| Investor Update H YAT T AN D R ELA TE D M A RK S AR E T R AD EM AR KS OF H YAT T C OR POR AT I ON OR I T S A FF I LI A T ES. © 20 25 H YA TT C OR PO RA T IO N . ALL R I GH T S R ES ER VED . H Y A T T Z I V A L O S C A B O S Playa Hotels Acquisition |

| C O N F I D E N T I A L A N D P R O P R I E T A R Y | H y a t t an d r ela t ed m ar k s ar e t r ad em a rk s o f H y at t C o rp or at i on or it s a f f ili at e s . © 20 25 H y at t C o rp or at i on . All ri gh t s re s er v ed. DISCLAIMERS 2 Forward-Looking Statements Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about the Company's plans, strategies, outlook, the proposed Playa acquisition, outcomes of the proposed acquisition, including impact on asset-light earnings mix, our ability to complete the sale of Playa’s owned real estate within targeted timeframes, net leverage and credit ratings expectations, financial performance, prospective or future events and involve known and unknown risks that are difficult to predict. As a result, the Company's actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and the Company's management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; the rate and pace of economic recovery following economic downturns; global supply chain constraints and interruptions, rising costs of construction-related labor and materials, and increases in costs due to inflation or other factors that may not be fully offset by increases in revenues in our business; risks affecting the luxury, resort, and all-inclusive lodging segments; levels of spending in business, leisure, and group segments, as well as consumer confidence; declines in occupancy and average daily rate; limited visibility with respect to future bookings; loss of key personnel; domestic and international political and geopolitical conditions, including political or civil unrest or changes in trade policy; the impact of global tariff policies or regulations; hostilities, or fear of hostilities, including future terrorist attacks, that affect travel; the effects that the announcement or pendency of the planned Playa Hotels Acquisition; inability to obtain required regulatory or government approvals or to obtain such approvals on satisfactory conditions; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive agreement to sell Playa’s real estate; the effects that any termination of the definitive agreement may have on us or our business; failure to successfully complete the planned disposition of Playa’s real estate; legal proceedings that may be instituted related to the planned acquisition; significant and unexpected costs, charges or expenses related to the planned acquisition; travel-related accidents; natural or man-made disasters, weather and climate-related events, such as hurricanes, earthquakes, tsunamis, tornadoes, droughts, floods, wildfires, oil spills, nuclear incidents, and global outbreaks of pandemics or contagious diseases, or fear of such outbreaks; our ability to successfully achieve specified levels of operating profits at hotels that have performance tests or guarantees in favor of our third-party owners; the impact of hotel renovations and redevelopments; risks associated with our capital allocation plans, share repurchase program, and dividend payments, including a reduction in, or elimination or suspension of, repurchase activity or dividend payments; the seasonal and cyclical nature of the real estate and hospitality businesses; changes in distribution arrangements, such as through internet travel intermediaries; changes in the tastes and preferences of our customers; relationships with colleagues and labor unions and changes in labor laws; the financial condition of, and our relationships with, third-party owners, franchisees, and hospitality venture partners; the possible inability of third-party owners, franchisees, or development partners to access the capital necessary to fund current operations or implement our plans for growth; risks associated with potential acquisitions and dispositions and our ability to successfully integrate completed acquisitions with existing operations; failure to successfully complete proposed transactions (including the failure to satisfy closing conditions or obtain required approvals); our ability to maintain effective internal control over financial reporting and disclosure controls and procedures; declines in the value of our real estate assets; unforeseen terminations of our management and hotel services agreements or franchise agreements; changes in federal, state, local, or foreign tax law; increases in interest rates, wages, and other operating costs; foreign exchange rate fluctuations or currency restructurings; risks associated with the introduction of new brand concepts, including lack of acceptance of new brands or innovation; general volatility of the capital markets and our ability to access such markets; changes in the competitive environment in our industry, industry consolidation, and the markets where we operate; our ability to successfully grow the World of Hyatt loyalty program and manage the Unlimited Vacation Club paid membership program; cyber incidents and information technology failures; outcomes of legal or administrative proceedings; and violations of regulations or laws related to our franchising business and licensing businesses and our international operations; and other risks discussed in the Company's filings with the SEC, including our annual reports on Form 10-K and quarterly reports on Form 10-Q, which filings are available from the SEC. All forward-looking statements attributable to the Company or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this presentation. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Non-GAAP Financial Measures This presentation includes references to certain financial measures, each identified with the symbol "†", that are not calculated or presented in accordance with generally accepted accounting principles in the United States ("GAAP"). These non-GAAP financial measures have important limitations and should not be considered in isolation or as a substitute for measures of the Company's financial performance prepared in accordance with GAAP. In addition, these non-GAAP financial measures, as presented, may not be comparable to similarly titled measures of other companies due to varying methods of calculations. During the year ended December 31, 2024, the Company revised its definition of Adjusted EBITDA† to exclude transaction and integration costs and recast prior-period results to provide comparability. Refer to schedule A-6 in the first quarter 2025 earnings release for additional detail. Key Business Metrics This presentation includes references to certain key business metrics used by the Company, each identified with the symbol "◊". |

