub-industry, followed by the passenger airlines sub-industry.

Positions | TripAdvisor, Inc., an interactive media & services company (no longer held at fiscal year-end), and Norwegian Cruise Line Holdings Ltd., a hotels, resorts & cruise lines company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

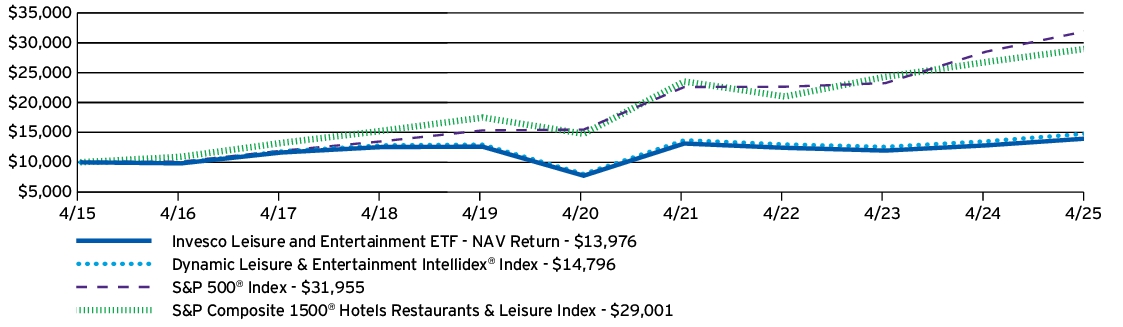

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed?

Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Leisure and Entertainment ETF — NAV Return |

8.91% |

12.49% |

3.40% |

| Dynamic Leisure & Entertainment Intellidex® Index |

9.51% |

12.97% |

4.00% |

| S&P 500® Index |

12.10% |

15.61% |

12.32% |

| S&P Composite 1500® Hotels Restaurants & Leisure Index |

8.32% |

14.46% |

11.23% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Hotels Restaurants & Leisure Index to the S&P 500® Index to reflect that the S&P 500® Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 313,594,104

|

|

| Holdings Count | Holding |

33

|

|

| Advisory Fees Paid, Amount |

$ 1,341,006

|

|

| Investment Company Portfolio Turnover |

157.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund?

(as of April 30, 2025)

| Fund net assets |

$313,594,104 |

| Total number of portfolio holdings |

33 |

| Total advisory fees paid |

$1,341,006 |

| Portfolio turnover rate |

157% |

|

|

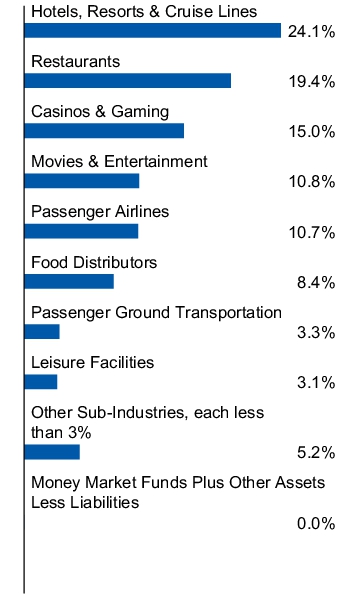

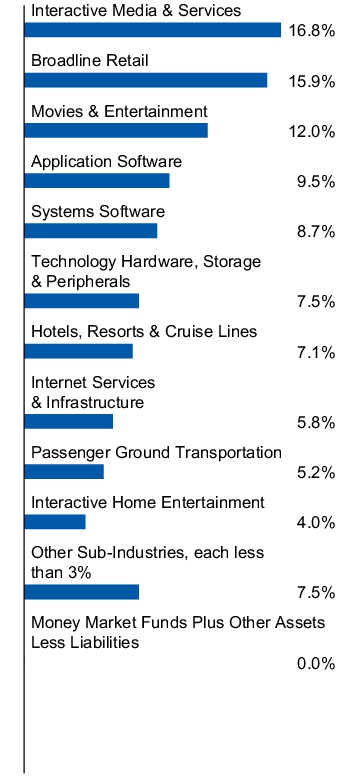

| Holdings [Text Block] |

What Comprised The Fund's Holdings?

(as of April 30, 2025)

Top ten holdings*

(% of net assets)

| DoorDash, Inc., Class A |

5.73% |

| Sysco Corp. |

5.45% |

| Royal Caribbean Cruises Ltd. |

5.14% |

| Hilton Worldwide Holdings, Inc. |

4.97% |

| Warner Bros. Discovery, Inc. |

4.61% |

| Carnival Corp. |

4.39% |

| United Airlines Holdings, Inc. |

4.05% |

| Delta Air Lines, Inc. |

3.83% |

| Sportradar Group AG |

3.49% |

| Super Group (SGHC) Ltd. |

3.34% |

| * Excluding money market fund holdings, if any. |

|

Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| DoorDash, Inc., Class A |

5.73% |

| Sysco Corp. |

5.45% |

| Royal Caribbean Cruises Ltd. |

5.14% |

| Hilton Worldwide Holdings, Inc. |

4.97% |

| Warner Bros. Discovery, Inc. |

4.61% |

| Carnival Corp. |

4.39% |

| United Airlines Holdings, Inc. |

4.05% |

| Delta Air Lines, Inc. |

3.83% |

| Sportradar Group AG |

3.49% |

| Super Group (SGHC) Ltd. |

3.34% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008296 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Next Gen Media and Gaming ETF

|

|

| Class Name |

Invesco Next Gen Media and Gaming ETF

|

|

| Trading Symbol |

GGME

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Next Gen Media and Gaming ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Next Gen Media and Gaming ETF |

$70 |

0.62%† |

|

† |

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 70

|

|

| Expense Ratio, Percent |

0.62%

|

[1] |

| Factors Affecting Performance [Text Block] |

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy, whereas global equities performed better toward the end of the fiscal year. During the period, movies & entertainment outperformed the broader stock market. In addition to the Fund's focus on media- and gaming-related industries, its thematic media methodology created a performance tailwind compared to the S&P Composite 1500® Media Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the STOXX World AC NexGen Media Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 24.72%, differed from the return of the Index, 25.43%, primarily due to fees and expenses incurred by the Fund during the period. What contributed to performance?

Sub-Industry Allocations | Movies & entertainment sub-industry, followed by the interactive home entertainment and technology hardware storage & peripherals sub-industries, respectively. Positions | Netflix, Inc., a movies & entertainment company, and Spotify Technology S.A., a movies & entertainment company. What detracted from performance?

Sub-Industry Allocations | Advertising sub-industry, followed by the consumer electronics sub-industry. Positions | Advanced Micro Devices, Inc., a semiconductors company, and Adobe Inc., an application software company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

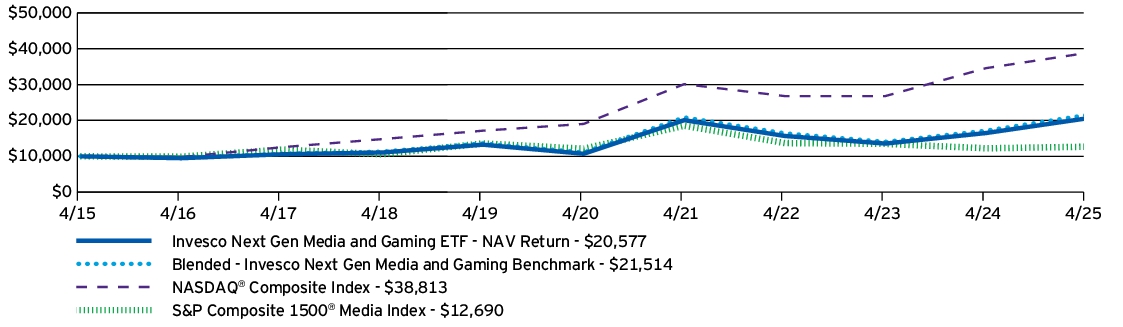

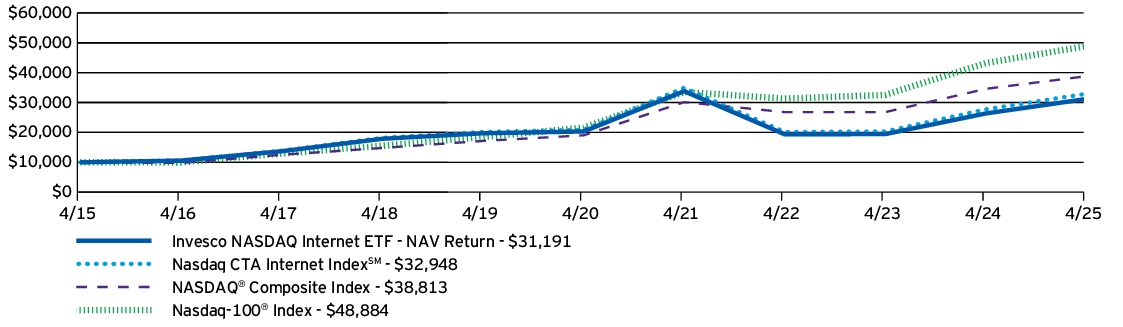

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Next Gen Media and Gaming ETF — NAV Return |

