Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Schwab Capital Trust

|

|

| Entity Central Index Key |

0000904333

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| Schwab International Opportunities Fund - SWMIX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab International Opportunities Fund

|

|

| Class Name |

Schwab International Opportunities Fund

|

|

| Trading Symbol |

SWMIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab International Opportunities Fund |

|

| * Annualized.

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.85%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab International Opportunities Fund (04/02/2004) 1,2,3 |

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. 1 Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. 2 The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. 3 The fund commenced operations on October 16, 1996 which became the Schwab International Opportunities Fund Investor Shares. The Investor Shares were consolidated into Select Shares on February 26, 2019. The performance presented is that of the former Select Shares which commenced operations on April 2, 2004. 4 The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

|

|

| Performance Inception Date |

Apr. 02, 2004

|

|

| No Deduction of Taxes [Text Block] |

returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 1,065,000,000

|

|

| Holdings Count | Holding |

900

|

|

| Investment Company, Portfolio Turnover |

29.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

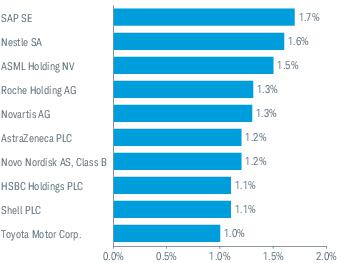

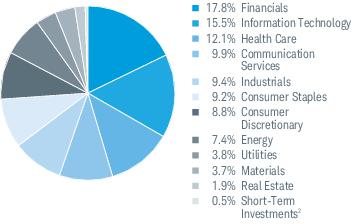

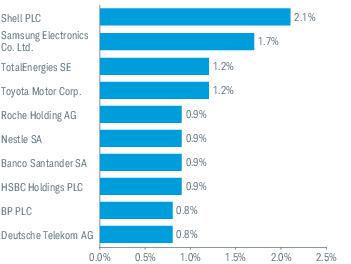

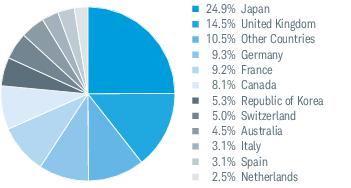

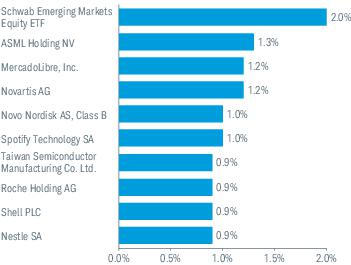

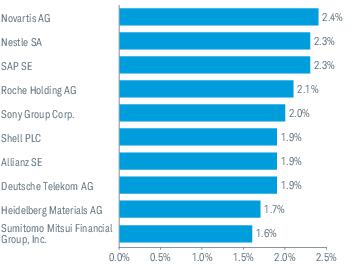

| Holdings [Text Block] |

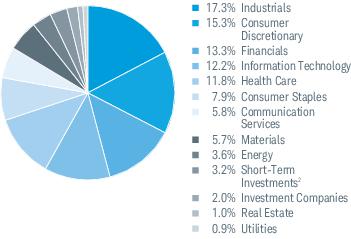

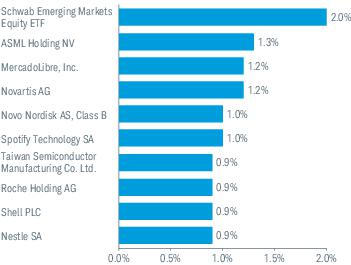

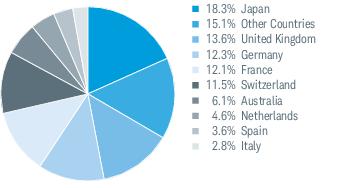

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Top Country Weightings % of Investments  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended . |

|

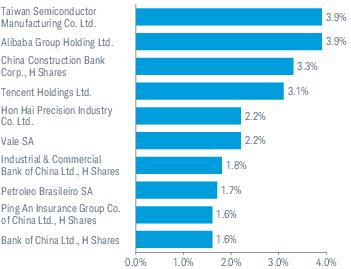

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Core Equity Fund - SWANX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Core Equity Fund

|

|

| Class Name |

Schwab Core Equity Fund

|

|

| Trading Symbol |

SWANX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT) |

|

| Expenses Paid, Amount |

$ 36

|

|

| Expense Ratio, Percent |

0.73%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Core Equity Fund (07/01/1996) 1 |

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly . Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Inception Date |

Jul. 01, 1996

|

|

| No Deduction of Taxes [Text Block] |

These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 1,345,000,000

|

|

| Holdings Count | Holding |

53

|

|

| Investment Company, Portfolio Turnover |

9.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

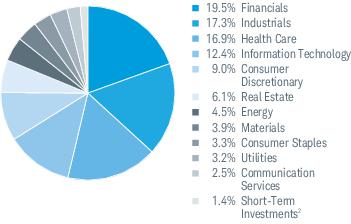

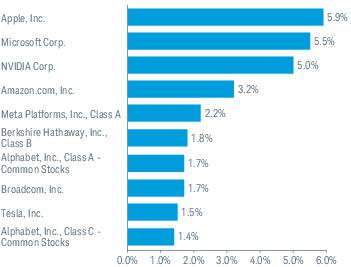

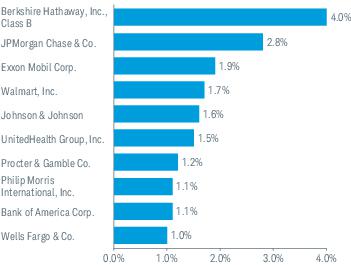

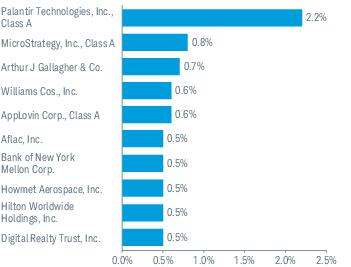

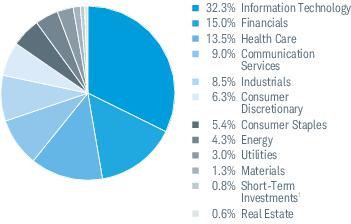

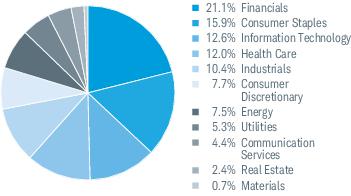

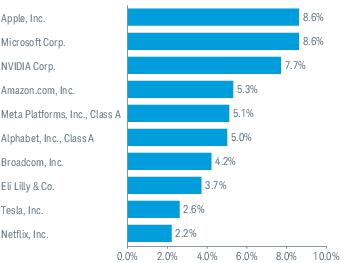

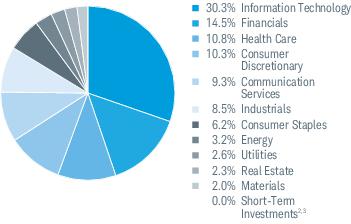

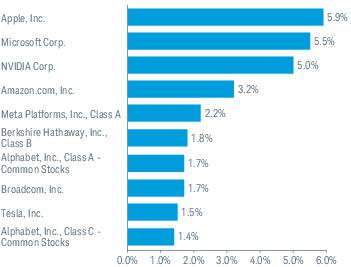

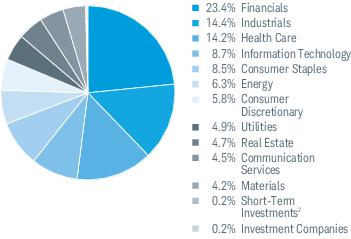

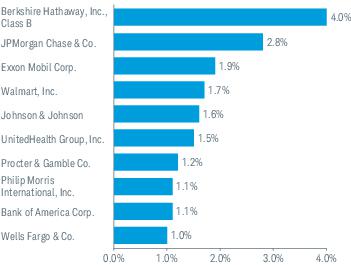

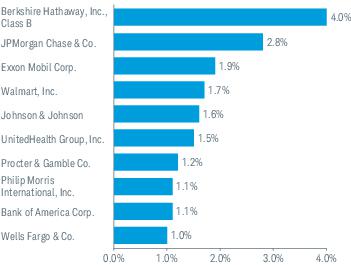

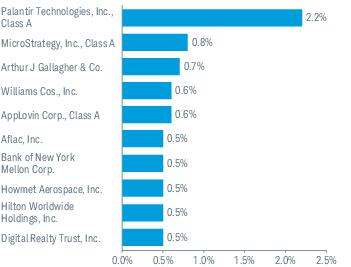

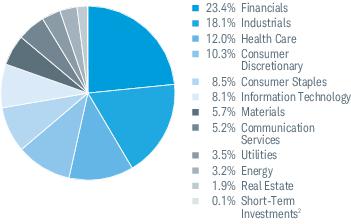

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Dividend Equity Fund - SWDSX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Dividend Equity Fund

|

|

| Class Name |

Schwab Dividend Equity Fund

|

|

| Trading Symbol |

SWDSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Dividend Equity Fund |

|

|

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.89%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Dividend Equity Fund (09/02/2003) 1,2 |

|

|

|

|

|

|

|

|

|

Russell 1000 ® Value Index |

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The Russell 1000 ® Value Index is the fund’s additional index and is more representative of the fund’s investment universe than the regulatory index. |

|

| Performance Inception Date |

Sep. 02, 2003

|

|

| No Deduction of Taxes [Text Block] |

These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 520,333,000

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company, Portfolio Turnover |

