FIRST AMENDMENT TO LEASE

THIS FIRST AMENDMENT TO LEASE (“First Amendment”) is made and entered into as of the 1ST day of March 2024, by and between PHELAN BUILDING LLC, a Delaware limited liability company (“Landlord”), and FIGMA, INC., a Delaware corporation (“Tenant”).

R E C I T A L S:

A. WHEREAS, Landlord and Tenant have heretofore entered into that certain Office Lease Agreement dated as of April 28, 2021 (the “Lease”) pursuant to which Tenant leased from Landlord, and Landlord leased to Tenant, certain premises currently containing seventy-three thousand thirty-seven (73,037) rentable square feet of space, consisting of approximately twenty four thousand three hundred twenty (24,320) rentable square feet of space consisting of the entire rentable portion of the Tenth Floor (the “Tenth Floor Premises”), approximately twenty-four thousand two hundred seventy-nine (24,279) rentable square feet of space consisting of the entire rentable portion of the Seventh Floor (the “Seventh Floor Premises”), and twenty-four thousand four hundred thirty eight (24,438) rentable square feet consisting of the entire rentable portion of the Fifth Floor (the “Fifth Floor Premises”) (the Tenth Floor Premises, Seventh Floor Premises and Fifth Floor Premises collectively referred to herein as the “Original Premises”) of the building known as the Phelan Building (the “Building”) located at 760 Market Street, San Francisco, California (as more particularly described in the Lease, the “Premises”; and

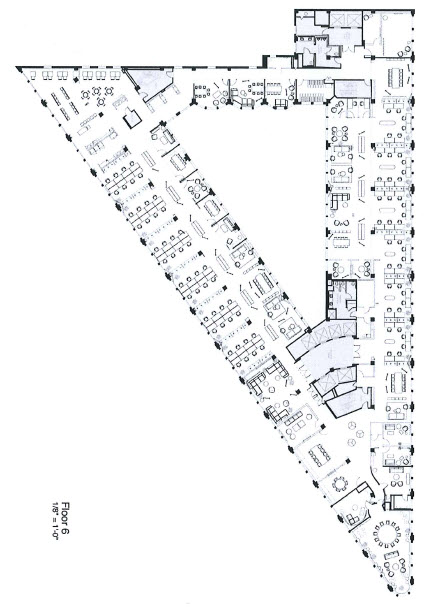

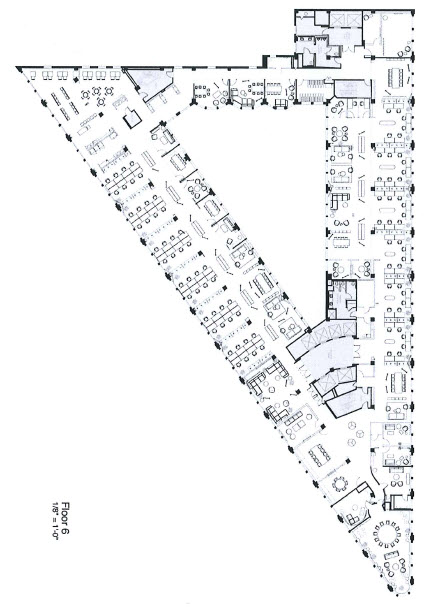

WHEREAS, Landlord and Tenant agree that (i) the Term of the Lease shall be extended, (ii) additional space containing approximately twenty-four thousand five hundred sixty-nine (24,569) rentable square feet consisting of the entire rentable portion of the sixth floor of the Building shown on Exhibit A hereto (the “Sixth Floor Premises”) be added to the Premises as of the “Sixth Floor Effective Date,” as defined below, and (iii) the annual Base Rent payable with respect to the Premises shall be modified. Landlord and Tenant further agree to make certain other modifications to the Lease, and in connection therewith, amend the Lease on the terms and conditions hereinafter provided, effective upon the full execution and delivery of this First Amendment.

