|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Congress Intermediate Bond ETF

|

$18

|

0.35%

|

|

Net Assets

|

$327,110,059

|

|

Number of Holdings

|

48

|

|

Portfolio Turnover

|

31%

|

|

Average Credit Quality

|

AA-/A+

|

|

Effective Duration

|

3.83 Years

|

|

30-Day SEC Yield

|

4.07%

|

|

30-Day SEC Yield Unsubsidized

|

4.07%

|

|

Weighted Average Maturity

|

4.94 Years

|

|

Top Holdings

|

(% of Net Assets)

|

|

United States Treasury Note/Bond

|

4.7%

|

|

United States Treasury Note/Bond

|

4.7%

|

|

United States Treasury Note/Bond

|

4.5%

|

|

United States Treasury Note/Bond

|

4.3%

|

|

United States Treasury Note/Bond

|

4.0%

|

|

United States Treasury Note/Bond

|

3.4%

|

|

United States Treasury Note/Bond

|

3.4%

|

|

United States Treasury Note/Bond

|

3.4%

|

|

United States Treasury Note/Bond

|

3.1%

|

|

United States Treasury Note/Bond

|

2.3%

|

|

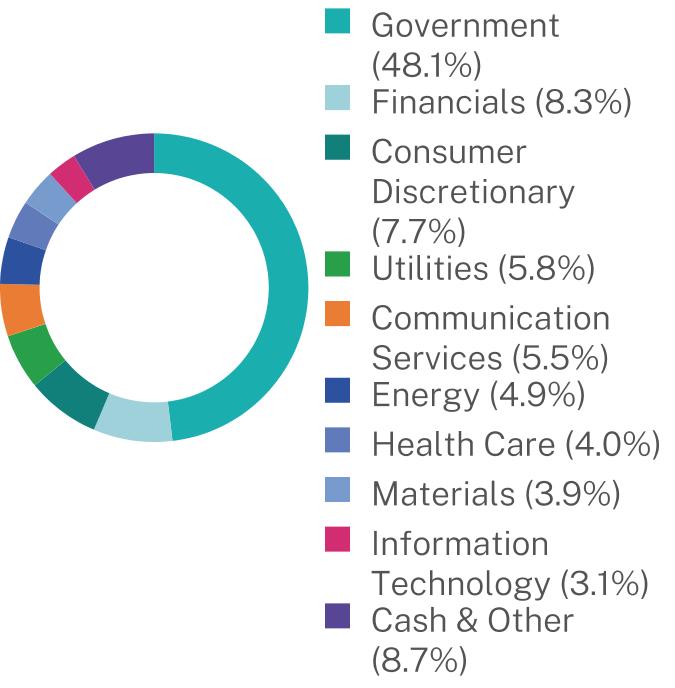

Industry

|

(% of Net Assets)

|

|

Public Finance Activities

|

31.1%

|

|

Sovereign

|

17.0%

|

|

Banks

|

6.2%

|

|

Auto Manufacturers

|

5.9%

|

|

Mining

|

3.9%

|

|

Electric

|

3.7%

|

|

Diversified Telecommunication Services

|

3.5%

|

|

Oil & Gas

|

3.1%

|

|

Collateralized Mortgage Obligation

|

2.5%

|

|

Cash & Other

|

23.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Congress Large Cap Growth ETF

|

$32

|

0.65%

|

|

Net Assets

|

$265,791,665

|

|

Number of Holdings

|

40

|

|

Net Advisory Fee

|

$865,035

|

|

Portfolio Turnover

|

42%

|

|

Top Holdings

|

(% of Net Assets)

|

|

NVIDIA Corp.

|

4.3%

|

|

Microsoft Corp.

|

3.8%

|

|

Apple, Inc.

|

3.5%

|

|

Costco Wholesale Corp.

|

3.5%

|

|

Eli Lilly & Co.

|

3.2%

|

|

ServiceNow, Inc.

|

3.2%

|

|

Netflix, Inc.

|

3.2%

|

|

Howmet Aerospace, Inc.

|

3.2%

|

|

Meta Platforms, Inc. - Class A

|

3.2%

|

|

Boston Scientific Corp.

