Climate change and energy transition

Dec. 31, 2024

This note describes how Shell has considered climate-related impacts in key areas of the financial statements and how this translates into the valuation of assets and measurement of liabilities as Shell makes progress in the energy transition. The note is structured as follows:

Climate change and energy transition

4. Climate change and energy transition continued

Note 2 Material accounting policies, judgements and estimates describes uncertainties, including those that have the potential to have a material effect on the Consolidated Balance Sheet in the next 12 months. This note describes the key areas of climate impacts that potentially have short-, medium- and longer-term effects on amounts recognised in the Consolidated Balance Sheet at December 31, 2024. Where relevant, this note contains references to other notes to the Consolidated Financial Statements and aims to provide an overarching summary of the energy transition impact.

In 2021, Shell launched its strategy to become a net-zero emissions energy business by 2050. The strategy aims to deliver more value with less emissions. Shell's targets include those related to its own operations: halve Scope 1 and 2 emissions on a net basis under operational control by 2030, compared with 2016 baseline, achieve methane emissions intensity below 0.2% and achieve near-zero methane emissions by 2030 and eliminate routine gas flaring by 2025. [A] In relation to emissions from the products we sell, Shell has a target to reduce the net carbon intensity of energy products sold by 9-13% by 2025, 15-20% by 2030 and 100% by 2050, compared with a 2016 baseline and an ambition, set in March 2024, to reduce customer emissions (Scope 3, Category 11) related to the use of oil products sold by 15-20% by 2030, compared with 2021. [B]

[A]This target was subject to the completion of the sale of The Shell Petroleum Development Company of Nigeria Limited (SPDC). With effect from January 1, 2025, SPDC ceased routine flaring. On March 13, 2025, Shell completed the sale of SPDC to Renaissance.

[B]Customer emissions from the use of our oil products (Scope 3, Category 11) were 517 million tonnes carbon dioxide equivalent (CO2e) in 2023 and 569 million tonnes CO2e in 2021.

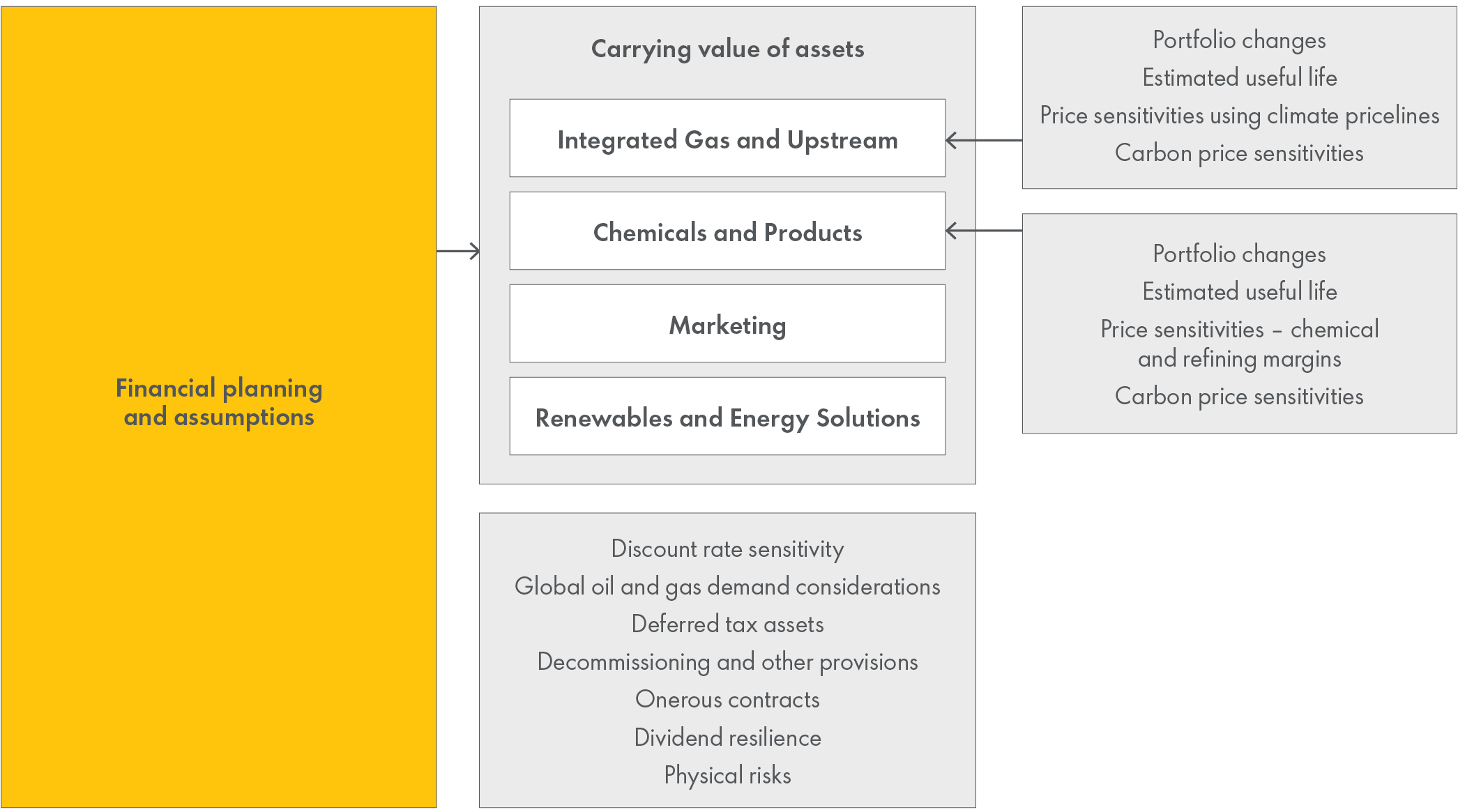

Financial planning and assumptions

This section provides an overview of key assumptions used for financial planning related to climate change and the energy transition. These assumptions that underpin the amounts recognised in these financial statements -- such as future oil and gas prices, future chemical and refining margins, discount rates, future costs of decommissioning and restoration, carbon emission cost and deferred tax assets -- take climate change and energy transition into account and are similarly used for impairment testing of carrying values of assets. The areas described focus on those most pertinent to Shell's business and how financial planning and assumptions interact with scenarios. Subsequently, the sensitivity of carrying values to commodity prices, carbon emission costs, chemical and refining margins, discount rates and demand, if different assumptions were applied, is described.

There is no one single scenario that underpins the financial statements. Shell Scenarios are not predictions. They are designed to stretch management's thinking when it comes to considering events that may be possible, even if only remotely. As a result, these scenarios are not intended to be predictions of likely future events or outcomes and are not the basis for Shell's financial statements and Operating Plans.

Shell Scenarios and the range of possible outcomes inform the development of Shell's strategy and Shell's view on future oil and gas price outlooks, refining margins and chemical margins. The oil and gas price outlooks are one of the key assumptions that underpin Shell's financial statements. Shell's scenarios inform high-, mid- and low-price outlooks. The mid-price outlook represents management's reasonable best estimate and is the basis for Shell's financial statements, Operating Plans and impairment testing. Impairment testing applies management's reasonable best estimates across the full life cycle of assets, which may go beyond the Operating Plan period.

Shell's targets — including to reduce absolute Scope 1 and 2 emissions on a net basis [C] by 50% by 2030, compared with 2016 baseline, and a 15-20% reduction of net carbon intensity [D] by 2030 — have been included in the Operating Plan. The Operating Plan also includes expected costs for evolving carbon regulations (see "Carbon price sensitivities" below) based on a forecast of Shell's equity share of emissions from operated and non-operated assets, also taking into account the estimated impact of free allowances. For impairment testing purposes, key assumptions that underpin the amounts recognised in the Consolidated Balance Sheet, such as future oil and gas prices, refining margins, chemical margins, discount rates, future costs of decommissioning and restoration, carbon emission cost and tax rates, all go beyond the planning horizon in the Operating Plan and do take climate change and energy transition into account.

