| Stockholder Transaction Expenses (as a percentage of the offering price): | ||||

| Sales load | – | %(1) | ||

| Offering expenses | – | %(2) | ||

| Dividend reinvestment plan expenses | – | (3) | ||

| Total stockholder transaction expenses | – | % | ||

| Annual Expenses (as a percentage of net assets attributable to common stock): | ||||

| Base management fee | 1.93 | %(4) | ||

| Incentive fee | 3.18 | %(5) | ||

| Interest payments on borrowed funds | 1.99 | %(6) | ||

| Other expenses | 0.97 | %(7) | ||

| Total annual expenses | 8.07 | % | ||

Example

The following example is furnished in response to the requirements of the SEC and illustrates the various costs and expenses that you would pay, directly or indirectly, on a $1,000 investment in shares of our common stock for the time periods indicated, assuming (1) total annual expenses of 8.07% of net assets attributable to our common stock and (2) a 5% annual return*:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return | $ | 81 | $ | 235 | $ | 379 | $ | 704 | ||||||||

| * | The example should not be considered a representation of future returns or expenses, and actual returns and expenses may be greater or less than those shown. The estimated incentive fee of 3.18% under the Investment Advisory Agreement, which assumes a 5% annual return, is included in the example. The example assumes that the estimated “other expenses” set forth in the Annual Expenses table are accurate, and that all dividends and distributions are reinvested at NAV. Our actual rate of return may be greater or less than the hypothetical 5% return shown in the example. The example does not include sales loads or estimated offering expenses which, if reflected, would result in higher expenses. In the event that the Company sells its securities publicly through underwriters or agents, the related prospectus supplement will disclose the applicable sales load and the estimated offering expenses borne by the Company. |

The following table is intended to assist you in understanding the costs and expenses that an investor in shares of our common stock will bear directly or indirectly. The expenses shown in the table under “Annual Expenses” are based on estimated amounts for our first full year of operations and assumes that we incur leverage in an amount up to approximately 27.4% of our total assets (as determined immediately after the leverage is incurred). In addition, such amounts are adjusted to reflect (i) committed equity financing up to the lesser of $25,000,000 in aggregate gross purchase price of our common stock and (ii) 4,052,100 shares of common stock plus (iii) the hypothetical borrowings of the full $100 million available under the Credit Facility); which would mean that the Company’s adjusted total assets are assumed to equal approximately $569 million. The following table should not be considered a representation of our future expenses. Actual expenses may be greater or less than shown.

Investment Objectives and Strategies

We are an externally managed, non-diversified closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, as amended, or the “1940 Act.” We intend to qualify annually as a regulated investment company, or “RIC,” under Subchapter M of the Internal Revenue Code of 1986, as amended, or the “Code,” beginning with our tax year ended September 30, 2024. We were formed on May 13, 2022 as Sound Point Meridian Capital, LLC, a Delaware limited liability company, and effective March 13, 2024, we converted to a Delaware corporation under the name Sound Point Meridian Capital, Inc. On June 14, 2024, our common stock began trading on the New York Stock Exchange (the “NYSE”) under the ticker symbol “SPMC” following our initial public offering of 4,000,000 shares of our common stock (the “IPO”) at a public offering price of $20.00 per share.

Our primary investment objective is to generate high current income, with a secondary objective to generate capital appreciation. We seek to achieve our investment objectives by investing primarily in third-party collateralized loan obligation (“CLO”) equity and mezzanine tranches of predominately U.S.-dollar denominated CLOs backed by corporate leveraged loans issued primarily to U.S. obligors. This investment strategy looks to opportunistically shift between the primary and secondary CLO markets, seeking to identify the most compelling relative value. Our focus is on the primary CLO market (i.e., acquiring securities at the inception of a CLO) when the discrepancy between the value of a CLO’s assets and liabilities is believed to present an attractive investment opportunity. We will opportunistically switch to the secondary market (i.e., acquiring existing CLO securities) during times of market volatility or when we identify attractive investment opportunities. The Adviser aims to identify top-tier CLO managers with proven track records of outperformance through increasing the value of the loans held by the CLO, generation of high equity distributions and active portfolio management. Additionally, the strategy is focused on CLOs with attractive structures, which include flexibility for the CLO manager, strong cushions on covenants and cashflow ratios, terms that are favorable to the holders of CLO equity securities and reinvestment periods that are consistent with the Adviser’s current market views.

We may also invest in other securities and instruments that the Adviser believes are consistent with our investment objectives, including, among other investments, junior debt tranches of CLOs and loan accumulation facilities. Loan accumulation facilities are short- to medium-term facilities, often provided by the bank that will serve as the placement agent or arranger on a CLO transaction and typically leveraged four to six times. The amount that we will invest in other securities and instruments will vary from time to time and, as such, may constitute a material part of our portfolio on any given date, based on the Adviser’s assessment of prevailing market conditions. Finally, the Adviser implements an active portfolio management style.

The CLO equity securities in which we primarily seek to invest are typically unrated and are considered speculative with respect to timely payment of interest and repayment of principal. The CLO equity securities in which we intend to invest are highly leveraged (with CLO equity securities typically being leveraged nine to 13 times), which magnifies our risk of loss on such investments. Risks in CLO tranches tend to evolve over time and across the cycle, as a function of the credit risk in the underlying portfolio and the behavior of the manager. Given that the CLO market is generally slow to reprice these changes in risk profiles, the Adviser believes it can mitigate these risks and take advantage of this latency to improve returns. The CLOs in which we intend to invest are typically collateralized by below-investment grade loans (sometimes referred to as leveraged loans). The equity tranche of a CLO represents the most subordinated tranche in a CLO’s capital structure. Such securities are therefore subject to greater risks than securities issued by a CLO in higher priority tranches, including credit (i.e., default) risk and liquidity risk.

CLO equity is an illiquid investment. For the most part, CLO equity trades “by appointment” and trading prices are heavily negotiated. Projected cashflows to CLO equity involve a number of assumptions about the future, including interest rates, reinvestment spreads on loans bought in the future, loan prepayment rates, and other factors that may be difficult to predict. As such, CLO equity is considered a “speculative” investment by rating agencies and there is generally no standard methodology or observable market that allows a buyer or seller to easily price a CLO equity position at the time of trade.

