|

Year

|

Summary Compensation Table Total for PEO¹

($) |

Compensation Actually Paid to PEO¹,²,³

($) |

Average Summary Compensation Table Total for Non-PEO NEOs1

($) |

Average Compensation Actually Paid to Non-PEO NEOs1,2,3

($) |

Value of Initial Fixed $100 Investment based on TSR ($)4

|

Net Income

($ Millions) |

|

2024

|

473,274

|

278,821

|

367,002

|

254,094

|

20.09

|

(28.9)

|

|

2023

|

888,683

|

860,554

|

532,038

|

561,010

|

63.23

|

(22.1)

|

|

2022

|

854,035

|

642,557

|

471,122

|

410,609

|

61.80

|

(19.6)

|

|

2022

|

2023

|

2024

|

|

Jeannine Lynch

|

Mike Lawless

|

Charles Remsberg

|

|

Almog Adar

|

Jeannine Lynch

|

Jeanine Lynch

|

|

Year

|

Summary

Compensation Table

Total for PEO

($)

|

Exclusion of Stock

Awards for PEO

($)(a)

|

Inclusion of Equity

Values for PEO

($)(b)

|

Compensation

Actually Paid

to PEO

($)

|

|

2024

|

473,274

|

0

|

(194,453)

|

278,821

|

|

2023

|

888,683

|

(167,714)

|

139,585

|

860,554

|

|

2022

|

854,035

|

(200,000)

|

(11,478)

|

642,557

|

|

Year

|

Average Summary

Compensation Table

Total for Non-PEO

NEOs

($)

|

Average Exclusion of

Stock Awards and

Option Awards for

Non-PEO NEOs

($)(a)

|

Average Inclusion

of Equity Values for Non-PEO

NEOs ($)(b)

|

Average

Compensation

Actually Paid

to Non-PEO

NEOs

($)

|

|

2024

|

367,002

|

0

|

(112,908)

|

254,094

|

|

2023

|

532,038

|

(90,750)

|

119,722

|

561,010

|

|

2022

|

471,122

|

(118,750)

|

58,236

|

410,609

|

|

Year

|

Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for PEO

($) |

Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for PEO

($) |

Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for PEO

($) |

Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for PEO

($) |

Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for PEO

($) |

Total - Inclusion of

Equity Values for PEO ($) |

|

2024

|

0

|

(152,530)

|

—

|

(41,923)

|

—

|

(194,453)

|

|

2023

|

155,540

|

5,280

|

—

|

(21,235)

|

—

|

139,585

|

|

2022

|

152,020

|

(123,950)

|

—

|

(39,548)

|

—

|

(11,478)

|

|

Year

|

Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO NEOs

($) |

Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO NEOs

($) |

Average Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Non-PEO NEOs

($) |

Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO NEOs

($) |

Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs

($) |

Total - Average Inclusion of

Equity Values for Non-PEO NEOs ($) |

|

2024

|

0

|

(93,675)

|

—

|

(19,233)

|

—

|

(112,908)

|

|

2023

|

117,627

|

2,942

|

—

|

(847)

|

—

|

119,722

|

|

2022

|

90,262

|

(27,166)

|

—

|

(4,860)

|

—

|

58,236

|

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Net Income

|

2022

|

2023

|

2024

|

|

Jeannine Lynch

|

Mike Lawless

|

Charles Remsberg

|

|

Almog Adar

|

Jeannine Lynch

|

Jeanine Lynch

|

|

Year

|

Summary

Compensation Table

Total for PEO

($)

|

Exclusion of Stock

Awards for PEO

($)(a)

|

Inclusion of Equity

Values for PEO

($)(b)

|

Compensation

Actually Paid

to PEO

($)

|

|

2024

|

473,274

|

0

|

(194,453)

|

278,821

|

|

2023

|

888,683

|

(167,714)

|

139,585

|

860,554

|

|

2022

|

854,035

|

(200,000)

|

(11,478)

|

642,557

|

|

Year

|

Average Summary

Compensation Table

Total for Non-PEO

NEOs

($)

|

Average Exclusion of

Stock Awards and

Option Awards for

Non-PEO NEOs

($)(a)

|

Average Inclusion

of Equity Values for Non-PEO

NEOs ($)(b)

|

Average

Compensation

Actually Paid

to Non-PEO

NEOs

($)

|

|

2024

|

367,002

|

0

|

(112,908)

|

254,094

|

|

2023

|

532,038

|

(90,750)

|

119,722

|

561,010

|

|

2022

|

471,122

|

(118,750)

|

58,236

|

410,609

|

|

Year

|

Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for PEO

($) |

Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for PEO

($) |

Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for PEO

($) |

Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for PEO

($) |

Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for PEO

($) |

Total - Inclusion of

Equity Values for PEO ($) |

|

2024

|

0

|

(152,530)

|

—

|

(41,923)

|

—

|

(194,453)

|

|

2023

|

155,540

|

5,280

|

—

|

(21,235)

|

—

|

139,585

|

|

2022

|

152,020

|

(123,950)

|

—

|

(39,548)

|

—

|

(11,478)

|

|

Year

|

Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO NEOs

($) |

Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO NEOs

($) |

Average Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Non-PEO NEOs

($) |

Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO NEOs

($) |

Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs

($) |

Total - Average Inclusion of

Equity Values for Non-PEO NEOs ($) |

|

2024

|

0

|

(93,675)

|

—

|

(19,233)

|

—

|

(112,908)

|

|

2023

|

117,627

|

2,942

|

—

|

(847)

