|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$99

|

1.01%

|

|

Top

contributors to performance: | |

|

↑

|

Overweighting

and stock selection in the health care services industry, where the shares of lead contributor Guardant Health more

than doubled in value. |

|

↑

|

Underweighting

and stock selection in the life sciences tools and services industry, where the Fund had no exposure to numerous

index component companies that sustained double-digit percentage losses. |

|

↑

|

Exceptionally

high one-year returns for several overweighted or off-benchmark holdings in the biotechnology and pharmaceuticals

industries, including key contributors Insmed, Benitec Biopharma, Arcutis Biotherapeutics, PTC Therapeutics, uniQure

(purchased during the period), ARS Pharmaceuticals and Argenx. Notably, the Fund’s lack of investment in poor-performing

index component company Moderna boosted relative returns more than any of these actively-held contributors. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection and overall declines in the biotechnology industry (averaging just over 79% of the portfolio), while biotech firms tracked

by the benchmark index appreciated; several overweight or off-benchmark holdings sustained double-digit percentage losses,

including Cullinan Therapeutics, Day One Biopharmaceuticals, HilleVax, and Spyre Therapeutics. |

|

↓

|

Underweighting

in Gilead Sciences, Alnylam Pharmaceuticals and other biotech stocks that posted exceptional gains, as well as the

Fund’s lack of investment in Summit Therapeutics, which saw a roughly sixfold increase on the benchmark index. |

|

↓

|

Stock

selection in the pharmaceuticals industry (averaging 13.4% of total net assets), where EyePoint Pharmaceuticals, Contineum Therapeutics

and Alto Neuroscience were among the key detractors. Elsewhere in the portfolio, a substantial loss for off-index bioprocessing

and laboratory supplies specialist Avantor was a key hindrance in the life sciences tools and services industry. |

|

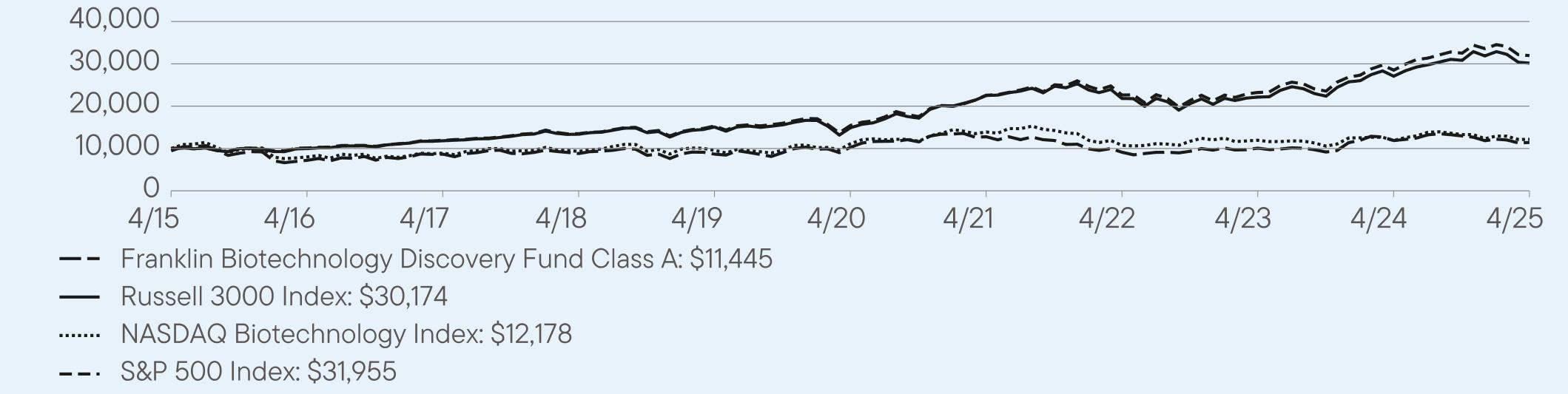

|

1

Year |

5

Year |

10

Year |

|

Class

A |

-3.64

|

2.16

|

1.93

|

|

Class

A (with sales charge) |

-8.93

|

1.01

|

1.36

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

NASDAQ

Biotechnology Index |

2.36

|

1.78

|

1.99

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$707,416,266

|

|

Total

Number of Portfolio Holdings*

|

95

|

|

Total

Management Fee Paid |

$5,096,357

|

|

Portfolio

Turnover Rate |

21.87%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

C |

$172

|

1.76%

|

|

Top

contributors to performance: | |

|

↑

|

Overweighting

and stock selection in the health care services industry, where the shares of lead contributor Guardant Health more

than doubled in value. |

|

↑

|

Underweighting

and stock selection in the life sciences tools and services industry, where the Fund had no exposure to numerous

index component companies that sustained double-digit percentage losses. |

|

↑

|

Exceptionally

high one-year returns for several overweighted or off-benchmark holdings in the biotechnology and pharmaceuticals

industries, including key contributors Insmed, Benitec Biopharma, Arcutis Biotherapeutics, PTC Therapeutics, uniQure

(purchased during the period), ARS Pharmaceuticals and Argenx. Notably, the Fund’s lack of investment in poor-performing

index component company Moderna boosted relative returns more than any of these actively-held contributors. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection and overall declines in the biotechnology industry (averaging just over 79% of the portfolio), while biotech firms tracked

by the benchmark index appreciated; several overweight or off-benchmark holdings sustained double-digit percentage losses,

including Cullinan Therapeutics, Day One Biopharmaceuticals, HilleVax, and Spyre Therapeutics. |

|

↓

|

Underweighting

in Gilead Sciences, Alnylam Pharmaceuticals and other biotech stocks that posted exceptional gains, as well as the

Fund’s lack of investment in Summit Therapeutics, which saw a roughly sixfold increase on the benchmark index. |

|

↓

|

Stock

selection in the pharmaceuticals industry (averaging 13.4% of total net assets), where EyePoint Pharmaceuticals, Contineum Therapeutics

and Alto Neuroscience were among the key detractors. Elsewhere in the portfolio, a substantial loss for off-index bioprocessing

and laboratory supplies specialist Avantor was a key hindrance in the life sciences tools and services industry. |

|

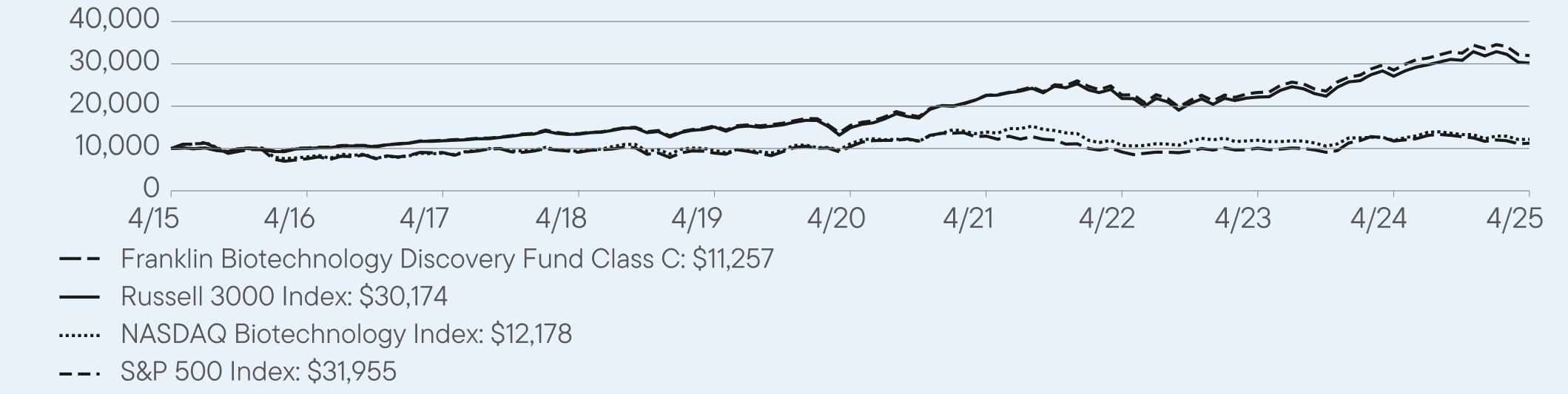

|

1

Year |

5

Year |

10

Year |

|

Class

C |

-4.36

|

1.43

|

1.19

|

|

Class

C (with sales charge) |

-5.23

|

1.43

|

1.19

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

NASDAQ

Biotechnology Index |

2.36

|

1.78

|

1.99

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$707,416,266

|

|

Total

Number of Portfolio Holdings*

|

95

|

|

Total

Management Fee Paid |

$5,096,357

|

|

Portfolio

Turnover Rate |

21.87%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R6 |

$65

|

0.66%

|

|

Top

contributors to performance: | |

|

↑

|

Overweighting

and stock selection in the health care services industry, where the shares of lead contributor Guardant Health more

than doubled in value. |

|

↑

|

Underweighting

and stock selection in the life sciences tools and services industry, where the Fund had no exposure to numerous

index component companies that sustained double-digit percentage losses. |

|

↑

|

Exceptionally

high one-year returns for several overweighted or off-benchmark holdings in the biotechnology and pharmaceuticals

industries, including key contributors Insmed, Benitec Biopharma, Arcutis Biotherapeutics, PTC Therapeutics, uniQure

(purchased during the period), ARS Pharmaceuticals and Argenx. Notably, the Fund’s lack of investment in poor-performing

index component company Moderna boosted relative returns more than any of these actively-held contributors. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection and overall declines in the biotechnology industry (averaging just over 79% of the portfolio), while biotech firms tracked

by the benchmark index appreciated; several overweight or off-benchmark holdings sustained double-digit percentage losses,

including Cullinan Therapeutics, Day One Biopharmaceuticals, HilleVax, and Spyre Therapeutics. |

|

↓

|

Underweighting

in Gilead Sciences, Alnylam Pharmaceuticals and other biotech stocks that posted exceptional gains, as well as the

Fund’s lack of investment in Summit Therapeutics, which saw a roughly sixfold increase on the benchmark index. |

|

↓

|

Stock

selection in the pharmaceuticals industry (averaging 13.4% of total net assets), where EyePoint Pharmaceuticals, Contineum Therapeutics

and Alto Neuroscience were among the key detractors. Elsewhere in the portfolio, a substantial loss for off-index bioprocessing

and laboratory supplies specialist Avantor was a key hindrance in the life sciences tools and services industry. |

|

|

1

Year |

5

Year |

10

Year |

|

Class

R6 |

-3.31

|

2.54

|

2.32

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

NASDAQ

Biotechnology Index |

2.36

|

1.78

|

1.99

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$707,416,266

|

|

Total

Number of Portfolio Holdings*

|

95

|

|

Total

Management Fee Paid |

$5,096,357

|

|

Portfolio

Turnover Rate |

21.87%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Advisor

Class |

$75

|

0.76%

|

|

Top

contributors to performance: | |

|

↑

|

Overweighting

and stock selection in the health care services industry, where the shares of lead contributor Guardant Health more

than doubled in value. |

|

↑

|

Underweighting

and stock selection in the life sciences tools and services industry, where the Fund had no exposure to numerous

index component companies that sustained double-digit percentage losses. |

|

↑

|

Exceptionally

high one-year returns for several overweighted or off-benchmark holdings in the biotechnology and pharmaceuticals

industries, including key contributors Insmed, Benitec Biopharma, Arcutis Biotherapeutics, PTC Therapeutics, uniQure

(purchased during the period), ARS Pharmaceuticals and Argenx. Notably, the Fund’s lack of investment in poor-performing

index component company Moderna boosted relative returns more than any of these actively-held contributors. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection and overall declines in the biotechnology industry (averaging just over 79% of the portfolio), while biotech firms tracked

by the benchmark index appreciated; several overweight or off-benchmark holdings sustained double-digit percentage losses,

including Cullinan Therapeutics, Day One Biopharmaceuticals, HilleVax, and Spyre Therapeutics. |

|

↓

|

Underweighting

in Gilead Sciences, Alnylam Pharmaceuticals and other biotech stocks that posted exceptional gains, as well as the

Fund’s lack of investment in Summit Therapeutics, which saw a roughly sixfold increase on the benchmark index. |

|

↓

|

Stock

selection in the pharmaceuticals industry (averaging 13.4% of total net assets), where EyePoint Pharmaceuticals, Contineum Therapeutics

and Alto Neuroscience were among the key detractors. Elsewhere in the portfolio, a substantial loss for off-index bioprocessing

and laboratory supplies specialist Avantor was a key hindrance in the life sciences tools and services industry. |

