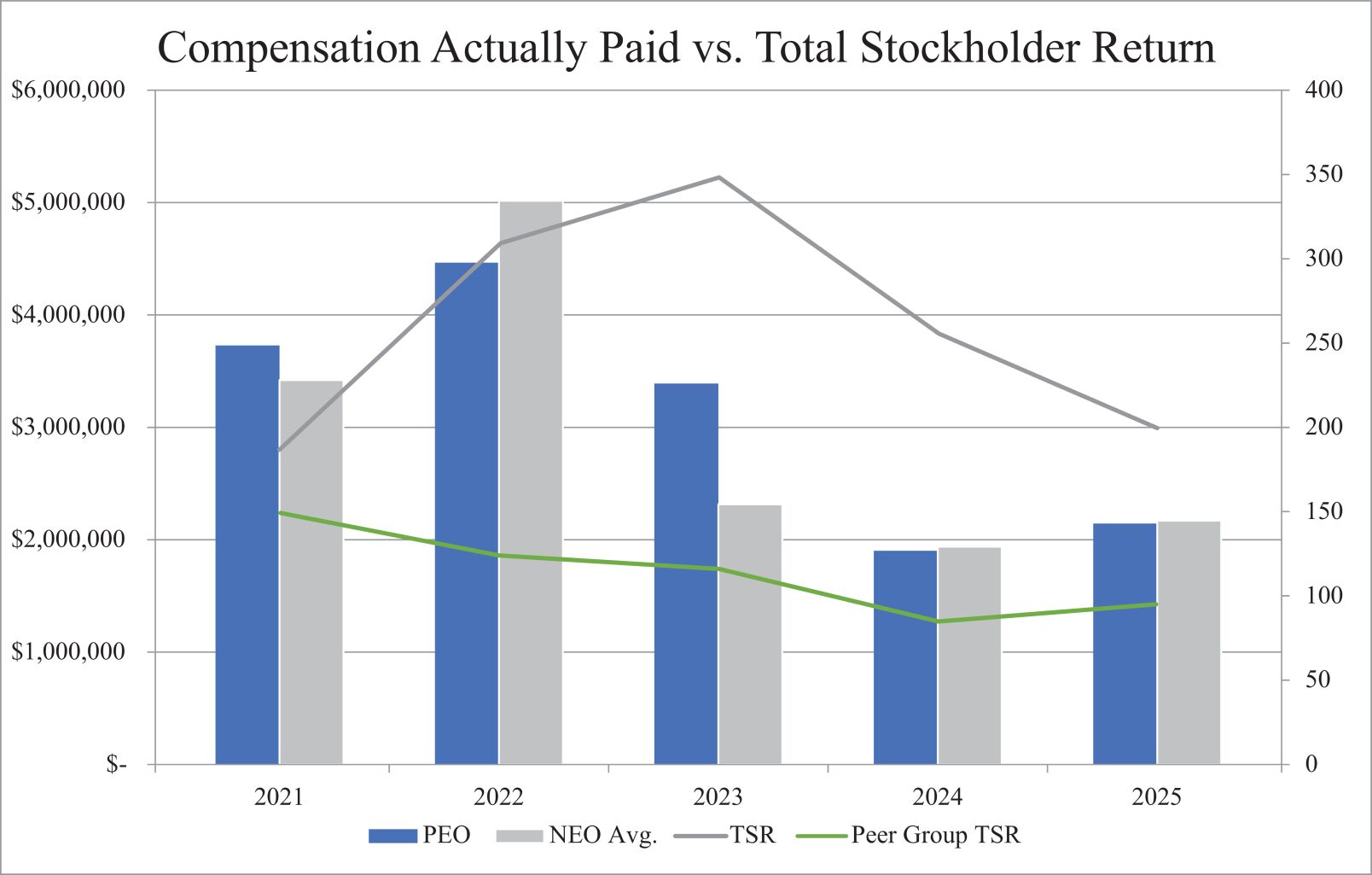

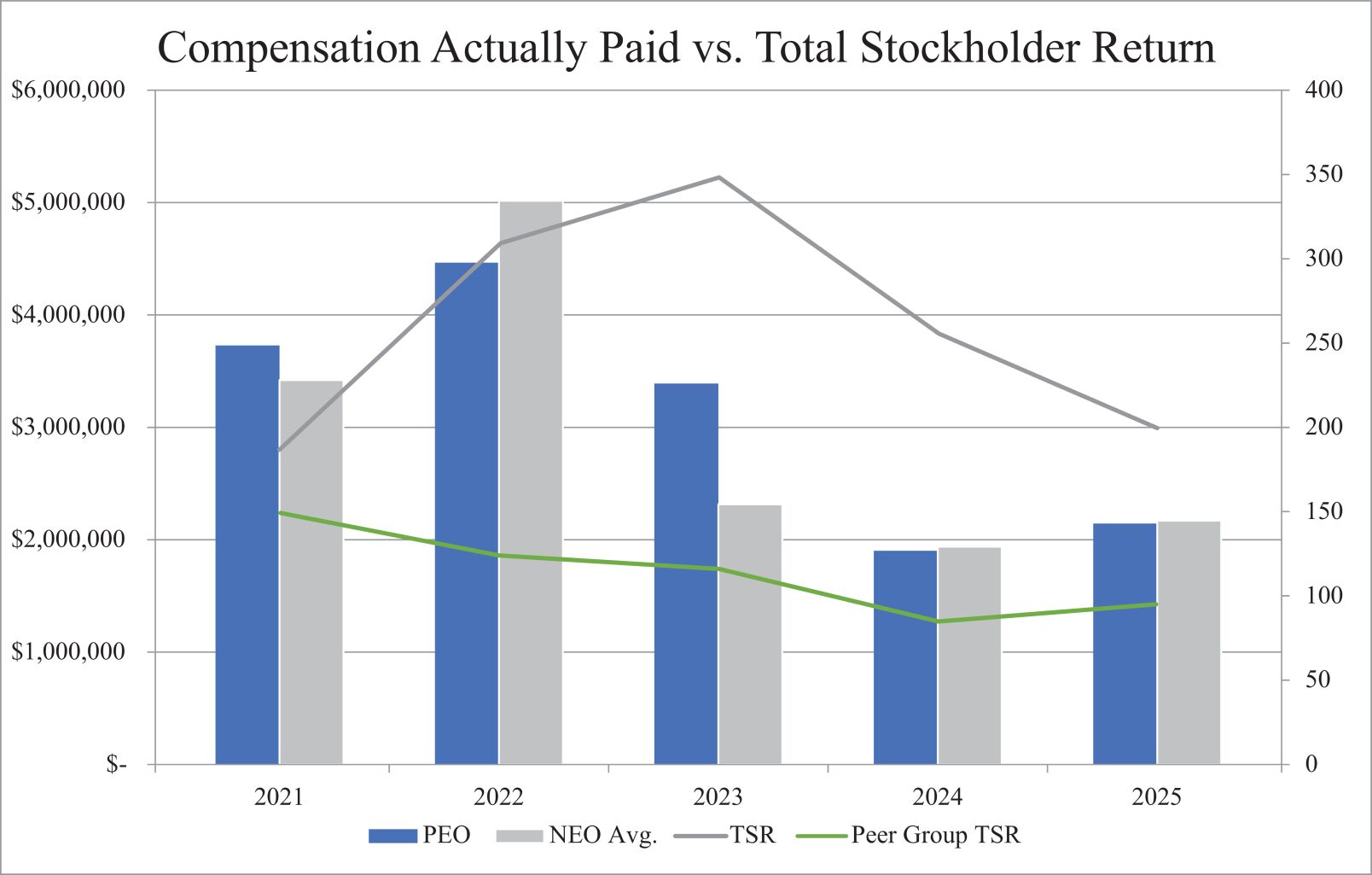

Value of Initial $100 Investment Based on: |

||||||||||||||||||||||||||||||||

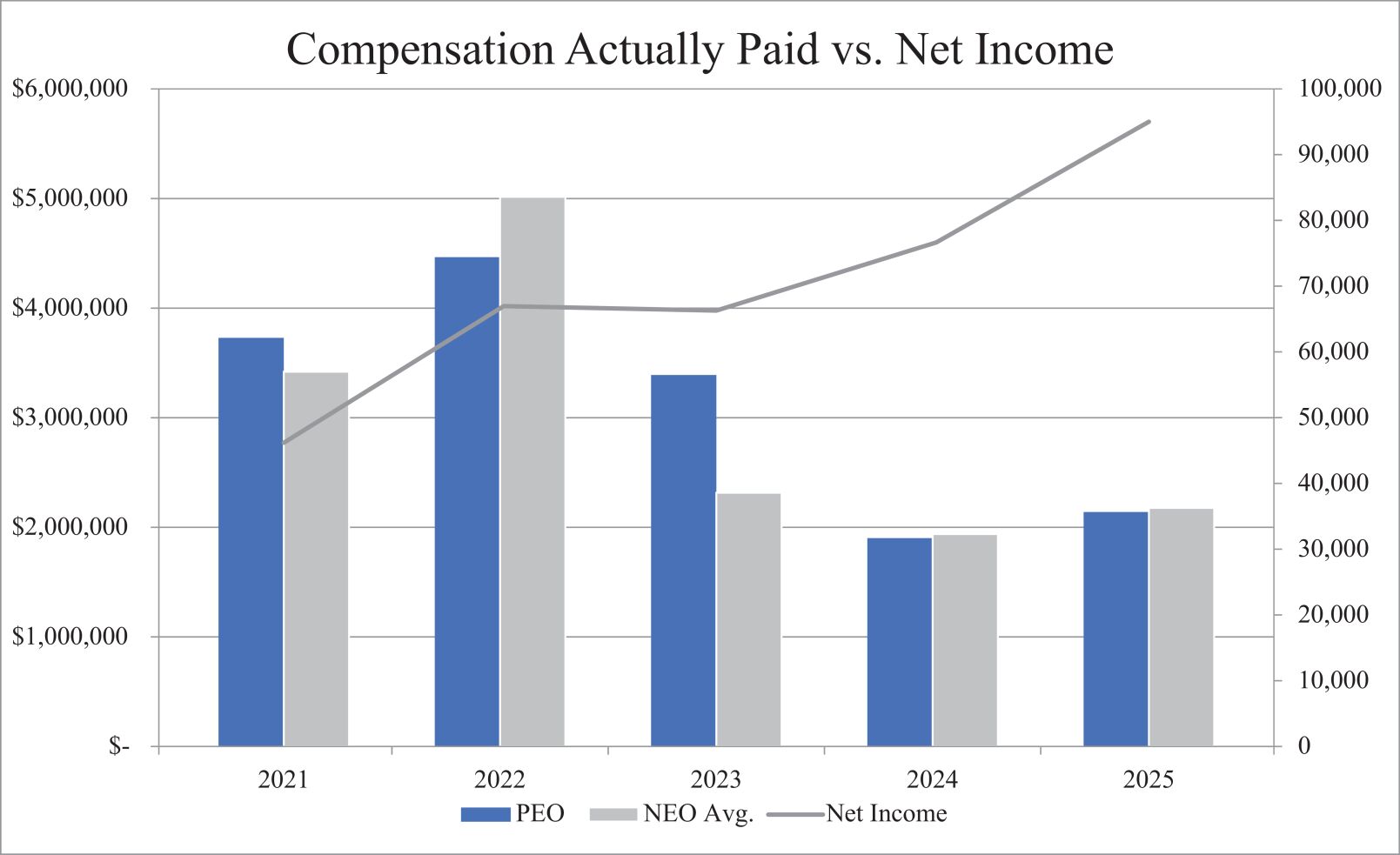

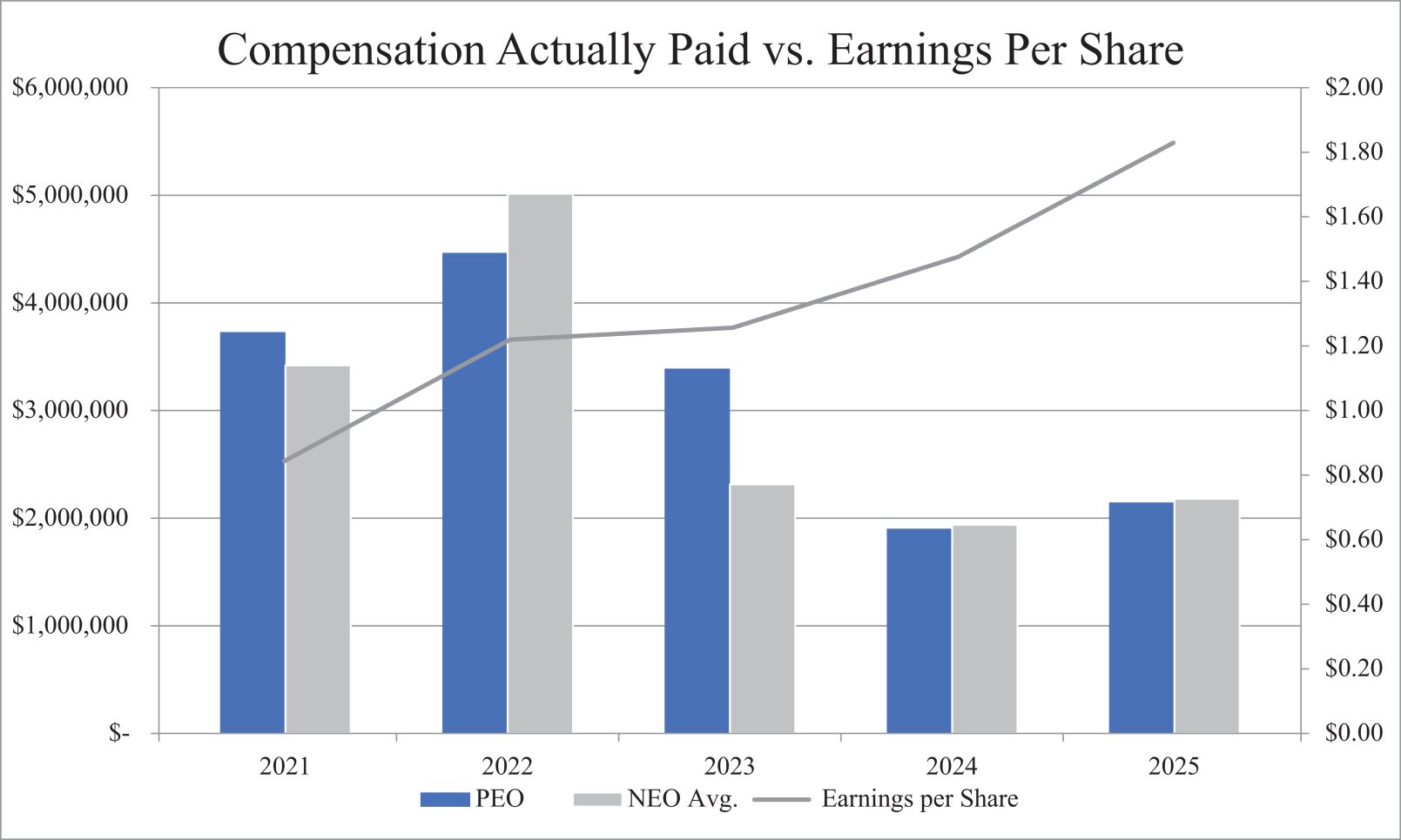

Fiscal Year |

Summary Compensation Table Total for PEO (1) ($) |

Compensation Actually Paid to PEO (1)(2) ($) |

Average Summary Compensation Table Total for Non-PEO NEOs (1) ($) |

Average Compensation Actually Paid to Non-PEO NEOs (1)(2) ($) |

Total Stockholder Return ($) |

Peer Group Total Stockholder Return (3) ($) |

Net Income (in thousands) ($) |

Diluted Earnings per Share ($) |

||||||||||||||||||||||||

2025 |