[C]Operational control boundary.

[D]GHG emissions based on the energy product sales included in the net carbon intensity (NCI) using equity boundary.

Goodwill, other intangible assets, property, plant and equipment, and joint ventures and associates

The carrying value of goodwill, other intangible assets, property plant and equipment, and joint ventures and associates by segment as at December 31 was as follows:

| 2024 | |||||||||||||||||

| $ billion | |||||||||||||||||

| Goodwill | Other intangible assets | Property, plant and equipment | Joint ventures and associates | Total | |||||||||||||

| Integrated Gas | 4.9 | 2.6 | 60.0 | 6.4 | 73.9 | ||||||||||||

| Upstream | 5.3 | 0.1 | 63.4 | 8.0 | 76.8 | ||||||||||||

| Chemicals and Products | 0.3 | 1.0 | 32.6 | 4.0 | 37.9 | ||||||||||||

| Marketing | 4.3 | 4.6 | 21.4 | 3.9 | 34.2 | ||||||||||||

| Renewables and Energy Solutions | 1.2 | 1.2 | 5.7 | 1.0 | 9.1 | ||||||||||||

| Corporate | — | — | 2.1 | 0.1 | 2.2 | ||||||||||||

| Total | 16.0 | 9.5 | 185.2 | 23.4 | 234.1 | ||||||||||||

4. Climate change and energy transition continued

| 2023 | |||||||||||||||||

| $ billion | |||||||||||||||||

| Goodwill | Other intangible assets | Property, plant and equipment | Joint ventures and associates | Total | |||||||||||||

| Integrated Gas | 4.9 | 3.2 | 57.7 | 6.1 | 71.9 | ||||||||||||

| Upstream | 5.4 | 0.3 | 70.9 | 7.6 | 84.2 | ||||||||||||

| Chemicals and Products [A] | 0.3 | 0.9 | 35.5 | 4.0 | 40.7 | ||||||||||||

| Marketing [A] | 4.4 | 4.4 | 23.6 | 4.7 | 37.1 | ||||||||||||

| Renewables and Energy Solutions | 1.7 | 1.5 | 4.8 | 2.0 | 10.0 | ||||||||||||

| Corporate | — | — | 2.3 | 0.1 | 2.4 | ||||||||||||

| Total | 16.7 | 10.3 | 194.8 | 24.5 | 246.3 | ||||||||||||

[A]Following resegmentation in 2024 (see Note 7), prior period comparatives have been revised to conform with current year presentation with an offsetting impact between Marketing and Chemicals & Products segments.

For Integrated Gas and Upstream, sensitivity to commodity prices and carbon prices has been tested (see below) covering the carrying amount of goodwill, other intangible assets, property, plant and equipment, and joint ventures and associates. Sensitivity testing was performed applying alternative price scenarios to the forecasted cash flows for the whole period until the end of life of the asset tested. For Chemicals and Products, sensitivity to chemical margins, refining margins and carbon prices has been tested (see below). Marketing and Renewables and Energy Solutions are expected to be resilient through the energy transition with limited exposure of stranded assets.

In addition, sensitivity to changes in the discount rate applied in impairment testing has also been tested (see below).

In calculating recoverable value, key assumptions are not determined in isolation to ensure relevant interdependencies are appropriately reflected. In particular, management considers the relationship between discount rates, forecast commodity prices and cash flow risking to ensure impairment testing assumptions result in an implicit expected return that is balanced and appropriate for the asset under review. Each of the sensitivities described above has been tested under a ceteris paribus assumption where all other factors remain unchanged, and, as such, does not reflect the potential offsetting effects of corresponding changes in other assumptions.

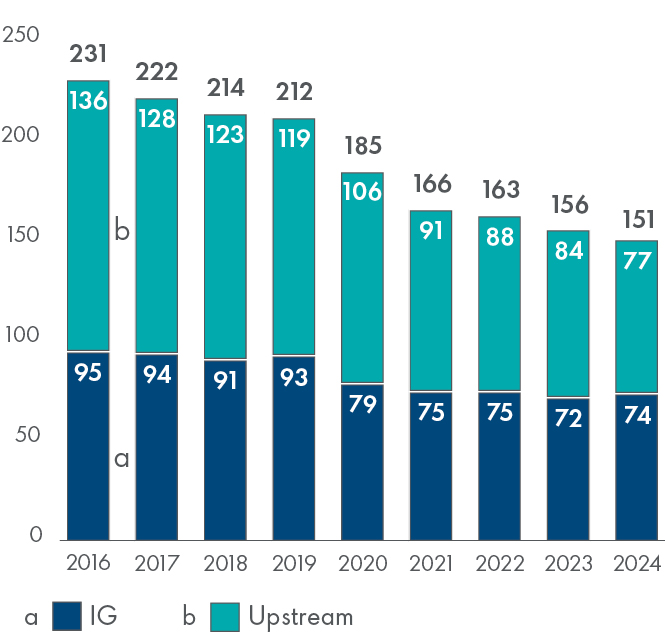

Carrying value of Integrated Gas and Upstream assets

Carrying value of Integrated Gas and Upstream assets $ billion as at December 31 | ||

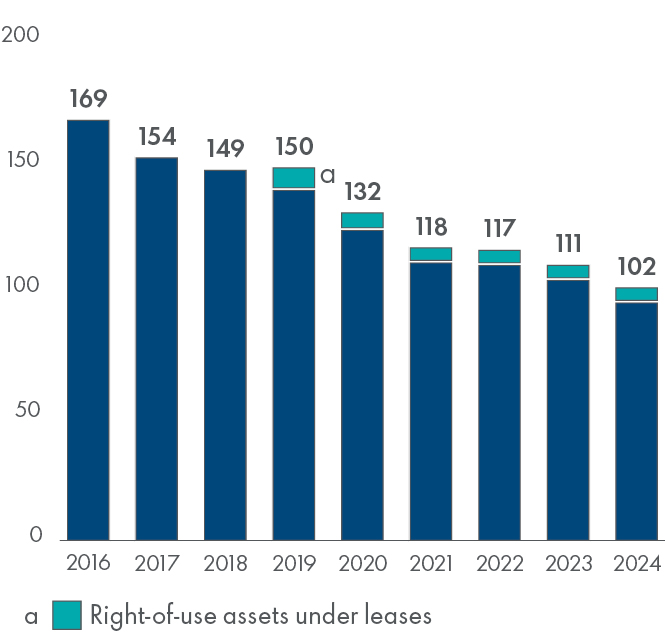

Carrying value of production assets $ billion as at December 31 | ||

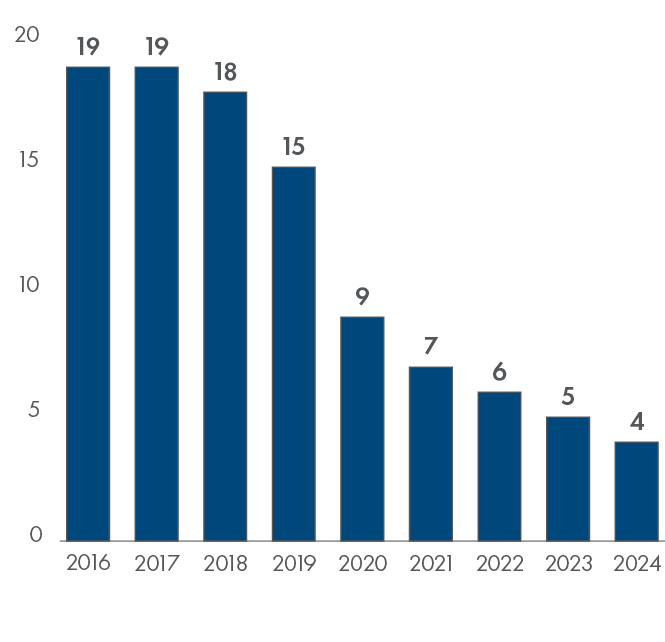

Carrying value of exploration and evaluation assets $ billion as at December 31 | ||

| Carrying amount of Integrated Gas and Upstream assets | ||

| $ billion | |||||||||||||||||||||||||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||

| Integrated Gas | 95 | 94 | 91 | 93 | 79 | 75 | 75 | 72 | 74 | ||||||||||||||||||||

| Upstream | 136 | 128 | 123 | 119 | 106 | 91 | 88 | 84 | 77 | ||||||||||||||||||||

| Total at December 31 | 231 | 222 | 214 | 212 | 185 | 166 | 163 | 156 | 151 | ||||||||||||||||||||