|

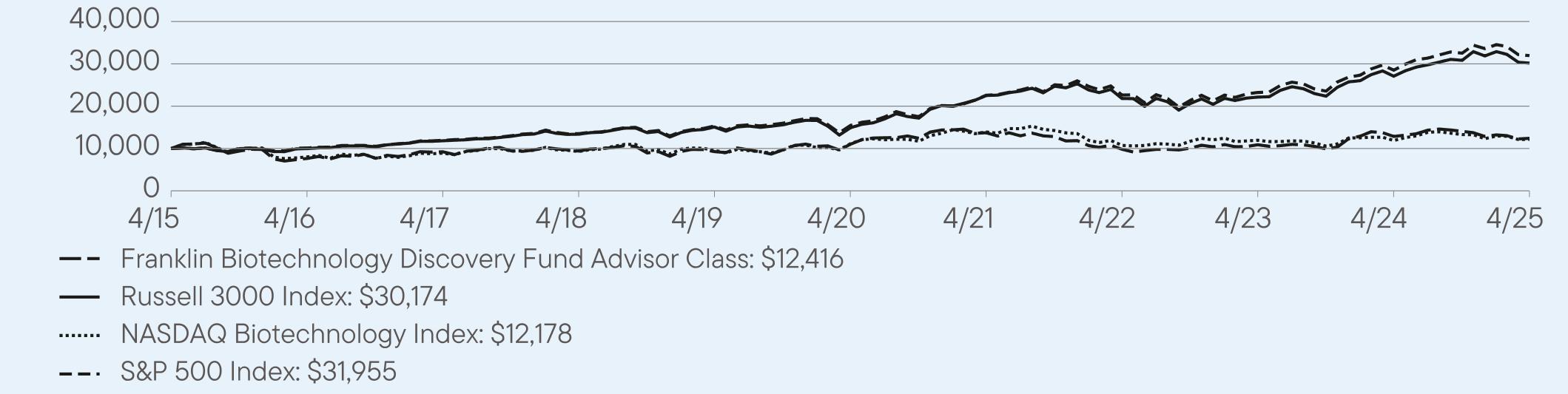

|

1

Year |

5

Year |

10

Year |

|

Advisor

Class |

-3.41

|

2.42

|

2.19

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

NASDAQ

Biotechnology Index |

2.36

|

1.78

|

1.99

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$707,416,266

|

|

Total

Number of Portfolio Holdings*

|

95

|

|

Total

Management Fee Paid |

$5,096,357

|

|

Portfolio

Turnover Rate |

21.87%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$88

|

0.85%

|

|

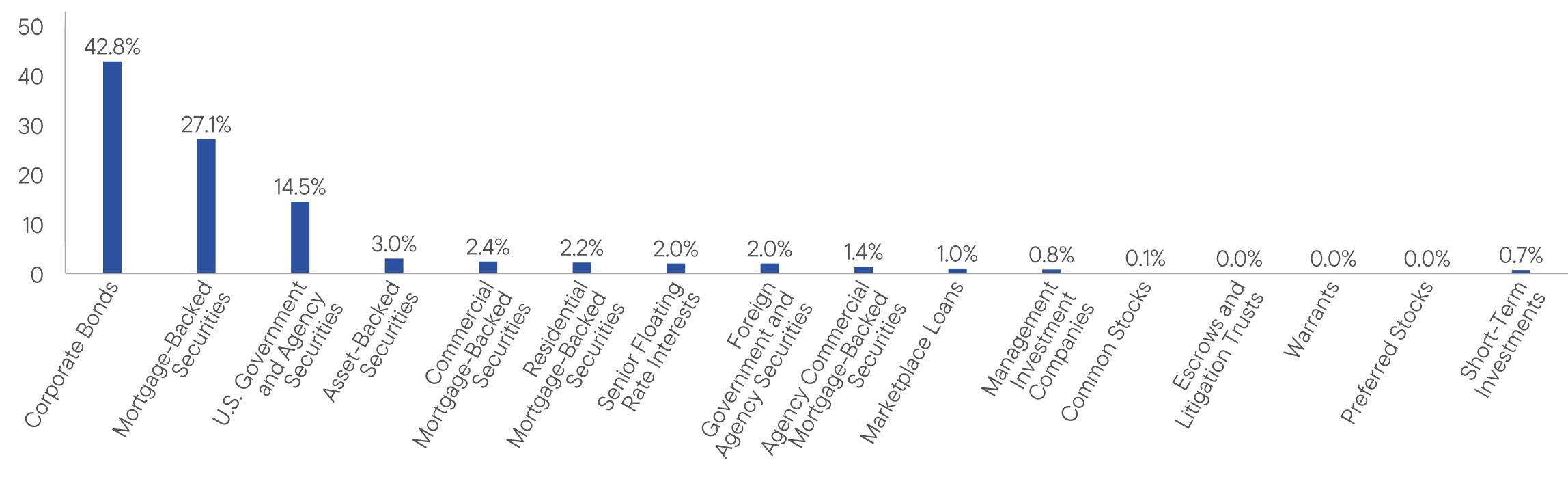

Top

contributors to performance: | |

|

↑

|

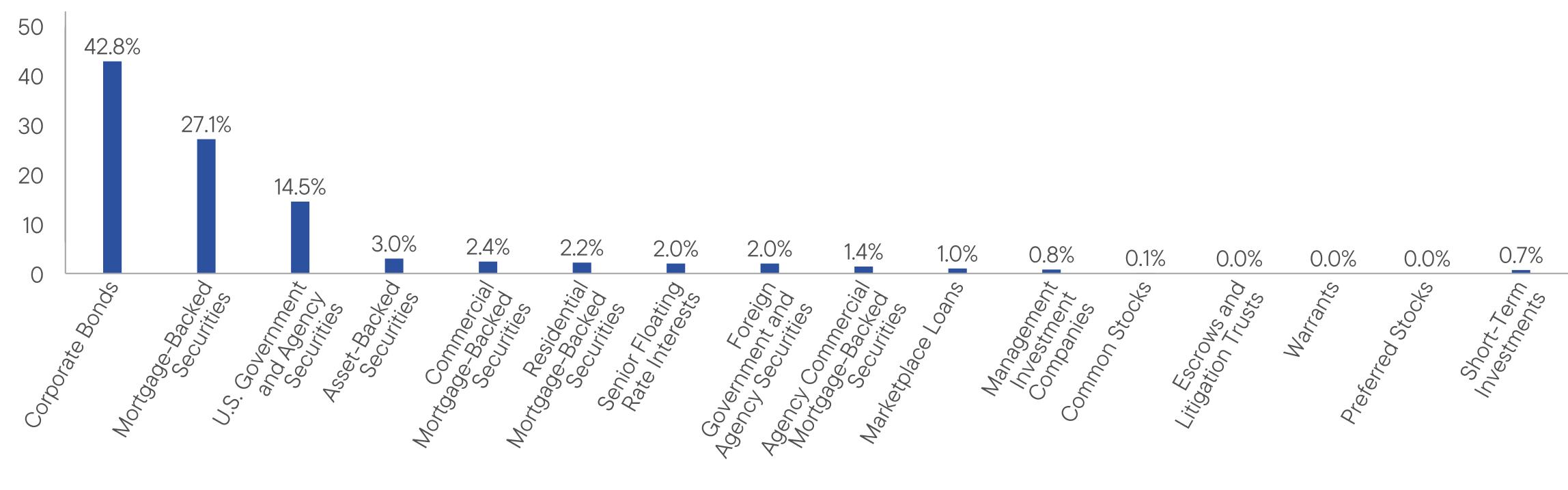

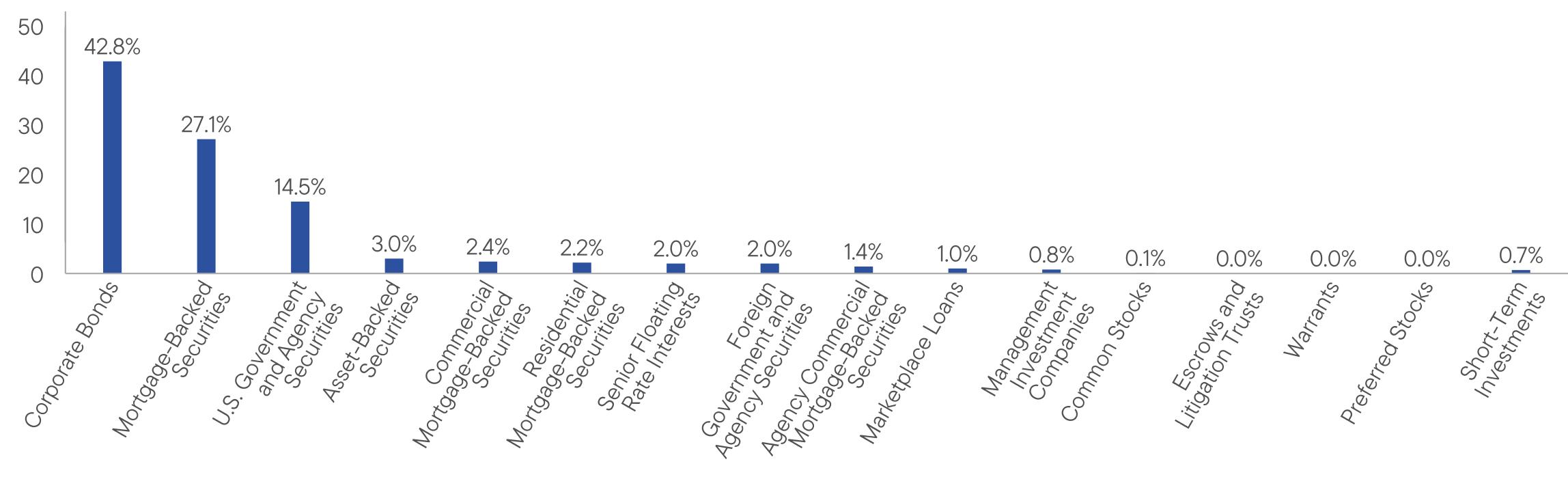

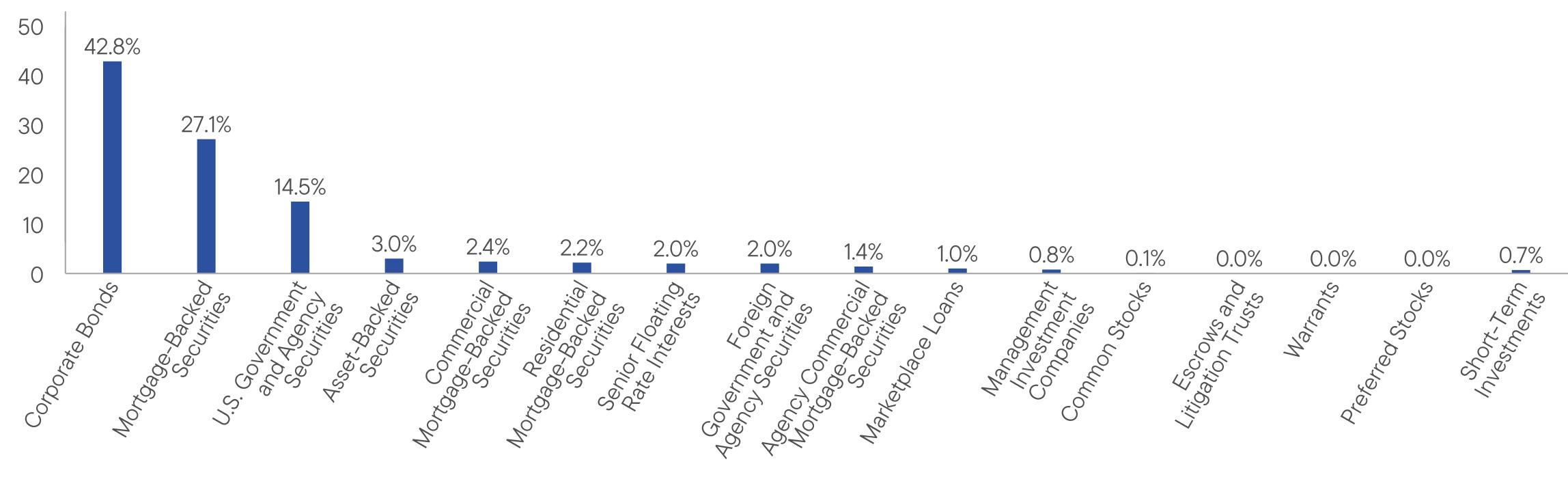

Overweight

allocation to high-yield (HY) corporate bonds, senior secured floating-rate bank loans and collateralized loan obligations.

|

|

↑

|

Security

selection in investment-grade (IG) corporate bonds. |

|

↑

|

Exposure

to the two- and five-year portions of the yield curve. |

|

Top

detractors from performance: | |

|

↓

|

Exposure

to the 10-, 20- and 30-year portions of the yield curve. |

|

↓

|

Underweight

allocation to agency mortgage-backed securities (MBS). |

|

↓

|

Security

selection in HY corporate bonds. |

|

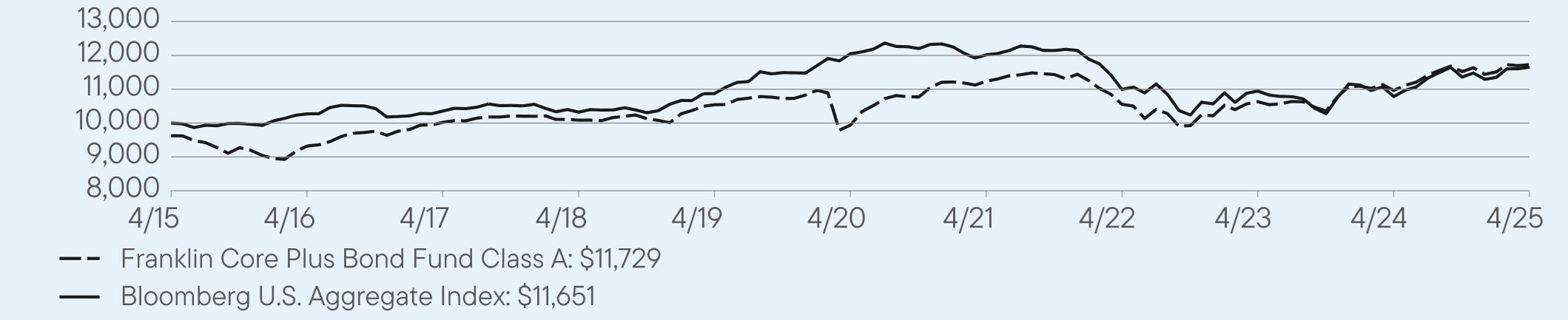

|

1

Year |

5

Year |

10

Year |

|

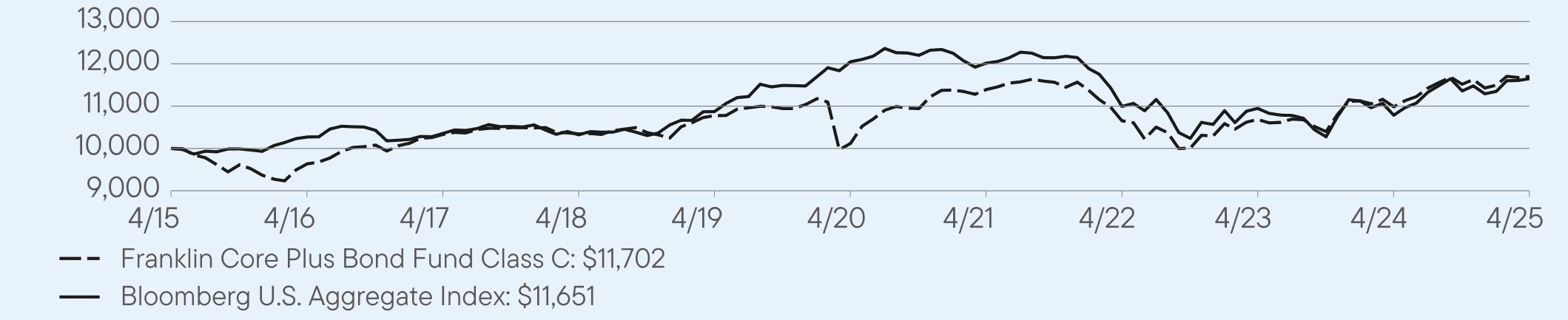

Class

A |

6.98

|

3.37

|

2.00

|

|

Class

A (with sales charge) |

2.91

|

2.57

|

1.61

|

|

Bloomberg

U.S. Aggregate Index |

8.02

|

-0.67

|

1.54

|

|

Total

Net Assets |

$2,468,245,569

|

|

Total

Number of Portfolio Holdings*

|

719

|

|

Total

Management Fee Paid |

$10,452,494

|

|

Portfolio

Turnover Rate |

156.08%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

C |

$130

|

1.26%

|

|

Top

contributors to performance: | |

|

↑

|

Overweight

allocation to high-yield (HY) corporate bonds, senior secured floating-rate bank loans and collateralized loan obligations.

