Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

1290 FUNDS

|

| Entity Central Index Key |

0001605941

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Apr. 30, 2025

|

| 1290 AVANTIS® U.S. LARGE CAP GROWTH FUND - CLASS A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 AVANTIS® U.S. LARGE CAP GROWTH FUND

|

| Class Name |

CLASS A

|

| Trading Symbol |

TNRAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Avantis ® U.S. Large Cap Growth Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class A |

|

$44 |

|

0.90% |

|

|

|

| Expenses Paid, Amount |

$ 44

|

| Expense Ratio, Percent |

0.90%

|

| Net Assets |

$ 168,766,417

|

| Holdings Count | Holding |

190

|

| Investment Company, Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

168,766,417 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

190 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

4% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weightings (as a % of Net Assets) |

|

|

|

|

|

|

Information Technology |

|

|

42.1 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

16.3 |

% |

|

|

|

|

|

Communication Services |

|

|

12.7 |

% |

|

|

|

|

|

Financials |

|

|

7.6 |

% |

|

|

|

|

|

Industrials |

|

|

7.4 |

% |

|

|

|

|

|

Health Care |

|

|

6.5 |

% |

|

|

|

|

|

Consumer Staples |

|

|

3.7 |

% |

|

|

|

|

|

Energy |

|

|

2.2 |

% |

|

|

|

|

|

Materials |

|

|

0.6 |

% |

|

|

|

|

|

Utilities |

|

|

0.6 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

0.1 |

% |

|

|

|

|

|

Cash and Other Assets Less Liabilities |

|

|

0.2 |

% |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

Apple, Inc. |

|

|

10.7 |

% |

|

|

|

|

|

Microsoft Corp. |

|

|

9.4 |

% |

|

|

|

|

|

NVIDIA Corp. |

|

|

8.1 |

% |

|

|

|

|

|

Amazon.com, Inc. |

|

|

6.2 |

% |

|

|

|

|

|

Meta Platforms, Inc., Class A |

|

|

5.1 |

% |

|

|

|

|

|

Alphabet, Inc., Class A |

|

|

3.2 |

% |

|

|

|

|

|

Broadcom, Inc. |

|

|

3.0 |

% |

|

|

|

|

|

Alphabet, Inc., Class C |

|

|

2.7 |

% |

|

|

|

|

|

Mastercard, Inc., Class A |

|

|

1.8 |

% |

|

|

|

|

|

Netflix, Inc. |

|

|

1.6 |

% |

|

| Largest Holdings [Text Block] |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

Apple, Inc. |

|

|

10.7 |

% |

|

|

|

|

|

Microsoft Corp. |

|

|

9.4 |

% |

|

|

|

|

|

NVIDIA Corp. |

|

|

8.1 |

% |

|

|

|

|

|

Amazon.com, Inc. |

|

|

6.2 |

% |

|

|

|

|

|

Meta Platforms, Inc., Class A |

|

|

5.1 |

% |

|

|

|

|

|

Alphabet, Inc., Class A |

|

|

3.2 |

% |

|

|

|

|

|

Broadcom, Inc. |

|

|

3.0 |

% |

|

|

|

|

|

Alphabet, Inc., Class C |

|

|

2.7 |

% |

|

|

|

|

|

Mastercard, Inc., Class A |

|

|

1.8 |

% |

|

|

|

|

|

Netflix, Inc. |

|

|

1.6 |

% |

|

| 1290 AVANTIS® U.S. LARGE CAP GROWTH FUND - CLASS I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 AVANTIS® U.S. LARGE CAP GROWTH FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

TNXIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Avantis ® U.S. Large Cap Growth Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

| Class I |

|

$32 |

|

0.65% |

|

|

|

| Expenses Paid, Amount |

$ 32

|

| Expense Ratio, Percent |

0.65%

|

| Net Assets |

$ 168,766,417

|

| Holdings Count | Holding |

190

|

| Investment Company, Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

168,766,417 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

190 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

4% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weightings (as a % of Net Assets) |

|

|

|

|

|

|

Information Technology |

|

|

42.1 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

16.3 |

% |

|

|

|

|

|

Communication Services |

|

|

12.7 |

% |

|

|

|

|

|

Financials |

|

|

7.6 |

% |

|

|

|

|

|

Industrials |

|

|

7.4 |

% |

|

|

|

|

|

Health Care |

|

|

6.5 |

% |

|

|

|

|

|

Consumer Staples |

|

|

3.7 |

% |

|

|

|

|

|

Energy |

|

|

2.2 |

% |

|

|

|

|

|

Materials |

|

|

0.6 |

% |

|

|

|

|

|

Utilities |

|

|

0.6 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

0.1 |

% |

|

|

|

|

|

Cash and Other Assets Less Liabilities |

|

|

0.2 |

% |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

Apple, Inc. |

|

|

10.7 |

% |

|

|

|

|

|

Microsoft Corp. |

|

|

9.4 |

% |

|

|

|

|

|

NVIDIA Corp. |

|

|

8.1 |

% |

|

|

|

|

|

Amazon.com, Inc. |

|

|

6.2 |

% |

|

|

|

|

|

Meta Platforms, Inc., Class A |

|

|

5.1 |

% |

|

|

|

|

|

Alphabet, Inc., Class A |

|

|

3.2 |

% |

|

|

|

|

|

Broadcom, Inc. |

|

|

3.0 |

% |

|

|

|

|

|

Alphabet, Inc., Class C |

|

|

2.7 |

% |

|

|

|

|

|

Mastercard, Inc., Class A |

|

|

1.8 |

% |

|

|

|

|

|

Netflix, Inc. |

|

|

1.6 |

% |

|

| Largest Holdings [Text Block] |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

Apple, Inc. |

|

|

10.7 |

% |

|

|

|

|

|

Microsoft Corp. |

|

|

9.4 |

% |

|

|

|

|

|

NVIDIA Corp. |

|

|

8.1 |

% |

|

|

|

|

|

Amazon.com, Inc. |

|

|

6.2 |

% |

|

|

|

|

|

Meta Platforms, Inc., Class A |

|

|

5.1 |

% |

|

|

|

|

|

Alphabet, Inc., Class A |

|

|

3.2 |

% |

|

|

|

|

|

Broadcom, Inc. |

|

|

3.0 |

% |

|

|

|

|

|

Alphabet, Inc., Class C |

|

|

2.7 |

% |

|

|

|

|

|

Mastercard, Inc., Class A |

|

|

1.8 |

% |

|

|

|

|

|

Netflix, Inc. |

|

|

1.6 |

% |

|

| 1290 DIVERSIFIED BOND FUND - CLASS A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 DIVERSIFIED BOND FUND

|

| Class Name |

CLASS A

|

| Trading Symbol |

TNUAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Diversified Bond Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class A |