A G R E E M E N T :

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained which are incorporated herein by reference and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree as follows:

1. Definitions. The capitalized terms used in this First Amendment shall have the same definitions as set forth in the Lease to the extent that such capitalized terms are defined therein and not redefined in this First Amendment.

2. Sixth Floor. Tenant is currently in possession of the Sixth Floor Premises pursuant to the Sublease (as that term is defined in the Lease). The Sixth Floor Premises shall be deemed to have been delivered to Tenant on, and accordingly, the Sixth Floor Effective Date

shall be, October l, 2024. As of the Sixth Floor Effective Date, the Premises, as defined in the Lease, shall include the Sixth Floor Premises, and all references to the “Premises” in the Lease shall include the Sixth Floor Premises. The Lease Term with respect to the Sixth Floor Premises shall commence on the Sixth Floor Effective Date and continue until the First Extended Expiration Date as hereinafter defined. Tenant hereby agrees to lease the Sixth Floor Premises in its then “AS-IS” condition, without representation or warranty, written or oral, by Landlord to Tenant as to the condition thereof, and otherwise as set forth in the Lease. Landlord agrees that: (i) it shall not require Tenant or Sublessor (as defined below) to remove and/or restore any and all of the improvements, additions, or alterations existing in the Sixth Floor Premises as of the date of this First Amendment, (ii) as of the date of this First Amendment, the Sixth Floor Premises is in the condition required for delivery under the lease by and between Landlord and Credit Karma (“Sublessor”) dated May 13, 2014 (the “Credit Kanna Lease”), as amended; (iii) Landlord will not, in the exercise of any of the rights arising or which may arise out of the Credit Karma Lease, disturb or deprive Tenant in or of its possession or its rights to possession of the Sixth Floor Premises or of any right or privilege granted to or incurring to the benefit of Tenant under the Sublease; and (iv) in the event of a termination of the Credit Karma Lease between Landlord and Sublessor, Tenant shall not be made a party to any removal or eviction action or proceeding, nor shall Tenant be evicted or removed of its possession or its right of possession of the Sixth Floor Premises, and the Sublease shall continue in full force and effect as a direct lease between Landlord and Tenant for the remainder of the term of the Sublease on the same terms and conditions as contained in Landlord’s Consent letter and the Sublease, without the necessity of executing a new lease or an amendment to the Lease. Additionally, except in the case of Tenant’s negligence or willful misconduct, Tenant shall not be responsible for any damages or rent owed to Landlord by Sublessor under the Credit Karma Lease.

3. Extension of Term. The Term of the Lease is hereby extended for a period of four (4) years and one (1) month (the “First Extended Term”), commencing on October 1, 2024 and expiring October 31, 2028 (the “First Extension Expiration Date”). Accordingly, the defined term “Lease Expiration Date” as used in the Lease is amended to be the First Extension Expiration Date.

4. Base Rent for the Premises.

(a) Commencing on October 1, 2024, Base Rent for the Premises (inclusive of the Sixth Floor Premises) shall be due and payable by Tenant to Landlord as on the first day of each month in accordance with the terms and conditions of the Lease, as follows:

