Exhibit 99.1

GOVERNMENT OF ALBERTA

Annual Report

Government of Alberta

2024-2025

| ● | Budget 2024 Key Results |

| ● | Consolidated Financial Statements |

| ● | Performance Results |

Exhibit 99.1

GOVERNMENT OF ALBERTA

Annual Report

Government of Alberta

2024-2025

| ● | Budget 2024 Key Results |

| ● | Consolidated Financial Statements |

| ● | Performance Results |

This is the report to Albertans on Budget 2024: A Responsible Plan for a Growing Province.

It is a permanent public record of the revenue, expense and results achieved by the Government of Alberta for the 2024–25 fiscal year.

The Government of Alberta 2024–25 Annual Report consists of three parts:

| • | Budget 2024 Key Results, which provide a description and variance analysis of government’s revenue, spending, assets and liabilities. |

| • | Consolidated Financial Statements, which provide an overall accounting of the government’s revenue and spending, and assets and liabilities. |

| • | Performance Results, which reports on the progress that has been made towards achieving the government’s goals. |

Annual reports for each ministry have also been published, providing additional detailed information on performance and financial results.

©2025 Government of Alberta | Published: June 2025

ISBN 978-1-4601-6304-7

ISSN 2291-6431

This publication is issued under the Open Government Licence – Alberta (http://open.alberta.ca/licence).

Note to Readers: Copies of the annual report are available on the Alberta Open Government Portal website, at https://open.alberta.ca/publications/2291-6431

www.alberta.ca

Preface

The Public Accounts of Alberta are prepared in accordance with the Financial Administration Act and the Sustainable Fiscal Planning and Transparency Act. The Public Accounts consist of the Annual Report of the Government of Alberta and the annual reports of each of the 25 ministries.

This Annual Report of the Government of Alberta contains Budget 2024 Key Results, the audited Consolidated Financial Statements and Performance Results, which compares actual performance results to desired results set out in the government’s strategic plan.

The annual reports of ministries are released concurrently with the Annual Report of the Government of Alberta. The ministry annual reports contain the financial information of the ministries and a comparison of actual performance results to desired results set out in the ministries’ business plans. Each ministry annual report also includes:

| • | Financial statements of entities making up the ministry which includes regulated funds, provincial agencies and Crown-controlled corporations for which the minister is responsible; |

| • | Other financial information as required by the Financial Administration Act and the Sustainable Fiscal Planning and Transparency Act, as separate reports, to the extent that the ministry has anything to report; |

| • | Financial information relating to accountable organizations and trust funds. |

| Government of Alberta | Annual Report 2024–2025 | 1 | |

Table of Contents

| Preface |

1 | |||

| Table of Contents |

2 | |||

| Budget 2024 Key Results |

5 | |||

| Financial Highlights |

7 | |||

| Fiscal Summary |

7 | |||

| Revenue Highlights |

8 | |||

| Expense Highlights |

9 | |||

| Statement of Financial Position |

10 | |||

| Financial Indicators and Risks |

11 | |||

| Historical Fiscal Summary 2013-14 to 2024-25 |

12 | |||

| Consolidated Financial Statements of the Province of Alberta |

13 | |||

| Table of Contents |

15 | |||

| Management’s Responsibility for the Consolidated Financial Statements |

17 | |||

| Independent Auditor’s Report |

18 | |||

| Consolidated Statement of Operations |

25 | |||

| Consolidated Statement of Financial Position |

26 | |||

| Consolidated Statement of Remeasurement Gains and Losses |

27 | |||

| Consolidated Statement of Change in Net Debt |

28 | |||

| Consolidated Statement of Cash Flows |

29 | |||

| Notes to the Consolidated Financial Statements |

30 | |||

| 1 Summary of Significant Accounting Policies and Reporting Practices |

30 | |||

| 2 Valuation of Financial Assets and Liabilities |

39 | |||

| 3 Financial Risk Management |

41 | |||

| 4 Budget and Legislative Authority |

49 | |||

| 5 Contractual Rights |

49 | |||

| 6 Contingent Assets |

50 | |||

| 7 Contractual Obligations and Commitments |

50 | |||

| 8 Contingent Liabilities |

51 | |||

| 9 Trust Funds Under Administration |

54 | |||

| 10 Comparative Figures |

54 | |||

| 2 | Government of Alberta | Annual Report 2024–2025 | |

Table of Contents

| Schedules to the Consolidated Financial Statements |

55 | |||

| 1 Revenues |

55 | |||

| 2 Revenues by Source by Ministry |

56 | |||

| 3 Expenses by Object by Ministry |

57 | |||

| 4 Cash and Cash Equivalents |

58 | |||

| 5 Accounts Receivable and Advances |

58 | |||

| 6 Portfolio Investments |

59 | |||

| 7 Endowment Funds |

60 | |||

| 8 Equity in Government Business Enterprises |

61 | |||

| 9 Loans Receivable |

65 | |||

| 10 Derivative Financial Instruments |

66 | |||

| 11 Accounts Payable and Other Accrued Liabilities |

67 | |||

| 12 Asset Retirement Obligations and Environmental Liabilities |

67 | |||

| 13 Debt |

68 | |||

| 14 Pension Plans and Other Defined Benefit Plans |

72 | |||

| 15 Deferred Contributions |

79 | |||

| 16 Tangible Capital Assets |

80 | |||

| 17 Adjustments to Net Assets - Operating |

81 | |||

| 18 Over-expenditure of Spending Authorities |

82 | |||

| 19 Listing of Organizations |

83 | |||

| Glossary (Unaudited) |

89 | |||

| Performance Results |

95 | |||

| Table of Contents |

96 | |||

| Management’s Responsibility for Reporting |

97 | |||

| Executive Overview |

98 | |||

| Priority One: Securing Alberta’s Future |

100 | |||

| Performance Indicators |

111 | |||

| Priority Two: Standing up for Albertans |

121 | |||

| Performance Indicators |

133 | |||

| Performance Indicators – Sources and Notes |

143 | |||

| Government of Alberta | Annual Report 2024–2025 | 3 | |

BLANK PAGE

| 4 | Government of Alberta | Annual Report 2024–2025 | |

Budget 2024 Key Results

| Government of Alberta | Annual Report 2024–2025 | 5 | |

Table of Contents

| Budget 2024 Key Results |

||||

| Financial Highlights |

7 | |||

| Fiscal Summary |

7 | |||

| Revenue Highlights |

8 | |||

| Expense Highlights |

9 | |||

| Statement of Financial Position |

10 | |||

| Financial Indicators and Risks |

11 | |||

| Historical Fiscal Summary, 2013-14 to 2024-25 |

12 | |||

Note on reclassification:

| • | 2023-24 Actual and 2024-25 Budget and Actual numbers have been reclassified to reflect the revised government structure under the Government Organization Act (Order in Council 234/2024, August 28, 2024, Order in Council 384/2024, December 12, 2024, and Ministerial Order 803/2024, August 28, 2024), and through amendments to Alberta’s Provincial Health Act (Ministerial Orders 701/2024 and 703/2024, June 21, 2024, and Ministerial Orders 330/2024 and 331/2024, November 12, 2024). |

| • | 2023-24 Actual has been reclassified to include $5.85 million in Alberta Enterprise Corporation’s investment-related revenue and expense. The reclassification reflects realized gains in 2023-24, whereas 2024-25 includes realized losses reported as expense. |

| • | 2024-25 budget numbers have been restated to reflect adoption of the new Public Private Partnerships (P3) accounting standard. |

| 6 | Government of Alberta | Annual Report 2024–2025 | |

Financial Highlights

Budget 2024 presented a responsible plan to manage the pressures faced by a growing province by supporting health care and education, and securing the future through a reinvigorated Heritage Fund.

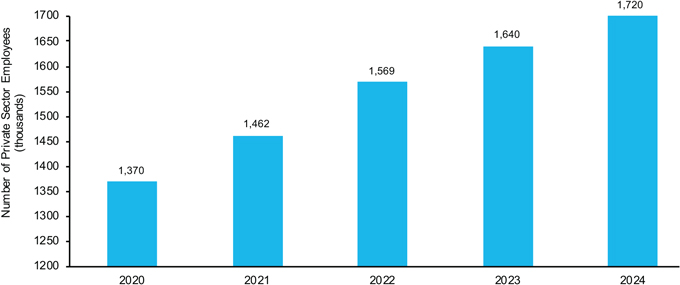

In 2024, Alberta experienced a second year of rapid population growth. Population grew by 4.4 per cent in 2024, following growth of 3.9 per cent in 2023. While this increase in population has supported economic growth, it has also added pressure to government programs and services. In 2024-25, the government focused on health, education and social programs spending. Hot and dry conditions in 2024, following the severe drought in 2023, led to significant wildfires and indemnity payments, income support and emergency relief spending for the agriculture sector.

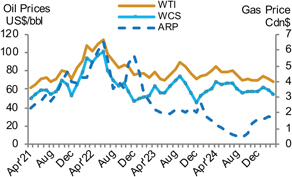

The 2024-25 results were a surplus of $8.3 billion, an increase of $4 billion from 2023-24 and an increase of $8 billion from Budget 2024, largely from higher resource revenue due to a narrower light-heavy differential and lower exchange rates. The West Texas Intermediate (WTI) oil price averaged US $74.34 per barrel (/bbl) compared to $74.00/bbl at budget.

