FLYING CLEAN WITH SYNTHETIC AVIATION FUELS INVESTOR PRESENTATION / JULY 2025 NASDAQ:

SAFX

DISCLAIMER 2 This presentation and any accompanying oral presentation (this

“Presentation”) is provided for information purposes only. This Presentation is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities in any jurisdiction nor shall there be any sale, issuance

or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption

therefrom, and otherwise in accordance with applicable law.

FORWARD LOOKING STATEMENTS 2 This Presentation includes “forward-looking statements”

within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”,

“will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. These forward-looking statements, including, without limitation, statements

regarding XCF Global’s expectations with respect to future performance and anticipated financial impacts of its recently completed business combination with Focus Impact BH3 Acquisition Company (the "Business Combination"), estimates and

forecasts of other financial and performance metrics, and projections of market opportunity and market share, are subject to risks and uncertainties, which could cause actual results to differ materially from those expressed or implied by such

forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by XCF Global and its management, are inherently uncertain and subject to material change. These

forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. New

risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1)

changes in domestic and foreign business, market, financial, political, and legal conditions; (2) unexpected increases in XCF Global’s expenses resulting from potential inflationary pressures and rising interest rates, including manufacturing

and operating expenses and interest expenses; (3) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any agreements with regard to XCF Global’s offtake arrangements; (4) the

outcome of any legal proceedings that may be instituted against the parties to the Business Combination Agreement or others; (5) XCF Global’s ability to meet Nasdaq’s continued listing standards; (6) XCF Global’s ability to integrate the

operations of New Rise and implement its business plan on its anticipated timeline; (7) XCF Global’s ability to raise financing in the future and the terms of any such financing; (8) New Rise’s ability to produce the anticipated quantities of

SAF without interruption or material changes to the SAF production process; (9) XCF Global’s ability to resolve current disputes between New Rise and its landlord with respect to the ground lease for the New Rise Reno facility; (10) XCF

Global’s ability to resolve current disputes between New Rise and its primary lender with respect to loans outstanding that were used in the development of the New Rise Reno facility; (11) costs related to the Business Combination and the New

Rise acquisitions; (12) the risk of disruption to the current plans and operations of XCF Global as a result of the consummation of the Business Combination; (13) XCF Global’s ability to recognize the anticipated benefits of the Business

Combination and the New Rise acquisitions, which may be affected by, among other things, competition, the ability of XCF Global to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management

and key employees; (14) changes in applicable laws or regulations; (15) risks related to extensive regulation, compliance obligations and rigorous enforcement by federal, state, and non-U.S. governmental authorities; (16) the possibility that

XCF Global may be adversely affected by other economic, business, and/or competitive factors; (17) the availability of tax credits and other federal, state or local government support; (18) risks relating to XCF Global’s and New Rise’s key

intellectual property rights; (19) the risk that XCF Global’s reporting and compliance obligations as a publicly-traded company divert management resources from business operations; (20) the effects of increased costs associated with operating

as a public company; and (21) various factors beyond management’s control, including general economic conditions and other risks, uncertainties and factors set forth in XCF Global’s filings with the Securities and Exchange Commission (“SEC”),

including the final proxy statement/prospectus relating to the Business Combination filed with the SEC on February 6, 2025, this Presentation and other filings XCF Global makes with the SEC in the future. If any of the risks actually occur,

either alone or in combination with other events or circumstances, or XCF Global’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks

that XCF Global does not presently know or that it currently believes are not material that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect XCF

Global’s expectations, plans or forecasts of future events and views as of the date of this Presentation. These forward-looking statements should not be relied upon as representing XCF Global’s assessments as of any date subsequent to the date

of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. While XCF Global may elect to update these forward-looking statements at some point in the future, XCF Global specifically disclaims any

obligation to do so.

TABLE OF CONTENTS 2 EXECUTIVE SUMMARY SAF MARKET OVERVIEW COMPANY OVERVIEW LOGISTICS

& FEEDSTOCKS OVERVIEW ILLUSTRATIVE SAF MARGIN OVERVIEW

Executive Summary

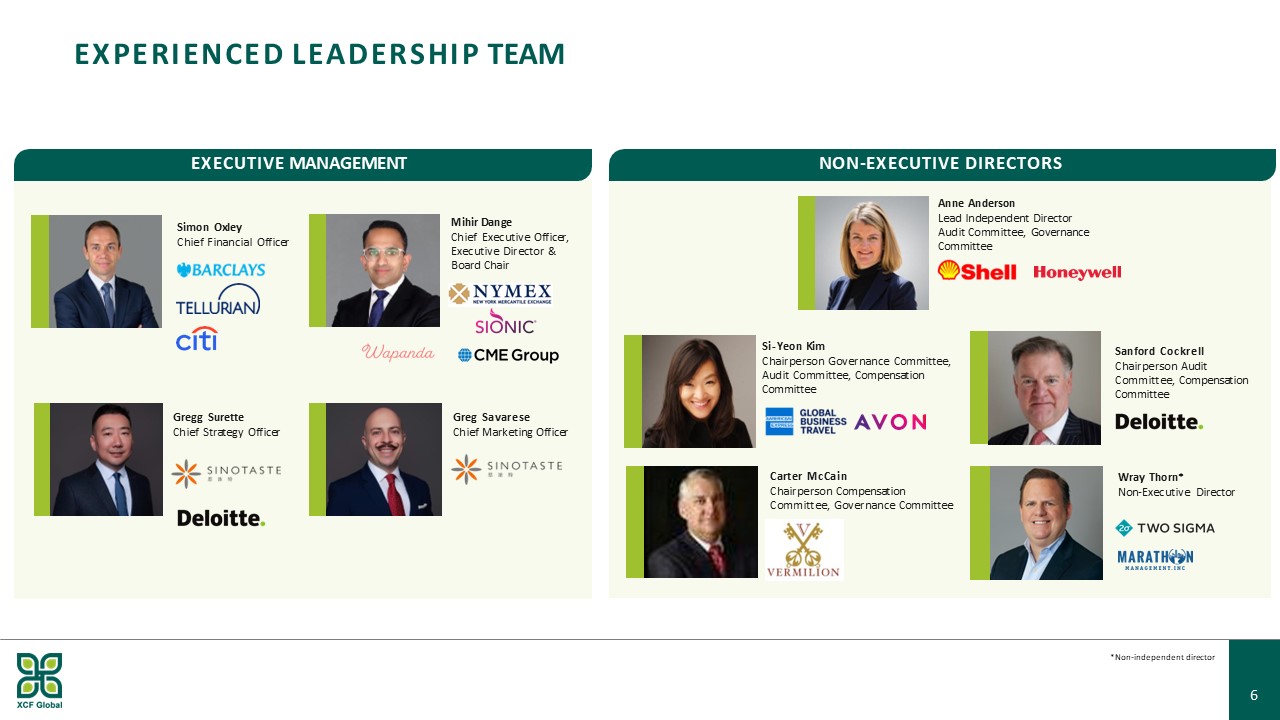

EXPERIENCED LEADERSHIP TEAM Carter McCain Chairperson Compensation Committee, Governance

Committee Si-Yeon Kim Chairperson Governance Committee, Audit Committee, Compensation Committee Wray Thorn* Non-Executive Director Anne Anderson Lead Independent Director Audit Committee, Governance Committee Sanford Cockrell Chairperson

Audit Committee, Compensation Committee Simon Oxley Chief Financial Officer NON-EXECUTIVE DIRECTORS EXECUTIVE MANAGEMENT Mihir Dange Chief Executive Officer, Executive Director & Board Chair *Non-independent director Gregg

Surette Chief Strategy Officer Greg Savarese Chief Marketing Officer 6

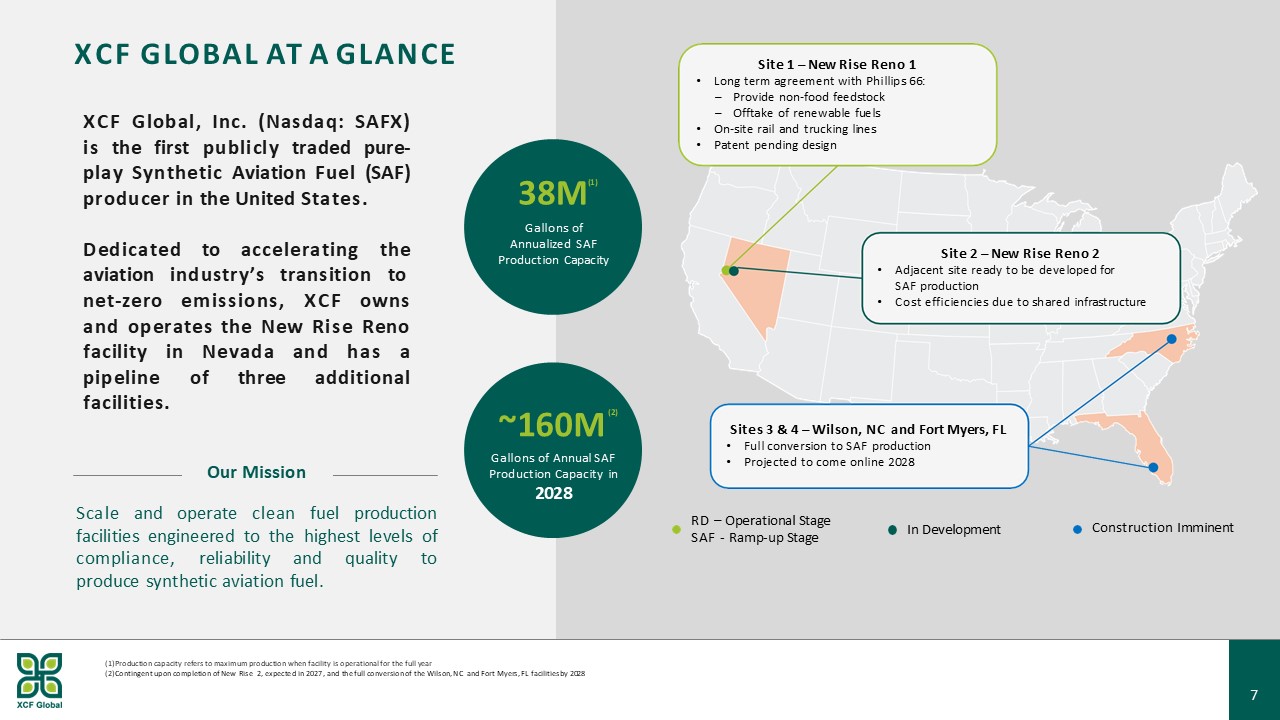

XCF GLOBAL AT A GLANCE XCF Global, Inc. (Nasdaq: SAFX) is the first publicly traded pure-