24.72% |

13.95% |

7.48% |

| Blended - Invesco Next Gen Media and Gaming Benchmark |

25.43% |

14.22% |

7.96% |

| NASDAQ® Composite Index |

12.22% |

15.32% |

14.52% |

| S&P Composite 1500® Media Index |

3.70% |

0.93% |

2.41% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Media Index to the NASDAQ® Composite Index to reflect that the NASDAQ® Composite Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 124,350,349

|

|

| Holdings Count | Holding |

87

|

|

| Advisory Fees Paid, Amount |

$ 230,167

|

|

| Investment Company Portfolio Turnover |

33.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$124,350,349 |

| Total number of portfolio holdings |

87 |

| Total advisory fees paid |

$230,167 |

| Portfolio turnover rate |

33% |

|

|

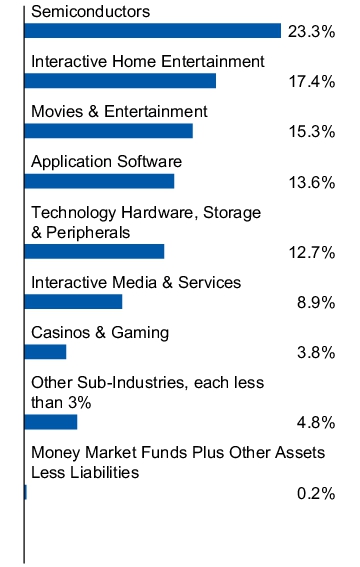

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| Netflix, Inc. |

9.86% |

| Apple, Inc. |

7.87% |

| QUALCOMM, Inc. |

7.41% |

| NVIDIA Corp. |

7.31% |

| Meta Platforms, Inc., Class A |

7.21% |

| Nintendo Co. Ltd. |

5.27% |

| Spotify Technology S.A. |

4.84% |

| Adobe, Inc. |

4.33% |

| Advanced Micro Devices, Inc. |

4.33% |

| MediaTek, Inc. |

3.98% |

| * Excluding money market fund holdings, if any. |

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Netflix, Inc. |

9.86% |

| Apple, Inc. |

7.87% |

| QUALCOMM, Inc. |

7.41% |

| NVIDIA Corp. |

7.31% |

| Meta Platforms, Inc., Class A |

7.21% |

| Nintendo Co. Ltd. |

5.27% |

| Spotify Technology S.A. |

4.84% |

| Adobe, Inc. |

4.33% |

| Advanced Micro Devices, Inc. |

4.33% |

| MediaTek, Inc. |

3.98% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008297 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Next Gen Connectivity ETF

|

|

| Class Name |

Invesco Next Gen Connectivity ETF

|

|

| Trading Symbol |

KNCT

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Next Gen Connectivity ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Next Gen Connectivity ETF |

$43 |

0.40% |

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.40%

|

|

| Factors Affecting Performance [Text Block] |

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy, whereas global equities performed better toward the end of the fiscal year. During the period, connectivity-related industries outperformed the broader stock market. In addition to the Fund's focus on connectivity-related industries, its thematic emerging connectivity methodology created a performance headwind compared to the S&P Composite 1500® Communications Equipment Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the STOXX World AC NexGen Connectivity Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 17.19%, differed from the return of the Index, 17.26%, primarily due to fees and expenses incurred by the Fund during the period, partially offset by income received from the securities lending program in which the Fund participates. What contributed to performance?

Sub-Industry Allocations | Integrated telecommunication services sub-industry, followed by the semiconductors and communications equipment sub-industries, respectively. Positions | Broadcom, Inc., a semiconductors company, and Apple, Inc., a technology hardware storage & peripherals company. What detracted from performance?

Sub-Industry Allocations | Internet services & infrastructure sub-industry, followed by the application software sub-industry. Positions | Samsung Electronics Co., Ltd., a technology hardware storage & peripherals company, and Intel Corp., a semiconductors company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

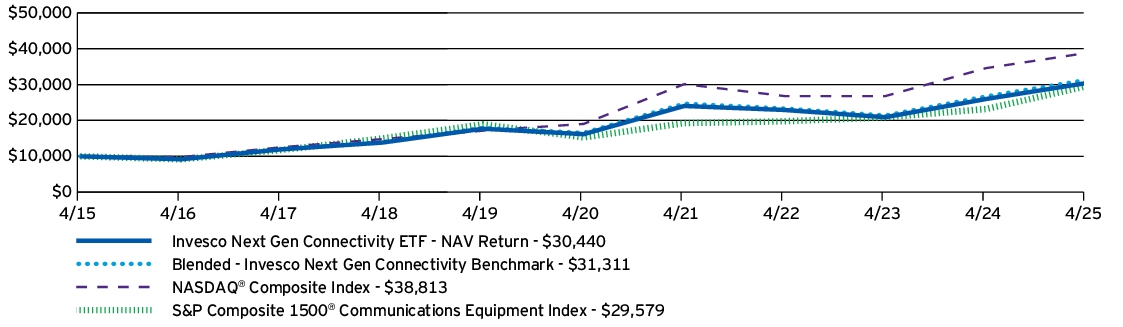

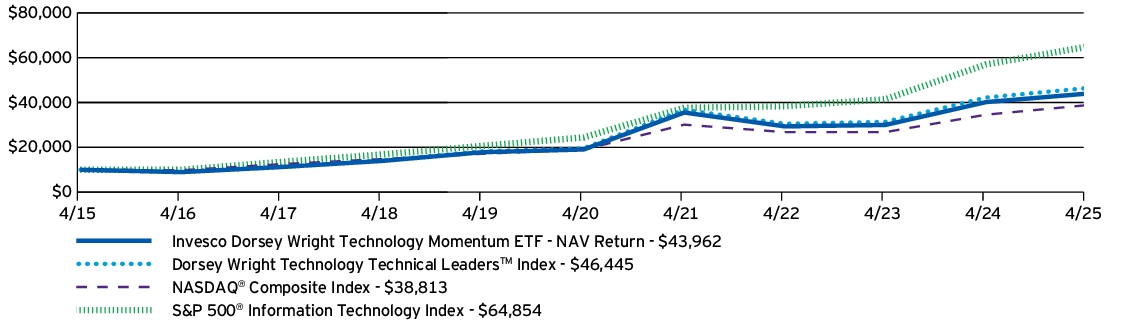

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Next Gen Connectivity ETF — NAV Return |

17.19% |

13.48% |

11.78% |

| Blended - Invesco Next Gen Connectivity Benchmark |

17.26% |

13.64% |

12.09% |

| NASDAQ® Composite Index |

12.22% |

15.32% |

14.52% |

| S&P Composite 1500® Communications Equipment Index |

27.52% |

14.14% |

11.45% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Communications Equipment Index to the NASDAQ® Composite Index to reflect that the NASDAQ® Composite Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Material Change Date |

