FORM 51-102F3

MATERIAL CHANGE REPORT

Item 1 Name and Address of Company

Vizsla Silver Corp.

Suite 1723, 595 Burrard Street

Vancouver, British Columbia, V7X 1J1

(the "Company" or "Vizsla Silver")

Item 2 Date of Material Change

May 15, 2025

Item 3 News Release

The news releases were disseminated on May 15, 2025 through Cision and filed on SEDAR+.

Item 4 Summary of Material Change

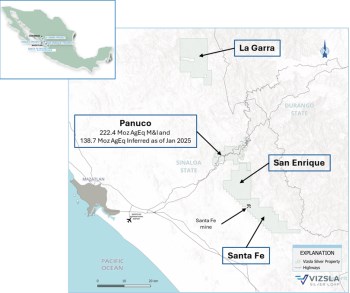

On May 15, 2025, the Company announced that, it has entered into an agreement to acquire the Santa Fe Project (the "Santa Fe Project"), including both production and exploration concessions, comprising 12,229 Ha located to the south of the Company's flagship Panuco project (the "Panuco Project" or "Panuco") for a combination of cash and shares. The Santa Fe Project benefits from permitted on-site production infrastructure including an operating 350 tonne per day ("tpd") mill situated along the highly prospective Panuco - San Dimas corridor and is covered 100% with LiDAR and high-resolution aero-magnetic and radiometric surveys.

Item 5 Full Description of Material Change

5.1 Full Description of Material Change

The Company announced that it has entered into an agreement to acquire the Santa Fe Project (the "Santa Fe Project"), including both production and exploration concessions, comprising 12,229 Ha located to the south of the Company's flagship Panuco project (the "Panuco Project" or "Panuco") for a combination of cash and shares. The Santa Fe Project benefits from permitted on-site production infrastructure including an operating 350 tonne per day ("tpd") mill situated along the highly prospective Panuco - San Dimas corridor and is covered 100% with LiDAR and high-resolution aero-magnetic and radiometric surveys.

Highlights

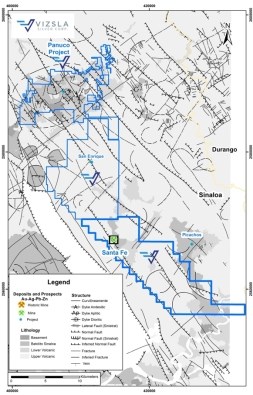

• Large property package comprised of 12,229 Ha located 22 km southeast from Panuco and immediately south of the recently acquired San Enrique prospect (see press released dated April 16, 2024).

2

• Fully permitted 350 tpd flotation plant that produces silver and gold from a northwest trending epithermal vein.

• From 2020 through 2024, the Santa Fe mine processed 370,366 tonnes of ore at average head grades of 203 g/t silver and 2.17 g/t gold.

• The project area is covered 100% with LiDAR and high-resolution aero-magnetic and radiometric surveys as well as detailed mapping and IP geophysics around the mine area.

• Previous drilling campaigns completed by Aurico Gold and Fortuna Mining in 2014 and 2020, respectively, outlined the high-grade shoot currently being mined but also reported anomalous silver intercepts in four other target areas.

• The producing Santa Fe mine and known vein prospects identified to date account for approximately 12% of the total property package.

3

Figure 1: Location map of the Santa Fe property and Santa Fe mine with respect to the Panuco Project, San Enrique and La Garra.

Figure 2. Geology of the silver-gold-rich Panuco - San Dimas corridor. The black square is the claim (144 Ha) that contains the producing Santa Fe mine and processing plant.

4

About the Santa Fe Project

Mining at Santa Fe likely dates back to the Spanish era, based on a historic shaft and smelter-furnace discovered by the previous operator, Mr. Eduardo de La Peña, when he started mining historic waste dumps on the property in 2008. Approximately 20,000 tonnes of dump material containing ~2.0 g/t gold and ~200 g/t silver were trucked to the El Coco mill in Panuco for processing (Pers. Comm. Eduardo de la Peña).