|

$38 |

|

0.75% |

|

|

|

| Expenses Paid, Amount |

$ 38

|

| Expense Ratio, Percent |

0.75%

|

| Net Assets |

$ 608,794,040

|

| Holdings Count | Holding |

109

|

| Investment Company, Portfolio Turnover |

75.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

608,794,040 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

109 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

75% |

|

|

|

|

|

|

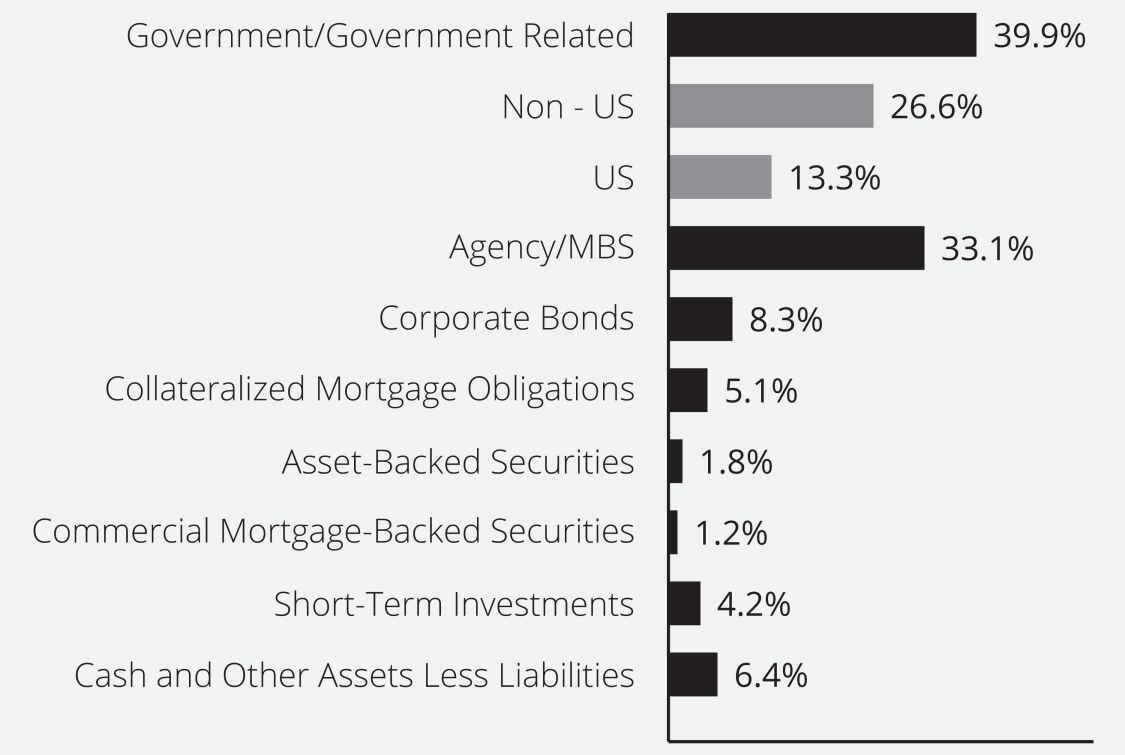

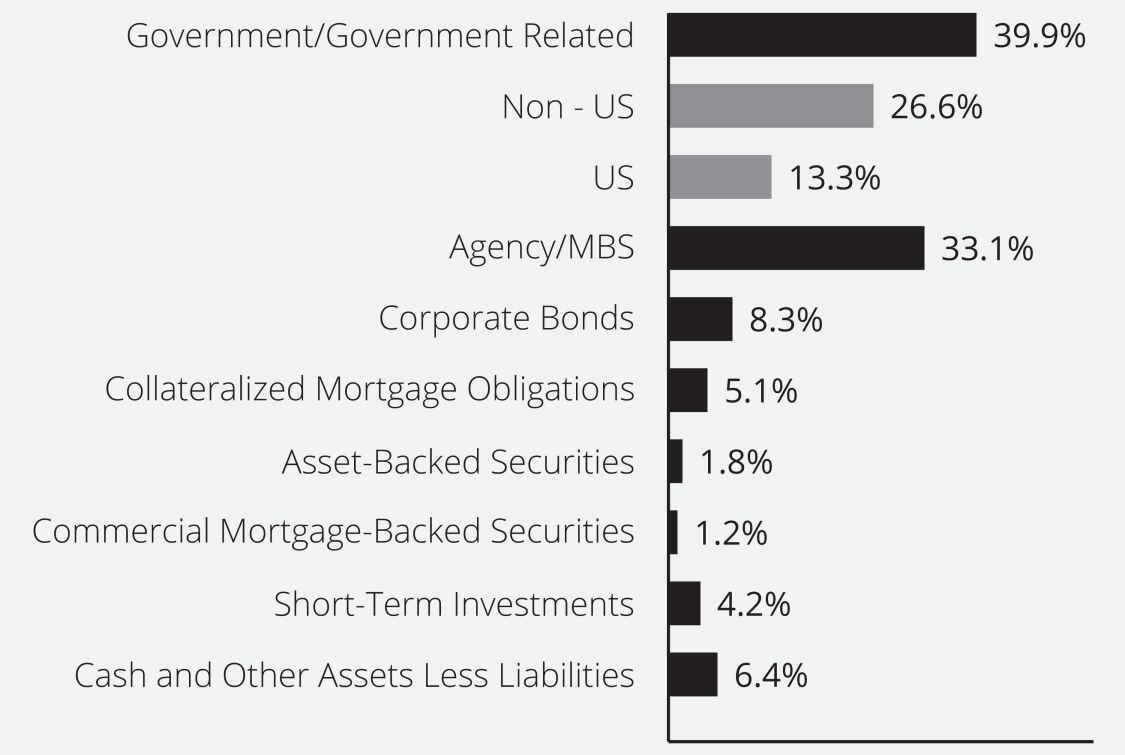

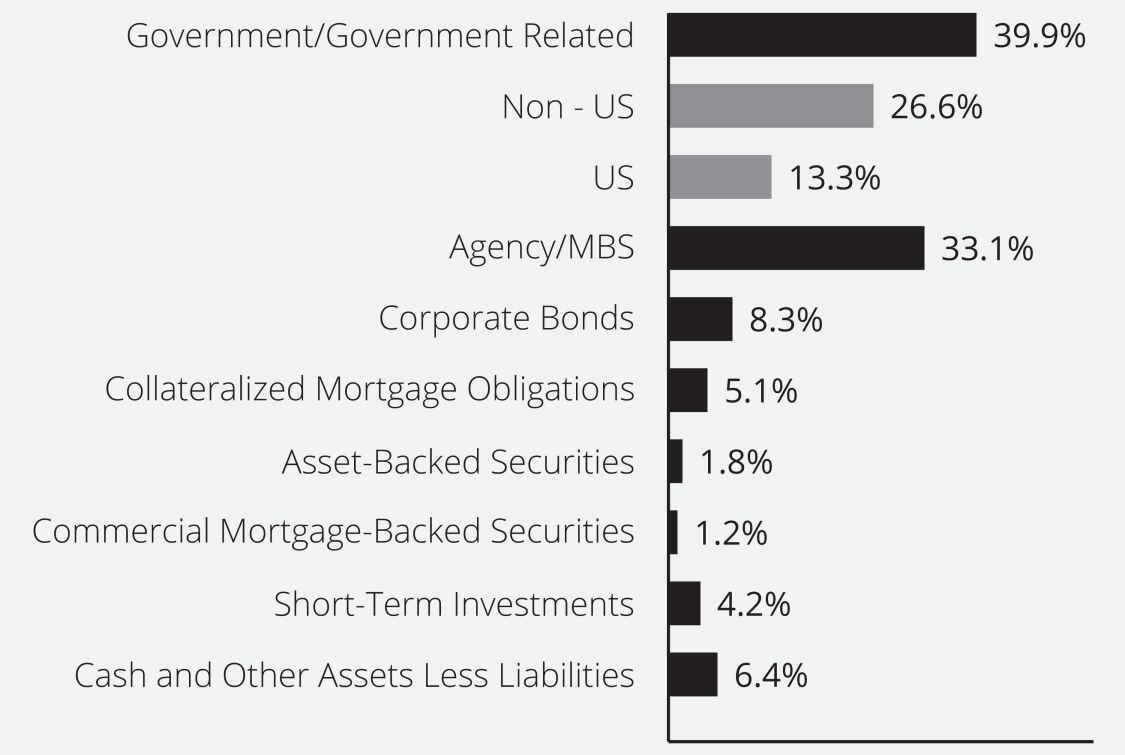

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Sector Weightings (as a % of Net Assets)

|

| 1290 DIVERSIFIED BOND FUND - CLASS I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 DIVERSIFIED BOND FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

TNUIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Diversified Bond Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class I |

|

$25 |

|

0.50% |

|

|

|

| Expenses Paid, Amount |

$ 25

|

| Expense Ratio, Percent |

0.50%

|

| Net Assets |

$ 608,794,040

|

| Holdings Count | Holding |

109

|

| Investment Company, Portfolio Turnover |

75.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

608,794,040 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

109 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

75% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Sector Weightings (as a % of Net Assets)

|

| 1290 DIVERSIFIED BOND FUND - CLASS R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 DIVERSIFIED BOND FUND

|

| Class Name |

CLASS R

|

| Trading Symbol |

TNURX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Diversified Bond Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class R |

|

$50 |

|

1.00% |

|

|

|

| Expenses Paid, Amount |

$ 50

|

| Expense Ratio, Percent |

1.00%

|

| Net Assets |

$ 608,794,040

|

| Holdings Count | Holding |

109

|

| Investment Company, Portfolio Turnover |

75.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

608,794,040 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

109 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

75% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Sector Weighti ng s (as a % of Net Assets) |

| 1290 ESSEX SMALL CAP GROWTH FUND - CLASS A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 ESSEX SMALL CAP GROWTH FUND

|

| Class Name |

CLASS A

|

| Trading Symbol |

ESCFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Essex Small Cap Growth Fund (the "Fund") for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class A |

|

$55 |

|

1.13% |

|

|

|

| Expenses Paid, Amount |

$ 55

|

| Expense Ratio, Percent |

1.13%

|

| Net Assets |

$ 63,742,994

|

| Holdings Count | Holding |

103

|

| Investment Company, Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

63,742,994 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

103 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

20% |

|

|

|

|

|

|

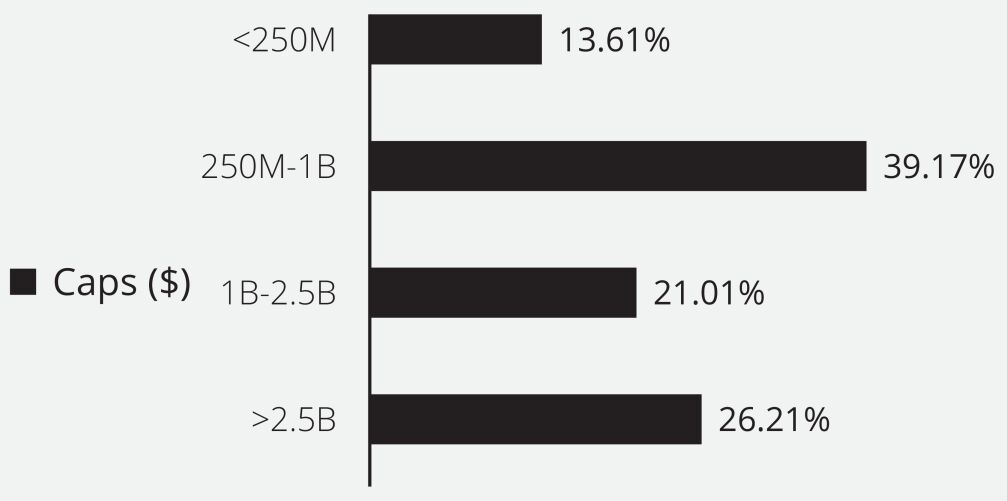

| Holdings [Text Block] |

What did th e F un d invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weight ing s (as a % of Net Assets) |