Aug. 28, 2023

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 30,883,953

|

|

| Holdings Count | Holding |

103

|

|

| Advisory Fees Paid, Amount |

$ 155,905

|

|

| Investment Company Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$30,883,953 |

| Total number of portfolio holdings |

103 |

| Total advisory fees paid |

$155,905 |

| Portfolio turnover rate |

14% |

|

|

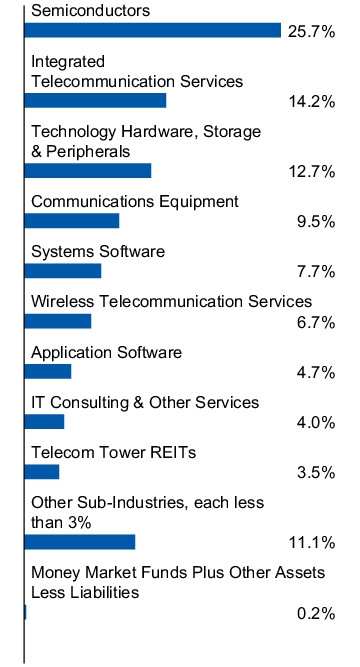

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| Apple, Inc. |

7.95% |

| Broadcom, Inc. |

7.89% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.59% |

| AT&T, Inc. |

4.23% |

| Cisco Systems, Inc. |

4.14% |

| Verizon Communications, Inc. |

3.99% |

| QUALCOMM, Inc. |

3.56% |

| Samsung Electronics Co. Ltd. |

2.69% |

| Palo Alto Networks, Inc. |

2.67% |

| T-Mobile US, Inc. |

2.49% |

| * Excluding money market fund holdings, if any. |

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Apple, Inc. |

7.95% |

| Broadcom, Inc. |

7.89% |

| Taiwan Semiconductor Manufacturing Co. Ltd. |

7.59% |

| AT&T, Inc. |

4.23% |

| Cisco Systems, Inc. |

4.14% |

| Verizon Communications, Inc. |

3.99% |

| QUALCOMM, Inc. |

3.56% |

| Samsung Electronics Co. Ltd. |

2.69% |

| Palo Alto Networks, Inc. |

2.67% |

| T-Mobile US, Inc. |

2.49% |

| * Excluding money market fund holdings, if any. |

|

|

|

| Material Fund Change [Text Block] |

How Has The Fund Changed Over The Past Year? This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903. The Fund's net expense ratio decreased from the prior fiscal year end as a result of a change in the Fund's investment advisory agreement which became effective on August 28, 2023.

|

|

| Material Fund Change Expenses [Text Block] |

The Fund's net expense ratio decreased from the prior fiscal year end as a result of a change in the Fund's investment advisory agreement which became effective on August 28, 2023.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

|

|

| Updated Prospectus Phone Number |

(800) 983-0903

|

|

| Updated Prospectus Web Address |

invesco.com/reports

|

|

| C000008298 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Pharmaceuticals ETF

|

|

| Class Name |

Invesco Pharmaceuticals ETF

|

|

| Trading Symbol |

PJP

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Pharmaceuticals ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Pharmaceuticals ETF |

$59 |

0.57% |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

0.57%

|

|

| Factors Affecting Performance [Text Block] |

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy. During the period, the health care sector underperformed the broader stock market. Despite the Fund's focus on health care stocks, its multi-factor methodology led to an overweight in health care equipment, which created a performance tailwind compared to the S&P Composite 1500® Pharmaceuticals Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Dynamic Pharmaceutical Intellidex® Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, 7.45%, differed from the return of the Index, 8.06%, primarily due to fees and expenses incurred by the Fund during the period. What contributed to performance?

Sub-Industry Allocations | Pharmaceuticals sub-industry followed by the biotechnology sub-industry. Positions | Corcept Therapeutics, Inc., a pharmaceuticals company, and Ligand Pharmaceuticals, Inc., a pharmaceuticals company. What detracted from performance?

Sub-Industry Allocations | No sub-industries detracted from the Fund's performance during the period. Positions | Merck & Co., Inc., a pharmaceuticals company, and Biogen, Inc., a biotechnology company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

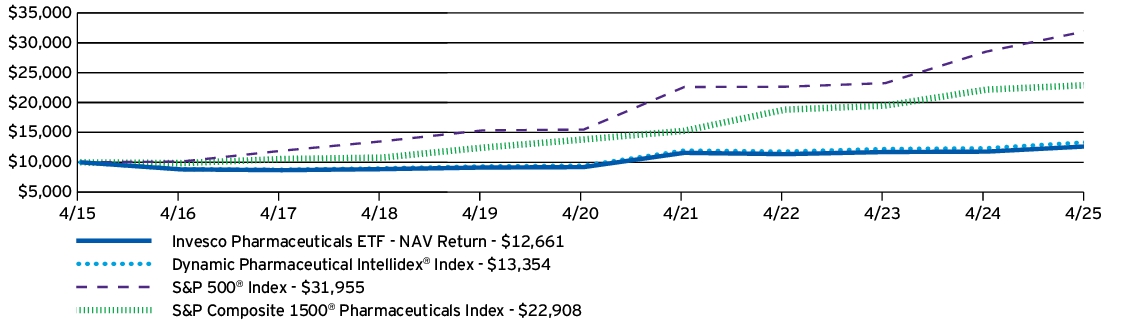

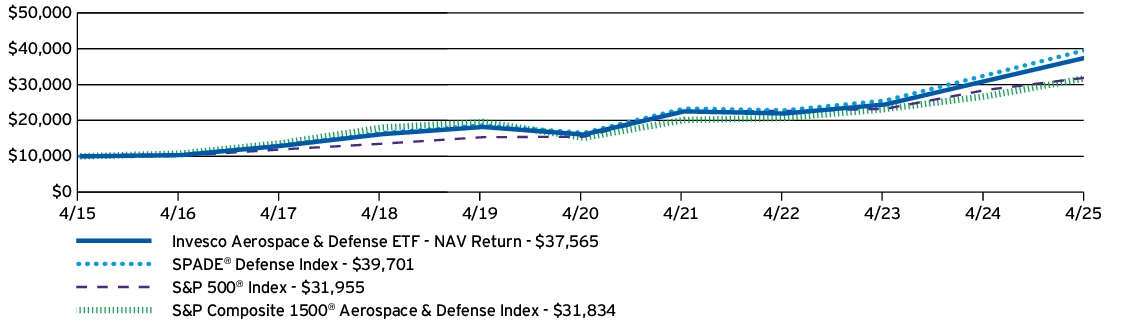

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Pharmaceuticals ETF — NAV Return |

7.45% |

6.59% |

2.39% |

| Dynamic Pharmaceutical Intellidex® Index |

8.06% |

7.15% |

2.93% |

| S&P 500® Index |

12.10% |

15.61% |

12.32% |

| S&P Composite 1500® Pharmaceuticals Index |

3.40% |

10.64% |

8.64% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Pharmaceuticals Index to the S&P 500® Index to reflect that the S&P 500® Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 243,737,940

|

|

| Holdings Count | Holding |

35

|

|

| Advisory Fees Paid, Amount |

$ 1,358,978

|

|

| Investment Company Portfolio Turnover |

48.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$243,737,940 |

| Total number of portfolio holdings |

35 |

| Total advisory fees paid |

$1,358,978 |

| Portfolio turnover rate |

48% |

|

|

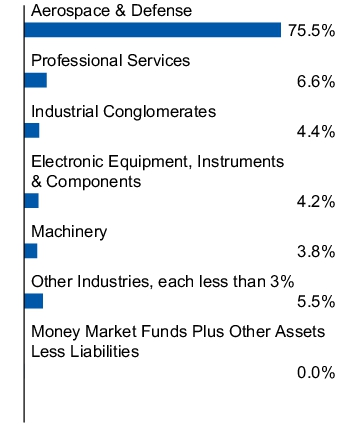

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| Eli Lilly and Co. |

5.30% |

| Abbott Laboratories |

5.12% |

| AbbVie, Inc. |

5.08% |

| Gilead Sciences, Inc. |

5.08% |

| Johnson & Johnson |

5.00% |

| Merck & Co., Inc. |

4.96% |

| Amgen, Inc. |

4.90% |

| Pfizer, Inc. |

4.85% |

| ANI Pharmaceuticals, Inc. |

3.77% |

| Tarsus Pharmaceuticals, Inc. |

3.65% |

| * Excluding money market fund holdings, if any. |

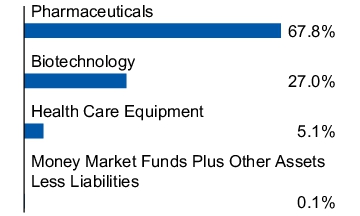

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Eli Lilly and Co. |

5.30% |

| Abbott Laboratories |

5.12% |

| AbbVie, Inc. |

5.08% |

| Gilead Sciences, Inc. |

5.08% |

| Johnson & Johnson |

5.00% |

| Merck & Co., Inc. |

4.96% |

| Amgen, Inc. |

4.90% |

| Pfizer, Inc. |

4.85% |

| ANI Pharmaceuticals, Inc. |

3.77% |

| Tarsus Pharmaceuticals, Inc. |

3.65% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008299 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Semiconductors ETF

|

|

| Class Name |

Invesco Semiconductors ETF

|

|

| Trading Symbol |

PSI

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco Semiconductors ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco Semiconductors ETF |

$52 |

0.56% |

|

|

| Expenses Paid, Amount |

$ 52

|

|

| Expense Ratio, Percent |

0.56%

|

|

| Factors Affecting Performance [Text Block] |

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy. During the period, semiconductors underperformed the broader stock market. In addition to the Fund's focus on semiconductor stocks, its multi-factor methodology created a performance headwind compared to the S&P Composite 1500® Semiconductor Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Dynamic Semiconductor Intellidex® Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, -13.95%, differed from the return of the Index, -13.50%, primarily due to fees and expenses incurred by the Fund during the period. What contributed to performance?

