Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

$ / shares

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Franklin Value Investors Trust

|

|

| Entity Central Index Key |

0000856119

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual Small-Mid Cap Value Fund

|

|

| Class Name |

Class

A

|

|

| Trading Symbol |

FRMCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual Small-Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

A |

$54

|

1.15%

|

|

[1],[2] |

| Expenses Paid, Amount |

$ 54

|

|

| Expense Ratio, Percent |

1.15%

|

|

| Net Assets |

$ 182,114,786

|

|

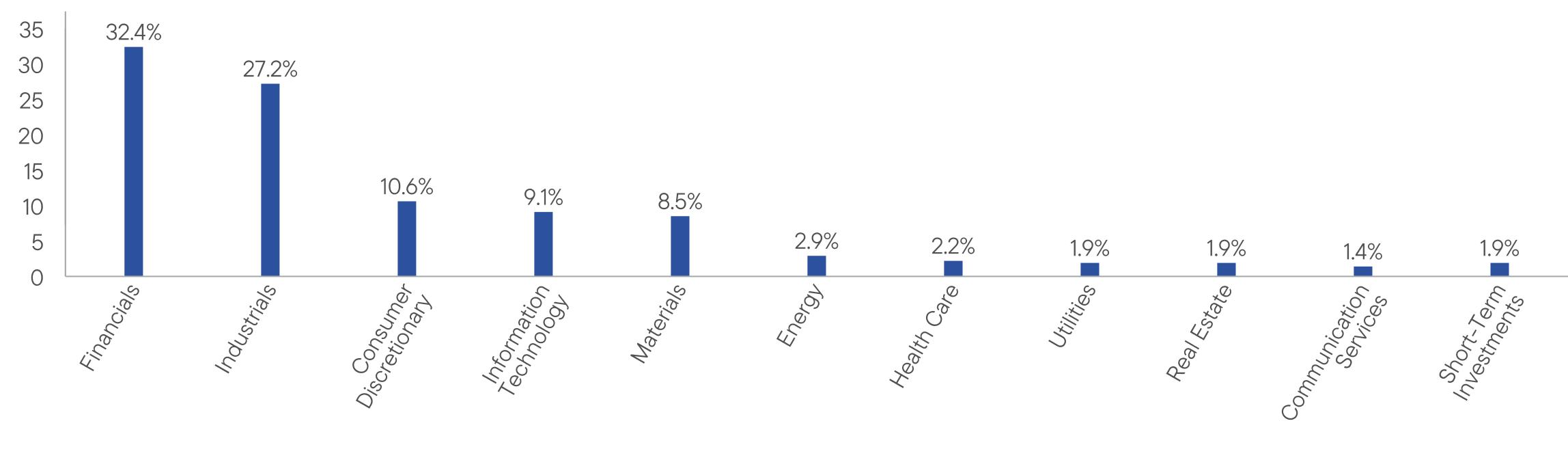

| Holdings Count | $ / shares |

64

|

[3] |