| PLAYA HOTELS ACQUISITION UPDATE 3 On June 17, 2025, Hyatt completed the acquisition of Playa Hotels & Resorts for $13.50 per share, or approximately $2.6 billion, including approximately $900 million of debt, net of cash On June 29, 2025, Hyatt entered into a definitive agreement to sell the entirety of Playa’s owned real estate portfolio, acquired from Playa on June 17, 2025, for $2.0 billion to Tortuga Resorts ("Tortuga"), a joint venture between KSL Capital Partners, LLC and Rodina Hyatt can achieve an additional $143 million earnout if certain operating thresholds are met The Playa Real Estate Transaction is expected to close before the end of 2025 and is subject to regulatory approval in Mexico and other customary closing conditions Hyatt is retaining $200 million of preferred equity in connection with the Playa Real Estate Transaction Net purchase price for Playa’s asset-light management business is approximately $555 million, net of gross proceeds from asset sales. Hyatt expects to earn $60 - $65 million of Adjusted EBITDA† in 2027 in relation to the acquired Playa assets, representing an implied multiple of 8.5x – 9.5x. The implied multiple would be further improved if the earnout conditions are met. H Y A T T Z I L A R A R O S E H A L L The Company’s outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. |

| DEAL RATIONALE 4 Following the Playa Real Estate Transaction, 13 properties will convert to long-term management agreements Expected to lead to asset-light earnings mix◊ in 2027 of at least 90% Net purchase price of approximately $555 million for Playa's management business Implied multiple of 9–10x 2026 Adjusted EBITDA† and 8.5x - 9.5x stabilized 2027 Adjusted EBITDA† Represents an attractive valuation and is accretive to Hyatt in the first full year STRENGTHENS HYATT'S ASSET-LIGHT EARNINGS ATTRACTIVE VALUATION EXPANDS HYATT'S ALL-INCLUSIVE PLATFORM RETAINS INVESTMENT GRADE PROFILE Hyatt’s Inclusive Collection grows by approximately 2,200 rooms, adding high-quality resorts in iconic locations and strategically important markets, expanding opportunities for World of Hyatt members Entire portfolio will benefit from Hyatt’s all-inclusive platform: ALG Vacations and Unlimited Vacation Club Expects to use proceeds from asset sales to repay the delayed draw term loan used to fund a portion of the Playa acquisition and expects pro forma net leverage to be consistent with thresholds necessary to maintain its investment-grade credit profile H Y A T T Z I V A & H Y A T T Z I L A R A C A P C A N A The Company’s outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. |

| PLAYA HOTELS ACQUISITION EXPECTED TO CREATE SIGNIFICANT VALUE FOR SHAREHOLDERS 5 H Y A T T Z I V A C A N C U N $60M $65M $65M $70M $25M $30M $35M $40M $45M $50M $55M $60M $65M $70M $75M 2026 2027 INCREMENTAL GROSS FEES (Ne t o f f ranc hi s e fee s Hy at t e arne d p re -tra ns ac ti o n) Converting Hyatt Ziva and Hyatt Zilara franchise agreements to management agreements, adding non-Hyatt branded properties, and integrating Hyatt’s existing distribution channels is expected to add significant incremental value. INCREMENTAL ADJUSTED EBITDA† (Ne t o f f ranc hi s e fee s Hy at t e arne d p re -tra ns ac ti o n; i nc l us i v e o f i n cre me nta l Di s tri but i on earn in gs a nd G& A ) $55M $60M $60M $65M 2026 2027 Implied Adjusted EBITDA† Multiple 10x – 9x 9.5x – 8.5x Adjusted EBITDA† multiple calculated based on net purchase price of approximately $555 million Low Case High Case The Company’s outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. |

