Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Mar. 29, 2025 |

Mar. 30, 2024 |

Apr. 01, 2023 |

Apr. 02, 2022 |

Mar. 27, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

Pay Versus Performance Table | | | | | | | | | | | | | | | | | | | | | | | | | | | | Summary Compensation Table Total for PEO ($) (b)(1) | Compensation Actually Paid to PEO ($) (c)(2) | Average Summary Compensation Table Total for Non-PEO NEOs ($) (d)(1) | Average Compensation Actually Paid to Non-PEO NEOs ($) (e)(3) | Value of Initial Fixed $100 Investment Based On: | Net (Loss) Income ($) (h)(6) | Adjusted Free Cash Flow ($) (i)(7) | | Year (a) | Total Shareholder Return ($) (f)(4) | Peer Group Total Shareholder Return ($) (g)(5) | | 2025 | 9,058,699 | | (3,108,694) | | 3,367,051 | | 490,172 | | 173.95 | | 75.28 | | (1,182,000,000) | | 153,000,000 | | | 2024 | 10,536,629 | | 9,772,501 | | 3,787,766 | | 3,469,234 | | 388.17 | | 81.73 | | (229,000,000) | | 120,000,000 | | | 2023 | 14,331,813 | | 10,961,037 | | 2,537,098 | | 2,219,512 | | 402.74 | | 98.52 | | 616,000,000 | | 715,000,000 | | | 2022 | 14,737,831 | | 15,510,572 | | 5,781,103 | | 5,579,572 | | 436.93 | | 145.97 | | 822,000,000 | | 573,000,000 | | | 2021 | 8,193,425 | | 32,610,713 | | 1,849,249 | | 6,935,898 | | 429.99 | | 191.02 | | (62,000,000) | | 807,000,000 | |

|

|

|

|

|

| Company Selected Measure Name |

free cash flow

|

|

|

|

|

| Named Executive Officers, Footnote |

Column (b) contains compensation amounts reported in the “Total” column of the Summary Compensation Table (“SCT”) for Mr. Idol, our Chief Executive Officer for each of the years listed. Column (d) contains the average of compensation amounts reported in the “Total” column of the Summary Compensation Table for our NEOs other than our Chief Executive Officer (“Non-PEO NEOs”) for each of the years listed. The Non-PEO NEOs for each applicable fiscal year are as follows: 2025: Mr. Edwards, Ms. Hendricks, Ms. McDonough and Mr. Wilmotte 2024: Mr. Edwards, Ms. Hendricks, Ms. McDonough and Mr. Wilmotte 2023: Mr. Edwards, Ms. Hendricks, Ms. McDonough and Daniel Purefoy, our former SVP, Global Operations and Head of Diversity and Inclusion (who served for four months of Fiscal 2023) 2022: Mr. Edwards, Ms. Hendricks, Ms. McDonough, Mr. Purefoy and Joshua Schulman, our former Chief Executive Officer of Michael Kors (who served for approximately seven months of Fiscal 2022) 2021: Mr. Edwards, Ms. McDonough and Mr. Purefoy

|

|

|

|

|

| Peer Group Issuers, Footnote |

The peer group used is the S&P 500 Apparel, Accessories & Luxury Goods Index, as used in the Company’s Share Performance Graph in our Annual Report on Form 10-K for Fiscal 2025. Peer group TSR is calculated assuming that a $100 investment was made on the day prior to the first fiscal year reported in the table above and that all dividends are reinvested until the last day of each reported fiscal year.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 9,058,699

|

$ 10,536,629

|

$ 14,331,813

|

$ 14,737,831

|

$ 8,193,425

|

| PEO Actually Paid Compensation Amount |

$ (3,108,694)

|

9,772,501

|

10,961,037

|

15,510,572

|

32,610,713

|

| Adjustment To PEO Compensation, Footnote |

Compensation actually paid to our PEO in each of the years listed as reflected in column (c) reflects the amount set forth in column (b) of the table above adjusted in accordance with SEC rules. The dollar amounts in column (c) do not reflect the actual amount of compensation earned or paid to our PEO in the applicable fiscal year. The adjustments made to our PEO’s total compensation for Fiscal 2025 to determine CAP are shown in the table below. | | | | | | | 2025