| Investment Company Portfolio Turnover |

57.89%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$182,114,786

|

|

Total

Number of Portfolio Holdings*

|

64

|

|

Portfolio

Turnover Rate |

57.89%

|

|

[3] |

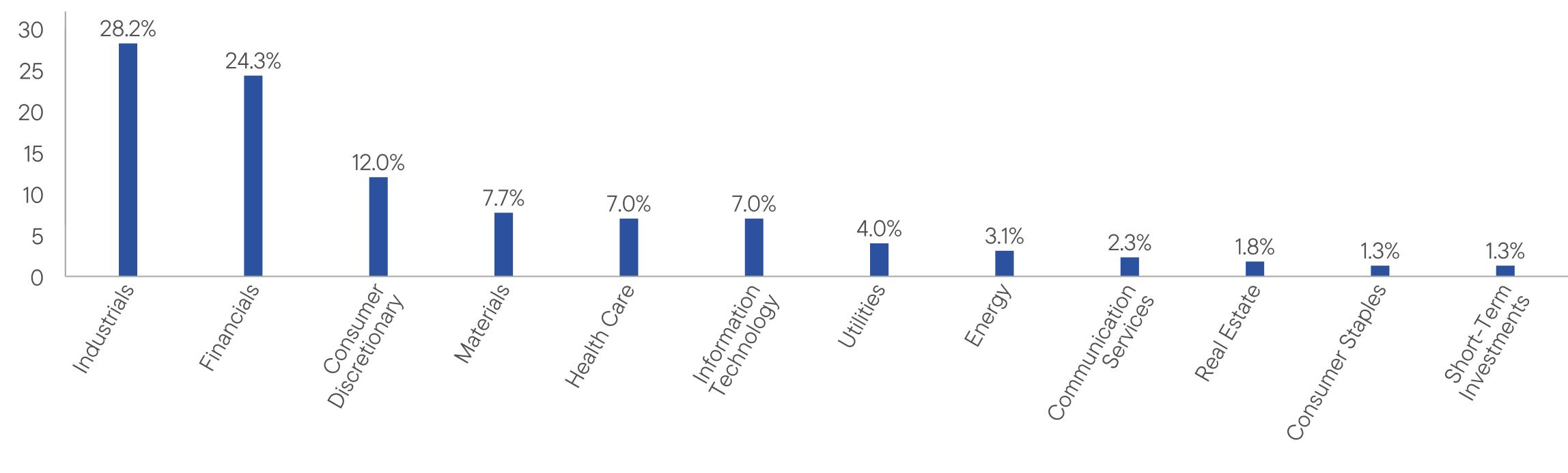

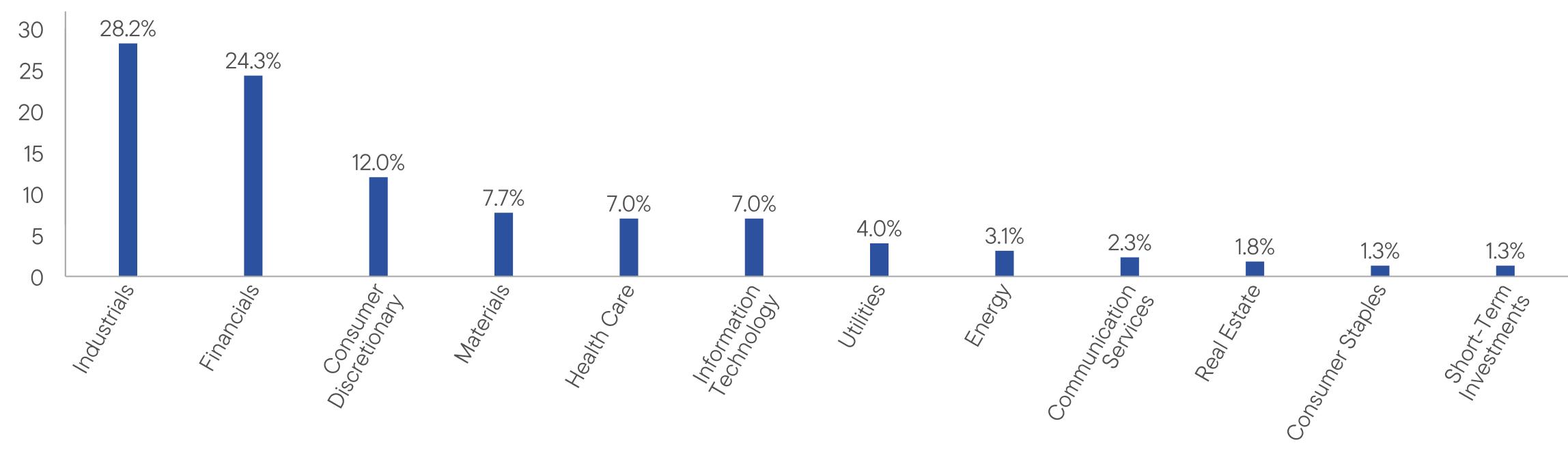

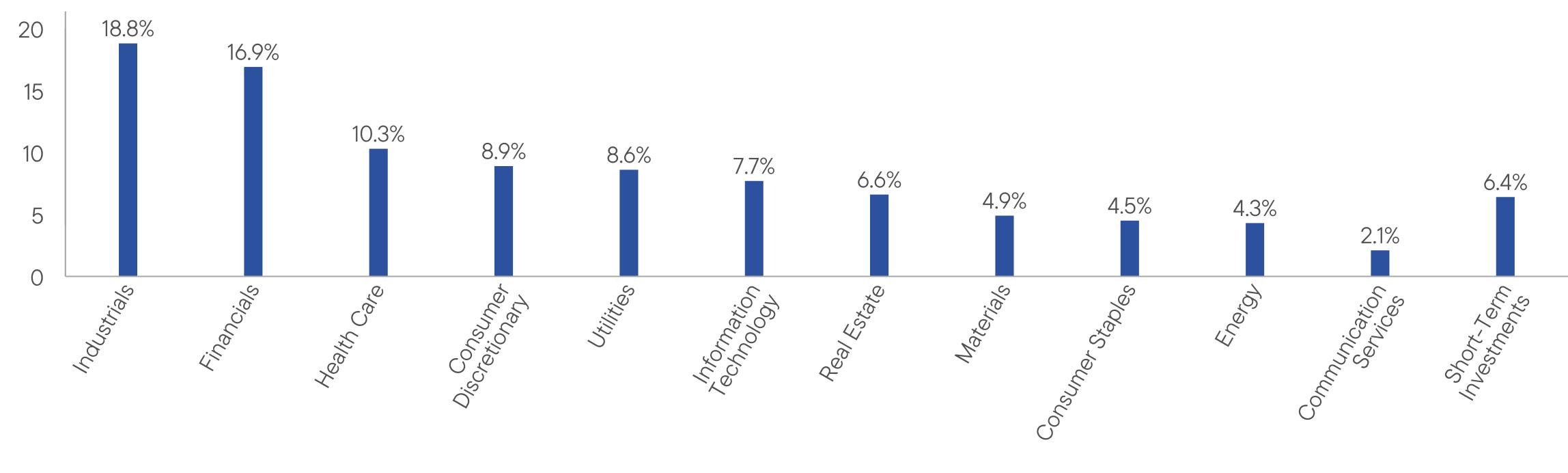

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R6 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual Small-Mid Cap Value Fund

|

|

| Class Name |

Class

R6

|

|

| Trading Symbol |

FMCVX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual Small-Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

R6 |

$41

|

0.87%

|

|

[4],[5] |