Between 2008 and 2014, Mr. de La Peña staked additional claims around the original Santa Fe mine and in 2014 drilled the first 1,000 meters on the property. In 2014, Oro de Altar (ODA, a subsidiary of Aurico Gold) optioned the property and conducted a high-resolution airborne survey, detailed mapping of the mine area and drilled 11,957 meters in 45 diamond drill holes. Aurico's drilling delineated a high-grade shoot along the main "Mother" vein, which motivated Mr. de la Peña to construct additional mine infrastructure including a 6 km long power line in 2016, and later, in 2018 a processing plant and underground mine. In 2020, Minera Cuzcatlan (subsidiary of Fortuna Silver Mines Inc.) optioned the property and drilled 7,547 metres in 17 holes and completed a LiDAR survey. Between 2020 and 2024 the Santa Fe plant processed 370,366 tonnes of ore with average head grades of 203 g/t silver and 2.17 g/t gold (Internal exploration and production reports provided by Eduardo de la Peña).

Transaction Terms

Option Agreement - Production Concessions

The Company entered into an option agreement (the "Option Agreement") dated May 14, 2025 with Mr. Eduardo de la Peña Gaitán, on his own behalf and in representation of Margarita Gaitán Enríquez, Mariano Pablo Fuente Chapoy, Industrial Minera Tres Tortugas, S.A. de C.V., Grupo Tres Tortugas, S.A. de C.V., Industrial Minera Sinaloa, S.A. de C.V. and Inca Azteca Gold, S.A. de C.V. (collectively, the "Optionors"). Under the terms of the Option Agreement, Vizsla Silver has the option (the "Option") to acquire a 100% interest in certain production concessions (the "Production Concessions") comprising the Santa Fe Project over a five-year period.

The Company may exercise the Option by:

5

All Option Shares will be subject to a hold period expiring four months and one day after their date of issue pursuant to applicable Canadian securities laws. In addition, the Optionors have agreed to voluntary resale restrictions whereby 1/3 of the Option Shares will be released from voluntary resale restrictions 12, 24 and 36 months after their issue date. In addition to the voluntary resale restrictions, if at any time the Optionors wish to sell or otherwise dispose of an amount equal to or greater than 20,000 shares in a single day, or 100,000 shares over any five consecutive trading days, the Company will have a right of first refusal to purchase such shares. The Optionors must notify the Company in advance of any such sale, and the Company will have five business days to exercise its purchase right.

In addition, the Company agreed to pay 50% of the mining duties payable on the Production Concessions until the date that is 60 months after the Effective Date.

No finder's fees were paid on the arm's length Option Agreement.

Purchase Agreement - Exploration Concessions

The Company also entered into a purchase agreement (the "Purchase Agreement") dated May 14, 2025, with Mr. Eduardo de la Peña Gaitán (the "Vendor"). Under the terms of the Purchase Agreement, Vizsla Silver agreed to purchase (the "Purchase") certain exploration concessions (the "Exploration Concessions") comprising the Santa Fe Project.

The Company may complete the Purchase by:

6

All Purchase Shares will be subject to a hold period expiring four months and one day after their date of issue pursuant to applicable Canadian securities laws. In addition, the Vendor has agreed to voluntary resale restrictions whereby 1/3 of the Purchase Shares will be released from voluntary resale restrictions 12, 24 and 36 months after their issue date. In addition to the voluntary resale restrictions, if at any time the Optionors wish to sell or otherwise dispose of an amount equal to or greater than 20,000 shares in a single day, or 100,000 shares over any five consecutive trading days, the Company will have a right of first refusal to purchase such shares. The Optionors must notify the Company in advance of any such sale, and the Company will have five business days to exercise its purchase right.

As part of the consideration under the Purchase Agreement, the Vendor will receive from the Company the processing plant known as the El Coco plant, including associated assets, in-kind. The Company will provide an inventory valuation of the El Coco plant within 30 days of the effective date.

In addition, the Company agreed to pay 50% of the mining duties due on the Exploration Concessions, which amounts to approximately US$394,682.

No finder's fees were paid on the arm's length Purchase Agreement.

The Option and Purchase are subject to applicable regulatory approvals, including the approval of the TSX and NYSE, and the satisfaction of certain other closing conditions customary in transactions of this nature.

5.2 Disclosure for Restructuring Transactions

Not applicable.

Item 6 Reliance on subsection 7.1(2) or (3) of National Instrument 51-102

Not applicable.

Item 7 Omitted Information

Not applicable.

Item 8 Executive Officer

For further information, contact:

Michael Konnert

Chief Executive Officer

Telephone: (604) 364-2215

Item 9 Date of Report

May 20, 2025