4. Climate change and energy transition continued

| Carrying amount of production assets | ||

| $ billion | |||||||||||||||||||||||||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||

| At December 31 | 169 | 154 | 149 | 141 | 125 | 112 | 111 | 105 | 96 | ||||||||||||||||||||

| Right of use assets | 9 | 7 | 6 | 6 | 6 | 6 | |||||||||||||||||||||||

| Total at December 31 | 169 | 154 | 149 | 150 | 132 | 118 | 117 | 111 | 102 | ||||||||||||||||||||

| Carrying amount of exploration and evaluation assets | ||

| $ billion | |||||||||||||||||||||||||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||

| At December 31 | 19 | 19 | 18 | 15 | 9 | 7 | 6 | 5 | 4 | ||||||||||||||||||||

Within Integrated Gas and Upstream, the assets potentially most sensitive to the energy transition are production assets and exploration and evaluation assets. Both production assets of $102 billion and exploration and evaluation assets of $4 billion are recognised within Property, plant and equipment within Integrated Gas and Upstream.

Portfolio composition and changes

Since 2016, the carrying value of production assets in Integrated Gas and Upstream decreased from $169 billion as at December 31, 2016, to$102 billion as at December 31, 2024. Over this period, depreciation was higher than additions for each year, and disposals of property, plant and equipment with a carrying value of $26 billion occurred. The carrying value of capitalised exploration and evaluation expenses decreased from $19 billion as at December 31, 2016, to $4 billion at December 31, 2024. This is the result of final investment decisions, reclassifications to production assets and amounts charged to expenses exceeding additions.

Estimated useful life

The energy transition and the pace at which it progresses may impact the remaining life of assets. Integrated Gas and Upstream assets are generally depreciated using a unit-of-production methodology where depreciation generally depends on production of SEC proved reserves. (See Note 2). Based on production plans of existing assets, 49%, 7% and 1% of SEC proved reserves as at December 31, 2024, would currently be left by 2030, 2040 and 2050, respectively. Based on the unit-of-production depreciation methodology applied, the carrying value for individual assets are depreciated to nil in the same pattern as the depletion of reserves towards nil. An analysis of Integrated Gas and Upstream production assets of $102 billion as at December 31, 2024, based on planned reserves depletion shows that these assets would be significantly further depreciated under the unit-of-production method by 2030 and nearly fully depreciated by 2050. This provides a further perspective on the risk of stranded assets carried in the Consolidated Balance Sheet as at December 31, 2024.

Price sensitivities using climate pricelines

As noted, in accordance with IFRS, Shell's financial statements are based on reasonable and supportable assumptions that represent management's current best estimate of the range of economic conditions that may exist in the foreseeable future. The mid-price outlook informed by Shell's scenario planning represents management's best estimate. A change of -10% or +10% to the mid-price outlook, as an average percentage over the whole life cycle of assets, would result in around $5-9 billion (2023: $5-8 billion) impairment or $2-5 billion

(2023: $2-5 billion) impairment reversal respectively in Integrated Gas and Upstream (see Note 13).

(2023: $2-5 billion) impairment reversal respectively in Integrated Gas and Upstream (see Note 13).

The energy transition will continue to bring volatility and there is significant uncertainty as to how commodity prices will develop over the next decades. Some pricelines see a structurally lower price during the transition period, while other pricelines see structurally higher commodity prices as a result of changes in supply and demand. As the risk of stranded assets is prevalent with downside price risk in energy transition scenarios, sensitivities have only been undertaken for such downside scenarios. If different price outlooks from external and often normative climate change scenarios were used, this would impact the recoverability of certain assets recognised in the Consolidated Balance Sheet as at December 31, 2024. These external scenarios are not representative of management's mid-price reasonable best estimate.

Sensitivity of carrying value to commodity prices described below is under the assumption that all other factors in the models used -- such as cost levels, volumes, mid-price CO2 assumptions and the discount rate -- to calculate recoverability of carrying value remains unchanged. Sensitivity testing has been performed by applying the alternative commodity price scenarios to cash flows for the whole period until the end of life of the assets tested, which may extend beyond the Operating Plan period. The alternative commodity prices were applied in the local cash flow models and thereafter aggregated by segment. Changes to commodity prices are applied because of the significant impact on Shell's business. It should be noted that a significant decrease in long-term forecasted commodity prices would probably lead to further changes, such as in portfolio choices and cost levels.

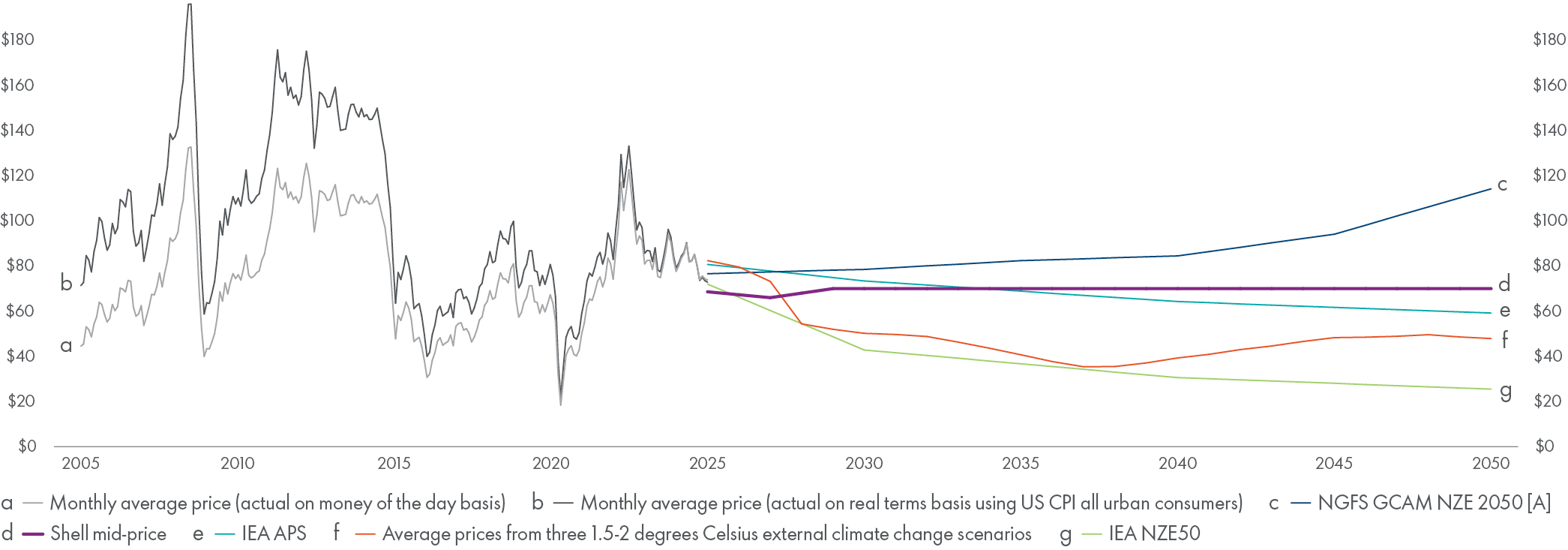

Sensitivity to changes in commodity prices in value in use calculations has been tested as follows:

Priceline 1 – Average prices from three 1.5-2°C external climate change scenarios: in view of the broad range of price outlooks across the various scenarios, the average of three external price outlooks was taken.