| | | | | | | | |

| Period | Annual Rent | Monthly Rent |

| October 1, 2024 - September 30, 2025 | $6,344,390.00 | $528,699.17 |

| October 1, 2025 - September 30, 2026 | $6,534,721.70 | $544,560.14 |

| October 1, 2026 - September 30, 2027 | $6,730,763.35 | $560,896.95 |

| October 1, 2027 - September 30, 2028 | $6,932,686.25 | $577,723.85 |

| October 1, 2028 - October 31, 2028 | $7,140,666.84 | $595,055.57 |

(b) Notwithstanding anything to the contrary set forth in this First Amendment or in the Lease, Tenant shall receive an abatement of Base Rent for the first month (i.e. October, 2024) of Base Rent due hereunder (the “Abatement”). If Tenant shall be in monetary default under the terms and conditions of the Lease beyond the expiration of all applicable grace and/or cure periods, the Abatement shall toll (and Tenant shall be required to pay Base Rent during such period) until Tenant has cured, to Landlord’s reasonable satisfaction, such default and at such time Tenant shall be entitled to receive any unapplied Abatement until fully applied. If a Default (as defined in the Lease) occurs during the initial Term or First Extended Term that results in a termination of the Lease, Landlord shall have the right to declare the unamortized portion of the Abatement due and payable by Tenant to Landlord, amortized on a straight-line basis over the First Extended Term, and recover such unamortized portion of the Abatement from Tenant as damages as more fully set forth therein.

(c) Commencing on the date in which this First Amendment becomes fully executed and expiring on September 30, 2024, Tenant shall receive a per diem Base Rent credit on the Original Premises in an amount equal to the figures outlined in the table below (the “Rent Credit”). If Tenant shall be in monetary default under the terms and conditions of the Lease beyond the expiration of all applicable grace and/or cure periods, the Rent Credit shall toll (and Tenant shall be required to pay the uncredited Base Rent during such period) until Tenant has cured, to Landlord’s reasonable satisfaction, such default and at such time the Rent Credit shall continue, however Tenant shall not be entitled to any unapplied Rent Credit accrued during Tenant’s Default. If a Default (as defined in the Lease) occurs during the Term or First Extended Term that results in a termination of the Lease, Landlord shall have the right to declare the unamortized portion of the Rent Credit due and payable by Tenant to Landlord, amortized on a straight-line basis over the date the Rent Credit commences and ending on the First Extension Expiration Date, and recover such unamortized portion of the Rent Credit from Tenant as damages as more fully set forth therein.

RENT CREDIT TABLE

| | | | | | | | | | | | | | | | | |

| | Period | Monthly Saving Rate | Daily Saving Rate | |

| 1 | 3/1/2024 | $73,044.69 | $2,356.28 | |

| 2 | 4/1/2024 | $73,044.69 | $2,434.82 | |

| 3 | 5/1/2024 | $73,044.69 | $2,356.28 | |

| 4 | 6/1/2024 | $73,044.69 | $2,434.82 | |

| 5 | 7/1/2024 | $84,774.29 | $2,734.65 | |

| 6 | 8/1/2024 | $84,774.29 | $2,734.65 | |

| 7 | 9/1/2024 | $84,774.29 | $2,825.81 | |

5. Additional Rent.

(a) Base Year. Effective October 1, 2024, the Base Year as defined in Article 4 of the Lease shall be revised to Calendar Year 2025 for the Premises. Tenant shall be responsible for paying Tenant’s Share of Direct Expenses for any Expense Year after the Base

Year in excess of Tenant’s Share of Direct Expenses for the Base Year for the duration of the First Extended Term.

(b) Tenant’s Share. Effective October 1, 2024, Article 4 of the Lease shall apply to the Sixth Floor Premises and for such purposes, Tenant’s Share for the Sixth Floor is 9.92%. Tenant’s Share for the entire Premises is 39.41 %.

(c) Remeasurement. During the First Extended Term, Landlord shall not have the right to remeasure the Premises except for physical changes to the square footage of the Premises (e.g. due to casualty or condemnation).