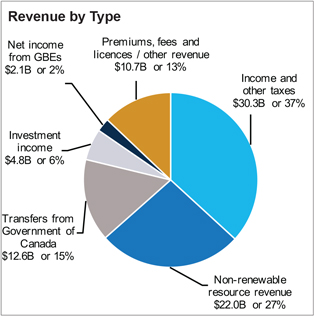

Total Revenue was $82.5 billion, $7.7 billion more than 2023-24 and $8.9 billion more than budget.

Change from 2023-24. Comprises of increases of $3.6 billion in tax revenue, $2.7 billion in

non-renewable resource revenue (NRR), $0.3 billion in federal government transfers, $0.2 billion in investment income, $0.8 billion in government business enterprise net income, and $0.1 billion in premiums, fees, and licences / other revenue.

Change from Budget. Consists of increases of $1.7 billion in tax revenue, $4.7 billion in NRR, $1.5 billion in investment income, and $1.1 billion in premiums, fees and licences / other revenue, offset by slight decrease of $0.1 billion in government business enterprise net income.

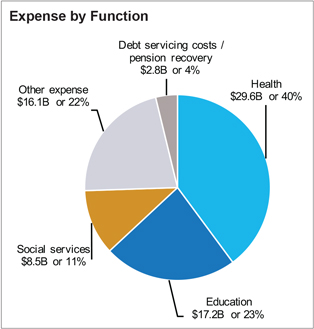

Total Expense was $74.1 billion, $3.7 billion more than 2023-24 and up $1 billion from budget. Budget 2024 included a contingency of $2 billion.

Change from 2023-24. Consists of increases of $2.1 billion in health function expense, $1.3 billion in education and social services function expense, $0.3 billion in other program functions, and minor increase in debt servicing and increase in pension expense.

Change from Budget. Consists of increases of $0.8 billion in health function expense, $0.5 billion in education and social services function expense, and $0.3 billion decreases in other program functions, debt servicing, and pension expense.

Net Financial Debt. At March 31, 2025, net financial debt was $34.3 billion, an improvement of $7.1 billion from $41.4 billion on March 31, 2024. Net debt to GDP in 2024-25 was 7.2 per cent.

| Fiscal Summary | Change from | |||||||||||||||||||

| (millions of dollars) | 2024-25 | 2023-24 | 2023-24 | |||||||||||||||||

| Budget | Actual | Actual | Budget | Actual | ||||||||||||||||

| Revenue |

||||||||||||||||||||

| Income and other taxes |

28,645 | 30,356 | 26,747 | 1,711 | 3,609 | |||||||||||||||

| Non-renewable resource revenue |

17,315 | 21,986 | 19,287 | 4,671 | 2,699 | |||||||||||||||

| Transfers from Government of Canada |

12,640 | 12,618 | 12,336 | (21 | ) | 283 | ||||||||||||||

| Net Investment income |

3,267 | 4,803 | 4,587 | 1,536 | 216 | |||||||||||||||

| Net income / (loss) from government business enterprises |

2,123 | 2,053 | 1,237 | (70 | ) | 816 | ||||||||||||||

| Premiums, fees and licences / other revenue |

9,548 | 10,653 | 10,544 | 1,106 | 108 | |||||||||||||||

| Total Revenue |

73,537 | 82,469 | 74,738 | 8,932 | 7,731 | |||||||||||||||

| Expense by Function |

||||||||||||||||||||

| Health |

28,732 | 29,560 | 27,447 | 828 | 2,113 | |||||||||||||||

| Education |

17,004 | 17,197 | 16,359 | 193 | 838 | |||||||||||||||

| Social Services |

8,143 | 8,462 | 8,035 | 319 | 427 | |||||||||||||||

| Other (Budget incl. 2.0 billion contingency) |

16,278 | 16,118 | 15,835 | (160 | ) | 283 | ||||||||||||||

| Total Program Expense |

70,157 | 71,337 | 67,676 | 1,180 | 3,661 | |||||||||||||||

| Debt servicing costs |

3,389 | 3,215 | 3,149 | (175 | ) | 65 | ||||||||||||||

| Pension recovery |

(364 | ) | (403 | ) | (372 | ) | (39 | ) | (31 | ) | ||||||||||

| Total Expense |

73,182 | 74,149 | 70,453 | 967 | 3,695 | |||||||||||||||

| Surplus |

355 | 8,320 | 4,285 | 7,965 | 4,036 | |||||||||||||||

| Net Financial Debt |

(42,092 | ) | (34,337 | ) | (41,364 | ) | 7,755 | 7,027 | ||||||||||||

| Government of Alberta | Annual Report 2024–2025 | 7 | |

Revenue Highlights

| · | Total 2024-25 revenue was $82.5 billion, $7.7 billion higher than in 2023-24 and $8.9 billion higher than budget. |

| · | Personal and corporate income tax revenue totaled $24.2 billion, comprising $16.1 billion in personal income tax (PIT) and $8.1 billion in corporate income tax (CIT). PIT increased $1 billion and $0.5 billion from 2023-24 and budget respectively, which can be attributed to strong growth in personal incomes and population. CIT increased $1.1 billion from both 2023-24 and budget mainly due to strong corporate profits and increases in interest and penalties due to larger tax reassessments. |

| · | Other tax revenue was $6.1 billion in 2024-25 comprising: $2.8 billion in education property tax and $3.3 billion in fuel, tobacco, insurance and other taxes. Fuel tax relief was provided to consumers in the prior fiscal year, which resulted in an increase of $1.2 billion from 2023-24 as the fuel tax was collected for the entire fiscal year in 2024-25. |

| · | NRR in 2024-25 was $22 billion, an increase of $2.7 billion from 2023-24 revenue and $4.7 billion from budget. Bitumen royalty in 2024-25 was $17.2 billion, an increase of $2.6 billion from 2023-24 and $4.6 billion from budget. The increases were primarily due to a lower exchange rate, narrower light-heavy differential, and lower cost due, in part, to lower natural gas prices. |

| · | The West Texas Intermediate (WTI) oil price averaged US$74.34 per barrel (/bbl) in 2024-25, down $3.49/bbl from 2023-24, but $0.34/bbl higher than the budget estimate. The light-heavy oil price differential averaged US$13.06/bbl in 2024-25, $4.23 narrower than in 2023-24, influenced by increased demand for heavier crude and the completion of the TMX project. |

| · | Federal government transfers in 2024-25 were $12.6 billion, $0.3 billion higher than in 2023-24 and remained steady compared to budget. The increase was mainly the result of the province’s larger revenue share of the Canada Health Transfer (CHT) and Canada Social Transfer (CST), as well as additional federal |

| funding received for the Canada-Alberta Canada- Wide Early Learning Child Care agreements. The increase from the prior year is partially offset by Alberta not qualifying for fiscal stabilization in 2024-25, after receiving $0.6 billion in 2023-24, and end of the pandemic-related CHT top-up payments. |

| · | Investment income was $4.8 billion, $0.2 billion higher than 2023-24 and $1.5 billion higher than budget, mainly due to conservative budget assumptions and strong performances of various equity investments. |

| · | Government business enterprise net income was $2.1 billion in 2024-25, an increase of $0.8 billion from 2023-24 and a decrease of $0.1 billion from budget. The increase is primarily a result of the Alberta Petroleum Marketing Corporation recognizing a $1.2 billion non-cash adjustment to the Sturgeon Refinery Processing Agreement Provision in 2023-24 due to changes in the onerous contract provision. |

| · | Other revenue totaled $10.7 billion, $0.1 billion more than 2023-24, and $1.1 billion higher than budget. The increase includes higher revenue from post-secondary institution tuition fees, increased number of AHS patients that were billable to non-residents and other responsible parties and reporting a portion of the settlement of tobacco litigation, offset by decreases in the Technology Innovation and Emissions Reduction Fund compliance payments due to changes in market conditions. |

| 8 | Government of Alberta | Annual Report 2024–2025 | |

Expense Highlights

| · | Total expense in 2024-25 was $74.1 billion, including $1.9 billion in disaster and emergency assistance. Expense increased by $1 billion from budget and increased $3.7 billion from prior year. The $2.0 billion contingency included in Budget 2024 was fully utilized in 2024-25. |

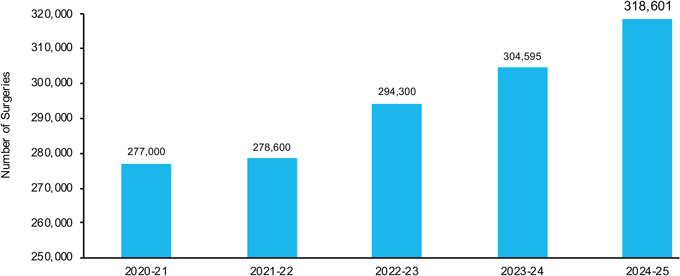

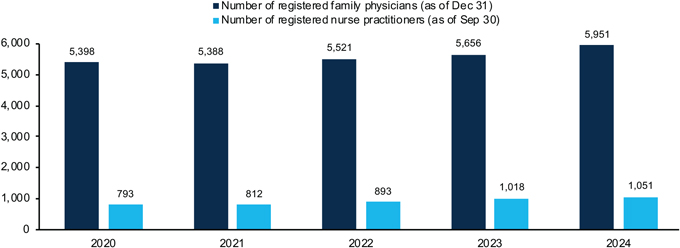

| · | Health function expense was $29.6 billion, an increase of $2.1 billion from 2023-24 and $0.8 billion from Budget 2024. Alberta’s health care system continues to face pressures, primarily due to growing clinical demands, workforce challenges, and a rising population, with inflation adding to the strain. Increases are mainly from higher physician volumes and service utilization, increased clinical activity and patient volumes across care areas, collective bargaining and overtime, greater benefit and drug utilization, expanded continuing care funding, and increased demand for additional health services. |