4. Climate change and energy transition continued

○IHS Markit/ACCS 2024 – under this scenario oil prices (real terms 2024 (RT24)) decrease from $110 per barrel (/b) in 2025 to around $100/b in 2026-2027. From 2028 prices gradually decrease from $50/b towards $31/b in 2037, gradually recovering to $92/b in 2048 with a subsequent decrease towards $90/b in 2050. Gas prices (RT24) are around $3 per million British thermal units (/MMBtu) until 2042 and gradually increase towards $4/MMBtu until 2050 for Henry Hub. For Europe, prices decrease from $10/MMBtu in 2025 towards around $4/MMBtu in 2032, with a subsequent increase to some $5 /MMBtu until 2050. For Asia, prices decrease from $11/MMBtu in 2025 towards around $6/MMBtu in 2033, and gradually increase towards $7/MMBtu until 2050.

○Woodmac WM AET-1.5 degree – under this scenario oil prices (RT24) gradually decrease from $64/b in 2025 towards $28/b in 2050. Gas prices (RT24) increase from $3/MMBtu in 2025 towards around $4/MMBtu until 2035, staying on that level until 2050 for Henry Hub. For Europe, gas prices (RT24) decrease gradually from around $13/MMBtu in 2025 to some $6/MMBtu in 2030, then gradually increase towards $9/MMBtu in 2035 and subsequently decrease towards $6/MMBtu in 2050. For Asia, gas prices decrease from $14/MMBtu in 2025 to $7/MMBtu in 2030, subsequently increasing to $10/MMBtu around 2036 and subsequently decreasing towards$7/MMBtu in 2050.

○IEA NZE50 – under this scenario oil prices (RT24) gradually decrease from $72/b in 2025 towards some $26/b in 2050. Gas prices (RT24) decrease from some$3/MMBtu in 2025 to around $2/MMBtu until 2050 for Henry Hub. For Europe and Asia, gas prices (RT24) decrease from some $10/MMBtu and $11/MMBtu respectively in 2025 to some $4/MMBtu in 2050 for Europe and $5/MMBtu around 2030, for Asia staying at that level until 2050.

This average priceline provides an external view of the development of commodity prices under 1.5-2°C external climate change scenarios over the whole period under review.

Applying this priceline to Integrated Gas assets of $74 billion (2023: $72 billion) and Upstream assets of $77 billion (2023: $84 billion) as at December 31, 2024, shows recoverable amounts that are $11-15 billion (2023: $12-16 billion) and $1-3 billion (2023: $3-5 billion) lower, respectively, than the carrying value as at December 31, 2024.

Priceline–2 - Hybrid Shell Plan and IEA NZE50: this priceline applies Shell's mid-price outlook for the first 10 years (see Note 13). Because of the greater uncertainty for the period after 10 years, the International Energy Agency (IEA) normative Net Zero Emissions scenario is applied. This gives less weight to the price-risk uncertainty in the first 10 years reflected in the Operating Plan period and applies more risk to the more uncertain subsequent periods.

Applying this priceline to Integrated Gas assets of $74 billion (2023: $72 billion) and Upstream assets of $77 billion (2023: $84 billion) as at December 31, 2024, shows recoverable amounts that are $7--10 billion (2023: $8-10 billion) and up to $1 billion (2023: $1-3 billion) lower, respectively, than the carrying value as at December 31, 2024.

Priceline–3 - IEA NZE50: this priceline applies the International Energy Agency normative Net Zero Emissions by 2050 (IEA NZE50) scenario over the whole period under review. This priceline has been applied in order to also reflect the sensitivity to a pure net-zero emissions scenario from the IEA.

Applying this priceline to Integrated Gas assets of $74 billion (2023: $72 billion) and Upstream assets of $77 billion (2023: $84 billion) as at December 31, 2024, shows recoverable amounts that are $21-27 billion (2023: $15-20 billion) and $5-7 billion (2023: $3-5 billion) lower, respectively, than the carrying value as at December 31, 2024. For Integrated Gas the change in sensitivity compared with 2023 is largely driven by lower oil and Asia gas prices applied in sensitivity testing for the whole period under review.

4. Climate change and energy transition continued

| Oil price assumptions | ||

[A]The Network for Greening the Financial System (NGFS) is a group of 143 central banks and supervisors and 21 observers committed to sharing best practices, contributing to the development of climate– and environment–related risk management in the financial sector and mobilising mainstream finance to support the transition toward a sustainable economy. This scenario results from the NGFS GCAM model. This model embodies certain assumptions on the relationships between economic and energy output and climate interactions. This NGFS scenario shows a decline in world oil demand relative to the current policies baseline, in part a response to substitution away from fossil fuels. At the same time prices increase due to supply constraints.

[B]All figures are presented on RT24 basis unless noted differently.

The graph above shows the oil pricelines on a real-terms basis applied for the period until 2050 for Shell's mid-price outlook in comparison with the IEA announced pledges (IEA APS) scenario, the NGFS GCAM NZE 2050 scenario, the average prices from three 1.5-2°C external climate change scenarios (Priceline 1, above) and the IEA Net Zero Emissions by 2050 scenario (IEA NZE50, Priceline 3 above). The development of future oil prices is uncertain and oil prices have been subject to significant volatility in the past. Future oil prices may be impacted by future changes in macroeconomic factors, available supply, demand, geopolitical and other factors. The pricelines as per the scenarios NGFS GCAM NZE 2050, IEA APS, the average prices from three 1.5-2°C external climate change scenarios and IEA NZE50 differ from Shell's best estimate and view of the future oil price.

| RT24 $/b | ||||||||||||||||||||

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |||||||||||||||

| Shell mid-price | 69 | 70 | 70 | 70 | 70 | 70 | ||||||||||||||

| Average prices from four 1.5-2°C external climate change scenarios | 82 | 50 | 41 | 39 | 48 | 48 | ||||||||||||||