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.87%

|

|

| Net Assets |

$ 182,114,786

|

|

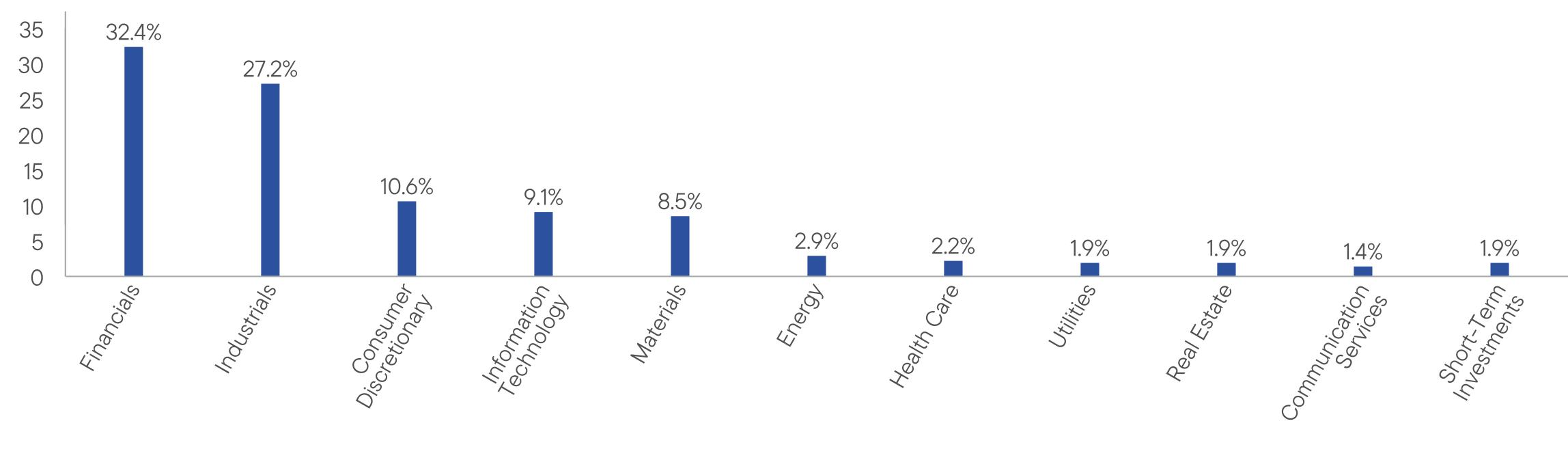

| Holdings Count | $ / shares |

64

|

[6] |

| Investment Company Portfolio Turnover |

57.89%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$182,114,786

|

|

Total

Number of Portfolio Holdings*

|

64

|

|

Portfolio

Turnover Rate |

57.89%

|

|

[6] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Advisor Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual Small-Mid Cap Value Fund

|

|

| Class Name |

Advisor

Class

|

|

| Trading Symbol |

FVRMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual Small-Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Advisor