|

—

|

119,722

|

|

2022

|

90,262

|

(27,166)

|

—

|

(4,860)

|

—

|

58,236

|

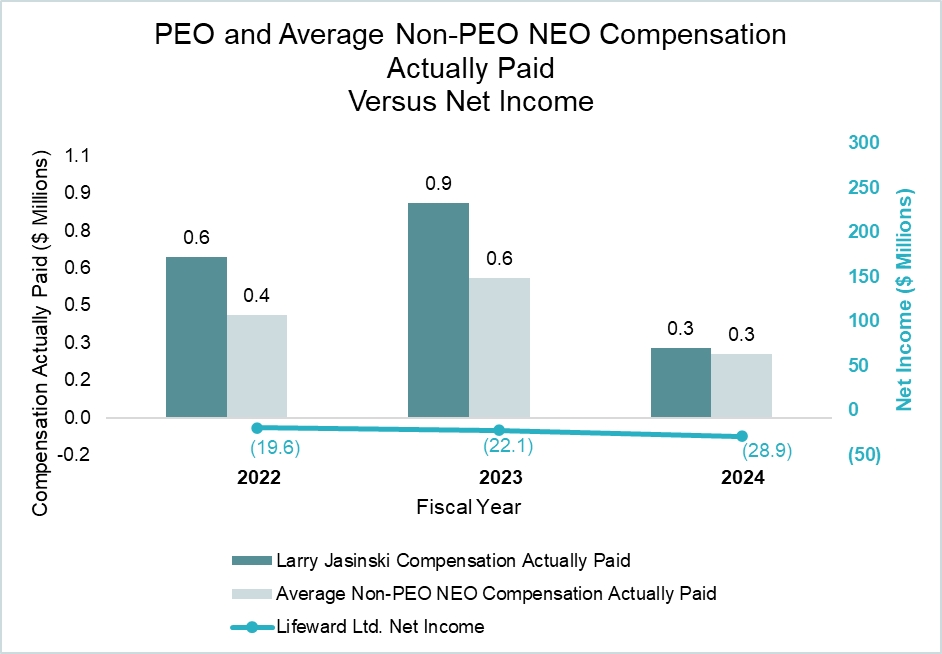

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Net Income

| [1] | Larry Jasinski was our PEO for each year presented. The individuals comprising the Non-PEO NEOs for each year presented are listed below. |

| [2] | Compensation Actually Paid reflects the exclusions and inclusions of certain amounts for the PEO and the Non-PEO NEOs as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718. Amounts in the Exclusion of Stock Awards and Option Awards column are the totals from the Stock Awards and Option Awards columns set forth in the Summary Compensation Table. |

| [3] | The amounts shown for “Compensation Actually Paid” have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the PEO or the Non-PEO NEOs. The dollar amounts reported are the amounts of total compensation reported for our PEO and Non-PEO NEOs for each corresponding year in the “Total” column of the Summary Compensation Table, with certain adjustments as described in footnote 3 below. |

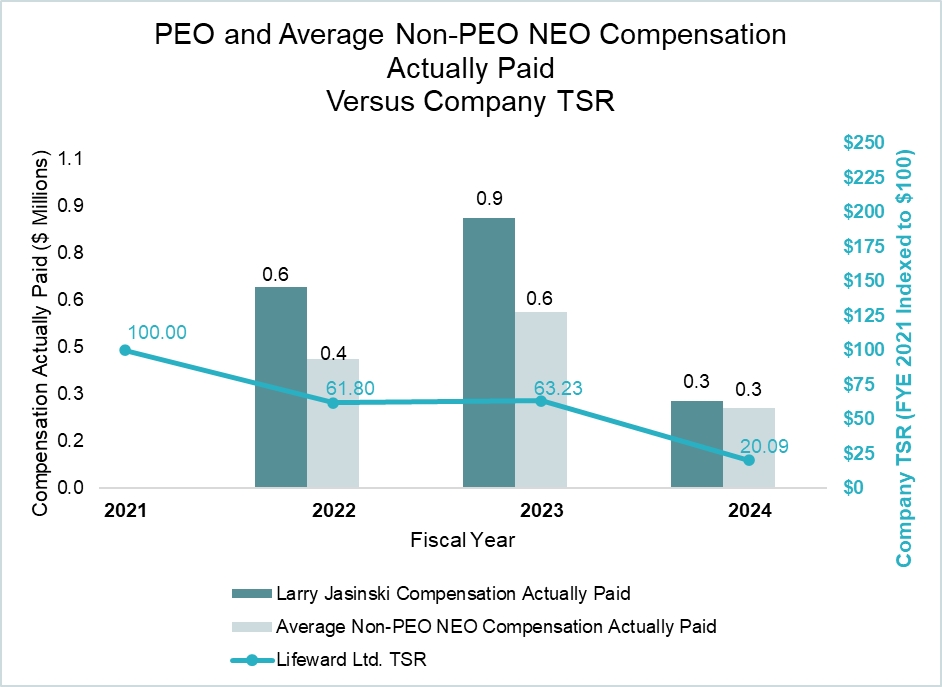

| [4] | Assumes $100 was invested in the Company for the period starting December 31, 2021, through the end of the listed year. Historical stock performance is not necessarily indicative of future stock performance. |

| [5] | The amounts reported in this column represent the total of the amounts reported in the “Stock Awards” and “Option Awards” columns in the Summary Compensation Table for the applicable year. |

| [6] | The amounts reported in this column include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same applicable year, the fair value as of the vesting date; (iv) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in the applicable year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |