Shareholder Report

|

6 Months Ended |

|

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

HARDING LOEVNER FUNDS INC

|

|

| Entity Central Index Key |

0001018170

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Apr. 30, 2025

|

|

| C000011818 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

HLMNX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the International Equity Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| International Equity (Investor Class) |

$58 |

1.15% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 58

|

|

| Expense Ratio, Percent |

1.15%

|

[1] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

The International Equity Investor Class (HLMNX) returned 4.59% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI All Country World ex US Index, increased 5.95% (net of source taxes).

Key Performance Factors

International markets gained despite uncertainty around US tariff policy and the risk that higher tariffs pose to growth. Rising long-end yields in Europe and Japan helped Financials outperform. AI-exposed companies inside China soared after the release of Chinese AI model DeepSeek, while those outside China fell sharply. Shares of the highest-quality, fastest-growing, and most expensive companies underperformed. The Fund lagged the index due to poor relative returns in Industrials and Europe ex EMU, but benefited from strong returns in Health Care, Consumer Discretionary, and Japan.

Sector Analysis

In Industrials, Hong Kong-based Techtronic Industries’ shares declined following the announcement of the Trump administration’s tariffs. Shares of Japan’s Chugai Pharmaceutical rose after its partner Lilly announced positive Phase 3 clinical trial results for Orforglipron, its oral GLP-1 candidate drug for diabetes.

Regional Analysis

Shares of Swiss hearing aid manufacturer Sonova declined due to tariff fears; the company has significant exposure to the US market. In Japan, Sony reported strong results, boosted by growth in its gaming and music divisions, and increased guidance for revenue and margins.

Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Sony |

|

Disco Corp |

| BBVA |

|

Delta Electronics |

| Allianz |

|

Schneider Electric |

| Chugai Pharmaceutical |

|

Techtronic Industries |

| Infineon Technologies |

|

Haier Smart Home |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

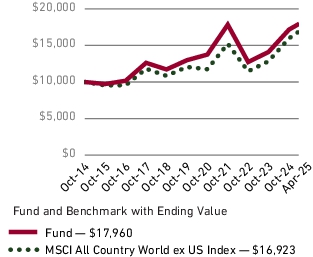

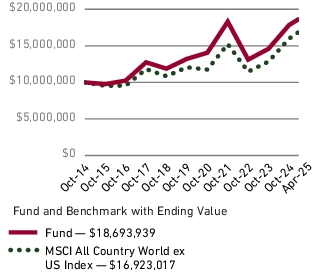

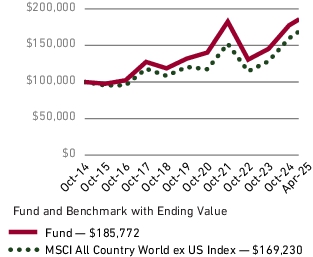

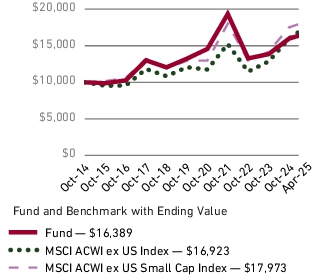

| Line Graph [Table Text Block] |

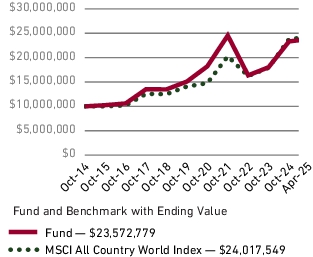

Fund Performance

The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $10,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index.

Growth of $10,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

11.49 |

8.86 |

5.42 |

| MSCI All Country World ex US Index |

11.92 |

10.09 |

4.83 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 12,199,500,000

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 41,200,000

|

|

| Investment Company Portfolio Turnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$12,199.5M |