|

|

↑

|

Security

selection in investment-grade (IG) corporate bonds. |

|

↑

|

Exposure

to the two- and five-year portions of the yield curve. |

|

Top

detractors from performance: | |

|

↓

|

Exposure

to the 10-, 20- and 30-year portions of the yield curve. |

|

↓

|

Underweight

allocation to agency mortgage-backed securities (MBS). |

|

↓

|

Security

selection in HY corporate bonds. |

|

|

1

Year |

5

Year |

10

Year |

|

Class

C |

6.53

|

2.95

|

1.58

|

|

Class

C (with sales charge) |

5.53

|

2.95

|

1.58

|

|

Bloomberg

U.S. Aggregate Index |

8.02

|

-0.67

|

1.54

|

|

Total

Net Assets |

$2,468,245,569

|

|

Total

Number of Portfolio Holdings*

|

719

|

|

Total

Management Fee Paid |

$10,452,494

|

|

Portfolio

Turnover Rate |

156.08%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R |

$114

|

1.10%

|

|

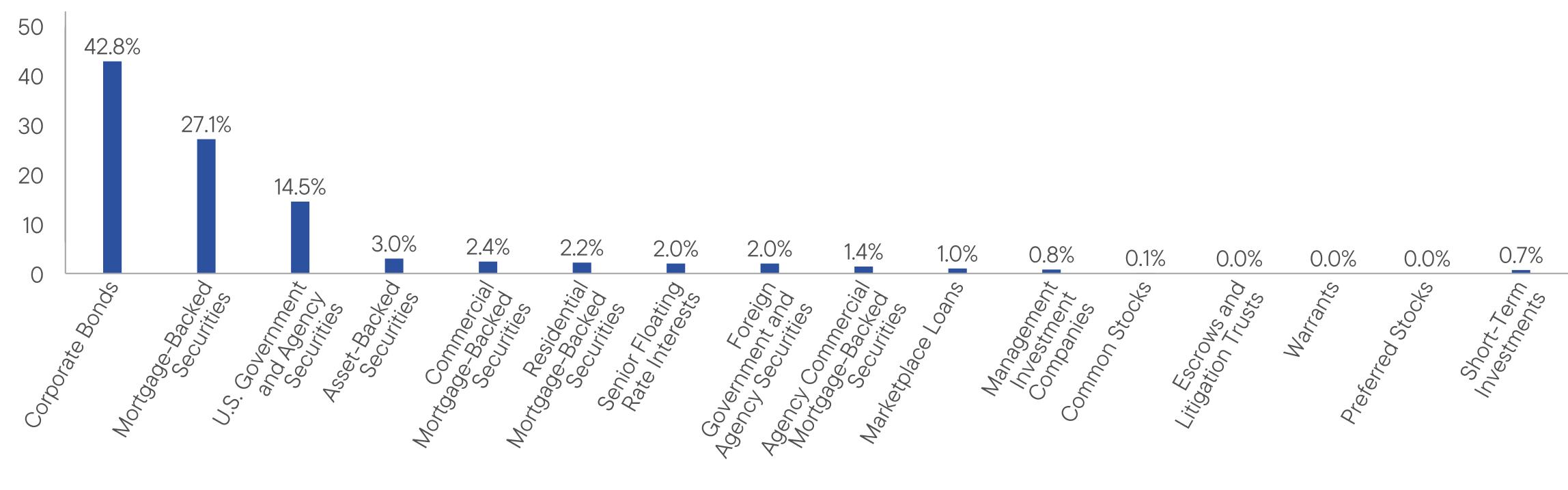

Top

contributors to performance: | |

|

↑

|

Overweight

allocation to high-yield (HY) corporate bonds, senior secured floating-rate bank loans and collateralized loan obligations.

|

|

↑

|

Security

selection in investment-grade (IG) corporate bonds. |

|

↑

|

Exposure

to the two- and five-year portions of the yield curve. |

|

Top

detractors from performance: | |

|

↓

|

Exposure

to the 10-, 20- and 30-year portions of the yield curve. |

|

↓

|

Underweight

allocation to agency mortgage-backed securities (MBS). |

|

↓

|

Security

selection in HY corporate bonds. |

|

|

1

Year |

5

Year |

10

Year |

|

Class

R |

6.62

|

3.10

|

1.73

|

|

Bloomberg

U.S. Aggregate Index |

8.02

|

-0.67

|

1.54

|

|

Total

Net Assets |

$2,468,245,569

|

|

Total

Number of Portfolio Holdings*

|

719

|

|

Total

Management Fee Paid |

$10,452,494

|

|

Portfolio

Turnover Rate |

156.08%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R6 |

$52

|

0.50%

|

|

Top

contributors to performance: | |

|

↑

|

Overweight

allocation to high-yield (HY) corporate bonds, senior secured floating-rate bank loans and collateralized loan obligations.

|

|

↑

|

Security

selection in investment-grade (IG) corporate bonds. |

|

↑

|

Exposure

to the two- and five-year portions of the yield curve. |

|

Top

detractors from performance: | |

|

↓

|

Exposure

to the 10-, 20- and 30-year portions of the yield curve. |

|

↓

|

Underweight

allocation to agency mortgage-backed securities (MBS). |

|

↓

|

Security

selection in HY corporate bonds. |

|

|

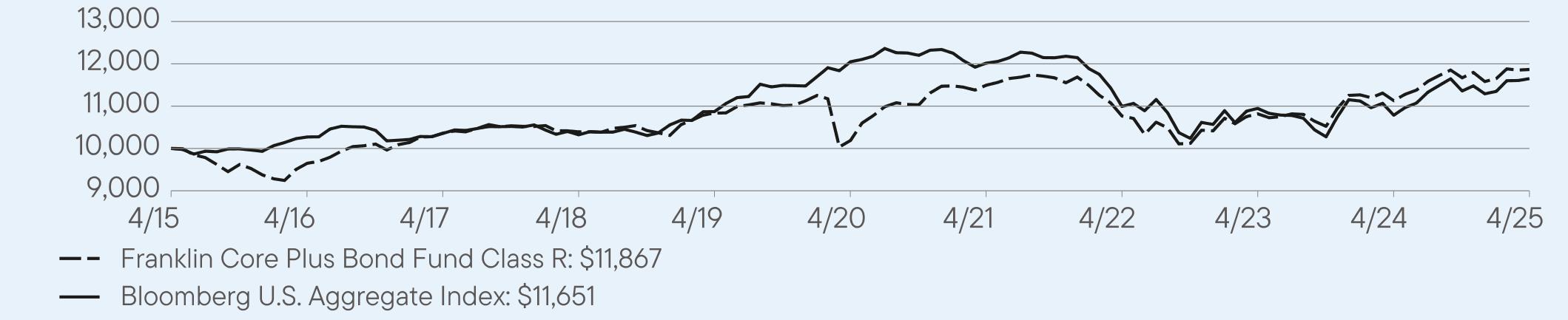

1

Year |

5

Year |

10

Year |

|

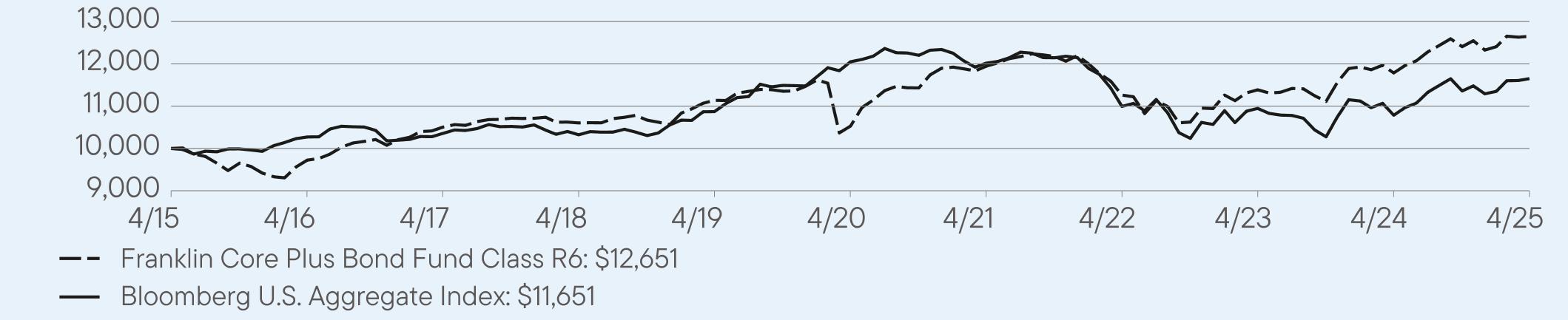

Class

R6 |

7.35

|

3.74

|

2.38

|

|

Bloomberg

U.S. Aggregate Index |

8.02

|

-0.67

|

1.54

|

|

Total

Net Assets |

$2,468,245,569

|

|

Total

Number of Portfolio Holdings*

|

719

|

|

Total

Management Fee Paid |

$10,452,494

|

|

Portfolio

Turnover Rate |

156.08%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Advisor

Class |

$62

|

0.60%

|

|

Top

contributors to performance: | |

|

↑

|

Overweight

allocation to high-yield (HY) corporate bonds, senior secured floating-rate bank loans and collateralized loan obligations.

|

|

↑

|

Security

selection in investment-grade (IG) corporate bonds. |

|

↑

|

Exposure

to the two- and five-year portions of the yield curve. |

|

Top

detractors from performance: | |

|

↓

|

Exposure

to the 10-, 20- and 30-year portions of the yield curve. |

|

↓

|

Underweight

allocation to agency mortgage-backed securities (MBS). |

|

↓

|

Security

selection in HY corporate bonds. |

|

|

1

Year |

5

Year |

10

Year |

|

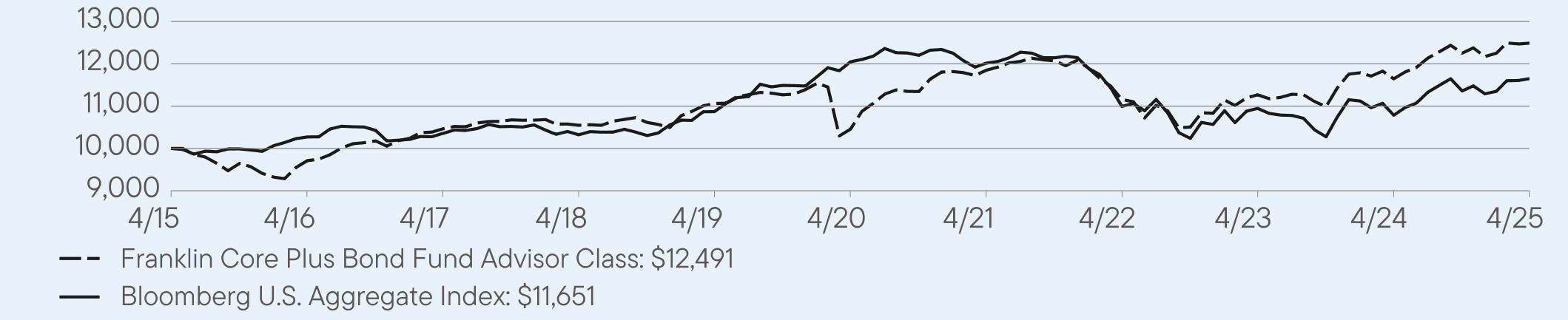

Advisor

Class |

7.24

|

3.62

|

2.25

|

|

Bloomberg

U.S. Aggregate Index |

8.02

|

-0.67

|

1.54

|

|

Total

Net Assets |

$2,468,245,569

|

|

Total

Number of Portfolio Holdings*

|

719

|

|

Total

Management Fee Paid |

$10,452,494

|

|

Portfolio

Turnover Rate |

156.08%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$92

|

0.89%

|

|

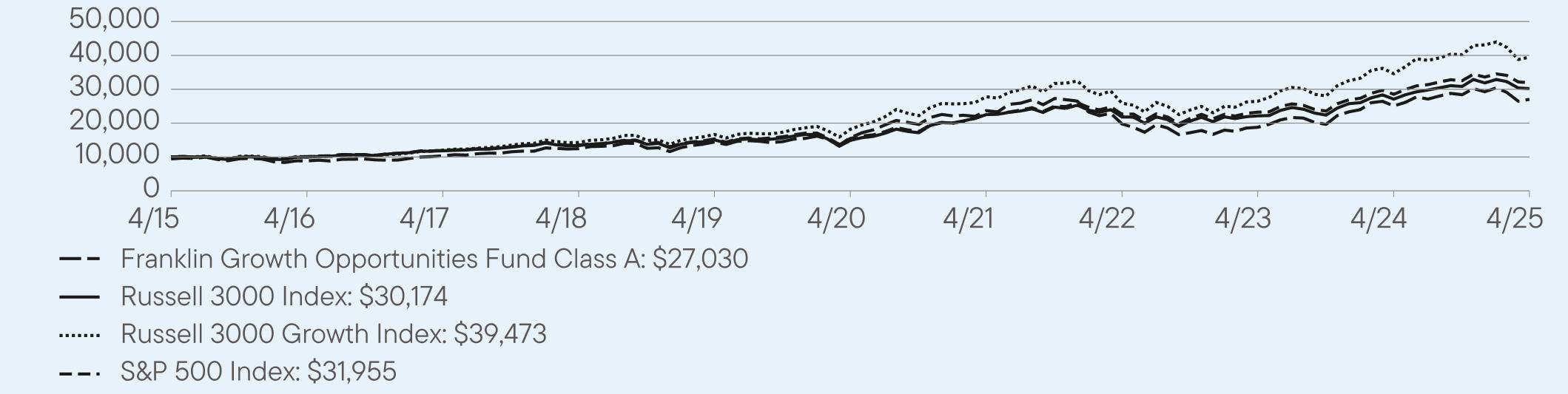

Top

contributors to performance: | |

|

↑

|

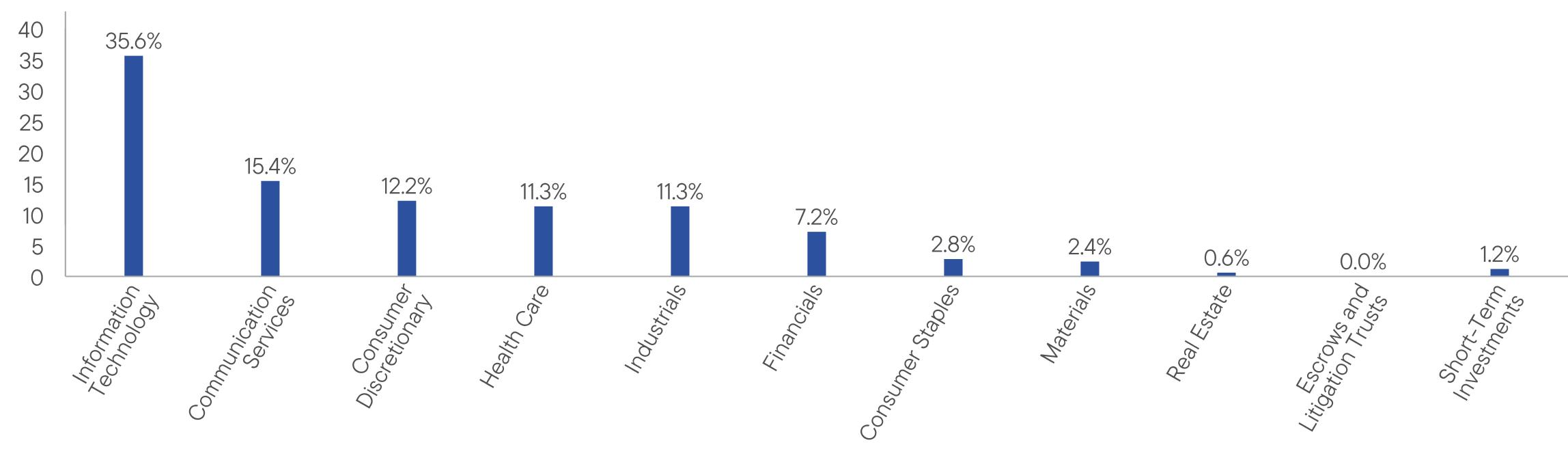

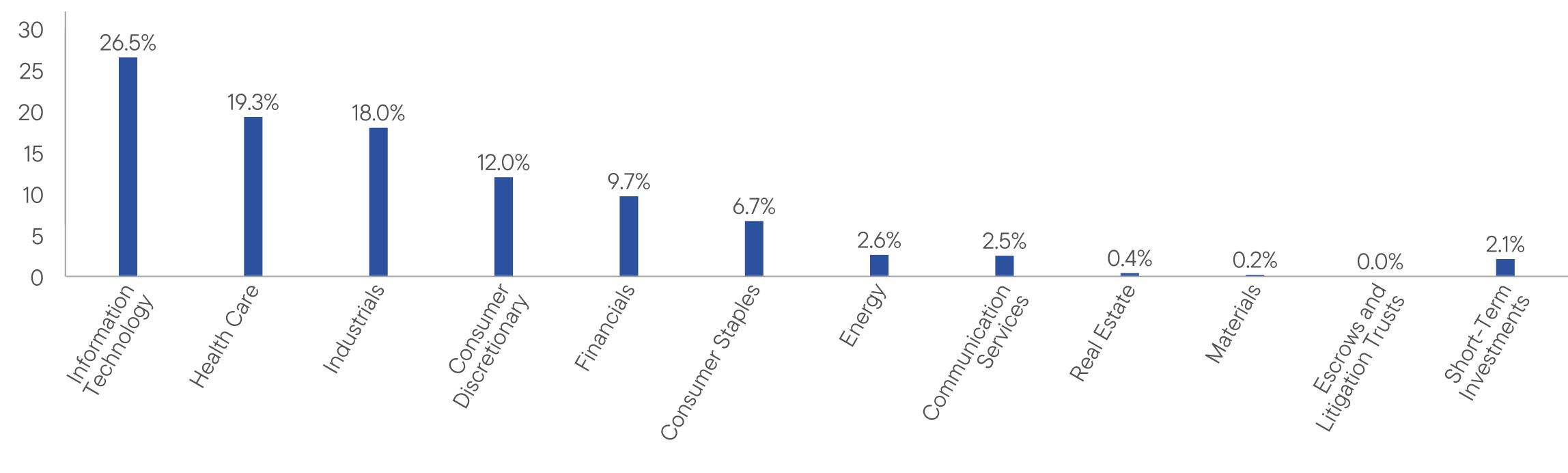

Stock

selection in the industrials and communication services sectors. Axon Enterprise, a law enforcement technology company, was

a leading relative contributor in the industrials sector. A focus on force enhancement, efficiency and artificial intelligence (AI) technology

from domestic and international police agencies have been growth drivers for Axon. In the communication services sector,

the Fund benefited from a lack of certain index component stocks that fared poorly over the period. |

|

↑

|

At

the stock level, a below-index weighting in Microsoft helped relative returns in the information technology (IT) sector. The software

giant’s cloud computing platform Azure continued to be profitable for the company but saw a moderation in growth.