| IEA NZE50 | 72 | 43 | 37 | 31 | 28 | 26 | ||||||||||||||

| NGFS GCAM NZE 2050 | 77 | 79 | 82 | 85 | 94 | 114 | ||||||||||||||

| IEA APS | 81 | 73 | 69 | 64 | 62 | 59 | ||||||||||||||

4. Climate change and energy transition continued

| Sensitivity + 10% to the mid-price outlook | ||

| $ billion | |||||||||||||||||||||||

| Carrying value | Sensitivity | ||||||||||||||||||||||

| Dec 31, 2024 | Dec 31, 2023 | 2024 | 2023 | ||||||||||||||||||||

| Integrated Gas | 74 | 72 | 2 | 4 | 2 | 4 | |||||||||||||||||

| Upstream | 77 | 84 | — | 1 | — | 1 | |||||||||||||||||

| Total | 151 | 156 | 2 | 5 | 2 | 5 | |||||||||||||||||

| Sensitivity averaged from three 1.5-2°C external climate change scenarios | ||

| $ billion | |||||||||||||||||||||||

| Carrying value | Sensitivity | ||||||||||||||||||||||

| Dec 31, 2024 | Dec 31, 2023 | 2024 | 2023 | ||||||||||||||||||||

| Integrated Gas | 74 | 72 | (11) | (15) | (12) | (16) | |||||||||||||||||

| Upstream | 77 | 84 | (1) | (3) | (3) | (5) | |||||||||||||||||

| Total | 151 | 156 | (12) | (18) | (15) | (21) | |||||||||||||||||

| Sensitivity IEA NZE50 | ||

| $ billion | |||||||||||||||||||||||

| Carrying value | Sensitivity | ||||||||||||||||||||||

| Dec 31, 2024 | Dec 31, 2023 | 2024 | 2023 | ||||||||||||||||||||

| Integrated Gas | 74 | 72 | (21) | (27) | (15) | (20) | |||||||||||||||||

| Upstream | 77 | 84 | (5) | (7) | (3) | (5) | |||||||||||||||||

| Total | 151 | 156 | (26) | (34) | (18) | (25) | |||||||||||||||||

| Sensitivity - 10% to the mid-price outlook | ||

| $ billion | |||||||||||||||||||||||

| Carrying value | Sensitivity | ||||||||||||||||||||||

| Dec 31, 2024 | Dec 31, 2023 | 2024 | 2023 | ||||||||||||||||||||

| Integrated Gas | 74 | 72 | (4) | (6) | (4) | (6) | |||||||||||||||||

| Upstream | 77 | 84 | (1) | (3) | (1) | (2) | |||||||||||||||||

| Total | 151 | 156 | (5) | (9) | (5) | (8) | |||||||||||||||||

Sensitivity Hybrid Shell Plan + IEA NZE50 | ||

| $ billion | |||||||||||||||||||||||

| Carrying value | Sensitivity | ||||||||||||||||||||||

| Dec 31, 2024 | Dec 31, 2023 | 2024 | 2023 | ||||||||||||||||||||

| Integrated Gas | 74 | 72 | (7) | (10) | (8) | (10) | |||||||||||||||||

| Upstream | 77 | 84 | — | (1) | (1) | (3) | |||||||||||||||||

| Total | 151 | 156 | (7) | (11) | (9) | (13) | |||||||||||||||||

Carbon price sensitivities

Carbon costs in the Operating Plan

The Operating Plan includes capital expenditure and operating costs to achieve Scope 1 and 2 emission reduction targets (see above). These include asset level abatement project costs that drive efficiencies and reduce emissions, expected costs for evolving carbon regulations based on a forecast of Shell's equity share of emissions and costs of offsets for any residual amounts.

The total capital expenditure for abatement projects which includes energy efficiency improvements, the transformation of energy and chemicals parks, CCS facilities and electrification of our facilities included in the Operating Plan is in excess of $6 billion. Total yearly carbon emission costs in Shell's Operating Plan gradually increase from $1 billion in 2025 to $5 billion in 2034 using the mid-price scenario. The sensitivity of carrying value of assets to changes in carbon prices is described in the section below.

Methods for estimating costs vary, depending on the nature of the cost. Abatement project costs to improve efficiencies and reduce emissions are estimated by applying a bottom-up approach where individual opportunities on an asset-level, project-by-project basis are identified.

Costs for evolving carbon regulations are based on a forecast of Shell's equity share of emissions and are included in the Operating Plan at Shell's mid-price outlook on a country-by-country basis and represent management's best estimate. In the short and near term, up to around 2030, costs for carbon emissions estimates are largely policy driven, through emissions trading schemes or taxation levied by governments which currently vary significantly on a country-by-country basis. Beyond 2030, where policy predictions are more challenging, the costs for carbon emissions are estimated based on the expected costs of abatement technologies required for 2050. The estimated costs are trending towards $50 to $230 per tonne (RT24), depending on the country, in 2050.

4. Climate change and energy transition continued

Sensitivity to changes in carbon price assumptions

There is significant uncertainty as to how carbon costs will develop over the next decades. These will depend on policies set by countries and the pace of the energy transition. In accordance with IFRS, Shell's financial statements are based on reasonable and supportable assumptions that represent management's current best estimate, which is policy based up to 2030 and then based on the mid-price outlook beyond 2030. As the risk of stranded assets is prevalent with higher carbon emission prices than anticipated, sensitivity analyses have only been undertaken for such a downside scenario. If the IEA NZE50 outlook is applied, this would impact the recoverability of certain assets recognised in the Consolidated Balance Sheet as at December 31, 2024. This scenario is not representative of management's mid-price reasonable best estimate.

Sensitivity of carrying value to carbon emission costs as described below is under the assumption that all other factors in the value in use models used to calculate recoverability of carrying value remain unchanged. Changes to carbon emission costs are applied for Integrated Gas, Upstream and Chemicals and Products because of the potential impact on Shell's business.

Applying the IEA NZE50 carbon price scenario to Integrated Gas assets of $74 billion (2023: $72 billion) and Upstream assets of $77 billion (2023: $84 billion), up to the end of life of these assets, shows recoverable amounts that are $1-2 billion (2023: $2-4 billion) lower for Integrated Gas and up to $1 billion lower for Upstream than the carrying value as at December 31, 2024.

Applying the IEA NZE50 carbon price scenario to Chemicals and Products assets of $38 billion shows recoverable amounts that are $1-2 billion lower than the carrying value as at December 31, 2024. For Chemicals and Products, increased carbon cost could however potentially be recovered partially through increased product sale prices.

| Sensitivity IEA NZE 2050 carbon price scenario | ||

| $ billion | |||||||||||||||||||||||

| Carrying value | Sensitivity | ||||||||||||||||||||||

| Dec 31, 2024 | Dec 31, 2023 | 2024 | 2023 | ||||||||||||||||||||

| Integrated Gas | 74 | 72 | (1) | (2) | (2) | (4) | |||||||||||||||||

| Upstream | 77 | 84 | — | (1) | — | (1) | |||||||||||||||||

| Chemicals and Products | 38 | 44 | (1) | (2) | (3) | (4) | |||||||||||||||||

| Total | 189 | 200 | (2) | (5) | (5) | (9) | |||||||||||||||||

For the key regions and countries the following carbon prices per tonne (RT24) have been assumed in the Operating Plan:

| Operating plan period | Subsequent period | ||||||||||

| Region | 2025-2034 | 2035-2050 | |||||||||

| European Union [A] | $92-$133 | $136-$185 | |||||||||

| Norway | $181-$230 | $230-$230 | |||||||||

| United Kingdom | $62-$133 | $136-$185 | |||||||||

| Canada (Federal) | $69-$115 | $115-$125 | |||||||||

| United States of America (Federal) | $0-$25 | $31-$125 | |||||||||

| Australia | $32-$76 | $80-$150 | |||||||||

| All other countries | $0-$65 | $13-$150 | |||||||||

[A]Except for the Netherlands where the ranges are $94-163 per tonne (2025-2034) and $164-185 per tonne (2035-2050).