| SUMMARY OF THE PLAYA REAL ESTATE TRANSACTION 6 H Y A T T Z I V A P U E R T O V A L L A R T A Hyatt entered into a definitive agreement on June 29, 2025, to sell Playa’s portfolio of 15 owned assets to Tortuga for $2.0 billion • Sales price represents a multiple of approximately 8x 2024 Adjusted EBITDA† , after normalizing for Hyatt management fees and reimbursed costs • Hyatt can achieve a $143 million earnout if certain operating thresholds are met • Hyatt and Tortuga will enter into 50-year management agreements for 13 of 15 Playa’s owned assets with attractive terms in-line with Hyatt’s existing all-inclusive fee structure • The remaining two assets will be managed under separate contractual arrangements • Hyatt is retaining $200 million of preferred equity • Tortuga expects to invest CapEx in selected properties • Proceeds from the transaction will be used to pay down Delayed Draw Term Loan |

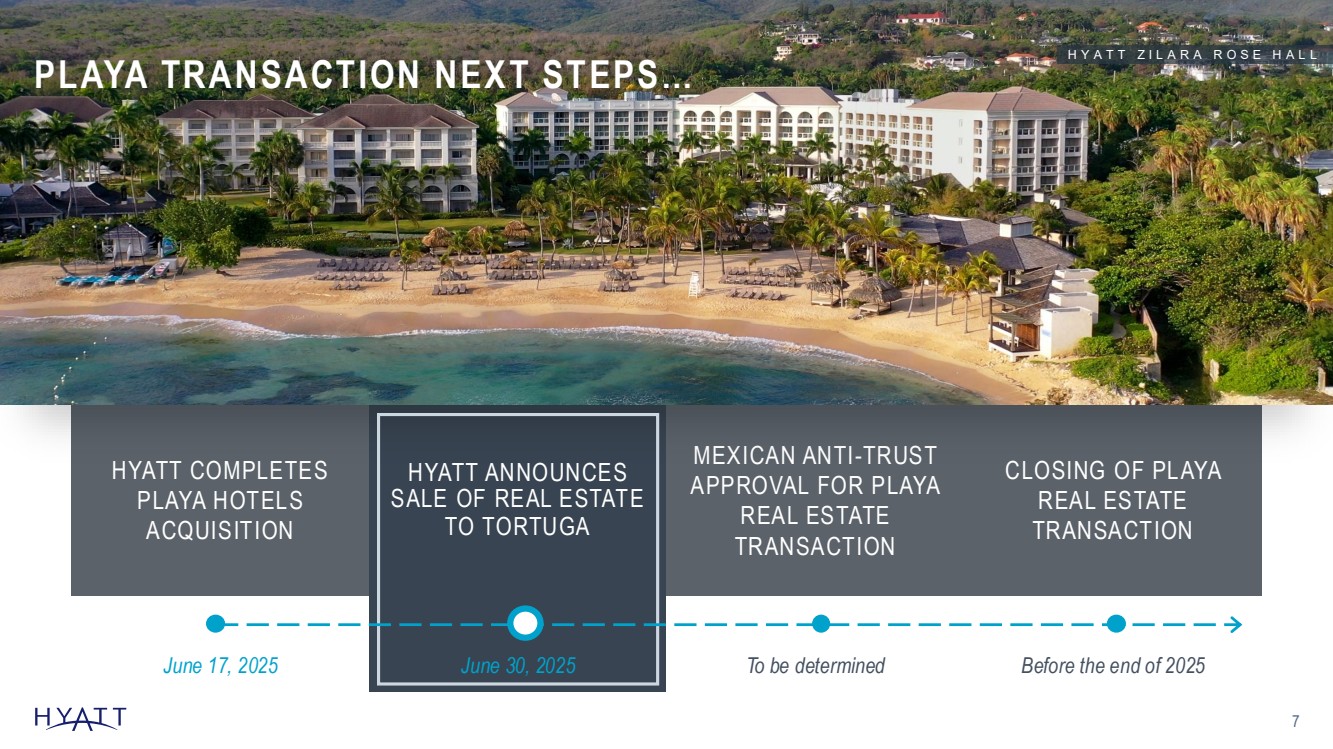

| HYATT COMPLETES PLAYA HOTELS ACQUISITION HYATT ANNOUNCES SALE OF REAL ESTATE TO TORTUGA MEXICAN ANTI-TRUST APPROVAL FOR PLAYA REAL ESTATE TRANSACTION CLOSING OF PLAYA REAL ESTATE TRANSACTION June 17, 2025 June 30, 2025 To be determined Before the end of 2025 PLAYA TRANSACTION NEXT STEPS… 7 H Y A T T Z I L A R A R O S E H A L L |

| Hy at t a nd rel at ed mark s a re t rade ma rks of Hy att Corp orat i on or i ts aff il i at es . © 2 025 Hy at t Co rpora ti on . A l l ri ght s res erv e d. APPENDIX |

| C O N F I D E N T I A L A N D P R O P R I E T A R Y | H y a t t an d r ela t ed m ar k s ar e t r ad em a rk s o f H y at t C o rp or at i on or it s a f f ili at e s . © 20 25 H y at t C o rp or at i on . All ri gh t s re s er v ed. DEFINITIONS 9 Adjusted Earnings Before Interest Expense, Taxes, Depreciation, and Amortization ("Adjusted EBITDA"): We use the term Adjusted EBITDA throughout this Investor Presentation. Adjusted EBITDA, as we define it, is a non-GAAP measure. We define consolidated Adjusted EBITDA as net income (loss) attributable to Hyatt Hotels Corporation plus net income (loss) attributable to noncontrolling interests and our pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA, primarily based on our ownership percentage of each owned and leased venture, adjusted to exclude the following items: • management and hotel services agreement and franchise agreement assets (key money assets) amortization and performance cure payments, which constitute payments to customers (Contra revenue); • revenues for reimbursed costs; • reimbursed costs that we intend to recover over the long term; • stock-based compensation expense; • transaction and integration costs; • depreciation and amortization; • equity earnings (losses) from unconsolidated hospitality ventures; • interest expense; • gains (losses) on sales of real estate and other; • asset impairments; • other income (loss), net; and • benefit (provision) for income taxes. We calculate consolidated Adjusted EBITDA by adding the Adjusted EBITDA of each of our reportable segments and eliminations to unallocated overhead expenses. Our board of directors and executive management team focus on Adjusted EBITDA as one of the key performance and compensation measures both on a segment and on a consolidated basis. Adjusted EBITDA assists us in comparing our performance over various reporting periods on a consistent basis because it removes from our operating results the impact of items that do not reflect our core operations both on a segment and on a consolidated basis. Our President and Chief Executive Officer, who is our chief operating decision maker, also evaluates the performance of each of our reportable segments and determines how to allocate resources to those segments, in part, by assessing the Adjusted EBITDA of each segment. In addition, the