Positioning for the Future Restructuring and Other Initiatives Responding to Pressured Macro Industry Conditions Exhibit 99.2 1 CULP Logo

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995 (Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934). Such statements are inherently subject to risks and uncertainties that may cause actual events and results to differ materially from such statements. Forward-looking statements are statements that include projections, expectations, or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often but not always characterized by qualifying words such as “expect,” “believe,” “will,” “may,” “should,” “could,” “potential,” “continue,” “target,” “predict”, “seek,” “anticipate,” “estimate,” “intend,” “plan,” “project,” and their derivatives, and include but are not limited to statements about expectations, projections, or trends for our future operations, strategic initiatives and plans, restructuring and integration actions, production levels, new product launches, sales, profit margins, profitability, operating (loss) income, capital expenditures, working capital levels, cost savings (including, without limitation, anticipated cost savings from restructuring, integration and consolidation actions), income taxes, SG&A or other expenses, pre-tax (loss) income, earnings, cash flow, and other performance or liquidity measures, as well as any statements regarding dividends, share repurchases, liquidity, use of cash and cash requirements, ending cash balances and cash positions, borrowing capacity, investments, potential acquisitions, cash and non-cash restructuring and restructuring-related charges, expenses, and/or credits, net proceeds from restructuring related asset dispositions, future economic or industry trends, public health epidemics, or future developments. There can be no assurance that we will realize these expectations or meet our guidance, or that these beliefs will prove correct. Factors that could influence the matters discussed in such statements include the level of housing starts and sales of existing homes, demand for home furnishings products, consumer confidence, trends in disposable income, and general economic conditions. Decreases in these economic indicators could have a negative effect on our business and prospects. Likewise, increases in interest rates, particularly home mortgage rates, and increases in consumer debt or the general rate of inflation, could affect us adversely. The future performance of our business depends in part on our success in conducting and finalizing acquisition negotiations and integrating acquired businesses into our existing operations. Changes in consumer tastes or preferences toward products not produced by us could erode demand for our products. Changes in tariffs or trade policy, including changes in U.S. trade enforcement priorities, or changes in the value of the U.S. dollar versus other currencies, could affect our financial results because a significant portion of our operations are located outside the United States. Strengthening of the U.S. dollar against other currencies could make our products less competitive on the basis of price in markets outside the United States, and strengthening of currencies in China can have a negative impact on our sales of products produced in those places. In addition, because our foreign operations use the U.S. dollar as their functional currency, changes in the exchange rate between the local currency of those operations and the U.S dollar can affect our reported profits from those foreign operations. Also, economic or political instability in international areas could affect our operations or sources of goods in those areas, as well as demand for our products in international markets. The impact of public health epidemics on employees, customers, suppliers, and the global economy, such as the coronavirus pandemic, could also adversely affect our operations and financial performance. In addition, the impact of potential asset impairments, including impairments of property, plant, and equipment, inventory, or intangible assets, as well as the impact of valuation allowances applied against our net deferred income tax assets, could affect our financial results. Increases in freight costs, labor costs, and raw material prices, including increases in market prices for petrochemical products, can also significantly affect the prices we pay for shipping, labor, and raw materials, respectively, and in turn, increase our operating costs and decrease our profitability. Also, our success in diversifying our supply chain with reliable partners to effectively service our global platform could affect our operations and adversely affect our financial results. Finally, the future performance of our business also depends on our ability to successfully restructure our mattress fabric operations and return the segment to profitability as well as successfully integrate our mattress fabric and upholstery fabric divisions, neither of which may meet our expectations. Further information about these factors, as well as other factors that could affect our future operations or financial results and the matters discussed in forward-looking statements, is included in Item 1A “Risk Factors” in our most recent Form 10-K and Form 10-Q reports filed with the Securities and Exchange Commission. Many of these factors are macroeconomic in nature and are, therefore, beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from those described in this presentation as anticipated, believed, estimated, expected, intended, planned or projected. The forward-looking statements included in this presentation are made only as of the date of this presentation. Unless required by United States federal securities laws, we neither intend nor assume any obligation to update these forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. Additional risks and uncertainties that we do not presently know about or that we currently consider to be immaterial may also affect our business operations or financial results. 2 Logo