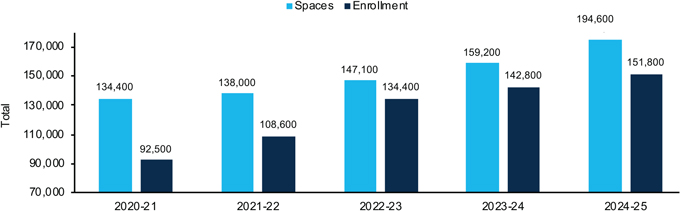

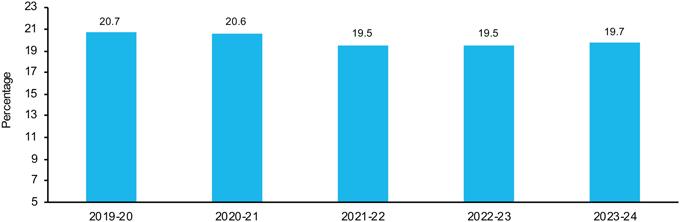

| · | Total education function expense was $17.2 billion in 2024-25, $0.8 billion higher than 2023-24, and $0.2 billion higher than Budget 2024. This comprises $9.9 billion for K-12 education and $7.2 billion for post-secondary and skills and training programs. The increase from 2023-24 reflects higher enrolment, resulting in greater expenditures on teaching staff, educational assistants, and support services. Public post-secondary institutions experienced increased costs in research-related activities and program expansions. |

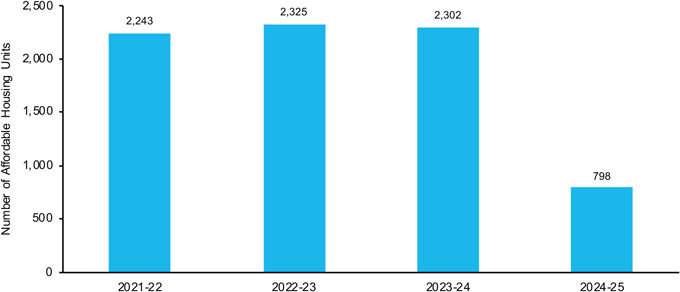

| · | Social services expense was $8.5 billion, an increase of $0.4 billion from 2023-24, and $0.3 billion higher than budget. The increase from 2023-24 was primarily due to rising caseloads and related program costs, new expense tied to homelessness task force priorities and operations of Navigation and Support Centres, as well as higher capital grants for continuing care and independent housing projects. Additional increases were related to child care affordability and access, and initiatives to support child care quality and the workforce. These were partially offset by reduced spending on Indigenous and affordable housing due to project re-profiling and |

| on the Affordability Support Payments program, which ended in June 2023. |

| · | Other expense was $16.1 billion, an increase of $0.3 billion from 2023-24, and a $0.2 billion decrease from budget. Increases were primarily driven by higher spending for resource development and orphan well management, as well as additional capital funding under the new Local Government Fiscal Framework Capital program. Protection of persons and property increased due to police support grants, though overall spending declined from the prior year due to reduced emergency management activity. These increases were partially offset by lower spending in emissions management and slower than anticipated construction progress by municipalities on several projects, including Edmonton and Calgary LRTs. |

| · | Debt servicing costs were $3.2 billion, an increase of $0.1 billion from 2023-24 and $0.2 billion lower than budget. This is mainly due to lower-than expected borrowing requirements as a result of the higher surplus. |

| · | Public sector pension plan liabilities decreased by $0.4 billion to $7.5 billion at March 31, 2025. |

| Government of Alberta | Annual Report 2024–2025 | 9 | |

Statement of Financial Position

| · | At March 31, 2025, total assets exceeded liabilities by $24.5 billion. This was an improvement of $8.3 billion from $16.2 billion on March 31, 2024, mainly due to a $6.3 billion increase in portfolio investments netted against $2.9 billion increase in debt. Net Assets consists of $21 billion in net assets and accumulated remeasurement gains of $3.5 billion. |

| · | Financial assets were $97.9 billion, an increase of $11 billion from March 31, 2024. Changes include a $6.3 billion increase in portfolio investments mainly from increased investment and growth in the market value of the Alberta Heritage Savings Trust Fund, a $1.1 billion increase in loans and other receivables, and a $3.7 billion increase in cash and cash equivalents. |

| · | Liabilities were $132.3 billion at year-end, $4 billion higher than on March 31, 2024, due to a $2.9 billion increase in debt and a $1.1 billion increase in other liabilities. |

| · | Capital / other non-financial assets, net of spent deferred capital contributions, amounted to $58.8 billion on March 31, 2025, an increase of $1.3 billion from the prior year-end, reflecting $4.3 billion in capital asset acquisition, offset by $3 billion in accounting adjustments, |

amortization and disposals. Major capital investment projects included:

| - | $1.3 billion for capital maintenance and renewal of key provincial assets including $0.7 billion for the provincial highway network, $0.2 billion for Parks, Government Facilities preservation, $0.3 billion for health facilities, school facilities and other provincial assets. |

| - | $0.7 billion in SUCH Sector Self-Financed capital spending. |

| - | $0.6 billion for K-12 schools, modernization and modular classrooms, with 12 school projects completed and 87 underway. |

| - | $0.5 billion in various road and bridge projects. |

| - | $0.4 billion for health facilities including completion of the Rockyview General Hospital Redevelopment project. |

| - | $0.3 billion for Information Technology and other capital projects. |

| - | $0.2 billion in public safety, emergency services and disaster mitigation, including $0.1 billion for completing Springbank Off-Stream Reservoir. |

| Summary Statement of Financial Position | at March 31 | |||||||||||

| (millions of dollars) | 2025 | 2024 | Change from | |||||||||

| Actual | Actual | 2024 | ||||||||||

| Financial Assets |

||||||||||||

| Cash and cash equivalents |

9,147 | 5,461 | 3,686 | |||||||||

| Portfolio investments |

53,568 | 47,310 | 6,258 | |||||||||

| Loans receivable |

21,276 | 21,246 | 30 | |||||||||

| Other |

13,944 | 12,872 | 1,072 | |||||||||

| 97,935 | 86,889 | 11,046 | ||||||||||

| Liabilities |

||||||||||||

| Debt |

102,707 | 99,793 | 2,914 | |||||||||

| Pension liabilities |

7,504 | 7,904 | (400 | ) | ||||||||

| Other |

22,061 | 20,556 | 1,505 | |||||||||

| 132,272 | 128,253 | 4,019 | ||||||||||

| Net Financial Debt |

(34,337 | ) | (41,364 | ) | 7,027 | |||||||

| Capital / Other Non-financial Assets |

62,925 | 61,515 | 1,410 | |||||||||

| Spent deferred capital contributions |

(4,080 | ) | (3,964 | ) | (116 | ) | ||||||

| Net Assets |

24,508 | 16,187 | 8,321 | |||||||||

| Net Assets - statement of operations |

20,966 | 12,649 | ||||||||||

| Accumulated remeasurement gains |

3,542 | 3,538 | ||||||||||

| Change in Net Assets - stmt. of operations |

8,317 | 4,149 | ||||||||||

Change in Net Assets - stmt. Of operations differ from the surplus numbers due to net assets adjustments (2025: $(3) million; 2024: ($136) million) on the adoption of PS 3160 Public Private Partnerships (P3), PS 3400 Revenue and PSG-8 Purchased Intangibles accounting standards (see Schedule 17, p.81 of the 2024-25 Consolidated Financial Statements respectively).

| 10 | Government of Alberta | Annual Report 2024–2025 | |

Financial Indicators and Risks

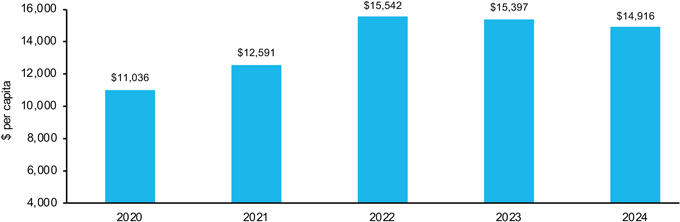

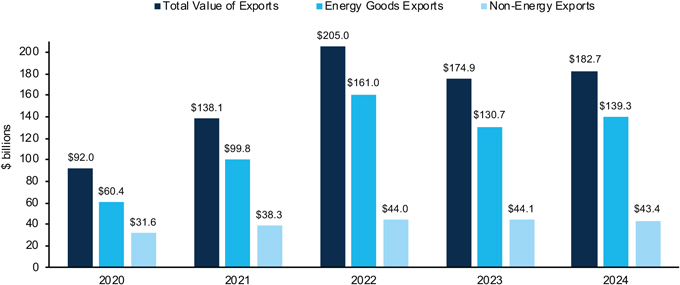

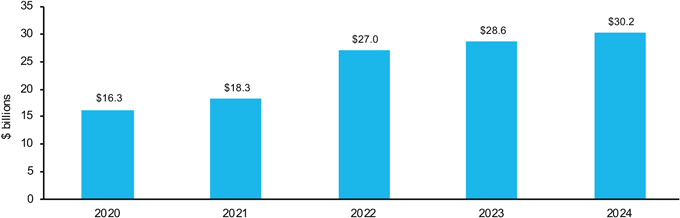

| · | Net financial debt was $34.3 billion, or $6,896 per Albertan on March 31, 2025, a deterioration of $38.3 billion since March 31, 2016, when the province was last in a net financial assets position, but is an improvement of $7 billion since March 31, 2024. Alberta’s fiscal position in 2024-25 continues to reflect the economic and revenue volatility of the province, including past economic shocks which contributed to a significant addition of debt. However, the province has gradually improved its financial position through strong population-driven economic activity and moderated spending contributing to in surpluses in recent years. |