|

|

|

|

|

|

Industrials |

|

|

31.3 |

% |

|

|

|

|

|

Health Care |

|

|

23.6 |

% |

|

|

|

|

|

Information Technology |

|

|

23.4 |

% |

|

|

|

|

|

Financials |

|

|

7.4 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

6.0 |

% |

|

|

|

|

|

Energy |

|

|

1.8 |

% |

|

|

|

|

|

Consumer Staples |

|

|

1.5 |

% |

|

|

|

|

|

Communication Services |

|

|

1.2 |

% |

|

|

|

|

|

Materials |

|

|

0.2 |

% |

|

|

|

|

|

Exchange Traded Fund |

|

|

1.1 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

3.5 |

% |

|

|

|

|

|

Cash and Other Assets Less Liabilities |

|

|

-1.0 |

% |

|

|

|

| |

|

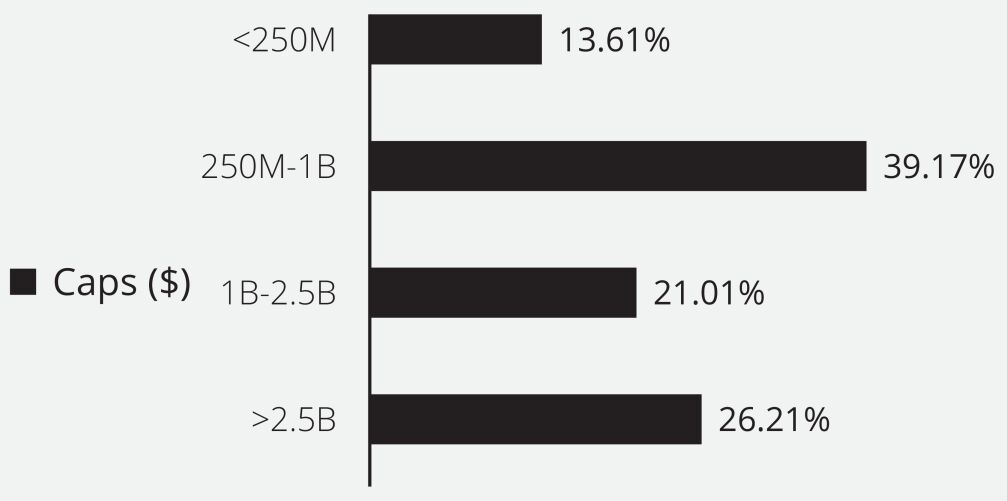

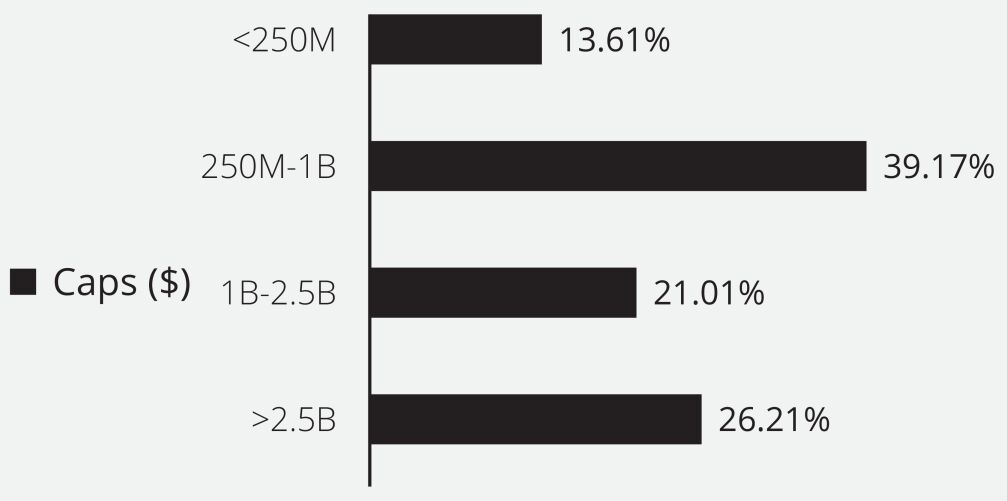

Market Ca p italiz ation (as a % of Net Assets) |

|

|

|

|

| |

| 1290 ESSEX SMALL CAP GROWTH FUND - CLASS I [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 ESSEX SMALL CAP GROWTH FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

ESCJX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Essex Small Cap Growth Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class I |

|

$43 |

|

0.88% |

|

|

|

| Expenses Paid, Amount |

$ 43

|

| Expense Ratio, Percent |

0.88%

|

| Net Assets |

$ 63,742,994

|

| Holdings Count | Holding |

103

|

| Investment Company, Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

63,742,994 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

103 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

20% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weightings (as a % of Net Assets) |

|

|

|

|

|

|

Industrials |

|

|

31.3 |

% |

|

|

|

|

|

Health Care |

|

|

23.6 |

% |

|

|

|

|

|

Information Technology |

|

|

23.4 |

% |

|

|

|

|

|

Financials |

|

|

7.4 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

6.0 |

% |

|

|

|

|

|

Energy |

|

|

1.8 |

% |

|

|

|

|

|

Consumer Staples |

|

|

1.5 |

% |

|

|

|

|

|

Communication Services |

|

|

1.2 |

% |

|

|

|

|

|

Materials |

|

|

0.2 |

% |

|

|

|

|

|

Exchange Traded Fund |

|

|

1.1 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

3.5 |

% |

|

|

|

|

|

Cash and Other Assets Less Liabilities |

|

|

-1.0 |

% |

|

|

|

| |

|

Market Capitalization (as a % of Net Assets) |

|

|

|

|

|

|

| 1290 ESSEX SMALL CAP GROWTH FUND CLASS R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 ESSEX SMALL CAP GROWTH FUND

|

| Class Name |

CLASS R

|

| Trading Symbol |

ESCKX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Essex Small Cap Growth Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class R |

|

$67 |

|

1.38% |

|

|

|

| Expenses Paid, Amount |

$ 67

|

| Expense Ratio, Percent |

1.38%

|

| Net Assets |

$ 63,742,994

|

| Holdings Count | Holding |

103

|

| Investment Company, Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

63,742,994 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

103 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

20% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weightings (as a % of Net Assets) |

|

|

|

|

|

|

Industrials |

|

|

31.3 |

% |

|

|

|

|

|

Health Care |

|

|

23.6 |

% |

|

|

|

|

|

Information Technology |

|

|

23.4 |

% |

|

|

|

|

|

Financials |

|

|

7.4 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

6.0 |

% |

|

|

|

|

|

Energy |

|

|

1.8 |

% |

|

|

|

|

|

Consumer Staples |

|

|

1.5 |

% |

|

|

|

|

|

Communication Services |

|

|

1.2 |

% |

|

|

|

|

|

Materials |

|

|

0.2 |

% |

|

|

|

|

|

Exchange Traded Fund |

|

|

1.1 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

3.5 |

% |

|

|

|

|

|

Cash and Other Assets Less Liabilities |

|

|

-1.0 |

% |

|

|

|

| |

|

Market Capitalization (as a % of Net Assets) |

|

|

|

|

|

|

| 1290 GAMCO SMALL/MID CAP VALUE FUND CLASS A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 GAMCO SMALL/MID CAP VALUE FUND

|

| Class Name |

CLASS A

|

| Trading Symbol |

TNVAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 GAMCO Small/Mid Cap Value Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class A |

|

$57 |

|

1.20% |

|

|

|

| Expenses Paid, Amount |

$ 57

|

| Expense Ratio, Percent |

1.20%

|

| Net Assets |

$ 144,471,594

|

| Holdings Count | Holding |

180

|

| Investment Company, Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

144,471,594 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

180 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

4% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weightings (as a % of Net Assets) |

|

|

|

|

|

|

Industrials |

|

|

33.8 |

% |

|

|

|

|

|

Communication Services |

|

|

19.4 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

14.6 |

% |

|

|

|

|

|

Consumer Staples |

|

|

8.3 |

% |

|

|

|

|

|

Materials |

|

|

6.8 |

% |

|

|

|

|

|

Utilities |

|

|

5.6 |

% |

|

|

|

|

|

Health Care |

|

|

2.4 |

% |

|

|

|

|

|

Financials |

|

|

2.3 |

% |

|

|

|

|

|

Information Technology |

|

|

2.2 |

% |

|

|

|

|

|

Energy |

|

|

1.0 |

% |

|

|

|

|

|

Real Estate |

|

|

0.6 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

5.9 |

% |

|

|

Cash and Other Assets Less Liabilities |

|

|

-2.9 |

% |

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

JPMorgan Prime Money Market Fund, IM Shares |

|

2.8% |

|

|

|

|

|

Mueller Industries, Inc. |

|

2.6% |

|

|

|

|

|

National Fuel Gas Co. |

|

2.2% |

|

|

|

|

|

Crane Co. |

|

2.1% |

|

|

|

|

|

Madison Square Garden Sports Corp. |

|

2.0% |

|

|

|

|

|

Paramount Global, Class A |

|

2.0% |

|

|

|

|

|

Sinclair, Inc. |

|

1.7% |

|

|

|

|

|

Astec Industries, Inc. |

|

1.7% |

|

|

|

|

|

Iveco Group NV |

|

1.6% |

|

|

|

|

|

AZZ, Inc. |

|

1.6% |

|

| Largest Holdings [Text Block] |

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

JPMorgan Prime Money Market Fund, IM Shares |

|

2.8% |

|

|

|

|

|

Mueller Industries, Inc. |

|

2.6% |

|

|

|

|

|

National Fuel Gas Co. |

|

2.2% |

|

|

|

|

|

Crane Co. |

|

2.1% |

|

|

|

|

|

Madison Square Garden Sports Corp. |

|

2.0% |

|

|

|

|

|

Paramount Global, Class A |

|

2.0% |

|

|

|

|

|

Sinclair, Inc. |

|

1.7% |

|

|

|

|

|

Astec Industries, Inc. |

|

1.7% |

|

|

|

|

|

Iveco Group NV |

|

1.6% |

|

|

|

|

|

AZZ, Inc. |

|

1.6% |

|

| 1290 GAMCO SMALL/MID CAP VALUE FUND CLASS I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 GAMCO SMALL/MID CAP VALUE FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

TNVIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 GAMCO Small/Mid Cap Value Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class I |

|

$45 |

|

0.95% |

|

|

|

| Expenses Paid, Amount |

$ 45

|

| Expense Ratio, Percent |

0.95%

|

| Net Assets |

$ 144,471,594

|

| Holdings Count | Holding |

180

|

| Investment Company, Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

144,471,594 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

180 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

4% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weightings (as a % of Net Assets) |

|

|

|

|

|

|

Industrials |

|

|

33.8 |

% |

|

|

|

|

|

Communication Services |

|

|

19.4 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

14.6 |

% |

|

|

|

|

|

Consumer Staples |

|

|

8.3 |

% |

|

|

|

|

|

Materials |

|

|

6.8 |

% |

|

|

|

|

|

Utilities |

|

|

5.6 |

% |

|

|

|

|

|

Health Care |

|

|

2.4 |

% |

|

|

|

|

|

Financials |

|

|

2.3 |

% |

|

|

|

|

|

Information Technology |

|

|

2.2 |

% |

|

|

|

|

|

Energy |

|

|

1.0 |

% |

|

|

|

|

|

Real Estate |

|

|

0.6 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

5.9 |

% |

|

|

|

|

|

Cash and Other Assets Less Liabilities |

|

|

-2.9 |

% |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

JPMorgan Prime Money Market Fund, IM Shares |

|

|

2.8 |

% |

|

|

|

|

|

Mueller Industries, Inc. |

|

|

2.6 |

% |

|

|

|

|

|

National Fuel Gas Co. |

|

|

2.2 |

% |

|

|

|

|

|

Crane Co. |

|

|

2.1 |

% |

|

|

|

|

|

Madison Square Garden Sports Corp. |

|

|

2.0 |

% |

|

|

|

|

|

Paramount Global, Class A |

|

|

2.0 |

% |

|

|

|

|

|

Sinclair, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Astec Industries, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Iveco Group NV |

|

|

1.6 |

% |

|

|

|

|

|

AZZ, Inc. |

|

|

1.6 |

% |

|

| Largest Holdings [Text Block] |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

JPMorgan Prime Money Market Fund, IM Shares |

|

|

2.8 |

% |

|

|

|

|

|

Mueller Industries, Inc. |

|

|

2.6 |

% |

|

|

|

|

|

National Fuel Gas Co. |

|

|

2.2 |

% |

|

|

|

|

|

Crane Co. |

|

|

2.1 |

% |

|

|

|

|

|

Madison Square Garden Sports Corp. |

|

|

2.0 |

% |

|

|

|

|

|

Paramount Global, Class A |

|

|

2.0 |

% |

|

|

|

|

|

Sinclair, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Astec Industries, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Iveco Group NV |

|

|

1.6 |

% |

|

|

|

|

|

AZZ, Inc. |

|

|

1.6 |

% |

|

| 1290 GAMCO SMALL/MID CAP VALUE FUND CLASS R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 GAMCO SMALL/MID CAP VALUE FUND

|

| Class Name |

CLASS R

|

| Trading Symbol |

TNVRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 GAMCO Small/Mid Cap Value Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class R |

|

$68 |

|

1.45% |

|

|

|

| Expenses Paid, Amount |

$ 68

|

| Expense Ratio, Percent |

1.45%

|

| Net Assets |

$ 144,471,594

|

| Holdings Count | Holding |

180

|

| Investment Company, Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

144,471,594 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

180 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

4% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

| |

|

Sector Weightings (as a % of Net Assets) |

|

|

|

|

|

|

Industrials |

|

|

33.8 |

% |

|

|

|

|

|

Communication Services |

|

|

19.4 |

% |

|

|

|

|

|

Consumer Discretionary |

|

|

14.6 |

% |

|

|

|

|

|

Consumer Staples |

|

|

8.3 |

% |

|

|

|

|

|

Materials |

|

|

6.8 |

% |

|

|

|

|

|

Utilities |

|

|

5.6 |

% |

|

|

|

|

|

Health Care |

|

|

2.4 |

% |

|

|

|

|

|

Financials |

|

|

2.3 |

% |

|

|

|

|

|

Information Technology |

|

|

2.2 |

% |

|

|

|

|

|

Energy |

|

|

1.0 |

% |

|

|

|

|

|

Real Estate |

|

|

0.6 |

% |

|

|

|

|

|

Short-Term Investments |

|

|

5.9 |

% |

|

|

|

|

|

Cash and Other Assets Less Liabilities |

|

|

-2.9 |

% |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

JPMorgan Prime Money Market Fund, IM Shares |

|

|

2.8 |

% |

|

|

|

|

|

Mueller Industries, Inc. |

|

|

2.6 |

% |

|

|

|

|

|

National Fuel Gas Co. |

|

|

2.2 |

% |

|

|

|

|

|

Crane Co. |

|

|

2.1 |

% |

|

|

|

|

|

Madison Square Garden Sports Corp. |

|

|

2.0 |

% |

|

|

|

|

|

Paramount Global, Class A |

|

|

2.0 |

% |

|

|

|

|

|

Sinclair, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Astec Industries, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Iveco Group NV |

|

|

1.6 |

% |

|

|

|

|

|

AZZ, Inc. |

|

|

1.6 |

% |

|

| Largest Holdings [Text Block] |

|

|

|

|

|

|

|

| |

|

Top Ten Holdings (as a % of Net Assets) |

|

|

|

|

|

|

JPMorgan Prime Money Market Fund, IM Shares |

|

|

2.8 |

% |

|

|

|

|

|

Mueller Industries, Inc. |

|

|

2.6 |

% |

|

|

|

|

|

National Fuel Gas Co. |

|

|

2.2 |

% |

|

|

|

|

|

Crane Co. |

|

|

2.1 |

% |

|

|

|

|

|

Madison Square Garden Sports Corp. |

|

|

2.0 |

% |

|

|

|

|

|

Paramount Global, Class A |

|

|

2.0 |

% |

|

|

|

|

|

Sinclair, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Astec Industries, Inc. |

|

|

1.7 |

% |

|

|

|

|

|

Iveco Group NV |

|

|

1.6 |

% |

|

|

|

|

|

AZZ, Inc. |

|

|

1.6 |

% |

|

| 1290 HIGH YIELD BOND FUND - CLASS A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 HIGH YIELD BOND FUND

|

| Class Name |

CLASS A

|

| Trading Symbol |

TNHAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 High Yield Bond Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class A |