1.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

|

|

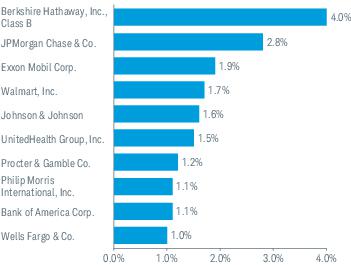

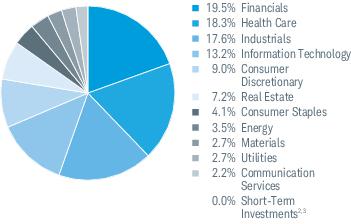

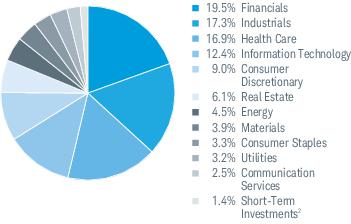

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard ( GICS ) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Large-Cap Growth Fund - SWLSX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Large-Cap Growth Fund

|

|

| Class Name |

Schwab Large-Cap Growth Fund

|

|

| Trading Symbol |

SWLSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Large-Cap Growth Fund |

|

|

|

|

| Expenses Paid, Amount |

$ 49

|

|

| Expense Ratio, Percent |

0.99%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Large-Cap Growth Fund (10/03/2005) 1 |

|

|

|

|

|

|

|

|

|

Russell 1000 ® Growth Index |

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The Russell 1000 ® Growth Index is the fund’s additional index and is more representative of the fund’s investment universe than the regulatory index. |

|

| Performance Inception Date |

Oct. 03, 2005

|

|

| No Deduction of Taxes [Text Block] |

These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 457,545,000

|

|

| Holdings Count | Holding |

57

|

|

| Investment Company, Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

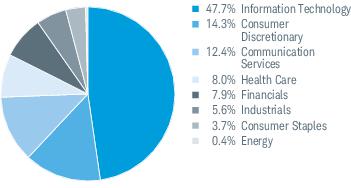

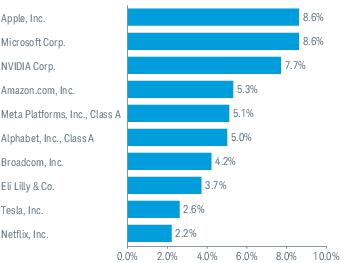

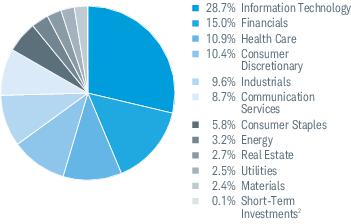

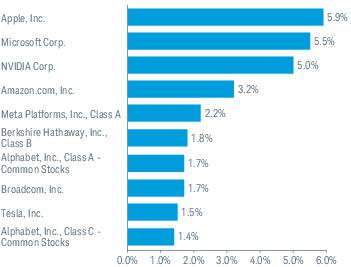

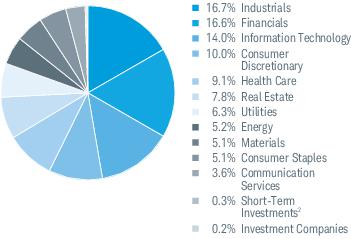

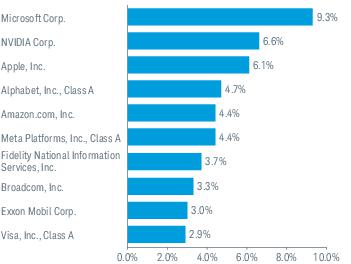

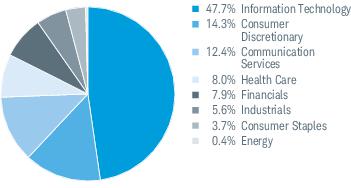

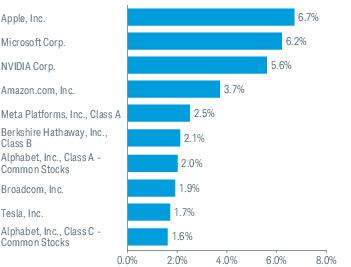

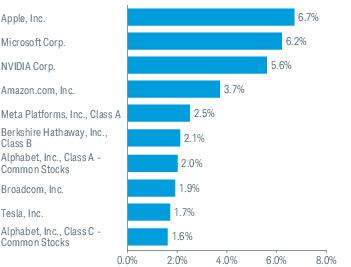

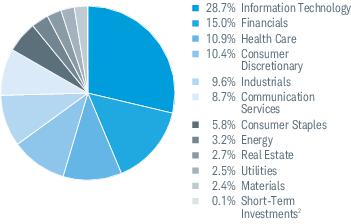

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Small-Cap Equity Fund - SWSCX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Small-Cap Equity Fund

|

|

| Class Name |

Schwab Small-Cap Equity Fund

|

|

| Trading Symbol |

SWSCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Small-Cap Equity Fund |

|

| * Annualized.

|

|

| Expenses Paid, Amount |

$ 51

|

|

| Expense Ratio, Percent |

1.09%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Small-Cap Equity Fund (07/01/2003) 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. 1 Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. 2 The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The Russell 2000 ® Index is the fund’s additional index and is more representative of the fund’s investment universe than the regulatory index.

|

|

| Performance Inception Date |

Jul. 01, 2003

|

|

| No Deduction of Taxes [Text Block] |

These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 546,308,000

|

|

| Holdings Count | Holding |

346

|

|

| Investment Company, Portfolio Turnover |

50.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

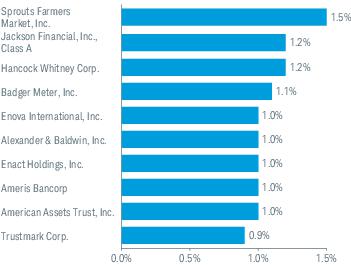

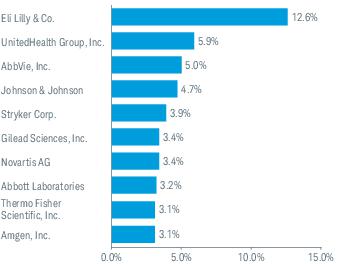

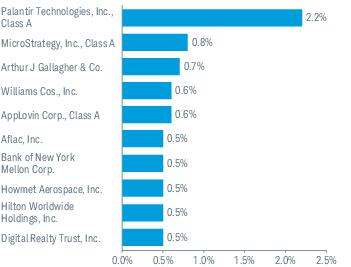

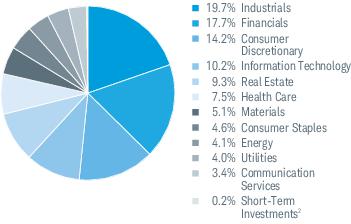

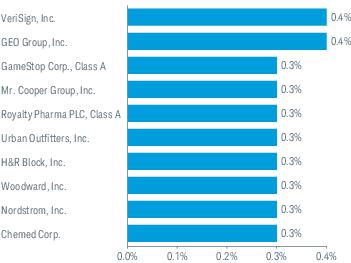

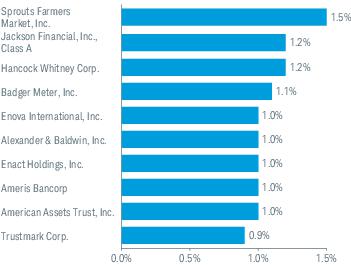

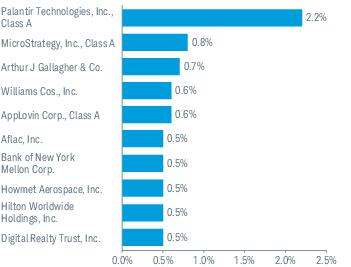

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Health Care Fund - SWHFX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Health Care Fund

|

|

| Class Name |

Schwab Health Care Fund

|

|

| Trading Symbol |

SWHFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT) * Annualized.

|

|

| Expenses Paid, Amount |

$ 39

|

|

| Expense Ratio, Percent |

0.79%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Health Care Fund (07/03/2000) 1,2 |

|

|

|

|

|

|

|

|

|

Dow Jones Global Health Care Index |

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. 1 Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. 2 The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. 3 The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The Dow Jones Global Health Care Index is the fund’s additional index and is more representative of the fund’s investment universe than the regulatory index.