We may also engage in “Derivative Transactions,” as described below, from time to time. To the extent we engage in Derivative Transactions, we expect to do so to hedge against interest rate, credit and/or other risks, or for other investment or risk management purposes. We may use Derivative

Transactions for investment purposes to the extent consistent with our investment objectives if the Adviser deems it appropriate to do so. We may purchase and sell a variety of derivative instruments, including exchange-listed and over-the-counter, or “OTC,” options, futures, options on futures, swaps and similar instruments, various interest rate transactions, such as swaps, caps, floors, or collars, and credit default swaps. We also may purchase and sell derivative instruments that combine features of these instruments. Collectively, we refer to these financial management techniques as “Derivative Transactions.”

CLO Structural Elements

Structurally, CLO vehicles are entities formed to originate and/or acquire a portfolio of loans. The loans within the CLO vehicle are generally limited to loans which meet established credit criteria and are subject to concentration limitations in order to limit a CLO vehicle’s exposure to a single credit.

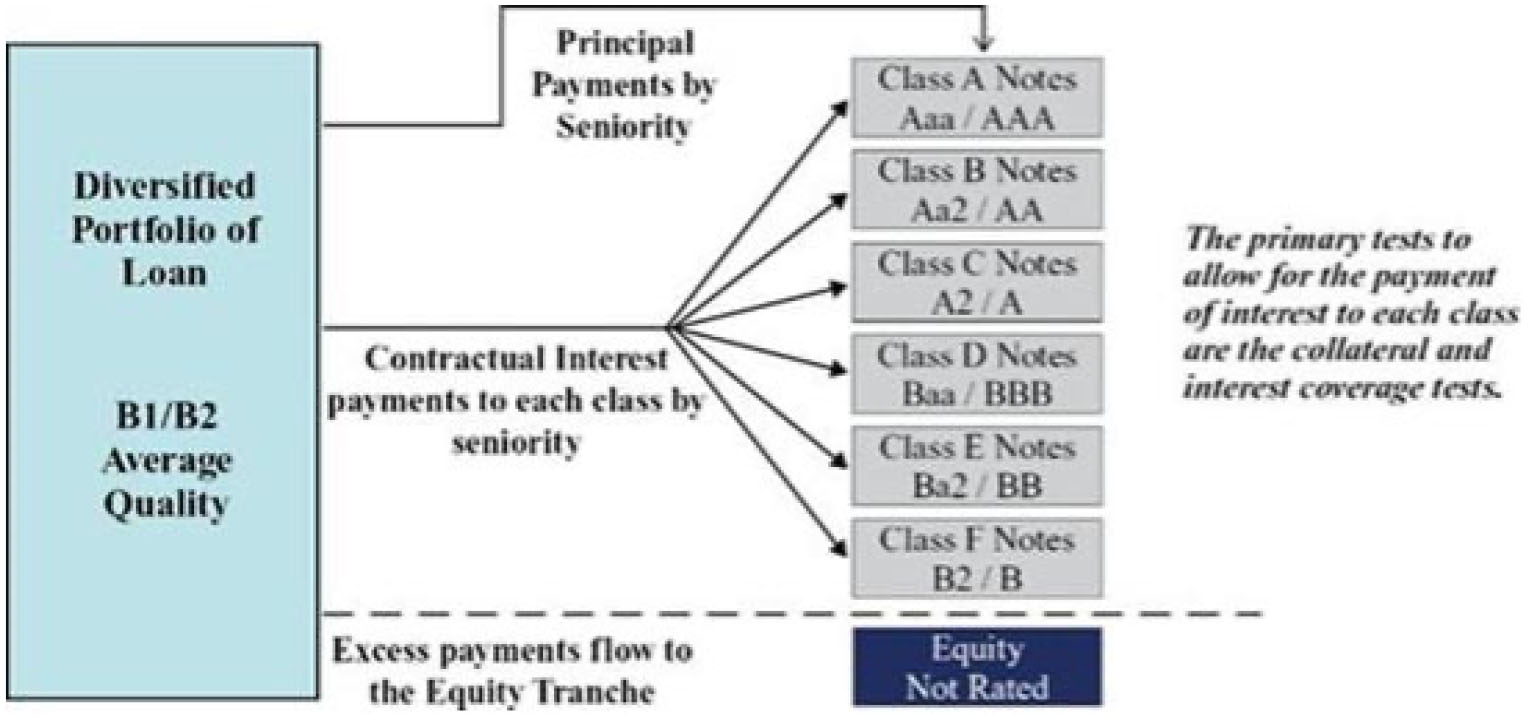

A CLO vehicle is formed by raising multiple “tranches” of debt (with the most senior tranches being rated “AAA” to the most junior tranches typically being rated “BB” or “B”) and equity. As interest payments are received, the CLO vehicle makes contractual interest payments to the holders of each tranche of debt based on their seniority. If there are funds remaining after each tranche of debt receives its contractual interest rate payment and the CLO vehicle meets or exceeds required collateral coverage levels (or other similar covenants), the remaining funds may be paid to the holders of the equity tranche. The contractual provisions setting out this order of payments are detailed in the CLO vehicle’s indenture. These provisions are referred to as the “priority of payments” or the “waterfall” and determine any other obligations that may be required to be paid ahead of payments of interest and principal on the securities issued by a CLO vehicle. In addition, for payments to be made to the holders of each tranche, after the most senior tranche of debt, there are various tests which must be complied with, which are different for each CLO vehicle. CLO indentures typically provide for adjustments to the priority of payments in the event that certain cashflow or collateral requirements are not maintained. The collateral quality tests that may divert cashflows in the priority of payments are predominantly determined by reference to the par values of the underlying loans, rather than their current market values.

The diagram below is for illustrative purposes only. The CLO vehicles in which we may invest may vary substantially from the illustrative example set forth below.

These investment objectives are not fundamental policies of ours and may be changed by our board of directors without prior approval of our stockholders.

Investment Restrictions

Our investment objectives and our investment policies and strategies, except for the six investment restrictions designated as fundamental policies under this caption, are not fundamental and may be changed by the board of directors without stockholder approval.