|

|

↑

|

The

IT sector also benefited from an investment in Fair Isaac—a credit scoring and data analytics provider. Pricing power and strong

customer demand in its credit scoring business lifted the stock to a record high over the period. The company has a dominant

position in mortgage scoring and is a vital component of the credit scoring process. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection in the consumer discretionary sector was a driver of negative relative returns over the period, led lower by an underweight

in Tesla. Stock performance for the electric carmaker was driven, in part, by positive market sentiment and increased expectations

for growth following the 2024 presidential election and announcements on progress with their self-driving car, robotaxi

and humanoid robot strategies. |

|

↓

|

Stock

selection in the IT sector had an adverse effect on relative performance. Underweights in Broadcom and Apple accounted for

a large share of the Fund’s relative decline but added to absolute returns. Semiconductor company Broadcom saw significant growth

in AI revenue supported by strong demand for its AI chips. |

|

↓

|

Apple’s

stock reached an all-time high in mid-July 2024 following the company’s announcement of Apple Intelligence, a software update

that brings AI features across its products. The technology giant also announced a record US$110 billion share buyback program,

making it the largest buyback in U.S. corporate history. |

|

|

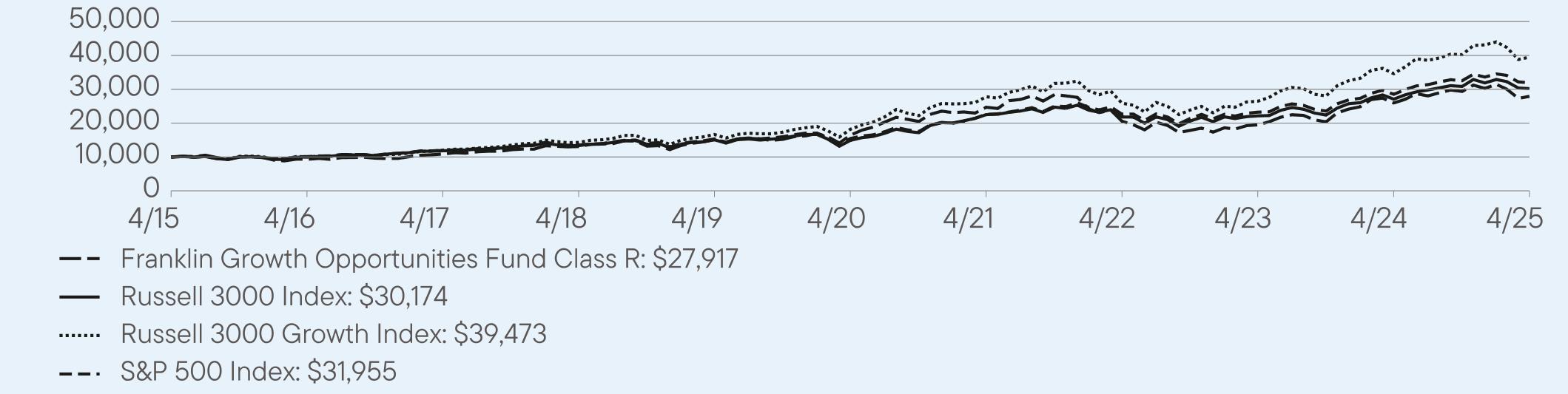

1

Year |

5

Year |

10

Year |

|

Class

A |

7.85

|

11.45

|

11.08

|

|

Class

A (with sales charge) |

1.91

|

10.20

|

10.45

|

|

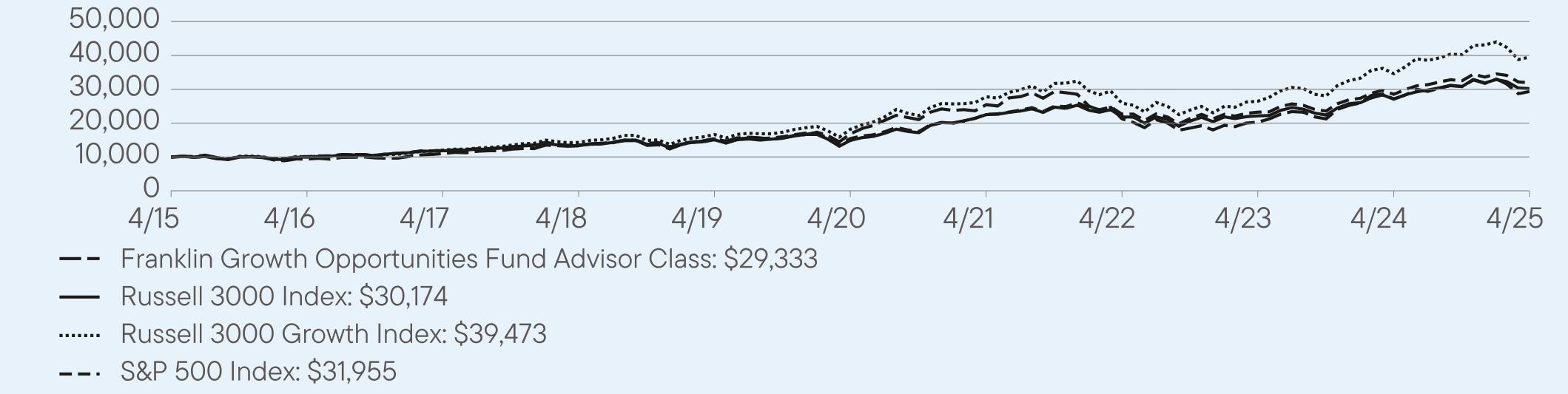

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

3000 Growth Index |

14.07

|

16.71

|

14.72

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$4,160,453,860

|

|

Total

Number of Portfolio Holdings*

|

85

|

|

Total

Management Fee Paid |

$24,439,109

|

|

Portfolio

Turnover Rate |

27.59%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

C |

$170

|

1.64%

|

|

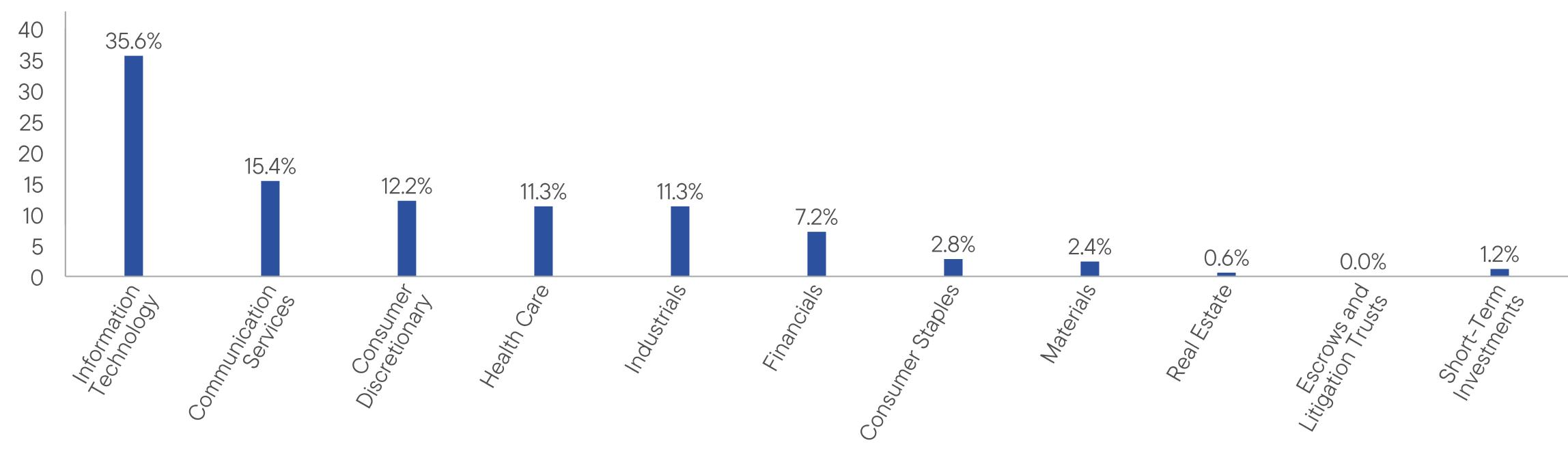

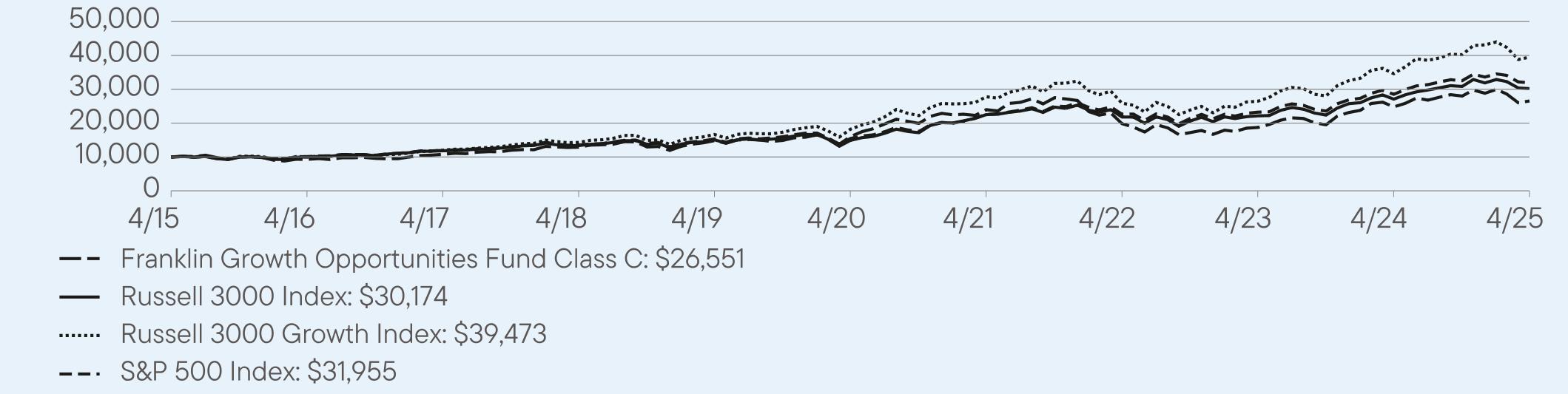

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials and communication services sectors. Axon Enterprise, a law enforcement technology company, was

a leading relative contributor in the industrials sector. A focus on force enhancement, efficiency and artificial intelligence (AI) technology

from domestic and international police agencies have been growth drivers for Axon. In the communication services sector,

the Fund benefited from a lack of certain index component stocks that fared poorly over the period. |

|

↑

|

At

the stock level, a below-index weighting in Microsoft helped relative returns in the information technology (IT) sector. The software

giant’s cloud computing platform Azure continued to be profitable for the company but saw a moderation in growth.

|

|

↑

|

The

IT sector also benefited from an investment in Fair Isaac—a credit scoring and data analytics provider. Pricing power and strong

customer demand in its credit scoring business lifted the stock to a record high over the period. The company has a dominant

position in mortgage scoring and is a vital component of the credit scoring process. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection in the consumer discretionary sector was a driver of negative relative returns over the period, led lower by an underweight

in Tesla. Stock performance for the electric carmaker was driven, in part, by positive market sentiment and increased expectations

for growth following the 2024 presidential election and announcements on progress with their self-driving car, robotaxi

and humanoid robot strategies. |

|

↓

|

Stock

selection in the IT sector had an adverse effect on relative performance. Underweights in Broadcom and Apple accounted for

a large share of the Fund’s relative decline but added to absolute returns. Semiconductor company Broadcom saw significant growth

in AI revenue supported by strong demand for its AI chips. |

|

↓

|

Apple’s

stock reached an all-time high in mid-July 2024 following the company’s announcement of Apple Intelligence, a software update

that brings AI features across its products. The technology giant also announced a record US$110 billion share buyback program,

making it the largest buyback in U.S. corporate history. |

|

|

1

Year |

5

Year |

10

Year |

|

Class

C |

7.03

|

10.61

|

10.26

|

|

Class

C (with sales charge) |

6.11

|

10.61

|

10.26

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

3000 Growth Index |

14.07

|

16.71

|

14.72

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$4,160,453,860

|

|

Total

Number of Portfolio Holdings*

|

85

|

|

Total

Management Fee Paid |

$24,439,109

|

|

Portfolio

Turnover Rate |

27.59%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R |

$118

|

1.14%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials and communication services sectors. Axon Enterprise, a law enforcement technology company, was

a leading relative contributor in the industrials sector. A focus on force enhancement, efficiency and artificial intelligence (AI) technology

from domestic and international police agencies have been growth drivers for Axon. In the communication services sector,

the Fund benefited from a lack of certain index component stocks that fared poorly over the period. |

|

↑

|

At

the stock level, a below-index weighting in Microsoft helped relative returns in the information technology (IT) sector. The software

giant’s cloud computing platform Azure continued to be profitable for the company but saw a moderation in growth.

|

|

↑

|

The

IT sector also benefited from an investment in Fair Isaac—a credit scoring and data analytics provider. Pricing power and strong

customer demand in its credit scoring business lifted the stock to a record high over the period. The company has a dominant

position in mortgage scoring and is a vital component of the credit scoring process. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection in the consumer discretionary sector was a driver of negative relative returns over the period, led lower by an underweight

in Tesla. Stock performance for the electric carmaker was driven, in part, by positive market sentiment and increased expectations

for growth following the 2024 presidential election and announcements on progress with their self-driving car, robotaxi

and humanoid robot strategies. |

|

↓

|

Stock

selection in the IT sector had an adverse effect on relative performance. Underweights in Broadcom and Apple accounted for

a large share of the Fund’s relative decline but added to absolute returns. Semiconductor company Broadcom saw significant growth

in AI revenue supported by strong demand for its AI chips. |

|

↓

|

Apple’s

stock reached an all-time high in mid-July 2024 following the company’s announcement of Apple Intelligence, a software update

that brings AI features across its products. The technology giant also announced a record US$110 billion share buyback program,

making it the largest buyback in U.S. corporate history. |

|

|

1

Year |

5

Year |

10

Year |

|

Class

R |

7.57

|

11.17

|

10.81

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

3000 Growth Index |

14.07

|

16.71

|

14.72

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$4,160,453,860

|

|

Total

Number of Portfolio Holdings*

|

85

|

|

Total

Management Fee Paid |

$24,439,109

|

|

Portfolio

Turnover Rate |

27.59%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R6 |

$59

|

0.57%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials and communication services sectors. Axon Enterprise, a law enforcement technology company, was

a leading relative contributor in the industrials sector. A focus on force enhancement, efficiency and artificial intelligence (AI) technology

from domestic and international police agencies have been growth drivers for Axon. In the communication services sector,

the Fund benefited from a lack of certain index component stocks that fared poorly over the period. |

|

↑

|

At

the stock level, a below-index weighting in Microsoft helped relative returns in the information technology (IT) sector. The software

giant’s cloud computing platform Azure continued to be profitable for the company but saw a moderation in growth.