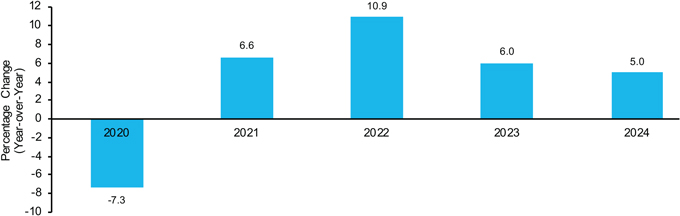

| · | Revenue in 2024-25 reached a record high of $82.5 billion, marking a 10.3 per cent increase over the previous year’s $74.7 billion. This represents a dramatic improvement from 2020-21, when revenue stood at just $43.1 billion, reflecting the province’s strengthened economic performance and improved resource revenues. |

| · | Expense in 2024-25 was $74.1 billion, up from $60.1 billion in 2020-21. This represents a 23.4 per cent increase over four years, or an average annual rate of 5.8 per cent, reflecting rising costs across core public services and population-driven demand. |

| · | Cost drivers, both expected and unpredictable, persisted in 2024-25, with health, education, and social services facing increased demand, and emergency response costs rising due to another severe wildfire season and agriculture sector support. These pressures, alongside population growth and inflationary impacts, led to higher-than-expected spending across multiple ministries. |

| · | Alberta heavily depends on revenue streams that are subject to significant volatility, particularly non-renewable resource royalties, corporate income tax, and other taxes. Revenue volatility is driven by a variety of factors, several of which are outlined below. |

| · | Oil prices are impacted by global supply and demand and have been volatile in recent years due to the global economic conditions and |

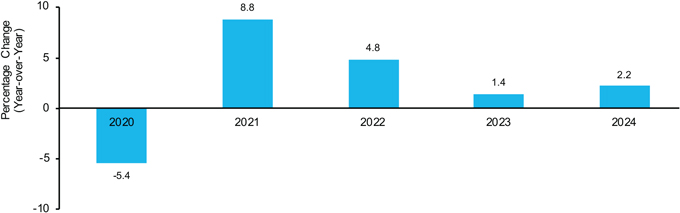

Oil and Natural Gas Prices 2021-25

| geopolitical tensions. Oil prices have pulled back since the 2022-23 high but have remained solid. Production climbed to a new record in 2024 as export capacity increased through the completion of TMX. |

| · | Other factors typically influencing energy prices include pipeline or refinery outages, speculative trading, OPEC + supply management, U.S. producer responses to price swings, drilling and investment decisions, Environmental, Social and Governance metrics, economic sanctions, and weather-related disruptions. |

| · | Lower interest rates typically encourage business investments and decrease debt servicing costs. The Bank of Canada reduced its interest rate to 2.75 per cent which was the second cut for 2025, reflecting ongoing trade uncertainties with U.S. A lower exchange rate improved the value of Alberta’s exports, while equity market performance is affected by a wide range of factors. These all add risk to Alberta government fiscal planning. |

| · | Changes in corporate income tax revenue can be difficult to predict as corporate taxable income can vary significantly due to adjustments to estimates of corporate income tax refunds and the carry forward and back of prior year losses. |

| · | To address the revenue and expense uncertainty, a voted, transferable contingency was introduced in Budget 2019. The contingency was budgeted at $2 billion in 2024-25, an increase of $0.5 billion from 2023-24. The government is continuing to adhere to the fiscal framework introduced in Budget 2023 by limiting expense growth, with allowable exceptions to address this uncertainty. |

| Government of Alberta | Annual Report 2024–2025 | 11 | |

Historical Fiscal Summary, 2013-14 to 2024-25 a

(millions of dollars)

| Statement of Operations | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 Actual |

||||||||||||||||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 |

Personal income tax | 10,537 | 11,042 | 11,357 | 10,763 | 10,775 | 11,874 | 11,244 | 11,257 | 13,335 | 13,925 | 15,160 | 16,120 | |||||||||||||||||||||||||||||||||||||

| 2 |

Corporate income tax | 5,488 | 5,796 | 4,195 | 3,769 | 3,448 | 4,871 | 4,107 | 3,037 | 4,718 | 8,167 | 7,044 | 8,125 | |||||||||||||||||||||||||||||||||||||

| 3 |

Other tax revenue | 4,500 | 4,598 | 5,168 | 5,649 | 6,538 | 6,833 | 5,747 | 5,285 | 5,453 | 4,271 | 4,543 | 6,111 | |||||||||||||||||||||||||||||||||||||

| 4 |

Resource revenue | 9,578 | 8,948 | 2,789 | 3,097 | 4,980 | 5,429 | 5,937 | 3,091 | 16,170 | 25,242 | 19,287 | 21,986 | |||||||||||||||||||||||||||||||||||||

| 5 |

Investment income | 3,423 | 3,113 | 2,544 | 3,698 | 3,126 | 2,349 | 2,828 | 2,643 | 3,579 | 1,334 | 4,587 | 4,803 | |||||||||||||||||||||||||||||||||||||

| 6 |

Premiums, fees and licences | 3,437 | 3,564 | 3,574 | 3,701 | 3,839 | 3,911 | 3,929 | 4,021 | 4,520 | 4,672 | 5,565 | 5,504 | |||||||||||||||||||||||||||||||||||||

| 7 |

Other own-source revenue | 5,412 | 6,438 | 5,850 | 3,637 | 6,983 | 6,292 | 3,360 | 3,272 | 8,952 | 7,008 | 6,216 | 7,202 | |||||||||||||||||||||||||||||||||||||

| 8 |

Total own-source revenue | 42,375 | 43,499 | 35,477 | 34,314 | 39,689 | 41,559 | 37,152 | 32,605 | 56,727 | 64,619 | 62,402 | 69,851 | |||||||||||||||||||||||||||||||||||||

| 9 |

Federal transfers | 7,059 | 5,982 | 7,142 | 7,979 | 7,606 | 8,013 | 9,072 | 10,532 | 11,595 | 11,363 | 12,336 | 12,618 | |||||||||||||||||||||||||||||||||||||

| 10 |

Total Revenue | 49,434 | 49,481 | 42,619 | 42,293 | 47,295 | 49,572 | 46,224 | 43,137 | 68,322 | 75,982 | 74,738 | 82,469 | |||||||||||||||||||||||||||||||||||||

| Expense by Function | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 |

Health | 17,967 | 19,366 | 20,115 | 20,687 | 21,239 | 21,921 | 22,408 | 23,984 | 25,143 | 25,486 | 27,447 | 29,560 | |||||||||||||||||||||||||||||||||||||

| 12 |

Basic / advanced education | 12,782 | 13,103 | 13,673 | 14,110 | 14,471 | 14,848 | 14,971 | 14,134 | 14,308 | 15,220 | 16,359 | 17,197 | |||||||||||||||||||||||||||||||||||||

| 13 |

Social services | 4,668 | 4,548 | 4,752 | 5,198 | 5,592 | 5,867 | 6,203 | 5,919 | 5,992 | 7,222 | 8,035 | 8,462 | |||||||||||||||||||||||||||||||||||||

| 14 |

Other program expense | 12,970 | 11,031 | 10,375 | 12,607 | 13,189 | 11,866 | 12,893 | 13,858 | 16,688 | 13,769 | 15,835 | 16,118 | |||||||||||||||||||||||||||||||||||||

| 15 |

Total program expense | 48,387 | 48,048 | 48,915 | 52,602 | 54,491 | 54,502 | 56,475 | 57,895 | 62,131 | 61,691 | 67,676 | 71,337 | |||||||||||||||||||||||||||||||||||||

| 16 |

Debt servicing costs | 601 | 722 | 776 | 1,018 | 1,420 | 1,971 | 2,235 | 2,486 | 2,641 | 2,828 | 3,149 | 3,215 | |||||||||||||||||||||||||||||||||||||

| 17 |

Pension provisions / recovery | 748 | (404 | ) | (630 | ) | (543 | ) | (593 | ) | (190 | ) | (334 | ) | (282 | ) | (365 | ) | (21 | ) | (372 | ) | (403 | ) | ||||||||||||||||||||||||||

| 18 |

Total Expense | 49,736 | 48,366 | 49,061 | 53,077 | 55,318 | 56,283 | 58,376 | 60,099 | 64,407 | 64,498 | 70,453 | 74,149 | |||||||||||||||||||||||||||||||||||||

| 19 |

Surplus / (Deficit) | (302 | ) | 1,115 | (6,442 | ) | (10,784 | ) | (8,023 | ) | (6,711 | ) | (12,152 | ) | (16,962 | ) | 3,915 | 11,484 | 4,285 | 8,320 | ||||||||||||||||||||||||||||||

| Capital Plan b |

5,770 | 6,181 | 6,558 | 6,578 | 9,021 | 6,057 | 5,545 | 6,896 | 6,622 | 5,633 | 6,300 | 7,243 | ||||||||||||||||||||||||||||||||||||||

| Statement of Financial Position (at March 31) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 |