As referred to above, the following six investment restrictions are designated as fundamental policies and, as such, cannot be changed without the approval of the holders of a majority of our outstanding voting securities:

| (1) | We may not issue senior securities (including borrowing money), except as permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, SEC staff or other authority with appropriate jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority with appropriate jurisdiction; |

| (2) | We may not engage in the business of underwriting securities issued by others, except to the extent that we may be deemed to be an underwriter in connection with the disposition of portfolio securities; |

| (3) | We may not purchase or sell physical commodities or contracts for the purchase or sale of physical commodities. Physical commodities do not include futures contracts with respect to securities, securities indices, currency or other financial instruments; |

| (4) | We may not purchase or sell real estate, which term does not include securities of companies which deal in real estate or mortgages or investments secured by real estate or interests therein, except that we reserve freedom of action to hold and to sell real estate acquired as a result of our ownership of securities; |

| (5) | We may not make loans, except to the extent consistent with our investment objectives and our investment policies and strategies described in this prospectus or otherwise permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, SEC staff, or other authority with appropriate jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff, or other authority with appropriate jurisdiction. For purposes of this investment restriction, the purchase of debt obligations (including acquisitions of loans, loan participations, or other forms of debt instruments) shall not constitute loans by us; and |

| (6) | We may not invest in any security if as a result of such investment, 25% or more of the value of our total assets, taken at market value at the time of each investment, are in the securities of issuers in any particular industry or group of industries except (a) securities issued or guaranteed by the U.S. government and its agencies and instrumentalities or tax-exempt securities of state and municipal governments or their political subdivisions (however, not including private purpose industrial development bonds issued on behalf of non-government issuers), (b) as otherwise provided by the 1940 Act, as amended from time to time, and as modified or supplemented from time to time by (i) the rules and regulations promulgated by the SEC under the 1940 Act, as amended from time to time, and (ii) any exemption or other relief applicable to us from the provisions of the 1940 Act, as amended from time to time, or (c) as set forth in the following paragraph. For purposes of this restriction, in the case of investments in loan participations between us and a bank or other lending institution participating out the loan, we will treat both the lending bank or other lending institution and the borrower as “issuers.” |

We may invest up to 100% of our assets in securities issued by CLO vehicles and in corporate debt instruments, which may be acquired directly in privately negotiated transactions or in secondary market purchases.

The latter part of certain of our fundamental investment restrictions (i.e., the references to “except to the extent permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, the SEC staff or other authority with appropriate jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority with appropriate jurisdiction”) provides us with flexibility to change our limitations in connection with changes in applicable law, rules, regulations, or exemptive relief. The language used in these restrictions provides the necessary flexibility to allow our board of directors to respond efficiently to these kinds of developments without the delay and expense of a stockholder meeting.

Whenever an investment policy or investment restriction set forth in this report or in our prospectus states a maximum percentage of assets that may be invested in any security or other asset or describes a policy regarding quality standards, such percentage limitation or standard shall be determined immediately after and as a result of our acquisition of such security or asset. Accordingly, any later increase or decrease resulting from a change in values, assets, or other circumstances will not compel us to dispose of such security or other asset. Notwithstanding the foregoing, we must always be in compliance with the borrowing policies set forth above.

Use of Leverage and Leverage Risks

The use of leverage, whether directly through borrowing under a revolving credit facility with Canadian Imperial Bank of Commerce (the “Credit Facility”) or the issuance of the 8.00% Series A Term Preferred Stock due 2029 (the “Series A Preferred Shares”), or indirectly through investments such as CLO junior debt and equity securities that inherently involve leverage, may magnify our risk of loss. CLO equity and junior debt securities are very highly leveraged (with CLO equity securities typically being leveraged nine to 13 times), and therefore the CLO securities in which we invest are subject to a higher degree of loss since the use of leverage magnifies losses.

We may use leverage to the extent permitted by the 1940 Act. We have incurred leverage by issuing preferred stock and incurring indebtedness for borrowing money. We are permitted to obtain additional leverage using any form of financial leverage instruments, including funds borrowed from banks or other financial institutions, margin facilities, notes, or preferred stock and leverage attributable to reverse repurchase agreements or similar transactions. In contrast to the CLOs in which we will invest, which are typically highly leveraged, we intend to use relatively limited amounts of leverage (generally expected to consist of borrowings or the issuances of preferred stock or debt securities) in order to optimize the returns to our stockholders. We seek to use appropriate leverage that enhances returns without creating undue risk in the portfolio in the case that the CLO market weakens. Over time, the Adviser may decide that it is appropriate to use more leverage to purchase assets or for other purposes, or to reduce leverage by repaying any outstanding facilities. The more leverage we employ, the more likely a substantial change will occur in our NAV. Accordingly, any event that adversely affects the value of an investment would be magnified to the extent leverage is utilized. The cumulative effect of the use of leverage with respect to any investments in a market that moves adversely to such investments could result in a substantial loss that would be greater than if our investments were not leveraged. The use of leverage creates additional expenses that will be borne entirely by common stockholders. The Company’s leverage strategy may not ultimately be successful.

The following table is intended to illustrate the effect of the use of direct leverage on returns from an investment in our common stock assuming various annual returns, net of expenses. The calculations in the table below are hypothetical and actual returns may be higher or lower than those appearing in the table below.

| Assumed Return on Our Portfolio (Net of Expenses) | -10% | -5% | 0% | 5% | 10% | ||||||||

| Corresponding return to common stockholder(1) | -16.81% | -9.93% | -3.04% | 3.84% | 10.73% |

| (1) | Assumes (i) $559.8m in pro forma total assets as of March 31, 2025 (adjusted to reflect (1) the committed equity financing of 4,052,100 shares of our common stock and (2) the hypothetical borrowings of the full $100 million available under the Credit Facility); (ii) $406.6m in pro forma net assets as of March 31, 2025 (adjusted to reflect the issuances and borrowings described above); and (iii) an annualized weighted average interest rate on our indebtedness and preferred equity, as of March 31, 2025, of 8.07%. |

Based on our assumed leverage described above, our investment portfolio would have been required to experience an annual return of at least 2.21% to cover annual interest and dividend payments on our outstanding indebtedness and preferred equity.

Principal Risk Factors

The following list is not intended to be a comprehensive list of all of the potential risks associated with the Company. The Company’s prospectus provides a detailed discussion of the Company’s risks and considerations. The risks described in the prospectus are not the only risks the Company faces. Additional risks and uncertainties not currently known to the Company or that are currently deemed to be immaterial also may materially and adversely affect its business, financial condition and/or operating results.

Limited Prior Operating History

We were formed in May 2022 and commenced operations on June 13, 2024, and are therefore subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objective and that the value of your investment could decline substantially.