Class |

$43

|

0.90%

|

|

[7],[8] |

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.90%

|

|

| Net Assets |

$ 182,114,786

|

|

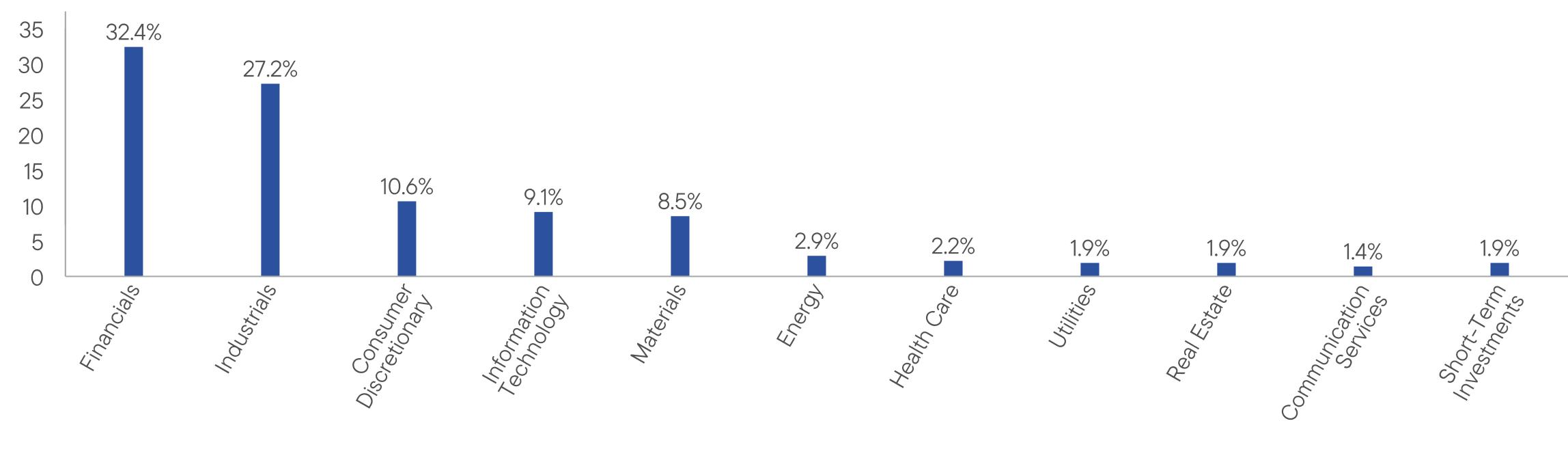

| Holdings Count | $ / shares |

64

|

[9] |

| Investment Company Portfolio Turnover |

57.89%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$182,114,786

|

|

Total

Number of Portfolio Holdings*

|

64

|

|

Portfolio

Turnover Rate |

57.89%

|

|

[9] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual U.S. Mid Cap Value Fund

|

|

| Class Name |

Class

A

|

|

| Trading Symbol |

FRBSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual U.S. Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