Total advisory fees paid

(after waiver/reimbursement) |

$41.2M |

| Total number of holdings |

58 |

Period portfolio turnover rate |

7% |

|

|

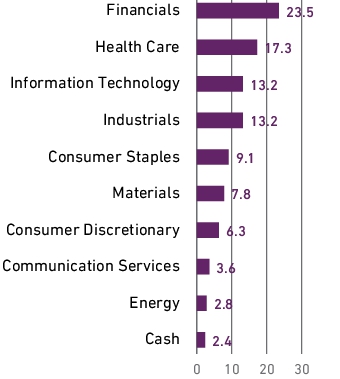

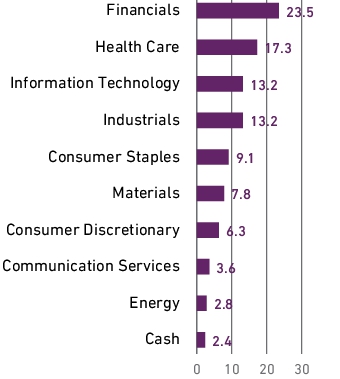

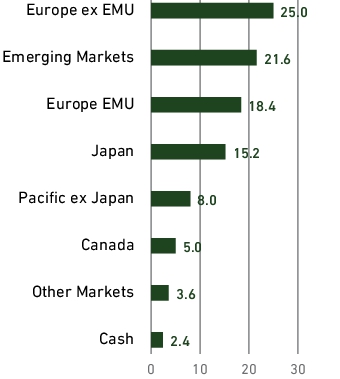

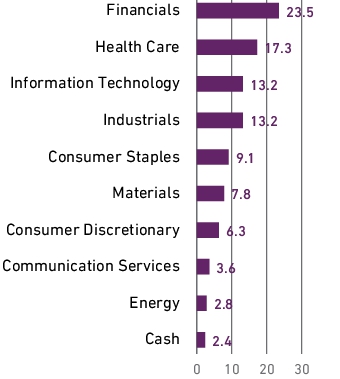

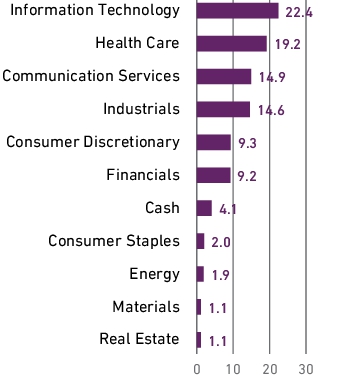

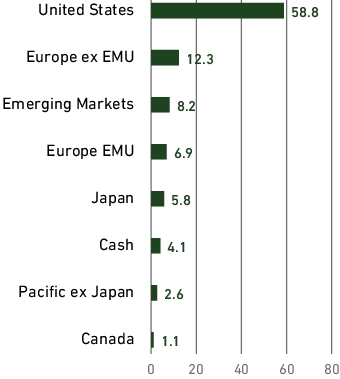

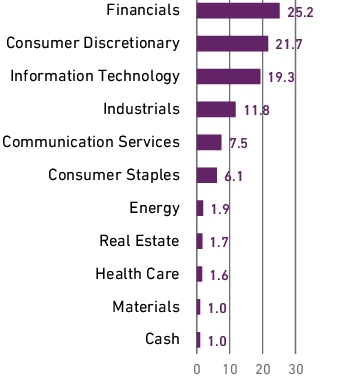

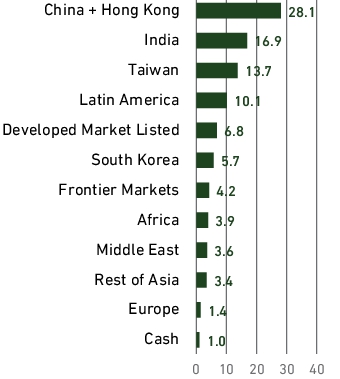

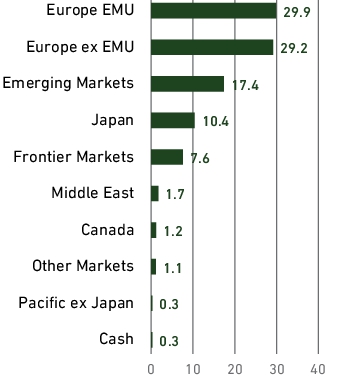

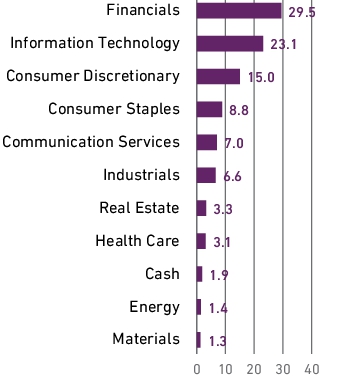

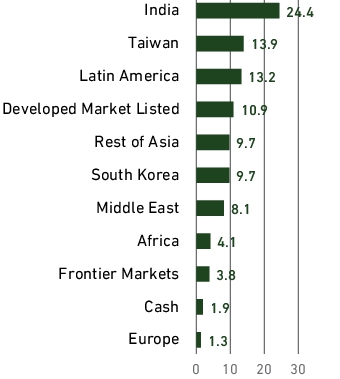

| Holdings [Text Block] |

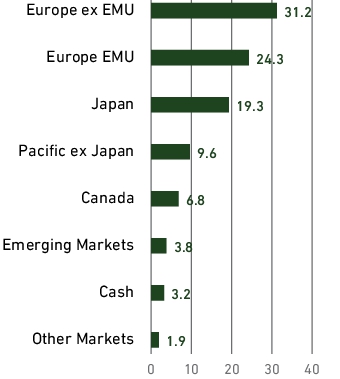

Graphical Representation of Holdings

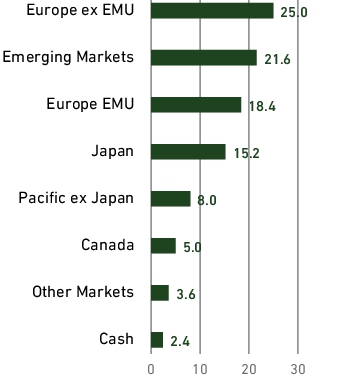

The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value.

Top Ten Holdings

%

Allocation

| Allianz SE, Reg S |

3.8 |

| Chugai Pharmaceutical Co., Ltd. |

3.7 |

| DBS Group Holdings Ltd. |

3.6 |

| HDFC Bank Ltd. - ADR |

3.5 |

| Sony Group Corp. |

3.1 |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR |

3.0 |

| Haleon plc |

2.9 |

| Manulife Financial Corp. |

2.8 |

| Shell plc |

2.8 |

| Roche Holding AG, Genusschein |

2.7 |

by Sector

by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

%

| Allianz SE, Reg S |

3.8 |

| Chugai Pharmaceutical Co., Ltd. |

3.7 |

| DBS Group Holdings Ltd. |

3.6 |

| HDFC Bank Ltd. - ADR |

3.5 |

| Sony Group Corp. |

3.1 |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR |

3.0 |

| Haleon plc |

2.9 |

| Manulife Financial Corp. |

2.8 |

| Shell plc |

2.8 |

| Roche Holding AG, Genusschein |

2.7 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000179658 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity

|

|

| Class Name |

Institutional Class Z

|

|

| Trading Symbol |

HLIZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the International Equity Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| International Equity (Institutional Class Z) |

$37 |

0.73% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.73%

|

[2] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

The International Equity Institutional Class Z (HLIZX) returned 4.80% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI All Country World ex US Index, increased 5.95% (net of source taxes).

Key Performance Factors

International markets gained despite uncertainty around US tariff policy and the risk that higher tariffs pose to growth. Rising long-end yields in Europe and Japan helped Financials outperform. AI-exposed companies inside China soared after the release of Chinese AI model DeepSeek, while those outside China fell sharply. Shares of the highest-quality, fastest-growing, and most expensive companies underperformed. The Fund lagged the index due to poor relative returns in Industrials and Europe ex EMU, but benefited from strong returns in Health Care, Consumer Discretionary, and Japan.

Sector Analysis

In Industrials, Hong Kong-based Techtronic Industries’ shares declined following the announcement of the Trump administration’s tariffs. Shares of Japan’s Chugai Pharmaceutical rose after its partner Lilly announced positive Phase 3 clinical trial results for Orforglipron, its oral GLP-1 candidate drug for diabetes.

Regional Analysis

Shares of Swiss hearing aid manufacturer Sonova declined due to tariff fears; the company has significant exposure to the US market. In Japan, Sony reported strong results, boosted by growth in its gaming and music divisions, and increased guidance for revenue and margins.

Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Sony |

|

Disco Corp |

| BBVA |

|

Delta Electronics |

| Allianz |

|

Schneider Electric |

| Chugai Pharmaceutical |

|

Techtronic Industries |

| Infineon Technologies |

|

Haier Smart Home |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

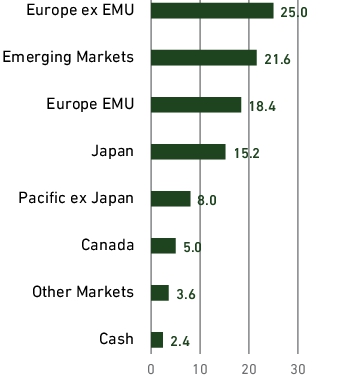

| Line Graph [Table Text Block] |

Fund Performance

The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $10,000,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index.

Growth of $10,000,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

11.97 |

9.30 |

5.84 |

| MSCI All Country World ex US Index |

11.92 |

10.09 |

4.83 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 12,199,500,000

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 41,200,000

|

|

| Investment Company Portfolio Turnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$12,199.5M |

Total advisory fees paid

(after waiver/reimbursement) |

$41.2M |

| Total number of holdings |

58 |

Period portfolio turnover rate |

7% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value.