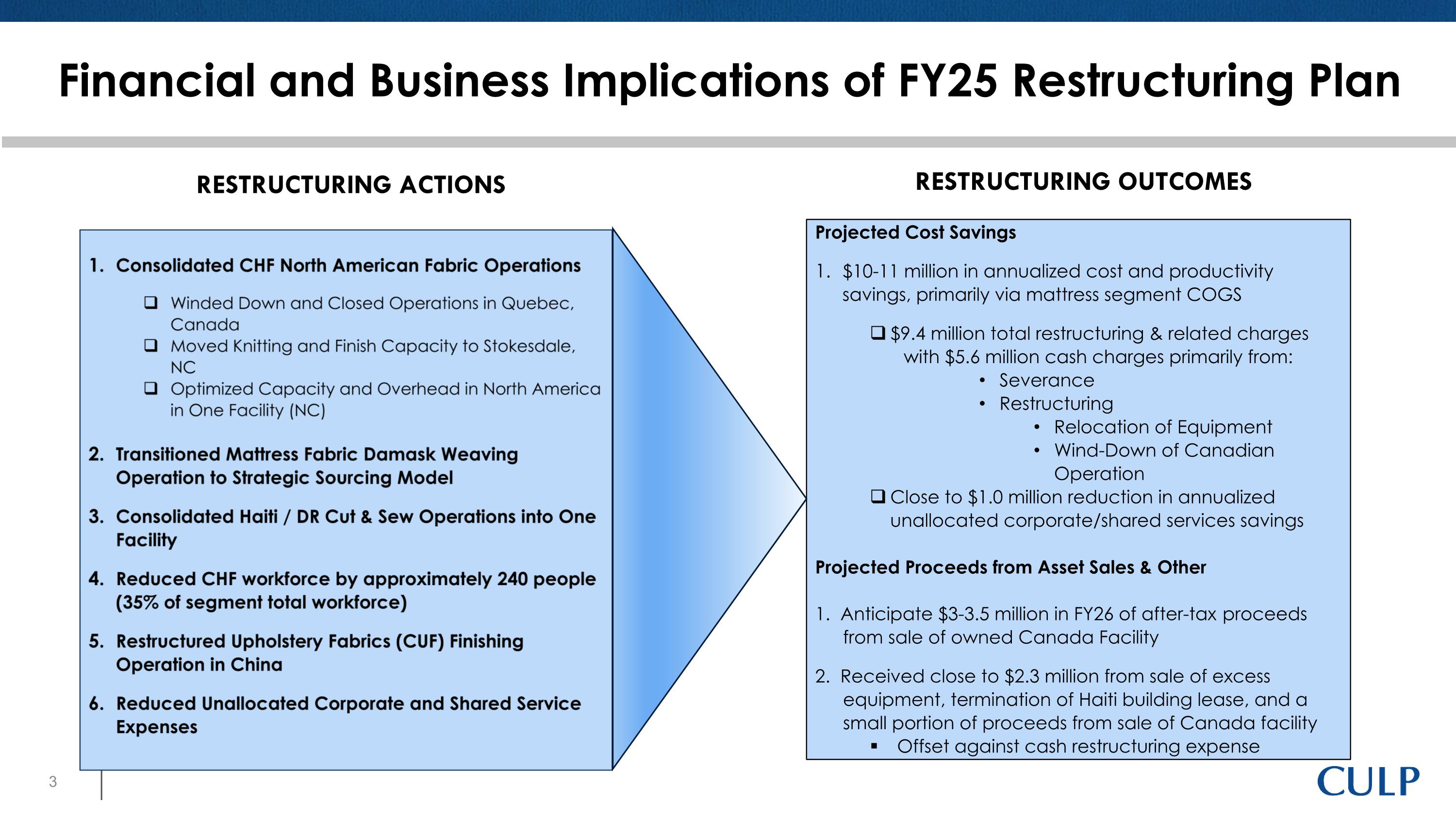

Financial and Business Implications of FY25 Restructuring Plan Consolidated CHF North American Fabric Operations Winded Down and Closed Operations in Quebec, Canada Moved Knitting and Finish Capacity to Stokesdale, NC Optimized Capacity and Overhead in North America in One Facility (NC) Transitioned Mattress Fabric Damask Weaving Operation to Strategic Sourcing Model Consolidated Haiti / DR Cut & Sew Operations into One Facility Reduced CHF workforce by approximately 240 people (35% of segment total workforce) Restructured Upholstery Fabrics (CUF) Finishing Operation in China Reduced Unallocated Corporate and Shared Service Expenses Projected Cost Savings $10-11 million in annualized cost and productivity savings, primarily via mattress segment COGS $9.4 million total restructuring & related charges with $5.6 million cash charges primarily from: Severance Restructuring Relocation of Equipment Wind-Down of Canadian Operation Close to $1.0 million reduction in annualized unallocated corporate/shared services savings Projected Proceeds from Asset Sales & Other 1. Anticipate $3-3.5 million in FY26 of after-tax proceeds from sale of owned Canada Facility 2. Received close to $2.3 million from sale of excess equipment, termination of Haiti building lease, and a small portion of proceeds from sale of Canada facility Offset against cash restructuring expense Restructuring Actions Restructuring Outcomes 3 Logo