1,191,679 | 2,140,427 | 464,106 | 2,247,009 | 200 | 96 | 95,165 | 1.83 | ||||||||||||||||||||||||

2024 |

966,969 | 1,901,252 | 485,139 | 1,937,349 | 256 | 85 | 76,252 | 1.47 | ||||||||||||||||||||||||

2023 |

2,090,066 | 3,389,141 | 413,594 | 2,313,754 | 349 | 116 | 66,365 | 1.26 | ||||||||||||||||||||||||

2022 |

1,420,744 | 4,464,818 | 482,747 | 5,014,662 | 309 | 124 | 66,410 | 1.22 | ||||||||||||||||||||||||

2021 |

1,510,130 | 3,728,177 | 467,858 | 3,419,311 | 188 | 149 | 46,356 | 0.85 | ||||||||||||||||||||||||

| (1) | The table below includes the name of each individual serving as an NEO during our last five fiscal years, including our PEO: |

Fiscal Year |

PEO |

Non-PEO NEOs | ||

2025 |

Michael G. Combs | Mark E. Bertels, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2024 |

Michael G. Combs | V. Gordon Clemons, Mark E. Bertels, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2023 |

Michael G. Combs | V. Gordon Clemons, Mark E. Bertels , Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2022 |

Michael G. Combs | V. Gordon Clemons, Diane J. Blaha, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2021 |

Michael G. Combs | V. Gordon Clemons, Diane J. Blaha, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss |

| (2) | The table below provides the adjustments to the Summary Compensation Table total compensation made to arrive at the compensation actually paid to the PEO and the aver a ge compensation actually paid to the non-PEO NEOs: |