(d) Tenant’s Audit Right. Provided that (a) no Default exists under this Lease beyond applicable cure periods, and (b) Tenant delivers to Landlord written notice of Tenant’s desire to review Landlord’s books and records related to Direct Expenses within six (6) full months after Landlord’s delivery of the Statement, then Tenant (but not any subtenant) may, at its sole cost and expense and no more than one (1) time per calendar year, upon prior written notice and during the hours of 9:00 a.m. to 5:30 p.m. from Monday to Friday at a time and place within the county in which the Premises is located and reasonably acceptable to Landlord, cause a certified public accountant or professional equivalent or by an independent, nationally recognized accounting firm or a local accounting firm (not hired on a contingency basis) reasonably acceptable to Landlord to audit Landlord’s records relating to Direct Expenses for the Expense Year being contested and the Base Year (provided the Base Year may only be audited one time). Any right of Tenant to review Landlord’s books and records and/or to object to Landlord’s determination of Direct Expenses is deemed void unless Tenant completes and delivers the audit to Landlord within sixty (60) days after the date Landlord makes Landlord’s complete books and records available for Tenant’s review as described herein. In the event Landlord, in good faith, disputes the results of any such audit, the parties shall in good faith attempt to resolve any disputed items. If Landlord and Tenant are not able to resolve such dispute, final settlement shall be made by a mutually satisfactory independent third party certified public accountant. The parties shall share the cost of the independent third-party certified public accountant, except if Tenant’s audit (if accepted by Landlord) or the third-party audit (if Landlord contests Tenant’s audit) shows that the amount of Direct Expenses was five percent (5%) or more than the amount that such audit reveals should have been determined, Landlord shall reimburse to Tenant, within forty-five (45) days of receipt of Tenant’s certificate setting forth such amount, Tenant’s costs incurred in connection with Tenant’s audit and Tenant’s portion of the costs for the third-party audit. If the audit shows that the amount of Direct Expenses was greater than the amount that such audit reveals should have been determined, unless Landlord reasonably contests the audit, Landlord will refund the excess amount to Tenant within forty-five (45) days after Landlord receives a copy of the audit report. If the audit shows that the amount of Direct Expenses was less than the amount that such audit reveals should have been determined, Tenant will pay to Landlord within forty-five (45) days of such determination, as Additional Rent, the difference between the amount Tenant paid and the amount determined in the audit. Pending resolution of any audit, Tenant will continue to pay to Landlord the amounts provided in the Estimate Statement pursuant to Section 4.4.2 of the Lease.

Except as required by law, Tenant must keep all information it obtains in any audit strictly confidential and may only use such information for the limited purpose described herein.

6. Electricity Service. Landlord shall continue to furnish electrical service for the Premises during the First Extended Term on a submetered basis in accordance with Article 3.3 of the Lease, and Tenant shall continue to be responsible for paying Landlord for its electricity consumption for the Premises (including the Sixth Floor Premises commencing October 1, 2024) under the terms & conditions set forth therein.

7. Deposit. The Deposit, as defined in Article 21 of the Lease, shall remain One Million Seven Hundred Twenty-eight Thousand Six Hundred Seven and 00/100 Dollars ($1,728,607.00) for the duration of the First Extended Term.

8. Renewal Option. Tenant is hereby granted one (1) five (5) year option to renew the Lease (“Renewal Option”), provided Tenant must exercise the Renewal Option for a minimum of three (3) floors, which is approximately seventy-five percent (75%) of the Premises. If the Tenant desires to exercise the Renewal Option, it shall so notify the Landlord, in writing, not later than November l, 2027. Such notice shall only be effective if delivered at a time when the Tenant is not in monetary default beyond applicable notice and cure periods. Within thirty (30) days following its receipt of Tenant’s notice of its desire to exercise the Renewal Option, given at the time and in the manner provided above, Landlord shall prepare and transmit to Tenant an appropriate amendment to this Lease extending the Term for five (5) years (“Second Extended Term”) and specifying (i) the Base Rent for such extension, which shall be Market Rent (as defined below), (ii) the Base Year shall be revised to Calendar Year 2029 for the Premises, (iii) Tenant shall lease the Premises in its as-is condition and (iv) that all other terms and conditions during the Second Extended Term are the same as those during the First Extended Term, except for any tenant improvement allowances, rights of first offer, expansion rights, reduction rights, renewal rights, or limitations on taxes and operating expenses. In the event Tenant shall be in monetary default beyond applicable notice and grace periods at the commencement date of the Second Extended Term, then, at Landlord’s option, Tenant’s purported exercise of its Renewal Option shall be of no force or effect and the Renewal Option shall become null and void. As used herein, “Market Rent” shall mean the Base Rent that a willing tenant would pay and a willing landlord would accept in arm’s length, bona fide negotiations for a comparable lease transaction (i.e., a renewal or right of first refusal, as applicable). The determination of the Market Rent will be based upon a comparison of the term of Tenant’s lease to other lease transactions in the Building and in other multi-tenant office buildings in the general area of the Building (provided lease transactions for locations with a water view shall not be deemed a comparable transaction), with appropriate adjustments as necessary to equate the other lease transactions being compared with the applicable terms of the Lease, taking into consideration all relevant factors including, without limitation, use, location and/or floor level within the applicable building, rentable area, leasehold improvements and allowances provided, quality and location of the applicable building, rental concessions (such as moving expenses, abatements and lease assumptions), extent of services to be provided, distinction between “gross” and “net” lease, base year or expense stop, the creditworthiness of the tenant, and whether a brokerage commission is paid.