Sub-Industry Allocations | Electronic manufacturing services sub-industry. Positions | Astera Labs, Inc. (no longer held at fiscal year-end), a semiconductors company, and Broadcom, Inc., a semiconductors company. What detracted from performance?

Sub-Industry Allocations | Semiconductor materials & equipment sub-industry followed by the semiconductors sub-industry. Positions | Ichor Holdings Ltd., a semiconductor materials & equipment company, and Texas Instruments, Inc., a semiconductors company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

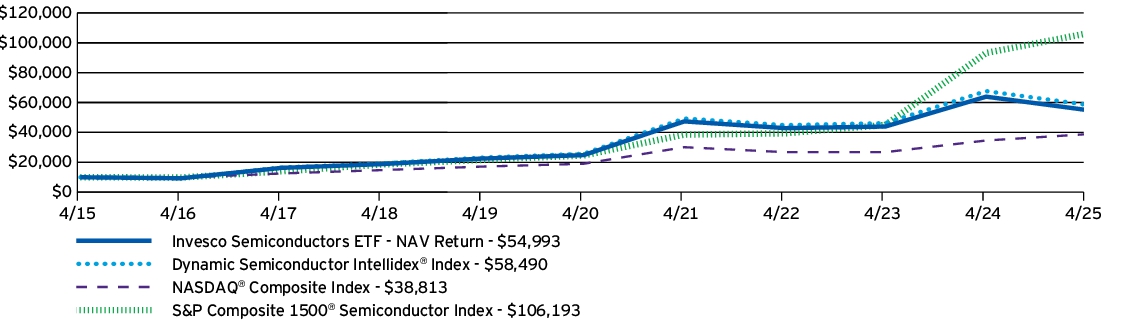

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Semiconductors ETF — NAV Return |

-13.95% |

17.25% |

18.59% |

| Dynamic Semiconductor Intellidex® Index |

-13.50% |

17.90% |

19.32% |

| NASDAQ® Composite Index |

12.22% |

15.32% |

14.52% |

| S&P Composite 1500® Semiconductor Index |

14.00% |

33.96% |

26.65% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Semiconductor Index to the NASDAQ® Composite Index to reflect that the NASDAQ® Composite Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 574,820,457

|

|

| Holdings Count | Holding |

33

|

|

| Advisory Fees Paid, Amount |

$ 3,800,130

|

|

| Investment Company Portfolio Turnover |

78.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$574,820,457 |

| Total number of portfolio holdings |

33 |

| Total advisory fees paid |

$3,800,130 |

| Portfolio turnover rate |

78% |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| KLA Corp. |

5.84% |

| Broadcom, Inc. |

5.73% |

| QUALCOMM, Inc. |

5.55% |

| Applied Materials, Inc. |

5.49% |

| Lam Research Corp. |

5.38% |

| NVIDIA Corp. |

5.19% |

| Analog Devices, Inc. |

4.99% |

| Texas Instruments, Inc. |

4.82% |

| SiTime Corp. |

3.01% |

| Monolithic Power Systems, Inc. |

3.00% |

| * Excluding money market fund holdings, if any. |

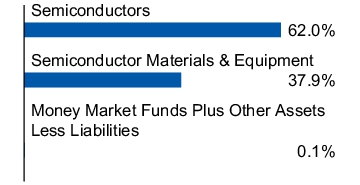

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| KLA Corp. |

5.84% |

| Broadcom, Inc. |

5.73% |

| QUALCOMM, Inc. |

5.55% |

| Applied Materials, Inc. |

5.49% |

| Lam Research Corp. |

5.38% |

| NVIDIA Corp. |

5.19% |

| Analog Devices, Inc. |

4.99% |

| Texas Instruments, Inc. |

4.82% |

| SiTime Corp. |

3.01% |

| Monolithic Power Systems, Inc. |

3.00% |

| * Excluding money market fund holdings, if any. |

|

|

|

| C000008300 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco AI and Next Gen Software ETF

|

|

| Class Name |

Invesco AI and Next Gen Software ETF

|

|

| Trading Symbol |

IGPT

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Invesco AI and Next Gen Software ETF (the “Fund”) for the period May 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

|

|

| Additional Information Phone Number |

(800) 983-0903

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Year ? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Invesco AI and Next Gen Software ETF |

$55 |

0.56% |

|

|

| Expenses Paid, Amount |

$ 55

|

|

| Expense Ratio, Percent |

0.56%

|

|

| Factors Affecting Performance [Text Block] |

How Did The Fund Perform During The Period? • During the fiscal year ended April 30, 2025, U.S. equities had strong performance in the beginning with a more challenging environment at the end due to uncertainty regarding global trade and tariff policy, whereas global equities performed better toward the end of the fiscal year. During the period, AI- and software-related industries underperformed the broader stock market. In addition to the Fund's focus on AI- and software-related industries, its thematic AI methodology created a performance headwind compared to the S&P Composite 1500® Software & Services Index. • The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the STOXX World AC NexGen Software Development Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index. • For the fiscal year ended April 30, 2025, the Fund's performance, on a net asset value ("NAV") basis, -2.88%, differed from the return of the Index, -2.51%, primarily due to fees and expenses incurred by the Fund during the period. What contributed to performance?

Sub-Industry Allocations | Interactive media & services sub-industry, followed by the health care equipment and application software sub-industries, respectively. Positions | NVIDIA Corp., a semiconductors company, and Meta Platforms Inc., Class A, an interactive media & services company. What detracted from performance?

Sub-Industry Allocations | Semiconductors sub-industry, followed by the technology hardware storage & peripherals and electronic equipment & instruments sub-industries, respectively. Positions | Advanced Micro Devices, Inc., a semiconductors company, and Intel Corp., a semiconductors company.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher.