Top Ten Holdings

%

Allocation

| Allianz SE, Reg S |

3.8 |

| Chugai Pharmaceutical Co., Ltd. |

3.7 |

| DBS Group Holdings Ltd. |

3.6 |

| HDFC Bank Ltd. - ADR |

3.5 |

| Sony Group Corp. |

3.1 |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR |

3.0 |

| Haleon plc |

2.9 |

| Manulife Financial Corp. |

2.8 |

| Shell plc |

2.8 |

| Roche Holding AG, Genusschein |

2.7 |

by Sector

by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings %

| Allianz SE, Reg S |

3.8 |

| Chugai Pharmaceutical Co., Ltd. |

3.7 |

| DBS Group Holdings Ltd. |

3.6 |

| HDFC Bank Ltd. - ADR |

3.5 |

| Sony Group Corp. |

3.1 |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR |

3.0 |

| Haleon plc |

2.9 |

| Manulife Financial Corp. |

2.8 |

| Shell plc |

2.8 |

| Roche Holding AG, Genusschein |

2.7 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000011817 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

HLMIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the International Equity Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| International Equity (Institutional Class) |

$42 |

0.83% |

|

1 |

Expense ratio is expressed on an annualized basis. |

|

|

| Expenses Paid, Amount |

$ 42

|

|

| Expense Ratio, Percent |

0.83%

|

[3] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance The International Equity Institutional Class (HLMIX) returned 4.70% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI All Country World ex US Index, increased 5.95% (net of source taxes). Key Performance Factors International markets gained despite uncertainty around US tariff policy and the risk that higher tariffs pose to growth. Rising long-end yields in Europe and Japan helped Financials outperform. AI-exposed companies inside China soared after the release of Chinese AI model DeepSeek, while those outside China fell sharply. Shares of the highest-quality, fastest-growing, and most expensive companies underperformed. The Fund lagged the index due to poor relative returns in Industrials and Europe ex EMU, but benefited from strong returns in Health Care, Consumer Discretionary, and Japan. Sector Analysis In Industrials, Hong Kong-based Techtronic Industries’ shares declined following the announcement of the Trump administration’s tariffs. Shares of Japan’s Chugai Pharmaceutical rose after its partner Lilly announced positive Phase 3 clinical trial results for Orforglipron, its oral GLP-1 candidate drug for diabetes. Regional Analysis Shares of Swiss hearing aid manufacturer Sonova declined due to tariff fears; the company has significant exposure to the US market. In Japan, Sony reported strong results, boosted by growth in its gaming and music divisions, and increased guidance for revenue and margins. Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Sony |

|

Disco Corp |

| BBVA |

|

Delta Electronics |

| Allianz |

|

Schneider Electric |

| Chugai Pharmaceutical |

|

Techtronic Industries |

| Infineon Technologies |

|

Haier Smart Home | The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

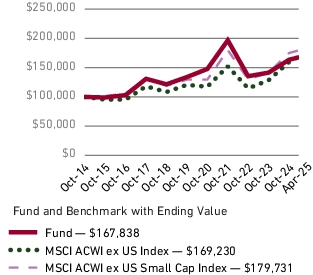

| Line Graph [Table Text Block] |

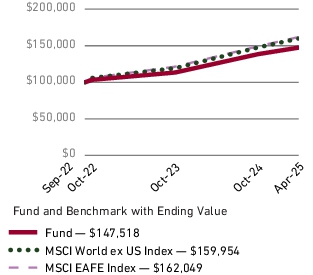

Fund Performance The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $100,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index. Growth of $100,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

11.82 |

9.20 |

5.76 |

| MSCI All Country World ex US Index |

11.92 |

10.09 |

4.83 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 12,199,500,000

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 41,200,000

|

|

| Investment Company Portfolio Turnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$12,199.5M |

Total advisory fees paid

(after waiver/reimbursement) |

$41.2M |

| Total number of holdings |

58 |

Period portfolio turnover rate |

7% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value. Top Ten Holdings % Allocation

| Allianz SE, Reg S |

3.8 |

| Chugai Pharmaceutical Co., Ltd. |

3.7 |

| DBS Group Holdings Ltd. |

3.6 |

| HDFC Bank Ltd. - ADR |

3.5 |

| Sony Group Corp. |

3.1 |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR |

3.0 |

| Haleon plc |

2.9 |

| Manulife Financial Corp. |

2.8 |

| Shell plc |

2.8 |

| Roche Holding AG, Genusschein |

2.7 | by Sector by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings %

| Allianz SE, Reg S |

3.8 |

| Chugai Pharmaceutical Co., Ltd. |

3.7 |

| DBS Group Holdings Ltd. |

3.6 |

| HDFC Bank Ltd. - ADR |

3.5 |

| Sony Group Corp. |

3.1 |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR |

3.0 |

| Haleon plc |

2.9 |

| Manulife Financial Corp. |

2.8 |

| Shell plc |

2.8 |

| Roche Holding AG, Genusschein |

2.7 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000179659 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Equity

|

|

| Class Name |

Institutional Class Z

|

|

| Trading Symbol |

HLGZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Global Equity Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| Global Equity (Institutional Class Z) |

$37 |

0.75% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 37

|

|

| Expense Ratio, Percent |

0.75%

|

[4] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

The Global Equity Institutional Class Z (HLGZX) increased 1.08% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI All Country World Index, increased 0.88% (net of source taxes).

Key Performance Factors

Donald Trump’s victory in the presidential election initially boosted US equities, as investors looked forward to business-friendly policies, while international markets took a more cautious view of the new administration. In April, the US government’s announcement of high tariffs on all trading partners (especially China) sent markets tumbling, though they recovered somewhat when it became clear US policymakers were open to negotiation.

Sector performance was mixed; Financials and Consumer Staples rose strongly while Information Technology, Energy, and Materials fell. The Fund outperformed the index, with good relative returns in Communication Services and Consumer Discretionary. Lagging returns in Industrials and an underweight in Financials detracted.

Sector Analysis

In Communication Services, shares of streaming business Netflix soared in response to strong subscriber growth. Japanese electronics and media company Sony outperformed in Consumer Discretionary, boosted by growth in its gaming and music divisions.

Regional Analysis

Signs of faltering enthusiasm for artificial intelligence (AI) investments hurt French energy equipment producer Schneider Electric, which provides power and cooling technology used in advanced AI server systems. The company also underwent a leadership transition. The Fund’s underweight in AI-chip producer NVIDIA in the US was helpful.

Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Netflix |

|

UnitedHealth Group |

| Sony |

|

Globant |

| NVIDIA |

|

Thermo Fisher Scientific |

| CME Group |

|

Schneider Electric |

| Chugai Pharmaceutical |

|

Accenture |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

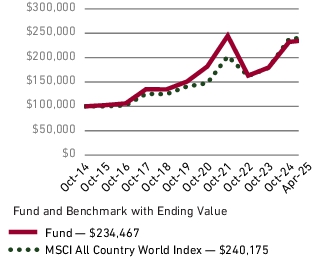

| Line Graph [Table Text Block] |

Fund Performance

The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $10,000,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index.