|

|

↑

|

The

IT sector also benefited from an investment in Fair Isaac—a credit scoring and data analytics provider. Pricing power and strong

customer demand in its credit scoring business lifted the stock to a record high over the period. The company has a dominant

position in mortgage scoring and is a vital component of the credit scoring process. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection in the consumer discretionary sector was a driver of negative relative returns over the period, led lower by an underweight

in Tesla. Stock performance for the electric carmaker was driven, in part, by positive market sentiment and increased expectations

for growth following the 2024 presidential election and announcements on progress with their self-driving car, robotaxi

and humanoid robot strategies. |

|

↓

|

Stock

selection in the IT sector had an adverse effect on relative performance. Underweights in Broadcom and Apple accounted for

a large share of the Fund’s relative decline but added to absolute returns. Semiconductor company Broadcom saw significant growth

in AI revenue supported by strong demand for its AI chips. |

|

↓

|

Apple’s

stock reached an all-time high in mid-July 2024 following the company’s announcement of Apple Intelligence, a software update

that brings AI features across its products. The technology giant also announced a record US$110 billion share buyback program,

making it the largest buyback in U.S. corporate history. |

|

|

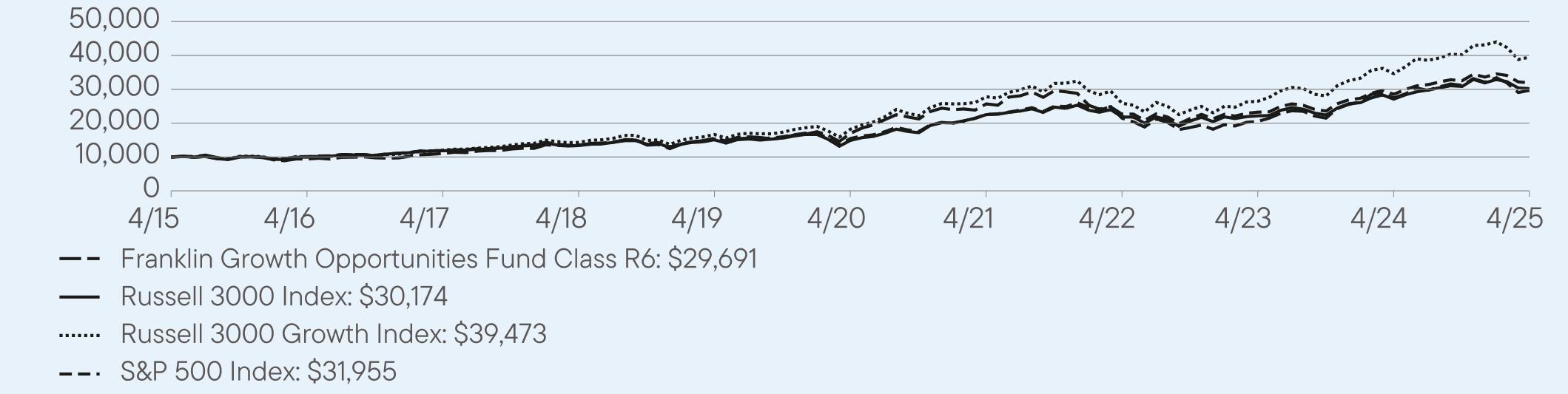

1

Year |

5

Year |

10

Year |

|

Class

R6 |

8.19

|

11.82

|

11.50

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

3000 Growth Index |

14.07

|

16.71

|

14.72

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$4,160,453,860

|

|

Total

Number of Portfolio Holdings*

|

85

|

|

Total

Management Fee Paid |

$24,439,109

|

|

Portfolio

Turnover Rate |

27.59%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Advisor

Class |

$67

|

0.64%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials and communication services sectors. Axon Enterprise, a law enforcement technology company, was

a leading relative contributor in the industrials sector. A focus on force enhancement, efficiency and artificial intelligence (AI) technology

from domestic and international police agencies have been growth drivers for Axon. In the communication services sector,

the Fund benefited from a lack of certain index component stocks that fared poorly over the period. |

|

↑

|

At

the stock level, a below-index weighting in Microsoft helped relative returns in the information technology (IT) sector. The software

giant’s cloud computing platform Azure continued to be profitable for the company but saw a moderation in growth.

|

|

↑

|

The

IT sector also benefited from an investment in Fair Isaac—a credit scoring and data analytics provider. Pricing power and strong

customer demand in its credit scoring business lifted the stock to a record high over the period. The company has a dominant

position in mortgage scoring and is a vital component of the credit scoring process. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection in the consumer discretionary sector was a driver of negative relative returns over the period, led lower by an underweight

in Tesla. Stock performance for the electric carmaker was driven, in part, by positive market sentiment and increased expectations

for growth following the 2024 presidential election and announcements on progress with their self-driving car, robotaxi

and humanoid robot strategies. |

|

↓

|

Stock

selection in the IT sector had an adverse effect on relative performance. Underweights in Broadcom and Apple accounted for

a large share of the Fund’s relative decline but added to absolute returns. Semiconductor company Broadcom saw significant growth

in AI revenue supported by strong demand for its AI chips. |

|

↓

|

Apple’s

stock reached an all-time high in mid-July 2024 following the company’s announcement of Apple Intelligence, a software update

that brings AI features across its products. The technology giant also announced a record US$110 billion share buyback program,

making it the largest buyback in U.S. corporate history. |

|

|

1

Year |

5

Year |

10

Year |

|

Advisor

Class |

8.12

|

11.73

|

11.36

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

3000 Growth Index |

14.07

|

16.71

|

14.72

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$4,160,453,860

|

|

Total

Number of Portfolio Holdings*

|

85

|

|

Total

Management Fee Paid |

$24,439,109

|

|

Portfolio

Turnover Rate |

27.59%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$96

|

0.99%

|

|

Top

contributors to performance: | |

|

↑

|

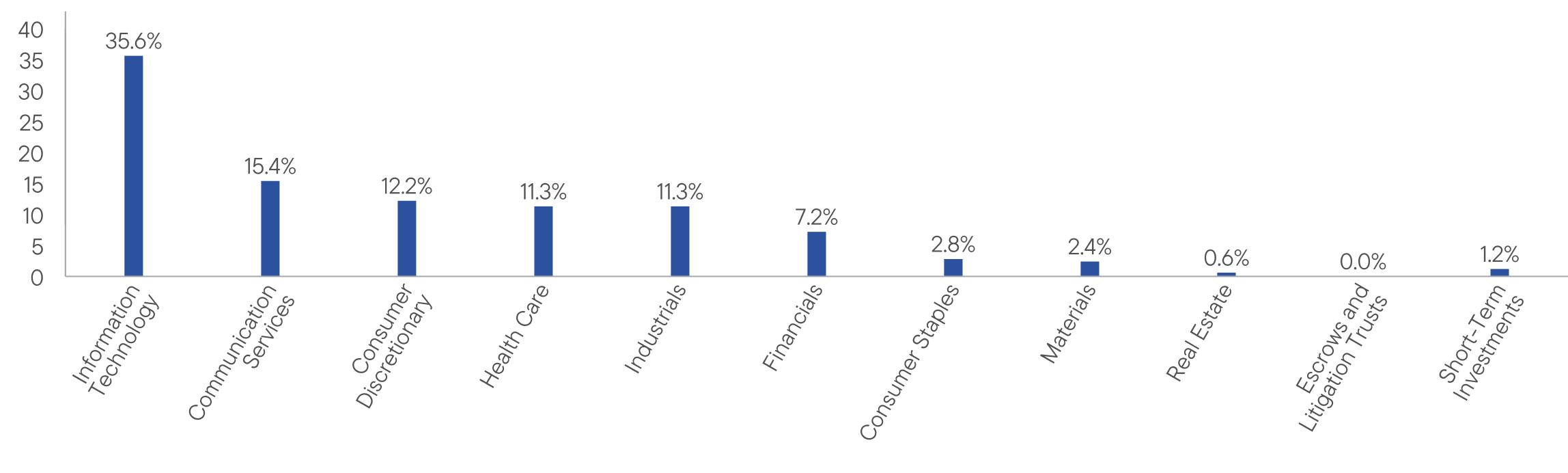

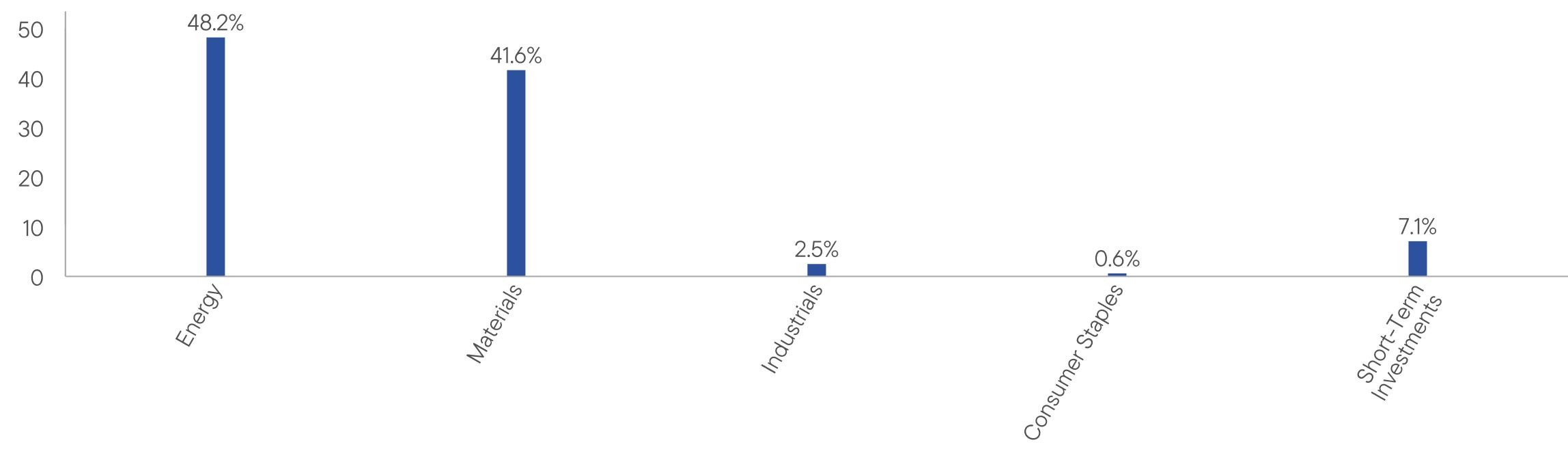

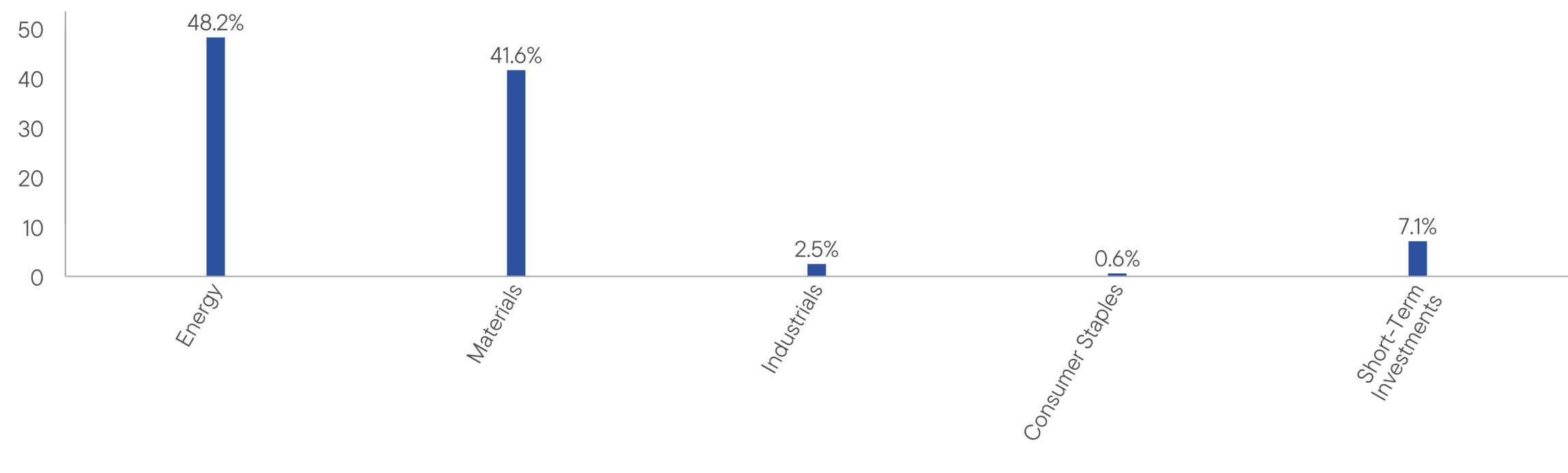

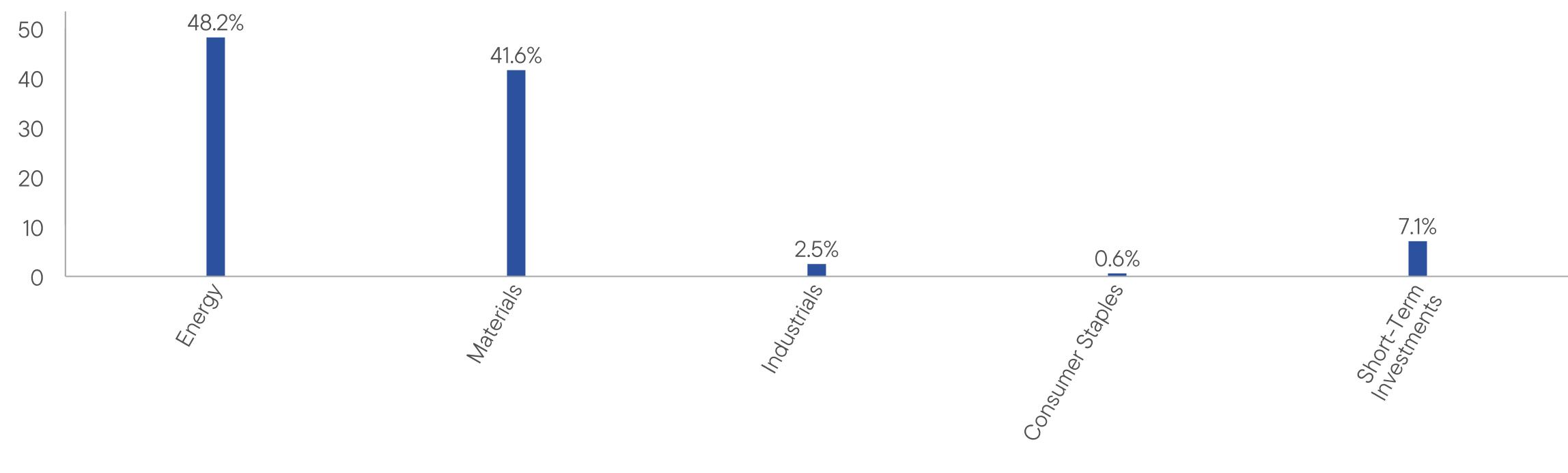

Stock

selection in the oilfield services industry, where robust gains for off-benchmark positions in Technip Energies and Ranger Energy