|

|

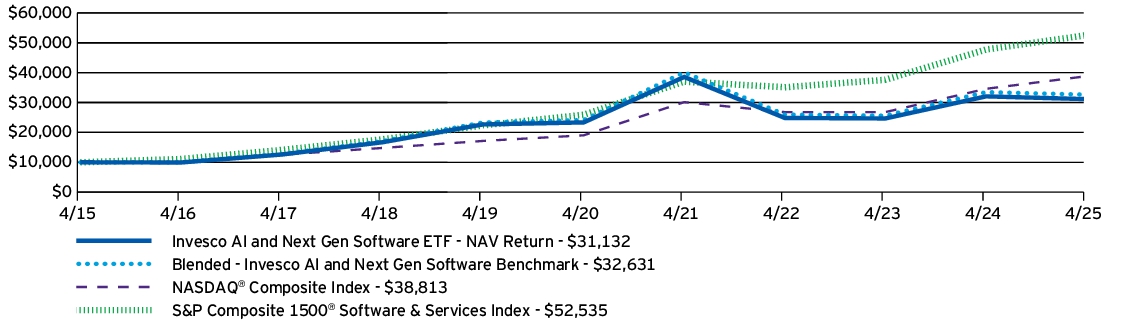

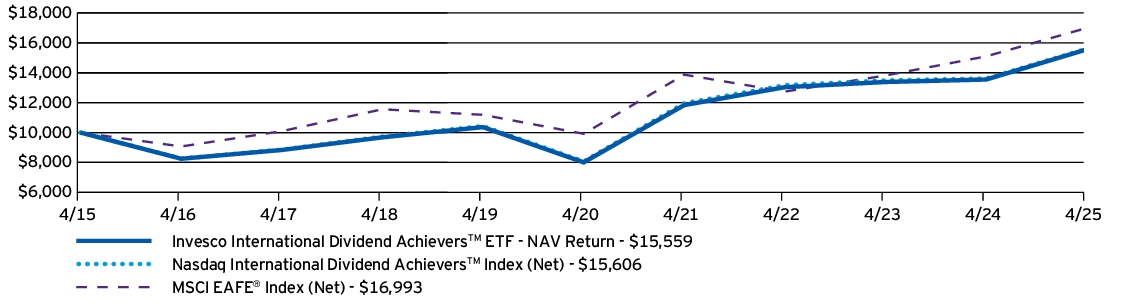

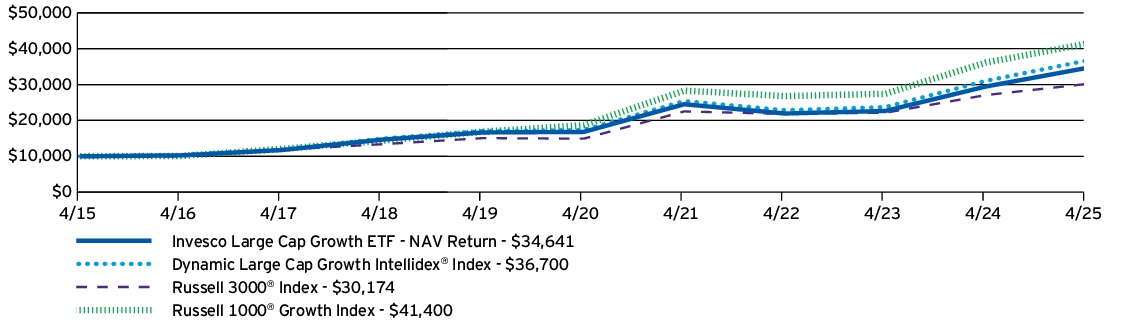

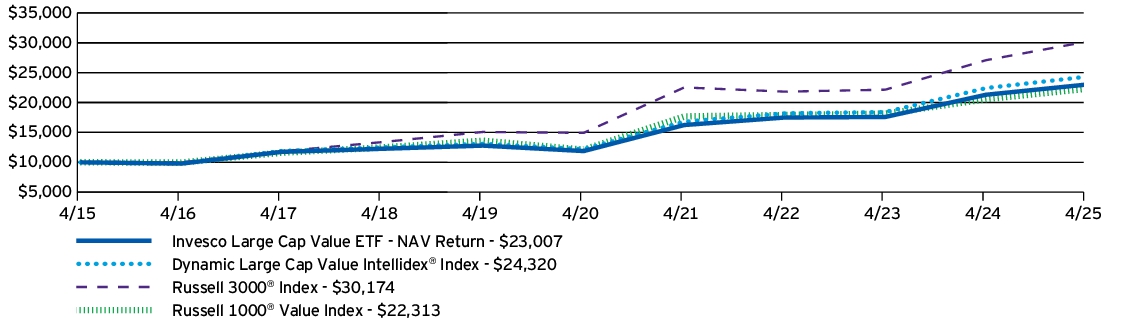

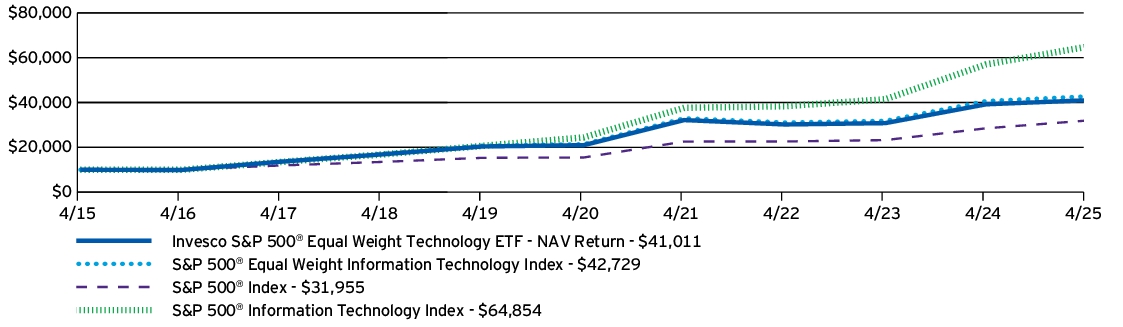

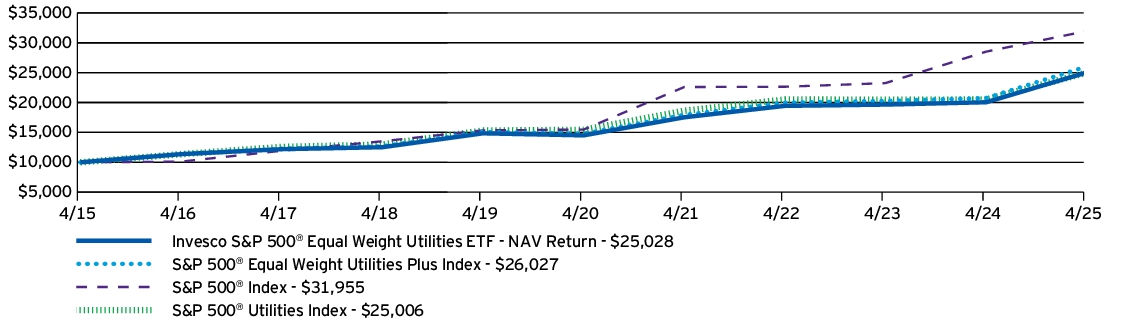

| Line Graph [Table Text Block] |

How Has The Fund Historically Performed? Growth of $10,000 Investment

|

|

| Average Annual Return [Table Text Block] |

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco AI and Next Gen Software ETF — NAV Return |

-2.88% |

5.93% |

12.03% |

| Blended - Invesco AI and Next Gen Software Benchmark |

-2.51% |

6.22% |

12.55% |

| NASDAQ® Composite Index |

12.22% |

15.32% |

14.52% |

| S&P Composite 1500® Software & Services Index |

10.06% |

15.18% |

18.04% |

|

|

| No Deduction of Taxes [Text Block] |

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

- Effective August 28, 2024, the Fund changed its broad-based securities market benchmark from the S&P Composite 1500® Software & Services Index to the NASDAQ® Composite Index to reflect that the NASDAQ® Composite Index can be considered more broadly representative of the overall applicable securities market.

|

|

| Updated Performance Information Location [Text Block] |

Please visit invesco.com/ETFs for more recent performance information.

|

|

| Net Assets |

$ 382,043,613

|

|

| Holdings Count | Holding |

101

|

|

| Advisory Fees Paid, Amount |

$ 1,948,987

|

|

| Investment Company Portfolio Turnover |

18.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of April 30, 2025)