4. Climate change and energy transition continued

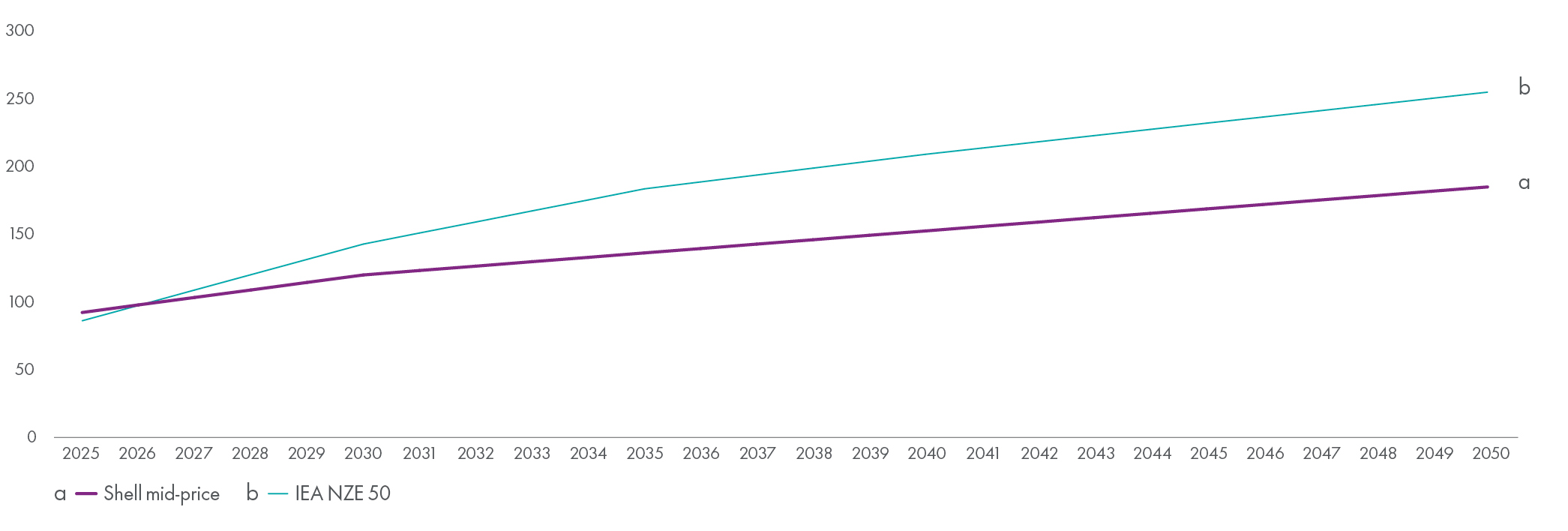

The graph below shows the carbon pricelines per tonne for the European Union on an RT24 basis under Shell's mid-price outlook that represents the best estimate as required to be applied under IFRS, in comparison with the IEA NZE50 scenario. The IEA NZE50 scenario differs from Shell's best estimate and view of future CO2 prices. Sensitivity of carrying value to the IEA NZE50 carbon price scenario is provided above.

CO2 prices - European Union RT24 $/tonne | ||

| RT24 $/tonne | ||||||||||||||||||||

| 2025 | 2030 | 2035 | 2040 | 2045 | 2050 | |||||||||||||||

| Shell mid-price | 92 | 120 | 136 | 153 | 169 | 185 | ||||||||||||||

| IEA NZE50 | 86 | 143 | 184 | 209 | 232 | 255 | ||||||||||||||

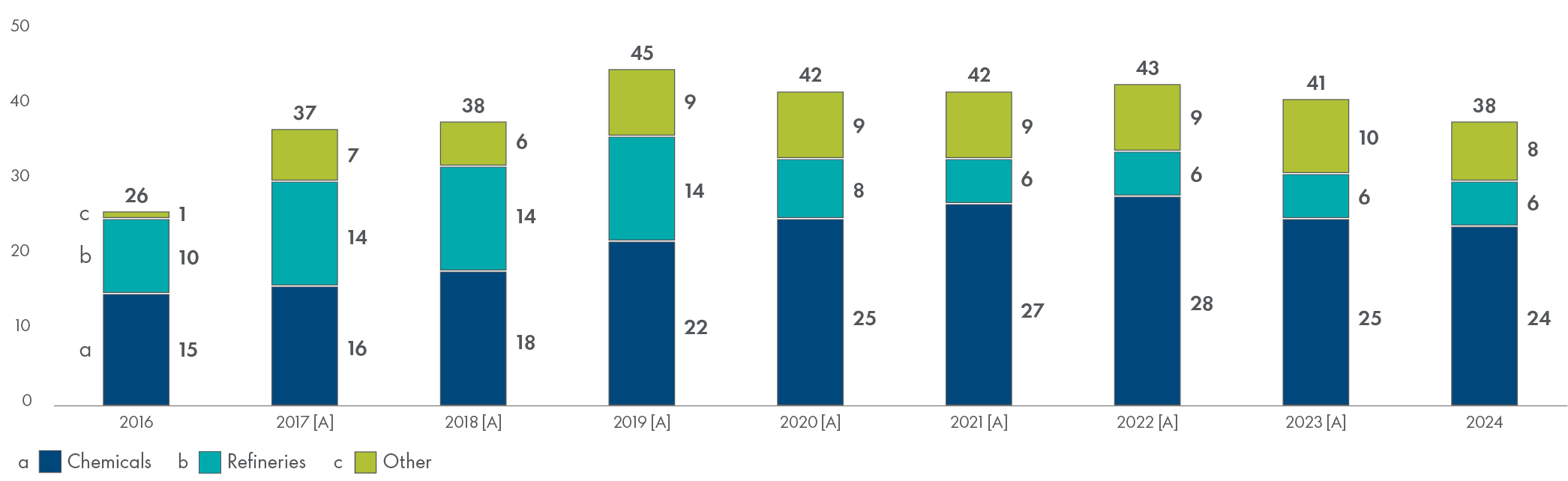

Carrying value of Chemicals and Products assets $ billion as at December 31 | ||

[A]Following resegmentation in 2024 (see Note 7), prior period comparatives have been revised to conform with current year presentation with an offsetting impact between Marketing and Chemicals & Products segments

| Carrying amount of Chemicals and Production assets | ||

| $ billion | |||||||||||||||||||||||||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||

| Chemicals | 15 | 16 | 18 | 22 | 25 | 27 | 28 | 25 | 24 | ||||||||||||||||||||

| Refineries | 10 | 14 | 14 | 14 | 8 | 6 | 6 | 6 | 6 | ||||||||||||||||||||

| Other | 1 | 7 | 6 | 9 | 9 | 9 | 9 | 10 | 8 | ||||||||||||||||||||

| Total at December 31 | 26 | 37 | 38 | 45 | 42 | 42 | 43 | 41 | 38 | ||||||||||||||||||||

4. Climate change and energy transition continued

Within Chemicals and Products, the assets potentially most sensitive to the energy transition are refineries.

Portfolio composition and changes

Since 2016, Shell's Chemicals and Products portfolio has evolved, shifting from 15 refineries at the end of 2016 to eight (of which one is classified as held for sale) at the end of 2024. During that period, Shell assumed the sole ownership of two refineries through the dissolution of the Motiva joint venture, and disposed of, converted or closed nine refineries. Further, during 2024 Shell agreed to sell one refinery (classified as assets held for sale at the end of 2024, see Note 19). The carrying value of refineries decreased from $10 billion as at December 31, 2016, to less than $6 billion as at December 31, 2024. In line with Shell's strategy, it is progressing the repurposing of its energy and chemicals parks; these key focused assets allows Shell to underpin its hydrocarbon energy sales and the sales of lower carbon products.

Estimated useful life

Refineries in the Chemicals and Products segment (carrying value as at December 31, 2024, $6 billion (2023: $6 billion)) may be impacted under a 2°C or less external climate scenario.

For refineries in Chemicals and Products, depreciation of assets is on a straight-line basis over the life of the assets, starting at the date the asset becomes available for use, over a period of 20 years (see Note 2). Over the course of the energy transition, the current carrying value of refineries will be fully depreciated, offset by anticipated investments in assets that are expected to be resilient in the energy transition as described above. Based on current depreciation of the carrying value as at December 31, 2024, and assuming no further investment, all refineries would be fully depreciated between and 11 years.

In addition to refineries, further assets of $32 billion include $24 billion of assets in relation to Chemicals. This includes $14 billion for the Pennsylvania chemical plant, which started operations in November 2022 and being a more efficient plant, it is expected to be more resilient in the energy transition. Chemical products are not produced with the aim to combust and consequently do not generate GHG emissions. Under the IEA NZE50 scenario chemical production volumes are not expected to decrease towards 2050, compared with current levels and hence chemical assets are expected to be resilient through the energy transition.