Risks of Investing in CLOs and Other Structured Debt Securities

CLOs and other structured finance securities are generally backed by a pool of credit-related assets that serve as collateral. Accordingly, CLO and structured finance securities present risks similar to those of other types of credit investments, including default (credit), interest rate and prepayment risks. Adverse credit events impacting a CLO’s or structured finance security’s underlying collateral would be expected to reduce cash flows payable to the Company as CLO equity investor. In addition, there is a risk that majority lenders to an underlying loan held by a CLO could amend or otherwise modify the loan to the detriment of the CLO (including, for example, by transferring collateral or otherwise reducing the priority of the CLO’s investment within the borrower’s capital structure). Such actions would impair the value of the CLO’s investment and, ultimately, the Company. In addition, CLO and structured finance securities also present risks related to the capability of the servicer of the securitized assets. CLOs and other structured finance securities are often governed by a complex series of legal documents and contracts, which increases the risk of dispute over the interpretation and enforceability of such documents relative to other types of investments. There is also a risk that the trustee of a CLO does not properly carry out its duties to the CLO, potentially resulting in loss to the CLO. CLOs are also inherently leveraged vehicles and are subject to leverage risk.

Subordinated Securities Risk

CLO equity and mezzanine securities that the Company may acquire are subordinated in right of payment to more senior tranches of CLO debt. CLO equity and mezzanine securities are subject to increased risks of default relative to the holders of superior priority interests in the same CLO. In addition, at the time of issuance, CLO equity securities are under-collateralized in that the face amount of the CLO debt and CLO equity of a CLO at inception exceed its total assets.

Re-Pricing Risk

If interest rates on investments similar to a CLO’s secured notes fall below the prevailing levels at the time of issuance of those secured notes, the holders of CLO equity may have the right to cause a re-pricing of one or more classes of the secured notes, which will result in the interest rate payable with respect to each re-priced class to be reduced. Any mezzanine CLO securities in which we invest that are re-priced will be redeemed if we elect not to participate in the re-pricing, and such redemption may be at a time when other investments bearing the same rate of interest may be more difficult or expensive to acquire. A re-pricing may also result in a shorter investment than a holder of secured notes may have initially anticipated. Holders subject to a re-pricing may recognize taxable income to the extent of the excess of any distributions made on their secured notes during the taxable year in which the re-pricing occurs and may recognize short-term capital gain or loss if they sell, exchange, retire, or otherwise dispose of their notes within one year after the re-pricing, even if such gain or loss otherwise would have been long-term capital gain or loss.

Covenant-Lite Loans Risk

Covenant-lite loans are loans that possess few or no financial maintenance and reporting covenants intended to protect lenders. Covenant-lite loans are subject to the risks associated with investments in other types of loans. Generally, covenant-lite loans allow the borrowers more freedom to operate because their covenants are incurrence-based, which means they are only tested, and therefore can only be breached, at the time of a proposed affirmative action of the borrower, rather than by a deterioration in the borrower’s financial condition. Accordingly, to the extent that the CLOs that we invest in hold covenant-lite loans, our CLOs may have fewer rights against a borrower and may have a greater risk of loss on such investments as compared to investments in loans with financial maintenance covenants.

High-Yield and Unrated Investment Risk

The CLO securities that the Company acquires are typically rated below investment grade or, in the case of CLO equity securities, unrated and are therefore considered “higher-yield” or “junk” securities and are considered speculative with respect to timely payment of interest and repayment of principal. The senior secured loans and other credit-related assets underlying CLOs are also higher-yield investments. Investing in CLO securities and other high-yield investments typically involves greater credit and liquidity risk than investment grade obligations, which may adversely impact the Company’s performance.

Leverage Risk

The use of leverage, whether directly or indirectly through investments such as CLO securities that inherently involve leverage, may magnify the Company’s risk of loss. CLOs are typically very highly leveraged (with CLO equity securities typically being leveraged nine to 13 times), and therefore the CLO securities in which the Company invests are subject to a higher degree of risk of loss since the use of leverage magnifies losses.

Credit Risk

If (1) a CLO in which the Company invests, (2) an underlying asset of any such CLO or (3) any other type of credit investment in the Company’s portfolio declines in price or the obligor fails to pay principal, interest or other return when due because the issuer or debtor, as the case may be, experiences a decline in its financial performance or has other credit related issues, the Company’s income, NAV and/or market price may be adversely impacted. Additionally, interest on a CLO may be paid in kind or deferred and capitalized (paid in the form of obligations of the same type rather than cash), which involves continued exposure to default risk with respect to such payments.

Key Personnel Risk

The Adviser manages our investments. We are dependent upon the key personnel of the Adviser for our future success. There can be no assurance that the professional personnel of the Adviser will continue to serve in their current positions or continue to be employed by the Adviser. The Company can offer no assurance that their services will be available for any length of time or that the Adviser will continue indefinitely as the Company’s investment adviser.

Conflicts of Interest Risk

The Company’s executive officers and directors, and the Adviser and certain of its affiliates and their officers and employees, including the members of the Adviser’s CLO investment team, have several conflicts of interest as a result of the other activities in which they engage.

Prepayment Risk

The assets underlying the CLO securities in which the Company invests are subject to prepayment by the underlying corporate borrowers. As such, the CLO securities and related investments in which the Company invests are subject to prepayment risk. If the Company or a CLO collateral manager are unable to reinvest prepaid amounts in a new investment with an expected rate of return at least equal to that of the investment repaid, the Company’s investment performance will be adversely impacted.

Liquidity Risk

Generally, there is no public market for the CLO investments in which the Company invests. As such, the Company may not be able to sell such investments quickly, or at all. If the Company is able to sell such investments, the prices the Company receives may not reflect the Adviser’s assessment of their fair value or the amount paid for such investments by the Company.

Incentive Fee Risk

Our incentive fee structure and the formula for calculating the fee payable to the Adviser may incentivize the Adviser to pursue speculative investments and use leverage in a manner that adversely impacts our performance. In view of the catch-up provision applicable to income incentive fees under the Investment Advisory Agreement, the Adviser could potentially receive a significant portion of the increase in our investment income attributable to a general increase in interest rates.

Fair Valuation of the Company’s Portfolio Investments

Generally, there is no public market for the CLO investments and certain other credit assets in which the Company may invest. The Adviser values these securities at least quarterly, or more frequently as may be required from time to time, at fair value. The Adviser’s determinations of the fair value of the Company’s investments have a material impact on the Company’s net earnings through the recording of unrealized appreciation or depreciation of investments and may cause the Company’s NAV on a given date to understate or overstate, possibly materially, the value that the Company ultimately realizes on one or more of the Company’s investments.

Limited Investment Opportunities Risk

The market for CLO securities is more limited than the market for other credit related investments. The Company can offer no assurances that sufficient investment opportunities for the Company’s capital will be available. In recent years there has been a marked increase in the number of, and flow of capital into, investment vehicles established to pursue investments in CLO securities whereas the size of this market is relatively limited. While the Company cannot determine the precise effect of such competition, such increase may result in greater competition for investment opportunities, which may result in an increase in the price of such investments relative to the risk taken on by holders of such investments. Such competition may also result under certain circumstances in increased price volatility or decreased liquidity with respect to certain positions.

Market Risk

Political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of the Company’s investments. A disruption or downturn in the capital markets and the credit markets could impair the Company’s ability to raise capital, reduce the availability of suitable investment opportunities for the Company, or adversely and materially affect the value of the Company’s investments, any of which would negatively affect the Company’s business. These risks may be magnified if certain events or developments adversely interrupt the global supply chain, and could affect companies worldwide.

CLO Warehouse Facilities Risk

The Company may invest in loan accumulation facilities, which are short- to medium-term facilities (also referred to as “CLO warehouses”) often provided by the bank that will serve as placement agent or arranger on a CLO transaction and which acquire loans on an interim basis which are expected to form part of the portfolio of a future CLO. Investments in CLO warehouses have risks similar to those applicable to investments in CLOs. Leverage is typically utilized in such a facility and as such the potential risk of loss will be increased for such facilities employing leverage. In the event a planned CLO is not consummated, or the loans are not eligible for purchase by the CLO, the CLO warehouse vehicle may be responsible for either holding or disposing of the loans. This could expose the Company to credit and/or mark-to-market losses, and other risks.

Currency Risk

Any of the Company’s investments that are denominated in currencies other than U.S. dollars will be subject to the risk that the value of such currency will decrease in relation to the U.S. dollar. Fluctuations in currency exchange rates will similarly affect the U.S. dollar equivalent of any interest, dividends, or other payments made that are denominated in a currency other than U.S. dollars.

Hedging Risk

Hedging transactions seeking to reduce risks may result in poorer overall performance than if the Company had not engaged in such hedging transactions. Additionally, such transactions may not fully hedge the Company’s risks.

Reinvestment Risk

CLOs will typically generate cash from asset repayments and sales that may be reinvested in substitute assets, subject to compliance with applicable investment tests. If the CLO collateral manager causes the CLO to purchase substitute assets at a lower yield than those initially acquired or sale proceeds are maintained temporarily in cash, it would reduce the excess interest-related cash flow, thereby having a negative effect on the fair value of the Company’s assets and the market value of the Company’s securities. In addition, the reinvestment period for a CLO may terminate early, which would cause the holders of the CLO’s securities to receive principal payments earlier than anticipated. There can be no assurance that the Company will be able to reinvest such amounts in an alternative investment that provides a comparable return relative to the credit risk assumed.

Interest Rate Risk

The price of certain of the Company’s investments may be significantly affected by changes in interest rates, including increases and decreases in interest rates caused by governmental actions and/or other factors. Although senior secured loans are generally floating rate instruments, the Company’s investments in senior secured loans through investments in junior equity and debt tranches of CLOs are sensitive to interest rate levels and volatility. For example, because CLO debt securities are floating rate securities, a reduction in interest rates would generally result in a reduction in the coupon payment and cash flow the Company receives on the Company’s CLO debt investments. Further, there may be some difference between the timing of interest rate resets on the assets and liabilities of a CLO. Such a mismatch in timing could have a negative effect on the amount of funds distributed to CLO equity investors. In addition, CLOs may not be able to enter into hedge agreements, even if it may otherwise be in the best interests of the CLO to hedge such interest rate risk. Furthermore, in the event of a changing interest rate environment and/or economic downturn, loan defaults may increase and result in credit losses that may adversely affect the Company’s cash flow, fair value of the Company’s assets and operating results. Because CLOs generally issue debt on a floating rate basis, an increase in the relevant benchmark index will increase the financing costs of CLOs.

Refinancing Risk

If the Company incurs debt financing and subsequently refinances such debt, the replacement debt may be at a higher cost and on less favorable terms and conditions. If the Company fails to extend, refinance or replace such debt financings prior to their maturity on commercially reasonable terms, the Company’s liquidity will be lower than it would have been with the benefit of such financings, which would limit the Company’s ability to grow, and holders of the Company’s common stock would not benefit from the potential for increased returns on equity that incurring leverage creates.

Tax Risk

If the Company fails to qualify for tax treatment as a RIC under Subchapter M of the Internal Revenue Code of 1986, as amended, for any reason, or otherwise becomes subject to corporate income tax, the resulting corporate taxes (and any related penalties) could substantially reduce the Company’s net assets, the amount of income available for distributions to the Company’s stockholders, and the amount of income available for payment of the Company’s other liabilities.

A purchase of the Company’s common stock shortly before payment of a dividend or distribution (referred to as “buying a dividend”) may be disadvantageous because the dividend or distribution to the purchaser has the effect of reducing the per share NAV of the common stock by the amount of the dividend or distribution. In addition, all or a portion of such dividends or distributions (although in effect a return of capital) may be taxable.

Derivatives Risk

Derivative instruments in which the Company may invest may be volatile and involve various risks different from, and in certain cases greater than, the risks presented by other instruments. The primary risks related to derivative transactions include counterparty, correlation, liquidity, leverage, volatility, over-the-counter trading, operational and legal risks. In addition, a small investment in derivatives could have a large potential impact on the Company’s performance, effecting a form of investment leverage on the Company’s portfolio. In certain types of derivative transactions, the Company could lose the entire amount of the Company’s investment; in other types of derivative transactions the potential loss is theoretically unlimited.

Counterparty Risk

The Company may be exposed to counterparty risk, which could make it difficult for the Company or the issuers in which the Company invests to collect on obligations, thereby resulting in potentially significant losses.

Price Risk

Investors who buy shares at different times will likely pay different prices.