A |

$43

|

0.88%

|

|

[10],[11] |

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.88%

|

|

| Net Assets |

$ 722,758,996

|

|

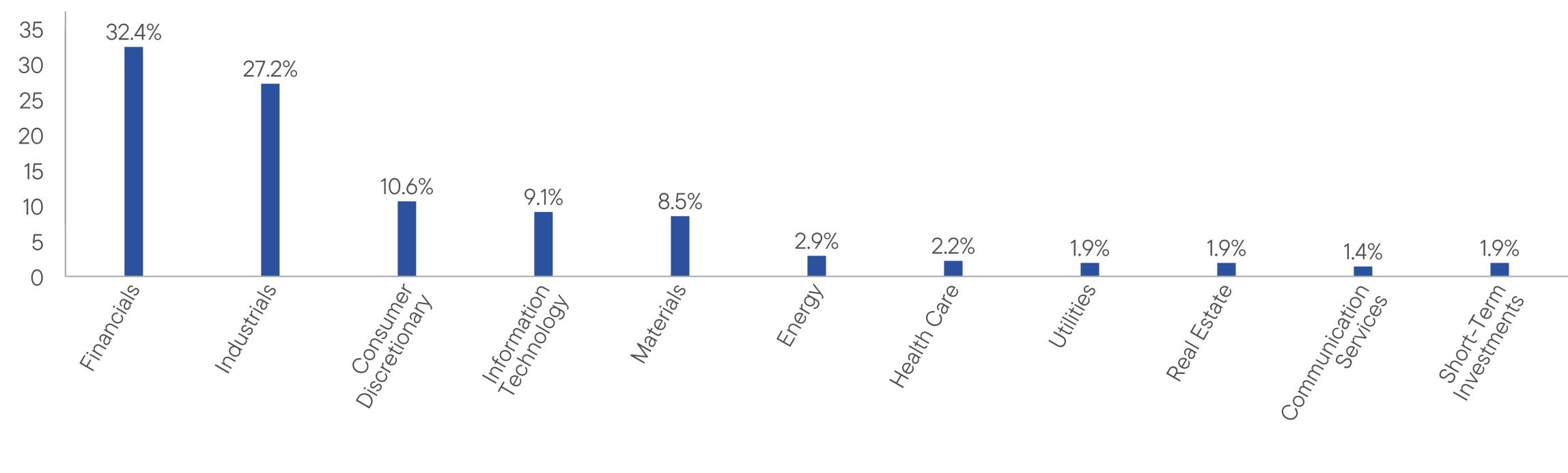

| Holdings Count | $ / shares |

53

|

[12] |

| Investment Company Portfolio Turnover |

24.10%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$722,758,996

|

|

Total

Number of Portfolio Holdings*

|

53

|

|

Portfolio

Turnover Rate |

24.10%

|

|

[12] |

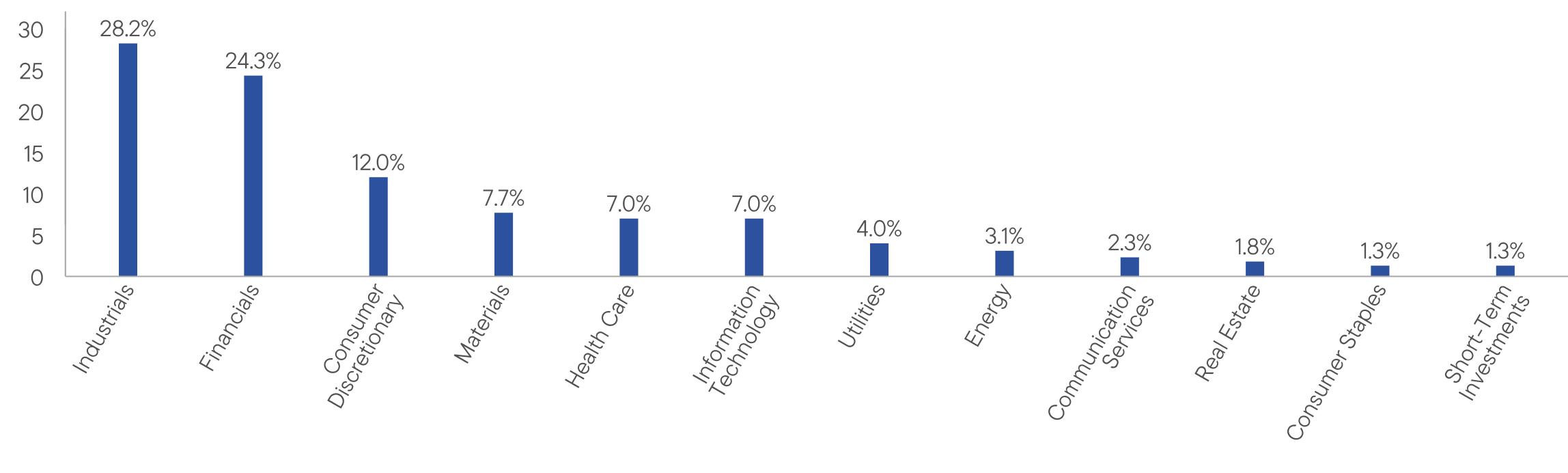

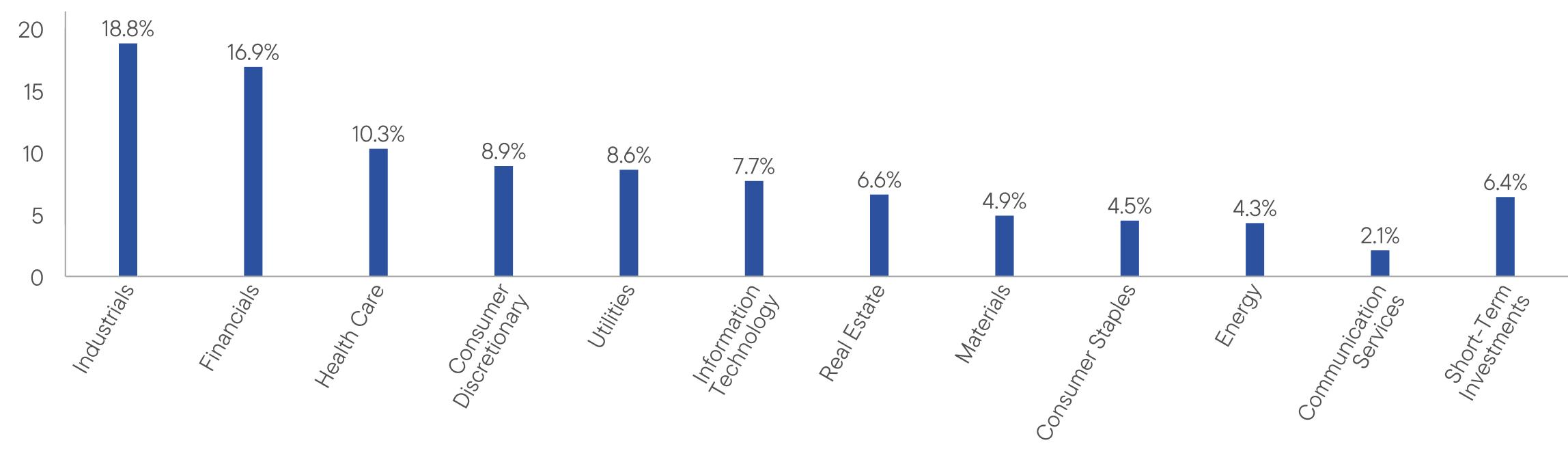

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual U.S. Mid Cap Value Fund

|

|

| Class Name |

Class

C

|

|

| Trading Symbol |

FCBSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual U.S. Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