compensation committee of our board of directors determines the annual variable compensation for certain members of our management based in part on consolidated Adjusted EBITDA, segment Adjusted EBITDA, or some combination of both. We believe Adjusted EBITDA is useful to investors because it provides investors with the same information that we use internally for purposes of assessing our operating performance and making compensation decisions and facilitates our comparison of results with our prior period and forecasted results as well as our industry and competitors. Adjusted EBITDA excludes certain items that can vary widely across different industries and among companies within the same industry, including interest expense and benefit or provision for income taxes, which are dependent on company specifics, including capital structure, credit ratings, tax policies, and jurisdictions in which they operate; depreciation and amortization, which are dependent on company policies including how the assets are utilized as well as the lives assigned to the assets; Contra revenue, which is dependent on company policies and strategic decisions regarding payments to hotel owners; and stock-based compensation expense, which varies among companies as a result of different compensation plans companies have adopted. We exclude revenues for reimbursed costs and reimbursed costs which relate to the reimbursement of payroll costs and for system-wide services and programs that we operate for the benefit of our hotel owners as contractually we do not provide services or operate the related programs to generate a profit over the terms of the respective contracts. If we collect amounts in excess of amounts spent, we have a commitment to our hotel owners to spend these amounts on the related system-wide services and programs. Additionally, if we spend in excess of amounts collected, we have a contractual right to adjust future collections or expenditures to recover prior-period costs. These timing differences are due to our discretion to spend in excess of revenues earned or less than revenues earned in a single period to ensure that the system-wide services and programs are operated in the best long-term interests of our hotel owners. Over the long term, these programs and services are not designed to impact our economics, either positively or negatively. Therefore, we exclude the net impact when evaluating period-over-period changes in our operating results. Adjusted EBITDA includes reimbursed costs related to system-wide services and programs that we do not intend to recover from hotel owners. Finally, we exclude other items that are not core to our operations and may vary in frequency or magnitude, such as transaction and integration costs, asset impairments, unrealized and realized gains and losses on marketable securities, and gains and losses on sales of real estate and other. Adjusted EBITDA is not a substitute for net income (loss) attributable to Hyatt Hotels Corporation, net income (loss), or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Adjusted EBITDA. Although we believe that Adjusted EBITDA can make an evaluation of our operating performance more consistent because it removes items that do not reflect our core operations, other companies in our industry may define Adjusted EBITDA differently than we do. As a result, it may be difficult to use Adjusted EBITDA or similarly named non-GAAP measures that other companies may use to compare the performance of those companies to our performance. Because of these limitations, Adjusted EBITDA should not be considered as a measure of the income (loss) generated by our business. Our management compensates for these limitations by referencing our GAAP results and using Adjusted EBITDA supplementally. |