($) | | Summary Compensation Table Total for PEO | 9,058,699 | | Minus Changes in Accumulated Benefits Under Defined Benefit and Actuarial Pension Plans(a) | — | | Minus Grant Date Fair Value of Stock Options and Stock Awards Granted in a Fiscal Year(b) | 7,000,000 | | Plus Fair Value at Fiscal Year-End of Outstanding Unvested Stock Options and Stock Awards Granted in Prior Fiscal Year(c) | 4,237,199 | | Plus / (Minus) Change in Fair Value of Outstanding and Unvested Stock Options and Stock Awards Granted in Prior Fiscal Year(c) | (7,904,650) | | Plus / (Minus) Change in Fair Value of Vesting Date of Stock Option and Stock Awards Granted in Years Prior for which Applicable Vesting Conditions Were Satisfied During Fiscal Year(c) | (1,499,942) | | Minus Fair Value as of Prior Fiscal Year End of Stock Option and Stock Awards Granted in Prior Fiscal Years that Failed to Meet Applicable Vesting Conditions During Fiscal Year(c) | — | | | Compensation Actually Paid to PEO | (3,108,694) | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 3,367,051

|

3,787,766

|

2,537,098

|

5,781,103

|

1,849,249

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 490,172

|

3,469,234

|

2,219,512

|

5,579,572

|

6,935,898

|

| Adjustment to Non-PEO NEO Compensation Footnote |

The average compensation actually paid to our Non-PEO NEOs in each of the years listed as reflected in column (e) reflects the amount set forth in column (d) of the table above adjusted in accordance with SEC rules. The dollar amounts in column (e) do not reflect the actual amount of compensation earned or paid to any Non-PEO NEOs in the applicable fiscal year. The adjustments made to our Non-PEO’s average total compensation for Fiscal 2025 to determine CAP are shown in the table below. | | | | | | | 2025

($) | | Average Summary Compensation Table Total for Non-PEO NEOs | 3,367,051 | | Minus Changes in Accumulated Benefits Under Defined Benefit and Actuarial Pension Plans(a) | — | | Minus Grant Date Fair Value of Stock Options and Stock Awards Granted in a Fiscal Year(b) | 1,875,008 | | Plus Fair Value at Fiscal Year-End of Outstanding Unvested Stock Options and Stock Awards Granted in Prior Fiscal Year(c) | 1,189,458 | | Plus / (Minus) Change in Fair Value of Outstanding and Unvested Stock Options and Stock Awards Granted in Prior Fiscal Year(c) | (1,888,794) | | Plus / (Minus) Change in Fair Value of Vesting Date of Stock Option and Stock Awards Granted in Years Prior for which Applicable Vesting Conditions Were Satisfied During Fiscal Year(c) | (302,535) | | Minus Fair Value as of Prior Fiscal Year End of Stock Option and Stock Awards Granted in Prior Fiscal Years that Failed to Meet Applicable Vesting Conditions During Fiscal Year(c) | — | | | Average Compensation Actually Paid to Non-PEO NEOs | 490,172 | |

|

|

|

|

|

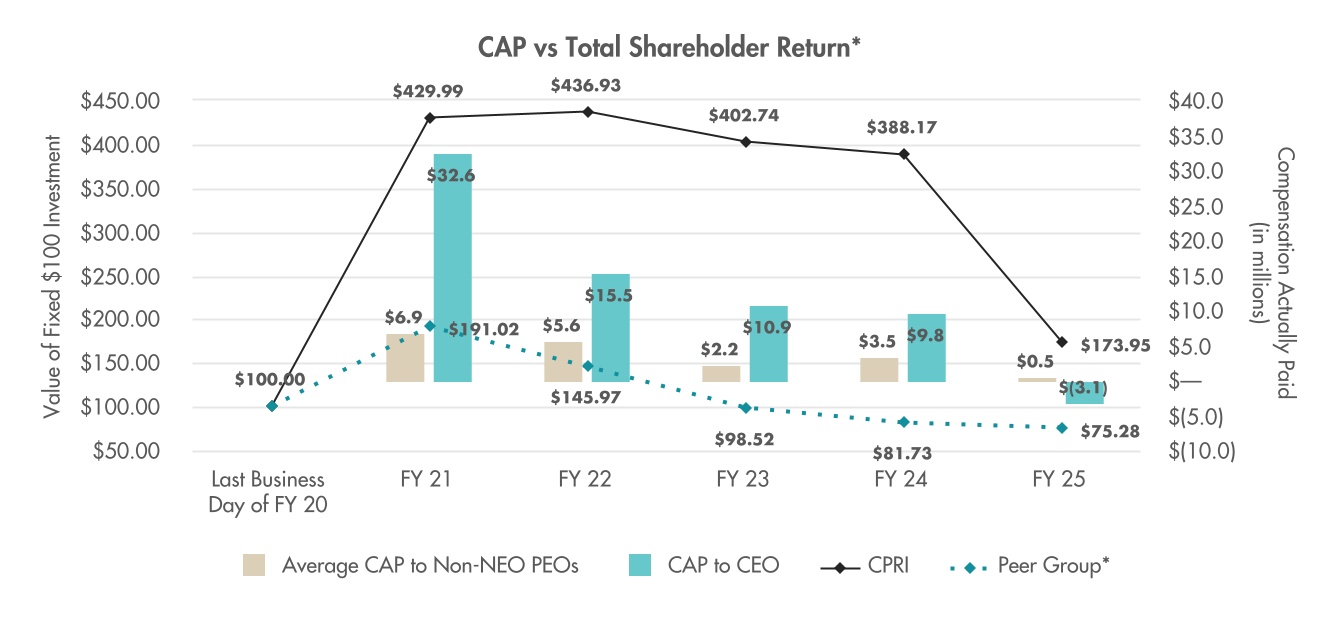

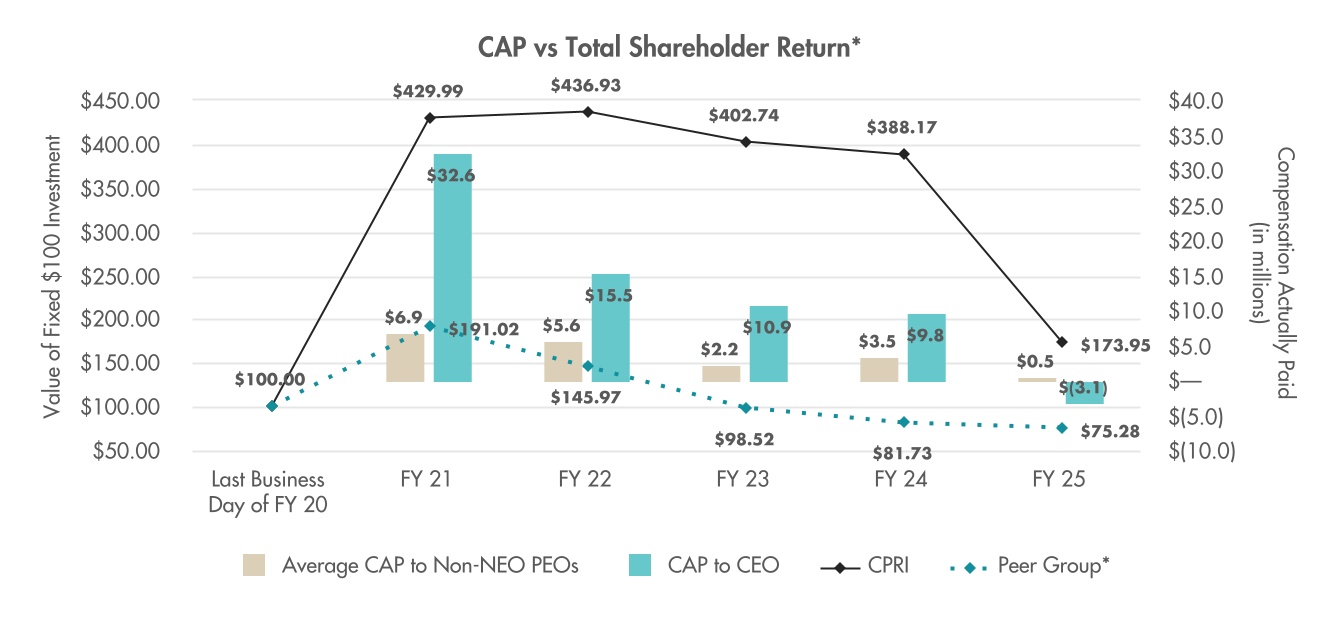

| Compensation Actually Paid vs. Total Shareholder Return |

*TSR is calculated assuming that a $100 investment was made on the last business day prior to the first fiscal year reported in the graph and that all dividends are reinvested until the last day of each reported fiscal year. On the last business day of fiscal 2020, which was March 27, 2020, our share price was $11.67 compared to $20.30 on the last business day of Fiscal 2025. The peer group used is the S&P 500 Apparel, Accessories & Luxury Goods Index, as used in the Company’s Share Performance Graph in our Annual Report on Form 10-K for Fiscal 2025.

|

|

|

|

|

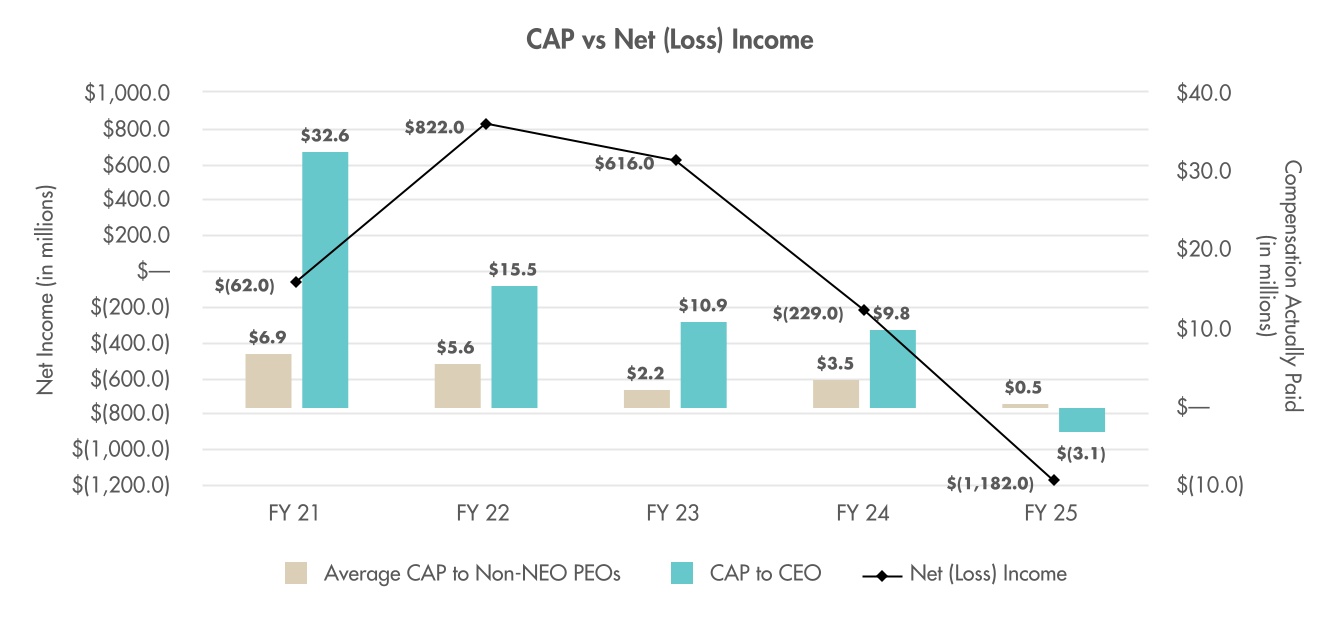

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

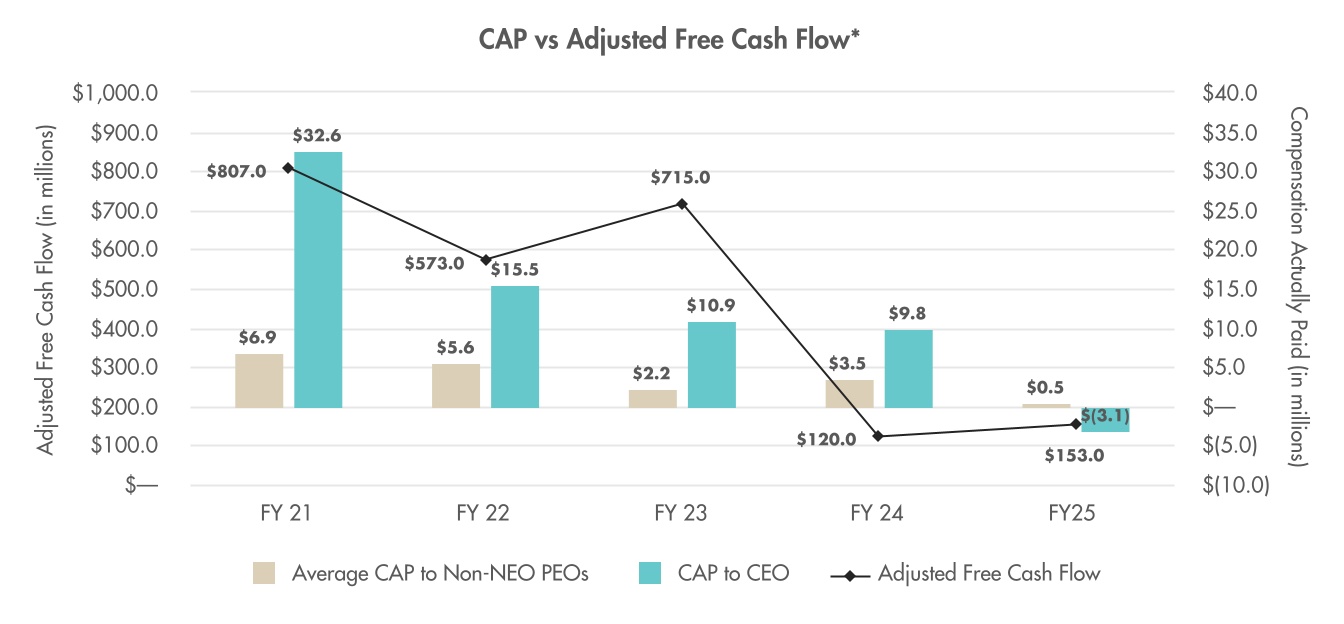

| Compensation Actually Paid vs. Company Selected Measure |

* The Company selected financial measure is free cash flow as adjusted in accordance with the Incentive Plan. Adjusted free cash flow as used in our Incentive Plan may differ from our public filings as additional items may be excluded in accordance with the terms of our Incentive Plan. For a further discussion of free cash flow and how it is used in our executive compensation program, see “Compensation Discussion and Analysis.”

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

*TSR is calculated assuming that a $100 investment was made on the last business day prior to the first fiscal year reported in the graph and that all dividends are reinvested until the last day of each reported fiscal year. On the last business day of fiscal 2020, which was March 27, 2020, our share price was $11.67 compared to $20.30 on the last business day of Fiscal 2025. The peer group used is the S&P 500 Apparel, Accessories & Luxury Goods Index, as used in the Company’s Share Performance Graph in our Annual Report on Form 10-K for Fiscal 2025.