play Synthetic Aviation Fuel (SAF) producer in the United States. Dedicated to accelerating the aviation industry’s transition to net-zero emissions, XCF owns and operates the New Rise Reno facility in Nevada and has a pipeline of three

additional facilities. Production capacity refers to maximum production when facility is operational for the full year Contingent upon completion of New Rise 2, expected in 2027, and the full conversion of the Wilson, NC and Fort Myers, FL

facilities by 2028 Site 1 – New Rise Reno 1 Long term agreement with Phillips 66: Provide non-food feedstock Offtake of renewable fuels On-site rail and trucking lines Patent pending design Sites 3 & 4 – Wilson, NC and Fort Myers,

FL Full conversion to SAF production Projected to come online 2028 RD – Operational Stage SAF - Ramp-up Stage In Development Site 2 – New Rise Reno 2 Adjacent site ready to be developed for SAF production Cost efficiencies due to shared

infrastructure Scale and operate clean fuel production facilities engineered to the highest levels of compliance, reliability and quality to produce synthetic aviation fuel. 38M(1) Gallons of Annualized SAF Production Capacity Gallons of

Annual SAF Production Capacity in 2028 ~160M (2) Construction Imminent 6 Our Mission

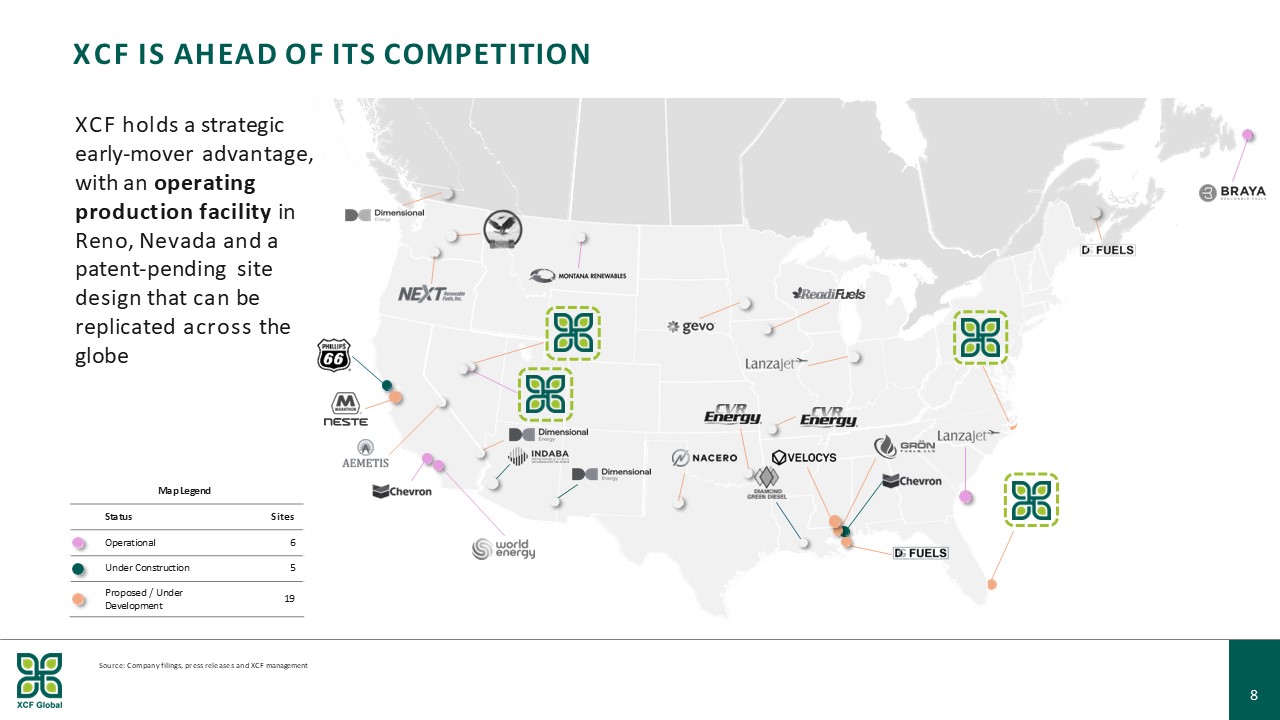

XCF IS AHEAD OF ITS COMPETITION XCF holds a strategic early-mover advantage, with an

operating production facility in Reno, Nevada and a patent-pending site design that can be replicated across the globe Source: Company filings, press releases and XCF management Map Legend Status Sites Operational 6 Under

Construction 5 Proposed / Under Development 19 8

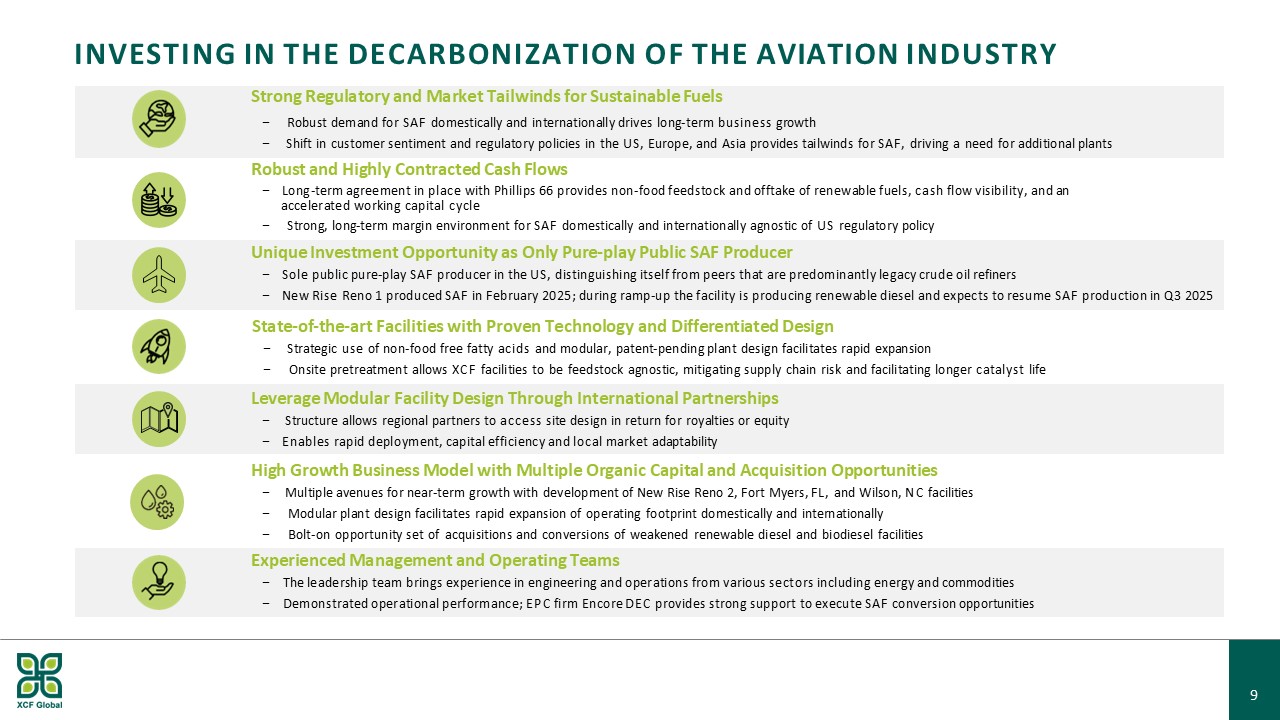

INVESTING IN THE DECARBONIZATION OF THE AVIATION INDUSTRY Strong Regulatory and Market

Tailwinds for Sustainable Fuels − Robust demand for SAF domestically and internationally drives long-term business growth − Shift in customer sentiment and regulatory policies in the US, Europe, and Asia provides tailwinds for SAF, driving a

need for additional plants Unique Investment Opportunity as Only Pure-play Public SAF Producer − Sole public pure-play SAF producer in the US, distinguishing itself from peers that are predominantly legacy crude oil refiners − New Rise Reno

1 produced SAF in February 2025; during ramp-up the facility is producing renewable diesel and expects to resume SAF production in Q3 2025 State-of-the-art Facilities with Proven Technology and Differentiated Design − Strategic use of

non-food free fatty acids and modular, patent-pending plant design facilitates rapid expansion − Onsite pretreatment allows XCF facilities to be feedstock agnostic, mitigating supply chain risk and facilitating longer catalyst life Leverage

Modular Facility Design Through International Partnerships − Structure allows regional partners to access site design in return for royalties or equity − Enables rapid deployment, capital efficiency and local market adaptability High Growth