Global Risks

Due to highly interconnected global economies and financial markets, the value of the Company’s securities and its underlying investments may go up or down in response to governmental actions and/or general economic conditions throughout the world. Events such as geopolitical events, war, military conflict, acts of terrorism, social unrest, natural disasters, recessions, inflation, rapid interest rate changes, supply chain disruptions, tariffs and other trade barriers, sanctions, the spread of infectious illness or other public health threats could also significantly impact the Company and its investments.

Banking Risk

The possibility of future bank failures poses risks of reduced financial market liquidity at clearing, cash management and other custodial financial institutions. The failure of banks which hold cash on behalf of the Company, the Company’s underlying obligors, the collateral managers of the CLOs in which the Company invests (or managers of other securitized or pooled vehicles in which the Company invests), or the Company’s service providers could adversely affect the Company’s ability to pursue its investment strategies and objectives. For example, if an underlying obligor has a commercial relationship with a bank that has failed or is otherwise distressed, such company may experience delays or other disruptions in meeting its obligations and consummating business transactions. Additionally, if a collateral manager has a commercial relationship with a distressed bank, the manager may experience issues conducting its operations or consummating transactions on behalf of the CLOs it manages, which could negatively affect the performance of such CLOs (and, therefore, the performance of the Company).

Additional Information

The Company makes certain unaudited portfolio information available each month on its website in addition to making certain other unaudited financial information available on its website (https://www.soundpointmeridiancap.com). This information includes (1) an estimated range of the Company’s net investment income (NII) and realized capital gains or losses per weighted average share of common stock for each calendar quarter end, generally made available within the first fifteen days after the applicable calendar month end, (2) an estimated range of the Company’s NAV per share of common stock for the prior month end and certain additional portfolio-level information, generally made available within the first fifteen days after the applicable calendar month end, and (3) during the latter part of each month, an updated estimate of NAV, if applicable, and, with respect to each calendar quarter end, an updated estimate of the Company’s NII and realized capital gains or losses for the applicable quarter.

Information contained on our website is not incorporated by reference into this Annual Report and you should not consider information contained on our website to be part of this Annual Report or any other report we file with the SEC.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this report may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Company’s filings with the SEC. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this report.

| Closing Sales Price | Premium (Discount) of High Sales Price to |

Premium (Discount) of Low Sales Price to |

||||||||||||||||||

| Period | NAV(1) | High | Low | NAV(2) | NAV(2) | |||||||||||||||

| Fiscal year ending March 31, 2025 | ||||||||||||||||||||

| First quarter(3) | $ | 19.91 | $ | 20.07 | $ | 19.90 | 0.80 | % | -0.05 | % | ||||||||||

| Second quarter | $ | 19.59 | $ | 20.35 | $ | 19.02 | 3.88 | % | -2.91 | % | ||||||||||

| Third quarter | $ | 20.52 | $ | 21.41 | $ | 18.75 | 4.34 | % | -8.63 | % | ||||||||||

| Fourth quarter | $ | 18.78 | $ | 22.11 | $ | 19.72 | 17.73 | % | 5.01 | % | ||||||||||

6. COMMON STOCK

As of March 31, 2025, there were 450,000,000 shares of common stock authorized, of which 20,318,901 shares were issued and outstanding.

On June 13, 2024, (commencement of operations), the Company issued 16,020,000 of common stock in exchange for $320,400,000 of Private Fund net assets at a value of $20.00 per share.

Pursuant to the final prospectus filed on the IPO Closing Date, on June 17, 2024, the Company issued common stock of 4,000,000 shares at an initial public offering price of $20.00 per share of common stock for net proceeds of $80,000,000.

On July 11, 2024, pursuant to the original IPO prospectus filed on the IPO Closing Date, the Company issued additional common stock via the overallotment of 175,000 shares at an initial public offering price of $20.00 per share of common for net proceeds of $3,500,000.

The Company is also party to a common stock purchase agreement with B. Riley Principal Capital II, LLC (“BRPC II”) whereby BRPC II has committed to purchase from the Company, at the Company’s direction, up to the lesser of (i) $25,000,000 in aggregate gross purchase price of our common stock and (ii) 4,052,100 shares of the Company’s common stock, subject to certain legal and regulatory restrictions. As of March 31, 2025, the total amount of capital raised under these issuances was approximately $116,599 and net proceeds were approximately $113,199 after deducting the sales agent’s commissions and offering expenses.

Limited Prior Operating History

We were formed in May 2022 and commenced operations on June 13, 2024, and are therefore subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objective and that the value of your investment could decline substantially.

Risks of Investing in CLOs and Other Structured Debt Securities

CLOs and other structured finance securities are generally backed by a pool of credit-related assets that serve as collateral. Accordingly, CLO and structured finance securities present risks similar to those of other types of credit investments, including default (credit), interest rate and prepayment risks. Adverse credit events impacting a CLO’s or structured finance security’s underlying collateral would be expected to reduce cash flows payable to the Company as CLO equity investor. In addition, there is a risk that majority lenders to an underlying loan held by a CLO could amend or otherwise modify the loan to the detriment of the CLO (including, for example, by transferring collateral or otherwise reducing the priority of the CLO’s investment within the borrower’s capital structure). Such actions would impair the value of the CLO’s investment and, ultimately, the Company. In addition, CLO and structured finance securities also present risks related to the capability of the servicer of the securitized assets. CLOs and other structured finance securities are often governed by a complex series of legal documents and contracts, which increases the risk of dispute over the interpretation and enforceability of such documents relative to other types of investments. There is also a risk that the trustee of a CLO does not properly carry out its duties to the CLO, potentially resulting in loss to the CLO. CLOs are also inherently leveraged vehicles and are subject to leverage risk.

Subordinated Securities Risk

CLO equity and mezzanine securities that the Company may acquire are subordinated in right of payment to more senior tranches of CLO debt. CLO equity and mezzanine securities are subject to increased risks of default relative to the holders of superior priority interests in the same CLO. In addition, at the time of issuance, CLO equity securities are under-collateralized in that the face amount of the CLO debt and CLO equity of a CLO at inception exceed its total assets.

Re-Pricing Risk

If interest rates on investments similar to a CLO’s secured notes fall below the prevailing levels at the time of issuance of those secured notes, the holders of CLO equity may have the right to cause a re-pricing of one or more classes of the secured notes, which will result in the interest rate payable with respect to each re-priced class to be reduced. Any mezzanine CLO securities in which we invest that are re-priced will be redeemed if we elect not to participate in the re-pricing, and such redemption may be at a time when other investments bearing the same rate of interest may be more difficult or expensive to acquire. A re-pricing may also result in a shorter investment than a holder of secured notes may have initially anticipated. Holders subject to a re-pricing may recognize taxable income to the extent of the excess of any distributions made on their secured notes during the taxable year in which the re-pricing occurs and may recognize short-term capital gain or loss if they sell, exchange, retire, or otherwise dispose of their notes within one year after the re-pricing, even if such gain or loss otherwise would have been long-term capital gain or loss.