Growth of $10,000,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

11.56 |

9.43 |

8.52 |

| MSCI All Country World Index |

11.84 |

13.07 |

8.63 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 528,100,000

|

|

| Holdings Count | Holding |

61

|

|

| Advisory Fees Paid, Amount |

$ 1,900,000

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$528.1M |

Total advisory fees paid

(after waiver/reimbursement) |

$1.9M |

| Total number of holdings |

61 |

Period portfolio turnover rate |

11% |

|

|

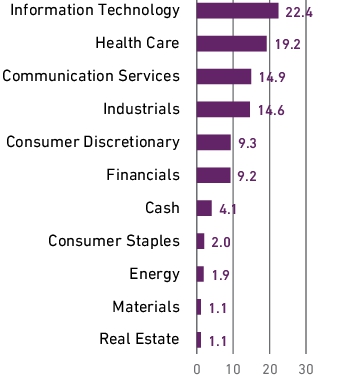

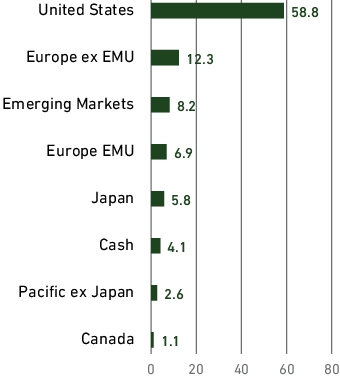

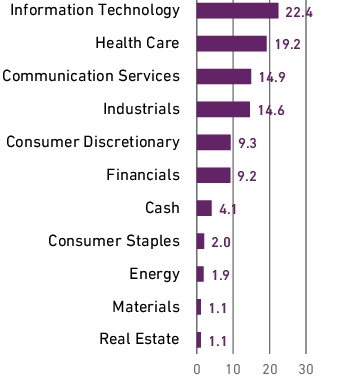

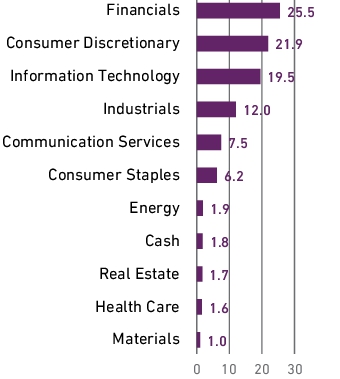

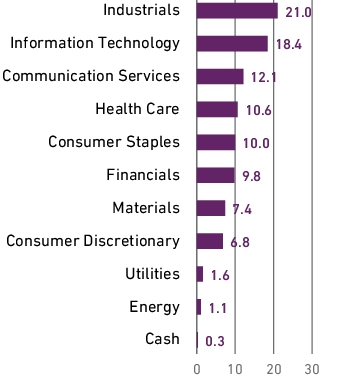

| Holdings [Text Block] |

Graphical Representation of Holdings

The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value.

Top Ten Holdings

%

Allocation

| Netflix Inc. |

4.7 |

| Northern Institutional Funds - Treasury Portfolio (Premier Shares) |

4.1 |

| Microsoft Corp. |

4.0 |

| Alphabet Inc., Class A |

3.9 |

| Vertex Pharmaceuticals Inc. |

3.8 |

| Amazon.com Inc. |

3.6 |

| Schneider Electric SE |

3.2 |

| Meta Platforms Inc., Class A |

2.8 |

| CME Group Inc. |

2.7 |

| Sony Group Corp. |

2.5 |

by Sector

by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

%

| Netflix Inc. |

4.7 |

| Northern Institutional Funds - Treasury Portfolio (Premier Shares) |

4.1 |

| Microsoft Corp. |

4.0 |

| Alphabet Inc., Class A |

3.9 |

| Vertex Pharmaceuticals Inc. |

3.8 |

| Amazon.com Inc. |

3.6 |

| Schneider Electric SE |

3.2 |

| Meta Platforms Inc., Class A |

2.8 |

| CME Group Inc. |

2.7 |

| Sony Group Corp. |

2.5 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000011819 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Equity

|

|

| Class Name |

Advisor Class

|

|

| Trading Symbol |

HLMGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Global Equity Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| Global Equity (Advisor Class) |

$55 |

1.11% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 55

|

|

| Expense Ratio, Percent |

1.11%

|

[5] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

The Global Equity Advisor Class (HLMGX) increased 0.91% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI All Country World Index, increased 0.88% (net of source taxes).

Key Performance Factors

Donald Trump’s victory in the presidential election initially boosted US equities, as investors looked forward to business-friendly policies, while international markets took a more cautious view of the new administration. In April, the US government’s announcement of high tariffs on all trading partners (especially China) sent markets tumbling, though they recovered somewhat when it became clear US policymakers were open to negotiation.

Sector performance was mixed; Financials and Consumer Staples rose strongly while Information Technology, Energy, and Materials fell. The Fund performed in line with the index, with good relative returns in Communication Services and Consumer Discretionary. Lagging returns in Industrials and an underweight in Financials detracted.

Sector Analysis

In Communication Services, shares of streaming business Netflix soared in response to strong subscriber growth. Japanese electronics and media company Sony outperformed in Consumer Discretionary, boosted by growth in its gaming and music divisions.

Regional Analysis

Signs of faltering enthusiasm for artificial intelligence (AI) investments hurt French energy equipment producer Schneider Electric, which provides power and cooling technology used in advanced AI server systems. The company also underwent a leadership transition. The Fund’s underweight in AI-chip producer NVIDIA in the US was helpful.

Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Netflix |

|

UnitedHealth Group |

| Sony |

|

Globant |

| NVIDIA |

|

Thermo Fisher Scientific |

| CME Group |

|

Schneider Electric |

| Chugai Pharmaceutical |

|

Accenture |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

| Line Graph [Table Text Block] |

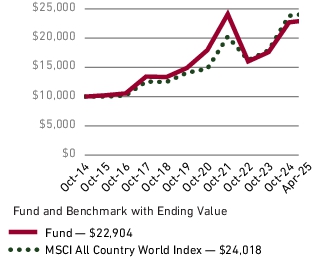

Fund Performance

The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $10,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index.

Growth of $10,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

11.19 |

9.11 |

8.23 |

| MSCI All Country World Index |

11.84 |

13.07 |

8.63 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 528,100,000

|

|

| Holdings Count | Holding |

61

|

|

| Advisory Fees Paid, Amount |

$ 1,900,000

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$528.1M |

Total advisory fees paid

(after waiver/reimbursement) |

$1.9M |

| Total number of holdings |

61 |

Period portfolio turnover rate |

11% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value.

Top Ten Holdings

%

Allocation

| Netflix Inc. |

4.7 |

| Northern Institutional Funds - Treasury Portfolio (Premier Shares) |

4.1 |

| Microsoft Corp. |

4.0 |

| Alphabet Inc., Class A |

3.9 |

| Vertex Pharmaceuticals Inc. |

3.8 |

| Amazon.com Inc. |

3.6 |

| Schneider Electric SE |

3.2 |

| Meta Platforms Inc., Class A |

2.8 |

| CME Group Inc. |

2.7 |

| Sony Group Corp. |

2.5 |

by Sector

by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

%

| Netflix Inc. |

4.7 |

| Northern Institutional Funds - Treasury Portfolio (Premier Shares) |

4.1 |

| Microsoft Corp. |

4.0 |

| Alphabet Inc., Class A |

3.9 |

| Vertex Pharmaceuticals Inc. |

3.8 |

| Amazon.com Inc. |

3.6 |

| Schneider Electric SE |

3.2 |

| Meta Platforms Inc., Class A |

2.8 |

| CME Group Inc. |

2.7 |

| Sony Group Corp. |

2.5 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000079785 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Equity

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

HLMVX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Global Equity Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| Global Equity (Institutional Class) |

$42 |

0.85% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 42

|

|

| Expense Ratio, Percent |

0.85%

|

[6] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

The Global Equity Institutional Class (HLMVX) increased 1.03% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI All Country World Index, increased 0.88% (net of source taxes).

Key Performance Factors

Donald Trump’s victory in the presidential election initially boosted US equities, as investors looked forward to business-friendly policies, while international markets took a more cautious view of the new administration. In April, the US government’s announcement of high tariffs on all trading partners (especially China) sent markets tumbling, though they recovered somewhat when it became clear US policymakers were open to negotiation.

Sector performance was mixed; Financials and Consumer Staples rose strongly while Information Technology, Energy, and Materials fell. The Fund outperformed the index, with good relative returns in Communication Services and Consumer Discretionary. Lagging returns in Industrials and an underweight in Financials detracted.

Sector Analysis

In Communication Services, shares of streaming business Netflix soared in response to strong subscriber growth. Japanese electronics and media company Sony outperformed in Consumer Discretionary, boosted by growth in its gaming and music divisions.

Regional Analysis

Signs of faltering enthusiasm for artificial intelligence (AI) investments hurt French energy equipment producer Schneider Electric, which provides power and cooling technology used in advanced AI server systems. The company also underwent a leadership transition. The Fund’s underweight in AI-chip producer NVIDIA in the US was helpful.

Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Netflix |

|

UnitedHealth Group |

| Sony |

|

Globant |

| NVIDIA |

|

Thermo Fisher Scientific |

| CME Group |

|

Schneider Electric |

| Chugai Pharmaceutical |

|

Accenture |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

| Line Graph [Table Text Block] |

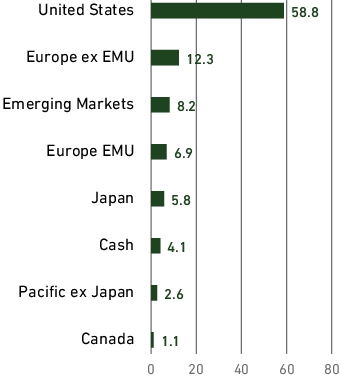

Fund Performance

The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $100,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index.

Growth of $100,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

11.47 |

9.34 |

8.47 |

| MSCI All Country World Index |

11.84 |

13.07 |

8.63 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 528,100,000

|

|

| Holdings Count | Holding |

61

|

|

| Advisory Fees Paid, Amount |

$ 1,900,000

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$528.1M |

Total advisory fees paid

(after waiver/reimbursement) |

$1.9M |

| Total number of holdings |

61 |

Period portfolio turnover rate |

11% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value.

Top Ten Holdings

%

Allocation

| Netflix Inc. |

4.7 |

| Northern Institutional Funds - Treasury Portfolio (Premier Shares) |

4.1 |

| Microsoft Corp. |

4.0 |

| Alphabet Inc., Class A |

3.9 |

| Vertex Pharmaceuticals Inc. |

3.8 |

| Amazon.com Inc. |

3.6 |

| Schneider Electric SE |

3.2 |

| Meta Platforms Inc., Class A |

2.8 |

| CME Group Inc. |

2.7 |

| Sony Group Corp. |

2.5 |

by Sector

by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

%

| Netflix Inc. |

4.7 |

| Northern Institutional Funds - Treasury Portfolio (Premier Shares) |

4.1 |

| Microsoft Corp. |

4.0 |

| Alphabet Inc., Class A |

3.9 |

| Vertex Pharmaceuticals Inc. |

3.8 |

| Amazon.com Inc. |

3.6 |

| Schneider Electric SE |

3.2 |

| Meta Platforms Inc., Class A |

2.8 |

| CME Group Inc. |

2.7 |

| Sony Group Corp. |

2.5 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000011821 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Emerging Markets

|

|

| Class Name |

Advisor Class

|

|

| Trading Symbol |

HLEMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Emerging Markets Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| Emerging Markets (Advisor Class) |

$57 |

1.15% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 57

|

|

| Expense Ratio, Percent |

1.15%

|

[7] |

| Factors Affecting Performance [Text Block] |

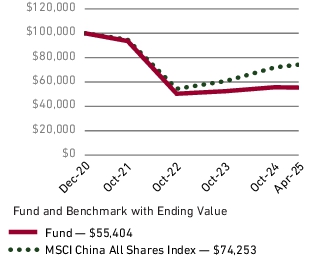

Management’s Discussion of Fund Performance

The Emerging Markets Advisor Class (HLEMX) fell 1.13% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI Emerging Markets Index, rose 0.40% in the same period (net of source taxes).

Key Performance Factors

Emerging markets (EMs) rose much of the period, supported by falling interest rates and the Chinese government’s launch of a large stimulus package to reignite its economy. EMs tumbled in early April after the US government announced high tariffs on all trading partners but recovered somewhat when it became clear US policymakers were open to negotiation. Communication Services was the best sector, boosted by Chinese technology leaders in the sector. The Information Technology (IT) sector fell sharply on concerns about a slowdown in AI spending. The Fund had weak relative returns in IT while good stocks in Consumer Staples were helpful.

Sector Analysis

Shares of IT-services company Globant fell due to concerns about slowing growth in the US, its key market. In Consumer Staples, bottler Coca-Cola HBC’s earnings topped market expectations.

Regional Analysis

Shares of Taiwanese semiconductor maker Aspeed were pressured by growth concerns for its AI-server end market. In India, HDFC Bank reported accelerating loan growth and has benefited from central bank efforts to improve liquidity in India’s financial system.

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| TSMC |

|

Globant |

| Emaar Properties |

|

Aspeed |

| Coca-Cola HBC |

|

Eclat Textile |

| Sanhua Intelligent Controls |

|

Techtronic Industries |

| HDFC Bank |

|

Hon Hai Precision |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

| Line Graph [Table Text Block] |

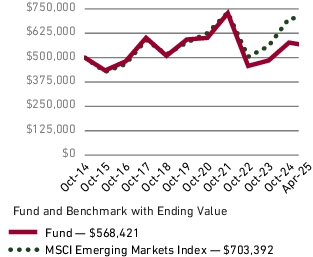

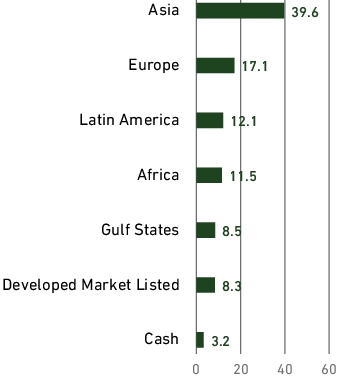

Fund Performance

The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $10,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index.