Services were most beneficial. Portfolio underweighting in poor-performing integrated oil and gas companies such as Chevron

and Exxon Mobil further buoyed the Fund’s energy sector results. |

|

↑

|

Among

metals and mining companies, exceptionally strong one-year gains for the Fund’s overweighted stakes in gold producers such

as Alamos Gold and Newmont. Similarly elevated returns were seen with select contributors in the diversified metals and mining

industry, led by a heavily-overweighted position in rare earths mining and processing company MP Materials. |

|

↑

|

Off-benchmark

investments in the fertilizers and agricultural chemicals industry, where Corteva and Nutrien were standout contributors;

and in the industrial gases industry, where Air Products and Chemicals was the best of two holdings that added to both

relative and absolute returns. |

|

Top

detractors from performance: | |

|

↓

|

Allocation

in the oil and gas storage and transportation industry, where the Fund maintained much lighter-than-index exposures to

Enbridge, Cheniere Energy and other energy pipeline/infrastructure companies that saw their equity values appreciate significantly

on the back of expected natural gas demand to power artificial intelligence (AI) focused data centers. |

|

↓

|

Keeping

roughly seven times the benchmark’s modest exposure to underperforming diversified metals and mining companies, including

several that suffered double-digit percentage declines. Overweighting in copper-focused miners was also detrimental as

key detractor ERO Copper and all other related holdings shed considerable equity value despite long-term expectations for healthy

demand from electrification trends. |

|

↓

|

Off-benchmark

renewable energy plays had a tough year amid shifting supply/demand, geopolitical and policy-related dynamics. Key

detractors were Albemarle (battery-grade lithium mining), Fluence Energy (digital renewable energy storage solutions; sold by

period-end), and some of Fluence’s green energy-focused peers in the electrical components and equipment industry.

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

A |

-6.87

|

18.07

|

0.64

|

|

Class

A (with sales charge) |

-11.99

|

16.74

|

0.07

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

S&P

North American Natural Resources Sector Index |

-3.60

|

18.67

|

3.94

|

|

S&P

Global Natural Resources Index |

-6.73

|

12.53

|

5.27

|

|

Total

Net Assets |

$293,885,401

|

|

Total

Number of Portfolio Holdings*

|

91

|

|

Total

Management Fee Paid |

$1,743,418

|

|

Portfolio

Turnover Rate |

19.72%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

C |

$167

|

1.74%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the oilfield services industry, where robust gains for off-benchmark positions in Technip Energies and Ranger Energy

Services were most beneficial. Portfolio underweighting in poor-performing integrated oil and gas companies such as Chevron

and Exxon Mobil further buoyed the Fund’s energy sector results. |

|

↑

|

Among

metals and mining companies, exceptionally strong one-year gains for the Fund’s overweighted stakes in gold producers such

as Alamos Gold and Newmont. Similarly elevated returns were seen with select contributors in the diversified metals and mining

industry, led by a heavily-overweighted position in rare earths mining and processing company MP Materials. |

|

↑

|

Off-benchmark

investments in the fertilizers and agricultural chemicals industry, where Corteva and Nutrien were standout contributors;

and in the industrial gases industry, where Air Products and Chemicals was the best of two holdings that added to both

relative and absolute returns. |

|

Top

detractors from performance: | |

|

↓

|

Allocation

in the oil and gas storage and transportation industry, where the Fund maintained much lighter-than-index exposures to

Enbridge, Cheniere Energy and other energy pipeline/infrastructure companies that saw their equity values appreciate significantly

on the back of expected natural gas demand to power artificial intelligence (AI) focused data centers. |

|

↓

|

Keeping

roughly seven times the benchmark’s modest exposure to underperforming diversified metals and mining companies, including

several that suffered double-digit percentage declines. Overweighting in copper-focused miners was also detrimental as

key detractor ERO Copper and all other related holdings shed considerable equity value despite long-term expectations for healthy

demand from electrification trends. |

|

↓

|

Off-benchmark

renewable energy plays had a tough year amid shifting supply/demand, geopolitical and policy-related dynamics. Key

detractors were Albemarle (battery-grade lithium mining), Fluence Energy (digital renewable energy storage solutions; sold by

period-end), and some of Fluence’s green energy-focused peers in the electrical components and equipment industry.

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

C |

-7.58

|

17.18

|

-0.11

|

|

Class

C (with sales charge) |

-8.49

|

17.18

|

-0.11

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

S&P

North American Natural Resources Sector Index |

-3.60

|

18.67

|

3.94

|

|

S&P

Global Natural Resources Index |

-6.73

|

12.53

|

5.27

|

|

Total

Net Assets |

$293,885,401

|

|

Total

Number of Portfolio Holdings*

|

91

|

|

Total

Management Fee Paid |

$1,743,418

|

|

Portfolio

Turnover Rate |

19.72%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R6 |

$60

|

0.62%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the oilfield services industry, where robust gains for off-benchmark positions in Technip Energies and Ranger Energy

Services were most beneficial. Portfolio underweighting in poor-performing integrated oil and gas companies such as Chevron

and Exxon Mobil further buoyed the Fund’s energy sector results. |

|

↑

|

Among

metals and mining companies, exceptionally strong one-year gains for the Fund’s overweighted stakes in gold producers such

as Alamos Gold and Newmont. Similarly elevated returns were seen with select contributors in the diversified metals and mining

industry, led by a heavily-overweighted position in rare earths mining and processing company MP Materials. |

|

↑

|

Off-benchmark

investments in the fertilizers and agricultural chemicals industry, where Corteva and Nutrien were standout contributors;

and in the industrial gases industry, where Air Products and Chemicals was the best of two holdings that added to both

relative and absolute returns. |

|

Top

detractors from performance: | |

|

↓

|

Allocation

in the oil and gas storage and transportation industry, where the Fund maintained much lighter-than-index exposures to

Enbridge, Cheniere Energy and other energy pipeline/infrastructure companies that saw their equity values appreciate significantly

on the back of expected natural gas demand to power artificial intelligence (AI) focused data centers. |

|

↓

|

Keeping

roughly seven times the benchmark’s modest exposure to underperforming diversified metals and mining companies, including

several that suffered double-digit percentage declines. Overweighting in copper-focused miners was also detrimental as

key detractor ERO Copper and all other related holdings shed considerable equity value despite long-term expectations for healthy

demand from electrification trends. |

|

↓

|

Off-benchmark

renewable energy plays had a tough year amid shifting supply/demand, geopolitical and policy-related dynamics. Key

detractors were Albemarle (battery-grade lithium mining), Fluence Energy (digital renewable energy storage solutions; sold by

period-end), and some of Fluence’s green energy-focused peers in the electrical components and equipment industry.

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

R6 |

-6.56

|

18.59

|

1.12

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

S&P

North American Natural Resources Sector Index |

-3.60

|

18.67

|

3.94

|

|

S&P

Global Natural Resources Index |

-6.73

|

12.53

|

5.27

|

|

Total

Net Assets |

$293,885,401

|

|

Total

Number of Portfolio Holdings*

|

91

|

|

Total

Management Fee Paid |

$1,743,418

|

|

Portfolio

Turnover Rate |

19.72%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Advisor

Class |

$72

|

0.74%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the oilfield services industry, where robust gains for off-benchmark positions in Technip Energies and Ranger Energy

Services were most beneficial. Portfolio underweighting in poor-performing integrated oil and gas companies such as Chevron

and Exxon Mobil further buoyed the Fund’s energy sector results. |

|

↑

|

Among

metals and mining companies, exceptionally strong one-year gains for the Fund’s overweighted stakes in gold producers such

as Alamos Gold and Newmont. Similarly elevated returns were seen with select contributors in the diversified metals and mining

industry, led by a heavily-overweighted position in rare earths mining and processing company MP Materials. |

|

↑

|

Off-benchmark

investments in the fertilizers and agricultural chemicals industry, where Corteva and Nutrien were standout contributors;

and in the industrial gases industry, where Air Products and Chemicals was the best of two holdings that added to both

relative and absolute returns. |

|

Top

detractors from performance: | |

|

↓

|

Allocation

in the oil and gas storage and transportation industry, where the Fund maintained much lighter-than-index exposures to

Enbridge, Cheniere Energy and other energy pipeline/infrastructure companies that saw their equity values appreciate significantly

on the back of expected natural gas demand to power artificial intelligence (AI) focused data centers. |

|

↓

|

Keeping

roughly seven times the benchmark’s modest exposure to underperforming diversified metals and mining companies, including

several that suffered double-digit percentage declines. Overweighting in copper-focused miners was also detrimental as

key detractor ERO Copper and all other related holdings shed considerable equity value despite long-term expectations for healthy

demand from electrification trends. |

|

↓

|

Off-benchmark

renewable energy plays had a tough year amid shifting supply/demand, geopolitical and policy-related dynamics. Key

detractors were Albemarle (battery-grade lithium mining), Fluence Energy (digital renewable energy storage solutions; sold by

period-end), and some of Fluence’s green energy-focused peers in the electrical components and equipment industry.

|

|

|

1

Year |

5

Year |

10

Year |

|

Advisor

Class |

-6.68

|

18.37

|

0.89

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

S&P

North American Natural Resources Sector Index |

-3.60

|

18.67

|

3.94

|

|

S&P

Global Natural Resources Index |

-6.73

|

12.53

|

5.27

|

|

Total

Net Assets |

$293,885,401

|

|

Total

Number of Portfolio Holdings*

|

91

|

|

Total

Management Fee Paid |

$1,743,418

|

|

Portfolio

Turnover Rate |

19.72%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$102

|

1.04%

|

|

Top

contributors to performance: | |

|

↑

|

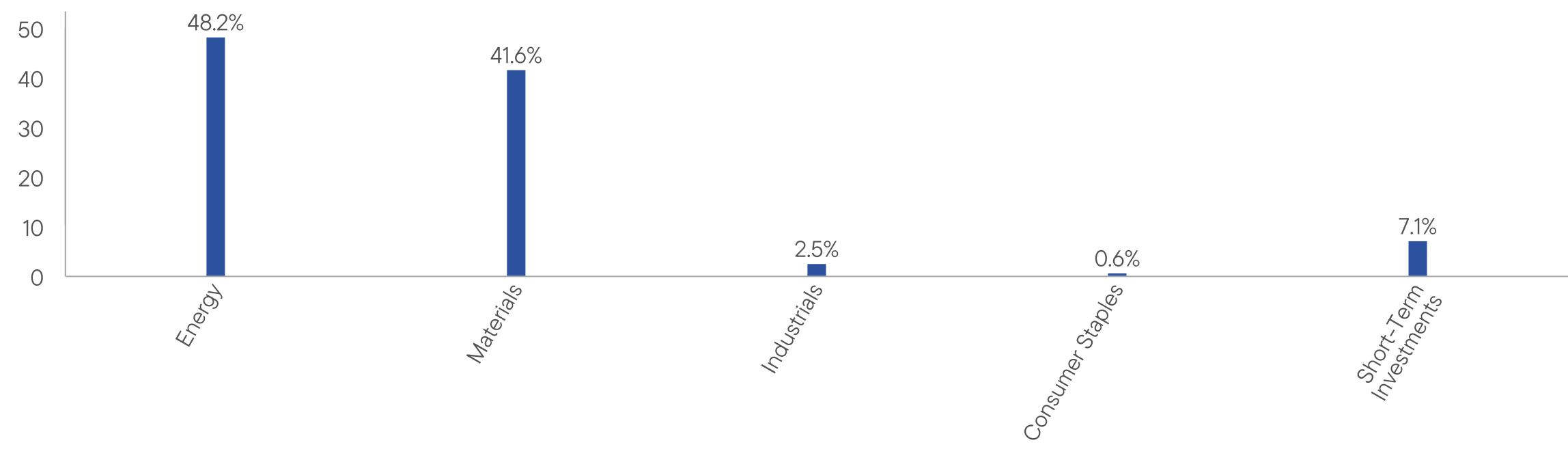

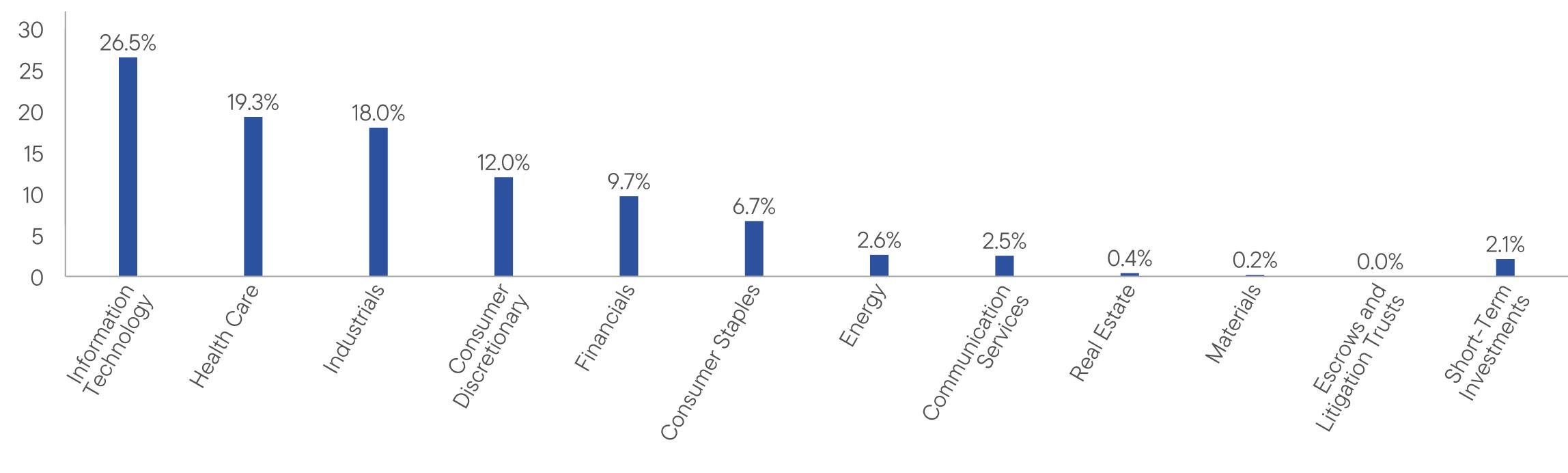

Stock

selection in the industrials sector was a driver of positive relative performance led by a position in Kratos Defense & Security.