Business Model with Multiple Organic Capital and Acquisition Opportunities − Multiple avenues for near-term growth with development of New Rise Reno 2, Fort Myers, FL, and Wilson, NC facilities − Modular plant design facilitates rapid

expansion of operating footprint domestically and internationally − Bolt-on opportunity set of acquisitions and conversions of weakened renewable diesel and biodiesel facilities Experienced Management and Operating Teams − The leadership

team brings experience in engineering and operations from various sectors including energy and commodities − Demonstrated operational performance; EPC firm Encore DEC provides strong support to execute SAF conversion opportunities Robust and

Highly Contracted Cash Flows − Long-term agreement in place with Phillips 66 provides non-food feedstock and offtake of renewable fuels, cash flow visibility, and an accelerated working capital cycle − Strong, long-term margin environment for

SAF domestically and internationally agnostic of US regulatory policy 8

SAF Market Overview

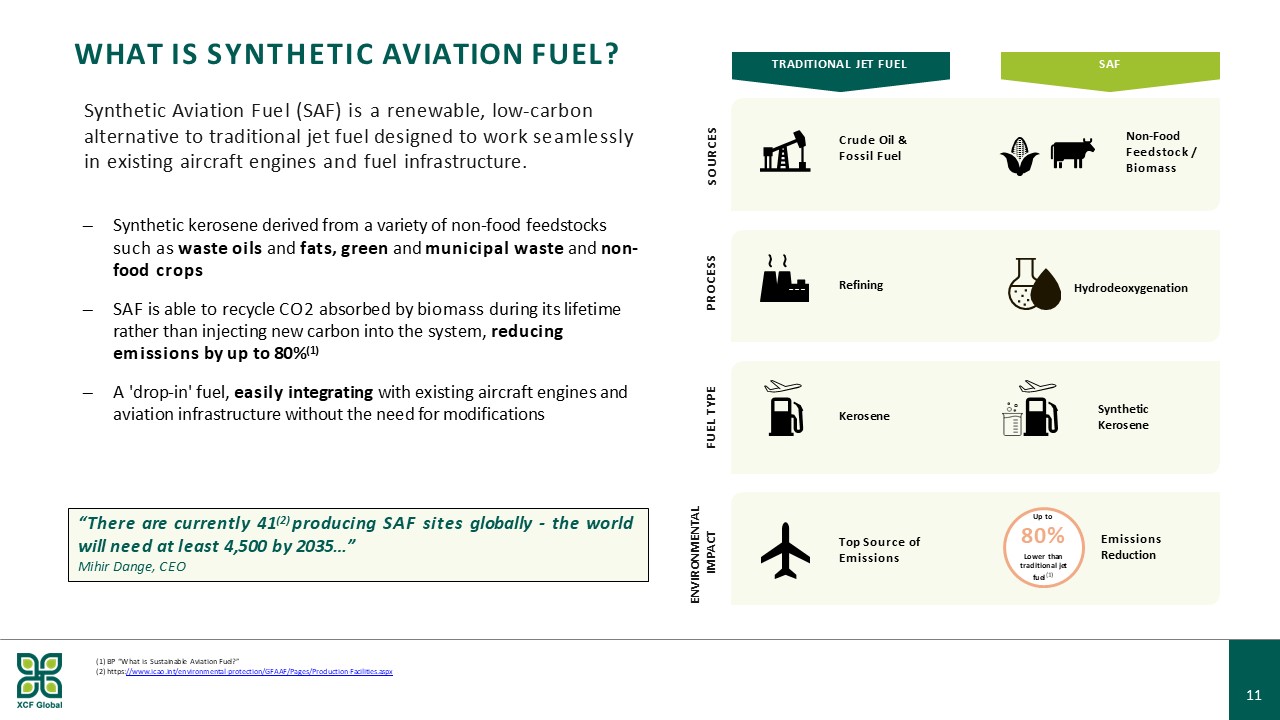

WHAT IS SYNTHETIC AVIATION FUEL? ─ Synthetic kerosene derived from a variety of non-food

feedstocks such as waste oils and fats, green and municipal waste and non- food crops ─ SAF is able to recycle CO2 absorbed by biomass during its lifetime rather than injecting new carbon into the system, reducing emissions by up to 80%(1) ─

A 'drop-in' fuel, easily integrating with existing aircraft engines and aviation infrastructure without the need for modifications Synthetic Aviation Fuel (SAF) is a renewable, low-carbon alternative to traditional jet fuel designed to work

seamlessly in existing aircraft engines and fuel infrastructure. Non-Food Feedstock / Biomass Top Source of Emissions Crude Oil & Fossil Fuel Kerosene Refining SOURCES Hydrodeoxygenation Emissions Reduction Up to 80% Lower than

traditional jet fuel(1) PROCESS FUEL TYPE ENVIRONMENTAL IMPACT TRADITIONAL JET FUEL SAF BP “What is Sustainable Aviation

Fuel?” https://www.icao.int/environmental-protection/GFAAF/Pages/Production-Facilities.aspx 11 Synthetic Kerosene “There are currently 41(2) producing SAF sites globally - the world will need at least 4,500 by 2035…” Mihir Dange, CEO

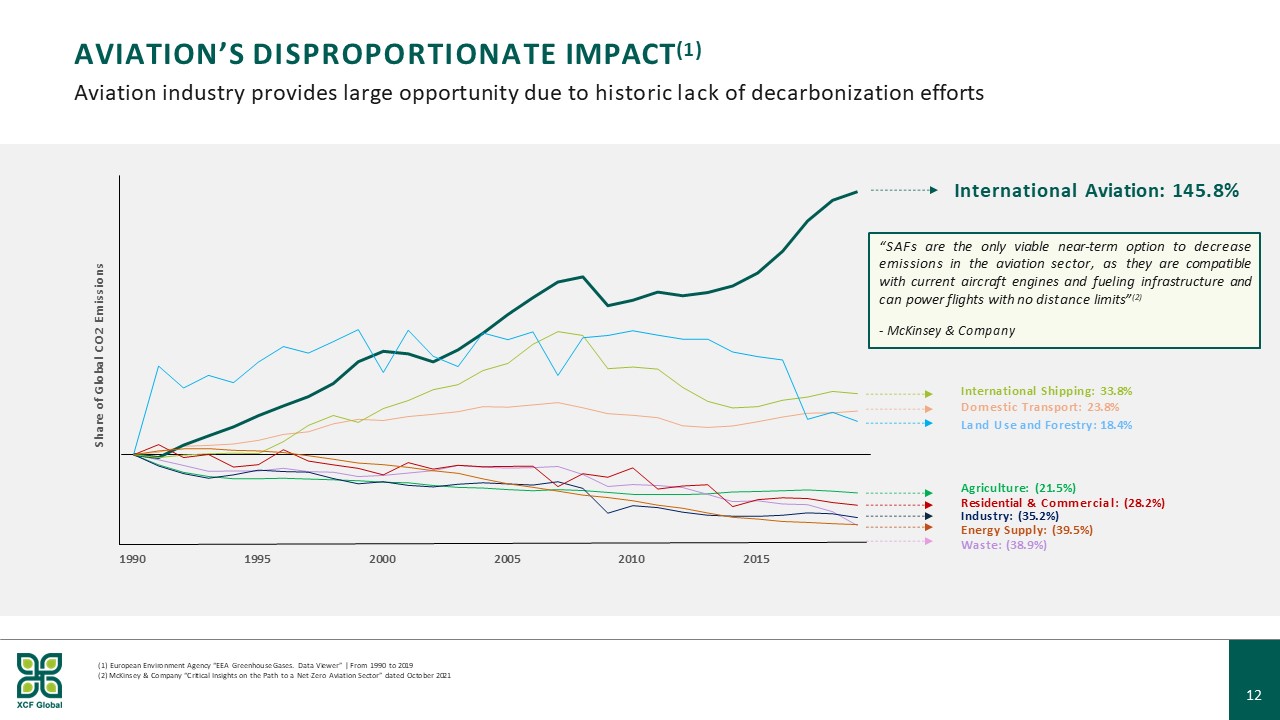

AVIATION’S DISPROPORTIONATE IMPACT(1) Aviation industry provides large opportunity due to

historic lack of decarbonization efforts International Aviation: 145.8% International Shipping: 33.8% Domestic Transport: 23.8% Land Use and Forestry: 18.4% Agriculture: (21.5%) Residential & Commercial: (28.2%) Industry:

(35.2%) Energy Supply: (39.5%) Waste: (38.9%) 1990 (2) McKinsey & Company “Critical Insights on the Path to a Net-Zero Aviation Sector” dated October 2021 12 1995 2000 2005 2010 2015 Share of Global CO2 Emissions (1) European