|

$50 |

|

1.00% |

|

|

|

| Expenses Paid, Amount |

$ 50

|

| Expense Ratio, Percent |

1.00%

|

| Net Assets |

$ 79,398,837

|

| Holdings Count | Holding |

277

|

| Investment Company, Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

79,398,837 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

277 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

17% |

|

|

|

|

|

|

| Holdings [Text Block] |

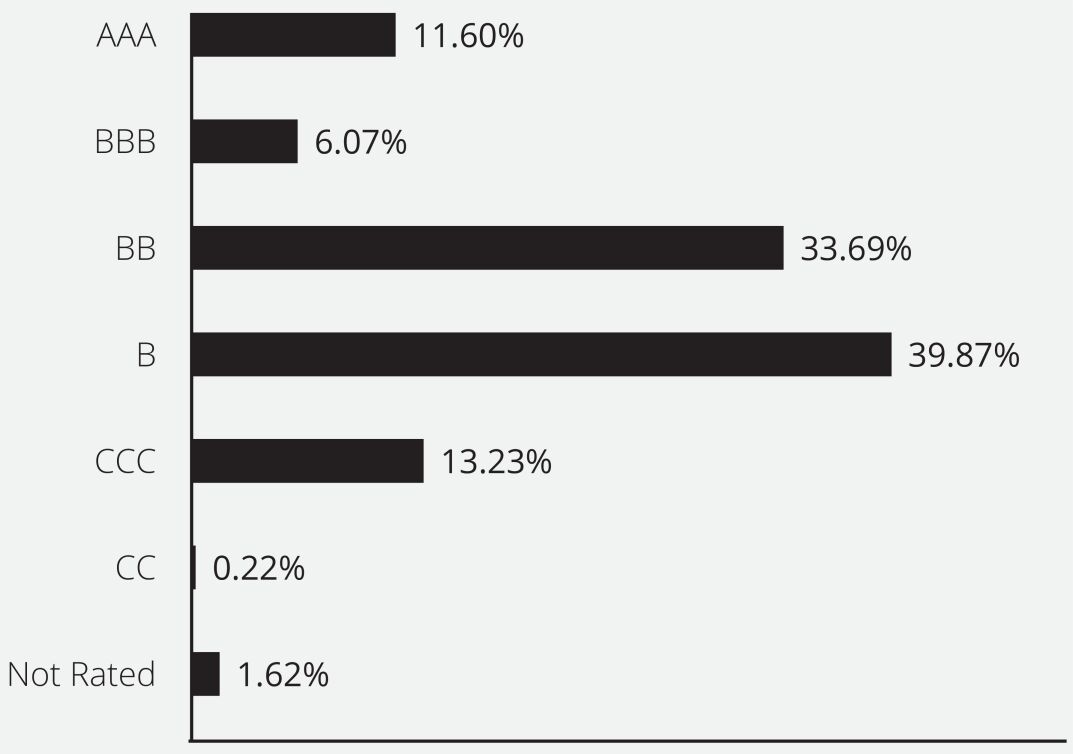

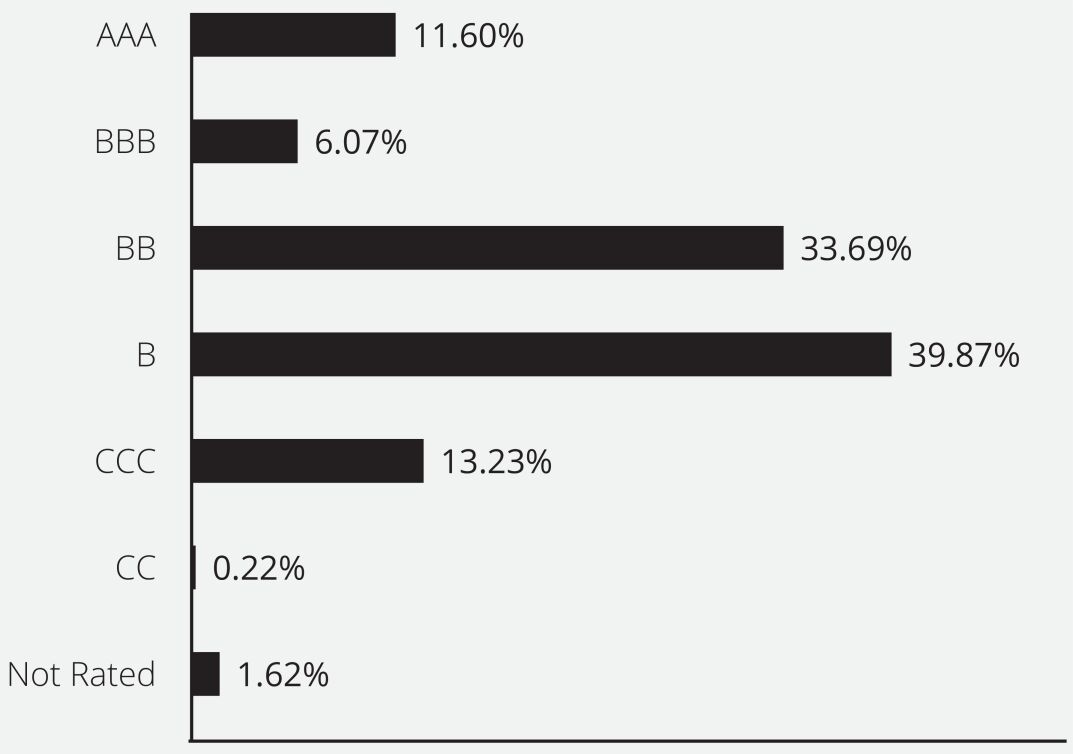

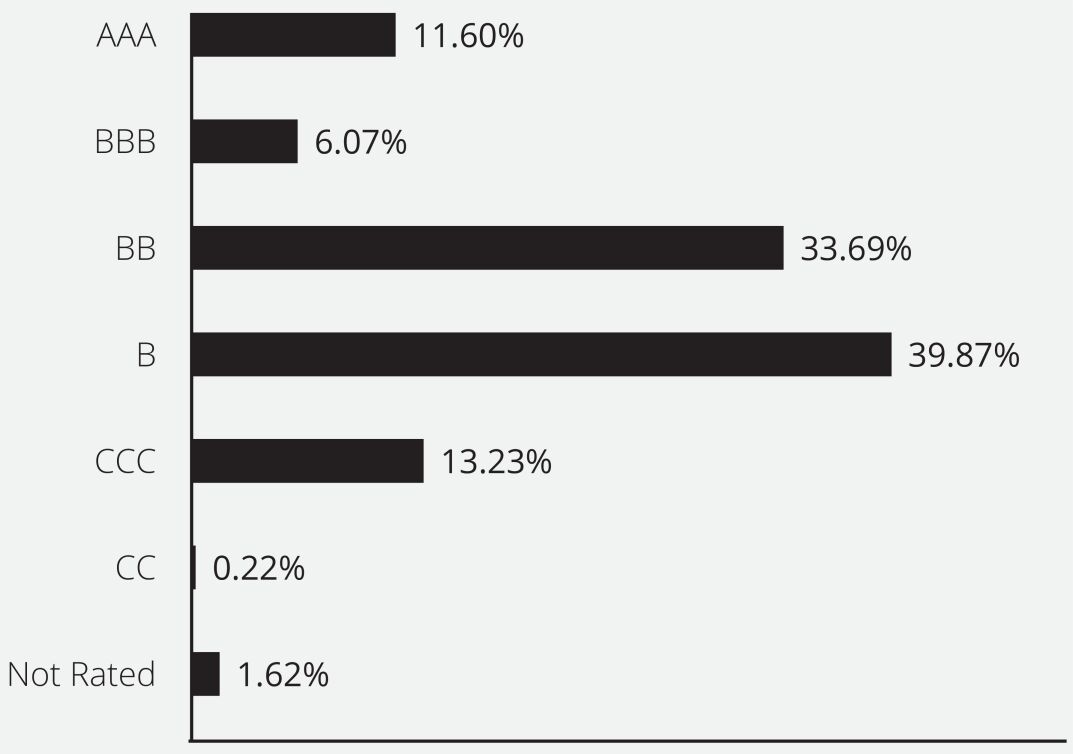

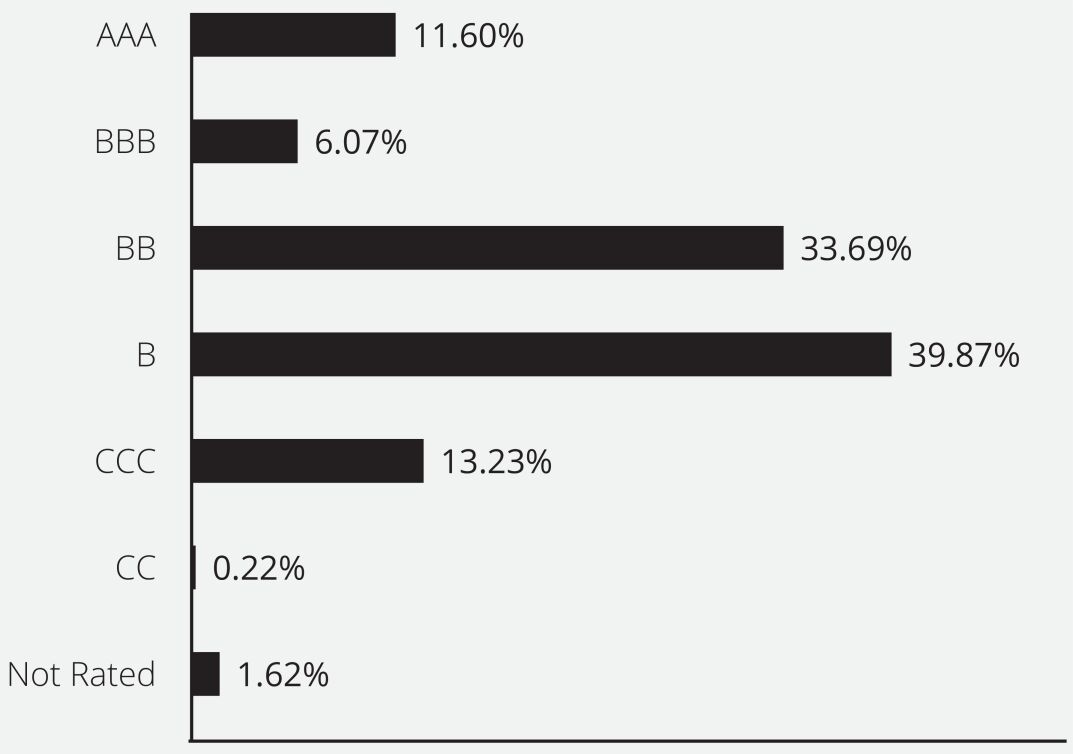

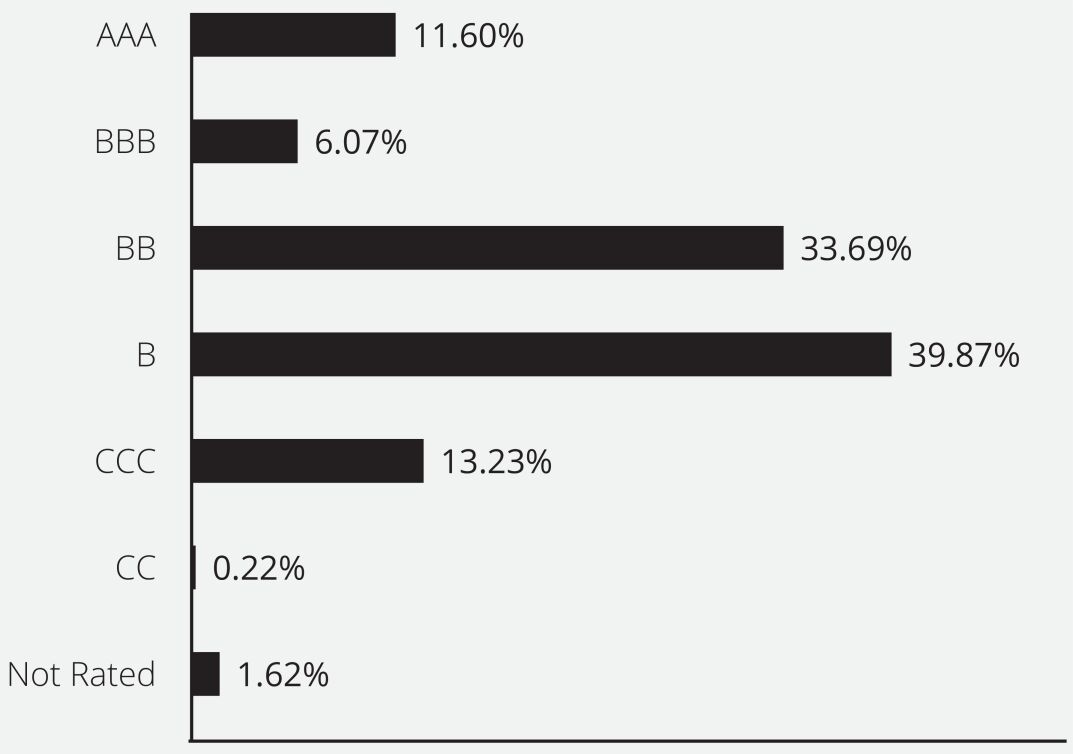

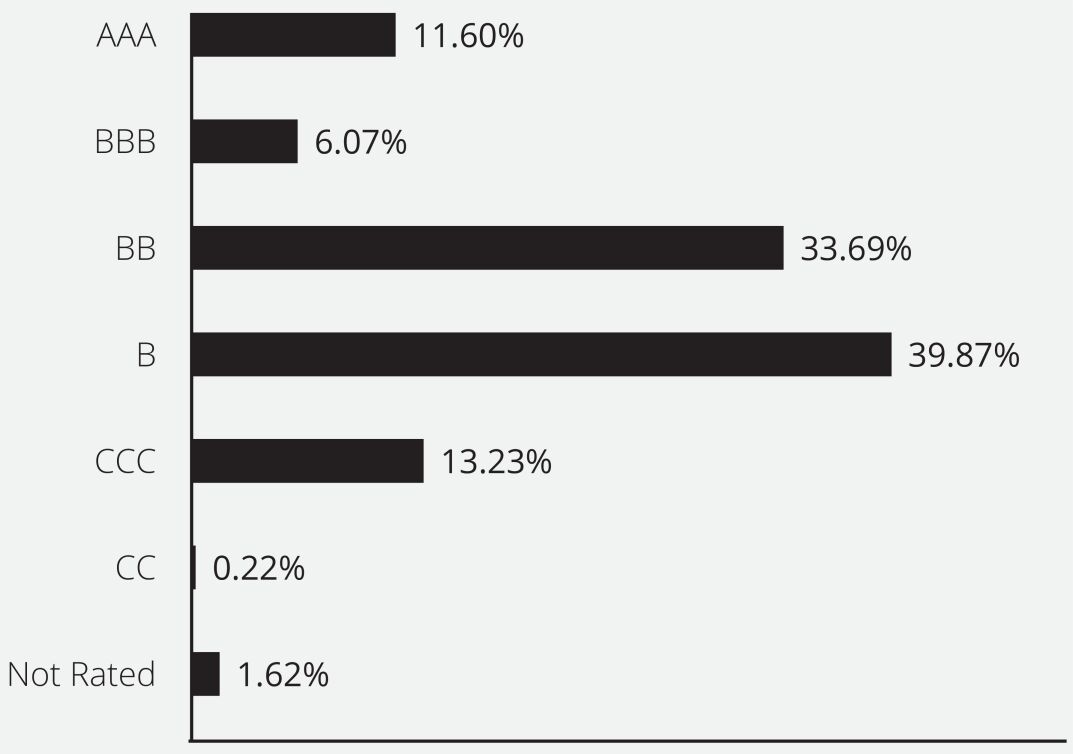

What did the Fund invest in? (as of April 30, 2025) Credit Quality Ratings (as a % of Net Assets)

|

| 1290 HIGH YIELD BOND FUND - CLASS I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 HIGH YIELD BOND FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

TNHIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 High Yield Bond Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class I |

|

$37 |

|

0.75% |

|

|

|

| Expenses Paid, Amount |

$ 37

|

| Expense Ratio, Percent |

0.75%

|

| Net Assets |

$ 79,398,837

|

| Holdings Count | Holding |

277

|

| Investment Company, Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

79,398,837 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

277 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

17% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Credit Quality Ratings (as a % of Net Assets)

|

| 1290 HIGH YIELD BOND FUND - CLASS R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 HIGH YIELD BOND FUND

|

| Class Name |

CLASS R

|

| Trading Symbol |

TNHRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 High Yield Bond Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class R |

|

$62 |

|

1.25% |

|

|

|

| Expenses Paid, Amount |

$ 62

|

| Expense Ratio, Percent |

1.25%

|

| Net Assets |

$ 79,398,837

|

| Holdings Count | Holding |

277

|

| Investment Company, Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

79,398,837 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

277 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

17% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Credit Quality Ratings (as a % of Net Assets)

|

| 1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND - CLASS A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND

|

| Class Name |

CLASS A

|

| Trading Symbol |

TNXAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Loomis Sayles Multi-Asset Income Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class A |