The defense contractor scored several lucrative contracts over the period, spotlighting the company’s continued growth

and innovation in defense and security solutions. |

|

↑

|

In

the financials sector, Paymentus Holdings is an out-of-benchmark position that significantly contributed to returns. The bill payment

services company has seen strong demand for its advanced payment platform and has onboarded several new, large enterprise

clients. |

|

↑

|

SiTime

was a leading contributor in the information technology (IT) sector. The semiconductor manufacturer commands a significant

portion of the precision timing industry and continued to see strong profit growth from its high-value applications and differentiated

product offerings. |

|

Top

detractors from performance: | |

|

↓

|

At

the sector level, relative returns were hurt most by stock selection in the health care sector, particularly in the biotechnology and

health care equipment and supplies industries. Stock selection and an overweight in the IT sector also meaningfully detracted

from relative results. Within IT, Onto innovation shares were hampered by a misalignment of supply-chain costs and inventory

levels over the period. |

|

↓

|

In

the financials sector, relative performance was hindered by a position in global payments software company Flywire, which faced

foreign exchange headwinds and student visa restrictions over the period. |

|

↓

|

In

the energy sector, Liberty Energy was a relative detractor as slower global economic growth and trade uncertainty curbed energy

demand. Notable leadership changes at the company also introduced some uncertainty that added to the stock’s decline.

|

|

|

1

Year |

5

Year |

10

Year |

|

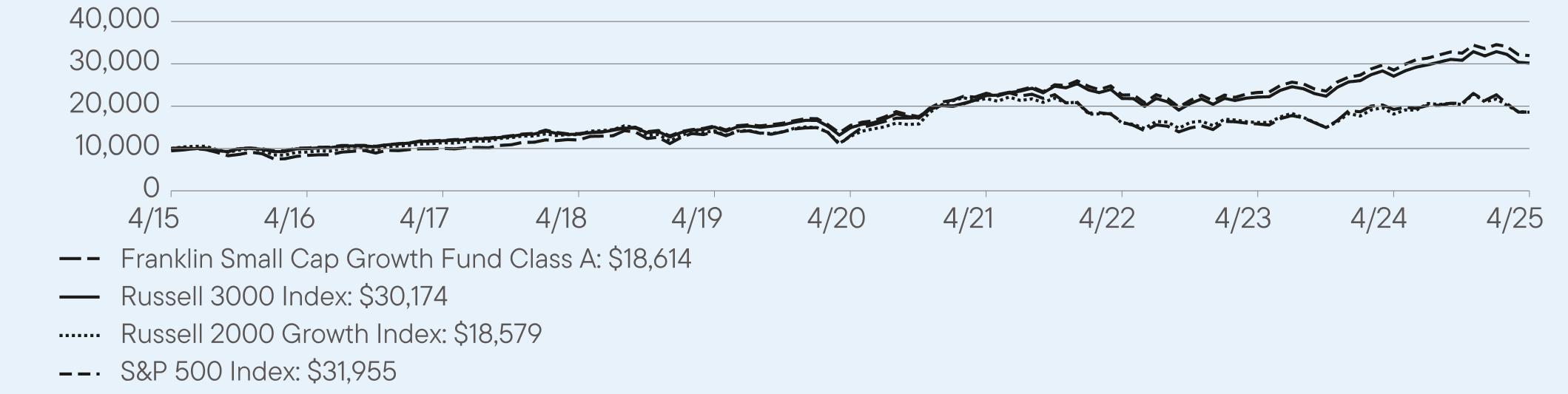

Class

A |

-3.25

|

7.33

|

7.01

|

|

Class

A (with sales charge) |

-8.58

|

6.12

|

6.41

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

2000 Growth Index |

2.42

|

7.60

|

6.39

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$2,278,348,128

|

|

Total

Number of Portfolio Holdings*

|

124

|

|

Total

Management Fee Paid |

$16,586,955

|

|

Portfolio

Turnover Rate |

16.31%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

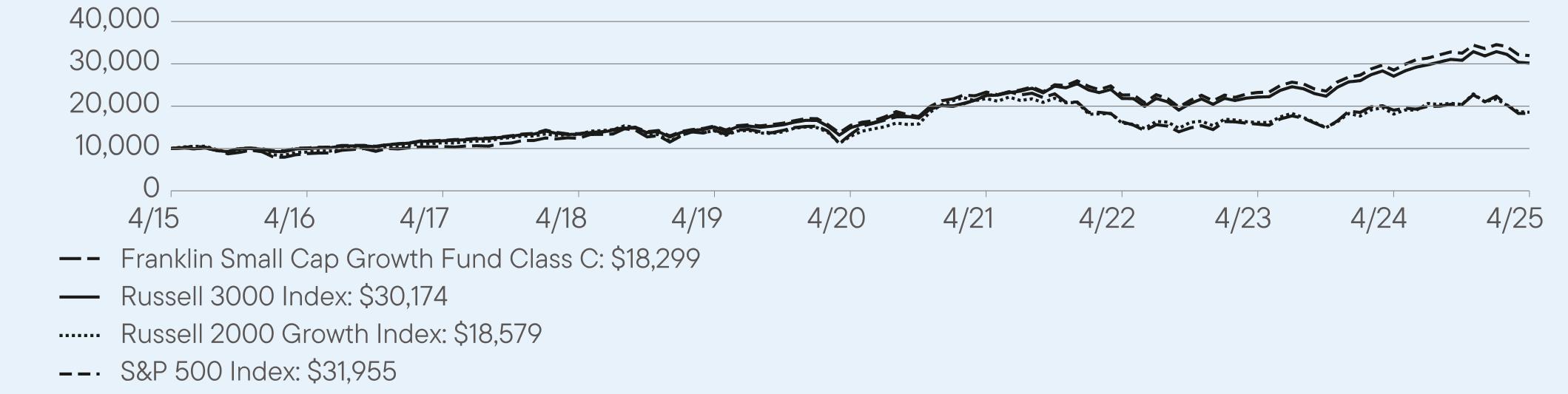

Class

C |

$175

|

1.79%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials sector was a driver of positive relative performance led by a position in Kratos Defense & Security.

The defense contractor scored several lucrative contracts over the period, spotlighting the company’s continued growth

and innovation in defense and security solutions. |

|

↑

|

In

the financials sector, Paymentus Holdings is an out-of-benchmark position that significantly contributed to returns. The bill payment

services company has seen strong demand for its advanced payment platform and has onboarded several new, large enterprise

clients. |

|

↑

|

SiTime

was a leading contributor in the information technology (IT) sector. The semiconductor manufacturer commands a significant

portion of the precision timing industry and continued to see strong profit growth from its high-value applications and differentiated

product offerings. |

|

Top

detractors from performance: | |

|

↓

|

At

the sector level, relative returns were hurt most by stock selection in the health care sector, particularly in the biotechnology and

health care equipment and supplies industries. Stock selection and an overweight in the IT sector also meaningfully detracted

from relative results. Within IT, Onto innovation shares were hampered by a misalignment of supply-chain costs and inventory

levels over the period. |

|

↓

|

In

the financials sector, relative performance was hindered by a position in global payments software company Flywire, which faced

foreign exchange headwinds and student visa restrictions over the period. |

|

↓

|

In

the energy sector, Liberty Energy was a relative detractor as slower global economic growth and trade uncertainty curbed energy

demand. Notable leadership changes at the company also introduced some uncertainty that added to the stock’s decline.

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

C |

-3.98

|

6.55

|

6.23

|

|

Class

C (with sales charge) |

-4.94

|

6.55

|

6.23

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

2000 Growth Index |

2.42

|

7.60

|

6.39

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$2,278,348,128

|

|

Total

Number of Portfolio Holdings*

|

124

|

|

Total

Management Fee Paid |

$16,586,955

|

|

Portfolio

Turnover Rate |

16.31%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

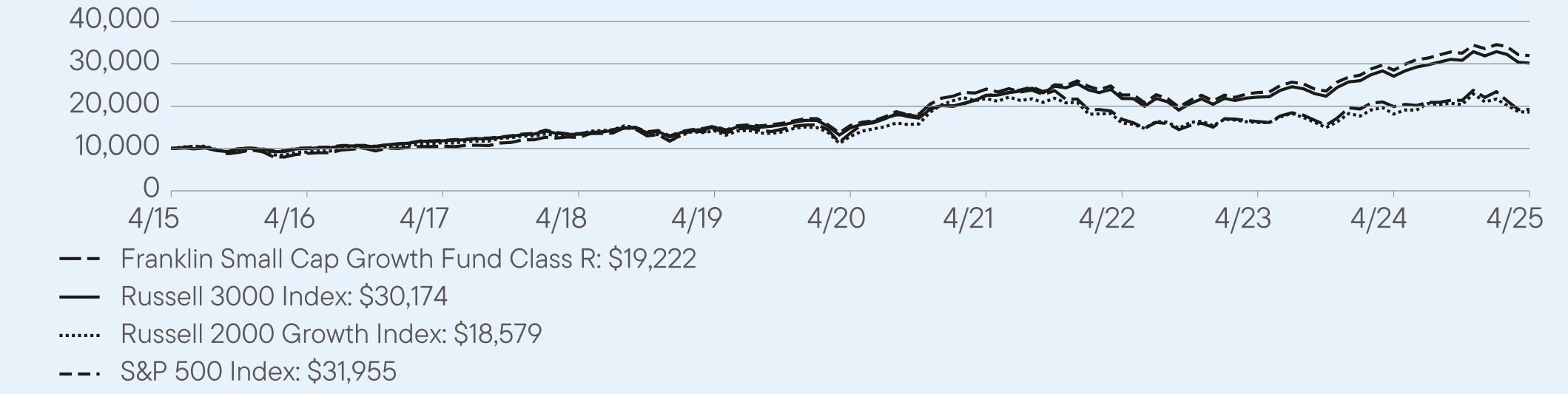

Class

R |

$127

|

1.29%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials sector was a driver of positive relative performance led by a position in Kratos Defense & Security.

The defense contractor scored several lucrative contracts over the period, spotlighting the company’s continued growth

and innovation in defense and security solutions. |

|

↑

|

In

the financials sector, Paymentus Holdings is an out-of-benchmark position that significantly contributed to returns. The bill payment

services company has seen strong demand for its advanced payment platform and has onboarded several new, large enterprise

clients. |

|

↑

|

SiTime

was a leading contributor in the information technology (IT) sector. The semiconductor manufacturer commands a significant

portion of the precision timing industry and continued to see strong profit growth from its high-value applications and differentiated

product offerings. |

|

Top

detractors from performance: | |

|

↓

|

At

the sector level, relative returns were hurt most by stock selection in the health care sector, particularly in the biotechnology and

health care equipment and supplies industries. Stock selection and an overweight in the IT sector also meaningfully detracted

from relative results. Within IT, Onto innovation shares were hampered by a misalignment of supply-chain costs and inventory

levels over the period. |

|

↓

|

In

the financials sector, relative performance was hindered by a position in global payments software company Flywire, which faced

foreign exchange headwinds and student visa restrictions over the period. |

|

↓

|

In

the energy sector, Liberty Energy was a relative detractor as slower global economic growth and trade uncertainty curbed energy

demand. Notable leadership changes at the company also introduced some uncertainty that added to the stock’s decline.

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

R |

-3.50

|

7.07

|

6.75

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

2000 Growth Index |

2.42

|

7.60

|

6.39

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$2,278,348,128

|

|

Total

Number of Portfolio Holdings*

|

124

|

|

Total

Management Fee Paid |

$16,586,955

|

|

Portfolio

Turnover Rate |

16.31%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R6 |

$64

|

0.65%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials sector was a driver of positive relative performance led by a position in Kratos Defense & Security.

The defense contractor scored several lucrative contracts over the period, spotlighting the company’s continued growth

and innovation in defense and security solutions. |

|

↑

|

In

the financials sector, Paymentus Holdings is an out-of-benchmark position that significantly contributed to returns. The bill payment

services company has seen strong demand for its advanced payment platform and has onboarded several new, large enterprise

clients. |

|

↑

|

SiTime

was a leading contributor in the information technology (IT) sector. The semiconductor manufacturer commands a significant

portion of the precision timing industry and continued to see strong profit growth from its high-value applications and differentiated

product offerings. |

|

Top

detractors from performance: | |

|

↓

|

At

the sector level, relative returns were hurt most by stock selection in the health care sector, particularly in the biotechnology and

health care equipment and supplies industries. Stock selection and an overweight in the IT sector also meaningfully detracted

from relative results. Within IT, Onto innovation shares were hampered by a misalignment of supply-chain costs and inventory

levels over the period. |

|

↓

|

In

the financials sector, relative performance was hindered by a position in global payments software company Flywire, which faced

foreign exchange headwinds and student visa restrictions over the period. |

|

↓

|

In

the energy sector, Liberty Energy was a relative detractor as slower global economic growth and trade uncertainty curbed energy

demand. Notable leadership changes at the company also introduced some uncertainty that added to the stock’s decline.

|

|

|

1

Year |

5

Year |

10

Year |

|

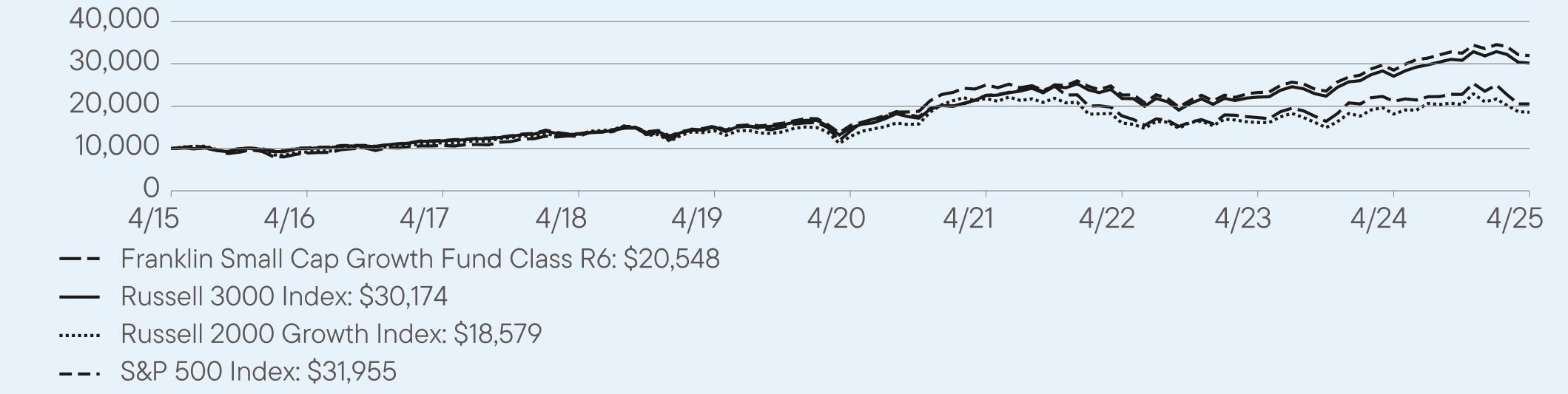

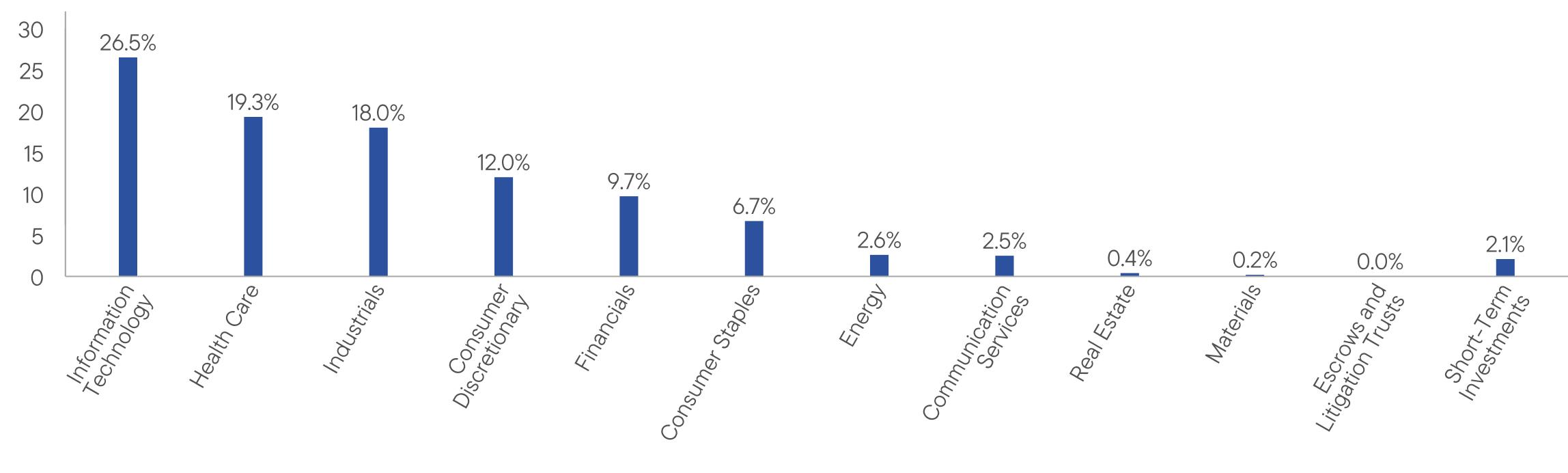

Class

R6 |

-2.88

|

7.77

|

7.47

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

2000 Growth Index |

2.42

|

7.60

|

6.39

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$2,278,348,128

|

|

Total

Number of Portfolio Holdings*

|

124

|

|

Total

Management Fee Paid |

$16,586,955

|

|

Portfolio

Turnover Rate |

16.31%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Advisor

Class |

$78

|

0.79%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection in the industrials sector was a driver of positive relative performance led by a position in Kratos Defense & Security.

