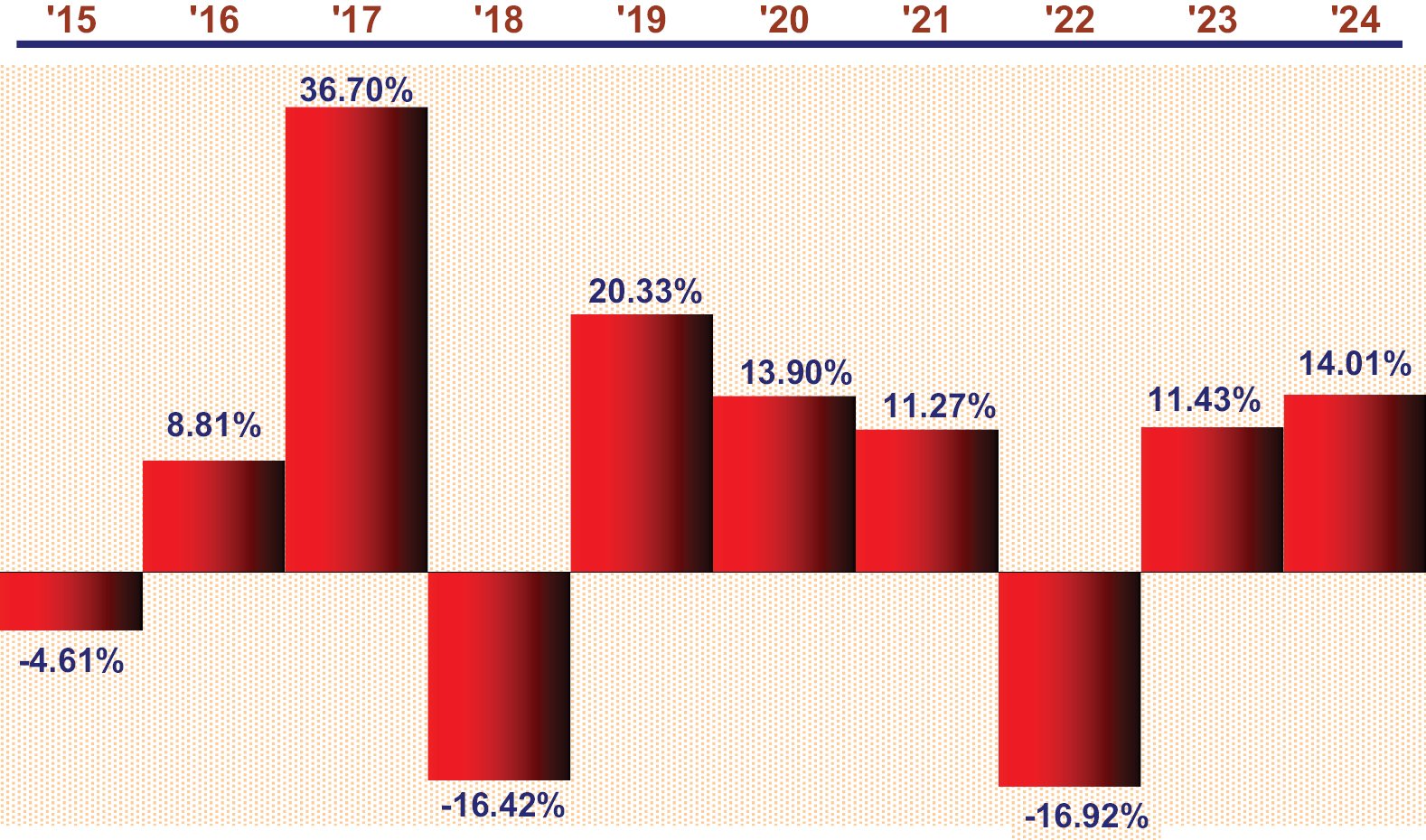

The following performance information indicates some of the risks of investing in the SmartETFs Asia Pacific Dividend Builder ETF.