|

3.1%

|

|

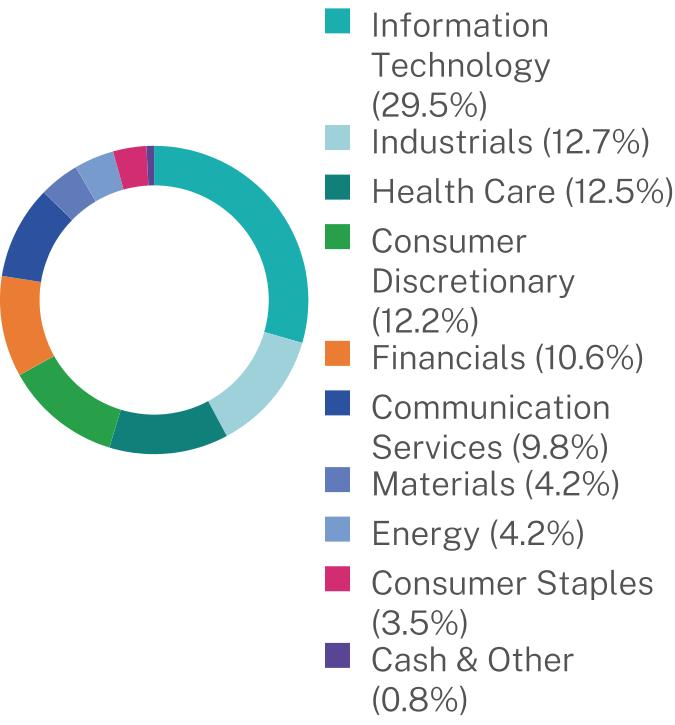

Industry

|

(% of Net Assets)

|

|

Software

|

11.3%

|

|

Specialty Retail

|

7.5%

|

|

Semiconductors & Semiconductor Equipment

|

6.9%

|

|

Health Care Equipment & Supplies

|

5.9%

|

|

Interactive Media & Services

|

5.7%

|

|

Technology Hardware, Storage & Peripherals

|

5.0%

|

|

Communications Equipment

|

4.6%

|

|

Capital Markets

|

4.5%

|

|

Consumer Staples Distribution & Retail

|

3.5%

|

|

Cash & Other

|

45.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Congress SMid Growth ETF

|

$33

|

0.68%

|

|

Net Assets

|

$272,198,158

|

|

Number of Holdings

|

44

|

|

Net Advisory Fee

|

$821,437

|

|

Portfolio Turnover

|

44%

|

|

Top Holdings

|

(% of Net Assets)

|

|

Comfort Systems USA, Inc.

|

4.3%

|

|

BJ’s Wholesale Club Holdings, Inc.

|

4.1%

|

|

CyberArk Software Ltd.

|

3.9%

|

|

Curtiss-Wright Corp.

|

3.6%

|

|

Halozyme Therapeutics, Inc.

|

3.1%

|

|

Tractor Supply Co.

|

3.0%

|

|

AZEK Co., Inc.

|

2.9%

|

|

Prestige Consumer Healthcare, Inc.

|

2.9%

|

|

Duolingo, Inc.

|

2.7%

|

|

PTC, Inc.

|

2.7%

|

|

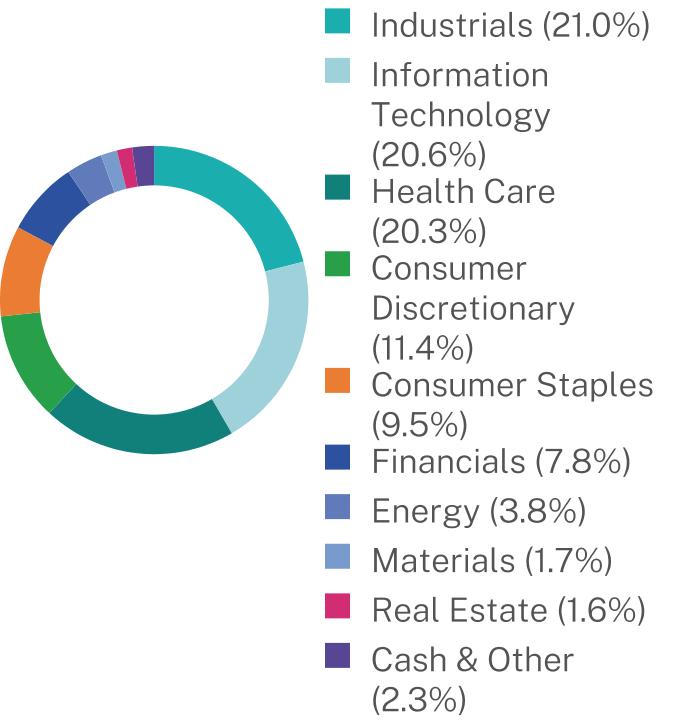

Industry

|

(% of Net Assets)

|

|

Software

|

12.9%

|

|

Health Care Equipment & Supplies

|

10.5%

|

|

Construction & Engineering

|

9.5%

|

|

Consumer Staples Distribution & Retail

|

5.9%

|

|

Electronic Equipment Instruments & Components

|

4.3%

|

|

Capital Markets

|

4.2%

|

|

Life Sciences Tools & Services

|

3.8%

|

|

Aerospace & Defense

|

3.6%

|

|

Semiconductors & Semiconductor Equipment

|

3.4%

|

|

Cash & Other

|

41.9%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|