Covenant-Lite Loans Risk

Covenant-lite loans are loans that possess few or no financial maintenance and reporting covenants intended to protect lenders. Covenant-lite loans are subject to the risks associated with investments in other types of loans. Generally, covenant-lite loans allow the borrowers more freedom to operate because their covenants are incurrence-based, which means they are only tested, and therefore can only be breached, at the time of a proposed affirmative action of the borrower, rather than by a deterioration in the borrower’s financial condition. Accordingly, to the extent that the CLOs that we invest in hold covenant-lite loans, our CLOs may have fewer rights against a borrower and may have a greater risk of loss on such investments as compared to investments in loans with financial maintenance covenants.

High-Yield and Unrated Investment Risk

The CLO securities that the Company acquires are typically rated below investment grade or, in the case of CLO equity securities, unrated and are therefore considered “higher-yield” or “junk” securities and are considered speculative with respect to timely payment of interest and repayment of principal. The senior secured loans and other credit-related assets underlying CLOs are also higher-yield investments. Investing in CLO securities and other high-yield investments typically involves greater credit and liquidity risk than investment grade obligations, which may adversely impact the Company’s performance.

Leverage Risk

The use of leverage, whether directly or indirectly through investments such as CLO securities that inherently involve leverage, may magnify the Company’s risk of loss. CLOs are typically very highly leveraged (with CLO equity securities typically being leveraged nine to 13 times), and therefore the CLO securities in which the Company invests are subject to a higher degree of risk of loss since the use of leverage magnifies losses.

Credit Risk

If (1) a CLO in which the Company invests, (2) an underlying asset of any such CLO or (3) any other type of credit investment in the Company’s portfolio declines in price or the obligor fails to pay principal, interest or other return when due because the issuer or debtor, as the case may be, experiences a decline in its financial performance or has other credit related issues, the Company’s income, NAV and/or market price may be adversely impacted. Additionally, interest on a CLO may be paid in kind or deferred and capitalized (paid in the form of obligations of the same type rather than cash), which involves continued exposure to default risk with respect to such payments.

Key Personnel Risk

The Adviser manages our investments. We are dependent upon the key personnel of the Adviser for our future success. There can be no assurance that the professional personnel of the Adviser will continue to serve in their current positions or continue to be employed by the Adviser. The Company can offer no assurance that their services will be available for any length of time or that the Adviser will continue indefinitely as the Company’s investment adviser.

Conflicts of Interest Risk

The Company’s executive officers and directors, and the Adviser and certain of its affiliates and their officers and employees, including the members of the Adviser’s CLO investment team, have several conflicts of interest as a result of the other activities in which they engage.

Prepayment Risk

The assets underlying the CLO securities in which the Company invests are subject to prepayment by the underlying corporate borrowers. As such, the CLO securities and related investments in which the Company invests are subject to prepayment risk. If the Company or a CLO collateral manager are unable to reinvest prepaid amounts in a new investment with an expected rate of return at least equal to that of the investment repaid, the Company’s investment performance will be adversely impacted.

Liquidity Risk

Generally, there is no public market for the CLO investments in which the Company invests. As such, the Company may not be able to sell such investments quickly, or at all. If the Company is able to sell such investments, the prices the Company receives may not reflect the Adviser’s assessment of their fair value or the amount paid for such investments by the Company.

Incentive Fee Risk

Our incentive fee structure and the formula for calculating the fee payable to the Adviser may incentivize the Adviser to pursue speculative investments and use leverage in a manner that adversely impacts our performance. In view of the catch-up provision applicable to income incentive fees under the Investment Advisory Agreement, the Adviser could potentially receive a significant portion of the increase in our investment income attributable to a general increase in interest rates.

Fair Valuation of the Company’s Portfolio Investments

Generally, there is no public market for the CLO investments and certain other credit assets in which the Company may invest. The Adviser values these securities at least quarterly, or more frequently as may be required from time to time, at fair value. The Adviser’s determinations of the fair value of the Company’s investments have a material impact on the Company’s net earnings through the recording of unrealized appreciation or depreciation of investments and may cause the Company’s NAV on a given date to understate or overstate, possibly materially, the value that the Company ultimately realizes on one or more of the Company’s investments.

Limited Investment Opportunities Risk

The market for CLO securities is more limited than the market for other credit related investments. The Company can offer no assurances that sufficient investment opportunities for the Company’s capital will be available. In recent years there has been a marked increase in the number of, and flow of capital into, investment vehicles established to pursue investments in CLO securities whereas the size of this market is relatively limited. While the Company cannot determine the precise effect of such competition, such increase may result in greater competition for investment opportunities, which may result in an increase in the price of such investments relative to the risk taken on by holders of such investments. Such competition may also result under certain circumstances in increased price volatility or decreased liquidity with respect to certain positions.

Market Risk

Political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of the Company’s investments. A disruption or downturn in the capital markets and the credit markets could impair the Company’s ability to raise capital, reduce the availability of suitable investment opportunities for the Company, or adversely and materially affect the value of the Company’s investments, any of which would negatively affect the Company’s business. These risks may be magnified if certain events or developments adversely interrupt the global supply chain, and could affect companies worldwide.

CLO Warehouse Facilities Risk

The Company may invest in loan accumulation facilities, which are short- to medium-term facilities (also referred to as “CLO warehouses”) often provided by the bank that will serve as placement agent or arranger on a CLO transaction and which acquire loans on an interim basis which are expected to form part of the portfolio of a future CLO. Investments in CLO warehouses have risks similar to those applicable to investments in CLOs. Leverage is typically utilized in such a facility and as such the potential risk of loss will be increased for such facilities employing leverage. In the event a planned CLO is not consummated, or the loans are not eligible for purchase by the CLO, the CLO warehouse vehicle may be responsible for either holding or disposing of the loans. This could expose the Company to credit and/or mark-to-market losses, and other risks.