|

$52 |

|

1.05% |

|

|

|

| Expenses Paid, Amount |

$ 52

|

| Expense Ratio, Percent |

1.05%

|

| Net Assets |

$ 77,754,631

|

| Holdings Count | Holding |

622

|

| Investment Company, Portfolio Turnover |

111.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

77,754,631 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

622 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

111% |

|

|

|

|

|

|

| Holdings [Text Block] |

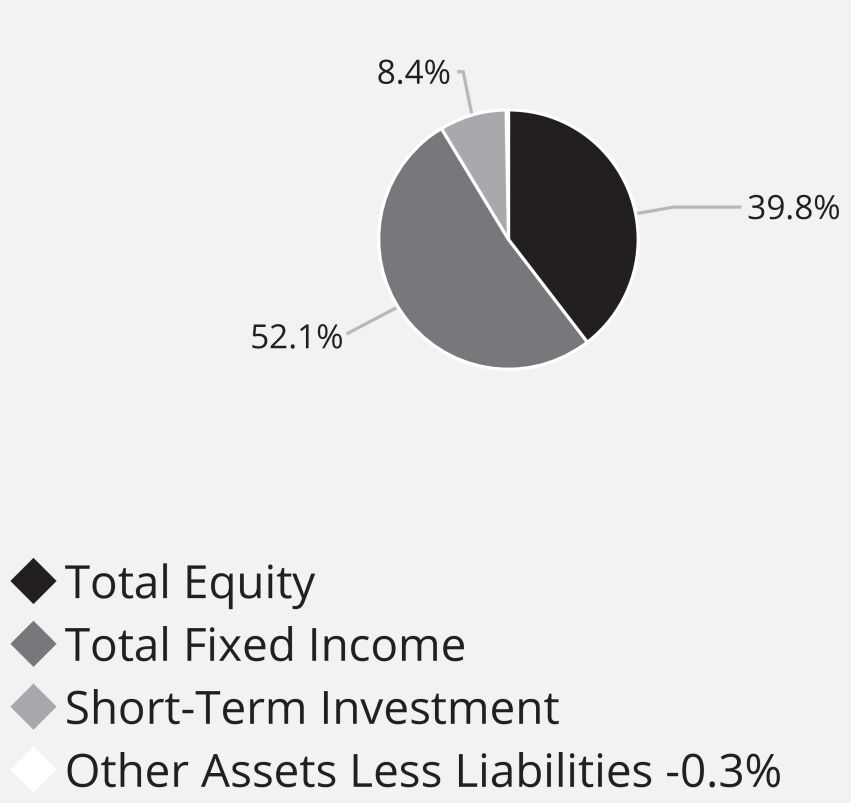

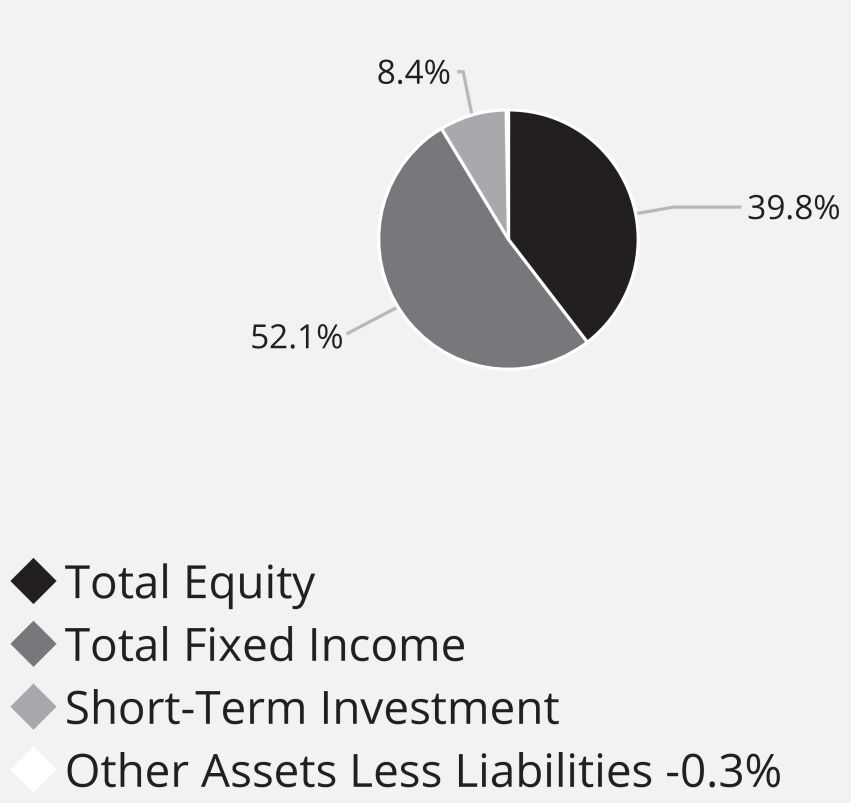

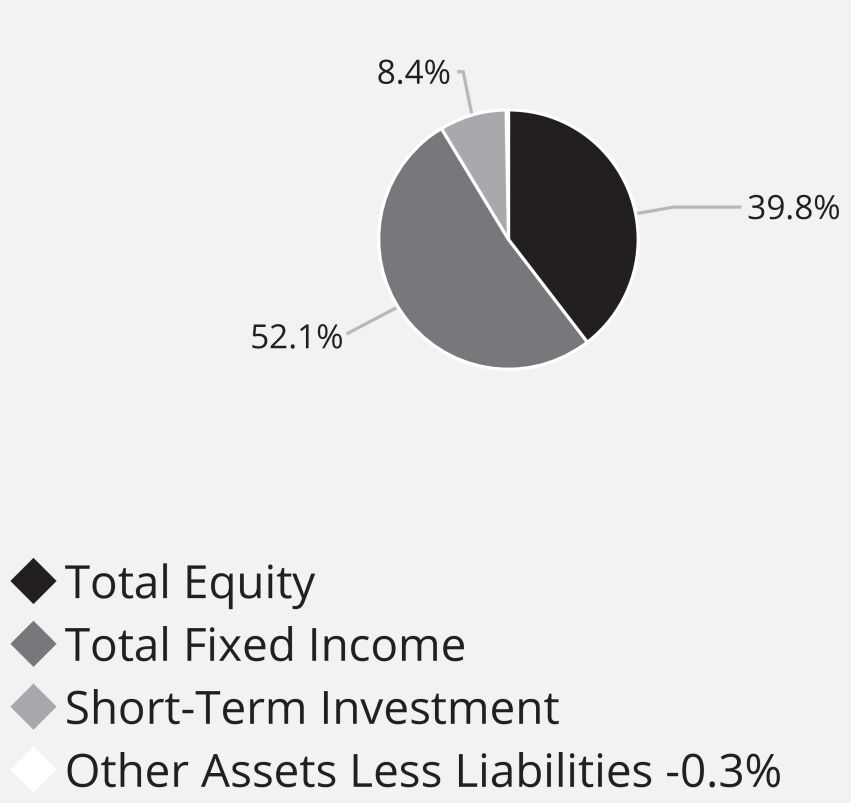

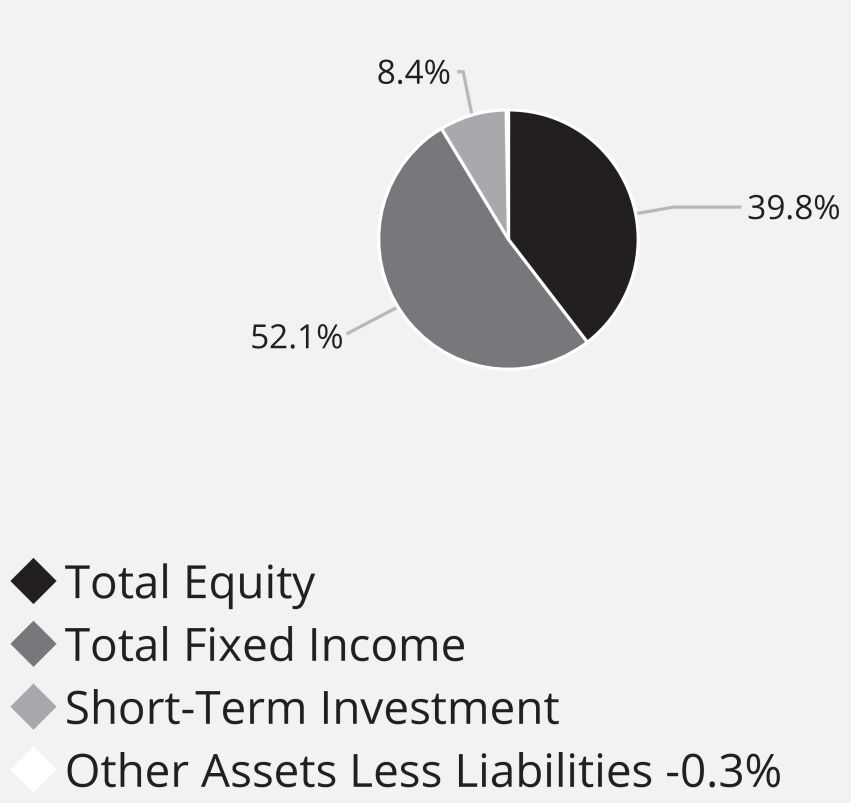

What did the Fund invest in? (as of April 30, 2025) Asset Allocation (as a % of Net Assets)

|

| 1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND CLASS I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

TNVDX

|

| Annual or Semi-Annual Statement [Text Block] |

T his semi-annual shareholder report contains important information about the 1290 Loomis Sayles Multi-Asset Income Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class I |

|

$40 |

|

0.80% |

|

|

|

| Expenses Paid, Amount |

$ 40

|

| Expense Ratio, Percent |

0.80%

|

| Net Assets |

$ 77,754,631

|

| Holdings Count | Holding |

622

|

| Investment Company, Portfolio Turnover |

111.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

77,754,631 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

622 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

111% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Asset Allocation (as a % of Net Assets)

|

| 1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND CLASS R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND

|

| Class Name |

CLASS R

|

| Trading Symbol |

TNYRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Loomis Sayles Multi-Asset Income Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class R |

|

$65 |

|

1.30% |

|

|

|

| Expenses Paid, Amount |

$ 65

|

| Expense Ratio, Percent |

1.30%

|

| Net Assets |

$ 77,754,631

|

| Holdings Count | Holding |

622

|

| Investment Company, Portfolio Turnover |

111.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

77,754,631 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

622 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

111% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Asset Allocation (as a % of Net Assets)

|

| 1290 MULTI-ALTERNATIVE STRATEGIES FUND CLASS A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 MULTI-ALTERNATIVE STRATEGIES FUND

|

| Class Name |

CLASS A

|

| Trading Symbol |

TNMAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Multi-Alternative Strategies Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class A |