Growth of $10,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

7.89 |

2.53 |

1.23 |

| MSCI Emerging Markets Index |

9.02 |

6.35 |

3.07 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 440,200,000

|

|

| Holdings Count | Holding |

70

|

|

| Advisory Fees Paid, Amount |

$ 1,900,000

|

|

| Investment Company Portfolio Turnover |

12.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$440.2M |

Total advisory fees paid

(after waiver/reimbursement) |

$1.9M |

| Total number of holdings |

70 |

Period portfolio turnover rate |

12% |

|

|

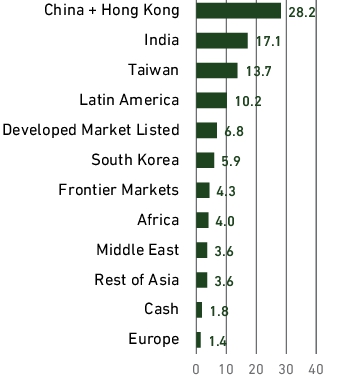

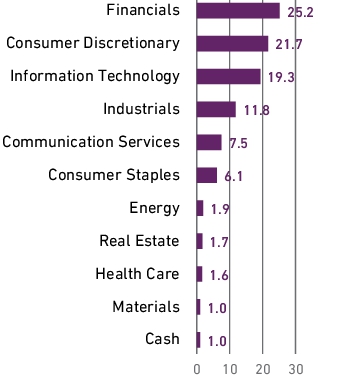

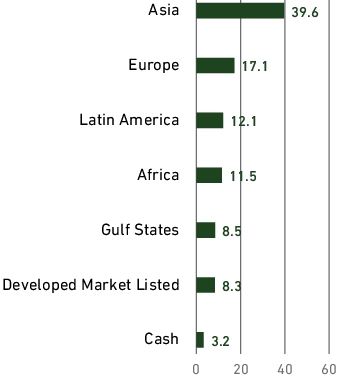

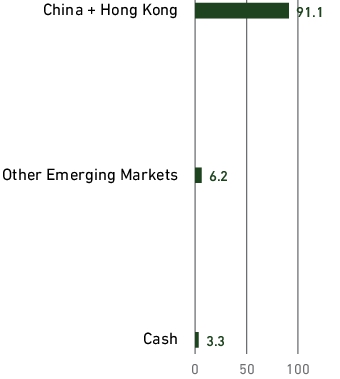

| Holdings [Text Block] |

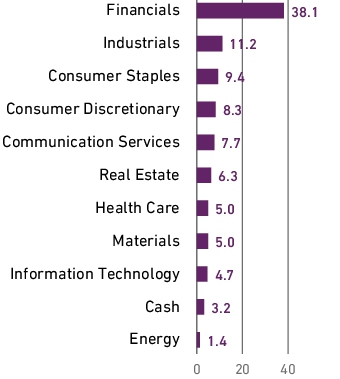

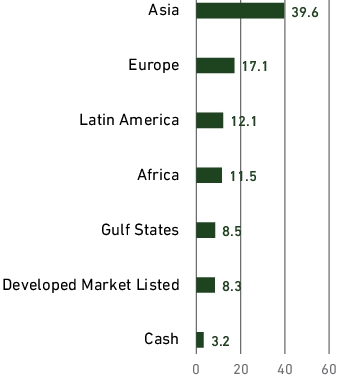

Graphical Representation of Holdings

The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value.

Top Ten Holdings

%

Allocation

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.5 |

| Tencent Holdings Ltd. |

5.2 |

| HDFC Bank Ltd. |

5.0 |

| Alibaba Group Holding Ltd. |

3.4 |

| Samsung Electronics Co., Ltd. - GDR, Reg S |

3.3 |

| Trip.com Group Ltd. |

3.2 |

| Tata Consultancy Services Ltd. |

3.0 |

| ICICI Bank Ltd. |

2.9 |

| Maruti Suzuki India Ltd. |

2.8 |

| ASPEED Technology Inc. |

2.0 |

by Sector

by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

%

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.5 |

| Tencent Holdings Ltd. |

5.2 |

| HDFC Bank Ltd. |

5.0 |

| Alibaba Group Holding Ltd. |

3.4 |

| Samsung Electronics Co., Ltd. - GDR, Reg S |

3.3 |

| Trip.com Group Ltd. |

3.2 |

| Tata Consultancy Services Ltd. |

3.0 |

| ICICI Bank Ltd. |

2.9 |

| Maruti Suzuki India Ltd. |

2.8 |

| ASPEED Technology Inc. |

2.0 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000011822 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Institutional Emerging Markets

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

HLMEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Institutional Emerging Markets Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| Institutional Emerging Markets (Institutional Class) |

$52 |

1.06% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 52

|

|

| Expense Ratio, Percent |

1.06%

|

[8] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance The Institutional Emerging Markets Institutional Class (HLMEX) fell 1.51% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI Emerging Markets Index, rose 0.40% in the same period (net of source taxes). Key Performance Factors Emerging markets (EMs) rose much of the period, supported by falling interest rates and the Chinese government’s launch of a large stimulus package to reignite its economy. EMs tumbled in early April after the US government announced high tariffs on all trading partners but recovered somewhat when it became clear US policymakers were open to negotiation. Communication Services was the best sector, boosted by Chinese technology leaders in the sector. The Information Technology (IT) sector fell sharply on concerns about a slowdown in AI spending. The Fund had weak relative returns in IT while good stocks in Consumer Staples were helpful. Sector Analysis Shares of IT-services company Globant fell due to concerns about slowing growth in the US, its key market. In Consumer Staples, bottler Coca-Cola HBC’s earnings topped market expectations. Regional Analysis Shares of Taiwanese semiconductor maker Aspeed were pressured by growth concerns for its AI-server end market. In India, HDFC Bank reported accelerating loan growth and has benefited from central bank efforts to improve liquidity in India’s financial system. Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Emaar Properties |