|

|

| Performance Inception Date |

Jul. 03, 2000

|

|

| No Deduction of Taxes [Text Block] |

These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 685,042,000

|

|

| Holdings Count | Holding |

79

|

|

| Investment Company, Portfolio Turnover |

19.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

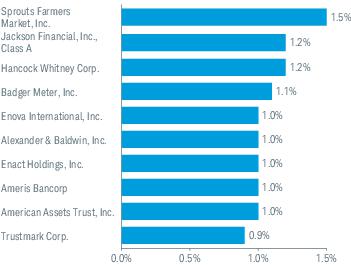

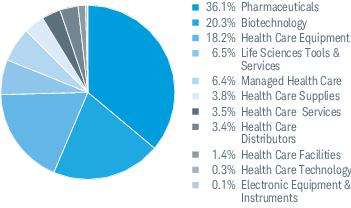

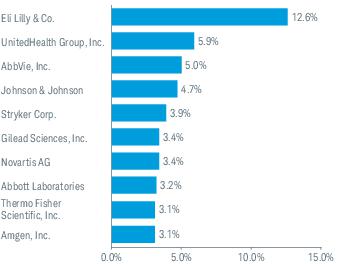

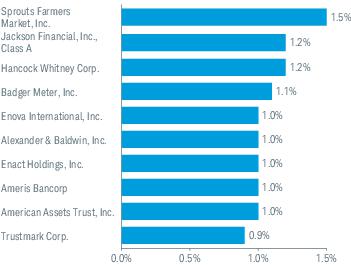

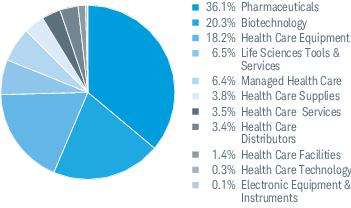

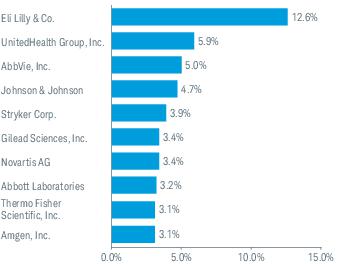

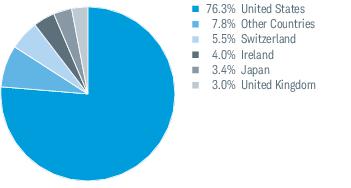

| Holdings [Text Block] |

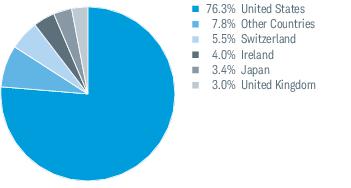

Industry Weightings % of Investments  Top Equity Holdings % of Net Assets  Top Country Weightings % of Investments  Portfolio holdings may have changed since the report dat e. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report dat e. |

|

| Schwab International Core Equity Fund - SICNX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab International Core Equity Fund

|

|

| Class Name |

Schwab International Core Equity Fund

|

|

| Trading Symbol |

SICNX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab International Core Equity Fund* |

|

| * Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 45

|

[2] |

| Expense Ratio, Percent |

0.86%

|

[1],[2] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab International Core Equity Fund (05/30/2008) 1,2 |

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

|

| Performance Inception Date |

May 30, 2008

|

|

| No Deduction of Taxes [Text Block] |

These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 686,653,000

|

|

| Holdings Count | Holding |

139

|

|

| Investment Company, Portfolio Turnover |

40.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/ Earnings Ratio (P/E) |

|

|

|

|

|

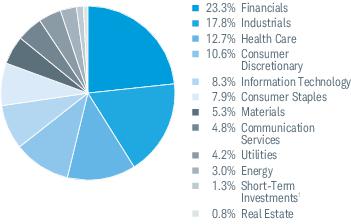

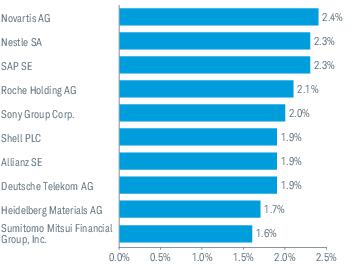

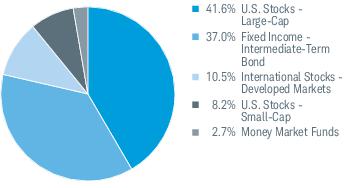

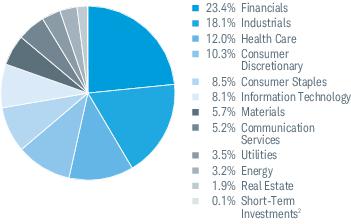

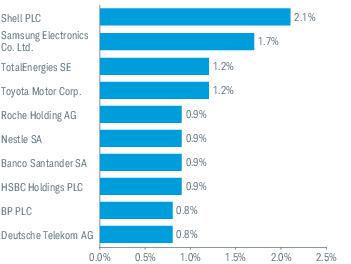

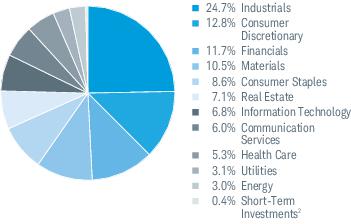

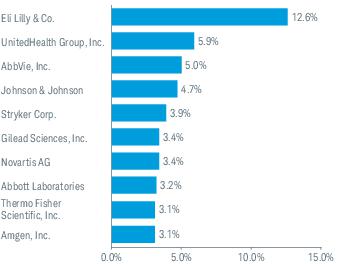

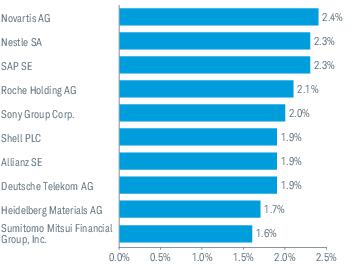

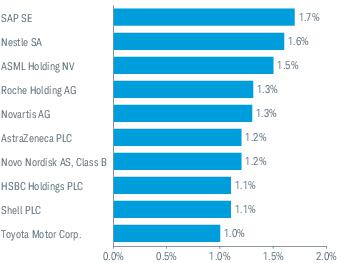

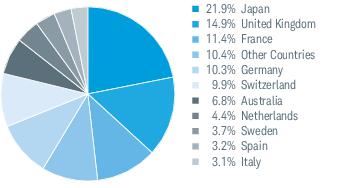

| Holdings [Text Block] |

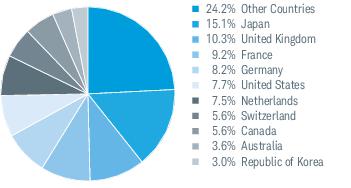

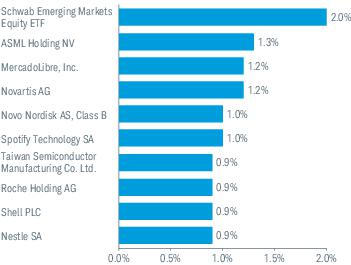

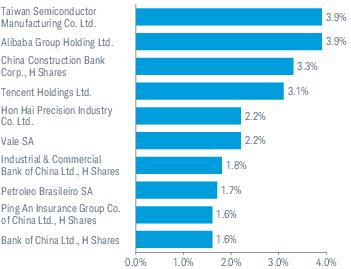

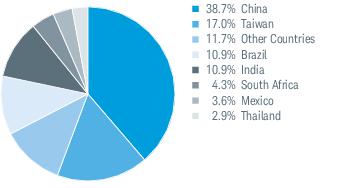

Sector Weightings % of Investments Top Equity Holdings % of Net Assets  Top Country Weightings % of Investments Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended . |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Balanced Fund - SWOBX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Balanced Fund

|

|

| Class Name |

Schwab Balanced Fund

|

|

| Trading Symbol |

SWOBX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

* Expenses were reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. This agreement to limit the total annual fund operating expenses is limited to the fund’s direct operating expenses and, therefore, does not apply to acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. ** Annualized.

|

|

| Expenses Paid, Amount |

$ 0

|

[3] |

| Expense Ratio, Percent |

0.00%

|

[1],[3] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Balanced Fund (11/18/1996) 1 |

|

|

|

|

|

|

|

|

|

Bloomberg US Aggregate Bond Index |

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions , please see www.schwabassetmanagement.com/glossary. 1 Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Inception Date |