Fiscal Year |

Executives |

Summary Compensation Table Total ($) |

Minus – Amount Reported in the “Option Awards” Column in the Summary Compensation Table ($) |

Plus – Fair Value of Awards Granted During Covered Fiscal Year that Remain Outstanding and Unvested as of Covered Fiscal Year End ($) (a) |

Plus/Minus – Change in Fair Value of Outstanding and Unvested Awards Granted in Prior Fiscal Years ($) (b) |

Plus/Minus – Change in Fair Value of Awards Granted During Prior Fiscal Years that Vested During the Covered Fiscal Year ($) (c) |

Minus Fair Value of Awards Granted During Prior Fiscal Years that were Forfeited During the Covered Fiscal Year ($) |

Compensation Actually Paid ($) |

||||||||||||||||||||||

2025 |

PEO | 1,191,679 | 95,669 | 53,113 | 343,505 | 647,799 | — | 2,140,427 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

464,106 | 95,046 | 428,028 | 187,966 | 1,261,955 | — | 2,247,009 | |||||||||||||||||||||||

2024 |

PEO | 966,969 | — | — | 701,539 | 232,744 | — | 1,901,252 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

485,139 | 178,369 | 676,067 | 565,128 | 389,384 | — | 1,937,349 | |||||||||||||||||||||||

2023 |

PEO | 2,090,066 | 1,176,522 | — | 2,387,906 | 90,528 | (2,836 | ) | 3,389,141 | |||||||||||||||||||||

| Average for Non- PEO NEOs |

413,594 | 148,254 | — | 1,917,315 | 138,017 | (6,918 | ) | 2,313,754 | ||||||||||||||||||||||