|

Globant |

| TSMC |

|

Aspeed |

| Coca-Cola HBC |

|

Eclat Textile |

| Sanhua Intelligent Controls |

|

Techtronic Industries |

| HDFC Bank |

|

Hon Hai Precision |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

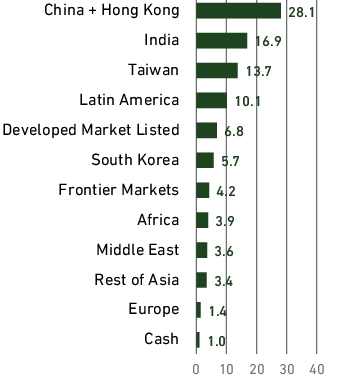

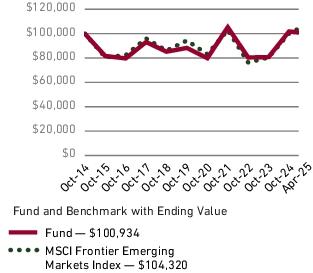

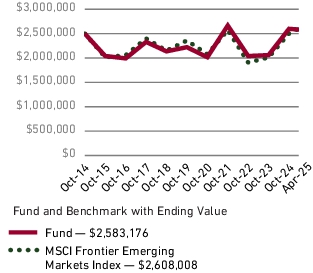

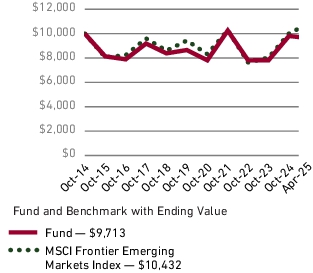

| Line Graph [Table Text Block] |

Fund Performance The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $500,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index. Growth of $500,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

8.34 |

2.50 |

1.29 |

| MSCI Emerging Markets Index |

9.02 |

6.35 |

3.07 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 390,100,000

|

|

| Holdings Count | Holding |

71

|

|

| Advisory Fees Paid, Amount |

$ 1,800,000

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$390.1M |

Total advisory fees paid

(after waiver/reimbursement) |

$1.8M |

| Total number of holdings |

71 |

Period portfolio turnover rate |

17% |

|

|

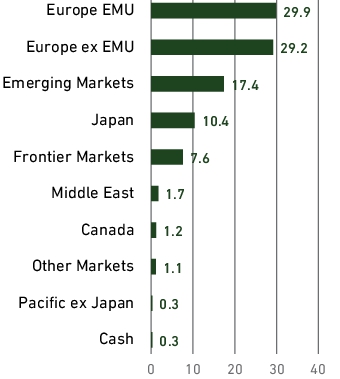

| Holdings [Text Block] |

Graphical Representation of Holdings The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value. Top Ten Holdings % Allocation

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.5 |

| Tencent Holdings Ltd. |

5.2 |

| HDFC Bank Ltd. |

5.0 |

| Alibaba Group Holding Ltd. |

3.4 |

| Samsung Electronics Co., Ltd. - GDR, Reg S |

3.2 |

| Trip.com Group Ltd. |

3.2 |

| Tata Consultancy Services Ltd. |

2.9 |

| ICICI Bank Ltd. |

2.8 |

| Maruti Suzuki India Ltd. |

2.8 |

| ASPEED Technology Inc. |

2.0 |

by Sector by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings %

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.5 |

| Tencent Holdings Ltd. |

5.2 |

| HDFC Bank Ltd. |

5.0 |

| Alibaba Group Holding Ltd. |

3.4 |

| Samsung Electronics Co., Ltd. - GDR, Reg S |

3.2 |

| Trip.com Group Ltd. |

3.2 |

| Tata Consultancy Services Ltd. |

2.9 |

| ICICI Bank Ltd. |

2.8 |

| Maruti Suzuki India Ltd. |

2.8 |

| ASPEED Technology Inc. |

2.0 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000138298 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Institutional Emerging Markets

|

|

| Class Name |

Institutional Class Z

|

|

| Trading Symbol |

HLEZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Institutional Emerging Markets Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| Institutional Emerging Markets (Institutional Class Z) |

$47 |

0.96% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.96%

|

[9] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance The Institutional Emerging Markets Institutional Class Z (HLEZX) fell 1.42% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI Emerging Markets Index, rose 0.40% in the same period (net of source taxes). Key Performance Factors Emerging markets (EMs) rose much of the period, supported by falling interest rates and the Chinese government’s launch of a large stimulus package to reignite its economy. EMs tumbled in early April after the US government announced high tariffs on all trading partners but recovered somewhat when it became clear US policymakers were open to negotiation. Communication Services was the best sector, boosted by Chinese technology leaders in the sector. The Information Technology (IT) sector fell sharply on concerns about a slowdown in AI spending. The Fund had weak relative returns in IT while good stocks in Consumer Staples were helpful. Sector Analysis Shares of IT-services company Globant fell due to concerns about slowing growth in the US, its key market. In Consumer Staples, bottler Coca-Cola HBC’s earnings topped market expectations. Regional Analysis Shares of Taiwanese semiconductor maker Aspeed were pressured by growth concerns for its AI-server end market. In India, HDFC Bank reported accelerating loan growth and has benefited from central bank efforts to improve liquidity in India’s financial system. Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Emaar Properties |

|

Globant |

| TSMC |

|

Aspeed |

| Coca-Cola HBC |

|

Eclat Textile |

| Sanhua Intelligent Controls |

|

Techtronic Industries |

| HDFC Bank |

|

Hon Hai Precision |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

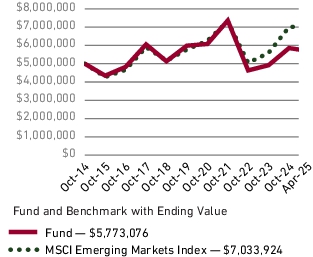

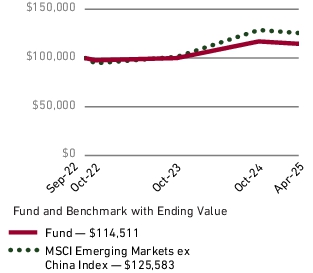

| Line Graph [Table Text Block] |

Fund Performance The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $5,000,000 initial investment in the Fund with an investment in an appropriate, broad-based securities market index. Growth of $5,000,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

8.47 |

2.62 |

1.43 |

| MSCI Emerging Markets Index |

9.02 |

6.35 |

3.07 |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 390,100,000

|

|

| Holdings Count | Holding |

71

|

|

| Advisory Fees Paid, Amount |

$ 1,800,000

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$390.1M |

Total advisory fees paid

(after waiver/reimbursement) |

$1.8M |

| Total number of holdings |

71 |

Period portfolio turnover rate |

17% |

|

|

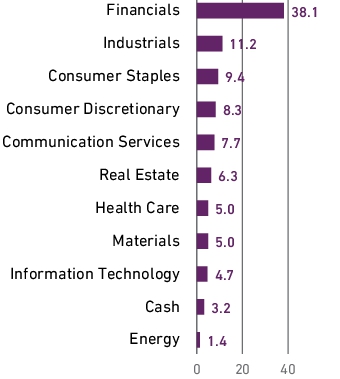

| Holdings [Text Block] |

Graphical Representation of Holdings The table and charts below show the investment makeup of the Fund; percentages indicated and graphical representations are based on the Fund’s net asset value. Top Ten Holdings % Allocation