Environment Agency “EEA Greenhouse Gases. Data Viewer” | From 1990 to 2019 “SAFs are the only viable near-term option to decrease emissions in the aviation sector, as they are compatible with current aircraft engines and fueling infrastructure

and can power flights with no distance limits”(2) - McKinsey & Company

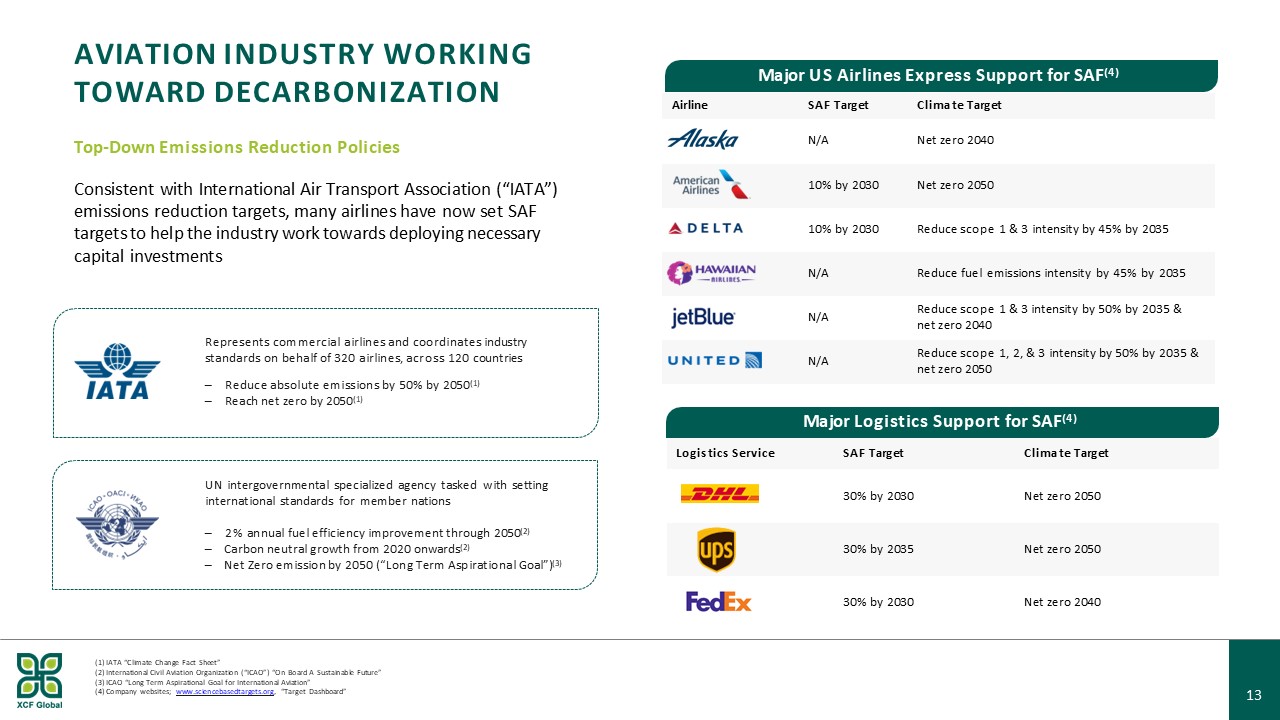

13 AVIATION INDUSTRY WORKING TOWARD DECARBONIZATION IATA “Climate Change Fact

Sheet” International Civil Aviation Organization (“ICAO”) “On Board A Sustainable Future” ICAO “Long Term Aspirational Goal for International Aviation” Company websites; www.sciencebasedtargets.org, “Target Dashboard” Airline SAF

Target Climate Target N/A Net zero 2040 10% by 2030 Net zero 2050 10% by 2030 Reduce scope 1 & 3 intensity by 45% by 2035 N/A Reduce fuel emissions intensity by 45% by 2035 N/A Reduce scope 1 & 3 intensity by 50% by 2035

& net zero 2040 N/A Reduce scope 1, 2, & 3 intensity by 50% by 2035 & net zero 2050 Major US Airlines Express Support for SAF(4) Top-Down Emissions Reduction Policies Consistent with International Air Transport Association

(“IATA”) emissions reduction targets, many airlines have now set SAF targets to help the industry work towards deploying necessary capital investments Represents commercial airlines and coordinates industry standards on behalf of 320

airlines, across 120 countries ─ Reduce absolute emissions by 50% by 2050(1) ─ Reach net zero by 2050(1) UN intergovernmental specialized agency tasked with setting international standards for member nations ─ 2% annual fuel efficiency

improvement through 2050(2) ─ Carbon neutral growth from 2020 onwards(2) ─ Net Zero emission by 2050 (“Long Term Aspirational Goal”)(3) Logistics Service SAF Target Climate Target 30% by 2030 Net zero 2050 30% by 2035 Net zero

2050 30% by 2030 Net zero 2040 Major Logistics Support for SAF(4)

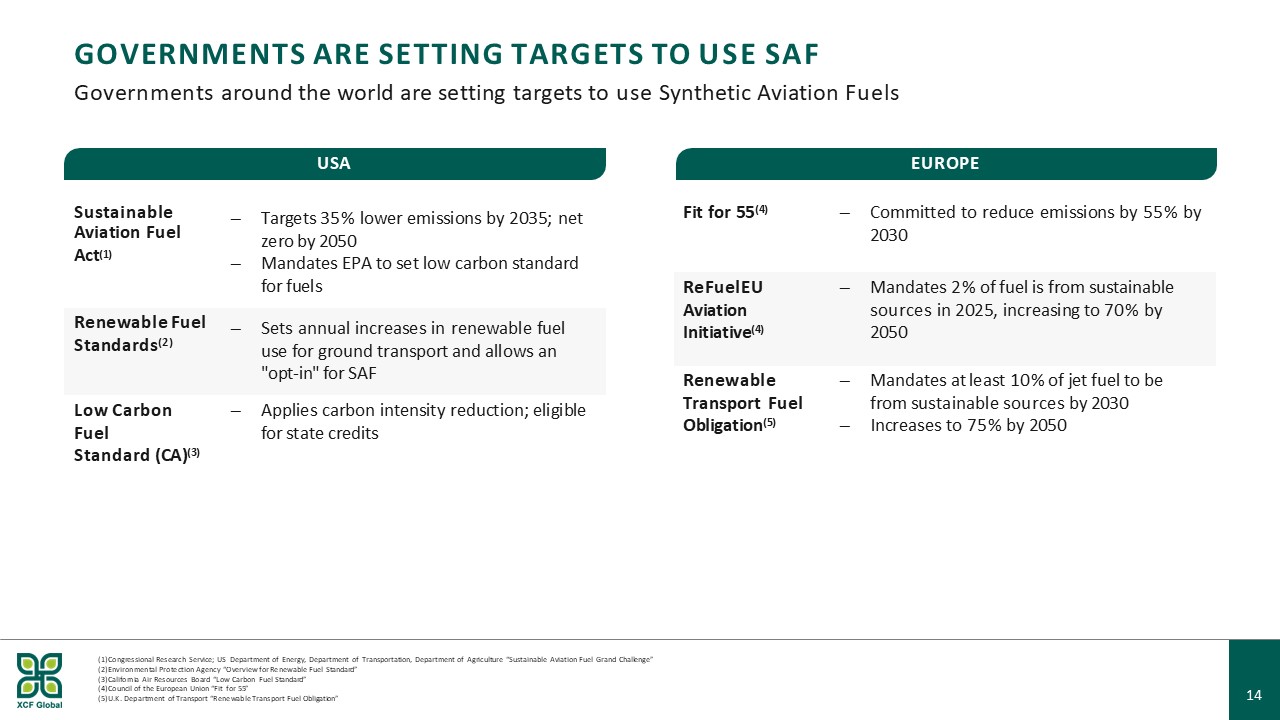

14 GOVERNMENTS ARE SETTING TARGETS TO USE SAF Governments around the world are setting

targets to use Synthetic Aviation Fuels Sustainable Aviation Fuel Act(1) ─ Targets 35% lower emissions by 2035; net zero by 2050 ─ Mandates EPA to set low carbon standard for fuels Renewable Fuel Standards(2) ─ Sets annual increases in

renewable fuel use for ground transport and allows an "opt-in" for SAF Low Carbon Fuel Standard (CA)(3) ─ Applies carbon intensity reduction; eligible for state credits Fit for 55(4) ─ Committed to reduce emissions by 55%

by 2030 ReFuelEU Aviation Initiative(4) ─ Mandates 2% of fuel is from sustainable sources in 2025, increasing to 70% by 2050 Renewable Transport Fuel Obligation(5) ─ Mandates at least 10% of jet fuel to be from sustainable sources by

2030 ─ Increases to 75% by 2050 USA EUROPE Congressional Research Service; US Department of Energy, Department of Transportation, Department of Agriculture “Sustainable Aviation Fuel Grand Challenge” Environmental Protection Agency

“Overview for Renewable Fuel Standard” California Air Resources Board “Low Carbon Fuel Standard” Council of the European Union “Fit for 55” U.K. Department of Transport “Renewable Transport Fuel Obligation”

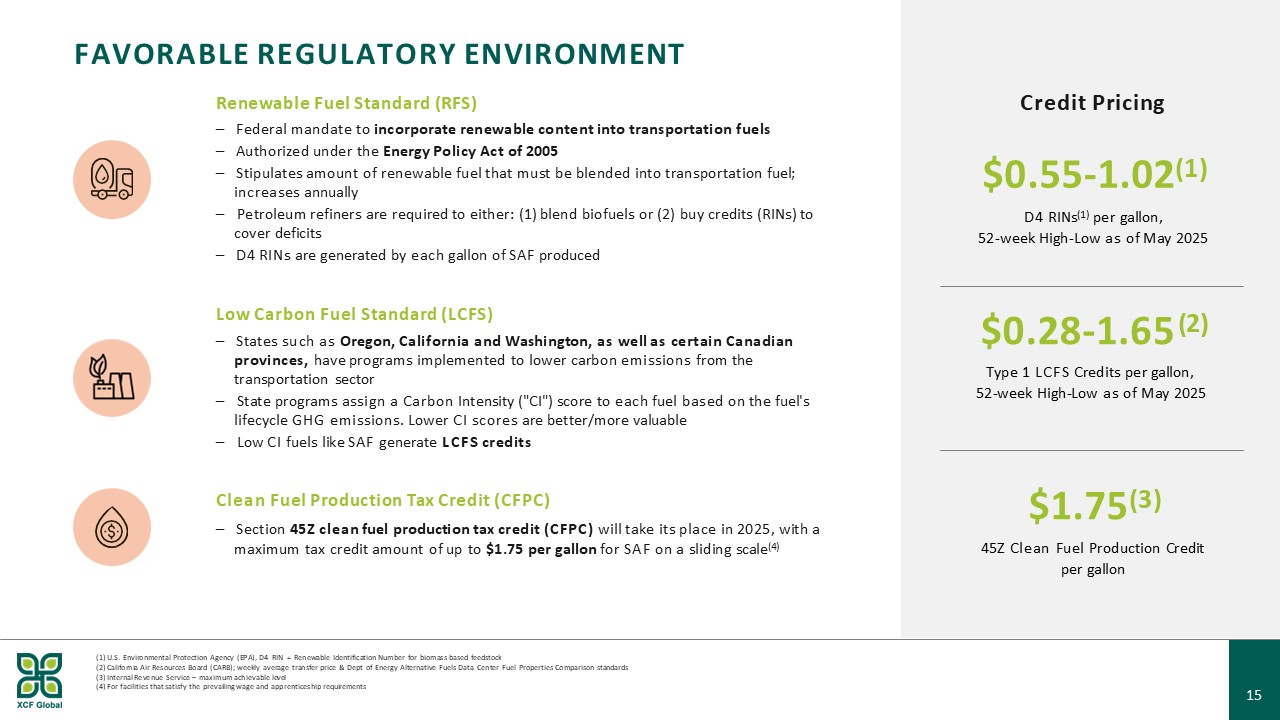

U.S. Environmental Protection Agency (EPA), D4 RIN = Renewable Identification Number for