2022 |

PEO | 1,420,744 | 309,939 | — | 1,780,517 | 1,573,496 | — | 4,464,818 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

482,747 | 150,374 | — | 2,759,634 | 1,922,655 | — | 5,014,662 | |||||||||||||||||||||||

2021 |

PEO | 1,510,130 | 543,248 | 77,425 | 1,802,464 | 912,931 | (31,525 | ) | 3,728,177 | |||||||||||||||||||||

| Average for Non- PEO NEOs |

467,858 | 174,865 | — | 2,286,279 | 878,058 | (38,019 | ) | 3,419,311 | ||||||||||||||||||||||

| (a) | The fair value amounts are calculated in accordance with ASC Topic 718 Compensation – Stock Compensation ASC 718 |

| (b) | The fair value amounts are determined based on the change in fair value from the prior fiscal year end to the covered fiscal year end calculated in accordance with ASC 718. |

| (c) | The fair value amounts are determined based on the change in fair value from the prior fiscal year end to the vesting date calculated in accordance with ASC 718. |

| (3) | The peer group used for this purpose is the Nasdaq Healthcare Services Index. |

| (1) | The table below includes the name of each individual serving as an NEO during our last five fiscal years, including our PEO: |

Fiscal Year |

PEO |

Non-PEO NEOs | ||

2025 |

Michael G. Combs | Mark E. Bertels, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2024 |

Michael G. Combs | V. Gordon Clemons, Mark E. Bertels, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2023 |

Michael G. Combs | V. Gordon Clemons, Mark E. Bertels , Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2022 |

Michael G. Combs | V. Gordon Clemons, Diane J. Blaha, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss | ||

2021 |

Michael G. Combs | V. Gordon Clemons, Diane J. Blaha, Maxim Shishin, Brandon T. O’Brien, Jennifer L. Yoss |

| (2) | The table below provides the adjustments to the Summary Compensation Table total compensation made to arrive at the compensation actually paid to the PEO and the aver a ge compensation actually paid to the non-PEO NEOs: |

Fiscal Year |

Executives |

Summary Compensation Table Total ($) |

Minus – Amount Reported in the “Option Awards” Column in the Summary Compensation Table ($) |

Plus – Fair Value of Awards Granted During Covered Fiscal Year that Remain Outstanding and Unvested as of Covered Fiscal Year End ($) (a) |

Plus/Minus – Change in Fair Value of Outstanding and Unvested Awards Granted in Prior Fiscal Years ($) (b) |

Plus/Minus – Change in Fair Value of Awards Granted During Prior Fiscal Years that Vested During the Covered Fiscal Year ($) (c) |

Minus Fair Value of Awards Granted During Prior Fiscal Years that were Forfeited During the Covered Fiscal Year ($) |

Compensation Actually Paid ($) |

||||||||||||||||||||||

2025 |

PEO | 1,191,679 | 95,669 | 53,113 | 343,505 | 647,799 | — | 2,140,427 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

464,106 | 95,046 | 428,028 | 187,966 | 1,261,955 | — | 2,247,009 | |||||||||||||||||||||||

2024 |

PEO | 966,969 | — | — | 701,539 | 232,744 | — | 1,901,252 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

485,139 | 178,369 | 676,067 | 565,128 | 389,384 | — | 1,937,349 | |||||||||||||||||||||||

2023 |

PEO | 2,090,066 | 1,176,522 | — | 2,387,906 | 90,528 | (2,836 | ) | 3,389,141 | |||||||||||||||||||||

| Average for Non- PEO NEOs |

413,594 | 148,254 | — | 1,917,315 | 138,017 | (6,918 | ) | 2,313,754 | ||||||||||||||||||||||

2022 |

PEO | 1,420,744 | 309,939 | — | 1,780,517 | 1,573,496 | — | 4,464,818 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

482,747 | 150,374 | — | 2,759,634 | 1,922,655 | — | 5,014,662 | |||||||||||||||||||||||