Nov. 18, 1996

|

|

| No Deduction of Taxes [Text Block] |

These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 663,679,000

|

|

| Holdings Count | Holding |

7

|

|

| Investment Company, Portfolio Turnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

| Holdings [Text Block] |

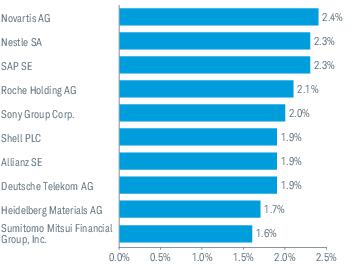

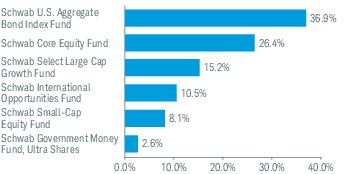

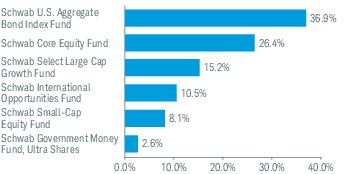

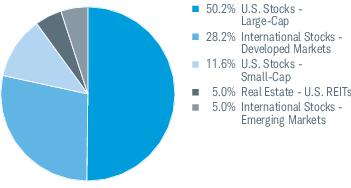

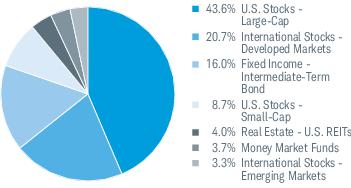

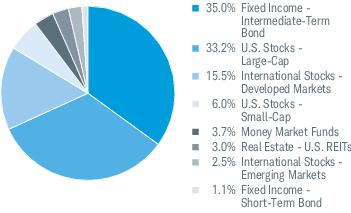

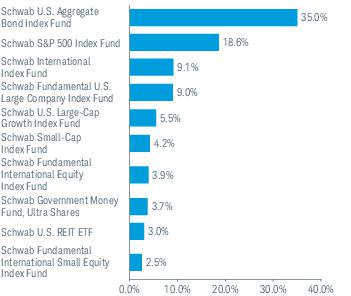

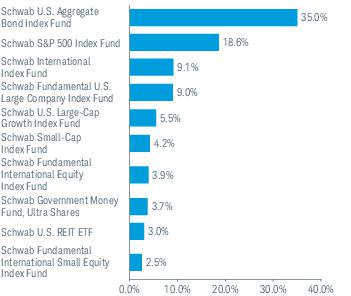

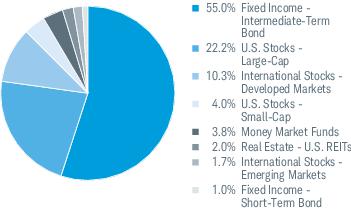

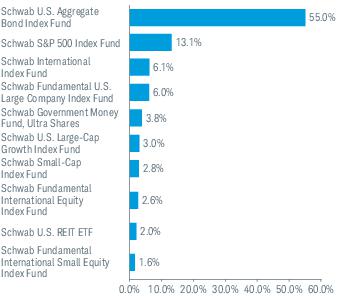

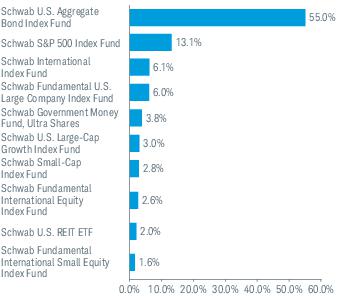

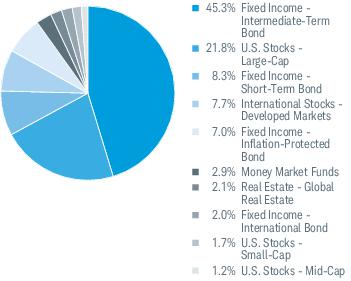

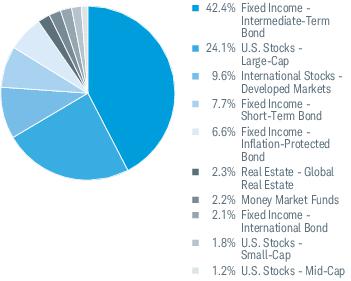

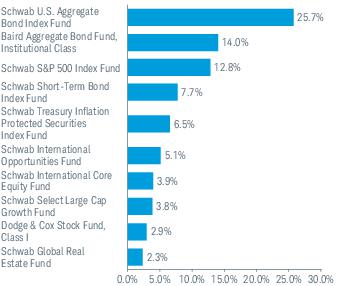

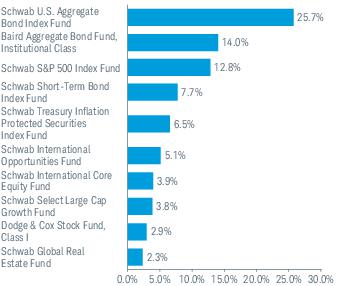

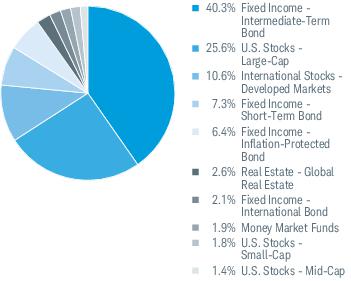

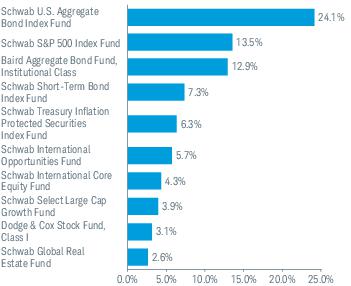

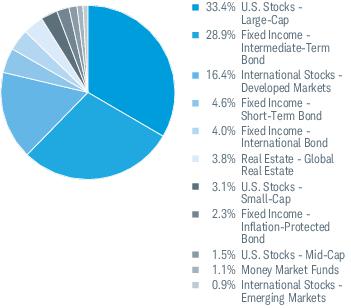

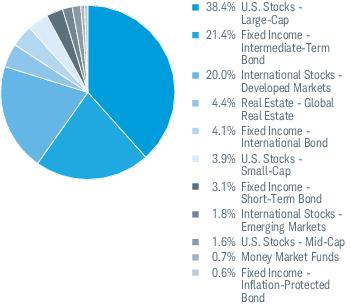

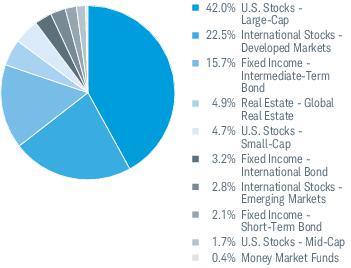

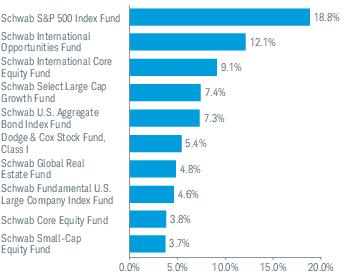

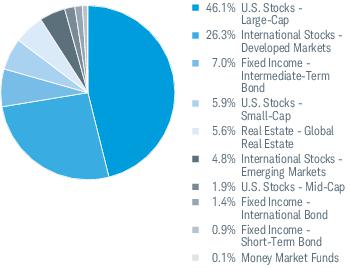

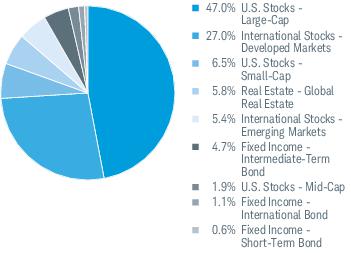

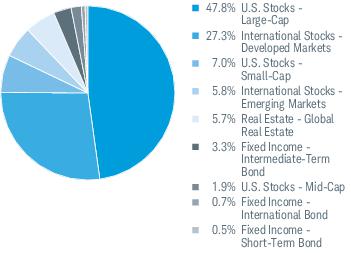

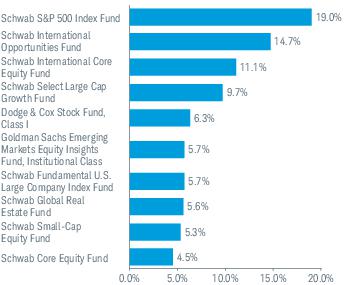

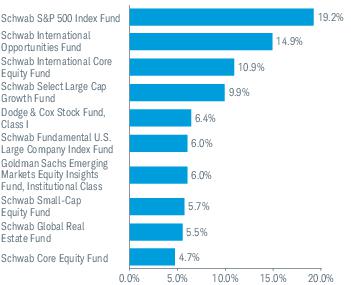

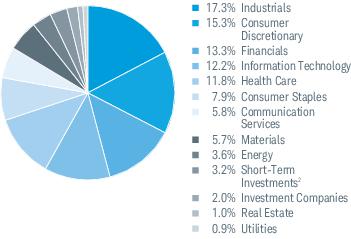

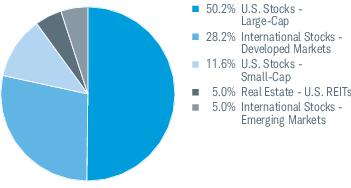

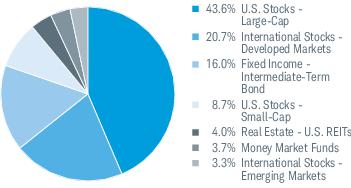

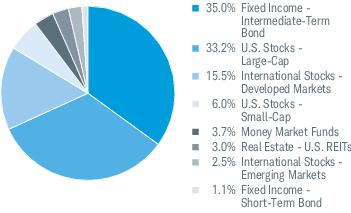

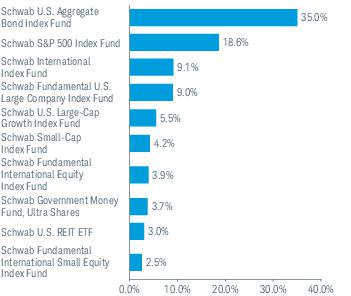

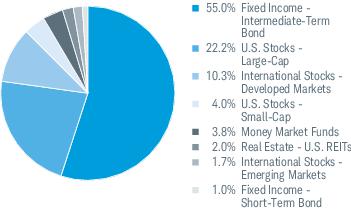

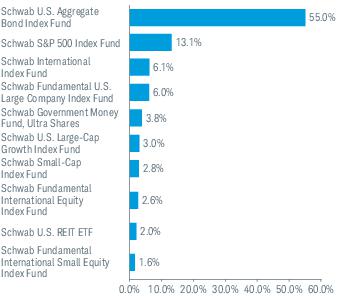

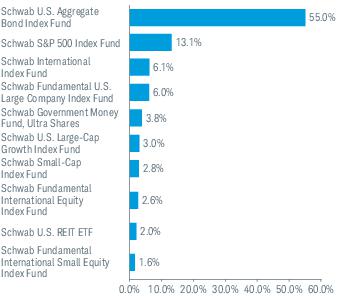

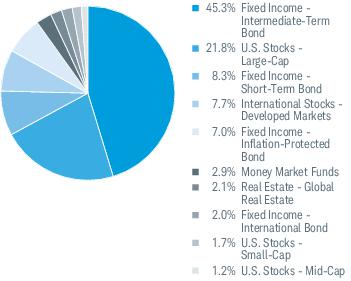

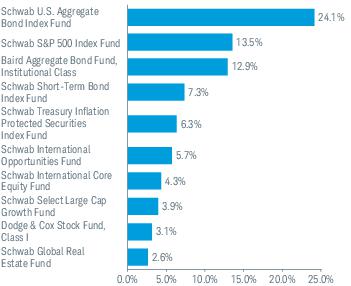

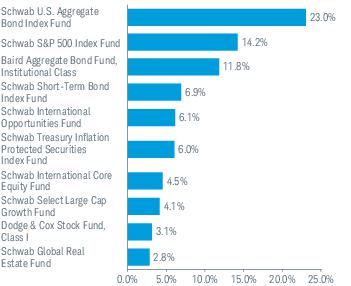

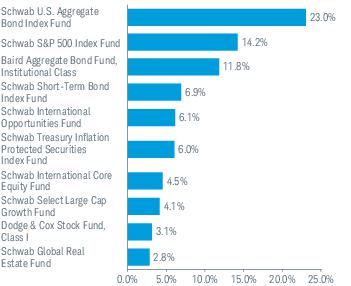

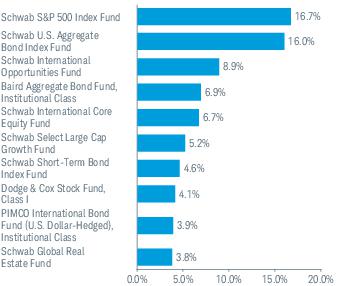

Asset Class Weightings % of Investments Portfolio holdings may have since the report date. The holdings listed exclude any temporary liquidity investments. |