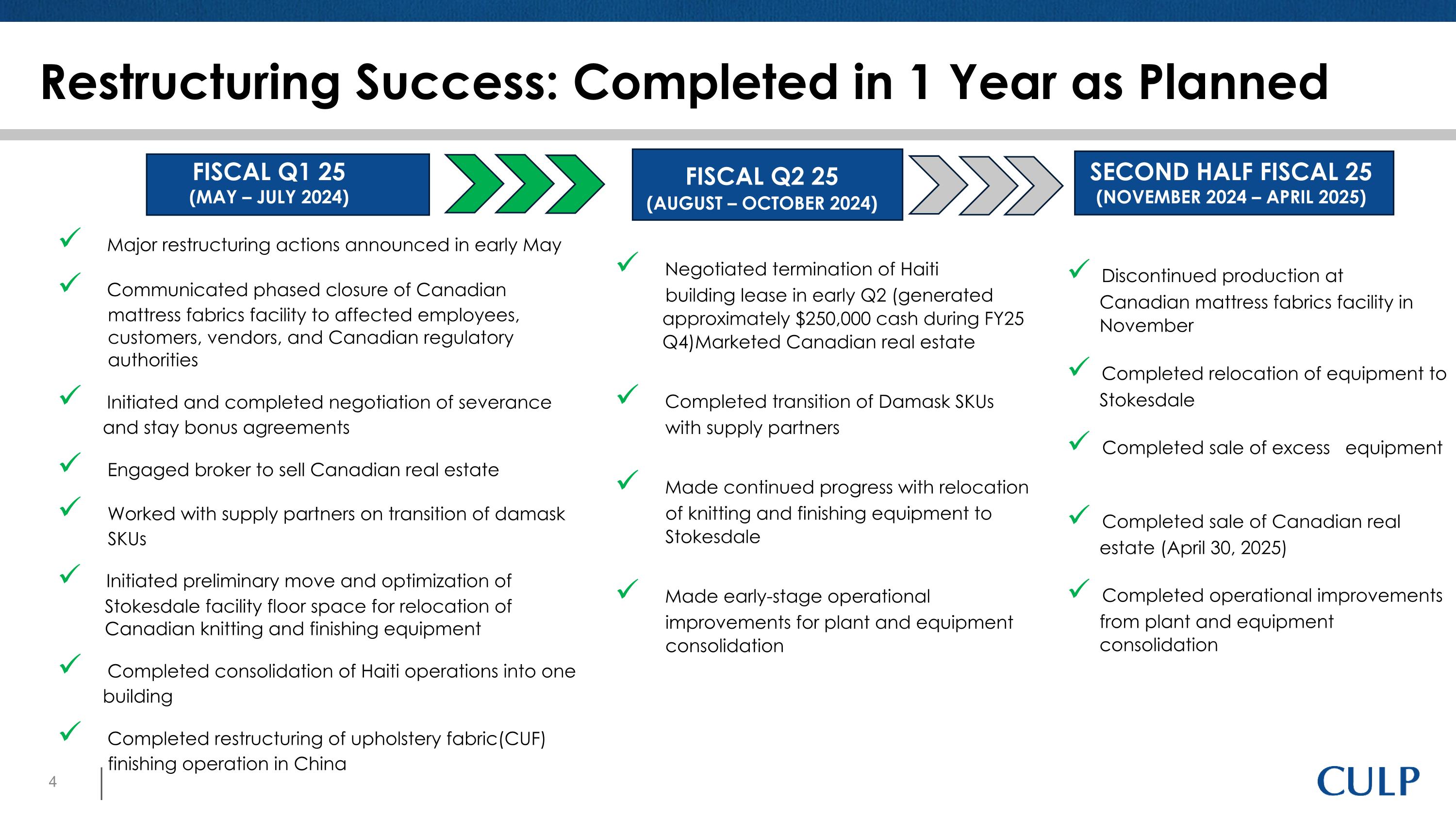

Second Half Fiscal 25 (November 2024 – April 2025) Fiscal Q2 25 (August – October 2024) Fiscal Q1 25 (May – July 2024) Restructuring Success: Completed in 1 Year as Planned Major restructuring actions announced in early May Communicated phased closure of Canadian mattress fabrics facility to affected employees, customers, vendors, and Canadian regulatory authorities Initiated and completed negotiation of severance and stay bonus agreements Engaged broker to sell Canadian real estate Worked with supply partners on transition of damask SKUs Initiated preliminary move and optimization of Stokesdale facility floor space for relocation of Canadian knitting and finishing equipment Completed consolidation of Haiti operations into one building Completed restructuring of upholstery fabric(CUF) finishing operation in China Negotiated termination of Haiti building lease in early Q2 (generated approximately $250,000 cash during FY25 Q4)Marketed Canadian real estate Completed transition of Damask SKUs with supply partners Made continued progress with relocation of knitting and finishing equipment to Stokesdale Made early-stage operational improvements for plant and equipment consolidation Discontinued production at Canadian mattress fabrics facility in November Completed relocation of equipment to Stokesdale Completed sale of excess equipment Completed sale of Canadian real estate (April 30, 2025) Completed operational improvements from plant and equipment consolidation 4 Logo