biomass-based feedstock California Air Resources Board (CARB); weekly average transfer price & Dept of Energy Alternative Fuels Data Center Fuel Properties Comparison standards Internal Revenue Service – maximum achievable level For

facilities that satisfy the prevailing wage and apprenticeship requirements Credit Pricing $0.28-1.65 (2) Type 1 LCFS Credits per gallon, 52-week High-Low as of May 2025 $0.55-1.02(1) D4 RINs(1) per gallon, 52-week High-Low as of May

2025 FAVORABLE REGULATORY ENVIRONMENT Renewable Fuel Standard (RFS) ─ Federal mandate to incorporate renewable content into transportation fuels ─ Authorized under the Energy Policy Act of 2005 ─ Stipulates amount of renewable fuel that

must be blended into transportation fuel; increases annually ─ Petroleum refiners are required to either: (1) blend biofuels or (2) buy credits (RINs) to cover deficits ─ D4 RINs are generated by each gallon of SAF produced Low Carbon Fuel

Standard (LCFS) ─ States such as Oregon, California and Washington, as well as certain Canadian provinces, have programs implemented to lower carbon emissions from the transportation sector ─ State programs assign a Carbon Intensity ("CI")

score to each fuel based on the fuel's lifecycle GHG emissions. Lower CI scores are better/more valuable ─ Low CI fuels like SAF generate LCFS credits 15 Clean Fuel Production Tax Credit (CFPC) ─ Section 45Z clean fuel production tax credit

(CFPC) will take its place in 2025, with a maximum tax credit amount of up to $1.75 per gallon for SAF on a sliding scale(4) $1.75(3) 45Z Clean Fuel Production Credit per gallon

Company Overview

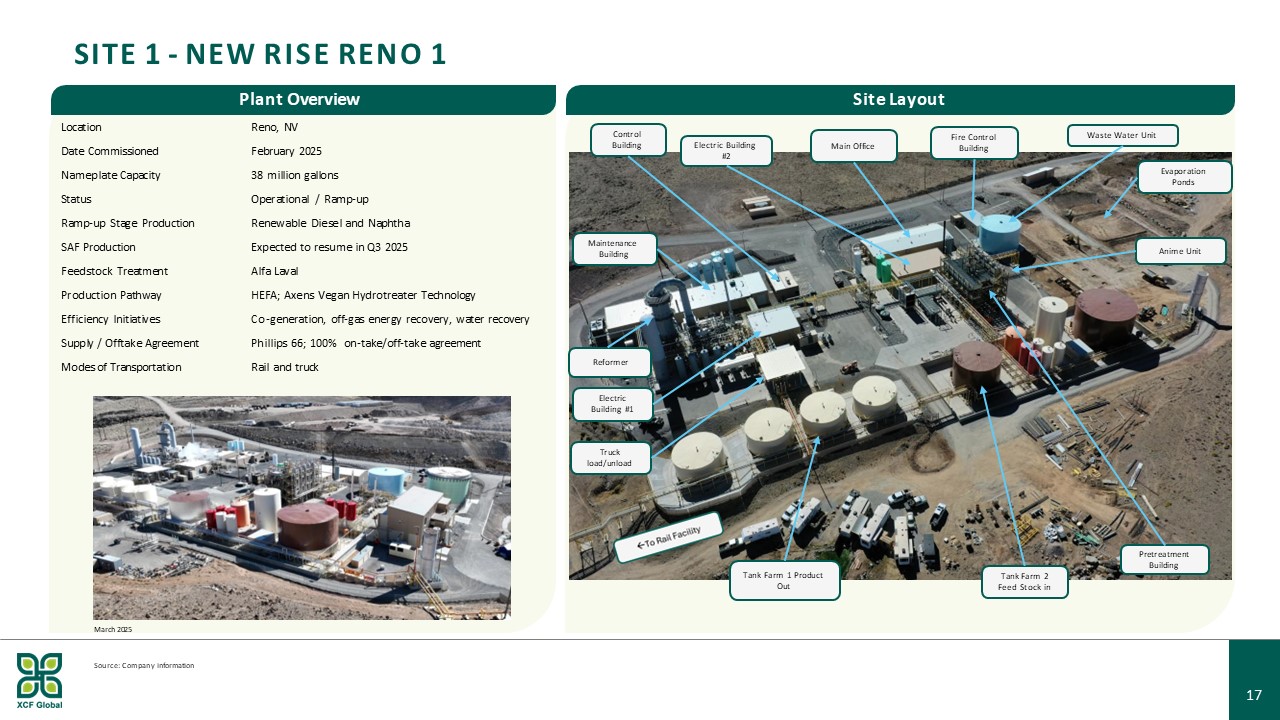

SITE 1 - NEW RISE RENO 1 Plant Overview Source: Company information Pretreatment

Building Truck load/unload Maintenance Building Evaporation Ponds Main Office Fire Control Building Electric Building #2 Control Building Reformer Electric Building #1 Tank Farm 2 Feed Stock in Anime Unit Waste Water Unit Tank

Farm 1 Product Out Site Layout Location Reno, NV Date Commissioned February 2025 Nameplate Capacity 38 million gallons Status Operational / Ramp-up Ramp-up Stage Production Renewable Diesel and Naphtha SAF Production Expected to

resume in Q3 2025 Feedstock Treatment Alfa Laval Production Pathway HEFA; Axens Vegan Hydrotreater Technology Efficiency Initiatives Co-generation, off-gas energy recovery, water recovery Supply / Offtake Agreement Phillips 66; 100%

on-take/off-take agreement Modes of Transportation Rail and truck March 2025 17

COMBINE ONSITE FEEDSTOCK PRETREATMENT WITH HEFA TECHNOLOGY XCF facilities employ a

two-stage process to production, adding a pretreatment stage prior to hydrotreatment Hydroprocessed Esters and Fatty Acids (“HEFA”) HEFA technology involves converting fats, oils and greases (FOGs) into a high-quality, renewable aviation

fuel through hydroprocessing Renewable Source: HEFA fuels are derived from sustainable feedstocks such as used cooking oil, animal fats and plant oils Compatibility: HEFA fuels can be used as drop-in replacements for conventional jet fuels

without modification to existing aircraft engines and fueling infrastructure Diversification of Feedstocks: HEFA technology allows for the use of a variety of feedstocks which promotes resource efficiency Pretreatment of

Feedstocks Pretreating feedstock onsite allows XCF facilities to be feedstock agnostic, mitigates supply chain risk, and facilitates longer catalyst life Pretreatment stage is already in place at New Rise and is expected to be installed at

the Wilson, NC and Ft. Myers, FL sites 17

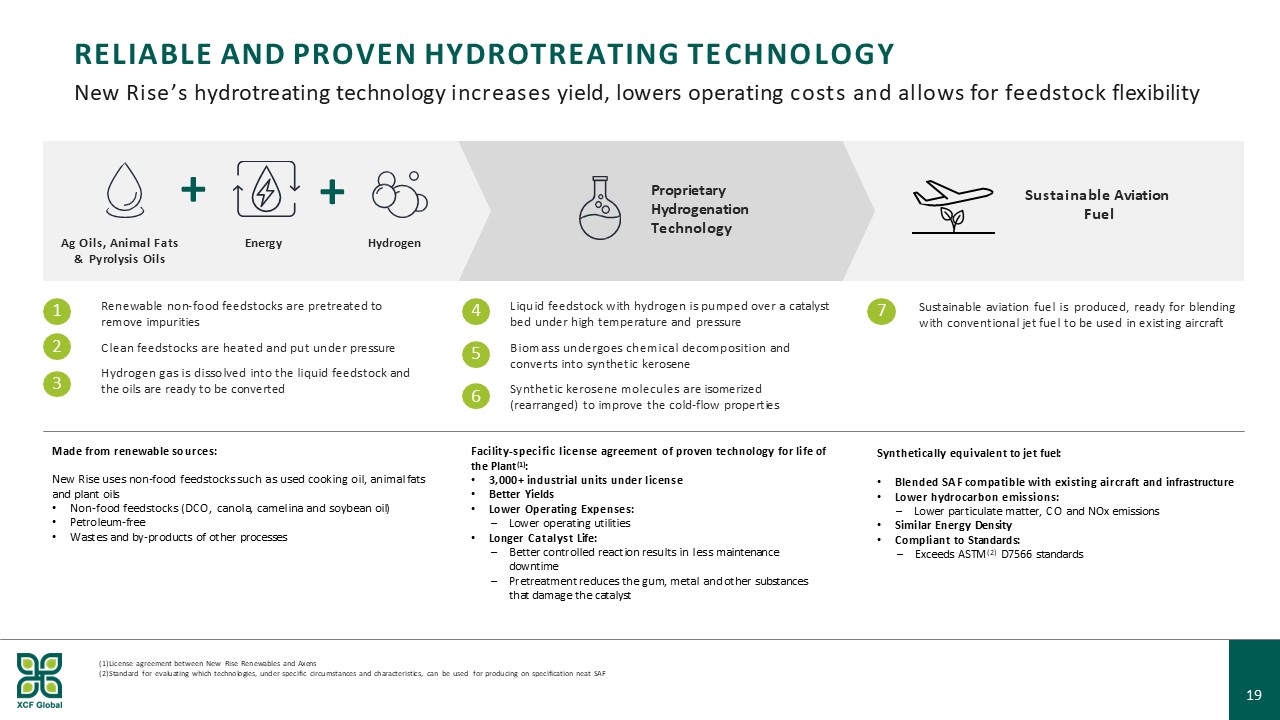

RELIABLE AND PROVEN HYDROTREATING TECHNOLOGY New Rise’s hydrotreating technology

increases yield, lowers operating costs and allows for feedstock flexibility License agreement between New Rise Renewables and Axens Standard for evaluating which technologies, under specific circumstances and characteristics, can be used for