C |

$79

|

1.63%

|

|

[13],[14] |

| Expenses Paid, Amount |

$ 79

|

|

| Expense Ratio, Percent |

1.63%

|

|

| Net Assets |

$ 722,758,996

|

|

| Holdings Count | $ / shares |

53

|

[15] |

| Investment Company Portfolio Turnover |

24.10%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$722,758,996

|

|

Total

Number of Portfolio Holdings*

|

53

|

|

Portfolio

Turnover Rate |

24.10%

|

|

[15] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual U.S. Mid Cap Value Fund

|

|

| Class Name |

Class

R

|

|

| Trading Symbol |

FBSRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual U.S. Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

R |

$55

|

1.13%

|

|

[16],[17] |

| Expenses Paid, Amount |

$ 55

|

|

| Expense Ratio, Percent |

1.13%

|

|

| Net Assets |

$ 722,758,996

|

|

| Holdings Count | $ / shares |

53

|

[18] |

| Investment Company Portfolio Turnover |

24.10%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$722,758,996

|

|

Total

Number of Portfolio Holdings*

|

53

|

|

Portfolio

Turnover Rate |

24.10%

|

|

[18] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R6 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual U.S. Mid Cap Value Fund

|

|

| Class Name |

Class

R6

|

|

| Trading Symbol |

FBSIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual U.S. Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