(a) If Landlord and Tenant are unable to agree upon the Market Rent for the Premises within twenty (20) business days of Tenant’s receipt of the Landlord proposed amendment, and Tenant elects to continue to desire to exercise the Renewal Option, the Market Rent shall be determined as follows (“Negotiation Period”). Within ten (10) business days after commencement of the Negotiation Period, each party, at its own cost and by giving written notice to the other party no later than ten (10) days after commencement of the Negotiation Period, shall appoint a licensed real estate broker who has at least ten (10) years’ full-time commercial experience in the leasing of office space in the greater San Francisco market to determine the Market Rent. The two brokers shall independently, and without consultation, prepare a written determination of the Market Rent within forty-five (45) days after the appointment of the last of them to be appointed. After both determinations are completed, the resulting determinations of the Market Rent shall be compared. If the higher determination is no greater than one hundred three percent (103%) of the lower determination, then the Market Rent shall be the average of the two determinations. If the higher determination is greater than one hundred three percent (103%) of the lower determination, then the two brokers shall promptly select a third broker meeting the qualifications set forth above, but who shall not have previously acted in any capacity for Landlord, Tenant, or any of their affiliates. If the two brokers cannot agree upon a third broker within ten (10) days after the determinations are compared, either Landlord or Tenant may apply to the local office of the American Arbitration Association (or its successor organization) for selection of a third broker meeting the qualifications stated above. Within thirty (30) days after his or her appointment, the third broker shall select either the determination of Landlord’s broker or the determination of Tenant’s broker as the Market Rent payable for the Premises during the Second Extended Term. The third broker shall have no right to propose a middle ground or to modify either of the two determinations. The determination of the third broker shall be binding on the parties.

(b) Each party shall pay the fees and expenses of its own broker and one-half of the fees and expenses of the third broker, if any.

9. Non-Disturbance. Within thirty (30) days of full execution of this First Amendment, Landlord shall use commercially reasonable efforts to obtain and deliver to Tenant a SNDA in a form reasonably acceptable to Tenant provided by all Superior Holders, which requires such Superior Holder to accept the Lease, and not to disturb Tenant’s possession, use and quiet enjoyment of the Premises, so long as a Default has not occurred and be continuing, executed by Landlord and the appropriate Superior Holder.

10. Indemnity. Landlord shall indemnify, defend, protect, and hold Tenant and the Tenant Parties harmless from any claim that is imposed or asserted and arises from (a) any act of negligence or willful misconduct of Landlord, and (b) any default by Landlord under the terms & conditions under the Lease beyond the expiration of all applicable grace and/or cure periods, except to the extent such claim arises from the negligence or willful misconduct of any Tenant Party, except to the extent such claim arises from the active negligence or willful misconduct of Tenant.