Other assets of $8 billion include $5 billion of assets mainly related to storage tanks, vessels, pipelines in trading and supply that are also expected to be resilient in the energy transition.

Price sensitivities

Where available Shell uses external climate scenarios for sensitivity testing. In relation to chemical and refining margin forecasts, no credible climate scenarios have been identified and consequently sensitivity testing is performed by providing sensitivity to changes in margins.

Chemical margins applied for impairment testing by reference to value in use are at an average of $197.5/tonne (20-year average). A change of -$30/tonne or +$30/tonne in long-term chemical margins over the entire cash flow projection period would ceteris paribus result in up to $0.5 billion (2023: up to $2 billion)impairment or no impairment reversal, respectively, in Chemicals and Products (see Note 13).

Refining margins applied for impairment testing by reference to value in use are at an average of $10/bbl (20-year). A change of -$1/bbl or +$1/bbl to the refining margin outlook over the entire cash flow projection period would ceteris paribus result in no impairment (2023: $1-2 billion) or up to $0.5 billion (2023: up to $1 billion) impairment reversal respectively in Chemicals and Products (see Note 13).

Sensitivities to carbon prices are described in the section above.

4. Climate change and energy transition continued

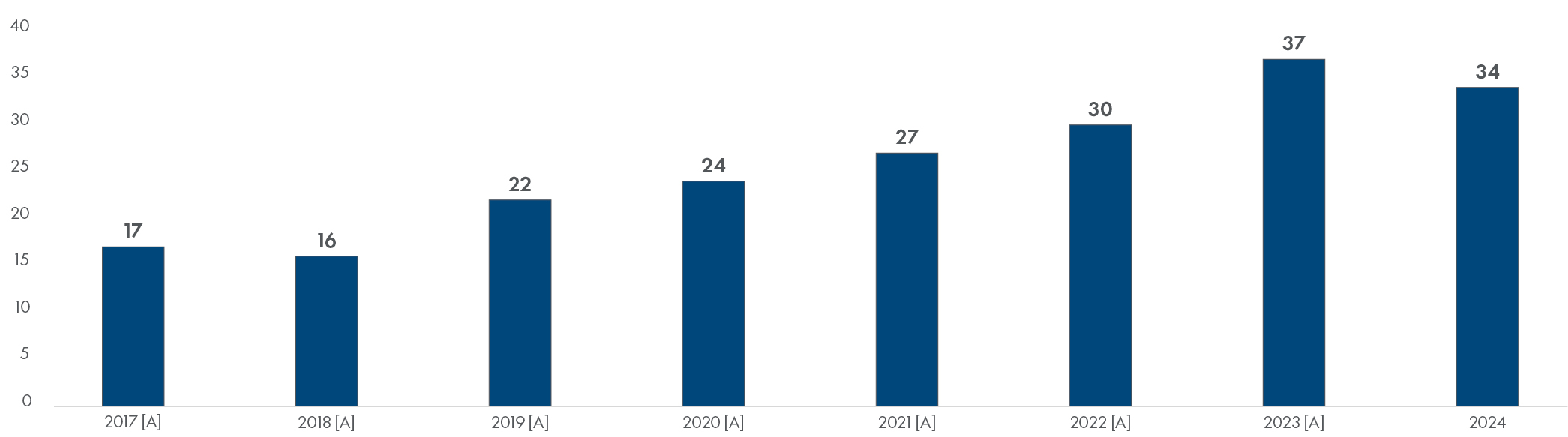

Carrying value of Marketing assets

Carrying value of Marketing assets $ billion as at December 31 | ||

[A]Following resegmentation in 2024 (see Note 7), prior period comparatives have been revised to conform with current year presentation with an offsetting impact between Marketing and Chemicals & Products segments.

| Carrying amount of Marketing assets | ||

| $ billion | |||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||||||||||

| At December 31 | 17 | 16 | 22 | 24 | 27 | 30 | 37 | 34 | |||||||||||||||||||||

Portfolio composition and changes

Assets in the Marketing segment are expected to be resilient through the energy transition with a change in the product mix as the energy transition progresses. The demand for products sold — such as chemicals, lubricants, biofuels, bitumen, electric vehicle charging and convenience retail -- is not expected to decrease and is expected to increase for a variety of these products in many markets. Shell is expanding networks of refuelling stations offering low-carbon fuels, including biofuels and various gaseous fuels, such as LNG and bio-LNG. As a result, the carrying value of these assets is not expected to be impacted by the energy transition or lower commodity price scenarios.

Carrying value of Renewables and Energy Solutions assets

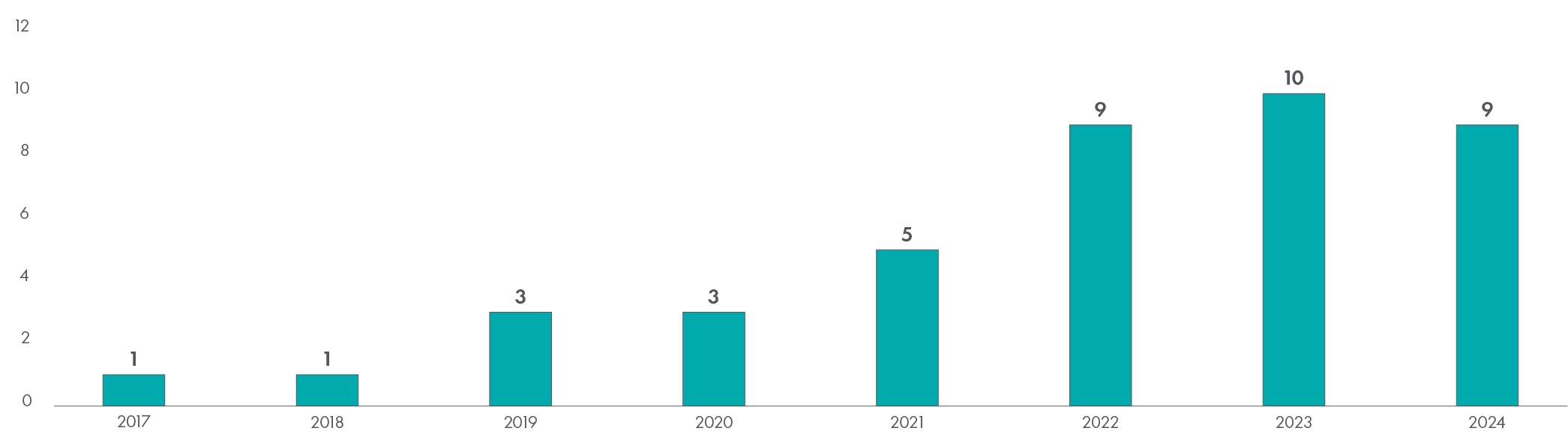

Carrying value of Renewables and Energy Solutions assets $ billion as at December 31 | ||

| Carrying amount of Renewables and Energy Solutions assets | ||

$ billion | |||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||||||||||

| At December 31 | 1 | 1 | 3 | 3 | 5 | 9 | 10 | 9 | |||||||||||||||||||||

4. Climate change and energy transition continued

Portfolio composition and changes

In 2024 Shell refreshed its renewable generation, energy marketing, and gas and power trading strategy, shifting Shell's asset portfolio towards energy storage and flexible generation with an increased focus on power trading and minimising new investments in offshore wind projects. The aim is to maximise returns from onshore positions using capital-light business models, debt finance and partnerships. The carrying value of assets in the Renewables and Energy Solutions segment in the balance sheet at December 31, 2024, is expected to be resilient through the energy transition.