2021 |

PEO | 1,510,130 | 543,248 | 77,425 | 1,802,464 | 912,931 | (31,525 | ) | 3,728,177 | |||||||||||||||||||||

| Average for Non- PEO NEOs |

467,858 | 174,865 | — | 2,286,279 | 878,058 | (38,019 | ) | 3,419,311 | ||||||||||||||||||||||

| (a) | The fair value amounts are calculated in accordance with ASC Topic 718 Compensation – Stock Compensation ASC 718 |

| (b) | The fair value amounts are determined based on the change in fair value from the prior fiscal year end to the covered fiscal year end calculated in accordance with ASC 718. |

| (c) | The fair value amounts are determined based on the change in fair value from the prior fiscal year end to the vesting date calculated in accordance with ASC 718. |

| (2) | The table below provides the adjustments to the Summary Compensation Table total compensation made to arrive at the compensation actually paid to the PEO and the aver a ge compensation actually paid to the non-PEO NEOs: |

Fiscal Year |

Executives |

Summary Compensation Table Total ($) |

Minus – Amount Reported in the “Option Awards” Column in the Summary Compensation Table ($) |

Plus – Fair Value of Awards Granted During Covered Fiscal Year that Remain Outstanding and Unvested as of Covered Fiscal Year End ($) (a) |

Plus/Minus – Change in Fair Value of Outstanding and Unvested Awards Granted in Prior Fiscal Years ($) (b) |

Plus/Minus – Change in Fair Value of Awards Granted During Prior Fiscal Years that Vested During the Covered Fiscal Year ($) (c) |

Minus Fair Value of Awards Granted During Prior Fiscal Years that were Forfeited During the Covered Fiscal Year ($) |

Compensation Actually Paid ($) |

||||||||||||||||||||||

2025 |

PEO | 1,191,679 | 95,669 | 53,113 | 343,505 | 647,799 | — | 2,140,427 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

464,106 | 95,046 | 428,028 | 187,966 | 1,261,955 | — | 2,247,009 | |||||||||||||||||||||||

2024 |

PEO | 966,969 | — | — | 701,539 | 232,744 | — | 1,901,252 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

485,139 | 178,369 | 676,067 | 565,128 | 389,384 | — | 1,937,349 | |||||||||||||||||||||||

2023 |

PEO | 2,090,066 | 1,176,522 | — | 2,387,906 | 90,528 | (2,836 | ) | 3,389,141 | |||||||||||||||||||||

| Average for Non- PEO NEOs |

413,594 | 148,254 | — | 1,917,315 | 138,017 | (6,918 | ) | 2,313,754 | ||||||||||||||||||||||

2022 |

PEO | 1,420,744 | 309,939 | — | 1,780,517 | 1,573,496 | — | 4,464,818 | ||||||||||||||||||||||

| Average for Non- PEO NEOs |

482,747 | 150,374 | — | 2,759,634 | 1,922,655 | — | 5,014,662 | |||||||||||||||||||||||

2021 |

PEO | 1,510,130 | 543,248 | 77,425 | 1,802,464 | 912,931 | (31,525 | ) | 3,728,177 | |||||||||||||||||||||

| Average for Non- PEO NEOs |

467,858 | 174,865 | — | 2,286,279 | 878,058 | (38,019 | ) | 3,419,311 | ||||||||||||||||||||||

| (a) | The fair value amounts are calculated in accordance with ASC Topic 718 Compensation – Stock Compensation ASC 718 |

| (b) | The fair value amounts are determined based on the change in fair value from the prior fiscal year end to the covered fiscal year end calculated in accordance with ASC 718. |

| (c) | The fair value amounts are determined based on the change in fair value from the prior fiscal year end to the vesting date calculated in accordance with ASC 718. |

Most Important Financial Performance Measures |

| Earnings per Share |

| Revenue |

| Income Before Income Taxes |