| Fund net assets |

$382,043,613 |

| Total number of portfolio holdings |

101 |

| Total advisory fees paid |

$1,948,987 |

| Portfolio turnover rate |

18% |

|

|

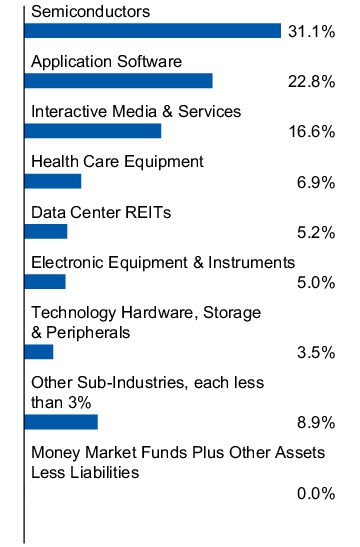

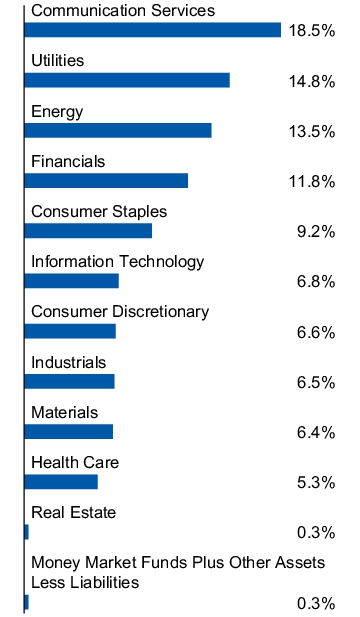

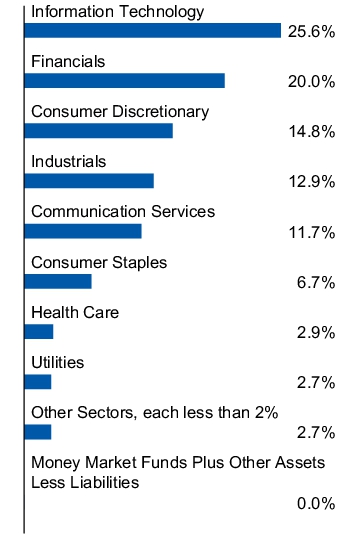

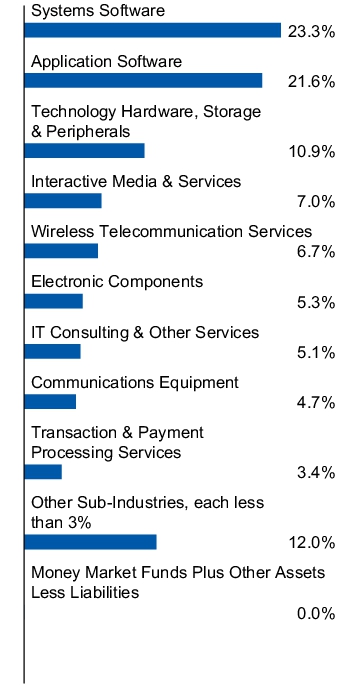

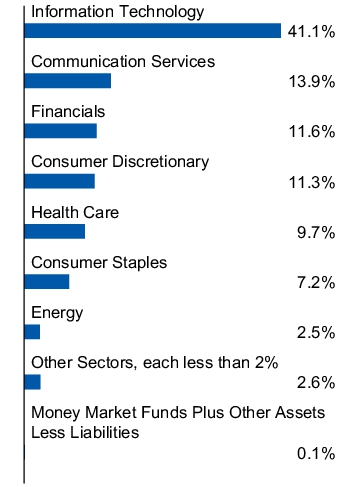

| Holdings [Text Block] |

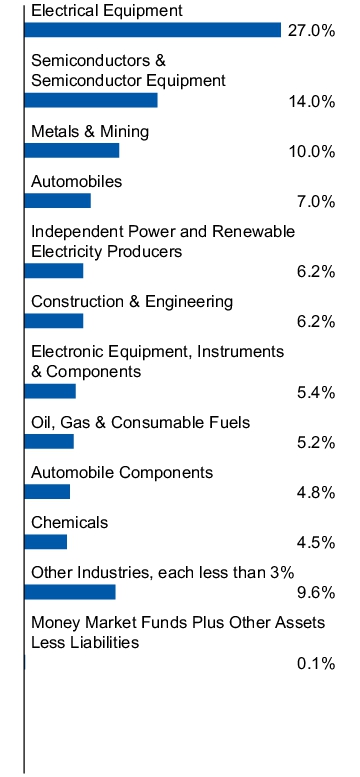

What Comprised The Fund's Holdings? (as of April 30, 2025) Top ten holdings*

(% of net assets)

| Alphabet, Inc., Class A |

7.92% |

| NVIDIA Corp. |

7.65% |

| Meta Platforms, Inc., Class A |

7.54% |

| Intuitive Surgical, Inc. |

6.93% |

| Adobe, Inc. |

6.25% |

| Advanced Micro Devices, Inc. |

5.97% |

| QUALCOMM, Inc. |

4.46% |

| MicroStrategy, Inc., Class A |

3.48% |

| Keyence Corp. |

3.33% |

| Micron Technology, Inc. |

3.28% |

| * Excluding money market fund holdings, if any. |

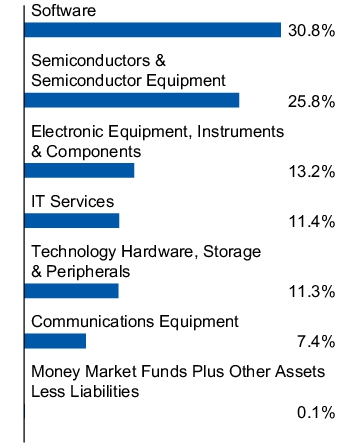

| Sub-industry allocation

(% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings*

(% of net assets)