Other energy transition considerations

Discount rate sensitivity

The discount rate applied for value in use impairment testing is based on a nominal post-tax weighted average cost of capital (WACC) and is determined at 7.5% except for the power activities in the Renewables and Energy Solutions segment where 6% is applied. The discount rate includes generic systematic risk for energy transition risk. In addition, cash flow projections applied in individual assets include specific asset risks, including risk of transition. An increase in systematic energy transition risk could lead to a higher WACC and consequently to a higher discount rate to be applied in impairment testing. An increase of the discount rate applied for impairment testing of 1% under the assumption that all other factors (such as commodity prices, product margins and carbon prices) in the models used to calculate recoverability of carrying value remain unchanged would lead to a change in the carrying value of $1-3 billion (2023: $2-4 billion) in Integrated Gas and Upstream, and no significant impairment in other segments (2023: up to $1 billion in Chemicals and Products).

Global oil and gas demand considerations

A decrease in global demand and unchanged supply of oil and gas would probably lead to a decrease in price (see price sensitivity above). During 2024 Shell's production of oil and gas accounted for some 1.5% and 2% of total global production of oil and gas respectively. Changes in global oil and gas demand are therefore not expected to directly impact the ability to sell volumes of oil and gas produced by Shell at market prices.

Deferred tax assets

In general, it is expected that sufficient deferred tax liabilities and forecasted taxable profits within the planning period of 10 years are available for recovery of the deferred tax assets recognised at December 31, 2024. Integrated Gas and Upstream deferred tax assets recognised are expected to be recovered within the period of production of each asset. For deferred tax assets of $625 million as at December 31, 2024 (2023: $241 million) this period extends beyond 10 years. Deferred tax assets in Chemicals and Products and in Marketing expected to be recovered in more than 10 years (between 11 and 20 years) are $315 million as at December 31, 2024 (2023: $455 million) for which the forecasted taxable profits to determine recoverability have been risked. (See Note 23).

Decommissioning and other provisions

The energy transition may result in decommissioning and restoration occurring earlier than expected. The risk on the timing of decommissioning and restoration activities for Integrated Gas and Upstream fields is limited, supported by production plans in the foreseeable future (see "Estimated useful life" above). Acceleration of decommissioning and restoration activities has also been reflected in the assessment of the appropriate discount rate. On an undiscounted basis the provision for decommissioning and restoration as at December 31, 2024 was $32 billion (2023: $33 billion), recognised on a discounted basis in the Consolidated Balance Sheet as at December 31, 2024 at $18 billion (2023: $19 billion). Sensitivity to changes in the discount rate is provided in Note 25.

Historically, in Chemicals and Products, it was industry practice not to recognise decommissioning and restoration provisions associated with manufacturing facilities. This was on the basis that these assets were considered to have indefinite lives, so it was considered remote that an outflow of economic benefits would be required. In 2020, Shell considered the changed macroeconomic fundamentals, together with Shell's plans to rationalise the Group's manufacturing portfolio. Shell also reconsidered whether it remained appropriate not to recognise decommissioning and restoration provisions for manufacturing facilities. Since 2020, decommissioning and restoration provisions are recognised for certain shorter-lived manufacturing facilities (see Notes 25 and 32). The energy and chemicals parks are considered longer-lived facilities that are expected to be resilient in the energy transition, and decommissioning would generally be more than 50 years away.

Onerous contracts

Closure or early termination of activities may lead to supply contracts becoming onerous. Onerous contract provisions (see Note 25) have been recognised as at December 31, 2024, to reflect changes in expected future utilisation of certain assets. These include contracts in relation to unused terminals and refineries. The total carrying value of the provision for onerous contracts as at December 31, 2024 was $1.1 billion (2023: $1.1 billion) principally related to contracts in relation to unused terminals and refineries.

Dividend resilience

External stakeholders have requested disclosures on how climate change affects dividend-paying capacity. If a further impairment had been recognised in 2024 using any of the climate change scenarios described above, this would not have impacted the ability to pay dividends in this financial year because of strong cash flow generation and financial reserves. Had Shell applied the IEA NZE50 scenario (see above), and if this had led to a decrease in the recoverable amount of Integrated Gas and Upstream assets of $26-34 billion and recognition of an equivalent impairment, this would not have impacted the distributable reserves available to Shell from which to pay dividends in 2024. This is on the basis that such impairment would have resulted in part-realisation of the merger reserve recognised by the Company of $234 billion

as at December 31, 2024.

as at December 31, 2024.

A forward-looking statement regarding future dividend-paying capacity cannot be provided because of unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements.

4. Climate change and energy transition continued

Physical risks

The potential impact of physical risks comes from both acute and chronic climate hazards. Acute hazards, such as flooding and droughts, wildfires and more severe tropical storms, and chronic hazards, such as rising temperatures and rising sea levels, could impact some of Shell's facilities, operations and supply chains. The frequency of these hazards and impacts is expected to increase in certain locations. Extreme weather events, whether or not related to climate change, could have a negative impact on Shell's earnings, cash flows and financial condition. Mitigation of physical risks, whether or not related to climate change, is considered and embedded in the design and construction of Shell's projects, and/or operation of its assets to minimise the risk of adverse incidents to Shell's employees and contractors, the communities where Shell operates, and Shell's equipment.

In 2023, Shell carried out a detailed review to assess the impact of a range of changing climatic conditions, including projected changes in temperature, precipitation, wind and sea levels, across segments and geographies for Shell's significant assets. Shell used IPCC climate modelling data covering three exploratory climate scenarios (RCP2.6, RCP4.5 and RCP8.5) across the time-horizons 2025, 2030 and 2050. These scenarios were selected to ensure a broad range of risks and uncertainties were assessed. There have been no changes to the climate modelling data that would require a full update of the 2023 assessment. Shell has confirmed there are no changes to the risk profile of Shell's significant assets and accounted for portfolio changes. In the short to medium term, the risks identified were found to be related to factors that Shell is already aware of (whether or not related to climate change) and that the assets are actively managing to mitigate, e.g. hurricane impacts in the US Gulf Coast, rising air temperatures in the Middle East and water scarcity in Europe and Asia. As an example, in recent years the Rhine river in Europe has seen historic lows during the summer months leading to challenges in the use of barges for transportation of Shell's products. Dredging of harbours and investment in shallower-draft barges have helped to mitigate the risk. In the long term, the results of the exercise indicated that while have evaluated against current climate modelling projections and Shell's current asset portfolio, by 2050 the frequency and severity of the climate hazards may differ from current projections. The level of predictability is such that the need for investment in climate adaptation measures at the assets is not immediate and the results mean Shell is in a position to monitor the assets and determine whether there is any need for adaptation action, e.g. the impact of potential water scarcity on various assets. Shell's testing to assess the potential impact of climate-related changes on its significant assets covers over 70% of the carrying value of Shell's physical assets as at December 31, 2023. Over 12% (based on the carrying value) of physical assets tested are considered to be exposed to climate-related physical risks in the short to medium term which the assets are already actively managing to mitigate. In addition, Shell reviewed significant acquisitions made in 2023 and 2024, none of which were found to have significant climate-related physical risks in the short to medium term. Shell's plan reflects the impact of mitigating actions in the short to medium term for the assets assessed. Shell will continue to monitor and assess the future exposure of Shell's assets in the longer term to changing climatic conditions to establish the need for any further adaptation actions and related metrics.

The impact of physical climate change on Shell's operations is unlikely to be limited to the boundaries of Shell's assets. For example, the downstream transportation and distribution of Shell's products from its own operations could potentially be exposed to climate-related hazards that ultimately impact Shell's operations. The overall impact, including how supply chains, resource availability and markets may be affected, also needs to be considered for a holistic assessment of this risk. Shell's assets manage this risk as part of broad risk and threat management processes as required by Shell's Environment and Asset Management (SEAM) standards, part of the wider Shell Performance Framework.