11. Landlord’s Renovation Work. Landlord is in the process of completing façade work on the atrium façade of the Building (the “Atrium Façade Renovation”). Landlord shall complete the Atrium Façade Renovation in three phases. Each phase shall encompass the renovation of a single building elevation, inclusive of the installation of scaffolding and interior containment, which shall be confined to the designated elevation for the respective phase. The first phase shall consist of the North elevation and is estimated to be completed by December 31, 2025. The second phase shall consist of the South elevation and is estimated to be completed by June 30, 2026. The third phase shall consist of West elevation and is estimated to be completed by December 31, 2026. Landlord will use commercially reasonable efforts to ensure that the Atrium Façade Renovation does not unreasonably interfere with Tenant’s use and enjoyment of the Premises. Tenant hereby warrants its understanding that i) the Atrium Façade Renovation work, for the purposes of the Lease, shall be considered a “Renovation”, governed by the provisions of Section 30.30 of the Lease and, as it relates to the construction work itself, Sections 7.2 and 7.3 of the Lease; ii) by phasing the work, the Atrium Façade Renovation shall not be deemed to interfere with Tenant’s use and enjoyment of the Premises or access thereto and iii) in the event Tenant’s access to the Premises is reasonably interfered with by the Atrium Façade Renovation, such interference shall be governed by the provisions of Section 6.3 of the Lease and Tenant’s remedies for such interference shall be limited to those provided within Section 6.3 of the Lease.

12. Certified Access Specialist. As of the Date hereof, the Project, including the Sixth Floor Premises has not been inspected by a Certified Access Specialist.

13. No Other Modification. Landlord and Tenant agree that except as otherwise specifically modified in this First Amendment, the Lease has not been modified, supplemented, amended, or otherwise changed in any way and the Lease remains in full force and effect between the parties hereto as modified by this First Amendment, and Landlord and Tenant do hereby ratify and confirm all of the terms and provisions of the Lease, subject to the modifications contained in this First Amendment. To the extent of any inconsistency between the terms and conditions of the Lease and the terms and conditions of this First Amendment, the teal’s and conditions of this First Amendment shall apply and govern the parties.

14. Miscellaneous.

(a) This First Amendment and the attached exhibits, which are hereby incorporated into and made a part of this First Amendment, set forth the entire agreement between the parties with respect to the matters set forth herein. There have been no additional oral or written representations or agreements.

(b) Tenant and Landlord hereby represents to each other that they have dealt with no broker in connection with this First Amendment other than Newmark and JLL. Tenant agrees to defend, indemnify and hold Landlord harmless from all claims of any brokers claiming to have represented Tenant in connection with this First Amendment. Landlord agrees to defend, indemnify and hold Tenant harmless from all claims of any brokers claiming to have represented Landlord in connection with this First Amendment. Landlord shall be pay a commission to the brokers pursuant to the terms of a separate agreement.

(c) Each party to this First Amendment represents hereby that its signatory has the authority to execute and deliver the same on behalf of the party hereto for which such signatory is acting.

(d) This First Amendment may be executed in multiple counterparts each of which is deemed an original but together constitute one and the same instrument. This First Amendment may be executed electronically (e.g. through e-signature applications such as DocuSign) and each party has the right to rely on such signatures by the other party to the same extent as if such party had received an original counterpart.

[remainder of page intentionally left blank; signature page follows]

IN WITNESS WHEREOF, Landlord and Tenant have duly executed this First Amendment as of the day and year first above written.

| | | | | | | | | | | | | | | | | | | | | | | |

| TENANT: | | LANDLORD: |

| | | | | | | |

| FIGMA, INC., | | PHELAN BUILDING LLC, |

| a Delaware corporation | | Delaware limited liability company |

| | | | | | | |

| By: | /s/ Dylan Field | | /s/ Patrick Hotung |

| Name: | Dylan Field | | Name: | Patrick Hotung |

| Title: | Co-Founder and CEO | | Title: | President |

EXHIBIT A

SIXTH FLOOR PREMISES