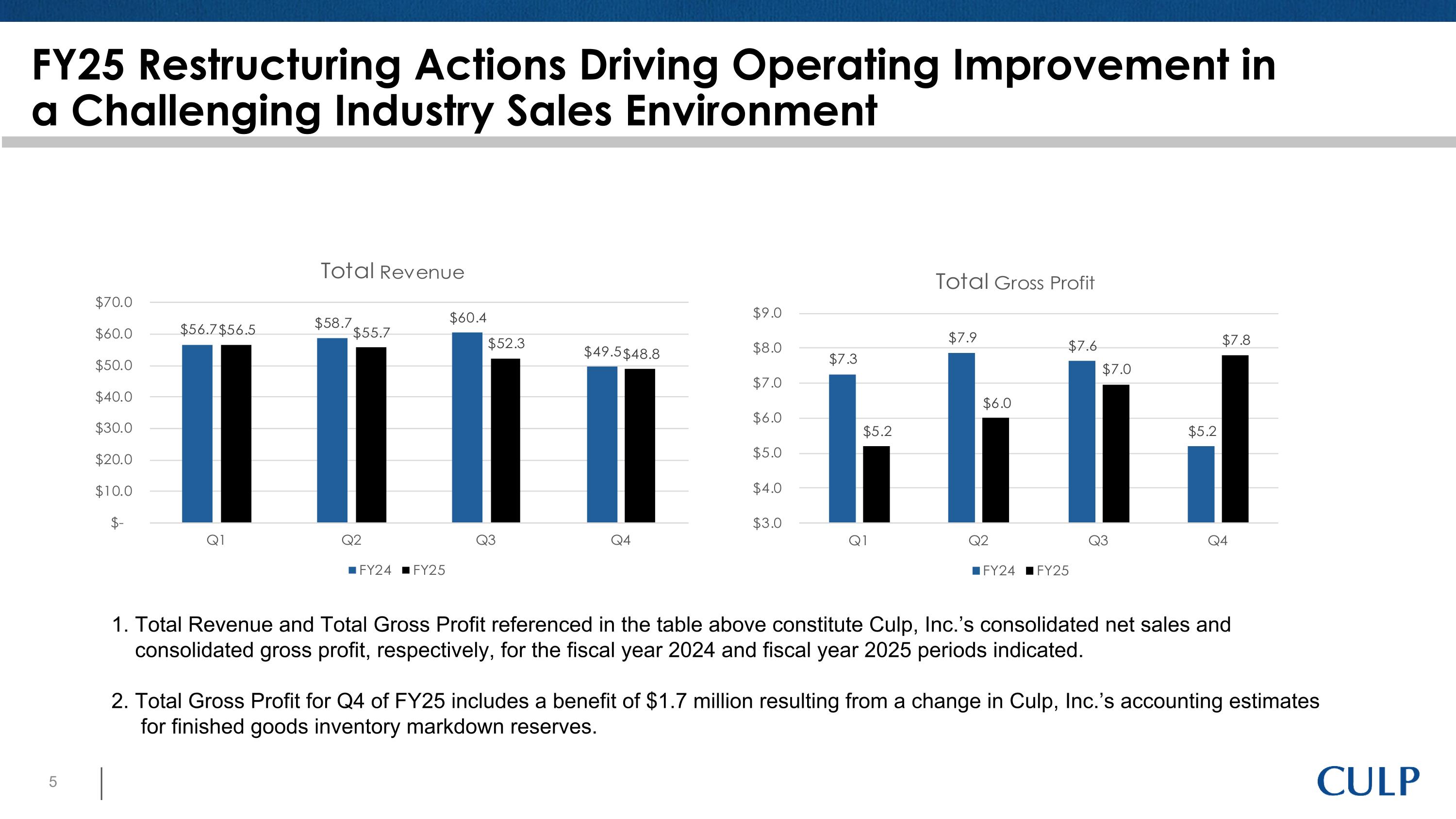

FY25 Restructuring Actions Driving Operating Improvement in a Challenging Industry Sales Environment 1. Total Revenue and Total Gross Profit referenced in the table above constitute Culp, Inc.’s consolidated net sales and consolidated gross profit, respectively, for the fiscal year 2024 and fiscal year 2025 periods indicated. 2. Total Gross Profit for Q4 of FY25 includes a benefit of $1.7 million resulting from a change in Culp, Inc.’s accounting estimates for finished goods inventory markdown reserves. Total Revenue Total Gross Profit Bar chart 5 Logo

FY26 Additional Actions Responding to Prolonged Industry Slowdown – Integration, Consolidation and Price Initiatives $5 to $6 Million in Projected Annualized Benefits Integration of Stand-Alone Divisions to Synergize/Harmonize Business and Leadership Teams Division Presidents transitioned to Company-wide CCO and COO roles Consolidate operations and CULP to serve as one supplier to home furnishings industry. Creates a more agile and flexible organization better equipped to respond to customer needs and market trends Appx. $1 million annualized savings and operating improvement beginning Q2 Consolidate USA Warehousing and Distribution Relocate leased facility in Burlington, NC into owned facility in Stokesdale, NC Appx $2.0 million annualized savings from exited lease, reduced headcount and synergized operations Timing: Q3 / Q4 Disciplined Price Action to Address Tariff Uncertainty Appx. $2.5 million annualized impact Timing: Phasing in beginning Q2 Additional cost and consolidation activity under review 6 Logo