The SmartETFs Asia Pacific Dividend Builder ETF acquired the assets and liabilities of the predecessor mutual fund, the Guinness Atkinson Asia Pacific Dividend Builder Fund, on March 26, 2021. As a result of the transaction, the Fund adopted the accounting and performance history of its predecessor mutual fund, the Guinness Atkinson Asia Pacific Dividend Builder Fund. The information shown below is for the predecessor mutual fund. The Fund’s total net operating expense ratio is lower than the net operating expense ratio of the predecessor mutual fund. Returns in the bar chart and table for the predecessor fund have not been adjusted.

The annual returns bar chart demonstrates the risks of investing in the SmartETFs Asia Pacific Dividend Builder ETF by showing how the predecessor mutual fund’s performance has varied from year to year. The table also demonstrates these risks by showing how the predecessor mutual fund’s average annual returns compare with those of a broad-based index. Unlike the predecessor mutual fund’s returns, the index returns do not reflect any deductions for fees, expenses

or taxes. For additional information on these indices, please see Index Descriptions in the prospectus. Past performance, before or after taxes, is not indicative of future performance. Updated performance information is available from the Fund’s website, www.smartetfs.com.

The year-to-date return for the Fund as of March 31, 2025, was 0.19%.

During the period shown in the bar chart, the best performance for the predecessor mutual fund for a quarter was 20.34% (for the quarter ended December 31, 2020). The worst performance was (21.11)% (for the quarter ended March 31, 2020).

| Average Annual Total Returns as of 12/31/24 | One Year | Five Years | Ten Years |

| SmartETFs Asia Pacific Dividend Builder ETF | |||

| Return Before Taxes | 14.01% | 5.99% | 6.68% |

| Return After Taxes on Distributions(1) | 12.61% | 3.56% | 5.05% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | 9.07% | 3.89% | 4.89% |

| MSCI AC Pacific ex Japan Index (Net Return) | 10.14% | 1.74% | 4.07% |

(1) This table shows returns for the predecessor mutual fund. After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their mutual fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

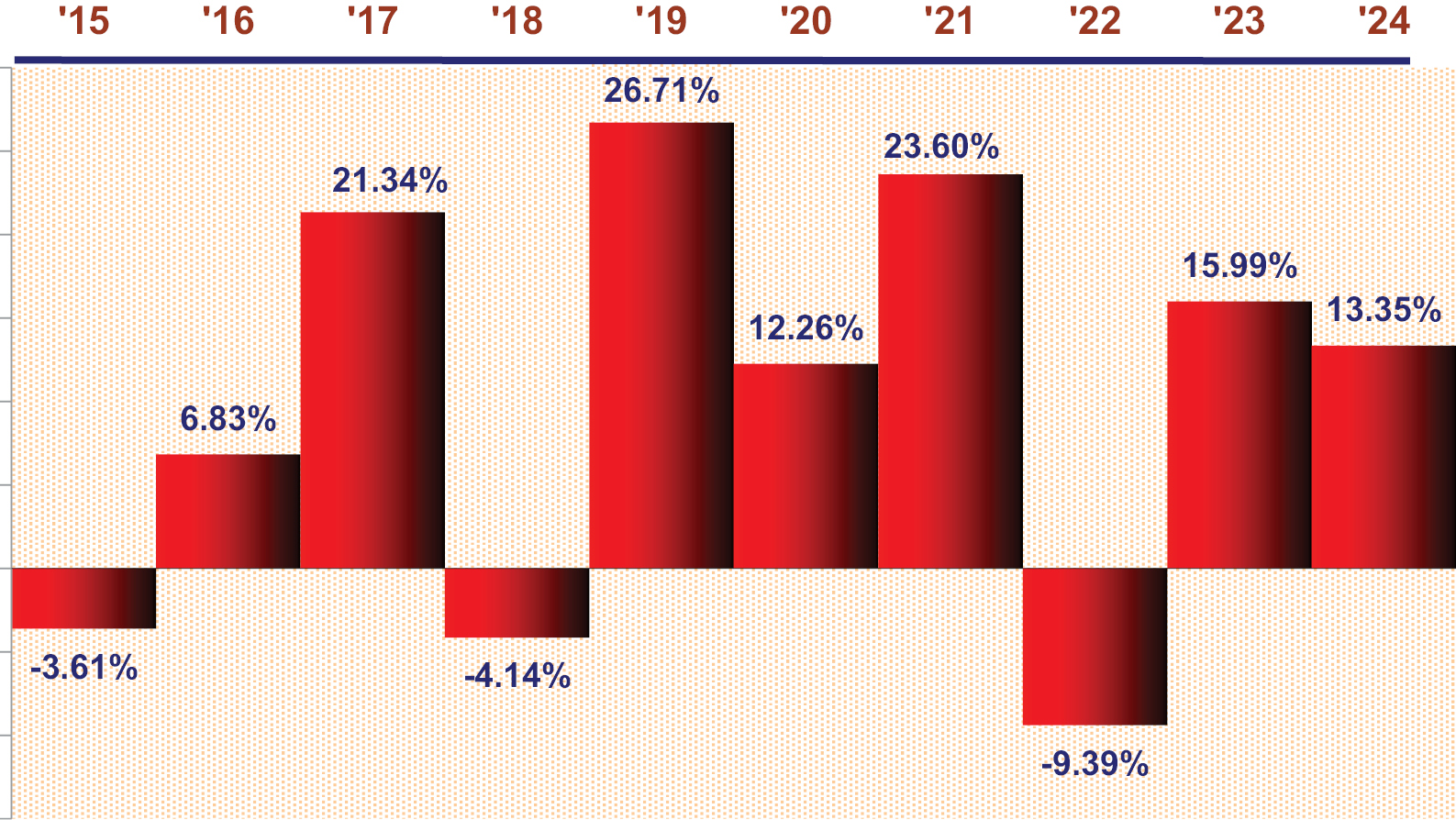

The following performance information indicates some of the risks of investing in the SmartETFs Dividend Builder ETF.

The SmartETFs Dividend Builder ETF acquired the assets and liabilities of the predecessor mutual fund, the Guinness Atkinson Dividend Builder Fund, on March 26, 2021. As a result of the transaction, the Fund adopted the accounting and performance history of its predecessor mutual fund, the Guinness Atkinson Dividend Builder Fund. The information shown below is for the predecessor mutual fund. The Fund’s total net operating expense ratio is lower than the net operating expense ratio of the predecessor mutual fund. Returns in the bar chart and table for the predecessor fund have not been adjusted.

The annual returns bar chart demonstrates the risks of investing in the SmartETFs Dividend Builder ETF by showing how the predecessor mutual fund’s performance has varied from year to year. The table also demonstrates these risks by showing how the predecessor mutual fund’s average annual returns compare with a broad-based securities market index. Unlike the predecessor mutual fund’s returns, these index returns do not reflect any deductions for fees, expenses or taxes. For additional information on these indices, please see Index Descriptions in the prospectus. Past performance, before or after taxes, is not indicative of future performance. Updated performance information is available from the Fund’s website www.smartetfs.com.

The year-to-date return for the Fund as of March 31, 2025, was 2.63%.

During the period shown in the bar chart, the best performance for a quarter was 15.33% (for the quarter ended June 30, 2020. The worst performance was (18.55)% (for the quarter ended March 31, 2020).

| Average Annual Total Returns as of 12/31/24 | One Year | Five Years | Ten Years |

| SmartETFs Dividend Builder ETF | |||

| Return Before Taxes | 13.35% | 10.58% | 9.63% |

| Return After Taxes on Distributions(1) | 12.66% | 9.58% | 8.80% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | 8.41% | 8.20% | 7.71% |

| MSCI World Index (Net Return) (Reflects No Deductions for Fees and Expenses) | 18.67% | 11.15% | 9.94% |

(1) After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

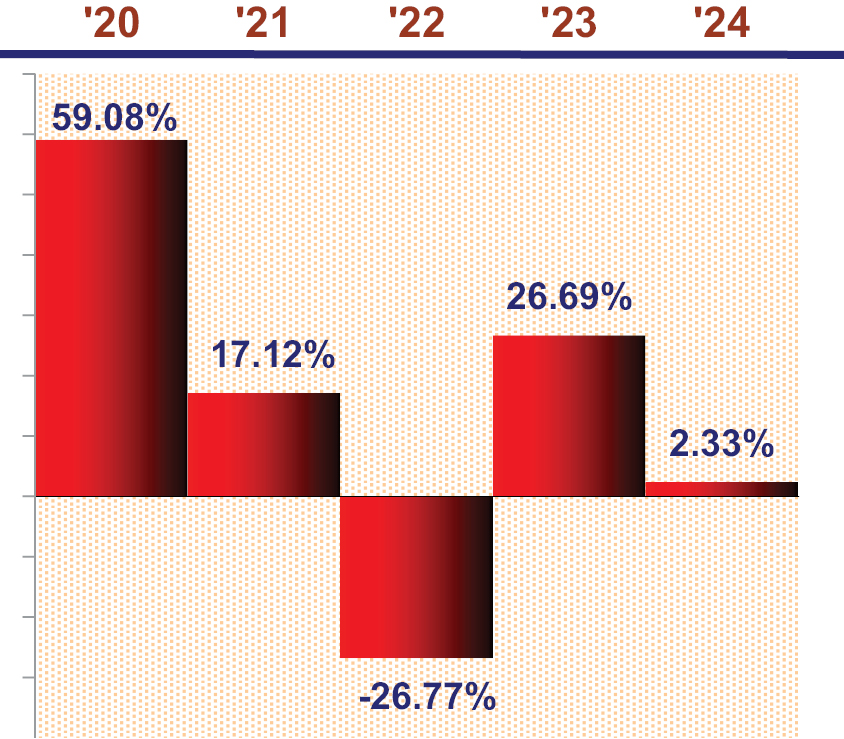

The bar chart and table below provide some indication of the risks of investing in the SmartETFs Smart Transportation & Technology ETF by showing how the fund’s performance has varied from year to year and by showing how the average annual total returns of the Fund compare with the average annual total returns of a broad-based market index. Unlike the Fund’s returns, the index returns do not reflect any deductions for fees, expenses or taxes. For additional information on these indices, please see Index Descriptions in the prospectus. Updated performance information is available from the Fund’s website, www.smartetfs.com. Past performance, before or after taxes, is not indicative of future performance.

The annual returns bar chart demonstrates the risks of investing in the SmartETFs Smart Transportation & Technology ETF by showing how the Fund’s performance has varied from year to year. The table below also demonstrates these risks by showing how the Fund’s average annual returns compare with those of a broad-based securities market index. Unlike the Fund’s returns, the index returns do not reflect any deductions for fees, expenses or taxes. For additional information on these indices, please see Index Descriptions in the prospectus. Past performance, before or after taxes, is not indicative of future performance. Updated performance information is available on the Fund’s website www.smartetfs.com.

The year-to-date return for the Fund as of March 31, 2025, was (6.77)%.

During the period shown in the bar chart, the best performance for a quarter was 30.64% (for the quarter ended December 31, 2020). The worst performance was (24.25)% (for the quarter ended March 31, 2020).

| Average Annual Total Returns as of 12/31/24 | One Year | Five Years | Since Inception (November 14, |

| SmartETFs Smart Transportation & Technology ETF | |||

| Return Before Taxes | 2.33% | 12.08% | 12.92% |

| Return After Taxes on Distributions(1) | 2.27% | 11.52% | 12.37% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | 1.73% | 9.54% | 10.26% |

| MSCI World Index (Net Return) (Reflects No Deductions for Fees and Expenses) | 18.67% | 11.15% | 11.77% |