Heritage / endowment funds | 18,562 | 18,860 | 19,262 | 19,836 | 20,306 | 20,700 | 20,670 | 21,090 | 22,176 | 23,920 | 26,158 | 30,349 | |||||||||||||||||||||||||||||||||||||

| 21 |

Contingency Account | 4,658 | 6,529 | 3,625 | 2,299 | 1,661 | 6,342 | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||

| 22 |

Other financial assets | 40,039 | 40,688 | 40,990 | 44,152 | 49,010 | 48,701 | 55,711 | 56,996 | 55,950 | 55,570 | 60,731 | 67,586 | |||||||||||||||||||||||||||||||||||||

| 23 |

Taxpayer-supported Capital Plan liabilities | (8,724 | ) | (11,922 | ) | (19,040 | ) | (23,769 | ) | (29,339 | ) | (33,597 | ) | (37,188 | ) | (42,733 | ) | (47,529 | ) | (45,525 | ) | (47,594 | ) | (50,560 | ) | |||||||||||||||||||||||||

| 24 |

Taxpayer-supported operating debt / pre-1992 TPP debt | (1,333 | ) | (1,053 | ) | (1,024 | ) | (10,751 | ) | (19,227 | ) | (29,060 | ) | (36,954 | ) | (50,303 | ) | (45,595 | ) | (33,763 | ) | (34,241 | ) | (34,665 | ) | |||||||||||||||||||||||||

| 25 |

Self-supported debt | (15,775 | ) | (16,592 | ) | (17,373 | ) | (17,822 | ) | (17,848 | ) | (18,134 | ) | (18,066 | ) | (18,398 | ) | (17,028 | ) | (17,596 | ) | (17,715 | ) | (17,257 | ) | |||||||||||||||||||||||||

| 26 |

Total Debt c |

(25,832 | ) | (29,567 | ) | (37,437 | ) | (52,342 | ) | (66,414 | ) | (80,791 | ) | (92,208 | ) | (111,434 | ) | (110,152 | ) | (96,884 | ) | (99,550 | ) | (102,482 | ) | |||||||||||||||||||||||||

| 27 |

Pension liabilities | (11,600 | ) | (11,196 | ) | (10,566 | ) | (10,023 | ) | (9,430 | ) | (9,252 | ) | (8,918 | ) | (8,636 | ) | (8,287 | ) | (8,272 | ) | (7,904 | ) | (7,504 | ) | |||||||||||||||||||||||||

| 28 |

Other liabilities | (12,795 | ) | (12,260 | ) | (11,955 | ) | (12,823 | ) | (14,477 | ) | (13,177 | ) | (15,399 | ) | (17,853 | ) | (18,680 | ) | (19,948 | ) | (20,799 | ) | (22,286 | ) | |||||||||||||||||||||||||

| 29 |

Net FinancialAssets / (Debt) | 13,032 | 13,054 | 3,919 | (8,901 | ) | (19,344 | ) | (27,477 | ) | (40,144 | ) | (59,837 | ) | (58,993 | ) | (45,614 | ) | (41,364 | ) | (34,337 | ) | ||||||||||||||||||||||||||||

| 30 |

Capital / non-fin. Assets | 40,839 | 42,197 | 44,623 | 46,622 | 49,015 | 50,744 | 51,570 | 54,076 | 55,745 | 56,928 | 57,551 | 58,845 | |||||||||||||||||||||||||||||||||||||

| 31 |

Net Assets / (Liabilities) d | 53,871 | 55,251 | 48,542 | 37,721 | 29,671 | 23,267 | 11,426 | (5,761 | ) | (3,248 | ) | 11,314 | 16,187 | 24,508 | |||||||||||||||||||||||||||||||||||

| Energy prices and exchange rate | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 32 |

Oil price (WTI US$/bbl) | 99.05 | 80.48 | 45.00 | 47.93 | 53.69 | 62.77 | 54.85 | 42.32 | 77.03 | 89.69 | 77.83 | 74.34 | |||||||||||||||||||||||||||||||||||||

| 33 |

Heavy oil price (WCS @ Hardisty; Cdn$/bbl) | 80.11 | 70.78 | 40.86 | 44.67 | 50.38 | 51.65 | 53.14 | 41.42 | 79.63 | 90.62 | 81.67 | 85.21 | |||||||||||||||||||||||||||||||||||||

| 34 |

Natural gas price (ARP; Cdn$/GJ) | 3.28 | 3.51 | 2.21 | 2.01 | 1.82 | 1.34 | 1.39 | 2.10 | 3.48 | 4.63 | 2.07 | 1.11 | |||||||||||||||||||||||||||||||||||||

| 35 |

Exchange rate (US¢/Cdn$) | 94.98 | 88.00 | 76.50 | 76.20 | 78.00 | 76.30 | 75.20 | 75.70 | 79.80 | 75.60 | 74.20 | 71.90 | |||||||||||||||||||||||||||||||||||||

| a | Numbers are not strictly comparable due to numerous accounting policy changes over time. 2019-20 and 2021-22 expense by function have been re-classified following re-organizations and other adjustments. |

| b | Reflects capital grants and other support included in expense, and capital investment in government-owned assets not included in expense. Capital investment adds to capital assets, which are depreciated over time through amortization expense. Numbers for 2013-14 are estimates as details required to consolidate SUCH sector capital spending with full accuracy are not readily available. |

| c | Does not include capital lease liabilities, or debt issued on behalf of government business enterprises which is reported on a net equity basis in Other Financial Assets. |

| d | The change in net assets / (debt) year over year does not match the surplus / (deficit) exactly in most years, due to various balance sheet adjustments, most of which are minor. 2021-22 opening amounts were restated to reflect adoption of the Asset Retirement Obligation accounting standard. In 2022-23, Financial Instruments and related standards were implemented resulting in unrealized remeasurement gains and losses being included in Net Assets but not in the surplus/deficit. |

| 12 | Government of Alberta | Annual Report 2024–2025 | |

Consolidated Financial Statements

| Government of Alberta | Annual Report 2024–2025 | 13 | |

BLANK PAGE

| 14 | Government of Alberta | Annual Report 2024–2025 | |

CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents

| CONSOLIDATED FINANCIAL STATEMENTS OF THE PROVINCE OF ALBERTA |

||||||||||

| Table of Contents | ||||||||||

| Management’s Responsibility for the Consolidated Financial Statements |

17 | |||||||||

| Independent Auditor’s Report |

18 | |||||||||

| Consolidated Statement of Operations |

25 | |||||||||

| Consolidated Statement of Financial Position |

26 | |||||||||

| Consolidated Statement of Remeasurement Gains and Losses |

27 | |||||||||

| Consolidated Statement of Change in Net Debt |

28 | |||||||||

| Consolidated Statement of Cash Flows |

29 | |||||||||

| Notes to the Consolidated Financial Statements |

||||||||||

| 1 | Summary of Significant Accounting Policies and Reporting Practices | 30 | ||||||||

| 2 | Valuation of Financial Assets and Liabilities | 39 | ||||||||

| 3 | Financial Risk Management | 41 | ||||||||

| 4 | Budget and Legislative Authority | 49 | ||||||||

| 5 | Contractual Rights | 49 | ||||||||

| 6 | Contingent Assets | 50 | ||||||||

| 7 | Contractual Obligations and Commitments | 50 | ||||||||

| 8 | Contingent Liabilities | 51 | ||||||||

| 9 | Trust Funds under Administration | 54 | ||||||||

| 10 | Comparative Figures | 54 | ||||||||

| Schedules to the Consolidated Financial Statements |

||||||||||

| 1 | Revenues | 55 | ||||||||

| 2 | Revenues by Source by Ministry | 56 | ||||||||

| 3 | Expenses by Object by Ministry | 57 | ||||||||

| 4 | Cash and Cash Equivalents | 58 | ||||||||

| 5 | Accounts Receivable and Advances | 58 | ||||||||

| 6 | Portfolio Investments | 59 | ||||||||

| 7 | Endowment Funds | 60 | ||||||||

| 8 | Equity in Government Business Enterprises | 61 | ||||||||

| 9 | Loans Receivable. | 65 | ||||||||

| 10 | Derivative Financial Instruments | 66 | ||||||||

| 11 | Accounts Payable and Other Accrued Liabilities | 67 | ||||||||

| Government of Alberta | Annual Report 2024–25 | 15 | |

CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents, continued

| Schedules to the Consolidated Financial Statements (continued) | ||||||||||

| 12 | Asset Retirement Obligations and Environmental Liabilities | 67 | ||||||||

| 13 | Debt | 68 | ||||||||

| 14 | Pension Plans and Other Defined Benefit Plans | 72 | ||||||||

| 15 | Deferred Contributions | 79 | ||||||||

| 16 | Tangible Capital Assets | 80 | ||||||||

| 17 | Adjustments to Net Assets - Operating | 81 | ||||||||

| 18 | Over-expenditure of Spending Authorities | 82 | ||||||||

| 19 | Listing of Organizations | 83 | ||||||||

| Glossary (Unaudited) |

89 | |||||||||

| 16 | Government of Alberta | Annual Report 2024–25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Management’s Responsibility

for the Consolidated Financial Statements

The consolidated financial statements are prepared by the Controller under the general direction of the Deputy Minister of Treasury Board and Finance as authorized by the President of Treasury Board and Minister of Finance pursuant to the Financial Administration Act. The consolidated financial statements are prepared in accordance with Canadian Public Sector Accounting Standards, and of necessity include some amounts that are based on estimates and judgments. As required by the Sustainable Fiscal Planning and Reporting Act, the consolidated financial statements are included in the consolidated annual report of the Province of Alberta that forms part of the Public Accounts.