The defense contractor scored several lucrative contracts over the period, spotlighting the company’s continued growth

and innovation in defense and security solutions. |

|

↑

|

In

the financials sector, Paymentus Holdings is an out-of-benchmark position that significantly contributed to returns. The bill payment

services company has seen strong demand for its advanced payment platform and has onboarded several new, large enterprise

clients. |

|

↑

|

SiTime

was a leading contributor in the information technology (IT) sector. The semiconductor manufacturer commands a significant

portion of the precision timing industry and continued to see strong profit growth from its high-value applications and differentiated

product offerings. |

|

Top

detractors from performance: | |

|

↓

|

At

the sector level, relative returns were hurt most by stock selection in the health care sector, particularly in the biotechnology and

health care equipment and supplies industries. Stock selection and an overweight in the IT sector also meaningfully detracted

from relative results. Within IT, Onto innovation shares were hampered by a misalignment of supply-chain costs and inventory

levels over the period. |

|

↓

|

In

the financials sector, relative performance was hindered by a position in global payments software company Flywire, which faced

foreign exchange headwinds and student visa restrictions over the period. |

|

↓

|

In

the energy sector, Liberty Energy was a relative detractor as slower global economic growth and trade uncertainty curbed energy

demand. Notable leadership changes at the company also introduced some uncertainty that added to the stock’s decline.

|

|

|

1

Year |

5

Year |

10

Year |

|

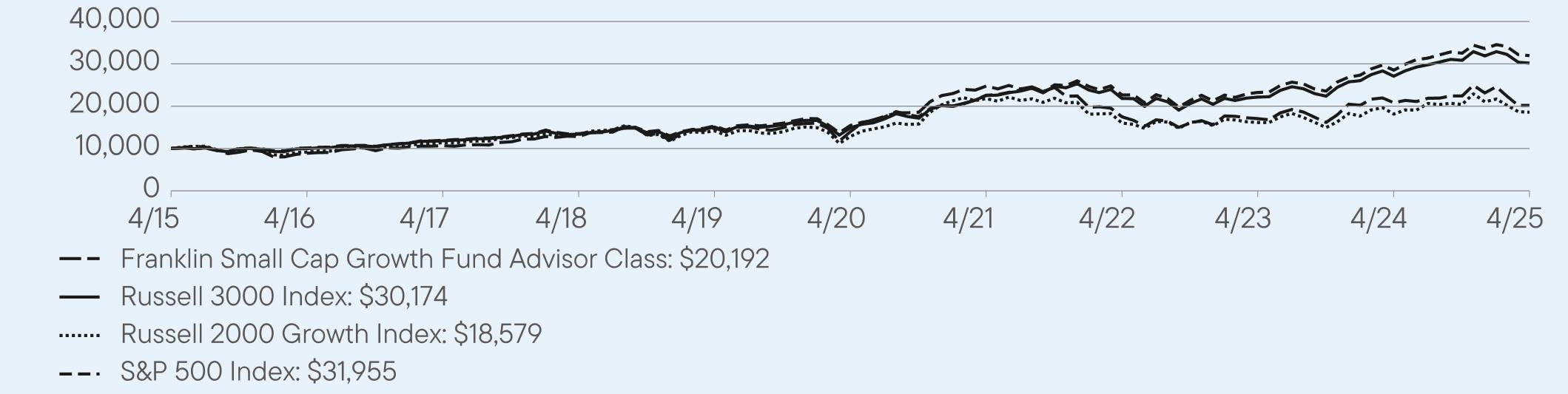

Advisor

Class |

-3.05

|

7.60

|

7.28

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

2000 Growth Index |

2.42

|

7.60

|

6.39

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$2,278,348,128

|

|

Total

Number of Portfolio Holdings*

|

124

|

|

Total

Management Fee Paid |

$16,586,955

|

|

Portfolio

Turnover Rate |

16.31%

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$85

|

0.84%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection and an overweight in the industrials sector where Axon Enterprise was a leading relative contributor. A focus on supporting

police budgets, lack of significant competition and minimal tariff exposure have been tailwinds for the law enforcement

technology company. |

|

↑

|

In

the consumer discretionary sector, DoorDash was a leading individual contributor at the stock level. The food delivery company

has dramatically improved its profitability year-over-year helped by DashPass subscriber growth and repeat orders. |

|

↑

|

In

the communication services sector, Roblox, a developer of an online game platform and game creation system, reported business

improvements that included stronger bookings and continued cost discipline. Management also stated that artificial intelligence

(AI) was being deployed across its platform for more efficient content creation and enhanced user experience. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection in the information technology (IT) sector meaningfully detracted from relative returns over the period. This was due

to stock selection and an underweight in the software industry, where an underweight in strong-performing shares of Applovin

detracted from relative returns. Company revenue grew substantially following the introduction of an AI-powered software

update that improves marketing and monetization of content. |

|

↓

|

In

the IT services industry, database specialist MongoDB faced several challenges that included a one-time revenue headwind that

impacted the company’s overall financial performance. Worsening economic conditions led the company to downgrade its guidance

for fiscal full-year 2025, which further pressured the stock. |

|

↓

|

A

challenging market environment also weighed on the shares of Blaize Holdings, which was another relative detractor in the IT sector.

The company specializes in AI-enabled edge computing solutions and went public in January 2025. |

|

|

1

Year |

5

Year |

10

Year |

|

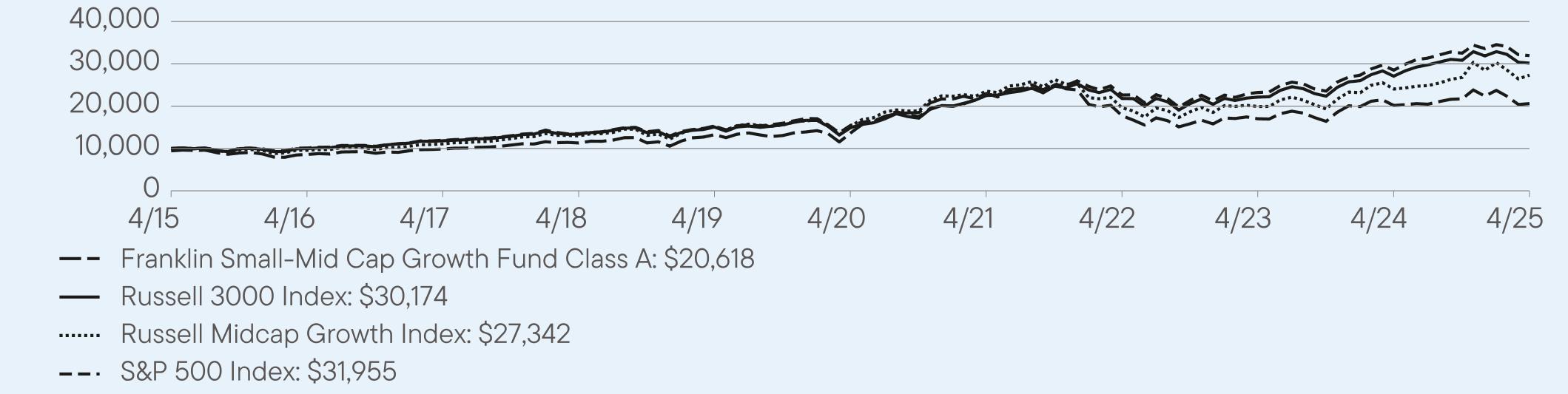

Class

A |

2.27

|

8.58

|

8.11

|

|

Class

A (with sales charge) |

-3.35

|

7.36

|

7.51

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|

Russell

Midcap Growth Index |

13.65

|

12.31

|

10.58

|

|

S&P

500 Index |

12.10

|

15.61

|

12.32

|

|

Total

Net Assets |

$3,531,973,205

|

|

Total

Number of Portfolio Holdings*

|

99

|

|

Total

Management Fee Paid |

$17,655,085

|

|

Portfolio

Turnover Rate |

33.86%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

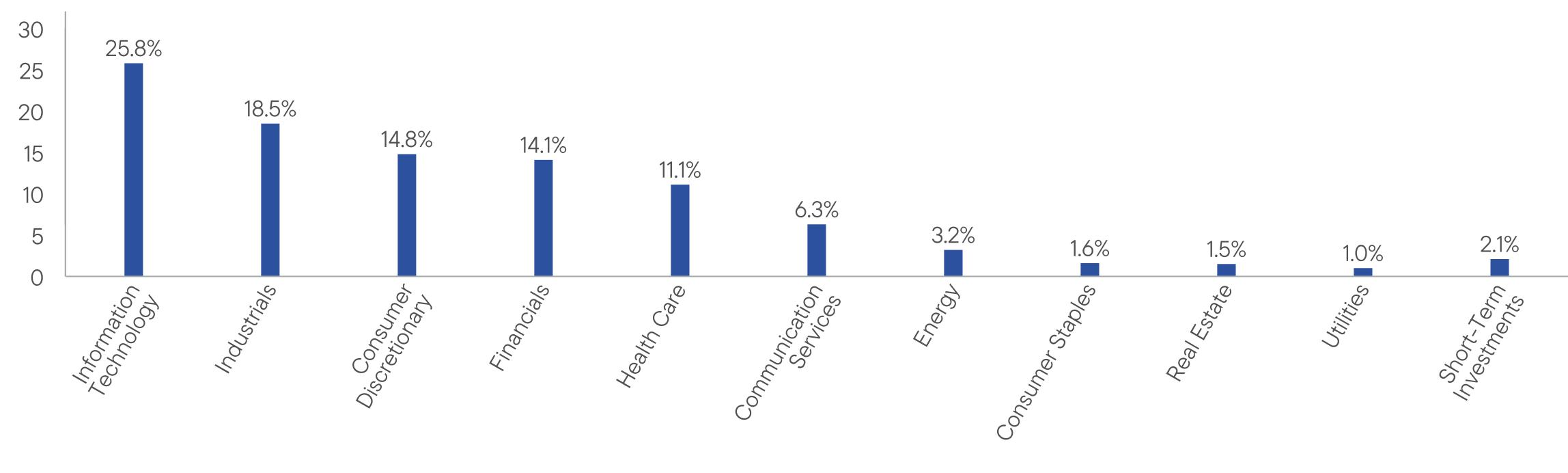

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

C |

$160

|

1.59%

|

|

Top

contributors to performance: | |

|

↑

|

Stock

selection and an overweight in the industrials sector where Axon Enterprise was a leading relative contributor. A focus on supporting

police budgets, lack of significant competition and minimal tariff exposure have been tailwinds for the law enforcement

technology company. |

|

↑

|

In

the consumer discretionary sector, DoorDash was a leading individual contributor at the stock level. The food delivery company

has dramatically improved its profitability year-over-year helped by DashPass subscriber growth and repeat orders. |

|

↑

|

In

the communication services sector, Roblox, a developer of an online game platform and game creation system, reported business

improvements that included stronger bookings and continued cost discipline. Management also stated that artificial intelligence

(AI) was being deployed across its platform for more efficient content creation and enhanced user experience. |

|

Top

detractors from performance: | |

|

↓

|

Stock

selection in the information technology (IT) sector meaningfully detracted from relative returns over the period. This was due

to stock selection and an underweight in the software industry, where an underweight in strong-performing shares of Applovin

detracted from relative returns. Company revenue grew substantially following the introduction of an AI-powered software

update that improves marketing and monetization of content. |

|

↓

|

In

the IT services industry, database specialist MongoDB faced several challenges that included a one-time revenue headwind that

impacted the company’s overall financial performance. Worsening economic conditions led the company to downgrade its guidance

for fiscal full-year 2025, which further pressured the stock. |

|

↓

|

A

challenging market environment also weighed on the shares of Blaize Holdings, which was another relative detractor in the IT sector.

The company specializes in AI-enabled edge computing solutions and went public in January 2025. |

|

|

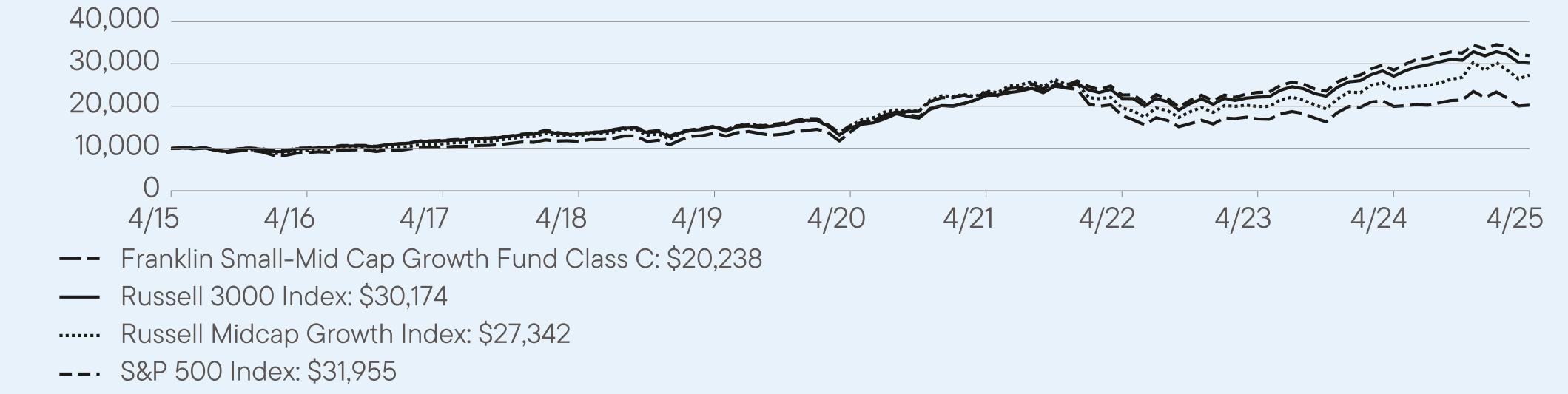

1

Year |

5

Year |

10

Year |

|

Class

C |

1.52

|

7.76

|

7.30

|

|

Class

C (with sales charge) |

0.52

|

7.76

|

7.30

|

|

Russell

3000 Index |

11.40

|

15.12

|

11.68

|

|