|

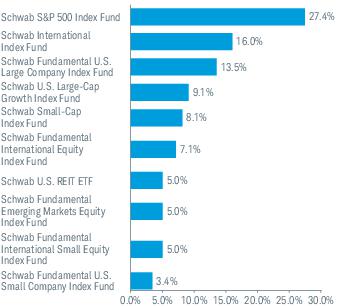

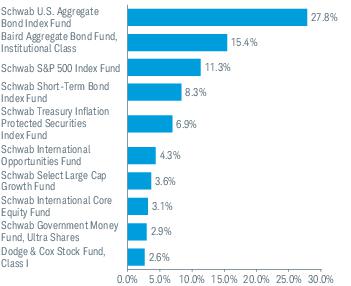

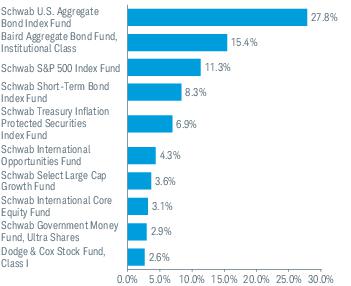

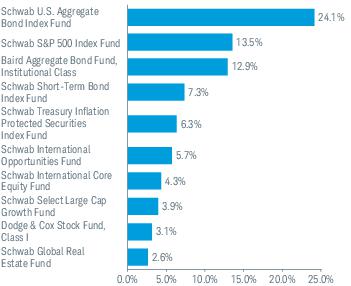

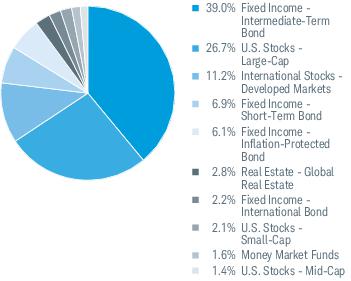

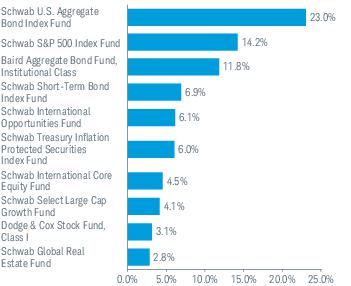

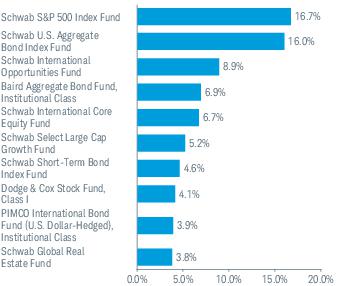

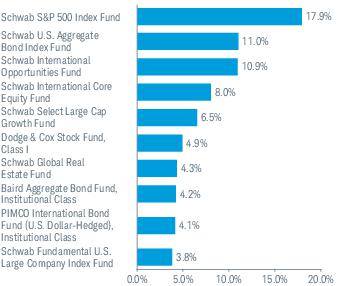

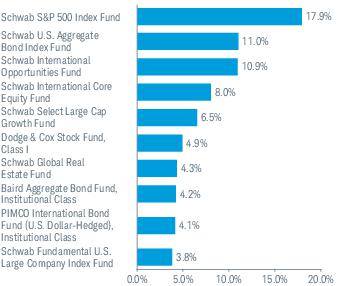

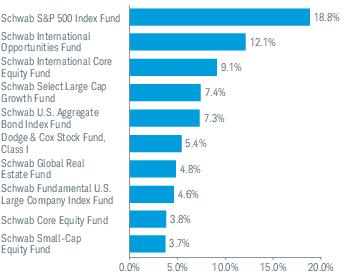

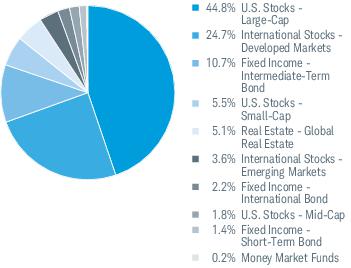

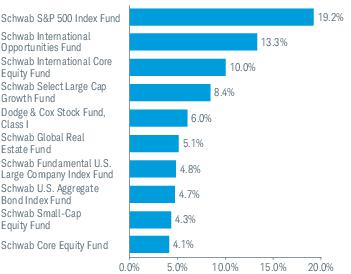

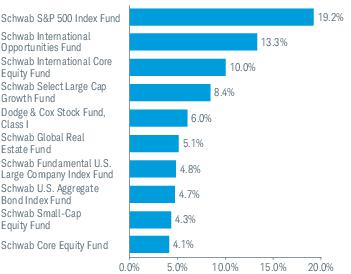

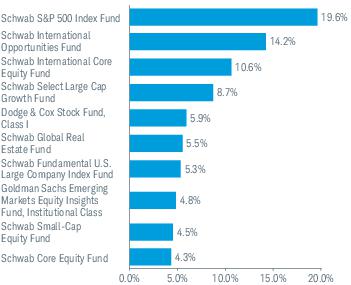

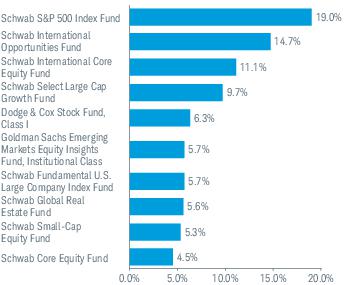

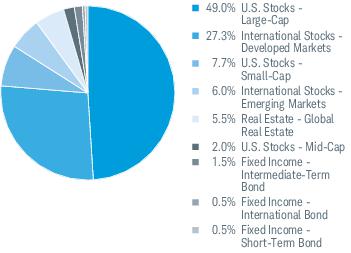

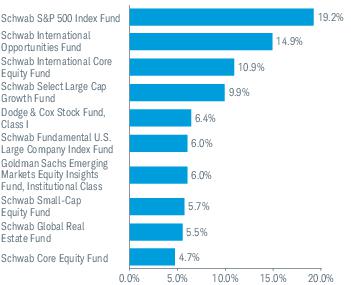

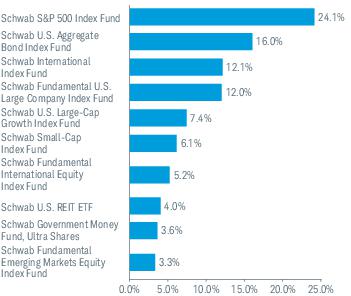

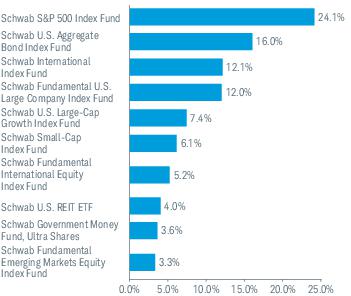

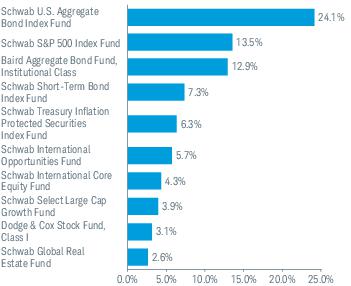

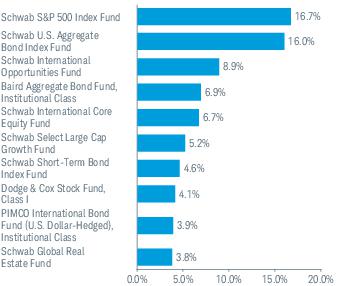

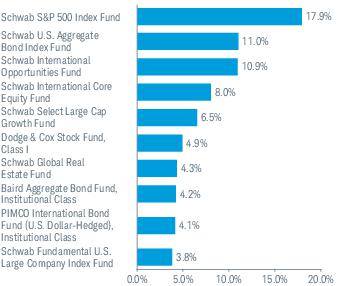

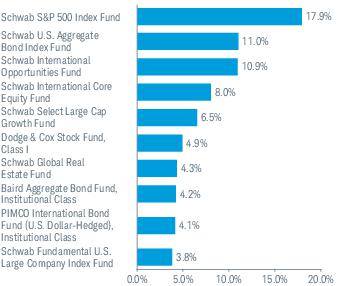

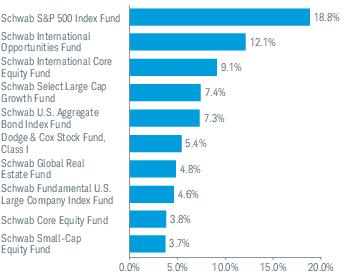

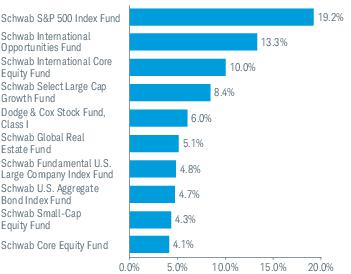

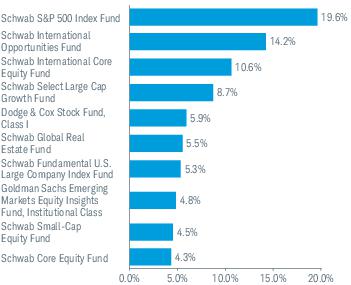

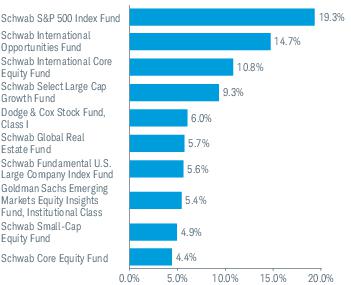

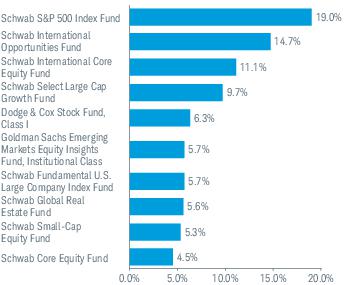

| Largest Holdings [Text Block] |

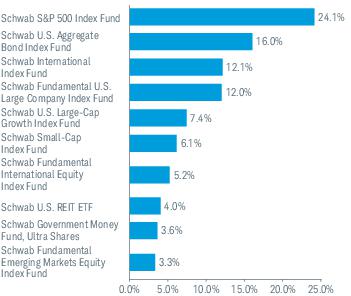

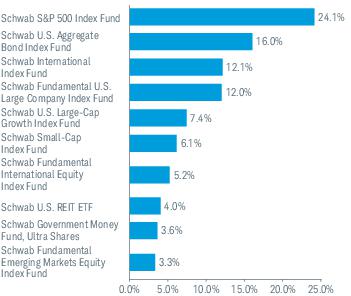

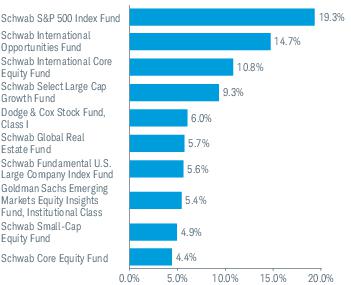

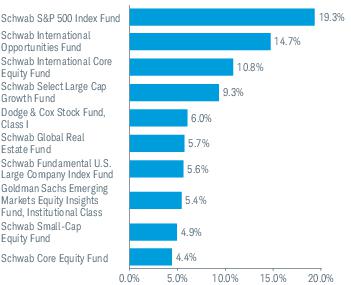

Portfolio holdings may have since the report date. The holdings listed exclude any temporary liquidity investments. |

|

| Schwab S&P 500 Index Fund - SWPPX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab S&P 500 Index Fund

|

|

| Class Name |

Schwab S&P 500 Index Fund

|

|

| Trading Symbol |

SWPPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab S&P 500 Index Fund |

|

| * Annualized.

|

|

| Expenses Paid, Amount |

$ 1

|

|

| Expense Ratio, Percent |

0.02%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab S&P 500 Index Fund (05/19/1997) 1 |

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – “Standard & Poor’s ® ,” “S&P ® ,” and “S&P 500 ® ” are registered trademarks of Standard & Poor’s Financial Services LLC (S&P), and “Dow Jones ® ” is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for certain purposes by Charles Schwab Investment Management, Inc. The “S&P 500 ® Index” is a product of S&P Dow Jones Indices LLC or its affiliates, and has been licensed for use by Charles Schwab Investment Management, Inc. The Schwab S&P 500 Index Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the advisability of investing in the fund. 1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Inception Date |