Currency Risk

Any of the Company’s investments that are denominated in currencies other than U.S. dollars will be subject to the risk that the value of such currency will decrease in relation to the U.S. dollar. Fluctuations in currency exchange rates will similarly affect the U.S. dollar equivalent of any interest, dividends, or other payments made that are denominated in a currency other than U.S. dollars.

Hedging Risk

Hedging transactions seeking to reduce risks may result in poorer overall performance than if the Company had not engaged in such hedging transactions. Additionally, such transactions may not fully hedge the Company’s risks.

Reinvestment Risk

CLOs will typically generate cash from asset repayments and sales that may be reinvested in substitute assets, subject to compliance with applicable investment tests. If the CLO collateral manager causes the CLO to purchase substitute assets at a lower yield than those initially acquired or sale proceeds are maintained temporarily in cash, it would reduce the excess interest-related cash flow, thereby having a negative effect on the fair value of the Company’s assets and the market value of the Company’s securities. In addition, the reinvestment period for a CLO may terminate early, which would cause the holders of the CLO’s securities to receive principal payments earlier than anticipated. There can be no assurance that the Company will be able to reinvest such amounts in an alternative investment that provides a comparable return relative to the credit risk assumed.

Refinancing Risk

If the Company incurs debt financing and subsequently refinances such debt, the replacement debt may be at a higher cost and on less favorable terms and conditions. If the Company fails to extend, refinance or replace such debt financings prior to their maturity on commercially reasonable terms, the Company’s liquidity will be lower than it would have been with the benefit of such financings, which would limit the Company’s ability to grow, and holders of the Company’s common stock would not benefit from the potential for increased returns on equity that incurring leverage creates.

Tax Risk

If the Company fails to qualify for tax treatment as a RIC under Subchapter M of the Internal Revenue Code of 1986, as amended, for any reason, or otherwise becomes subject to corporate income tax, the resulting corporate taxes (and any related penalties) could substantially reduce the Company’s net assets, the amount of income available for distributions to the Company’s stockholders, and the amount of income available for payment of the Company’s other liabilities.

A purchase of the Company’s common stock shortly before payment of a dividend or distribution (referred to as “buying a dividend”) may be disadvantageous because the dividend or distribution to the purchaser has the effect of reducing the per share NAV of the common stock by the amount of the dividend or distribution. In addition, all or a portion of such dividends or distributions (although in effect a return of capital) may be taxable.

Derivatives Risk

Derivative instruments in which the Company may invest may be volatile and involve various risks different from, and in certain cases greater than, the risks presented by other instruments. The primary risks related to derivative transactions include counterparty, correlation, liquidity, leverage, volatility, over-the-counter trading, operational and legal risks. In addition, a small investment in derivatives could have a large potential impact on the Company’s performance, effecting a form of investment leverage on the Company’s portfolio. In certain types of derivative transactions, the Company could lose the entire amount of the Company’s investment; in other types of derivative transactions the potential loss is theoretically unlimited.

Counterparty Risk

The Company may be exposed to counterparty risk, which could make it difficult for the Company or the issuers in which the Company invests to collect on obligations, thereby resulting in potentially significant losses.

Price Risk

Investors who buy shares at different times will likely pay different prices.

Global Risks

Due to highly interconnected global economies and financial markets, the value of the Company’s securities and its underlying investments may go up or down in response to governmental actions and/or general economic conditions throughout the world. Events such as geopolitical events, war, military conflict, acts of terrorism, social unrest, natural disasters, recessions, inflation, rapid interest rate changes, supply chain disruptions, tariffs and other trade barriers, sanctions, the spread of infectious illness or other public health threats could also significantly impact the Company and its investments.

Banking Risk

The possibility of future bank failures poses risks of reduced financial market liquidity at clearing, cash management and other custodial financial institutions. The failure of banks which hold cash on behalf of the Company, the Company’s underlying obligors, the collateral managers of the CLOs in which the Company invests (or managers of other securitized or pooled vehicles in which the Company invests), or the Company’s service providers could adversely affect the Company’s ability to pursue its investment strategies and objectives. For example, if an underlying obligor has a commercial relationship with a bank that has failed or is otherwise distressed, such company may experience delays or other disruptions in meeting its obligations and consummating business transactions. Additionally, if a collateral manager has a commercial relationship with a distressed bank, the manager may experience issues conducting its operations or consummating transactions on behalf of the CLOs it manages, which could negatively affect the performance of such CLOs (and, therefore, the performance of the Company).

Additional Information

The Company makes certain unaudited portfolio information available each month on its website in addition to making certain other unaudited financial information available on its website (https://www.soundpointmeridiancap.com). This information includes (1) an estimated range of the Company’s net investment income (NII) and realized capital gains or losses per weighted average share of common stock for each calendar quarter end, generally made available within the first fifteen days after the applicable calendar month end, (2) an estimated range of the Company’s NAV per share of common stock for the prior month end and certain additional portfolio-level information, generally made available within the first fifteen days after the applicable calendar month end, and (3) during the latter part of each month, an updated estimate of NAV, if applicable, and, with respect to each calendar quarter end, an updated estimate of the Company’s NII and realized capital gains or losses for the applicable quarter.

Information contained on our website is not incorporated by reference into this Annual Report and you should not consider information contained on our website to be part of this Annual Report or any other report we file with the SEC.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this report may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Company’s filings with the SEC. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this report.

Interest Rate Risk

The price of certain of the Company’s investments may be significantly affected by changes in interest rates, including increases and decreases in interest rates caused by governmental actions and/or other factors. Although senior secured loans are generally floating rate instruments, the Company’s investments in senior secured loans through investments in junior equity and debt tranches of CLOs are sensitive to interest rate levels and volatility. For example, because CLO debt securities are floating rate securities, a reduction in interest rates would generally result in a reduction in the coupon payment and cash flow the Company receives on the Company’s CLO debt investments. Further, there may be some difference between the timing of interest rate resets on the assets and liabilities of a CLO. Such a mismatch in timing could have a negative effect on the amount of funds distributed to CLO equity investors. In addition, CLOs may not be able to enter into hedge agreements, even if it may otherwise be in the best interests of the CLO to hedge such interest rate risk. Furthermore, in the event of a changing interest rate environment and/or economic downturn, loan defaults may increase and result in credit losses that may adversely affect the Company’s cash flow, fair value of the Company’s assets and operating results. Because CLOs generally issue debt on a floating rate basis, an increase in the relevant benchmark index will increase the financing costs of CLOs.