|

|

|

|

|

| Tabular List, Table |

| | | | | | | | | | | | | | | Free Cash Flow | Operating Income |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 173.95

|

388.17

|

402.74

|

436.93

|

429.99

|

| Peer Group Total Shareholder Return Amount |

75.28

|

81.73

|

98.52

|

145.97

|

191.02

|

| Net Income (Loss) |

$ (1,182,000,000)

|

$ (229,000,000)

|

$ 616,000,000

|

$ 822,000,000

|

$ (62,000,000)

|

| Company Selected Measure Amount |

153,000,000

|

120,000,000

|

715,000,000

|

573,000,000

|

807,000,000

|

| PEO Name |

Mr. Idol

|

|

|

|

|

| Additional 402(v) Disclosure |

We have not reported any amounts in our SCT with respect to “Change in Pension and Nonqualified Deferred Compensation.” Accordingly, the adjustments with respect to such items prescribed by the pay versus performance rules are not relevant to our analysis and no adjustments have been made.The amounts reflect the aggregate grant date fair value reported in the “Share Awards” and “Option Awards” columns in the SCT for the applicable fiscal year. In accordance with Item 402(v) requirements, the fair values of unvested and outstanding equity awards to our PEO were remeasured at the end of each fiscal year, and as of the vesting date, during the years displayed in the table above. We approached the determination of fair value in the same way as we historically have determined fair value and fair values as of each measurement date using valuation assumptions and methodologies (including expected term, volatility, dividend yield, and risk-free interest rates) that are generally consistent with those used to estimate fair value at grant under U.S. GAAP. See Note 17 (Share-Based Compensation) to our audited financial statements included in our Annual Report on Form 10-K for Fiscal 2025. We have not reported any amounts in our SCT with respect to “Change in Pension and Nonqualified Deferred Compensation.” Accordingly, the adjustments with respect to such items prescribed by the pay versus performance rules are not relevant to our analysis and no adjustments have been made. The amounts reflect the aggregate grant date fair value reported in the “Share Awards” and “Option Awards” columns in the SCT for the applicable fiscal year.In accordance with Item 402(v) requirements, the fair values of unvested and outstanding equity awards to our Non-PEO NEOs were remeasured at the end of each fiscal year, and as of the vesting date, during the years displayed in the table above. We approached the determination of fair value in the same way as we historically have determined fair value and fair values as of each measurement date using valuation assumptions and methodologies (including expected term, volatility, dividend yield, and risk-free interest rates) that are generally consistent with those used to estimate fair value at grant under U.S. GAAP. See Note 17 (Share-Based Compensation) to our audited financial statements included in our Annual Report on Form 10-K for Fiscal 2025. TSR is calculated assuming that a $100 investment was made on the day prior to the first fiscal year reported in the table above and that all dividends are reinvested until the last day of each reported fiscal year. On the last business day of fiscal 2020, which was March 27, 2020, our share price was $11.67 compared to $20.30 on the last business day of Fiscal 2025. The dollar amounts reported are the Company’s net (loss) income reflected in the Company’s audited financial statements for the applicable year.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Free Cash Flow

|

|

|

|

|

| Non-GAAP Measure Description |

The Company selected financial measure is free cash flow as adjusted in accordance with the Incentive Plan. Adjusted free cash flow as used in our Incentive Plan may differ from our public filings as additional items may be excluded in accordance with the terms of our Incentive Plan. For a further discussion of free cash flow and how it is used in our executive compensation program, see “Compensation Discussion and Analysis.”

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Operating Income

|

|

|

|

|

| PEO | Aggregate Change in Present Value of Accumulated Benefit for All Pension Plans Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(7,000,000)

|

|

|

|

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(7,904,650)

|

|

|

|

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,499,942)

|

|

|

|

|

| PEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Year-End Fair Value Of Equity Awards Granted In Prior Years That Are Outstanding And Unvested [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

4,237,199

|

|

|

|

|

| Non-PEO NEO | Aggregate Change in Present Value of Accumulated Benefit for All Pension Plans Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,875,008)

|

|

|

|

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,888,794)

|

|

|

|

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(302,535)

|

|

|

|

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Year-End Fair Value Of Equity Awards Granted In Prior Years That Are Outstanding And Unvested [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 1,189,458

|

|

|

|

|