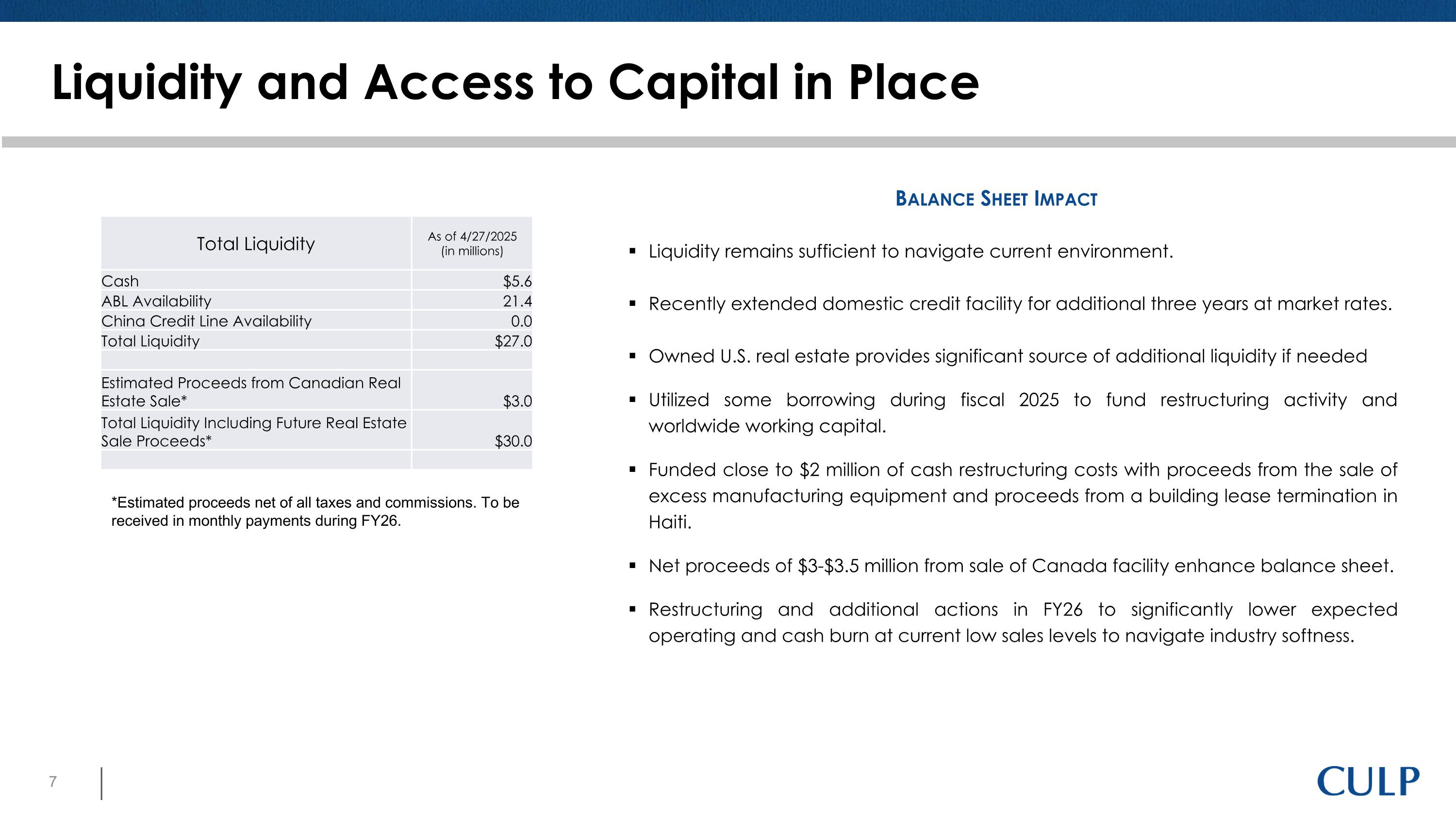

Liquidity and Access to Capital in Place Liquidity remains sufficient to navigate current environment. Recently extended domestic credit facility for additional three years at market rates. Owned U.S. real estate provides significant source of additional liquidity if needed Utilized some borrowing during fiscal 2025 to fund restructuring activity and worldwide working capital. Funded close to $2 million of cash restructuring costs with proceeds from the sale of excess manufacturing equipment and proceeds from a building lease termination in Haiti. Net proceeds of $3-$3.5 million from sale of Canada facility enhance balance sheet. Restructuring and additional actions in FY26 to significantly lower expected operating and cash burn at current low sales levels to navigate industry softness. *Estimated proceeds net of all taxes and commissions. To be received in monthly payments during FY26. Balance Sheet Impact Total Liquidity As of 4/27/2025 (in millions) Cash $5.6 ABL Availability 21.4 China Credit Line Availability 0.0 Total Liquidity $27.0 Estimated Proceeds from Canadian Real Estate Sale* $3.0 Total Liquidity Including Future Real Estate Sale Proceeds* $30.0 7 Logo

What Gives CULP Confidence in Restructuring Plan / Recovery? Key Success Factors Experienced leadership team focused on profitable growth Successfully navigated significant restructuring of upholstery business beginning in early 2000’s Available liquidity to support growth Strong relationships with key customers and long-term suppliers Emphasis on design creativity and product innovation Strategic manufacturing and global sourcing platform responsive to tariff fluidity Market position improving with solid placements priced in line with current costs Consistent improvement in operating performance for mattress fabrics business in FY25, in very difficult demand environment 8 Logo

Logo