| Alphabet, Inc., Class A |

7.92% |

| NVIDIA Corp. |

7.65% |

| Meta Platforms, Inc., Class A |

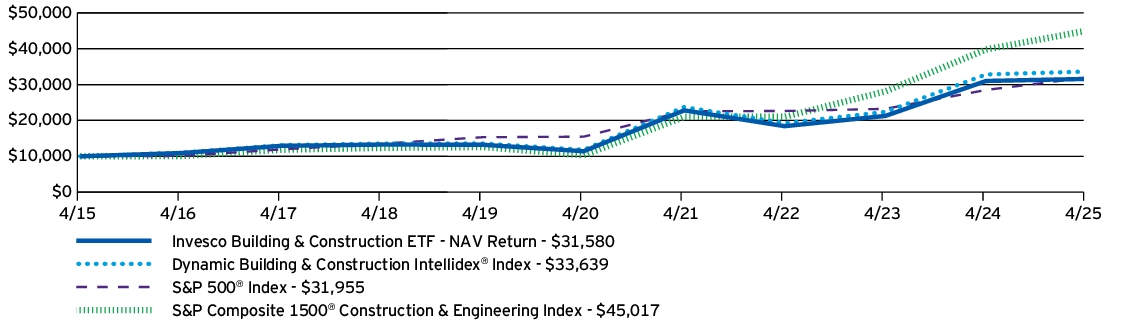

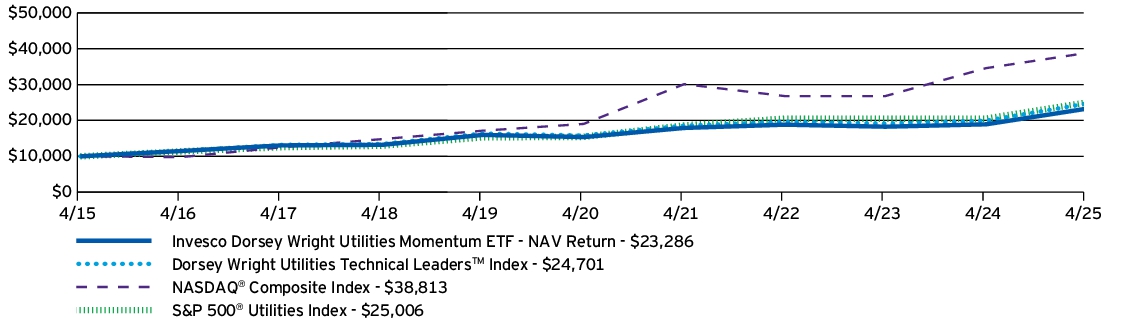

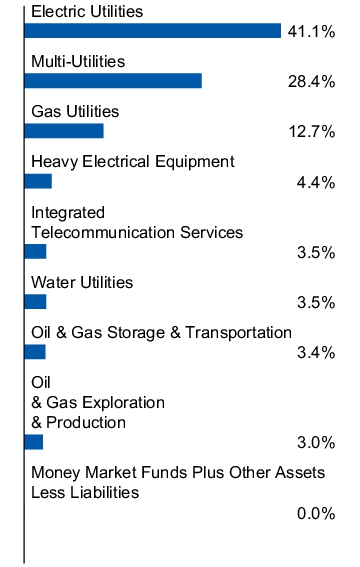

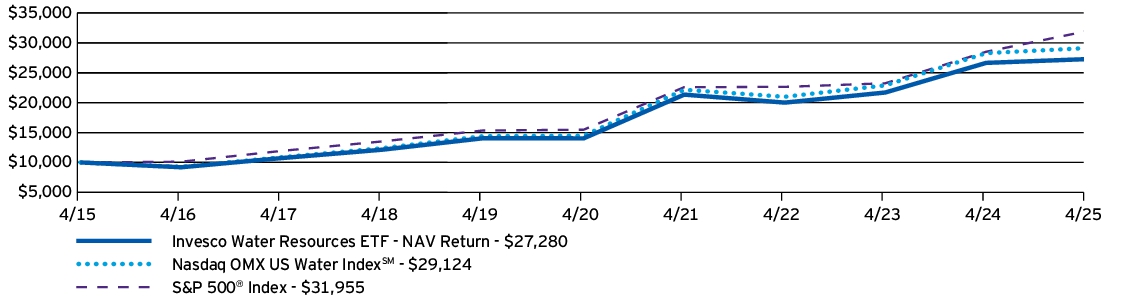

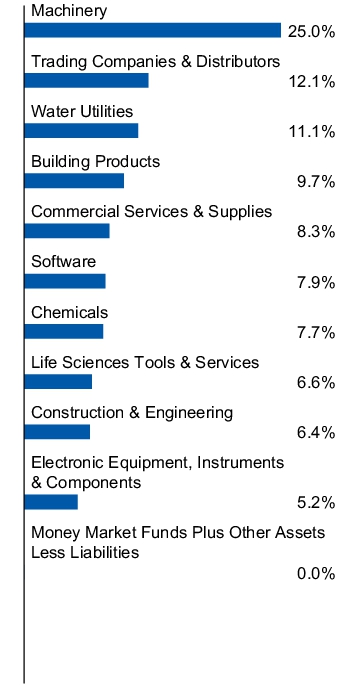

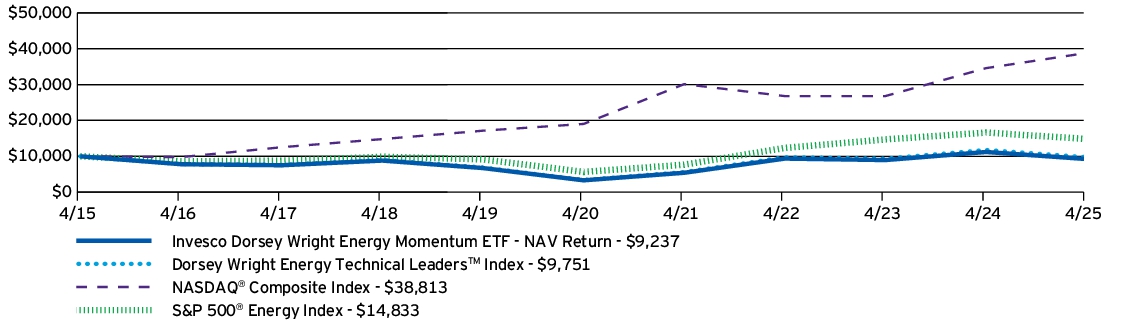

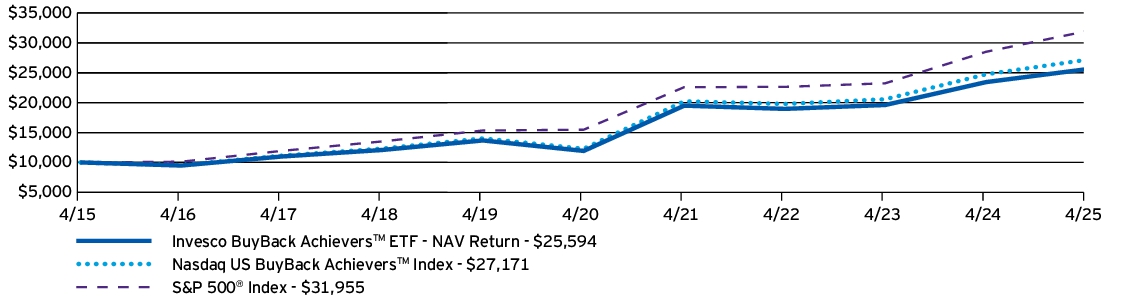

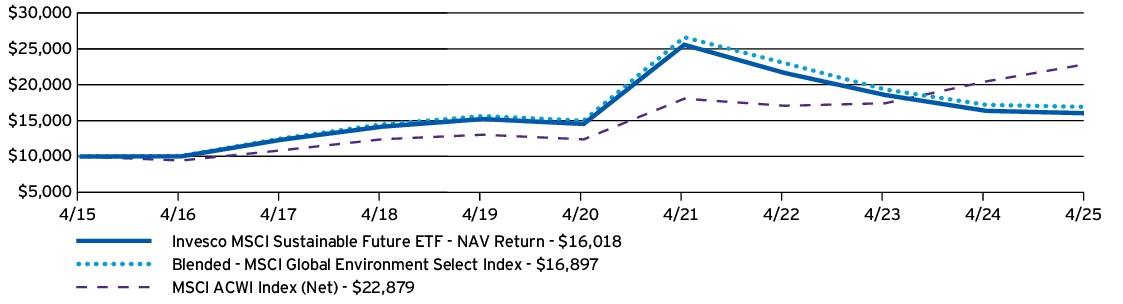

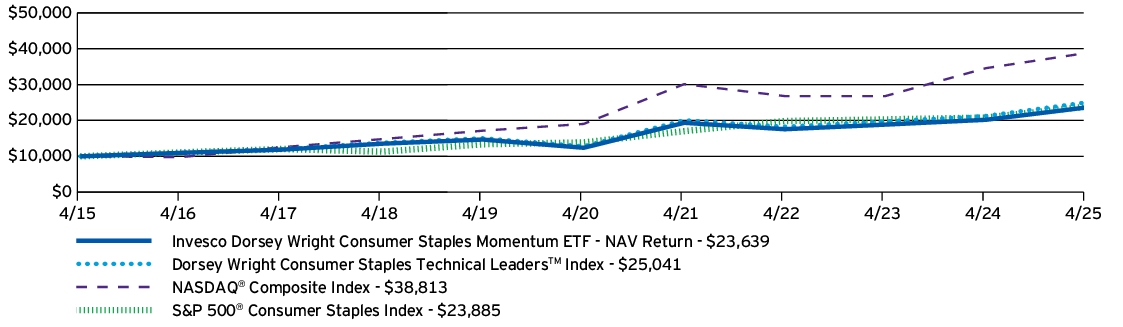

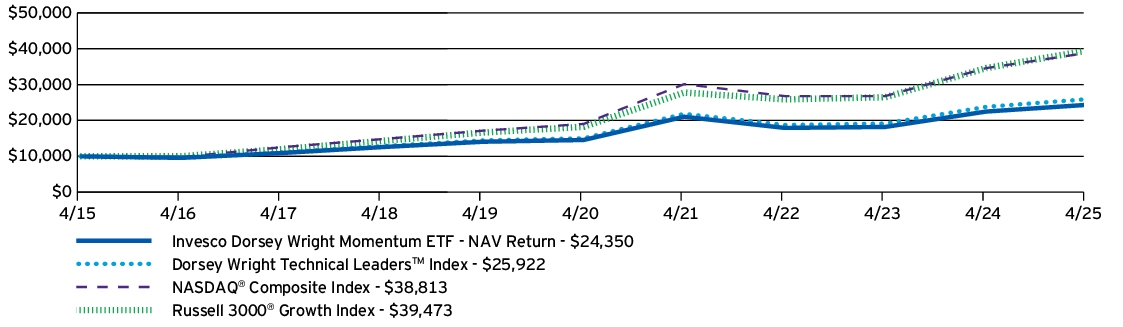

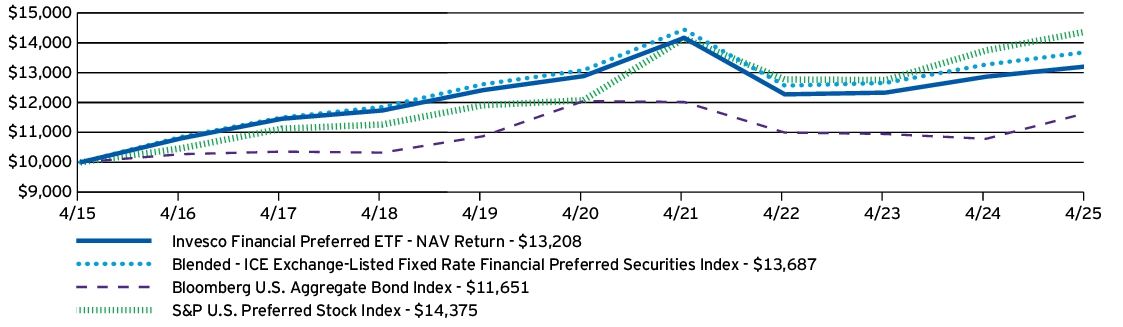

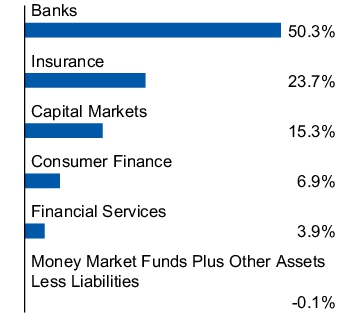

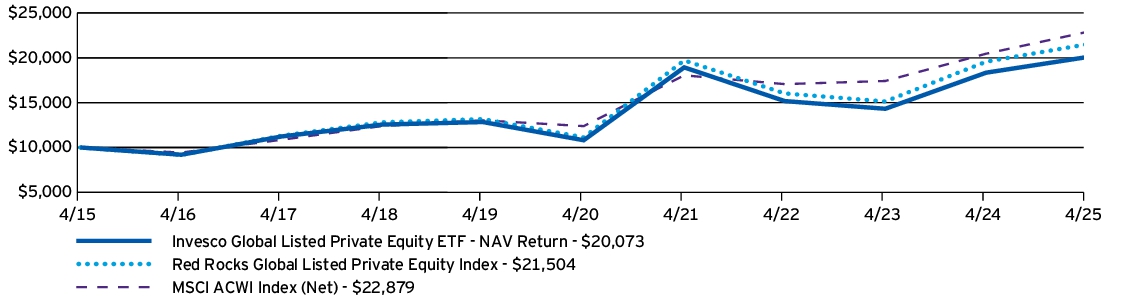

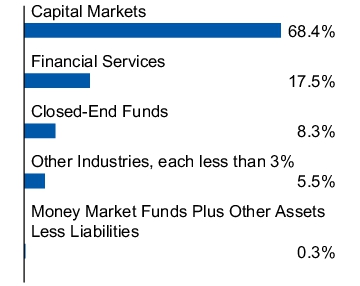

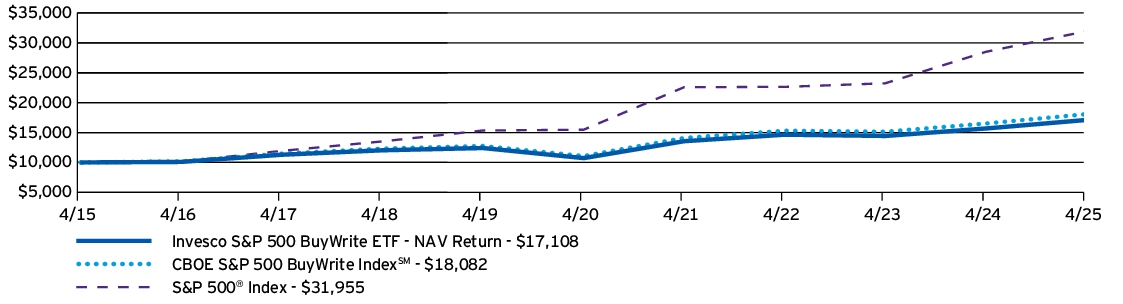

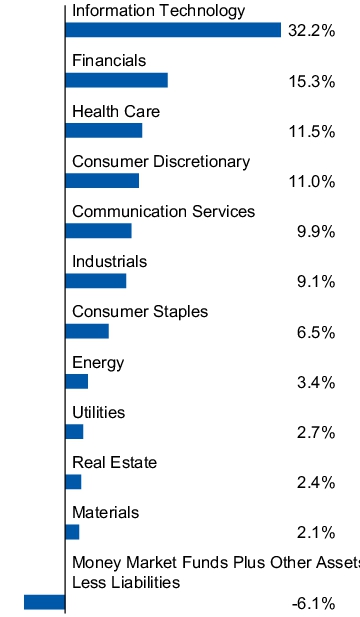

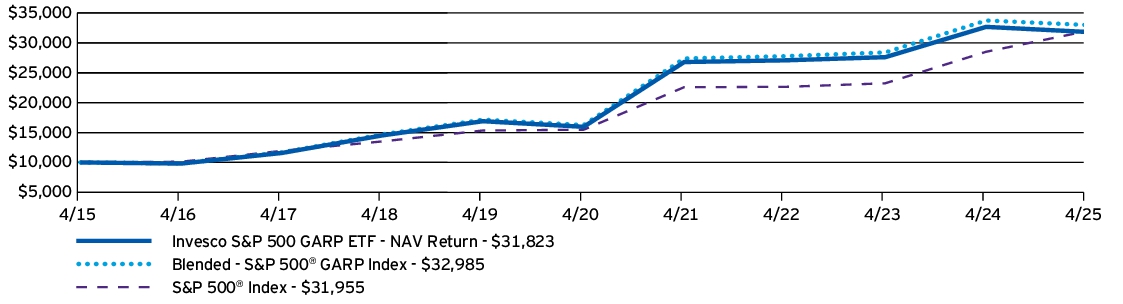

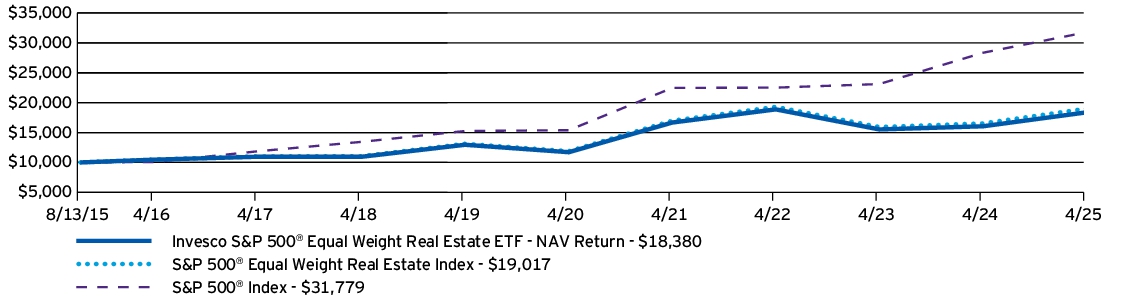

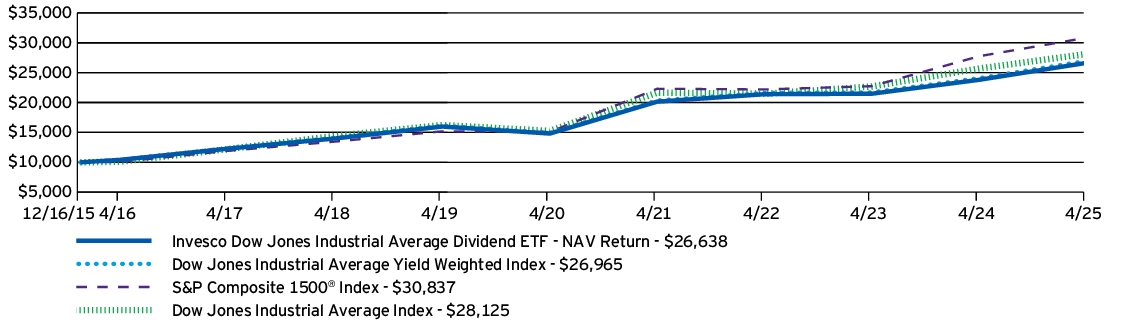

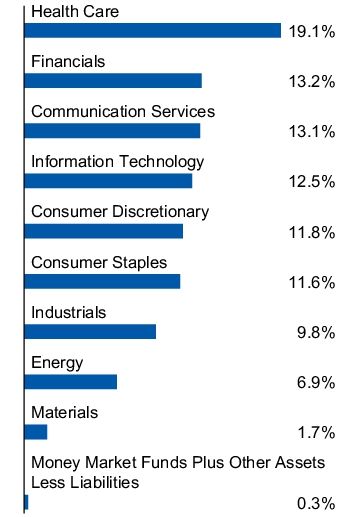

7.54% |