producing on specification neat SAF Made from renewable sources: New Rise uses non-food feedstocks such as used cooking oil, animal fats and plant oils Non-food feedstocks (DCO, canola, camelina and soybean oil) Petroleum-free Wastes and

by-products of other processes Ag Oils, Animal Fats & Pyrolysis Oils Energy Hydrogen Renewable non-food feedstocks are pretreated to remove impurities Clean feedstocks are heated and put under pressure Hydrogen gas is dissolved into

the liquid feedstock and the oils are ready to be converted Proprietary Hydrogenation Technology Sustainable Aviation Fuel + + 1 2 3 Liquid feedstock with hydrogen is pumped over a catalyst bed under high temperature and

pressure Biomass undergoes chemical decomposition and converts into synthetic kerosene Synthetic kerosene molecules are isomerized (rearranged) to improve the cold-flow properties Sustainable aviation fuel is produced, ready for

blending with conventional jet fuel to be used in existing aircraft 4 5 6 7 Facility-specific license agreement of proven technology for life of the Plant(1): 3,000+ industrial units under license Better Yields Lower Operating

Expenses: Lower operating utilities Longer Catalyst Life: Better controlled reaction results in less maintenance downtime Pretreatment reduces the gum, metal and other substances that damage the catalyst 17 Synthetically equivalent to

jet fuel: Blended SAF compatible with existing aircraft and infrastructure Lower hydrocarbon emissions: Lower particulate matter, CO and NOx emissions Similar Energy Density Compliant to Standards: Exceeds ASTM(2) D7566 standards

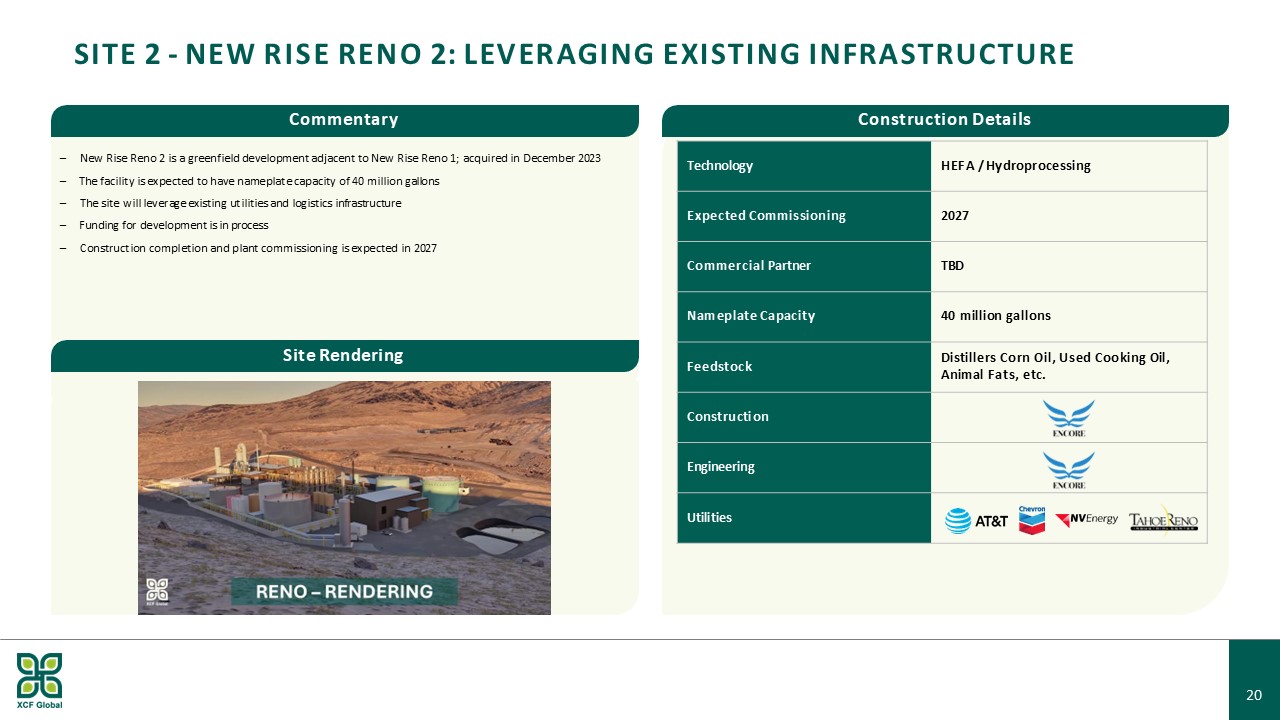

─ New Rise Reno 2 is a greenfield development adjacent to New Rise Reno 1; acquired in

December 2023 ─ The facility is expected to have nameplate capacity of 40 million gallons ─ The site will leverage existing utilities and logistics infrastructure ─ Funding for development is in process ─ Construction completion and plant

commissioning is expected in 2027 Construction Details SITE 2 - NEW RISE RENO 2: LEVERAGING EXISTING INFRASTRUCTURE Technology HEFA / Hydroprocessing Expected Commissioning 2027 Commercial Partner TBD Nameplate Capacity 40 million

gallons Feedstock Distillers Corn Oil, Used Cooking Oil, Animal Fats, etc. Construction Engineering Utilities Commentary Site Rendering 17

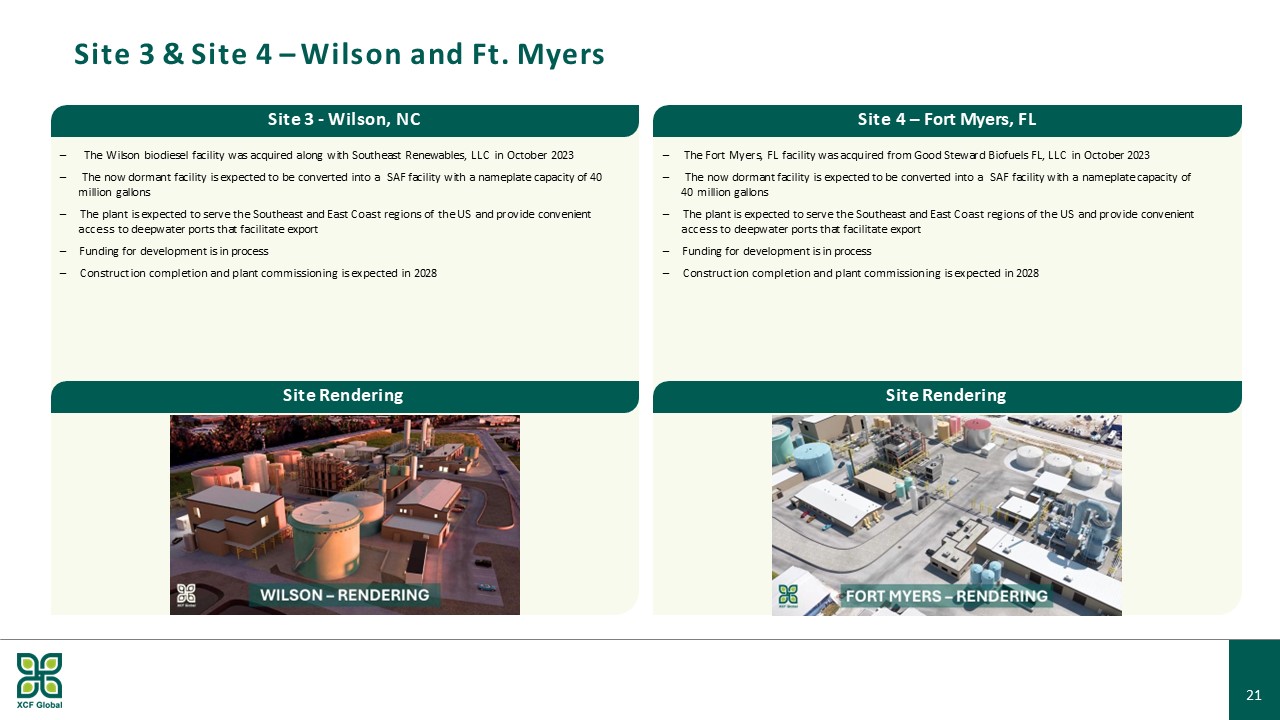

Site Rendering Site 3 - Wilson, NC ─ The Wilson biodiesel facility was acquired along

with Southeast Renewables, LLC in October 2023 ─ The now dormant facility is expected to be converted into a SAF facility with a nameplate capacity of 40 million gallons ─ The plant is expected to serve the Southeast and East Coast regions of

the US and provide convenient access to deepwater ports that facilitate export ─ Funding for development is in process ─ Construction completion and plant commissioning is expected in 2028 Site 3 & Site 4 – Wilson and Ft. Myers Site