| C O N F I D E N T I A L A N D P R O P R I E T A R Y | H y a t t an d r ela t ed m ar k s ar e t r ad em a rk s o f H y at t C o rp or at i on or it s a f f ili at e s . © 20 25 H y at t C o rp or at i on . All ri gh t s re s er v ed. DEFINITIONS 10 Asset-Light Earnings Mix: Asset-Light Earnings Mix is calculated as Adjusted EBITDA from the management and franchising segment and distribution segment divided by Adjusted EBITDA, excluding overhead and eliminations. Our management uses this calculation to assess the composition of the Company's earnings. Delayed Draw Term Loan: On April 11, 2025, the Company entered into a credit agreement with a syndicate of lenders for a $1.7 billion delayed draw term loan facility whereby proceeds will be used to finance a portion of the Playa Hotels Acquisition. On June 11, 2025, Hyatt borrowed $1.7 billion of DDTL Loans under the Delayed Draw Term Loan Facility to finance the acquisition of Playa, repay certain indebtedness of Playa and its subsidiaries in connection with such acquisition and to pay related fees and expenses. The DDTL Loans will bear interest, at Hyatt’s option, at base rate plus a range of 0.000% to 0.425% per annum, depending on Hyatt’s debt ratings, or term SOFR plus a range of 0.815% to 1.425% per annum, depending on Hyatt’s debt ratings. Playa Hotels Acquisition: On February 9, 2025, we agreed to acquire all of the outstanding shares of Playa Hotels & Resorts N.V., a leading owner, operator, and developer of all-inclusive resorts in prime beachfront locations in popular vacation destinations. Pursuant to the purchase agreement, Hyatt completed a tender offer to purchase all of the issued and outstanding ordinary shares at a cash price of $13.50 per share, for an enterprise value of approximately $2,600 million, including approximately $900 million of debt, net of cash acquired. On June 17, 2025, Hyatt completed the acquisition of Playa Hotels & Resorts, N.V. Playa Real Estate Transaction: On June 29, 2025, the Company signed a purchase and sale agreement with a joint venture between KSL Capital Partners, LLC and Rodina (“Tortuga”), to sell the entirety of Playa Hotels & Resorts N.V.’s owned real estate portfolio acquired from Playa on June 17, 2025, for $2.0 billion, subject to customary closing conditions and approval from Mexican anti-trust authorities. Hyatt and Tortuga will enter into 50-year management agreements for 13 of 15 Playa’s owned assets with terms in-line with Hyatt’s existing all-inclusive fee structure, and the remaining wo assets will be sold unencumbered due to lack of brand fit and will exit Hyatt’s system upon sale. |

| Hy at t a nd rel at ed mark s a re t rade ma rks of Hy att Corp orat i on or i ts aff il i at es . © 2 025 Hy at t Co rpora ti on . A l l ri ght s res erv e d. |