To fulfill its accounting and reporting responsibilities, management maintains systems of financial management and internal control which give consideration to costs, benefits and risks, and which are designed to:

| · | Provide reasonable assurance that transactions are properly authorized, executed in accordance with prescribed legislation and regulations, and properly recorded so as to maintain accountability for public money; and |

| · | Safeguard the assets and properties of the Province of Alberta under government administration. |

Under the Financial Administration Act, deputy heads are responsible for the collection of revenue payable to the Crown, and for making and controlling disbursements with respect to their departments. They are also responsible for prescribing the accounting systems to be used in their departments. In order to meet government accounting and reporting requirements, the Controller obtains information relating to departments, regulated funds, provincial agencies and Crown-controlled corporations, including schools, universities, colleges, polytechnic institutes, Alberta Health Services and other health entities from ministries as necessary.

The Auditor General of Alberta provides an independent opinion on the consolidated financial statements. The duties of the Auditor General in that respect are contained in the Auditor General Act.

Annually, the consolidated annual report is tabled in the Legislature as a part of the Public Accounts and is referred to the Standing Committee on Public Accounts of the Legislative Assembly.

Approved by:

Katherine White

Deputy Minister of Treasury Board and Finance

Dan Stadlwieser, CPA, CA

Controller

Edmonton, Alberta

June 16, 2025

| Government of Alberta | Annual Report 2024–25 | 17 | |

CONSOLIDATED FINANCIAL STATEMENTS

| Independent Auditor’s Report |

|

To the Members of the Legislative Assembly

Report on the Consolidated Financial Statements

Opinion

I have audited the consolidated financial statements of the Province of Alberta (the Province), which comprise the consolidated statement of financial position as at March 31, 2025, and the consolidated statements of operations, remeasurement gains and losses, change in net debt, and cash flows for the year then ended, and notes and schedules to the consolidated financial statements, including a summary of significant accounting policies.

In my opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Province as at March 31, 2025, and the results of its operations, its remeasurement gains and losses, its changes in net debt, and its cash flows for the year then ended in accordance with Canadian public sector accounting standards (PSAS).

Basis for opinion

I conducted my audit in accordance with Canadian generally accepted auditing standards. My responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of my report. I am independent of the Province in accordance with the ethical requirements that are relevant to my audit of the consolidated financial statements in Canada, and I have fulfilled my other ethical responsibilities in accordance with these requirements. I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Key audit matters

Key audit matters are those matters that, in my professional judgment, were of most significance in my audit of the Province’s consolidated financial statements for the year ended March 31, 2025. These matters were addressed in the context of my audit of the Province’s consolidated financial statements as a whole, and in forming my opinion thereon, and I do not provide a separate opinion on these key audit matters.

| 18 | Government of Alberta | Annual Report 2024–25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

| Key audit matter | How the matter was addressed in the audit | |

| Environmental liabilities | ||

|

The Province records environmental liabilities for remediation of contamination and reclamation of sites it is directly responsible for or when it has accepted responsibility, and when costs can be reasonably estimated.

Under the Province’s polluter-pay principle, those responsible for contamination of sites are responsible for remediation of the sites. For sites where the Province is directly responsible or accepts responsibility for contaminated sites, it estimates costs of required work and records a liability in the Province’s consolidated financial statements.

As at March 31, 2025, the Province recorded $181 million (2024: $168 million) as environmental liabilities (Schedule 12).

The Province did not record a liability for a significant number of sites because it has not determined responsibility, and/or not determined a remediation or reclamation strategy. Management is at various stages of testing, evaluation and studies to determine the extent of contamination and possible site management options and who would do the work. The Province may need to account for additional environmental liabilities in the future as it completes these activities.

I identified accounting for environmental liabilities as a key audit matter since:

● there are a significant number of sites where responsibility and/or strategies for remediation or reclamation have not been established.

● my Report of the Auditor General-June 2021, Processes to Provide information about Government’s Environmental Liabilities describes weaknesses related to the processes to provide information about environmental liabilities.

● it requires interpretation of environmental law and standards to determine who is responsible to do the work when polluters won’t do the work or no longer exist.

|

In the context of the audit of the Province’s consolidated financial statements as a whole, audit work to address this matter included:

● obtaining an understanding of the systems, processes and controls relating to identifying and evaluating contaminated sites.

● assessing the appropriateness of the methods used to estimate the liability.

● examining the liabilities recorded for a sample of sites where the Province was directly responsible or had accepted responsibility by reviewing engineering reports and assessing and verifying if management’s estimates and assumptions were reasonable.

● selecting a sample of sites where management did not record a liability, and reviewing management’s assumptions and explanations and determining that recognition criteria for environmental liabilities had not been met.

● assessing the appropriateness of the disclosures in the consolidated financial statements against the standards for disclosures required by PSAS. | |

| Government of Alberta | Annual Report 2024–25 | 19 | |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

|

Key audit matter

|

How the matter was addressed in the audit

| |

|

● it requires expertise to assess the nature and extent of contamination and the work required to remediate and reclaim sites, and then to estimate the costs to do the work.

The consolidated financial statements include the following disclosures: Note 1– Summary of Significant Accounting Policies and Reporting Practices Note 8 – Contingent Liabilities Schedule 12 – Asset Retirement Obligations and Environmental Liabilities

|

||

|

Pension liabilities

| ||

| The Province records pension liabilities relating to several public sector pension plans.

As at March 31, 2025, the Province recorded $7.5 billion (2024: $7.9 billion) as pension liabilities (Schedule 14).

Management estimates pension obligations for each respective pension plan using various assumptions. Key assumptions include salary escalation rates, inflation rates, and discount rates. The valuation of pension liabilities is inherently uncertain and is based on an actuarial extrapolation from the most recent actuarial valuations.

Pension liabilities are net of the investment balances in the pension plans. Pension plan investment balances include significant allocations to private equity and alternative investment asset classes which are subject to measurement uncertainty.

I identified pension liabilities as a key audit matter given the measurement uncertainty inherent in the determination of the pension liability.

The consolidated financial statements include the following disclosures:

Note 1– Summary of Significant Accounting Policies and Reporting Practices

Schedule 14 – Pension Plans and Other Defined Benefit Plans

|

In the context of the audit of the Province’s consolidated financial statements as a whole, audit work to address this matter included:

● examining independent actuaries’ work on the estimate of pension obligations.

● assessing the actuaries’ qualifications.

● reviewing management’s method used to estimate pension obligations.

● assessing the reasonability of the assumptions used in the estimates.

● testing controls over the completeness and accuracy of data provided to the actuaries.

● examining the reasonability of the fair values of pension plan investments.

● assessing the appropriateness of the disclosures in the consolidated financial statements against the standards for disclosures required by PSAS. | |

|

Private equities, inflation sensitive and alternative investments

| ||

| The Province records private equities, inflation sensitive and alternative investments at fair value. Management uses valuation models to estimate the | In the context of the audit of the Province’s consolidated financial statements as a | |

| 20 | Government of Alberta | Annual Report 2024–25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

| Key audit matter | How the matter was addressed in the audit | |

|

fair value of these investments. At March 31, 2025, the fair value of these investments was $13.2 billion (2024: $12.2 billion) (Schedule 6).

The valuations of these investments are subject to measurement uncertainty because they are based on valuation models that make use of inputs and assumptions which are not based on observable market data or quoted market prices.

I identified the recording of private equities, inflation sensitive and alternative investments as a key audit matter given that estimated fair values may differ significantly from the value that would have been recorded had readily available market prices existed for these investments.

The consolidated financial statements include the following disclosures: Note 1– Summary of Significant Accounting Policies and Reporting Practices Note 2 – Valuation of Financial Assets and Liabilities Note 3 – Financial Risk Management Schedule 6 – Portfolio Investments |

whole, audit work to address this matter included:

● testing controls over the valuation process, including evidence of review, approval, segregation of duties, and oversight from management and those charged with governance.

● agreeing valuations in investment accounting records to recent valuations.

● assessing the valuators’ qualifications.

● confirming appropriate valuation models were used consistently between similar asset classes.

● assessing the quality of management’s support for key assumptions and inputs used in the valuation models.

● examining management’s process to obtain and consider information obtained subsequent to the valuation date that may provide evidence of conditions that existed at the reporting date.

● assessing the appropriateness of the disclosures in the consolidated financial statements against the standards for disclosures required by PSAS.

| |

| Investments in and toll commitments related to the North West Redwater Partnership (NWRP) | ||

|

The Province, via Alberta Petroleum Marketing Commission (APMC), has entered into a processing agreement, whereby NWRP will process Crown royalty bitumen, and market the refined products on behalf of APMC. APMC is responsible to supply bitumen and pay 75 per cent of the monthly cost of service toll (including the unconditional debt tolls related to paying NWRP’s debt).

At March 31, 2025, the Province:

● recorded the total deficit of APMC in equity in government business enterprises on the consolidated statement of financial position. Included in the liabilities of APMC is a provision of $2.1 billion (2024: $2.0 billion) since it estimated that the unavoidable costs of meeting the obligations under the agreement exceed the economic benefits expected to be received under it.

|

In the context of the audit of the Province’s consolidated financial statements as a whole, audit work to address this matter included:

● examining the cash flow model used to assess if the processing agreement represents an onerous contract.