|

$55 |

|

1.10% |

|

|

|

| Expenses Paid, Amount |

$ 55

|

| Expense Ratio, Percent |

1.10%

|

| Net Assets |

$ 19,564,023

|

| Holdings Count | Holding |

11

|

| Investment Company, Portfolio Turnover |

14.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

19,564,023 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

11 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

14% |

|

|

|

|

|

|

| Holdings [Text Block] |

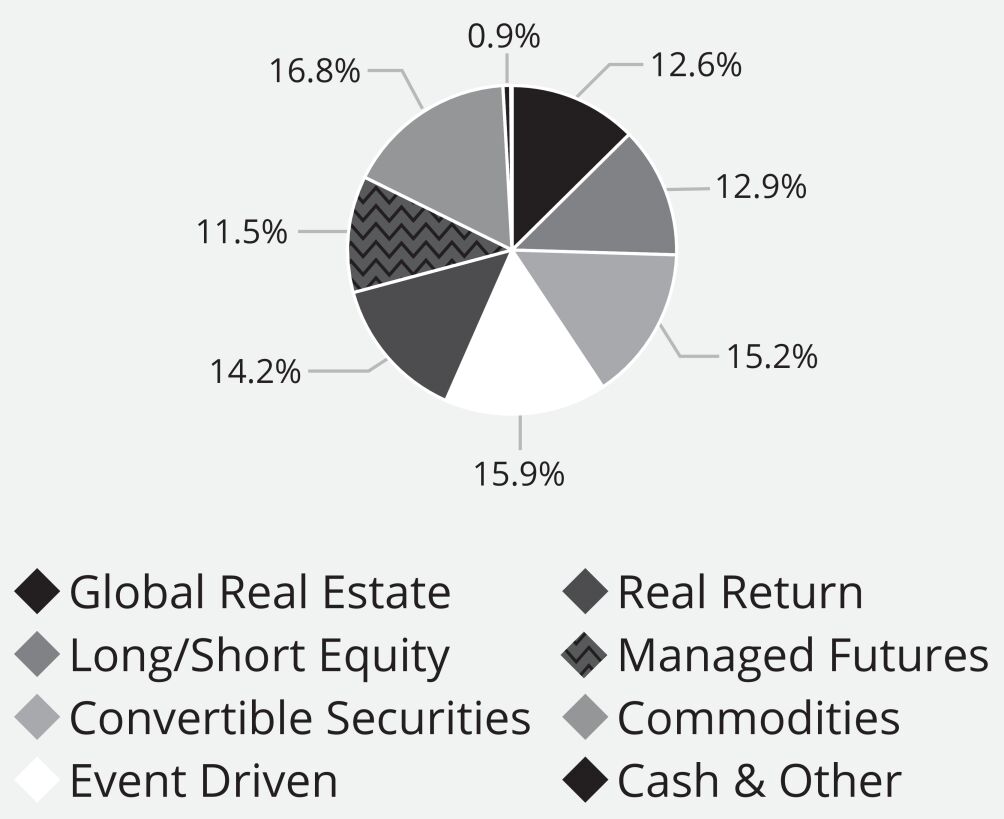

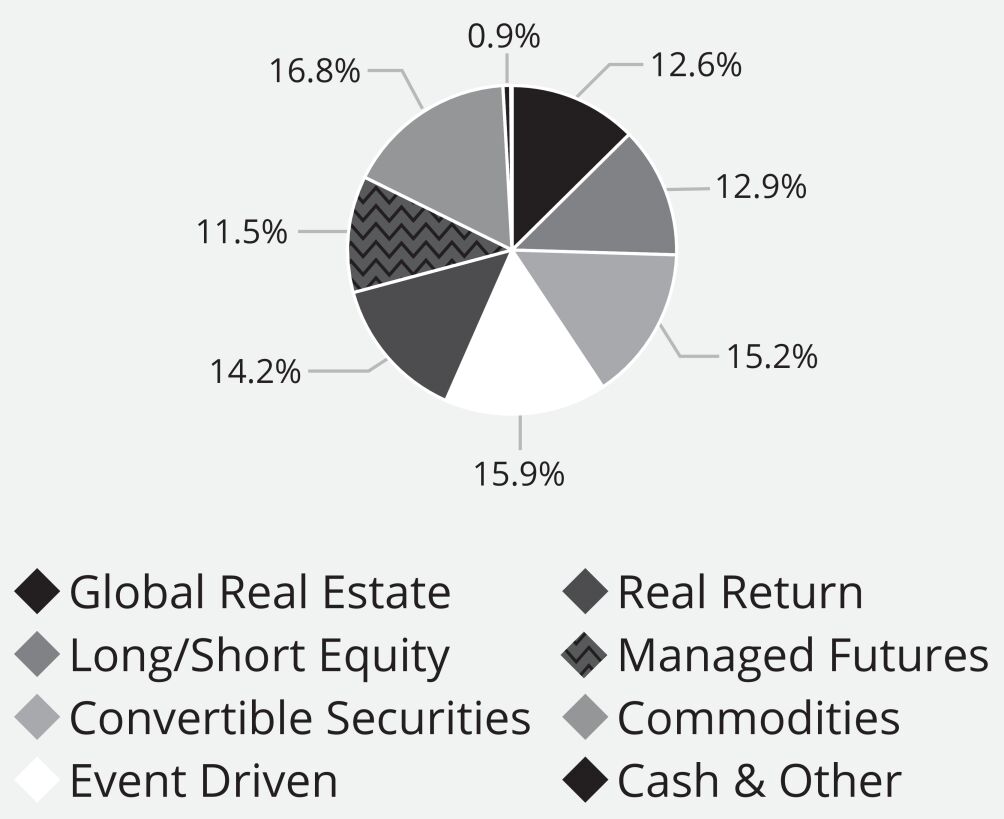

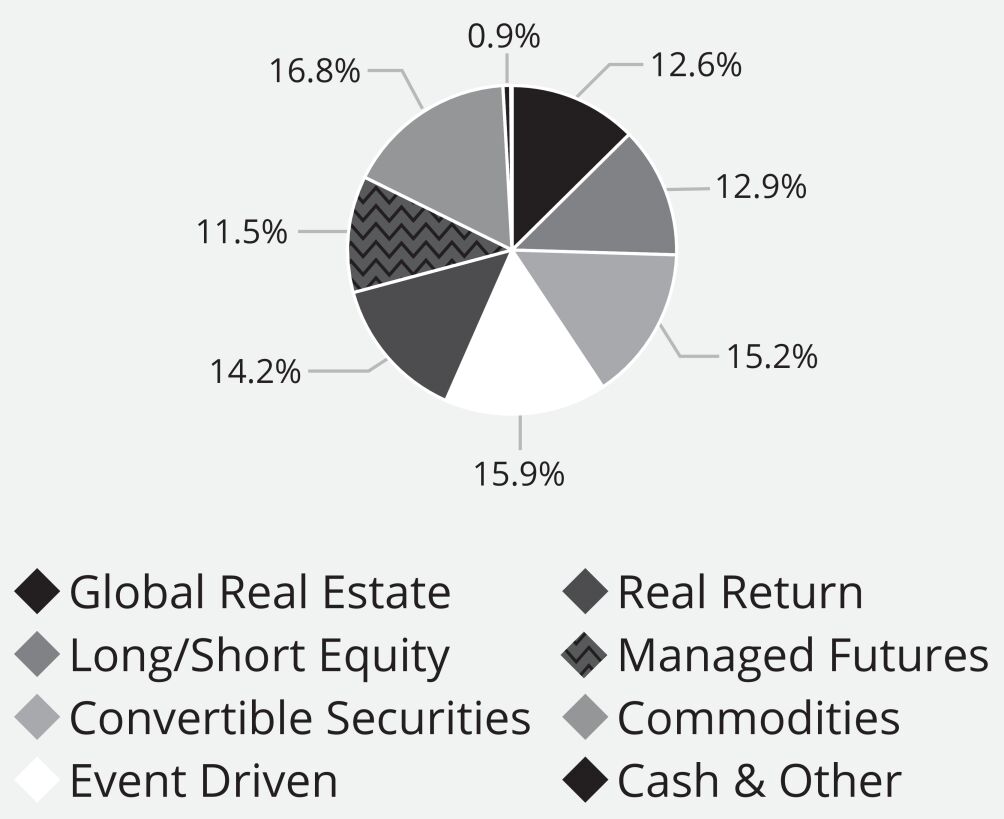

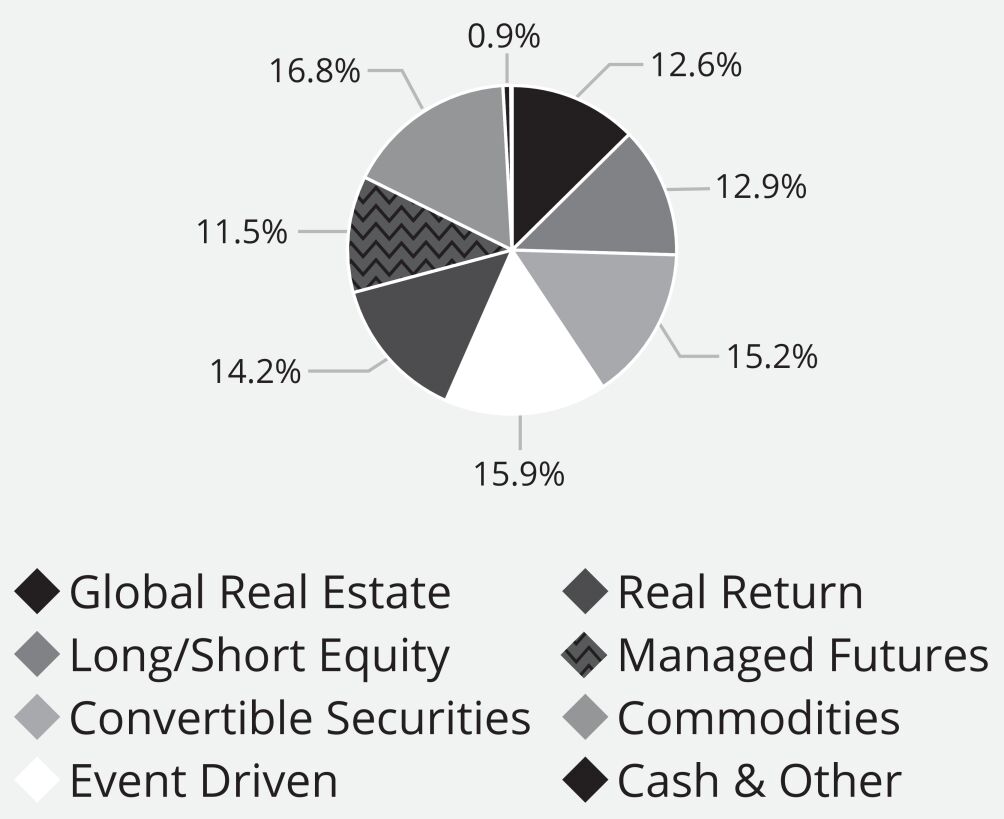

What did the Fund invest in? (as of April 30, 2025) Alternative Category and Strategy Allocation (as a % of Net Assets)

|

| 1290 MULTI-ALTERNATIVE STRATEGIES FUND CLASS I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 MULTI-ALTERNATIVE STRATEGIES FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

TNMIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Multi-Alternative Strategies Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class I |

|

$43 |

|

0.85% |

|

|

|

| Expenses Paid, Amount |

$ 43

|

| Expense Ratio, Percent |

0.85%

|

| Net Assets |

$ 19,564,023

|

| Holdings Count | Holding |

11

|

| Investment Company, Portfolio Turnover |

14.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

19,564,023 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

11 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

14% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Alternative Category and Strategy Allocation (as a % of Net Assets)

|

| 1290 MULTI-ALTERNATIVE STRATEGIES FUND CLASS R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 MULTI-ALTERNATIVE STRATEGIES FUND

|

| Class Name |

CLASS R

|

| Trading Symbol |

TNMRX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Multi-Alternative Strategies Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at 1-888-310-0416.

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

Class R |

|

$67 |

|

1.35% |

|

|

|

| Expenses Paid, Amount |

$ 67

|

| Expense Ratio, Percent |

1.35%

|

| Net Assets |

$ 19,564,023

|

| Holdings Count | Holding |

11

|

| Investment Company, Portfolio Turnover |

14.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

Fund Statistics |

|

|

|

|

|

|

|

|

(as of April 30, 2025) |

|

|

|

|

|

|

|

|

Net Assets |

|

$ |

19,564,023 |

|

|

|

|

|

Number of Portfolio Holdings |

|

|

11 |

|

|

|

|

|

Portfolio Turnover Rate |

|

|

14% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025) Alternative Category and Strategy Allocation (as a % of Net Assets)

|

| 1290 RETIREMENT 2020 FUND - CLASS I |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

1290 RETIREMENT 2020 FUND

|

| Class Name |

CLASS I

|

| Trading Symbol |

TNIIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the 1290 Retirement 2020 Fund (the “Fund”) for the period November 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

|

| Additional Information Phone Number |

1-888-310-0416

|

| Additional Information Website |

https://www.1290funds.com/resources/#shareholderReports

|

| Expenses [Text Block] |

What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

|

|

|

|

|

|

|

| Share Class |

|

Costs of a $10,000 investment |

|

Costs paid as a percentage of a $10,000 investment |

|

|

| Class I |

|

$28 |

|

0.56% |

|

|

|

| Expenses Paid, Amount |

$ 28

|

| Expense Ratio, Percent |

0.56%

|

| Material Change Date |

Nov. 01, 2024

|

| Net Assets |

$ 1,252,061

|

| Holdings Count | Holding |

17

|

| Investment Company, Portfolio Turnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| (as of April 30, 2025) |

|

|

|

|

|

|

|

|

| Net Assets |

|

$ |

1,252,061 |

|

|

|

|

|

| Number of Portfolio Holdings |

|

|

17 |

|

|

|

|

|

| Portfolio Turnover Rate |

|

|

1% |

|

|

|

|

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of April 30, 2025)

|

|

|

|

|

|

|

|

|

Security Type & Asset Class (as a % of Net Assets) |

|

| |

|

|

|

|

|

|

99.7% |

|

| |

|

|