May 19, 1997

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 104,967,000,000

|

|

| Holdings Count | Holding |

502

|

|

| Investment Company, Portfolio Turnover |

1.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

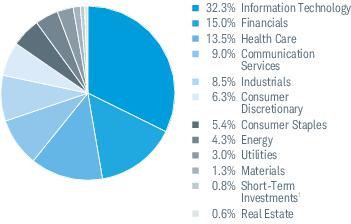

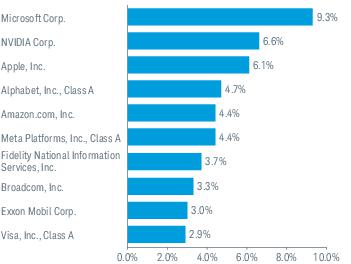

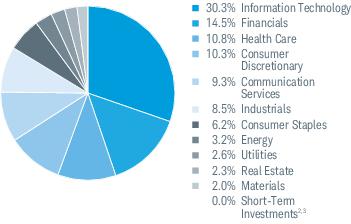

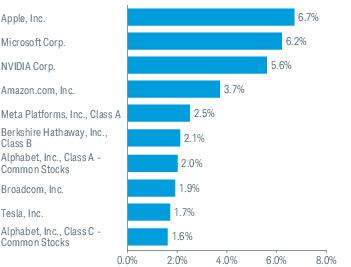

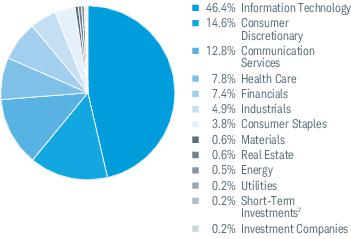

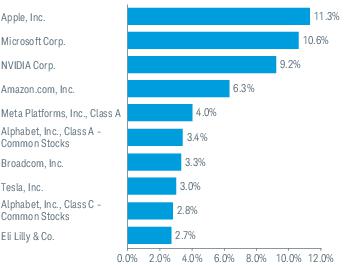

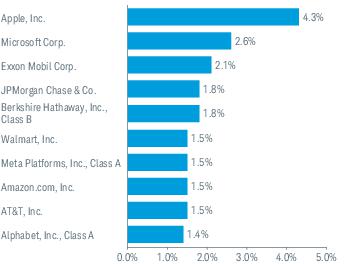

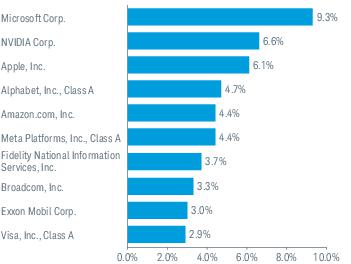

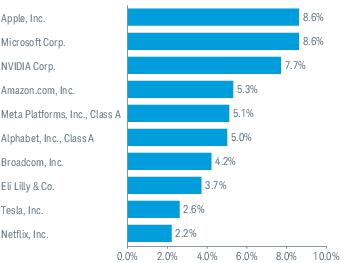

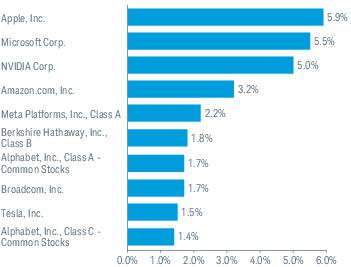

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Small-Cap Index Fund - SWSSX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Small-Cap Index Fund

|

|

| Class Name |

Schwab Small-Cap Index Fund

|

|

| Trading Symbol |

SWSSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Small-Cap Index Fund |

|

| * Annualized.

|

|

| Expenses Paid, Amount |

$ 2

|

|

| Expense Ratio, Percent |

0.04%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Small-Cap Index Fund (05/19/1997) 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – “Russell 2000 ® ” is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab Small-Cap Index Fund. The Schwab Small-Cap Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund. 1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. 2 The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The fund generally invests in securities that are included in the Russell 2000 ® Index. The fund does not seek to track the regulatory index.

|

|

| Performance Inception Date |

May 19, 1997

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 5,827,000,000

|

|

| Holdings Count | Holding |

1,938

|

|

| Investment Company, Portfolio Turnover |

2.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

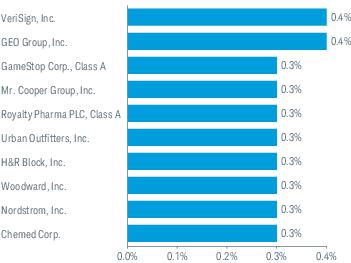

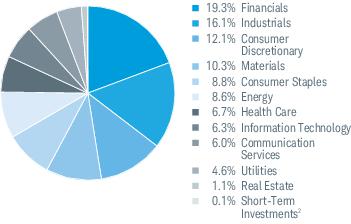

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Total Stock Market Index Fund - SWTSX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Total Stock Market Index Fund

|

|

| Class Name |

Schwab Total Stock Market Index Fund

|

|

| Trading Symbol |

SWTSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Total Stock Market Index Fund |

|

|

|

|

| Expenses Paid, Amount |

$ 1

|

|

| Expense Ratio, Percent |

0.03%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Total Stock Market Index Fund (06/01/1999) 1 |

|

|

|

|

Dow Jones U.S. Total Stock Market Index SM |

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – “Standard & Poor’s ® ” and “S&P ® ” are registered trademarks of Standard & Poor’s Financial Services LLC (S&P), and “Dow Jones ® ” is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for certain purposes by Charles Schwab Investment Management, Inc. The “Dow Jones U.S. Total Stock Market Index SM ” is a product of S&P Dow Jones Indices LLC or its affiliates, and has been licensed for use by Charles Schwab Investment Management, Inc. The Schwab Total Stock Market Index Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the advisability of investing in the fund. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

|

| Performance Inception Date |

Jun. 01, 1999

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 25,637,000,000

|

|

| Holdings Count | Holding |

3,061

|

|

| Investment Company, Portfolio Turnover |

1.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

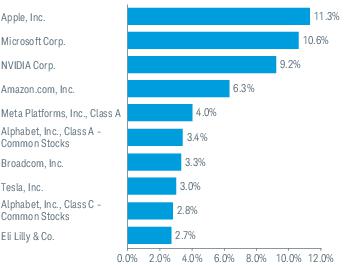

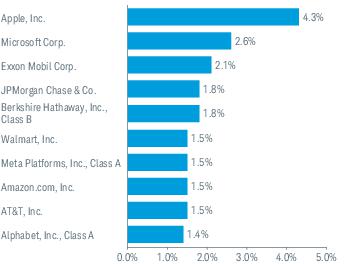

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab U.S. Large-Cap Growth Index Fund |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab U.S. Large-Cap Growth Index Fund

|

|

| Class Name |

Schwab U.S. Large-Cap Growth Index Fund

|

|

| Trading Symbol |

SWLGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab U.S. Large-Cap Growth Index Fund |

|

| * Annualized.

|

|

| Expenses Paid, Amount |

$ 2

|

|

| Expense Ratio, Percent |

0.035%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

|

|

|

|

|

Fund: Schwab U.S. Large-Cap Growth Index Fund (12/20/2017) 1 |

|

|

|

|

|

|

|

|

|

Russell 1000 ® Growth Index |

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – The Russell 1000 ® Growth Index is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab U.S. Large-Cap Growth Index Fund. The Schwab U.S. Large-Cap Growth Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund. 1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. 2 The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The fund generally invests in securities that are included in the Russell 1000 ® Growth Index. The fund does not seek to track the regulatory index.

|

|

| Performance Inception Date |

Dec. 20, 2017

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 3,097,000,000

|

|

| Holdings Count | Holding |

390

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

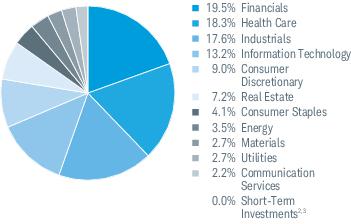

| Holdings [Text Block] |

Sector Weightings % of Investments Top Equity Holdings % of Net Assets Portfolio holdings may have c hange d since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets Portfolio holdings may have c hange d since the report date. |

|

| Schwab U.S. Large-Cap Value Index Fund - SWLVX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab U.S. Large-Cap Value Index Fund

|

|

| Class Name |

Schwab U.S. Large-Cap Value Index Fund

|

|

| Trading Symbol |

SWLVX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab U.S. Large-Cap Value Index Fund |

|

| * Annualized.

|

|

| Expenses Paid, Amount |

$ 2

|

|

| Expense Ratio, Percent |

0.035%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

|

|

|

|

|

Fund: Schwab U.S. Large-Cap Value Index Fund (12/20/2017) 1 |

|

|

|

|

|

|

|

|

|

Russell 1000 ® Value Index |

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – The Russell 1000 ® Value Index is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab U.S. Large-Cap Value Index Fund. The Schwab U.S. Large-Cap Value Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The fund generally invests in securities that are included in the Russell 1000 ® Value Index. The fund does not seek to track the regulatory index. |

|

| Performance Inception Date |

Dec. 20, 2017

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 777,792,000

|

|

| Holdings Count | Holding |

859

|

|

| Investment Company, Portfolio Turnover |

3.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

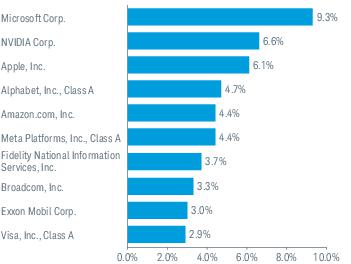

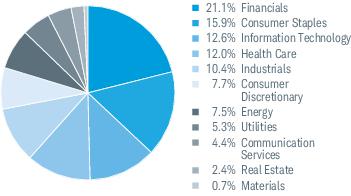

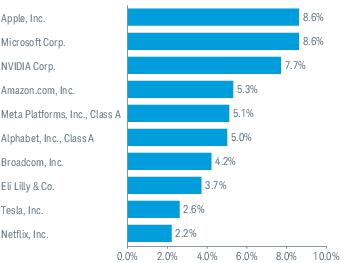

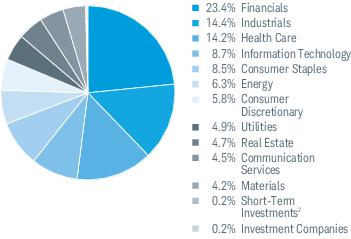

| Holdings [Text Block] |

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab U.S. Mid-Cap Index Fund - SWMCX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab U.S. Mid-Cap Index Fund

|

|

| Class Name |

Schwab U.S. Mid-Cap Index Fund

|

|

| Trading Symbol |

SWMCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab U.S. Mid-Cap Index Fund |