Rendering Site 4 – Fort Myers, FL ─ The Fort Myers, FL facility was acquired from Good Steward Biofuels FL, LLC in October 2023 ─ The now dormant facility is expected to be converted into a SAF facility with a nameplate capacity of 40

million gallons ─ The plant is expected to serve the Southeast and East Coast regions of the US and provide convenient access to deepwater ports that facilitate export ─ Funding for development is in process ─ Construction completion and

plant commissioning is expected in 2028 17

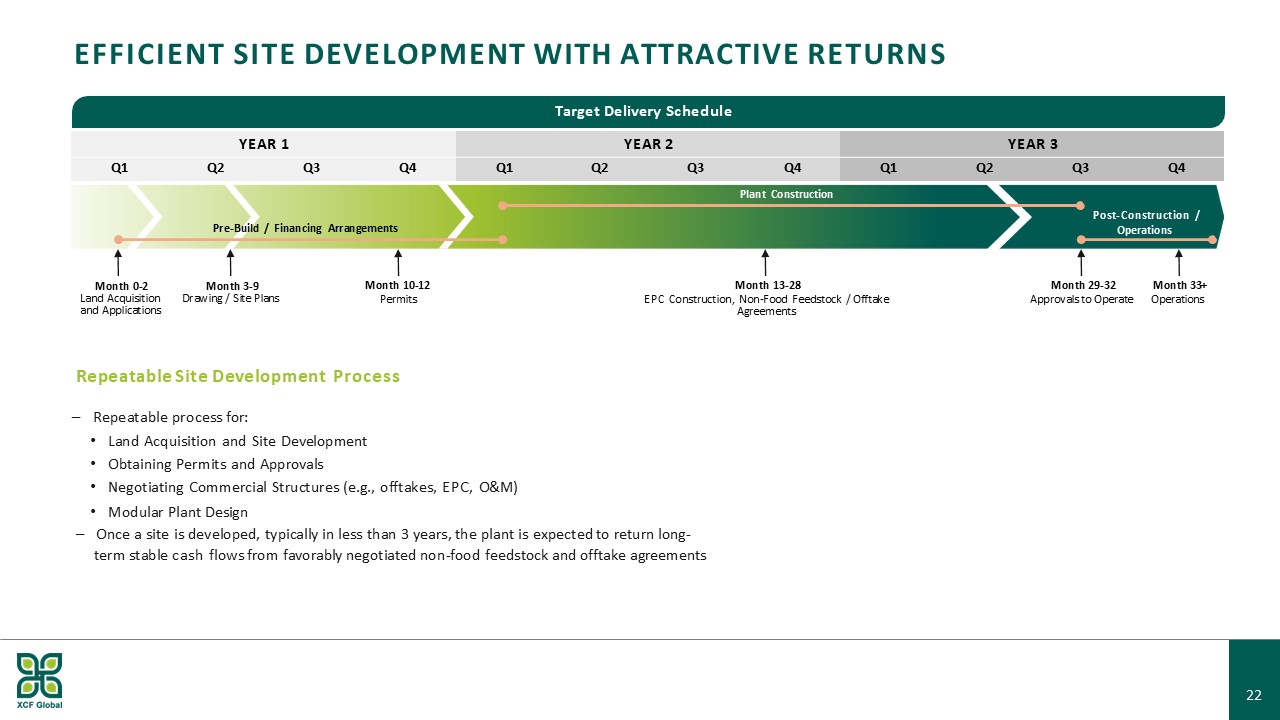

EFFICIENT SITE DEVELOPMENT WITH ATTRACTIVE RETURNS Repeatable Site Development Process ─

Repeatable process for: Land Acquisition and Site Development Obtaining Permits and Approvals Negotiating Commercial Structures (e.g., offtakes, EPC, O&M) Modular Plant Design ─ Once a site is developed, typically in less than 3 years,

the plant is expected to return long- term stable cash flows from favorably negotiated non-food feedstock and offtake agreements YEAR 1 YEAR 2 YEAR 3 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Month 0-2 Month 3-9 Land Acquisition

Drawing / Site Plans and Applications Month 33+ Operations Month 10-12 Permits Month 29-32 Approvals to Operate Month 13-28 EPC Construction, Non-Food Feedstock / Offtake Agreements Pre-Build / Financing Arrangements Plant

Construction Post-Construction / Operations Target Delivery Schedule 17

POWERED BY XCF - INTERNATIONAL GROWTH STRATEGY Leverage XCF's modular, patent-pending

facility design, layout, and configuration ─ State-of-the-art sites ─ Operational blueprint: Enables efficient deployment Lowers capital intensity Increase scalability across borders Partnership model for rapid deployment, capital

efficiency, and local market adaptability ─ Structured to provide regional partners with access to its integrated SAF platform through licensing arrangements ─ XCF retains intellectual property ─ Long-term incentives through equity

and royalty-based economics Global expansion strategy designed to meet growing SAF demand ─ Memorandum of Understanding signed with Continual Renewable Industries (Australia) in June 2025 to utilize XCF’s platform for developing the

Australian market ─ Licensing agreement shortens development timelines and lowers cost ─ “Copy and paste” expansion style allows XCF to take advantage of under-served markets flexibly and rapidly ~ Equity interests for zero capital deployed

~ 17

MULTIPLE LEVERS FOR CONTINUED GROWTH OPERATING BASE EXPANSION Identify, acquire and

convert additional sites into XCF SAF production facilities using XCF’s Nevada site as a design blueprint DECARBONIZATION SOLUTIONS Carbon capture, utilization and storage could decarbonize our platform and lead to a lower Carbon Intensity

(CI) score OTHER RENEWABLE FUELS Expansion into other products such as marine biofuels, biogas and RFNBOs (Renewable Fuels of Non-Biological Origin) NEAR-TERM LONG-TERM FEEDSTOCK PROCUREMENT AND SUPPLY CHAIN OPTIMIZATION In conversations

to form a joint venture to secure long-term feedstock agreements EXISTING PIPELINE BUILDOUT Existing owned and leased sites expected to come online 2027-2028 17

Logistics & Feedstocks Overview

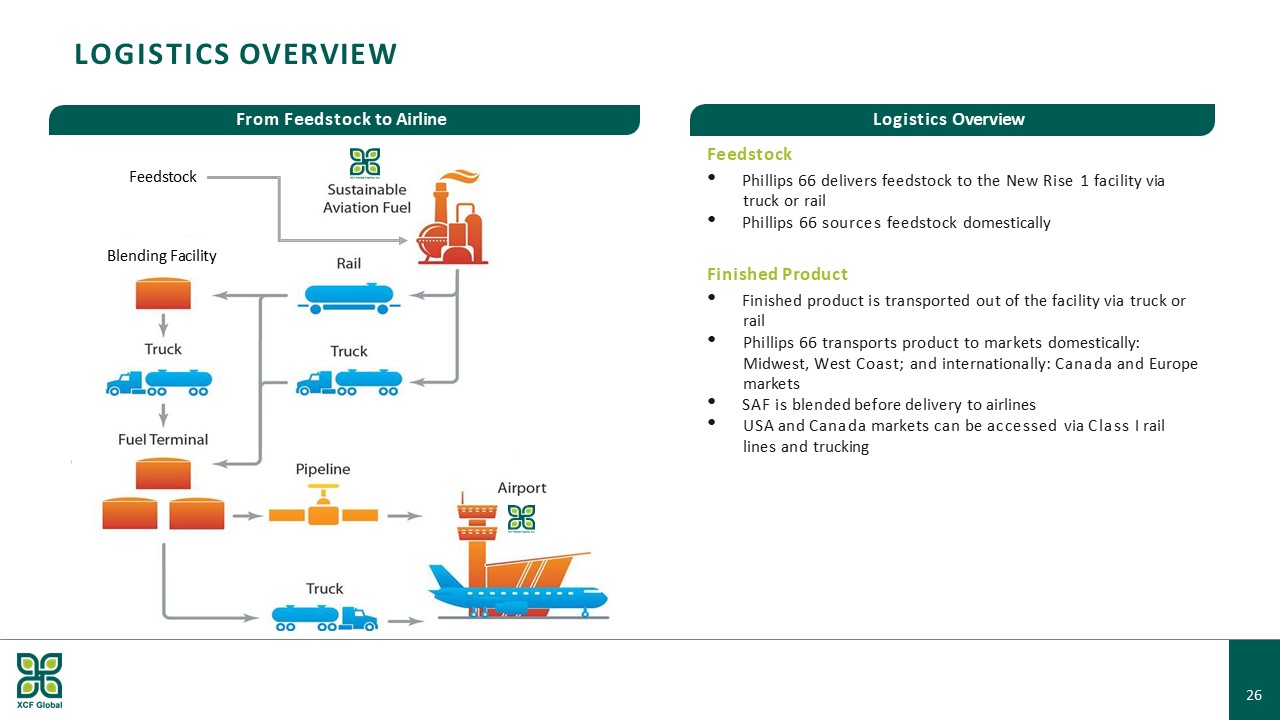

From Feedstock to Airline Logistics Overview LOGISTICS OVERVIEW truck or

rail Feedstock Phillips 66 delivers feedstock to the New Rise 1 facility via Phillips 66 sources feedstock domestically rail Finished Product Finished product is transported out of the facility via truck or Phillips 66 transports product

to markets domestically: Midwest, West Coast; and internationally: Canada and Europe markets SAF is blended before delivery to airlines USA and Canada markets can be accessed via Class I rail lines and trucking Feedstock Blending