● assessing the reasonability of inputs and assumptions used in the model.

● verifying appropriate application of onerous contract accounting.

● assessing the appropriateness of the disclosures in the consolidated financial statements against the standards for disclosures required by PSAS. | |

| Government of Alberta | Annual Report 2024–25 | 21 | |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

| Key audit matter | How the matter was addressed in the audit | |

|

● estimated the toll commitments to be approximately $35.6 billion (2024: $37.3 billion).

I identified the accounting for the investment in NWRP and the toll commitments as a key audit matter since it requires significant judgements and long-term assumptions about future oil prices, inflation rates, and operation of the refinery over its expected life.

The consolidated financial statements include the following disclosures: Schedule 8 – Equity in Government Business Enterprises

|

||

| Personal income tax revenue | ||

|

The Province estimated personal income tax revenues of $16.1 billion (2024: $15.2 billion) for the year ended March 31, 2025, which is subject to measurement uncertainty because tax assessments are finalized after the consolidated financial statements are published. The Province uses an economic model, which contains several inputs and assumptions, such as population growth, personal income growth, and tax elasticity of income to estimate revenues.

I identified the accounting for personal income tax as a key audit matter since it requires significant judgements and several inputs and assumptions to estimate revenues for the reporting period.

The consolidated financial statements include the following disclosures: Note 1– Summary of Significant Accounting Policies and Reporting Practices Schedule 1 – Revenues

|

In the context of the audit of the Province’s consolidated financial statements as a whole, audit work to address this matter included:

● examining management’s methodology and economic model used to estimate the personal income tax revenues.

● assessing the appropriateness and reasonability of the economic assumptions and data used to generate the personal income tax accrual.

● verifying the mathematical accuracy of the model.

● assessing management’s processes to review and approve the model and assumptions.

● assessing the appropriateness of the disclosures in the consolidated financial statements against the standards for disclosures required by PSAS.

| |

Other information

Management is responsible for the other information. The other information comprises the information included in the 2024-25 Final Results Year-end Report and the 2024-2025 Government of Alberta Annual Report, but does not include the consolidated financial statements and my auditor’s report thereon.

My opinion on the consolidated financial statements does not cover the other information identified above and I do not and will not express any form of assurance conclusion thereon.

| 22 | Government of Alberta | Annual Report 2024–25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

In connection with my audit of the consolidated financial statements, my responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or my knowledge obtained in the audit, or otherwise appears to be materially misstated.

The 2024-25 Final Results Year-end Report and the 2024-2025 Government of Alberta Annual Report are expected to be made available to me after the date of my auditor’s report. If, based on the work I will perform on this other information, I conclude that there is a material misstatement of this other information, I am required to communicate the matter to those charged with governance.

Responsibilities of management and those charged with governance for the consolidated financial statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of the consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Province’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless an intention exists to liquidate or to cease operations, or there is no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Province’s financial reporting process.

Auditor’s responsibilities for the audit of the consolidated financial statements

My objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes my opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, I exercise professional judgment and maintain professional skepticism throughout the audit. I also:

| ● | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for my opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| ● | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Province’s internal control. |

| ● | Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| Government of Alberta | Annual Report 2024–25 | 23 | |

CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditor’s Report, continued

| ● | Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Province’s ability to continue as a going concern. If I conclude that a material uncertainty exists, I am required to draw attention in my auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify my opinion. My conclusions are based on the audit evidence obtained up to the date of my auditor’s report. However, future events or conditions may cause the Province to cease to continue as a going concern. |

| ● | Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

| ● | Plan and perform the group audit to obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the consolidated financial statements as a basis for forming an opinion on the group financial statements. I am responsible for the direction, supervision and review of the audit work performed for purposes of the group audit. I remain solely responsible for my audit opinion. |

I communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that I identify during my audit.

I also provide those charged with governance with a statement that I have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on my independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, I determine those matters that were of most significance in the audit of the Province’s consolidated financial statements of the current period and are therefore the key audit matters. I describe these matters in my auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, I determine that a matter should not be communicated in my auditor’s report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

In accordance with the Auditor General Act, I am responsible to report the independent opinion on the consolidated financial statements of the Province completed by my office.

[Original signed by W. Doug Wylie FCPA, FCMA, ICD.D]

Auditor General

June 16, 2025

Edmonton, Alberta

| 24 | Government of Alberta | Annual Report 2024–25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Operations

| Year Ended March 31

|

||||||||||||

| 2025 | 2024 | |||||||||||

| Budget

|

Actual

|

Actual

|

||||||||||

| In millions

|

||||||||||||

| Revenues (Schedules 1 and 2) |

||||||||||||

| Income taxes |

$ 22,632 | $ 24,245 | $ 22,204 | |||||||||

| Other taxes |

6,013 | 6,111 | 4,543 | |||||||||

| Non-renewable resource revenue |

17,315 | 21,986 | 19,287 | |||||||||

| Transfers from Government of Canada |

12,639 | 12,618 | 12,336 | |||||||||

| Net income from government business enterprises (Schedule 8) |

2,123 | 2,053 | 1,237 | |||||||||

| Net investment income |

3,267 | 4,803 | 4,587 | |||||||||

| Premiums, fees and licences |

5,384 | 5,504 | 5,565 | |||||||||

| Other |

4,164 | 5,149 | 4,979 | |||||||||

| 73,537 | 82,469 | 74,738 | ||||||||||

| Expenses by function (Schedule 3) |

||||||||||||

| Health |

28,732 | 29,560 | 27,447 | |||||||||

| Education |

17,004 | 17,197 | 16,359 | |||||||||

| Social services |

8,143 | 8,462 | 8,035 | |||||||||

| Agriculture, resource management and economic development |

2,734 | 4,125 | 4,171 | |||||||||

| General government |

3,831 | 3,445 | 3,503 | |||||||||

| Protection of persons and property |

4,238 | 3,186 | 3,454 | |||||||||

| Transportation, communications and utilities |

2,725 | 2,489 | 2,189 | |||||||||

| Regional planning and development |

1,156 | 1,375 | 1,095 | |||||||||

| Environment |

732 | 647 | 652 | |||||||||

| Recreation and culture |

473 | 445 | 438 | |||||||||

| Housing |

401 | 406 | 333 | |||||||||

| Debt servicing costs (Schedule 13) |

3,365 | 3,215 | 3,149 | |||||||||

| Pension recovery (Schedule 14) |

(364 | ) | (403 | ) | (372 | ) | ||||||

| 73,170 | 74,149 | 70,453 | ||||||||||

| Annual surplus |

367 | 8,320 | 4,285 | |||||||||

| Net assets - operating at beginning of year |

12,649 | 12,649 | 8,500 | |||||||||

| Other adjustments to net assets - operating (Schedule 17) |

- | (3 | ) | (136 | ) | |||||||

| Net assets - operating at end of year |

$ 13,016 | $ 20,966 | $ 12,649 | |||||||||

The accompanying notes and schedules are part of these consolidated financial statements.

| Government of Alberta | Annual Report 2024–25 | 25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Financial Position

| As at March 31 | ||||||||

| 2025 | 2024 | |||||||

| In millions |

||||||||

| Financial assets |

||||||||

| Cash and cash equivalents (Schedule 4) |

$ 9,147 | $ 5,461 | ||||||

| Accounts receivable and advances (Schedule 5) |

12,175 | 10,651 | ||||||

| Portfolio investments (Schedule 6) |

||||||||

| Operating |

49,358 | 43,460 | ||||||

| Endowments (Schedule 7) |

4,210 | 3,850 | ||||||

| Equity in government business enterprises (Schedule 8) |

735 | 862 | ||||||

| Loans receivable (Schedule 9) |

21,276 | 21,246 | ||||||

| Derivative financial instruments (Schedule 10) |

975 | 1,299 | ||||||

| Inventories for resale and other |

59 | 60 | ||||||

| 97,935 | 86,889 | |||||||

| Liabilities |

||||||||

| Accounts payable and other accrued liabilities (Schedule 11) |

15,920 | 13,744 | ||||||

| Asset retirement obligations and environmental liabilities (Schedule 12) |

2,760 | 2,559 | ||||||

| Debt (Schedule 13) |

102,707 | 99,793 | ||||||

| Derivative financial instruments (Schedule 10) |

969 | 1,833 | ||||||

| Pension liabilities (Schedule 14) |

7,504 | 7,904 | ||||||

| Unspent deferred contributions (Schedule 15) |

2,412 | 2,420 | ||||||

| 132,272 | 128,253 | |||||||

| Net debt |

(34,337 | ) | (41,364 | ) | ||||

| Non-financial assets |

||||||||

| Tangible capital assets (Schedule 16) |

61,708 | 60,371 | ||||||

| Prepaid expenses |

631 | 547 | ||||||

| Inventories of supplies |

422 | 441 | ||||||

| Purchased intangibles and other |

164 | 156 | ||||||

| 62,925 | 61,515 | |||||||

| Spent deferred capital contributions (Schedule 15) |

4,080 | 3,964 | ||||||

| Net assets |

$ 24,508 | $ 16,187 | ||||||

| Net assets are comprised of: |

||||||||

| Net assets - operating |

$ 20,966 | $ 12,649 | ||||||

| Accumulated remeasurement gains |

3,542 | 3,538 | ||||||

Contractual rights, obligations and commitments (Notes 5 and 7)