R6 |

$27

|

0.55%

|

|

[19],[20] |

| Expenses Paid, Amount |

$ 27

|

|

| Expense Ratio, Percent |

0.55%

|

|

| Net Assets |

$ 722,758,996

|

|

| Holdings Count | $ / shares |

53

|

[21] |

| Investment Company Portfolio Turnover |

24.10%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$722,758,996

|

|

Total

Number of Portfolio Holdings*

|

53

|

|

Portfolio

Turnover Rate |

24.10%

|

|

[21] |

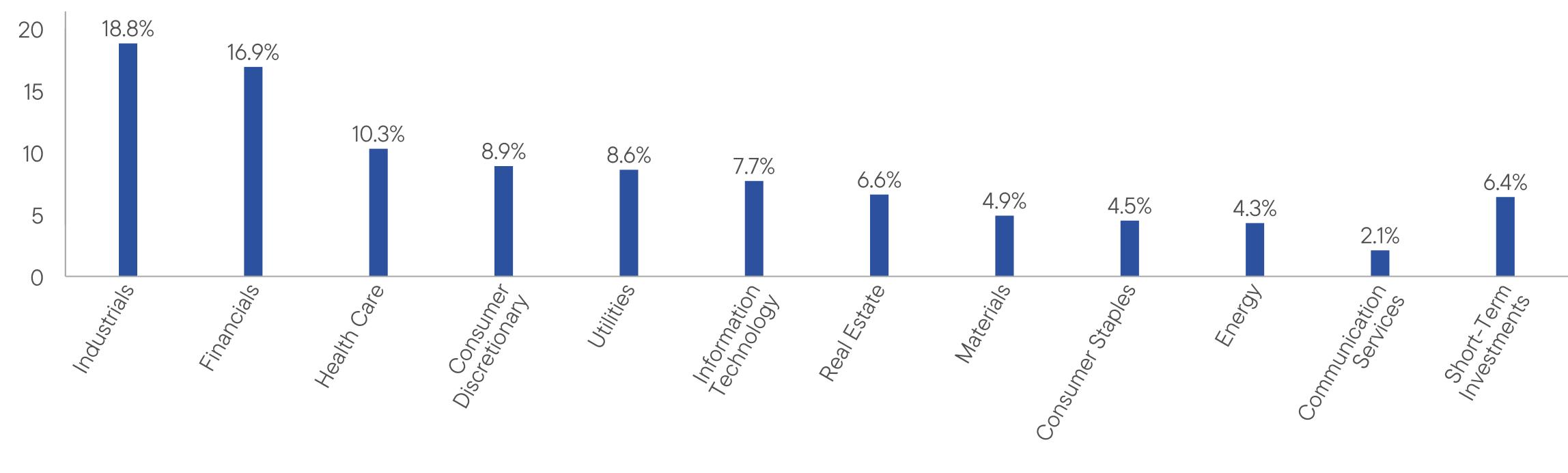

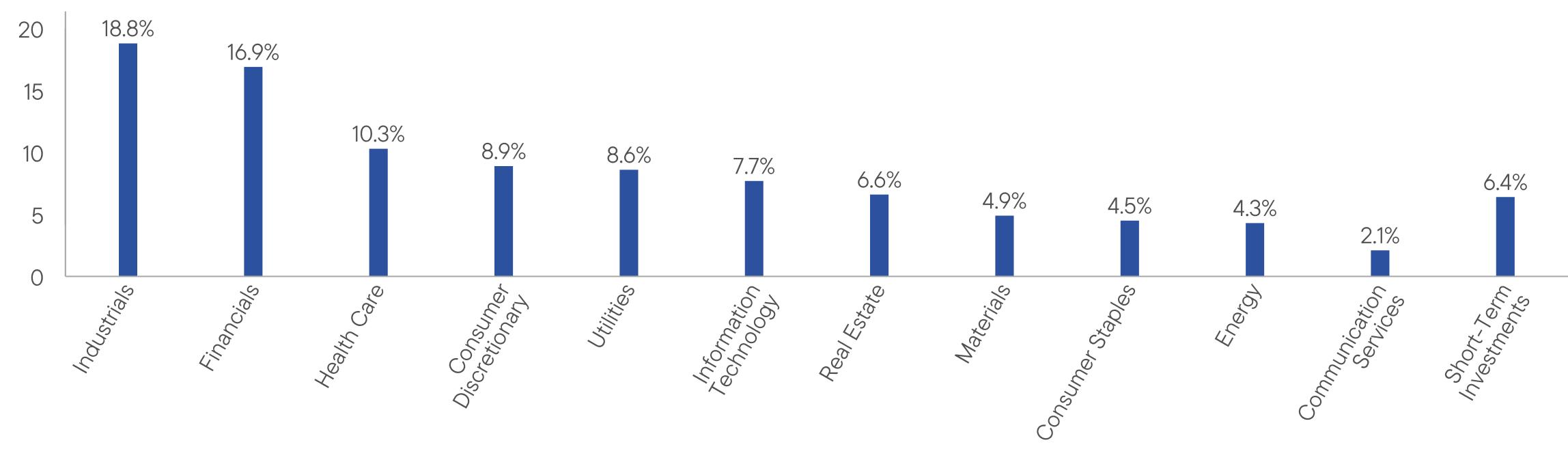

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Advisor Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Mutual U.S. Mid Cap Value Fund

|

|

| Class Name |

Advisor

Class

|

|

| Trading Symbol |

FBSAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Mutual U.S. Mid Cap Value Fund for the period November

1, 2024, to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Advisor

Class |

$31

|

0.63%

|

|

[22],[23] |

| Expenses Paid, Amount |

$ 31

|

|

| Expense Ratio, Percent |

0.63%

|

|

| Net Assets |

$ 722,758,996

|

|

| Holdings Count | $ / shares |

53

|

[24] |

| Investment Company Portfolio Turnover |

24.10%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$722,758,996

|

|

Total

Number of Portfolio Holdings*

|

53

|

|

Portfolio

Turnover Rate |

24.10%

|

|

[24] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Small Cap Value Fund

|

|

| Class Name |

Class

A

|

|

| Trading Symbol |

FRVLX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Small Cap Value Fund for the period November

