Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Columbia Funds Series Trust II

|

|

| Entity Central Index Key |

0001352280

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| Columbia Seligman Global Technology Fund - Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Seligman Global Technology Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SHGTX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Seligman Global Technology Fund (the Fund) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 61 | 1.26 % (a) |

|

|

| Expenses Paid, Amount |

$ 61

|

|

| Expense Ratio, Percent |

1.26%

|

[1] |

| Net Assets |

$ 2,128,392,277

|

|

| Holdings Count | Holding |

68

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets | $ 2,128,392,277 | | Total number of portfolio holdings | 68 | | Portfolio turnover for the reporting period | 11% |

|

|

| Holdings [Text Block] |

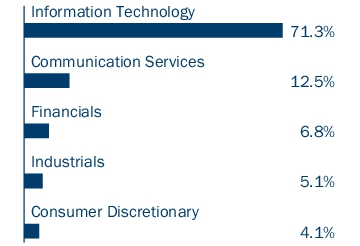

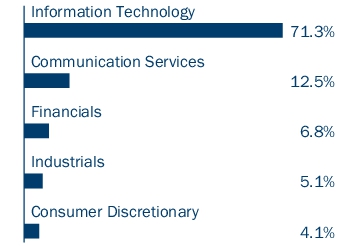

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

Information Technology Sub-industry Allocation |

|

| Largest Holdings [Text Block] |

| Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

|

|

| Columbia Seligman Global Technology Fund - Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Seligman Global Technology Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

SHTCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Seligman Global Technology Fund (the Fund) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 96 | 2.01 % (a) |

|

|

| Expenses Paid, Amount |

$ 96

|

|

| Expense Ratio, Percent |

2.01%

|

[1] |

| Net Assets |

$ 2,128,392,277

|

|

| Holdings Count | Holding |

68

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets | $ 2,128,392,277 | | Total number of portfolio holdings | 68 | | Portfolio turnover for the reporting period | 11% |

|

|

| Holdings [Text Block] |

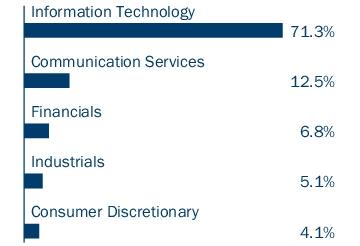

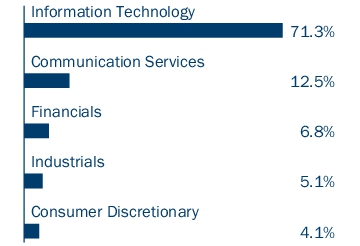

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

Information Technology Sub-industry Allocation |

|

| Largest Holdings [Text Block] |

| Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

|

|

| Columbia Seligman Global Technology Fund - Institutional Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Seligman Global Technology Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

CSGZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Seligman Global Technology Fund (the Fund) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 49 | 1.01 % (a) |

|

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

1.01%

|

[1] |

| Net Assets |

$ 2,128,392,277

|

|

| Holdings Count | Holding |

68

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets | $ 2,128,392,277 | | Total number of portfolio holdings | 68 | | Portfolio turnover for the reporting period | 11% |

|

|

| Holdings [Text Block] |

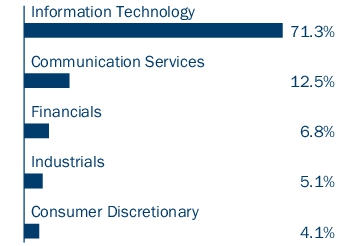

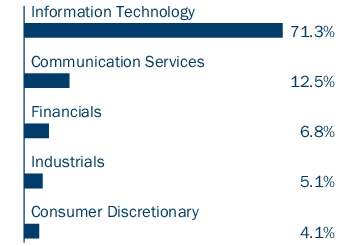

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

Information Technology Sub-industry Allocation |

|

| Largest Holdings [Text Block] |

| Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

|

|

| Columbia Seligman Global Technology Fund - Institutional 2 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Seligman Global Technology Fund

|

|

| Class Name |

Institutional 2 Class

|

|

| Trading Symbol |

SGTTX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Seligman Global Technology Fund (the Fund) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 2 Class | $ 46 | 0.96 % (a) |

|

|

| Expenses Paid, Amount |

$ 46

|

|

| Expense Ratio, Percent |

0.96%

|

[1] |

| Net Assets |

$ 2,128,392,277

|

|

| Holdings Count | Holding |

68

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets | $ 2,128,392,277 | | Total number of portfolio holdings | 68 | | Portfolio turnover for the reporting period | 11% |

|

|

| Holdings [Text Block] |

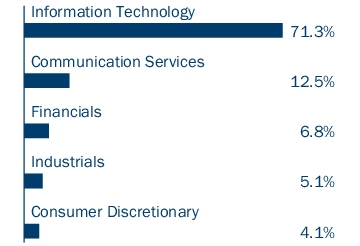

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

Information Technology Sub-industry Allocation |

|

| Largest Holdings [Text Block] |

| Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

|

|

| Columbia Seligman Global Technology Fund - Institutional 3 Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Seligman Global Technology Fund

|

|

| Class Name |

Institutional 3 Class

|

|

| Trading Symbol |

CGTYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Seligman Global Technology Fund (the Fund) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 44 | 0.91 % (a) |

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.91%

|

[1] |

| Net Assets |

$ 2,128,392,277

|

|

| Holdings Count | Holding |

68

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets | $ 2,128,392,277 | | Total number of portfolio holdings | 68 | | Portfolio turnover for the reporting period | 11% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

Information Technology Sub-industry Allocation |

|

| Largest Holdings [Text Block] |

| Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

|

|

| Columbia Seligman Global Technology Fund - Class R |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Seligman Global Technology Fund

|

|

| Class Name |

Class R

|

|

| Trading Symbol |

SGTRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Seligman Global Technology Fund (the Fund) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class R | $ 73 | 1.51 % (a) |

|

|

| Expenses Paid, Amount |

$ 73

|

|

| Expense Ratio, Percent |

1.51%

|

[1] |

| Net Assets |

$ 2,128,392,277

|

|

| Holdings Count | Holding |

68

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets | $ 2,128,392,277 | | Total number of portfolio holdings | 68 | | Portfolio turnover for the reporting period | 11% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

Information Technology Sub-industry Allocation |

|

| Largest Holdings [Text Block] |

| Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

|

|

| Columbia Seligman Global Technology Fund - Class S |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Columbia Seligman Global Technology Fund

|

|

| Class Name |

Class S

|

|

| Trading Symbol |

CSGAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Columbia Seligman Global Technology Fund (the Fund) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

|

| Additional Information Phone Number |

1-800-345-6611

|

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class S | $ 49 | 1.01 % (a) |

|

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

1.01%

|

[1] |

| Net Assets |

$ 2,128,392,277

|

|

| Holdings Count | Holding |

68

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

| Fund net assets | $ 2,128,392,277 | | Total number of portfolio holdings | 68 | | Portfolio turnover for the reporting period | 11% |

|

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

Information Technology Sub-industry Allocation |

|

| Largest Holdings [Text Block] |

| Broadcom, Inc. | 5.8 % | | Lam Research Corp. | 5.2 % | | NVIDIA Corp. | 5.2 % | | Microsoft Corp. | 5.1 % | | Alphabet, Inc., Class A | 4.3 % | | Apple, Inc. | 4.1 % | | Bloom Energy Corp., Class A | 3.7 % | | Visa, Inc., Class A | 3.1 % | | Applied Materials, Inc. | 2.9 % | | Oracle Corp. | 2.6 % |

|

|

|

|