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.5 |

| Tencent Holdings Ltd. |

5.2 |

| HDFC Bank Ltd. |

5.0 |

| Alibaba Group Holding Ltd. |

3.4 |

| Samsung Electronics Co., Ltd. - GDR, Reg S |

3.2 |

| Trip.com Group Ltd. |

3.2 |

| Tata Consultancy Services Ltd. |

2.9 |

| ICICI Bank Ltd. |

2.8 |

| Maruti Suzuki India Ltd. |

2.8 |

| ASPEED Technology Inc. |

2.0 |

by Sector by Region

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings %

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.5 |

| Tencent Holdings Ltd. |

5.2 |

| HDFC Bank Ltd. |

5.0 |

| Alibaba Group Holding Ltd. |

3.4 |

| Samsung Electronics Co., Ltd. - GDR, Reg S |

3.2 |

| Trip.com Group Ltd. |

3.2 |

| Tata Consultancy Services Ltd. |

2.9 |

| ICICI Bank Ltd. |

2.8 |

| Maruti Suzuki India Ltd. |

2.8 |

| ASPEED Technology Inc. |

2.0 |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants Effective January 31, 2025, KPMG LLP ("KPMG") was dismissed as the independent registered public accounting firm of the Fund. There were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures during the two most recent fiscal years and the subsequent interim period through January 31, 2025. PricewaterhouseCoopers LLP has been appointed as the Fund's independent registered public accounting firm for the fiscal year ending October 31, 2025.

|

|

| C000045117 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Small Companies

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

HLMSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the International Small Companies Fund (“Fund”) for the period of November 1, 2024 to April 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at HardingLoevnerFunds.com. You can also request this information by calling (877) 435-8105 or by sending an e-mail request to hardingloevnerfunds@ntrs.com.

|

|

| Additional Information Phone Number |

(877) 435-8105

|

|

| Additional Information Email |

hardingloevnerfunds@ntrs.com

|

|

| Additional Information Website |

HardingLoevnerFunds.com

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment1 |

| International Small Companies (Investor Class) |

$66 |

1.32% |

|

1

|

Expense ratio is expressed on an annualized basis.

|

|

|

| Expenses Paid, Amount |

$ 66

|

|

| Expense Ratio, Percent |

1.32%

|

[10] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

The International Small Companies Investor Class (HLMSX) rose 2.62% (net of fees and expenses) in the six-month period ended April 30, 2025. The Fund's benchmark, the MSCI ACWI ex US Small Cap Index, rose 2.66% in the same period (net of source taxes).1

Key Performance Factors

International small caps gained during the period, outperforming US small caps, as investors worried about the impact of higher tariffs on US growth and inflation. European markets rallied after German legislators approved its fiscal stimulus package. Rising long-end yields in Europe and Japan helped Financials outperform. Information Technology (IT) underperformed as the release of Chinese AI model DeepSeek rattled stocks across the tech supply chain. The Fund kept pace with the index due to strong relative returns in IT and Communication Services but was hurt by weak returns in Consumer Discretionary and Industrials.

Sector Analysis

In Communication Services, mobile network operator Airtel Africa received regulatory approval to increase rates up to 50% in Nigeria. In Consumer Discretionary, Philippine home-improvement retailer Wilcon Depot reported disappointing results due to slow demand and discounting by peers.

Regional Analysis

Yantai China Pet Foods soared after the company reported strong sales and an improvement in profit margins. German life-science products manufacturer STRATEC suffered weakening pricing power; we reduced our holding.

Performance

| 🡱 Top Contributors |

|

🡳 Top Detractors |

| Airtel Africa |

|

Wilcon Depot |

| Yantai China Pet Foods |

|

YouGov |

| CyberArk |

|

Thule Group |

| Scout24 |

|

Globant |

| Bankinter |

|

SH Kelkar |

The securities shown do not represent all holdings, and it should not be assumed that investment in these securities has been or will be profitable. The following is available upon request: (1) information describing the methodology of the contribution data and (2) a list showing the weight and relative contribution of all holdings during the period. Contribution is the contribution to overall performance over the period.

1 The Fund considers the non-broad-based index most relevant when analyzing the Fund’s performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

Performance data quoted represents past performance; past performance does not guarantee future results.

|

|

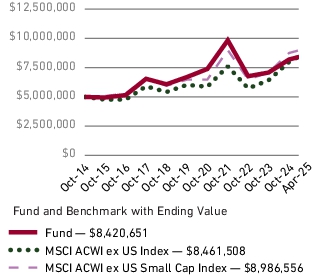

| Line Graph [Table Text Block] |

Fund Performance

The following graph and chart compare the beginning and ending account values for the most recently completed 10 fiscal years of the Fund. It compares a $10,000 initial investment in the Fund with an investment in (i) an appropriate, broad-based securities market index and (ii) an additional index that reflects the market sectors in which the Fund invests.

Growth of $10,000 (USD)

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Return (%)

|

1 Year |

5 Year |

10 Year |

| Fund |

6.13 |

6.76 |

4.60 |

| MSCI ACWI ex US Index* |

11.92 |

10.09 |

4.83 |

| MSCI ACWI ex US Small Cap Index* |

8.23 |

10.31 |

5.19 |

*In accordance with new regulatory requirements, the Fund has selected the MSCI ACWI ex US Index as the Fund's broad-based securities market index. The Fund has selected the MSCI ACWI ex US Small Cap Index as a secondary benchmark.

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit HardingLoevnerFunds.com for the most recent performance information.

|

|

| Net Assets |

$ 301,300,000

|

|

| Holdings Count | Holding |

81

|

|

| Advisory Fees Paid, Amount |

$ 1,800,000

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

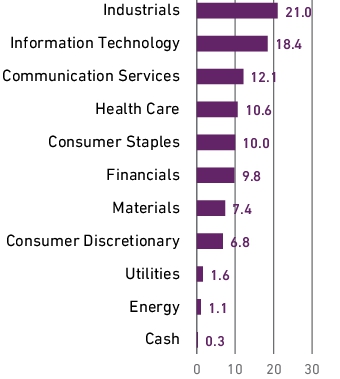

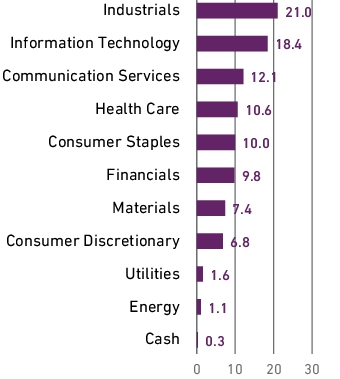

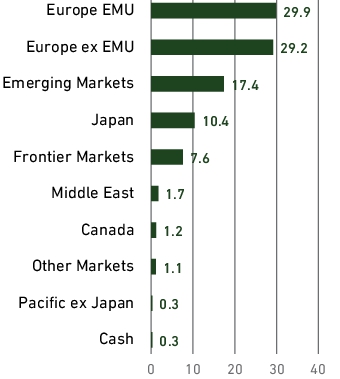

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

During Reporting Period

| Fund net assets |

$301.3M |

Total advisory fees paid