(1) After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

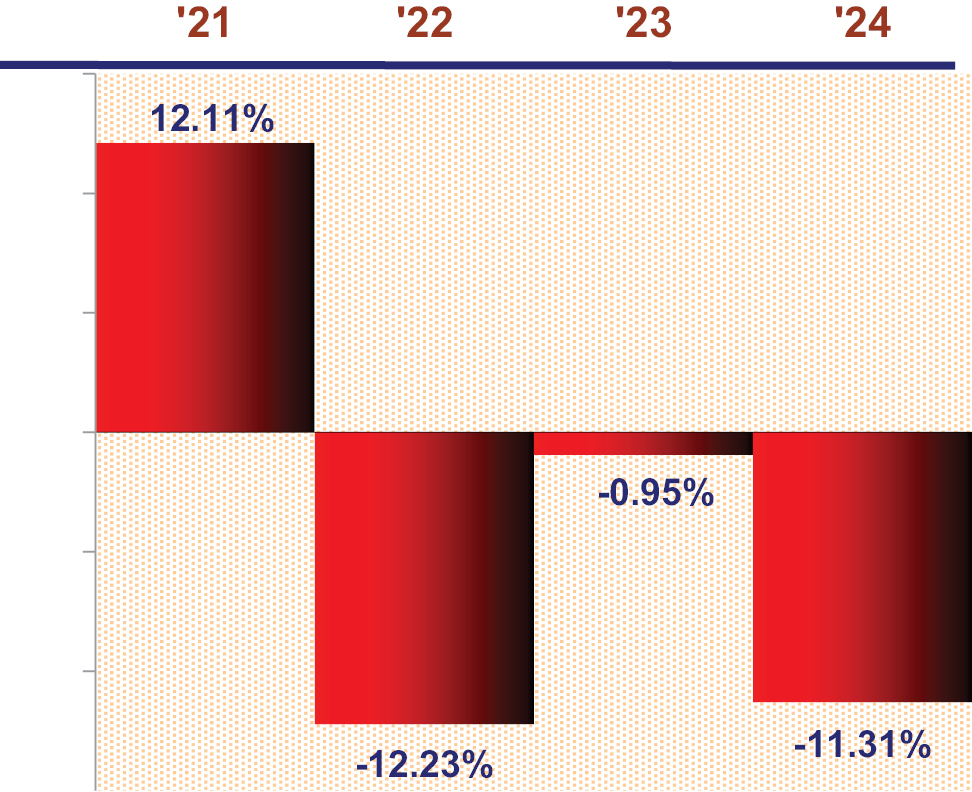

The bar chart and table below provide some indication of the risks of investing in the SmartETFs Sustainable Energy II ETF by showing how the fund’s performance has varied from year to year and by showing how the average annual total returns of the Fund compare with the average annual total returns of a broad-based market index. Unlike the Fund’s returns, the index returns do not reflect any deductions for fees, expenses or taxes. For additional information on these indices, please see Index Descriptions in the prospectus. Updated performance information is available from the Fund’s website, www.smartetfs.com. Past performance does not necessarily indicate how the Fund will perform in future periods.

The annual returns bar chart demonstrates the risks of investing in the SmartETFs Sustainable Energy II ETF by showing how the Fund’s performance has varied from year to year. The table below also demonstrates these risks by showing how the Fund’s average annual returns compare with those of a broad-based securities market index. Unlike the Fund’s returns, the index returns do not reflect any deductions for fees, expenses or taxes. For additional information on these indices, please see Index Descriptions in the prospectus. Past performance, before or after taxes, is not indicative of future performance. Updated performance information is available on the Fund’s website www.smartetfs.com.

The year-to-date return for the Fund as of March 31, 2025, was (4.97)%.

During the period shown in the bar chart, the best performance for a quarter was 10.99% (for the quarter ended December 31, 2022). The worst performance was (15.99)% (for the quarter ended September 30, 2023).

| Average Annual Total Returns as of 12/31/24 | One Year | Since Inception |

| SmartETFs Sustainable Energy II ETF | ||

| Return Before Taxes | (11.31)% | 0.56% |

| Return After Taxes on Distributions(1) | (11.42)% | 0.17% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | (6.50)% | 0.37% |

| MSCI World Index (Net Return) (Reflects No Deductions for Fees and Expenses) | 18.67% | 11.36% |

(1) After-tax returns are calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.