|

|

|

|

| Expenses Paid, Amount |

$ 2

|

|

| Expense Ratio, Percent |

0.04%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

|

|

|

|

|

Fund: Schwab U.S. Mid-Cap Index Fund (12/20/2017) 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – The Russell Midcap ® Index is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab U.S. Mid-Cap Index Fund. The Schwab U.S. Mid-Cap Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The S&P 500 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The fund generally invests in securities that are included in the Russell Midcap ® Index. The fund does not seek to track the regulatory index. |

|

| Performance Inception Date |

Dec. 20, 2017

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 1,864,000,000

|

|

| Holdings Count | Holding |

795

|

|

| Investment Company, Portfolio Turnover |

2.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

| Holdings [Text Block] |

Sector Weightings % of Investments Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date . The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. ( MSCI ) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended . |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date . |

|

| Schwab International Index Fund - SWISX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab International Index Fund

|

|

| Class Name |

Schwab International Index Fund

|

|

| Trading Symbol |

SWISX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab International Index Fund |

|

|

|

|

| Expenses Paid, Amount |

$ 3

|

|

| Expense Ratio, Percent |

0.06%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab International Index Fund (05/19/1997) 1,2 |

|

|

|

|

|

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – “MSCI EAFE ® ” is a registered mark of MSCI and has been licensed for use by the Schwab International Index Fund. The Schwab International Index Fund is not sponsored, endorsed, sold or promoted by MSCI and MSCI bears no liability with respect to the fund. The Statement of Additional Information contains a more detailed description of the limited relationship MSCI has with the fund. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

|

| Performance Inception Date |

May 19, 1997

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 10,937,000,000

|

|

| Holdings Count | Holding |

697

|

|

| Investment Company, Portfolio Turnover |

4.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

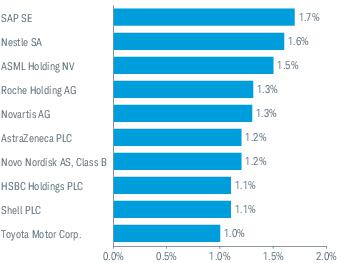

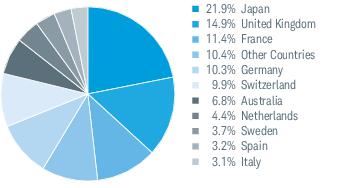

| Holdings [Text Block] |

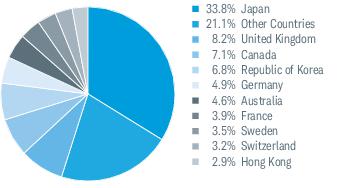

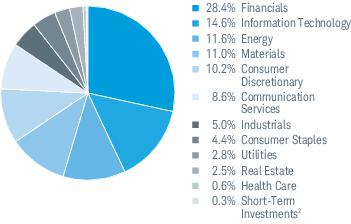

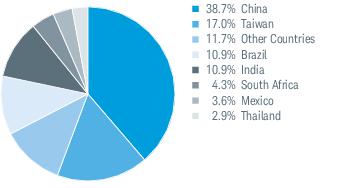

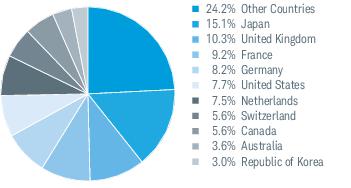

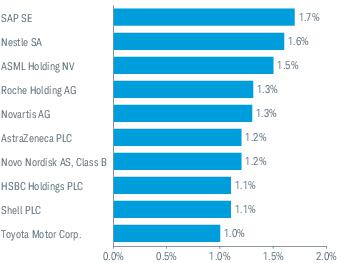

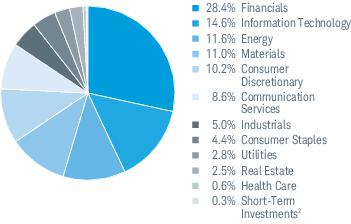

Sector Weightings % of Investments  Top Equity Holdings % of Net Assets  Top Country Weightings % of Investments  Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended . |

|

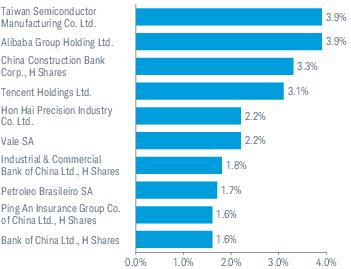

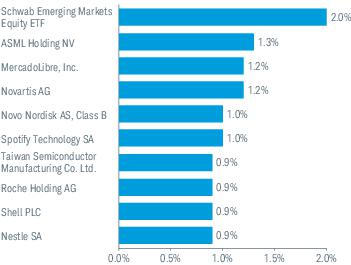

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets  Portfolio holdings may have changed since the report date. |

|

| Schwab Fundamental U.S. Large Company Index Fund - SFLNX |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Schwab Fundamental U.S. Large Company Index Fund

|

|

| Class Name |

Schwab Fundamental U.S. Large Company Index Fund

|

|

| Trading Symbol |

SFLNX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semiannual shareholder report contains important information about the fund for the period of November 1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at www.schwabassetmanagement.com/prospectus . You can also request this information by calling or by sending an email request to orders@mysummaryprospectus.com .

|

|

| Additional Information Phone Number |

1-866-414-6349

|

|

| Additional Information Email |

orders@mysummaryprospectus.com

|

|

| Additional Information Website |

www.schwabassetmanagement.com/prospectus

|

|

| Expenses [Text Block] |

FUND COSTS FOR THE LAST six months ENDED April 30, 2025 (BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

|

|

|

Schwab Fundamental U.S. Large Company Index Fund |

|

| * Annualized.

|

|

| Expenses Paid, Amount |

$ 12

|

|

| Expense Ratio, Percent |

0.25%

|

[1] |

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance. Past performance does not guarantee future results.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

|

|

|

|

|

Fund: Schwab Fundamental U.S. Large Company Index Fund (04/02/2007) 1 |

|

|

|

|

|

|

|

|

|

RAFI Fundamental High Liquidity US Large Index 3 |

|

|

|

|

Russell RAFI TM US Large Company Index |

|

|

|

|

Fundamental US Large Spliced Index |

|

|

|

| All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. For index definitions, please see www.schwabassetmanagement.com/glossary. Index ownership – The RAFI Fundamental High Liquidity US Large Index (the Index) is a service mark of RAFI Indices, LLC or its affiliates (collectively, RAFI) and has been licensed for use by Charles Schwab Investment Management, Inc. The intellectual and other property rights to the Index are owned by or licensed to RAFI. The Schwab Fundamental U.S. Large Company Index Fund is not sponsored, endorsed, sold or promoted by RAFI, its agents or service providers (collectively, the RAFI Parties). The RAFI Parties: (i) make no representation or warranty as to the results to be obtained from the use of the Index or otherwise; and (ii) shall not be liable (whether in negligence or otherwise) to any person for any error in the Index. For full disclaimer, please see the fund’s statement of additional information. 1 Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. 2 The Russell 1000 ® Index serves as the fund’s regulatory index and provides a broad measure of market performance. The fund generally invests in securities that are included in the RAFI Fundamental High Liquidity US Large Index. The fund does not seek to track the regulatory index. 3 Effective June 21, 2024, the fund changed its comparative index from the Russell RAFI™ US Large Company Index to the RAFI Fundamental High Liquidity US Large Index in connection with a change to the fund’s investment objective and investment strategy to invest its assets in accordance with the index. The inception date of the RAFI Fundamental High Liquidity US Large Index is January 31, 2024. The fund began tracking the index after the close of business on June 21, 2024.

|

|

| Performance Inception Date |

Apr. 02, 2007

|

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective June 21, 2024, the fund changed its comparative index from the Russell RAFI™ US Large Company Index to the RAFI Fundamental High Liquidity US Large Index in connection with a change to the fund’s investment objective and investment strategy to invest its assets in accordance with the index. The inception date of the RAFI Fundamental High Liquidity US Large Index is January 31, 2024. The fund began tracking the index after the close of business on June 21, 2024.

|

|

| Updated Performance Information Location [Text Block] |

To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/prospectus |

|

| Net Assets |

$ 9,156,000,000

|

|

| Holdings Count | Holding |

744

|

|

| Investment Company, Portfolio Turnover |

6.00%

|

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

(not annualized; excludes in-kind transactions) |

|

Weighted Average Market Cap (millions) |

|

Price/Earnings Ratio (P/E) |

|

|

|

|

|

| Holdings [Text Block] |

Sector Weightings % of Investments Top Equity Holdings % of Net Assets Portfolio holdings may have changed since the report date. The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

|

| Largest Holdings [Text Block] |

Top Equity Holdings % of Net Assets Portfolio holdings may have changed since the report date. |

|

| Schwab Fundamental U.S. Small Company Index Fund - SFSNX |

|

|