Facility 26

Supply & Offtake Agreement 15-year contract term Well-known Fortune 50

company Stable feedstock supply Visibility on offtake WITH WORLD-CLASS PARTNER XCF has partnered with Phillips 66, an established Fortune 50 company who will supply 100% of the non-food feedstock and is the priority buyer for SAF and

renewable diesel produced at New Rise Reno 1 for 15 years A small fee will be paid to access Partner’s working capital used in obtaining non-food feedstock supply. This minimizes financial impact from changesin working capital cycle Phillips

66 will be purchasing at a price tied to SAF prices in California LONG-TERM AGREEMENT Phillips 66 is a Leading 26 Integrated Downstream Energy Provider World-Class Partnership Phillips 66, New Rise’s feedstock and prioritized offtake

partner, is a top global energy company with brand recognition, mature infrastructure and established markets Stable Non-Food Feedstock Supply Distiller’s corn oil is a by-product of Ethanol production. Phillips 66 works with several Ethanol

plants, where it can source non-food feedstock supplies (distiller’s corn oil and other vegetable oils) Reduced Working Capital Requirements Access to feedstock and Phillips 66’s balance sheet(1) to source, procure and transport agricultural

waste; Phillips 66 also coordinates logistics with preferential pricing Visibility on Offtake(2) Long term agreement for offtake of renewable fuels Elimination of Offtake Transportation Investments Phillips 66 is responsible for the costs

and logistics of offtake transportation, storage and terminals

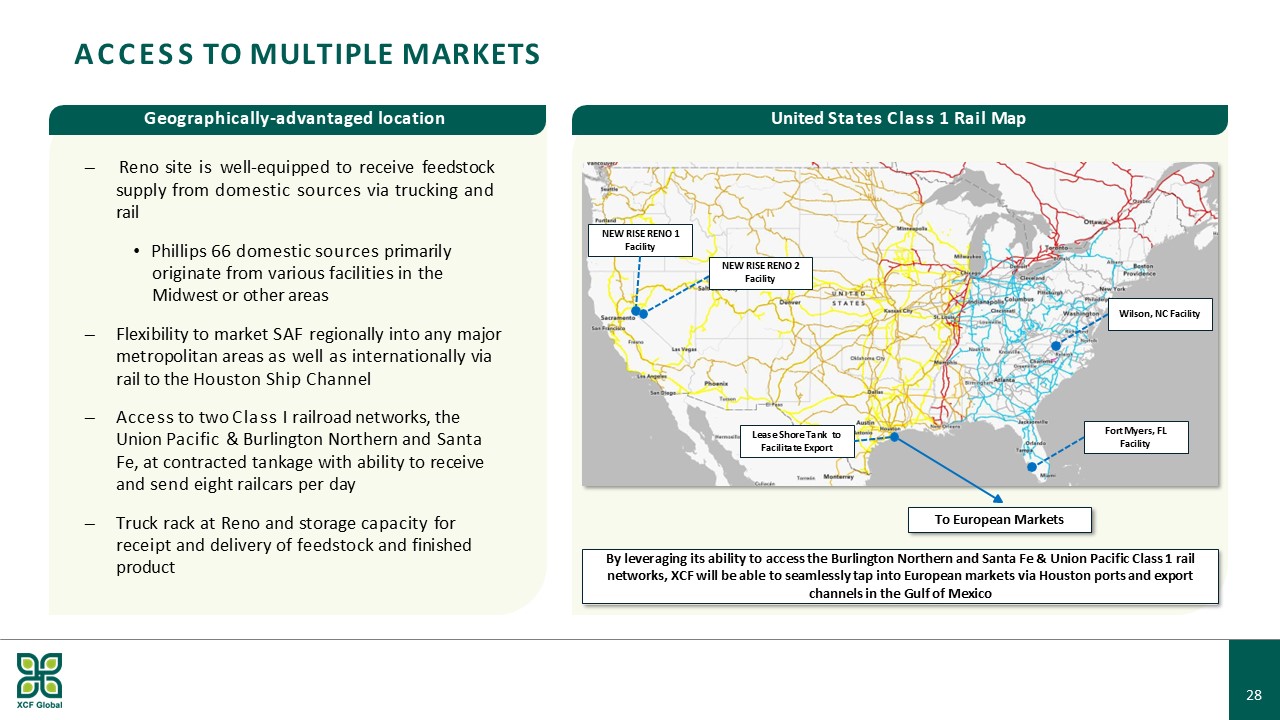

ACCESS TO MULTIPLE MARKETS United States Class 1 Rail Map Geographically-advantaged

location ─ Reno site is well-equipped to receive feedstock supply from domestic sources via trucking and rail Phillips 66 domestic sources primarily originate from various facilities in the Midwest or other areas ─ Flexibility to market SAF

regionally into any major metropolitan areas as well as internationally via rail to the Houston Ship Channel ─ Access to two Class I railroad networks, the Union Pacific & Burlington Northern and Santa Fe, at contracted tankage with

ability to receive and send eight railcars per day ─ Truck rack at Reno and storage capacity for receipt and delivery of feedstock and finished product By leveraging its ability to access the Burlington Northern and Santa Fe & Union

Pacific Class 1 rail networks, XCF will be able to seamlessly tap into European markets via Houston ports and export channels in the Gulf of Mexico NEW RISE RENO 1 Facility To European Markets NEW RISE RENO 2 Facility Fort Myers, FL

Facility Wilson, NC Facility Lease Shore Tank to Facilitate Export 26

Illustrative SAF Margin Overview

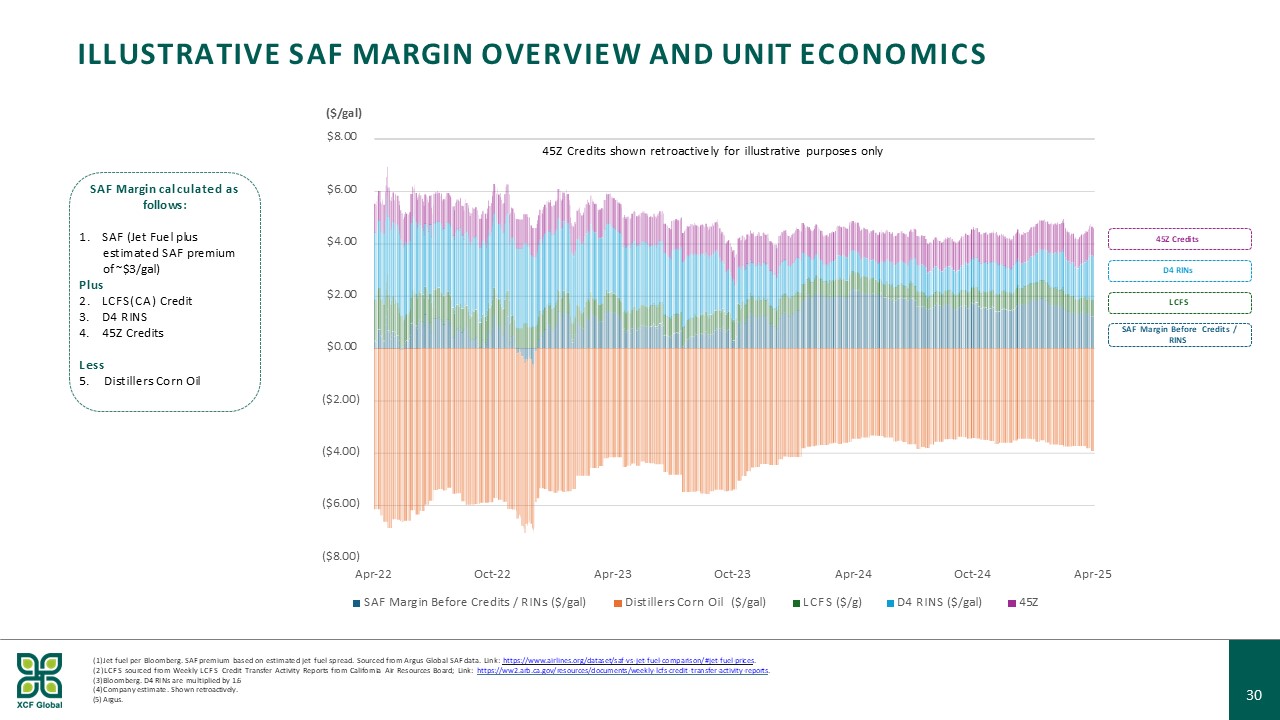

30 ILLUSTRATIVE SAF MARGIN OVERVIEW AND UNIT ECONOMICS 45Z Credits D4 RINs SAF Margin

calculated as follows: SAF (Jet Fuel plus estimated SAF premium of ~$3/gal) Plus LCFS(CA) Credit D4 RINS 45Z Credits Less 5. Distillers Corn Oil Jet fuel per Bloomberg. SAF premium based on estimated jet fuel spread. Sourced from Argus

Global SAF data. Link: https://www.airlines.org/dataset/saf-vs-jet-fuel-comparison/#jet-fuel-prices. LCFS sourced from Weekly LCFS Credit Transfer Activity Reports from California Air Resources Board; Link:

https://ww2.arb.ca.gov/resources/documents/weekly-lcfs-credit-transfer-activity-reports. Bloomberg. D4 RINs are multiplied by 1.6 Company estimate. Shown

retroactively. Argus. ($2.00) ($4.00) ($6.00) $0.00 $2.00 $4.00 $6.00 ($/gal) $8.00 Apr-24 LCFS ($/g) Oct-24 D4 RINS ($/gal) Apr-25 ($8.00) Apr-22 Oct-22 SAF Margin Before Credits / RINs ($/gal) Apr-23 Oct-23 Distillers Corn

Oil ($/gal) 45Z LCFS SAF Margin Before Credits / RINS 45Z Credits shown retroactively for illustrative purposes only

THANK YOU.