1, 2024, to April

30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

A |

$45

|

0.95%

|

|

[25],[26] |

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.95%

|

|

| Net Assets |

$ 3,469,674,313

|

|

| Holdings Count | $ / shares |

75

|

[27] |

| Investment Company Portfolio Turnover |

24.41%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$3,469,674,313

|

|

Total

Number of Portfolio Holdings*

|

75

|

|

Portfolio

Turnover Rate |

24.41%

|

|

[27] |

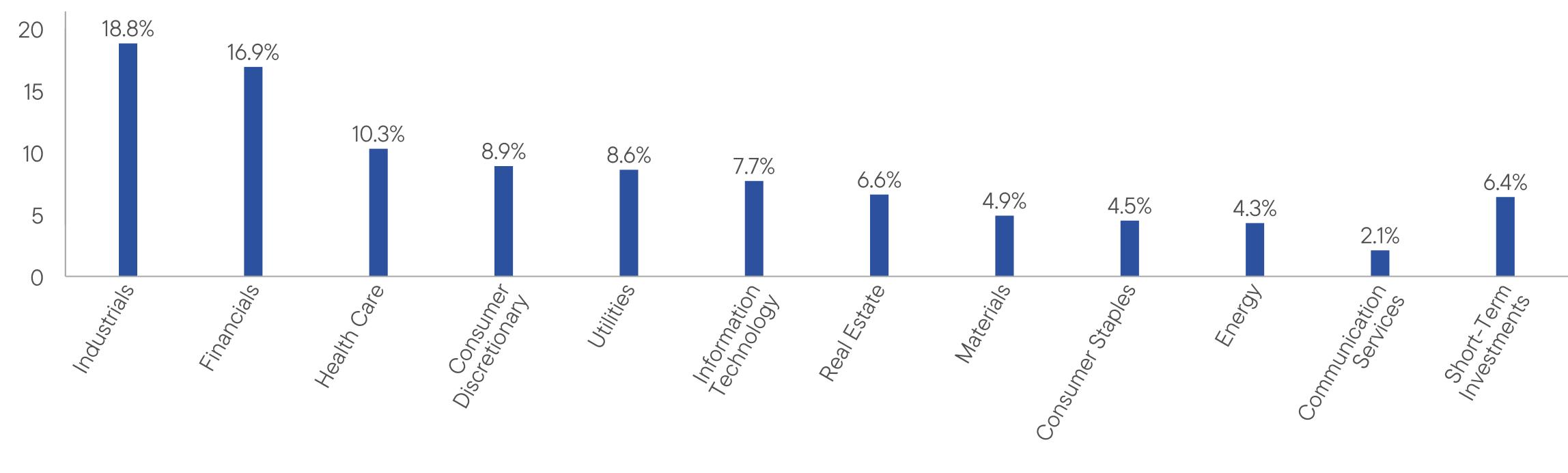

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Small Cap Value Fund

|

|

| Class Name |

Class

C

|

|

| Trading Symbol |

FRVFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Small Cap Value Fund for the period November

1, 2024, to April

30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

C |

$80

|

1.70%

|

|

[28],[29] |

| Expenses Paid, Amount |

$ 80

|

|

| Expense Ratio, Percent |

1.70%

|

|

| Net Assets |

$ 3,469,674,313

|

|

| Holdings Count | $ / shares |

75

|

[30] |

| Investment Company Portfolio Turnover |

24.41%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$3,469,674,313

|

|

Total

Number of Portfolio Holdings*

|

75

|

|

Portfolio

Turnover Rate |

24.41%

|

|

[30] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Small Cap Value Fund

|

|

| Class Name |

Class

R

|

|

| Trading Symbol |

FVFRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Small Cap Value Fund for the period November

1, 2024, to April

30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

R |

$57

|

1.20%

|

|

[31],[32] |

| Expenses Paid, Amount |

$ 57

|

|

| Expense Ratio, Percent |

1.20%

|

|

| Net Assets |

$ 3,469,674,313

|

|

| Holdings Count | $ / shares |

75

|

[33] |

| Investment Company Portfolio Turnover |

24.41%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$3,469,674,313

|

|

Total

Number of Portfolio Holdings*

|

75

|

|

Portfolio

Turnover Rate |

24.41%

|

|

[33] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R6 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Small Cap Value Fund

|

|

| Class Name |

Class

R6

|

|

| Trading Symbol |

FRCSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Small Cap Value Fund for the period November

1, 2024, to April

30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Class

R6 |

$28

|

0.59%

|

|

[34],[35] |

| Expenses Paid, Amount |

$ 28

|

|

| Expense Ratio, Percent |

0.59%

|

|

| Net Assets |

$ 3,469,674,313

|

|

| Holdings Count | $ / shares |

75

|

[36] |

| Investment Company Portfolio Turnover |

24.41%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$3,469,674,313

|

|

Total

Number of Portfolio Holdings*

|

75

|

|

Portfolio

Turnover Rate |

24.41%

|

|

[36] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Advisor Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Franklin

Small Cap Value Fund

|

|

| Class Name |

Advisor

Class

|

|

| Trading Symbol |

FVADX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual

shareholder report

contains important information about Franklin

Small Cap Value Fund for the period November

1, 2024, to April

30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

DIAL BEN/342-5236.

|

|

| Additional Information Phone Number |

(800)

DIAL BEN/342-5236

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*,†

|

|

Advisor

Class |

$33

|

0.70%

|

|

[37],[38] |

| Expenses Paid, Amount |

$ 33

|

|

| Expense Ratio, Percent |

0.70%

|

|

| Net Assets |

$ 3,469,674,313

|

|

| Holdings Count | $ / shares |

75

|

[39] |

| Investment Company Portfolio Turnover |

24.41%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of April 30, 2025)

|

|

|

Total

Net Assets |

$3,469,674,313

|

|

Total

Number of Portfolio Holdings*

|

75

|

|

Portfolio

Turnover Rate |

24.41%

|

|

[39] |

| Holdings [Text Block] |

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

|

|