Contingent assets and liabilities (Notes 6 and 8)

The accompanying notes and schedules are part of these consolidated financial statements.

| 26 | Government of Alberta | Annual Report 2024–25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Remeasurement Gains and Losses

| Year Ended March 31 | ||||||||

| 2025 | 2024 | |||||||

| In millions |

||||||||

| Accumulated remeasurement gains at beginning of year |

$ | 3,538 | $ | 2,814 | ||||

| Unrealized gains/(losses) attributable to: |

||||||||

| Foreign exchange |

(1,631 | ) | (40 | ) | ||||

| Derivative financial instruments |

802 | 509 | ||||||

| Portfolio investments |

||||||||

| Quoted in an active market |

138 | 658 | ||||||

| Designated at fair value |

909 | (372 | ) | |||||

| Amounts reclassified to the Consolidated Statement of Operations: |

||||||||

| Foreign exchange |

284 | 215 | ||||||

| Derivative financial instruments |

(286 | ) | (218 | ) | ||||

| Portfolio investments |

||||||||

| Quoted in an active market |

(121 | ) | (66 | ) | ||||

| Designated at fair value |

(251 | ) | (86 | ) | ||||

| Other comprehensive income from government business enterprises (Schedule 8) |

160 | 124 | ||||||

| Net remeasurement gains for the year |

4 | 724 | ||||||

| Accumulated remeasurement gains at end of year |

$ | 3,542 | $ | 3,538 | ||||

The accompanying notes and schedules are part of these consolidated financial statements.

| Government of Alberta | Annual Report 2024–25 | 27 | |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Change in Net Debt

| Year Ended March 31 | ||||||||||||

| 2025 | 2024 | |||||||||||

| Budget | Actual | Actual | ||||||||||

| In millions | ||||||||||||

| Annual surplus |

$ | 367 | $ | 8,320 | $ | 4,285 | ||||||

| Acquisition of tangible capital assets and intangible assets |

(4,829 | ) | (4,247 | ) | (4,121 | ) | ||||||

| Additions to public private partnerships, asset retirement obligations, capital leases, donated capital assets and other |

(1 | ) | (88 | ) | (110 | ) | ||||||

| 10% cash flow adjustment |

800 | - | - | |||||||||

| Amortization of tangible capital assets and purchased intangibles |

2,955 | 2,968 | 2,764 | |||||||||

| Net (gain)/loss on disposal and adjustments of tangible capital assets and purchased intangibles |

- | (56 | ) | 164 | ||||||||

| Proceeds on sale of tangible capital assets |

- | 84 | 129 | |||||||||

| (Increase)/decrease in inventory of supplies |

(26 | ) | 19 | 334 | ||||||||

| Increase in prepaid expenses and other non-financial assets |

- | (90 | ) | (51 | ) | |||||||

| Increase in spent deferred capital contributions (Schedule 15) |

21 | 116 | 268 | |||||||||

| Other adjustments to net assets - operating (Schedule 17) |

- | (3 | ) | (136 | ) | |||||||

| (Increase)/decrease in net debt excluding net remeasurement gains |

(713 | ) | 7,023 | 3,526 | ||||||||

| Net remeasurement gains |

- | 4 | 724 | |||||||||

| (Increase)/decrease in net debt |

(713 | ) | 7,027 | 4,250 | ||||||||

| Net debt at beginning of year |

(41,364 | ) | (41,364 | ) | (45,614 | ) | ||||||

| Net debt at end of year |

$ | (42,077 | )$ | (34,337 | ) | $ | (41,364 | ) | ||||

The accompanying notes and schedules are part of these consolidated financial statements.

| 28 | Government of Alberta | Annual Report 2024–25 | |

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Cash Flows

| Year Ended March 31 | ||||||||

| 2025 | 2024 | |||||||

| In millions |

||||||||

| Operating transactions |

||||||||

| Annual surplus |

$ | 8,320 | $ | 4,285 | ||||

| Non-cash items |

||||||||

| Amortization of tangible capital assets and purchased intangibles |

2,968 | 2,764 | ||||||

| Deferred contributions recognized as revenue |

(3,671 | ) | (2,951 | ) | ||||

| Pension recovery |

(403 | ) | (372 | ) | ||||

| Net Income from government business enterprises |

(2,053 | ) | (1,237 | ) | ||||

| Other non-cash items included in annual surplus |

(319 | ) | 153 | |||||

| 4,842 | 2,642 | |||||||

| Decrease/(increase) in accounts receivable and advances, inventories, prepaids and other assets |

142 | (1,281 | ) | |||||

| Increase in accounts payable and other accrued liabilities |

1,711 | 937 | ||||||

| Distribution from government business enterprises |

2,379 | 2,332 | ||||||

| Cash provided by operating transactions |

9,074 | 4,630 | ||||||

| Capital transactions |

||||||||

| Acquisition of tangible capital assets and intangible assets |

(4,241 | ) | (4,218 | ) | ||||

| Proceeds on sale of tangible capital assets |

84 | 129 | ||||||

| Cash applied to capital transactions |

(4,157 | ) | (4,089 | ) | ||||

| Investing transactions |

||||||||

| Purchases of portfolio investments |

(41,592 | ) | (32,163 | ) | ||||

| Disposals of portfolio investments |

36,879 | 25,769 | ||||||

| Loans made |

(2,777 | ) | (3,174 | ) | ||||

| Repayment of loans |

2,602 | 2,380 | ||||||

| Cash applied to investing transactions |

(4,888 | ) | (7,188 | ) | ||||

| Financing transactions |

||||||||

| Retirement of direct borrowing |

(34,734 | ) | (39,591 | ) | ||||

| Issuance of direct borrowing |

34,739 | 42,624 | ||||||

| Contributions restricted for capital and operations |

3,763 | 3,429 | ||||||

| Repayment of liabilities under capital leases and public private partnerships |

(111 | ) | (124 | ) | ||||

| Cash provided by financing transactions |

3,657 | 6,338 | ||||||

| Increase/(decrease) in cash and cash equivalents |

3,686 | (309 | ) | |||||

| Cash and cash equivalents at beginning of year |

5,461 | 5,770 | ||||||

| Cash and cash equivalents at end of year |

$ | 9,147 | $ | 5,461 | ||||

| Supplementary Information

|

||||||||

| Interest received |

$ | 1,410 | $ | 1,446 | ||||

| Interest paid |

3,150 | 3,155 | ||||||

The accompanying notes and schedules are part of these consolidated financial statements.

| Government of Alberta | Annual Report 2024–25 | 29 | |

CONSOLIDATED FINANCIAL STATEMENTS

Notes to the Consolidated Financial Statements

| NOTE 1 | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND REPORTING PRACTICES |

These consolidated financial statements are prepared in accordance with Canadian Public Sector Accounting Standards (PSAS).

| (a) | REPORTING ENTITY |

The consolidated financial statements of the Province of Alberta (Province) include the accounts of organizations that meet the criteria of control as established under PSAS. The consolidated financial statements also include the accounts of the Office of the Legislative Assembly and Offices of the Legislature.

A list of organizations included in these consolidated financial statements can be found in Schedule 19.

| (b) | METHOD OF CONSOLIDATION |

The accounts of government sector entities, except those designated as government business enterprises, are consolidated using the line-by-line method. Under this method, accounting policies of the consolidated entities are adjusted to conform to government accounting policies, and the results of each line item in their financial statements (revenue, expense, assets and liabilities) are included in the Province’s results. Revenue, expense, capital, investing and financing transactions, as well as related asset and liability balances between consolidated entities have been eliminated.

Schools and some post-secondary institutions (PSI), government business enterprises and government organizations have year-ends that are other than March 31. The significant transactions of these organizations that have occurred during the period between their year-ends and the Province’s year-end of March 31, 2025, have been recorded in these financial statements.

In 2024-25, one PSI changed their fiscal year-end from June 30 to March 31 to coincide with the fiscal year of the Province. The Province’s financial statements include adjustments to reflect the PSI’s balances as at March 31.

The accounts of provincial agencies designated as government business enterprises (Schedule 8) are accounted for on the modified equity basis, with the equity being computed based on their results which are prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board. Under the modified equity method, the accounting policies of government business enterprises are not adjusted to conform to those of the government. Inter-entity revenue and expense transactions and related asset and liability balances are not eliminated except for inter-entity gains and losses, which are eliminated on assets and liabilities remaining within the government reporting entity at the financial statement date.

| (c) | FUTURE CHANGES IN ACCOUNTING STANDARDS |

Effective April 1, 2026, the Province will adopt the new Conceptual Framework for Financial Reporting in the Public Sector (Conceptual Framework) and PS 1202 Financial Statement Presentation. The impact on the consolidated financial statements is currently being assessed.

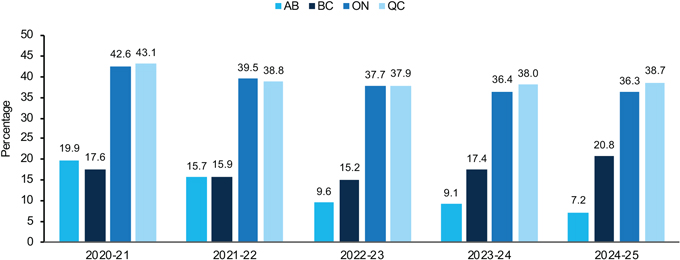

Conceptual Framework